Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - KIWA BIO-TECH PRODUCTS GROUP CORP | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | v308218_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - KIWA BIO-TECH PRODUCTS GROUP CORP | v308218_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - KIWA BIO-TECH PRODUCTS GROUP CORP | v308218_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ______ to ______

Commission file number: 000-33167

| KIWA BIO-TECH PRODUCTS GROUP CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Delaware | 77-0632186 | |||

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |||

|

310 N. Indian Hill Blvd., #702 Claremont, California 91711 |

||||

|

(Address of principal executive offices) |

||||

| (626) 715-5855 | ||||

|

(Registrant’s telephone number, including area code) |

||||

|

Securities registered pursuant to Section 12(b) of the Act: |

Securities registered pursuant to Section 12(g) of the Act: (Title of Each Class) | |||

| None |

Common Stock, $0.001 par value |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.¨Yes xNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.¨Yes xNo

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.xYes¨No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). xYes ¨No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨Yes xNo

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). oYes xNo

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant, based upon the closing bid quotation for the registrant’s common stock, as reported on the OTC Bulletin Board quotation service, as of June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1,600,000.

The number of shares of registrant’s common stock outstanding as of March 30, 2012 was 400,000,000.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2011

INDEX

TABLE OF CONTENTS

| Part I | 1 | ||

| ITEM 1. | Business | 1 | |

| ITEM 1A. | Risk Factors | 9 | |

| ITEM 1B. | Unresolved Staff Comments | 20 | |

| ITEM 2. | Properties | 21 | |

| ITEM 3. | Legal Proceedings | 21 | |

| ITEM 4. | Mine Safety Disclosure | 22 | |

| Part II | 23 | ||

| ITEM 5. | Market for Registrants’ Common Equity, Related Stockholder Matters and Issuer Purchasers of Equity Securities | 23 | |

| ITEM 6. | Selected Financial Data | 23 | |

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 | |

| ITEM 8. | Financial Statements and Supplementary Data | 32 | |

| ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 32 | |

| ITEM 9A. | Controls and Procedures | 33 | |

| ITEM 9B. | Other Information | 34 | |

| Part III | 35 | ||

| ITEM 10. | Directors, Executive Officers and Corporate Governance | 35 | |

| ITEM 11. | Executive Compensation | 38 | |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 40 | |

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 41 | |

| ITEM 14. | Principal Accountant Fees and Services | 42 | |

| Part IV | 44 | ||

| ITEM 15. | Exhibits and Financial Statement Schedules | 44 | |

| Signatures | 46 | ||

| Index to Consolidated Financial Statements | 47 | ||

Part I

Special Note Regarding Forward-Looking Statements

On one or more occasions, we may make forward-looking statements in this Annual Report on Form 10-K regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” or similar expressions identify forward-looking statements. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described elsewhere in this report and our other Securities and Exchange Commission filings.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent annual and periodic reports filed with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K and Proxy Statements on Schedule 14A.

References herein to “we,” “us,” “our” or “the Company” refer to Kiwa Bio-Tech Products Group Corporation and its wholly-owned and majority-owned subsidiaries unless the context specifically states or implies otherwise.

ITEM 1. Business

The Company

We are the result of a share exchange transaction completed in March 2004 between the shareholders of Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah, and the shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002. The share exchange resulted in a change of control of Tintic, with former Kiwa BVI stockholders owning approximately 89% of Tintic on a fully diluted basis and Kiwa BVI surviving as a wholly-owned subsidiary of Tintic. Subsequent to the share exchange transaction, Tintic changed its name to Kiwa Bio-Tech Products Group Corporation. On July 21, 2004, we completed our reincorporation in the State of Delaware.

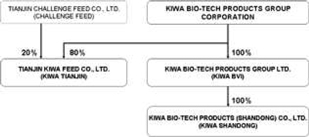

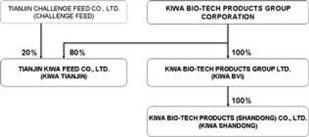

We established two subsidiaries in China: (1) Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”) in 2002 and (2) Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”) in July 2006. The following chart summarizes our organizational and ownership structure.

We develop, manufacture, distribute and market innovative, cost-effective and environmentally safe bio-technological products for agriculture. Our main products are bio-fertilizers. Our products are designed to enhance the quality of human life by increasing the value, quality and productivity of crops and decreasing the negative environmental impact of chemicals and other wastes.

| 1 |

Bio-fertilizers

We have developed a number of bio-fertilizers and are continuing to develop new products in this area. In 2002, Kiwa BVI chartered Kiwa Shandong, a wholly-owned subsidiary organized under the laws of the PRC, as its offshore fertilizer manufacturing base to capitalize on low cost, high quality manufacturing advantages available in China. In October 2003, Kiwa Shandong completed the first phase of construction of its manufacturing facility in Shandong Province, China. In November 2003, Kiwa Shandong began shipping its bio-fertilizer products to the agricultural market in China. Since then, we have been devoted to expanding our market share.

In June 2008, Kiwa Shandong received approval from the Ministry of Commerce of the PRC to sell fertilizer products of other manufacturers on a wholesale basis, including chemical fertilizers, complex fertilizers, and compound fertilizers. Based on applicable tax laws in China, these products will be exempt from value-added tax.

Bio-enhanced Feed

On July 11, 2006, we entered into a joint venture with Tianjin Challenge Feed Co., Ltd. (“Challenge Feed”) to develop, manufacture, and market biologically enhanced feed for livestock. Pursuant to the joint venture agreement between the Company and Challenge Feed, we formed Kiwa Tianjin, a company organized and operating under the laws of the PRC, and the Company invested $480,000 in cash in return for an 80% equity share of Kiwa Tianjin and Challenge Feed invested machinery and equipment used in one of Kiwa Tianjin’s two bio-enhanced feed production lines with an agreed value of $120,000 for the remaining 20% equity. We also leased another production line from Challenge Feed.

On December 22, 2009, Kiwa Tianjin filed a lawsuit against Challenge Feed in the local court of Wuqing District, Tianjin, where Kiwa Tianjin is domiciled. In the lawsuit, Kiwa Tianjin asserted that Challenge Feed unlawfully disposed of the assets held by Kiwa Tianjin, such assets include:

(1) Machinery and equipment. Challenge Feed entered into a settlement agreement with one of its creditors, in accordance with which Challenge Feed agreed to transfer title of the machinery and equipment, which had been assigned to Kiwa Tianjin in 2006 in connection with the establishment of Kiwa Tianjin as a joint venture between the Company and Challenge feed, to repay Challenge Feed’s debt. Challenge Feed did not obtain Kiwa Tianjin’s consent nor inform Kiwa Tianjin of such transfer.

(2) Inventories. Kiwa Tianjin had a long standing agreement to lease Challenge Feed’s factory facilities and warehouse for storage of its inventory. Challenge Feed disposed of Kiwa Tianjin’s inventories including raw materials, packages and finished goods stored in the factory to repay Challenge Feed’s debt without permission from Kiwa Tianjin.

