Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10‑K

(Mark One)

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to __________

Commission File Number 1‑35143

TESORO LOGISTICS LP

(Exact name of registrant as specified in its charter)

Delaware | 27‑4151603 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

19100 Ridgewood Pkwy, San Antonio, Texas 78259-1828 | ||

(Address of principal executive offices) (Zip Code) | ||

210-626-6000 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to 12(b) of the Act: | ||

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Units Representing Limited Partnership Interests | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer ¨ | ||

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

At June 30, 2015, the aggregate market value of common limited partner units held by non-affiliates of the registrant was approximately $2.7 billion based upon the closing price of its common units on the New York Stock Exchange Composite tape. The registrant had 93,569,345 common units and 1,900,515 general partner units outstanding at February 18, 2016.

DOCUMENTS INCORPORATED BY REFERENCE: None

TESORO LOGISTICS LP

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

PART I. | Page | |

PART II. | ||

PART III. | ||

PART IV. | ||

This Annual Report on Form 10-K (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements”.

As used in this Annual Report on Form 10-K, the terms “Tesoro Logistics LP,” “we,” “us” or “our” may refer to Tesoro Logistics LP, one or more of its consolidated subsidiaries or all of them taken as a whole.

IMPORTANT INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (including information incorporated by reference) includes and references “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to, among other things, expectations regarding revenues, cash flows, capital expenditures, and other financial items. These statements also relate to our business strategy, goals and expectations concerning our market position, future operations, and profitability. We have used the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “would” and similar terms and phrases to identify forward-looking statements in this Annual Report on Form 10-K, which speak only as of the date the statements were made.

Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to:

• | changes in global economic conditions and the effects of a global economic downturn on our business, on the business of our key customers, including Tesoro, and on our customers’ suppliers, customers, business partners and credit lenders; |

• | a material decrease in the crude oil and natural gas produced in the Bakken Shale/Williston Basin area of North Dakota and Montana (the “Bakken Region”); |

• | a material decrease in the natural gas and crude oil produced in the Green River Basin, Uinta Basin and Vermillion Basin in the states of Utah, Colorado and Wyoming (the “Rockies Region”); |

• | the ability of our key customers, including Tesoro, to remain in compliance with the terms of their outstanding indebtedness; |

• | changes in insurance markets impacting costs and the level and types of coverage available; |

• | changes in the cost or availability of third-party vessels, pipelines and other means of delivering and transporting crude oil, feedstocks, natural gas, natural gas liquids (“NGLs”) and refined products; |

• | the coverage and ability to recover claims under our insurance policies; |

• | the availability and costs of crude oil, other refinery feedstocks and refined products; |

• | the timing and extent of changes in commodity prices and demand for refined products, natural gas and NGLs; |

• | changes in our cash flow from operations; |

• | impact of QEP Resources’ and Questar Gas Company’s failure to perform under the terms of our gathering agreements as they are our largest customers in TLLP’s natural gas business. |

• | the risk of contract cancellation, non-renewal or failure to perform by those in our supply and distribution chains, including Tesoro and Tesoro’s customers, and the ability to replace such contracts and/or customers; |

• | the suspension, reduction or termination of Tesoro’s obligation under our commercial agreements and our secondment agreement; |

• | a material decrease in profitability among our customers, including Tesoro; |

• | earthquakes or other natural disasters affecting operations; |

• | direct or indirect effects on our business resulting from actual or threatened terrorist incidents, cyber-security breaches or acts of war; |

• | weather conditions affecting operations by us or our key customers, including Tesoro, or the areas in which the customers we serve operate; |

• | disruptions due to equipment interruption or failure at our facilities, Tesoro’s facilities or third-party facilities on which our key customers, including Tesoro, are dependent; |

• | changes in the expected value of and benefits derived from acquisitions; |

• | actions of customers and competitors; |

• | changes in our credit profile; |

• | state and federal environmental, economic, health and safety, energy and other policies and regulations, including those related to climate change and any changes therein and any legal or regulatory investigations, delays, compliance costs or other factors beyond our control; |

• | operational hazards inherent in refining operations and in transporting and storing crude oil, natural gas, NGLs and refined products; |

• | changes in capital requirements or in execution and benefits of planned capital projects; |

1

• | seasonal variations in demand for natural gas and refined products; |

• | adverse rulings, judgments, or settlements in litigation or other legal or tax matters, including unexpected environmental remediation costs in excess of any accruals, which affect us or Tesoro; |

• | risks related to labor relations and workplace safety; and |

• | political developments. |

Many of these factors are described in greater detail in Part I with “Competition” in Business, Item 1, “Properties” in Item 2 and “Risk Factors” in Item 1A. All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the previous statements. We undertake no obligation to update any information contained herein or to publicly release the results of any revisions to any forward-looking statements that may be made to reflect events or circumstances that occur, or that we become aware of, after the date of this Annual Report on Form 10-K.

GLOSSARY OF TERMS

Bhp - Brake horsepower.

Bpd - Barrel per day.

BTU - British thermal unit—a measure of the amount of energy required to raise the temperature of a one-pound mass of water one degree Fahrenheit at sea level.

Common Carrier Pipeline - A pipeline engaged in the transportation of crude oil, refined products or other hydrocarbon-based products as a common carrier for hire.

End User - The ultimate user and consumer of transported energy products.

FERC - Federal Energy Regulatory Commission.

Fractionation - The process of separating natural gas liquids into its component parts by heating the natural gas liquid stream and boiling off the various fractions in sequence from the lighter to the heavier hydrocarbon.

Gas Processing - A complex industrial process designed to remove the heavier and more valuable natural gas liquids components from raw natural gas allowing the residue gas remaining after extraction to meet the quality specifications for long-haul pipeline transportation or commercial use.

Life-Of-Reserves Contract - A contract that remains in effect as long as commercial production of hydrocarbons is ongoing.

Mbpd - Thousand barrels per day.

MMBtu - Million British thermal units.

MMBtu/d - Million British thermal units per day.

MMcf - Million cubic feet. Cubic foot or feet is a common unit of gas measurement. One standard cubic foot equals the volume of gas in one cubic foot measured at standard temperature (60 degrees Fahrenheit) and standard pressure (14.73 pounds standard per square inch). One MMBtu is equivalent to one MMcf adjusted for water content.

MMcf/d - Million cubic feet per day.

NGL - Natural gas liquids.

Refined Products - Hydrocarbon compounds, such as gasoline, diesel fuel, jet fuel and residual fuel that are produced by a refinery.

Throughput - The volume of hydrocarbon-based products transported or passing through a pipeline, plant, terminal or other facility during a particular period.

Unit Train - A train consisting of approximately one hundred rail cars containing a single material (such as crude oil) that is transported by the railroad as a single unit from its origin point to the destination, enabling decreased transportation costs and faster deliveries.

2

PART I

ITEM 1. BUSINESS

Tesoro Logistics LP (“TLLP” or the “Partnership”) is a fee-based, growth-oriented Delaware limited partnership formed in December 2010 by Tesoro Corporation and its wholly owned subsidiary, Tesoro Logistics GP, LLC (“TLGP”), our general partner, to own, operate, develop and acquire logistics assets. Unless the context otherwise requires, references in this report to “we,” “us,” “our,” or “ours” refer to Tesoro Logistics LP, one or more of its consolidated subsidiaries or all of them taken as a whole. Unless the context otherwise requires, references in this report to “Tesoro” or our “Sponsor” refer collectively to Tesoro Corporation and any of its subsidiaries, other than TLLP, its subsidiaries and its general partner.

In April 2011, we completed our initial public offering (the “Initial Offering”). Subsequent to the Initial Offering we have acquired additional assets from Tesoro, and those assets, liabilities and results of operations are collectively referred to as the “Predecessors.” Our financial information for all periods with the exception of the consolidated balance sheet as of December 31, 2015, includes the historical results of our Predecessor and the results of TLLP. The financial statements of our Predecessor have been prepared from the separate records maintained by Tesoro and may not necessarily be indicative of the conditions that would have existed or the results of operations if our Predecessor had been operated as an unaffiliated entity. Most notably, this applies to the revenue associated with the terms of the commercial agreements as our Predecessors did not record revenue for transactions with Tesoro in the Terminalling and Transportation segment, with the exception of regulatory tariffs charged to Tesoro on the refined products pipeline included in the West Coast Logistics Assets Acquisition.

TLLP is a full-service logistics company operating primarily in the western and mid-continent regions of the United States. We own and operate networks of over 3,500 miles of crude oil, refined products and natural gas pipelines and 29 crude oil and refined products truck and marine terminals that have over 15 million barrels of storage capacity. In addition, we own and operate four natural gas processing complexes and one fractionation facility. Our assets are categorized into a Gathering segment, a Processing segment and a Terminalling and Transportation segment. Segment disclosures are discussed in Note 14 to our combined consolidated financial statements in Part II, Item 8. Our business is affected by seasonality due to weather conditions, access restrictions as well as supply and demand.

We generate revenues by charging fees for gathering crude oil and natural gas, for terminalling, transporting and storing crude oil and refined products and for processing natural gas. We are generally not directly exposed to commodity price risk with respect to any of the crude oil, natural gas, natural gas liquids (“NGLs”) or refined products that we handle, as part of our normal operations. However, we may be subject to nominal commodity risk exposure due to pipeline loss allowance provisions in many of our pipeline gathering and transportation contracts and a nominal amount of condensate retained as part of our natural gas gathering services. In the event actual measured pipeline losses are less than the loss allowance we are able to sell the natural gas and crude oil at market price adjusted for premiums; vice versa when actual losses exceed loss allowances we purchase natural gas or crude oil at market prices. As part of acquiring all of the limited liability company interests of QEP Field Services, LLC, (the “Rockies Natural Gas Business Acquisition”), we acquired a natural gas imbalance created by accumulating monthly loss allowance gains that were not sold. The natural gas imbalance exposes us to fluctuations in natural gas prices. At December 31, 2015, the estimated value of the imbalance was $2 million. For the NGLs that we handle under “keep-whole” agreements, the Partnership has a fee-based processing agreement with Tesoro, which minimizes the impact of commodity price movements during the annual period subsequent to renegotiation of terms and pricing each year. We do not engage in the trading of crude oil, natural gas, NGLs or refined products; therefore, we have minimal direct exposure to risks associated with commodity price fluctuations. However, through their effects on our customers’ operations, these risks indirectly influence our activities and results of operations over the long term. Tesoro and QEP Resources accounted for 55% and 16% of our total revenues in the year ended December 31, 2015, respectively.

The Partnership is not a taxable entity for federal and state income tax purposes. Instead, each partner of the Partnership is required to take into account its share of income, gain, loss and deduction of the partnership in computing its federal and state income tax liabilities, regardless of whether cash distributions are made to the partner by the Partnership. The taxable income reportable to each partner takes into account differences between the tax bases and financial reporting bases of assets and liabilities, the acquisition price of their units and the taxable income allocation requirements under the partnership agreement.

3

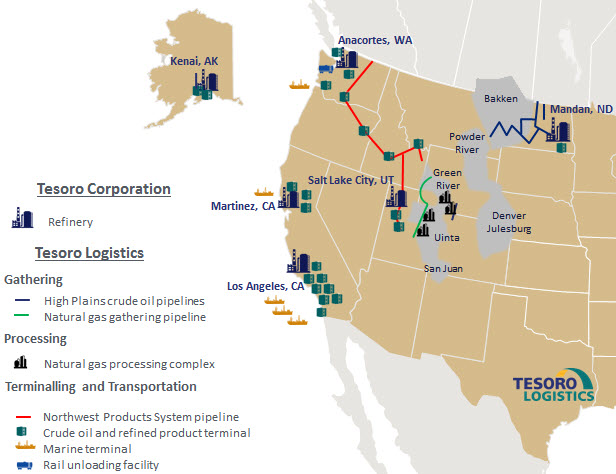

The following provides an overview of our assets and operations in relation to Tesoro’s refineries:

4

GATHERING

Our gathering systems include crude oil and natural gas pipeline gathering systems in the Bakken Shale/Williston Basin area of North Dakota and Montana (the “Bakken Region”) and the Green River Basin, Uinta Basin and Vermillion Basin in the states of Utah, Colorado and Wyoming (the “Rockies Region”), including:

• | a common carrier crude oil gathering and transportation system in North Dakota and Montana (the “High Plains System”); |

• | the Williston Gathering System, which consists of a crude oil and natural gas gathering system located in the Williston Basin, North Dakota; |

• | the Uinta Basin Gathering System, which consists of natural gas gathering systems and compression assets located in northeastern Utah; |

• | the Green River System, which consists of an integrated natural gas gathering and transportation system; |

• | the Vermillion Gathering System, which consists of natural gas gathering and compression assets located in Southern Wyoming, northwest Colorado and northeast Utah; |

• | a 50% equity method investment in Three Rivers Gathering, which transports natural gas to our natural gas processing facilities, located in the Uinta Basin; and |

• | a 38% equity method investment in Uintah Basin Field Services, which operates gathering pipeline and gas compression assets located in the southeastern Uinta Basin. |

The following table details the average aggregate Mbpd and MMBtus of natural gas transported through our assets for the year ended December 31, 2015.

Crude oil transported (Mbpd): | ||

Pipelines (a) | 188 | |

Trucking | 38 | |

Natural gas transported (thousands of MMBtu/d): | ||

Pipelines | 1,077 | |

____________

(a) | Also includes barrels that were gathered and then delivered into our High Plains Pipeline by truck. |

High Plains System. We own and operate a common carrier crude oil gathering and transportation system consisting of approximately 1,020 miles of common carrier pipeline in North Dakota and Montana (the “High Plains Pipeline”), which gathers and transports crude oil. The Partnership transports all of the crude oil processed at Tesoro’s North Dakota refinery via the High Plains System.

As part of our High Plains System, we own storage facilities in North Dakota for the Bakken region with tanks located in strategic areas of the basin, which provide our customers access to and from multiple pipelines and rail loading facilities in the area. The current commercial storage capacity is approximately 780,000 barrels as of December 31, 2015.

In addition, we own and operate a truck-based crude oil gathering operation. This operation uses a combination of proprietary and third-party trucks, all of which we dispatch and schedule. These trucks gather and transport crude oil from well sites or nearby collection points in the Bakken Region and deliver it to our High Plains Pipeline and third-party destinations. We charge per-barrel tariffs and service fees for picking up and transporting crude oil, for dispatching and scheduling proprietary and third-party trucks and for use of our field unloading tanks.

Williston Gathering System. The Williston Gathering System is a crude oil and natural gas gathering system located in the Williston Basin in McLean County, North Dakota. The Williston Gathering System is primarily supported by long-term, fee-based, crude oil and gas gathering agreements with minimum volume commitments. The crude oil gathering results of operations and volumes from this system are included in the amounts disclosed for the High Plains System.

Uinta Basin Gathering System. The Uinta Basin Gathering System consists of natural gas gathering systems and compression assets located in northeast Utah, which include approximately 602 miles of low-pressure gathering pipeline and 54,280 bhp of natural gas compression. We refer to these individual gas gathering systems collectively as the Uinta Basin Gathering System. The gathering system is primarily supported by acreage dedications and long-term, fee-based gathering agreements that contain annual inflation adjustment mechanisms and minimum volume commitments.

5

Green River System. The Green River System, located in western Wyoming, consists of three integrated assets: the Green River Gathering Assets, the assets owned by Rendezvous Gas Services, L.L.C. (“Rendezvous Gas”) and the Rendezvous Pipeline Company, LLC (“Rendezvous Pipeline”). In addition to gathering natural gas, the system also gathers crude oil production, transports the crude oil to an interstate pipeline interconnect, and gathers and handles produced and flowback water associated with well completion and production activities.

• | The Green River Gathering Assets are primarily supported by Life-of-Reserves Contracts and long-term, fee-based gathering agreements with minimum volume commitments. |

• | Rendezvous Gas is an indirect, non-wholly owned subsidiary of TLLP, which was formed to own and operate the infrastructure that transports gas from certain fields to several re-delivery points, including natural gas processing facilities that are owned by TLLP or a third party. |

• | Rendezvous Pipeline provides gas transportation services from the Blacks Fork processing complex in southwest Wyoming to an interconnect with the Kern River Pipeline. The capacity on the Rendezvous Pipeline system is contracted under long-term take or pay transportation contracts. |

Vermillion Gathering System. The Vermillion Gathering System consists of gas gathering and compression assets located in southern Wyoming, northwest Colorado and northeast Utah. The Vermillion Gathering System is primarily supported by Life-of-Reserves Contracts and long-term, fee-based gas gathering agreements with minimum volume commitments.

Three Rivers Gathering System. Three Rivers Gathering, L.L.C. (“Three Rivers Gathering”) is a joint venture between TLLP and Ute Energy, which was formed to transport natural gas gathered by Uintah Basin Field Services, an equity method investment in which we own a 50% fee interest, and other third-party volumes to gas processing facilities owned by us and third parties. The Three Rivers Gathering system is primarily supported by long-term, fee-based gas gathering agreements with minimum volume commitments.

Uintah Basin Field Services, L.L.C. Uintah Basin Field Services is a joint venture between QEP Field Services, LLC’ (“QEPFS”), Discovery Natural Resources LLC, and Ute Energy Midstream Holdings, LLC that was formed to allow the partners to jointly develop the natural gas gathering infrastructure within a defined area of mutual interest located in the southeastern Uinta Basin. The gathering system consists of approximately 96 miles of gathering pipeline and 2,370 bhp of gas compression and is operated by us. The gathering system is supported by long-term, fee-based gas gathering agreements that contain firm throughput commitments, which generate fees whether or not the capacity is used. The system is currently fully subscribed due to these firm commitments, but we believe we can easily expand this system by adding incremental compression or looping a portion of the existing pipeline. The gathering system has total throughput capacity of approximately 120 MMcf/d.

The following table provides information regarding the gathering assets by system as of December 31, 2015.

Gathering System | Products Handled | Length (miles) | Compression (bhp) | |||||

High Plains System | Crude Oil | 1,020 | — | |||||

Williston Gathering System | Natural gas | 20 | 239 | |||||

Crude Oil | 18 | — | ||||||

Uinta Basin Gathering System | Natural gas | 602 | 54,280 | |||||

Green River System | ||||||||

Green River Gathering Assets | Natural gas | 366 | 49,131 | |||||

Crude oil | 208 | — | ||||||

Water | 38 | — | ||||||

Rendezvous Gas Services, L.L.C. | Natural gas | 311 | 7,800 | |||||

Rendezvous Pipeline | Natural gas | 21 | — | |||||

Vermillion Gathering System | Natural gas | 480 | 25,562 | |||||

Three Rivers Gathering, L.L.C. | Natural gas | 52 | 4,735 | |||||

Uintah Basin Field Services, L.L.C. | Natural gas | 96 | 2,370 | |||||

Total | 3,232 | 144,117 | ||||||

6

Our natural gas operations are affected by seasonal weather conditions and certain access restrictions imposed by the Bureau of Land Management (“BLM”) on federal lands to protect migratory and breeding patterns of native species. During the winter months, our customers typically reduce drilling and completion activities due to adverse weather conditions and access restrictions imposed by the BLM reduce our ability to complete expansion projects and connect to newly completed wells. We mitigate these seasonal risks through prudent planning and coordination with our customers to ensure expansion projects are completed prior to these periods, if located in an affected area. Condensate sales, however, tend to increase in the first quarter of each year, as the colder ground causes more condensates to fall out of the gas stream in our gathering system. We expect the impact of such seasonality to diminish as we expand our existing assets or acquire additional assets outside of the affected areas.

PROCESSING

Our Processing segment consists of the Vermillion processing complex (“Vermillion Complex”), the Uinta Basin processing complex (“Uinta Basin Complex”), the Blacks Fork processing complex (“Blacks Fork Complex”) and the Emigrant Trail processing complex (“Emigrant Trail Complex”). Approximately 60-65% of our plant production is currently supported by long-term, fee-based processing agreements with minimum volume commitments. The following table outlines the locations of our processing and fractionation facilities and their respective asset type, facility type, throughput capacities and average daily throughput as of December 31, 2015.

Asset | Primary Location | Facility Type | Throughput Capacity (a) | Throughput (a) | ||||||

Processing Complexes | ||||||||||

Vermillion Complex | Southern Green River Basin | Cryogenic | 57 | 57 | ||||||

Uinta Basin Complex | Uinta Basin | Cryogenic / Refrigeration | 590 | 275 | ||||||

Blacks Fork Complex | Green River Basin | Cryogenic / Joule-Thomson | 730 | 526 | ||||||

Emigrant Trail Complex | Green River Basin | Cryogenic | 55 | 52 | ||||||

Total Processing | 1,432 | 910 | ||||||||

Fractionation Complex | ||||||||||

Blacks Fork Complex | Green River Basin | Fractionator | 15,000 | 2,931 | ||||||

Total Fractionation | 15,000 | 2,931 | ||||||||

______________

(a) | Capacity and throughput is measured in MMcf/d for processing complexes and bpd for the fractionation complex. |

Vermillion Complex. The Vermillion Complex, located in Sweetwater County, Wyoming, consists of two cryogenic processing trains. A portion of the natural gas volumes that we have gathered at the Vermillion Complex are made available to us pursuant to certain natural gas gathering agreements with several producer customers. The plant receives the majority of its gas from the Vermillion sub-basin in southern Wyoming and northwest Colorado.

Uinta Basin Complex. The Uinta Basin Complex, located in Uintah County, Utah, consists of five separate processing trains with raw gas inlet processing capacity. The complex receives the majority of its gas from various natural gas fields located in the Uinta Basin.

Blacks Fork Complex. The Blacks Fork Complex, located in Sweetwater and Uinta Counties, Wyoming, consists of three separate gas processing trains and a NGL fractionation facility. The complex receives the majority of its gas from various gas fields located in the Green River Basin of western Wyoming.

Emigrant Trail Complex. The Emigrant Trail Complex, located in Uinta County, Wyoming, consists of one cryogenic gas processing train. The complex receives the majority of its gas from various gas fields located in the Green River Basin of western Wyoming.

7

TERMINALLING AND TRANSPORTATION

We generate terminalling and transportation revenues by charging our customers fees for:

• | transferring refined products from terminals to trucks, barges and pipelines; |

• | delivering crude oil and intermediate feedstocks from vessels to refineries and terminals; |

• | transporting refined products; |

• | unloading crude oil transported by unit train to Tesoro’s Washington refinery; |

• | providing storage services; |

• | providing ancillary services, ethanol blending and additive injection, and for barge loading or unloading fees; and |

• | handling petroleum coke for Tesoro’s Los Angeles refinery. |

Our refined products terminals are supplied by Tesoro-owned and third-party pipelines, trucks, and barges. Our marine terminals load and unload vessels, our rail car unloading facility receives crude oil transported on unit trains leased by Tesoro, and our petroleum coke facility handles and stores petroleum coke.

Terminalling

The tables below set forth the average daily terminalling or loading capacity and total average terminalling throughput for our crude oil and refined products terminals (in bpd) for the year ended December 31, 2015.

Crude oil and refined products terminals: | Daily Available Terminalling Capacity | Throughput | |||

California Marine Terminals | 795,000 | 456,497 | |||

California Terminals and Storage Facilities | 707,600 | 270,855 | |||

Idaho Terminals | 50,000 | 43,575 | |||

Utah Terminal | 82,000 | 40,337 | |||

Washington Terminals and Storage Facilities | 120,500 | 80,820 | |||

North Dakota Terminal | 28,500 | 21,983 | |||

Alaska Terminals | 66,500 | 20,631 | |||

Total Crude Oil and Refined Products | 1,850,100 | 934,698 | |||

The following table outlines the locations and types of products handled by our crude oil and refined products terminals and storage facilities including their storage capacities (in shell barrels) as of December 31, 2015.

Terminal Location | Products Handled | Total Storage Capacity (a) | Dedicated Storage (b) | |||||

California Marine Terminals | Crude Oil; Intermediate Feedstocks; Gasoline; Diesel; Jet Fuel | 2,735,311 | 1,996,000 | |||||

California Terminals and Storage Facilities | Crude Oil; Diesel; Intermediate Feedstocks; Gasoline; Gasoline Blendstocks; Jet Fuel; Light Ends; NGLs | 13,791,378 | 11,446,000 | |||||

Idaho | Gasoline; Diesel; Jet Fuel | 878,260 | — | |||||

Utah | Gasoline; Diesel; Jet Fuel; Crude Oil Storage; Truck Unloading | 895,000 | 878,000 | |||||

Washington | Gasoline; Diesel; NGLs | 2,373,784 | 1,540,000 | |||||

Alaska | Gasoline; Diesel; Jet Fuel; Aviation Gasoline | 1,095,000 | — | |||||

Total Crude Oil and Refined Products | 21,768,733 | 15,860,000 | ||||||

____________

(a) | Includes storage capacity for refined products and ethanol only; excludes additive storage for gasoline and diesel. |

(b) | Represents dedicated portion of total storage capacity for which we charge a per barrel monthly fee based on storage capacity. |

8

California Marine Terminals. The California marine terminals consist of four marine terminals and a marine storage facility that support Tesoro’s Los Angeles refinery, Tesoro’s Martinez refinery and third parties. One of the marine terminals is currently subleased from Tesoro pursuant to a master lease between Tesoro and the City of Long Beach, which expires in 2032. One of these marine terminals, Berth 121, is capable of handling a two million barrel capacity very large crude carrier. The other marine terminal, Terminal 2, is comprised of a two-vessel berth dock and is adjacent to our Terminal 3 storage facility. Tesoro currently leases a portion of Berth 121 from the City of Long Beach under a lease that expires in 2023 and a portion of Terminal 2, which is currently under a month to month lease while negotiations are underway to provide a long term lease. Until the effectiveness of the subleases between Tesoro and TLLP for these properties, TLLP is operating the assets pursuant to the Berth 121 Operating Agreement and the Terminals 2 and 3 Operating Agreement.

The Martinez Crude Oil Marine Terminal is located near Tesoro’s Martinez refinery and consists of a single-berth dock, storage tanks and related pipelines that receive crude oil from vessels for delivery to Tesoro’s refinery and a third-party terminal. The single-berth dock and related leasehold improvements are situated on an offshore parcel of land that is currently being leased by Tesoro from the California State Lands Commission under a term lease. The lease will be legally transferred to TLLP upon renewal and approval from the California State Lands Commission. We are currently operating these assets under the terms of the Amorco Marine Terminal Use and Throughput Agreement entered into in April 2012.

California Terminals and Storage Facilities. We own and operate ten terminals in Southern California, including three storage facilities. We operate a refined products terminal in Stockton, which we lease from the Port of Stockton under a five-year lease expiring in 2019 that can be extended for up to two additional five-year terms. We own and operate a terminal located at Tesoro’s Martinez refinery that includes a three-lane, refined products truck rack, a two-lane, NGL truck facility and an NGL rail loading and unloading facility. The Martinez terminal receives refined products via pipelines from the Martinez refinery, some of which we blend with renewable fuels before delivery. On November 12, 2015, we purchased crude oil and refined product storage and pipeline assets in Los Angeles, California (the "LA Storage and Handling Assets") from Tesoro, which included 97 crude oil, feedstock, and refined product storage tanks with combined capacity of 6.6 million barrels and a 50% fee interest in a 16-mile pipeline that transports jet fuel from Tesoro’s Los Angeles refinery to the Los Angeles International Airport.

Idaho Terminals. We own and operate three terminals in Idaho, which include terminals located in Boise, Pocatello and Burley, acquired on June 19, 2013, in the Northwest Products System Acquisition. Refined products received at the Idaho terminals are distributed by Tesoro and third parties through the truck loading racks.

Utah Terminal. We own and operate a refined products terminal adjacent to Tesoro’s Utah refinery. The Salt Lake City terminal has the ability to receive refined products directly from the refinery via pipeline. Refined products received and ethanol blended into gasoline at this terminal are sold locally and regionally by Tesoro and third parties through our five-bay truck loading rack. We own and operate a crude oil truck terminal that allows us to receive approximately 12 Mbpd of black wax crude oil for Tesoro’s use in its Utah refinery. We also own and operate a crude oil and refined products storage facility in Salt Lake City with 878,000 barrels of storage capacity. The storage tanks are connected to Tesoro’s Utah refinery through our four interconnecting pipelines, but are not directly connected to our Salt Lake City terminal. The storage facility supplies crude oil to Tesoro’s Utah refinery and receives refined and intermediate products from the refinery.

Washington Terminals and Storage Facilities. Our Washington terminals consist of three terminals located in Vancouver, Pasco and Anacortes. The Vancouver terminal is leased from the Port of Vancouver under a 10-year lease expiring in 2016, with two 10-year renewal options. We receive gasoline and distillates at this terminal from Tesoro’s Washington refinery through a third-party common carrier pipeline. We also have access to a marine dock owned by the Port of Vancouver under a non-preferential berthing agreement, which allows us to receive gasoline and distillates from Tesoro’s Washington refinery and third-party sources through barge deliveries and to transport those refined products to the terminal on proprietary interconnecting pipelines. Refined products received at this terminal are sold locally by Tesoro and others through our two-bay truck loading rack or through barges loaded at the Port of Vancouver dock.

Our owned and operated Pasco terminal is supplied with refined products from our Northwest Products Pipeline and can receive refined products delivered by barge via the Columbia River. The refined products received by the terminal can be delivered to Spokane, Washington via the Northwest Products Pipeline or distributed via truck from its four-bay truck rack.

The Anacortes terminal consists of a two-lane, refined products truck rack, a two-lane NGL truck rack, an NGL rail loading and unloading facility, and four crude and heavy oil storage tanks with a shell capacity of approximately 1,500,000 barrels, all located at Tesoro’s Anacortes refinery. In addition, during 2015, a new truck rack at the Anacortes terminal was completed, which has a capacity of 20 Mbpd. The Anacortes terminal is included in the real property leased under the agreement with Tesoro for the Anacortes Rail Facility, discussed below.

9

The Anacortes Rail Facility in Washington includes a four-track unloading platform with two receiving and two departing tracks capable of handling a 100-car unit train and two additional short track spurs. The facility, which was placed in service in September 2012, has a permitted capacity to unload up to an annual average of 50 Mbpd of crude oil to Tesoro’s Washington refinery. We entered into an agreement with Tesoro to lease its real property at the Anacortes Rail Facility for a term of ninety-nine years in connection with the Anacortes Rail Facility Acquisition.

North Dakota Terminal. We own and operate a refined products terminal located at Tesoro’s North Dakota refinery in Mandan. The terminal receives product directly from Tesoro’s North Dakota refinery.

Alaska Terminals. Our Alaska terminals consist of two terminals located in Anchorage and Nikiski. The Anchorage terminal is located on property at two adjacent leaseholds within the Port of Anchorage. A portion of the terminal is on land that is leased by Tesoro from the Alaska Railroad Corporation through December 31, 2016. Tesoro may renew the lease for up to two additional five-year terms. We sublease this portion of the terminal from Tesoro under the same expiration and renewal terms. The remainder of the terminal is on land that we lease from the Municipality of Anchorage on a month to month basis. We expect that we will secure a 20 year lease renewal in the first quarter of 2016. This terminal has the ability to receive refined products from Tesoro’s Alaska refinery through our state-regulated common carrier pipeline acquired in the West Coast Logistics Assets Acquisition and from marine vessels through the Port of Anchorage. The terminal also has a rail rack that is leased to a third party. It can hold and unload ten rail cars and is connected to a pipeline that runs to a neighboring third-party jet fuel storage facility. Refined products received at the terminals are sold locally by Tesoro and others through two separate two-bay truck loading racks, through third-party barges loaded at a Port of Anchorage dock or through pipelines to a third-party storage facility. The Nikiski terminal includes a two-lane truck rack, and six storage tanks with approximately 212,000 barrels of storage capacity. The terminal is supplied with refined products by a direct pipeline from Tesoro’s Kenai refinery.

Carson California Petroleum Coke Handling and Storage Facility. We operate a coke handling and storage facility adjacent to Tesoro’s Los Angeles refinery. The Partnership acquired the coke handling and storage facility from Tesoro in the Los Angeles Logistics Assets Acquisition. Tesoro has committed to throughput 2,600 metric tons per day of petroleum coke at this facility. We lease the facility to Tesoro under an agreement that expires in 2024 and can be renewed by Tesoro for six renewal terms of ten years each.

Transportation

We own and operate the Northwest Products Pipeline, a 760-mile long common carrier refined products pipeline that is the primary transportation option from Salt Lake City to Idaho and eastern Washington, an approximately 70-mile long refined products pipeline connecting Tesoro’s Kenai refinery to Anchorage, Alaska and approximately 160-miles of pipeline in our southern California transportation pipeline system. We also own a number of proprietary pipelines in Salt Lake City and Los Angeles that transport a number of products between various facilities, including Tesoro’s refineries, and other owned and third-party terminals and pipelines. The table below sets forth the total average throughput for transportation services on our crude oil and refined products pipelines for the year ended December 31, 2015.

Transportation volumes (Mbpd): | ||

Tesoro | 754 | |

Third parties | 71 | |

Total | 825 | |

COMMERCIAL AGREEMENTS

Tesoro

Tesoro accounted for $615 million, or 55%, of our total revenues in the year ended December 31, 2015. No revenue was recorded by the Predecessors for transactions with Tesoro in the Terminalling and Transportation segment prior to the Acquisitions from Tesoro, with the exception of regulatory tariffs charged to Tesoro for 2014 and prior.

We process gas for certain producers under “keep-whole” processing agreements. Under a “keep-whole” agreement, a producer transfers title to the NGLs produced during gas processing, and the processor, in exchange, delivers to the producer natural gas with a BTU content equivalent to the NGLs removed. See Note 3 to our combined consolidated financial statements in Part II, Item 8 for additional information on our “keep-whole” agreements.

10

We have various long-term, fee-based commercial agreements with Tesoro, under which we provide pipeline transportation, trucking, terminal distribution, storage services and coke handling services to Tesoro. See Note 3 to our combined consolidated financial statements in Part II, Item 8 for additional information on our commercial agreements.

Third-Parties

Third-party agreements accounted for $497 million, or 45%, of our total revenues for the year ended December 31, 2015. Of this, approximately $270 million is under committed arrangements in which we provide gathering, processing, pipeline transportation, terminal distribution and storage services.

COMPETITION

Gathering

Our High Plains System competes with a number of transportation companies for gathering and transporting crude oil produced in the Bakken Region. We may also compete for opportunities to build gathering lines from producers or other pipeline companies. Other companies have existing pipelines that are available to ship crude oil and continue to (or have announced their intent to) expand their pipeline systems in the Bakken Region. We also compete with third-party carriers that deliver crude oil by truck.

Although we compete for third-party shipments of crude oil on our High Plains System, our contractual relationship with Tesoro under our Transportation Services Agreement (High Plains System) (the “High Plains Pipeline Transportation Services Agreement”) and our connection to Tesoro’s North Dakota refinery provide a strong competitive position for the Partnership in the Bakken Region.

Our competitors for natural gas gathering include other midstream companies and producers. Competition for natural gas volumes is primarily based on reputation, commercial terms, reliability, service levels, flexibility, access to markets, location, available capacity, capital expenditures and fuel efficiencies. In addition to competing for crude oil and natural gas volumes, we face competition for customer markets, which is primarily based on the proximity of the pipelines to the markets, price and assurance of supply.

Processing

Our competitors for processing include other midstream companies and producers. Competition for natural gas volumes is primarily based on reputation, commercial terms, reliability, service levels, flexibility, access to markets, location, available capacity, capital expenditures and fuel efficiencies. In addition to competing for natural gas volumes, we face competition for customer markets, which is primarily based on the proximity of the facilities to the markets, price and assurance of supply.

Terminalling and Transportation

Our competition primarily comes from independent terminal and pipeline companies, integrated petroleum companies, refining and marketing companies and distribution companies with marketing and trading arms. Competition in particular geographic areas is affected primarily by the volumes of refined products produced by refineries located in those areas, the availability of refined products and the cost of transportation to those areas from refineries located in other areas.

We may compete with third-party terminals for volumes in excess of minimum volume commitments under our commercial agreements with Tesoro and third-party customers as other terminals and pipelines may be able to supply Tesoro’s refineries or end user markets on a more competitive basis, due to terminal location, price, versatility and services provided. If Tesoro’s customers reduced their purchases of refined products from Tesoro due to the increased availability of less expensive product from other suppliers or for other reasons, Tesoro may only receive or deliver the minimum volumes through our terminals (or pay the shortfall payment if it does not deliver the minimum volumes), which would cause a decrease in our revenues.

11

PIPELINE, TERMINAL AND RAIL SAFETY

Pipeline Safety

Our pipelines, gathering systems and terminal operations are subject to increasingly strict safety laws and regulations. The transportation and storage of refined products, natural gas and crude oil involve a risk that hazardous liquids may be released into the environment, potentially causing harm to the public or the environment. The U.S. Department of Transportation, through the Pipeline and Hazardous Materials Safety Administration (“PHMSA”) and state agencies, enforce safety regulations with respect to the design, construction, operation, maintenance, inspection and management of our pipeline and storage facilities. These regulations contain requirements for the development and implementation of pipeline integrity management programs, which include the inspection and testing of pipelines and the investigation of anomalies and if necessary, corrective action. These regulations also require that pipeline operation and maintenance personnel meet certain qualifications and that pipeline operators develop comprehensive spill response plans, including extensive spill response training for pipeline personnel.

We may incur significant costs and liabilities associated with repair, remediation, preventative or mitigation measures associated with our pipelines. These costs and liabilities might relate to repair, remediation, preventative or mitigating actions that may be determined to be necessary as a result of the testing program, as well as lost cash flows resulting from shutting down our pipelines during the pendency of such repairs. Additionally, if we fail to comply with PHMSA or comparable state regulations, we could be subject to penalties and fines. If future PHMSA regulations were to impose new regulatory requirements on our assets, the costs associated with compliance could have a material effect on our operations.

While we operate and maintain our pipelines consistent with applicable regulatory and industry standards, we cannot predict the outcome of legislative or regulatory initiatives. Such legislative and regulatory changes could have a material effect on our operations, particularly by extending more stringent and comprehensive safety regulations to pipelines and gathering lines not previously subject to such requirements. While we expect any legislative or regulatory changes to allow us time to comply with new requirements, costs associated with compliance may have a material effect on our operations.

Natural Gas Processing Safety

Our natural gas processing plants and operations are subject to safety regulations under the U.S. Occupational Safety Health Administration (“OSHA”) and comparable state and local requirements. A number of our natural gas processing facilities are also subject to OSHA’s process safety management regulations and the Environmental Protection Agency’s (“EPA”) risk management plan requirements. Together these regulations are designed to prevent or minimize the probability and consequences of an accidental release of toxic, reactive, flammable or explosive chemicals. A number of our facilities are also regulated under the Department of Homeland Security Chemical Facility Anti-Terrorism Standards, which are designed to regulate the security of high-risk chemical facilities. Our natural gas processing plants and operations are operated in a manner consistent with industry safe practices and standards.

Terminal Safety

Our operations are subject to regulations under OSHA and comparable state and local regulations. Our terminal facilities are operated in a manner consistent with industry safe practices and standards. The storage tanks that are at our terminals are designed for crude oil and refined products and are equipped with appropriate controls that minimize emissions and promote safety. Our terminal facilities have response and control plans, spill prevention and other programs to respond to emergencies.

Rail Safety

Our rail operations are limited to loading and unloading rail cars at our facilities. Generally, rail operations are subject to federal, state and local regulations. We believe our entire rail car loading and unloading operations meet or exceed all applicable regulations.

12

RATE AND OTHER REGULATIONS

General Interstate Regulation

Our High Plains Pipeline, Northwest Products Pipeline and two other interstate pipelines are common carriers subject to regulation by various federal, state and local agencies. The FERC regulates interstate transportation on our crude oil transportation and gathering pipelines and Northwest Products Pipeline under the Interstate Commerce Act (“ICA”), the Energy Policy Act of 1992 (the “EPAct”), and the rules and regulations promulgated under those laws. The ICA and its implementing regulations require that tariff rates for interstate service on oil pipelines, including interstate pipelines that transport crude oil and refined products (collectively referred to as “Petroleum Pipelines”), be just and reasonable and non-discriminatory and that such rates and terms and conditions of service be filed with the FERC. Under the ICA, shippers may challenge new or existing rates or services. The FERC is authorized to suspend the effectiveness of a challenged rate for up to seven months, though rates are typically not suspended for the maximum allowable period. A successful rate challenge could result in Petroleum Pipelines paying refunds for the period that the rate was in effect and/or reparations for up to two years prior to the filing of a complaint. There are no pending challenges or complaints regarding our current tariffs.

Certain interstate Petroleum Pipeline rates in effect at the inception of the EPAct are deemed to be just and reasonable under the ICA. These rates are referred to as grandfathered rates. Our rates for interstate transportation service on the Northwest Products Pipeline are grandfathered. The FERC allows for an annual rate change under its indexing methodology, which applies to transportation on our High Plains Pipeline and Northwest Products Pipeline.

We own a natural gas pipeline, located in Wyoming. Under the Natural Gas Act of 1938 (the “NGA”), FERC has authority to regulate natural gas companies that provide natural gas pipeline transportation services in interstate commerce. Federal regulation of interstate pipelines extends to such matters as rates, services, and terms and conditions of service; the types of services offered to customers; the certification and construction of new facilities; the acquisition, extension, disposition or abandonment of facilities; the maintenance of accounts and records; relationships between affiliated companies involved in certain aspects of the natural gas business; the initiation and continuation of services; market manipulation in connection with interstate sales, purchases or transportation of natural gas; and participation by interstate pipelines in cash management arrangements. FERC prohibits natural gas companies from unduly preferring or unreasonably discriminating against any person with respect to pipeline rates or terms and conditions of service. Under the NGA, the rates for service on interstate facilities must be just and reasonable and not unduly discriminatory. The FERC has granted the Rendezvous Pipeline Company (“Rendezvous”) market-based rate authority, subject to certain reporting requirements. In the event the FERC were to suspend Rendezvous’ market-based rate authority, it could have an adverse impact on our revenue associated with the transportation service.

Intrastate Regulation

The intrastate operations of our High Plains Pipeline in North Dakota and our refined products pipeline in Alaska are subject to regulation by the North Dakota Public Service Commission (“NDPSC”) and the Regulatory Commission of Alaska, respectively. Applicable state law requires that:

•pipelines operate as common carriers;

•access to transportation services and pipeline rates be non-discriminatory;

• | transported crude oil volumes must be apportioned without unreasonable discrimination if more crude oil is offered for transportation than can be transported immediately; and |

•pipeline rates are just and reasonable.

Pipelines

We operate our crude oil gathering pipelines and the Northwest Products Pipeline as common carriers pursuant to tariffs filed with the FERC, and the NDPSC for the High Plains Pipeline. The High Plains Pipeline offers tariffs from various locations in Montana and North Dakota to a variety of destinations. Tesoro has historically been the shipper of the majority of the volumes transported on the High Plains Pipeline, although third-party movements have increased on this system in 2015 and may continue to increase as additional origins and destinations have been added. The Northwest Products Pipeline extends from Salt Lake City, Utah to Spokane, Washington and offers tariffs from various locations to a variety of destinations, which serves both third-party customers and Tesoro. Our pipeline provides gathering of condensate in Wyoming. We also provide other crude oil gathering in North Dakota.

13

The FERC and state regulatory agencies generally have not investigated rates on their own initiative when those rates have not been the subject of a protest or a complaint by a shipper. Tesoro has agreed not to contest our tariff rates for the term of our commercial agreements. However, our pipelines are common carrier pipelines, and we may be required to accept additional third-party shippers who wish to transport through our system. The FERC or the NDPSC could investigate our rates at any time. If an interstate rate for service on the High Plains Pipeline or Northwest Products Pipeline were investigated, the challenger would have to establish that there has been a substantial change since the enactment of the EPAct, in either the economic circumstances or the nature of the service that formed the basis for the rate. If our rates were investigated, the inquiry could result in a comparison of our rates to those charged by others or to an investigation of our costs.

Section 1(b) of the NGA exempts natural gas gathering facilities from the jurisdiction of the FERC. Although the FERC has not made formal determinations with respect to all of the facilities we consider to be gathering facilities, we believe that our natural gas pipelines meet the traditional tests that the FERC has used to determine that a pipeline is a gathering pipeline and are, therefore, not subject to FERC jurisdiction.

States may regulate gathering pipelines. State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements and complaint-based regulation. Our natural gas and crude oil gathering operations are subject to ratable take and common purchaser statutes in most of the states in which we operate. These statutes generally require our gathering pipelines to take natural gas or crude oil without undue discrimination as to source of supply or producer. The regulations under these statutes can have the effect of imposing some restrictions on our ability as an owner of gathering facilities to decide with whom we contract to gather natural gas or crude oil. Failure to comply with state regulations can result in the imposition of administrative, civil and criminal remedies. To date, there has been no adverse effect to our system due to these regulations.

ENVIRONMENTAL REGULATIONS

General

Our operations of pipelines, terminals and associated facilities in connection with the storage and transportation of crude oil and refined products as well as gathering and processing of natural gas is subject to extensive and frequently-changing federal, state and local laws, regulations, permits and ordinances relating to the protection of the environment. Among other things, these laws and regulations govern the emission or discharge of pollutants into or onto the land, air and water, the handling and disposal of solid and hazardous wastes and the remediation of contamination. Compliance with existing and anticipated environmental laws and regulations increases our overall cost of business, including our capital costs to construct, maintain, operate and upgrade equipment and facilities. Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties. Certain environmental statutes impose strict, joint and several liability for costs required to clean up and restore sites where hazardous substances, hydrocarbons or wastes have been disposed or otherwise released. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment. These requirements may also significantly affect our customers’ operations and may have an indirect effect on our business, financial condition and results of operations. However, we do not expect such effects will have a material impact on our financial position, results of operations or liquidity.

Under the Amended Omnibus Agreement and the Carson Assets Indemnity Agreement, Tesoro indemnifies us for certain matters, including environmental, title and tax matters associated with the ownership of our assets at or before the closing of the Initial Offering and the subsequent Acquisitions from Tesoro. See Note 11 to our combined consolidated financial statements in Part II, Item 8 for additional information regarding the Amended Omnibus Agreement and Carson Assets Indemnity Agreement.

Air Emissions and Climate Change Regulations

Our operations are subject to the Clean Air Act and comparable state and local statutes. Under these laws, permits may be required before construction can commence on a new source of potentially significant air emissions, and operating permits may be required for sources that are already constructed. If regulations become more stringent, additional emission control technologies may be required to be installed at our facilities. Any such future obligations could require us to incur significant additional capital or operating costs. If regulations become more stringent, additional emission control technologies may be required to be installed at our facilities and our ability to secure future permits may become less certain.

14

The EPA has undertaken significant regulatory initiatives under authority of the Clean Air Act’s New Source Review/Prevention of Significant Deterioration program (“NSR/PSD”) in an effort to further reduce emissions of volatile organic compounds, nitrogen oxides, sulfur dioxide, and particulate matter. These regulatory initiatives have been targeted at industries with large manufacturing facilities that are significant sources of emissions, such as refining, paper and pulp, and electric power generating industries. The basic premise of these initiatives is the EPA’s assertion that many of these industrial establishments have modified or expanded their operations over time without complying with NSR/PSD regulations adopted by the EPA that require permits and new emission controls in connection with any significant facility modifications or expansions that can result in emission increases above certain thresholds. As part of this ongoing NSR/PSD regulatory initiative, the EPA has entered into, or is negotiating, consent decrees with several refiners, including Tesoro, that may require the refiners to make significant capital expenditures to install emissions control equipment at selected facilities. However, we do not expect any additional requirements will have a material impact on our financial position, results of operations or liquidity.

On October 1, 2015, EPA strengthened the National Ambient Air Quality Standards (“NAAQS”) for ground-level ozone to 70 parts per billion (“ppb”) from the 75 ppb level set in 2008. To implement the revised ozone NAAQS, all states will need to review their existing air quality management infrastructure State Implementation Plan for ozone and ensure it is appropriate and adequate. Where areas remain in ozone non-attainment, or come into ozone non-attainment as a result of the revised NAAQS it is likely that additional planning and control obligations will be required. States may impose additional emissions control requirements on stationary sources, changes in fuels specifications, and changes in fuels mix and mobile source emissions controls. The ongoing and potential future requirements imposed by states to meet the ozone NAAQS could have direct impacts on Tesoro facilities through additional requirements and increased permitting costs, and could have indirect impacts through changing or decreasing fuel demand.

The Energy Independence and Security Act was enacted into federal law in December 2007 creating a second Renewable Fuels Standard (“RFS2”) requiring the total volume of renewable transportation fuels (including ethanol and advanced biofuels) sold or introduced in the U.S. to reach 36.0 billion gallons by 2022. On December 14, 2015, the EPA issued a final rule establishing the Renewable Fuel Standard requirements for 2014 (16.28 billion gallons), 2015 (16.93 billion gallons) and 2016 (18.11 billion gallons). The ongoing and increasing requirements for renewable fuels in RFS2 could reduce future demand for petroleum products and thereby have an indirect effect on certain aspects of our business, although it could increase demand for our ethanol and biodiesel fuel blending services at our truck loading racks.

Currently, multiple legislative and regulatory measures to address greenhouse gas emissions are in various phases of discussion or implementation. These include actions to develop national, state or regional programs, each of which could require reductions in our greenhouse gas emissions or those of Tesoro. On October 22, 2015, the EPA finalized amendments to the Petroleum and Natural Gas Systems source category (Subpart W) of the Greenhouse Gas Reporting Program, including adding a new Onshore Petroleum and Natural Gas Gathering and Boosting segment, which will include greenhouse gas emissions from equipment and sources within the petroleum and natural gas gathering and boosting systems. The initial and ongoing reporting requirements under Subpart W will impose additional burdens on our business and may require additional monitoring equipment to be installed in order to comply.

Hazardous Substances and Waste Regulations

To a large extent, the environmental laws and regulations affecting our operations relate to the release of hazardous substances or solid wastes into soils, groundwater, and surface water, and include measures to control pollution of the environment. These laws generally regulate the generation, storage, treatment, transportation, and disposal of solid and hazardous waste. They also require corrective action, including investigation and remediation, at a facility where such waste may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), and comparable state laws, impose liability, without regard to fault or to the legality of the original conduct, on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include the owner or operator of the site where the release occurred and companies that disposed of, or arranged for the disposal of, the hazardous substances found at the site.

15

Under CERCLA, these persons may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources, and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover from the responsible classes of persons the costs they incur. In the course of our ordinary operations, we generate waste that falls within CERCLA’s definition of a hazardous substance and, as a result, may be jointly and severally liable under CERCLA for all or part of the costs required to clean up sites. Costs for these remedial actions, if any, as well as any related claims are all covered by indemnities from Tesoro to the extent the release occurred or existed before the close of the Initial Offering and subsequent Acquisitions from Tesoro. Neither the Partnership nor Tesoro are currently engaged in any CERCLA related claims.

We also generate solid wastes, including hazardous wastes that are subject to the requirements of the Federal Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes. From time to time, the EPA considers the adoption of stricter disposal standards for non-hazardous wastes, including wastes generated from the transportation and storage of crude oil, natural gas, NGLs and refined products. We are not currently required to comply with a substantial portion of the RCRA requirements because the majority of our facilities operate as small quantity generators of hazardous wastes by the EPA and state regulations. However, it is possible that additional wastes, which could include wastes currently generated during operations, will in the future be designated as hazardous wastes. Hazardous wastes are subject to more rigorous and costly disposal requirements than are non-hazardous wastes. Any changes in the regulations could increase our capital or operating costs.

We currently own and lease properties where crude oil, refined petroleum hydrocarbons and fuel additives, such as methyl tertiary butyl ether and ethanol have been handled for many years by previous owners. At some facilities, hydrocarbons or other waste may have been disposed of or released on or under the properties owned or leased by us or on or under other locations where these wastes have been taken for disposal. In addition, many of these properties have been operated by third parties whose treatment and disposal or release of hydrocarbons or other wastes was not under our control. These properties and wastes disposed thereon may be subject to CERCLA, RCRA, and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed or released wastes (including wastes disposed of or released by prior owners or operators), to clean up contaminated property (including impacted groundwater), or to perform remedial operations to prevent future contamination to the extent we are not indemnified for such matters.

Water Pollution Regulations

Our operations can result in the discharge of pollutants, including chemical components of crude oil, natural gas, NGLs and refined products. Many of our facilities operate near environmentally sensitive waters, where tanker, pipeline and other petroleum product transportation operations are regulated by federal, state and local agencies and monitored by environmental interest groups. The transportation and storage of crude oil and refined products over and adjacent to water involves risk and subjects us to the provisions in some cases of the Oil Pollution Act of 1990 (“OPA 90”), and in all cases to related state requirements. These requirements can subject owners of covered facilities to strict, joint, and potentially unlimited liability for removal costs and other consequences of an oil spill where the spill is into navigable waters, along shorelines or in the exclusive economic zone of the United States. In the event of an oil spill into navigable waters, substantial liabilities could be imposed upon us. States in which we operate have also enacted similar, or in some cases, more stringent laws.

Regulations under the Water Pollution Control Act of 1972 (the “Clean Water Act”), OPA 90 and state laws also impose additional regulatory burdens on our operations. Spill prevention control and countermeasure requirements of federal laws and state laws require containment to mitigate or prevent contamination of waters in the event of a crude oil, natural gas, NGLs or refined products overflow, rupture, or leak from above-ground pipelines and storage tanks. The Clean Water Act requires us to maintain spill prevention control and countermeasure plans at our facilities with above-ground storage tanks and pipelines. In addition, OPA 90 requires that most oil transport and storage companies maintain and update various oil spill prevention and oil spill contingency plans. We maintain such plans, and where required have submitted plans and received federal and state approvals necessary to comply with OPA 90, the Clean Water Act and related regulations. Our crude oil, natural gas, NGLs and refined product spill prevention plans and procedures are frequently reviewed and modified to prevent crude oil, natural gas, NGLs and refined product releases and to minimize potential impacts should a release occur. At our facilities adjacent to water, federally certified Oil Spill Response Organizations (“OSROs”) are available to respond to a spill on water from above ground storage tanks or pipelines. We have contracts in place to ensure support from the respective OSROs for spills in both open and inland waters.

16

The OSROs are capable of responding to a spill on water equal to the greatest volume of the largest above ground storage tank at our facilities. Those volumes range from 5,000 barrels to 125,000 barrels. The OSROs are rated and certified by the United States Coast Guard and are required to annually demonstrate their response capability to the United States Coast Guard and state agencies. The OSROs rated and certified to respond to open water spills (which include those OSROs with which we contract at our marine terminals) must demonstrate the capability to recover up to 50,000 barrels of oil per day and store up to 100,000 barrels of recovered oil at any given time. The OSROs rated and certified to respond to inland spills must demonstrate the capability to recover from 1,875 to 7,500 barrels of oil per day and store from 3,750 to 15,000 barrels of recovered oil at any given time.

At each of our facilities, we maintain spill-response capability to mitigate the impact of a spill from our facilities until either an OSRO or other contracted service providers can deploy, and Tesoro has entered into contracts with various parties to provide spill response services augmenting that capability, if required. Our spill response capability at our marine terminals meets the United States Coast Guard and state requirements to either deploy on-water containment equipment two times the length of a vessel at our dock or have smaller vessels available to recover 50 barrels of oil per day and store 100 barrels of recovered oil at any given time. Our spill response capabilities at our other facilities meet applicable federal and state requirements. In addition, we contract with various spill-response specialists to ensure appropriate expertise is available for such contingencies. We believe these contracts provide the additional services necessary to meet or exceed all regulatory spill-response requirements.

The Clean Water Act also imposes restrictions and strict controls regarding the discharge of pollutants into navigable waters. In certain locations, we contract with third parties for wastewater disposal. Our remaining facilities may have portions of their wastewater reclaimed by Tesoro’s nearby refineries. In the event regulatory requirements change, or interpretations of current requirements change, and our facilities are required to undertake different wastewater management arrangements, we could incur substantial additional costs. The Clean Water Act and RCRA can both impose substantial potential liability for the violation of permits or permitting requirements and for the costs of removal, remediation, and damages resulting from such discharges. In addition, states maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater.

Tribal Lands

Various federal agencies, including the EPA and the Department of the Interior, along with certain Native American tribes, promulgate and enforce regulations pertaining to oil and gas operations on Native American tribal lands where we operate. These regulations include such matters as lease provisions, drilling and production requirements, and standards to protect environmental quality and cultural resources. For example, the EPA has established a preconstruction permitting program for new and modified minor sources throughout Indian country, and new and modified major sources in nonattainment areas in Indian country effective March 2016. In addition, each Native American tribe is a sovereign nation having the right to enforce laws and regulations and to grant approvals independent from federal, state and local statutes and regulations. These laws and regulations may increase our costs of doing business on Native American tribal lands and impact the viability of, or prevent or delay our ability to conduct, our natural gas gathering operations on such lands.

Hydraulic Fracturing

We do not conduct hydraulic fracturing operations, but substantially all of our customers’ natural gas and crude oil production requires hydraulic fracturing as part of the completion process. Hydraulic fracturing is an essential and common practice in the oil and natural gas industry used to stimulate production of natural gas and/or oil from dense subsurface rock formations. The process is typically regulated by state oil and natural-gas commissions, but the EPA and other federal agencies have asserted federal regulatory authority over the process. For example, the EPA has announced its intent to propose standards for wastewater discharge from oil and gas extraction activities, and in May 2014 issued an Advanced Notice of Proposed Rulemaking seeking public comment on its plans to develop and issue regulations under the Toxic Substances Control Act to require companies to disclose information regarding the chemicals used in hydraulic fracturing. In addition, the U.S. Department of the Interior published a revised proposed rule on May 16, 2013 that would implement updated requirements for hydraulic fracturing activities on federal lands, including new requirements relating to public disclosure, well bore integrity, and handling of flowback water.

If additional levels of regulation and permits are required through the adoption of new laws and regulations at the federal, state or local level that could lead to delays, increased operating costs and prohibitions for producers who drill near our pipelines, which could reduce the volumes of crude oil and natural gas available to move through our gathering systems and processing facilities, which could materially adversely affect our revenue and results of operations.

17

WORKING CAPITAL