Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex322_7.htm |

| EX-32.1 - EX-32.1 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex321_6.htm |

| EX-31.2 - EX-31.2 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex312_9.htm |

| EX-31.1 - EX-31.1 - InPoint Commercial Real Estate Income, Inc. | ck0001690012-ex311_8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-55782

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

(Exact name of registrant as specified in its charter)

|

Maryland |

32-0506267 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

2901 Butterfield Road Oak Brook, Illinois |

60523 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (800) 826-8228

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

|

|

Non-accelerated filer |

☒ |

Smaller Reporting Company |

☒ |

|

|

|

|

|

|

Emerging Growth Company |

☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 11, 2020, the Registrant had the following shares outstanding: 10,151,787 shares of Class P common stock, 397,575 shares of Class T common stock, 379,326 shares of Class I common stock, 654,322 shares of Class A common stock, 50,184 shares of Class D common stock and no shares of Class S common stock.

|

PART I FINANCIAL INFORMATION |

|

||

|

Item 1. |

Financial Statements |

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets as of September 30, 2020 (unaudited) and December 31, 2019 |

2 |

|

|

|

|

|

|

|

|

3 |

||

|

|

|

|

|

|

|

4 |

||

|

|

|

|

|

|

|

5 |

||

|

|

|

|

|

|

|

6 |

||

|

|

|

|

|

|

|

7 |

||

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

22 |

|

|

|

|

|

|

|

Item 3. |

40 |

||

|

|

|

|

|

|

Item 4. |

41 |

||

|

|

|

|

|

|

PART II OTHER INFORMATION |

|

||

|

|

|

|

|

|

Item 1. |

41 |

||

|

|

|

|

|

|

Item 1A. |

42 |

||

|

|

|

|

|

|

Item 2. |

44 |

||

|

|

|

|

|

|

Item 3. |

45 |

||

|

|

|

|

|

|

Item 4. |

45 |

||

|

|

|

|

|

|

Item 5. |

45 |

||

|

|

|

|

|

|

Item 6. |

46 |

||

|

|

|

||

|

47 |

|||

1

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

(Dollar amounts in thousands, except share data)

|

|

|

September 30, 2020 (unaudited) |

|

|

December 31, 2019 |

|

||

|

ASSETS |

|

|

|

|

|

|||

|

Cash and cash equivalents |

|

$ |

52,828 |

|

|

$ |

37,210 |

|

|

Restricted cash |

|

|

— |

|

|

|

429 |

|

|

Real estate securities at fair value |

|

|

12,790 |

|

|

|

157,869 |

|

|

Commercial mortgage loans at cost |

|

|

446,744 |

|

|

|

504,702 |

|

|

Real estate owned, net of depreciation |

|

|

32,756 |

|

|

|

— |

|

|

Finance lease right of use asset, net of amortization |

|

|

5,543 |

|

|

|

— |

|

|

Deferred debt finance costs |

|

|

933 |

|

|

|

1,133 |

|

|

Receivable for real estate securities sold |

|

|

12,066 |

|

|

|

— |

|

|

Accrued interest receivable |

|

|

1,147 |

|

|

|

1,822 |

|

|

Prepaid expenses and other assets |

|

|

1,011 |

|

|

|

154 |

|

|

Total assets |

|

$ |

565,818 |

|

|

$ |

703,319 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

|

|

Repurchase agreements—real estate securities |

|

$ |

— |

|

|

$ |

107,489 |

|

|

Repurchase agreements—commercial mortgage loans |

|

|

301,330 |

|

|

|

335,805 |

|

|

Finance lease liability |

|

|

16,717 |

|

|

|

— |

|

|

Loan fees payable |

|

|

231 |

|

|

|

55 |

|

|

Due to related parties |

|

|

2,013 |

|

|

|

698 |

|

|

Interest payable |

|

|

230 |

|

|

|

652 |

|

|

Distributions payable |

|

|

866 |

|

|

|

1,699 |

|

|

Accrued expenses |

|

|

3,611 |

|

|

|

755 |

|

|

Total liabilities |

|

|

324,998 |

|

|

|

447,153 |

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

Class P common stock, $0.001 par value, 500,000,000 shares authorized, 10,151,787 and 10,182,305 shares issued and outstanding at September 30, 2020 and December 31, 2019, respectively |

|

|

10 |

|

|

|

10 |

|

|

Class A common stock, $0.001 par value, 500,000,000 shares authorized, 653,566 and 272,006 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively |

|

|

1 |

|

|

|

— |

|

|

Class T common stock, $0.001 par value, 500,000,000 shares authorized, 397,251 and 121,718 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively |

|

— |

|

|

|

— |

|

|

|

Class S common stock, $0.001 par value, 500,000,000 shares authorized, 0 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively |

|

— |

|

|

|

— |

|

|

|

Class D common stock, $0.001 par value, 500,000,000 shares authorized, 50,081 and 41,538 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively |

|

— |

|

|

|

— |

|

|

|

Class I common stock, $0.001 par value, 500,000,000 shares authorized, 378,302 and 100,743 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively |

|

— |

|

|

|

— |

|

|

|

Additional paid in capital (net of offering costs of $24,852 and $22,718 at September 30, 2020 and December 31, 2019, respectively) |

|

|

287,476 |

|

|

|

265,963 |

|

|

Accumulated deficit |

|

|

(46,667 |

) |

|

|

(9,807 |

) |

|

Total stockholders’ equity |

|

|

240,820 |

|

|

|

256,166 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

565,818 |

|

|

$ |

703,319 |

|

The accompanying notes are an integral part of these consolidated financial statements

