Attached files

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 10-Q

R QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2011

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ______ to ______

Commission File Number: 000-33167

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

77-0632186

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

310 N. Indian Hill Blvd.,

#702Claremont, California

|

91711

|

|

|

(Address of principal executive

offices)

|

(Zip Code)

|

(626) 715-5855

(Registrant’s telephone number, including area code)

|

415 West Foothill Blvd, Suite 206

Claremont, California91711-2766

|

||

|

(Former address)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

|

Non-accelerated filer ¨

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Class

|

Outstanding at May13, 2011

|

|

|

Common Stock, $0.001 par

value per share

|

400,000,000 shares

|

|

|

TABLE OF CONTENTS

|

PART I.

|

FINANCIAL INFORMATION

|

2

|

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

2

|

|

ITEM 2.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

16

|

|

ITEM 3.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

20

|

|

ITEM 4.

|

CONTROLS AND PROCEDURES

|

21

|

|

PART II.

|

OTHER INFORMATION

|

23

|

|

ITEM 1.

|

LEGAL PROCEEDINGS

|

23

|

|

ITEM 1A.

|

RISK FACTORS

|

23

|

|

ITEM 2.

|

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

23

|

|

ITEM 3.

|

DEFAULTS UPON SENIOR SECURITIES

|

23

|

|

ITEM 4.

|

RESERVED

|

24

|

|

ITEM 5.

|

OTHER INFORMATION

|

24

|

|

ITEM 6.

|

EXHIBITS

|

24

|

|

SIGNATURES

|

26

|

|

1

|

PART I.

|

FINANCIAL INFORMATION

|

|

ITEM 1.

|

FINANCIAL STATEMENTS

|

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

|

March 31, 2011

|

December 31, 2010

|

|||||||

|

|

(Unaudited)

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash and cash equivalents

|

$ | 13,618 | $ | 32,816 | ||||

|

Deposits and other receivables

|

70,353 | 72,808 | ||||||

|

Current assets of discontinued operation

|

402 | 398 | ||||||

|

Total current assets

|

84,373 | 106,022 | ||||||

|

Property, plant and equipment - net

|

24,347 | 25,922 | ||||||

|

Total assets

|

$ | 108,720 | $ | 131,944 | ||||

|

LIABILITIES AND STOCKHOLDERS’ DEFICIENCY

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable

|

$ | 339,521 | $ | 319,299 | ||||

|

Advances from customers

|

13,651 | 13,514 | ||||||

|

Construction costs payable

|

270,771 | 268,060 | ||||||

|

Due to related parties - trade

|

465,194 | 422,788 | ||||||

|

Due to related parties - non-trade

|

3,042,061 | 2,898,242 | ||||||

|

Convertible notes payable

|

1,631,088 | 1,631,088 | ||||||

|

Salary payable

|

759,771 | 707,712 | ||||||

|

Taxes payable

|

187,530 | 166,255 | ||||||

|

Penalty payable

|

1,217,767 | 1,086,315 | ||||||

|

Interest payable

|

579,894 | 520,813 | ||||||

|

Other payable

|

646,290 | 625,386 | ||||||

|

Current liabilities of discontinued operation

|

109,890 | 108,790 | ||||||

|

Total current liabilities

|

9,263,428 | 8,768,262 | ||||||

|

Long-term liabilities, less current portion

|

||||||||

|

Unsecured loans payable

|

1,754,012 | 1,736,452 | ||||||

|

Total long-term liabilities

|

1,754,012 | 1,736,452 | ||||||

|

Total liabilities

|

11,017,440 | 10,504,714 | ||||||

|

Stockholders’ deficiency

|

||||||||

|

Common stock - $0.001 par value Authorized 400,000,000 shares, issued and outstanding 400,000,000 at March 31, 2011 and December 31, 2010

|

400,000 | 400,000 | ||||||

|

Preferred stock - $0.001 par value Authorized 20,000,000 shares, none issued

|

- | - | ||||||

|

Additional paid-in capital

|

8,093,337 | 8,093,337 | ||||||

|

Deficit accumulated

|

(19,147,352 | ) | (18,670,713 | ) | ||||

|

Accumulated other comprehensive deficiency

|

(254,705 | ) | (195,394 | ) | ||||

|

Total Kiwa stockholders’ deficiency

|

(10,908,720 | ) | (10,372,770 | ) | ||||

|

Total liabilities and stockholders' deficiency

|

$ | 108,720 | $ | 131,944 | ||||

SEE ACCOMPANYING NOTES

2

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE LOSS

(Unaudited)

|

Three Months Ended March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Net sales

|

$ | - | $ | 78,787 | ||||

|

Cost of sales

|

- | 47,152 | ||||||

|

Gross profit

|

- | 31,635 | ||||||

|

Operating expenses

|

||||||||

|

Consulting and professional fees

|

36,824 | 40,762 | ||||||

|

Officers’ compensation

|

35,369 | 38,254 | ||||||

|

General and administrative

|

302,686 | 296,106 | ||||||

|

Selling expenses

|

- | 2,142 | ||||||

|

Research and development

|

37,976 | 46,222 | ||||||

|

Depreciation and amortization

|

1,831 | 19,858 | ||||||

|

Total operating expenses

|

414,686 | 443,344 | ||||||

|

Operating loss

|

(414,686 | ) | (411,709 | ) | ||||

|

Interest expense

|

(61,953 | ) | (59,824 | ) | ||||

|

Net loss before income tax

|

(476,639 | ) | (471,533 | ) | ||||

|

Income tax

|

- | - | ||||||

|

Net loss after income tax

|

(476,639 | ) | (471,533 | ) | ||||

|

Net loss attributable to Kiwa stockholders

|

(476,639 | ) | (471,533 | ) | ||||

|

Other comprehensive loss

|

||||||||

|

Translation adjustment

|

(59,311 | ) | (2,053 | ) | ||||

|

Total comprehensive loss

|

$ | (535,950 | ) | $ | (473,586 | ) | ||

|

Net loss per common share - basic and diluted

|

$ | (0.001 | ) | $ | (0.001 | ) | ||

|

Weighted average number of common shares outstanding-basic and diluted

|

400,000,000 | 400,000,000 | ||||||

SEE ACCOMPANYING NOTES

3

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

Three Months Ended March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net loss

|

$ | (476,639 | ) | $ | (471,533 | ) | ||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Depreciation and amortization

|

1,831 | 28,752 | ||||||

|

Provision for penalty payable

|

131,452 | 117,583 | ||||||

|

Interest payable on convertible notes

|

59,081 | 56,708 | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Inventories

|

- | 4,873 | ||||||

|

Prepaid expenses

|

- | (2,747 | ) | |||||

|

Other current assets

|

3,177 | (1,400 | ) | |||||

|

Accounts payable

|

- | 30,742 | ||||||

|

Salary payable

|

49,636 | 46,597 | ||||||

|

Taxes payable

|

19,514 | 18,821 | ||||||

|

Due to related parties-trade

|

37,975 | (7,324 | ) | |||||

|

Other payable

|

19,408 | (132,473 | ) | |||||

|

Net cash used in operating activities

|

(154,565 | ) | (311,401 | ) | ||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of property and equipment

|

- | (30,443 | ) | |||||

|

Net cash used in investing activities

|

- | (30,443 | ) | |||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from related parties