The local court of Wuqing District ruled that the local court would not examine the lawsuit against Challenge Feed since Challenge Feed entered into bankruptcy proceedings and that all related matters would be solved during Challenge Feed’s bankruptcy proceedings.

At the end of 2009, Kiwa Tianjin could no longer use these assets, which included machinery and inventory, in the normal course of operations. In addition, because Kiwa Tianjin has no offices or assets it has not been able to register as a feed manufacturer with the applicable regulatory authorities and is also unable to meet the annual inspection requirements, which could result in a revocation of Kiwa Tianjin's business license. As a result, as of December 31, 2011, the Company classified its bio-enhanced feed business through Kiwa Tianjin as discontinued operations.

On December 27, 2011, Challenge Feed’s bankruptcy administrator informed the Company that the bankruptcy court granted the Company’s request to repossess the machinery and equipment and Kiwa Tianjin’s bio-enhanced feed production line that were held in Challenge Feed’s domicile. If the Company failed to repossess such machinery and equipment before December 31, 2011, the Company would then be responsible for losses resulting from any damages to the machinery and equipment after such date. Such equipment has not been maintained for over two years, and some of the components and parts are missing. On February 9, 2012, the Company sold such machinery and equipment for $8,000.

| 2 |

AF-01 Anti-viral Aerosol

On May 8, 2006, we entered into a Technology Transfer Agreement (“TTA”) with Jinan Kelongboao Bio-Tech Co., Ltd. (“JKB”), pursuant to which JKB agreed to transfer to the Company’s PRC subsidiary, its AF-01 anti-viral aerosol technology for veterinary medicine applications, including the exclusive production and other related rights to produce an anti-viral aerosol veterinary drug. The AF-01 anti-viral aerosol technology is a broad-spectrum antiviral agent with potent inhibitory and/or viricidal effects on a variety of RNA viruses found in animals and fowls such as bird flu. Pursuant to the payment schedule in the TTA, the transfer of the technology will be effective upon the full payment of the first installment of the purchase price in the amount of RMB 3,000,000. As of December 31, 2011, the Company had paid one-third of the first installment or RMB 1,000,000. The Company intends to use this technology to develop a commercialized aerosol for application in fowl houses and other animal holding facilities to prevent and cure viral-borne diseases.

In addition, pursuant to the TTA, JKB agreed to supply us on an exclusive basis the raw material for the AF-01 anti-viral aerosol, which must have an index of 200,000 zymolysis units per milliliter. There is no alternative supplier if JKB fails to perform its supply obligations under the contract.

The TTA provides that in the event the Company fails to develop the AF-01 product or fails to sell veterinary medicine product within two years, JKB has the right to take back the development rights to such product in which case any products developed will belong to JKB. The Technology Transfer Agreement expired on May 6, 2008. However, the Company is negotiating with JKB a renewal of the TTA. There can be no assurance that we can renew the TTA or successfully acquire the AF-01 anti-viral aerosol technology. As a result, the Company has determined to discontinue this project.

Strategies

With the world’s largest population to feed, China’s demand for agricultural products is immense. Problems with pollution and soil contamination have increased pressure on the Chinese government to conserve land and enhance environmental protection. Serious diseases such as H5N1 avian flu are spreading around the world and have threatened animal husbandry. More critically, such diseases have threatened the health and safety of humans through possible bird to human and human to human transmission. China thus faces an urgent need to improve unit land yield, prevent and treat such diseases, and reduce pollution. We plan to address this need through the development of our ag-biotech inputs which may resolve many of these problems in environmentally friendly ways. To exploit this opportunity, our core strategies are as follows:

General Operational Strategy

| l |

Build a platform for world-class biotechnological research and development results to be commercialized into products for applications in agriculture; |

| l | Invest in mature technologies that will not require substantial research and development to commercialize; |

| l | Utilize proprietary technology to supply ag-biotech inputs to the market at lower cost than our competitors; |

| l | Construct or acquire new production facilities, and improve existing facilities to improve our manufacturing capability in China; |

| l | Build and strengthen our “KIWA” brand which will increase our ability to become one of the leading companies in China’s “biological, safe and environment-friendly” agricultural inputs industry; |

| l | Establish strategic alliances for research and development, sales and distribution and customer acquisition with complimentary entities in the biological-agriculture industry; and |

| 3 |

| l | Enhance our overall management systems, operational structure and corporate governance. |

Sales Strategy

| l | Our sales strategy involves utilizing both a direct sales force and distribution networks. Our distribution efforts are expected to include the following: |

| · | Choosing green food/organic food planting bases or other demonstrative agricultural products producers, carrying out regional field tests, fanning out from a point to an area, cultivating market network; |

| · | Leveraging government and industrial organizations (such as “China Green Food Association”) to strengthen existing sales networks in rural areas, thereby reaching end-users in a more cost-effective manner; cut off selling expenses incurred during middle tiers of supply chain to boost end-user’s value; |

| · | Cooperating with special agricultural production materials distributors who also help farmers resell their products; focusing on large-to-medium size wholesalers of agricultural production materials at provincial and municipal levels; |

| · | Establishing a three-level distribution network consisting of a company-centralized sales office, prefectural representative offices, and direct distributors in villages and towns; and |

| · | Leveraging existing sales channels and network of affiliates’ products to save costs of building the network from scratch. |

Strategy Regarding Customers

| l | Our targeted customers include major agricultural companies and growers that can realize significant financial benefits from using our products including: |

| · | Chinese agricultural products producers that provide high value-added agricultural products (such as fruits, vegetables, meat, eggs that meet the requirements of green food/organic food) ; |

| · | Agricultural products producers located in China who are exporting to Japan, Korea, Europe, US, and other regional markets of the world; |

| · | Chinese agricultural products producers who have generated internal needs of ag-biotech inputs to solve the problems of soil-caused diseases, anti-biotic drug tolerance, leftover and others; and |

| · | “Green” or organic growers throughout the world. |

Given the global trend of customers favoring environmentally safe green food and organically grown food, producers’ needs for higher yields and better quality, and an increasing pressure of treating and preventing diseases such as H5N1 avian flu, we also foresee strong market needs in other international markets including East Asia and Southeast Asia. We plan to explore these markets when the time is right.

Intellectual Property and Product Lines

Our goal is to build a platform to commercialize bio-technological research and development results for applications in agriculture and environmental protection. In this respect, we are working on developing cooperative research relationships with several universities and institutions in China. When our liquidity position improves, we also intend to continue to acquire technologies to reduce research and development costs and shorten commercialization cycles.

| 4 |

Bio-fertilizers

We have developed six bio-fertilizer products with bacillus spp and/or photosynthetic bacteria as core ingredients. Some of our products contain ingredients of both photosynthesis and bacillus bacteria. Bacillus spp is a species of bacteria that interacts with plants and promotes biological processes. It is highly effective for promoting plant growth, enhancing yield, improving quality and elevating resistances. Photosynthetic bacteria are a group of green and purple bacteria. Bacterial photosynthesis differs from green plant photosynthesis in that bacterial photosynthesis occurs in an anaerobic environment and does not produce oxygen. Photosynthetic bacteria can enhance the photosynthetic capacity of green plants by increasing the utilization of sunlight, which helps keep the photosynthetic process at a vigorous level, enhances the capacity of plants to transform inorganic materials to organic products, and boosts overall plant health and productivity.