2

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, dollar amounts in thousands, except share data)

|

|

|

Three-months ended September 30, |

|

|

Nine-months ended September 30, |

|

||||||||||

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

||||

|

Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

$ |

7,667 |

|

|

$ |

9,464 |

|

|

$ |

26,782 |

|

|

$ |

24,511 |

|

|

Less: Interest expense |

|

|

(1,983 |

) |

|

|

(3,734 |

) |

|

|

(8,628 |

) |

|

|

(9,998 |

) |

|

Net interest income |

|

|

5,684 |

|

|

|

5,730 |

|

|

|

18,154 |

|

|

|

14,513 |

|

|

Revenue from real estate owned |

|

|

365 |

|

|

|

— |

|

|

|

365 |

|

|

|

— |

|

|

Total income |

|

|

6,049 |

|

|

|

5,730 |

|

|

|

18,519 |

|

|

|

14,513 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advisory fee |

|

|

1,572 |

|

|

|

1,601 |

|

|

|

3,973 |

|

|

|

5,086 |

|

|

Debt finance costs |

|

|

403 |

|

|

|

271 |

|

|

|

961 |

|

|

|

692 |

|

|

Directors compensation |

|

|

25 |

|

|

|

22 |

|

|

|

73 |

|

|

|

66 |

|

|

Professional service fees |

|

|

246 |

|

|

|

183 |

|

|

|

1,758 |

|

|

|

492 |

|

|

Real estate owned operating expenses |

|

|

944 |

|

|

|

— |

|

|

|

944 |

|

|

|

— |

|

|

Depreciation and amortization |

|

|

122 |

|

|

|

— |

|

|

|

122 |

|

|

|

— |

|

|

Other expenses |

|

|

209 |

|

|

|

192 |

|

|

|

681 |

|

|

|

358 |

|

|

Total operating expenses |

|

|

3,521 |

|

|

|

2,269 |

|

|

|

8,512 |

|

|

|

6,694 |

|

|

Other income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reversal of (provision for) loan losses |

|

|

54 |

|

|

|

— |

|

|

|

(5,711 |

) |

|

|

— |

|

|

Realized loss on sale of commercial loan |

|

|

— |

|

|

|

— |

|

|

|

(375 |

) |

|

|

— |

|

|

Unrealized gain (loss) in value of real estate securities |

|

|

13,404 |

|

|

|

(205 |

) |

|

|

(5,499 |

) |

|

|

1,585 |

|

|

Realized loss on the sale of real estate securities |

|

|

(9,930 |

) |

|

|

— |

|

|

|

(29,218 |

) |

|

|

(43 |

) |

|

Total other income (loss) |

|

|

3,528 |

|

|

|

(205 |

) |

|

|

(40,803 |

) |

|

|

1,542 |

|

|

Net income (loss) |

|

$ |

6,056 |

|

|

$ |

3,256 |

|

|

$ |

(30,796 |

) |

|

$ |

9,361 |

|

|

Net income (loss) per share basic and diluted |

|

$ |

0.52 |

|

|

$ |

0.32 |

|

|

$ |

(2.67 |

) |

|

$ |

1.11 |

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

11,630,987 |

|

|

|

10,116,083 |

|

|

|

11,537,483 |

|

|

|

8,407,217 |

|

|

Diluted |

|

|

11,631,431 |

|

|

|

10,116,516 |

|

|

|

11,537,483 |

|

|

|

8,407,450 |

|

The accompanying notes are an integral part of these consolidated financial statements

3

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited, dollar amounts in thousands)

|

For the three-months ended September 30, 2020 |

Par Value Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

|||||||||

|

Balance as of June 30, 2020 |

$ |

10 |

|

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

287,703 |

|

|

$ |

(50,184 |

) |

|

$ |

237,530 |

|

|

Proceeds from issuance of common stock |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(235 |

) |

|

|

— |

|

|

|

(235 |

) |

|

Net income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,056 |

|

|

|

6,056 |

|

|

Distributions declared |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,539 |

) |

|

|

(2,539 |

) |

|

Distribution reinvestment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Redemptions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Equity-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8 |

|

|

|

— |

|

|

|

8 |

|

|

Balance as of September 30, 2020 |

$ |

10 |

|

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

287,476 |

|

|

$ |

(46,667 |

) |

|

$ |

240,820 |

|

|

For the three-months ended September 30, 2019 |

Par Value Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

|||||||||

|

Balance as of June 30, 2019 |

$ |

9 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

236,562 |

|

|

$ |

(7,427 |

) |

|

$ |

229,144 |

|

|

Proceeds from issuance of common stock |

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

24,487 |

|

|

|

— |

|

|

|

24,488 |

|

|

Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,796 |

) |

|

|

— |

|

|

|

(3,796 |

) |

|

Net income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,256 |

|

|

|

3,256 |

|

|

Distributions declared |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,936 |

) |

|

|

(4,936 |

) |

|

Distribution reinvestment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

Redemptions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(451 |

) |

|

|

— |

|

|

|

(451 |

) |

|

Equity-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

5 |

|

|

Balance as of September 30, 2019 |

$ |

10 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

256,808 |

|

|

$ |

(9,107 |

) |

|

$ |

247,711 |

|

The accompanying notes are an integral part of these consolidated financial statements

4

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited, dollar amounts in thousands)

|

For the nine-months ended September 30, 2020 |

Par Value Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

|||||||||

|

Balance as of December 31, 2019 |

$ |

10 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

265,963 |

|

|

$ |

(9,807 |

) |

|

$ |

256,166 |

|

|

Proceeds from issuance of common stock |

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

24,261 |

|

|

|

— |

|

|

|

24,262 |

|

|

Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,135 |

) |

|

|

— |

|

|

|

(2,135 |

) |

|

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(30,796 |

) |

|

|

(30,796 |

) |

|

Distributions declared |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,064 |

