Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex322_6.htm |

| EX-32.1 - EX-32.1 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex321_8.htm |

| EX-31.2 - EX-31.2 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex312_9.htm |

| EX-31.1 - EX-31.1 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex311_7.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 000-55782

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

(Exact name of registrant as specified in its charter)

|

Maryland |

32-0506267 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

2901 Butterfield Road Oak Brook, Illinois |

60523 |

|

(Address of principal executive offices) |

(Zip Code) |

(800) 826-8228

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

|

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller Reporting Company |

☒ |

|

|

|

|

|

|

Emerging Growth Company |

☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 9, 2018, there were 2,851,844 shares of the Registrant’s Class P Common Stock outstanding.

|

PART I FINANCIAL INFORMATION |

|

||

|

Item 1. |

Financial Statements |

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets as of March 31, 2018 (unaudited) and December 31, 2017 |

1 |

|

|

|

|

|

|

|

|

Unaudited Consolidated Statements of Operations for the three-months ended March 31, 2018 and 2017 |

2 |

|

|

|

|

|

|

|

|

3 |

||

|

|

|

|

|

|

|

Unaudited Consolidated Statements of Cash Flows for the three-months ended March 31, 2018 and 2017 |

4 |

|

|

|

|

|

|

|

|

5 |

||

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 |

|

|

|

|

|

|

|

Item 3. |

24 |

||

|

|

|

|

|

|

Item 4. |

26 |

||

|

|

|

|

|

|

PART II OTHER INFORMATION |

|

||

|

|

|

|

|

|

Item 1. |

26 |

||

|

|

|

|

|

|

Item 1A. |

26 |

||

|

|

|

|

|

|

Item 2. |

26 |

||

|

|

|

|

|

|

Item 3. |

26 |

||

|

|

|

|

|

|

Item 4. |

26 |

||

|

|

|

|

|

|

Item 5. |

27 |

||

|

|

|

|

|

|

Item 6. |

27 |

||

|

|

|

||

|

28 |

|||

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

|

|

|

March 31, 2018 (unaudited) |

|

|

December 31, 2017 |

|

||

|

ASSETS |

|

|

|

|

|

|||

|

Cash and cash equivalents |

|

$ |

5,765,417 |

|

|

$ |

1,406,331 |

|

|

Real estate securities at fair value |

|

|

30,947,171 |

|

|

|

25,993,258 |

|

|

Commercial mortgage loans at cost, net of allowance for loan loss of $0 |

|

|

51,549,976 |

|

|

|

32,094,441 |

|

|

Deferred debt finance costs |

|

|

466,502 |

|

|

|

— |

|

|

Deferred offering costs |

|

|

1,345,495 |

|

|

|

1,502,901 |

|

|

Accrued interest receivable |

|

|

166,465 |

|

|

|

142,138 |

|

|

Prepaid expenses |

|

|

20,458 |

|

|

|

2,553 |

|

|

Other assets |

|

|

500 |

|

|

|

500 |

|

|

Total assets |

|

$ |

90,261,984 |

|

|

$ |

61,142,122 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Repurchase agreements—real estate securities |

|

|

18,771,000 |

|

|

|

17,113,000 |

|

|

Repurchase agreements—commercial mortgage loans |

|

|

9,300,000 |

|

|

|

— |

|

|

Due to related parties |

|

|

1,347,031 |

|

|

|

1,511,679 |

|

|

Loan fees payable |

|

|

155,000 |

|

|

|

40,000 |

|

|

Interest payable |

|

|

24,209 |

|

|

|

23,518 |

|

|

Distributions payable |

|

|

384,568 |

|

|

|

258,470 |

|

|

Accrued expenses |

|

|

233,212 |

|

|

|

210,479 |

|

|

Total liabilities |

|

|

30,215,020 |

|

|

|

19,157,146 |

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

Class P common stock, $0.001 par value, 450,000,000 shares authorized, 2,476,245 and 1,733,392 shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively |

|

|

2,476 |

|

|

|

1,733 |

|

|

Additional paid in capital (net of offering costs of $4,494,086 and $2,918,704 at March 31, 2018 and December 31, 2017, respectively) |

|

|

62,001,173 |

|

|

|

43,428,043 |

|

|

Distributions in excess of earnings |

|

|

(1,956,685 |

) |

|

|

(1,444,800 |

) |

|

Total stockholders’ equity |

|

|

60,046,964 |

|

|

|

41,984,976 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

90,261,984 |

|

|

$ |

61,142,122 |

|

The accompanying notes are an integral part of these consolidated financial statements

1

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

|

|

Three-months ended March 31, |

|

|||||

|

|

|

2018 |

|

|

2017 |

|

||

|

Interest income: |

|

|

|

|

|

|

|

|

|

Interest income |

|

|

830,204 |

|

|

|

101,738 |

|

|

Less: Interest expense |

|

|

(102,944 |

) |

|

|

(10,415 |

) |

|

Net interest income |

|

|

727,260 |

|

|

|

91,323 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Debt finance costs |

|

|

64,984 |

|

|

|

— |

|

|

Administration expense |

|

|

— |

|

|

|

28,750 |

|

|

Directors compensation |

|

|

21,600 |

|

|

|

20,750 |

|

|

Professional service fees |

|

|

116,499 |

|

|

|

20,812 |

|

|

Other expenses |

|

|

59,214 |

|

|

|

22,552 |

|

|

Total operating expenses |

|

|

262,297 |

|

|

|

92,864 |

|

|

Other income: |

|

|

|

|

|

|

|

|

|

Unrealized gain in value of real estate securities |

|

|

30,828 |

|

|

|

89,433 |

|

|

Total other income |

|

|

30,828 |

|

|

|

89,433 |

|

|

Net income |

|

$ |

495,791 |

|

|

$ |

87,892 |

|

|

Net income per share basic and diluted |

|

$ |

0.23 |

|

|

$ |

0.31 |

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,119,814 |

|

|

|

280,856 |

|

|

Diluted |

|

|

2,119,831 |

|

|

|

280,856 |

|

The accompanying notes are an integral part of these consolidated financial statements

2

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

Three-months ended March 31, 2018

(unaudited)

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Number of Shares |

|

|

Par Value |

|

|

Additional Paid in Capital |

|

|

Distributions in Excess of Earnings |

|

|

Total Stockholders’ Equity |

|

|||||

|

Balance as of December 31, 2017 |

|

|

1,733,392 |

|

|

$ |

1,733 |

|

|

$ |

43,428,043 |

|

|

$ |

(1,444,800 |

) |

|

$ |

41,984,976 |

|

|

Proceeds from offering |

|

|

742,853 |

|

|

|

743 |

|

|

|

20,147,679 |

|

|

|

— |

|

|

|

20,148,422 |

|

|

Offering costs |

|

|

— |

|

|

|

— |

|

|

|

(1,575,382 |

) |

|

|

— |

|

|

|

(1,575,382 |

) |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

495,791 |

|

|

|

495,791 |

|

|

Distributions declared |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,007,676 |