Our bacillus bacteria based fertilizers are protected by patents. In 2004, we acquired patent no. ZL 93101635.5 entitled “Highly Effective Composite Bacteria for Enhancing Yield and the Related Methodology for Manufacturing” from China Agricultural University (“CAU”) for the aggregate purchase of $480,411, consisting of $60,411 in cash and 1,000,000 shares of our common stock, valued at $0.42 per share (aggregate value of $420,000). Our photosynthetic bacteria based fertilizers are also protected by trade secret laws.

The patent acquired from CAU covers six different species of bacillus which have been tested as bio-fertilizers to enhance yield and plant health. The production methods of the six species are also patented. The patent will expire on February 9, 2013. There are no limitations under this agreement on our exclusive use of the patent. Pursuant to our agreement with CAU, the University agreed to provide research and technology support services at no additional cost to us in the event we decide to use the patent to produce commercial products. These research and technology support services include: (1) furnishing faculty or graduate-level researchers to help bacteria culturing, sampling, testing, trial production and production formula adjustment; (2) providing production technology and procedures to turn the products into powder form while keeping live required bacteria in the products; (3) establishing quality standards and quality control systems; (4) providing testing and research support for us to obtain necessary sale permits from the Chinese government; and (5) cooperation in developing derivative products.

On January 5, 2011, the State Intellectual Property Office of the PRC (“Intellectual Property Office”) granted Kiwa Shandong two Certificates of Patent of Invention for (1) “A cucumber dedicated composite anti-continuous cropping effect probiotics and their specific strainswith related application” with patent number of “ZL 2008 1 0144492.6”; and (2) “Cotton dedicated composite anti-continuous cropping effect probiotics and their special strains with related application” with patent number of “ZL 2008 1 0144491.1” These two patents have been developed by Kiwa-CAU R&D Center. These two patents will expire on August 5, 2028.

We have obtained five fertilizer registration certificates from the Chinese government - four covering our bacillus bacteria fertilizer and one covering our photosynthetic bacteria fertilizer. The five registration certificates are: (1) Microorganism Microbial Inoculum Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (2) Photosynthetic Bacteria Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (3) Amino Acid Foliar Fomular Fertilizer Registration Certificate issued by the PRC Ministry of Agriculture; (4) Organic Fertilizer Registration Certificate issued by Agriculture Department of Shandong Province; and (5) Organic Matter-Decomposing Inoculants Registration Certificate issued by the PRC Ministry of Agriculture on February 16, 2008. Protected by these five fertilizer registration certificates and five trademarks under the names of “KANGTAN” (Chinese translation name for Kiwa), “ZHIGUANGYOU,” “PUGUANGFU,” “JINWA” and “KANGGUAN,” we have developed six series of bio-fertilizer products with bacillus spp and/or photosynthetic bacteria as core ingredients.

Kiwa-CAU Research and Development Center

In July 2006, we established a new research center with CAU through our subsidiary, Kiwa Shandong, which known as Kiwa-CAU Bio-Tech Research & Development Center (the “Kiwa-CAU R&D Center”). Pursuant to an agreement between CAU and Kiwa Shandong dated November 14, 2006, Kiwa Shandong agreed to contribute RMB 1 million (approximately $157,818) each year to fund research at Kiwa-CAU R&D Center. Under the above agreement, the Kiwa-CAU R&D Center is responsible for fulfilling the overall research-and-development functions of Kiwa Shandong, including: (1) development of new technologies and new products (which will be shared by Kiwa and CAU); (2) subsequent perfection of existing product-related technologies; and (3) training quality-control personnel and technicians and technical support for marketing activities. The Company has spent $166,716 and $182,970 for its research and development activities during the years ended December 31, 2011 and 2010, respectively. The costs incurred by Company’s research and development activities are not borne directly by customers.

| 5 |

During fiscal 2011, Kiwa-CAU R&D Center concentrated on the following activities:

| 1. | Screening of growth-promoting bacteria; |

| 2. | Screening of bio-control bacteria; |

| 3. | Screening of environmental microbiology; and |

| 4. | Studying on fermentation technology and related production process. |

During fiscal 2011, Kiwa-CAU R&D Center had successfully isolated twenty-four strains of endophytic bacillus from plants. A number of strains had been observed to have the capability of boosting crop yield and dispelling chemical pesticide residual from soil. These strains could be used for developing not only new biological preparation but also environmental protection preparation.

During 2011, Intellectual Property Office granted Kiwa Shandong two Certificates of Patent of Invention for (1) “A cucumber dedicated composite anti-continuous cropping effect probiotics and their specific strains with related application” with patent number of “ZL 2008 1 0144492.6”; and (2) “Cotton dedicated composite anti-continuous cropping effect probiotics and their special strains with related application” with patent number of “ZL 2008 1 0144491.1” These two patents have been developed by Kiwa CAU R&D developed by Kiwa-CAU R&D Center. These two patents will expire on August 5, 2028.

Market Overview

Modern agricultural practices largely rely on heavy use of chemical fertilizers, pesticides and veterinary drugs that can cause tremendous harm to the environment, soils and human health. Such practices have been under an increasing public scrutiny across the world, leading to an increased consumer demand for agricultural practices that are more environmentally friendly. China has only 9.26% of the world’s arable land but needs to feed over 1.3 billion people, or approximately 22.9% of the world’s population. If the situation continues unchanged, the largest population in the world could potentially face severe food and water shortages and an increasingly polluted living environment. One solution to the environmental problem is to develop environmentally friendly fertilizers, veterinary drugs and animal feed.

China’s agricultural production has steadily increased for more than 20 years due to agricultural policy reform, improved agricultural technology and recent government support programs, including price supports, export incentives, direct payment and tax incentives. The following table shows the increase in output of major agriculture products between 1970 and 2008:

| Data item | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1990 | 1980 | 1970 | |||||||||||||||||||||||||||||||||||||||

| Corn | 165,910 | 152,300 | 145,482 | 139,365 | 130,287 | 115,830 | 121,310 | 114,094 | 106,001 | 128,084 | 96,821 | 62,600 | 33,030 | |||||||||||||||||||||||||||||||||||||||

| Cotton | 7,492 | 7,624 | 6,746 | 5,714 | 6,324 | 4,860 | 4,916 | 5,324 | 4,417 | 3,829 | 4,508 | 2,707 | 2,277 | |||||||||||||||||||||||||||||||||||||||

| Early rice | N/A | 31,515 | 31,868 | 31,873 | 32,217 | 29,484 | 30,288 | 34,002 | 37,623 | 40,973 | 51,649 | 49,140 | 37,410 | |||||||||||||||||||||||||||||||||||||||

| Late rice | N/A | 33,513 | 34,669 | 34,614 | 32,959 | 31,903 | 35,244 | 41,754 | 41,423 | 48,120 | 50,438 | 36,710 | 26,320 | |||||||||||||||||||||||||||||||||||||||

| Middle rice | N/A | 121,005 | 116,034 | 114,104 | 113,914 | 99,268 | 109,007 | 101,382 | 108,861 | 109,394 | 89,661 | 44,410 | 39,320 | |||||||||||||||||||||||||||||||||||||||

| Wheat | 112,460 | 109,298 | 104,467 | 97,445 | 91,952 | 86,488 | 90,290 | 93,874 | 99,637 | 113,879 | 98,220 | 55,210 | 29,185 | |||||||||||||||||||||||||||||||||||||||

