Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Great Elm Capital Group, Inc. | d752386dex321.htm |

| EX-23.2 - EX-23.2 - Great Elm Capital Group, Inc. | d752386dex232.htm |

| EX-23.1 - EX-23.1 - Great Elm Capital Group, Inc. | d752386dex231.htm |

| EX-31.2 - EX-31.2 - Great Elm Capital Group, Inc. | d752386dex312.htm |

| EX-31.1 - EX-31.1 - Great Elm Capital Group, Inc. | d752386dex311.htm |

| EX-10.55 - EX-10.55 - Great Elm Capital Group, Inc. | d752386dex1055.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Great Elm Capital Group, Inc. | Financial_Report.xls |

| EX-21.1 - EX-21.1 - Great Elm Capital Group, Inc. | d752386dex211.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2014

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-16073

UNWIRED PLANET, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3219054 | |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

| 170 South Virginia Street, Suite 201, Reno, Nevada | 89501 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (775) 980-2345

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.001 Par Value | The NASDAQ Stock Market LLC | |

| (NASDAQ Global Select Market) |

Securities registered pursuant to section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $150,312,588 as of December 31, 2013 based upon the closing sale price on the NASDAQ Global Select Market reported for such date. Shares of common stock held by each officer and director have been excluded in that such persons may be deemed to be affiliates. Shares of common stock held by other persons, including persons who own more than 5% of the outstanding shares of common stock, have not been excluded in that such persons are not deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were 111,762,785 shares of the registrant’s common stock issued and outstanding as of September 8, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents, or portions thereof, are incorporated by reference into the following parts of this Form 10-K:

Proxy Statement for the 2014 Annual Meeting of Stockholders- Part III, Items 10, 11, 12, 13 and 14.

Table of Contents

Table of Contents

Forward-Looking Statements

In addition to historical information, this Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended. These forward-looking statements are based upon current expectations and beliefs of our management and are subject to risks and uncertainties that may cause actual events, and our results of performance to differ materially from those indicated by these statements. Words such as “anticipates”, “expects”, “intends”, “plans”, “believes”, “seeks”, “estimates” and similar expressions identify such forward-looking statements. Such statements address future events and conditions concerning intellectual property acquisition and development, licensing and enforcement activities, recognition of revenue related to licensing activities, capital expenditures, earnings, litigation, regulatory matters, markets for our services, liquidity and capital resources and accounting matters. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, changes in demand for our services, legislative, regulatory and competitive developments in markets in which we and our subsidiaries operate, results of litigation and other circumstances affecting anticipated revenues and costs and the other risks discussed under the subheading “Risk Factors” in Item 1A. The occurrence of the events described above or in “Item 1A. Risk Factors” below could harm our business, results of operations and financial condition. These forward-looking statements are made as of the date of this Annual Report and we undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements except as required by law. Readers should carefully review the risk factors described in this section and in the “Risk Factors” below and other risks identified from time to time in our public statements and reports filed with the Securities and Exchange Commission.

PART I

Unwired Planet, Inc. (referred to as “Unwired Planet”, “UP”, “our”, “we”, “us”, or the “Company”) is an intellectual property licensing company with approximately 2,500 mobile technology patents and patent applications. The patents cover a wide range of technology associated with mobile communications. The Company pursues licensing in three key markets: Mobile Cloud & Services, Infrastructure related to wireless networks and Mobile Devices.

Unless the context otherwise requires:

| • | the terms “we”, “us” and “our” are references to Unwired Planet, Inc. and/or its subsidiaries. |

All period references are to our fiscal years which begin July 1 and end June 30.

Unwired Planet was incorporated in 1994 as a Delaware corporation, and we completed our initial public offering in June 1999. Our principal executive offices are located at 170 South Virginia Street, Suite 201, Reno, Nevada, 89501. Our telephone number is (775) 980-2345. We file periodic reports and other documents with the Securities and Exchange Commission. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. We make available, free of charge through our Internet website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained on our website www.unwiredplanet.com is not incorporated by reference to this document and you should not rely on information on our website in connection with making an investment decision.

Our Strategy

License Our Mobile Technology Patents. Many manufacturers of wireless devices and wireless communications equipment as well as wireless network operators use our patented ideas without our authorization. We desire to enter into long-term license agreements providing reasonable royalties for use of our patented ideas.

1

Table of Contents

Manage Our Portfolio. We review our patent portfolio as a regular part of our operations. We may, from time-to-time, sell patents or purchase patents in light of the value of particular assets in licensing opportunities with customers.

As we execute our licensing strategy, we anticipate the related revenue in future periods to be unpredictable and volatile. Additionally, legal costs associated with our efforts to license and protect our intellectual property and proprietary rights could be material at any given period and are, likewise, unpredictable and volatile. Effectively policing and enforcing our intellectual property is time consuming and costly. In addition, there can be no assurance that any ongoing or future litigation will be successful.

History of Our Business

Our company began in 1994 as Libris, Inc. and quickly became known as Unwired Planet. In 1999, Unwired Planet acquired Apiion, Ltd. of Belfast, Ireland and changed its name to Phone.com. After acquiring several high-tech startup companies and merging with Software.com in 2001, we changed our name to Openwave Systems, Inc., focusing on the development and delivery of mobile and fixed broadband software infrastructure to a global base of communication service providers.

As of June 30, 2011, Openwave Systems had an accumulated deficit of approximately $3.2 billion. In January 2012, we announced the pursuit of strategic alternatives to divest our product businesses and narrow our focus on our intellectual property business.

In May 2012, we officially changed our name back to Unwired Planet, a name which recalls the formative years when many of our foundational mobile communication patents were filed, and began trading on NASDAQ under the new symbol: UPIP. On April 30, 2012, we completed the sale of our remaining product businesses. Unwired Planet is now solely focused on a multi-pronged intellectual property strategy that includes, among other things, licensing and enforcement, when necessary, to protect the value of its patent portfolio.

Our Intellectual Property Focus

Unwired Planet established many of the foundational patents that allow mobile devices to connect to the Internet. Over the years, we have amassed through the efforts of our own R&D, a large patent portfolio, much of which is considered foundational to mobile communications. In the late 1990’s we joined with Telefonaktiebolaget LM Ericsson (Ericsson) in the development of the Wireless Application Protocol (“WAP”) for the nascent mobile industry. In 2013, we again paired with Ericsson when Unwired Planet LLC (“UP LLC”) acquired a portfolio of theirs that includes standard essential patents for 2G, 3G and LTE systems. We have filed a number of the agreements that we entered into with Ericsson as exhibits to this Annual Report. You should read those agreements carefully in their entirety, and our descriptions of those agreements in this Annual Report are qualified in their entirety by reference to those agreements.

Unwired Planet’s founding team was among the first to consider and solve the technical and practical problems of accessing useful data on mobile devices, such as the Internet, user data and access to a variety of personal and enterprise applications, solutions for which are reflected in our earliest patents. Developing and deploying these groundbreaking solutions led to a robust and continuous pattern of creativity and innovation in mobility. Inventors at Unwired Planet focused on many forms of data and improved ways in which this data could be transferred, accessed, secured and used, both from the perspective of a mobile device and from the perspective of networks and servers communicating with mobile devices.

