Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Great Elm Capital Group, Inc. | gec-ex321_12.htm |

| EX-32.1 - EX-32.1 - Great Elm Capital Group, Inc. | gec-ex321_7.htm |

| EX-31.2 - EX-31.2 - Great Elm Capital Group, Inc. | gec-ex312_9.htm |

| EX-31.1 - EX-31.1 - Great Elm Capital Group, Inc. | gec-ex311_8.htm |

| EX-23.3 - EX-23.3 - Great Elm Capital Group, Inc. | gec-ex233_334.htm |

| EX-23.2 - EX-23.2 - Great Elm Capital Group, Inc. | gec-ex232_331.htm |

| EX-23.1 - EX-23.1 - Great Elm Capital Group, Inc. | gec-ex231_333.htm |

| EX-21.1 - EX-21.1 - Great Elm Capital Group, Inc. | gec-ex211_14.htm |

| EX-10.41 - EX-10.41 - Great Elm Capital Group, Inc. | gec-ex1041_151.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2018

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ________

Commission file number: 001-16073

GREAT ELM CAPITAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

94-3219054 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

800 South Street, Suite 230 Waltham, MA |

|

02453 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (617) 375-3006

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common stock, par value $0.001 per share |

|

The Nasdaq Stock Market LLC |

|

|

|

(Nasdaq Global Select Market) |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☐ |

Large accelerated filer |

☒ |

Accelerated filer |

|

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

|

|

|

☐ |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $87.6 million as of December 31, 2017. Shares of common stock held by persons who are not directors or executive officers, including persons who own more than 5% of the outstanding shares of common stock, are included in that such persons are not deemed to be affiliates for purpose of this calculation.

As of September 4, 2018 , there were 25,903,000 outstanding shares of the registrant’s common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement (the “Proxy Statement”), which will be filed with the SEC within 120 days following June 30, 2018, in connection with the registrant’s 2018 annual meeting of stockholders, to be held on October 16, 2018, are incorporated by reference into Part III of this report.

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

2 |

|

|

Item 1A. |

|

|

4 |

|

|

Item 1B. |

|

|

14 |

|

|

Item 2. |

|

|

14 |

|

|

Item 3. |

|

|

15 |

|

|

Item 4. |

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

15 |

|

|

Item 6. |

|

|

17 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

18 |

|

Item 7A. |

|

|

30 |

|

|

Item 8. |

|

|

30 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

30 |

|

Item 9A. |

|

|

31 |

|

|

Item 9B. |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

36 |

|

|

Item 11. |

|

|

36 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

36 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

36 |

|

Item 14. |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

36 |

|

|

Item 16 |

|

|

36 |

|

|

|

|

|

|

|

|

|

37 |

|||

|

|

41 |

|||

|

|

F-1 |

|||

|

|

|

|

||

i

Unless the context otherwise requires, “we,” “us,” “our,” the “Company,” “Great Elm” and terms of similar import refer to Great Elm Capital Group, Inc. and/or its subsidiaries.

Cautionary Statement Regarding Forward-Looking Information

This report and certain information incorporated herein by reference contain forward-looking statements under the Private Securities Litigation Reform Act of 1995. Such statements often include words such as “may,” “will,” “should,” “believe,” “expect,” “seek,” “anticipate,” “intend,” “estimate,” “plan,” “target,” “project,” “forecast,” “envision” and other similar phrases. Although we believe the assumptions and expectations reflected in these forward-looking statements are reasonable, these assumptions and expectations may not prove to be correct, and we may not achieve the financial results or benefits anticipated. These forward-looking statements are not guarantees of actual results. Our actual results may differ materially from those suggested in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control, including, without limitation:

|

|

▪ |

our ability to profitably manage Great Elm Capital Corp. (NASDAQ: GECC); |

|

|

▪ |

our ability to grow our investment management business; |

|

|

▪ |

our ability to grow our real estate business; |

|

|

▪ |

our ability to raise capital to fund our business plan; |

|

|

▪ |

our ability to create a merchant banking business; |

|

|

▪ |

our ability to make acquisitions and manage any businesses we acquire; |

|

|

▪ |

conditions in the equity capital markets and debt capital markets as well as the economy generally; |

|

|

▪ |

our ability to maintain the security of electronic and other confidential information; |

|

|

▪ |

serious disruptions and catastrophic events; |

|

|

▪ |

competition, mostly from larger, well-financed organizations (both domestic and foreign), including operating companies, global asset managers, investment banks, commercial banks, and private equity funds; |

|

|

▪ |

the transformation of our board of directors (Board) and executive leadership; |

|

|

▪ |

our ability to attract, assimilate and retain key personnel; |

|

|

▪ |

compliance with laws, regulations and orders; |

|

|

▪ |

changes in laws and regulations; |

|

|

▪ |

outcomes of litigation and proceedings and the availability of insurance, indemnification and other third-party coverage of any losses suffered in connection therewith; and |

|

|

▪ |

other factors described under “Risk Factors” or as set forth from time to time in our Securities and Exchange Commission (SEC) filings. |

These forward-looking statements speak only as of the time of filing of this report and we do not undertake to update or revise them as more information becomes available. You are cautioned not to place undue reliance on these forward-looking statements. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated events.

1

Overview

Great Elm has continued our transformation over the past year. We:

|

|

▪ |

expanded our investment management business; |

|

|

▪ |

closed on our first real estate business opportunity; and |

|

|

▪ |

explored a number of acquisition and investment opportunities and in September 2018, we closed on our first operating company acquisition. For additional information see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

Our goal is to build a diversified holding company focused on generating attractive risk-adjusted returns on investment and long-term value creation. We will accomplish this principally through:

|

|

▪ |

continuous review of acquisitions of businesses, securities and assets that generate attractive risk-adjusted returns and exhibit the potential for significant long-term value creation; |

|

|

▪ |

effective use of the skills of our team, our financial resources, including our tax assets, our willingness to create bespoke solutions and our ability to prudently assume risks; and |

|

|

▪ |

evaluating the retention and disposition of our operations and holdings. |

In February 2018, we expanded our investment management business through agreements to provide investment advisory services to a group of separately managed accounts (SMA). This grows the investment management business previously established in connection with the launch of GECC in 2016. Additionally, in March 2018 we started our real estate business and made our first real estate acquisition, an 80.1% interest in CRIC IT Fort Myers LLC, through Great Elm FM Holdings, Inc., a majority-owned subsidiary.

We continue to explore other opportunities in the investment management and real estate businesses including, but not limited to, transactions with other business development companies (BDCs) that trade at a discount to their net asset value, as well as the creation of closed-end investment vehicles.

