Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - GCP Applied Technologies Inc. | d334050dex991.htm |

| EX-2.1 - EX-2.1 - GCP Applied Technologies Inc. | d334050dex21.htm |

| 8-K - 8-K - GCP Applied Technologies Inc. | d334050d8k.htm |

GCP Applied Technologies Receives Binding Offer from Henkel AG & Co. to Acquire Darex Packaging Technologies March 2, 2017 ©2017 GCP Applied Technologies Inc. Exhibit 99.2

This document contains, and our other public communications may contain, forward-looking statements, that is, information related to future, not past, events. Such statements generally include the words "believes," "plans," "intends," "targets," "will," "expects," "suggests," "anticipates," "outlook," "continues" or similar expressions. Forward-looking statements include, without limitation, statements about the proposed transaction and the anticipated timing thereof; expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; and markets for securities. Like other businesses, we are subject to risks and uncertainties that could cause our actual results to differ materially from our projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual events to materially differ from those contained in the forward-looking statements include, without limitation: the possibility that the transaction will not be completed, or if completed, not completed in the expected timeframe, and the potential that the expected strategic benefits or opportunities from the transaction may not be realized, or may take longer to realize than expected; risks related to foreign operations, especially in emerging regions; the cost and availability of raw materials and energy; the effectiveness of GCP's research and development and growth investments; acquisitions and divestitures of assets and gains and losses from dispositions; developments affecting GCP’s outstanding indebtedness; developments affecting GCP's funded and unfunded pension obligations; GCP's legal and environmental proceedings; uncertainties related to the Company’s ability to realize the anticipated benefits of the spin-off / separation from W.R. Grace; the inability to establish or maintain certain business relationships and relationships with customers and suppliers or the inability to retain key personnel; costs of compliance with environmental regulation and those factors set forth in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which have been filed with the Securities and Exchange Commission ("SEC") and are available on the Internet at www.sec.gov. Our reported results should not be considered as an indication of our future performance. Readers are cautioned not to place undue reliance on our projections and forward-looking statements, which speak only as of the date thereof. We undertake no obligation to publicly release any revisions to the projections and forward-looking statements contained in this document, or to update them to reflect events or circumstances occurring after the date of this document. Non-GAAP Financial Measures These slides contain certain “non-GAAP financial measures”. Please refer to the Appendix for definition of the non-GAAP financial measures used herein and a reconciliation of those non-GAAP financial measures to their most comparable GAAP measures. Forward Looking Statements

Deal Overview – Proposed Sale of Darex to Henkel ©2017 GCP Applied Technologies Inc. GCP Applied Technologies has received a binding offer from Henkel AG & Co. KGaA to acquire its Darex Packaging Technologies business for $1.05B Efficient transaction structure to minimize tax leakage results in estimated after-tax net proceeds of ~$800mm before deal and other one-time costs In connection with binding offer, GCP will begin consultation process with relevant Works Councils and Labor Unions Upon completion of the process, GCP expects to enter into a definitive agreement for the proposed sale Proposed transaction also subject to customary closing conditions, including regulatory approvals, and is expected to close in the middle of 2017 Strong strategic rationale: GCP to begin repositioning to a specialty construction materials business

Compelling Rationale for Proposed Darex Sale ©2017 GCP Applied Technologies Inc. Attractive opportunity to monetize Darex Monetization occurs at attractive time in the cycle Positions company to focus on growth in construction markets Compelling after-tax proceeds to fund bolt-on acquisitions GCP’s Capital Allocation Strategy Strong Fundamental Strategic Underpinning Grow construction business Focused on high performance products Organic growth, new products and technologies Bolt-on acquisitions Maintain modest leverage profile Manage through cycles while preserving flexibility for growth Uphold existing debt agreements and look to redeem notes when economically makes sense Return excess capital to shareholders over time 1 2 3