) |

|

|

(6,064 |

) |

|

Distribution reinvestment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

127 |

|

|

|

— |

|

|

|

127 |

|

|

Redemptions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(763 |

) |

|

|

— |

|

|

|

(763 |

) |

|

Equity-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

23 |

|

|

|

— |

|

|

|

23 |

|

|

Balance as of September 30, 2020 |

$ |

10 |

|

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

287,476 |

|

|

$ |

(46,667 |

) |

|

$ |

240,820 |

|

|

For the nine-months ended September 30, 2019 |

Par Value Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Class P |

|

|

Class A |

|

|

Class T |

|

|

Class S |

|

|

Class D |

|

|

Class I |

|

|

Additional Paid in Capital |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

|||||||||

|

Balance as of December 31, 2018 |

$ |

6 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

148,650 |

|

|

$ |

(6,384 |

) |

|

$ |

142,272 |

|

|

Proceeds from issuance of common stock |

|

4 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

118,800 |

|

|

|

— |

|

|

|

118,804 |

|

|

Offering costs |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10,117 |

) |

|

|

— |

|

|

|

(10,117 |

) |

|

Net income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,361 |

|

|

|

9,361 |

|

|

Distributions declared |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(12,084 |

) |

|

|

(12,084 |

) |

|

Distribution reinvestment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

Redemptions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(541 |

) |

|

|

— |

|

|

|

(541 |

) |

|

Equity-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15 |

|

|

|

— |

|

|

|

15 |

|

|

Balance as of September 30, 2019 |

$ |

10 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

256,808 |

|

|

$ |

(9,107 |

) |

|

$ |

247,711 |

|

The accompanying notes are an integral part of these consolidated financial statements

5

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, dollar amounts in thousands)

|

|

|

For the nine-months ended September 30, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(30,796 |

) |

|

$ |

9,361 |

|

|

Adjustments to reconcile net (loss) income to cash provided by operations: |

|

|

|

|

|

|

|

|

|

Net realized loss on real estate securities |

|

|

29,218 |

|

|

|

43 |

|

|

Net unrealized loss (gain) on real estate securities |

|

|

5,499 |

|

|

|

(1,585 |

) |

|

Provision for loan losses |

|

|

5,711 |

|

|

|

— |

|

|

Realized loss on sale of commercial mortgage loan |

|

|

375 |

|

|

|

— |

|

|

Depreciation and amortization expense |

|

|

128 |

|

|

|

— |

|

|

Amortization of equity-based compensation |

|

|

23 |

|

|

|

15 |

|

|

Amortization of debt finance costs to operating expense |

|

|

961 |

|

|

|

692 |

|

|

Amortization of debt finance costs to interest expense |

|

|

60 |

|

|

|

61 |

|

|

Amortization of bond discount |

|

|

(307 |

) |

|

|

(594 |

) |

|

Amortization of origination fees |

|

|

(1,228 |

) |

|

|

(1,411 |

) |

|

Amortization of deferred exit fees |

|

|

62 |

|

|

|

(406 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accrued interest receivable |

|

|

389 |

|

|

|

(452 |

) |

|

Accrued expenses |

|

|

503 |

|

|

|

711 |

|

|

Loan fees payable |

|

|

176 |

|

|

|

— |

|

|

Accrued interest payable |

|

|

(532 |

) |

|

|

142 |

|

|

Due to related parties |

|

|

687 |

|

|

|

13 |

|

|

Prepaid expenses and other assets |

|

|

(679 |

) |

|

|

59 |

|

|

Net cash provided by operating activities |

|

|

10,250 |

|

|

|

6,649 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Origination of commercial loans |

|

|

(59,990 |

) |

|

|

(254,725 |

) |

|

Origination fees received on commercial loans |

|

|

— |

|

|

|

1,951 |

|

|

Principal repayments of commercial loans |

|

|

85,080 |

|

|

|

74,478 |

|

|

Proceeds from sale of commercial loan |

|

|

9,625 |

|

|

|

— |

|

|

Acquisition of real estate owned |

|

|

(637 |

) |

|

|

— |

|

|

Purchase of real estate securities |

|

|

— |

|

|

|

(50,459 |

) |

|

Proceeds from real estate securities sold |

|

|

96,453 |

|

|

|

9,211 |

|

|

Real estate securities principal pay-down |

|

|

2,178 |

|

|

|

1,215 |

|

|

Net cash provided by (used in) investing activities |

|

|

132,709 |

|

|

|

(218,329 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock |

|

|

24,261 |

|

|

|

118,804 |

|

|

Redemptions of common stock |

|

|

(763 |

) |

|

|

(541 |

) |

|

Payment of offering costs |

|

|

(1,714 |

) |

|

|

(10,035 |

) |

|

Proceeds from repurchase agreements |

|

|

578,182 |

|

|

|

925,238 |

|

|

Principal repayments of repurchase agreements |

|

|

(720,180 |

) |

|

|

(789,908 |

) |

|

Debt finance costs |

|

|

(786 |

) |

|

|

(1,487 |

) |

|

Distributions paid |

|

|

(6,770 |

) |

|

|

(11,373 |

) |

|

Net cash (used in) provided by financing activities |

|

|

(127,770 |

) |

|

|

230,698 |

|

|

Net change in cash, cash equivalents and restricted cash |

|

|

15,189 |

|

|

|

19,018 |

|

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

37,639 |

|

|

|

28,497 |

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

52,828 |

|

|

$ |

47,515 |

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

|

|

|

Change in deferred offering costs and accrued offering expenses, included in due to related parties |

|

$ |

— |

|

|

$ |

(505 |

) |

|

Amortization of deferred exit fees due to related party |

|

$ |

208 |

|

|

$ |

— |

|

|

Interest paid |

|

$ |

9,050 |

|

|

$ |

9,939 |

|

|

Distributions payable |

|

$ |

866 |

|

|

$ |

1,650 |

|

|

Receivables for real estate securities sold |

|

$ |

12,066 |

|

|

$ |

— |

|

|

Payable for real estate securities purchased |

|

$ |

— |

|

|

$ |

1,500 |

|

|

Deferred interest capitalized on commercial loan |

|

$ |

258 |

|

|

$ |

— |

|

|

Accrued stockholder servicing fee due to related party |

|

$ |

420 |

|

|

$ |

82 |

|

|

Distribution reinvestment |

|

$ |

127 |

|

|

$ |

1 |

|

The accompanying notes are an integral part of these consolidated financial statements

