Attached files

| file | filename |

|---|---|

| EX-32.2 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex32-2.htm |

| EX-32.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex32-1.htm |

| EX-31.2 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex31-2.htm |

| EX-31.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2017

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ____________ to ____________

Commission File Number: 000-33167

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 77-0632186 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

3200 Guasti Road, Suite #100, Ontario, California |

91761 | |

| (Address of principal executive offices) | (Zip Code) |

(909) 456-8828

(Registrant’s telephone number, including area code)

310 N. Indian Hill Blvd., #702 Claremont, California 91711 |

||

| (Former address) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of August 14, 2017, the Company had 10,459,217 shares of common stock, $0.001 par value, issued and outstanding.

Table of contents

| 2 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, 2017 | December 31, 2016 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 71,554 | $ | 13,469 | ||||

| Accounts receivable, net | 9,425,359 | 1,122,754 | ||||||

| Prepaid expenses | 66,769 | 92,504 | ||||||

| Other receivable | 1,471,291 | 1,561,331 | ||||||

| Rent Deposit-current | 39,301 | - | ||||||

| Advance to suppliers | 1,255,218 | 1,805,044 | ||||||

| Total current assets | 12,329,492 | 4,595,102 | ||||||

| OTHER ASSETS | ||||||||

| Property, plant and equipment, net | 43,312 | 59,778 | ||||||

| Rent Deposit-non current | 33,907 | 34,519 | ||||||

| Deposit for Long-Term Investment | 147,423 | - | ||||||

| Goodwill and Intangible Assets | 35,114 | 34,112 | ||||||

| Total non-current assets | 259,756 | 128,409 | ||||||

| Total assets | $ | 12,589,248 | $ | 4,723,511 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY(DEFICIENCY) | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 4,697,764 | $ | 1,318,802 | ||||

| Accrued expenses | 17,183 | 35,715 | ||||||

| Advances from customers | - | 12,883 | ||||||

| Construction costs payable | - | 255,539 | ||||||

| Due to related parties - trade | - | 1,122,754 | ||||||

| R&D expense payable | 233,598 | 160,461 | ||||||

| Due to related parties - non-trade | 83,798 | 100,798 | ||||||

| Convertible notes payable | 1,106,205 | 150,250 | ||||||

| Notes payable | 360,000 | 360,000 | ||||||

| Unsecured loans payable | - | 1,655,343 | ||||||

| Salary payable | 1,225,869 | 1,688,353 | ||||||

| Taxes payable | 616,908 | 919,255 | ||||||

| Penalty payable | 523,140 | 482,327 | ||||||

| Interest payable | 1,124,638 | 1,042,661 | ||||||

| Other payables | 865,793 | 1,019,583 | ||||||

| Total current liabilities | 10,854,896 | 10,324,724 | ||||||

| SHAREHOLDER’S EQUITY(DEFICIENCY) | ||||||||

| Preferred stock - $0.001 par value, Authorized 20,000,000 shares. Issued and outstanding 500,000 and 500,000 shares at June 30, 2017 and December 31, 2016, respectively. | 500 | 500 | ||||||

| Common stock - $0.001 per value. Authorized 100,000,000 shares. Issued and outstanding $10,028,219 and 8,728,981 shares at June 30, 2017 and December 31, 2016, respectively | 10,028 | 8,729 | ||||||

| Additional paid-in capital | 15,741,427 | 13,789,990 | ||||||

| Statutory Reserve | 307,350 | 127,884 | ||||||

| Accumulated deficit | (14,343,604) | (19,489,400) | ||||||

| Accumulated other comprehensive gain (loss) | 18,651 | (38,916) | ||||||

| Total stockholders’ equity (deficiency) | 1,734,352 | (5,601,213) | ||||||

| Total liabilities and shareholder’s equity | $ | 12,589,248 | $ | 4,723,511 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenue | $ | 5,682,108 | $ | - | $ | 8,827,897 | $ | - | ||||||||

| Cost of goods sold | (3,970,915 | ) | - | (6,034,924 | ) | - | ||||||||||

| Gross Profit | 1,711,193 | - | 2,792,973 | - | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling expense | 54,232 | - | 90,485 | - | ||||||||||||

| Research and development | 36,433 | 74,776 | 72,724 | 151,769 | ||||||||||||

| General and administrative | 664,019 | 138,786 | 1,095,396 | 225,670 | ||||||||||||

| Total operating expenses | 754,685 | 213,562 | 1,258,606 | 377,439 | ||||||||||||

| Operating income (loss) | 956,508 | (213,562 | ) | 1,534,367 | (377,439 | ) | ||||||||||

| Other Income | ||||||||||||||||

| License revenue | - | 443,085 | - | 710,095 | ||||||||||||

| Other expense | ||||||||||||||||

| Penalty expense | (20,575 | ) | (19,223 | ) | (40,814 | ) | (38,108 | ) | ||||||||

| Interest expense | (52,346 | ) | (28,325 | ) | (83,430 | ) | (56,443 | ) | ||||||||

| Total other expense | (72,921 | ) | (47,548 | ) | (124,244 | ) | (94,551 | ) | ||||||||

| Income from continuing operations before income taxes |

883,587 | 181,975 | 1,410,123 | 238,105 | ||||||||||||

| Income taxes | (379,973 | ) | - | (599,022 | ) | - | ||||||||||

| Income from continuing operations | 503,614 | 181,975 | 811,101 | 238,105 | ||||||||||||

| Discontinued operations | ||||||||||||||||

| Gain from discontinued operations, net of taxes | 4,513,363 | - | 4,514,161 | - | ||||||||||||

| Net Income | 5,016,977 | 181,975 | 5,325,262 | 238,105 | ||||||||||||

| Other comprehensive income | ||||||||||||||||

| Foreign currency translation adjustment | 89,910 | 129,199 | 57,567 | 94,105 | ||||||||||||

| Total comprehensive income | $ | 5,106,887 | $ | 311,174 | $ | 5,382,830 | $ | 332,210 | ||||||||

| Earnings per share – Basis: | ||||||||||||||||

| Income from continuing operations | 0.05 | 0.07 | 0.09 | 0.06 | ||||||||||||

| Discontinued operations | 0.46 | - | 0.47 | - | ||||||||||||

| Net Income | 0.51 | 0.07 | 0.56 | 0.06 | ||||||||||||

| Earnings per share – Diluted: | ||||||||||||||||

| Income from continuing operations | 0.05 | 0.05 | 0.08 | 0.04 | ||||||||||||

| Discontinued operations | 0.40 | - | 0.41 | - | ||||||||||||

| Net Income | 0.45 | 0.05 | 0.49 | 0.04 | ||||||||||||

| Weighted average number of common shares outstanding - basic | 9,865,031 | 2,617,584 | 9,564,506 | 3,766,705 | ||||||||||||