Ericsson, too, has invested extensively in R&D to pioneer mobile communication. Patents developed by Ericsson include standard essential patents for 2G, 3G and LTE devices, as well as implementation patents critical to mobile communication. The combined portfolio we have of Ericsson and UPIP patents spans the full mobile communication spectrum.

In March 2014, the Company entered into (i) a Patent License Agreement (“patent license”) with Lenovo PC International Limited and (ii) a Patent Purchase Agreement (“patent sale”) with Lenovo Group Limited. The agreements are referred to collectively as “the Lenovo Agreements”, and “Agreements”. Lenovo PC International Limited and Lenovo Group Limited are collectively referred to as “Lenovo”. With the closing of the Lenovo transactions, which generated $100.0 million in gross proceeds, the Company realized its first patent license and sale transactions since restructuring the Company in 2012 to focus on intellectual property.

2

Table of Contents

The Intellectual Property Business

Selling patent licenses requires coordinated sale, engineering and legal efforts. Reasonable royalties for our patented ideas are best secured through negotiated license agreements thereby avoiding the costs and uncertainties of litigation. Sales of patent licenses require long sales cycles, which are extended when litigation is required.

Obtaining reasonable royalties for use of our patented ideas is generally dependent on:

| • | Showing that the customer’s products infringe the claims in our patents; |

| • | Resolving disputes as to claim construction – the correct meaning of the claims in our patents; |

| • | Establishing the reasonable royalty rate for using our patents; and |

| • | Defeating arguments that our patents are not valid or are not enforceable. |

Although our licensing team is engaged with many potential customers, some customers do not take advantage of the discounts we offer in non-litigation licensing from the reasonable royalties that we as the patent holder are legally entitled to. As a result, enforcement becomes necessary.

Due to the long and highly variable sales cycle involved with intellectual property, revenue recognition and profitability can be extremely volatile and episodic.

Intellectual property licensing requires other parties to be reasonable and willing to work out a fair royalty arrangement. In fact, many of these parties have teams in place precisely for the purpose of delaying or avoiding such a royalty discussion. Our customers willingness and ability to pay reasonable royalties is, in part, affected by the number of patents infringed by its products, the concentration of the holders of those patents, the customers cost of licensing those patents, and the profitability of the infringing product.

Some of the companies that we believe use our patented technology may not voluntarily enter into license agreements. As a result, we have developed abilities to plan, execute and sustain enforcement campaigns to protect our patent portfolio. Enforcement campaigns are expensive and the legal process takes an unpredictably long time.

When litigation becomes necessary, intellectual property companies choose how to compensate their lawyers. Lawyers may be paid:

| • | on an hourly basis – where the result of the case has no effect on the lawyers’ compensation; |

| • | on a contingency basis – where the lawyer only gets paid if the matter is resolved successfully; or |

| • | a hybrid of the above – where the risk is shared between the client and the lawyer. |

Our Patent Portfolio

As of June 30, 2014, we owned 2,268 issued patents and 235 patent applications. A patent is a government issued right for the patent owner to exclude others from using, making, having made, selling, offering for sale or importing products that infringe the claims in the patent. In general, a patent is issued on a new or novel idea, chemical structure, design, or business method. Generally speaking, for a patent to be valid:

| • | the claims must not cover unpatentable subject matter; |

| • | the claims must not be invalid because they were obvious at the time of invention to one skilled in the art; |

| • | the claims must not be invalid because they were anticipated in prior art; |

| • | the patent must not have been obtained through inequitable conduct before the patent office; and |

| • | the patent must not be unenforceable under non-patent law, such as anti-trust laws, or under patent law. |

3

Table of Contents

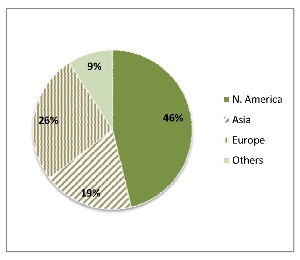

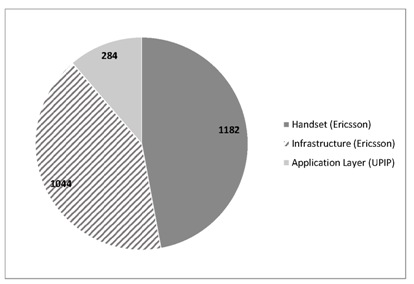

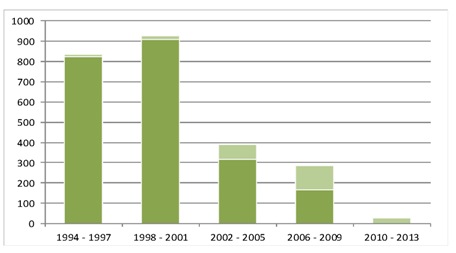

The following charts highlight elements of our patent portfolio as of June 30, 2014.

Distribution of Granted and Pending Patent Applications by Geographical Area

Distribution of Granted and Pending Patent Applications by Utility

4

Table of Contents

Distribution of Granted Patents and Pending Patent Applications by Year

Although the rules are extremely technical, in general, United States patents expire twenty years from their filing date.

Competition

We believe that our principal competition for our patents may come from our prospective customers, some of whom are evaluating and developing products based on technologies that they contend or may contend do not infringe our patents.

In addition, though other patent holders seeking licenses are not direct competitors, their actions can adversely affect us. For example, they compete with us for the time, resources and attention of the potential licensees, thereby potentially slowing progress in our technical discussions and negotiations. In addition, some licensing parties are inexperienced, undercapitalized, impatient or subject to adverse business pressures. As a result, they may enter into license arrangements that undervalue their own patents. These suboptimal agreements can be used by our licensee targets as comparables to attempt to drive values down.

We also face a form of competition known as royalty stacking. Royalty stacking exists where there are many patent owners who seek to obtain royalties on the same product. Absent an increase in price, as royalty costs from different patent owners stack-up in the bill of materials of a particular product, our customer’s gross profit shrinks as its costs of goods sold rises. As this pressure increases, our customers become more reluctant to pay royalties for patented ideas used in their products.

A number of large technology companies are lobbying to change the United States patent system. To date, we have not made a significant investment in government affairs. It is possible that the United States patent system may become so weak as to reduce the value of our patented ideas and thereby resulting in a material adverse effect on our business strategy.

Employees

As of June 30, 2014, we had 15 employees.

Our business is subject to a number of risks, many of which are described below. If any of the events described in these risks factors actually occur, our business, financial condition or results of operations could be materially and adversely affected, which would likely have a corresponding impact on the value of our common stock.

5

Table of Contents

Further, the risk factors described below could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. These risk factors should be reviewed carefully. You should refer to the explanation of the qualifications and limitations on forward-looking statements beginning on page 1.

Risks Related to Our Business

We have a revenue sharing arrangement with Ericsson; certain contractual obligations with Ericsson related to our licensing strategy may result in a longer period of time before revenue may be realized by us and may lead to smaller up-front payments.