(All in thousand tons)

Source: ERS-United States Department of Agriculture

| 6 |

In response to the increasingly severe deterioration in food safety, environment pollution, rural area stability and other challenges, the Chinese government attaches high importance to the problems of farmers, rural areas, and agriculture. On January 1, 2006, the agricultural tax was abolished. Since 2004, the Central People’s Government of the PRC has continuously issued “Number One Document” regarding rural areas of China. The latest “Number One Document” issued on January 31, 2010, contains a wide-range policies promoting the development of sustainable agriculture methods, for examples, improving the income level of hundreds of millions of farmers, strengthening supervision of farm inputs, and actively developing green-food and organic food production.

Bio-fertilizer Market

To increase overall crop yield, farmers in China use vast amounts of chemical fertilizers. According to the U.S. Department of Agriculture, the use of chemical fertilizers in China skyrocketed from 10,863,000 tons in 1979 to 52,390,000 tons in 2008, underpinning a compound annual growth rate of 5.58%. However, notwithstanding the continuous growth of total fertilizer consumption, the way that Chinese farmers apply fertilizer is beginning to change. From 1979 to 2008, the percentage of nitrogenous fertilizer application to total amount of fertilizer consumption decreased gradually from 76% to 43.9%. Meanwhile, the percentage of phosphate fertilizer and potash fertilizer increased steadily. More importantly, whereas in 1976, 100% of China’s fertilizer consumption was chemical fertilizer (including nitrogenous fertilizer, phosphate fertilizer and potash fertilizer); in 2008, the rate decreased to 69%. Other fertilizers, including bio-fertilizer, have begun to be accepted by Chinese farmers. (Source: ERS-United States Department of Agriculture)

The excessive use of chemical fertilizers in China is also reflected by the China-to-U.S. rate of chemical fertilizer application. According to data from the U.S. Department of Agriculture, in 2005 Chinese farmers applied 2.05 times the nitrogen fertilizer and 1.8 times the phosphate fertilizer compared to their U.S. counterparts.

Use of chemical fertilizer in China is now higher than it has ever been. This increase in use of chemical fertilizers has led to a series of severe problems including degradation of the soil structure, natural biodiversity, and ecological system instability. Promoting the use of bio-fertilizer together with chemical fertilizer is one of the solutions to solve these problems.

Our serial commercialized products, with bacillus and/or Photosynthesis Biological Catalyst as core ingredients, capitalize on this market trend and we hope to become one of the leaders in developing green technologies for productive, more sustainable agriculture in China.

Competition

Bio-fertilizer

The Company believes that there are about 400 producers of microbial fertilizers in China, most of which are small-scale, workshop producing enterprises with backward equipment and production processes and poor quality. Some of the producers over-exaggerate product effectiveness, employ improper artifice and even produce fake and shoddy products, all of which have caused losses to farmers and lowered the reputation of bio-fertilizer.

Due to the unique products that we offer and the very early stage of the bio-fertilizer market in China, we believe there is a limited direct competition for our products in the Chinese marketplace. We believe that we have product differentiation and cost advantages (cost to customer) which will enable us to be more profitable than our competitors for the following reasons, among others:

| l | Highly effective in boosting crop yield and quality while being environmentally friendly; |

| l | Lower price point and higher return on investment to end users; and |

| l | Complimentary to existing use of chemical fertilizer which will help minimize switching costs for end users. |

| 7 |

In addition, we face competition from large chemical fertilizer manufacturers in China. These chemical fertilizer manufacturers have provided chemical fertilizers to farmers in China for more than twenty years and customers are more accustomed to using their established products as compared to our products.

Raw Materials and Suppliers

The key raw materials used in manufacturing of our products are available from a wide variety of supply sources. Historically, we have not experienced any difficulties in procuring adequate quantities of raw materials for use in our bio-fertilizer and biologically enhanced livestock feed production. We do not have long-term agreements with our suppliers due to the availability of other numerous suppliers that have the ability to supply our required raw materials to us on fairly short notice. We typically place purchase orders when we need raw material supplies.

The major raw materials for our bio-fertilizer production can be divided into two categories: (1) growth media such as sodium acetate, glucose and turf for culturing bacillus spp., and (2) photosynthetic and bacillus bacteria, which are the core ingredients for our finished products. Some other main ingredients include urea, aminophenol, humus, diammonium phosphate, and dipotassium hydrogen phosphate. Prior to the completion of our bacillus manufacturing facility upgrade in Shandong, we had purchased semi-manufactured bacillus goods.

In fiscal 2011, we did not purchase any raw materials from any suppliers.

Customers

Our principal business generated no revenue during 2011, thus as of December 31, 2011, we had no customers. We had a total of 15 customers as of December 31, 2010. A single customer accounted for 79.9% of our net sales for the year ended December 31, 2010. No other single customer accounted for more than 7% of our revenues in this product line.

Seasonality

Our operating results have been and are expected to continue to be subject to seasonal trends. This trend is dependent on numerous factors, including the markets in which we operate, growing seasons, climate, economic conditions, and numerous other factors beyond our control. Generally, we expect the second and third quarters to be stronger than the first and fourth quarters, primarily because the second and third quarters correspond with the growing seasons in our primary markets in China. It is during those growing seasons when application of our products by our customers would be most beneficial and we therefore expect greater demand for our products during those periods. There can be no assurance that these operating patterns will occur or continue.

Employees

We currently employ 12 full-time employees in China, including seven management staff, and one employee in the United States.

Available Information

The Company files or furnishes Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, registration statements, and other items with the Securities and Exchange Commission (SEC). The Company provides access free of charge to all of these SEC filings, as soon as reasonably practicable after filing or furnishing, on its Internet site located at http://www.kiwabiotech.com/tuoziy.htm?eid=12. The Company will also make available to any stockholder, without charge, copies of its Annual Report on Form 10-K as filed with the SEC.

| 8 |

The public may read and copy any materials and files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Regulatory Concerns

Our production must comply with bio-fertilizer, livestock feed production, and testing procedure standards promulgated by the PRC Ministry of Agriculture and local administrative authorities. We have complied with the applicable PRC government standard production and testing procedures. The amount of costs incurred in connection with compliance with environmental laws during fiscal 2011 and 2010 was immaterial.

Environmental Matters

Our two manufacturing facilities, Kiwa Shandong and Kiwa Tianjin,

have passed environmental impact assessments by local environmental authorities. Photosynthesis bacteria, bacillus ssp,

and actinomycetes are environmentally friendly and are not known to cause any environmental problems.

