Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Great Elm Capital Group, Inc. | gec-20160630ex322c6e61a.htm |

| EX-32.1 - EX-32.1 - Great Elm Capital Group, Inc. | gec-20160630ex3217c7f94.htm |

| EX-31.2 - EX-31.2 - Great Elm Capital Group, Inc. | gec-20160630ex3127e27a5.htm |

| EX-31.1 - EX-31.1 - Great Elm Capital Group, Inc. | gec-20160630ex3111c14ee.htm |

| EX-23.1 - EX-23.1 - Great Elm Capital Group, Inc. | gec-20160630ex231efa18d.htm |

| EX-21.1 - EX-21.1 - Great Elm Capital Group, Inc. | gec-20160630ex211a37308.htm |

| EX-14.1 - EX-14.1 - Great Elm Capital Group, Inc. | gec-20160630ex1414153b0.htm |

| EX-10.21 - EX-10.21 - Great Elm Capital Group, Inc. | gec-20160630ex10213d567.htm |

| EX-10.20 - EX-10.20 - Great Elm Capital Group, Inc. | gec-20160630ex102049905.htm |

| EX-4.1 - EX-4.1 - Great Elm Capital Group, Inc. | gec-20160630ex4103ef9ab.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _________

Commission file number: 001-16073

Great Elm Capital Group, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

94-3219054 |

|

State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization |

|

Identification No.) |

|

|

|

|

|

200 Clarendon Street, 51st Floor |

|

|

|

Boston MA |

|

02116 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code (617) 735-3500

UNWIRED PLANET, INC.

(Former name changed from last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common stock, par value $0.001 per share |

|

The Nasdaq Stock Market LLC |

|

|

|

(Nasdaq Global Select Market) |

Securities registered pursuant to section 12(g) of the Act:

None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

Yes ☐ No ☒ |

|

|

|

|

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. |

Yes ☐ No ☒ |

|

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

Yes ☒ No ☐ |

|

|

|

|

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

Yes ☒ No ☐ |

|

|

|

|

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐ |

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

||

|

|

|

|

|

Large accelerated filer ☐ Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Accelerated filer ☒ Smaller reporting company ☐ |

|

|

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): |

Yes ☐ No ☒ |

|

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $73.1 million as of December 31, 2015. Shares of common stock held by persons who are not directors or executive officers, including persons who own more than 5% of the outstanding shares of common stock, are included in that such persons are not deemed to be affiliates for purpose of this calculation.

As of September 13, 2016, there were 9,466,670 outstanding shares of the registrant’s common stock.

LOCATION OF EXHIBIT INDEX

The exhibit index is located immediately following the signature page to this report.

i

All references to “Great Elm,” “we,” “us,” “our,” “Company” and words of similar import are to Great Elm Capital Group, Inc. (which was formerly named Unwired Planet, Inc.) and/or our subsidiaries.

Overview

Great Elm has undergone a significant transformation in the last year. We:

|

· |

divested our legacy patent business; |

|

· |

changed and are further changing our leadership; |

|

· |

changed our name from Unwired Planet to Great Elm Capital Group; and |

|

· |

began building a diversified holding company. |

Our goal is to build a diversified holding company focused on return on investment and long-term value creation. We will accomplish this principally through:

|

· |

continuous review of acquisitons of businesses, securities and assets that have the potential for significant long-term value creation; |

|

· |

effective use of the skills of our team, our financial resources, including our tax assets, our willingness to create bespoke solutions and our ability to prudently assume risks; and |

|

· |

evaluating the retention and disposition of our operations and holdings. |

Our first investment for long-term value creation is in the asset management business. In June 2016, we invested $30 million in Great Elm Capital Corp. (GECC). On June 23, 2016, GECC entered into a merger agreement with Full Circle Capital Corporation (Full Circle), a business development company (BDC). Upon closing the Full Circle merger, we will:

|

· |

earn management fees and receive expense reimbursement; |

|

· |

be entitled to incentive fees from GECC if GECC meets financial targets; and |

|

· |

own registered Nasdaq-listed shares of GECC that we may hold to generate dividends or sell to redeploy our capital in higher yielding opportunities. |

We continue to explore other opportunities in the investment management business including, but not limited to, other BDCs that trade at a discount to their net asset value.

As of June 30, 2016, we had $1.7 billion of net operating loss (NOL) carryforwards for Federal income tax purposes.

In the near term, we expect to begin marketing financial products that will give us and our counter-parties the opportunity to generate after tax returns. For example, we may acquire real estate projects in exchange for stock of our subsidiaries.

We have a business development effort focused on industries and businesses with attractive long-term value creation prospects where our business, mergers and acquisitions and financial acumen provides a competitive advantage.

Our corporate headquarters are located at 200 Clarendon Street, 51st Floor, Boston, Massachusetts 02116 and our phone number is (617) 735-3500. Our corporate website address is www.greatelmcap.com. The information contained in, or accessible through, our corporate website does not constitute part of this report. We are a Delaware corporation that was incorporated in 1994 and completed our initial public offering in 1999.

Our Former Patent Business

On April 6, 2016, we entered into a purchase and sale agreement with Optus UP Holdings, LLC (Optis) providing for the sale of the entities that conducted our patent licensing business (the Divestiture). The Divestiture was completed on June 30, 2016.

1

In the Divestiture, we received $34.2 million in gross cash proceeds, inclusive of reimbursement of $4.2 million of agreed upon expenses, and may be entitled to up to an additional $10 million cash payment on June 30, 2018. Optis has the right to make claims against that $10 million payment, and we cannot assure you that we will receive any of such amount. Our patent business is reflected in our financial statements as discontinued operations. We remain a party to two lawsuits related to our patent business. See Item 3.

Great Elm Capital Corporation ― Our Business Development Company

We decided to invest in the asset management business because of our assessment of its ability to generate recurring free cash flows, its growth prospects and our board of directors’ industry expertise.

On June 23, 2016, GECC entered into an agreement and plan of merger with Full Circle (the Merger Agreement) and entered into a subscription agreement (the Subscription Agreement) with us and private investment funds (the MAST Funds) managed by MAST Capital Management, LLC (MAST Capital). We also entered into a non-binding memorandum of understanding (the MOU) with MAST Capital and some of its partners that provides for us to hire substantially all of the partners and employees of MAST Capital at the closing of the transactions contemplated by the Merger Agreement.

We contributed $30 million in cash to GECC. As of June 30, 2016, GECC was our wholly-owned subsidiary and it is consolidated in our June 30, 2016 financial statements. Before the Merger, the MAST Funds will contribute to GECC a portfolio of debt investments that had a May 31, 2016 fair value of $90 million. Following the MAST Funds contribution, GECC will elect to be treated as a BDC under the Investment Company Act of 1940, as amended. Following the BDC election and assuming the conditions to closing under the Merger Agreement are satisfied or waived, Full Circle will merge with and into GECC (the Merger) in exchange for shares of GECC common stock. GECC’s common stock is expected to be listed on the NASDAQ Global Market.