) |

|

|

(1,007,676 |

) |

|

Equity based compensation |

|

|

— |

|

|

|

— |

|

|

|

833 |

|

|

|

— |

|

|

|

833 |

|

|

Balance as of March 31, 2018 |

|

|

2,476,245 |

|

|

$ |

2,476 |

|

|

$ |

62,001,173 |

|

|

$ |

(1,956,685 |

) |

|

$ |

60,046,964 |

|

The accompanying notes are an integral part of these consolidated financial statements

3

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

For the three-months ended March 31, |

|

|||||

|

|

|

2018 |

|

|

2017 |

|

||

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Net income |

|

|

495,791 |

|

|

|

87,892 |

|

|

Adjustments to reconcile net income to cash provided by operations: |

|

|

|

|

|

|

|

|

|

Net unrealized gain on real estate securities |

|

|

(30,828 |

) |

|

|

(89,433 |

) |

|

Amortization of equity based compensation |

|

|

833 |

|

|

|

— |

|

|

Amortization of debt finance costs |

|

|

64,984 |

|

|

|

— |

|

|

Amortization of bond premium |

|

|

— |

|

|

|

15,513 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accrued interest receivable |

|

|

(24,327 |

) |

|

|

(19,184 |

) |

|

Deferred debt finance costs |

|

|

(531,486 |

) |

|

|

— |

|

|

Prepaid expenses |

|

|

(17,905 |

) |

|

|

(25,535 |

) |

|

Interest payable |

|

|

691 |

|

|

|

3,588 |

|

|

Loan fees payable |

|

|

115,000 |

|

|

|

— |

|

|

Accrued expenses |

|

|

22,733 |

|

|

|

28,749 |

|

|

Due to related parties |

|

|

(7,242 |

) |

|

|

88,900 |

|

|

Other assets |

|

|

— |

|

|

|

(500 |

) |

|

Net cash provided by operating activities |

|

$ |

88,244 |

|

|

$ |

89,990 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Origination of commercial loans |

|

|

(19,455,535 |

) |

|

|

— |

|

|

Purchase of real estate securities |

|

|

(5,000,000 |

) |

|

|

(5,125,000 |

) |

|

Real estate securities sold or principal pay-down |

|

|

76,915 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

$ |

(24,378,620 |

) |

|

$ |

(5,125,000 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

20,148,422 |

|

|

|

2,612,634 |

|

|

Payment of offering costs |

|

|

(1,575,382 |

) |

|

|

— |

|

|

Proceeds from repurchase agreements |

|

|

65,647,000 |

|

|

|

3,578,000 |

|

|

Principal repayments of repurchase agreements |

|

|

(54,689,000 |

) |

|

|

— |

|

|

Distributions paid |

|

|

(881,578 |

) |

|

|

(114,463 |

) |

|

Net cash provided by financing activities |

|

$ |

28,649,462 |

|

|

$ |

6,076,171 |

|

|

Net change in cash and cash equivalents |

|

|

4,359,086 |

|

|

|

1,041,161 |

|

|

Cash and cash equivalents beginning of period |

|

|

1,406,331 |

|

|

|

511,854 |

|

|

Cash and cash equivalents end of period |

|

$ |

5,765,417 |

|

|

$ |

1,553,015 |

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Change in deferred offering costs and accrued offering expenses, included in due to related parties |

|

$ |

(157,406 |

) |

|

$ |

213,351 |

|

|

Cash paid for interest |

|

$ |

102,253 |

|

|

$ |

6,827 |

|

|

Distributions payable |

|

$ |

384,568 |

|

|

$ |

52,273 |

|

The accompanying notes are an integral part of these consolidated financial statements

4

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

March 31, 2018

(unaudited)

Note 1 – Organization and Business Operations

InPoint Commercial Real Estate Income, Inc. (the “Company”) was incorporated in Maryland on September 13, 2016 to originate, acquire and manage a diversified portfolio of commercial real estate (“CRE”) investments primarily comprised of (i) CRE debt, including first mortgage loans, subordinate mortgage and mezzanine loans (“Credit Loans”), and participations in such loans and (ii) CRE securities, such as commercial mortgage-backed securities (“CMBS”), senior unsecured debt of publicly traded real estate investment trusts (“REITs”), and collateralized debt obligation notes. The Company may also invest in select equity investments in single-tenant, net leased properties. Substantially all of the Company’s business is conducted through InPoint REIT Operating Partnership, LP (the “OP”), a Delaware limited partnership. The Company is the sole general partner and directly or indirectly holds all of the limited partner interests in the OP.

The Company is externally managed by Inland InPoint Advisor, LLC (the “Advisor”), a Delaware limited liability company formed in August 2016 that is a wholly-owned indirect subsidiary of Inland Real Estate Investment Corporation, a member of The Inland Real Estate Group of Companies, Inc. The Advisor is responsible for coordinating the management of the day-to-day operations and originating, acquiring and managing the Company’s CRE investment portfolio, subject to the supervision of the Company’s board of directors. The Advisor performs its duties and responsibilities as the Company’s fiduciary pursuant to an advisory agreement dated October 25, 2016 among the Company, the Advisor and the OP (the “Advisory Agreement”).

The Advisor has delegated certain of its duties to SPCRE InPoint Advisors, LLC (the “Sub-Advisor”), a Delaware limited liability company formed in September 2016 that is a wholly-owned subsidiary of Sound Point CRE Management, LP, pursuant to a sub-advisory agreement between the Advisor and the Sub-Advisor. Among other duties, the Sub-Advisor has the authority to identify, negotiate, acquire and originate the Company’s investments and provide portfolio management, disposition, property management and leasing services to the Company. Notwithstanding such delegation to the Sub-Advisor or affiliates of the Sub-Advisor or Advisor, the Advisor retains ultimate responsibility for the performance of all the matters entrusted to it under the Advisory Agreement, including those duties which the Advisor has not delegated to the Sub-Advisor such as (i) valuation of the Company’s assets and calculation of the Company’s net asset value; (ii) management of the Company’s day-to-day operations, including the hiring and supervising of its employees, if any; (iii) preparation of stockholder reports and communications and arrangement of the Company’s annual stockholder meeting; and (iv) advising the Company regarding its qualification as a REIT for U.S. federal income tax purposes and monitoring its ongoing compliance with the REIT qualification requirements thereafter.

5

Note 2 – Summary of Significant Accounting Policies

Disclosures discussing all significant accounting policies are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 (the “Annual Report”), as filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2018, under the heading Note 2-Summary of Significant Accounting Policies. There have been no changes to the Company’s significant accounting policies for the three months ended March 31, 2018, except as noted below.

Equity-Based Compensation

In accordance with the Company’s Independent Director Restricted Share Plan (the “RSP”), restricted shares are issued to independent directors as compensation. The Company recognizes expense related to the fair value of equity-based compensation awards as operating expense in the consolidated statements of operations. The Company recognizes expense based on the fair value at the grant date on a straight-line basis over the vesting period representing the requisite service period. See Note 10 – "Equity-Based Compensation" for further information.