Under the terms of our acquisition of certain patents and patent applications from Telefonaktiebolaget L M Ericsson and an indirect subsidiary (collectively, “Ericsson”) pursuant to a Master Sale Agreement (the “MSA”), dated as of January 10, 2013, between Unwired Planet Inc. and certain of our subsidiaries, including our indirect subsidiary, UP LLC, UP will pay Ericsson the following portion of UP LLC’s cumulative gross revenue on a quarterly basis in accordance with the provisions of the MSA (the “Gross Revenue Payments”): (i) 20% of the amount of Cumulative Gross Revenue, until the Cumulative Gross Revenue equals $100 million; plus (ii) 50% of the amount of Cumulative Gross Revenue in excess of $100 million, until the Cumulative Gross Revenue equals $500 million; plus (iii) 70% of the amount of Cumulative Gross Revenue in excess of $500 million. Revenue sharing may be adjusted in Ericsson’s favor as described below. This revenue sharing may be adjusted depending on the terms of specific licensing arrangements. As a result, we will not realize the benefit of all of the revenue we generate, and we will lose an increasing percentage of our revenue if we are successful.

Further, UP LLC granted Ericsson licenses and other rights in the transferred patents and all other patents owned or controlled by UP LLC. The transferred patents are also subject to encumbrances relating to existing Ericsson licenses, and UP LLC has granted Ericsson a lien on all of UP LLC’s assets. Additionally, we have agreed not to engage in, or provide services to any person who conducts or otherwise engages in, the business of generating revenue or otherwise monetizing patents through licensing or selling of patents or initiation or participation in litigation or other legal proceedings to protect and enforce any patent or any other intellectual property right or any other business that is competitive with the business of UP LLC. During a specified period following the closing of the Ericsson transaction, with respect to certain patents, the MSA establishes revenue sharing adjustments in favor of Ericsson if UP LLC grants licenses (or similar rights) below certain agreed-upon royalty rates. Additionally, UP LLC has accepted an obligation to behave in a manner that is fair, reasonable and non-discriminatory (“FRAND”).

The aggregate result of these commitments, together with other obligations contained in the Ericsson transaction documents, is such that we will pursue recurring revenue license arrangements that reflect the fair value of our entire patent portfolio, while at the same time respecting Ericsson’s existing commitments, customers and, to the extent applicable, any FRAND obligations. We believe that such an approach will maximize value for our stockholders over the long term, but such arrangements may take a longer period of time to achieve and may result in smaller up-front payments, as compared to lump sum perpetual licensing.

If the Company defaults upon its obligations to Ericsson under certain circumstances, Ericsson will be entitled to monetary damages of $1.05 billion.

The MSA also provides that upon the occurrence of any Trigger Event (as defined below), Ericsson will be entitled to monetary damages of at least $1.05 billion less Gross Revenue Payments actually received by Ericsson prior to the date such amount of damage is paid. A “Trigger Event” includes: (a) any representation or warranty in the MSA and the ancillary documents (collectively, the “Purchase Documents”) failing to be true and correct and that would result in a material adverse effect; (b) a default in the payment of obligations under the Purchase Documents in an aggregate amount exceeding $5 million (except in the case of a good faith dispute); (c) a knowing or willful, uncured default in the performance of any other material covenant, condition or agreement contained in the Purchase Documents or a default in the performance of any other material covenant, condition or agreement contained in the Purchase Documents that would reasonably be expected to result in an Insolvency Event; (d) any event or condition that results in the acceleration of more than $5 million in indebtedness of UP LLC or its members, or UP LLC or its members failing to pay more than $5 million of indebtedness at maturity; (e) the commencement of certain bankruptcy proceedings and other Insolvency Events; (f) the failure by UP LLC or its members to pay one or more final judgments in an aggregate amount exceeding $5 million (to the extent not

6

Table of Contents

covered by insurance); or (g) the Company asserting in writing that any provision of the Purchase Documents is not a legal, valid and binding obligation of any party thereto, or that any guarantees or any security interests purported to be created by the Purchase Documents are not in full force and effect including, if applicable, a valid and perfected security interest in the securities, assets or properties covered thereby. The occurrence of such a default may have a material adverse effect on the Company and its business.

Change of control provisions in the MSA may discourage an acquisition of our Company, which could affect our stock price.

The MSA provides that in connection with a UP Change of Control (as defined in the MSA), Ericsson will have the right either to (i) terminate the MSA and receive a cash payment (the “Sale Payment”) or (ii) elect to continue the MSA in full force and effect and not receive the Sale Payment. In the event Ericsson elects to receive the Sale Payment, such Sale Payment will be equal to Ericsson’s share of the fair market value of all patents and other assets owned or held by UP LLC (the “Patent FMV”). The Patent FMV will be determined per the MSA. After the Patent FMV has been determined it will be deemed incremental “Cumulative Gross Revenue” and distributed in accordance with the formula for Gross Revenue Payments described above. However, if a UP Change of Control occurs before February 17, 2016 and Ericsson elects to receive the Sale Payment, the Sale Payment will be at least $1.05 billion less Gross Revenue Payments actually received by Ericsson prior to the consummation of the UP Change of Control. The cumulative effect of these provisions could have the effect of delaying or preventing changes in control of our Company, which could adversely affect our stock price.

Ericsson has a lien on all of our assets.

In connection with the Ericsson transaction, UP LLC has entered into a security and interest agreement in favor of Ericsson pursuant to which UP LLC granted Ericsson a lien on all of UP LLC’s assets. In addition, the members of UP LLC, which are subsidiaries of Unwired Planet, have agreed to guarantee the obligations of UP LLC under the MSA and have pledged all of their assets, including the equity interests of UP LLC, to Ericsson to secure such obligations. A default under the applicable security agreements will occur upon the occurrence of a Trigger Event.

Our alternative fee structures with litigation counsel could limit our net proceeds derived from any successful patent enforcement actions.

We have entered into several agreements for legal services on a blended fee basis for our patent enforcement matters. These agreements typically require payment of a fixed fee for a period of time or fixed fees on occurrence of milestones and payment of a contingency fee upon a settlement or collection of a judgment. Contingency fees in our agreements are usually based upon a percentage of the amount of a settlement or a judgment. Some of the agreements contain dollar limits on the total contingency fee that may be earned. We are responsible for the current payment of out of pocket expenses incurred in connection with the patent enforcement matters.

We depend on recruiting and retaining key management with patent and intellectual property experience.

Our performance depends on attracting and retaining key management and personnel with the requisite expertise. Competition for qualified personnel with intellectual property expertise is significant. We believe that there are only a limited number of persons with the requisite skills to serve in many of our key positions, and it is generally difficult to hire and retain these persons. Furthermore, it may become more difficult to hire and retain key persons as a result of our past restructurings, any future restructurings, and our past stock performance. In the event of turnover within key positions, integration of new employees will require additional time and resources, which could adversely affect our business plan. If we are unable to attract or retain qualified personnel, our business could be adversely affected.

Our exposure to governmental regulations and court decisions, including new legislation and court actions by the United States Patent and Trademark Office, could adversely affect our ability to execute on our patent strategy and licensing initiatives and our results of operations.