We have two opportunities to generate free cash flow from GECC:

First, Great Elm Capital Management, Inc., our wholly-owned subsidiary (GECM), will be the external investment manager of GECC. Under the investment management agreement that is an exhibit to the Subscription Agreement, GECM will be entitled to:

|

· |

management fees measured by GECC’s gross assets (other than cash); |

|

· |

an incentive fee if GECC’s net investment income exceeds a hurdle rate; |

|

· |

an incentive fee based on GECC’s capital gains; and |

|

· |

reimbursement of the portion of GECM’s expenses allocable to GECC. |

Under the MOU, GECM will share part of this revenue stream with its employees and consultants.

Second, we will own registered Nasdaq-listed shares of GECC that we may hold to generate dividends or sell to redeploy our capital in higher yielding opportunities. We agreed that we would not sell these shares until one year following the Merger, but we may finance these shares during that holding period to generate liquidity before our contractual holding period expires.

Our Transformation

In addition to divesting our patent business that had never generated positive operating income (other than as a result of the asset sale to Lenovo) and securing our GECC opportunity, since July 1, 2015:

|

· |

five members of our board of directors have departed to be replaced by board members with mergers and acquisitions, leveraged finance and investment management experience; |

|

· |

we have transitioned our chief executive officer; |

|

· |

we have changed our name and ticker symbol; and |

|

· |

we have begun the process of moving our corporate headquarters to Boston. |

In 2011, investment funds managed by Starboard Value LP took an active interest in our company. Beginning in 2012, we divested our legacy software and product businesses and focused our business on licensing our patents. In January

2

2013, we acquired from Ericsson a portfolio of over 2,000 patents that includes standard essential patents for 2G, 3G and LTE mobile communication systems. Other than a one-time item patent sale and related license with Lenovo, our intellectual property business was unprofitable.

Competition

We face competition from larger and better financed organizations (both domestic and foreign), including operating companies, global asset managers, investment banks, commercial banks, private equity funds, sovereign wealth funds and state owned enterprises. Government regulation is a key competitive factor.

Employees

We had 7 employees on June 30, 2016.

Information about Great Elm on the Internet

The following documents and reports are available on or through our website as soon as reasonably practicable after we electronically file such materials with, or furnish to, the SEC:

|

· |

Code of Ethics; |

|

· |

Reportable waivers, if any, from our Code of Ethics by our executive officers; |

|

· |

Charter of the audit committee of our board of directors (our Board); |

|

· |

Charter of the nominating and corporate governance committee of our Board; |

|

· |

Charter of the compensation committee of our Board; |

|

· |

Annual reports on Form 10-K; |

|

· |

Quarterly reports on Form 10-Q; |

|

· |

Current reports on Form 8-K; |

|

· |

Proxy or information statements we send to our stockholders; and |

|

· |

Any amendments to the above-mentioned documents and reports. |

Our stockholders may also obtain a printed copy of any of these documents or reports free of charge by sending a request to Great Elm Capital Group, Inc., 200 Clarendon Street, 51st Floor, Boston, MA 02116; Attention: Investor Relations, or by calling (617) 375-3500.

Our business is subject to a number of risks. You should carefully consider the following risk factors, together with all of the other information included or incorporated by reference in this report, before you decide whether to invest in our securities. The following risks are not the only risks we face. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common shares could decline, and you may lose all or part of your investment.

We are in the midst of a transition and there are a number of uncertain factors. We are in the midst of a transition and there are a number of uncertain factors including, but not limited to:

|

· |

There may be unknown liabilities or obligations related to businesses we have divested; |

|

· |

We are recruiting new members of our board of directors and a new chief financial officer; |

|

· |

We recently hired an interim chief executive officer; |

|

· |

We have signed contracts for our first investment in the asset management business, but we cannot assure you that the transaction will be consummated; |

|

· |

Our historical financial statements have been restated to reflect our discontinued operations and those financial statements do not serve as a basis for evaluating our new business; |

|

· |

We are relocating our headquarters and implementing new information systems; and |

|

· |

We have plans to make significant investments but cannot provide specificity as to our future investments or financing plans. |

3

These and other factors, including the other risk factors described in this document, make it difficult for you and other market participants to value our company and our prospects. We are unaware of any comparable company that securities analysts can use to benchmark our performance and valuation. We cannot give any assurance that any of the uncertainties or risk factors in this document will be favorably resolved.

Our growth strategy may not be successful. The process to identify potential investment opportunities and acquisition targets, to investigate and evaluate the future returns therefrom and business prospects thereof and to negotiate definitive agreements with respect to such transactions on mutually acceptable terms can be time consuming and costly. We are likely to encounter intense competition from other companies with similar business objectives to ours, including private equity and venture capital funds, sovereign wealth funds, investment firms with significantly greater financial and other resources and operating businesses competing for acquisitions. Many of these companies are well established, well financed and have extensive experience in identifying and effecting business combinations.

Because we will consider investments in different industries, you have no basis at this time to ascertain the merits or risks of any business that we may ultimately invest in. Our business strategy contemplates investment in one or more operating businesses. We are not limited to acquisitions and/or investments in any particular industry or type of business. Accordingly, there is no current basis for you to evaluate the possible merits or risks of the particular industry in which we may ultimately invest or the target businesses with which we may ultimately invest. We cannot assure you that all of the significant risks present in that opportunity will be properly assessed. Even if we properly assess those risks, some of them may be outside of our control or ability to affect. Except as required under Nasdaq rules and applicable law, we will not seek stockholder approval of any investment that we may pursue, so you will most likely not be provided with an opportunity to evaluate the specific merits or risks of such a transaction before we become committed to the transaction.

We may not correctly assess the management teams of the businesses we invest in. The value of the businesses we invest in is driven by the quality of the leaders of those businesses. When evaluating the desirability of a prospective target business, our ability to assess the target business' management may be limited due to a lack of time, resources or information. Our assessment of the capabilities of the target's management, therefore, may prove to be incorrect and such management may lack the skills, qualifications or abilities we expected. Should the target's management not possess the necessary skills, qualifications or abilities, the operations and profitability of that business will be negatively impacted.