Basis of Accounting

The accompanying consolidated financial statements and related footnotes have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and require management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reported periods. Actual results could differ from such estimates.

Commercial Mortgage Loans Held for Investment and Allowance for Loan Losses

Commercial mortgage loans are held for investment purposes and are anticipated to be held until maturity. Accordingly, they are carried at cost, net of unamortized loan fees and origination costs, and premiums or discounts. Commercial mortgage loans that are deemed to be impaired will be carried at amortized cost less a specific allowance for loan losses. Interest income is recorded on the accrual basis and related discounts, premiums and net deferred fees or costs on investments are amortized over the life of the investment using the effective interest method. Amortization is reflected as an adjustment to interest income in the Company’s consolidated statements of operations. Upon measurement of impairment, the Company records an allowance for loan losses to reduce the carrying value of the loan with a corresponding charge through the provision for loan losses on the Company’s consolidated statements of operations.

The allowance for loan losses reflects management's estimate of loan losses inherent in the loan portfolio as of the balance sheet date. The Company uses a uniform process for determining its allowance for loan losses. The allowance for loan losses includes an asset-specific component and may include a general, formula-based component when the portfolio is determined to be of sufficient size to warrant such a reserve.

The asset-specific reserve component relates to reserves for losses on individual impaired loans. The Company considers a loan to be impaired when, based upon current information and events, it believes that it is probable that the Company will be unable to collect all amounts due under the contractual terms of the loan agreement. This assessment is made on an individual loan basis each quarter based on such factors as payment status, lien position, borrower financial resources and investment in collateral, collateral type, project economics and geographic location, as well as national and regional economic factors. A reserve is established for an impaired loan when the present value of payments expected to be received, observable market prices or the estimated fair value of the collateral (for loans that are dependent on the collateral for repayment) is lower than the carrying value of that loan.

For collateral dependent impaired loans, impairment is measured using the estimated fair value of collateral less the estimated cost to sell. Valuations are performed or obtained at the time a loan is determined to be impaired and designated non-performing, and they are updated if circumstances indicate that a significant change in value has occurred. The Advisor generally will use the income approach through internally developed valuation models to estimate the fair value of the collateral for such loans. In more limited cases, the Advisor will obtain external “as is” appraisals for loan collateral, generally when third party participations exist.

General reserves are recorded when (i) available information as of each balance sheet date indicates that it is probable a loss has occurred in the portfolio and (ii) the amount of the loss can be reasonably estimated. The Company’s policy is to estimate loss rates based on actual losses experienced, if any, or based on historical realized losses experienced in the industry if the Company has not

6

experienced any losses. Current collateral and economic conditions affecting the probability and severity of losses are taken into account when establishing the allowance for loan losses.

The Company performs a comprehensive analysis of its loan portfolio and assigns risk ratings to loans that incorporate management's current judgments about their credit quality based on all known and relevant internal and external factors that may affect collectability. The Company considers, among other things, payment status, lien position, borrower financial resources and investment in collateral, collateral type, project economics and geographic location, as well as national and regional economic factors. This methodology results in loans being segmented by risk classification into risk rating categories that are associated with estimated probabilities of default and principal loss. Ratings range from “1” to “5” with “1” representing the lowest risk of loss and “5” representing the highest risk of loss.

Loans are generally placed on non-accrual status when principal or interest payments are past due 90 days or more or when there is reasonable doubt that principal or interest will be collected in full. Accrued and unpaid interest is generally reversed against interest income in the period the loan is placed on non-accrual status. Interest payments received on non-accrual loans may be recognized as income or applied to principal depending upon management's judgment regarding the borrower's ability to make pending principal and interest payments. Non-accrual loans are restored to accrual status when past due principal and interest is paid and, in management's judgment, are likely to remain current. The Company may make exceptions to placing a loan on non-accrual status if the loan has sufficient collateral value and is in the process of collection.

As of March 31, 2018 and December 31, 2017, the Company has not recorded any allowance for loan losses as the Company did not consider a loan loss to be probable.

The Company qualified as a REIT under the Internal Revenue Code of 1986, as amended, for federal income tax purposes commencing with the tax year ending December 31, 2017. As a REIT, the Company generally will not be subject to federal income tax to the extent it distributes its REIT taxable income, subject to certain adjustments, to its stockholders. Subsequently, if the Company fails to qualify as a REIT in any taxable year, the Company will be subject to federal income tax on its taxable income at regular corporate tax rates. Even if the Company qualifies for taxation as a REIT, the Company may be subject to certain state and local taxes on its income, property or net worth and federal income and excise taxes on its undistributed income.

The Company had no uncertain tax positions as of March 31, 2018 or December 31, 2017. The Company expects no significant increases or decreases in uncertain tax positions due to changes in tax positions within one year of March 31, 2018. The Company had no interest or penalties relating to income taxes recognized in the consolidated statements of operations for the three-month periods ended March 31, 2018 or 2017. As of March 31, 2018, returns for the calendar year 2016 and 2017 remain subject to examination by U.S. and various state and local tax jurisdictions. For the periods ended March 31, 2018 and 2017, the Company incurred no current income tax expense.

Accounting Pronouncements Recently Issued but Not Yet Effective

In June 2016, the Financial Accounting Standards Board issued ASU 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which changes how entities measure credit losses for financial assets carried at amortized cost. ASU 2016-13 eliminates the requirement that a credit loss must be probable before it can be recognized and instead requires an entity to recognize the current estimate of all expected credit losses. ASU 2016-13 is effective for SEC filers for reporting periods beginning after December 15, 2019. The amendments may be adopted early for reporting periods beginning after December 15, 2018. The Company is currently evaluating the impact ASU 2016-13 will have on its allowance for loan losses estimate.

7

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

Note 3 – Real Estate Securities

The following is a summary of the Company’s real estate securities as of March 31, 2018:

|

|

Collateral Type |

|

Interest Rate |

|

Maturity Date |

|

Par Value |

|

|

Fair Value |

|

||

|

CMBS 1 |

Hospitality |

|

LIBOR + 0.9200% |

|

August/2019 |

|

$ |

15,802,417 |

|

|

$ |

15,846,663 |

|

|

CMBS 2 |

Retail |

|

LIBOR + 3.4000% |

|

July/2019 |

|

|

5,078,500 |

|

|

|

5,079,008 |

|

|

CMBS 3 |

Hospitality |

|

LIBOR + 0.9000% |

|

November/2019 |

|

|

5,000,000 |

|

|

|

5,004,500 |

|

|

CMBS 4 |

Hospitality |

|

LIBOR + 3.0000% |

|

February/2020 |

|

|

5,000,000 |

|

|

|

5,017,000 |

|

|

Total |

|

|

|

|

|

|

$ |

30,880,917 |

|

|

$ |

30,947,171 |

|

The Company classified its CMBS as available-for-sale as of March 31, 2018. These investments are reported at fair value in the consolidated balance sheets with changes in fair value recorded in other income or loss in the consolidated statements of operations. The following table shows the amortized cost, unrealized gains/losses and fair value of the Company’s CMBS investments as of March 31, 2018:

|

|

|

Amortized Cost |

|

|

Unrealized Gains |

|

|

Unrealized Losses |

|

|

Fair Value |

|

||||

|

CMBS 1 |

|

$ |

15,802,417 |

|

|

$ |

44,246 |

|

|

|

— |

|

|

$ |

15,846,663 |

|

|

CMBS 2 |

|

|

5,078,500 |

|

|

|

508 |

|

|

|

— |

|

|

|

5,079,008 |

|

|

CMBS 3 |

|

|

5,000,000 |

|

|

|

4,500 |

|

|

|

— |

|

|

|

5,004,500 |

|

|

CMBS 4 |

|

|

5,000,000 |

|

|

|

17,000 |

|

|

|

— |

|

|

|

5,017,000 |

|

|

Total |

|

$ |

30,880,917 |

|

|

$ |

66,254 |

|

|

$ |

— |

|

|

$ |

30,947,171 |

|

The following is a summary of the Company’s real estate securities as of December 31, 2017:

|

|

|

Collateral Type |

|

Interest Rate |

|

Maturity Date |

|

Par Value |

|

|

Fair Value |

|

||

|

CMBS 1 |

|

Hospitality |

|

LIBOR + 0.9200% |

|

August/2019 |

|

$ |

15,879,331 |

|

|

$ |

15,914,266 |

|

|

CMBS 2 |

|

Retail |

|

LIBOR + 3.4000% |

|

July/2019 |

|

|

5,078,500 |

|

|

|

5,077,992 |

|

|

CMBS 3 |

|

Hospitality |

|

LIBOR + 0.9000% |

|

November/2019 |

|

|

5,000,000 |

|

|

|

5,001,000 |

|

|

Total |

|

|

|

|

|

|

|

$ |

25,957,831 |

|

|

$ |

25,993,258 |

|

The Company classified its CMBS as available-for-sale as of December 31, 2017. These investments are reported at fair value in the consolidated balance sheets with changes in fair value recorded in other income or loss in the consolidated statements of operations. The following table shows the amortized cost, unrealized gains/losses and fair value of the Company’s CMBS investments as of December 31, 2017:

|

|

|

Amortized Cost |

|

|

Unrealized Gains |

|

|

Unrealized Losses |

|

|

Fair Value |

|

||||

|

CMBS 1 |

|

$ |

15,879,331 |

|

|

$ |

34,935 |

|

|

$ |

— |

|

|

$ |

15,914,266 |

|

|

CMBS 2 |

|

|

5,078,500 |

|

|

|

— |

|

|

|

(508 |

) |

|

|

5,077,992 |

|

|

CMBS 3 |

|

|

5,000,000 |

|

|

|

1,000 |

|

|

|

— |

|

|

|

5,001,000 |

|

|

Total |

|

$ |

25,957,831 |

|

|

$ |

35,935 |

|

|

$ |

(508 |

) |

|

$ |

25,993,258 |

|

As of March 31, 2018, the Company held four CMBS with a total carrying value of $30,947,171 with a total unrealized gain of $66,254. As of December 31, 2017, the Company held three CMBS with a carrying value of $25,993,258 with an unrealized gain of $35,935 and an unrealized loss of $508. No position had an unrealized loss for a period greater than 12 months. The Company did not have any realized gains or losses during the three-month periods ended March 31, 2018 and 2017.

As of March 31, 2018 and December 31, 2017, amortized cost equaled par value since there were no discounts or premiums on

CMBS.

8

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

Note 4 – Commercial Mortgage Loans Held for Investment

The following is a summary of the Company’s commercial mortgage loans held for investment as of March 31, 2018:

|

|

|

Number of Loans |

|

|

Principal Balance |

|

|

Unamortized (fees)/costs, net |

|

|

Carrying Value |

|

|

Weighted Average Coupon |

|

|

Weighted Average Years to Maturity |

|

||||||

|

First mortgage loans |

|

|

3 |

|

|

$ |

41,510,966 |

|

|

$ |

(460,990 |

) |

|

$ |

41,049,976 |

|

|

|

6.04 |

% |

|

|

2.8 |

|

|

Credit loans |

|

|

2 |

|

|

|

10,500,000 |

|

|

|

— |

|

|

|

10,500,000 |

|

|

|

9.24 |

% |

|

|

8.2 |

|

|

Total and average |

|

|

5 |

|

|

$ |

52,010,966 |

|

|

$ |

(460,990 |

) |

|

$ |

51,549,976 |

|

|

|

6.69 |

% |

|

|

3.9 |

|

The following is a summary of the Company’s commercial mortgage loans held for investment as of December 31, 2017:

|

|

|

Number of Loans |

|

|

Principal Balance |

|

|

Unamortized (fees)/costs, net |

|

|

Carrying Value |

|

|

Weighted Average Coupon |

|

|

Weighted Average Years to Maturity |

|

||||||

|

First mortgage loans |

|

|

2 |

|

|

$ |

24,950,941 |

|

|

$ |

(356,500 |

) |

|

$ |

24,594,441 |

|

|

|

6.08 |

% |

|

|

3.0 |

|

|

Credit loans |

|

|

1 |

|

|

|

7,500,000 |

|

|

|

— |

|

|

$ |

7,500,000 |

|

|

|

9.20 |

% |

|

|

9.8 |

|

|

Total and average |

|

|

3 |

|

|

$ |

32,450,941 |

|

|

$ |

(356,500 |

) |

|

$ |

32,094,441 |

|

|

|

6.80 |

% |

|

|

4.6 |

|

9

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

As part of the Company’s process for monitoring the credit quality of its loans, it performs a quarterly asset review of the loan portfolio and assigns risk ratings to each of its loans. Risk factors include payment status, lien position, borrower financial resources and investment in collateral, collateral type, project economics and geographic location, as well as national and regional economic factors. To determine the likelihood of loss, the loans are rated on a 5-point scale as follows:

|

Investment Grade |

Investment Grade Definition |

|

1 |

Investment exceeding fundamental performance expectations and/or capital gain expected. Trends and risk factors since time of investment are favorable. |

|

2 |

Performing consistent with expectations and a full return of principal and interest expected. Trends and risk factors are neutral to favorable. |

|

3 |

Performing loan requiring closer monitoring. Trends and risk factors show some deterioration. Collection of principal and interest is still expected. |

|

4 |

Underperforming investment with the potential of some interest loss but still expecting a positive return on investment. Trends and risk factors are negative. |

|

5 |

Underperforming investment with expected loss of interest and some principal. |

All commercial mortgage loans are assigned an initial risk rating of 2 at origination. The Company performed the quarterly asset review and assigned a risk rating of 2 to all loans as of March 31, 2018 and December 31, 2017. The Company has not recorded any allowance for loan losses as the Company did not consider a loan loss to be probable.