| Weighted average number of common shares outstanding - diluted | 11,360,700 | 3,550,696 | 11,033,303 | 5,623,035 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended June, 30 | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 5,325,262 | $ | 238,105 | ||||

| Adjustments to reconcile net income to net cash used in operating activities: | ||||||||

| Depreciation | 17,787 | 3,073 | ||||||

| Amortization | 58 | - | ||||||

| Provision for penalty payable | 40,813 | 38,108 | ||||||

| Accrued interest on convertible notes | 83,430 | 56,443 | ||||||

| Employee benefits | 102,743 | - | ||||||

| Consulting fee | 372,465 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (8,164,649 | ) | (54,940 | ) | ||||

| Other receivables | 126,080 | (1,210,111 | ) | |||||

| Advance to supplier | 585,523 | - | ||||||

| Rent & Utility Deposit | (37,412 | ) | - | |||||

| Prepaid expenses | 26,626 | - | ||||||

| Accounts payable | 3,302,256 | 49,999 | ||||||

| Advance from customers | (13,018 | ) | - | |||||

| Accrued expenses | (19,089 | ) | - | |||||

| Salary payable | (468,631 | ) | 78,080 | |||||

| Taxes payable | (320,211 | ) | 29,982 | |||||

| Due to related parties - trade | (1,061,367 | ) | 153,033 | |||||

| Other payable | (166,874 | ) | 469,297 | |||||

| Loan payable | (1,672,666 | ) | - | |||||

| Construction cost payable | (258,213 | ) | - | |||||

| Net cash used in operating activities | (2,199,087 | ) | (148,931 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Purchase of intangible assets | (1,047 | ) | ||||||

| Investment in subsidiary | (145,449 | ) | - | |||||

| Purchase of property plant and equipment | (1,286 | ) | (78,775 | ) | ||||

| Net cash used by investing activities | (147,782 | ) | (78,775 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from related parties, net of payments to related parties | 17,000 | 40,500 | ||||||

| Proceeds from sales of common stock | 1,481,508 | 176,000 | ||||||

| Proceeds from convertible note | 955,955 | - | ||||||

| Net cash provided by financing activities | 2,454,463 | 216,500 | ||||||

| Effect of exchange rate change | (49,509 | ) | 22,852 | |||||

| Cash and cash equivalents: | ||||||||

| Net increase | 58,085 | 11,646 | ||||||

| Balance at beginning of period | 13,469 | 721 | ||||||

| Balance at end of period | $ | 71,554 | $ | 12,367 | ||||

| Non-cash financing activities: | ||||||||

| Issuance of common stock for debts settlement | $ | - | $ | 3,141,000 | ||||

| Issuance of common stock for consulting service | $ | 179,897 | $ | - | ||||

| Supplemental Disclosures of Cash flow Information: | ||||||||

| Cash paid for interest | $ | - | $ | - | ||||

| Cash paid for income taxes | $ | 411,846 | $ | - | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 5 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. Description of Business and Organization

Organization

Kiwa Bio-Tech Products Group Corporation (“the Company”) is the result of a share exchange transaction accomplished on March 12, 2004 between the shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah. The share exchange resulted in a change of control of Tintic, with former Kiwa BVI stockholders owning approximately 89% of Tintic on a fully diluted basis and Kiwa BVI surviving as a wholly-owned subsidiary of Tintic. Subsequent to the share exchange transaction, Tintic changed its name to Kiwa Bio-Tech Products Group Corporation. On July 21, 2004, the Company completed its reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

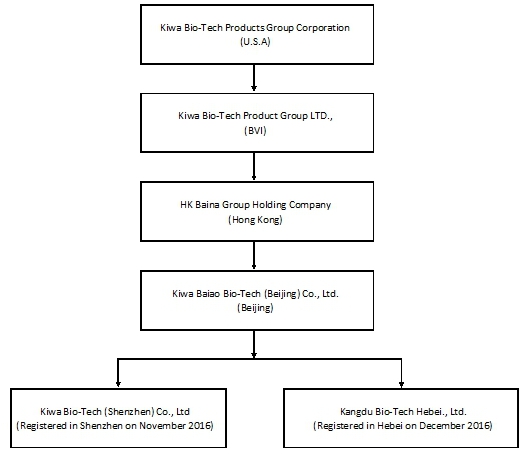

The Company operates through a series of subsidiaries in the Peoples Republic of China as detailed in the following Organizational Chart. The Company had previously operated its business through its subsidiaries Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”) and Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin “). Kiwa Tianjin has been dissolved since July 11, 2012. On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest in Kiwa Shandong to the Transferee for USD $1.00. On April 12, 2017, the government processing of transfer has been completed.

| 6 |

Business

The Company’s business plan is to develop and market innovative, manufacture, distribute cost-effective and environmentally safe bio-technological products for agriculture markets primarily in China. The Company has acquired technologies to produce and market bio-fertilizer.

2. Summaries of Significant Accounting Policies

Principle of Consolidation

These consolidated financial statements include the financial statements of the Company and its wholly-owned subsidiaries, Kiwa BVI, Hong Kong Baina Group Holding Company, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd, Kiwa Baiao Bio-Tech (Shandong) Co., Ltd (“Kiwa Shandong”), Kiwa Bio-Tech Products (Shenzhen) Co., Ltd and Kiwa Bio-Tech Products (Hebei) Co., Ltd. All significant inter-company balances or transactions are eliminated on consolidation.

Reverse Split

On January 14, 2016, the Company filed a Certificate of Amendment of its Certificate of Incorporation with the State of Delaware with reference to a 1-for-200 reverse stock split with respect to its Common Stock with effective date of January 28, 2016. In connection with the reverse split, the Company’s authorized capital was amended to be 120,000,000 shares, comprising 100,000,000 shares of Common Stock par value $0.001 and 20,000,000 shares of Preferred Stock par value $0.001. All relevant information relating to numbers of shares, options and per share information have been retrospectively adjusted to reflect the reverse stock split for all periods presented.

| 7 |

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant accounting estimates include the valuation of securities issued, deferred tax assets and related valuation allowance.

Certain of our estimates, including evaluating the collectability of accounts receivable and the fair market value of long-lived assets, could be affected by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external factors could have an effect on our estimates that could cause actual results to differ from our estimates. We re-evaluate all of our accounting estimates annually based on these conditions and record adjustments when necessary.

Cash and Cash Equivalents

Cash and cash equivalents consist of all cash balances and highly liquid investments with an original maturity of three months or less. Because of the short maturity of these investments, the carring amounts approximate their fair value. Restricted cash is excluded from cash and cash equivalents.

Accounts Receivables

Accounts receivables represent customer accounts receivables. The allowance for doubtful accounts is based on a combination of current sales, historical charge offs and specific accounts identified as high risk. Uncollectible accounts receivable are charged against the allowance for doubtful accounts when all reasonable efforts to collect the amounts due have been exhausted. Such allowances, if any, would be recorded in the period the impairment is identified.

