Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Great Elm Capital Group, Inc. | gec-ex992_6.htm |

| EX-2.1 - EX-2.1 - Great Elm Capital Group, Inc. | gec-ex21_7.htm |

| 8-K - 8-K - Great Elm Capital Group, Inc. | gec-8k_20180306.htm |

Great Elm Capital Group, Inc. An Introduction to the Fort Myers Transaction & GEC’s Real Estate Strategy March 6, 2018 © 2018 Great Elm Capital Group, Inc. Exhibit 99.1

© 2018 Great Elm Capital Group, Inc. Disclaimer Statements in this presentation that are “forward-looking” statements, including statements regarding potential or expected IRRs, cash-on-cash returns and net operating loss utilization, involve risks and uncertainties that may individually or collectively impact the matters described herein. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made and represent Great Elm Capital Group, Inc.’s (“Great Elm” or “GEC”) assumptions and expectations in light of currently available information. These statements involve risks, variables and uncertainties, and Great Elm’s actual performance results may differ from those projected, and any such differences may be material. For information on certain factors that could cause actual events or results to differ materially from Great Elm’s expectations, please see Great Elm’s filings with the Securities and Exchange Commission (the “SEC”), including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Additional information relating to Great Elm’s financial position and results of operations is also contained in Great Elm’s annual and quarterly reports filed with the SEC and available for download at its website www.greatelmcap.com or at the SEC website www.sec.gov.

© 2018 Great Elm Capital Group, Inc. Slide(s): 4 - 5Organizational Overview 6 - 7Real Estate Overview 8 - 12An Introduction to the Fort Myers Transaction 13 – 18An Introduction to GEC’s Real Estate Strategy 19Q&A 20 – 24Appendix Table of Contents

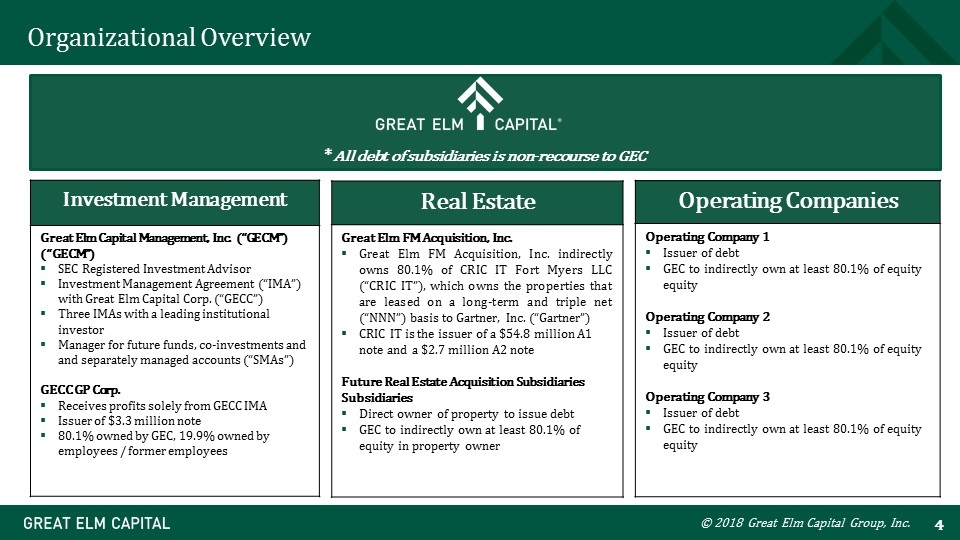

© 2018 Great Elm Capital Group, Inc. Organizational Overview *All debt of subsidiaries is non-recourse to GEC Real Estate Great Elm FM Acquisition, Inc. Great Elm FM Acquisition, Inc. indirectly owns 80.1% of CRIC IT Fort Myers LLC (“CRIC IT”), which owns the properties that are leased on a long-term and triple net (“NNN”) basis to Gartner, Inc. (“Gartner”) CRIC IT is the issuer of a $54.8 million A1 note and a $2.7 million A2 note Future Real Estate Acquisition Subsidiaries Direct owner of property to issue debt GEC to indirectly own at least 80.1% of equity in property owner Investment Management Great Elm Capital Management, Inc. (“GECM”) SEC Registered Investment Advisor Investment Management Agreement (“IMA”) with Great Elm Capital Corp. (“GECC”) Three IMAs with a leading institutional investor Manager for future funds, co-investments and separately managed accounts (“SMAs”) GECC GP Corp. Receives profits solely from GECC IMA Issuer of $3.3 million note 80.1% owned by GEC, 19.9% owned by employees / former employees Operating Companies Operating Company 1 Issuer of debt GEC to indirectly own at least 80.1% of equity Operating Company 2 Issuer of debt GEC to indirectly own at least 80.1% of equity Operating Company 3 Issuer of debt GEC to indirectly own at least 80.1% of equity

