Attached files

© 2015 Tesoro Corporation. All Rights Reserved.

TLLP Investing $1.1 Billion in Acquisitions

Strengthens Position as a Leading

Integrated Midstream Services Company

November 21, 2016

Tesoro Logistics 2

Forward Looking Statements

This Presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements

relate to, among other things:

• anticipated completion of the acquisitions in North Dakota; • the expected benefits of transactions, including accretion to unitholders ; our expected

annual distribution growth; • the anticipated impact of the acquisitions on net earnings, EBITDA and revenues; • estimates regarding volumes and

capital expenditures; • expectations regarding drilling activity in North Dakota, asset utilization and the composition of our portfolio of assets ; • our

ability to meet 2017 revenue and EBITDA targets; and • expected growth opportunities.

We have used the words “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “should”, “will” and

similar terms and phrases to identify forward-looking statements in this Presentation.

Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove

to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. Our operations and anticipated transactions

involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our

results of operations and whether the forward-looking statements ultimately prove to be correct.

Actual results and trends in the future may differ materially from those suggested or implied by the forward-looking statements depending on a

variety of factors which are described in greater detail in our filings with the SEC. All future written and oral forward-looking statements attributable to

us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any

information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events

or circumstances that occur, or that we become aware of, after the date of this Presentation.

Our management uses a variety of financial and operating measures to analyze operating segment performance and also uses additional measures

that are known as “non-GAAP” financial measures in its evaluation of past performance and prospects for the future to supplement our financial

information presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). These measures are

significant factors in assessing our operating results and profitability and include earnings before interest, income taxes, and depreciation and

amortization expense (“EBITDA”). We have included various estimates of EBITDA, each of which is a non-GAAP financial measure, throughout the

presentation. Please see the Appendix for reconciliation of these EBITDA estimates.