Subsequent to an investment, we may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and our share price, which could cause you to lose some or all of your investment. Even if we conduct extensive due diligence on a target business that we invest in, we cannot assure you that this diligence will identify all material issues that may be present inside a particular target business, that it would be possible to uncover all material issues through a customary amount of due diligence, or that factors outside of the target business or outside of our control will not later arise. As a result of these factors, we may be forced to later write-down or write-off assets, restructure our operations, or incur impairment or other charges that could result in us reporting losses. Even if our due diligence successfully identifies certain risks, unexpected risks may arise and previously known risks may materialize in a manner not consistent with our preliminary risk analysis. Even though these charges may be non-cash items and not have an immediate impact on our liquidity, the fact that we report charges of this nature could contribute to negative market perceptions about us or our securities. In addition, charges of this nature may cause us to violate net worth or other covenants under our debt agreements. Accordingly, you could suffer a significant reduction in the value of your shares.

Changing conditions in financial markets and the economy could impact us through decreased revenues, losses or other adverse consequences. Global or regional changes in the financial markets or economic conditions could adversely affect our business in many ways, including the following:

|

· |

Adverse changes in the market could also lead to a reduction in revenues from asset management fees and investment income from managed funds and losses on our own capital invested in managed funds. Even in the absence of a market downturn, below-market investment performance by our funds and portfolio managers could reduce asset management revenues and assets under management and result in reputational damage that might make it more difficult to attract new investors. |

|

· |

Limitations on the availability of credit, such as occurred during 2008, can affect our ability to borrow on a secured or unsecured basis, which may adversely affect our liquidity and results of operations. Global market and economic conditions have been disrupted and volatile in the last several years and may be in the future. Our cost and availability of funding could be affected by illiquid credit markets and wider credit spreads. |

4

|

· |

New or increased taxes on compensation payments or financial transactions items may adversely affect our profits, if earned. |

|

· |

Should one of our customers, debtors or competitors fail, our business prospects and revenue could be negatively impacted due to negative market sentiment causing customers to cease doing business with us and our lenders to cease extending credit to us, which could adversely affect our business, funding and liquidity. |

We intend to create bespoke financial products. These initiatives may expose us to unexpected market, legal, operational or reputational risks. We intend to create bespoke financial products that will solve challenges for our customers by using our human and financial resources, including our tax profile, and our risk modeling capabilities. These products may, among other things:

|

· |

not perform as we model them; |

|

· |

have unknown or unexpected correlations to changes in the economy or markets; |

|

· |

require the investment of more of our capital than we anticipate; |

|

· |

not be in bankruptcy remote entities even though we have structured them to be bankruptcy remote; |

|

· |

not survive challenge by regulatory bodies or in court; |

|

· |

result in a change in law as legislators and regulators discover unintended consequences of current legislation and regulation; |

|

· |

require us to indemnity our customer against certain risks; |

|

· |

result in negative publicity for us or our customers; and |

|

· |

have unknown or inadequately planned for structural challenges. |

Our business, financial condition and results of operations are dependent upon those of our individual businesses, and our aggregate investment in particular industries. We are a holding company that will make investments in businesses and assets in a number of industries. Our business, financial condition and results of operations are dependent upon our investments. Any material adverse change in one of our investments or in a particular industry in which we invest may cause material adverse changes to our business, financial condition and results of operations. Concentration of capital we devote to a particular investment or industry may increase the risk that such investment could significantly impact our financial condition and results of operations, possibly in a material adverse way. Our portfolio of investments will change from time to time.

Our ability to successfully grow our new business and to be successful thereafter will be totally dependent upon the efforts of our key personnel. The loss of key personnel could negatively impact the operations and profitability of our business. Our ability to successfully effect our growth strategy is dependent upon the efforts of our key personnel. Peter A. Reed is Chief Executive Officer of GECC and is expected to become Chief Investment Officer of GECM upon completion of the Merger. Richard S. Chernicoff has been our lead independent director, chairman of our board and is now our Chief Executive Officer. Our key personnel realize their importance to our business and may demand increased compensation as a result. The loss of our key personnel could severely negative impact the operations and profitability of our business. We compete with many other entities for skilled management and staff employees, including entities that operate in different market sectors than us. Delays in recruiting and costs to recruit and retain adequate personnel could materially adversely affect results of operations.

Difficult market conditions can adversely affect our asset management business in many ways, by reducing the value or performance of our funds (including our invested funds and funds invested by third parties) or by reducing the ability of our funds to raise or deploy capital, each of which could negatively impact our income and cash flow and adversely affect our financial condition. The build-out of our asset management business is affected by conditions in the financial markets and economic conditions and events throughout the world, such as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws and regulations, market perceptions and other factors. In addition, we have substantially invested in GECC. Adverse changes could lead to a reduction in investment income, losses on our own capital invested and lower revenues from asset management fees. Such adverse changes may also lead to a decrease in new capital raised and may cause investors to withdraw their investments and commitments. Even in the absence of a market downturn, below market investment performance by our funds and portfolio managers could reduce asset management revenues and assets under management and result in reputational damage that may make it more difficult to attract new investors or retain existing investors.

We may issue additional shares of common stock or shares of our preferred stock to obtain additional financial resources, as acquisition currency or under employee incentive plans. Any such issuances would dilute the interest of

5

our stockholders and likely present other risks. Our certificate of incorporation authorizes our board of directors to issue shares of our common stock or preferred stock from time to time in their business judgement up to the amount of our then authorized capitalization. We may issue a substantial number of additional shares of our common stock, and may issue shares of our preferred stock. These issuances:

|

· |

may significantly dilute your equity interests; |

|

· |

require you to make an additional investment in us or suffer dilution of your equity interest; |

|

· |

may subordinate the rights of holders of shares of our common stock if shares of preferred stock are issued with rights senior to those afforded to our common stock; |

|

· |

could cause a change in control if a substantial number of shares of our common stock are issued; |

which may affect, among other things, our ability to use our net operating loss carry forwards and could result in the resignation or removal of our present officers and directors; and

|

· |

may adversely affect prevailing market prices for our common stock. |

We may issue notes or other debt securities, or otherwise incur substantial debt, which may adversely affect our leverage and financial condition and thus negatively impact the value of our stockholders’ investment in us. We may choose to incur substantial debt to finance our growth plans. The incurrence of debt could have a variety of negative effects, including:

|

· |

default and foreclosure on our assets if our operating cash flows are insufficient to repay our debt obligations; |

|

· |

acceleration of our obligations to repay the indebtedness even if we make all principal and interest payments when due if we breach covenants that require the maintenance of financial ratios or reserves without a waiver or renegotiation of that covenant; |

|

· |

our immediate payment of all principal and accrued interest, if any, if the debt is payable on demand; |

|

· |

our inability to pay dividends on our common stock; |

|

· |

using a substantial portion of our cash flow to pay principal and interest on our debt, which will reduce the funds available for dividends on our common stock if declared, expenses, capital expenditures, acquisitions and other general corporate purposes; |

|

· |

limitations on our flexibility in planning for and reacting to changes in our business and in the industry in which we operate; |

|

· |

increased vulnerability to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation; and |

|

· |

limitation on our ability to borrow additional amounts for expenses, capital expenditures, acquisitions, debt service requirements, execution of our strategy and other purposes and other disadvantages compared to our competitors who have less debt. |

If we are deemed to be an investment company under the Investment Company Act of 1940 (the Investment Company Act), we may be required to institute burdensome compliance requirements and our activities may be restricted, which may make it difficult for us to execute our growth plans. If we are deemed to be an investment company under the Investment Company Act, our activities may be restricted, including:

|

· |

restrictions on the nature of our investments, and |

|

· |

restrictions on the issuance of securities, |

each of which may make it difficult for us to run our business.