Allowance for doubtful accounts

The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience and a review of the current status of trade accounts receivable. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. There was no allowance for doubtful accounts at June 30, 2017 and December 31, 2016.

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Gains or losses on disposals are reflected as gain or loss in the year of disposal. The cost of improvements that extend the life of property, plant and equipment are capitalized. These capitalized costs may include structural improvements, equipment and fixtures. All ordinary repair and maintenance costs are expensed as incurred. Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets as follows:

| Useful Life | ||||

| (In years) | ||||

| Buildings | 30 - 35 | |||

| Machinery and equipment | 5 - 10 | |||

| Automobiles | 8 | |||

| Office equipment | 2 - 5 | |||

| Computer software | 3 | |||

| 8 |

Impairment of Long-Lived Assets

The Company’s long-lived assets consist of property, equipment and intangible assets. The Company evaluates its investment in long-lived assets, including property and equipment, for recoverability whenever events or changes in circumstances indicate the net carrying amount may not be recoverable. Judgments regarding potential impairment are based on legal factors, market conditions and operational performance indicators, among others. In assessing the impairment of property and equipment, the Company makes assumptions regarding the estimated future cash flows and other factors to determine the fair value of the respective assets.

Goodwill and Other Intangibles

In accordance with Accounting Standards Update (ASU) No. 2014-02, management evaluates goodwill on an annual basis in the fourth quarter of more frequently if management believes indicators of impairment exist. Such indicators could, but are not limited to (1) a significant adverse change in legal factors or in business climate, (2) unanticipated competition, or (3) an adverse action or assessment by a regulator. The Company first assesses qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, including goodwill. If management concludes that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, management conducts a two-step quantitative goodwill impairment test. The first step of the impairment test involves comparing the fair value of the applicable reporting unit with its carrying value. The Company estimates the fair value of its reporting units using a combination of the income, or discounted cash flows, approach and the market approach, with utilizes comparable companies’ data. If the carrying amount of a reporting unit exceeds the reporting unit’s fair value, management performs the second step of the goodwill impairment test. The second step of the goodwill impairment test involves comparing the implied fair value of the affected reporting unit’s goodwill with the carrying value of that goodwill. The amount, by which the carrying value of the goodwill exceeds its implied fair value, if any, is recognized as an impairment loss. The Company’s evaluation of goodwill completed during the three and six months ended June 30, 2017 resulted in no impairment losses.

Fair Value of Financial Instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820- 10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value with U.S. GAAP, and expands disclosures about fair value measurements.

To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| ● | Level 1: quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| ● | Level 2: pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| ● | Level 3: Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

| 9 |

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amount of the Company’s financial assets and liabilities, such as cash and cash equivalent, prepaid expenses, accounts payable and accrued expenses, approximate their fair value because of the short maturity of those instruments.

Transactions involving related parties cannot be presumed to be carried out on an arm’s-length basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm’s-length transactions unless such representations can be substantiated.

It is not however practical to determine the fair value of advances from stockholders, if any, due to their related party nature.

Revenue Recognition

The Company applies paragraph 605-10-S99-1 of the FASB Accounting Standards Codification for revenue recognition. The Company recognizes revenue when it is realized or realizable and earned. The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

The Company derives its revenues from sales contracts with its customers with revenues being recognized upon delivery of products. Persuasive evidence of an arrangement is demonstrated via invoice; and the sales price to the customer is fixed upon acceptance of the purchase order and there is no separate sales rebate, discount, or volume incentive.

Advertising Costs

The Company charges all advertising costs to expense as incurred. The total amounts of advertising costs charged to selling, general and administrative expense were $58,419 and nil for the six months ended June 30, 2017 and 2016, and were $935 and nil for the three months ended June 30, 2017 and 2016, respectively.

Research and Development Costs

Research and development costs are charged to expense as incurred. During the six months ended June 30, 2017 and 2016, research and development costs were $72,724 and $151,769, respectively. During the three months ended June 30, 2017 and 2016, research and development costs were $36,433 and $74,776, respectively.

Shipping and Handling Costs

Substantially all costs of shipping and handling of products to customers are included in selling expense. Shipping and handling costs for the three and six months ended June 30, 2017 and 2016 were nil, respectively.

Income Taxes

The Company accounts for income taxes under the provisions of FASB ASC Topic 740, “Income Tax,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company establishes a valuation when it is more likely than not that the assets will not be recovered.

| 10 |

ASC Topic 740.10.30 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements and prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC Topic 740.10.40 provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. We have no material uncertain tax positions for any of the reporting periods presented.

Stock Based Compensation

The Company accounts for share-based compensation awards to employees in accordance with FASB ASC Topic 718, “Compensation – Stock Compensation”, which requires that share-based payment transactions with employees be measured based on the grant-date fair value of the equity instrument issued and recognized as compensation expense over the requisite service period.

The Company accounts for share-based compensation awards to non-employees in accordance with FASB ASC Topic 718 and FASB ASC Subtopic 505-50, “Equity-Based Payments to Non-employees”. Under FASB ASC Topic 718 and FASB ASC Subtopic 505-50, stock compensation granted to non-employees has been determined as the fair value of the consideration received or the fair value of equity instrument issued, whichever is more reliably measured and is recognized as an expense as the goods or services are received.

Foreign Currency Translation and Other Comprehensive Income

The Company uses United States dollars (“US Dollar” or “US$” or “$”) for financial reporting purposes. However, the Company maintains the books and records in its functional currency, Chinese Renminbi (“RMB”), being the functional currency of the economic environment in which its operations are conducted. In general, the Company translates its assets and liabilities into U.S. dollars using the applicable exchange rates prevailing at the balance sheet date, and the statement of comprehensive loss and the statement of cash flow are translated at average exchange rates during the reporting period. Equity accounts are translated at historical rates. Adjustments resulting from the translation of the Company’s financial statements are recorded as accumulated other comprehensive income.

Other comprehensive income for the six months ended June 30, 2017 and 2016 represented foreign currency translation adjustments and were included in the consolidated statements of comprehensive loss.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the consolidated financial statements were as follows:

| As

of June 30, 2017 | As

of December 31, 2016 | |||||||

| Balance sheet items, except for equity accounts | 6.7832 | 6.9472 | ||||||

| Six months ended June 30 | ||||||||

| 2017 | 2016 | |||||||

| Items in the statements of comprehensive loss | 6.8753 | 6.5345 | ||||||

Earnings Per Common Share

Net income per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net income per common share is computed by dividing net income by the weighted average number of common shares outstanding during the period.

Diluted net income per common share is computed by dividing net income by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period to reflect the potential dilution that could occur from common shares issuable through contingent shares issuance arrangement, stock options or warrants.

| 11 |

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions. Pursuant to Section 850-10-20 the related parties include: a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly Influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated financial statements is not required in those statements. The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the consolidated financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Commitments and Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows.