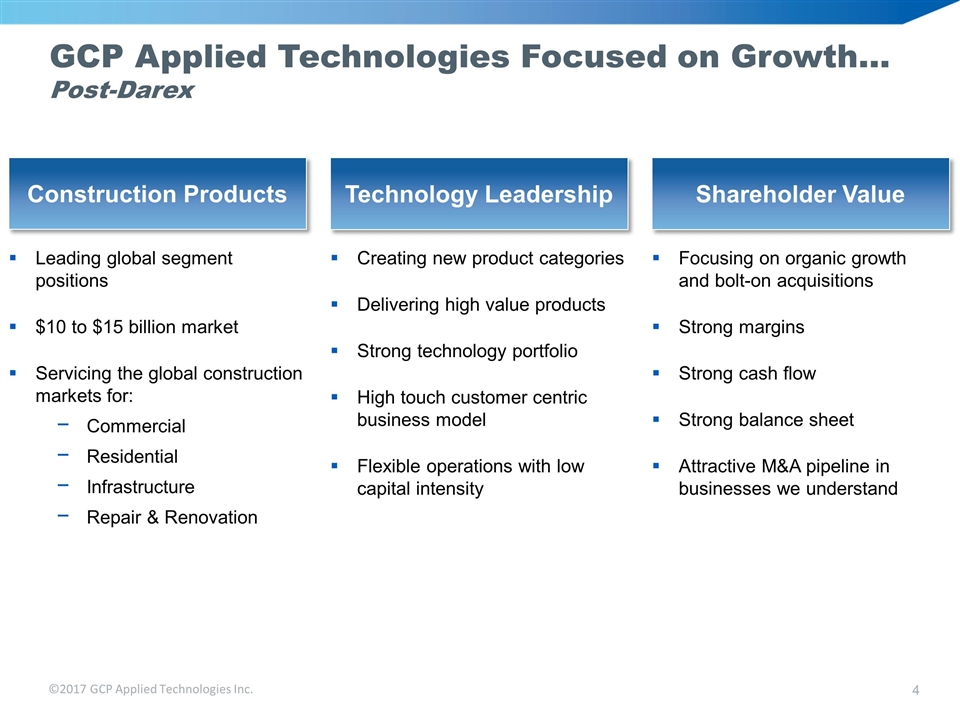

GCP Applied Technologies Focused on Growth… Post-Darex ©2017 GCP Applied Technologies Inc. Technology Leadership Shareholder Value Construction Products Focusing on organic growth and bolt-on acquisitions Strong margins Strong cash flow Strong balance sheet Attractive M&A pipeline in businesses we understand Leading global segment positions $10 to $15 billion market Servicing the global construction markets for: Commercial Residential Infrastructure Repair & Renovation Creating new product categories Delivering high value products Strong technology portfolio High touch customer centric business model Flexible operations with low capital intensity

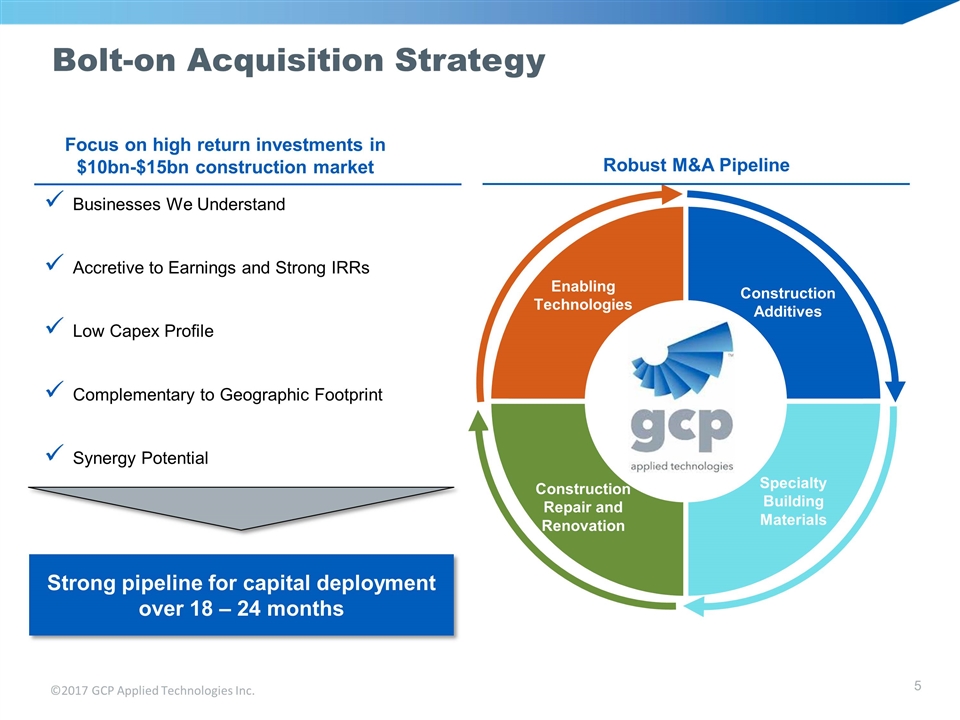

Bolt-on Acquisition Strategy ©2017 GCP Applied Technologies Inc. Focus on high return investments in $10bn-$15bn construction market Businesses We Understand Accretive to Earnings and Strong IRRs Low Capex Profile Complementary to Geographic Footprint Synergy Potential Strong pipeline for capital deployment over 18 – 24 months Robust M&A Pipeline