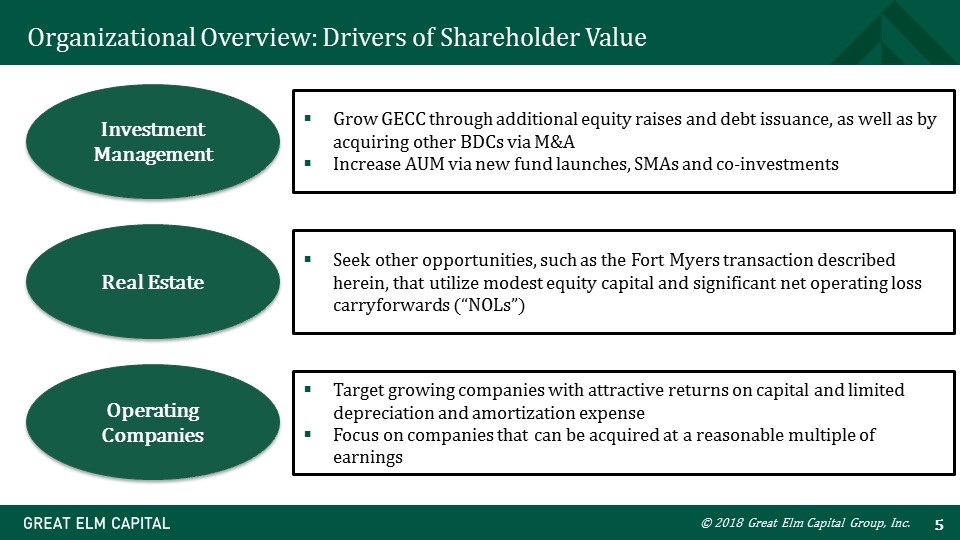

© 2018 Great Elm Capital Group, Inc. Organizational Overview: Drivers of Shareholder Value Target growing companies with attractive returns on capital and limited depreciation and amortization expense Focus on companies that can be acquired at a reasonable multiple of earnings Investment Management Operating Companies Real Estate Grow GECC through additional equity raises and debt issuance, as well as by acquiring other BDCs via M&A Increase AUM via new fund launches, SMAs and co-investments Seek other opportunities, such as the Fort Myers transaction described herein, that utilize modest equity capital and significant net operating loss carryforwards (“NOLs”)

Real Estate Overview © 2018 Great Elm Capital Group, Inc.