Cash Flows Reporting

The Company adopted paragraph 230-10-45-24 of the FASB Accounting Standards Codification for cash flows reporting, classifies cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions of each category, and uses the indirect or reconciliation method (“Indirect method”) as defined by paragraph 230-10-45-25 of the FASB Accounting Standards Codification to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating activities by removing the effects of (a) all deferrals of past operating cash receipts and payments and all accruals of expected future operating cash receipts and payments and (b) all items that are included in net income that do not affect operating cash receipts and payments. The Company reports the reporting currency equivalent of foreign currency cash flows, using the current exchange rate at the time of the cash flows and the effect of exchange rate changes on cash held in foreign currencies is reported as a separate item in the reconciliation of beginning and ending balances of cash and cash equivalents and separately provides information about investing and financing activities not resulting in cash receipts or payments in the period pursuant to paragraph 830-230-45-1 of the FASB Accounting Standards Codification.

| 12 |

Subsequent Events

The Company follows the guidance in Section 855-10-50 of the FASB Accounting Standards Codification for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements were issued. Pursuant to ASU 2010-09 of the FASB Accounting Standards Codification, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR.

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update No. 2014-09 (ASU 2014-09), Revenue from Contracts with Customers. ASU 2014-09 will eliminate transaction- and industry-specific revenue recognition guidance under current GAAP and replace it with a principle based approach for determining revenue recognition. ASU 2014-09 will require that companies recognize revenue based on the value of transferred goods or services as they occur in the contract. ASU 2014-09 also will require additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. Based on the FASB’s Exposure Draft Update issued on April 29, 2015, and approved in July 2015, Revenue from Contracts With Customers (Topic 606): Deferral of the Effective Date, ASU 2014-09 is now effective for reporting periods beginning after December 15, 2017, with early adoption permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. Entities will be able to transition to the standard either retrospectively or as a cumulative-effect adjustment as of the date of adoption. The adoption of ASU 2014-09 is not expected to have any impact on the Company’s financial statement presentation or disclosures.

In February 2016, the FASB issued Accounting Standards Update No. 2016-02 (ASU 2016-02), Leases (Topic 842). ASU 2016-02 requires a lessee to record a right-of-use asset and a corresponding lease liability, initially measured at the present value of the lease payments, on the balance sheet for all leases with terms longer than 12 months, as well as the disclosure of key information about leasing arrangements. ASU 2016-02 requires recognition in the statement of operations of a single lease cost, calculated so that the cost of the lease is allocated over the lease term. ASU 2016-02 requires classification of all cash payments within operating activities in the statement of cash flows. Disclosures are required to provide the amount, timing and uncertainty of cash flows arising from leases. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. ASU 2016-02 is effective for fiscal years beginning after December IS, 2018, including interim periods within those fiscal years. Early application is permitted. The Company has not yet evaluated the impact of the adoption of ASU 2016-02 on the Company’s financial statement presentation or disclosures.

In January 2017, the FASB issued ASU 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business.” The amendments in this guidance are clarifying the definition of a business to assist entities when determining whether an integrated set of assets and activities meets the definition of a business. The update provides that when substantially all the fair value of the assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. The guidance is effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The adoption of this new guidance is not expected to have a material impact on our consolidated financial statements.

In January 2017, the FASB issued ASU 2017-04—Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. The amendments in this guidance to eliminate the requirement to calculate the implied fair value of goodwill to measure goodwill impairment charge (Step 2). As a result, an impairment charge will equal the amount by which a reporting unit’s carrying amount exceeds its fair value, not to exceed the amount of goodwill allocated to the reporting unit. An entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. The amendment should be applied on a prospective basis. The guidance is effective for goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for goodwill impairment tests performed after January 1, 2017. The impact of this guidance for the Company will depend on the outcomes of future goodwill impairment tests.

| 13 |

In May 2017, the FASB issued Accounting Standards Update No. 2017-09 (ASU 2017-09), Compensation — Stock Compensation (Topic 718) Scope of Modification Accounting. The amendments in ASU 2017-09 provide guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting in Topic 718. The adoption of ASU 2017-09 which will become effective for annual periods beginning after December 15, 2017 and for interim periods within those annual periods, is not expected to have any impact on the Company’s financial statement presentation or disclosures.

Management does not believe that any other recently issued, but not yet effective, authoritative guidance, if currently adopted, would have a material impact on the Company’s financial statement presentation or disclosures.

3. Accounts Receivable, net

Accounts receivable consisted of the following:

| June 30, 2017 | December 31, 2016 | |||||||

| Accounts receivable | $ | 9,425,359 | $ | 1,122,754 | ||||

| Less: Allowance for doubtful debts | - | - | ||||||

| Accounts receivable, net | $ | 9,425,359 | $ | 1,122,754 | ||||

As of June 30, 2017 and December 31, 2016, the management has determined that no allowance for doubtful debts was necessary.

4. Prepaid Expense

Prepaid expenses consisted of the following:

| June 30, 2017 | December 31, 2016 | |||||||

| Prepaid office rent | $ | 28,021 | $ | 12,504 | ||||

| Prepaid government filing expense | 33,588 | 5,000 | ||||||

| Prepaid packaging expense | - | 75,000 | ||||||

| Prepayment for purchasing furniture | 5,160 | - | ||||||

| $ | 66,769 | $ | 92,504 | |||||

5. Other Receivable

Other receivable consisted of the following:

| June 30, 2017 | December 31, 2016 | |||||||

Due from customer-Kangtan Gerui (Beijing) Bio-Tech Co., Ltd. | 1,338,111 | 1,522,435 | ||||||

| Advance to employees | 105,171 | 31,700 | ||||||

| Others | 28,009 | 7,196 | ||||||

| Less: Allowance for doubtful debts | - | - | ||||||

| Other receivable, net | $ | 1,471,291 | $ | 1,561,331 | ||||

Due from customer-Kangtan Gerui (Beijing) Bio-Tech Co.,Ltd. represents the remaining balance of advancement for production of fertilizers during the first through the third quarter of 2016. In September 2016, the Company obtained a fertilizer sales permit from Chinese government and began to sell the products by their own and gradually decrease the business cooperation with Gerui.

| 14 |

For the six months ended June 30, 2017, the Company has collected $184,324 advancement from Gerui and management has determined that no allowance for doubtful debts was necessary.

6. Advance to suppliers

Since currently the Company does not have manufacturing facility, it has contracted with several third parties to produce fertilizer products. Pursuant to the agreements entered by the Company and those third party companies, the Company was required to make partially prepayments in advance of purchase or completion of productions. As of June 30, 2017 and December 31, 2016, such advance to suppliers was $ 1,255,218 and $1,805,044, respectively.

