Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Great Elm Capital Group, Inc. | gec-ex992_38.htm |

| 8-K - 8-K - Great Elm Capital Group, Inc. | gec-8k_20200630.htm |

Exhibit 99.1

GREAT ELM CAPITAL GROUP, INC. REPORTS FISCAL FOURTH QUARTER AND FULL YEAR 2020 FINANCIAL RESULTS

|

|

▪ |

DME fiscal Q4 revenue grew 7.9% year-over-year despite a significant negative impact from COVID-19 |

|

|

▪ |

DME fiscal Q4 net income of $2.8 million and adjusted EBITDA of $7.0 million, up from ($1.0) million and $2.8 million, respectively, during the same period in the prior year |

|

|

▪ |

Investment Management is poised for growth in AUM, revenue, and earnings if GECC rights offering is completed |

|

|

▪ |

Consolidated fiscal Q4 net income of $4.1 million, up from ($1.0) million during the same period in the prior year |

WALTHAM, MA, September 18, 2020 – Great Elm Capital Group, Inc. (NASDAQ: GEC, “Great Elm”) announced its financial results for the fiscal quarter and year ended June 30, 2020. Great Elm will host a conference call and webcast on Friday, September 18, 2020 at 8:00 a.m. Eastern Time to discuss its fiscal fourth quarter 2020 financial results. Please see below for details.

BUSINESS OVERVIEW

Great Elm is a diversified, publicly-traded holding company that seeks to build long-term shareholder value across two verticals: Operating Companies and Investment Management.

Select highlights from the fiscal fourth quarter 2020 include:

|

|

▪ |

DME’s investments in people, process and technology have been critical in adapting to uncertain business conditions caused by the COVID-19 pandemic. DME continues to operate and serve patients in all markets |

|

|

▪ |

Having completed significant investments into the platform, DME management is focused on continuing organic growth, driving improved margins, and making add-on acquisitions |

|

|

referrals and PAP setups improved over their post-COVID lows, but have not yet reached pre-COVID levels. |

|

|

▪ |

For the three months ended June 30, 2020, generated $13.9 million of revenue, $2.8 million of net income and $7.0 million of adjusted EBITDA |

|

|

▪ |

Investment Management: |

|

|

▪ |

For the three months ended June 30, 2020, generated $0.8 million of revenue, net income of ($0.0) million and $0.2 million of adjusted EBITDA |

|

|

▪ |

Great Elm Capital Corp. (“GECC”) managed by Great Elm Capital Management, Inc. (“GECM”), announced a rights offering on August 31, 2020. If completed, this would increase AUM, revenue, and earnings for our Investment Management business |

|

|

▪ |

Great Elm and certain other shareholders of GECC (the “Participating Shareholders”) have agreed to purchase up to $24 million of shares in this offering through an exercise of their basic and oversubscription rights; provided that any over-subscription by the Participating Shareholders will be effected only after pro rata allocation of over-subscription shares to record date holders (other than the Participating Shareholders) who fully exercise all rights issued to them |

“We have significant momentum in both our DME business and our Investment Management business,” remarked Peter A. Reed, Great Elm’s Chief Executive Officer. “After a long period of investment in the platform, DME is focused on driving organic growth and making follow on acquisitions. GECC has had success in its specialty finance investments, has an attractive pipeline of potential future investments, and has announced a rights offering in order to capitalize upon those opportunities.”

Alignment of Interest

The employees of Great Elm and GECM collectively own approximately 2.0 million shares of GEC stock, representing approximately 7% of its outstanding shares. Additionally, the directors of Great Elm collectively own or manage approximately 20% of Great Elm’s shares. Altogether, insiders collectively own or manage approximately 27% of the company’s outstanding shares, which Great Elm believes fosters a strong alignment of interest between employees, directors and the company’s shareholders.

Operating Companies

In the three months ended June 30, 2020, DME generated $2.8 million of net income and $7.0 million of adjusted EBITDA, an increase from ($1.0) million of net income and $2.8 million of adjusted EBITDA during the same period in the prior year. During the quarter, DME experienced significant growth in its sales of PAP supplies, with more moderate growth in rental revenue driven by lower new PAP patient setups. We continue to

explore ways to lower DME’s cost of capital and obtain additional funds for potential future acquisitions.

Investment Management

In the three months ended June 30, 2020, Investment Management generated ($0.0) million of net income and $0.2 million of adjusted EBITDA1, an increase from ($0.1) million of net income and $0.0 million of adjusted EBITDA during the same period in the prior year. We remain focused on driving increased revenue and earnings through higher AUM. During the quarter, GECC benefitted from strong performance of its specialty finance investments, the redeployment of funds into attractive risk-adjusted opportunities and the rebounding of the valuations of certain of its investments following COVID related volatility in the prior quarter.

FINANCIAL REVIEW: SEGMENT FINANCIALS

As of June 30, 2020, Great Elm had four operating segments: Durable Medical Equipment, Investment Management, Real Estate and General Corporate.

Durable Medical Equipment

Three and Twelve Months Ended June 30, 2020:2

Revenue:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized $13.9 million and $55.7 million in total revenue vs. $12.9 million and $41.9 million during the same periods in the prior year. |

Net Income (Loss):

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized net income of $2.8 million and a net loss of $0.1 million vs. a net loss of $1.0 million and $1.1 million during the same periods in the prior year. |

Adjusted EBITDA:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized $7.0 million and $16.0 million of adjusted EBITDA vs. $2.8 million and $10.4 million during the same periods in the prior year. |

1Prior year non-GAAP adjustments have been updated to conform to current year presentation by removing adjustments associated with the adoption of ASC 606 Contracts with Customers

2 Prior year twelve-month period reflects a partial year from September 7, 2018 to June 30, 2019

Three and Twelve Months Ended June 30, 2020:

Revenue:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized total investment management revenue of $0.7 million and $3.3 million vs. $0.9 million and $3.8 million during the same periods in the prior year. |

Net Income (Loss):

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized net income of ($0.0) million and $0.4 million vs. a net loss of $0.1 million and $1.0 million during the same periods in the prior year. |

Adjusted EBITDA1:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized adjusted EBITDA of $0.2 million and $1.2 million vs. $0.0 million and $0.4 million during the same periods in the prior year. |

Real Estate

Three and Twelve Months Ended June 30, 2020:

Revenue:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized $1.3 million and $5.1 million in rental revenue vs. $1.3 million and $5.5 million during the same periods in the prior year. |

Net Income (Loss):

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized $0.03 million and $0.2 million in net income vs. $0.06 million and $0.2 million in net income during the same periods in the prior year. |

Adjusted EBITDA:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized $1.1 million and $4.6 million in adjusted EBITDA vs. $1.2 million and $4.6 million during the same periods in the prior year. |

Three and Twelve Months Ended June 30, 2020:

Revenue:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized $0.05 million and $.16 million in revenue vs. approximately $0.06 million and $.12 million in revenue during the same periods in the prior year. |

Net Income (Loss):

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized $1.3 million in net income and a net loss of $13.7 million vs. $0.04 million in net income and a net loss of $1.2 million during the same periods in the prior year. $2.9 million of the $1.3 million net income during the quarter derived from an unrealized gain on our investment in GECC stock |

Adjusted EBITDA:

|

|

▪ |

During the three and twelve months ended June 30, 2020, Great Elm recognized ($1.2) million and ($6.0) million in adjusted EBITDA vs. ($1.6) million and ($6.1) million during the same periods in the prior year. |

Conference Call & Webcast

Great Elm will host a conference call and webcast on Friday, September 18, 2020 at 8:00 a.m. Eastern Time to discuss its fiscal fourth quarter 2020 financial results.

All interested parties are invited to participate in the conference call by dialing +1 (844) 559-0750; international callers should dial +1 (647) 689-5386. Participants should enter the Conference ID 2416529 when asked. For a copy of the slide presentation that will be referenced during the course of our conference call, please visit: https://www.greatelmcap.com/events-and-presentations/default.aspx.

The conference call will be webcast simultaneously at: https://event.on24.com/wcc/r/2395114/5E5DD7BDBB644C6852EF57E7C8AA0EE5

About Great Elm Capital Group, Inc.