Legal Proceedings

On December 22, 2009, Kiwa Tianjin filed a lawsuit against Challenge Feed in the local court of Wuqing District, Tianjin, where Kiwa Tianjin is domiciled. In the lawsuit, Kiwa Tianjin asserted that Challenge Feed unlawfully disposed of the assets held by Kiwa Tianjin, such assets include:

(1) Machinery and equipment. Challenge Feed entered into a settlement agreement with one of its creditors, in accordance with which Challenge Feed agreed to transfer title of the machinery and equipment, which had been assigned to Kiwa Tianjin in 2006 in connection with the establishment of Kiwa Tianjin as a joint venture between the Company and Challenge feed, to repay Challenge Feed’s debt. Challenge Feed did not obtain Kiwa Tianjin’s consent nor inform Kiwa Tianjin of such transfer.

(2) Inventories. Kiwa Tianjin had a long standing agreement to lease Challenge Feed’s factory facilities and warehouse for storage of its inventory. Challenge Feed has disposed Kiwa Tianjin’s inventories including raw materials, packages and finished goods stored in the factory to repay Challenge Feed’s debt without any permission from Kiwa Tianjin.

The local court of Wuqing District ruled that the local court would not examine the lawsuit against Challenge Feed since Challenge Feed entered into bankruptcy proceedings and that all related matters would be solved during Challenge Feed’s bankruptcy proceedings.

On December 27, 2011, Challenge Feed’s bankruptcy administrator informed the Company that the bankruptcy court has granted the Company’s request to repossess the machinery and equipment and Kiwa Tianjin’s bio-enhanced feed production lines that was positioned in Challenge Feed’s domicile. If the Company fails to repossess such machinery and equipment before December 31, 2011, the Company would then be responsible for losses resulting from any damages to the machinery and equipment after such date. On February 9, 2012, the Company sold such machinery and equipment for $8,000.

ITEM 1A.Risk Factors

We operate in a market environment that is difficult to predict and involves significant risks and uncertainties, many of which are beyond our control. The following risk factors and other information included in this annual report should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, operating results, and cash flows could be materially adversely affected.

| 9 |

(1) Risks Related to Our Business

We have not yet generated any profits and if we do not become profitable or obtain additional funding to implement our business plan our ability to continue as a going concern is in doubt.

Overview of the Company’s Financial Condition as of December 31, 2011

As of December 31, 2011, the Company had an accumulated deficit of $20,362,032, of which, $1,691,319 and $2,275,783 were incurred during the years ended December 31, 2011 and 2010, respectively.

As of December 31, 2011, we had cash and cash equivalents of $16,307 and total current assets of $42,677; at the same time, we had current liabilities of $10,593,526, denoting a current ratio (current assets divided by current liabilities) of 0.004 and a quick ratio (cash divided by current liabilities) of 0.002. At the end of fiscal 2011, we also had long-term liabilities of $1,814,911.

On June 29, 2006, the Company entered into a securities purchase agreement with six institutional investors (the “Purchasers”) for the issuance and sale of (1) 6% secured convertible notes, due three years from the date of issuance, in the aggregate principal amount of $2,450,000, convertible into shares of the Company’s common stock (the “6% Notes”), and (2) warrants to purchase 12,250,000 shares of the Company’s common stock (the “Warrants”). As of December 31, 2010, the outstanding principal of 6% Notes was $1,518,171. On June 29, 2009, the 6% Notes were due. The Company has informed the Purchasers of its inability to repay the outstanding balance on the due date. Therefore, the 6% Notes are in default.

On January 31, 2008, the Company entered into three Callable Secured Convertible Notes Agreements (“2% Notes”) with four of the Company’s 6% Notes purchasers converting their unpaid interest of $112,917 in total, into principal with an interest rate of 2% per annum, which fell due on January 31, 2011. Other terms of the 2% Notes are similar to the 6% Notes. No principal of the 2% Notes has been converted so far. The outstanding principal balance on the 2% Notes was $112,917 as of December 31, 2011. On January 31, 2011, the 2% Notes were due and the Company failed to make repayment for outstanding balances. Thus, the 2% Notes are in default.

To the extent that we are unable to successfully raise the capital necessary to fund our future cash requirements on a timely basis and under acceptable terms and conditions, we will not have sufficient cash resources to maintain operations and repay our liabilities, and may have to curtail or cease operations and consider a formal or informal restructuring or reorganization.

Overview of the Company’s Operating Results for the Years Ended December 31, 2011 and 2010

During the years ended December 31, 2011 and 2010, our sales revenue from continuing operations was $nil and $88,056, respectively. The Company’s gross profit was $nil and negative $9,466, respectively. During fiscal years 2011 and 2010, the Company’s net losses were $1,691,319 and $2,275,783, respectively.

Overview of the Company’s Cash flow Status for the Years Ended December 31, 2011 and 2010

During fiscal years ended December 31, 2011 and 2010, the net cash used in our operating activities was $499,807 and $983,280, respectively. We also invested $nil and $424 in purchasing property and equipment for the fiscal years ended December 31, 2011 and 2010, respectively. Although the net cash provided by our financing activities was $448,880 and $1,070,998 in the fiscal years of 2011 and 2010, respectively, we had cash of only $16,307 and $32,816 on December 31, 2011 and 2010, respectively.

| 10 |

The Company’s Ability of Raising New Financing

Three factors have significantly impaired the Company’s ability to raise additional financing. They are: i) no revenue, ii) continuous losses, and iii) a low share price. In addition, the Company does not have assets to secure the obligations of new debt. As of December 31, 2011, the closing price of our common stock reported by on the OTC Bulletin Board was $0.0003 and the market value of the Company was $120,000. The Company’s obligations under the 6% Notes and the Warrants are secured by a first priority security interest in the Company’s intellectual property pursuant to an Intellectual Property Security Agreement with the Purchasers, and by a first priority security interest in all of the Company’s other assets pursuant to a Security Agreement with the Purchasers. In addition, the Company’s Chief Executive Officer has pledged all of his common stock of the Company as collateral security for the Company’s obligations under the 6% Notes and the Warrants.

Moreover, the 6% Notes require the Company to obtain the Purchaser’s consent to take certain actions including paying dividends, repurchasing stock, incurring debt, guaranteeing obligations, merging or restructuring the Company, or selling significant assets. As a result of these restrictions, our ability to raise new financing is severely limited.

Conclusion

The Company’s ability to continue as a going concern is in doubt. We expect to continue to have operating losses for the foreseeable future as we are still in the process of exploring new markets and conducting further research and product tests. We will require additional capital to implement our business plan and continue operating. To the extent that we are unable to successfully raise the capital necessary to fund our future cash requirements on a timely basis and under acceptable terms and conditions, we will not have sufficient cash resources to maintain operations, and may have to curtail or cease operations and consider a formal or informal restructuring or reorganization.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with our financial statements for the latest nine fiscalyears, which states that the financial statements raise substantial doubt as to our ability to continue as a going concern. Our ability to make operations profitable or obtain additional funding will determine our ability to continue as a going concern.