7. Property, Plant and Equipment

Property, plant and equipment, net consisted of the following:

| June 30, 2017 | December 31, 2016 | |||||||

| Office equipment | $ | 942 | $ | 942 | ||||

| Furniture | 10,260 | 8,276 | ||||||

| Leasehold improvement | 72,174 | 70,871 | ||||||

| Total Property, plant and equipment | $ | 83,376 | $ | 80,089 | ||||

| Less: accumulated depreciation | (40,064 | ) | (20,311 | ) | ||||

| Less: impairment of long-lived assets | - | - | ||||||

| Property, plant and equipment - net | $ | 43,312 | $ | 59,778 | ||||

Depreciation expense was $17,787 and $ 3,073 for the six months ended June 30, 2017 and 2016, and $8,318 and $3,073 for the three months ended June 30, 2017 and 2016, respectively.

Impairment of long-lived assets was nil for the three and six months ended June 30, 2017 and 2016, respectively.

All of our property, plant and equipment have been held as collateral to secure the 6% Notes (see Note 14).

8. Deposit for long-term investment

On June 8, 2017, the Company entered an equity purchase agreement with Yantai Peng Hao New Materials Technology Co. Ltd., which relates to the acquisition of a new factory for purchase price of about $2.2 million (approximately RMB 15 million). The factory to be acquired by the Company will be completed in accordance with the Company’s construction plan to facilitate the production design of combining of microbial fermentation and terminal fertilizer products.

Pursuant to the payment terms of purchase agreement, the Company made the first payment of $147,423 (approximately RMB 1,000,000) to Yantai Peng Hao New Materials Technology Co. Ltd. on June 30, 2017.

9. Goodwill and other intangibles

On November 30, 2015, Kiwa Bio-tech Products Group Ltd in BVI (“Kiwa BVI”) entered an acquisition agreement with shareholders of Caber Holdings Ltd. (“Acquiree”) in Hong Kong to acquire 100 percent entity interest of the acquiree, including a wholly owned subsidiary, Oriental Baina Co., Ltd. in Beijing for US$30,000. The acquisition was completed in January, 2016. On the acquisition date, there was no any asset or liability acquired, and thus no fair value was allocated to asset and liability. Including legal fee and government fees, the total payment of approximately $34,112 ($30,000 plus legal fee and government fees totaled $4,112) was recorded as goodwill. The fair value of the goodwill is tested prior to June 30, 2017 and management determined there is no impairment to the goodwill as of June 30, 2017.

The Company purchased the computer software in May, 2017, which cost was $ 1,061. Amortization expense for the three and six months ended June 30, 2017 was $59 and nil.

| 15 |

10. Construction Costs Payable

Construction costs payable mainly represents the payables which had been carried on Kiwa Shandong’s book for a length of years. As of December 31, 2016, construction costs payable was $255,539.

On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest, as well as all the obligations in Kiwa Shandong to the Transferee for USD $1.00. On April 12, 2017, the transaction was completed and the balance was removed.

11. Related Party Transactions

(1). Amounts due to related parties

Amounts due to related parties consisted of the following as of June 30, 2017 and December 31, 2016:

| Item | Nature | Notes | June 30, 2017 | December 31, 2016 | ||||||||

| Kiwa-CAU R&D Center | Trade | (b) | - | 1,122,754 | ||||||||

| CAAS IARRP and IAED Institutes | Trade | (c) | - | 160,461 | ||||||||

| Total | $ | - | $ | 1,283,215 | ||||||||

(a) Yvonne Wang

Ms. Wang is a board member and Acting President, Acting Chief Executive Officer and Acting Chief Financial Officer. From time to time, Ms. Wang paid various expenses on behalf of the Company. As of June 30, 2017 and December 31, 2016, the amount due to Ms. Wang was $83,798 and $100,798, respectively.

(b) In November 2006, Kiwa and China Agricultural University (the “CAU”) agreed to jointly establish a new research and development center, named Kiwa-CAU R&D Center. Pursuant to the agreement, Kiwa committed to fund RMB 1 million (approximately $160,000) annually to the research center. Prof. Qi Wang, a director of the Company was also the director of Kiwa-CAU R&D Center. Although the agreement was expired on June 30, 2016, the payable balance remains on Kiwa Shandong’s book until April 12, 2017 when the transaction of transfer Kiwa Shandone’s all assets and liabilities to Dian ShiCheng Jing (Beijing) was completed.

The Company recorded nil and $36,363 research and development expenses related to this Kiwa-CAU R&D Center for the six months ended June 30, 2017 and 2016, respectively.

(c) On November 5, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). The term of the Agreement was three years ends on November 4, 2017.

Pursuant to the agreement, Kiwa agree to invest RMB 1 million (approximately $160,000) each year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes. Prof. Yong Chang Wu, the authorized representative of IARRP, CAAS, was also one of the Company's directors until he resigned on March 13, 2017. Since Prof. Yong Chang Wu is no longer a board member, the balance of $233,598 at June 30, 2017 has been reclassified from part due to related party – trade to R&D expenses payable.

The Company recorded $36,291and $38,764 research and development expenses related to the institutes, for the six months ended June 30, 2017 and 2016, respectively.

| 16 |

(2). Convertible Note Payables

(a). Geng Liu

Geng Liu became a shareholder of the Company and has held 500,000 shares of common stock since September, 2016

On January 17, 2017, the Company entered into a Convertible Loan Agreement with Geng Liu wherein the lender agreed to advance of approximately US $442,269 (RMB3,000,000) under a Convertible Promissory Note with a term of 12 months bearing interest at a rate of Fifteen Percent (15%) per annum. The Loan is convertible into Common Stock at any time at the option of the Lender at a conversion price of $ 0.90 per share within the term.

As of June 30, 2017, the Company received proceeds about $147,423 (RMB 1,000,000) from Geng Liu and recorded interest expense related to this note $5,442 and $8,472 for the three and six months ended June 30, 2017, respectively.

(b). Junwei Zheng

Junwei Zheng became a shareholder of the Company and has held 920,000 shares of common stock since March, 2017

On May 9, 2017, Company entered into a Convertible Loan Agreement with Junwei Zheng wherein the lender agreed to advance of approximately US$ 4.5 million (RMB 30,000,000) under a Convertible Promissory Note with a term of 24 months bearing interest at a rate of Fifteen Percent (15%) per annum. The Loan is convertible into Common Stock at any time at the option of the Lender at a conversion price of $3.50 per share within the term

As of June 30, 2017, the Company has received proceeds of about $810,827 (RMB 5,500,000) from Junwei Zheng and the interest expense related to this note was $17,328 for the three and six months ended June 30, 2017.

12. Unsecured Loans Payable

Unsecured loan payable mainly represents the payables of the subsidiary company - Kiwa Shandong, which hadn’t achieved active operation for a lengh of years. As of December 31, 2016, construction costs payable was $1,655,343.