Great Elm is a publicly-traded holding company that seeks to build a business across two operating verticals: Operating Companies and Investment Management. Great Elm’s website can be found at www.greatelmcap.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Statements in this press release that are “forward-looking” statements, including statements regarding expected growth, profitability and outlook involve risks and uncertainties that may individually or collectively impact the matters described herein. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and represent Great Elm’s assumptions and expectations in light of currently available information. These statements involve risks, variables and uncertainties, and Great Elm’s actual performance results may differ from those projected, and any such differences may be material. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are risks associated with the economic impact of the COVID-19 pandemic on Great Elm’s businesses, including DME as well as GECC and its portfolio investments. For information on certain factors that could cause actual events or results to differ materially from Great Elm’s expectations, please see Great Elm’s filings with the SEC, including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Additional information relating to Great Elm’s financial position and results of operations is also contained in Great Elm’s annual and quarterly reports filed with the SEC and available for download at its website www.greatelmcap.com or at the SEC website www.sec.gov.

Non-GAAP Financial Measures

The SEC has adopted rules to regulate the use in filings with the SEC, and in public disclosures, of financial measures that are not in accordance with US GAAP, such as adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”). Adjusted EBITDA is derived from methodologies other than in accordance with US GAAP. Great Elm believes that Adjusted EBITDA is an important measure for investors to use in evaluating Great Elm’s businesses. In addition, Great Elm’s management reviews Adjusted EBITDA as they evaluate acquisition opportunities.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it either in isolation from, or as a substitute for, analyzing Great Elm’s results as reported under US GAAP. Non-GAAP financial measures reported by Great Elm may not be comparable to similarly titled amounts reported by other companies.

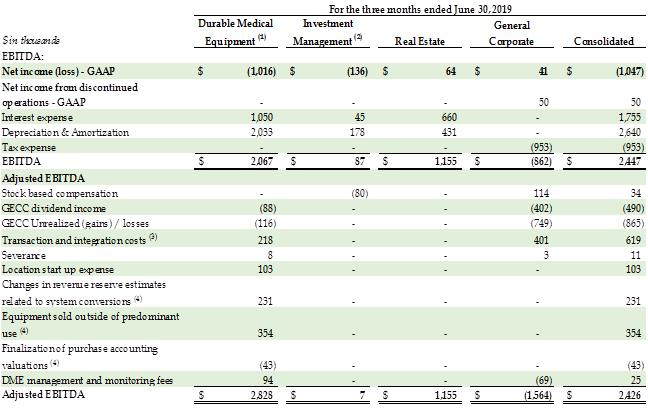

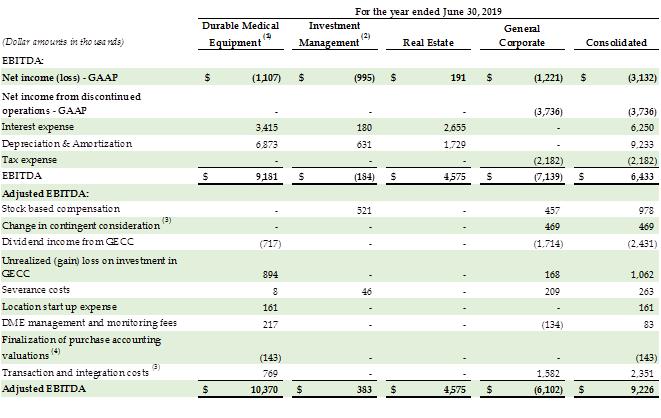

Set forth below is a reconciliation of Adjusted EBITDA to the most directly comparable US GAAP financial measure, net income. The information in the table below represents Great Elm’s assumptions and expectations in light of currently available information. Great Elm’s actual performance results may differ from those projected in in the table below, and any such differences may be material.

(1): Our durable medical equipment business began in September 2018. Prior year figures represent activity for the period September 1, 2018 through June 30, 2019, where applicable.

(2): Prior year non-GAAP adjustments have been updated to conform to current year presentation by removing adjustments associated with the adoption of ASC 606 Contracts with Customers.

(3): Transaction and integration related costs include costs to acquire and integrate acquired businesses. This also represents change in contingent consideration liability since the initial valuation at the acquisition date.

(4): Represents approximately $0.5 million of aggregate adjustments which negatively impact adjusted EBITDA by the same amount for the period beginning with the acquisition of DME on September 7, 2018 and ending March 31, 2019. There is no material impact on the US GAAP numbers reported for this period.

Media & Investor Contact:

Investor Relations

+1 (617) 375-3006

investorrelations@greatelmcap.com