We did not have any customers in 2011 and we used to depend on a few customers for a significant portion of our revenue and we are still in the initial stage of market development.

We do not have long-term contracts with any of our customers. Generally, we sign an annual distribution agreement with each customer and purchases in most cases occur on an order-by-order basis. Relationships exist as long as there is a perceived benefit to both parties. A decision by a major customer, whether motivated by competitive considerations, financial difficulties and economic conditions or otherwise, to decrease its purchases from us or to change its manner of doing business with us, could adversely affect our business and financial condition.

During fiscal 2011, our principal business did not generate any sales revenue. We did not have any customers during that period. During fiscal 2010, one customer accounted for approximately 79.9% of our net sales in bio-fertilizer product line. No other single customer accounted for more than 7% of our revenues in this product line. The customer concentration in this production line has been increasing. The loss of any of our significant customers would result in a material reduction in our sales and results of operations.

We are still in the initial stage of market development and need more time to construct a robust customer base. There can be no assurance that we will be able to retain these customers. Our inability to generate new customers and retain old customers could negatively impact our business and our ability to continue as a going concern.

Our business is subject to seasonal fluctuations.

Our operating results have been and are expected to continue to be subject to seasonal trends. This trend is dependent on numerous factors, including the markets in which we operate, growing seasons, climate, economic conditions and numerous other factors beyond our control.

| 11 |

Our operating results may fluctuate significantly, which may result in volatility or have an adverse effect on the market price of our common stock.

We have experienced, and expect to continue to experience, substantial variation in our net sales and operating results from quarter to quarter. Our business is subject to seasonal fluctuations due to growing seasons in different markets. We believe the factors that influence this variability of quarterly results include:

| l | the timing and size of orders from major customers; |

| l | budgeting and purchasing cycles of customers; |

| l | the timing of enhancements to products or new products introduced by us or our competitors; |

| l | changes in pricing policies made by us, our competitors or suppliers, including possible decreases in average selling prices of products in response to competitive pressures; |

| l | fluctuations in general economic conditions; |

| l | the status of operating cash flow; and |

| l | natural disasters and contagious animal diseases. |

We may also choose to reduce prices or increase spending in response to competition or pursue new market opportunities. Due to fluctuations in our revenue and operating expenses, we believe that period-to-period comparisons of our results of operations are not a good indication of our future performance. It is possible that in some future quarter or quarters our operating results will be below the expectations of securities analysts or investors. In that case, our stock price could fluctuate significantly or decline.

From January 1, 2011 to December 31, 2011, the market close price for our common stock as quoted on the OTC Bulletin Board has ranged from a low of $0.0003 to a high of $0.0045 per share. High volatility in the market price of our common stock may result in lower prices for our common stock, making it more difficult for us to obtain equity financing on terms and conditions which are favorable to us, if at all. We expect to continue to incur losses in the future as we develop and market our initial products. As a result, we will be dependent on additional debt or equity financing to fund our operations. If such financing is not available on terms which are acceptable to us, we may have to delay development of new products and/or reduce sales and marketing efforts for our existing products. Such actions may have an adverse effect on our results of operations. In addition, uncertainties with respect to our ability to raise additional capital would make operational planning more difficult for management.

Our success depends in part on our successful development and sale of products which are currently in the research and development stage.

Some of our product candidates are still in the research and development stage. The successful development of new products is uncertain and subject to a number of significant risks. Potential products that appear to be promising at early stages of development may not reach the market for a number of reasons, including but not limited to, the cost and time of development. Potential products may be found to be ineffective or cause harmful side effects, fail to receive necessary regulatory approvals, be difficult to manufacture on a large scale or be uneconomical or fail to win market acceptance. Our failure to develop and sell new products may delay or eliminate future acquisition plans and would most likely slow our development. Our plans to introduce additional proprietary products may not be realized as expected, if at all.

As above mentioned, the China bio-fertilizer market is still in a very early stage and is very fragmented with many potential customers, but with no single producer or small group of producers dominating the market. To some extent, however, we also face competition from large chemical fertilizer manufacturers in China. These chemical fertilizer manufacturers have provided chemical fertilizers to farmers in China for over twenty years and customers are more accustomed to using their established products as compared with new products. The livestock feed industry is fully developed in China. We are new entrants to the livestock feed industry, and our production capacity is small relative to that of the whole industry.

| 12 |

There can be no assurance that any of our intended products will be successfully developed or that we will achieve significant revenues from such products even if they are successfully developed. Our success is dependent upon our ability to develop and market our products on a timely basis. There can be no assurance that we will be successful in developing or marketing such products or taking advantage of the perceived demand for such products. In addition, there can be no assurance that products or technologies developed by others will not render our products or technologies non-competitive or obsolete.

Failure to adequately expand to address expanding market opportunities could have a material adverse effect on our business and results of operations.

We anticipate that a significant expansion of operations will be required to address potential market opportunities. There can be no assurance that we will expand our operations in a timely or sufficiently large manner to capitalize on these market opportunities. The anticipated substantial growth is expected to place a significant strain on our managerial, operational and financial resources and systems. While management believes it must implement, improve and effectively use our operational, management, research and development, marketing, financial and employee training systems to manage anticipated substantial growth, there can be no assurance that these practices will be successful.

Our success depends in part upon our ability to retain and recruit key personnel.

Our success is highly dependent upon the continued services of our executive officers, key product development and scientific personnel. Given the intense competition for qualified management and product development personnel in our industry, the loss of the services of any key management or product development personnel may significantly and detrimentally affect our business and prospects. We maintain employment agreements with all members of management or key personnel. Pursuant to our joint agreement with CAU, it must make available at least six R&D staff to join the Kiwa-CAU R&D Center, at least three of which must have professor or doctorate degrees, and at least two must have master degrees. There can be no assurance that we will be able to retain these personnel, and it may be time-consuming and costly to recruit qualified personnel replacement.

We currently do not have sufficient revenues to support our business activities, expect operating losses continue, and will require additional financing which we may not be able to secure.

We require substantial working capital to fund our business. In the short term, we still need to continue building out our bio-fertilizer manufacturing facility, adjust our product formula to improve product stability and optimize our product offerings, expand our sales and marketing efforts in China, expand our distribution base in China, maintain the Kiwa-CAU R&D Centeroperation, introduce new veterinary drug products and acquire a small or medium sized biotechnology company or a factory with GMP qualification for this new product. In the long term, we plan to become a commercialization platform for world-class biotechnological research and development results for applications in agriculture, natural resources conservation and environment protection, launch our products in the Southeast Asia, United States and other markets, continue our introduction of new products, create formal strategic alliances with selected United States companies to co-develop and/or co-market products in the United States and China, and form an international biotechnology research center in China for the research and development of agricultural, environmental and medical applications.

During fiscal 2011, our sales revenue was $nil, and we are continuing to experience losses. We currently do not have sufficient revenues to support our business activities and we expect operating losses to continue. We will require additional capital to fund our operations and finance our research and development activities. Funding, whether from a public or private offering of debt or equity, a bank loan or a collaborative agreement, may not be available when needed or on favorable terms. Further, any significant equity or debt financing will require us to give priority to holders of the 6% secured convertible notes (“6% Notes”) under the terms of a securities purchase agreement dated June 29, 2006, which may raise the difficulty level of completing a financing. (For more details regarding the 6% Notes see Note 8 to consolidated financial statements under Item 8, Part II.) If we are unable to obtain necessary financing in the amounts and on terms deemed acceptable, we will have to limit, delay, scale back or eliminate our research and development activities or future operations. Any of the foregoing may adversely affect our business and cause us to discontinue as a going concern.

| 13 |

The risks associated with raising capital through collaborations and licensing agreements could adversely affect our business.

We will be required to raise additional capital to fund our operations and finance our research and development activities through collaborative and/or licensing agreements. Under these agreements, we may be subject to various restrictive covenants which could significantly limit our operating and financial flexibility and may limit our ability to respond to changes in our business or competitive environment. If we are unable to obtain necessary financing in the amounts and on terms deemed acceptable, we may have to limit, delay, scale back or eliminate our research and development activities or future operations. Any of the foregoing may adversely affect our business.

Restrictions on currency exchange may limit our ability to effectively receive and use our revenue.

Since most of our future revenues may be in the form of China Renminbi, any future restrictions on currency exchanges may limit our ability to use revenue generated in Renminbi to fund our business activities outside China or to make dividend or other payments in U.S. Dollars. Although the Chinese government introduced regulations since 1996 to allow greater convertibility of Renminbi, for current account transactions, significant restrictions still remain, including primarily the restriction that foreign invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents. In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of Renminbi, especially with respect to foreign exchange transactions.

We may also be subject to foreign exchange risk and foreign ownership restrictions. The Chinese government is loosening its control on foreign exchange transactions, and has steadily appreciated Renminbi relative to the U.S. dollar since July 2005. However, there can be no assurance that this policy will continue. More liberal foreign exchange policies will reduce our foreign exchange risk by increasing the liquidity of revenues generated in Renminbi. Fluctuations in the exchange rate of Renminbi against the U.S. Dollar could adversely affect our results of operations by affecting our reported earnings for any given period. In addition, foreign ownership restrictions could also impact our ability to expand our business through investment and acquisition opportunities. If we are unable to pursue such strategic opportunities due to foreign ownership regulations, the growth of our business could be limited.

Changes in China’s political, social, economic or legal systems could materially harm our business.

All of our manufacturing and production as well as the majority of our sales occur in China. Consequently, an investment in our common stock may be adversely affected by the political, social and economic environment in China. Under its current leadership, China has been pursuing economic reform policies, including the encouragement of private economic activities and greater economic decentralization. There can be no assurance, however, that the Chinese government will continue to pursue such policies, that such policies will be successful if pursued, or that such policies will not be significantly altered from time to time.

Our business and prospects are dependent upon agreements and regulatory approval with various entities controlled by Chinese governmental instrumentalities. Historically, our operations in China have received relatively favorable treatment from these instrumentalities as a result of the Chinese government’s policies of encouraging economic development and innovation, especially in underdeveloped regions. However, our operations and prospects would be materially and adversely affected by a change in China’s economic policies, which could make it more difficult for us to obtain necessary approvals from governmental authorities and to obtain economic incentives from governmental authorities. In addition, if the Chinese government elects not to honor certain contracts as a result of political change, it might be difficult to enforce these contracts against such governmental entities in China. In addition, the legal system of China relating to foreign investments is both new and continually evolving, and currently there can be no certainty as to the application of its laws and regulations in particular instances.

| 14 |

For example, in June 2002, we entered into an agreement with Zoucheng Municipal Government granting us the use of at least 15.7 acres in Shandong Province, China at no cost for 10 years to construct a manufacturing facility. Pursuant to relevant Chinese laws and regulations, we had paid tenure tax on quarterly basis at the rate of approximately $1,660 per acre. However, from January 1, 2007, China central government adopted a series of policies to strengthen land management, including doubling tenure tax to $3,320 per acre. In February 2008, the Ministry of Land and Resources of China issued “Controlling Indexes of Construction Land Use for Industrial Projects,” which requires the building coverage should not be less than 30%. Up to now, the current situation in Kiwa Shandong does not meet this requirement. The Company is also considering plans to reduce the acreage that we lease and return part of the land to the local authority to lower taxes.

A slow-down in the Chinese economy may adversely affect our growth and profitability.

The growth of the Chinese economy has been uneven across geographic regions and economic sectors. There can be no assurance that growth of the Chinese economy will be steady or that any recessionary conditions will not have a negative effect on our business. To the extent that there is a slow-down in the Chinese economy, the agricultural industry may be adversely affected. Consequently, the growth and profitability of our bio-fertilizer business and bio-enhanced feed business may slow down. The financial meltdown has significantly slowed down the growth of the world economy. There can be no assurance that Chinese economy and our growth and profitability will not be affected.

Any recurrence of SARS, avian influenza or another widespread public health problem, could adversely affect our business and results of operations.

A renewed outbreak of SARS, avian influenza, highly pathogenic blue-ear disease or another widespread public health problem in China, where most of our revenue is derived, could have a negative effect on our operations. Our operations may be impacted by a number of health-related factors, including the following: (1) quarantines or closures of some of our offices and factories which would severely disrupt our operations, (2) the sickness or death of our key officers and employees, (3) a general slowdown in the Chinese economy, especially rapid decrease of stockbreeding.

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our business and results of operations.

Our ability to generate revenues could suffer if the Chinese ag-biotechnology market does not develop as anticipated.

The agriculture-biotechnology market in China, the primary market in which we do business, is in the early stages of development. While we believe the market opportunity looks promising, we expect that the market will take several years to develop. While it is difficult to project exactly how long it will take to develop the ag-biotechnology industry in China, we anticipate that it will take at least ten years to reach a level of development that is similar to the current state of the industry in the United States. Successful development of the ag-biotechnology market in China depends on the following: (1) continuation of governmental and consumer trends favoring the use of products and technologies designed to create sustainable agriculture; (2) educating the Chinese agricultural community and consumers about the uses of ag-biotechnology products; and (3) certain institutional developments such as governmental agricultural subsidies designed to promote the use of environmentally friendly ag-biotechnological products.

| 15 |

There are no assurance that these trends will continue, governmental subsidies will be offered, or that the Chinese agricultural community and consumers will be successfully educated about the uses of ag-biotechnology products. The conduct of business in the ag-biotechnology market involves high risks. There can be no assurance that the ag-biotechnology market in China will develop sufficiently to facilitate our profitable operation. While we believe that we will benefit from our first-mover advantage in a growing market, existing competitors and new entrants in the ag-biotechnology market are expected to create fierce competition in the future as the market evolves. Competitors and new entrants may introduce new products into the market that may detrimentally affect sales of our existing products, and consequently our revenues. We intend to fund operations through sales, debt and equity financings until such time as the ag-biotechnology market in China is sufficiently developed to support our profitable operation.

We may not be able to adequately protect our intellectual property rights, and may be exposed to infringement claims from third parties.