|

149,250 | 362,882 | ||||||

|

Repayment to related parties

|

(4,815 | ) | (456 | ) | ||||

|

Repayment of long-term borrowings

|

- | (1,121 | ) | |||||

|

Net cash provided by financing activities

|

144,435 | 361,305 | ||||||

|

Effect of exchange rate change

|

(9,068 | ) | (1,324 | ) | ||||

|

Cash and cash equivalents:

|

||||||||

|

Net (decrease)/increase

|

(19,198 | ) | 18,137 | |||||

|

Balance at beginning of period

|

32,816 | 28,765 | ||||||

|

Balance at end of period

|

$ | 13,618 | $ | 46,902 | ||||

|

Supplemental Disclosures of Cash Flow Information:

|

||||||||

|

Cash paid for interest

|

$ | - | $ | - | ||||

|

Cash paid for income taxes

|

$ | - | $ | - | ||||

| Non-cash financing activities: | ||||||||

|

Interest payable on convertible notes

|

59,081 | 56,708 | ||||||

SEE ACCOMPANYING NOTES

4

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' DEFICIENCY

(Unaudited)

|

Kiwa Stockholders

|

||||||||||||||||||||||||||||

|

Common Stock

|

Additional

Paid-in

|

Accumulated

|

Other

Comprehensive

|

Non-controlling

|

||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficits

|

Deficiency

|

Interest

|

Total

|

||||||||||||||||||||||

|

Balance, December 31, 2010

|

400,000,000 | $ | 400,000 | $ | 8,093,337 | $ | (18,670,713 | ) | $ | (195,394 | ) | $ | - | $ | (10,372,770 | ) | ||||||||||||

|

Net loss attributable to Kiwa stockholders for the three months ended March 31, 2011

|

- | - | - | $ | (476,639 | ) | - | - | $ | (476,639 | ) | |||||||||||||||||

|

Foreign currency translation difference

|

- | - | - | - | $ | (59,311 | ) | - | $ | (59,311 | ) | |||||||||||||||||

|

Balance, March 31, 2011

|

400,000,000 | $ | 400,000 | $ | 8,093,337 | $ | (19,147,352 | ) | $ | (254,705 | ) | $ | - | $ | (10,908,720 | ) | ||||||||||||

SEE ACCOMPANYING NOTES

5

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

|

1.

|

Description of Business and Organization

|

References herein to “Kiwa” or the “Company” refer to Kiwa Bio-Tech Products Group Corporation and its wholly-owned and majority-owned subsidiaries unless the context specifically states or implies otherwise.

Organization–The Company is the result of a share exchange transaction accomplished on March 12, 2004 between the shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah. The share exchange resulted in a change of control of Tintic, with former Kiwa BVI stockholders owning approximately 89% of Tintic on a fully diluted basis and Kiwa BVI surviving as a wholly-owned subsidiary of Tintic. Subsequent to the share exchange transaction, Tintic changed its name to Kiwa Bio-Tech Products Group Corporation. On July 21, 2004, the Company completed its reincorporation in the State of Delaware.

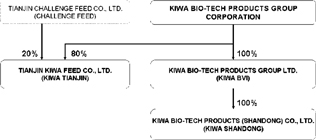

The Company has established two subsidiaries in China: (1) Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”) in 2002 and (2) Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”). The following chart summarizes the Company’s organizational and ownership structure.

Business – The Company’s business plan is to develop, manufacture, distribute and market innovative, cost-effective and environmentally safe bio-technological products for agriculture markets located primarily in China. The Company has acquired technologies to produce and market bio-fertilizer and bio-enhanced feed products, and has also been developing a veterinary drug based on AF-01 anti-viral aerosol technology.

|

2.

|

Summaries of Significant Accounting Policies

|

Principle of consolidation - These condensed consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiaries, Kiwa BVI and Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”), and also its majority-owned subsidiary, Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”). All significant inter-company balances or transactions are eliminated on consolidation.

Basis of preparation - These interim condensed consolidated financial statements are unaudited. In the opinion of management, all adjustments and disclosures necessary for a fair presentation of these interim condensed consolidated financial statements have been included. The results reported in the condensed consolidated financial statements for any interim periods are not necessarily indicative of the results that may be reported for the entire year. The (a) condensed consolidated balance sheet as of December 31, 2010, which was derived from audited financial statements, and (b) the unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made are adequate to make the information not misleading. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying footnotes of the Company for the year ended December 31, 2010.

Use of Estimates - The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant accounting estimates include the bad debt provision, impairment of inventory and long-lived assets, depreciation and amortization and fair value of warrants and options.

6

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

Country Risk - As the Company’s principal operations are conducted in China, the Company is subject to special considerations and significant risks not typically associated with companies operating in North America and Western Europe. These risks include, among others, risks associated with the political, economic and legal environments and foreign currency exchange limitations encountered in China. The Company’s results of operations may be adversely affected by changes in the political and social conditions in China, and by changes in governmental policies with respect to laws and regulations, among other things.

In addition, all of the Company’s transactions undertaken in China are denominated in China Renminbi (“RMB”), which must be converted into other currencies before remittance out of China may be made. Both the conversion of RMB into foreign currencies and the remittance of foreign currencies out of China require the approval from the Chinese government. In recent years, the Chinese government has gradually loosened its control over foreign exchange, especially with respect to current foreign exchange accounts, for instance, by removing the requirement for advance examination and approval to open a current foreign exchange account and by increasing the quota for foreign exchange accounts.

Credit Risk - The Company performs ongoing credit evaluations of its customers and intends to establish an allowance for doubtful accounts when amounts are not considered fully collectable. According to the Company’s credit policy, the Company generally provides a 100% bad debt provision for the amounts outstanding over 365 days after the deduction of the amount subsequently settled after the balance sheet date, which management believes is consistent with industry practice in China region.

Going Concern - The condensed consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the condensed consolidated financial statements do not purport to represent the realizable or settlement values.

As of March 31, 2011, the Company had cash of $13,618, current ratio of 0.01 and quick ratio of 0.001. The Company had an accumulated deficit of $19,147,352, and incurred net losses of $476,639 during the three months ended March 31, 2011. This trend is expected to continue.These factors create substantial doubt about the Company’s ability to continue as a going concern.

In addition, during the year ended December 31, 2009, Challenge Feed, the 20% minority shareholder of Kiwa Tianjin, without the Company’s prior permission, transferred titles to machinery, equipment and inventory of Kiwa Tianjin to its own creditors to settle its own debts. On December 22, 2009, Kiwa Tianjin filed a lawsuit against Challenge Feed in the local court of Wuqing District, Tianjin, where Kiwa Tianjin is domiciled, asserting that Challenge Feed unlawfully disposed of the assets held by Kiwa Tianjin.

The local court of Wuqing District has informed the Company the lawsuit against Challenge Feed will not be examined since Challenge Feed has entered into bankruptcy proceedings. Related matters will be solved during Challenge Feed’s bankruptcy proceedings.

On August 29, 2010, Kiwa Tianjin filed objections to the local court of Wuqing District and Challenge Feed’s bankruptcy administrator. According to Challenge Feed’s bankruptcy administrator, objections filed have been received but have not been examined.