On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest, as well as all the obligations in Kiwa Shandong to the Transferee for USD $1.00. On April 12, 2017, the transaction was completed.

| 17 |

13. Convertible Notes Payable

Convertible notes payable consists $ 150,250 of 6% secured convertible notes issued to FirsTrust Group Inc. on June 29, 2006 , $145,127 of 15% convertible note issued to Mr. Geng Liu on January 17, 2017 and $810,827 of 15% convertible note issued to Mr. Junwei Zheng on May 9, 2017.

6% secured convertible notes

In 2006, we completed a $2.45 million 6% Secured Convertible Note (“6% Convertible Note”) transaction with six institutional investors, including Nite Capital LP, which purchased a total of $300,000 of the Note in three tranches ($105,000, $90,000, $105,000 respectively). The 6% Convertible Note allows the note holder to convert into shares of our common stock. We filed a registration statement under the Securities Act covering the resale of the shares issued upon conversion of the 6% Notes in 2006 and the registration statement was declared effective on October 13, 2006.

On March 18, 2008, FirsTrust Group, Inc. purchased three remaining 6% Convertible Notes, totaling $168,000 ($59,100, $50,400 and $59,100 respectively), from Nite Capital for a cash payment of $100,000. As of June 30, 2017, there is no other outstanding 6% Note than those owned by FirsTrust Group. The total outstanding Convertible Note payable to FirsTrust is $150,250, and the total accumulated interest and penalty is $194,537 and $523,141, respectively.

15% convertible notes- Geng Liu

On January 17, 2017, the Company entered a Convertible Note Agreement with an individual person with principal of RMB 3 million or approximately $435,380. The note bears interest at 15% per annum and will mature on January 16, 2018. Before the maturity date, the Note holder has an option to convert partial or all of the outstanding principal and accrued interest to the Company’s common shares with a conversion price of $0.90 per share. As of June 30, 2017, the Company has received partial principal totaled $145,127 (RMB 1 million). The Company accrued $5,442 and $8,472 interest expense on this convertible notes for the three and six months ended June 30, 2017, respectively.

15% convertible notes- Junwei Zheng

On May 9, 2017, the Company entered a Convertible Note Agreement with an individual person with principal of RMB 30 million or approximately $4.5 million. The note bears interest at 15% per annum and will mature on May 8, 2019. Before the maturity date, the Note holder has an option to convert partial or all of the outstanding principal and accrued interest to the Company’s common shares with a conversion price of $3.5 per share. As of June 30, 2017, the Company has received partial principal totaled $810,827 (RMB 5.5 million). The Company accrued $17,328 interest expense on this convertible notes for both of the six months and three months ended June 30, 2017.

14. Note Payable

On May 29, 2007, the Company issued a $360,000 promissory note (the “Promissory Note”) to an unrelated individual (the “Original Note holder”). This note bears interest at 18% per annum and was due on July 27, 2007. This note is currently in default and bears interest of 25% per annum (the “Default rate”) until paid in full. This note is secured by a pledge of 6,178,336 (post-reverse split 30,892) shares of the Company’s common stock owned by Investlink (China) Limited (the “Pledged Shares”). The Company accrued $45,000 and $45,000 interest expense on note payable for the six months ended June 30, 2017 and 2016, and $22,500 and $22,500 interest expense on note payable for the three months ended June 30, 2017 and 2016, respectively.

As of December 31, 2016, the Original Note holder informed us that all right, title and interests in the Promissory Note has been assigned and transferred to FirsTrust Group, Inc. (“FirsTrust”). As of June 30, 2017, all of $360,000 of Promissory Note to FirsTrust is still outstanding, and total interest of the Promissory Note is $ 904,300. We have begun preliminary discussion with FirsTrust with regards to a potential settlement of the Note, but no agreement has been reached. As of June 30, 2017, with the Company’s acknowledgement, FirsTrust has taken possession of 30,892 Pledged Share from Investline (China) Limited according to the default clause of the Promissory Note.

| 18 |

15. Other Payable

Other payable includes the payables to two unrelated potential investors and other liabilities. As of June 30, 2017, two potential investors have made the payments approximately $471,754 to the Company and the investment agreements have not been finalized. Other payable were $865,793 and $1,019,583 at June 30, 2017 and December 31, 2017, respectively,

16. Stockholders’ Equity

In March, 2016, the Company issued 3,140,000 shares of common stock to Mr. Li and Ms. Wang for debt and salary payable settlement for an aggregate amount of $3,141,000. In addition, the Company issued 101,947 common shares to Jimmy Zhou, former CEO in August 2016, to settle payable to him for $50,974. All of issuances of common shares for settlement of debts were based the stock price on the transaction dates.

During the year ended December 31, 2016, the Company issued 1,650,000 common shares for cash at $0.8 per share for an aggregate subscribe price equivalent to $1,320,000, of which $759,659 has received while approximately $560,341 remaining subscribe receivable at December 31, 2016. The remaining subscribe receivable was totally received in August 3, 2017.

On November 15, 2016, the Company completed another private offering of common stock to an accredited investor for 125,000 shares of its common stock and warrants to purchase 300,000 shares of Company common stock at an exercise price of $3.00 per share prior to November 15, 2021. The Company may adjust the exercise price for some or all of the warrants under certain terms and conditions. We have determined the issued warrants do not meet the definition of a derivative security, and thus allocated the net proceeds of the sale of the common stock to the par value of the common stock, with the remainder to additional paid in capital.

During the year ended December 31, 2016, the Company issued 1,710,808 common shares to four consulting companies and three individuals as compensation for their consulting service received. The agreements have the service periods from 6 months to 36 months with a total of $1,688,300 that was determined as fair value at the time of execution of the agreement. The total services fee will be recognized based straight-line amortization method over the service term. The Company recorded $331,800 as consulting service expense for the six months ended June 30, 2017 and $254,250 approximately for the year ended December 31, 2016.

In February, 2017, the Company issued 1,000,000 common shares to Mr. Junwei Zheng for cash at $1.00 per share for an aggregate price to $1,000,000, all of which has been received as of June 30, 2017.

On February 15, 2017, the Company entered a consulting agreement with Mr. Yuan Wang to assist the Company in financing projects. The agreement has one year term with a total of $85,400 that was determined as fair value at the time of execution of the agreement. The total services fee will be recognized based straight-line amortization method over the service term. On March 3, 2017, the Company issued 70,000 common shares to Mr. Yuan Wang based on market price of $1.22 per share. The Company realized $32,025 as a compensation for Mr. Wang’s consulting service for the six months ended June 30, 2017.

On May 25, 2017, the Company issued 19,380 common shares to an individual to assist the Company in financing projects based on market price of $2.74 per share. The agreement has one year term with a total of $53,101 that was determined as fair value at the time of execution of the agreement. The total services fee will be recognized based straight-line amortization method over the service term. The Company recorded $5,237 as consulting service expense for the six months ended June 30, 2017.