Note 5 – Repurchase Agreements

Commercial Mortgage Loans

A wholly owned subsidiary of the Company entered into a Master Repurchase Agreement (the “Repo Facility”) with Column Financial, Inc. as administrative agent for certain of its affiliates. The Repo Facility provides up to $100.0 million in advances, subject to adjustment up to $250.0 million, which the Company expects to use to finance the acquisition or origination of eligible loans. The Repo Facility acts in the manner of a revolving credit facility that can be repaid as the Company's assets are paid off and re-drawn as advances against new assets. Advances under the Repo Facility accrue interest at a per annum rate equal to LIBOR plus 2.25%. The initial maturity date of the Repo Facility is February 15, 2019, with extensions which may be exercised upon the satisfaction of certain conditions.

The details of the Repo Facility as of March 31, 2018 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|||||

|

Committed Financing |

|

|

Amount Outstanding |

|

|

Accrued Interest Payable |

|

|

Collateral Pledged |

|

|

Interest Rate |

|

|

Days to Maturity |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

100,000,000 |

|

|

$ |

9,300,000 |

|

|

$ |

12,624 |

|

|

$ |

12,400,000 |

|

|

|

4.07 |

% |

|

|

319 |

|

The Company had no Repo Facility as of December 31, 2017.

10

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

Real Estate Securities

As of March 31, 2018 and December 31, 2017, the Company had entered into one master repurchase agreement for real estate securities with one counterparty and had three and two outstanding real estate security repurchase agreements outstanding, respectively, as described in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|||||

|

|

|

Amount Outstanding |

|

|

Accrued Interest Payable |

|

|

Collateral Pledged |

|

|

Interest Rate |

|

|

Days to Maturity |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2018 |

|

$ |

18,771,000 |

|

|

$ |

11,585 |

|

|

$ |

21,000,000 |

|

|

|

2.55 |

% |

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2017 |

|

$ |

17,113,000 |

|

|

$ |

23,518 |

|

|

$ |

19,946,000 |

|

|

|

2.27 |

% |

|

|

7 |

|

Note 6 – Stockholders’ Equity

During the three-month period ended March 31, 2018, pursuant to a private offering (the “Offering”), the Company issued 742,853 shares of Class P common stock (“Class P Shares”) at an average price of $27.12 per share with total net proceeds of $18,573,040 after offering costs of $1,575,382. In addition, the Company incurred $121,943 in reimbursable deferred offering costs that are payable to the Advisor and Sub-Advisor from future stock issuance.

Distributions Declared

The table below sets forth the distributions declared for Class P Shares during the three-month period ended March 31, 2018.

|

|

|

Distributions Declared Per Share |

||||||

|

Date Declared |

|

Distribution Period |

|

Daily Distribution Amount |

|

|

Date of Payment |

|

|

March 14, 2018 |

|

April 1, 2018 through April 30, 2018 |

|

$ |

0.005260274 |

|

|

May 1, 2018 |

|

March 14, 2018 |

|

May 1, 2018 through May 31, 2018 |

|

$ |

0.005260274 |

|

|

On or before June 6, 2018 |

Distributions Paid

The table below sets forth the distributions paid in cash with respect to the Class P Shares during the three-month period ended March 31, 2018.

|

Distribution Period |

|

Payment Date |

|

Distribution Amount |

|

|

|

December 2017 |

|

January 2, 2018 |

|

$ |

258,470 |

|

|

January 2018 |

|

February 1, 2018 |

|

|

309,426 |

|

|

February 2018 |

|

March 1, 2018 |

|

|

313,682 |

|

|

Total |

|

|

|

$ |

881,578 |

|

During the three-month period ended March 31, 2018, the Company declared distributions of $1,007,676 and paid cash distributions of $881,578. As of March 31, 2018, distributions declared but not yet paid amounted to $384,568.

11

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

The following table is a summary of the basic and diluted net income per share computation for the three-month periods ended March 31, 2018 and 2017:

|

|

|

Three-month period ended March 31, |

|

|||||

|

|

|

2018 |

|

|

2017 |

|

||

|

Net income |

|

$ |

495,791 |

|

|

$ |

87,892 |

|

|

Weighted average shares outstanding, basic |

|

|

2,119,814 |

|

|

|

280,856 |

|

|

Weighted average shares outstanding, diluted |

|

|

2,119,831 |

|

|

|

280,856 |

|

|

Net income per share, basic and diluted |

|

$ |

0.23 |

|

|

$ |

0.31 |

|

Note 8 – Commitments and Contingencies

Litigation and Regulatory Matters

In the ordinary course of business, the Company may become subject to litigation, claims and regulatory matters. The Company has no knowledge of material legal or regulatory proceedings pending or known to be contemplated against the Company at this time.

Note 9 – Transactions with Related Parties

As of March 31, 2018, the Advisor had invested $1.0 million in the Company through the purchase of 40,040 Class P Shares. The purchase price per Class P Share for the Advisor’s investment was $25.00 (the “Transaction Price”), with no payment of selling commissions, dealer manager fees or organization and offering expenses. The Advisor has agreed pursuant to its subscription agreement that, for so long as it or its affiliate is serving as the Advisor, (i) it will not sell or transfer at least 8,000 of the Class P Shares that it has purchased, accounting for $200,000 of its investment, to an unaffiliated third party; (ii) it will not be eligible to submit a request for these 40,040 Class P Shares pursuant to the Company’s share repurchase program prior to the fifth anniversary of the date on which such shares were purchased; and (iii) repurchase requests made for these shares will only be accepted (a) on the last business day of a calendar quarter, (b) after all repurchase requests from all other stockholders for such quarter have been accepted and (c) to the extent that such repurchases do not cause total repurchases in the quarter in which they are being repurchased to exceed that quarter’s repurchase cap.

As of March 31, 2018, Sound Point Capital Management, LP (“Sound Point”), an affiliate of the Sub-Advisor, had invested $3.0 million in the Company through the purchase of 120,000 Class P Shares. The purchase price per Class P Share for this investment was the Transaction Price, with no payment of selling commissions, dealer manager fees or organization and offering expenses. Sound Point has agreed pursuant to its subscription agreement that, for so long as the Sub-Advisor or its affiliate is serving as the Sub-Advisor, (i) it will not be eligible to submit a request for the repurchase of these 120,000 shares pursuant to the Company’s share repurchase program prior to the fifth anniversary of the date on which such shares were purchased; and (ii) repurchase requests made for these shares will only be accepted (a) on the last business day of a calendar quarter, (b) after all repurchase requests from all other stockholders for such quarter have been accepted and (c) to the extent that such repurchases do not cause total repurchases in the quarter in which they are being repurchased to exceed that quarter’s repurchase cap.