In addition, the law may impose upon us burdensome requirements, including:

|

· |

registration as an investment company; |

|

· |

adoption of a specific form of corporate structure; and |

|

· |

reporting, record keeping, voting, proxy and disclosure requirements and other rules and regulations. |

There are conflicts of interest involving MAST Capital and its affiliates. These conflicts of interest, include, among others:

|

· |

Funds managed by MAST Capital are our largest stockholder; |

6

|

· |

Funds managed by MAST Capital own all of our Senior Secured Notes due 2019; |

|

· |

Peter A. Reed, a partner in MAST Capital, is a member of our board of directors and chairman of our board of directors’ nominating and corporate governance committee and compensation committee; |

|

· |

Mr. Reed is Chief Executive Officer of GECC Mr. Reed will become Chief Investment Officer of GECM upon closing of the Merger; |

|

· |

All of the partners of MAST Capital and all of its employees will become our employees or consultants upon closing the Merger and thereafter will continue to be partners or employees of MAST Capital devoting substantial time to MAST Capital’s business; |

|

· |

MAST Capital will be obligated to reimburse us for its allocable portion of costs of running our asset management business; |

|

· |

We will assume MAST Capital’s commercial contracts, leases and other obligations at the time of the Merger closing; and |

|

· |

MAST Capital, its partners and employees will receive compensation, including minority ownership of one of our subsidiaries, in connection with GECC’s business |

These conflicts of interest may result in arrangements that are not as favorable to us as those available on an arms-length basis. The significant ownership stake held by the MAST Funds may result in MAST Capital and its partners having undue influence over our affairs. These conflicts of interests may adversely affect the perception of our company, the value of our common stock or the willingness of new investors to invest in us.

Our officers and directors may become aware of business opportunities which may be appropriate for presentation to us and the other entities to which they owe certain fiduciary or contractual duties. Accordingly, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. These conflicts may not be resolved in our favor and a potential target business may be presented to another entity prior to its presentation to us, subject to their fiduciary duties under applicable law.

We may engage in a business combination with one or more target businesses that may be affiliated with or have relationships with MAST Capital, our executive officers, directors which may raise potential conflicts of interest. In light of the involvement of our executive officers and directors with other entities in the investment management business and otherwise, we may decide to acquire or do business with one or more businesses affiliated with MAST Capital or our executive officers and directors. Our directors also serve as officers and board members for other entities. Such entities may compete with us. We could pursue an affiliate transaction if we determined that such affiliated entity met our criteria for a business combination and such transaction was approved by a majority of our disinterested directors. Potential conflicts of interest may exist and, as a result, the terms of the business combination may not be as advantageous to our public stockholders as they would be absent any conflicts of interest.

Increased competition may adversely affect our revenues, profitability and staffing. All aspects of our business are intensely competitive. We will compete directly with a number of bank holding companies and commercial banks, other brokers and dealers, investment banking firms, BDCs, private equity funds, and other financial institutions. In addition to competition from firms currently in the securities business, there has been increasing competition from others offering financial services, including automated trading and other services based on technological innovations. Increased competition or an adverse change in our competitive position could lead to a reduction of business and therefore a reduction of revenues and profits.

Competition also extends to the hiring and retention of highly skilled employees. A competitor may be successful in hiring away employees, which may result in us losing business formerly serviced by such employees. Competition can also raise our costs of hiring and retaining the employees we need to effectively operate our business.

The financial services industry is subject to extensive laws, rules and regulations. Firms that engage in securities and derivatives trading, wealth and asset management and investment banking must comply with the laws, rules and regulations imposed by national and state governments and regulatory and self-regulatory bodies with jurisdiction over such activities. Such laws, rules and regulations cover all aspects of the financial services business, including, but not limited to, sales and trading methods, trade practices, use and safekeeping of customers’ funds and securities, capital structure, anti-money laundering and anti-bribery and corruption efforts, recordkeeping and the conduct of directors, officers and employees.

7

Regulators will supervise our business activities to monitor compliance with laws, rules and regulations of the relevant jurisdiction. In addition, if there are instances in which our regulators question our compliance with laws, rules, and regulations, they may investigate the facts and circumstances to determine whether we have complied. At any moment in time, we may be subject to one or more such investigation or similar reviews. There can be no assurance that our operations will not violate such laws, rules, or regulations and such investigations and similar reviews will not result in adverse regulatory requirements, regulatory enforcement actions and/or fines.

We may not be able to generate sufficient taxable income to fully realize our deferred tax asset, which would also have to be reduced if U.S. federal income tax rates are lowered. At June 30, 2016, we have significant deferred tax assets. If we are unable to generate sufficient taxable income, we will not be able to fully realize the recorded amount of the gross deferred tax asset. If we are unable to generate sufficient taxable income prior to the expiration of our Federal NOL carryforwards, the NOLs would expire unused. Our projections of future taxable income required to fully realize the recorded amount of the gross deferred tax asset reflect numerous assumptions about our operating businesses and investments, and are subject to change as conditions change specific to our business units, investments or general economic conditions. Changes that are adverse to us could result in the need to increase the deferred tax asset valuation allowance resulting in a charge to results of operations and a decrease to stockholders’ equity. In addition, if U.S. federal income tax rates are lowered, we would be required to reduce our net deferred tax asset with a corresponding reduction to earnings during the period.

If our tax filing positions were to be challenged by federal, state and local or foreign tax jurisdictions, we may not be wholly successful in defending our tax filing positions. We record reserves for unrecognized tax benefits based on our assessment of the probability of successfully sustaining tax filing positions. Management exercises significant judgment when assessing the probability of successfully sustaining tax filing positions, and in determining whether a contingent tax liability should be recorded and if so estimating the amount. If our tax filing positions are successfully challenged, payments could be required that are in excess of reserved amounts or we may be required to reduce the carrying amount of our gross deferred tax asset, either of which result could be significant to our financial position, cash balances and results of operations.

