Attached files

| file | filename |

|---|---|

| EX-32.2 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex32-2.htm |

| EX-32.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex32-1.htm |

| EX-31.2 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex31-2.htm |

| EX-31.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ______ to ______

Commission File Number: 000-33167

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 77-0632186 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

3200 Guasti Road, Suite #100, Ontario, California |

91761 | |

| (Address of principal executive offices) | (Zip Code) |

(909) 456-8828

(Registrant’s telephone number, including area code)

n/a

(Former address)

Securities registered pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on which registered | ||

| Common Stock, par value $0.001 | KWBTB | OTCQB |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | Emerging growth company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2019, based on a closing price of $0.75 was approximately $10,522,514.

As of May 29, 2020, the Company had 282,385,206 shares of common stock, $0.001 par value, issued and outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

| 2 |

Special Note Regarding Forward-Looking Statements

On one or more occasions, we may make forward-looking statements in this Annual Report on Form 10-K regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” or similar expressions identify forward-looking statements. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described elsewhere in this report and our other Securities and Exchange Commission filings.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent annual and periodic reports filed with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K and Proxy Statements on Schedule 14A.

References herein to “we,” “us,” “our” or “the Company” refer to Kiwa Bio-Tech Products Group Corporation and its wholly-owned and majority-owned subsidiaries unless the context specifically states or implies otherwise.

The Company

1. Organizational History

The Company took its present corporate form in March 2004 when shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, entered into a share exchange transaction. The share exchange transaction left the shareholders of Kiwa BVI owning a majority of Tintic and Kiwa BVI a wholly-owned subsidiary of Tintic. For accounting purposes this transaction was treated as an acquisition of Tintic by Kiwa BVI in the form of a reverse triangular merger and a recapitalization of Kiwa BVI and its wholly owned subsidiary, Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”). On July 21, 2004, we completed our reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

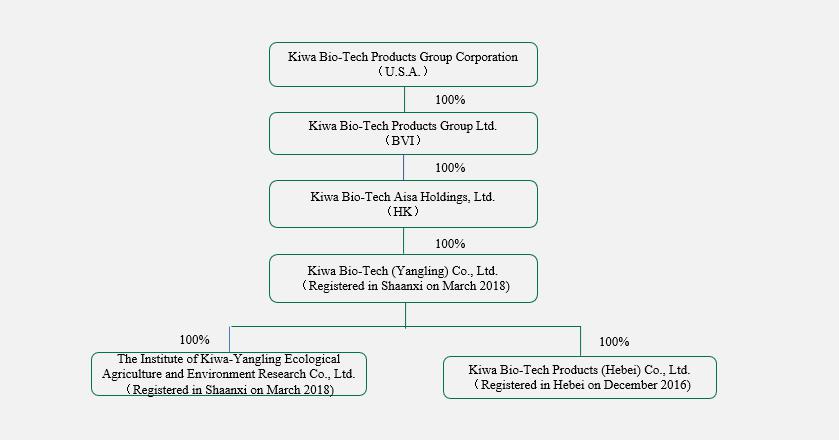

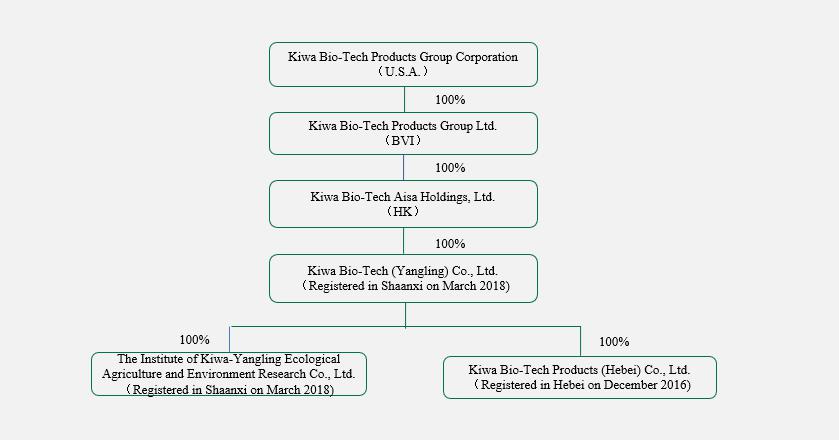

The Company currently mainly operates its business through Kiwa Bio-Tech (Yangling) Co., Ltd. (“Kiwa Yangling”), which incorporated in March 2018, Kiwa Bio-Tech Products (Hebei) Co., Ltd. (“Kiwa Hebei”), which was incorporated in China in December 2016, and The Institute of Kiwa-Yangling Ecological Agriculture and Environment Research Co., Ltd. (“Kiwa Institute”), which incorporated in March 2018.

On October 12, 2018, the Company got the approval from the Administrative Committee of Yangling Agricultural High-tech Industry Demonstration Zone to obtain land to construct a new manufacturing facility to help meet the growing demand in China for bio-fertilizers. Yangling Free Trade Zone has agreed to offer the Company approximately US$432,975 (RMB 3,000,000) in incentives and provide tax preferences for the first three years of production. The manufacturing facility will specialize in developing and producing Kiwa Bio-Tech’s core microbes, the fundamental components for making high-quality bio-fertilizers. The total facility construction area is approximately 8.77 acres, and will include fermentation and production terminals, agricultural produce sorting facilities and storage, a research and development institute and corresponding ancillary facilities. The construction of the first phase of the manufacturing facility is expected to be completed in 2020 and have a production capacity of 60,000 tons of Kiwa Bio-Tech’s core microbes. The annual production value is expected to be over US$65 million (approximately 462 million RMB).

| 3 |

On October 21, 2019, the Company transferred all of its right, title and interest in Kiwa Bio-Tech Asia Holdings (Shenzhen) Ltd. (Kiwa Asia), Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. (“Kiwa Beijing”), Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. (“Kiwa Shenzhen”), and Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. Xian Branch Company, (“Kiwa Xian”), to the Hong Kong Sano Group Co., Ltd. for the HKD 17,000,000 equivalent of US $2,169,862. As Kiwa Asia, Kiwa Shenzhen, Kiwa Beijing, and Kiwa Xian has transferred all of their bio-technological products business to Kiwa Yangling, this restructuring did not constitute a strategic shift that will have a major effect on the Company’s operations and financial results. Therefore, the results of operations for Kiwa Asia, Kiwa Shenzhen, Kiwa Beijing, and Kiwa Xian were not reported as discontinued operations under the guidance of Accounting Standards Codification (“ASC”) 205.

2. Overview of Business

We develop, manufacture, distribute and market innovative, cost-effective and environmentally safe bio-technological products for agriculture use. Our products are designed to enhance the quality of human life by increasing the value, quality and productivity of crops and decreasing the negative environmental impact of chemicals and other wastes.

Our Products

We have developed three bio-fertilizer products with bacillus species (“bacillus spp”) and/or photosynthetic bacteria as core ingredients. For the year ended December 31, 2019, we are currently generating revenues from our four bio-fertilizer products: 1) Biological Organic Fertilizer; 2) Compound Microbial Fertilizer; 3) Bio-Water Soluble Fertilizer; 4) Microbial Inoculum Fertilizer.

Some of our products contain ingredients of both photosynthesis and bacillus bacteria. Bacillus spp is a species of bacteria that interacts with plants and promotes biological processes. It is highly effective for promoting plant growth, enhancing yield, improving quality and elevating resistances. Photosynthetic bacteria are a group of green and purple bacteria. Bacterial photosynthesis differs from green plant photosynthesis in that bacterial photosynthesis occurs in an anaerobic environment and does not produce oxygen. Photosynthetic bacteria can enhance the photosynthetic capacity of green plants by increasing the utilization of sunlight, which helps keep the photosynthetic process at a vigorous level, enhances the capacity of plants to transform inorganic materials to organic products, and boosts overall plant health and productivity.