7

Table of Contents

The substantial majority of our asset value consists of intangible property rights, which are largely dependent upon U.S. and foreign laws and enforcement procedures. Patent law is a constantly evolving body of law, and changes can affect our rights and our ability to execute on our strategy and our financial results. These changes may come from court decisions, patent office procedures and decisions, legislative changes and/or executive orders in the United States as well as similar changes in the many foreign countries where we hold patents. We may spend a significant amount of resources to enforce existing and any newly acquired patents. If new legislation, regulations or rules are implemented that impact the patent application process, the patent enforcement process or the rights of patent holders, these changes could negatively affect our strategy and would likely have a material adverse effect on our business, prospects, financial condition, results of operations and cash flows.

In addition, it is difficult to predict the outcome of patent enforcement litigation at the trial level and the amount of time it may take to complete an enforcement action. There is a higher rate of successful appeals in patent enforcement litigation than more standard business litigation. Such appeals are expensive and time consuming, resulting in increased costs and delayed revenue. Although we intend to diligently pursue enforcement litigation, we cannot predict with significant reliability the decisions made by juries and trial courts.

Focusing our business model on realizing the value of our intellectual property is a relatively recent initiative and may not result in anticipated benefits.

Until recently, we were primarily a software company delivering Mediation and Messaging solutions to communication service providers. We sold the last of our products businesses as of April 30, 2012 and are focusing our efforts on realizing the value of our intellectual property portfolio. Since focusing our Company exclusively on intellectual property, we have completed one significant patent licensing transaction and one sale transaction both in April 2014. We have a limited operating history and a limited track record with respect to our intellectual property strategy, which could make it difficult to evaluate our current business and future prospects. We have encountered and will continue to encounter risks and difficulties frequently experienced by companies with evolving business strategies. If we do not manage these risks successfully, our business and operating results will be adversely affected.

The mobile handset market is consolidating which could limit our ability to enter into profitable and long-term licensing agreements and negatively impact our business.

Our largest market for patent licensing, the mobile device market, has few participants. Recently there has been consolidation in the mobile device market with certain companies emerging as the dominant market participants. The remaining market participants in the mobile device market are suffering financial losses and may not have the financial ability or willingness to enter into a licensing agreement with the Company. In addition, the now dominant market participants in the mobile handset market are well capitalized with greater financial resources than ours providing them with a greater ability to sustain patent infringement litigation, which may put us at a disadvantage. This, in turn, may adversely affect our financial condition, results of operations, and ability to raise additional capital on terms we consider acceptable.

Efforts to realize the value of our patents may not be successful, which may lead to expensive and time-consuming litigation.

Litigation may be necessary to secure payment for the use of our patented ideas. Litigation is time consuming, expensive, uncertain, subject to appeal, increases time to revenue, unpredictable and subject to many factors beyond our control. Our results of operations, financial condition and cash flows will be adversely affected during the pendency of the dispute and we expect that the uncertainty arising from the litigation will increase volatility in the market price of our securities.

We are litigating with very sophisticated companies with extensive resources that have many tactics available to them. Their actions can become very costly and time consuming for us and may lead to negative, adverse results for us.

We are litigating with very sophisticated companies with extensive resources. These companies have many tactics available to them, such as delay tactics, venue change, requests for patent reexaminations, counterclaims and administrative investigations for alleged violations of fair, reasonable, and non-discriminatory licensing commitments, and others. Although we believe in the intrinsic value of our patents, these tactics may delay enforcement and collection of royalties on our patents and can force us to spend significant sums to react to them.

8

Table of Contents

Our operations require sufficient cash flows from operating activities, cash on hand and financings.

Starting in 2012, we began to focus on pursuing a multi-pronged strategy to realize the value of our patent portfolio, including direct licensing or sale of our patents, joint ventures, and partnering with one or more intellectual property specialists. In furtherance of this strategy, we may from time to time spend significant resources in enforcing existing patents in litigation and taking certain other actions. Since 2012, we have completed two revenue generating transactions, both with Lenovo in the 2014 fiscal year. Until we begin generating additional revenue from the licensing or sale of our patent portfolio, these activities will be funded primarily by our current working capital. We believe our current working capital will be able to meet our cash needs for at least the next 12 months. Additionally, we may pursue contingency arrangements and/or alternative financing contracts to increase our available cash and fund our planned intellectual property initiatives. From time to time, in addition, or as an alternative, we also may consider raising capital through public or private offerings of securities. If financing is required to sustain our working capital and is unavailable or prohibitively expensive when we require it, we may not be able to fully realize the value of our patent portfolio and we may be forced to reduce the scope of planned intellectual property initiatives. This may have a material adverse effect on our business, operating results, financial condition and prospects.

In connection with patent enforcement actions that we may conduct, a court may rule that we have violated certain statutory, regulatory, federal, local or governing rules or standards, which may expose us to certain material liabilities.

In connection with any of our patent enforcement actions, it is possible that a defendant may request and/or a court may rule that we have violated statutory authority, regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions against us or award attorney’s fees and/or expenses to a defendant(s), which could be material, and if we are required to pay such monetary sanctions, attorneys’ fees and/or expenses, such payment could materially harm our operating results and our financial position.

In certain foreign jurisdictions where we have or may initiate litigation we may be responsible for all or a portion of defendant’s legal fees and costs.

In March 2014, the Company filed parallel infringement actions in the United Kingdom (UK) and Germany. Should we be deemed the losing party in any of its applications to the court in the UK or Germany, we may be held responsible for all or a portion of the defendant’s legal fees for the relevant application or for the litigation.

Our patents have existing licensing encumbrances.

Existing licensing encumbrances preclude us from deriving licensing revenue from certain third parties. In many cases we fully understand these encumbrances, their impact and their expiration. However, in other cases there may be unknown encumbrances, or unexpected impact from encumbrances (such as an unknown supply chain or partnership) within the complex mobile ecosystem that negatively impact our potential revenue. If additional encumbrances are discovered, they could restrict our revenue opportunities with affected licenses and thus have an adverse impact on our business, results of operations, and cash flows.

Our acquisitions of patents and patent applications may be time consuming, complex and costly, which could adversely affect our operating results.

Our acquisitions of patents and patent applications may be time consuming, complex and costly to consummate. We may utilize many different transaction structures in our acquisitions and the terms of the acquisition agreements may be very heavily negotiated. As a result, we may incur significant operating expenses during the negotiations even where the acquisition is ultimately not consummated. In addition, as a result of any future acquisitions, we might need to issue additional equity securities, spend our cash or incur debt or assume significant liabilities, any of which could adversely affect our business and results of operations. Even if we successfully acquire particular patents, there is no guarantee that we will generate sufficient revenue related to those patents to offset the acquisition costs. While we intend to conduct confirmatory due diligence on the patents

9

Table of Contents

we are considering for acquisition, we may acquire patents from a seller who does not have proper title to those assets. In those cases, we may be required to spend significant resources to defend our interests in the patents and, if we are not successful, our acquisition may be invalid, in which case we could lose part or all of our investment in the patents.

Patents have a limited lifespan. If our operating subsidiaries are unable to develop or acquire new technologies and patents, our ability to generate revenues could be substantially impaired.