The following table summarizes the Company’s related party transactions for the three-month periods ended March 31, 2018 and 2017:

|

|

|

Three-month period ended March 31, |

|

|

Payable as of March 31, |

|

||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

Organization and offering expense reimbursement(1) |

|

$ |

121,943 |

|

|

$ |

213,351 |

|

|

$ |

1,345,495 |

|

|

$ |

1,188,317 |

|

|

Selling commissions and dealer manager fee(2) |

|

|

1,296,032 |

|

|

|

142,366 |

|

|

|

— |

|

|

|

— |

|

|

Advisory fee(3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Operating expense reimbursement(4) |

|

|

1,536 |

|

|

|

88,899 |

|

|

|

1,536 |

|

|

|

109,650 |

|

|

Total |

|

$ |

1,419,511 |

|

|

$ |

444,616 |

|

|

$ |

1,347,031 |

|

|

$ |

1,297,967 |

|

12

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

|

(1) |

The Company reimburses the Advisor, the Sub-Advisor and their respective affiliates for costs and other expenses related to the Offering, provided that aggregate reimbursements of such costs and expenses shall not exceed the organization and offering expenses paid by investors in connection with the sale of Class P Shares in the Offering. Offering costs are offset against stockholders’ equity when paid. Unpaid amounts are recorded as deferred offering costs and included in due to related parties in these consolidated balance sheets. |

|

(2) |

Inland Securities Corporation, the Company’s dealer manager and an affiliate of the Advisor, receives selling commissions up to 5%, and a dealer manager fee up to 3%, of the Transaction Price for each Class P Share sold in the Offering, the majority of which is paid to third-party broker-dealers. |

|

(3) |

The Company pays the Advisor an advisory fee comprised of (1) a fixed component and (2) a performance component. The fixed component of the advisory fee is paid quarterly in arrears in an amount equal to 1/4th of 1.5% of the average aggregate value of the Company’s assets over such quarter, where the value of each asset shall be the value determined in accordance with the Company’s valuation policies or, if such value has not yet been determined, the book value of the asset. The performance component of the advisory fee is calculated and paid annually with respect to the Class P Shares, such that for any year in which the Company’s total return per Class P Share exceeds 7% per annum, the Advisor will receive 20% of the excess total return allocable to the Class P Shares; provided that in no event will the performance component of the advisory fee exceed 15% of the aggregate total return allocable to Class P Shares for such year. The Advisor has waived the advisory fee for the three months ended March 31, 2018 and 2017. |

|

(4) |

The Company reimburses the Advisor or its affiliates for out-of-pocket expenses that it incurs in connection with providing services to the Company, provided that the Company does not reimburse overhead costs, including rent and utilities or personnel costs (including salaries, bonuses, benefits and severance payments). |

Note 10 – Equity-Based Compensation

On March 1, 2018, the Company granted each of its three independent directors 400 restricted Class P Shares for a total of 1,200 Class P Shares with a total value of $30,000. The restricted Class P Shares will vest in equal one-third increments on March 1, 2019, 2020 and 2021.

Under the RSP, restricted shares generally vest over a three year vesting period from the date of the grant, subject to the specific terms of the grant. Restricted shares are included in common stock outstanding on the date of vesting. The grant-date value of the restricted shares is amortized over the vesting period representing the requisite service period. Compensation expense associated with the restricted shares issued to the independent directors was $833, in the aggregate, for the three months ended March 31, 2018. As of March 31, 2018, the Company had $29,167 of unrecognized compensation expense related to the unvested restricted shares, in the aggregate. The weighted average remaining period that compensation expense related to unvested restricted shares will be recognized is 2.92 years.

Note 11 – Fair Value of Financial Instruments

The following table presents the Company’s financial instruments carried at fair value in the consolidated balance sheets by its level in the fair value hierarchy (see Note 2 – Summary of Significant Accounting Policies included in the Annual Report) as of March 31, 2018 and December 31, 2017:

|

|

|

March 31, 2018 |

|

|

December 31, 2017 |

|

||||||||||||||||||||||||||

|

|

|

Total |

|

|

Level I |

|

|

Level II |

|

|

Level III |

|

|

Total |

|

|

Level I |

|

|

Level II |

|

|

Level III |

|

||||||||

|

Real estate securities |

|

$ |

30,947,171 |

|

|

|

— |

|

|

$ |

30,947,171 |

|

|

|

— |

|

|

$ |

25,993,258 |

|

|

|

— |

|

|

$ |

25,993,258 |

|

|

|

— |

|

The Company did not transfer any assets within fair value levels during the three months ended March 31, 2018 or during the year ended December 31, 2017.

As discussed in Note 2 of the Annual Report, GAAP requires the disclosure of fair value information about financial instruments, whether or not recognized in the consolidated balance sheets, for which it is practicable to estimate that value. The following table details the carrying amount and fair value of the financial instruments described in Note 2 of the Annual Report:

13

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

|

March 31, 2018 |

|

|

December 31, 2017 |

|

|||||||||||

|

|

Carrying Amount |

|

|

Estimated Fair Value |

|

|

Carrying Amount |

|

|

Estimated Fair Value |

|

||||

|

Financial assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

5,765,417 |

|

|

$ |

5,765,417 |

|

|

$ |

1,406,331 |

|

|

$ |

1,406,331 |

|

|

Commercial mortgage loans, net |

|

51,549,976 |

|

|

|

51,775,400 |

|

|

|

32,094,441 |

|

|

|

32,094,441 |

|

|

Total |

$ |

57,315,393 |

|

|

$ |

57,540,817 |

|

|

$ |

33,500,772 |

|

|

$ |

33,500,772 |

|

|

Financial liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase agreements - real estate securities |

$ |

18,771,000 |

|

|

$ |

18,771,000 |

|

|

$ |

17,113,000 |

|

|

$ |

17,113,000 |

|

|

Repurchase agreements - commercial mortgage loans |

|

9,300,000 |

|

|

|

9,300,000 |

|

|

|

— |

|

|

|

— |

|

|

Total |

$ |

28,071,000 |

|

|

$ |

28,071,000 |

|

|

$ |

17,113,000 |

|

|

$ |

17,113,000 |

|

The following describes our methods for estimating the fair value for financial instruments:

|

• |

The estimated fair value of cash and cash equivalents was based on the bank balance and was a Level 1 fair value measurement. |

|

• |

The estimated fair value of commercial mortgage loans, net is a Level 3 fair value measurement. The Sub-Advisor estimates the fair values of commercial loans by analyzing interest rate spreads on loans based on various factors including capitalization rates, occupancy rates, sponsorship, geographic concentration, collateral type, market conditions and actions of other lenders. |

|

• |

The estimated fair value of repurchase agreements is a Level 3 fair value measurement based on an expected present value technique. This method discounts future estimated cash flows using rates we determined best reflect current market interest rates that would be offered for repurchase agreements with similar characteristics and credit quality. |

Note 12 – Subsequent Events

The Company has evaluated subsequent events through May 10, 2018, the date the financial statements were issued, and determined that there have not been any events that have occurred that would require adjustments to disclosures in the consolidated financial statements except for the following transactions:

Sale of Common Stock

As of May 9, 2018, the Company had 2,851,844 shares of common stock outstanding and had raised proceeds from the Offering since March 31, 2018 and since inception as follows:

|

Source of Capital |

|

April 1, 2018 through May 9, 2018 |

|

|

Total |

|

||

|

Class P Shares |

|

$ |

10,203,809 |

|

|

$ |

76,700,800 |

|

Distributions Declared

The table below sets forth the distributions declared for Class P Shares.

|

|

|

Distributions Declared Per Share |

||||||

|

Date Declared |

|

Distribution Period |

|

Daily Distribution Amount |

|

|

Date of Payment |

|

|

May 9, 2018 |

|

June 1, 2018 through June 30, 2018 |

|

$ |

0.005260274 |

|

|

On or before July 9, 2018 |

|

May 9, 2018 |

|

July 1, 2018 through July 31, 2018 |

|

$ |

0.005260274 |

|

|

On or before August 7, 2018 |

|

May 9, 2018 |

|

August 1, 2018 through August 31, 2018 |

|

$ |

0.005260274 |

|

|

On or before September 10, 2018 |

14

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements (continued)

March 31 2018

(unaudited)

The table below sets forth the distributions paid in cash with respect to the Class P Shares.

|

Distribution Period |

|

Payment Date |

|

Distribution Amount |

|

|

|

March 2018 |

|

April 2, 2018 |

|

$ |

384,568 |

|

|

April 2018 |

|

May 1, 2018 |

|

$ |

411,276 |

|

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Certain statements in this Quarterly Report on Form 10-Q constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Words such as “may,” “could,” “should,” “expect,” “intend,” “plan,” “goal,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “variables,” “potential,” “continue,” “expand,” “maintain,” “create,” “strategies,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions, are intended to identify forward-looking statements.

These forward-looking statements are not historical facts but reflect the intent, belief or current expectations of the management of InPoint Commercial Real Estate Income, Inc. (which we refer to herein as the “Company,” “we,” “our” or “us”) based on their knowledge and understanding of the business and industry, the economy and other future conditions. These statements are not guarantees of future performance, and we caution stockholders not to place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or forecasted in the forward-looking statements due to a variety of risks, uncertainties and other factors, including but not limited to the factors described below:

|

|

• |

Market disruptions may adversely impact many aspects of our operating results and operating condition; |

|

|

• |

If we cannot generate sufficient cash flow from operations to fully fund distributions, some or all of our distributions may be paid from other sources, including from the proceeds from sales of our Class P common stock (our “Class P Shares”), which will reduce the amount of cash we ultimately have to invest in assets; |

|

|

• |

There is no current public trading market for our Class P Shares, and we do not expect that such a market will ever develop. Therefore, repurchase of shares by us will likely be the only way for stockholders to dispose of their shares and even if our stockholders are able to sell their shares by our share repurchase program, or otherwise, they may not be able to recover the amount of their investment in our shares; |

|

|

• |

Our charter generally limits the total amount we may borrow to 300% of our net assets, equivalent to 75% of the costs of our assets; |

|

|

• |

Inland InPoint Advisor, LLC (our “Advisor”) and SPCRE InPoint Advisors, LLC (our “Sub-Advisor”) may face conflicts of interest in allocating personnel and resources between their affiliates; |

|

|

• |

We do not have arm’s-length agreements with our Advisor, our Sub-Advisor or any affiliates of our Advisor or Sub-Advisor; and |

|

|

• |

If we fail to continue to qualify as a real estate investment trust (“REIT”), our operations and distributions to stockholders will be adversely affected. |

Forward-looking statements in this Quarterly Report on Form 10-Q reflect our management’s view only as of the date of this Quarterly Report, and may ultimately prove to be incorrect or false. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results except as required by applicable law. We intend for these forward-looking statements to be covered by the applicable safe harbor provisions created by Section 27A of the Securities Act and Section 21E of the Exchange Act.

The following discussion and analysis relates to the three-months ended March 31, 2018 and 2017 and as of March 31, 2018 and December 31, 2017. You should read the following discussion and analysis along with our consolidated financial statements and the related notes included in this report.

Overview

We are a Maryland corporation formed on September 13, 2016 to originate, acquire and manage a diversified portfolio of commercial real estate (“CRE”) investments primarily comprised of (i) CRE debt, including first mortgage loans, subordinate mortgage and mezzanine loans (“Credit Loans”), and participations in such loans and (ii) CRE securities, such as commercial mortgage-backed securities (“CMBS”), senior unsecured debt of publicly traded REITs, and collateralized debt obligation notes. We may also invest in select equity investments in single-tenant, net leased properties. Substantially all of our business is conducted through our operating partnership, of which we are the sole general partner. We are externally managed by Inland InPoint Advisor, LLC, an indirect subsidiary of Inland Real Estate Investment Corporation. Our Advisor has engaged SPCRE InPoint Advisors, LLC, a subsidiary of Sound Point CRE Management, LP, to perform certain services on behalf of the Advisor for us.

16

We operate in a manner that will allow us to qualify as a REIT for U.S. federal income tax purposes commencing with the taxable year ending December 31, 2017. Among other requirements, REITs are required to distribute to stockholders at least 90% of their annual REIT taxable income (computed without regard to the dividends-paid deduction and excluding net capital gain).

On October 25, 2016, we commenced a private offering (the “Offering”) of up to $500,000,000 in our Class P Shares, pursuant to a private placement memorandum dated October 25, 2016. The purchase price per Class P Share currently equals $25.00 plus applicable selling commissions, dealer manager fees and organization and offering expenses, resulting in a total purchase price of $27.38 per Class P Share if maximum selling commissions, dealer manager fees and organization and offering expenses are paid. Inland Securities Corporation, an affiliate of our Advisor, is our dealer manager for the Offering. As of May 9, 2018, we had received and accepted investors’ subscriptions for and issued 2,851,844 Class P Shares in the Offering, resulting in gross proceeds of $76,700,800. As of May 9, 2018, $423,299,200 of Class P Shares remained to be sold in the Offering.

Significant Accounting Policies and Use of Estimates

Disclosures discussing all significant accounting policies are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 (the “Annual Report”), as filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2018, under the heading “Note 2-Summary of Significant Accounting Policies.” There have been no changes to the Company’s significant accounting policies for the three months ended March 31, 2018, except as noted in Note 2 – “Summary of Significant Accounting Policies” which is included in our notes to consolidated financial statements included in this Quarterly Report on Form 10-Q.

Portfolio

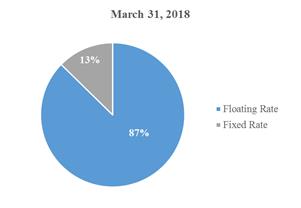

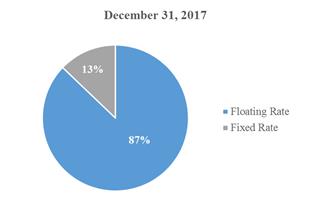

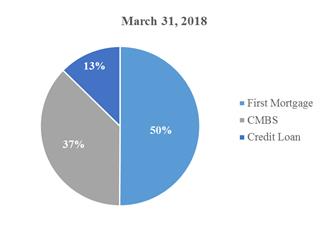

We began operations in October 2016 and our objective is to originate, acquire and manage an investment portfolio of CRE debt and CRE securities that is primarily floating rate and diversified based on the type and location of collateral securing the underlying CRE debt and CRE securities. We anticipate our investment portfolio will be less diversified and have higher concentrations in asset class, collateral type and geographic location until our capital raise reaches levels that will allow for greater diversification.

