Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InPoint Commercial Real Estate Income, Inc. | ck0001690012-8k_20210428.htm |

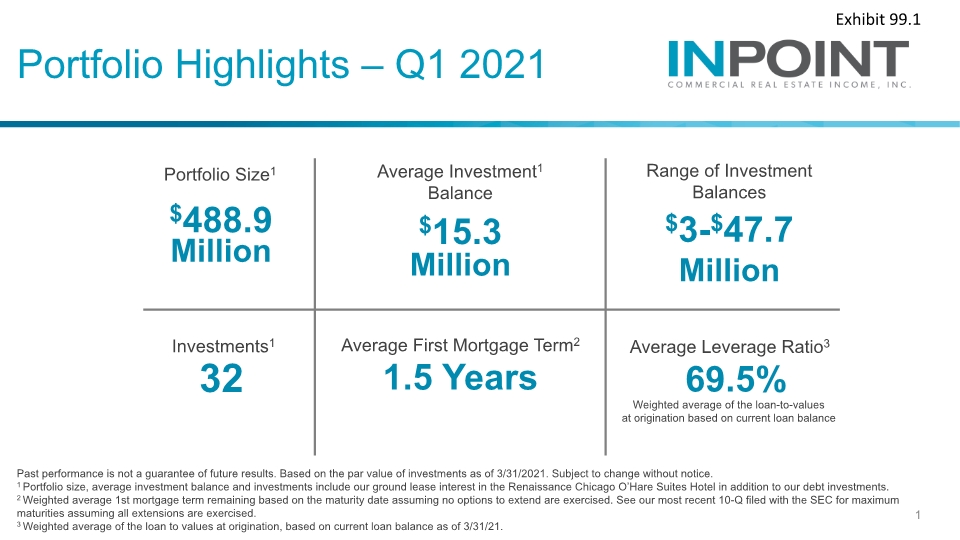

1 Portfolio Highlights – Q1 2021 Average Leverage Ratio3 $3-$47.7 Million 1.5 Years Average Investment1 Balance Weighted average of the loan-to-values at origination based on current loan balance Portfolio Size1 $488.9 Million $15.3 Million Range of Investment Balances Investments1 32 Average First Mortgage Term2 69.5% Past performance is not a guarantee of future results. Based on the par value of investments as of 3/31/2021. Subject to change without notice. 1 Portfolio size, average investment balance and investments include our ground lease interest in the Renaissance Chicago O’Hare Suites Hotel in addition to our debt investments. 2 Weighted average 1st mortgage term remaining based on the maturity date assuming no options to extend are exercised. See our most recent 10-Q filed with the SEC for maximum maturities assuming all extensions are exercised. 3 Weighted average of the loan to values at origination, based on current loan balance as of 3/31/21. Exhibit 99.1

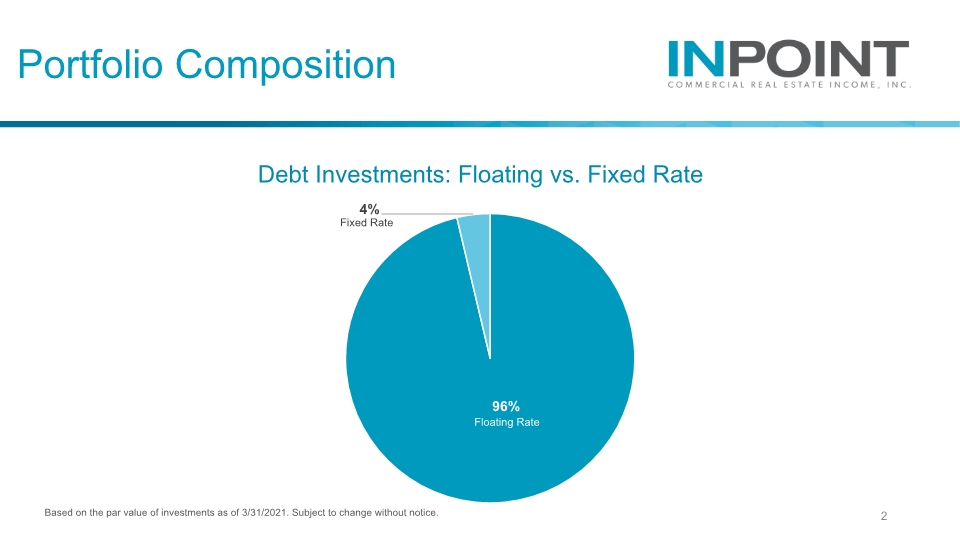

2 Debt Investments: Floating vs. Fixed Rate Fixed Rate Floating Rate Based on the par value of investments as of 3/31/2021. Subject to change without notice. Portfolio Composition