The United States and foreign patent systems afford a limited lifespan of protection for each patent. In the United States, a patent is entitled to 20 years of protection from the date of filing the application. Our existing portfolio will begin to expire towards the end of 2015, with a material quantity of patents in our portfolio expiring over time beginning in 2016 through 2025. If we are unable to develop or acquire new technologies and patents with a longer lifespan, our ability to generate revenues could be substantially impaired following these dates of expiration.

Focusing our business model on realizing the value of our intellectual property is a relatively recent initiative and may not result in anticipated benefits.

Until recently, we were primarily a software company delivering Mediation and Messaging solutions to communication service providers. We sold the last of our products businesses as of April 30, 2012 and are focusing our efforts on realizing the value of our intellectual property portfolio. Since focusing our Company exclusively on intellectual property, we have completed one significant patent licensing transaction and one sale transaction both in April 2014. We have a limited operating history and a limited track record with respect to our intellectual property strategy, which could make it difficult to evaluate our current business and future prospects. We have encountered and will continue to encounter risks and difficulties frequently experienced by companies with evolving business strategies. If we do not manage these risks successfully, our business and operating results will be adversely affected.

We face risks of technological obsolescence.

A superior technology could be developed during the life of our patents that makes the benefits of our patents obsolete. We conduct business in markets characterized by intense competition, rapid technological change, and evolving industry standards. We expect to face competition from existing competitors and new and emerging companies that may enter our existing or future markets with similar or alternative technologies, which may be less costly or provide additional features.

Running royalty arrangements expose us to fluctuations in our customers’ business.

We believe we optimize the value of our intellectual property by structuring our relationships with our intellectual property customers in the form of long-term running royalty license agreements where possible. These running royalty arrangements expose us to fluctuations in our intellectual property customers’ revenues which are, in part, dependent on the success of their products, conditions in the markets they serve, competing technologies, the relevance of our patented ideas to their products, and the effectiveness of the terms of our license agreements. Accordingly, our intellectual property revenue streams and cash flows will fluctuate, often unpredictably, and we will report these variable revenues at least one quarter following the sale of products we license. Volatility in our revenue or cash flow streams may adversely affect the market price for our securities.

Additionally, our intellectual property revenue streams will be dependent upon our license agreements. Our customers may not fully comply with their obligations under those agreements, we may not negotiate terms that effectively secure the revenue streams we expect, we may have to audit or resolve disputes under the license agreements and we may have to renew or replace the revenue stream when licenses expire. Any of these conditions may have a material adverse effect on our business, prospects, financial condition, results of operations and cash flows.

We may require additional capital to grow our business.

10

Table of Contents

From time to time, we may require additional capital to execute on our growth plan. New equity capital could be dilutive to your voting rights and economic ownership of us. Additional outstanding shares of our common stock may result in lower earnings per share. We may issue preferred stock that has preferences over our common stock, requires periodic interest payment in cash or other securities, has superior voting rights to those of our common stock, and is entitled to elect directors or vote on other matters submitted to our stockholders or other privileges.

We may assume or incur indebtedness. If we default on our indebtedness, we may be forced into bankruptcy in which you are likely to lose your entire investment in our common stock. Indebtedness could have other important consequences to us, including the following:

| • | Our ability to obtain additional financing, if necessary, for working capital, or other purposes may be impaired or such financing may not be available on favorable terms; |

| • | Our funds available for operations, future business opportunities and distributions to stockholders will be reduced by that portion of our cash flow required to make future interest or principal payments on our debt; and |

| • | We may be more vulnerable to competitive pressures or a downturn in business or the economy generally. |

Our ability to service our debt in the future will depend upon, among other things, our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, and other factors, many of which are beyond our control.

If we are unable to successfully maintain or license existing patents, our ability to generate revenues could be substantially impaired.

Our ability to be successful in the future will depend on our continued efforts and success in licensing existing patents, including maintaining and prosecuting our patents properly. While we expect for the foreseeable future to have sufficient liquidity and capital resources to maintain the level of maintenance necessary, various factors may require us to have greater liquidity and capital resources than we currently expect. If we are unable to successfully license our existing patents, our ability to generate revenues could be substantially impaired and our business and financial condition could be materially harmed.

If we are unable to substantially utilize our net operating loss carry-forwards, our financial results may be adversely affected.

As of June 30, 2014, we had net operating loss, or NOL, carry-forwards for U.S. federal and state income tax purposes of approximately $1.68 billion and $383.0 million, respectively. In order to preserve our substantial tax assets associated with NOLs and built-in-losses under Section 382 of the Internal Revenue Code, we adopted a Tax Benefits Preservation Agreement which was approved at the November 2013 Annual Meeting of Stockholders. Under Section 382 of the Internal Revenue Code, a corporation that undergoes an “ownership change” may be subject to limitations on its ability to utilize its pre-change NOLs to offset future taxable income. In general, an ownership change occurs if the aggregate stock ownership of certain stockholders (generally 5% stockholders, applying certain look-through and aggregation rules) increases by more than 50% over such stockholders’ lowest percentage ownership during the testing period (generally three years). Purchases of our common stock in amounts greater than specified levels, which will be beyond our control, could create a limitation on our ability to utilize our NOLs for tax purposes in the future. Although we have taken steps intended to preserve our ability to utilize our NOLs, such efforts may not be successful. Limitations imposed on our ability to utilize NOLs could cause U.S. federal and state income taxes to be paid earlier than would be paid if such limitations were not in effect and could cause such NOLs to expire unused, in each case reducing or eliminating the benefit of such NOLs. Furthermore, we may not be able to generate sufficient taxable income to utilize our NOLs before they expire. If any of these events occur, we may not derive some or all of the expected benefits from our NOLs. In addition, at the state level there may be periods during which the use of NOLs is suspended or otherwise limited, which would accelerate or may permanently increase state taxes owed. See Note 12 of the Notes to the Consolidated Financial Statements for more details.

We have a history of losses and we may not be able to achieve or maintain consistent profitability.

11

Table of Contents

With the exception of our 2006, and 2014 fiscal years, we have incurred annual losses from continuing operations since our inception. As of June 30, 2014, we had an accumulated deficit of approximately $3.2 billion. We expect to continue to spend significant amounts to execute our intellectual property initiatives, which may not generate significant revenue in future periods. Our prospects must be considered in light of the risks, expenses, delays and difficulties frequently encountered by companies with business strategies similar to ours.

We have concluded that a material weakness in our internal control over financial reporting existed at the end of the 2013 fiscal year as a result of not having adequate personnel with sufficient experience in financial reporting.

As part of its assessment, management concluded that, as of June 30, 2013, a material weakness in internal control over financial reporting existed as a result of not having adequate personnel with sufficient experience in financial reporting. We have taken certain remedial measures to address this weakness, which we determined to be adequate as of March 31, 2014, and reaffirmed as of June 30, 2014. Through enhanced review of financial reporting resources, training of personnel, and hiring of new personnel with experience in financial reporting, we believe we have adequately remediated this material weakness. However, even with these remedial measures successfully implemented, the effectiveness of any system of disclosure controls and procedures is subject to limitations, including the exercise of judgment in designing, implementing and evaluating the controls and procedures, the assumptions used in identifying the likelihood of future events and the inability to eliminate misconduct completely. Moreover, additional material weaknesses in our internal control over financial reporting may be identified in the future.