We may incur losses if our risk management is not effective. We seek to monitor and control our risk exposure. Our risk management processes and procedures are designed to limit our exposure to acceptable levels as we conduct our business. We intend to develop and apply a comprehensive framework of limits on a variety of key metrics to constrain the risk profile of our business activities. The size of the limit reflects our risk tolerance for a certain activity. The framework is expected to include investment position and exposure limits on a gross and net basis, scenario analysis and stress tests, value-at-risk, sensitivities, exposure concentrations, aged inventory, amount of Level 3 assets, counterparty exposure, leverage, cash capital, and performance analysis. While we intend to employ various risk monitoring and risk mitigation techniques, those techniques and the judgments that accompany their application, including risk tolerance determinations, cannot anticipate every economic and financial outcome or the specifics and timing of such outcomes. As a result, we may incur losses notwithstanding our risk management processes and procedures.

Operational risks may disrupt our business, result in regulatory action against us or limit our growth. Our businesses will be highly dependent on our ability to process, on a daily basis, transactions across numerous and diverse markets, and the transactions we process have become increasingly complex. If any of our financial, accounting or other data processing systems do not operate properly or are disabled or if there are other shortcomings or failures in our internal processes, people or systems, we could suffer an impairment to our liquidity, financial loss, a disruption of our businesses, liability to clients, regulatory intervention or reputational damage. These systems may fail to operate properly or become disabled as a result of events that are wholly or partially beyond our control, including a disruption of electrical or communications services or our inability to occupy one or more of our buildings. The inability of our systems to accommodate an increasing volume of transactions could also constrain its ability to expand its businesses.

Our financial and other data processing systems will rely on access to and the functionality of operating systems maintained by third parties. If the accounting, trading or other data processing systems on which we are dependent are unable to meet increasingly demanding standards for processing and security or, if they fail or have other significant shortcomings, we could be adversely affected. Such consequences may include our inability to effect transactions and manage our exposure to risk.

8

In addition, our ability to conduct business may be adversely impacted by a disruption in the infrastructure that supports our businesses and the communities in which they are located. This may include a disruption involving electrical, communications, transportation or other services used by us or third parties with which we conduct business.

Our operations will rely on the secure processing, storage and transmission of confidential and other information in our computer systems and networks. Our computer systems, software and networks may be vulnerable to unauthorized access, computer viruses or other malicious code, and other events that could have a security impact. Additionally, if a customer’s computer system, network or other technology is compromised by unauthorized access, we may face losses or other adverse consequences by unknowingly entering into unauthorized transactions. If one or more of such events occur, this potentially could jeopardize our, our customers’ or counterparties’ confidential and other information processed and stored in, and transmitted through, our computer systems and networks. Furthermore, such events may cause interruptions or malfunctions in our, our customers’, our counterparties’ or third parties’ operations, including the transmission and execution of unauthorized transactions.

We may be required to expend significant additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures, and we may be subject to litigation and financial losses that are either not insured against or not fully covered through any insurance maintained by us. The increased use of smartphones, tablets and other mobile devices as well as cloud computing may also heighten these and other operational risks. We and our third party providers are the subject of attempted unauthorized access, computer viruses and malware, and cyber attacks designed to disrupt of degrade service or cause other damage and denial of service. Additional challenges are posed by external parties, including foreign state actors. There can be no assurance that such unauthorized access or cyber incidents will not occur in the future, and they could occur more frequently and on a larger scale. Legal liability arising from such risks may harm our business. Many aspects of our business involve substantial risks of liability.

Recent legislation and new or pending regulation may significantly affect our business. In recent years, there has been significant legislation and increased regulation affecting the financial services industry. These legislative and regulatory initiatives affect us, our competitors, our managed investment products and our customers. These changes could have an effect on our revenue and profitability, limit our ability to pursue business opportunities, impact the value of assets that we hold, require us to change certain business practices, impose additional costs on us, require us to raise and hold additional equity capital and otherwise adversely affect its business. Accordingly, we cannot provide assurance that legislation and regulation will not eventually have an adverse effect on our business, results of operations, cash flows and financial condition.

Our financial and operational controls may not be adequate. As we expand our business, there can be no assurance that financial controls, the level and knowledge of personnel, operational abilities, legal and compliance controls and other corporate support systems will be adequate to manage our business and growth. The ineffectiveness of any of these controls or systems could adversely affect our business and prospects. In addition, if we acquire new businesses and introduce new products, we face numerous risks and uncertainties integrating their controls and systems, including financial controls, accounting and data processing systems, management controls and other operations. A failure to integrate these systems and controls, and even an inefficient integration of these systems and controls, could adversely affect our business and prospects.

From time to time we are subject to litigation, for which we may be unable to accurately assess our level of exposure and which if adversely determined, may have a significant adverse effect on our consolidated financial condition or results of operations. We are and may become parties to legal proceedings that are considered to be either ordinary, routine litigation incidental to our business or not significant to our consolidated financial position or liquidity. Although our current assessment is that, other than as disclosed in this report, there is no pending litigation that could have a significant adverse impact, if our assessment proves to be in error, then the outcome of litigation could have a significant impact on our financial statements.

We have identified a material weakness in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements. Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act. As disclosed in Item 9A, management identified a material weakness in our internal control over financial reporting related to the application of ASC 740-20 allocating taxes between continuing operations and discontinued operations. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial

9

statements will not be prevented or detected on a timely basis. As a result of this material weakness, our management concluded that our internal control over financial reporting was not effective based on criteria set forth by the Committee of Sponsoring Organization of the Treadway Commission (COSO) in Internal Control—An Integrated Framework (2013). We are actively engaged in developing a remediation plan designed to address this material weakness. If our remedial measures are insufficient to address the material weakness, or if additional material weaknesses or significant deficiencies in our internal control are discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results.

Risks Relating to Our Common Stock

Our common stock is subject to transfer restrictions. We have significant NOLs and other tax attributes, the amount and availability of which are subject to certain qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of the tax attributes, our certificate of incorporation contains provisions that generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of 5% or more of our common stock and the ability of persons or entities now owning 5% or more of our common shares from acquiring additional common shares. The restriction will remain until the earliest of (1) the repeal of Section 382 of the Code or any successor statute if our board of directors determines that the restriction on transfer is no longer necessary or desirable for the preservation of tax benefits, (2) the close of business on the first day of a taxable year as to which our board of directors determines that no tax benefits may be carried forward, (3) such date as our board of directors may fix for expiration of transfer restrictions and (4) January 29, 2018. The restriction may be waived by our board of directors on a case by case basis. You are advised to carefully monitor your ownership of our common shares and consult your own legal advisors and/or us to determine whether your ownership of our common shares approaches the proscribed level.