As a result, Kiwa Tianjin has been unable to carry on the normal business and has classified the bio-enhanced feed business through Kiwa Tianjin as discontinued operations.

Management is in the course of sourcing additional capital and considering ways to restructure or adjust the Company’s operations and product mix so as to increase profit margins in the future. However, there is no guarantee that these actions will be successful.

The condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Foreign Currency Translation - The Company uses United States dollars (“US Dollar” or “US$” or “$”) for financial reporting purposes. However, the Company maintains the books and records in its functional currency, Chinese Renminbi (“RMB”), being the primary currency of the economic environment in which its operations are conducted. In general, the Company translates its assets and liabilities into U.S. dollars using the applicable exchange rates prevailing at the balance sheet date, and the statement of income is translated at average exchange rates during the reporting period. Equity accounts are translated at historical rates. Adjustments resulting from the translation of the Company’s financial statements are recorded as accumulated other comprehensive income.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the condensed consolidated financial statements were as follows:-

|

As of March 31, 2011

|

As of December 31, 2010

|

||

|

Balance sheet items, except for equity accounts

|

US$1=RMB6.5564

|

US$1=RMB6.6227

|

|

Three months ended March 31,

|

|||

|

2011

|

2010

|

||

|

Items in the statements of income and cash flows

|

US$1=RMB6.5832

|

US$1=RMB6.8269

|

|

7

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

Impairment of Long-Lived Assets - The Company's long-lived assets consist of property, equipment and intangible assets. The Company periodically evaluates its investment in long-lived assets, including property and equipment, for recoverability whenever events or changes in circumstances indicate the net carrying amount may not be recoverable. Judgments regarding potential impairment are based on legal factors, market conditions and operational performance indicators, among others. In assessing the impairment of property and equipment, the Company makes assumptions regarding the estimated future cash flows and other factors to determine the fair value of the respective assets. If these estimates or the related assumptions change in the future, the Company may be required to record impairment charges for these assets. Based on the Company's analysis, no further impairment on long-lived assets was charged during the three months ended March 31, 2011.

Revenue Recognition - The Company recognizes revenue for its products in accordance with Securities and Exchange Commission Staff Accounting Bulletin (“SAB”) No. 101, “Revenue Recognition in Financial Statements,” as amended by SAB No. 104, “Revenue Recognition.” Sales represent the invoiced value of goods, net of value added tax, supplied to customers, and are recognized upon delivery of goods and passage of title.

Advertising costs - The Company charges all advertising costs to expense as incurred. The total amounts of advertising costs charged to selling, general and administrative expense were nil and $307 for the three months ended March 31, 2011 and 2010, respectively.

Research and development costs - Research and development costs are charged to expense as incurred. During the three months ended March 31, 2011and 2010, research and development costs were $37,976 and $46,222, respectively.

Shipping and handling costs - Substantially all costs of shipping and handling of products to customers are included in selling, general and administrative expense. Shipping and handling costs for the three months ended March 31, 2011and 2010 were nil and $370, respectively.

Income Taxes - The Company accounts for income taxes under the provisions of FASB ASC Topic 740, “Income Tax”, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company establishes a valuation when it is more likely than not that the assets will not be recovered.

Net Loss Per Common Share - Basic loss per common share is calculated by dividing net loss by the weighted-average number of shares of common stock outstanding during the period. Diluted loss per common share includes the effect of dilutive securities (stock options, warrants, convertible debt, stock subscription and other stock commitments issuable). These potentially dilutive securities were not included in the calculation of loss per share for the periods presented because the Company incurred a loss during such periods and thus the effect would have been anti-dilutive. Accordingly, basic and diluted loss per common share is the same for all periods presented. As of March 31, 2011, potentially dilutive securities aggregated 1,093,465,171 shares of common stock.

Recent Accounting Pronouncement Adopted –In January 2011, the FASB issued ASU No. 2011-01- Receivables (Topic 310): Deferral of the Effective Date of Disclosures about Troubled Debt Restructurings in Update No. 2010-20. The amendments in this update temporarily delay the effective date of the disclosures about troubled debt restructurings in ASU No. 2010-20, Receivables (Topic 310): Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses, for public entities. The delay is intended to allow the FASB time to complete its deliberations on what constitutes a troubled debt restructuring. The effective date of the new disclosures about troubled debt restructurings for public entities and the guidance for determining what constitutes a troubled debt restructuring will then be coordinated. This deferral will have no material impact on the Company’s consolidated financial statements.

In January 2011, the FASB issued ASU No. 2011-02- Receivables (Topic 310): A Creditor’s Determination of Whether a Restructuring Is a Troubled Debt Restructuring. The amendments in this update provide additional guidance to assist creditors in determining whether a restructuring of a receivable meets the criteria to be considered a troubled debt restructuring. For public companies, the new guidance is effective for interim and annual periods beginning on or after June 15, 2011, and applies retrospectively to restructurings occurring on or after the beginning of the fiscal year of adoption. Early application is permitted. The adoption of the provisions in ASU 2011-02 will have no material impact on the Company’s consolidated financial statements.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

|

3.

|

Property, Plant and Equipment

|

The total gross amount of property, plant and equipment was $2,094,491 and $2,073,521 as of March 31, 2011 and December 31, 2010, respectively. The following table presents the property, plant and equipment as of March 31, 2011 and December 31, 2010.

|

March 31, 2011

|

December 31, 2010

|

|||||||

|

Property, Plant and Equipment

|

||||||||

|

Buildings

|

$ | 1,294,671 | $ | 1,281,711 | ||||

|

Machinery and equipment

|

589,200 | 583,304 | ||||||

|

Automobiles

|

84,845 | 83,994 | ||||||

|

Office equipment

|

103,711 | 102,670 | ||||||

|

Computer software

|

22,064 | 21,842 | ||||||

|

Property, plant and equipment - total

|

2,094,491 | 2,073,521 | ||||||

|

Less: accumulated depreciation

|

(732,995 | ) | (723,836 | ) | ||||

|

Less: impairment on long-lived assets

|

(1,337,149 | ) | (1,323,763 | ) | ||||

|

Property, plant and equipment - net

|

$ | 24,347 | $ | 25,922 | ||||

The building is on a piece of land the use right of which was granted to Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”) by local government free for 10 years from May 26, 2002. Then for another 20 years on a fee calculated according to Kiwa Shandong’s net profit.Since Kiwa Shandong did not generate any net profit, no fee is payable.The Company is in negotiation with Zoucheng Municipal Government to renew the agreement. However, there is no assurance that the Company will successfully renew the agreement with Zoucheng Municipal Government. In the future, the Company may consider moving the primary location of Kiwa Shandong’s operation to other locations in China.

8

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

No impairment on long-lived assets was charged to expense during three months ended March 31, 2011 and 2010, respectively.