As a publicly listed company with a 13 year history in product sales prior to transforming ourselves into an intellectual property licensing company, we could be exposed to litigation proceedings related to former customers.

We have retained certain ongoing liabilities with respect to indemnification claims related to our former customers that were initiated prior to the closing of the sales of our product businesses. While at this time we are not aware of any claims, litigation related to product-indemnification claims could be costly and time consuming and could divert our management and key personnel from our intellectual property strategy and our business operations.

Our success may depend in part upon our ability to retain the best legal counsel to represent us in patent enforcement litigation.

The success of our intellectual property licensing business may depend upon our ability to retain the best legal counsel to pursue patent infringement litigation. As our patent enforcement actions increase, it may become more difficult to find the best legal counsel to handle all of our cases because many of the best law firms may have a conflict of interest that prevents their representation of us.

We face litigation risks that could have a material adverse effect on our Company.

We may be the subject of private or government actions. For example, in the past we have been the subject of several shareholder derivative lawsuits relating to our past option grants and practices. Litigation may be time-consuming, expensive and disruptive to normal business operations, and the outcome of litigation is difficult to predict. The defense of these lawsuits may result in significant expense and a diversion of management’s time and attention from the operation of our business, which could impede our ability to achieve our business objectives, and an unfavorable outcome, may have a material adverse effect on our business, financial condition and results of operations. Additionally, any amount that we may be required to pay to satisfy a judgment or settlement of litigation may not be covered by insurance. Under our charter and the indemnification agreements that we have entered into with our officers and directors, we are required to indemnify, and advance expenses to them in connection with their participation in proceedings arising out of their service to us. There can be no assurance that any of these payments will not be material.

Our current indebtedness and debt we incur in the future may limit our flexibility to obtain financing and to pursue other business opportunities.

12

Table of Contents

Our current indebtedness and debt we incur in the future may limit our flexibility to obtain financing and to pursue other business opportunities. Our current leverage and future level of indebtedness could have important consequences to us, including the following:

| • | our ability to obtain additional financing, if necessary, for working capital, or other purposes may be impaired or such financing may not be available on favorable terms; |

| • | our funds available for operations, future business opportunities and distributions to shareholders will be reduced by that portion of our cash flow required to make future interest payments on our debt; and |

| • | we may be more vulnerable to competitive pressures or a downturn in our business or the economy generally. |

Our ability to service our debt in the future will depend upon, among other things, our future financial and operating performance, which will be affected by prevailing economic conditions and financial, business, and other factors, some of which are beyond our control.

Risks Related to Owning Our Common Stock

Our quarterly operating results may fluctuate significantly as a result of factors outside of our control, which could cause the market price of our common stock to decline.

We expect our revenues and operating results to vary from quarter to quarter. As a consequence, our operating results in any single quarter may not meet the expectations of securities analysts and investors, which could cause the price of our common stock to decline. Our licensing revenue is difficult to forecast and is likely to fluctuate from quarter to quarter.

Factors that may lead to significant fluctuation in our operating results include, but are not limited to:

| • | the uncertain nature of securing licenses; |

| • | litigation risks and uncertainties; |

| • | timing uncertainties associated with the legal process in the courts and the relevant patent offices; |

| • | restructuring or impairment charges we may take; |

| • | the timing of the receipt of license fee payments; |

| • | fluctuations in the net number of active licensees period to period; |

| • | costs related to alliances, licenses and other efforts to expand our business; |

| • | the timing of payments under the terms of any license agreements into which we may enter; |

| • | expenses related to, and the timing and results of, patent filings and other enforcements proceedings relating to intellectual property rights; |

| • | revenue recognition and other accounting policies; |

| • | the perceived relevance and value in our existing patent asset portfolio by existing or potential licensees; |

| • | changes in and timing of new governmental, statutory and industry association laws, regulations, procedures or requirements; |

| • | fluctuations in currency exchange rates; and |

| • | industry and economic conditions, including competitive pressures or conditions that affect the intellectual property risk and management of existing or potential licensees. |

Our operating results could be impacted by the amount and timing of operating costs and capital expenditures relating to our business and our ability to accurately estimate and control costs. Our internal expenses, such as compensation for current employees and lease payments for facilities and equipment, are largely fixed. Third party expenses associated with licensing and enforcement can be significant and highly variable. In addition, our expense levels are based, in part, on our expectations regarding future revenues. As a result, any shortfall in revenues relative to our expectations could cause significant changes in our operating results from period to period. Due to the foregoing factors, we believe period-to-period comparisons of our historical operating results may be of limited use. In any event, we may be unable to meet our internal projections or the projections of securities analysts and investors. If we are unable to do so, we expect that, as in the past, the trading price of our stock may fall dramatically.

13

Table of Contents

Anti-takeover provisions in our amended and restated certificate of incorporation and amended and restated bylaws, as well as provisions of Delaware law, could impair a takeover attempt.

Our amended and restated certificate of incorporation, amended and restated bylaws and Delaware law contain provisions which could have the effect of rendering more difficult, delaying, or preventing an acquisition deemed undesirable by our board of directors. Among other things, our amended and restated certificate of incorporation and amended and restated bylaws include provisions:

| • | authorizing “blank check” preferred stock, which could be issued by our board of directors without stockholder approval and may contain voting, liquidation, dividend and other rights superior to our common stock; |

| • | limiting the liability of, and providing indemnification to, our directors and officers; |

| • | limiting the ability of our stockholders to call and bring business before special meetings; |

| • | requiring advance notice of stockholder proposals for business to be conducted at meetings of our stockholders and for nominations of candidates for election to our board of directors; and |

| • | controlling the procedures for the conduct and scheduling of board of directors and stockholder meetings. |

These provisions, alone or together, could delay or prevent hostile takeovers and changes in control or changes in our management.

As a Delaware corporation, we are also subject to provisions of Delaware law, including Section 203 of the Delaware General Corporation law, which prevents certain stockholders holding more than 15% of our outstanding common stock from engaging in certain business combinations without approval of the holders of at least two-thirds of our outstanding common stock not held by such 15% or greater stockholder.

Any provision of our amended and restated certificate of incorporation, amended and restated bylaws or Delaware law that has the effect of delaying, preventing or deterring a change in control could limit the opportunity for our stockholders to receive a premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our common stock.

We do not expect to declare any dividends in the foreseeable future.

We do not anticipate declaring any cash dividends to holders of our common stock in the foreseeable future. Consequently, investors may need to rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment. Investors seeking cash dividends should not purchase our common stock.

We cannot predict the effect of the pending changes in accounting standards on our stock price.

In May 2014, the Financial Accounting Standards Board adopted an Accounting Standards Update that changes how companies account for contracts with customers. We may be required to restate our financial statements to give effect to this new accounting standard and to apply it prospectively. The new accounting standard may require us to recognize revenue from license agreements with our customers in a manner different than under current GAAP. We cannot predict how security analysts and equity market participants will view our valuation if our accounting for licensing agreements becomes more volatile as a result of this new accounting standard.