We also have a tax benefits preservation rights plan that would be triggered if any person acquires 4.99% or more of our common stock without prior approval by our board of directors. Holders of more than 4.99% of our common stock on the day the rights plan was adopted were exempted from this limitation as to the number shares they held at the time of adoption of the rights plan.

Anti-takeover provisions contained in our certificate of incorporation and bylaws, as well as provisions of Delaware law, could impair a takeover attempt. Our certificate of incorporation, bylaws and Delaware law contain provisions that could have the effect of rendering more difficult or discouraging an acquisition deemed undesirable by our board of directors. Our corporate governance documents include provisions:

|

· |

authorizing blank check preferred stock, which could be issued with voting, liquidation, dividend and other rights superior to our common stock; |

|

· |

limiting the liability of, and providing indemnification to, our directors and officers; |

|

· |

limiting the ability of our stockholders to call and bring business before special meetings and to take action by written consent in lieu of a meeting; |

|

· |

requiring advance notice of stockholder proposals for business to be conducted at meetings of our stockholders and for nominations of candidates for election to our board of directors; |

|

· |

controlling the procedures for the conduct and scheduling of board of directors and stockholder meetings; |

|

· |

limiting the ability for persons to acquire 4.99% or more of our common stock; |

|

· |

providing our board of directors with the express power to postpone previously scheduled annual meetings and to cancel previously scheduled special meetings; |

|

· |

limiting the determination of the number of directors on our board of directors and the filling of vacancies or newly created seats on the board to our board of directors then in office; and |

|

· |

providing that directors may be removed by stockholders only for cause. |

These provisions, alone or together, could delay hostile takeovers and changes in control of our company or changes in our management.

As a Delaware corporation, we are also subject to provisions of Delaware law, including Section 203 of the Delaware General Corporation Law, which prevents some stockholders holding more than 15% of our outstanding common stock from engaging in certain business combinations without approval of the holders of substantially all of our outstanding common stock.

10

Any provision of our amended and restated certificate of incorporation or bylaws or Delaware law that has the effect of delaying or deterring a change in control could limit the opportunity for our stockholders to receive a premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our common stock.

Item 1B. Unresolved Staff Comments.

None.

We currently lease office space in Los Altos, California and Reno, Nevada. We expect to exit those leases as soon as practicable. We are in the process of relocating our corporate headquarters to the Boston, Massachusetts area where we will co-locate with MAST Capital.

In the case captioned Unwired Planet International Limited, as Claimant, and Huwawei Technologies Co., Limited, Huawei Technologies (UK) Co., Limited, Samsung Electronics Co., Limited and Samsung Electronics (UK) Limited, as Defendants, in which Unwired Planet, Inc. was named as a party (Case No: HP-2014-00005), in the High Court of Justice, Chancery Division, Patents Court of England, the Defendants assert that we violated European Union competition law in entering into a master sale agreement with Telefonaktiebolaget L. M. Ericsson. We entered into a joint defense agreement with our divested patent subsidiaries and Optis. Those parties are leading the defense of this case. We believe the allegations against us are without merit, but we cannot assure you that we will not incur liability under the claims in this case.

We were awarded summary judgement in a breach of contract action captioned Unwired Planet, Inc. v. Microsoft Corporation (Civ. 14-967-SLR) in the United States District Court of and for the State of Delaware. Microsoft has appealed that decision to the United States Court of Appeals for the Third Circuit (0:16-cv-03140). If that decision is reversed on appeal and we were to subsequently lose the case, we may be liable for Microsoft’s legal fees in that matter.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Record Holders

As of July 19, 2016, there were 173 record holders of our common stock.

Dividends

We did not pay dividends during the fiscal years ended June 30, 2016, 2015, or 2014. We do not currently intend to pay dividends. The payment of dividends in the future is subject to the discretion of our board of directors and will depend upon general business conditions, legal and contractual restrictions on the payment of dividends and other factors that our board of directors may deem to be relevant.

Restrictions on Ownership

We have significant NOL carryforwards and other tax attributes, the amount and availability of which are subject to qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of our tax attributes, our certificate of incorporation contains provisions which generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of five percent or more of the common shares and the ability of persons or entities now owning five percent or more of the common shares

11

from acquiring additional common shares. We also have a tax benefits preservation rights plan that restricts ownership of 4.99% or more of our outstanding shares of common stock. Our board of directors has granted a waiver for the MAST Funds to own up to 19.9% of our common stock. Persons that owned more than 4.99% of our common stock when the rights plan was adopted were grandfathered as to their then-current holdings of our common stock.

Trading Prices

Our common stock is traded on the Nasdaq Global Select Market. Our common stock traded under the symbol “UPIP” until June 17, 2016 when it began trading under the symbol “GEC.” On January 5, 2016, we effected a one for twelve stock split. All share numbers in this report have been retroactively restated to give effect to the 1:12 reverse stock split. The following table shows the high and low trading price during the applicable period as reported by Bloomberg LP.

|

Fiscal Period |

|

Low |

|

High |

|

||

|

2016 |

|

|

|

|

|

|

|

|

Fourth quarter |

|

$ |

5.45 |

|

$ |

10.10 |

|

|

Third quarter |

|

$ |

8.44 |

|

$ |

11.31 |

|

|

Second quarter |

|

$ |

8.11 |

|

$ |

12.96 |

|

|

First quarter |

|

$ |

7.20 |

|

$ |

10.32 |

|

|

|

|

|

|

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

Fourth quarter |

|

$ |

6.60 |

|

$ |

9.59 |

|

|

Third quarter |

|

$ |

6.86 |

|

$ |

12.60 |

|

|

Second quarter |

|

$ |

10.18 |

|

$ |

21.84 |

|

|

First quarter |

|

$ |

22.32 |

|

$ |

27.00 |

|

|

|

|

|

|

|

|

|

|

|

2014 |

|

|

|

|

|

|

|

|

Fourth quarter |

|

$ |

24.00 |

|

$ |

27.72 |

|

|

Third quarter |

|

$ |

15.48 |

|

$ |

26.04 |

|

|

Second quarter |

|

$ |

15.36 |

|

$ |

23.16 |

|

|

First quarter |

|

$ |

20.04 |

|

$ |

25.44 |

|

12

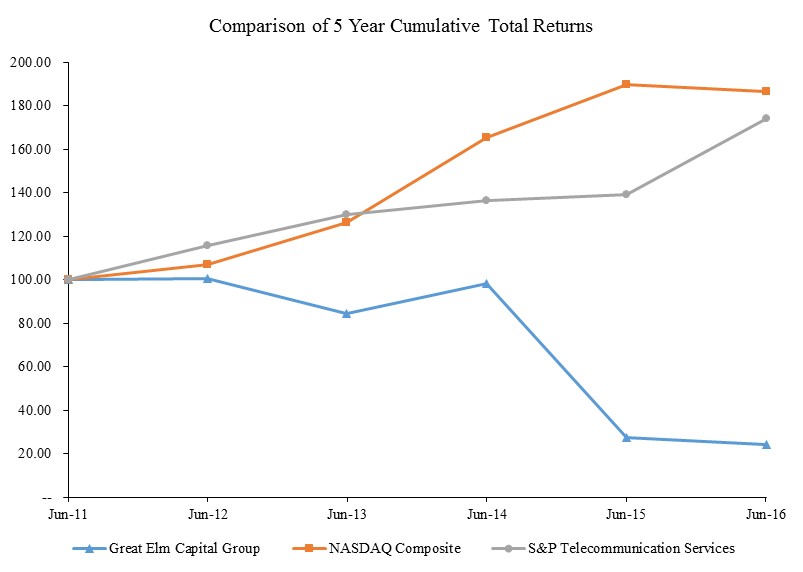

Performance Graph

|

*$100 invested on June 30, 2011 in stock or index, including reinvestment of dividends. |

|

Fiscal year ending June 30. |

|

|

|

Copyright 2015 S&P, a division of McGraw Hill Financial. All rights reserved. |

Stock Purchases

None

Item 6. Selected Financial Data.

The following selected financial data should be read in conjunction with our consolidated financial statements and related notes thereto and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7.

13

The following table sets forth selected consolidated statement of operations and consolidated balance sheet data, revised to reflect discontinued operations, for the 2016, 2015, 2014, 2013, and 2012 fiscal years (in thousands, except per share data):

|

|

|

Fiscal Year ended June 30, |

|

|||||||||||||

|

|

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

2012 |

|

|||||

|

Selected Consolidated Statements of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

Operating expenses |

|

|

9,835 |

|

|

8,040 |

|

|

5,709 |

|

|

14,965 |

|

|

5,338 |

|

|

Operating loss from continuing operations |

|

|

(9,835) |

|

|

(8,040) |

|

|

(5,709) |

|

|

(14,965) |

|

|

(5,338) |

|

|

Loss from continuing operations |

|

|

(9,440) |

|

|

(12,196) |

|

|

(5,592) |

|

|

(15,153) |

|

|

(4,518) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from discontinued operations, net of tax |

|

|

(5,830) |

|

|

(29,563) |

|

|

6,025 |

|

|

(24,676) |

|

|

(31,209) |

|

|

Gain (loss) on sale of discontinued operations |

|

|

24,692 |

|

|

— |

|

|

— |

|

|

(7,784) |

|

|

50,294 |

|

|

Total income (loss) from discontinued operations |

|

|

18,862 |

|

|

(29,563) |

|

|

6,025 |

|

|

(32,460) |

|

|

19,085 |

|

|

Net income (loss) |

|

$ |

9,422 |

|

$ |

(41,759) |

|

$ |

433 |

|

$ |

(47,613) |

|

$ |

14,567 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(1.00) |

|

$ |

(1.31) |

|

$ |

(0.62) |

|

$ |

(2.00) |

|

$ |

(0.63) |

|

|

Discontinued operations |

|

$ |

2.00 |

|

$ |

(3.17) |

|

$ |

0.67 |

|

$ |

(4.29) |

|

$ |

2.65 |

|

|

Net income (loss) per share |

|

$ |

1.00 |

|

$ |

(4.48) |

|

$ |

0.05 |

|

$ |

(6.29) |

|

$ |

2.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing basic and diluted earnings (loss) per share: |

|

|

9,412 |

|

|

9,332 |

|

|

8,999 |

|

|

7,570 |

|

|

7,196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, |

|

|||||||||||||

|

|

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

2012 |

|

|||||

|

Selected Consolidated Balance Sheets Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

80,711 |

|

$ |

73,755 |

|

$ |

93,877 |

|

$ |

47,613 |

|

$ |

39,709 |

|

|

Investments (1) |

|

$ |

— |

|

$ |

11,713 |

|

$ |

51,813 |

|

$ |

10,793 |

|

$ |

53,283 |

|

|

Total assets |

|

$ |

81,751 |

|

$ |

88,884 |

|

$ |

150,441 |

|

$ |

78,238 |

|

$ |

97,493 |

|

|

Fee share obligation (3) |

|

$ |

— |

|

$ |

500 |

|

$ |

20,032 |

|

$ |

— |

|

$ |

— |

|

|

Deferred revenue (2) |

|

$ |

— |

|

$ |

29,567 |

|

$ |

33,571 |

|

$ |

— |

|

$ |

— |

|

|

Related party note payable |

|

$ |

34,670 |

|

$ |

29,874 |

|

$ |

25,693 |

|

$ |

22,096 |

|

$ |

— |

|

|

Stockholders' equity |

|

$ |

36,821 |

|

$ |

23,504 |

|

$ |

63,071 |

|

$ |

43,927 |

|

$ |

68,629 |

|

|

(1) |

Includes short and long-term investments. |

|

(2) |

Includes current and non-current deferred revenue. These amounts have been reclassified to liabilities related to assets sold in the accompanying consolidated balance sheets. |

|

(3) |

Includes current and non-current fee share obligation. These amounts have been reclassified to liabilities related to assets sold in the accompanying consolidated balance sheets. |

14

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with, and is qualified entirely by, our consolidated financial statements (including Notes to the Consolidated Financial Statements) and the other consolidated financial information appearing elsewhere in this report. In addition to historical financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risk and uncertainties. Actual results and timing of events could differ from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview

Until the fourth quarter of the fiscal year ended June 30, 2016, we conducted an intellectual property licensing business drawing upon a portfolio of approximately 2,500 patent assets with a goal of generating revenue by selling and licensing our patents. In 2013, we combined our legacy intellectual property assets together with over 2,000 patent assets acquired from Telefonaktiebolaget LM Ericsson and one of its subsidiaries (collectively, Ericsson). Our patent licensing operations and holding of the underlying patents were conducted through our wholly-owned subsidiaries.

In April 2016, we entered into an agreement to divest our patent licensing operations. That transaction closed on June 30, 2016. We have restated our financial statements to account for the patent licensing component of our operations as discontinued operations.

Our goal is to build a diversified holding company focused on return on investment and long-term value creation. Our first investment in furtherance of this goal is our transaction with Full Circle. We have invested $30 million in GECC which as of June 30, 2016 was our wholly-owned subsidiary. Our GECM subsidiary will be GECC's external investment advisor, and we expect that costs against GECMs investment management fee stream to be in the range 45% to 65% of revenue which is expected to result in recurring free cash flows and taxable income in the future.

We are embarking on a program of creating bespoke financial products and creating an active pipeline of acquisition opportunities. These efforts are currently constrained by our capital resources and we expect to access the equity and debt markets as opportunities present themselves.