6

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited, dollar amounts in thousands, except share data)

Note 1 – Organization and Business Operations

InPoint Commercial Real Estate Income, Inc. (the “Company”) was incorporated in Maryland on September 13, 2016 to originate, acquire and manage a diversified portfolio of commercial real estate (“CRE”) investments primarily comprised of (i) CRE debt, including floating-rate first mortgage loans, subordinate mortgage and mezzanine loans, and participations in such loans and (ii) floating-rate CRE securities, such as commercial mortgage-backed securities (“CMBS”), and senior unsecured debt of publicly traded real estate investment trusts (“REITs”). The Company may also invest in select equity investments in single-tenant, net leased properties. Substantially all of the Company’s business is conducted through InPoint REIT Operating Partnership, LP (the “Operating Partnership”), a Delaware limited partnership. The Company is the sole general partner and directly or indirectly holds all of the limited partner interests in the Operating Partnership. The Company has elected to be taxed as a REIT for U.S. federal income tax purposes.

The Company is externally managed by Inland InPoint Advisor, LLC (the “Advisor”), a Delaware limited liability company formed in August 2016 that is a wholly owned indirect subsidiary of Inland Real Estate Investment Corporation, a member of The Inland Real Estate Group of Companies, Inc. The Advisor is responsible for coordinating the management of the day-to-day operations and originating, acquiring and managing the Company’s CRE investment portfolio, subject to the supervision of the Company’s board of directors (the “Board”). The Advisor performs its duties and responsibilities as the Company’s fiduciary pursuant to an amended and restated advisory agreement dated April 29, 2019 among the Company, the Advisor and the Operating Partnership (the “Advisory Agreement”), which supersedes and replaces the advisory agreement dated October 25, 2016 (the “Prior Advisory Agreement”).

The Advisor has delegated certain of its duties to SPCRE InPoint Advisors, LLC (the “Sub-Advisor”), a Delaware limited liability company formed in September 2016 that is a wholly owned subsidiary of Sound Point CRE Management, LP, pursuant to an amended and restated sub-advisory agreement between the Advisor and the Sub-Advisor dated April 29, 2019. Among other duties, the Sub-Advisor has the authority to identify, negotiate, acquire and originate the Company’s investments and provide portfolio management, disposition, property management and leasing services to the Company. Notwithstanding such delegation to the Sub-Advisor, the Advisor retains ultimate responsibility for the performance of all the matters entrusted to it under the Advisory Agreement, including those duties which the Advisor has not delegated to the Sub-Advisor such as (i) valuation of the Company’s assets and calculation of the Company’s net asset value (“NAV”); (ii) management of the Company’s day-to-day operations; (iii) preparation of stockholder reports and communications and arrangement of the Company’s annual stockholder meeting; and (iv) advising the Company regarding its initial qualification as a REIT for U.S. federal income tax purposes and monitoring its ongoing compliance with the REIT qualification requirements thereafter.

On October 25, 2016, the Company commenced a private offering (the “Private Offering”) of up to $500,000 in shares of Class P common stock (“Class P Shares”). Inland Securities Corporation, an affiliate of the Advisor (the “Dealer Manager”), was the dealer manager for the Private Offering. On June 28, 2019, the Company terminated the Private Offering in anticipation of selling shares in the IPO (described below). The Company accepted Private Offering subscription proceeds through July 16, 2019 from subscription agreements executed no later than June 28, 2019. The Company issued 10,258,094 Class P Shares in the Private Offering, resulting in gross proceeds of $276,681.

On March 22, 2019, the Company filed a Registration Statement on Form S-11 (File No. 333-230465) (the “Registration Statement”) to register up to $2,350,000 in shares of common stock (the “IPO”).

On April 29, 2019, the Company filed articles of amendment with the State Department of Assessments and Taxation of the State of Maryland (the “SDAT”) (i) to modify the number of shares of capital stock the Company has authority to issue under its charter from 500,000,000 to 3,050,000,000, consisting of 3,000,000,000 Class P Shares and 50,000,000 shares of preferred stock, and (ii) to modify the aggregate par value of all authorized shares of stock from $500 to $3,050.

On April 29, 2019, the Company also filed articles supplementary with SDAT to reclassify and designate: (i) 500,000,000 authorized but unissued Class P Shares as Class A common shares; (ii) 500,000,000 authorized but unissued Class P Shares as Class D common shares; (iii) 500,000,000 authorized but unissued Class P Shares as Class I common shares; (iv) 500,000,000 authorized but unissued Class P Shares as Class S common shares; and (v) 500,000,000 authorized but unissued Class P Shares as Class T common shares.

On May 3, 2019, the Securities and Exchange Commission (the “SEC”) declared effective the Registration Statement and the Company commenced the IPO. Prior to July 17, 2019 (the “NAV Pricing Date”), the purchase price for each class of its common

7

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited, dollar amounts in thousands, except share data)

stock in its primary offering was $25.00 per share, plus applicable upfront selling commissions and dealer manager fees. Following the NAV Pricing Date, the purchase price per share for each class of common stock in the IPO varies and generally equals the prior month’s NAV per share, as determined monthly, plus applicable upfront selling commissions and dealer manager fees. The Dealer Manager serves as the Company’s exclusive dealer manager for the IPO on a best efforts basis.