On June 1, 2017, the Company issued 15,108 common shares to an individual to assist the Company in technical support based on market price of $2.78 per share. The agreement has one year term with a total of $41,396 that was determined as fair value at the time of execution of the agreement. The total services fee will be recognized based straight-line amortization method over the service term. The Company recorded $3,402 as consulting service expense for the six months ended June 30, 2017.

| 19 |

On June 13, 2017, the Company issued 96,900 common shares to Mr. Yuan Wang for cash at $3.00 per share for an aggregate price to $290,700, all of which has been received as of June 30, 2017.

On June 30, 2017, the Company issued 97,850 common shares to ten employees for cash at $1.95 per share for an aggregate price to $190,807, all of which has been received as of June 30, 2017. The Company determined the fair price per common stock was $3.0 per share, thus the difference of $1.05 per share between fair price per share ($3.00) and the employees purchase price per share ($1.95), totaled $102,273 was recognized as expense of employee benefits and accordingly, credited the same amount to APIC.

Subsequently the Company issued 98,000 shares of common stock for cash $294,000, and 88,000 shares of common stock for consulting service. Please refer to Note 22 Subsequent Events for additional information.

17. Stock-based Compensation

On March 15, 2017, the Board of Directors approved a new stock option plan with ten years’ term. As of June 30, 2017, the Company has not granted any incentive compensation under this plan.

18. Statutory Reserves

The Company is required to make appropriations to reserve funds, comprising the statutory surplus reserve, statutory public welfare fund and discretionary surplus reserve, based on after-tax net income determined in accordance with generally accepted accounting principles of the PRC (the “PRC GAAP”). Appropriation to the statutory surplus reserve should be at least 10% of the after tax net income determined in accordance with the PRC GAAP until the reserve is equal to 50% of the entities’ registered capital or members’ equity. In accordance with the Chinese Company Law, the Company allocated 10% of income after taxes to the statutory surplus reserve for the six months ended June 30, 2017 and the year ended December 31, 2016, statutory reserve activity is as follows:

| Balance – January 1, 2016 | $ | - | ||

| Addition to statutory reserve in 2016 | 127,884 | |||

| Balance – December 31, 2016 | 127,884 | |||

| Addition to statutory reserve for the six months ended June 30, 2017 | 179,466 | |||

| Balance – June 30, 2017 | $ | 307,350 |

19. Income Tax

In accordance with the current tax laws in China, Kiwa Shandong is subject to a corporate income tax rate of 25% on its taxable income. However, Kiwa Shandong has not provided for any corporate income taxes since it had no taxable income for the six months ended June 30, 2017 and 2016.

Kiwa Baiao Co., Ltd., is also subject to a corporation income tax rate of 25% on its taxable income. For the six months ended June 30, 2017, it recorded income tax provision for RMB 4,112,924 or approximately $598,222. For the three months ended June 30, 2017, it recorded income tax provision for RMB 2,601,847 or approximately $379,973.

Provision for taxes $800 to the minimum California state franchise tax. In accordance with the relevant tax laws in the British Virgin Islands, Kiwa BVI, as an International Business Company, is exempt from income taxes.

| 20 |

A reconciliation of the provision for income taxes determined at the local income tax rate to the Company’s effective income tax rate is as follows:

| Three months ended June 30, | Six months ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Pre-tax income | $ | 5,396,950 | $ | 181,975 | $ | 5,924,464 | $ | 238,105 | ||||||||

| U.S. federal corporate income tax rate | 34 | % | 34 | % | 34 | % | 34 | % | ||||||||

| Income tax computed at U.S. federal corporation income tax rate | 1,834,963 | 61,872 | 2,014,318 | 80,956 | ||||||||||||

| Reconciling items: | ||||||||||||||||

| Rate differential for PRC earnings | (124,683 | ) | 8,770 | (202,353 | ) | 13,668 | ||||||||||

| Change of valuation allowance | 195,403 | 80,006 | 305,935 | 146,608 | ||||||||||||

| Non-deductible expenses | (1,525,710 | ) | (150,648 | ) | (1,518,877 | ) | (241,232 | ) | ||||||||

| Effective tax expenses | $ | 379,973 | $ | - | $ | 599,022 | $ | - | ||||||||

The Company had deferred tax assets as follows:

| June 30, 2017 | December 31, 2016 | |||||||

| Net operating losses carried forward | $ | 3,458,902 | $ | 3,473,331 | ||||

| Less: Valuation allowance | (3,458,902 | ) | (3,473,331 | ) | ||||

| Net deferred tax assets | $ | - | $ | - | ||||

As of June 30, 2017 and December 31, 2016, the Company had approximately $3.4 million and $3.4 million net operating loss carryforwards available to reduce future taxable income. Net operating loss of the Company could be carried forward and taken against any taxable income for a period of not more than twenty years from the year of the initial loss pursuant to Section 172 of the Internal Revenue Code of 1986, as amended. The net operating loss of Kiwa Shandong could be carried forward for a period of not more than five years from the year of the initial loss pursuant to relevant PRC tax laws and regulations. It is more likely than not that the deferred tax assets cannot be utilized in the future because there will not be significant future earnings from the entity which generated the net operating loss. Therefore, the Company recorded a full valuation allowance on its deferred tax assets.

As of June 30, 2017 and December 31, 2016, the Company has no material unrecognized tax benefits which would favorably affect the effective income tax rate in future periods and does not believe that there will be any significant increases or decreases of unrecognized tax benefits within the next twelve months. No interest or penalties relating to income tax matters have been imposed on the Company during six months ended June 30, 2017 and December 31, 2016, and no provision for interest and penalties is deemed necessary as of June 30, 2017 and December 31, 2016.

According to the PRC Tax Administration and Collection Law, the statute of limitations is three years if the underpayment of taxes is due to computational errors made by the taxpayer or its withholding agent. The statute of limitations extends to five years under special circumstances, which are not clearly defined. In the case of a related party transaction, the statute of limitation is ten years. There is no statute of limitation in the case of tax evasion.

20. Commitments and Contingencies

The Company has the following material contractual obligations:

(1) Investment in manufacturing facilities in Penglai City, Shandong Province in China

On June 8, 2017, the Company entered an equity purchase agreement with Yantai Peng Hao New Materials Technology Co. Ltd. (“Acquirer”), which relates to the acquisition of a new factory for purchase price of about $2.2 million (approximately RMB 15 million). The factory to be acquired by the Company will be completed in accordance with the Company’s construction plan to facilitate the production design of combining of microbial fermentation and terminal fertilizer products.