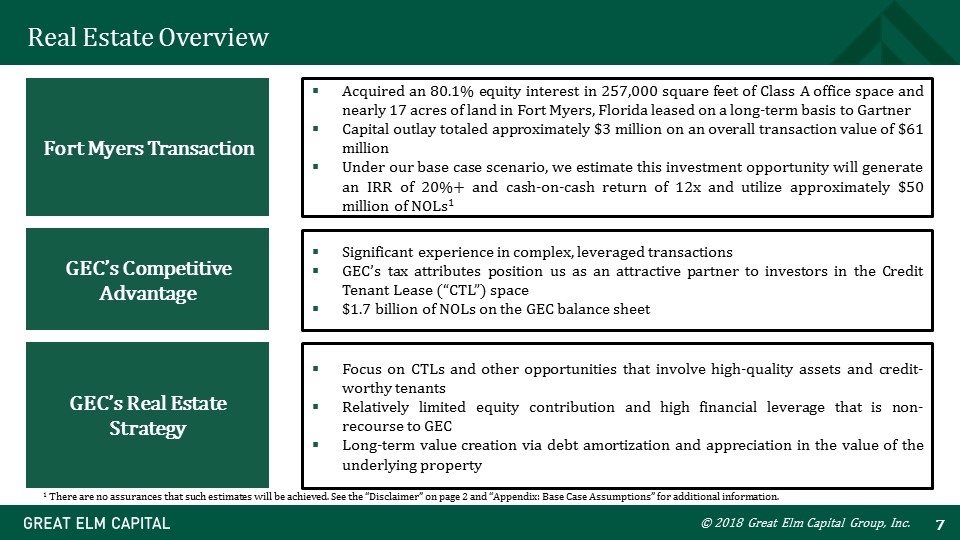

Fort Myers Transaction GEC’s Competitive Advantage GEC’s Real Estate Strategy Acquired an 80.1% equity interest in 257,000 square feet of Class A office space and nearly 17 acres of land in Fort Myers, Florida leased on a long-term basis to Gartner Capital outlay totaled approximately $3 million on an overall transaction value of $61 million Under our base case scenario, we estimate this investment opportunity will generate an IRR of 20%+ and cash-on-cash return of 12x and utilize approximately $50 million of NOLs1 Significant experience in complex, leveraged transactions GEC’s tax attributes position us as an attractive partner to investors in the Credit Tenant Lease (“CTL”) space $1.7 billion of NOLs on the GEC balance sheet Focus on CTLs and other opportunities that involve high-quality assets and credit-worthy tenants Relatively limited equity contribution and high financial leverage that is non-recourse to GEC Long-term value creation via debt amortization and appreciation in the value of the underlying property Real Estate Overview © 2018 Great Elm Capital Group, Inc. 1 There are no assurances that such estimates will be achieved. See the “Disclaimer” on page 2 and “Appendix: Base Case Assumptions” for additional information.

An Introduction to the Fort Myers Transaction © 2018 Great Elm Capital Group, Inc.

We are excited to announce the closing of our first real estate investment with the acquisition of an 80.1% equity interest in 257 thousand square feet of Class A office space on nearly 17 acres of land in Fort Myers, Florida (the “Property”) for approximately $3 million utilizing a CTL financing structure Under our base case scenario, we estimate the announced transaction will generate an attractive IRR in excess of 20% and 12x cash-on-cash return in a little over a decade, while also allowing us to utilize approximately $50 million of NOLs1 We will further benefit by partnering with a respected real estate investment fund that has been managing the Property and may create a deal-sourcing pipeline for future real estate financings. Importantly, the structure of this transaction can be replicated to make us an advantaged partner to other real estate investors This opportunity also offers robust downside protection due to the durable cash flows from a well-capitalized, high-quality lessee (Gartner, Inc., NYSE: IT), strong asset value in two recently-constructed commercial office buildings, and the Property’s position in a rapidly growing location of strategic importance to the lessee Importantly, we believe we can leverage the resources of the GECM team to source a number of attractive transactions as we build a diversified portfolio of high-quality real estate assets © 2018 Great Elm Capital Group, Inc. An Introduction to the Fort Myers Transaction 1 There are no assurances that such estimates will be achieved. See the “Disclaimer” on page 2 and “Appendix: Base Case Assumptions” for additional information.

© 2018 Great Elm Capital Group, Inc. An Introduction to the Fort Myers Transaction