As of June 30, 2018, we had approximately $1.7 billion of net operating loss (NOL) carryforwards for Federal income tax purposes.

For financial information regarding our reportable business segments, see “Item 6. Selected Financial Data.”

Our corporate headquarters is located at 800 South Street, Suite 230, Waltham, Massachusetts 02453 and our phone number is (617) 375-3006. Our corporate website address is www.greatelmcap.com. The information contained in, or accessible through, our corporate website does not constitute part of this report. We are a Delaware corporation that was incorporated in 1994 and completed our initial public offering in 1999.

Our Divested Patent Business

On April 6, 2016, we entered into a purchase and sale agreement with Optis UP Holdings, LLC (Optis) providing for the sale of the entities that conducted our patent licensing business (the Divestiture). The Divestiture was completed on June 30, 2016.

In the Divestiture, we received $34.2 million in gross cash proceeds, inclusive of reimbursement of $4.2 million of agreed upon expenses, and may be entitled to up to an additional $10 million cash payment due on June 30, 2018. Optis has claimed that it has losses indemnifiable under the purchase and sale agreement in excess of the $10 million contractual payment. As of June 30, 2018, the Company is in active discussions with Optis regarding final payment terms. As a result, we have not recognized any portion of the $10 million in the accompanying consolidated financial statements for the periods presented. Our legacy patent licensing business is reflected in our financial statements as discontinued operations.

Great Elm Capital Corp. ― Our Investment Management Business

We decided to invest in the asset management business because of our assessment of its ability to generate recurring free cash flows, its growth prospects and our Board’s and employees’ industry expertise.

2

GECC was established in 2016 and obtained its initial portfolio of investments in November 2016 through a merger (the Merger) with Full Circle Capital Corporation (Full Circle) and an in-kind contribution from certain private investment funds (the MAST Funds) managed by Mast Capital Management, LLC (MAST Capital), along with $30 million cash contributed by the Company. At this time, GECC elected to be treated as a BDC under the Investment Company Act of 1940, as amended (the Investment Company Act).

Great Elm Capital Management, Inc., our wholly-owned registered investment adviser subsidiary (GECM), is the external investment adviser to GECC. In connection with the November 2016 contribution by the MAST Funds, GECM hired all of the employees of MAST Capital, acquired the entire infrastructure used by our GECM team, and established a cost sharing agreement with MAST Capital.

In September 2017, we entered into a separation agreement that separated our business from MAST Capital (Separation Agreement) which restructured many of these arrangements.

GECC and GECM entered into an investment management agreement in September 2016, whereby GECM is entitled to:

|

|

▪ |

management fees measured by GECC’s gross assets (other than cash and cash equivalents, including investments in money market funds); |

|

|

▪ |

an incentive fee if GECC’s net investment income (NII) exceeds a hurdle rate; and |

|

|

▪ |

an incentive fee based on GECC’s capital gains. |

We also earn an administration fee based on the reimbursement of the portion of GECM’s expenses allocable to GECC.

We own approximately 18% of GECC’s shares that we may hold to generate dividends or sell to redeploy our capital in higher yielding opportunities. In September 2018, we transferred 668,306 of these shares to Great Elm DME Holdings, Inc., our wholly-owned subsidiary.

GECM is also the investment advisor to three SMAs and our newly launched credit fund, Great Elm Opportunity Fund, L.P. (GEOF).

Acquisition Program

GECM’s team also is developing an active acquisition program for us in the investment management business, in select opportunities in real estate and other industries through the acquisition of operating businesses. In the fiscal year ended June 30, 2018, we evaluated a number of opportunities in these areas.

Competition

We face competition from larger, well financed organizations (both domestic and foreign), including operating companies, global asset managers, investment banks, commercial banks, private equity funds, sovereign wealth funds and state owned enterprises. Government regulation is a key competitive factor.

Employees

We had 12 employees as of June 30, 2018.

3

Information about Great Elm on the Internet

The following documents and reports are available on or through our website as soon as reasonably practicable after we electronically file such materials with, or furnish to, the SEC:

|

|

▪ |

Code of Ethics; |

|

|

▪ |

Reportable waivers, if any, from our Code of Ethics by our executive officers; |

|

|

▪ |

Charter of the audit committee of our Board; |

|

|

▪ |

Charter of the nominating and corporate governance committee of our Board; |

|

|

▪ |

Charter of the compensation committee of our Board; |

|

|

▪ |

Annual reports on Form 10-K; |

|

|

▪ |

Quarterly reports on Form 10-Q; |

|

|

▪ |

Current reports on Form 8-K; |

|

|

▪ |

Proxy or information statements we send to our stockholders; and |

|

|

▪ |

Any amendments to the above-mentioned documents and reports. |

Our stockholders may also obtain a printed copy of any of these documents or reports free of charge by sending a request to Great Elm Capital Group, Inc., 800 South Street, Suite 230, Waltham, MA 02453; Attention: Investor Relations, or by calling (617) 375-3006.

Our business is subject to a number of risks. You should carefully consider the following risk factors, together with all of the other information included or incorporated by reference in this report, before you decide whether to invest in our securities. The following risks are not the only risks we face. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common shares could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We have a limited track record in the investment management and real estate businesses, and provide no assurance as to our acquisition and investment program. We entered the investment management business in November 2016 and we entered the real estate business in March 2018; consequently, there is limited historical information about our performance in either business on which to base your investment decision.

We have plans to make significant investments and will continue to explore opportunities in the investment management and real estate sectors, but cannot provide specificity as to our future investments or financing plans.

These and other factors, including the other risk factors described in this document, make it difficult for you and other market participants to value our company and our prospects. We are unaware of any comparable company that securities analysts can use to benchmark our performance and valuation. We cannot give any assurance that any of the uncertainties or risk factors in this document will be favorably resolved.

Our investment management agreements may be terminated. The investment management agreements (IMAs) we have through GECM (e.g., with GECC and the SMAs) may be cancelled at each counterparty’s discretion on 60 days’ notice for any reason or no reason. We do not control the board of directors of GECC or the SMAs, and they may cancel our respective IMA at their discretion without making any termination payment to us. GECM’s team investment performance is a key element of retaining this business. We have recorded an intangible asset attributable to the IMAs that is being amortized over a 15-year economic life even though the IMAs are cancellable by the respective counterparty without penalty or termination fee and are renewable annually through a process mandated under the Investment Company Act.

4

Our growth strategy may not be successful. The process to identify potential investment opportunities and acquisition targets, to investigate and evaluate the future returns therefrom and business prospects thereof and to negotiate definitive agreements with respect to such transactions on mutually acceptable terms can be time consuming and costly. We are likely to encounter intense competition from other companies with similar business objectives to ours, including private equity and venture capital funds, sovereign wealth funds, special purpose acquisition companies, investment firms with significantly greater financial and other resources and operating businesses competing for acquisitions. Many of these companies are well established, well financed and have extensive experience in identifying and effecting business combinations.

Because we will consider investments in different industries, you have no basis at this time to ascertain the merits or risks of any business that we may ultimately invest in. Our business strategy contemplates investment in one or more operating businesses. We are not limited to acquisitions and/or investments in any particular industry or type of business. Accordingly, there is no current basis for you to evaluate the possible merits or risks of the particular industry in which we may ultimately invest or the target businesses with which we may ultimately invest. We may not properly assess all of the significant risks present in that opportunity. Even if we properly assess those risks, some of them may be outside of our control or ability to affect. Except as required under the Nasdaq Stock Market LLC (Nasdaq) rules and applicable law, we will not seek stockholder approval of any investment that we may pursue, so you will most likely not be provided with an opportunity to evaluate the specific merits or risks of such a transaction before we become committed to the transaction.

Our business, financial condition and results of operations are dependent upon those of our individual businesses, and our aggregate investment in particular industries. We are a holding company that will make investments in businesses and assets in a number of industries. Our business, financial condition and results of operations are dependent upon our investments. Any material adverse change in one of our investments or in a particular industry in which we invest may cause material adverse changes to our business, financial condition and results of operations. Concentration of capital we devote to a particular investment or industry may increase the risk that such investment could significantly impact our financial condition and results of operations, possibly in a material adverse way. Our portfolio of investments will change from time to time.

We may not correctly assess the management teams of the businesses we invest in. The value of the businesses we invest in is driven by the quality of the leaders of those businesses. When evaluating the desirability of a prospective target business, our ability to assess the target business’ management may be limited due to a lack of time, resources or information. Our assessment of the capabilities of the target’s management, therefore, may prove to be incorrect and such management may lack the skills, qualifications or abilities we expected. Should the target’s management not possess the necessary skills, qualifications or abilities, the operations and profitability of that business will be negatively impacted. In addition, we may acquire private, non-public companies, with unsophisticated accounting operations and personnel.

Subsequent to an investment, we may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and our share price, which could cause you to lose some or all of your investment. Even if we conduct extensive due diligence on a target business that we invest in, we cannot assure you that this diligence will identify all material issues that may be present inside a particular target business, that it would be possible to uncover all material issues through a customary amount of due diligence, or that factors outside of the target business or outside of our control will not later arise. As a result of these factors, we may be forced to later write-down or write-off assets, restructure our operations, or incur impairment or other charges that could result in us reporting losses. Even if our due diligence successfully identifies certain risks, unexpected risks may arise and previously known risks may materialize in a manner not consistent with our preliminary risk analysis. Even though these charges may be non-cash items and not have an immediate impact on our liquidity, the fact that we report charges of this nature could contribute to negative market perceptions about us or our securities. In addition, charges of this nature may cause us to violate covenants under our debt agreements. Accordingly, you could suffer a significant reduction in the value of your shares.

5

Changing conditions in financial markets and the economy could impact us through decreased revenues, losses or other adverse consequences. Global or regional changes in the financial markets or economic conditions could adversely affect our business in many ways, including the following:

|

|

▪ |

Adverse changes in the market could also lead to a reduction in investment management fees and investment income from managed funds and losses on our own capital invested in managed funds. Even in the absence of a market downturn, below-market investment performance by our funds and portfolio managers could reduce asset management revenues and assets under management and result in withdrawal of fee-generating assets under management and reputational damage that might make it more difficult to attract new investors. |

|

|

▪ |

Limitations on the availability of credit, such as occurred during 2008, can affect our ability to borrow on a secured or unsecured basis, which may adversely affect our liquidity and results of operations. Global market and economic conditions have been disrupted and volatile in the last several years and may be in the future. Our cost and availability of funding could be affected by illiquid credit markets and wider credit spreads. |

|

|

▪ |

New or increased taxes on compensation payments or financial transactions may adversely affect our profits, if earned. Should one of our customers, debtors or competitors fail, our business prospects and revenue could be negatively impacted due to negative market sentiment causing customers to cease doing business with us and our lenders to cease extending credit to us, which could adversely affect our business, funding and liquidity. |

Difficult market conditions can adversely affect our asset management business in many ways, by reducing the value or performance of our funds (including our invested funds and funds invested by third parties) or by reducing the ability of our funds to raise or deploy capital, each of which could negatively impact our income and cash flow and adversely affect our financial condition. The build-out of our asset management business is affected by conditions in the financial markets and economic conditions and events throughout the world, such as interest rates, availability of credit, inflation rates, economic uncertainty, changes in laws and regulations, market perceptions and other factors. In addition, we made a substantial investment in GECC that has resulted in an unrealized losses as of June 30, 2018 of approximately 39% of our investment. Adverse changes could lead to a reduction in investment income, losses on our own capital invested and lower revenues from asset management fees. Such adverse changes may also lead to a decrease in new capital raised and may cause investors to withdraw their investments and commitments. Even in the absence of a market downturn, below market investment performance by our funds and portfolio managers could reduce asset management revenues and assets under management and result in reputational damage that may make it more difficult to attract new investors or retain existing investors.

Our ability to successfully grow our new business and to be successful thereafter will be dependent upon the efforts of our key personnel. The loss of key personnel could negatively impact the operations and profitability of our business. Our ability to successfully effect our growth strategy is dependent upon the efforts of our key personnel. The loss of our key personnel could severely negatively impact the operations and profitability of our business. We compete with many other entities for skilled management and staff employees, including entities that operate in different market sectors than us. Delays in recruiting and costs to recruit and retain adequate personnel could materially adversely affect results of operations.

6

We may issue notes or other debt securities, or otherwise incur substantial debt, which may adversely affect our leverage and financial condition and thus negatively impact the value of our stockholders’ investment in us. We may choose to incur substantial debt to finance our growth plans. The incurrence of debt could have a variety of negative effects, including:

|

|

▪ |

default and foreclosure on our assets if our operating cash flows are insufficient to repay our debt obligations; |

|

|

▪ |

acceleration of our obligations to repay the indebtedness even if we make all principal and interest payments when due if we breach covenants that require the maintenance of financial ratios or reserves without a waiver or renegotiation of that covenant; |

|

|

▪ |

our immediate payment of all principal and accrued interest, if any, if the debt is payable on demand; |

|

|

▪ |

our inability to pay dividends on our common stock; |

|

|

▪ |

using a substantial portion of our cash flow to pay principal and interest on our debt, which will reduce the funds available for dividends on our common stock (if declared), expenses, capital expenditures, acquisitions and other general corporate purposes; |

|

|

▪ |

limitations on our flexibility in planning for and reacting to changes in our business and in the industry in which we operate; |

|

|

▪ |

increased vulnerability to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation; and |

|

|

▪ |

limitation on our ability to borrow additional amounts for expenses, capital expenditures, acquisitions, debt service requirements, execution of our strategy and other purposes and other disadvantages compared to our competitors who have less debt. |

If we are deemed to be an investment company under the Investment Company Act, we may be required to institute burdensome compliance requirements and our activities may be restricted, which may make it difficult for us to execute our growth plans. Under the Investment Company Act, our activities may be restricted, including:

|

|

▪ |

restrictions on the nature of our investments, and |

|

|

▪ |

restrictions on the issuance of securities. |

Each of these may make it difficult for us to run our business. In addition, the law may impose upon us burdensome requirements, including:

|

|

▪ |

registration as an investment company; |

|

|

▪ |

adoption of a specific form of corporate structure; and |

|

|

▪ |

reporting, record keeping, voting, proxy and disclosure requirements and other rules and regulations. |

7

There are conflicts of interest involving MAST Capital and its affiliates, that own approximately 9.4% of the Company’s outstanding stock, and are participants in material transactions. These conflicts of interest, include, among others:

|

|

▪ |

Funds managed by MAST Capital are our largest stockholder and appointed two members of our Board; |

|

|

▪ |

Funds managed by MAST Capital owned all of our previously outstanding senior secured notes which we settled in October 2016 for total cash payments of approximately $39.8 million; |

|

|

▪ |

Peter A. Reed was a partner in MAST Capital, became our Chief Executive Officer in September 2017, is a member of our Board, Chief Executive Officer of GECC and Chief Investment Officer of GECM; |

|

|

▪ |

Adam M. Kleinman was a partner in MAST Capital, became our President and Chief Operating Officer in March 2018, is Chief Compliance Officer of GECC and Chief Operating Officer, Chief Compliance Officer and General Counsel of GECM; |

|

|

▪ |

In connection with hiring the MAST Capital team, we took over a substantial portion of the operating expenses of MAST Capital and those transactions were restructured in September 2017; |

|

|

▪ |

We assumed certain of MAST Capital’s commercial contracts, leases and other obligations; and |

|

|

▪ |

MAST Capital will receive compensation in connection with GECC’s business through its equity ownership of GECC GP Corp. (GP Corp.) and a note payable of GP Corp. |

These conflicts of interest may result in arrangements that are not as favorable to us as those available on an arms-length basis. The significant ownership stake held by the MAST Funds may result in MAST Capital having undue influence over our affairs. These conflicts of interests may adversely affect the perception of our company, the value of our common stock or the willingness of new investors to invest in us.

Our officers and directors may become aware of business opportunities which may be appropriate for presentation to us and the other entities to which they owe certain fiduciary or contractual duties. Accordingly, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. These conflicts may not be resolved in our favor and a potential target business may be presented to another entity prior to its presentation to us, subject to their fiduciary duties under applicable law.

We may engage in a business combination with one or more target businesses that have relationships with the MAST Funds, our executive officers, directors or existing holders which may raise potential conflicts of interest. In light of the involvement of our executive officers and directors with other entities in the investment management business and otherwise, we may decide to acquire or do business with one or more businesses affiliated with the MAST Funds or our executive officers and directors.

Our directors also serve as officers and board members for other entities. Such entities may compete with us. We could pursue an affiliate transaction if we determined that such affiliated entity met our criteria for a business combination and such transaction was approved by a majority of our disinterested directors. Potential conflicts of interest may exist, and, as a result, the terms of the business combination may not be as advantageous to our public stockholders as they would be absent any conflicts of interest.

8

Our initial investment through our real estate business includes property (the Property) leased pursuant to a long-term triple net lease and the failure of the tenant to satisfy its obligations under the lease may adversely affect the condition of the Property or the results of our real estate business segment. Because the Property is leased pursuant to a long-term triple net lease, we depend on the tenant to pay all insurance, taxes, utilities, common area maintenance charges, maintenance and repair expenses and to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities arising in connection with its business, including any environmental liabilities resulting from the tenant’s failure to comply with applicable environmental laws. There are no assurances that the tenant will have sufficient assets and income to enable it to satisfy its payment obligations to us under the lease. The inability or unwillingness of the tenant to meet its rent obligations could materially adversely affect the business, financial position or results of operations of our real estate business segment. Furthermore, the inability or unwillingness of the tenant to satisfy its other obligations under the lease, such as the payment of insurance, taxes and utilities, could materially and adversely affect the condition of the Property. Our triple net lease agreement requires that the tenant maintains comprehensive liability and all risk property insurance. However, there are certain types of losses (including losses arising from environmental conditions or of a catastrophic nature, such as earthquakes, hurricanes and floods) that may be uninsurable or not economically insurable. Insurance coverage may not be sufficient to pay the full current market value or current replacement cost of a loss. Inflation, changes in building codes and ordinances, environmental considerations, and other factors also might make it infeasible to use insurance proceeds to replace the Property after such property has been damaged or destroyed. In addition, if we experience a loss that is uninsured or that exceeds policy coverage limits, we could lose the capital invested in the Property as well as the anticipated future cash flows from the Property.

We are subject to risks inherent in ownership of real estate. Cash flows from our real estate business segment and real estate values are affected by a number of factors, including competition from other available properties and the ability to provide adequate property maintenance and insurance and to control operating costs. Cash flows from our real estate business segment and real estate values are also affected by such factors as governmental regulations (including zoning, usage and tax laws), property tax rates, utility expenses, potential liability under environmental and other laws and changes in environmental and other laws.

Natural disasters, terrorist attacks or other unforeseen events could cause damage to the property we currently own, or may in the future own, resulting in increased expenses and reduced revenues. Natural disasters, such as earthquakes, hurricanes and floods, or terrorist attacks could cause significant damage and require significant repair costs, and make the property we currently own, or may in the future own, temporarily uninhabitable, reducing our revenues. Damage and business interruption losses could exceed the aggregate limits of any insurance coverage we may have. We may not have sufficient insurance coverage for losses caused by a terrorist attack, or such insurance may not be maintained, available or cost-effective.

We may incur significant liabilities from environmental contamination. Existing or future laws impose or may impose liability on us to clean up environmental contamination on or around the property that we currently own, or may in the future own, even if we were not responsible for or aware of the environmental contamination or even if such environmental contamination occurred prior to our involvement with such property. From time to time, we may conduct environmental assessments, commonly referred to as “Phase 1 Environmental Reports,” on properties in which we are considering an investment. These assessments typically include an investigation (excluding soil or groundwater sampling or analysis) and a review of publicly available information regarding the site and other nearby properties. However, such environmental assessments may not identify all potential environmental liabilities.

We may face potential difficulties or delays renewing leases or re-letting space. We currently derive all of our real estate business income from rent received from a single tenant in connection with our initial investment in Class A office buildings in Fort Myers, FL. If the tenant experiences a downturn in its business or other types of financial distress, it may be unable to make timely rental payments. Also, in the event that the tenant does not renew the lease, we may not be able to re-let the space or there could be a substantial delay in re-letting the space. Even if the tenant decides to renew or lease new space, the terms of renewals or new leases, including the cost of required renovations or concessions, may be less favorable to us than the current lease term.

9

We face potential adverse effects from major tenant’s bankruptcy or insolvency. The bankruptcy or insolvency of a tenant may adversely affect the income produced by our property, or by any properties we may own in the future. Our tenant could file for bankruptcy protection or become insolvent in the future. A bankrupt tenant may reject and terminate its lease with us. In such case, our claim against the bankrupt tenant for unpaid and future rent would be subject to a statutory cap that might be substantially less than the remaining rent actually owed under the lease. This shortfall could adversely affect our cash flow and results of operations.

We face possible risks associated with the physical effects of climate change. The physical effects of climate change could have a material adverse effect on our properties, and consequently on our operations and business. For example, we have Class A office buildings located in southern Florida; to the extent climate change causes changes in weather patterns, that geographic area could experience increases in storm intensity and rising sea-levels. Over time, these conditions could result in declining demand for office space in our office buildings or our inability to operate the buildings at all. Climate change may also have indirect effects on our business by increasing the cost of (or making unavailable) property insurance on terms we find acceptable, increasing the cost of energy at the Property. There can be no assurance that climate change will not have a material adverse effect on our property, operations or business.

We depend upon personnel of our property manager. We do not have any internal real estate management capacity. We depend, and will depend in the future, on our property managers and their personnel to efficiently manage the day-to-day operations at certain of our properties; any difficulties our property managers encounter in hiring, training and retaining skilled personnel may adversely affect the income produced by our properties.

We may not be able to generate sufficient taxable income to fully realize our deferred tax asset, which would also have to be reduced if U.S. federal income tax rates are lowered. At June 30, 2018, we had net operating loss carryforwards of approximately $1.7 billion. If we are unable to generate sufficient taxable income, we will not be able to fully realize the full amount of the deferred tax asset. If we are unable to generate sufficient taxable income prior to the expiration of our U.S. federal net operating loss carryforwards, the net operating loss carryforwards would expire unused. Our projections of future taxable income required to fully realize the recorded amount of the gross deferred tax asset reflect numerous assumptions about our operating businesses and investments, and are subject to change as conditions change specific to our business units, investments or general economic conditions. Changes that are adverse to us could result in the need to increase the deferred tax asset valuation allowance resulting in a charge to results of operations and a decrease to stockholders’ equity. In addition, if U.S. federal income tax rates are lowered, we would be required to reduce our net deferred tax asset with a corresponding reduction to earnings during the period.

If our tax filing positions were to be challenged by federal, state and local or foreign tax jurisdictions, we may not be wholly successful in defending our tax filing positions. We record reserves for unrecognized tax benefits based on our assessment of the probability of successfully sustaining tax filing positions. Management exercises significant judgment when assessing the probability of successfully sustaining tax filing positions, and in determining whether a contingent tax liability should be recorded and, if so, estimating the amount. If our tax filing positions are successfully challenged, payments could be required that are in excess of reserved amounts or we may be required to reduce the carrying amount of our net deferred tax asset, either of which result could be significant to our financial position, cash balances and results of operations.

Catastrophic events (or a combination of events), such as terrorism/sabotage, or fire, as well as deliberate cyber terrorism, could adversely impact our financial performance. Our assets under management could be exposed to effects of catastrophic events, such as severe weather conditions, natural disasters, major accidents, acts of malicious destruction, sabotage or terrorism, which could adversely impact our operations.

Additionally, the perceived threat of a terrorist attack could negatively impact us. Any damage or business interruption costs as a result of uninsured or underinsured acts of terrorism could result in a material cost to us and could adversely affect our business, financial condition or results of operation. Adequate terrorism insurance may not be available at rates we believe are reasonable in the future. All of the risks indicated in this paragraph could be heightened by foreign policy decisions of the U.S. and other influential countries or general geopolitical conditions.

10

Losses not covered by insurance may be large, which could adversely impact our financial performance. We carry various insurance policies on our assets. These policies contain policy specifications, limits and deductibles that may mean that such policies do not provide coverage or sufficient coverage against all potential material losses. There are certain types of risk (generally of a catastrophic nature such as war or environmental contamination) which are either uninsurable or not economically insurable. Further, there are certain types of risk for which insurance coverage is not equal to the full replacement cost of the insured assets. Should any uninsured or underinsured loss occur, we could lose our investment in, and anticipated profits and cash flows from, one or more of our assets or operations.

We also carry directors and officers liability insurance (D&O insurance) for losses or advancement of defense costs in the event a legal action is brought against the company’s directors, officers or employees for alleged wrongful acts in their capacity as directors, officers or employees. Our D&O insurance contains certain customary exclusions that may make it unavailable for the company in the event it is needed; and in any case our D&O insurance may not be adequate to fully protect the company against liability for the conduct of its directors, officers or employees.

Increased competition may adversely affect our revenues, profitability and staffing. All aspects of our business are intensely competitive. We will compete directly with a number of business development companies, private equity funds, other financial institutions and special purpose acquisition companies. There has been increasing competition from others offering financial services, including services based on technological innovations. Increased competition or an adverse change in our competitive position could lead to a reduction of business and therefore a reduction of revenues and profits.

Competition also extends to the hiring and retention of highly skilled employees. A competitor may be successful in hiring away employees, which may result in us losing business formerly serviced by such employees. Competition can also increase our costs of hiring and retaining the employees we need to effectively operate our business. The financial services industry is subject to extensive laws, rules and regulations. Firms that engage in securities and derivatives trading, wealth and asset management and investment banking must comply with the laws, rules and regulations imposed by national and state governments and regulatory and self-regulatory bodies with jurisdiction over such activities. Such laws, rules and regulations cover all aspects of the financial services business, including, but not limited to, sales and trading methods, trade practices, use and safekeeping of customers’ funds and securities, capital structure, anti-money laundering and anti-bribery and corruption efforts, recordkeeping and the conduct of directors, officers and employees. Regulators will supervise our business activities to monitor compliance with laws, rules and regulations of the relevant jurisdiction. In addition, if there are instances in which our regulators question our compliance with laws, rules, and regulations, they may investigate the facts and circumstances to determine whether we have complied.

At any moment in time, we may be subject to one or more such investigation or similar reviews. There can be no assurance that our operations will not violate such laws, rules, or regulations and such investigations and similar reviews will not result in adverse regulatory requirements, regulatory enforcement actions and/or fines.

We may incur losses if our risk management is not effective. We seek to monitor and control our risk exposure. Our risk management processes and procedures are designed to limit our exposure to acceptable levels as we conduct our business. We intend to develop and apply a comprehensive framework of limits on a variety of key metrics to constrain the risk profile of our business activities. The size of the limit reflects our risk tolerance for a certain activity. The framework is expected to include investment position and exposure limits on a gross and net basis, scenario analysis and stress tests, value-at-risk, sensitivities, exposure concentrations, aged inventory, amount of Level 3 assets, counterparty exposure, leverage, cash capital, and performance analysis. While we intend to employ various risk monitoring and risk mitigation techniques, those techniques and the judgments that accompany their application, including risk tolerance determinations, cannot anticipate every economic and financial outcome or the specifics and timing of such outcomes. As a result, we may incur losses notwithstanding our risk management processes and procedures.

11

Operational risks may disrupt our business, result in regulatory action against us or limit our growth. Our businesses will be highly dependent on our ability to process, on a daily basis, transactions across numerous and diverse markets and the transactions we process have become increasingly complex. If any of our financial, accounting or other data processing systems do not operate properly or are disabled or if there are other shortcomings or failures in our internal processes, people or systems, we could suffer an impairment to our liquidity, a financial loss, a disruption of our businesses, liability to clients, regulatory intervention or reputational damage. These systems may fail to operate properly or become disabled as a result of events that are wholly or partially beyond our control, including a disruption of electrical or communications services or our inability to occupy one or more of our buildings. The inability of our systems to accommodate an increasing volume of transactions could also constrain our ability to expand our businesses.

Our financial and other data processing systems will rely on access to and the functionality of operating systems maintained by third parties. If the accounting, trading or other data processing systems on which we are dependent are unable to meet increasingly demanding standards for processing and security or if they fail or have other significant shortcomings, we could be adversely affected. Such consequences may include our inability to effect transactions and manage our exposure to risk.

In addition, our ability to conduct business may be adversely impacted by a disruption in the infrastructure that supports our businesses and the communities in which they are located. This may include a disruption involving electrical, communications, transportation or other services used by us or third parties with which we conduct business. Our operations will rely on the secure processing, storage and transmission of confidential and other information in our computer systems and networks. Our computer systems, software and networks may be vulnerable to unauthorized access, computer viruses or other malicious code, and other events that could have a security impact. Additionally, if a customer’s computer system, network or other technology is compromised by unauthorized access, we may face losses or other adverse consequences by unknowingly entering into unauthorized transactions. If one or more of such events occur, this potentially could jeopardize our, our customers’ or counterparties’ confidential and other information processed and stored in, and transmitted through, our computer systems and networks. Furthermore, such events may cause interruptions or malfunctions in our, our customers’, our counterparties’ or third parties’ operations, including the transmission and execution of unauthorized transactions.

We may be required to expend significant additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures, and we may be subject to litigation and financial losses that are either not insured against or not fully covered through any insurance maintained by us. The increased use of smartphones, tablets and other mobile devices as well as cloud computing may also heighten these and other operational risks. We and our third-party providers are the subject of attempted unauthorized access, computer viruses and malware, and cyber-attacks designed to disrupt or degrade service or cause other damage and denial of service. Additional challenges are posed by external parties, including foreign state actors. There can be no assurance that such unauthorized access or cyber incidents will not occur in the future, and they could occur more frequently and on a larger scale. Legal liability arising from such risks may harm our business. Many aspects of our business involve substantial risks of liability.

Our financial and operational controls may not be adequate. As we expand our business, there can be no assurance that financial controls, the level and knowledge of personnel, operational abilities, legal and compliance controls and other corporate support systems will be adequate to manage our business and growth. The ineffectiveness of any of these controls or systems could adversely affect our business and prospects. In addition, if we acquire new businesses and introduce new products, we face numerous risks and uncertainties integrating their controls and systems, including financial controls, accounting and data processing systems, management controls and other operations. A failure to integrate these systems and controls, and even an inefficient integration of these systems and controls, could adversely affect our business and prospects.

Recent legislation and new or pending regulation may significantly affect our business. In recent years, there has been significant legislation and increased regulation affecting the financial services industry. These legislative and regulatory initiatives affect us, our competitors, our managed investment products and our customers. These changes could have an effect on our revenue and profitability, limit our ability to pursue business opportunities, impact the value of assets that we hold, require us to change certain business practices, impose additional costs on us, and otherwise adversely affect its business. Accordingly, we cannot provide assurance that legislation and regulation will not eventually have an adverse effect on our business, results of operations, cash flows and financial condition.

12

We have identified material weaknesses in our internal control over financial reporting that could, if not remediated, result in material misstatements in our financial statements. In connection with the audit of our consolidated financial statements as of and for the year ended June 30, 2018, we have identified and concluded that we continue to have material weaknesses relating to our internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis. Refer to Part II, Item 9A in this Form 10-K for more details. While the material weaknesses described in that section creates a reasonable possibility that an error in financial reporting may go undetected, after extensive review and the performance of additional analysis and other procedures, no material adjustments, restatement or other revisions to our previously issued financial statements were required.

As further described in Part II, Item 9A of this form 10-K below, we are taking specific steps to remediate our material weaknesses that we identified by implementing and enhancing our internal control procedures. These material weaknesses will not be considered remediated until all necessary internal controls have been implemented, repeatably tested and determined to be operating effectively. In addition, we may need to take additional measures to address the material weakness or modify the remediation steps, and we cannot be certain that the measures we have taken, and expect to take, to improve our internal controls will be sufficient to address the issues identified, to ensure that our internal controls are effective or to ensure that the identified material weaknesses will not result in a material misstatement of our annual or interim consolidated financial statements.

Risks Relating to Our Common Stock

Our common stock is subject to transfer restrictions. We have significant net operating loss carryforwards and other tax attributes, the amount and availability of which are subject to certain qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of the tax attributes, our amended and restated certificate of incorporation (our certificate of incorporation) contains provisions that generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of 4.99% or more of our common stock and the ability of persons or entities now owning 5% or more of our common shares from acquiring additional common shares. The restriction will remain until the earliest of (1) the repeal of Section 382 of the Internal Revenue Code of 1986, as amended (the Code) or any successor statute if our Board determines that the restriction on transfer is no longer necessary or desirable for the preservation of tax benefits, (2) the close of business on the first day of a taxable year as to which our Board determines that no tax benefits may be carried forward, (3) such date as our Board may fix for expiration of transfer restrictions and (4) January 29, 2028. The restriction may be waived by our Board on a case by case basis. You are advised to carefully monitor your ownership of our common shares and consult your own legal advisors to determine whether your ownership of our common shares approaches the proscribed level.

We also have a Tax Rights Plan that would be triggered if any person acquires 4.99% or more of our common stock without prior approval by our Board. Holders of more than 4.99% of our common stock on the day the rights plan was adopted were exempted from this limitation as to the number shares they held at the time of adoption of the rights plan.

We may issue additional shares of common stock or shares of our preferred stock to obtain additional financial resources, as acquisition currency or under employee incentive plans. Any such issuances would dilute the interest of our stockholders and likely present other risks. Our certificate of incorporation authorizes our Board to issue shares of our common stock or preferred stock from time to time in their business judgement up to the amount of our then authorized capitalization. We may issue a substantial number of additional shares of our common stock and may issue shares of our preferred stock. These issuances:

|

|

▪ |

may significantly dilute your equity interests; |

|

|

▪ |

may require you to make an additional investment in us or suffer dilution of your equity interest; |

|

|

▪ |

may subordinate the rights of holders of shares of our common stock if shares of preferred stock are issued with rights senior to those afforded to our common stock; |

|

|

▪ |

could cause a change in control if a substantial number of shares of our common stock are issued; |

|

|

▪ |

may affect, among other things, our ability to use our net operating loss carry forwards and could result in the resignation or removal of our present officers and directors; and |

|

|

▪ |

may adversely affect prevailing market prices for our common stock. |

13

Our common stock price may be volatile. The trading price of our common stock may fluctuate substantially, depending on many factors, some of which are beyond our control and may not be directly related to our operating performance. These factors include, but are not limited to, the following:

|

|

▪ |

price and volume fluctuations in the overall stock market from time to time; |

|

|

▪ |

significant volatility in the market price and trading volume of securities of our competitors; |

|

|

▪ |

actual or anticipated changes in our earnings or fluctuations in our operating results or changes in the expectations or recommendations of securities analysts; |

|

|

▪ |

material announcements by us or our competitors regarding business performance, financings, mergers and acquisitions or other transactions; |

|

|

▪ |

general economic conditions and trends; |

|

|

▪ |

legislative or regulatory changes affecting the businesses we invest in; or |

|

|

▪ |

departures of key personnel. |

Anti-takeover provisions contained in our certificate of incorporation and amended and restated bylaws (our bylaws), as well as provisions of Delaware law, could impair a takeover attempt. Our certificate of incorporation, bylaws and Delaware law contain provisions that could have the effect of rendering more difficult or discouraging an acquisition deemed undesirable by our Board. Our corporate governance documents include provisions:

|

|

▪ |

authorizing blank check preferred stock, which could be issued with voting, liquidation, dividend and other rights superior to our common stock; |

|

|

▪ |

limiting the liability of, and providing indemnification to, our Board and officers; |

|

|

▪ |

limiting the ability of our stockholders to call and bring business before special meetings and to take action by written consent in lieu of a meeting; |

|

|

▪ |

requiring advance notice of stockholder proposals for business to be conducted at meetings of our stockholders and for nominations of candidates for election to our Board; |

|

|

▪ |

controlling the procedures for the conduct and scheduling of Board and stockholder meetings; |

|

|

▪ |

limiting the ability for persons to acquire 4.99% or more of our common stock; |

|

|

▪ |

providing our Board with the express power to postpone previously scheduled annual meetings and to cancel previously scheduled special meetings; |

|

|

▪ |

limiting the determination of the number of directors on our Board and the filling of vacancies or newly created seats on the board to our Board then in office; and |

|

|

▪ |

providing that directors may be removed by stockholders only for cause. |

These provisions, alone or together, could delay hostile takeovers and changes in control of our company or changes in our management.

As a Delaware corporation, we are also subject to provisions of Delaware law, including Section 203 of the Delaware General Corporation Law, which prevents some stockholders holding more than 15% of our outstanding common stock from engaging in certain business combinations without approval of the holders of substantially all of our outstanding common stock. Any provision of our certificate of incorporation or bylaws or Delaware law that has the effect of delaying or deterring a change in control could limit the opportunity for our stockholders to receive a premium for their shares of our common stock, and could also affect the price that some investors are willing to pay for our common stock.

Item 1B. Unresolved Staff Comments.

None.

We currently lease office space in Waltham, Massachusetts. Our lease is non-cancellable through September 2024.

14

We have been named in two related complaints, captioned Daniel Saunders, on behalf of himself and all others similarly situated, v. Full Circle Capital Corporation, et al., filed on September 23, 2016 (the Saunders Action), and William L. Russell, Jr., individually and on behalf of all others similarly situated, v. Biderman, et al. filed on September 12, 2016 and amended on September 22, 2016 (the Russell Action), in the United States District Court for the District of Maryland and in the Circuit Court for Baltimore City, (the Circuit Court), respectively. On October 7, 2016, a complaint captioned David Speiser, individually and on behalf of all others similarly situated v. Felton, et al., was filed in the Circuit Court (the Speiser Action, and together with the Russell Action, the State Court Actions) (the State Court Actions, together with the Saunders Action, the Actions).

On October 24, 2016, we, along with Full Circle, GECC, MAST Capital, certain directors of Full Circle and the plaintiffs in the Actions reached an agreement in principle providing for the settlement of the Actions on the terms and conditions set forth in a memorandum of understanding (the MOU). Pursuant to the terms of the MOU, without agreeing that any of the claims in the Actions have merit or that any supplemental disclosure was required under any applicable statute, rule, regulation or law, Full Circle and GECC agreed to and did make the supplemental disclosures with respect to the Merger. The MOU further provides that, among other things, (a) the parties to the MOU will enter into a definitive stipulation of settlement (the Stipulation) and will submit the Stipulation to the Circuit Court for review and approval; (b) the Stipulation will provide for dismissal of the Actions on the merits; (c) the Stipulation will include a general release of defendants of claims relating to the transactions contemplated by the merger agreement between GECC and Full Circle; and (d) the proposed settlement is conditioned on final approval by the Circuit Court after notice to Full Circle's stockholders.

In March 2018, the Saunders Action was voluntarily dismissed by the plaintiff without prejudice as contemplated by the Stipulation. In August 2018, the State Court Actions were dismissed by the Circuit Court without prejudice for failure to prosecute.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Record Holders

As of August 24, 2018, there were 3,630 record holders of our common stock.

Dividends

We did not pay dividends during the fiscal years ended June 30, 2018 and 2017. We do not currently intend to pay dividends. The payment of dividends in the future is subject to the discretion of our Board and will depend upon general business conditions, legal and contractual restrictions on the payment of dividends and other factors that our Board may deem to be relevant.

Restrictions on Ownership

We have significant NOL carryforwards and other tax attributes, the amount and availability of which are subject to qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of our tax attributes, our certificate of incorporation contains provisions which generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of 5% or more of the common shares and the ability of persons or entities now owning 5% or more of the common shares from acquiring additional common shares. We also have a tax benefits preservation rights plan that restricts ownership of 4.99% or more of our outstanding shares of common stock. Our Board has granted a waiver for the MAST Funds to own up to 19.9% of our common stock (as of the date of this report, the MAST Funds and affiliates own approximately 9.4% of outstanding shares of common stock). Persons that owned more than 4.99% of our common stock when the rights plan was adopted were grandfathered as to their then-current holdings of our common stock.

15

Our common stock is traded on the Nasdaq Global Select Market. Our common stock traded under the symbol “UPIP” until June 17, 2016, when it began trading under the symbol “GEC.”

|

Fiscal Period |

|

Low |

|

|

High |

|

||

|

2018 |

|

|

|

|

|

|

|

|

|

Fourth quarter |

|

$ |

3.40 |

|

|

$ |

4.05 |

|

|

Third quarter |

|

$ |

3.50 |

|

|

$ |

4.15 |

|

|

Second quarter |

|

$ |

3.50 |

|

|

$ |

4.40 |

|

|

First quarter |

|

$ |

3.20 |

|

|

$ |

3.75 |

|

|

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

|

|

|

|

|

|

Fourth quarter |

|

$ |

3.10 |

|

|

$ |

3.70 |

|

|

Third quarter |

|

$ |

2.95 |

|

|

$ |

3.85 |

|

|

Second quarter |

|

$ |

3.45 |

|

|

$ |

4.79 |

|

|

First quarter |

|

$ |

4.10 |

|

|

$ |

6.97 |

|

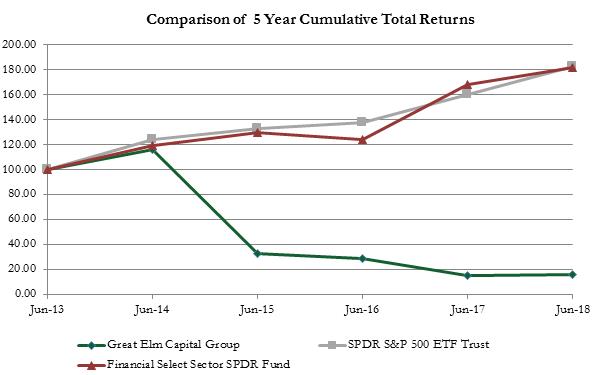

Performance Graph

Based on $100 invested on June 30, 2013 in stock or index, including reinvestment of dividends through the fiscal year ended June 30, 2018.

Stock Purchases

None.

16

Item 6. Selected Financial Data.

The following selected financial data should be read in conjunction with our consolidated financial statements and related notes thereto and with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

The following table sets forth selected consolidated statements of operations and consolidated balance sheets data, revised to reflect discontinued operations as of, and for the following fiscal years:

|

|

|

For the years ended June 30, |

|

|||||||||||||||||

|

Amounts in thousands (except per share data) |

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|||||

|

Selected Consolidated Statements of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

|

5,935 |

|

|

|

4,927 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Operating expenses |

|

|

16,404 |

|

|

|

9,532 |

|

|

|

9,835 |

|

|

|

8,040 |

|

|

|

5,709 |

|

|

Operating income (loss) from continuing operations |

|

|

(10,469 |

) |

|

|

(4,605 |

) |

|

|

(9,835 |

) |

|

|

(8,040 |

) |

|

|

(5,709 |

) |

|

Dividends and interest income |

|

|

2,579 |

|

|

|

1,306 |

|

|

|

6 |

|

|

|

72 |

|

|

|

121 |

|

|

Unrealized gain (loss) on investments |

|

|

(2,714 |

) |

|

|

(9,114 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Interest expense |

|

|

(1,071 |

) |

|

|

(6,321 |

) |

|

|

(4,947 |

) |

|

|

(4,332 |

) |

|

|

(3,697 |

) |

|

Other Income, net |

|

|

5 |

|

|

|

84 |

|

|

|

233 |

|

|

|

268 |

|

|

|

625 |

|

|

Loss from continuing operations, before income taxes |

|

|

(11,670 |

) |

|

|

(18,650 |

) |

|

|

(14,543 |

) |

|

|

(12,032 |

) |

|

|

(8,660 |

) |

|

Provision for (benefit from) income taxes |

|

|

(329 |

) |

|

|

(1,210 |

) |

|

|

(5,103 |

) |

|

|

164 |

|

|

|

(3,068 |

) |

|

Loss from continuing operations |

|

|

(11,341 |

) |

|

|

(17,440 |

) |

|

|

(9,440 |

) |

|

|

(12,196 |

) |

|

|

(5,592 |

) |

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from discontinued operations, net of tax |

|

|

(165 |

) |

|

|

2,203 |

|

|

|

(5,830 |

) |

|

|

(29,563 |

) |

|

|

6,025 |

|

|

Gain (loss) on sale of discontinued operations |

|

|

- |

|

|

|

- |

|

|

|

24,692 |

|

|

|

- |

|

|

|

- |

|

|

Total income (loss) from discontinued operations |

|

|

(165 |

) |

|

|

2,203 |

|

|

|

18,862 |

|

|

|

(29,563 |

) |

|

|

6,025 |

|

|

Net income (loss) |

|

$ |

(11,506 |

) |

|

$ |

(15,237 |

) |

|

$ |

9,422 |

|

|

$ |

(41,759 |

) |

|

$ |

433 |

|

|

Less: net loss attributable to non-controlling interest |

|

|

(439 |

) |

|

|

(30 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Net income (loss) attributable to Great Elm Capital Group, Inc. |

|

$ |

(11,067 |

) |

|

$ |

(15,207 |

) |

|

$ |

9,422 |

|

|

$ |

(41,759 |

) |

|

$ |

433 |

|

|