Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InPoint Commercial Real Estate Income, Inc. | ck0001690012-8k_20180411.htm |

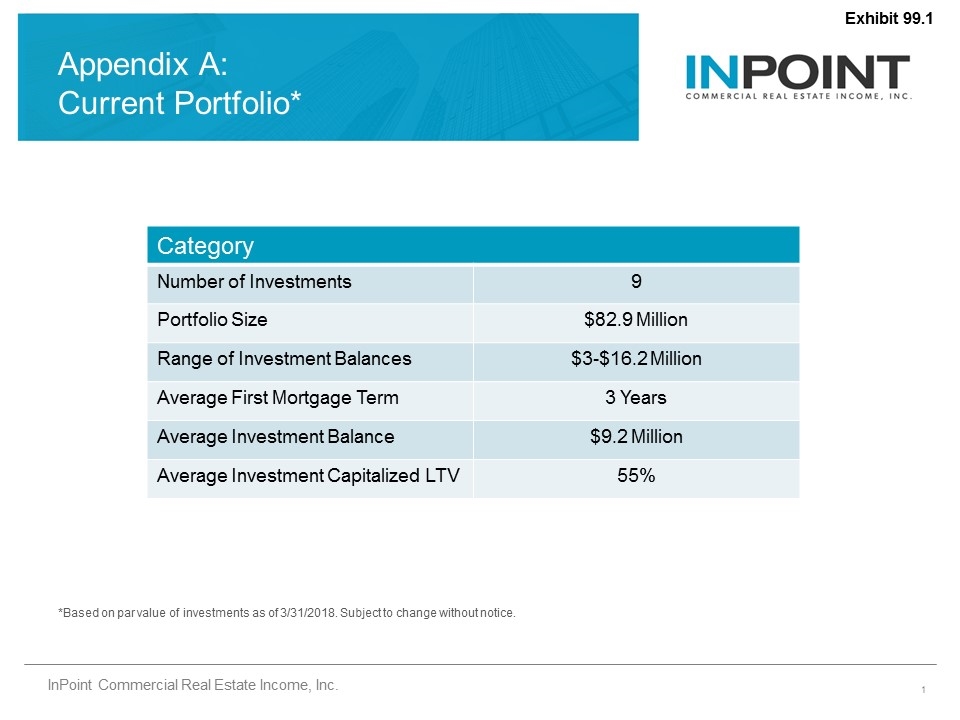

*Based on par value of investments as of 3/31/2018. Subject to change without notice. Category Number of Investments 9 Portfolio Size $82.9 Million Range of Investment Balances $3-$16.2 Million Average First Mortgage Term 3 Years Average Investment Balance $9.2 Million Average Investment Capitalized LTV 55% Appendix A: Current Portfolio* Exhibit 99.1

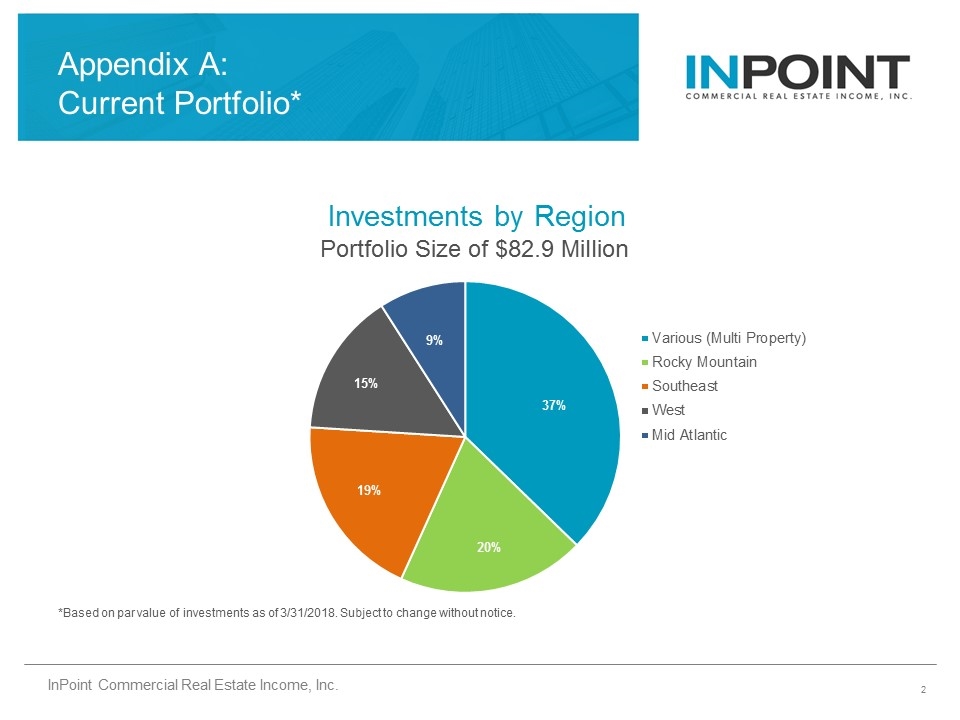

Investments by Region Appendix A: Current Portfolio* Portfolio Size of $82.9 Million *Based on par value of investments as of 3/31/2018. Subject to change without notice.

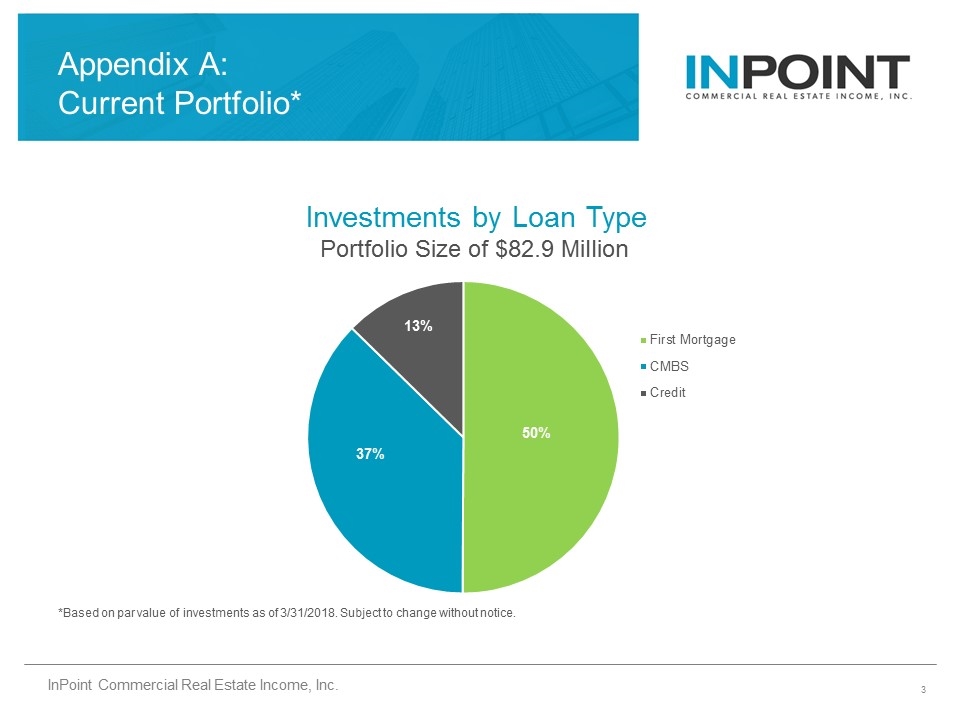

Appendix A: Current Portfolio* Investments by Loan Type Portfolio Size of $82.9 Million *Based on par value of investments as of 3/31/2018. Subject to change without notice.

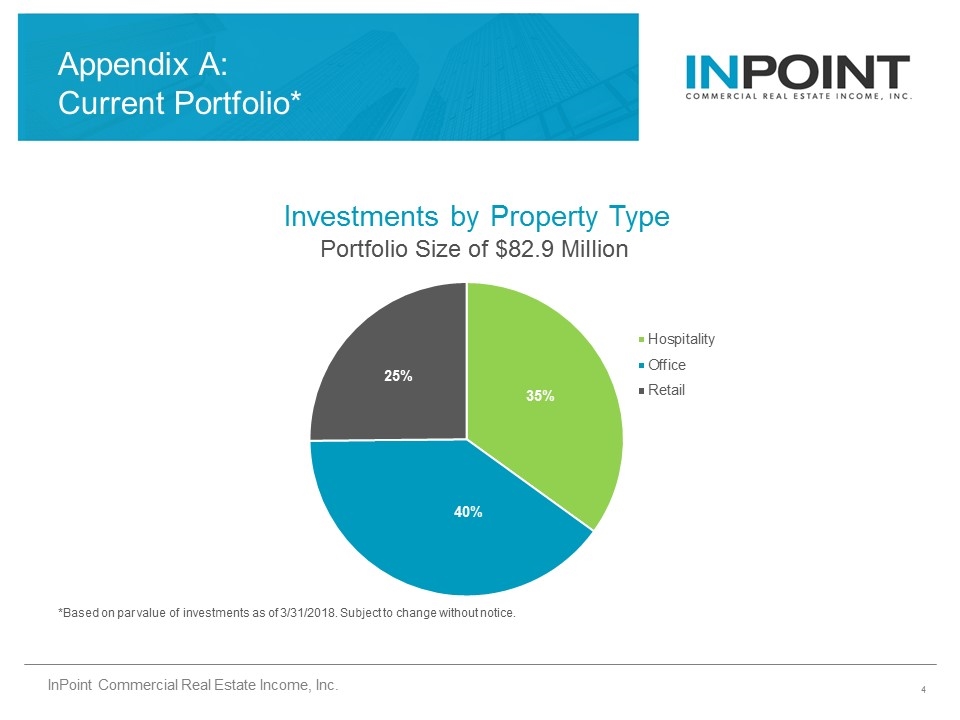

Appendix A: Current Portfolio* Investments by Property Type Portfolio Size of $82.9 Million *Based on par value of investments as of 3/31/2018. Subject to change without notice.

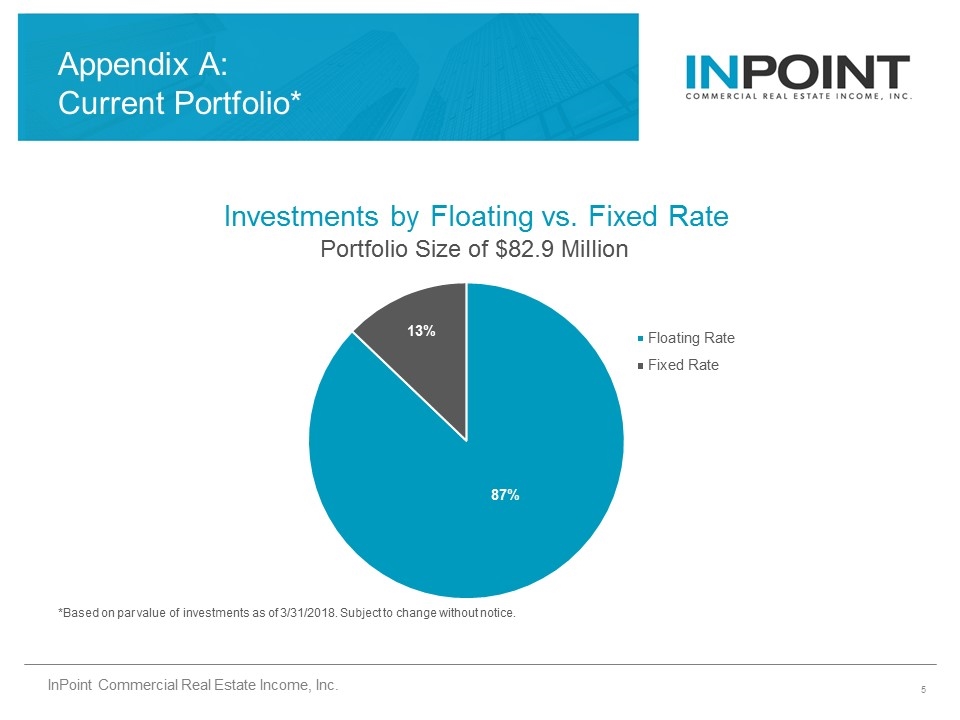

Appendix A: Current Portfolio* Investments by Floating vs. Fixed Rate Portfolio Size of $82.9 Million *Based on par value of investments as of 3/31/2018. Subject to change without notice.

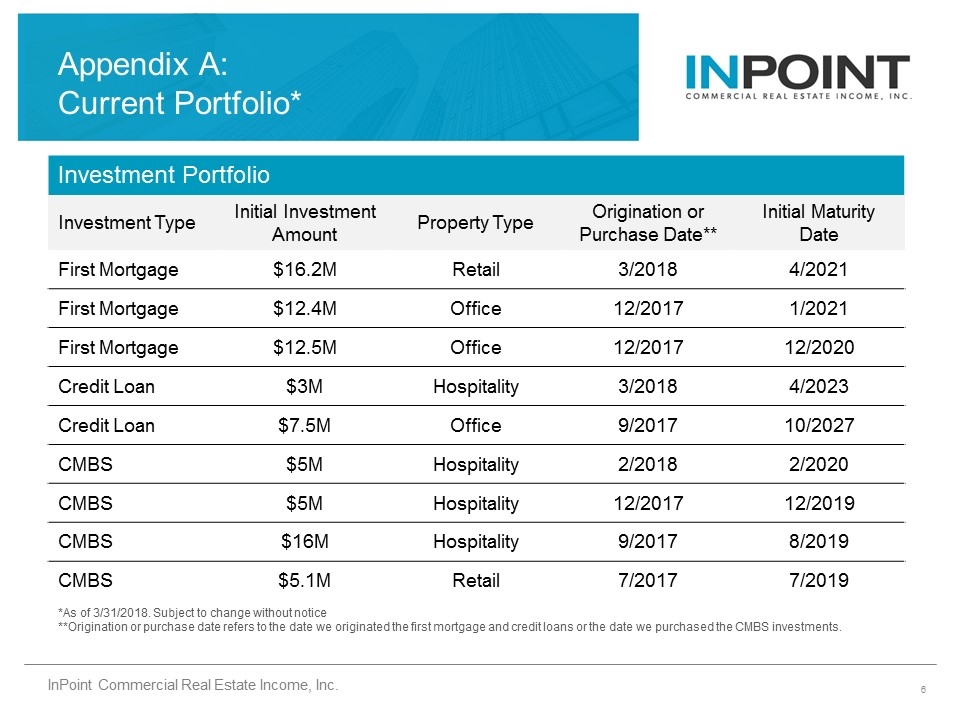

*As of 3/31/2018. Subject to change without notice **Origination or purchase date refers to the date we originated the first mortgage and credit loans or the date we purchased the CMBS investments. Investment Portfolio Investment Type Initial Investment Amount Property Type Origination or Purchase Date** Initial Maturity Date First Mortgage $16.2M Retail 3/2018 4/2021 First Mortgage $12.4M Office 12/2017 1/2021 First Mortgage $12.5M Office 12/2017 12/2020 Credit Loan $3M Hospitality 3/2018 4/2023 Credit Loan $7.5M Office 9/2017 10/2027 CMBS $5M Hospitality 2/2018 2/2020 CMBS $5M Hospitality 12/2017 12/2019 CMBS $16M Hospitality 9/2017 8/2019 CMBS $5.1M Retail 7/2017 7/2019 Appendix A: Current Portfolio*