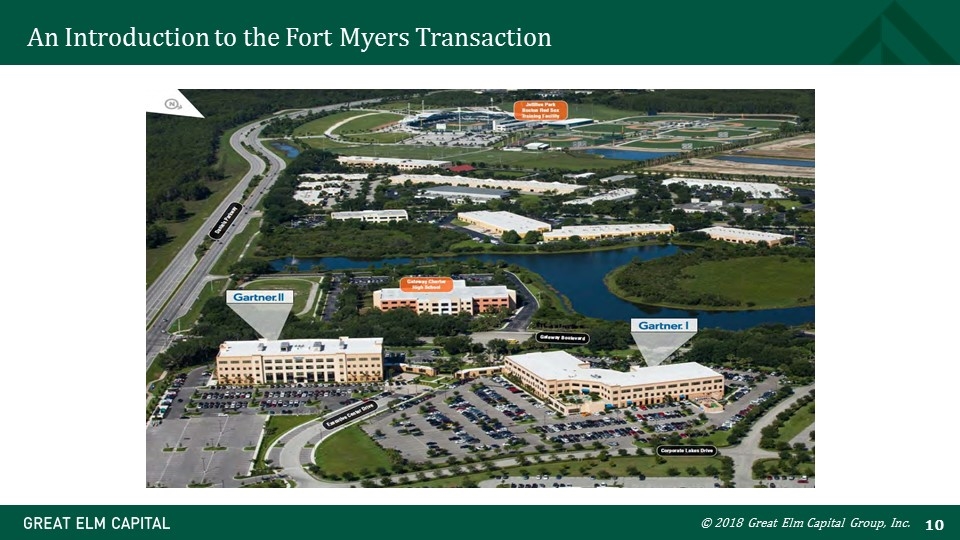

The Property is comprised of two, connected office buildings (Gartner I & II) situated on 16.99 acres of land in the upscale Gateway Community of Fort Myers, one of the fastest growing Metropolitan Statistical Areas (“MSAs”) in the country. The two buildings that comprise the Property are high-quality, Class A office space with an appraised value in excess of the transaction value The Property is 100% leased on a NNN basis to Gartner ($11B Mkt Cap, $3.3B Revenue) until March 31, 2030, which date may be extended in accordance with the terms of the lease. Importantly, the Property is considered to be a key asset in Gartner’s global footprint, as its second largest office in the U.S., its fastest growing U.S. location and its largest sales office, globally. In the coming years, this campus is expected to house 2,000 sales, research and finance employees The Property is strategically located in an area of both high population growth and strong demand for commercial office space, as it lies immediately adjacent to Southwest Florida International Airport and “worker bee” populations Furthermore, the buildings were constructed in 2012 and 2014 and currently require little maintenance capital expenditure The Property was previously majority-owned by CRIC2, a Boston-based commercial real estate investment firm that will remain involved through both a minority equity stake and a continued role managing the Property © 2018 Great Elm Capital Group, Inc. An Introduction to the Fort Myers Transaction

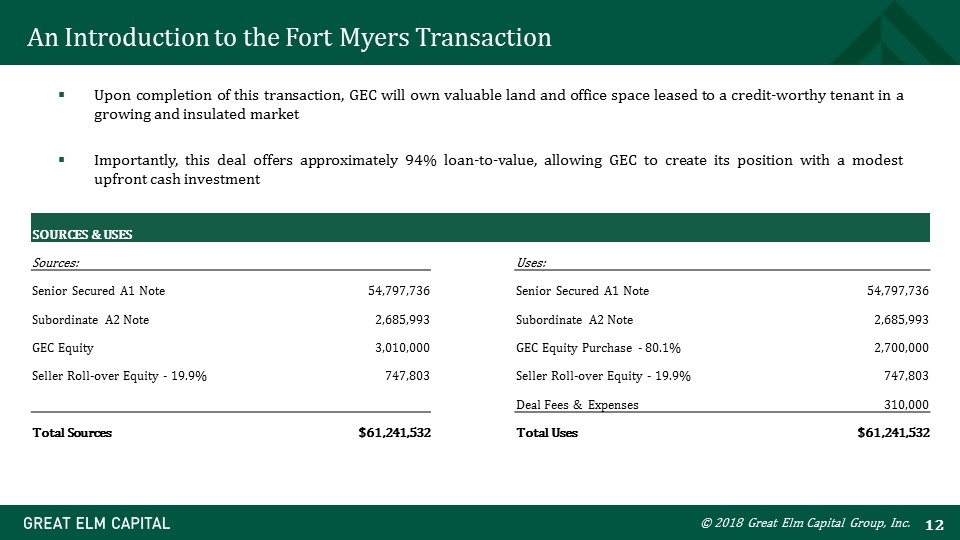

Upon completion of this transaction, GEC will own valuable land and office space leased to a credit-worthy tenant in a growing and insulated market Importantly, this deal offers approximately 94% loan-to-value, allowing GEC to create its position with a modest upfront cash investment © 2018 Great Elm Capital Group, Inc. An Introduction to the Fort Myers Transaction SOURCES & USES Sources: Uses: Senior Secured A1 Note 54,797,736 Senior Secured A1 Note 54,797,736 Subordinate A2 Note 2,685,993 Subordinate A2 Note 2,685,993 GEC Equity 3,010,000 GEC Equity Purchase - 80.1% 2,700,000 Seller Roll-over Equity - 19.9% 747,803 Seller Roll-over Equity - 19.9% 747,803 Deal Fees & Expenses 310,000 Total Sources $61,241,532 Total Uses $61,241,532

An Introduction to GEC’s Real Estate Strategy © 2018 Great Elm Capital Group, Inc.

We intend to create long-term shareholder value by building a diversified portfolio of high-quality, income-producing real estate assets. We expect our tax attributes to give us a significant advantage when we compete to acquire certain of these assets What is an example of Great Elm’s advantage? One of the biggest challenges for investors in the CTL space is the generation of what is often referred to as “phantom income” CTL transactions typically generate a tax obligation for the owner as a result of the rental revenue exceeding the expenses. Typically, the primary use of cash flow generated by the lease is to service the debt payments. This combination of a tax obligation with de minimis cash flow generation creates this “phantom income” Given GEC’s significant tax attributes, we can build equity in a property by absorbing taxable income, amortizing debt and benefitting from appreciation in the property’s value without incremental cash outlay The high financial leverage inherent in CTL transactions means we have the ability to generate an asymmetric amount of taxable income per dollar deployed © 2018 Great Elm Capital Group, Inc. An Introduction to GEC’s Real Estate Strategy

A CTL is a method of financing the purchase of real estate. The highly leveraged sub-set of the CTL market on which we are focusing is relatively liquid with an estimated $5 billion+ of deal activity per year In a CTL structure, a real estate buyer acquires property currently leased to a credit-worthy lessee The purchase of the property is financed with debt that is secured by a mortgage on the property and an assignment of leases and rents Lease payments are made to a trustee who directs such payments to service the outstanding debt The property owner builds equity value through both the amortization of debt and the appreciation of the underlying property value Thus, the property owner deploys limited equity capital and creates lasting equity value in commercial real estate assets © 2018 Great Elm Capital Group, Inc. An Introduction to GEC’s Real Estate Strategy – CTL Description

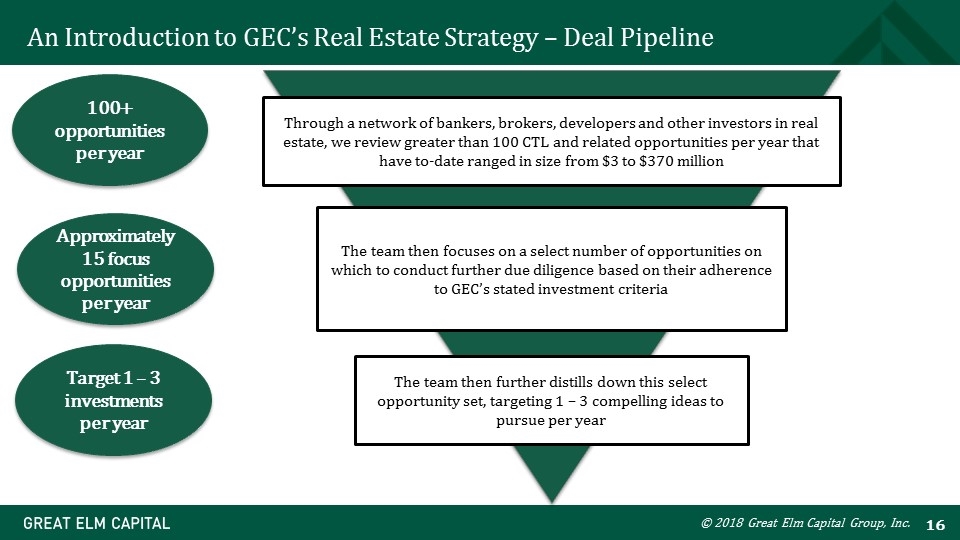

Through a network of bankers, brokers, developers and other investors in real estate, we review greater than 100 CTL and related opportunities per year that have to-date ranged in size from $3 to $370 million The team then focuses on a select number of opportunities on which to conduct further due diligence based on their adherence to GEC’s stated investment criteria The team then further distills down this select opportunity set, targeting 1 – 3 compelling ideas to pursue per year 100+ opportunities per year Approximately 15 focus opportunities per year Target 1 – 3 investments per year © 2018 Great Elm Capital Group, Inc. An Introduction to GEC’s Real Estate Strategy – Deal Pipeline

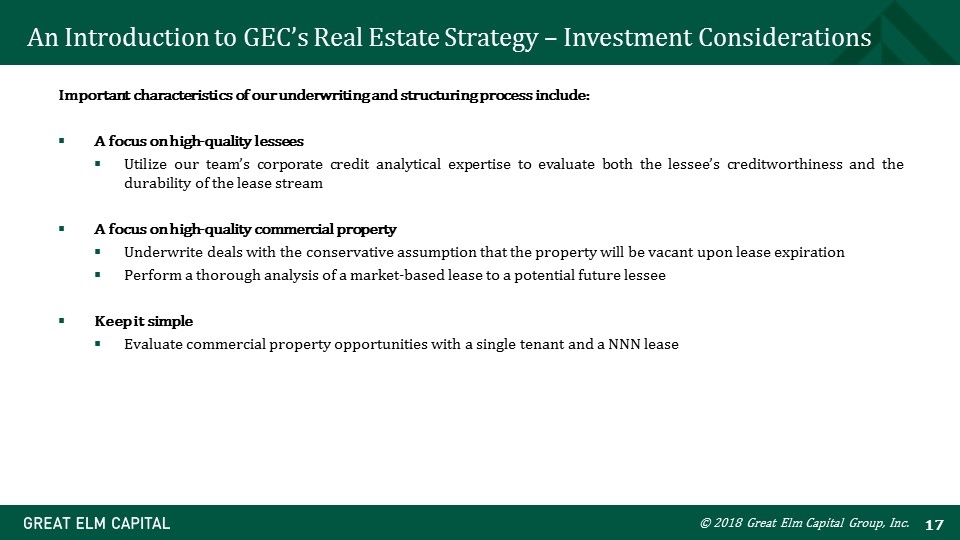

Important characteristics of our underwriting and structuring process include: A focus on high-quality lessees Utilize our team’s corporate credit analytical expertise to evaluate both the lessee’s creditworthiness and the durability of the lease stream A focus on high-quality commercial property Underwrite deals with the conservative assumption that the property will be vacant upon lease expiration Perform a thorough analysis of a market-based lease to a potential future lessee Keep it simple Evaluate commercial property opportunities with a single tenant and a NNN lease © 2018 Great Elm Capital Group, Inc. An Introduction to GEC’s Real Estate Strategy – Investment Considerations

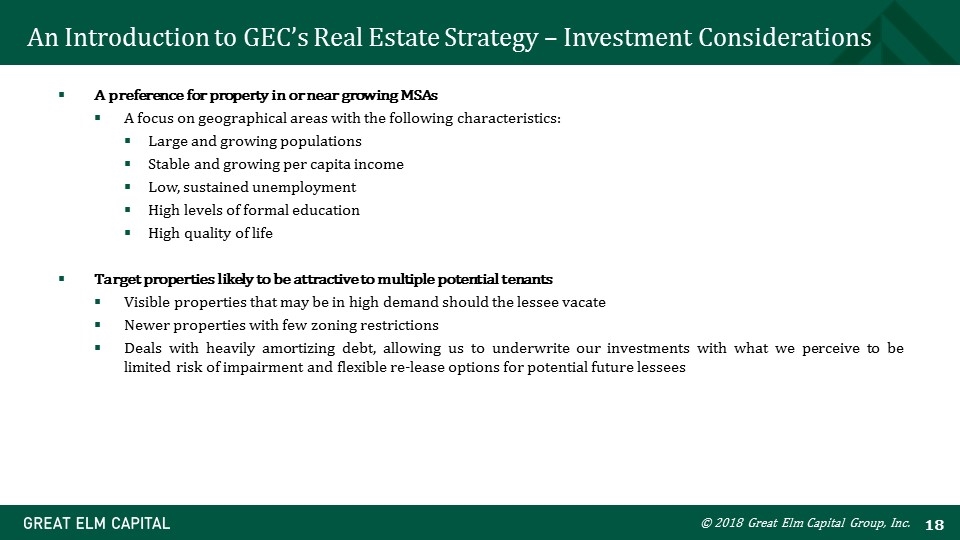

A preference for property in or near growing MSAs A focus on geographical areas with the following characteristics: Large and growing populations Stable and growing per capita income Low, sustained unemployment High levels of formal education High quality of life Target properties likely to be attractive to multiple potential tenants Visible properties that may be in high demand should the lessee vacate Newer properties with few zoning restrictions Deals with heavily amortizing debt, allowing us to underwrite our investments with what we perceive to be limited risk of impairment and flexible re-lease options for potential future lessees © 2018 Great Elm Capital Group, Inc. An Introduction to GEC’s Real Estate Strategy – Investment Considerations

Q&A © 2018 Great Elm Capital Group, Inc.

Appendix © 2018 Great Elm Capital Group, Inc.

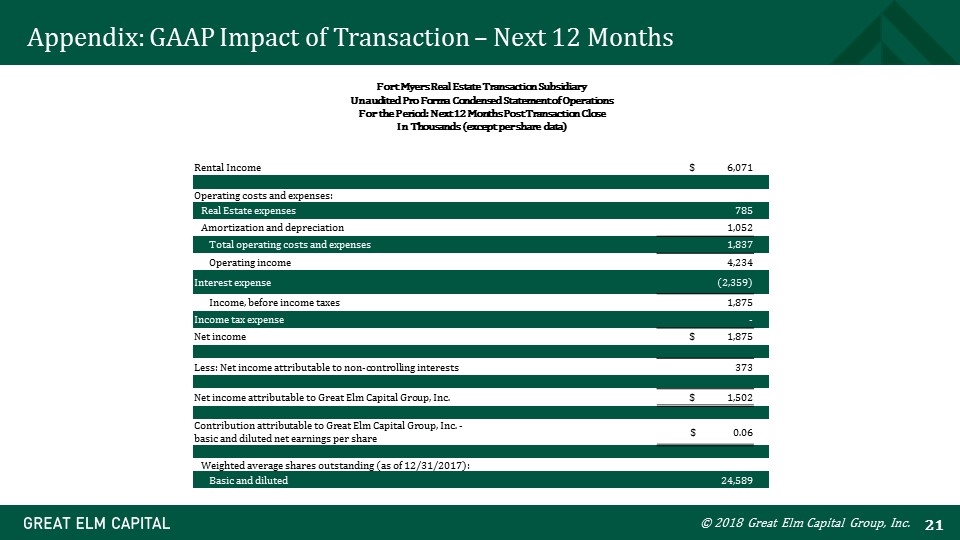

© 2018 Great Elm Capital Group, Inc. Appendix: GAAP Impact of Transaction – Next 12 Months Fort Myers Real Estate Transaction Subsidiary Unaudited Pro Forma Condensed Statement of Operations For the Period: Next 12 Months Post Transaction Close In Thousands (except per share data) Rental Income $ 6,071 Operating costs and expenses: Real Estate expenses 785 Amortization and depreciation 1,052 Total operating costs and expenses 1,837 Operating income 4,234 Interest expense (2,359) Income, before income taxes 1,875 Income tax expense - Net income $ 1,875 Less: Net income attributable to non-controlling interests 373 Net income attributable to Great Elm Capital Group, Inc. $ 1,502 Contribution attributable to Great Elm Capital Group, Inc. - basic and diluted net earnings per share $ 0.06 Weighted average shares outstanding (as of 12/31/2017): Basic and diluted 24,589