On September 13, 2016, we called our Senior Secured Notes due 2019 (the Notes) for redemption and announced a proposed $45.0 million rights offering (together with a $36.6 million backstop commitment).

Critical Accounting Policies and Judgments

There are several accounting policies that are critical to understanding our historical business, as these policies affected the reported amounts of revenue and other significant areas that involve management judgment and estimates. A description of the policies requiring significant management judgment and estimation are as follows:

Revenue Recognition

The timing and amount of revenue recognized from each licensee depended upon a variety of factors, including the specific terms of each agreement and the nature of the deliverables and obligations. These agreements can be complex and include multiple elements. These agreements included, without limitation, elements related to the settlement of past patent infringement liabilities, up-front and non-refundable license fees for the use of our patents, patent licensing royalties on covered products sold by customers, and settlement of intellectual property enforcement. We elected to use a lease-based model for revenue recognition associated with term licenses, with revenue being recognized over the expected period of benefit to the licensee. We have received one or a combination of the following forms of payment as consideration for permitting our licensees to use our patented ideas in their applications and products:

Consideration for Past Patent Royalties. Consideration related to a customer’s product sales from prior periods may result from a negotiated agreement with a customer that utilized our patented ideas before signing a patent license agreement with us or in connection with the settlement of patent litigation where there was no prior patent license agreement. In these

15

cases, we recorded the consideration as revenue when we obtained a signed agreement, identified a fixed or determinable price and determine that collectability was reasonably assured.

Prepaid Royalty Payments. These are up-front, non-refundable royalty payments that fulfill a customer’s obligation to us under a patent license agreement for a specified time period, for sales in certain countries, or a combination thereof. We recognized revenues related to prepaid royalty payments on a straight line basis over the effective term of the license. We utilized the straight-line method because we could not reliably predict in which periods, within the term of a license, the licensee would benefit from the use of our patents. Our customers’ obligations to pay royalties typically extend beyond the exhaustion of their prepayment balance. Once a customer exhausts its prepayment balance, they were required to make current royalty payments.

Current Royalty Payments. These are royalty payments covering a customer’s obligations to us related to authorized making, selling, using, offering for sale, importing or selling of covered products in the current contractual reporting period. Customers that owed us current royalty payments were obligated to provide us with quarterly or semi-annual royalty reports that summarize their royalty bearing products and their related royalty obligations to us. We were entitled to receive these royalty reports subsequent to the period in which our customer’s royalty bearing sales have occurred. Consequently, we believed it was impractical for us to recognize revenue in the period in which the royalty bearing sales occur and we recognized revenue in the period in which the royalty report is received and other revenue recognition criteria are met due to the fact that without royalty reports from our licensees, we could not reasonably estimate our customers’ current royalty obligation for the period.

Payments Received with Refund Provisions. These are payments typically made by a seller of products that utilized our patented inventions, which required a refund of some or all of the payment made to us if specified agreements were entered into between us and specified third parties. We recognized revenue in respect of such payments received with refund provisions when a contingency related to a potential refund event was resolved.

Patent Sales. We recognized revenue from the sales of our intellectual property when there was persuasive evidence of a sales arrangement, the sales price was fixed or determinable, delivery has occurred, and collectability was reasonably assured. These requirements were generally fulfilled upon closing of a patent sale transaction.

Summary of Results for the Fiscal Years ended June 30, 2016, 2015, and 2014

As a result of divestiture of the patent licensing component of our business, the results related to these activities have been reclassified to discontinued operations, inclusive of the recognized gain on the disposal, for all periods presented in the accompanying consolidated statements of operations. The following table illustrates (in thousands) the material items of discontinued operations as reclassified in each fiscal year ended June 30:

|

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

Net revenue |

|

$ |

27,826 |

|

$ |

4,505 |

|

$ |

36,396 |

|

Patent licensing expenses |

|

|

(30,780) |

|

|

(31,069) |

|

|

(23,008) |

|

General and administrative expenses |

|

|

(2,876) |

|

|

(2,989) |

|

|

(4,266) |

|

Other non-significant expenses |

|

|

— |

|

|

(10) |

|

|

(29) |

|

Gain (loss) from discontinued operations |

|

|

(5,830) |

|

|

(29,563) |

|

|

9,093 |

|

Gain on sale of discontinued operations |

|

|

29,795 |

|

|

— |

|

|

— |

|

Total pretax gain (loss) on discontinued operations |

|

|

23,965 |

|

|

(29,563) |

|

|

9,093 |

|

Income tax benefit (expense) |

|

|

(5,103) |

|

|

— |

|

|

(3,068) |

|

Net gain (loss) from discontinued operations |

|

$ |

18,862 |

|

$ |

(29,563) |

|

$ |

6,025 |

Net Revenues, Discontinued Operations

Our recognized revenues for the periods presented were substantially derived from licensing and selling of our intellectual property in two significant transactions with Lenovo that closed in April 2014. The fluctuations in net revenue year over year were the result of timing differences related to recognizing the individual accounting components associated with the Lenovo transaction. During the fiscal year ended June 30, 2016 we recognized net revenue of $27.8 million, representing non-cash revenue equal to all of the remaining deferred revenue of the Lenovo contract, as a result of the disposal of our intellectual property portfolio and corresponding performance obligations. The 88% decrease for the fiscal year ended

16

June 30, 2015 from the same period ended 2014 resulted from non-recurring patent sales and past patent royalties recognized in 2014 upon entry into the Lenovo contract.

Patent Licensing Expense, Discontinued Operations

Patent licensing expenses included legal and consulting costs related to technical and economic evaluation, licensing, maintaining, and defending or asserting our patents, as well as salary and benefit expenses and travel expenses for our employees that were engaged in the activities on a full-time basis. From mid calendar 2013 through the fourth quarter of our 2016 fiscal year, we incurred significant expenses associated with our patent licensing efforts, the majority which related to enforcement litigation.

As it relates to patent licensing for the 2016 fiscal year, the majority of our enforcement and litigation efforts were centered around six trials primarily taking place in the United Kingdom and Germany. In addition, we continued our breach of contract action against Microsoft domestically. Our litigation costs and expenses fluctuated in relation to various court rulings outside of our control.

Throughout fiscal 2016 we experienced limited successes abroad resulting in the recognition of litigation fee reimbursements totaling approximately $3.0 million which were immediately offset by rulings in favor of the defendants in trials in the United Kingdom totaling approximately $3.1 million.

On June 15, 2016 we were awarded a summary judgment in our enforcement efforts against Microsoft. That decision is subject to Microsoft’s pending appeal. If we are successful at collecting the proceeds from the summary judgements, we will be required to split such proceeds with Ericsson and with Optis.

General and Administrative Expenses, Discontinued Operations