Our success will depend in part on our ability to obtain patent protection for our technology, preserve our trade secrets, and operate without infringing on the proprietary rights of third parties. We have several trademarks registered in China, which will be protected by the trademark laws in China for ten years and are renewable at the expiration of the initial ten-year term.

We may also file patents with the PRC Intellectual Property Bureau and/or the U.S. Patent and Trademark Office as we deem appropriate, or buy other patents such as the above mentioned anti-viral aerosol technologies. There can be no assurance that the patents applied for will be reviewed in a timely manner, that any additional patents will be issued or that any patents issued will afford meaningful protection against competitors with similar technology or that any patents issued will not be challenged by third parties. There also can be no assurance that others will not independently develop similar technologies, duplicate our technologies or design around our technologies whether or not patented. There also can be no assurance that we will have sufficient resources to maintain a patent infringement lawsuit should anyone be found or believed to be infringing our patents. There also can be no assurance that the technology ultimately used by us will be covered in any additional patent applications that we may file. We do not believe that our technology infringes on the patent rights of third parties. However, there can be no assurance that certain aspects of our technology will not be challenged by the holders of other patents or that we will not be required to license or otherwise acquire from third parties the right to use additional technology. The failure to overcome such challenges or obtain such licenses or rights on acceptable terms could have a material adverse impact on our results of operations and financial condition.

The processes and know-how of importance to our technology are dependent upon the skills, knowledge and experience of our technical personnel, consultants and advisors and such skills, knowledge and experience are not patentable. To help protect our rights, we require employees, significant consultants and advisors with access to proprietary information to enter into confidentiality and proprietary rights agreements. There can be no assurance, however, that these agreements will provide adequate protection for our trade secrets, know-how or proprietary information in the event of any unauthorized use or disclosure. There can be no assurance that we will be able to obtain a license for any technology that we may require to conduct our business or that, if obtainable, such technology can be licensed at a reasonable cost. The cost of obtaining and enforcing patent protection and of protecting proprietary technology may involve a substantial commitment of our resources. Any such commitment may divert resources from other areas of our operations. We may be required to license or sublicense certain technology or patents in order to commence operations. There can be no assurance that we will be able to obtain any necessary licenses or to do so on satisfactory terms. In addition, we could incur substantial costs in defending ourselves against suits brought by other parties for infringement of intellectual property rights and there can be no assurance that we will have the resources to do so.

We may become involved in intellectual property litigation, the defense of which could adversely impact our business operations.

Currently we have three patents in China (1) “Highly Effective Composite Bacteria for Enhancing Yield and the Related Methodology for Manufacturing”(Patent Number ZL93 101635.5), which covers six different species of bacillus which have been tested as bio-fertilizers to enhance yield and plant health as well as the production methods of the six species. The patent will expire on February 19, 2013. (2) “A cucumber dedicated composite anti-continuous cropping effect probiotics and their specific strains with related application” (Patent Number: ZL 2008 1 0144492.6), which will expire on August 5, 2028; and (3) “Cotton dedicated composite anti-continuous cropping effect probiotics and their special strains with related application” (Patent Number: ZL 2008 1 0144491.1), which will expire on August 5, 2028.

| 16 |

While we have not received any allegations, complaints or threats of litigation relating to any intellectual property rights, we may, from time to time, become involved in litigation regarding patent and other intellectual property rights. From time to time, we may receive notices from third parties of potential infringement and claims of potential infringement. Defending these claims could be costly and time consuming and would divert the attention of management and key personnel from other business issues. The complexity of the technology involved and the uncertainty of intellectual property litigation increase these risks. Claims of intellectual property infringement also might require us to enter into costly royalty or license agreements. However, we may be unable to obtain royalty or license agreements on terms acceptable to us, or at all. In addition, third parties may attempt to appropriate the confidential information and proprietary technologies and processes used in our business, which we may be unable to prevent and which would harm the businesses and our prospects.

We face technical risks associated with commercializing our technology which could have a material adverse impact on our business results and operations.

A key to our future success is the ability to produce our planned animal flu disinfector, livestock feed and bacillus series of products at lower costs than our competitors. Although we are currently utilizing our proprietary technology to produce such products at lower costs, our method for producing such products on a commercial basis has only recently begun. Further, although results from recent independent tests and our early production results have been encouraging, the ability of our technology to commercially produce such products at consistent levels is still being evaluated. There can be no assurance that we will be able to produce products at lower costs than our competitors, or that our technology will be able to commercially produce such products at consistent levels.

We have no business insurance coverage.

We do not have any business liability insurance coverage for our operations. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

As a public company, we are subject to report on our internal control structure and procedures for financial reporting in our annual reports on Form 10-K, as a requirement of Section 404 of the U.S. Sarbanes-Oxley Act of 2002 by the U.S. Securities and Exchange Commission (the “SEC”). The report must contain an assessment by management about the effectiveness of our internal controls over financial reporting.

As required by Section 404 of the U.S. Sarbanes-Oxley Act, our management has concluded that our internal controls over our financial reporting are ineffective as of December 31, 2011. Any failure to implement and maintain improvements in the controls over our financial reporting, or difficulties encountered in the implementation of any improvements in our controls, could cause us to fail to meet our reporting obligations. Any failure to improve our internal controls to address these identified weaknesses could also cause investors to lose confidence in our reported financial information, which could have a negative impact on the trading price of our stock.

(2) Risk Related to Our Common Stock

If an active trading market for our securities does not remain in existence, the market price of our securities may decline and stockholders’ liquidity may be reduced.

Our common stock is quoted on the OTC QB; however, trading volume is very limited. We cannot guarantee that we will develop sufficient trading volumes to sustain a regular trading market. The OTC Bulletin Board is an inter-dealer, over-the-counter market that provides significantly less liquidity than the NASDAQ’s automated quotation system. Market prices for our common stock will be influenced by a number of factors, including but not limited to: (1) the issuance of new equity securities; (2) changes in interest rates; (3) competitive developments, including announcements by competitors of new products or services or significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; (4) variations in quarterly operating results; (5) change in financial estimates by securities analysts; (6) the depth and liquidity of the market for our common stock; (7) investor perceptions of our company and the ag-biotechnology industry generally; and (8) general economic and other conditions.

| 17 |

The designation of our common stock as “penny stock” could impact the trading market for our common stock due to broker-dealer requirements imposed by the designation of our common stock as “penny stock.”

Our common stock is a “penny stock” as defined in Rules 15g-2 through 15g-6 promulgated under Section 15(g) of the Securities Exchange Act of 1934, as amended, as it meets the following definitions: (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange, or even if so, has a price less than $5.00 per share; and (iii) is issued by a company with net tangible assets less than $2.0 million, if in business more than a continuous three years, or with average revenues of less than $6.0 million for the past three years. The principal result or effect of being designated as a “penny stock” is that securities broker-dealers cannot recommend the stock but must trade in it on an unsolicited basis.

Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rule 15g-2 promulgated thereunder by the SEC require broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and obtain a manually signed and dated written receipt of the document before effecting any transaction in a penny stock for the investor’s account.