Depreciation expenses for the three months ended March 31, 2011 and 2010 were $1,831 and $19,858, respectively. All of our property, plant and equipment have been held as collateral to secure the 6% Notes (See Note 8 below).

|

4.

|

Advances from Customers

|

The balances of advances from customers as of March 31, 2011 and December 31, 2010 were $13,651 and $13,514, respectively, representing payments by customers prior to delivery of goods.

|

5.

|

Construction Costs Payable

|

Construction costs payable represents remaining amounts to be paid for the first phase of construction of the Company’s bio-fertilizer facility in Shandong.As of March 31, 2011 and December 31, 2010, construction costs payable was $270,771 and $268,060, respectively.

|

6.

|

Related Party Transactions

|

Amounts due to related parties consisted of the following as of March 31, 2011 and December 31, 2010:

|

Item

|

Nature

|

Notes

|

Balances

|

||||||||||

|

March 31, 2011

|

December 31, 2010

|

||||||||||||

|

Mr. Wei Li ("Mr. Li")

|

Non-trade

|

(1) | $ | 2,842,040 | $ | 2,710,605 | |||||||

|

Kangtai International Logistics (Beijing) Co., Ltd. ("Kangtai")

|

Non-trade

|

(2) | (47,479 | ) | (46,863 | ) | |||||||

|

Ms. Yvonne Wang ("Ms. Wang")

|

Non-trade

|

(3) | 247,500 | 234,500 | |||||||||

|

Subtotal

|

3,042,061 | 2,898,242 | |||||||||||

|

Kiwa-CAU R&D Center

|

Trade

|

(4) | 465,194 | 422,788 | |||||||||

|

Subtotal

|

465,194 | 422,788 | |||||||||||

|

Total

|

$ | 3,507,255 | $ | 3,321,030 | |||||||||

(1) Mr. Li

Mr. Li is the Chairman of the Board and the Chief Executive Officer of the Company.

Advances and Loans

As of December 31, 2010, the remaining balance due Mr. Li was $2,710,605. During the three months ended March 31, 2011, Mr. Li advanced $136,250 to the Company and was repaid $4,815. As of March 31, 2011, the balance due Mr. Li was $2,842,040. Mr. Li has agreed that the Company may repay the balance when its cash flow circumstance allows.

Motor Vehicle Lease

In December 2004, the Company entered into an agreement with Mr. Li, pursuant to which Mr. Li leases to the Company a motor vehicle. The monthly rental payment is RMB15,000 (approximately $2,288). The Company has extended this lease agreement with Mr. Li to the end of fiscal 2011.

Guarantees for the Company

Mr. Li has pledged without any compensation from the Company, all of his common stock of the Company as collateral security for the Company’s obligations under the 6% Notes. (See Note 8 below).

9

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

(2) Kangtai

Kangtai, formerly named China Star Investment Management Co., Ltd., is a private company, 28% owned by Mr. Li. Mr. Li is the Chairman of Kangtai.

On December 31, 2010, the amount due fromKangtai was $46,863. The balance due from Kangtai on March 31, 2011 was $47,479.

(3) Ms. Wang

Ms. Wang is the Secretary of the Company.

On December 31, 2010, the amount due Ms. Wang was $234,500. During the three months ended March 31, 2011, Ms. Wang advanced $13,000 to the Company. As of March 31, 2011, the amount due Ms. Wang was $247,500. Ms. Wang has agreed that the Company may repay the balance when its cash flow circumstance allows.

(4) Kiwa-CAU R&D Center

Pursuant to the agreement with China Agricultural University (“CAU”), the Company agree to invest RMB 1 million (approximately $152,523) each year to fund research at Kiwa-CAU R&D Center. Prof. Qi Wang, one of the Company’s directors, is also the director of Kiwa-CAU R&D Center.

On December 31, 2010, the amount due to Kiwa-CAU R&D Center was $422,788. During the three months ended March 31, 2011, the Company did not pay Kiwa-CAU R&D Center. As of March 31, 2011, the outstanding balance due Kiwa-CAU R&D Center was $465,194.

|

7.

|

Unsecured Loans Payable

|

The balance of unsecured loans payable was $1,754,012 and $1,736,452 as of March 31, 2011 and December 31, 2010, respectively. The difference of $17,560 was due to the different exchange rates prevailing at the two dates. Unsecured loans payable consisted of the following at March 31, 2011 and December 31, 2010:

|

Item

|

March 31, 2011

|

December 31, 2010

|

||||||

|

Unsecured loan payable to Zoucheng Municipal Government, non-interest bearing, becoming due within three years from Kiwa Shandong’s first profitable year on a formula basis, interest has not been imputed due to the undeterminable repayment date

|

$ | 1,372,705 | $ | 1,358,962 | ||||

|

Unsecured loan payable to Zoucheng Science & Technology Bureau, non-interest bearing, it is due in Kiwa Shandong’s first profitable year, interest has not been imputed due to the undeterminable repayment date

|

381,307 | 377,490 | ||||||

|

Total

|

$ | 1,754,012 | $ | 1,736,452 | ||||

The Company qualifies for non-interest bearing loans under a Chinese government sponsored program to encourage economic development in certain industries and locations in China. To qualify for the favorable loan terms, a company must meet the following criteria: (1) be a technology company with innovative technology or product (as determined by the Science Bureau of the central Chinese government); (2) operate in specific industries that the Chinese government has determined are important to encourage development, such as agriculture, environmental, education, and others; and (3) be located in an undeveloped area such as Zoucheng, Shandong Province, where the manufacturing facility of the Company is located.

According to a project agreement, Zoucheng Municipal Government granted the Company use of at least 15.7 acres in Shandong Province, China at no cost for 10 years to construct a manufacturing facility. Under the agreement, the Company has the option to pay a fee of RMB480,000 ($73,211) per acre for the land use right after the 10-year period. The Company may not transfer or pledge the temporary land use right. The Company is in negotiation with Zoucheng Municipal Government to renew the agreement. However, there is no assurance that the Company will successfully renew the agreement with Zoucheng Municipal Government. As of March 31, 2011, the Company had not renewed the agreement. In the future, the Company may consider moving the primary location of Kiwa Shandong’s operation to other locations in China. The Company also committed to invest approximately $18 million to $24 million for developing the manufacturing and research facilities in Zoucheng, Shandong Province. As of March 31, 2011, the Company invested approximately $1.91 million for the property, plant and equipment of the project.

10

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

|

8.

|

Convertible Notes Payable

|

On June 29, 2006, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with six institutional investors (collectively, the “Purchasers”) for the issuance and sale of (1) 6% secured convertible notes, due three years from the date of issuance, in the aggregate principal amount of $2,450,000 (the “6% Notes”), convertible into shares of the Company’s common stock, and (2) warrants (the “Warrants”) to purchase 12,250,000 shares of the Company’s common stock.

In conjunction with the sale and issuance of the 6% Notes, the Company entered into a Registration Rights Agreement, amended in October 2006, the requirements of which the Company met by filing its registration statement on Form SB-2 on August 11, 2006 and subsequently amended on October 20, 2006 and June 29, 2007.

Closings for the sale of the 6% Notes occurred on June 29, August 15 and October 31, 2006 for $857,500, $735,000 and $857,500 principal amount, respectively. The Company received $2,450,000 in aggregate from the three sales of the 6% Notes.

The conversion price of the 6% Notes is based on a 40% discount to the average of the trading price of the Company’s common stock on the OTC Bulletin Board over a 20-day trading period. The conversion price is also adjusted for certain subsequent issuances of equity securities of the Company at prices below the conversion price then in effect. The 6% Notes contain a volume limitation that prohibits the holder from further converting the 6% Notes if doing so would cause the holder and its affiliates to hold more than 4.99% of the Company’s outstanding common stock. In addition, each holder of the 6% Notes agrees that they may not convert more than their pro-rata share (based on original principal amount) of the greater of $120,000 principal amount of the 6% Notes per calendar month or the average daily dollar volume calculated during the 10 business days prior to a conversion, per conversion. This conversion limit has since been eliminated pursuant to an agreement by the Company and the Purchasers (see discussion below).