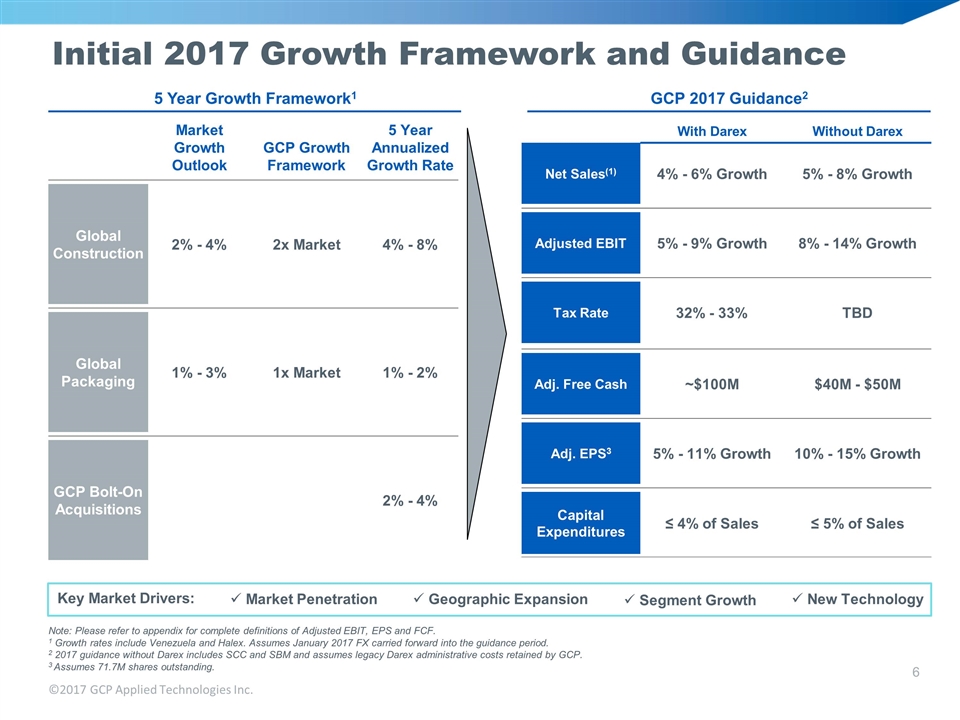

Initial 2017 Growth Framework and Guidance ©2017 GCP Applied Technologies Inc. 5 Year Growth Framework1 GCP 2017 Guidance2 Market Penetration Key Market Drivers: Segment Growth New Technology Geographic Expansion Note: Please refer to appendix for complete definitions of Adjusted EBIT, EPS and FCF. 1 Growth rates include Venezuela and Halex. Assumes January 2017 FX carried forward into the guidance period. 2 2017 guidance without Darex includes SCC and SBM and assumes legacy Darex administrative costs retained by GCP. 3 Assumes 71.7M shares outstanding. Market Growth Outlook GCP Growth Framework 5 Year Annualized Growth Rate Global Construction 2% - 4% 2x Market 4% - 8% Global Packaging 1% - 3% 1x Market 1% - 2% GCP Bolt-On Acquisitions 2% - 4% With Darex Without Darex Net Sales(1) 4% - 6% Growth 5% - 8% Growth Adjusted EBIT 5% - 9% Growth 8% - 14% Growth Tax Rate 32% - 33% TBD Adj. Free Cash ~$100M $40M - $50M Adj. EPS3 5% - 11% Growth 10% - 15% Growth Capital Expenditures ≤ 4% of Sales ≤ 5% of Sales

Analysis of Operations The Company defines Adjusted EBIT (a non-GAAP financial measure) to be net income attributable to GCP shareholders adjusted for interest income; interest expense and related financing costs; income taxes; currency and other financial losses in Venezuela; restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits; income and expense items related to certain product lines and investments; gains and losses on sales of businesses, product lines and certain other investments; third-party acquisition-related costs; the amortization of acquired inventory fair value adjustment; and certain other items that are not representative of underlying trends. Adjusted EBIT Margin means Adjusted EBIT divided by net sales. GCP uses Adjusted EBIT to assess and measure its operating performance and in determining performance-based compensation. GCP uses Adjusted EBIT as a performance measure because it provides improved period-to-period comparability for management's decision-making and compensation purposes and because it allows management to measure the ongoing earnings results of the Company's strategic and operating decisions. The Company defines Adjusted Earnings Per Share (a non-GAAP financial measure) to be earnings per share ("EPS") on a diluted basis adjusted for costs related to restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected return on plan assets, and amortization of prior service costs/credits; gains and losses on sales of businesses, product lines and certain other investments; third-party acquisition-related costs; other financing costs associated with the modification or extinguishment of debt; certain other items that are not representative of underlying trends; and certain discrete tax items. GCP uses Adjusted EPS as a performance measure to review its diluted earnings per share results on a consistent basis. The Company defines Adjusted Free Cash Flow (a non-GAAP financial measure) to be net cash provided by or used for operating activities minus capital expenditures plus cash paid for restructuring and repositioning; taxes paid for repositioning; capital expenditures related to repositioning; accelerated payments under defined benefit pension arrangements; and expenditures for legacy items. GCP uses Adjusted Free Cash Flow as a liquidity measure to evaluate its ability to generate cash to support its ongoing business operations, to invest in its businesses, to provide a return of capital to shareholders and to determine payments of performance-based compensation. When GCP provides its expectations for non-GAAP Adjusted EBIT, Adjusted EPS and Adjusted Free Cash Flow on a forward-looking basis, a reconciliation of the differences between this non-GAAP expectation and the corresponding GAAP measures (operating income, earnings per share and net cash provided by operating activities) is not available without unreasonable effort because GCP has not estimated items including the fair value of the assets and liabilities expected to be sold in the transaction. The variability of the items that have not yet been determined may have a significant, and potentially unpredictable, impact on GCP’s future GAAP results.