Tesoro Logistics 3

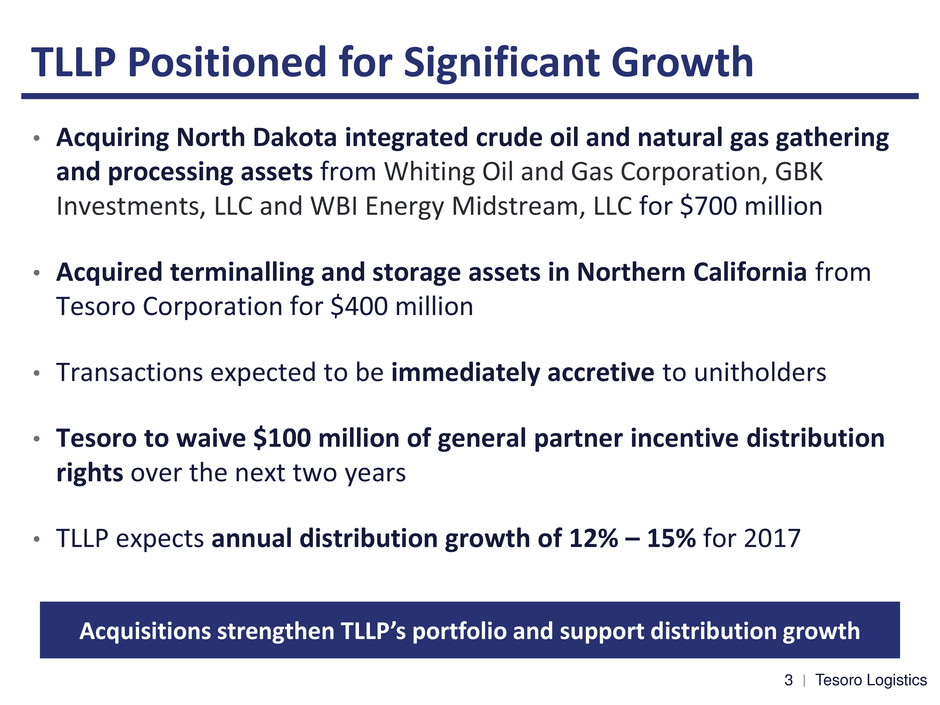

TLLP Positioned for Significant Growth

• Acquiring North Dakota integrated crude oil and natural gas gathering

and processing assets from Whiting Oil and Gas Corporation, GBK

Investments, LLC and WBI Energy Midstream, LLC for $700 million

• Acquired terminalling and storage assets in Northern California from

Tesoro Corporation for $400 million

• Transactions expected to be immediately accretive to unitholders

• Tesoro to waive $100 million of general partner incentive distribution

rights over the next two years

• TLLP expects annual distribution growth of 12% – 15% for 2017

Acquisitions strengthen TLLP’s portfolio and support distribution growth

Tesoro Logistics 4

North Dakota Gathering and Processing Acquisition

Asset Description

• Over 650 miles of crude oil, natural gas and

produced water gathering pipeline

• Two processing facilities with 170 MMcf/d of

processing capacity with 18,700 barrels per day

fractionation capacity

Strategic Highlights

• Attractive purchase multiple expected to drive

immediate accretion to unitholders

• Significant growth potential from drilling locations

in core Bakken producing zones

• Highly utilized assets at current production levels

• Complements existing North Dakota footprint

Financial Highlights

• Total consideration of $700 million

• Expected annual net earnings of $79 – $89 million;

annual EBITDA of $100 – $110 million

• Revenues are approximately 90% fee-based and

supported by existing production

BASH Facility

TSO Fryburg Rail

Terminal

High Plains

Pipeline

TSO BakkenLink

Pipeline

Robinson Lake

Gathering &

Processing

Belfield

Gathering &

Processing

Mountrail

Billings

Dunn

Stark

Tesoro Logistics 5

0

20

40

60

80

100

120

140

160

180

200

2017 2018 2019

Committed Acreage Natural

Gas Production Profile1

MMcf/d

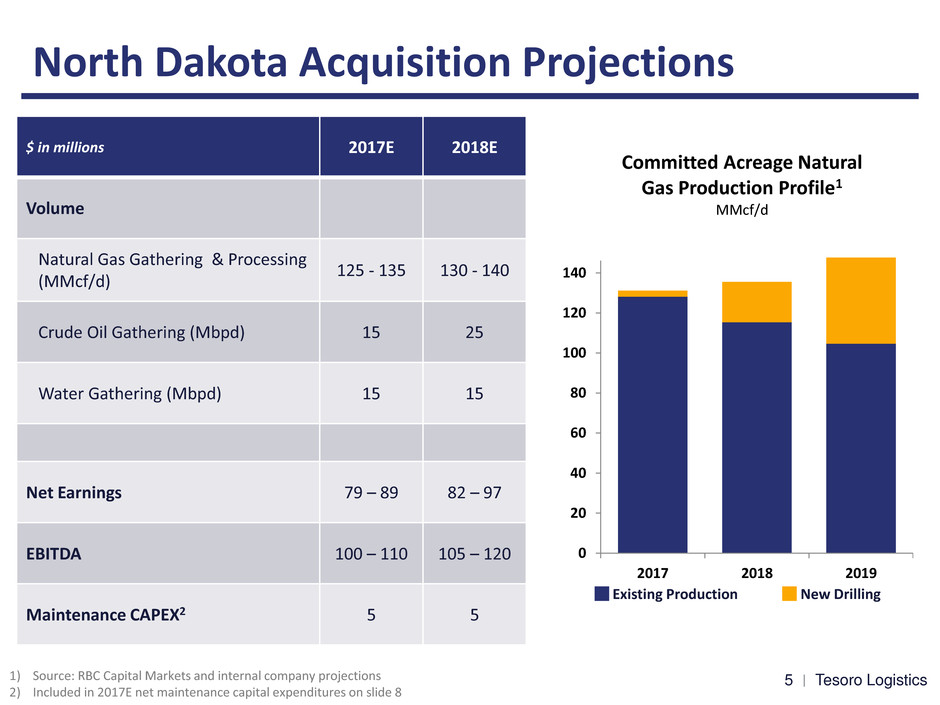

North Dakota Acquisition Projections

$ in millions 2017E 2018E

Volume

Natural Gas Gathering & Processing

(MMcf/d)