On March 24, 2020, the Board suspended (i) the sale of shares in the IPO, (ii) the operation of the share repurchase program (the “SRP”), (iii) the payment of distributions to the Company’s stockholders, and (iv) the operation of the distribution reinvestment plan (the “DRP”), effective as of April 6, 2020. In determining to suspend the IPO, the SRP, the payment of distributions and the DRP, the Board considered various factors, including the impact of the global COVID-19 pandemic on the economy, the inability to accurately calculate the Company’s NAV per share due to uncertainty, volatility and lack of liquidity in the market, the Company’s need for liquidity due to financing challenges related to additional collateral required by the banks that regularly finance the Company’s assets and these uncertain and rapidly changing economic conditions.

Though the Company did not calculate the NAV for the months of March through May 2020, the Advisor has determined since then that there has been reduced volatility in the market for the Company’s investments and some improvement in the U.S. economic outlook and resumed calculation of the NAV beginning as of June 30, 2020. In August 2020 the Company resumed paying distributions monthly to stockholders of record for all classes of its common stock. On October 1, 2020, the SEC declared effective the Company’s post-effective amendment to the Registration Statement thereby permitting the Company to resume offers and sales of shares of common stock in the IPO, including through the DRP. The Company will continue to closely monitor the pandemic, the economy and the markets for the Company’s investments in order to determine an appropriate time to resume the SRP. Please refer to “Note 15 – Subsequent Events” and Part II, “Item 1A – Risk Factors” for updates to the Company’s business after September 30, 2020 and risk factors related to the COVID-19 pandemic, respectively.

Note 2 – Summary of Significant Accounting Policies

Disclosures discussing all significant accounting policies are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (the “Annual Report”), as filed with the SEC on March 11, 2020, under the heading Note 2 – Summary of Significant Accounting Policies. The Company has added to its significant accounting policies for the nine-months ended September 30, 2020 as a result of a real estate property acquired via a deed-in-lieu of foreclosure in August 2020.

Basis of Accounting

The accompanying consolidated financial statements and related footnotes have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and require management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reported periods. Actual results could differ from such estimates.

In the opinion of management, the accompanying unaudited consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation.

Real Estate Owned

Real estate owned (“REO”) represents real estate acquired by the Company through foreclosure, deed-in-lieu of foreclosure, or purchase. For real estate acquired by the Company through foreclosure or deed-in-lieu of foreclosure, REO assets are recorded at fair value at acquisition and are presented net of accumulated depreciation. For REO assets acquired through purchase, REO assets are recorded at cost at acquisition and are presented net of accumulated depreciation.

REO assets are depreciated using the straight-line method over estimated useful lives of up to 40 years for buildings and improvements and up to 15 years for furniture, fixtures and equipment. Renovations and/or replacements that improve or extend the life of the real estate asset are capitalized and depreciated over their estimated useful lives.

8

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited, dollar amounts in thousands, except share data)

Revenue from Real Estate Owned

Revenue from REO represents revenue associated with the operations of a hotel property classified as REO. Revenue from the operation of the hotel property is recognized when guestrooms are occupied, services have been rendered or fees have been earned. Revenues are recorded net of any discounts and sales and other taxes collected from customers. Revenues consist of room sales, food and beverage sales and other hotel revenues.

Leases

Finance lease right of use ("ROU") assets represent the Company’s right to use an underlying asset during the lease term, and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets are recorded based on the fair value of the underlying property. Lease liabilities are recognized at commencement date based on the present value of fixed lease payments over the lease term. Leases will be classified as either a finance or operating lease, with such classification affecting the pattern and classification of expense recognition in the consolidated statements of operations. For leases greater than 12 months, the Company determines, at the inception of the contract, if the arrangement meets the classification criteria for an operating or finance lease. For leases that have extension options, which can be exercised at the Company's discretion, management uses judgment to determine if it is reasonably certain that such extension options will be elected. If the extension options are reasonably certain to occur, the Company includes the extended term's lease payments in the calculation of the respective lease liability. Total lease expense is recognized as interest on the finance lease liability and amortization of the ROU asset on a straight-line basis over the lease term. The incremental borrowing rate used to discount the lease liability is determined at commencement of the lease, or upon modification of the lease, as the interest rate a lessee would have to pay to borrow on a fully collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment. The Company's incremental borrowing rate considers information at both the corporate and property level and analysis of current market conditions for obtaining new financings. As of September 30, 2020, the Company had one finance lease assumed as part of a deed-in-lieu of foreclosure of a hotel property during August 2020.

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include funds on deposit with financial institutions, including demand deposits with financial institutions with original maturities of three months or less. The account balance may exceed the Federal Deposit Insurance Corporation (“FDIC”) insurance coverage limits and, as a result, there could be a concentration of credit risk related to amounts on deposit in excess of FDIC insurance coverage limits. The Company believes that the risk will not be significant, as the Company does not anticipate the financial institutions’ non-performance.

Restricted cash represents cash the Company is required to hold in a segregated account as additional collateral on real estate securities repurchase agreements. As of September 30, 2020, the Company had repaid all outstanding repurchase agreements secured by real estate securities and, therefore, had no required additional collateral posted.