14

Table of Contents

Compliance with laws, rules and regulations relating to corporate governance and public disclosure may result in additional expenses.

Federal securities laws, rules and regulations, as well as NASDAQ rules and regulations, require companies to maintain extensive corporate governance measures, impose comprehensive reporting and disclosure requirements, set strict independence and financial expertise standards for audit and other committee members and impose civil and criminal penalties for companies and their chief executive officers, chief financial officers and directors for securities law violations. These laws, rules and regulations and the interpretation of these requirements are evolving, and we are making investments to evaluate current practices and to continue to achieve compliance. As a result, our compliance programs have increased and will continue to increase general and administrative expenses and have diverted and will continue to divert management’s time and attention from revenue-generating activities. Further, in July 2010, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) which includes various provisions requiring the Securities and Exchange Commission to adopt new rules and regulations with respect to enhanced investor protection, corporate governance and executive compensation. We expect the Dodd-Frank Act and the rules and regulations promulgated thereunder to increase our legal and financial compliance costs and to make some activities more time consuming and costly.

Our stock price has been and is likely to continue to be volatile and you may not be able to resell shares of our common stock at or above the price you paid, if at all.

The trading price of our common stock has experienced wide fluctuations due to the factors discussed in this risk factors section and elsewhere in this Annual Report. In addition, the stock market in general has, and the NASDAQ Global Market and technology companies in particular have, experienced extreme price and volume fluctuations. These trading prices and valuations may not be sustainable. These broad market and industry factors may decrease the market price of our common stock, regardless of our actual operating performance. In addition, in the past, following periods of volatility in the overall market and the market price of a company’s securities, securities class action litigation has often been instituted against companies that experienced such volatility. This litigation, if instituted against us, regardless of its outcome, could result in substantial costs and a diversion of our management’s attention and resources.

Item 1B. Unresolved Staff Comments

None.

Our principal office is located in Reno, Nevada, where we lease approximately 3,797 square feet under a sublease agreement that terminates on July 15, 2016. We have another facility in Dublin, Ireland which is our international headquarters. We have one other facility lease that dates back prior to our restructuring. This facility is located in Burlington, Massachusetts, and the lease on it will expire in November 2014. The future lease payments, net of sublease income, for this facility is included in accrued restructuring costs in our consolidated balance sheet.

We believe that our facilities are sufficient for our purposes for the foreseeable future.

From time to time, the Company may be involved in litigation or other legal proceedings, including those noted below, relating to or arising out of its day-to-day operations or otherwise. Litigation is inherently uncertain and the Company could experience unfavorable rulings. Should the Company experience an unfavorable ruling, there exists the possibility of a material adverse impact on its financial condition, results of operations, cash flows or on its business for the period in which the ruling occurs and/or in future periods.

| (a) | Openwave Systems Inc.(Unwired Planet) v. Apple Inc. (“Apple”), Research in Motion Ltd, and Research in Motion Corp. (“RIM”) (now known as Blackberry) |

On August 31, 2011, the Company filed a complaint in the Federal District Court for the District of Delaware against Apple and RIM, alleging that Apple and RIM products infringe certain of the Company’s patents, seeking

15

Table of Contents

among other things a declaration that the Company’s patents cited in the complaint have been infringed by Apple and RIM (the “Defendants”) and that these patents are valid and enforceable, damages as a result of the infringement, and an injunction against further infringement. This matter was stayed pending a parallel case filed with the International Trade Commission (“ITC”). The Company withdrew the ITC investigation in October 2012. The Federal District Court in Delaware lifted the stay in January 2013 and a single claim Markman or claim construction hearing was held in November 2013. In February 2014, the Court issued a Memorandum Opinion regarding the results of the claim construction hearing. A trial date for the above matter has been scheduled for February 2016. The Defendants have filed a motion for summary judgment of non-infringement based upon their interpretation of the claim construction and we have opposed the Defendants’ motion. The Court has not yet ruled on Defendants’ motion for summary judgment. If Defendants’ motion for summary judgment is granted, this case would then proceed to the appellate level.

| (b) | Unwired Planet LLC v. Apple Inc. (“Apple”) |

In September 2012, the Company filed a complaint in the U.S. District Court for the District of Nevada. The case charges infringement of ten patents related to smart mobile devices, cloud computing, digital content stores, push notification technologies, and Location-based services such as mapping and advertising. In August 2013, the U.S. District Court for the District of Nevada granted Apple’s motion to transfer venue from the District of Nevada to the Northern District of California. A Markman hearing was held in August 2014 and a claim construction order is anticipated to be issued in the near future. Trial for this matter has been scheduled for February 2015 but the Company expects the trial date will be deferred. Discovery is ongoing in this case.

| (c) | Unwired Planet LLC v. Google, Inc. (“Google”) |

In September 2012, the Company filed a complaint in the U.S. District Court for the District of Nevada. The case charges infringement of ten patents related to cloud computing, digital content stores, push notification technologies, and Location-based services such as mapping and advertising. Google filed an application in August 2013 for Inter Partes reexamination with the United States Patent Office and sought and obtained a partial stay on those patents. In July 2014, the Company voluntarily dismissed infringement claims on three of ten patents. A Markman hearing was held in August 2014 and the Company is waiting for a claim construction order. Discovery has closed in this case, and the next phase involves expert reports and testimony.

| (d) | Unwired Planet LLC v. Square Inc. (“Square”) |

On October 20, 2013, the Company filed a complaint in the U.S. District Court for the District of Nevada, charging Square with infringing three patents related to mobile payment technologies. A Markman hearing has been scheduled for September 22, 2014. Square has applied for Inter Partes reexamination on the three patents in the suit. The United States Patent Office has not yet determined whether to institute those proceedings.

| (e) | Unwired Planet International Ltd v. Samsung, Google, Huawei, et.al (collectively “EU Defendants”) |

In March 2014, the Company filed parallel patent infringement actions in the United Kingdom (UK) and Germany. The UK lawsuit charged Samsung, Google, and Huawei with infringing six UK patents related to technologies fundamental to wireless communications found in mobile devices and network equipment, including the use of LTE telecommunication standards and push notification technology underpinning the Android ecosystem. The German lawsuit charged Samsung, Google, Huawei, LG, and HTC with infringing the six German equivalents of the above UK patents. Due to the number of defendants, both the UK and German courts have schedule staggered trial dates. The first trial date will occur in June 2015 in Germany and in October 2015 in the UK. Additionally, in July 2014, the German court denied Defendants motion for the Company to post a bond securing attorney fees and costs.

| (f) | Unwired Planet, Inc. vs. Microsoft |

In July 2014, the Company filed suit in the U.S. District Court of Delaware alleging Microsoft breached a patent license agreement the two companies entered into in September 2011. The Company is seeking a declaratory judgment and damages for breach of contract.