Biological Fertilizer provide beneficial living microorganisms and micronutrition to soil and improve plants absorptivity of main growth ingredients. Proper use could prevent soil-borne, crops disease, improve soil fertility, alleviate agricultural pollution and degrade heavy metal in farmland soil.

| 4 |

Compound Microbial Fertilizer is adding appropriate amount of nitrogen, phosphorus, potassium and other nutrients into Biological Organic Fertilizer. Through the action of organic matter and beneficial microorganisms, the utilization rate of nitrogen, phosphorus, potassium can be significantly improved.

The Bio-Water Soluble Fertilizer is mainly another form of the biological fertilizer that we firstly introduced in the first quarter of 2018. It is in the form of powder which has high water solubility, and it is convenient for the farmers to use during the drop irrigation.

Microbial Inoculum Fertilizer is an environment-friendly biological soil conditioner that made of compound high-silicon, calcium, and mineral raw materials, on the basis of dissolving-phosphorus, dissolving-potassium, and disease-resistant microbial agents. It is rich in highly active microorganisms, which can improve the micro-ecological environment in the soil, transform and reduce heavy metal toxicity, release the plant growth stimulants, promote crop growth, and enhance the stress resistance.

Compound Microbial Fertilizer, Bio-Water Soluble Fertilizer, and Microbial Inoculum Fertilizer generally contain more microorganism and have a higher effectiveness on the productivity of crops and increasing the value and quality of the crops harvested than Biological Organic Fertilizer. As a result, our Compound Microbial Fertilizer, Bio-Water Soluble Fertilizer, and Microbial Inoculum Fertilizer generally have a higher average selling price as compared to Biological Organic Fertilizer.

Intellectual Property

Our bacillus bacteria based fertilizers are protected by patents. In 2004, we acquired patent no. ZL 93101635.5 entitled “Highly Effective Composite Bacteria for Enhancing Yield and the Related Methodology for Manufacturing” from China Agricultural University (“CAU”) for the aggregate purchase of $480,411, consisting of $60,411 in cash and 5,000 shares of our common stock, valued at $84.00 per share (aggregate value of $420,000). Our photosynthetic bacteria based fertilizers are also protected by trade secret laws.

The patent acquired from CAU covers six different species of bacillus which have been tested as bio-fertilizers to enhance yield and plant health. The production methods of the six species are also patented. The patent has expired on February 19, 2013.There are no limitations under this agreement on our exclusive use of the patent. Pursuant to our agreement with CAU, the University agreed to provide research and technology support services at no additional cost to us in the event we decide to use the patent to produce commercial products. These research and technology support services include: (1) furnishing faculty or graduate-level researchers to help bacteria culturing, sampling, testing, trial production and production formula adjustment; (2) providing production technology and procedures to turn the products into powder form while keeping live required bacteria in the products; (3) establishing quality standards and quality control systems; (4) providing testing and research support for us to obtain necessary sale permits from the Chinese government; and (5) cooperation in developing derivative products.

On January 5, 2011, the State Intellectual Property Office of the PRC (“Intellectual Property Office”) granted Kiwa two Certificates of Patent of Invention for (1) “A cucumber dedicated composite anti-continuous cropping effect probiotics and their specific strains with related application” with patent number of “ZL 2008 1 0144492.6”; and (2) “Cotton dedicated composite anti-continuous cropping effect probiotics and their special strains with related application” with patent number of “ZL 2008 1 0144491.1” These two patents have been developed by Kiwa-CAU R&D Center. These two patents will expire on August 5, 2028. These two patents can be used to develop specific environment-friendly bio-fertilizer.

We have obtained three fertilizer registration certificates from the Chinese government - two covering our bacillus bacteria fertilizer and one covering our photosynthetic bacteria fertilizer. The five registration certificates are: (1) Biological Organic Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (2) Compound Microbial Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (3) Compound Microbial Water Soluble Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture. Protected by these three fertilizer registration certificates and five trademarks under the names of “KANGTAN” (Chinese translation name for Kiwa), “ZHIGUANGYOU,” “PUGUANGFU,” “JINWA” and “KANGGUAN,” we have developed three series of bio-fertilizer products with bacillus spp and/or photosynthetic bacteria as core ingredients. Valid period of fertilizer registration certificates is five years and may be extended for another five years upon application from the owner of fertilizer registration certificates. The Company has determined to re-apply the Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture.

| 5 |

Our Customers

For the year ended December 31, 2019, three customers accounted for 46%, 31%, and 23% of the Company’s sales.

1. Qingdao Lanhai Hanrui Biotechnology Co., Ltd. (46% of sales)

2. Yangling Shaotao Agricultural Service Co., Ltd. (31% of sales)

3. Mingke Biotechnology Development (Shenzhen) Co., Ltd. (23% of sales)

Should we lose any of these large-scale customers in the future and are unable to obtain additional customers, our revenues and operation results might be adversely affected.

Our Suppliers

For the year ended December 31, 2019, one supplier Shandong Ronghua Bio-Tech Co., Ltd. accounted for 94% of the Company’s total purchases, respectively.

Our Competition

We compete primarily on the basis of quality, technological innovation and price. Some of our competitors have achieved greater market penetration but with less sophisticated technological innovation than our products as they were in the transition period from being the chemical bio-fertilizer producers to the organically bio-fertilizer producers. We believe that we have a better competitive advantage over them as we are the pioneer within our markets. Some of our competitors competed within our markets have lesser financial and other resources than us as they have established their companies a few years behind us. If we are unable to compete successfully in our markets, our relative market share and profits could be reduced.

Our main competitors include China Green Agriculture, Inc., Genliduo Biotechnology Ltd., Shenzhen Baitan Ecotypic Engineering Co. Ltd., Hunan Taigu Biotechnology Co. Ltd. and Shanxi A.K. Quantum Agricultural Technology Corporation.

Research and Development

In July 2006, we established a new research center with China Agricultural University (“CAU”) which is known as Kiwa-CAU Bio-Tech Research & Development Center (the “Kiwa-CAU R&D Center”). Pursuant to an agreement between CAU and Kiwa Shandong dated November 14, 2006, Kiwa agreed to contribute RMB 1 million (approximately $160,000) each year to fund research at Kiwa-CAU R&D Center. The term of this agreement was ten years starting from July 1, 2006. Prof. Qi Wang, who became one of our directors in July 2007, has acted as the Director of Kiwa-CAU R&D Center since July 2006. Under the above agreement, the Kiwa-CAU R&D Center is responsible for fulfilling the overall research-and-development functions of Kiwa Shandong, including: (1) development of new technologies and new products (which will be shared by Kiwa and CAU); (2) subsequent perfection of existing product-related technologies; and (3) training quality-control personnel and technicians and technical support for marketing activities.

During fiscal 2014, Kiwa-CAU R&D Center had successfully isolated several strains of endophytic bacillus from plants. A number of strains had been observed to have the capability of boosting crop yield and dispelling chemical pesticide residual from soil. These strains could be used for developing not only new biological preparation but also environmental protection preparation. The Company terminated its cooperation with CAU when the agreement expired on July 1, 2016. All the liabilities owed to Kiwa-CAU R&D Center were assumed by the Transferee of Kiwa Shandong when the Company disposed Kiwa Shandong on Feb 11, 2017.

| 6 |

On November 5, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). Pursuant to the Agreement, the Company will form a strategic partnership with the two institutes and establish an “International Cooperation Platform for Internet and Safe Agricultural Products”. To fund the cooperation platform’s R&D activities, the Company will provide RMB 1 million (approximately $160,000) per year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institute. The term of the Agreement is for three years beginning November 20, 2015. However, the Company is only liable for the annual funds to be provided to the extent of the contract obligations performed by CAAS IARRP and IAED, and the agreement is terminable before the three years’ commitment date based on negotiations of both parties. Prof. Yong Chang Wu, the authorized representative of IARRP, CAAS, is also one of the Company’s directors effective since November 20, 2015 until March 13, 2017.