The exercise price of the Warrants is $0.45 per share, subject to anti-dilution adjustments pursuant to a broad-based weighted average formula for subsequent issues of equity securities by the Company below the trading price of the shares. The Purchase Agreement requires the Company to maintain a reserve of authorized common stock equal to 110% of the number of shares issuable upon full conversion of the 6% Notes and exercise of the Warrants. The Purchase Agreement imposes financial penalties in cash (equal to 2% of the number of shares that the Purchaser is entitled to multiplied by the market price for each day) if the authorized number of shares of common stock is insufficient to satisfy the reserve requirements. The 6% Notes and the Warrants also impose financial penalties on the Company if it fails to timely deliver common stock upon conversion of the 6% Notes and exercise of the Warrants, respectively.

To enable reservation of a sufficient amount of authorized shares that may be issued pursuant to conversion of the 6% Notes and exercise of the Warrants, the Purchase Agreement required the Company to amend its Certificate of Incorporation to increase the number of authorized shares of common stock. At the annual meeting for 2006, which was held on September 12, 2006, a proposal to amend our Certificate of Incorporation to increase the number of authorized shares of common stock, from 100,000,000 shares to 200,000,000 shares was approved by the required vote of our stockholders. At the annual meeting held for 2008 on December 30, 2008 we further amended our Certificate of Incorporation by increasing the number of authorized shares of common stock from 200,000,000 to 400,000,000. At our annual meeting for 2009, which was held on December 28, 2009, the proposal of further amend the Certificate of Incorporation to increase the number of authorized shares from 400,000,000 to 800,000,000 was not approved by stockholders.At our annual meeting for 2010, which was held on December 15, 2010, the proposal of further amend the Certificate of Incorporation to increase the number of authorized shares from 400,000,000 to 800,000,000 was not approved by stockholders.

The Company incurs a financial penalty in cash or shares at the option of the Company (equal to 2% of the outstanding amount of the Notes per month plus accrued and unpaid interest on the Notes, prorated for partial months) if it breaches this or other affirmative covenants in the Purchase Agreement, including a covenant to maintain a sufficient number of authorized shares under its Certificate of Incorporation to cover at least 110% of the stock issuable upon full conversion of the Notes and the Warrants. Pursuant to the relevant provisions for liquidated damages in the Purchase Agreement, as of March 31, 2011 and December 31, 2010, the Company has accrued a penalty of $1,217,767 and $1,086,315 respectively, of which $131,452 and $117,583 was included in general and administrative expenses for the three months ended March 31, 2011 and 2010, respectively.

11

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

The 6% Notes require the Company to procure the Purchaser’s consent prior to taking certain actions including the payment of dividends, repurchasing stock, incurring debt, guaranteeing obligations, merging or restructuring the Company, or selling significant assets.

The Company’s obligations under the 6% Notes and the Warrants are secured by a first priority security interest in the Company’s intellectual property pursuant to an Intellectual Property Security Agreement with the Purchasers, and by a first priority security interest in all of the Company’s other assets pursuant to a Security Agreement with the Purchasers. In addition, the Company’s Chief Executive Officer has pledged all of his common stock of the Company as collateral for the Company’s obligations under the 6% Notes and the Warrants. The Purchasers are accredited investors as defined under the Securities Act and the 6% Notes and the Warrants and the underlying common stock upon conversion and exercise will be issued without registration under the Securities Act in reliance on the exemption provided by Rule 506 under Regulation D under the Securities Act. The intellectual property pledged had a cost of $592,901 which carrying value of $179,897 was fully impaired during the year ended December 31, 2009.

The fair value of the Warrants underlying the three sales of the 6% Notes (amounting to 4,287,500 shares, 3,675,000 shares and 4,287,500 shares respectively) at the time of their issuance was determined to be $545,477, $416,976 and $505,503 calculated pursuant to the Black-Scholes option pricing model. The fair value was recorded as a reduction to the 6% Notes payable and was charged to operations as interest expense in accordance with effective interest method within the period of the 6% Notes.

The Purchasers of the 6% Notes and Warrants were introduced to the Company by an investment bank pursuant to an engagement letter agreement with the Company. Pursuant to the engagement letter, the investment bank received a cash fee equal to 8% of the aggregate proceeds raised in the financing and to warrants in the quantity equal to 8% of the securities issued in the financing. The Company recorded the cash fee and other direct costs incurred for the issuance of the convertible loan in aggregate of $30,000 as deferred debt issuance costs. Debt issuance costs were amortized on the straight-line method over the term of the 6% Notes, with the amounts amortized being recognized as interest expense. As of June 30, 2009 the debt issuance costs were fully amortized.

The warrants issued to the investment bank in connection with each tranche of the 6% Notes (amounting to 343,000 shares, 294,000 shares and 343,000 shares) are exercisable for three years and have an exercise price equal to $0.2598. The fair value of these warrants at the time of their issuance was determined to be $94,005, $60,324 and $77,214 calculated pursuant to the Black-Scholes option pricing model. As of June 29, 2009, warrants issued to the investment bank had expired.

On January 31, 2008, the Company entered into three Callable Secured Convertible Notes Agreements (“2% Notes”) with four of the Company’s 6% Notes purchasers converting their unpaid interest of $112,917 in total, into principal with an interest rate of 2% per annum, which fell due on January 31, 2011. Other terms of the 2% Notes are similar to the 6% Notes. No principal of the 2% Notes has been converted so far. The outstanding principal balance on the 2% Notes was $112,917 as of March 31, 2011.

On September 25 and October 7, 2008, the Company entered into an agreement with the Purchasers to redeem all of the 6% Notes and the 2% Notes. Under the redemption agreement, the Purchasers agreed to waive their participation right with respect to any new financing that closes before October 31, 2008, and suspend conversions of principal and interest under the 6% Notes and the 2% Notes from September 25 to October 31, 2008. The Company agreed to redeem the notes for a specified price if a new financing was completed before October 31, 2008. Under the redemption agreement, if the Company failed to redeem the notes by October 31, 2008, the 6% Notes and the 2% Notes would be automatically amended to remove limitations on the Purchasers’ right to convert under the 6% Notes and the 2% Notes no more than (1) $120,000 per calendar month; and (2) the average daily dollar volume calculated during the ten (10) business days prior to a conversion, per conversion.

On October 27, 2008, the Company had informed the Purchasers that the Company would not be able to redeem the 6% Notes and the 2% Notes due to failure to close an anticipated new financing. Therefore, the amendment to the 6% Notes and the 2% Notes took effect and the Purchasers resumed conversion.

On June 3, 2009, the Company received a Notice of Default from four of the holders of the Company’s 6% Notes for failure to timely file a registration statement or effect registration. However, the Company believes that such claim is invalid and has not made any provision for liquidated damages in this regard.

On June 29, 2009, the 6% Notes were due. The Company informed the Purchasers of its inability to repay the outstanding balance on the due date. Therefore, the 6% Notes are in default and the default interest rate of 15% per annum is being charged on the 6% Notes.

During the three months ended March 31, 2011, the Purchasers converted nil principal and nil interest into shares of common stock. As of March 31, 2011, the face amount of the 6% Notes outstanding was $1,518,171.

During three months ended March 31, 2011, interest of $56,152 and $2,930 was accrued on the 6% Notes and the 2% Notes, respectively. During the same period of 2010, interest of $56,152 and $557 was accrued on the 6% Notes and the 2% Notes, respectively.

Unpaid interest of $579,894 and $520,813 was included on the balance sheet as of March 31, 2011 and December 31, 2010, respectively.

On January 31, 2011, the 2% Notes were also due. The Company informed the Purchasers of its inability to repay the outstanding balance on the due date. Therefore, the 2% Notes are in default and the default interest rate of 15% per annum is being charged on the 2% Notes.

12

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

|

9.

|

Equity-Based Transactions

|

As of March 31, 2011 and December 31, 2010, the Company had 400,000,000 shares of common stock outstanding, respectively. From January 1, 2011 to March 31, 2011, the Company has not engaged in equity-based transactions.

|

10.

|

Stock-based Compensation

|

On December 12, 2006, the Company granted options for 2,000,000 shares of its common stock under its 2004 Stock Incentive Plan. Summary of options issued and outstanding at March 31, 2011 and the movements during the three months then ended are as follows:

|

Number of

Underlying

Shares

|

Weighted-

Average

Exercise Price

Per Share

|

Aggregate

Intrinsic

Value (1)

|

Weighted- Average

Contractual Life

Remaining in Years

|

|||||||||||||

|

Outstanding at December 31, 2010

|

1,232,600 | $ | 0.175 | $ | - | 6 | ||||||||||

|

Exercised

|

- | - | ||||||||||||||

|

Expired

|

- | - | - | |||||||||||||

|

Forfeited

|

- | - | - | |||||||||||||

|

Outstanding at March 31, 2011

|

1,232,600 | $ | 0.175 | $ | - | 5.75 | ||||||||||

|

Exercisable at March 31, 2011

|

1,232,600 | $ | 0.175 | $ | - | 5.75 | ||||||||||

|

(1)

|

The market value of the Company’s common stock at December 31, 2010 was $0.004 per share. The outstanding options had no intrinsic value at December 31, 2010.

|

|||||||||||||

|

11.

|

Segment Reporting

|

The Company’s principal business is the development, manufacture and sale of bio-fertilizers. The Company used to engage in the bio-enhanced feed business and chemical fertilizer trade business. At the end of fiscal 2009, the Company classified its bio-enhanced feed business as a discontinued operation. Management believes that the following table highlights relevant information considered by the Company’s chief decision makers for measuring business performances and financing needs and preparing the corporate budget and other items. As most of the Company’s customers are located in China, no geographical segment information is presented.

|

|

Bio-fertilizer

|

Bio-enhanced Feed

(Discontinued)

|

Corporate (1)

|

Total

|

||||||||||||

|

Three Months Ended March 31, 2011

|

||||||||||||||||

|

Net sales

|

$ | - | $ | - | $ | - | $ | - | ||||||||

|

Gross profit

|

- | - | - | - | ||||||||||||

|

Operating expenses

|

14,880 | - | 399,806 | 414,686 | ||||||||||||

|

Operating loss

|

(14,880 | ) | - | (399,806 | ) | (414,686 | ) | |||||||||

|

Interest expense

|

- | - | (61,953 | ) | (61,953 | ) | ||||||||||

|

Net loss attributable to Kiwa stockholders

|

$ | (14,880 | ) | $ | - | $ | (461,759 | ) | $ | (476,639 | ) | |||||

|

Total assets as of March 31, 2011

|

$ | 1,473 | $ | 402 | $ | 106,845 | $ | 108,720 | ||||||||

|

|

Bio-fertilizer

|

Bio-enhanced Feed

(Discontinued)

|

Corporate (1)

|

Total

|

||||||||||||

|

Three Months Ended March 31, 2010

|

||||||||||||||||

|

Net sales

|

$ | 78,787 | $ | - | $ | - | $ | 78,787 | ||||||||

|

Gross profit

|

31,635 | - | - | 31,635 | ||||||||||||

|

Operating expenses

|

57,465 | - | 385,879 | 443,344 | ||||||||||||

|

Operating loss

|

(25,830 | ) | - | (385,879 | ) | (411,709 | ) | |||||||||

|

Interest expense

|

(8 | ) | - | (59,816 | ) | (59,824 | ) | |||||||||

|

Net loss attributable to Kiwa stockholders

|

$ | (25,838 | ) | $ | - | $ | (445,695 | ) | $ | (471,533 | ) | |||||

|

Total assets as of March 31, 2010

|

$ | 216,461 | $ | 385 | $ | 197,354 | $ | 414,200 | ||||||||

(1) The Beijing Representative Office of Kiwa Shandong fulfills part of corporate managerial function. Most of its expenses relating to this function were categorized into the corporate segment.

13

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

|

12.

|

Commitments and Contingencies

|

The Company has the following material contractual obligations:

|

(1)

|

Operating lease commitments

|

The Company leased an office in Beijing on July 15, 2007. The operating lease agreement will expire at January 14, 2012. The monthly rental payment for the office is RMB 80,324 (approximately $12,251). Rent expense under the operating leases for the three months ended March 31, 2011 and 2010 was $41,987 and $57,449 respectively.

The Company’s commitments for minimum lease payments under the operating lease for the next five years and thereafter as of March 31, 2011 are as follows:

|

Fiscal Year

|

Amount

|

|||

|

Remainder of fiscal 2011

|

$ | 110,259 | ||

|

2012

|

6,126 | |||

|

2013

|

- | |||

|

2014

|

- | |||

|

2015

|

- | |||

|

Thereafter

|

- | |||

|

Total

|

$ | 116,385 | ||

|

(2)

|

Technology acquisition

|

On May 8, 2006 the Company entered into a Technology Transfer Agreement with Jinan Kelongboao Bio-Tech Co. Ltd. (“JKB”). Pursuant to the agreement, JKB agreed to transfer its AF-01 Anti-viral Aerosol technology for veterinary medicines to the Company. Pursuant to the agreement the Company will pay JKB a transfer fee of RMB10 million (approximately $1.53million), of which RMB6 million is to be paid in cash and RMB4 million is to be paid in stock. The cash portion is to be paid in installments, the first installment RMB3 million was set for May 23, 2006 initially, of which RMB1 million has been paid and both parties have agreed to extend the remaining RMB2 million to the date when the application for new veterinary drug certificate is accepted. Three other installments of RMB1 million are due upon the achievement of certain milestones, the last milestone being the issuance by the PRC Ministry of Agriculture of a new medicine certificate in respect of the technology. The RMB4 million stock payment will be due 90 days after the AF-01 technology is approved by the appropriate PRC department for use as a livestock disinfector for preventing bird flu. The agreement will become effective when the first installment has been fully paid.

As of March 31, 2011, the Company had paid one-third of the first installment, or RMB1,000,000 (or $150,996) to JKB. Since the Company did not make full payment for the first installment, the deposit paid had been charged to expenses in 2009.

The Company is still pursuing to acquire AF-01 technology and develop veterinary drug products based on this technology. There have been no changes to the terms of the Technology Transfer Agreement.

|

(3)

|

Operation of Kiwa-CAUR&DCenter

|

Pursuant to the agreement on joint incorporation of the research and development center between CAU and Kiwa Shandong dated November 14, 2006, Kiwa Shandong agrees to invest RMB1 million (approximately $152,523) each year to fund research at the R&D Center. The term of this Agreement is ten years starting from July 1, 2006.Qi Wang, one of our directors commencing in July 2007 has acted as Director of Kiwa-CAU R&D Center since July 2006.

|

(4)

|

Investment in manufacturing and research facilities in Zoucheng, Shandong Province in China

|

According to the Project Agreement with Zoucheng Municipal Government in 2002, the Company has committed to investing approximately $18 million to $24 million for developing the manufacturing and research facilities in Zoucheng, Shandong Province. As of March 31, 2011, the Company had invested approximately $1.91 million for the project.

|

(5)

|

PRC employee costs

|

According to the prevailing laws and regulations of the PRC, the Company’s subsidiaries in the PRC are required to cover its employees with medical, retirement and unemployment insurance programs. Management believes that due to the transient nature of its employees, they do not need to provide all employees with such social insurances, and have not paid the social insurances for all employees.

In the event that any current or former employee files a complaint with the PRC government, the Company's subsidiaries may be subject to making up the social insurances as well as administrative fines. As the Company believes that these fines would not be material, no provision has been made in this regard.

|

(6)

|

Convertible notes liquidated damages

|

On June 3, 2009, the Company has received Notice of Default from four of 6% Notes purchasers for reason of the Company’s failure to timely file registration or effect registration. However, the Company believes that such Notes Purchasers’ claim is not valid and has not made any provision for liquidated damages in this regard.

14

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS

(UNAUDITED)

|

13.

|

Discontinued Operation

|

In accordance with the provisions of ASC topic 360, “Accounting for the Impairment or Disposal of Long-Lived Assets,” the disposal of the Company’s bio-enhanced feed business segment is presented as assets and liabilities of a discontinued operation.

The following table summarizes the assets and liabilities of the discontinued operation, excluding intercompany balances eliminated in consolidation, at March 31, 2011 and December 31, 2010, respectively:

|

March 31,

2011

|

December 31,

2010

|

|||||||

|

Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 402 | $ | 398 | ||||

|

Total assets

|

$ | 402 | $ | 398 | ||||

|

Liabilities

|

||||||||

|

Due to related parties-trade

|

$ | 33,357 | $ | 33,023 | ||||

|

Salary payable

|

76,533 | 75,767 | ||||||

|

Total liabilities

|

$ | 109,890 | $ | 108,790 | ||||

The Company's operation of bio-enhanced teed business had no sales and expense transactions since the quarter ended March 31, 2010.

|

14.

|

Income Tax

|

No provision for taxes is made as the Company and its subsidiaries do not have any taxable income in the U.S., the British Virgin Islands or the PRC.

The Company had deferred tax assets as follows:

|

March 31,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

Net operating losses carried forward

|

$ | 5,457,004 | 5,327,606 | |||||

|

Less: Valuation allowance

|

(5,457,004 | ) | (5,327,606 | ) | ||||

|

Net deferred tax assets

|

$ | − | $ | − | ||||

The net operating losses carried forward were approximately $18,318,946 and $ 17,884,509 at March 31, 2011 and December 31, 2010, which will expire in years through 2025. Full valuation allowance has been made because it is considered more likely than not that the deferred tax assets will not be realized through sufficient future earnings of the entity to which the operating losses relate. As of March 31, 2011 and December 31, 2010, the Company did not have any other significant temporary differences and carry forwards that may result in deferred tax assets or liabilities.

15. Major Customers and Suppliers

Bio-fertilizer Products

As of March 31, 2011, we had no customers. We had a total of 10 customers as of March 31, 2010, of which our largest customer accounted for 89.2% of our net sales for the three months ended March 31, 2010.

During first quarter of 2011, we had no suppliers. Comparably, our top two suppliers accounted for 83.5% and 16.5% of our net purchases during the three months ended March 31, 2010.

15

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This Quarterly Report on Form 10-Q for the three months ended March 31, 2011 contains “forward-looking statements” within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, including statements that include the words “believes,” “expects,” “anticipates,” or similar expressions. These forward-looking statements include, among others, statements concerning our expectations regarding our working capital requirements, financing requirements, business, growth prospects, competition and results of operations, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. The forward-looking statements in this Quarterly Report on Form 10-Q for the three months ended March 31, 2011 involve known and unknown risks, uncertainties and other factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by the forward-looking statements contained herein.

Overview

The Company took its present corporate form in March 2004 when shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, entered into a share exchange transaction. The share exchange transaction left the shareholders of Kiwa BVI owning a majority of Tintic and Kiwa BVI a wholly-owned subsidiary of Tintic. For accounting purposes this transaction was treated as an acquisition of Tintic by Kiwa BVI in the form of a reverse triangular merger and a recapitalization of Kiwa BVI and its wholly owned subsidiary, Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”). On July 21, 2004, we completed our reincorporation in the State of Delaware.

We have established two subsidiaries in China: (1) Kiwa Shandong in 2002, a wholly-owned subsidiary, engaging in the bio-fertilizer business, and (2) Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”) in July 2006, engaging in the bio-enhanced feed business, of which we hold 80% equity.At the end of 2009, Kiwa Tianjin could no longer use its assets including machinery and inventory in the normal course of operations. The Company has classified the bio-enhanced feed business as discontinued operations.

We generated nil and $78,787 in revenue in the three months ended March 31, 2011 and 2010, respectively.We incurred a net loss of $476,639 and $471,533 for the three months ended March 31, 2011 and 2010, respectively.

As of March 31, 2011, the Company had cash of $13,618. Due to our limited revenues from sales and continuing losses, we have relied on the proceeds from the sale of our equity securities and loans from both unrelated and related parties to provide the resources necessary to fund the development of our business plan and operations. During the three months ended March 31, 2011, related parties advanced $149,250 in total to the Company, which was partly offset by repayment to related party of $4,815. These funds are insufficient to execute our business plan as currently contemplated. Management is currently looking for alternative sources of capital to fund our operations.

Going Concern

Our condensed consolidated financial statements have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the consolidated financial statements do not purport to represent the realizable or settlement values.

As of March 31, 2011, we had an accumulated deficit of $19,147,352, of which $476,639 was incurred during the three months ended March 31, 2011. We currently do not have sufficient revenues to support our business activities and we expect operating losses to continue. We will require additional capital to fund our operations.

As of March 31, 2011, our current liabilities were $9,263,428, which exceeded current assets by $9,179,055, representing a current ratio of 0.01 and a quick ratio 0.001; comparably, on December 31, 2010, our current liabilities exceeded current assets by $8,662,240, resulting in a current ratio of 0.01 and a quick ratio of 0.004.The 6% Notes became due on June 29, 2009.The 2% Notes became due on January 31, 2011. If we can achieve the necessary financing to increase our working capital, we believe the Company will be well-positioned to further increase sales of our products and to generate more revenues in the future. There can be no assurances that we will be successful in obtaining this financing or in increasing our sales revenue if we do obtain the financing.

16

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with our financial statements for the latest eight years, which states that the financial statements raise substantial doubt as to our ability to continue as a going concern.Our ability to make operations profitable or obtain additional funding will determine our ability to continue as a going concern.

Trends and Uncertainties in Regulation and Government Policy in China

Foreign Investment Policy Change in China

On March 16, 2007, China’s parliament, the National People’s Congress, adopted the Enterprise Income Tax Law, which took effective on January 1, 2008. The new income tax law sets a unified income tax rate for domestic and foreign companies at 25% and abolishes the favorable policy for foreign invested enterprises. As a result subsidiaries established in China in the future will not enjoy the original favorable policy unless they are certified as qualified high and new technology enterprises.

According to the enterprise income tax law previously in effect, our PRC subsidiaries, Kiwa Shandong and Kiwa Tianjin, were exempt from corporate income taxes for their first two profitable years and were entitled to a 50% tax reduction for the succeeding three years. Now that the new income tax law is in effect, fiscal year 2008 is regarded as the first profitable year even if Kiwa Shandong or Kiwa Tianjin are not profitable that year; thereby narrowing the time period when the favorable tax treatment may be available to us.

Critical Accounting Policies and Estimates

We prepared our condensed consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Management periodically evaluates the estimates and judgments made. Management bases its estimates and judgments on historical experience and on various factors that are believed to be reasonable under current circumstances. Actual results may differ from these estimates as a result of different assumptions or conditions.

The following critical accounting policies affect the more significant judgments and estimates used in the preparation of our consolidated financial statements. In addition, you should refer to our accompanying financial statements and the related notes thereto, for further discussion of our accounting policies.

17

Impairment of Long-Lived Assets

Our long-lived assets consist of property, equipment and intangible assets. As of March 31, 2011, the net value of property and equipment was $24,347, which represented approximately 22.4% of our total assets.

We periodically evaluate our investment in long-lived assets, including property and equipment, for recoverability whenever events or changes in circumstances indicate the net carrying amount may not be recoverable. Our judgments regarding potential impairment are based on legal factors, market conditions and operational performance indicators, among others. In assessing the impairment of property and equipment, we make assumptions regarding the estimated future cash flows and other factors to determine the fair value of the respective assets. If these estimates or the related assumptions change in the future, we may be required to record impairment charges for these assets.

Based on our analysis, no further impairment on long-lived assets was charged during the three months ended March 31, 2011.

Revenue Recognition

We recognize revenue for our products in accordance with Securities and Exchange Commission Staff Accounting Bulletin (“SAB”) No. 101, “Revenue Recognition in Financial Statements,” as amended by SAB No. 104, “Revenue Recognition.” Sales represent the invoiced value of goods, net of value added tax, supplied to customers, and are recognized upon delivery of goods and passage of title.

Income Taxes

The Company accounts for income taxes under the provisions of FASB ASC Topic 740, “Income Tax”, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company establishes a valuation when it is more likely than not that the assets will not be recovered.

Major Customers and Suppliers

Bio-fertilizer Products

As of March 31, 2011, we had no customers. We had a total of 10 customers as of March 31, 2010, of which our largest customer accounted for 89.2%of our net sales for the three months ended March 31, 2010.

During first quarter of 2011, we had no suppliers. Comparably, our top two suppliers accounted for 83.5% and 16.5% of our net purchases during the three months ended March 31, 2010.

18

Results of Operations

Results of Operations for Three Months Ended March 31, 2011

Net Sales

Net sales were nil and $78,787 for the three months ended March 31, 2011 and 2010, respectively.The Company did not generate any sales revenue during the first quarter of 2011 mainly due to severe market conditions.

Cost of Sales

During the three months ended March 31, 2010, cost of sales was $47,152. Cost of sales were nil during the comparable period of 2011. The decrease of cost of sales was mainly due to decrease of net sales.

Gross Profit

Gross profit for the three months ended March 31, 2010 was $31,635. In comparison, gross profit for the same period in 2011 was nil.The gross profit margin for our bio-fertilizer business was 40.2% during the first quarter of 2010.

Consulting and Professional Fees

Consulting and professional fees were $36,824 and $40,762 for the three months ended March 31, 2011 and 2010, respectively, representing $3,938 or 9.7% decrease.

Officers’ Compensation

Officers’ compensation for the three months ended March 31, 2011 and 2010 was $35,369 and $38,254, respectively, representing a $2,885 or 7.5% decrease.

General and Administration

General and administration expenses for three months ended March 31, 2011 and 2010 were $302,686 and $296,106, respectively, representing a $6,580 or 2.2% increase. General and administrative expenses include salaries, travel and entertainment, rent, office expense, telephone expense and insurance costs. The penalty charge, which is calculated monthly at 2% of the outstanding amounts of convertible notes and unpaid interest on the notes, was $131,452 for three months ended March 31, 2011, increased by $13,869 compared to $117,583 of the same period of 2010.

Selling Expenses

Selling expenses for the three months ended March 31, 2010 were $2,142. In comparison, the Company incurred no selling expenses during the first quarter of 2011.

Research and Development

Research and development expense for the three months ended March 31, 2011 reflected a slight decrease of $8,246 or 17.84% from $46,222 in the same period of 2010 to $37,976.

Depreciation and Amortization

Depreciation and amortization, excluding depreciation charged to cost of production and deprecation of research equipment, decreased $18,027 or 90.8% to $1,831 for the three months ended March 31, 2011, as compared to $19,858 for the same period of 2010. The decrease was a result of more fully depreciated and impaired property and machinery items brought forward from 2010.

Interest Expenses

Net interest expense was $61,953 in the three months ended March 31, 2011 and $59,824 in the same period of 2010, representing a $2,129 or 3.6% increase. The increase in interest expenses was due to increased rate of interest on the 2% Notes from 2% per annum to 15% per annum when it became due on January 31, 2011.

19

Net Loss Attributable to Kiwa Stockholders

During the three months ended March 31, 2011, net loss attributable to Kiwa stockholders was $476,639, representing an increase of $5,106 or 1.1%, comparing with $471,533 for the same period of 2010. This increase resulted from the following factors: (1) decrease in gross profit of $31,635; (2) decrease in operating expenses of $28,658 or 6.5%; (3) increase in interest expenses of $2,129 or 3.6%.

Comprehensive Loss

Comprehensive loss increased by $62,364 or 13.2% to $535,950 for the three months ended March 31, 2011, as compared to $473,586 for the comparable period of 2010. This increase resulted from an increase in translation adjustments of $57,258 in addition to the reasons stated above.

Liquidity and Capital Resources

Since inception of our ag-biotech business in 2002, we have relied on the proceeds from the sale of our equity securities and loans from both unrelated and related parties to provide the resources necessary to fund our operations and the execution of our business plan. During the three months ended March 31, 2011, related parties advanced $149,250 in total to the Company, which was partially offset by repayment to related parties of $4,815. As of March 31, 2011, our current liabilities exceeded current assets by $9,179,055, reflecting a current ratio of 0.01:1 and a quick ratio of 0.001:1. Comparably, as of December 31, 2010, our current liabilities exceeded current assets by $8,662,240, denoting a current ratio of 0.01:1 and quick ratio of 0.004:1.