125 - 135 130 - 140

Crude Oil Gathering (Mbpd) 15 25

Water Gathering (Mbpd) 15 15

Net Earnings 79 – 89 82 – 97

EBITDA 100 – 110 105 – 120

Maintenance CAPEX2 5 5

1) Source: RBC Capital Markets and internal company projections

2) Included in 2017E net maintenance capital expenditures on slide 8

Existing Production New Drilling

Tesoro Logistics 6

Northern California Terminalling and Storage Acquisition

Asset Description

• 5.8 million barrels of crude oil, feedstock and

refined product storage capacity

• Marine terminal with 35,000 BPD of feedstock

and refined product throughput

Strategic Highlights

• Strategically located assets integrated with

TLLP and TSO current operations

• Expect 10% – 15% improvement in asset

utilization over next several years

• Additional organic growth opportunities

Financial Highlights

• Total consideration of $400 million

• Expected annual net earnings of $28 – $33

million; annual EBITDA of $45 – $50 million

• Initial 10 year, fee-based contract for storage

capacity and terminalling throughput

• $400 million total consideration, consisting of

borrowings under revolving credit facilities and

common and general partner units to Tesoro

Martinez

Refinery

Marine Terminal

Martinez Truck Rack

and Rail Loading

Marine

Terminal

Martinez

Refinery

Martinez

Storage

Tesoro Logistics 7

Balanced Portfolio with Minimal Commodity Exposure

• Resulting portfolio remains

balanced with 50% – 55% of

expected EBITDA from

Terminalling and Transportation

• Maintaining key revenue targets:

− Strong, fee-based business

− Approximately 50% third-party

− Approximately 1% direct commodity

exposure

2017E Pro Forma TLLP EBITDA

Profile

Terminalling &

Transportation

50%-55%

Gathering

25%-30%

Processing

15%-20%

Tesoro Logistics 8

Growth Outlook

• On target to achieve $635 million of net earnings and $1 billion of

EBITDA in 2017

• Expect 2017 annual distribution growth of 12% – 15%

• Expect 2017 growth capital expenditures of $230 million and net

maintenance capital of $65 million

• Transactions expected to be immediately accretive to unitholders

• Tesoro IDR waiver supports balanced growth of GP and LP

interests

• Continuing execution of drop down portfolio; at least $500 million

of annual earnings remain available

Tesoro Logistics 9

Continuing to Drive Unitholder Value

9

Well-Positioned Assets

Attractive, Visible

Growth Opportunities

Experienced

Management Team

Strong

Sponsorship

Stable, Fee-Based Cash

Flow

© 2015 Tesoro Corporation. All Rights Reserved.

Appendix

Tesoro Logistics 11

Non-GAAP Financial Measures

Expected Annual EBITDA Contribution

North Dakota Gathering and Processing

Assets Acquisition

Northern California

Terminalling and

Storage Assets

Acquisition

2017E 2018E 2017E

Reconciliation of Projected Net Earnings to Projected Annual EBITDA

Projected net earnings $ 79 - 89 $ 82 - 97 $ 28 - 33

Add: Depreciation and amortization expenses 15 17 8

Add: Interest and financing costs, net 6 6 9

Projected Annual EBITDA $ 100 - 110 $ 105 - 120 $ 45 - 50

Tesoro Logistics

LP EBITDA

Reconciliation

(in millions) Unaudited 2017E

Projected net earnings $ 635

Add depreciation and amortization expense 180

Add interest and financing costs, net 185

Projected EBITDA $ 1,000