The following table provides a reconciliation of cash, cash equivalents and restricted cash in the Company’s consolidated balance sheets to the total amount shown in the Company’s consolidated statements of cash flows:

|

|

|

September 30, |

|

|

December 31, |

|

||

|

|

|

2020 |

|

|

2019 |

|

||

|

Cash and cash equivalents |

|

$ |

52,828 |

|

|

$ |

37,210 |

|

|

Restricted cash |

|

|

— |

|

|

|

429 |

|

|

Total cash, cash equivalents, and restricted cash |

|

$ |

52,828 |

|

|

$ |

37,639 |

|

Accounting Pronouncements Recently Issued but Not Yet Effective

In June 2016, the Financial Accounting Standards Board (“FASB”) issued ASU 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which changes how entities measure credit losses for financial assets carried at amortized cost. ASU 2016-13 eliminates the requirement that a credit loss must be probable before it can be recognized and instead requires an entity to recognize the current estimate of all expected credit losses. ASU 2016-13 is effective for SEC filers for reporting periods beginning after December 15, 2019. In November 2019, the FASB issued ASU 2019-10, “Financial Instruments – Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842): Effective Dates”,

9

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited, dollar amounts in thousands, except share data)

which grants smaller reporting companies (as defined by the SEC) until reporting periods commencing after December 15, 2022 to implement ASU 2016-13. The Company has elected to use this extension and is continuing to evaluate the impact ASU 2016-13 will have on its allowance for loan losses estimate.

Note 3 – Commercial Mortgage Loans Held for Investment

The tables below show the Company’s commercial mortgage loans held for investment as of September 30, 2020 and December 31, 2019:

September 30, 2020

|

|

|

Number of Loans |

|

|

Principal Balance |

|

|

Unamortized (fees)/costs, net |

|

|

Carrying Value |

|

|

Weighted Average Interest Rate |

|

|

Weighted Average Years to Maturity |

|

||||||

|

First mortgage loans |

|

|

26 |

|

|

$ |

430,569 |

|

|

$ |

(325 |

) |

|

$ |

430,244 |

|

|

|

5.3 |

% |

|

|

1.7 |

|

|

Credit loans |

|

|

3 |

|

|

|

16,500 |

|

|

|

— |

|

|

|

16,500 |

|

|

|

9.5 |

% |

|

|

5.1 |

|

|

Total and average |

|

|

29 |

|

|

$ |

447,069 |

|

|

$ |

(325 |

) |

|

$ |

446,744 |

|

|

|

5.5 |

% |

|

|

1.8 |

|

December 31, 2019

|

|

|

Number of Loans |

|

|

Principal Balance |

|

|

Unamortized (fees)/costs, net |

|

|

Carrying Value |

|

|

Weighted Average Interest Rate |

|

|

Weighted Average Years to Maturity |

|

||||||

|

First mortgage loans |

|

|

29 |

|

|

$ |

489,902 |

|

|

$ |

(1,700 |

) |

|

$ |

488,202 |

|

|

|

5.6 |

% |

|

|

2.0 |

|

|

Credit loans |

|

|

3 |

|

|

|

16,500 |

|

|

|

— |

|

|

|

16,500 |

|

|

|

9.5 |

% |

|

|

5.9 |

|

|

Total and average |

|

|

32 |

|

|

$ |

506,402 |

|

|

$ |

(1,700 |

) |

|

$ |

504,702 |

|

|

|

5.7 |

% |

|

|

2.2 |

|

For the nine months ended September 30, 2020 and the year ended December 31, 2019, the activity in the Company’s commercial mortgage loans, held-for-investment portfolio was as follows:

|

|

|

Nine Months Ended September 30, 2020 |

|

|

Year Ended December 31, 2019 |

|

||

|

Balance at Beginning of Year |

|

$ |

504,702 |

|

|

$ |

249,573 |

|

|

Loan originations |

|

|

59,990 |

|

|

|

329,155 |

|

|

Principal repayments |

|

|

(85,080 |

) |

|

|

(74,478 |

) |

|

Amortization of loan origination and deferred exit fees |

|

|

1,374 |

|

|

|

2,403 |

|

|

Sale of commercial loan |

|

|

(10,000 |

) |

|

|

— |

|

|

Origination fees received on commercial loans |

|

|

— |

|

|

|

(1,951 |

) |

|

Provision for loan losses |

|

|

(5,711 |

) |

|

|

— |

|

|

Deferred interest capitalized on commercial loan |

|

|

258 |

|

|

|

— |

|

|

Transfer on deed-in-lieu of foreclosure to real estate owned |

|

|

(18,789 |

) |

|

|

— |

|

|

Balance at End of Period |

|

$ |

446,744 |

|

|

$ |

504,702 |

|

During May 2020, the Company sold one credit loan with an outstanding principal balance of $10,000 generating proceeds of $9,625. The Company had not previously planned to sell the loan and had classified it as held for investment. The Company recognized a loss of $375 recorded in realized loss on sale of commercial loan.

10

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited, dollar amounts in thousands, except share data)

The following table presents the activity in the Company’s allowance for loan losses:

|

|

|

Nine Months Ended September 30, 2020 |

|

|

Nine Months Ended September 30, 2019 |

|

||

|

Beginning of period |

|

$ |

— |

|

|

$ |

— |

|

|

Provision for loan losses |

|

|

(5,711 |

) |

|

|

— |

|

|

Charge-offs |

|

|

5,711 |

|

|

|

— |

|

|

Ending allowance for loan losses |

|

$ |

— |

|

|

$ |

— |

|

In accordance with the Company’s allowance for loan loss policy, during the nine-month period ended September 30, 2020, the Company recorded impairment charges of $5,711 on one first mortgage loan secured by a hotel property in Illinois. The impairment charges were based on the estimated fair value of the underlying collateral, and the loan was terminated during August in connection with the Company’s acquisition of the collateral via a deed-in-lieu of foreclosure. In addition, the Company previously recorded a provision for loan loss of $1,500 on a mezzanine loan secured by a hotel property in Miami, Florida that had been negatively impacted by the economic effects of the COVID-19 pandemic. During the quarter ended September 30, 2020, the Company determined that the loan had improved and that a loss was no longer probable. As such, the $1,500 allowance for loan loss previously recorded was reversed against the provision for loan losses. For the three and nine months ended September 30, 2020, interest income for the impaired loan was $0 and $465, respectively. For further information on the Company’s allowance for loan losses policy, see “Note 2 – Summary of Significant Accounting Policies” in its Annual Report.

Credit Characteristics

As part of the Company’s process for monitoring the credit quality of its investments, it performs a quarterly asset review of the investment portfolio and assigns risk ratings to each of its loans and CMBS. Risk factors include payment status, lien position, borrower financial resources and investment in collateral, collateral type, project economics and geographic location, as well as national and regional economic factors. To determine the likelihood of loss, the loans are rated on a 5-point scale as follows:

|

Investment Grade |

Investment Grade Definition |

|

1 |

Investment exceeding fundamental performance expectations and/or capital gain expected. Trends and risk factors since time of investment are favorable. |

|

2 |

Performing consistent with expectations and a full return of principal and interest expected. Trends and risk factors are neutral to favorable. |

|

3 |

Performing investment requiring closer monitoring. Trends and risk factors show some deterioration. Collection of principal and interest is still expected. |

|

4 |

Underperforming investment with the potential of some interest loss but still expecting a positive return on investment. Trends and risk factors are negative. |

|

5 |

Underperforming investment with expected loss of interest and some principal. |

All investments are assigned an initial risk rating of 2 at origination or acquisition.

As of September 30, 2020, 19 loans had a risk rating of 2, seven had a risk rating of 3 and three had a risk rating of 4. As of December 31, 2019, 30 loans had a risk rating of 2 and two had a risk rating of 3.

Loan Modifications

During April 2020, the Company agreed to modify one first mortgage loan on a hospitality property providing for a two-month partial reduction in the required monthly interest payment with payment of the amount by which the interest payments were reduced deferred to the nine-month period beginning in October 2020. During June 2020, the partial reduction of the monthly interest payments was extended through the July payment, and during August 2020 this was further extended through the September payment. Later during August 2020, the Company agreed, in exchange for a fee charged to the borrower, to further modify this loan to provide partial reduction of the monthly interest payments through December 2020 with repayment of all the deferred payments, including those

11

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited, dollar amounts in thousands, except share data)

previously deferred, to be made during a nine-month period beginning in January 2021. Prior to the COVID-19 pandemic, the loan was current on all required payments.

Note 4 – Real Estate Securities

The Company classified its real estate securities as available-for-sale. These investments are reported at fair value in the consolidated balance sheets with changes in fair value recorded in other income or loss in the consolidated statements of operations.

The tables below show the Company’s real estate securities as of September 30, 2020 and December 31, 2019:

September 30, 2020

|

Number of Positions |

|

|

External Credit Rating |

|

Collateral |

|

Weighted Average Interest Rate |

|

|

Weighted Average Years to Maturity |

|

|

Par Value |

|

|

Amortized Cost |

|

|

Unrealized Gains |

|

|

Unrealized Losses |

|

|

Fair Value |

|

||||||||

|

1 |

|

|

BB- |

|

Hospitality |

|

|

3.6 |

% |

|

0.7 |

|

|

|

8,500 |

|

|

|

8,500 |

|

|

|

— |

|

|

|

(1,290 |

) |

|

|

7,210 |

|

||

|

1 |

|

|

B+ |

|

Hospitality |

|

|

3.9 |

% |

|

|

— |

|

|

|

10,000 |

|

|

|

10,000 |

|

|

|

— |

|

|

|

(4,420 |

) |

|

|

5,580 |

|

|

|

|

2 |

|

|

|

|

|

|

|

3.7 |

% |

|

0.3 |

|

|

$ |

18,500 |

|

|

$ |

18,500 |

|

|

$ |

— |

|

|

$ |

(5,710 |

) |

|

$ |

12,790 |

|

|

December 31, 2019

|

Number of Positions |

|

|

External Credit Rating |

|

Collateral |

|

Weighted Average Interest Rate |

|

|

Weighted Average Years to Maturity |

|

Par Value |

|

|

Amortized Cost |

|

|

Unrealized Gains |

|

|

Unrealized Losses |

|

|

Fair Value |

|

|||||||

|

3 |

|

|

AAA |

|

Hospitality, Office |

|

|

2.6 |

% |

|

0.5 |

|

$ |

19,113 |

|

|

$ |

19,081 |

|

|

$ |

— |

|

|

$ |

(43 |

) |

|

$ |

19,038 |

|

|

|

1 |

|

|

AA- |

|

Hospitality |

|

|

2.8 |

% |

|

0.4 |

|

|

2,000 |

|

|

|

1,999 |

|

|

|

— |

|

|

|

(11 |

) |

|

|

1,988 |

|

|

|

9 |

|

|

BB- |

|

Retail, Hospitality, Mixed Use, Office |

|

|

4.4 |

% |

|

1.3 |

|

|

72,052 |

|

|

|

72,033 |

|

|

|

104 |

|

|

|

(81 |

) |

|

|

72,056 |

|

|

|

1 |

|

|

BBB- |

|

Multifamily |

|

|

3.4 |

% |

|

1.5 |

|

|

10,000 |

|

|

|

10,000 |

|

|

|

— |

|

|

|

— |

|

|

|

10,000 |

|

|

|

3 |

|

|

Unrated |

|

Hospitality |

|

|

7.0 |

% |

|

0.7 |

|

|

55,275 |

|

|

|

54,967 |

|

|

|

— |

|

|

|

(180 |

) |

|

|

54,787 |

|

|

|

|

17 |

|

|

|

|

|

|

|

5.0 |

% |

|

1.0 |

|

$ |

158,440 |

|

|

$ |

158,080 |

|

|

$ |

104 |

|

|

$ |

(315 |

) |

|

$ |

157,869 |

|

At September 30, 2020, the Company held two CMBS with a total carrying value of $12,790 and a total net unrealized loss of $5,710. At December 31, 2019, the Company held 17 CMBS with a total carrying value of $157,869 and a total net unrealized loss of $211. The increase in the unrealized loss was primarily attributed to the significant economic impact of the COVID-19 pandemic on the economy. In particular, CMBS secured by hospitality properties were severely impacted due to concerns over a decline in hotel stays throughout the country. During the three and nine months ended September 30, 2020, the Company sold real estate securities for $52,525 and $96,453, respectively, that resulted in realized losses of $9,930 and $29,218, respectively. During the nine months ended September 30, 2019, the Company sold real estate securities for $9,211 that resulted in realized losses of $43.

As of September 30, 2020, one of the CMBS had an internal risk rating of 3 and one of the CMBS had an internal risk rating of 5. As of December 31, 2019, each CMBS had an internal risk rating of 2.

Note 5 – Repurchase Agreements

Commercial Mortgage Loans

On February 15, 2018, the Company, through a wholly owned subsidiary, entered into a master repurchase agreement (the “CF Repo Facility”) with Column Financial, Inc. as administrative agent for certain of its affiliates. The CF Repo Facility had an initial advance amount of $100,000 subject to a maximum advance amount of $250,000. The Company increased the advance amount in August 2018 to $175,000, and in January 2019 to $250,000. In March 2020, the Company temporarily increased the maximum advance amount to

12

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

September 30, 2020

(Unaudited, dollar amounts in thousands, except share data)

$300,000, and this increase expired on June 30, 2020 and the maximum advance amount reverted to $250,000. The initial term of the CF Repo Facility was 12 months and the Company extended the maturity date in March 2020 to February 2021. Advances under the CF Repo Facility accrue interest at a per annum rate equal to the London Interbank Offered Rate (“LIBOR”) plus 2.0%. The CF Repo Facility is subject to certain financial covenants. The Company was in compliance with all financial covenant requirements as of September 30, 2020 and December 31, 2019.

On May 6, 2019, the Company, through a wholly owned subsidiary, entered into an uncommitted master repurchase agreement (the “JPM Repo Facility”) with JPMorgan Chase Bank, National Association. The JPM Repo Facility provides up to $150,000 in advances that the Company expects to use to finance the acquisition or origination of eligible loans and participation interests therein. Advances under the JPM Repo Facility accrue interest at per annum rates equal to the sum of (i) the applicable LIBOR index rate plus (ii) a margin of between 1.75% to 2.50%, depending on the attributes of the purchased assets. The initial maturity date of the JPM Repo Facility is May 6, 2021, with two successive one-year extensions at the Company’s option, which may be exercised upon the satisfaction of certain conditions. The JPM Repo Facility is subject to certain financial covenants. The Company was in compliance with all financial covenant requirements as of September 30, 2020 and December 31, 2019.

The JPM Repo Facility and CF Repo Facility (collectively, the “Repo Facilities”) are used to finance eligible loans and each act in the manner of a revolving credit facility that can be repaid as the Company’s assets are paid off and re-drawn as advances against new assets.

The tables below show the Repo Facilities as of September 30, 2020 and December 31, 2019:

|

September 30, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|||||

|

|

Committed Financing |

|

|

Amount Outstanding(1) |

|

|

Accrued Interest Payable |

|

|

Collateral Pledged |

|

|

Interest Rate |

|

|

Days to Maturity |

|

||||||

|

CF Repo Facility |

$ |

250,000 |

|

|

$ |

170,598 |

|

|

$ |

132 |

|

|

$ |

242,577 |

|

|

|

2.15 |

% |

|

|

135 |

|

|

JPM Repo Facility |

|

150,000 |

|

|

|

130,778 |

|

|

|

98 |

|

|

|

187,992 |

|

|

|

2.07 |

% |

|

|

218 |

|

|

|

$ |

400,000 |

|

|

$ |

301,376 |

|

|

$ |

230 |

|

|

$ |

430,569 |

|

|

|

2.12 |

% |

|

|

171 |

|

|

December 31, 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|||||

|

|

Committed Financing |

|

|

Amount Outstanding(1) |

|

|

Accrued Interest Payable |

|

|

Collateral Pledged |

|

|

Interest Rate |

|

|

Days to Maturity |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CF Repo Facility |

$ |

250,000 |

|

|

$ |

224,590 |

|

|

$ |

327 |

|

|

$ |

304,708 |

|

|

|

3.74 |

% |

|

|

318 |

|

|

JPM Repo Facility |

|

150,000 |

|

|

|

111,295 |

|

|

|

157 |

|

|

|

153,194 |

|

|

|

3.63 |

% |

|

|

492 |

|

|

|

$ |

400,000 |

|

|

$ |

335,885 |

|

|

$ |

484 |

|

|

$ |

457,902 |

|

|

|

3.70 |

% |

|

|

376 |

|

|

(1) |

Excludes $46 and $80 of unamortized debt issuance costs at September 30, 2020 and December 31, 2019, respectively. |

Real Estate Securities

The Company entered into two master repurchase agreements for real estate securities with separate counterparties and had the following balances outstanding as described in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

|||||

|

|

|

Amount Outstanding |

|

|

Accrued Interest Payable |

|

|

Collateral Pledged |

|

|

Interest Rate |

|

|

Days to Maturity |

|

|||||

|

As of September 30, 2020 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

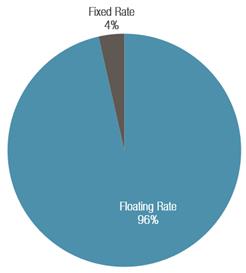

|