Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Great Elm Capital Group, Inc. | gec-ex992_25.htm |

| EX-2.1 - EX-2.1 - Great Elm Capital Group, Inc. | gec-ex21_14.htm |

| 8-K - 8-K - Great Elm Capital Group, Inc. | gec-8k_20180907.htm |

Great Elm Capital Group, Inc. The Acquisition of Valley Healthcare Group and Northwest Medical September 11, 2018 © 2018 Great Elm Capital Group, Inc. Exhibit 99.1

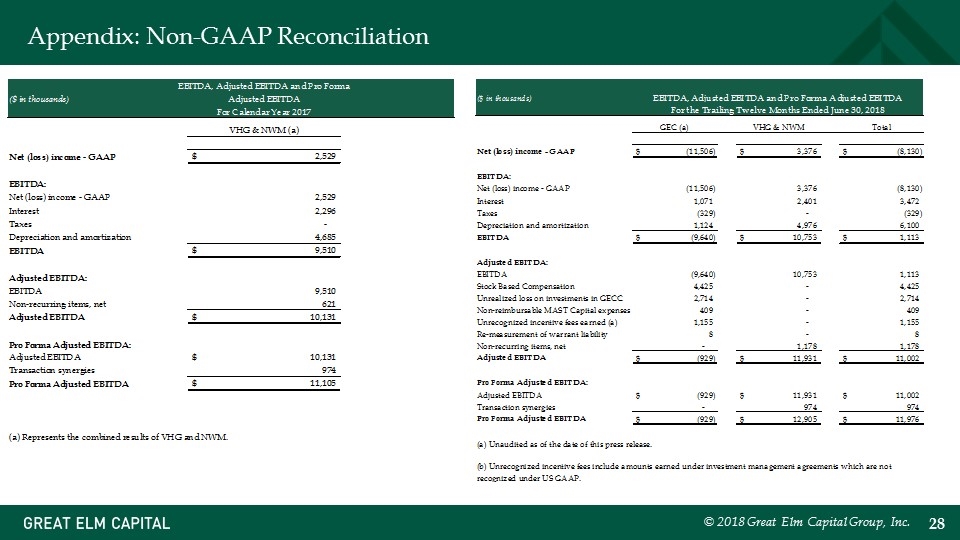

© 2018 Great Elm Capital Group, Inc. Disclaimer Forward-Looking Statements Statements in this presentation that are “forward-looking” statements, including statements regarding estimated cost synergies, our future growth strategy for the combined business and post-closing initiatives, involve risks and uncertainties that may individually or collectively impact the matters described herein. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and represent Great Elm Capital Group, Inc.’s (“Great Elm” or “GEC”) assumptions and expectations in light of currently available information. These statements involve risks, variables and uncertainties, and Great Elm’s actual performance results may differ from those projected, and any such differences may be material. For information on certain factors that could cause actual events or results to differ materially from Great Elm’s expectations, please see Great Elm’s filings with the Securities and Exchange Commission (the “SEC”), including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Additional information relating to Great Elm’s financial position and results of operations is also contained in Great Elm’s annual and quarterly reports filed with the SEC and available for download at its website www.greatelmcap.com or at the SEC website www.sec.gov. Non-GAAP Financial Measures The SEC has adopted rules to regulate the use in filings with the SEC, and in public disclosures, of financial measures that are not in accordance with US GAAP, such as adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”). See the Appendix for important information regarding the use of non-GAAP financial measures and reconciliations of non-GAAP measures to their most directly comparable GAAP measures. Valley Healthcare Group (“VHG”) and Northwest Medical (“NWM”) Financial Information As private entities, VHG’s and NWM’s historic financial information has not been prepared in accordance with Regulation S-X. When Regulation S-X compliant financial information is available and included in Great Elm’s SEC filings following the date hereof, the presentation of this financial information may change from that presented in this presentation, and any such changes may be material.

© 2018 Great Elm Capital Group, Inc. Slide(s): 4 - 5 Executive Summary 6 - 11Introduction 12 - 14Key Investment Considerations 15 - 17The Transaction 18 - 19Post Closing Initiatives 20 - 21Summary 22 - 25Great Elm Capital Group, Inc.: Organizational Overview 26Q&A 27 - 30Appendix Table of Contents

Executive Summary © 2018 Great Elm Capital Group, Inc.

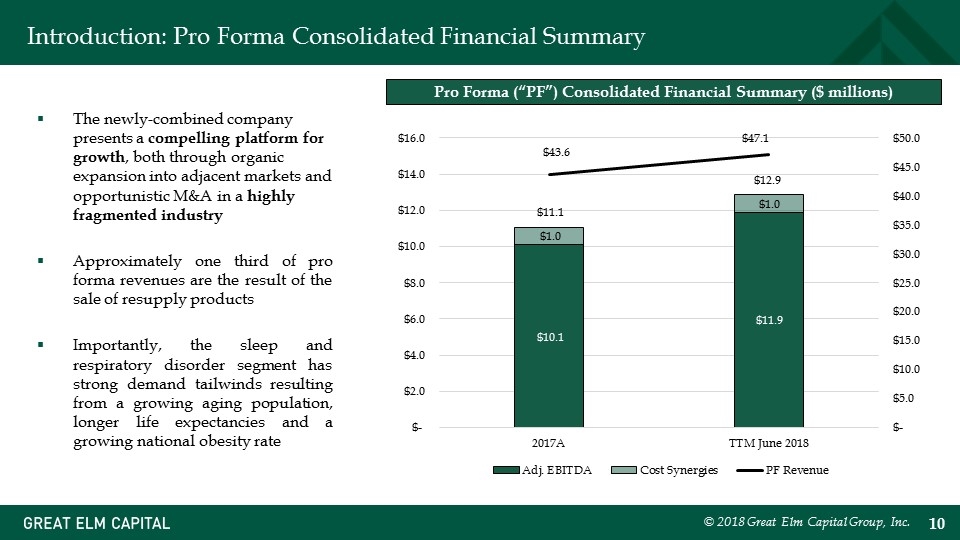

Executive Summary Great Elm has partnered with the management team of Valley Healthcare Group (“VHG”) to acquire and combine VHG and Northwest Medical (“NWM”) VHG and NWM, which together serve approximately 70,000 patients annually across five states in the United States, are leading regional providers of sleep and respiratory-related durable medical equipment (“DME”) and services High quality care, education and customer service resulting in industry leading patient compliance rates Well positioned for organic growth in attractive markets and to consolidate a fragmented DME industry Great Elm acquired an 80.1% equity interest in the combined companies at a purchase price of $63.6 million1, which represents a 4.9x multiple of TTM Pro Forma Adjusted EBITDA for the period ended June 30, 2018 Pro forma for the transaction, the new company would have generated revenue, net income and Adjusted Pro Forma EBITDA of $43.6 million, $2.5 million and $11.1 million, respectively, for the year ended December 2017, and $47.1 million, $3.4 million and $12.9 million, respectively, for the TTM ended June 2018 $19.7 million of the purchase was funded using cash on GEC’s balance sheet A strong and aligned management team will maintain a 9.9% minority stake in the combined business Ron Evans (CEO), Co-Founder of VHG, and Chad Vance (CFO) have a longstanding, successful record of both organic revenue growth and integrating roll-up acquisitions NWM sellers are also retaining a 9.9% interest in the combined business Represents Great Elm’s first operating company acquisition Fits with Great Elm’s value creation strategy of targeting operating companies, such as VHG and NWM, with meaningful cash flow and earnings, which will be enhanced by Great Elm’s substantial tax assets © 2018 Great Elm Capital Group, Inc. 1 Excludes financing, closing and professional fees and expenses and contingent consideration.

Introduction © 2018 Great Elm Capital Group, Inc.

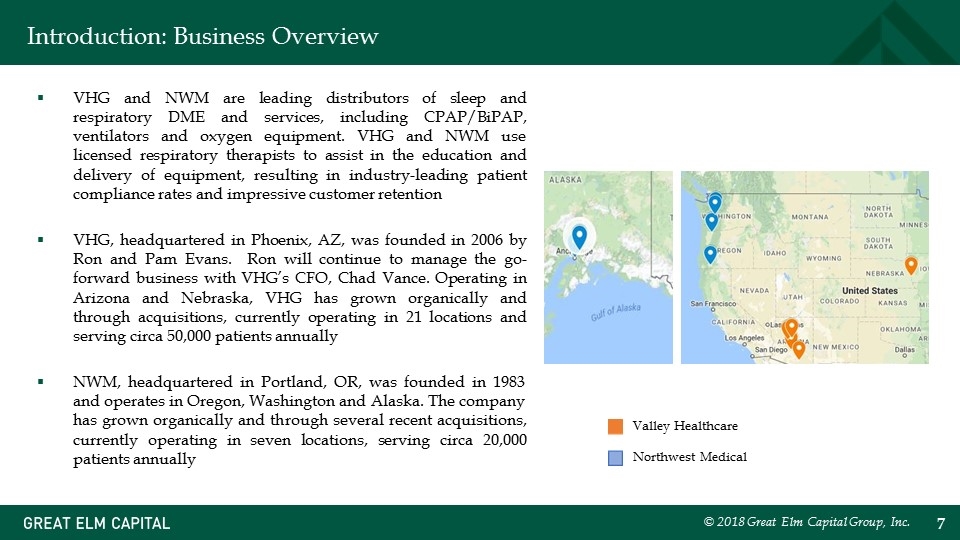

Introduction: Business Overview VHG and NWM are leading distributors of sleep and respiratory DME and services, including CPAP/BiPAP, ventilators and oxygen equipment. VHG and NWM use licensed respiratory therapists to assist in the education and delivery of equipment, resulting in industry-leading patient compliance rates and impressive customer retention VHG, headquartered in Phoenix, AZ, was founded in 2006 by Ron and Pam Evans. Ron will continue to manage the go-forward business with VHG’s CFO, Chad Vance. Operating in Arizona and Nebraska, VHG has grown organically and through acquisitions, currently operating in 21 locations and serving circa 50,000 patients annually NWM, headquartered in Portland, OR, was founded in 1983 and operates in Oregon, Washington and Alaska. The company has grown organically and through several recent acquisitions, currently operating in seven locations, serving circa 20,000 patients annually Valley Healthcare Northwest Medical © 2018 Great Elm Capital Group, Inc.

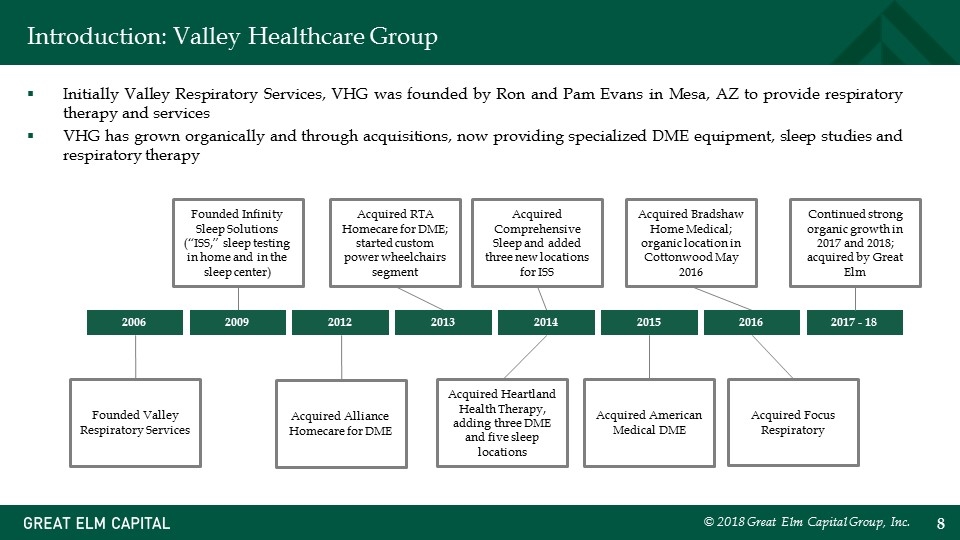

Introduction: Valley Healthcare Group Initially Valley Respiratory Services, VHG was founded by Ron and Pam Evans in Mesa, AZ to provide respiratory therapy and services VHG has grown organically and through acquisitions, now providing specialized DME equipment, sleep studies and respiratory therapy Founded Valley Respiratory Services Founded Infinity Sleep Solutions (“ISS,” sleep testing in home and in the sleep center) Acquired Alliance Homecare for DME Acquired RTA Homecare for DME; started custom power wheelchairs segment Acquired Comprehensive Sleep and added three new locations for ISS Acquired Heartland Health Therapy, adding three DME and five sleep locations Acquired Bradshaw Home Medical; organic location in Cottonwood May 2016 Acquired Focus Respiratory Acquired American Medical DME 2006 2009 2012 2013 2014 2015 2017 - 18 2016 Continued strong organic growth in 2017 and 2018; acquired by Great Elm © 2018 Great Elm Capital Group, Inc.

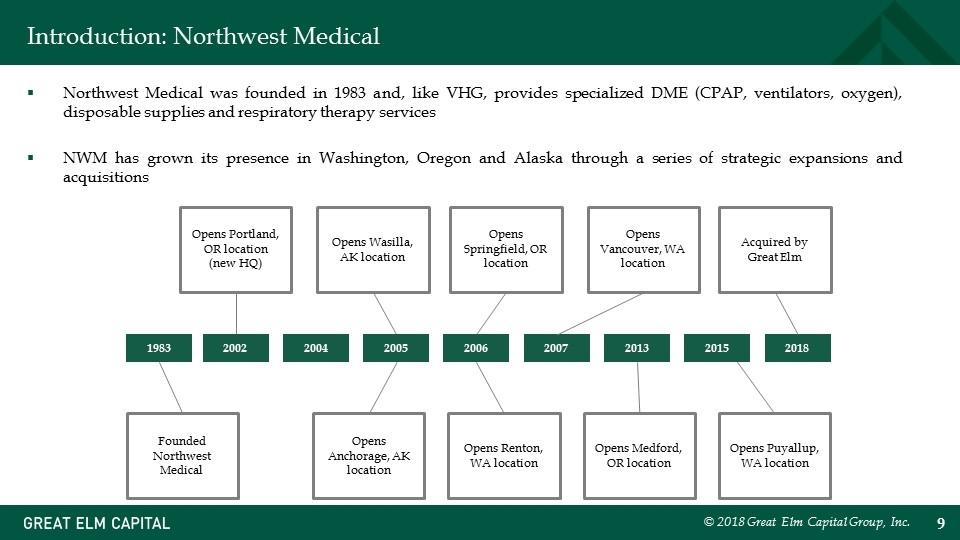

Introduction: Northwest Medical Northwest Medical was founded in 1983 and, like VHG, provides specialized DME (CPAP, ventilators, oxygen), disposable supplies and respiratory therapy services NWM has grown its presence in Washington, Oregon and Alaska through a series of strategic expansions and acquisitions © 2018 Great Elm Capital Group, Inc. 2014 Founded Northwest Medical Opens Portland, OR location (new HQ) Opens Anchorage, AK location Opens Wasilla, AK location Opens Springfield, OR location Opens Renton, WA location Opens Puyallup, WA location Opens Medford, OR location 1983 2002 2005 2006 2013 2015 2018 Acquired by Great Elm 2004 2007 Opens Vancouver, WA location

Introduction: Pro Forma Consolidated Financial Summary Pro Forma (“PF”) Consolidated Financial Summary ($ millions) © 2018 Great Elm Capital Group, Inc. The newly-combined company presents a compelling platform for growth, both through organic expansion into adjacent markets and opportunistic M&A in a highly fragmented industry Approximately one third of pro forma revenues are the result of the sale of resupply products Importantly, the sleep and respiratory disorder segment has strong demand tailwinds resulting from a growing aging population, longer life expectancies and a growing national obesity rate

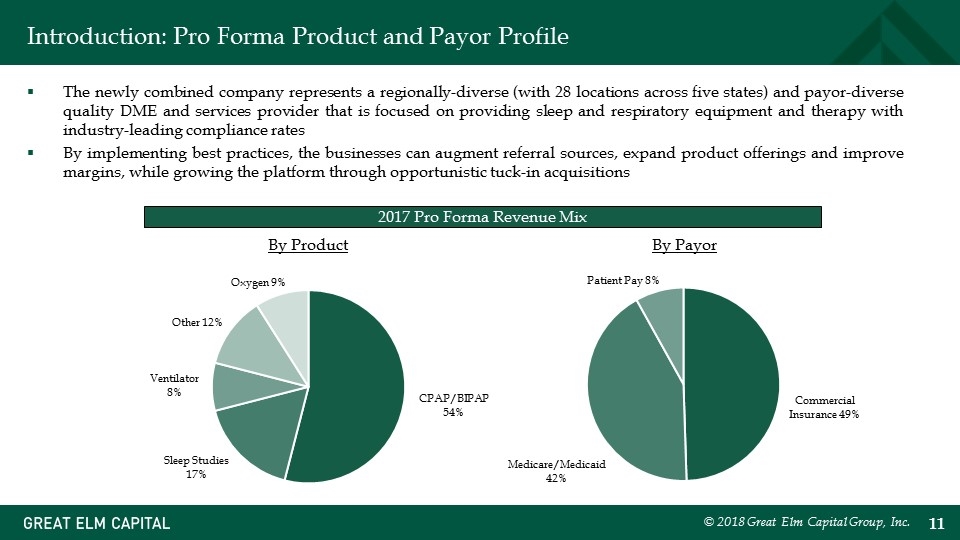

Introduction: Pro Forma Product and Payor Profile The newly combined company represents a regionally-diverse (with 28 locations across five states) and payor-diverse quality DME and services provider that is focused on providing sleep and respiratory equipment and therapy with industry-leading compliance rates By implementing best practices, the businesses can augment referral sources, expand product offerings and improve margins, while growing the platform through opportunistic tuck-in acquisitions By Product By Payor 2017 Pro Forma Revenue Mix © 2018 Great Elm Capital Group, Inc.

Key Investment Considerations © 2018 Great Elm Capital Group, Inc.

Key Investment Considerations Platform for Growth Great Elm is forming a sleep and respiratory-focused provider of home durable medical equipment and services that is well-positioned both for organic and inorganic growth Organic Growth Opportunities: Grow market, take market share in existing geographic markets and open new locations in adjacent geographic markets Acquisition Growth Opportunities: List of acquisition targets that we believe are both actionable and complementary VHG and NWM share very similar, patient-focused cultures, but have no geographic overlap, providing multiple avenues for sales growth Large and Growing Market An estimated 50 to 70 million Americans suffer from sleep disorders1 Obstructive sleep apnea is being increasingly linked with other morbidities, heightening the search for effective treatment2 An aging U.S. population, rising obesity rates and the prevalence of smoking are all causative factors The North American respiratory device distribution market is expected to grow at a compound annual growth rate of 7.3% from 2018 – 20253 CPAP devices have been effectively treating Obstructive Sleep Apnea for over a decade and manufacturers continue to innovate to help improve effectiveness and patient outcomes © 2018 Great Elm Capital Group, Inc. 1 Source: The American Sleep Association, Grand View Research. 2 Source: Grand View Research. 3 Source: Grand View Research.

Key Investment Considerations (continued) Management: Strong and Aligned Led by Co-Founder Ron Evans, VHG has experienced very impressive revenue growth since inception Prior to the NWM transaction described herein, Ron and his team have completed seven successful acquisitions over the past five years Management will maintain a 9.9% minority stake in the business, highlighting lasting commitment Attractive Financial Characteristics High and growing recurring resupply revenue drives consistent cash flows Post respiratory equipment purchase or lease, patients often buy supplies and receive therapy for the duration of what may be lifelong, chronic illness Annually generated free cash flow inures to Great Elm’s benefit as we target future acquisitions Achievable cost synergies of nearly $1 million, but additional synergies may be realized over time Increasing taxable income pairs well with Great Elm’s deferred tax assets © 2018 Great Elm Capital Group, Inc.

The Transaction © 2018 Great Elm Capital Group, Inc.

The Transaction: Overview Great Elm has purchased an 80.1% equity interest in an entity formed to acquire and combine VHG and NWM The transaction purchase price of $63.6 million, excluding financing, closing and professional fees and expenses and contingent consideration, was funded using $19.7 million of cash from Great Elm’s balance sheet The remainder was funded using $31.3 million of secured debt, $5.3 million of qualified preferred stock and $7.3 million of equity rollover from Ron and Pam Evans and Corbel Capital Partners In addition, up to $2.4 million of deferred purchase price consideration may be paid to the sellers upon achieving increased financial targets for 2018 and 2019 An attractive purchase price of 4.9x TTM Pro Forma Adjusted EBITDA1 The sellers of both VHG and NWM are rolling equity into the business All debt incurred to fund the transaction is non-recourse to Great Elm The attractive purchase price and considerable earnings power of the business will be enhanced by Great Elm's substantial tax assets, supporting further growth and facilitating follow-on acquisition opportunities © 2018 Great Elm Capital Group, Inc. 1Adjusted for one-time and non-cash items, as well as estimated cost synergies as though achieved at the beginning of the period.

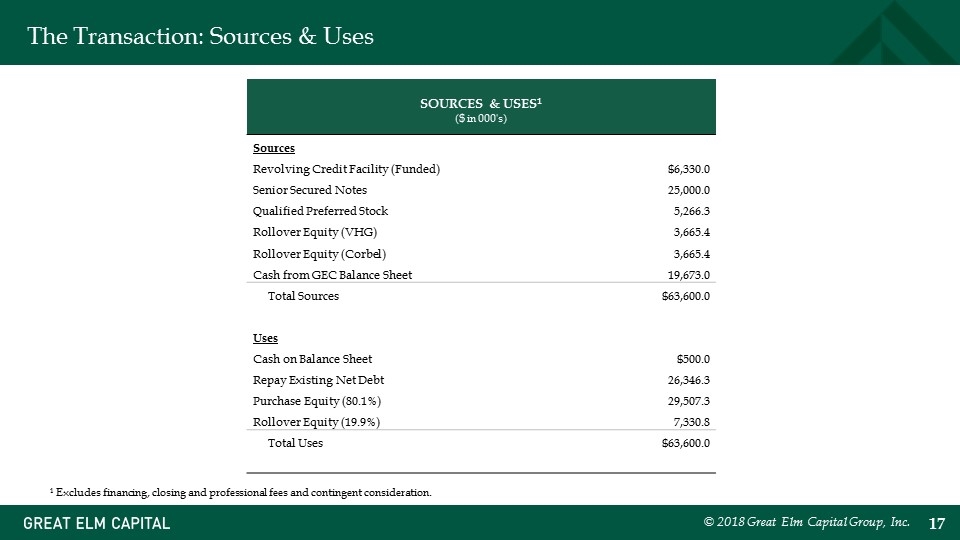

The Transaction: Sources & Uses © 2018 Great Elm Capital Group, Inc. SOURCES & USES1 ($ in 000's) Sources Revolving Credit Facility (Funded) $6,330.0 Senior Secured Notes 25,000.0 Qualified Preferred Stock 5,266.3 Rollover Equity (VHG) 3,665.4 Rollover Equity (Corbel) 3,665.4 Cash from GEC Balance Sheet 19,673.0 Total Sources $63,600.0 Uses Cash on Balance Sheet $500.0 Repay Existing Net Debt 26,346.3 Purchase Equity (80.1%) 29,507.3 Rollover Equity (19.9%) 7,330.8 Total Uses $63,600.0 1 Excludes financing, closing and professional fees and contingent consideration.

Post Closing Initiatives © 2018 Great Elm Capital Group, Inc.

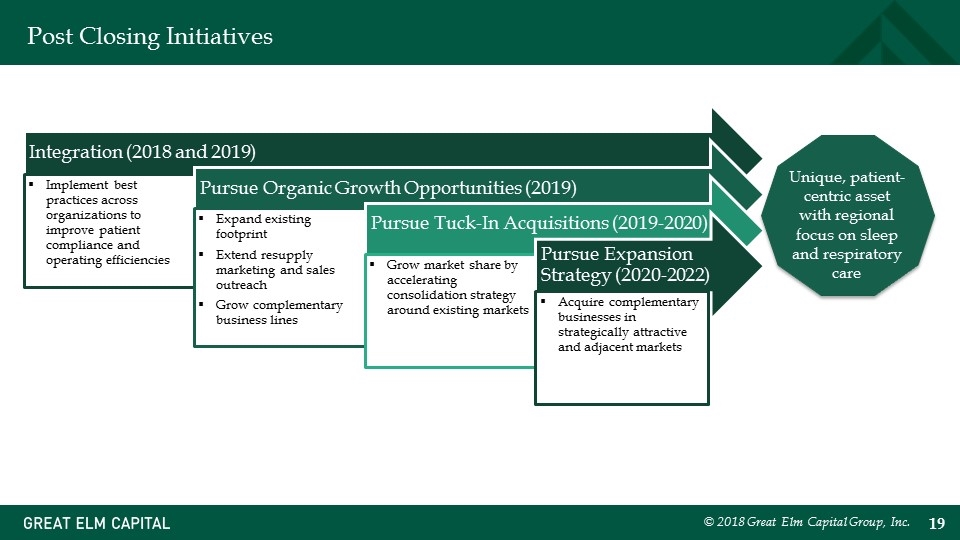

Post Closing Initiatives Unique, patient-centric asset with regional focus on sleep and respiratory care © 2018 Great Elm Capital Group, Inc. Integration (2018 and 2019) Implement best practices across organizations to improve patient compliance and operating efficiencies Pursue Organic Growth Opportunities (2019) Expand existing footprint Extend resupply marketing and sales outreach Grow complementary business lines Pursue Tuck-In Acquisitions (2019-2020) Grow market share by accelerating consolidation strategy around existing markets Pursue Expansion Strategy (2020-2022) Acquire complementary businesses in strategically attractive and adjacent markets

Summary © 2018 Great Elm Capital Group, Inc.

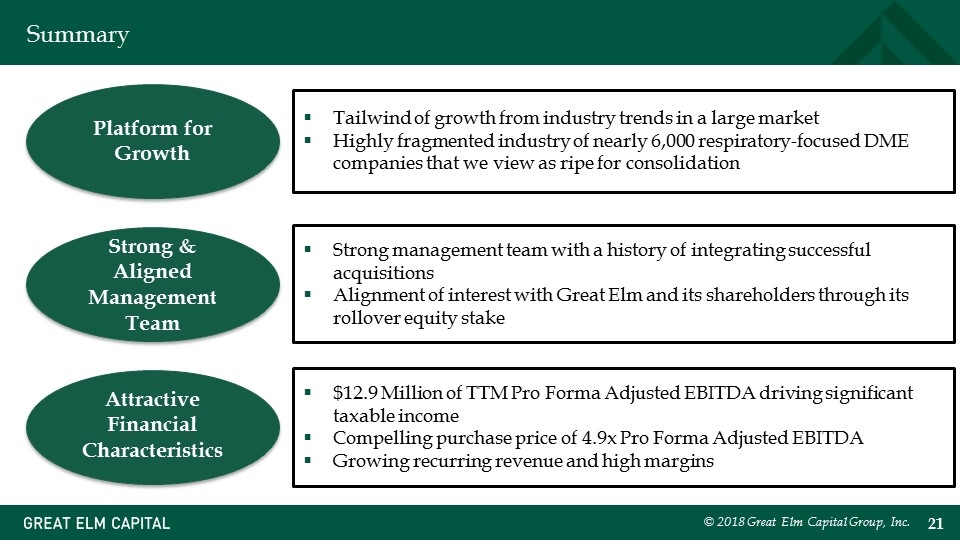

© 2018 Great Elm Capital Group, Inc. Summary Strong management team with a history of integrating successful acquisitions Alignment of interest with Great Elm and its shareholders through its rollover equity stake Platform for Growth Strong & Aligned Management Team Attractive Financial Characteristics Tailwind of growth from industry trends in a large market Highly fragmented industry of nearly 6,000 respiratory-focused DME companies that we view as ripe for consolidation $12.9 Million of TTM Pro Forma Adjusted EBITDA driving significant taxable income Compelling purchase price of 4.9x Pro Forma Adjusted EBITDA Growing recurring revenue and high margins

Great Elm Capital Group, Inc.: Organizational Overview © 2018 Great Elm Capital Group, Inc.

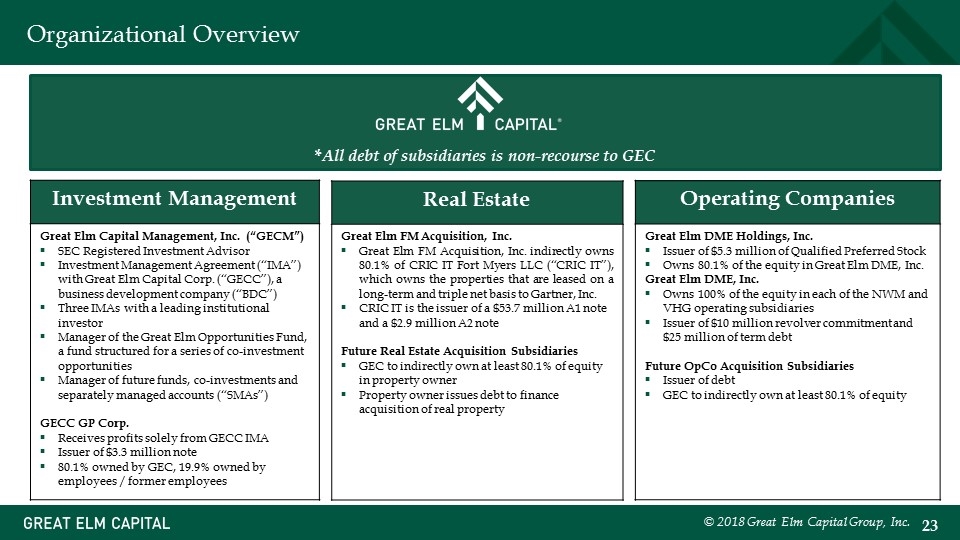

Organizational Overview *All debt of subsidiaries is non-recourse to GEC Real Estate Great Elm FM Acquisition, Inc. Great Elm FM Acquisition, Inc. indirectly owns 80.1% of CRIC IT Fort Myers LLC (“CRIC IT”), which owns the properties that are leased on a long-term and triple net basis to Gartner, Inc. CRIC IT is the issuer of a $53.7 million A1 note and a $2.9 million A2 note Future Real Estate Acquisition Subsidiaries GEC to indirectly own at least 80.1% of equity in property owner Property owner issues debt to finance acquisition of real property Investment Management Great Elm Capital Management, Inc. (“GECM”) SEC Registered Investment Advisor Investment Management Agreement (“IMA”) with Great Elm Capital Corp. (“GECC”), a business development company (“BDC”) Three IMAs with a leading institutional investor Manager of the Great Elm Opportunities Fund, a fund structured for a series of co-investment opportunities Manager of future funds, co-investments and separately managed accounts (“SMAs”) GECC GP Corp. Receives profits solely from GECC IMA Issuer of $3.3 million note 80.1% owned by GEC, 19.9% owned by employees / former employees Operating Companies Great Elm DME Holdings, Inc. Issuer of $5.3 million of Qualified Preferred Stock Owns 80.1% of the equity in Great Elm DME, Inc. Great Elm DME, Inc. Owns 100% of the equity in each of the NWM and VHG operating subsidiaries Issuer of $10 million revolver commitment and $25 million of term debt Future OpCo Acquisition Subsidiaries Issuer of debt GEC to indirectly own at least 80.1% of equity © 2018 Great Elm Capital Group, Inc.

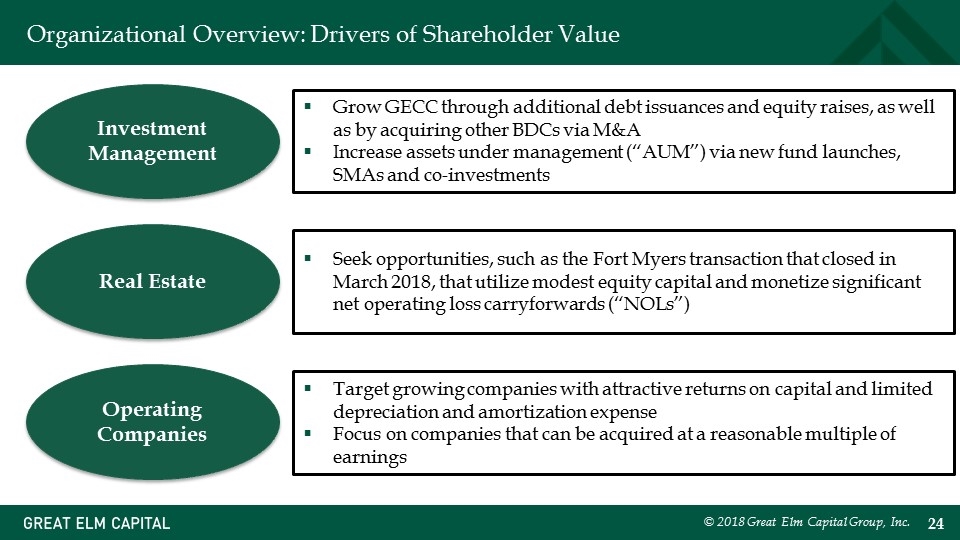

© 2018 Great Elm Capital Group, Inc. Organizational Overview: Drivers of Shareholder Value Target growing companies with attractive returns on capital and limited depreciation and amortization expense Focus on companies that can be acquired at a reasonable multiple of earnings Investment Management Operating Companies Real Estate Grow GECC through additional debt issuances and equity raises, as well as by acquiring other BDCs via M&A Increase assets under management (“AUM”) via new fund launches, SMAs and co-investments Seek opportunities, such as the Fort Myers transaction that closed in March 2018, that utilize modest equity capital and monetize significant net operating loss carryforwards (“NOLs”)

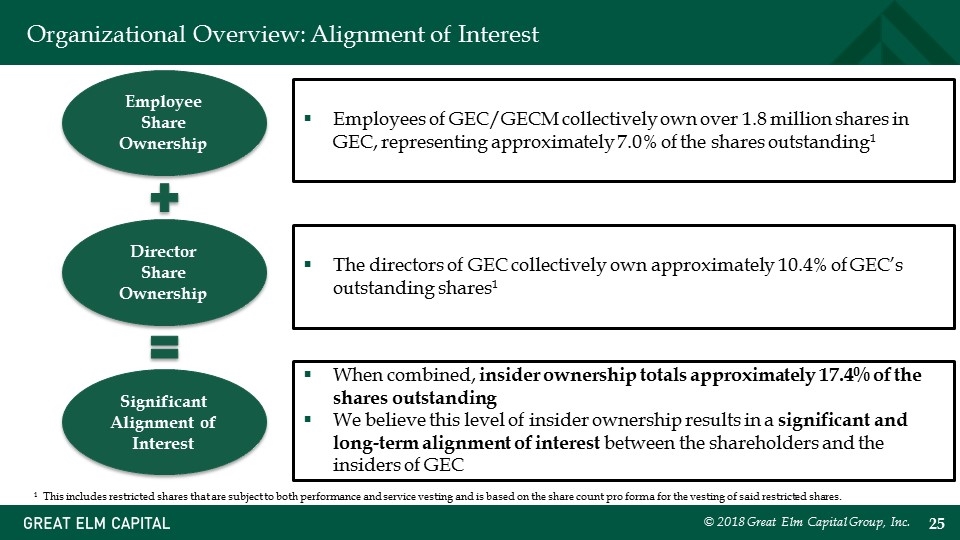

Organizational Overview: Alignment of Interest When combined, insider ownership totals approximately 17.4% of the shares outstanding We believe this level of insider ownership results in a significant and long-term alignment of interest between the shareholders and the insiders of GEC Director Share Ownership Employees of GEC/GECM collectively own over 1.8 million shares in GEC, representing approximately 7.0% of the shares outstanding1 The directors of GEC collectively own approximately 10.4% of GEC’s outstanding shares1 Significant Alignment of Interest Employee Share Ownership 1 This includes restricted shares that are subject to both performance and service vesting and is based on the share count pro forma for the vesting of said restricted shares. © 2018 Great Elm Capital Group, Inc.

Q&A © 2018 Great Elm Capital Group, Inc.

Appendix © 2018 Great Elm Capital Group, Inc.

Appendix: Non-GAAP Reconciliation © 2018 Great Elm Capital Group, Inc.

Appendix: Experienced Management Team Ronald A. Evans (Founder/CEO of VHG) Ron is involved in all areas of VHG including operations, sales, logistics, customer service, inventory management and strategic planning More than three decades of direct experience in respiratory care Twelve years as Respiratory Supervisor at Phoenix Children’s Hospital and Good Samaritan Hospital in Phoenix Industry management experience while working as an Account Manager, Operations Manager and Operations/Clinical Manager for other providers of respiratory equipment in the Phoenix market (Advanced Respiratory, Physicians Respiratory and Praxair) Registered Respiratory Therapist and state-licensed Respiratory Care Practitioner Chad R. Vance (CFO of VHG) In 2011, Chad became CFO/CEO for S.T.A.R.S. until 2014 (acquired by VHG) and then became VHG’s CFO Oversees financial management and billing and participates in operations and planning In 1992, he accepted his first leadership position as CFO for Horizon Human Services, serving an integral role in the company’s successful reorganization and subsequently spent over seven years on the Board of Directors, including multiple officer roles, including President At O2 Science, acquired and integrated 18 infusion companies before selling to Sirona Infusion Chad has held other senior level positions including: CFO and subsequently CEO of Valley Home Health Services from 1999 to 2000, CFO of O2 Science from 2000 to 2005, President/CEO of SW Truss from 2005 to 2007, Controller of Clinical Research Advantage from 2008 to 2010, CFO of Sirona Infusion from 2010 to 2011 Liz Dean (VP of Operations at NWM) Liz joined Northwest Medical in January 2000, performing and scoring sleep studies Became a Branch Manager and opened NMI’s Vancouver and Washington offices in 2007 Moved to the corporate office to become the organization’s Senior Manager. In this role, Liz Dean has moved the organization forward, location by location, updating processes with more sophisticated technology, which has contributed to greater efficiencies and outcomes Liz has overseen the corporate-wide patient compliance with respect to PAP services, which has resulted in dramatically improving NMW’s compliance and billings © 2018 Great Elm Capital Group, Inc.

Appendix: Contact Information Investor Relations Meaghan K. Mahoney Senior Vice President 800 South Street, Suite 230 Waltham, MA 02453 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com © 2018 Great Elm Capital Group, Inc.