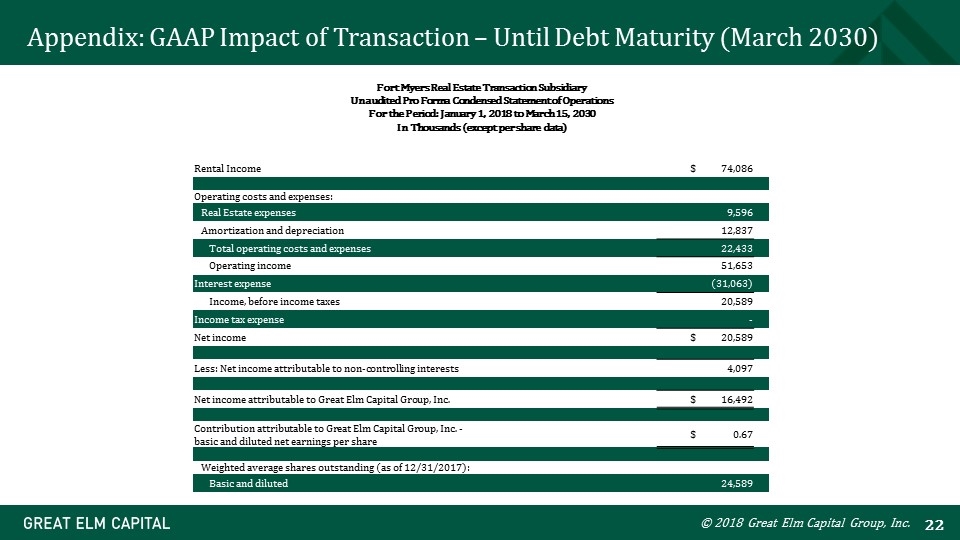

© 2018 Great Elm Capital Group, Inc. Appendix: GAAP Impact of Transaction – Until Debt Maturity (March 2030) Fort Myers Real Estate Transaction Subsidiary Unaudited Pro Forma Condensed Statement of Operations For the Period: January 1, 2018 to March 15, 2030 In Thousands (except per share data) Rental Income $ 74,086 Operating costs and expenses: Real Estate expenses 9,596 Amortization and depreciation 12,837 Total operating costs and expenses 22,433 Operating income 51,653 Interest expense (31,063) Income, before income taxes 20,589 Income tax expense - Net income $ 20,589 Less: Net income attributable to non-controlling interests 4,097 Net income attributable to Great Elm Capital Group, Inc. $ 16,492 Contribution attributable to Great Elm Capital Group, Inc. - basic and diluted net earnings per share $ 0.67 Weighted average shares outstanding (as of 12/31/2017): Basic and diluted 24,589

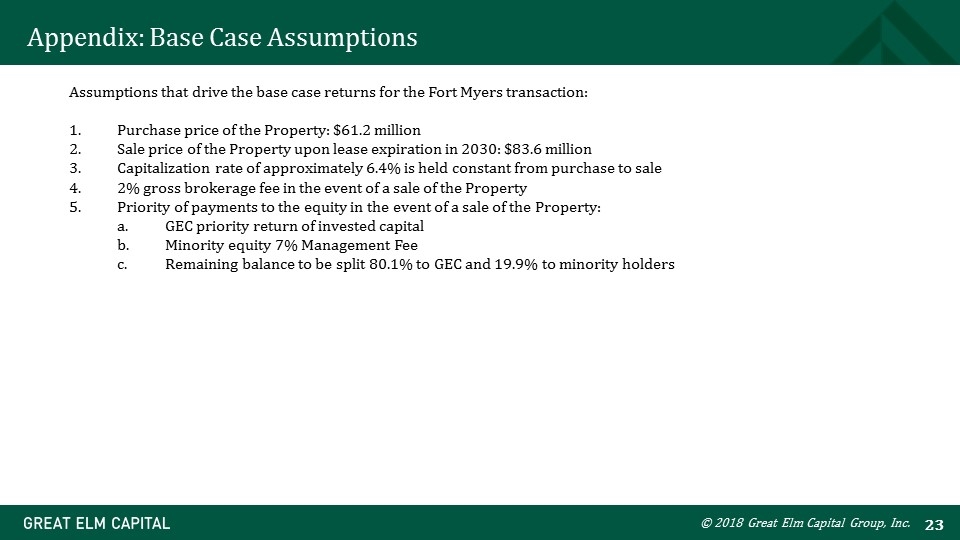

© 2018 Great Elm Capital Group, Inc. Appendix: Base Case Assumptions Assumptions that drive the base case returns for the Fort Myers transaction: 1.Purchase price of the Property: $61.2 million 2.Sale price of the Property upon lease expiration in 2030: $83.6 million 3.Capitalization rate of approximately 6.4% is held constant from purchase to sale 4.2% gross brokerage fee in the event of a sale of the Property 5.Priority of payments to the equity in the event of a sale of the Property: a.GEC priority return of invested capital b.Minority equity 7% Management Fee c.Remaining balance to be split 80.1% to GEC and 19.9% to minority holders

Appendix: Contact Information Investor Relations Meaghan K. Mahoney Senior Vice President 800 South Street, Suite 230 Waltham, MA 02453 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com © 2018 Great Elm Capital Group, Inc.