In March 2018, Kiwa Bio-Tech has established a Research Institute of Ecological Agriculture and Environmental Research. Based on cooperation with various Universities including the China Agriculture University, Northwest University, Northwest A&F University, Harbin Institute of Technology and Tsinghua University, we believe that it can secure a leading position in the KETS technology in the next thirty years. In comparison to our existing technology, Ecology Technological Sustainability (“KETS”) technology is comprised of microorganisms with a larger scale of micro-flora. The micro-flora could significantly increase the beneficial microorganism in the soil that enhances the yield of the plant crops and prevents soil ecological problems. The newly upgraded technology will be applied to the main crop planting areas and presently-polluted arable areas for soil restoration.

Other

On February 27, 2017, the Company signed a strategic cooperation agreement with the Beijing Zhongpin Agricultural Science and Technology Development Center (“Zhongpin Center”). Zhongpin Center is the Chinese Agricultural Science and Technology Innovation and Development Committee’s executive implementation agency (referred to as the Agricultural Science and Technology Commission). The Agricultural Science and Technology Commission is set up by the Chinese Central Government for the construction of the National Ecological Security Agriculture Industrial Chain standardization system. This includes the establishment of National Ecology Safe Agricultural Industrial Parks to build China’s Ecological Security and Agricultural Industrial in an orderly business environment, including completion of the National Soil Remediation Program and governance of the various government functions of the institutions. Through the guidance and support by the Zhongpin Center, Kiwa will participate and be involved in China’s National Soil Remediation Program and construction of the National Ecological Security Agriculture Industrial Chain Standardization System’s operation and process.

On April 2, 2018, the company had terminated its cooperation agreement with ETS Biological Science and Technology Development Co., Ltd. (“ETS”) and, in its place, has developed “Ecology Technological Sustainability” (“KETS”) as its core technology to upgrade its microbial fertilizer products. In February 2017, the Company had signed a strategic cooperation agreement with ETS and planned to build new product categories based on the cooperative research results. Following the research, the two parties did not reach a further agreement and determined to terminate the partnership. As a result, the Company switched its focus to the KETS technology to fulfill its needs in connection with fertilizer production. As a part of this process, Kiwa Bio-Tech has established a Research Institute of Ecological Agriculture and Environmental Research. Based on cooperation with various Universities including the China Agriculture University, Northwest University, Northwest A&F University, Harbin Institute of Technology and Tsinghua University, the Company believes that it can secure a leading position in the KETS technology in the next thirty years. In comparison to the Company’s existing technology, KETS technology is comprised of microorganisms with a larger scale of micro-flora. The micro-flora could significantly increase the beneficial bacteria in the soil that enhances the yield of the plant crops and prevents soil ecological problems. The newly upgraded technology will be applied to the main crop planting areas and presently-polluted arable areas for soil restoration.

Employees

As of December 31, 2019, we employed 16 full-time employees. The following table sets forth the number of our full-time employees by function as of December 31, 2019.

| 7 |

Employees and their Functions

| Management & Administrative Staff | 7 | 44 | % | |||||

| Sales | 4 | 25 | % | |||||

| Technical & Engineering Staff | 5 | 31 | % | |||||

| Total | 16 | 100.00 | % |

As required by applicable PRC law, we have entered into employment contracts with all our officers, managers and employees. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff.

In addition, we are required by PRC law to cover employees in China with various types of social insurance and believe that we are in material compliance with the relevant laws.

Insurance

We believe our insurance coverage is customary and standard for companies of comparable size in comparable industries in China.

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. Unresolved Staff Comments

None.

On April 3, 2019, Kiwa Bio-Tech (Yangling) Co., Ltd. entered an office lease agreement with three-year term. Monthly lease payment is approximately RMB 14,000 or approximately of USD $2,000. The total useable space is 685 square meters.

None.

ITEM 4. Mine Safety Disclosures

Not applicable.

| 8 |

ITEM 5. Market for Registrants’ Common Equity, Related Stockholder Matters and Issuer Purchasers of Equity Securities

Market Information

The Company’s common stock has been quoted under the symbol “KWBT” since March 30, 2004. Our shares are currently traded on the OTCQB.

The following table sets forth the high and low bid quotations per share of our common stock as reported on the OTCQB for the periods indicated. The high and low bid quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year 2019 | High | Low | ||||||

| First Quarter | $ | 1.40 | $ | 0.37 | ||||

| Second Quarter | $ | 1.09 | $ | 0.52 | ||||

| Third Quarter | $ | 1.00 | $ | 0.50 | ||||

| Fourth Quarter | $ | 0.38 | $ | 0.02 | ||||

| Fiscal Year 2018 | High | Low | ||||||

| First Quarter | $ | 1.77 | $ | 1.70 | ||||

| Second Quarter | $ | 1.23 | $ | 1.17 | ||||

| Third Quarter | $ | 1.02 | $ | 0.97 | ||||

| Fourth Quarter | $ | 0.58 | $ | 0.54 | ||||

Holders

As of December 31, 2019, there were approximately 500 shareholders of record of our common shares.

Dividend Policy

We have not paid any dividends on our common shares since our inception and do not anticipate that dividends will be paid at any time in the immediate future.

Equity Compensation Plan Information

The information required by Item 5 regarding securities authorized for issuance under equity compensation plans is included in Item 12 of this report.

Recent Sales of Unregistered Securities

The following is a list of shares of Company Common Stock issued for cash, the conversion of convertible debentures or as stock compensation to consultants during the period from January 1, 2019 through May 29, 2020, which were not registered under the Securities Act:

| Stock Purchase for Cash | 220,000 shares |

| Commitment shares | 1,463,333 shares |

| Consultant Fees | 804,999 shares |

| Conversion of Convertible Note | 262,587,130 shares |

| Salary Compensation | 124,484 shares |

| Debt Settlement | 300,000 shares |

| Total | 265,499,946 shares |

There were no other sales of unregistered securities not already reported on the Company’s quarterly filings on Form 10-Q or on a Current Report on Form 8-K.

| 9 |

ITEM 6. Selected Financial Data

Not required.

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Annual Report on Form 10-K for the fiscal year ended December 31, 2019 contains “forward-looking” statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, including statements that include the words “believes,” “expects,” “anticipates,” or similar expressions. These forward-looking statements include, among others, statements concerning our expectations regarding our working capital requirements, financing requirements, business, growth prospects, competition and results of operations, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. The forward-looking statements in this Annual Report on Form 10-K for the fiscal year ended December 31, 2019 involve known and unknown risks, uncertainties and other factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by the forward-looking statements contained herein.

Overview

The Company took its present corporate form in March 2004 when shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, entered into a share exchange transaction. The share exchange transaction left the shareholders of Kiwa BVI owning a majority of Tintic and Kiwa BVI a wholly-owned subsidiary of Tintic. For accounting purposes this transaction was treated as an acquisition of Tintic by Kiwa BVI in the form of a reverse triangular merger and a recapitalization of Kiwa BVI and its wholly owned subsidiary, Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”). On July 21, 2004, we completed our reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

The Company develops, manufactures, distributes and markets innovative, cost-effective and environmentally safe bio-technological products for agricultural use. Our products are designed to enhance the quality of human life by increasing the value, quality and productivity of crops and decreasing the negative environmental impact of chemicals and other wastes.

The Company currently mainly operates its business through Kiwa Bio-Tech (Yangling) Co., Ltd. (“Kiwa Yangling”), which incorporated in March 2018, Kiwa Bio-Tech Products (Hebei) Co., Ltd. (“Kiwa Hebei”), which was incorporated in China in December 2016, and The Institute of Kiwa-Yangling Ecological Agriculture and Environment Research Co., Ltd. (“Kiwa Institute”), which incorporated in March 2018.

On October 21, 2019, the Company transferred all of its right, title and interest in Kiwa Bio-Tech Asia Holdings (Shenzhen) Ltd. (Kiwa Asia), Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. (“Kiwa Beijing”), Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. (“Kiwa Shenzhen”), and Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. Xian Branch, (“Kiwa Xian”), to the Hong Kong Sano Group Co., Ltd. for a consideration of HKD 17,000,000 equivalent of US $2,169,862. Kiwa Asia, Kiwa Shenzhen, Kiwa Beijing, and Kiwa Xian has transferred all of their bio-technological products business to Kiwa Yangling, the Company conduct the same business of bio-technological products before and after the disposal of these entities.. These disposed subsidiaries did not operate or generate any revenue in 2019. This restructuring did not constitute a strategic shift that will have a major effect on the Company’s operations and financial results. Therefore, the results of operations for Kiwa Asia, Kiwa Shenzhen, Kiwa Beijing, and Kiwa Xian were not reported as discontinued operations under the guidance of Accounting Standards Codification (“ASC”) 205. The disposal transactions resulted in loss of approximately $3.5 million.

| 10 |

Principal Factors Affecting Our Financial Performance

We believe that the following factors could affect our financial performance:

| ● | Change in the Chinese Government Policy on agricultural industry. The Chinese Government is continuously to promote green environment and implement quality standards and environmentally sensitive policies in the Agricultural industry. Below is a list of government policies issued by the Chinese Government to promote green environment and these policies are either directly or indirectly to encourage the end users of the bio-fertilizer to use more organic related products. Unfavorable changes to these policies could affect demand of our products that we produce and could materially and adversely affect the results of operations. Although we have generally benefited from these policies by using our bio-fertilizer to enhances the capacity of plants to transform inorganic materials to organic products, to boost overall plant health and productivity and not to deteriorate landfall soil. |

| ○ | In April 2008, the Ministry of Finance of PRC issued Circular No. 2008-56 to tax-exempt value-added taxes on all organically fertilizer related products effectively from June 1, 2008. | |

| ○ | In January 2016, the PRC State Council official website issued statements to fasten the agricultural modernization process. | |

| ○ | In June 2016, the PRC State Council issued Circular No. 2016-31 to prevent further deterioration of landfall soil action plan. | |

| ○ | In February 2017, the PRC State Council official website issued statements to promote agricultural structural reform on accelerating the cultivation in the agricultural development. | |

| ○ | In February 2017, the Ministry of Agriculture of PRC issued Circular No. 2017-02 to carry out replacement of chemical bio-fertilizers by organically bio-fertilizers action plan on vegetables, fruits and teas planting. | |

| ○ | In April 2017, the Ministry of Agriculture of PRC issued Circular No. 2017-06 to implementing five major action plans on agriculture green development with an action plan for replacing chemical bio-fertilizers with organically bio-fertilizers on vegetables, fruits and teas planting under action plan No. 2-2. | |

| ○ | In April 2018, at the second meeting of the 13th National People’s Congress meeting, the Minister of the Agriculture and Rural Affairs has pronoun that the Chinese government will continue to promote green environment, to ensure food safety and food qualify for the people in the PRC, and to provide more education and training cause to the farmer in the Agriculture industry. Follow up with the second meeting, in July 2018, the Chinese government is in the process of setting up some government grants to these companies or individuals, including but not limited, organic fertilizer production companies, organic fertilizer raw materials (livestock and poultry excrement) storage and transportation companies, users of organic fertilizer, and users of organic fertilizer production machinery. |

| ● | Innovation Efforts. We strive to produce the most technically and scientifically advanced products for our customers and maintained close relationships with institutes in the PRC. |

| 11 |

| ○ | In March 2018, Kiwa Bio-Tech has established a Research Institute of Ecological Agriculture and Environmental Research. Based on cooperation with various Universities including the China Agriculture University, Northwest University, Northwest A&F University, Harbin Institute of Technology and Tsinghua University, we believe that it can secure a leading position in the KETS technology in the next thirty years. In comparison to our existing technology, Ecology Technological Sustainability (“KETS”) technology is comprised of microorganisms with a larger scale of micro-flora. The micro-flora could significantly increase the beneficial microorganism in the soil that enhances the yield of the plant crops and prevents soil ecological problems. The newly upgraded technology will be applied to the main crop planting areas and presently-polluted arable areas for soil restoration.

On October 12, 2018, Kiwa Bio-Tech got the approval from the Administrative Committee of Yangling Agricultural High-tech Industry Demonstration Zone to obtain land use rights to construct a new manufacturing facility to help meet the growing demand in China for bio-fertilizers. Yangling Free Trade Zone has agreed to offer Kiwa Bio-Tech approximately US$432,975 (RMB 3,000,000) in incentives and provide tax preferences for the first three years of production.

The manufacturing facility will specialize in developing and producing Kiwa Bio-Tech’s core microbes, the fundamental components for making high-quality bio-fertilizers. The total facility construction area is approximately 8.77 acres, and will include fermentation and production terminals, agricultural produce sorting facilities and storage, a research and development institute and corresponding ancillary facilities. The construction of the manufacturing facility is expected to be completed in 2020 and have a production capacity of 60,000 tons of Kiwa Bio-Tech’s core microbes. The annual production value is expected to be over US$65 million (approximately RMB462 million). |

| ● | Experienced Management. Management’s technical knowledge and business relationships give us the ability to secure more sales orders with our customers. If there were to be any significant turnover in our senior management, it could deplete the institutional knowledge held by our existing senior management team. | |

| ● | Large Scale Customer Relationship. We have contracts with major customers that are distributors of our products. Our sales efforts focus on these distributors which place large recurring orders. For the year ended December 31, 2019, three customers accounted for 46%, 31%, and 23% of the Company’s total sales. Should we lose any large-scale customer in the future and are unable to obtain additional customers, our revenues will suffer. |

| ● | Competition. Our competition includes a number of publicly traded companies in the PRC and privately-held PRC-based companies that produce and sell products similar to ours. We compete primarily on the basis of quality, technological innovation and price. Some of our competitors have achieved greater market penetration but with less sophisticated technological innovation than our products as there were in the transition period from being the chemical bio-fertilizer producers to the organically bio-fertilizer producers. We believe that we have a better competitive advantage over them as we are the pioneer within our markets. Some of our competitors competed within our markets have lesser financial and other resources than us as they have established their companies a few years behind us. If we are unable to compete successfully in our markets, our relative market share and profits could be reduced. |

| 12 |

Results of Operations for the Years ended December 31, 2019 and 2018

The following table summarizes the results of our operations for the years ended December 31, 2019 and 2018, respectively, and provides information regarding the dollar and percentage increase or (decrease) during such periods.

Years Ended December 31, | Amount Increase | Percentage Increase | ||||||||||||||

| Statement of Operations Data: | 2019 | 2018 | (Decrease) | (Decrease) | ||||||||||||

| Revenues | $ | 40,089,457 | $ | 30,650,402 | $ | 9,439,055 | 31 | % | ||||||||

| Cost of goods sold | (30,757,460 | ) | (22,391,952 | ) | (8,365,508 | ) | 37 | % | ||||||||

| Gross profit | 9,331,997 | 8,258,450 | 1,073,547 | 13 | % | |||||||||||

| Operating expenses | ||||||||||||||||

| Provision for deferred cost of goods sold | 2,411,006 | - | 2,411,006 | 100 | % | |||||||||||

| Research and development expense | - | 122,774 | (122,774 | ) | (100 | )% | ||||||||||

| Selling expenses | 199,664 | 617,387 | (417,723 | ) | (68 | )% | ||||||||||

| General and administrative expenses | 4,379,851 | 4,928,943 | (549,092 | ) | (11 | )% | ||||||||||

| Loss on sale of subsidiaries | 3,527,254 | - | 3,527,254 | 100 | % | |||||||||||

| Total operating expenses | 10,517,775 | 5,669,104 | 4,848,671 | 86 | % | |||||||||||

| Operating income/(expense) | (1,185,778 | ) | 2,589,346 | (3,775,124 | ) | (146 | )% | |||||||||

| Other income/(expense), net | ||||||||||||||||

| Change in fair value of derivative liabilities | 101,765 | 241,312 | (139,547 | ) | (58 | )% | ||||||||||

| Interest expense | (3,943,751 | ) | (634,874 | ) | (3,308,877 | ) | 521 | % | ||||||||

| Other income/(expense) | 37,253 | (1,185 | ) | 38,438 | (3,244 | )% | ||||||||||

| Exchange gain | 15,296 | 55,444 | (40,148 | ) | (72 | )% | ||||||||||

| Total other expense | (3,789,437 | ) | (339,303 | ) | (3,450,134 | ) | 1,017 | % | ||||||||

| Income (loss) from continuing operations before income taxes | (4,975,215 | ) | 2,250,043 | (7,225,258 | ) | (321 | )% | |||||||||

| Provision for income taxes | ||||||||||||||||

| Current | (2,091,736 | ) | (1,906,222 | ) | (185,514 | ) | 10 | % | ||||||||

| Deferred | 431,655 | - | 431,655 | 100 | % | |||||||||||

| Income taxes | (1,660,081 | ) | (1,906,222 | ) | 246,141 | (13 | )% | |||||||||

| Net Income (loss) | $ | (6,635,296 | ) | $ | 343,821 | $ | (6,979,117 | ) | (2,030 | )% | ||||||

Revenue

Revenue increased by approximately $9.4 million or 31%, to approximately $40.1 million in the year ended December 31, 2019 from approximately $30.7 million in the year ended December 31, 2018. More sales are achieved for most of our four product lines in quantities are due to the good quality of our products and more reputation gained in different regions of the PRC, such as Hainan Province, Guangdong Province and Shaanxi Province upon establishment of our sales channel in different regions.

We currently realized revenue in four major product categories of Biological Organic Fertilizer, Compound Microbial Fertilizer, Bio-Water Soluble Fertilizer, and Microbial Inoculum Fertilizer. Our revenues from our major product category are summarized as follows:

| 13 |

For the year ended December 31, 2019 | For the year ended December 31, 2018 | Change | Change (%) | |||||||||||||

| Biological Organic Fertilizer | ||||||||||||||||

| Sold and shipped in USD | $ | 16,026,941 | $ | 15,311,862 | $ | 715,079 | 5 | % | ||||||||

| Quantity sold in tons | 92,229 | 84,139 | 8,090 | 10 | % | |||||||||||

| Average selling price | $ | 173.77 | $ | 181.98 | $ | (8.21 | ) | (5 | )% | |||||||

| Compound Microbial Fertilizer | ||||||||||||||||

| Sold and shipped in USD | $ | 20,770,479 | $ | 13,499,578 | $ | 7,270,901 | 54 | % | ||||||||

| Quantity sold in tons | 65,196 | 40,585 | 24,611 | 61 | % | |||||||||||

| Average selling price | $ | 318.59 | $ | 332.62 | $ | (14.03 | ) | (4 | )% | |||||||

| Bio-Water Soluble Fertilizer | ||||||||||||||||

| Sold and shipped in USD | $ | 3,292,037 | $ | 1,825,752 | $ | 1,466,285 | 80 | % | ||||||||

| Quantity sold in tons | 5,050 | 2,733 | 2,317 | 85 | % | |||||||||||

| Average selling price | $ | 651.89 | $ | 668.04 | $ | (16.15 | ) | (2 | )% | |||||||

| Microbial Inoculum Fertilizer | ||||||||||||||||

| Sold and shipped in USD | $ | - | $ | 13,210 | $ | (13,210 | ) | (100 | )% | |||||||

| Quantity sold in tons | - | 18 | (18 | ) | (100 | )% | ||||||||||

| Average selling price | $ | - | $ | 733.89 | $ | (733.89 | ) | (100 | )% | |||||||

| Total | ||||||||||||||||

| Sold and shipped in USD | $ | 40,089,457 | $ | 30,650,402 | $ | 9,439,055 | 31 | % | ||||||||

| Quantity sold in tons | 162,475 | 127,475 | 35,000 | 27 | % | |||||||||||

| Average selling price | $ | 246.74 | $ | 240.44 | $ | 6.30 | 3 | % | ||||||||

Average selling prices of Biological Organic Fertilizers, Compound Microbial Fertilizer and Bio-Water Soluble Fertilizer decreased by $8.21 or 5%, $14.03 or 4% and $16.15 or 2%, respectively in the year ended December 31, 2019 as compared with the same period of 2018. This decrease is mainly due to the fluctuation of exchange rate as Chinese Yuan depreciated against U.S. dollars by approximately 4% for the year 2019 compares to the year 2018.

Because the Chinese Government is continuously to promote green environment and implement quality standards and environmentally sensitive policies in the Agricultural industry, we expect our revenues from our innovated and highly effective products, Compound Microbial Fertilizer, Bio-Water Soluble Fertilizer, and Microbial Inoculum Fertilizer will continue to grow in a higher rate than that from Biological Organic Fertilizer. Our Compound Microbial Fertilizer, Bio-Water Soluble Fertilizer, and Microbial Inoculum Fertilizer generally have a higher effectiveness on the productivity of crops that are suitable for promoting green environment. In addition, our marketing team is expanding to the Western areas of China and Hainan province and we expect our revenues will continue to grow in 2020. Meanwhile, we expect to continue to gain more market shares in our existing sales channel bases in the Northern and the Southern areas of China due to the good quality of the products and better reputation in the industry.

| 14 |

Cost of Revenue

Our cost of revenues from our major product categories are summarized as follows:

For the year ended December 31, 2019 | For the year ended December 31, 2018 | Change | Change (%) | |||||||||||||

| Biological Organic Fertilizer | ||||||||||||||||

| Cost of sold and shipped in USD | $ | 11,233,403 | $ | 10,470,687 | $ | 762,716 | 7 | % | ||||||||

| Quantity sold and shipped in tons | 92,229 | 84,139 | 8,090 | 10 | % | |||||||||||

| Average unit cost | $ | 121.80 | $ | 124.45 | $ | (2.65 | ) | (2 | )% | |||||||

| Compound Microbial Fertilizer | ||||||||||||||||

| Cost of sold and shipped in USD | $ | 17,264,806 | $ | 10,644,951 | $ | 6,619,855 | 62 | % | ||||||||

| Quantity sold and shipped in tons | 65,196 | 40,585 | 24,611 | 61 | % | |||||||||||

| Average unit cost | $ | 264.81 | $ | 262.29 | $ | 2.52 | 1 | % | ||||||||

| Bio-Water Soluble Fertilizer | ||||||||||||||||

| Cost of sold and shipped in USD | $ | 2,259,251 | $ | 1,264,068 | $ | 995,183 | 79 | % | ||||||||

| Quantity sold and shipped in tons | 5,050 | 2,733 | 2,317 | 85 | % | |||||||||||

| Average unit cost | $ | 447.38 | $ | 462.52 | $ | (15.14 | ) | (3 | )% | |||||||

| Microbial Inoculum Fertilizer | ||||||||||||||||

| Cost of sold and shipped in USD | $ | - | $ | 12,246 | $ | (12,246 | ) | (100 | )% | |||||||

| Quantity sold and shipped in tons | - | 18 | (18 | ) | (100 | )% | ||||||||||

| Average unit cost | $ | - | $ | 680.33 | $ | (680.33 | ) | (100 | )% | |||||||

| Total | ||||||||||||||||

| Cost of sold and shipped in USD | $ | 30,757,460 | $ | 22,391,952 | $ | 8,365,508 | 37 | % | ||||||||

| Quantity sold and shipped in tons | 162,475 | 127,475 | 35,000 | 27 | % | |||||||||||

| Average unit cost | $ | 189.31 | $ | 175.66 | $ | 13.65 | 8 | % | ||||||||

Cost of revenue from Biological Organic Fertilizer, Compound Microbial Fertilizer and Bio-Water Soluble Fertilizer increased by approximately $0.8 million, $6.6 million and $1.0 million or 7%, 62% and 79% to approximately $11.2 million, $17.3 million and $2.3 million in the year ended December 31, 2019 from approximately $10.5 million, $10.6 million and $1.3 million in the year ended December 31, 2018. The increase is mainly due to the total quantity of products sold increased due to the good quality of our products and more reputation gained in the agricultural industry, which offset by the fluctuation of exchange rate as Chinese Yuan depreciated against U.S. dollars by approximately 4.4% during the year ended December 31, 2019 compared to the year ended December 31, 2018.

Average unit cost of Biological Organic Fertilizers decreased by $2.65 or 2% in the year ended December 31, 2019 as compared with the same period of 2018. The decrease is mainly due to the fluctuation of exchange rate changes as Chinese Yuan depreciated against U.S. dollars by approximately 4.4% and offset by a slightly increase in overall purchase price of the raw material. Average unit cost of Compound Microbial Fertilizer increased by $2.52 or 1% is mainly due to increase in overall purchase price of raw material. Average unit cost of Bio-Water Soluble Fertilizer decreased by $15.14 or 3% is mainly due to the RMB depreciation against USD of approximately 4.4% along with a 2.6% decrease due to we outsourced manufacturing to a third party vendor in the year ended December 31, 2019 compares to the year ended December 31, 2018.

We did not sell any Microbial Inoculum Fertilizer during the year ended December 31, 2019. The company is adjusting the formula of Microbial Inoculum Fertilizer and plans to re-make the packaging and launch it in the market in August, 2020.

| 15 |

Gross Profit

Our gross profit from our major product categories are summarized as follows:

For the year ended December 31, 2019 |

For the year ended December 31, 2018 |

Change | Change (%) | |||||||||||||

| Biological Organic Fertilizer | ||||||||||||||||

| Gross Profit | $ | 4,793,538 | $ | 4,841,175 | $ | (47,637 | ) | (1 | )% | |||||||

| Gross Profit Percentage | 30 | % | 32 | % | (2 | )% | (6 | )% | ||||||||

| Compound Microbial Fertilizer | ||||||||||||||||

| Gross Profit | $ | 3,505,673 | $ | 2,854,627 | $ | 651,046 | 23 | % | ||||||||

| Gross Profit Percentage | 17 | % | 21 | % | (4 | )% | (19 | )% | ||||||||

| Bio-Water Soluble Fertilizer | ||||||||||||||||

| Gross Profit | $ | 1,032,786 | $ | 561,684 | $ | 471,102 | 84 | % | ||||||||

| Gross Profit Percentage | 31 | % | 31 | % | - | % | - | % | ||||||||

| Microbial Inoculum Fertilizer | ||||||||||||||||

| Gross Profit | $ | - | $ | 964 | $ | (964 | ) | (100 | )% | |||||||

| Gross Profit Percentage | - | % | 7 | % | (7 | )% | (100 | )% | ||||||||

| Total | ||||||||||||||||

| Gross Profit | 9,331,997 | 8,258,450 | 1,073,547 | 13 | % | |||||||||||

| Gross Profit Percentage | 23 | % | 27 | % | (4 | )% | (15 | )% | ||||||||

Gross profit percentage for Biological Organic Fertilizer decreased from 32% for the year ended December 31, 2018 to 30% for the year ended December 31, 2019 mainly due to the decrease in average unit cost less than the decrease in average selling price of our products as discussed above.

Gross profit percentage for Compound Microbial decreased from 21% for the year ended December 31, 2018 to 17% for the year ended December 31, 2019 mainly due to the increase in average unit cost was less than the decrease in average selling price of our products as discussed above.

Gross profit percentage for Bio-Water Soluble Fertilizer remains unchanged as 31% for year ended December 31, 2019 and 2018, respectively.

Gross profit percentage for Microbial Inoculum Fertilizer was 7% for the year ended December 31, 2018. We did not sell any Microbial Inoculum Fertilizer during the year ended December 31, 2019.

Provision for Deferred Cost of Goods Sold

Provision on deferred cost of goods sold was $2.4 million for the year ended December 31, 2019, increased by approximately $2.4 million or 100% from nil for the year ended December 31, 2018. The increase in provision on deferred cost of goods sold is made based on historical collection experience on related accounts receivable and realizability of deferred revenue. Because part of the shipments to several clients, for which revenue have already been deferred, have been assessed to be uncollectible, $2.4 million of provision for deferred cost of goods sold were made during the year ended December 31, 2019.

Research and Development Expenses

Research and development expenses was $0 for the year ended December 31, 2019, decreased by approximately $123,000 or 100% from approximately $123,000 (RMB 801,630) for the year ended December 31, 2018. On November 20, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). Pursuant to the Agreement, the Company will form a strategic partnership with the two institutes and establish an “International Cooperation Platform for Internet and Safe Agricultural Products”. To fund the cooperation platform’s R&D activities, the Company will provide RMB 1 million (approximately $148,000) per year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes. The term of the Agreement is for three years beginning November 20, 2015 and has expired on November 19, 2018. We did not have such expenses during the year ended December 31, 2019.

| 16 |

Selling Expenses

Selling expenses include salaries of sales personnel, sales commission, travel and entertainment as well as freight out expenses. Selling expenses for the years ended December 31, 2019 and 2018 were approximately $200,000 and $617,000, respectively. The decrease in selling expenses is because we were in the position of integrating and closing our offices from different locations and consolidated our bio-technological products business to Kiwa Yangling. The decrease in selling expenses is mainly due to a decrease of approximately $273,000 of sales personnel salary, a decrease of office, insurance, travel, entertainment expenses and other selling expenses of approximately $118,000, and a decrease of freight out and shipping expenses as our customers required to pay for its own shipping costs in 2019 of approximately $50,000, offset by an increase of approximately $23,000 advertising expenses.

General and Administrative Expenses

G&A expenses include professional fees, depreciation and amortization, insurance, salaries, employee benefits, travel, auto expense, meal and entertainment, rent, office expense and telephone expense and other miscellaneous G&A expenses. General and administrative (“G&A”) expenses decreased by approximately $0.5 million or 11% from approximately $4.9 million in the year ended December 31, 2018 to approximately $4.4 million in the same period in 2019. The decrease in G&A expenses is because we were in the position of integrating and closing our offices from different location and consolidated our bio-technological products business to Kiwa Yangling. The decrease in G&A expenses is mainly due to a decrease of approximately $783,000 salaries expense and employee benefits, a decrease of approximately $258,000 rent expense and related utilities and management fees, and a decrease of approximately $154,000 consulting and professional fees. This decrease is offset by an increase of approximately $410,000 of meals and entertainment, travel, office expense, and other G&A expenses, and an increase of approximately $235,000 bad debt expenses according to the company policy of allowance for doubtful accounts.

Loss on Sales of Subsidiaries

We were in the position of integrating and closing our offices from different locations and consolidated our bio-technological products business to Kiwa Yangling as we deemed restructuring our offices into our headquarters is the best course for the Company. On October 21, 2019, we transferred all of our right, title and interest in Kiwa Bio-Tech Asia Holdings (Shenzhen) Ltd. (Kiwa Asia), Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. (“Kiwa Beijing”), Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. (“Kiwa Shenzhen”), and Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. Xian Branch Company, (“Kiwa Xian”), to the Hong Kong Sano Group Co., Ltd. for the HKD 17,000,000 equivalent of US $2,169,862, which resulted in a loss of $3,527,254.

Interest Expense

Net interest expense was $3,943,751 and $634,874 for the years ended December 31, 2019 and 2018, respectively, representing an increase of $3,308,877 or 521%. Interest expense included accrued interest on convertible note and other note payable, and the amortization of the convertible note discount, and the issuance cost of the convertible note for the year ended December 31, 2019 and 2018. The increase in interest expenses is mainly attributed to the six 12% convertible notes issued during the year ended December 31, 2019 where we did not have these in the year ended December 31, 2018.

Provision for income taxes

Provision for income taxes was $1,660,081 and $1,906,222 for the years ended December 31, 2019 and 2018, respectively, representing a decrease of $246,141 or 13%. Our profitable PRC subsidiaries incurred more of taxable income in 2019 as compared to the same period in 2018 offset by the deferred income tax benefits resulted from the temporary difference of accrued expenses between book basis and tax basis.

Net Income

During the fiscal year 2019, net loss was $6,635,296, compared with a net income of $343,821 or the same period of 2018, representing a decrease of $6,979,117 or 2,030%. Such change was the result of the combination of the changes as discussed above.

| 17 |

Critical Accounting Policies and Estimates

We prepared our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Management periodically evaluates the estimates and judgments made. Management bases its estimates and judgments on historical experience and on various factors that are believed to be reasonable under current circumstances. Actual results may differ from these estimates as a result of different assumptions or conditions.

The following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements. In addition, you should refer to our accompanying consolidated balance sheets as of December 31, 2019, and the consolidated statements of operations and comprehensive income, and cash flows for the year ended December 31, 2019, and the related notes thereto, for further discussion of our accounting policies.

Revenue Recognition

On January 1, 2018, the Company adopted Accounting Standards Update (“ASU”) 2014-09 Revenue from Contracts with Customers (FASB ASC Topic 606) using the modified retrospective method for contracts that were not completed as of January 1, 2018. We did not result in an adjustment to the retained earnings upon adoption of this new guidance as the Company’s revenue was recognized based on the amount of consideration we expect to receive in exchange for satisfying the performance obligations.

The core principle underlying the revenue recognition ASU is that the Company will recognize revenue to represent the transfer of goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in such exchange. This will require the Company to identify contractual performance obligations and determine whether revenue should be recognized at a point in time or over time, based on when control of goods and services transfers to a customer. The Company’s revenue streams are recognized at a point in time.

The ASU requires the use of a new five-step model to recognize revenue from customer contracts. The five-step model requires that the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation. The application of the five-step model to the revenue streams compared to the prior guidance did not result in significant changes in the way the Company records its revenue. Upon adoption, the Company evaluated its revenue recognition policy for all revenue streams within the scope of the ASU under previous standards and using the five-step model under the new guidance and confirmed that there were no differences in the pattern of revenue recognition.

The Company accounts for a contract with a customer when the contract is committed in writing, the rights of the parties, including payment terms, are identified, the contract has commercial substance and consideration to collect is substantially probable.

The Company continues to derive its revenues from sales contracts with its customers with revenues being recognized upon delivery of products. Persuasive evidence of an arrangement is demonstrated via sales contract and invoice; and the sales price to the customer is fixed upon acceptance of the sales contract and there is no separate sales rebate, discount, or volume incentive. The Company recognizes revenue when title and ownership of the goods are transferred upon shipment to the customer by the Company to consider control of goods are transferred to its customer and collectability of payment is reasonably assured. The Company’s revenues are recognized at a point in time after all performance obligations are satisfied.

| 18 |

The Company’s customers are mainly agricultural cooperative company and distributors who then resell the Company’s products to individual farmers. Because the crop growing cycle usually takes approximately 3 to 9 months in the agricultural industry for some of these Co-ops and distributors, will take approximately similar time frame of 3 to 9 months for farmers to harvest crops and to realize profits to repay the resellers. As a result, for the sales contracts with these customers, the collectability of payment is highly dependent on the successful harvest of corps and the customers’ ability to collect money from farmers. The Company deemed the collectability of payment may not be reasonably assured until after the Company get paid. Collectability is a necessary condition for the contract to be accounted for to meet the criteria of the first step “identifying the contract with the customer” under the new revenue guidance in ASC 606. As a result, the sales contracts with these customers are not considered a contract under ASC 606, thus the shipments under these contracts are not recognized as revenue until all criteria for “identifying the contract with the customer” and revenue recognition are met using the five-step model.

Deferred Revenue and Deferred Cost of Goods Sold

Deferred revenue and deferred cost of goods sold result from transactions where the Company has shipped product for which all revenue recognition criteria under the five-step model have not yet been met. Though these contracts are not considered a contract under ASC 606, they are legally enforceable, and the Company has an unconditional and immediate right to payment after the Company has shipped products, therefore, the Company recognizes a receivable and a corresponding deferred revenue upon shipment. Deferred cost of goods sold related to deferred product revenues includes direct inventory costs. Once all revenue recognition criteria under the five-step model have been met, the deferred revenues and associated cost of goods sold are recognized. The Company’s provision for deferred cost of goods sold is made based on historical collection experience on such related accounts receivable and realizability of deferred revenue.

Accounts receivable and allowance for doubtful accounts

Accounts receivable represent customer accounts receivables. The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience, the economic environment trends in the microbial fertilizer industry, and a review of the current status of trade accounts receivable. Management reviews its accounts receivable each reporting period to determine if the allowance for doubtful accounts is adequate. Such allowances, if any, would be recorded in the period the impairment is identified. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. Uncollectible accounts receivables are charged against the allowance for doubtful accounts when all reasonable efforts to collect the amounts due have been exhausted.

Impairment of Long-Lived Assets

The Company’s long-lived assets consist of property and equipment. The Company evaluates its investment in long-lived assets for recoverability whenever events or changes in circumstances indicate the net carrying amount may not be recoverable. It is possible that these assets could become impaired as a result of legal factors, market conditions, operational performance indicators, technological or other industry changes. If circumstances require a long-lived asset or asset group to be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques, including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary.

Income Taxes

The Company accounts for income taxes under the provisions of FASB ASC Topic 740, “Income Tax,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company establishes a valuation when it is more likely than not that the assets will not be recovered.

| 19 |

ASC Topic 740-10, “Accounting for Uncertainty in Income Taxes,” defines uncertainty in income taxes and the evaluation of a tax position as a two-step process. The first step is to determine whether it is more likely than not that a tax position will be sustained upon examination, including the resolution of any related appeals or litigation based on the technical merits of that position. The second step is to measure a tax position that meets the more-likely-than-not threshold to determine the amount of benefit to be recognized in the financial statements. A tax position is measured at the largest amount of benefit that is greater than 50 percent likelihood of being realized upon ultimate settlement. Tax positions that previously failed to meet the more-likely-than-not recognition threshold should be recognized in the first subsequent period in which the threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not criteria should be de-recognized in the first subsequent financial reporting period in which the threshold is no longer met. Penalties and interest incurred related to underpayment of income tax are classified as income tax expense in the period incurred.

Liquidity and Capital Resources

In assessing our liquidity, we monitor and analyze our cash on-hand and our operating and capital expenditure commitments. Our liquidity needs is to meet our working capital requirements, operating expenses and capital expenditure obligations.

Our business is capital intensive as we need to make advance payment to our suppliers to secure timely delivery and current market price of raw materials. Debt financing in the form of notes payable and loans from related parties have been utilized to finance our working capital requirements. As of December 31, 2019, our working capital was approximately $8.6 million, however, we had only cash of approximately $8,000, with remaining current assets mainly composed of advance to suppliers, notes receivable, other receivables, and prepaid expenses. In addition, we sold Convertible Promissory Notes (“Notes”) in the aggregate principal amount of $1,901,250 for the year ended 2019.

We may have to consider supplementing our available sources of funds for operations through the following sources:

| ● | We will continuously seek additional equity financing to support our working capital; | |

| ● | other available sources of financing from PRC banks and other financial institutions; and | |

| ● | financial support and credit guarantee commitments from our major shareholder. |

Based on the above considerations, our management is of the opinion that it does not have sufficient funds to meet our working capital requirements and debt obligations as they become due one year from the date of this report. Therefore, our consolidated financial statements have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. If the Company can’t raise enough funds, it might be unable to fund our future cash requirement on a timely basis and under acceptable terms and conditions and may not have sufficient liquidity to maintain operations and repay our liabilities for the next twelve months. As a result, we may be unable to implement our current plans for expansion, repay our debt obligations or respond to competitive pressures, any of which would have a material adverse effect on our business, prospects, financial condition and results of operations.

The following table set forth summary of our cash flows for the periods indicated:

| Years Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Net cash provided by (used in) operating activities | $ | 183,067 | $ | (1,648,963 | ) | |||

| Net cash used in investing activities | (2,070,522 | ) | (52,992 | ) | ||||

| Net cash provided by financing activities | 1,482,086 | 510,707 | ||||||

| Effect of exchange rate changes on cash | 405,475 | 115,568 | ||||||

| Net increase (decrease) in cash | 106 | (1,075,680 | ) | |||||

| Cash, beginning of year | 7,859 | 1,083,539 | ||||||

| Cash, end of year | $ | 7,965 | $ | 7,859 | ||||

| 20 |

Operating Activities

Net cash provided by operating activities was approximately $0.2 million for the year ended December 31, 2019, compared to cash used in operating activities of approximately $1.6 million for the same period in 2018. Net cash provided by operating activities for the year ended December 31, 2019 was primarily attributable to 1) a decrease of approximately $3.4 million accounts receivable, 2) approximately $3.5 million loss on selling those subsidiaries, 3) approximately $2.7 million provision for deferred cost of goods sold and bad debt expenses, 4) approximately $2.1 million accrued interest, penalties and financing costs of convertible note, 5) an increase of approximately $2.1 million in tax payables, 6) a decrease of approximately $1.6 million of inventories 7) approximately $1.9 million stock compensation for services, 8) a decrease of approximately $1.2 million of prepaid expenses, 9) an increase of approximately $0.3 million in other payables and accruals, 10) an increase of approximately $0.5 million in salary payable, and 11) an increase of approximately $0.5 million in advance from customers. This increase in cash was offset by 1) a net loss of approximately $6.6 million, 2) an increase in approximately $7.2 note receivables as promissory notes was received, 3) an increase of approximately $3.4 million deferred revenue, 4) a decrease of approximately $1.5 million accounts payables, and 5) an increase of approximately $0.4 million deferred tax assets, and 6) an increase approximately $0.3 million advance to suppliers.

Investing Activities

Net cash used in investing activities was approximately $2.1 million in the year ended December 31, 2019, which was mainly attributable to loan to third parties as they were our important strategy partners. Net cash used in investing activities was approximately $53,000 for the year ended December 31, 2018.

Financing Activities

Net cash provided by financing activities was approximately $1.5 million for the year ended December 31, 2019 and net cash provided by financing activities was approximately $0.6 million for the year ended December 31, 2018. The cash inflow for the year ended December 31, 2019 was mainly due to an approximately $1.6 million proceed from six new issued convertible notes, and an approximately 0.2 million proceeds from sale of common stocks; offset by an approximately $0.3 million net payment to related parties.

Trends and Uncertainties in Regulation and Government Policy in China

Foreign Exchange Policy Changes

China is considering allowing its currency to be freely exchangeable for other major currencies. This change will result in greater liquidity for revenues generated in Renminbi (“RMB”). We would benefit by having easier access to and greater flexibility with capital generated in and held in the form of RMB. The majority of our assets are located in China and most of our earnings are currently generated in China and are therefore denominated in RMB. Changes in the RMB-U.S. Dollar exchange rate will impact our reported results of operations and financial condition. In the event that RMB appreciates over the next year as compared to the U.S. Dollar, our earnings will benefit from the appreciation of the RMB. However, if we have to use U.S. Dollars to invest in our Chinese operations, we will suffer from the depreciation of U.S. Dollars against the RMB. On the other hand, if the value of the RMB were to depreciate compared to the U.S. Dollar, then our reported earnings and financial condition would be adversely affected when converted to U.S. Dollars.

From the end of 2018 through December 31, 2019, the value of the RMB depreciated by approximately 1.6% against the U.S. Dollar. With the development of the foreign exchange market and progress towards interest rate liberalization and RMB internationalization, the PRC government may in the future announce further changes to the exchange rate system and there is no guarantee that the RMB will not appreciate or depreciate significantly in value against the U.S. Dollar in the future. It is difficult to predict how market forces or PRC or U.S. government policy may impact the exchange rate between the RMB and the U.S. Dollar in the future. The exchange rate of U.S. Dollar against RMB on December 31, 2019 was US$1.00 = RMB 6.9860.

| 21 |

Risk

Credit Risk

Credit risk is one of the most significant risks for our business.

Financial instruments that potentially subject us to significant concentrations of credit risk consist primarily of cash and accounts receivable. Cash held at major financial institutions located in the PRC are not insured by the government. While management believes that these financial institutions are of high credit quality, it also continually monitors their credit worthiness.

Accounts receivable are typically unsecured and derived from revenue (or deferred revenue) earned from customers, thereby exposed to credit risk. Credit risk is controlled by the application of credit approvals, limits and monitoring procedures. We manage credit risk through in-house research and analysis of the Chinese economy and the underlying obligors and transaction structures. To minimize credit risk, we normally require certain prepayment from the customers prior to begin production or delivery products. We identify credit risk collectively based on industry, geography and customer type. This information is monitored regularly by management.

In measuring the credit risk of our sales to our customers, we mainly reflect the “probability of default” by the customer on its contractual obligations and considers the current financial position of the customer and the exposures to the customer and its likely future development.

Liquidity Risk

We are also exposed to liquidity risk which is risk that it is unable to provide sufficient capital resources and liquidity to meet its commitments and business needs. Liquidity risk is controlled by the application of financial position analysis and monitoring procedures. When necessary, we will turn to other financial institutions or related parties to obtain short-term funding to meet the liquidity shortage.

Inflation Risk

We are also exposed to inflation risk Inflationary factors, such as increases in raw material and overhead costs, could impair our operating results. Although we do not believe that inflation has had a material impact on our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and operating expenses as a percentage of sales revenue if the selling prices of our products do not increase with such increased costs.

Coronavirus (COVID-19) Pandemic Risk