Pursuant to the payment terms of purchase agreement, the Company made the first payment of $147,423 (approximately RMB 1,000,000) to the Acquirer on June, 2017 and will make the second payment of RMB 10,000,000 as long as the Company obtains the land use right certificate and will make the final payment of RMB 4,000,000 after the government processing has been completed.

| 21 |

(2) Strategic cooperation with the institutes in China

On November 5, 2015, the Company signed a strategic cooperation agreement (the “Agreement”) with China Academy of Agricultural Science (“CAAS”)’s Institute of Agricultural Resources & Regional Planning (“IARRP”) and Institute of Agricultural Economy & Development (“IAED”). Pursuant to the Agreement, the Company will form a strategic partnership with the two institutes and establish an “International Cooperation Platform for Internet and Safe Agricultural Products”. To fund the cooperation platform’s R&D activities, the Company will provide RMB 1 million (approximately $160,000) per year to the Spatial Agriculture Planning Method & Applications Innovation Team that belongs to the Institutes. The term of the Agreement is for three years beginning November 20, 2015 and will expire on November 19, 2018.

(3) Distribution agreement with Kangtan Gerui Bio-Tech in China

On December 17, 2015, Kiwa Bio-Tech Products Group Corporation (the “Company”) entered into a distribution agreement (the “Agreement”) with Kangtan Gerui (Beijing) Bio-Tech Co., Ltd. (“Gerui”) and formally awarded Gerui a right to sell and distribute the Company’s fertilizer products in 3 major agricultural regions of China— Hainan Province, Hunan Province and Xinjiang Autonomous Region. The Company’s Research and Development department has been conducting application experiments in Hainan and Hunan Provinces since August 2015, in accordance with the market requirements. The experiment data indicates that the Company’s fertilizer products have fulfilled the requirements of reduction of content of heavy metals in soil and improve crop yield. Gerui was founded in Beijing in April 2015 and relies on the sales network of China’s Supply and Marketing Cooperatives system. Currently, the Company and Gerui do not hold any interest in each other; however, a collaboration and integration may take place in the future. The term of the Agreement is for a period of three years commencing December 17, 2015. In September 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd obtained a fertilizer sales permit from the Chinese government and began to sale the products directly to customers in those 3 major agricultural regions.

(4) Lease payments

(1) On April 29, 2016, Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. entered an office lease agreement with two-year term. Monthly lease payment and building management fee totaled RMB 77,867 or approximately USD $11,303.

(2) In June 20, 2017, Kiwa Bio-Tech (Shenzhen) Co., Ltd, a newly established subsidiary entered an office lease agreement with two-year term. Monthly lease payment is RMB 115,000 or approximately of USD $16,954. And the previous lease agreement terminated automatically since the landloard is the same one.

(3) On May 5, 2017, Kiwa Bio-Tech Products Group Corporation entered an office lease agreement with 13 months term. Monthly lease payment totaled USD $680.

(4) On July 1, 2017, Kiwa Bio-Tech Products Group Corporation entered an office lease agreement with one-year term. Monthly lease payment totaled USD $1,087.

The future lease payments at June 30, 2017 are summarized below.

| Beijing Office | Shenzhen Office | USA Office | Total | |||||||||||||

| 2017 | $ | 68,876 | $ | 101,722 | $ | 10,605 | $ | 181,203 | ||||||||

| 2018 | $ | 45,917 | 203,444 | $ | 9,925 | $ | 259,286 | |||||||||

| 2019 | $ | - | $ | 101,722 | $ | - | $ | 101,722 | ||||||||

| Thereafter | $ | - | $ | - | $ | - | $ | - | ||||||||

21. Discontinued Operation

On February 11, 2017, the Company executed an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) whereby the Company transferred all of its right, title and interest in Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Shandong”) to the Transferee for the RMB equivalent of US$1.00. The government processing of the transaction has been completed on April 12, 2017. This transaction was completed and effective on April 12, 2017. The Company recorded a net gain of approximately $4,514,161 during the six months ended June 30, 2017 and approximately $4,513,363 during the three months ended June 30, 2017 based on the discharge of the excess liabilities over the assets of the Kiwa Shandong.

| 22 |

22. Subsequent Events

On July 1, 2017, Kiwa Bio-Tech Products Group Corporation entered an office lease agreement with two-year term. Monthly lease payment totaled USD $1,087.

On July 19, 2017, the Company entered into Common Stock Purchase Agreement with Junwei Zheng. Pursuant to the Agreement, the Company will issue total 245,000 shares of restricted common stock at $3.00 per share price for an aggregate amount of $735,000. As of August 14, 2017, the Company has not received the amount yet.

On July 19, 2017, the Company entered into Common Stock Purchase Agreement with Quanzhen Shen. Pursuant to the Agreement, the Company will issue total 98,000 shares of restricted common stock at $3.00 per share price for an aggregate amount of $294,000. The Company has received the full amount.

On July 19, 2017, the Company issued 49,000 common shares to Quanzhen Shen for her consulting service to assist the Company in financing projects. The number of shares was determined based on the fair value of the service. The agreement has one year term.

On July 18, 2017, the Company issued 39,000 common shares to Yuan Wang in assistance with the Company financing projects. The number of shares was determined based on the fair value of the service. The agreement has one year term.

On August 3, 2017, the Company fully collected $487,627 (RMB 3,360,000) of the entire subscribe receivable balance at December 31, 2016.

The Company has evaluated the existence of significant events subsequent to the balance sheet date through the date these financial statements were issued and has determined that, other than as stated above, there were no subsequent events or transactions which would require recognition or disclosure in the financial statements, other than noted herein.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

This Quarterly Report on Form 10-Q for the three and six months ended June 30, 2017 contains “forward-looking statements” within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, including statements that include the words “believes,” “expects,” “anticipates,” or similar expressions. These forward-looking statements include, among others, statements concerning our expectations regarding our working capital requirements, financing requirements, business, growth prospects, competition and results of operations, and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. The forward-looking statements in this Quarterly Report on Form 10-Q for the three and six months ended June 30, 2017 involve known and unknown risks, uncertainties and other factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by the forward-looking statements contained herein.

Overview

The Company took its present corporate form in March 2004 when shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, entered into a share exchange transaction. The share exchange transaction left the shareholders of Kiwa BVI owning a majority of Tintic and Kiwa BVI a wholly-owned subsidiary of Tintic. For accounting purposes this transaction was treated as an acquisition of Tintic by Kiwa BVI in the form of a reverse triangular merger and a recapitalization of Kiwa BVI and its wholly owned subsidiary, Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”). On July 21, 2004, we completed our reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

| 23 |

We have established a subsidiary in China, Kiwa Shandong in 2002, a wholly-owned subsidiary, engaging in the bio-fertilizer business. Formerly, our subsidiary Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”), was engaged in the bio-enhanced feed business. At the end of 2009, Kiwa Tianjin could no longer use its assets including machinery and inventory in the normal course of operations. Kiwa Tianjin has been dissolved since July 11, 2012. On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest in Kiwa Shandong to the Transferee for USD $1.00. On April 12, 2017, the government processing of transfer has been completed.