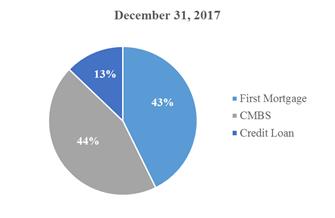

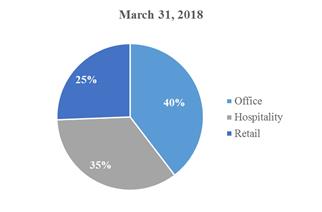

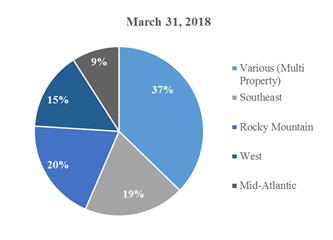

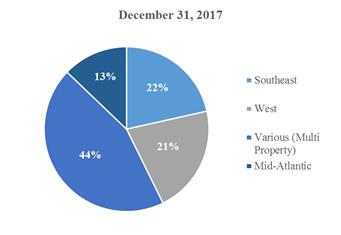

The charts below summarize our portfolio as a percentage of par value by type of rate, loan type, collateral type and geographical region as of March 31, 2018 and December 31, 2017:

Floating vs. Fixed Rate:

17

Investments by Property Type:

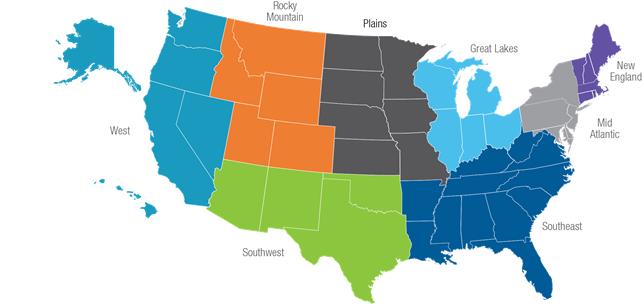

Investments by Region:

18

An investment’s region is defined according to the below map based on the location of underlying property.

The changes in our portfolio as of March 31, 2018 compared to December 31, 2017 were primarily due to the new loans originated during the period. Due to the small number of investments in our portfolio, the changes in the portfolio composition may be significant. We anticipate that these changes will become less significant as our portfolio increases in size.

Real Estate Securities

As of March 31, 2018 and December 31, 2017, our portfolio of real estate securities consisted of four and three investments in CMBS, respectively. Our CMBS investments had a fair value of $30,947,171 and $25,993,258 as of March 31, 2018 and December 31, 2017, respectively. The increase in the size of our portfolio of real estate securities is due to investing capital received from the Offering and increased leverage arising from a Master Repurchase Agreement (the “MRA”).

As of March 31, 2018 and December 31, 2017, our CMBS investments had a weighted average coupon of 3.4% and 2.9% and a remaining life of 1.5 and 1.7 years, respectively. As of March 31, 2018, 67% of our real estate securities portfolio based on fair value was rated AAA and 33% was rated BB- from at least one national rating agency. As of December 31, 2017, 80% of our portfolio based on fair value had a rating by a national rating agency of AAA and 20% BB-. The change in the ratings was due to the purchase of additional assets as we invested capital received from the Offering. Our credit process evaluates the underlying quality of the loans securing the CMBS at the time of purchase and we continually review the credit performance while we own the CMBS. Ratings by national rating agencies are subject to change and may not be continuously updated, and therefore we do not place reliance on these ratings.

Commercial Mortgage Loans Held for Investment

As of March 31, 2018 and December 31, 2017, our portfolio of commercial mortgage loans held for investment consisted of five and three loans, respectively, with outstanding principal balance of $52,010,966 and $32,450,941, respectively. The increase in the size of our portfolio is due to investing capital received from the Offering. The portfolio had a weighted average interest rate of 6.69% and 6.80% as of March 31, 2018 and December 31, 2017, respectively. The change in weighted average interest rate was due to change in portfolio composition through the additional loans originated. Due to the small number of loans in our portfolio, the weighted average interest rate may change significantly as we continue to originate loans in the future.

Allowance for Loan Losses

As of March 31, 2018 and December 31, 2017, we have not recorded any allowance for loan losses as the loans in the portfolio were not impaired and were performing in compliance with the contractual terms and no losses were probable. See Note 2 - “Summary of Significant Accounting Policies” which is included in our notes to consolidated financial statements included in the Annual Report for further description of our allowance for loan loss policy.

19

Comparison of the Three-Months Ended March 31, 2018 to the Three-Months Ended March 31, 2017

Net Interest Income

Net interest income is generated on our interest-earning assets less related interest-bearing liabilities. The following table presents the average balance of interest-earning assets less related interest-bearing liabilities, associated interest income and expense and corresponding yield earned and incurred for the periods indicated.

|

|

|

Three-Month Period Ended March 31, |

|

|||||||||||||||||||||

|

|

|

2018 |

|

|

2017 |

|

||||||||||||||||||

|

|

|

Average Carrying Value (1) |

|

|

Interest Income/ Expense (2) |

|

|

Weighted Average Yield/Financing Cost (3) |

|

|

Average Carrying Value (1) |

|

|

Interest Income/ Expense (2) |

|

|

Weighted Average Yield/Financing Cost (3) |

|

||||||

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate securities |

|

$ |

27,697,704 |

|

|

$ |

215,986 |

|

|

|

3.1 |

% |

|

$ |

7,737,323 |

|

|

$ |

101,738 |

|

|

|

5.3 |

% |

|

Commercial mortgage loans |

|

|

34,544,898 |

|

|

|

614,218 |

|

|

|

7.1 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total/Weighted Average |

|

$ |

62,242,602 |

|

|

$ |

830,204 |

|

|

|

5.3 |

% |

|

$ |

7,737,323 |

|

|

$ |

101,738 |

|

|

|

5.3 |

% |

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase agreements—securities |

|

$ |

15,173,367 |

|

|

$ |

89,160 |

|

|

|

2.4 |

% |

|

$ |

3,576,636 |

|

|

$ |

10,415 |

|

|

|

2.4 |

% |

|

Repurchase agreements—commercial mortgage loans |

|

$ |

1,343,333 |

|

|

$ |

13,784 |

|

|

|

4.1 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total/Weighted Average |

|

$ |

16,516,700 |

|

|

$ |

102,944 |

|

|

|

2.5 |

% |

|

$ |

3,576,636 |

|

|

$ |

10,415 |

|

|

|

2.4 |

% |

|