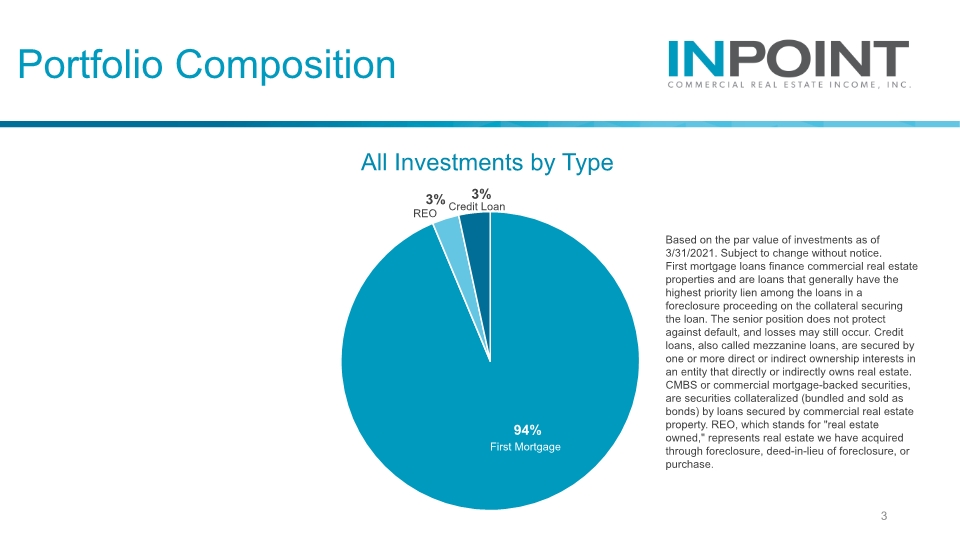

3 All Investments by Type REO First Mortgage Credit Loan Based on the par value of investments as of 3/31/2021. Subject to change without notice. First mortgage loans finance commercial real estate properties and are loans that generally have the highest priority lien among the loans in a foreclosure proceeding on the collateral securing the loan. The senior position does not protect against default, and losses may still occur. Credit loans, also called mezzanine loans, are secured by one or more direct or indirect ownership interests in an entity that directly or indirectly owns real estate. CMBS or commercial mortgage-backed securities, are securities collateralized (bundled and sold as bonds) by loans secured by commercial real estate property. REO, which stands for "real estate owned," represents real estate we have acquired through foreclosure, deed-in-lieu of foreclosure, or purchase. Portfolio Composition

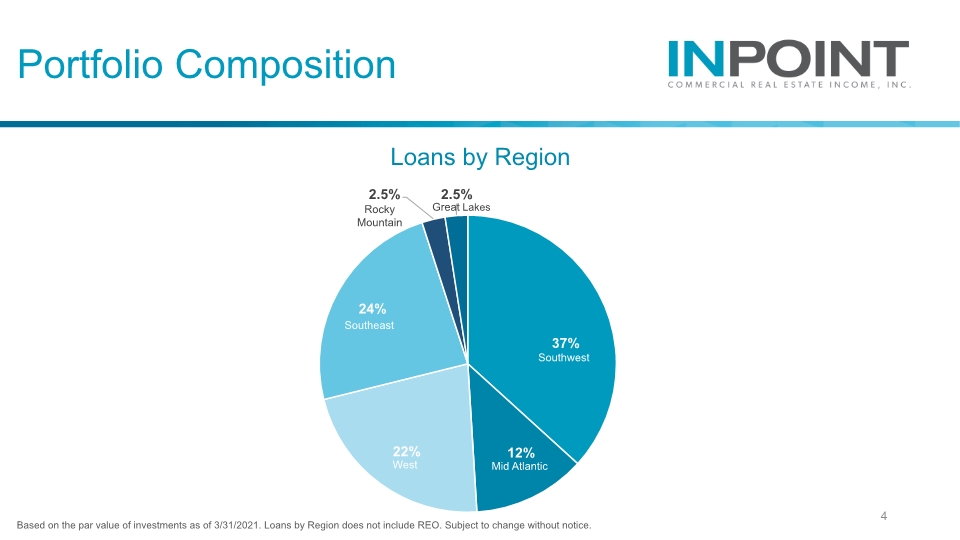

4 Loans by Region Southwest West Southeast Mid Atlantic Rocky Mountain Based on the par value of investments as of 3/31/2021. Loans by Region does not include REO. Subject to change without notice. Portfolio Composition

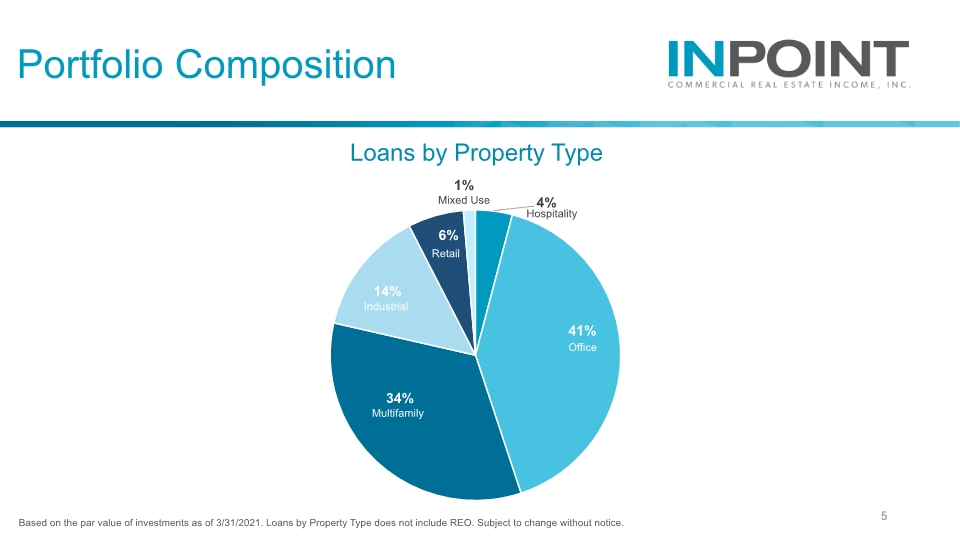

Loans by Property Type 5 Multifamily Office Retail Hospitality 1% Mixed Use Based on the par value of investments as of 3/31/2021. Loans by Property Type does not include REO. Subject to change without notice. Portfolio Composition