16

Table of Contents

Indemnification claims

Prior to the sale of the Company’s product businesses, the Company’s software license and services agreements generally included a limited indemnification provision for claims from third parties relating to its intellectual property. In connection with the sale of the Company’s product businesses, the Company retains certain ongoing liabilities with respect to indemnification claims related to its former customers that were initiated prior to the sale of the Location business line and the Messaging and Mediation product businesses.

Originally, three licensees of the Company sought indemnification from the Company under their respective license agreements. All of these matters have been resolved and there are no threatened, pending, or outstanding indemnification claims that the Company is aware of at this time. Accordingly, nothing has been accrued for indemnifications as of June 30, 2014.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Price Range of Common Stock

Our common stock is listed for quotation on the NASDAQ Global Select Market under the symbol “UPIP.” The following table sets forth the reported high and low closing sales prices for our common stock for the fiscal periods indicated.

| Stock price by quarter | High | Low | ||||||

| Fiscal year ended June 30, 2014: |

||||||||

| First quarter |

$ | 2.19 | $ | 1.65 | ||||

| Second quarter |

$ | 1.98 | $ | 1.26 | ||||

| Third quarter |

$ | 2.29 | $ | 1.28 | ||||

| Fourth quarter |

$ | 2.44 | $ | 1.95 | ||||

| Fiscal year ended June 30, 2013: |

||||||||

| First quarter |

$ | 2.52 | $ | 1.61 | ||||

| Second quarter |

$ | 1.96 | $ | 1.17 | ||||

| Third quarter |

$ | 2.47 | $ | 1.23 | ||||

| Fourth quarter |

$ | 2.24 | $ | 1.79 | ||||

As of August 19, 2014 there were 278 holders of record of our common stock. Because many of our shares of common stock are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of beneficial owners of our stock represented by these record holders.

Dividend Policy

Our policy has been to retain future earnings for reinvestment in our business, and accordingly, we have not paid cash dividends other than a special one-time cash dividend paid in June 2007, and we do not anticipate paying cash dividends in the foreseeable future.

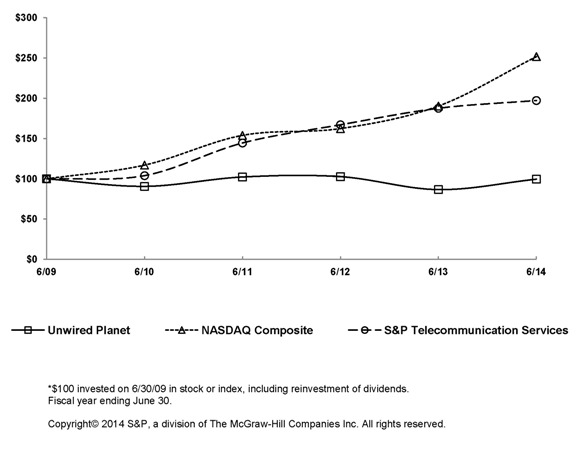

Performance Graph

The information contained in the Performance Graph shall not be deemed to be “soliciting material” or “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act or the Exchange Act.

17

Table of Contents

The following graph compares the cumulative total stockholder return on our common stock, the NASDAQ Composite Index, and the S&P Telecommunication Services Index. The graph assumes that $100 was invested in our common stock, the NASDAQ Composite Index and the S&P Telecommunication Services Index on June 30, 2009, and calculates the return quarterly through June 30, 2014. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Unwired Planet, the NASDAQ Composite Index

and the S&P Telecommunication Services Index

Item 6. Selected Financial Data

The following selected financial data should be read in conjunction with our consolidated financial statements and related notes thereto and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Annual Report.

18

Table of Contents

The following table sets forth selected Consolidated Statements of Operations and Consolidated Balance Sheet data, revised to reflect discontinued operations, for the 2014, 2013, 2012, 2011 and 2010, fiscal years (in thousands, except per share data):

| Fiscal Year ended June 30, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Selected Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Net revenues |

$ | 36,396 | $ | 121 | $ | 15,050 | $ | 4,019 | $ | — | ||||||||||

| Operating expenses |

32,992 | 39,612 | 24,020 | 11,356 | 11,901 | |||||||||||||||

| Operating income (loss) from continuing operations |

3,404 | (39,491 | ) | (8,970 | ) | (7,337 | ) | (11,901 | ) | |||||||||||

| Income (loss) from continuing operations |

453 | (39,679 | ) | (8,150 | ) | (8,105 | ) | (11,929 | ) | |||||||||||

| Discontinued operations: |

||||||||||||||||||||

| Income (loss) from discontinued operations, net of tax |

(20 | ) | (7,784 | ) | (27,577 | ) | (17,379 | ) | 1,556 | |||||||||||

| Gain (loss) on sale of discontinued operations |

— | (150 | ) | 50,294 | (9,764 | ) | 4,516 | |||||||||||||

| Total income (loss) from discontinued operations |

(20 | ) | (7,934 | ) | 22,717 | (27,143 | ) | 6,072 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 433 | $ | (47,613 | ) | $ | 14,567 | $ | (35,248 | ) | $ | (5,857 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings (loss) per share |

||||||||||||||||||||

| Continuing operations |

$ | 0.00 | $ | (0.44 | ) | $ | (0.09 | ) | $ | (0.10 | ) | $ | (0.14 | ) | ||||||

| Discontinued operations |

$ | 0.00 | $ | (0.09 | ) | $ | 0.26 | $ | (0.32 | ) | $ | 0.07 | ||||||||

| Net income (loss) per share |

$ | 0.00 | $ | (0.53 | ) | $ | 0.17 | $ | (0.42 | ) | $ | (0.07 | ) | |||||||

| Shares used in computing basic earnings (loss) per share |

107,982 | 90,843 | 86,354 | 84,577 | 83,500 | |||||||||||||||

| Shares used in computing diluted earnings (loss) per share |

108,694 | 90,843 | 86,354 | 84,577 | 83,500 | |||||||||||||||

| As of June 30, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Selected Consolidated Balance Sheets Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 93,877 | $ | 47,613 | $ | 39,709 | $ | 47,266 | $ | 60,935 | ||||||||||

| Investments (1) |

$ | 51,813 | $ | 10,793 | $ | 53,283 | $ | 49,577 | $ | 58,433 | ||||||||||

| Total assets |

$ | 150,441 | $ | 78,238 | $ | 97,493 | $ | 147,817 | $ | 188,609 | ||||||||||

| Fee share obligation (3) |

$ | 20,032 | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Deferred revenue (2) |

$ | 33,571 | $ | — | $ | — | $ | 38,458 | $ | 46,932 | ||||||||||

| Notes payable |

$ | 25,693 | $ | 22,096 | $ | — | $ | — | $ | — | ||||||||||

| Stockholders’ equity |

$ | 63,071 | $ | 43,927 | $ | 68,629 | $ | 42,945 | $ | 72,759 | ||||||||||

| (1) | includes short and long-term investments |

| (2) | includes current and non-current deferred revenue |

| (3) | includes current and non-current fee share obligation |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with, and is qualified entirely by, our consolidated financial statements (including Notes to the Consolidated Financial Statements) and the other consolidated financial information appearing elsewhere in this Annual Report on Form 10-K. In addition to historical financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risk and uncertainties. Actual results and timing of events could differ from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview