Attached files

| file | filename |

|---|---|

| EX-32.2 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex32-2.htm |

| EX-32.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex32-1.htm |

| EX-31.2 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex31-2.htm |

| EX-31.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2017

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ____________ to ____________

Commission File Number: 000-33167

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

(Exact name of registrant as specified in its charter)

| Naveda | 77-0632186 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

3200 Guasti Road, Suite #100, Ontario, California |

91761 | |

| (Address of principal executive offices) | (Zip Code) |

(909) 456-8828 (Registrant’s telephone number, including area code)

310 N. Indian Hill Blvd., #702 Claremont, California 91711 |

||

| (Former address) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

There were 9,798,981 shares of the issuer’s common stock outstanding as of May 15, 2017.

Table of contents

| 2 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| March 31, 2017 | December 31, 2016 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 140,101 | $ | 13,469 | ||||

| Accounts receivable, net | 3,772,440 | 1,122,754 | ||||||

| Prepaid expenses | 29,619 | 92,504 | ||||||

| Other receivable | 2,427,316 | 1,561,331 | ||||||

| Advance to suppliers | 139,148 | 1,805,044 | ||||||

| Total current assets | 6,508,624 | 4,595,102 | ||||||

| Property, plant and equipment - net | 50,146 | 59,778 | ||||||

| Deposit | 34,803 | 34,519 | ||||||

| Goodwill | 34,112 | 34,112 | ||||||

| Total non-current assets | 119,061 | 128,409 | ||||||

| Total assets | $ | 6,627,685 | $ | 4,723,511 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIENCY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 1,337,466 | $ | 1,318,802 | ||||

| Accrued expenses | 38,437 | 35,715 | ||||||

| Advances from customers | 12,989 | 12,883 | ||||||

| Construction costs payable | 257,642 | 255,539 | ||||||

| Due to related parties - trade | 1,328,736 | 1,283,215 | ||||||

| Due to related parties - non-trade | 73,798 | 100,798 | ||||||

| Convertible notes payable | 295,377 | 150,250 | ||||||

| Notes payable | 360,000 | 360,000 | ||||||

| Unsecured loans payable | 1,668,965 | 1,655,343 | ||||||

| Salary payable | 1,722,121 | 1,688,353 | ||||||

| Taxes payable | 1,159,702 | 919,255 | ||||||

| Penalty payable | 502,566 | 482,327 | ||||||

| Interest payable | 1,073,439 | 1,042,661 | ||||||

| Other payables | 945,222 | 1,019,583 | ||||||

| Total current liabilities | 10,776,460 | 10,324,724 | ||||||

| SHAREHOLDER’S EQUITY | ||||||||

| Preferred stock - $0.001 par value, Authorized 20,000,000 shares. Issued and outstanding 500,000 and 500,000 shares at March 31, 2017 and December 31, 2016, respectively. | 500 | 500 | ||||||

| Common stock - $0.001 per value. Authorized 100,000,000 shares. Issued and outstanding $9,798,981 and 2,000,000 shares at March 31, 2017 and December 31, 2016, respectively | 9,799 | 8,729 | ||||||

| Additional paid-in capital | 14,965,417 | 13,789,990 | ||||||

| Statutory Reserve | 193,691 | 127,884 | ||||||

| Accumulated deficit | (19,247,049 | ) | (19,489,400 | ) | ||||

| Accumulated other comprehensive loss | (71,132 | ) | (38,916 | ) | ||||

| Total stockholders’ deficiency | (4,148,775 | ) | (5,601,213 | ) | ||||

| Total liabilities and shareholder’s equity | $ | 6,627,685 | $ | 4,723,511 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 3 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| Three Months Ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Revenue | $ | 3,150,667 | $ | - | ||||

| Cost of goods sold | 2,067,680 | - | ||||||

| Gross profit | 1,082,987 | - | ||||||

| Operating expenses | ||||||||

| Research and development | 36,291 | 76,993 | ||||||

| Selling expenses | 36,286 | - | ||||||

| General and administrative | 431,570 | 86,883 | ||||||

| Total operating expenses | 504,147 | 163,876 | ||||||

| Operating income (loss) | 578,840 | (163,876 | ) | |||||

| Other income | ||||||||

| License revenue | - | 267,010 | ||||||

| Other expense | ||||||||

| Penalty expense | (20,239 | ) | (18,886 | ) | ||||

| Interest expense | (31,087 | ) | (28,118 | ) | ||||

| Total other expense | (51,326 | ) | (47,004 | ) | ||||

| Net income before income tax | 527,514 | 56,130 | ||||||

| Income tax provision | (219,356 | ) | - | |||||

| Net income | 302,715 | 56,130 | ||||||

| Other comprehensive income | ||||||||

| Foreign currency translation adjustment | 32,216 | (35,093 | ) | |||||

| Total comprehensive income | $ | 340,374 | $ | 21,037 | ||||

| Net income per common share - basic | $ | 0.03 | $ | 0.03 | ||||

| Net income per common share - diluted | 0.03 | 0.01 | ||||||

| Weighted average number of common shares outstanding - basic | $ | 9,257,970 | $ | 2,241,743 | ||||

| Weighted average number of common shares outstanding - diluted | 10,851,204 | 4,098,410 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 4 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Three Months Ended March, 31 | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 308,158 | $ | 56,130 | ||||

| Adjustments to reconcile net income to net cash used in operating activities: | ||||||||

| Depreciation | 9,466 | 1,036 | ||||||

| Provision for penalty payable | 20,239 | 18,886 | ||||||

| Accrued interest on convertible notes | 30,778 | 28,119 | ||||||

| Consulting fee | 165,891 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (2,641,137 | ) | (40,616 | ) | ||||

| Other receivables | (853,360 | ) | (185,120 | ) | ||||

| Advance to supplier | 1,681,189 | - | ||||||

| Prepaid expenses | 62,983 | - | ||||||

| Accounts payable | 7,813 | - | ||||||

| Accrued expenses | 2,443 | - | ||||||

| Salary payable | 29,303 | 42,000 | ||||||

| Taxes payable | 232,944 | 14,980 | ||||||

| Due to related parties - trade | 36,282 | 76,459 | ||||||

| Other payable | (79,676 | ) | (10,523 | ) | ||||

| Net cash provided (used) in operating activities | (986,684 | ) | 1,351 | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from related parties, net of payments to related parties | 27,000 | 38,500 | ||||||

| Proceeds from sales of common stock | 1,000,000 | - | ||||||

| Proceeds from convertible note | 145,165 | |||||||

| Net cash provided by financing activities | 1,172,165 | 38,500 | ||||||

| Effect of exchange rate change | (58,849 | ) | 2,073 | |||||

| Cash and cash equivalents: | ||||||||

| Net increase | 126,632 | 41,924 | ||||||

| Balance at beginning of period | 13,469 | 721 | ||||||

| Balance at end of period | $ | 140,101 | $ | 42,645 | ||||

| Non-cash financing activities: | ||||||||

| Issuance of common stock for debts settlement | $ | - | $ | 3,141,000 | ||||

| Issuance of common stock for consulting service | $ | 10,605 | $ | - | ||||

| Supplemental Disclosures of Cash flow Information: | ||||||||

| Cash paid for interest | $ | - | $ | - | ||||

| Cash paid for income taxes | $ | - | $ | - | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. Description of Business and Organization

Organization

Kiwa Bio-Tech Products Group Corporation (“the Company”) is the result of a share exchange transaction accomplished on March 12, 2004 between the shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah. The share exchange resulted in a change of control of Tintic, with former Kiwa BVI stockholders owning approximately 89% of Tintic on a fully diluted basis and Kiwa BVI surviving as a wholly-owned subsidiary of Tintic. Subsequent to the share exchange transaction, Tintic changed its name to Kiwa Bio-Tech Products Group Corporation. On July 21, 2004, the Company completed its reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

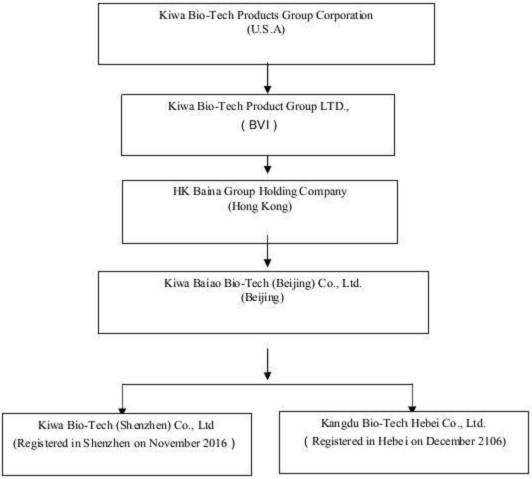

The Company operates through a series of subsidiaries in the Peoples Republic of China as detailed in the following Organizational Chart. The Company had previously operated its business through its subsidiaries Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”) and Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin “). Kiwa Tianjin has been dissolved since July, 11, 2012. On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest in Kiwa Shandong to the Transferee for USD $1.00. Currently, the completion of transfer is under the government processing.

| 6 |

Business

The Company’s business plan is to develop and market innovative, manufacture, distribute cost-effective and environmentally safe bio-technological products for agriculture markets primarily in China. The Company has acquired technologies to produce and market bio-fertilizer.

2. Summaries of Significant Accounting Policies

Principle of Consolidation

These consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiaries, Kiwa BVI, Hong Kong Baina Group Holding Company, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd, Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”). All significant inter-company balances or transactions are eliminated on consolidation.

Reverse Split

On January 14, 2016, the Company filed a Certificate of Amendment of its Certificate of Incorporation with the State of Delaware with reference to a 1-for-200 reverse stock split with respect to its Common Stock with effective date of January 28, 2016. In connection with the reverse split, the Company’s authorized capital was amended to be 120,000,000 shares, comprising 100,000,000 shares of Common Stock par value $0.001 and 20,000,000 shares of Preferred Stock par value $0.001. All relevant information relating to numbers of shares, options and per share information have been retrospectively adjusted to reflect the reverse stock split for all periods presented.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant accounting estimates include the valuation of securities issued, deferred tax assets and related valuation allowance.

Certain of our estimates, including evaluating the collectability of accounts receivable and the fair market value of long-lived assets, could be affected by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external factors could have an effect on our estimates that could cause actual results to differ from our estimates. We re-evaluate all of our accounting estimates annually based on these conditions and record adjustments when necessary.

Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less to be cash and cash equivalents. At times, such investments may be in excess of Federal Deposit Insurance Corporation (FDIC) insurance limit.

Accounts Receivables

Accounts receivables represent customer accounts receivables. The allowance for doubtful accounts is based on a combination of current sales, historical charge offs and specific accounts identified as high risk. Uncollectible accounts receivable are charged against the allowance for doubtful accounts when all reasonable efforts to collect the amounts due have been exhausted. Such allowances, if any, would be recorded in the period the impairment is identified.

Allowance for doubtful accounts

The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience and a review of the current status of trade accounts receivable. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. There was no allowance for doubtful accounts at March 31, 2017 and December 31, 2016.

| 7 |

Inventories

Inventories are stated at the lower of cost, determined on the weighted average method, and net realizable value. Work in progress and finished goods are composed of direct material, direct labor and a portion of manufacturing overhead. Net realizable value is the estimated selling price in the ordinary course of business, less estimated costs to complete and dispose.

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Gains or losses on disposals are reflected as gain or loss in the year of disposal. The cost of improvements that extend the life of property, plant and equipment are capitalized. These capitalized costs may include structural improvements, equipment and fixtures. All ordinary repair and maintenance costs are expensed as incurred. Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets as follows:

| Useful Life | ||||

| (In years) | ||||

| Buildings | 30 - 35 | |||

| Machinery and equipment | 5 - 10 | |||

| Automobiles | 8 | |||

| Office equipment | 2 - 5 | |||

| Computer software | 3 | |||

Impairment of Long-Lived Assets

The Company’s long-lived assets consist of property, equipment and intangible assets. The Company evaluates its investment in long-lived assets, including property and equipment, for recoverability whenever events or changes in circumstances indicate the net carrying amount may not be recoverable. Judgments regarding potential impairment are based on legal factors, market conditions and operational performance indicators, among others. In assessing the impairment of property and equipment, the Company makes assumptions regarding the estimated future cash flows and other factors to determine the fair value of the respective assets.

Fair value of warrants and options

The Company adopted ASC Topic 815, “Accounting for Derivative Instruments and Hedging Activities” to recognize warrants relating to loans and warrants issued to consultants as compensation as derivative instruments in our consolidated financial statements. The Company also adopted ASC Topic 718, “Share Based Payment” to recognize options granted to employees as derivative instruments in our consolidated financial statements. The Company calculates the fair value of the warrants and options using the Black-Scholes Model.

Revenue Recognition

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

The Company derives its revenues from sales contracts with its customer with revenues being generated upon delivery of products. Persuasive evidence of an arrangement is demonstrated via invoice; and the sales price to the customer is fixed upon acceptance of the purchase order and there is no separate sales rebate, discount, or volume incentive.

| 8 |

Shipping and Handling Costs

Substantially all costs of shipping and handling of products to customers are included in selling expense. Shipping and handling costs for the three months ended March 31, 2017 and 2016 were $ nil, respectively.

Income Taxes

The Company accounts for income taxes under the provisions of FASB ASC Topic 740, “Income Tax,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company establishes a valuation when it is more likely than not that the assets will not be recovered.

ASC Topic 740.10.30 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements and prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC Topic 740.10.40 provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. We have no material uncertain tax positions for any of the reporting periods presented.

Foreign Currency Translation and Other Comprehensive Income

The Company uses United States dollars (“US Dollar” or “US$” or “$”) for financial reporting purposes. However, the Company maintains the books and records in its functional currency, Chinese Renminbi (“RMB”), being the primary currency of the economic environment in which its operations are conducted. In general, the Company translates its assets and liabilities into U.S. dollars using the applicable exchange rates prevailing at the balance sheet date, and the statement of comprehensive loss and the statement of cash flow are translated at average exchange rates during the reporting period. Equity accounts are translated at historical rates. Adjustments resulting from the translation of the Company’s financial statements are recorded as accumulated other comprehensive income.

Other comprehensive income for the three months ended March 31, 2017 and 2016 represented foreign currency translation adjustments and were included in the consolidated statements of comprehensive loss.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the consolidated financial statements were as follows:

| As of March 31, 2017 | As of December 31, 2016 | |||||||

| Balance sheet items, except for equity accounts | 6.8905 | 6.9472 | ||||||

| Three months ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Items in the statements of comprehensive loss | 6.8887 | 6.5395 | ||||||

Advertising Costs

The Company charges all advertising costs to expense as incurred. The total amounts of advertising costs charged to selling, general and administrative expense were $57,374 and nil for the three months ended March 31, 2017 and 2016, respectively.

| 9 |

Research and Development Costs

Research and development costs are charged to expense as incurred. During the three months ended March 31, 2017 and 2016, research and development costs were $36,291 and $76,993, respectively.

Net Loss Per Common Share

Net income per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net income per common share is computed by dividing net income by the weighted average number of common shares outstanding during the period.

Diluted net income per common share is computed by dividing net income by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period to reflect the potential dilution that could occur from common shares issuable through contingent shares issuance arrangement, stock options or warrants.

As of March 31, 2017 and 2016, potentially dilutive securities aggregated 10,851,204 and 4,098,410 shares of common stock, respectively.

Fair Value of Financial Instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820- 10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value with U.S. GAAP, and expands disclosures about fair value measurements.

To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| ● | Level 1: quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| ● | Level 2: pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| ● | Level 3: Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amount of the Company’s financial assets and liabilities, such as cash and cash equivalent, prepaid expenses, accounts payable and accrued expenses, approximate their fair value because of the short maturity of those instruments.

| 10 |

Transactions involving related parties cannot be presumed to be carried out on an arm’s-length basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm’s-length transactions unless such representations can be substantiated.

It is not however practical to determine the fair value of advances from stockholders, if any, due to their related party nature.

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions. Pursuant to Section 850-10-20 the related parties include: a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly Influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated financial statements is not required in those statements. The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the consolidated financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Commitments and Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely

| 11 |

Stock Based Compensation

The Company accounts for employee and non-employee stock awards under ASC 718, whereby equity instruments issued to employees for services are recorded based on the fair value of the instrument issued and those issued to non-employees are recorded based on the fair value of the consideration received or the fair value of the equity instrument, whichever is more reliably measurable.

No stock based compensation was issued or outstanding as of March 31, 2017 and December 31, 2016.

Income Tax Provision

Income taxes are accounted for using the asset and liability method. Deferred income taxes are provided for temporary differences in recognizing certain income, expense and credit items for financial reporting purposes and tax reporting purposes. Such deferred income taxes primarily relate to the difference between the tax basis of assets and liabilities and their financial reporting amounts. Deferred tax assets and liabilities are measured by applying enacted statutory tax rates applicable to the future years in which deferred tax assets or liabilities are expected to be settled or realized. There were no material deferred tax assets or liabilities as of March 31, 2017 and December 31, 2016.

As of March 31, 2017 and December 31, 2016, the Company did not identify any material uncertain tax positions.

As of March 31, 2017, the Company’s returns are subject to examination by federal and state taxing authorities, generally for three years and four years, respectively, after they are filed.

Cash Flows Reporting

The Company adopted paragraph 230-10-45-24 of the FASB Accounting Standards Codification for cash flows reporting, classifies cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions of each category, and uses the indirect or reconciliation method (“Indirect method”) as defined by paragraph 230-10-45-25 of the FASB Accounting Standards Codification to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating activities by removing the effects of (a) all deferrals of past operating cash receipts and payments and all accruals of expected future operating cash receipts and payments and (b) all items that are included in net income that do not affect operating cash receipts and payments. The Company reports the reporting currency equivalent of foreign currency cash flows, using the current exchange rate at the time of the cash flows and the effect of exchange rate changes on cash held in foreign currencies is reported as a separate item in the reconciliation of beginning and ending balances of cash and cash equivalents and separately provides information about investing and financing activities not resulting in cash receipts or payments in the period pursuant to paragraph 830-230-45-1 of the FASB Accounting Standards Codification.

Subsequent Events

The Company follows the guidance in Section 855-10-50 of the FASB Accounting Standards Codification for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements were issued. Pursuant to ASU 2010-09 of the FASB Accounting Standards Codification, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR.

Recent accounting pronouncements

In January 2016, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-01, “Recognition and Measurement of Financial Assets and Financial Liabilities.” ASU 2016-01 requires equity investments to be measured at fair value with changes in fair value recognized in net income; simplifies the impairment assessment of equity investments without readily determinable fair values by requiring a qualitative assessment to identify impairment; Eliminates the requirement for public business entities to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost on the balance sheet; requires public business entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes; requires an entity to present separately in other comprehensive income the portion of the total change in the fair value of a liability resulting from a change in the instrument-specific credit risk when the entity has elected to measure the liability at fair value in accordance with the fair value option for financial instruments; requires separate presentation of financial assets and financial liabilities by measurement category and form of financial assets on the balance sheet or the accompanying notes to the financial statements and clarifies that an entity should evaluate the need for a valuation allowance on a deferred tax asset related to available-for-sale securities in combination with the entity’s other deferred tax assets. ASU 2016-01 is effective for financial statements issued for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. The Company does not expect these changes to have a material impact on the Company’s consolidated financial statements.

| 12 |

In March 2016, the FASB issued ASU 2016-09—Compensation—Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. The amendments in this guidance are relating to employee share-based compensation. Under the new guidance, we are required to recognize the tax effects of stock compensation as income tax expense or benefit in the income statement and treat the tax effects of exercised or vested awards as discrete items in the reporting period in which they occur. Excess tax benefits are required to be classified as operating activities, and shares we withhold on behalf of employees for tax purposes are required to be classified as financing activities. We may make an accounting policy election to continue to estimate the number of awards that are expected to vest or account for forfeitures when they occur. The threshold to qualify for equity classification permits withholding up to the maximum statutory tax rates. This guidance is required to be adopted in the first quarter of 2017. We are currently evaluating the impact this guidance will have on our consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15—Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (a consensus of the Emerging Issues Task Force). The amendments in this guidance on eight specific cash flow issues with regard to how cash receipts and cash payments are presented and classified in the statement of cash flows in order to clarify existing guidance and reduce diversity in practice. The guidance is required to be adopted in the first quarter of 2018 on a retrospective basis, unless it is impracticable to apply, in which case it should be applied prospectively as of the earliest date practicable. Early adoption is permitted. We are currently evaluating the impact this guidance will have on our consolidated statement of cash flows.

In January 2017, the FASB issued ASU 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business.” The amendments in this guidance are clarifying the definition of a business to assist entities when determining whether an integrated set of assets and activities meets the definition of a business. The update provides that when substantially all the fair value of the assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. The guidance is effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The adoption of this new guidance is not expected to have a material impact on our consolidated financial statements.

In January 2017, the FASB issued ASU 2017-04—Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. The amendments in this guidance to eliminate the requirement to calculate the implied fair value of goodwill to measure goodwill impairment charge (Step 2). As a result, an impairment charge will equal the amount by which a reporting unit’s carrying amount exceeds its fair value, not to exceed the amount of goodwill allocated to the reporting unit. An entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. The amendment should be applied on a prospective basis. The guidance is effective for goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for goodwill impairment tests performed after January 1, 2017. The impact of this guidance for the Company will depend on the outcomes of future goodwill impairment tests.

| 13 |

There were other updates recently issued. The Company does not believe that other than disclosed above, the recently issued, but not yet adopted, accounting pronouncements will have a material impact on its financial position, results of operations or cash flows.

Goodwill and Other Intangibles

In accordance with Accounting Standards Update (ASU) No. 2014-02, management evaluates goodwill on an annual basis in the fourth quarter of more frequently if management believes indicators of impairment exist. Such indicators could, but are not limited to (1) a significant adverse change in legal factors or in business climate, (2) unanticipated competition, or (3) an adverse action or assessment by a regulator. The Company first assesses qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, including goodwill. If management concludes that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, management conducts a two-step quantitative goodwill impairment test. The first step of the impairment test involves comparing the fair value of the applicable reporting unit with its carrying value. The Company estimates the fair value of its reporting units using a combination of the income, or discounted cash flows, approach and the market approach, with utilizes comparable companies’ data. If the carrying amount of a reporting unit exceeds the reporting unit’s fair value, management performs the second step of the goodwill impairment test. The second step of the goodwill impairment test involves comparing the implied fair value of the affected reporting unit’s goodwill with the carrying value of that goodwill. The amount, by which the carrying value of the goodwill exceeds its implied fair value, if any, is recognized as an impairment loss. The Company’s evaluation of goodwill completed during the three months ended March 31, 2017 resulted in no impairment losses.

3. Going Concern

The consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As of March 31, 2017, the Company’s current liabilities substantially exceeded its current assets by $4,267,836, had an accumulated deficit of $19,247,049, and stockholders’ deficiency of $4,148,775. These circumstances, among others, raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. The financial statements also do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classifications of liabilities that might be necessary should the Company be unable to continue as a going concern.

The management of the Company already raised additional equity for approximately $1,000,000 and convertible note for approximately $145,165 during the first quarter of 2017. The Company is generating additional revenue while seeking additional equity financing. Management is very optimistic about the Company’s continue profitability for the coming years.

4. Accounts Receivable, net

Accounts receivable consisted of the following:

| March 31, 2017 | December 31, 2016 | |||||||

| Accounts receivable | $ | 3,772,440 | $ | 1,122,754 | ||||

| Less: Allowance for doubtful debts | - | - | ||||||

| Accounts receivable, net | $ | 3,772,440 | $ | 1,122,754 | ||||

| 14 |

As of March 31, 2017 and December 31, 2016, the management has determined that no allowance for doubtful debts was necessary.

5. Other Receivable

Other receivable consisted of the following:

| March 31, 2017 | December 31, 2016 | |||||||

| Due to customer-Kangtan Gerui (Beijing) Bio-Tech Co., Ltd. | $ | 1,317,271 | $ | 1,522,434 | ||||

| Advance to employees | 56,337 | 31,700 | ||||||

| Others | 1,053,708 | 7,197 | ||||||

| $ | 2,427,316 | $ | 1,561,331 | |||||

6. Property, Plant and Equipment

Property, plant and equipment, net consisted of the following:

| March 31, 2017 | December 31, 2016 | |||||||

| Property, Plant and Equipment | ||||||||

| Buildings | $ | - | $ | - | ||||

| Machinery and equipment | - | - | ||||||

| Automobiles | - | - | ||||||

| Office equipment | 942 | 942 | ||||||

| Furniture | 8,276 | 8,276 | ||||||

| Leasehold improvement | 70,871 | 70,871 | ||||||

| Computer software | - | - | ||||||

| Property, plant and equipment - total | $ | 80,089 | $ | 80,089 | ||||

| Less: accumulated depreciation | (29,943 | ) | (20,311 | ) | ||||

| Less: impairment of long-lived assets | - | - | ||||||

| Property, plant and equipment - net | $ | 50,146 | $ | 59,778 | ||||

The building is on a piece of land the use right of which was granted to Kiwa Bio-Tech Products (Shandong) Co., Ltd. by local government free for 10 years and then for another 20 years on a fee calculated according to Kiwa Shandong’s net profit. Since Kiwa Shandong did not generate any net profit, no fee is payable.

Depreciation expense was $9,466 and $nil for the three months ended March 31, 2017 and 2016, respectively.

Impairment of long-lived assets was $nil for the three months ended March 31, 2017 and 2016, respectively.

All of our property, plant and equipment have been held as collateral to secure the 6% Notes (see Note 12).

7. Goodwill

On November 30, 2015, Kiwa Bio-tech Products Group Ltd in BVI (“Kiwa BVI”) entered an acquisition agreement with shareholders of Caber Holdings Ltd. (“Acquiree”) in Hong Kong to acquire 100 percent entity interest of the acquiree, including a wholly owned subsidiary, Oriental Baina Co., Ltd. in Beijing for US$30,000. The acquisition was completed in January, 2016. On the acquisition date, there was no any asset or liability acquired, and thus no fair value was allocated to asset and liability. Including legal fee and government fees, the total payment of approximately $34,112 ($30,000 plus legal fee and government fees totaled $4,112) was recorded as goodwill. The fair value of the goodwill is tested prior to March 31, 2017 and management determined there is no impairment to the goodwill as of March 31, 2017.

| 15 |

8. Construction Costs Payable

Construction costs payable represents outstanding balance to be settled for the first phase of construction of bio-fertilizer facility in Shandong. The balances of construction costs payable as of March 31, 2017 and December 31, 2016 were $257,642 and $255,539, respectively.

On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest, as well as all the obligations in Kiwa Shandong to the Transferee for RMB ¥1.00. Currently, the completion of transfer is under the government processing.

9. Related Party Transactions

Amounts due to related parties consisted of the following as of March 31, 2017 and December 31, 2016:

| Item | Nature | Notes | March 31, 2017 | December 31, 2016 | ||||||||||||

| Ms. Yvonne Wang (“Ms. Wang”) | Non-trade | (1 | ) | 73,798 | 100,798 | |||||||||||

| Kiwa-CAU R&D Center | Trade | (2 | ) | 1,131,993 | 1,122,754 | |||||||||||

| CAAS IARRP and IAED Institutes | Trade | (3 | ) | 196,743 | 160,461 | |||||||||||

| Total | $ | 1,402,534 | $ | 1,384,013 | ||||||||||||

(1) Ms. Wang

Ms. Wang is the Secretary of the Company until November 20, 2015. Effective as of November 20, 2015, the Company appointed Ms. Wang as the Chairman of the Board. Effective August 11, 2016, the Company’s Board of Directors has assigned Ms. Wang the additional titles of Acting President, Acting Chief Executive Officer and Acting Chief Financial Officer.

On December 14, 2015, Ms. Wang subscribed for the purchase of 250,000 shares of preferred stock for the aggregate amount of $500,000, and agrees to the concurrent cancellation of debt owed by the Company.

On March 24, 2016, the Company issued 240,000 shares of common stock to Ms. Wang to pay off the loan balance of $240,000. During the three months ended March 31, 2017, Ms. Wang paid various expenses on behalf of the Company. As of March 31, 2017, the amount due to Ms. Wang was $73,798.

(2) Kiwa-CAU R&D Center

In November 2006, Kiwa and China Agricultural University (the “CAU”) agreed to jointly establish a new research and development center, named Kiwa-CAU R&D Center. The term of the agreement was ten years commencing July 1, 2006.

Pursuant to the agreement, Kiwa agree to invest RMB 1 million (approximately $160,000) each year to fund research at Kiwa-CAU R&D Center. Prof. Qi Wang, a director of the Company, is also the director of Kiwa-CAU R&D Center. The Company recorded nil and $38,229 research and development expenses related to this R&D Center for the three months ended March 31, 2017 and 2016, respectively.

(3) CAAS IARRP and IAED Institutes

On November 5, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). The term of the Agreement was three years commencing November 20, 2015.

| 16 |

Pursuant to the agreement, Kiwa agree to invest RMB 1 million (approximately $160,000) each year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes. Prof. Yong Chang Wu, the authorized representative of IARRP, CAAS, is also one of the Company’s directors effective since November 20, 2015 until March 13, 2017. The Company recorded $36,291 and $38,764 research and development expenses related to the institutes, for the three months ended March 31, 2017 and 2016, respectively.

10. Unsecured Loans Payable

Unsecured loans payable consisted of the following:

| Item | March 31, 2017 | December 31, 2016 | ||||||

| Unsecured loan payable to Zoucheng Municipal Government, non-interest bearing, becoming due within three years from Kiwa Shandong’s first profitable year on a formula basis, interest has not been imputed due to the undeterminable repayment date | $ | 1,283,502 | $ | 1,269,880 | ||||

| Unsecured loan payable to Zoucheng Science & Technology Bureau, non-interest bearing, it is due in Kiwa Shandong’s first profitable year, interest has not been imputed due to the undeterminable repayment date | 385,463 | 385,463 | ||||||

| Total | $ | 1,668,965 | $ | 1,655,343 | ||||

The Company qualifies for non-interest bearing loans under a Chinese government sponsored program to encourage economic development in certain industries and locations in China. To qualify for the favorable loan terms, a company must meet the following criteria: (1) be a technology company with innovative technology or product (as determined by the Science Bureau of the central Chinese government); (2) operate in specific industries that the Chinese government has determined are important to encourage development, such as agriculture, environmental, education, and others; and (3) be located in an undeveloped area such as Zoucheng, Shandong Province, where the manufacturing facility of the Company is located.

According to the Company’s project agreement, Zoucheng Municipal Government granted the Company use of at least 15.7 acres in Shandong Province, China at no cost for 10 years to construct a manufacturing facility. Under the agreement, the Company has the option to pay a fee of RMB 480,000 ($77,100) per acre for the land use right after the 10-year period until May 2012. The Company may not transfer or pledge the temporary land use right. The Company also committed to invest approximately $18 million to $24 million for developing the manufacturing and research facilities in Zoucheng, Shandong Province. As of December 31, 2016, the Company has invested approximately $1.91 million for the property, plant and equipment of the project and these assets were impaired as of December 31, 2016.

On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest in Kiwa Shandong to the Transferee for USD $1.00. Currently, the completion of transfer is under the government processing.

11. Convertible Notes Payable

Convertible notes payable consists $ 150,250 of 6% secured convertible notes issued to FirsTrust Group Inc. on June 29, 2006 and $145,127 of 15% convertible note issued to Mr. Geng Liu on January 17, 2017.

6% secured convertible notes

The notes beard interest at 6% and were due on June 29, 2009. Once the note is pass due, the interest rate increased to 15% per annum. The Company accrued $5,557 and $5,619 interest expense on convertible notes for the three months ended March 31, 2017 and 2016, respectively. Interest payable to FirstTrust Group Inc. totaled $188,919 and $183,361 at March 31, 2017 and December 31, 2016, respectively.

| 17 |

The conversion price of the 6% Notes is based on a 40% discount to the average of the trading price of the Company’s common stock on the OTC Bulletin Board over a 20-day trading period. The conversion price is also adjusted for certain subsequent issuances of equity securities of the Company at prices below the conversion price then in effect. The 6% Notes contain a volume limitation that prohibits the holder from further converting the 6% Notes if doing so would cause the holder and its affiliates to hold more than 4.99% of the Company’s outstanding common stock. In addition, the holder of the 6% Notes agrees that they may not convert more than their pro-rata share (based on original principal amount) of the greater of $120,000 principal amount of the 6% Notes per calendar month or the average daily dollar volume calculated during the 10 business days prior to a conversion, per conversion. This conversion limit has since been eliminated pursuant to an agreement by the Company and the Purchasers.

The Company incurs a financial penalty in cash or shares at the option of the Company (equal to 2% of the outstanding amount of the Notes per month plus accrued and unpaid interest on the Notes, prorated for partial months) if it breaches this or other affirmative covenants in the Purchase Agreement, including a covenant to maintain a sufficient number of authorized shares under its Certificate of Incorporation to cover at least 110% of the stock issuable upon full conversion of the Notes. Pursuant to the relevant provisions for liquidated damages in the Purchase Agreement, the Company has accrued the penalty of $20,239 and $18,886 for the three months ended March 31, 2017 and 2016, respectively.

The 6% Notes require the Company to procure the Purchaser’s consent prior to taking certain actions including the payment of dividends, repurchasing stock, incurring debt, guaranteeing obligations, merging or restructuring the Company, or selling significant assets.

The Company’s obligations under the 6% Notes are secured by a first priority security interest in the Company’s intellectual property pursuant to an Intellectual Property Security Agreement with the Purchasers, and by a first priority security interest in all of the Company’s other assets pursuant to a Security Agreement with the Purchasers. In addition, Mr. Li, the Company’s former Chief Executive Officer until July 1, 2015, has pledged all of his common stock of the Company as collateral for the Company’s obligations under the 6% Notes. The intellectual property pledged had a cost of $592,901 which carrying value of $179,897 was fully impaired during the year ended December 31, 2009.

15% convertible notes

On January 17, 2017, the Company entered a Convertible Note Agreement with an individual person with principal of RMB 3 million or approximately USD 435,380. The note bears interest at 15% per annum and will be mature on January 16, 2018. Before the maturity date, the Note holder has an option to convert partial or all of the outstanding principal and accrued interest to the Company’s common shares with the conversion price of $0.99 per share. As of March 31, 2017, the Company has received partial principal totaled RMB1 million. Using weighted average method, the Company accrued $2,721 interest expense on convertible notes for the three months ended March 31, 2017.

12. Note payable

On May 29, 2007, the Company issued a $360,000 promissory note to an unrelated individual. This note bears interest at 18% per annum and due on July 27, 2007. This note is currently in default and bears interest of 25% per annum (the “Default rate”) until paid in full. This note is secured by a pledge of 6,178,336 (post-reverse split 30,892) shares of the Company’s common stock owned by Investlink (China) Limited, a British Virgin Island corporation. The Company accrued $22,500 and $22,500 interest expense on note payable for the three months ended March 31, 2017 and 2016, respectively.

13. Other payable

Other payable includes the payables to two unrelated potential investors and other liabilities. As of March 31, 2017, two potential investors have made the payments approximately $464,4004 to the Company and the investment agreements have not finalized.

| 18 |

14.Stockholders’ Deficiency

In March, 2016, the Company issued 3,140,000 shares of common stock to Mr. Li and Ms. Wang for debt and salary payable settlement for an aggregate amount of $3,141,000. In addition, the Company issued 101,947 common shares to Jimmy Zhou, former CEO in August 2016, to settle payable to him for $50,974. All of issuances of common shares for settlement of debts were based the stock price on the transaction dates.

During the year ended December 31, 2016, the Company issued 1,650,000 common shares for cash at $0.8 per share for an aggregate subscribe price equivalent to $1,320,000, of which $759,659 has received while approximately $560,341 remaining subscribe receivable at December 31, 2016.

On November 15, 2016, the Company completed another private offering of common stock to an accredited investor for 125,000 shares of its common stock and warrants to purchase 300,000 shares of Company common stock at an exercise price of $3.00 per share prior to November 15, 2021. The Company may adjust the exercise price for some or all of the warrants under certain terms and conditions. We have determined the issued warrants do not meet the definition of a derivative security, and thus allocated the net proceeds of the sale of the common stock to the par value of the common stock, with the remainder to additional paid in capital.

During the year ended December 31, 2016, the Company issued 1,711,808 common shares to four consulting companies as compensation for their consulting service received, totaled $254,250 approximately for the year ended December 31, 2016.

In February, 2017, the Company issued 1,000,000 common shares to Mr. Junwei Zheng for cash at $1.00 per share for an aggregate price to $1,000,000, all of which has been received as of March 31, 2017.

On February 15, 2017, the Company entered an consulting agreement with Mr. Yuan Wang to assist the Company in financing projects. The agreement has one year team with a total of USD85,400 that was determined as fair value at the time of execution of the agreement. The total services fee will be recognized based straight-line amortization method over the service term. On March 3, 2017, the Company issued 70,000 common shares to Mr. Yuan Wang based on market price of $1.22 per share. At March 31, 2017, the Company realized $10,675 as a compensation for Mr. Wang’s consulting service for the period of 1.5 months. The $10,675 was allocated between Common Shares for $70 and AIPC for $10,605.

15. Stock-based Compensation

On December 12, 2006, the Company granted options for 2,000,000 shares (10,000 post-reverse split shares) of its common stock under its 2004 Stock Incentive Plan. However, this stock option plan was expired on December 11, 2016, and all outstanding options were forfeited.

On March 15, 2017, the Board of Directors approved a new stock option plan with ten years’ term. As of March 31, 2017, the Company has not granted any option yet.

16. Income Tax

In accordance with the current tax laws in China, Kiwa Shandong is subject to a corporate income tax rate of 25% on its taxable income. However, Kiwa Shandong has not provided for any corporate income taxes since it had no taxable income for the three months ended March 31, 2017 and 2016.

Kiwa Baiao Co., Ltd., is also subject to a corporation income tax rate of 25% on its taxable income. For the three months ended March 31, 2017, it recorded income tax provision for RMB1,511,077 or approximately USD219,356.

No provision for taxes is made for U.S. income tax as the Company has no taxable income in the U.S. In accordance with the relevant tax laws in the British Virgin Islands, Kiwa BVI, as an International Business Company, is exempt from income taxes.

| 19 |

A reconciliation of the provision for income taxes determined at the local income tax rate to the Company’s effective income tax rate is as follows:

| Three months ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Pre-tax income (loss) | $ | 527,514 | $ | 56,130 | ||||

| U.S. federal corporate income tax rate | 34 | % | 34 | % | ||||

| Income tax computed at U.S. federal corporate income tax rate | 179,355 | 19,084 | ||||||

| Reconciling items: | ||||||||

| Rate differential for PRC earnings | (77,670 | ) | 4,898 | |||||

| Change of valuation allowance | 110,532 | 66,602 | ||||||

| Non-deductible expenses | 7,140 | (90,584 | ) | |||||

| Effective tax expense | $ | 219,356 | $ | - | ||||

The Company had deferred tax assets as follows:

| March 31, 2017 | December 31, 2016 | |||||||

| Net operating losses carried forward | $ | 3,565,236 | $ | 3,475,563 | ||||

| Less: Valuation allowance | (3,565,236 | ) | (3,475,563 | ) | ||||

| Net deferred tax assets | $ | - | $ | - | ||||

As of March 31, 2017 and December 31, 2016, the Company had approximately $3.6 million and $3.5 million net operating loss carryforwards available to reduce future taxable income. Net operating loss of the Company could be carried forward and taken against any taxable income for a period of not more than twenty years from the year of the initial loss pursuant to Section 172 of the Internal Revenue Code of 1986, as amended. The net operating loss of Kiwa Shandong could be carried forward for a period of not more than five years from the year of the initial loss pursuant to relevant PRC tax laws and regulations. It is more likely than not that the deferred tax assets cannot be utilized in the future because there will not be significant future earnings from the entity which generated the net operating loss. Therefore, the Company recorded a full valuation allowance on its deferred tax assets.

As of March 31, 2017 and December 31, 2016, the Company has no material unrecognized tax benefits which would favorably affect the effective income tax rate in future periods and does not believe that there will be any significant increases or decreases of unrecognized tax benefits within the next twelve months. No interest or penalties relating to income tax matters have been imposed on the Company during three months ended March 31, 2017 and December 31, 2016, and no provision for interest and penalties is deemed necessary as of March 31, 2017 and December 31, 2016.

According to the PRC Tax Administration and Collection Law, the statute of limitations is three years if the underpayment of taxes is due to computational errors made by the taxpayer or its withholding agent. The statute of limitations extends to five years under special circumstances, which are not clearly defined. In the case of a related party transaction, the statute of limitation is ten years. There is no statute of limitation in the case of tax evasion.

17. Commitments and Contingencies

The Company has the following material contractual obligations:

(1) Investment in manufacturing and research facilities in Zoucheng, Shandong Province in China

| 20 |

According to the Project Agreement with Zoucheng Municipal Government in 2002, we have committed to investing approximately $18 million to $24 million for developing the manufacturing and research facilities in Zoucheng, Shandong Province. As of December 31, 2016, we had invested approximately $1.91 million for the project. On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest in Kiwa Shandong to the Transferee for USD $1.00. Currently, the completion of transfer is under the government processing.

(2) Strategic cooperation with two institutes in China

On November 5, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). Pursuant to the Agreement, the Company will form a strategic partnership with the two institutes and establish an “International Cooperation Platform for Internet and Safe Agricultural Products”. To fund the cooperation platform’s R&D activities, the Company will provide RMB 1 million (approximately $160,000) per year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes. The term of the Agreement is for three years beginning November 20, 2015. Prof. Yong Chang Wu, the authorized representative of IARRP, CAAS, is also one of the Company’s directors effective since November 20, 2015 until March 13, 2017.

(3) Distribution agreement with Kangtan Gerui Bio-Tech in China

On December 17, 2015, Kiwa Bio-Tech Products Group Corporation (the “Company”) entered into a distribution agreement (the “Agreement”) with Kangtan Gerui (Beijing) Bio-Tech Co., Ltd. (“Gerui”) and formally awarded Gerui a right to sell and distribute the Company’s fertilizer products in 3 major agricultural regions of China— Hainan Province, Hunan Province and Xinjiang Autonomous Region. The Company’s Research and Development department has been conducting application experiments in Hainan and Hunan Provinces since August 2015, in accordance with the market requirements. The experiment data indicates that the Company’s fertilizer products have fulfilled the requirements of reduction of content of heavy metals in soil and improve crop yield. Gerui was founded in Beijing in April 2015 and relies on the sales network of China’s Supply and Marketing Cooperatives system. Currently, the Company and Gerui do not hold any interest in each other; however, a collaboration and integration may take place in the future. The term of the Agreement is for a period of three years commencing December 17, 2015. In September 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd obtained a fertilizer sales permit from the Chinese government and began to sale the products directly to customers in those 3 major agricultural regions.

(4) Lease payments

(1) On April 29, 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. entered an office lease agreement with two-year team. Monthly lease payment and building management fee totaled RMB 77,867 or approximately USD $11,303.

(2) On November 11, 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. entered an apartment lease agreement for its employees. The lease term is one year with monthly lease payment of RMB 6,000 or approximately USD $871.

(3) In March 15, 2017, Kiwa Bio-Tech (Shenzhen) Co., Ltd, a newly established subsidiary entered an office lease agreement with one-year term. Monthly lease payment is RMB 29,000 or approximately of USD $4,210.

The future lease payments at March 31, 2017 are summarized below.

| Beijing Office | Beijing Apartment | Shenzhen Office | Total | |||||||||||||

| 2017 | $ | 101,727 | $ | 6,384 | $ | 37,890 | $ | 146,001 | ||||||||

| 2018 | $ | 45,212 | - | $ | 10,525 | $ | 55,737 | |||||||||

| Thereafter | - | - | - | - | ||||||||||||

18. Subsequent Events

On May 9, 2017, the Company entered into a Convertible Loan Agreement with Junwei Zheng with principal of approximately US$ 4.5 million (RMB 30,000,000) with a term of 24 months and bearing interest at a rate of Fifteen Percent (15%) per annum. The Loan is convertible at any time at the option of the Lender at a conversion price of $3.50 per share. The net proceeds will be used for the further development of Kiwa products and distribution, as well as for general working capital. As of May 15, 2017, the Company has received partial principal totaled $507,946.

| 21 |

The Company has evaluated the existence of significant events subsequent to the balance sheet date through the date these financial statements were issued and has determined that, other than as stated above, there were no subsequent events or transactions which would require recognition or disclosure in the financial statements, other than noted herein.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This Quarterly Report on Form 10-Q for the three months ended March 31, 2017 contains “forward-looking statements” within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, including statements that include the words “believes,” “expects,” “anticipates,” or similar expressions. These forward-looking statements include, among others, statements concerning our expectations regarding our working capital requirements, financing requirements, business, growth prospects, competition and results of operations, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. The forward-looking statements in this Quarterly Report on Form 10-Q for the three months ended March 31, 2017 involve known and unknown risks, uncertainties and other factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by the forward-looking statements contained herein.

Overview

The Company took its present corporate form in March 2004 when shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, entered into a share exchange transaction. The share exchange transaction left the shareholders of Kiwa BVI owning a majority of Tintic and Kiwa BVI a wholly-owned subsidiary of Tintic. For accounting purposes this transaction was treated as an acquisition of Tintic by Kiwa BVI in the form of a reverse triangular merger and a recapitalization of Kiwa BVI and its wholly owned subsidiary, Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”). On July 21, 2004, we completed our reincorporation in the State of Delaware.

We have established a subsidiary in China, Kiwa Shandong in 2002, a wholly-owned subsidiary, engaging in the bio-fertilizer business. Formerly, our subsidiary Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”), was engaged in the bio-enhanced feed business. At the end of 2009, Kiwa Tianjin could no longer use its assets including machinery and inventory in the normal course of operations. The Company has classified the bio-enhanced feed business as discontinued operations. Effective on July 11, 2012, the Company formally dissolved Kiwa Tianjin and Kiwa Shandong is inactive as and is remaining inactive through March 31, 2017.

On November 30, 2015, we entered into an acquisition agreement (the “Agreement”) with the shareholders of Caber Holdings LTD, whose Chinese name is Hong Kong Baina Group Co., Ltd, located in Hong Kong (“Baina Hong Kong”), and Oriental Baina Co. Ltd. (hereinafter referred to as “Baina Beijing”), Baina Hong Kong’s wholly-owned subsidiary in Beijing, China. Kiwa will rename Baina Beijing to Kiwa Baiao Co. Ltd. Kiwa Baiao Co. Ltd will replace Kiwa’s current subsidiary in China - Kiwa Bio-Tech (Shandong) Co., Ltd (“Kiwa Shandong”) - to operate Kiwa’s bio-fertilizer market expansion and become Kiwa’s platform for future acquisitions of new agricultural-related projects in China. In accordance with the terms of the Agreement, Kiwa agreed to pay US$30,000 to the Baina Hong Kong Shareholders for the acquisition of 100% of the equity of Baina Hong Kong. The acquisition was completed on January 7, 2016. Both Baina Hong Kong and Baina Beijing had no activities before the acquisition date and had no assets and liabilities. The purpose of this acquisition was to acquire Baina Hong Kong’s corporation registration in Hong Kong and In China. The total payment of approximately $34,000 was recorded as intangible assets.

| 22 |

We started to generate revenues from selling Bio Organic fertilizers in the third quarter of 2016 and through March 31, 2017. Comparing with three months ended March 31, 2017 and 2016, there was no sales revenues in the three months ended March 31, 2016 while we recorded approximately $3.15 million revenue for the three months ended March 31, 2017. On the other hand, we generated no license revenue in the first quarter ended March 31, 2017, compared approximately $267,000 license revenues recorded in the first quarter ended March 31, 2016. We incurred a net income of $308,158 and $56,130 for the three months ended March 31, 2017 and 2016, respectively.

On December 17, 2015, the Company entered into an agreement with Kangtan Gerui (Beijing) Bio-Tech Co., Ltd. (“Gerui”), to grant Gerui to sell products with the Company’s trademark starting in the first quarter of 2016. According to the agreement, Gerui will pay 10% of total sales revenue to the Company as license fee. The Company recognized license fees when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, and no other significant obligations of the Company exist and collectability is reasonably assured. Starting the fourth quarter of 2016, no more licensing revenue would be received and recognized. The Company began using its own trademark to generate sales revenue.

As of March 31, 2017, the Company had cash of $141,101. Due to shortage of working capital, we have relied on the proceeds from advances from related parties to fund the development of our business plan and operations. Meanwhile, The Company is generating additional revenue while seeking additional equity and or debt financing. Management of the Company already raised additional equity for approximately $1,000,000 and approximately $145,127 from issuance of convertible note during the first quarter of 2017. Management is very optimistic about the Company’s continue profitability for the coming years.

Going Concern

Our consolidated financial statements have been prepared assuming that we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The carrying amounts of assets and liabilities presented in the consolidated financial statements do not purport to represent the realizable or settlement values.

As of March 31, 2017 we had an accumulated deficit of $19,247,049. We currently have negative working capital,and we require additional cash to fund our operations.

As of March 31, 2017, our current liabilities were $10,776,460 which exceeded current assets by $4,267,836, representing a current ratio of 0.60; comparably, as of December 31, 2016, we had total current assets of $4,595,102 and current liabilities of $10,324,724, denoting a current ratio of 0.445. If we can achieve the necessary financing to increase our working capital, we believe the Company will be well-positioned to generate sales of our products and to generate more revenues in the future. There can be no assurances that we will be successful in obtaining this financing or in increasing our sales revenue if we do obtain the enough financing.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with our financial statements for the latest eight years, which states that the financial statements raise substantial doubt as to our ability to continue as a going concern. Our ability to make operations profitable or obtain additional funding will determine our ability to continue as a going concern.

Trends and Uncertainties in Regulation and Government Policy in China

Foreign Investment Policy Change in China

On March 16, 2007, China’s parliament, the National People’s Congress, adopted the Enterprise Income Tax Law, which took effect on January 1, 2008. The new income tax law sets a unified income tax rate for domestic and foreign companies at 25% and abolishes the favorable policy for foreign invested enterprises. As a result subsidiaries established in China in the future will not enjoy the original favorable policy unless they are certified as qualified high and new technology enterprises.

| 23 |

Results of Operations

Results of Operations for Three Months Ended March 31, 2017 and 2016

Revenue

Revenue was $3,150,667 and nil for the three months ended March 31, 2017 and 2016, respectively. Revenue was generated from sales of products.

Cost of Revenue and Gross Profit

Cost of revenue for the three months ended March 31, 2017 was $2,067,680, reflecting an increase of 100% from the same period last year. Consequently, gross margin as a percentage of total sales is 34.37% compared with nil for the same period last year, principally due to the increase of sales of products.

Selling Expense

Selling expenses for the three months ended March 31, 2017 and 2016 were $36,286 and nil, respectively, representing a 100% increase from the same period last year. Selling expenses include salaries of sales personnel, sales commission, travel and entertainment etc.

General and Administration