Attached files

| file | filename |

|---|---|

| EX-3.3 - FIRST AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP TESORO LOGISTICS LP - ANDEAVOR LOGISTICS LP | tllp1q201710-qex33.htm |

| EX-32.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 906 - ANDEAVOR LOGISTICS LP | tllp1q201710-qex322.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 906 - ANDEAVOR LOGISTICS LP | tllp1q201710-qex321.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 302 - ANDEAVOR LOGISTICS LP | tllp1q201710-qex312.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 - ANDEAVOR LOGISTICS LP | tllp1q201710-qex311.htm |

| EX-3.4 - SECOND AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT - ANDEAVOR LOGISTICS LP | tllp1q201710-qex34.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______________to __________

Commission File Number 1‑35143

TESORO LOGISTICS LP

(Exact name of registrant as specified in its charter)

Delaware |  | 27‑4151603 |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

19100 Ridgewood Pkwy, San Antonio, Texas 78259-1828 | ||

(Address of principal executive offices) (Zip Code) | ||

210-626-6000 | ||

(Registrant’s telephone number, including area code) | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | þ | Accelerated filer | o | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Emerging growth company | o | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

There were 108,002,273 common units and 2,202,880 general partner units of the registrant outstanding at May 4, 2017.

TABLE OF CONTENTS | ||

TESORO LOGISTICS LP

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2017

PART I - FINANCIAL INFORMATION | |||

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2.

2 | Tesoro Logistics LP | ||

FINANCIAL STATEMENTS | ||

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TESORO LOGISTICS LP

CONDENSED STATEMENTS OF CONSOLIDATED OPERATIONS

(Unaudited)

Three Months Ended March 31, | |||||||

2017 | 2016 (a) | ||||||

(In millions, except per unit amounts) | |||||||

Revenues | |||||||

Affiliate | $ | 203 | $ | 169 | |||

Third-party | 217 | 131 | |||||

Total Revenues | 420 | 300 | |||||

Costs and Expenses | |||||||

Cost of sales | 59 | — | |||||

Operating expenses | 126 | 110 | |||||

General and administrative expenses | 27 | 24 | |||||

Depreciation and amortization expenses | 58 | 46 | |||||

Loss on asset disposals and impairments | — | 1 | |||||

Operating Income | 150 | 119 | |||||

Interest and financing costs, net | (60 | ) | (44 | ) | |||

Equity in earnings of equity method investments | 2 | 4 | |||||

Other income, net | — | 6 | |||||

Net Earnings | $ | 92 | $ | 85 | |||

Loss attributable to Predecessors | $ | — | $ | 7 | |||

Net Earnings Attributable to Partners | 92 | 92 | |||||

General partner’s interest in net earnings, including incentive distribution rights | (37 | ) | (32 | ) | |||

Limited Partners’ Interest in Net Earnings | $ | 55 | $ | 60 | |||

Net Earnings per Limited Partner Unit | |||||||

Common - basic | $ | 0.51 | $ | 0.64 | |||

Common - diluted | $ | 0.51 | $ | 0.64 | |||

Weighted Average Limited Partner Units Outstanding | |||||||

Common units - basic | 104.8 | 93.6 | |||||

Common units - diluted | 104.9 | 93.6 | |||||

Cash Distributions Paid Per Unit | $ | 0.91 | $ | 0.78 | |||

(a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

March 31, 2017 | 3 | ||

FINANCIAL STATEMENTS | ||

TESORO LOGISTICS LP

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

March 31, 2017 | December 31, 2016 | ||||||

(In millions, except unit amounts) | |||||||

ASSETS | |||||||

Current Assets | |||||||

Cash and cash equivalents | $ | 35 | $ | 688 | |||

Receivables, net of allowance for doubtful accounts | |||||||

Trade | 136 | 129 | |||||

Affiliate | 99 | 101 | |||||

Prepayments and other current assets | 23 | 20 | |||||

Total Current Assets | 293 | 938 | |||||

Property, Plant and Equipment, Net | 3,986 | 3,444 | |||||

Acquired Intangibles, Net | 1,090 | 947 | |||||

Goodwill | 123 | 117 | |||||

Equity Method Investments | 332 | 337 | |||||

Other Noncurrent Assets, Net | 49 | 77 | |||||

Total Assets | $ | 5,873 | $ | 5,860 | |||

LIABILITIES AND EQUITY | |||||||

Current Liabilities | |||||||

Accounts payable | |||||||

Trade | $ | 71 | $ | 69 | |||

Affiliate | 38 | 56 | |||||

Accrued interest and financing costs | 97 | 42 | |||||

Other current liabilities | 36 | 45 | |||||

Total Current Liabilities | 242 | 212 | |||||

Debt, Net of Unamortized Issuance Costs | 3,765 | 4,053 | |||||

Other Noncurrent Liabilities | 61 | 53 | |||||

Total Liabilities | 4,068 | 4,318 | |||||

Commitments and Contingencies (Note 6) | |||||||

Equity | |||||||

Common unitholders; 108,002,273 units issued and outstanding (102,981,495 in 2016) | 1,869 | 1,608 | |||||

General partner; 2,202,880 units issued and outstanding (2,100,900 in 2016) | (64 | ) | (66 | ) | |||

Total Equity | 1,805 | 1,542 | |||||

Total Liabilities and Equity | $ | 5,873 | $ | 5,860 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4 | Tesoro Logistics LP | ||

FINANCIAL STATEMENTS | ||

TESORO LOGISTICS LP

CONDENSED STATEMENTS OF CONSOLIDATED CASH FLOWS

(Unaudited)

Three Months Ended March 31, | |||||||

2017 | 2016 (a) | ||||||

(In millions) | |||||||

Cash Flows From (Used In) Operating Activities: | |||||||

Net earnings | $ | 92 | $ | 85 | |||

Adjustments to reconcile net earnings to net cash from operating activities: | |||||||

Depreciation and amortization expenses | 58 | 46 | |||||

Other operating activities | 8 | 14 | |||||

Changes in current assets and liabilities | 54 | 14 | |||||

Changes in noncurrent assets and liabilities | (5 | ) | (3 | ) | |||

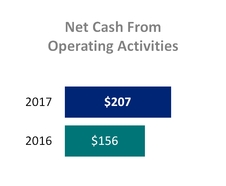

Net cash from operating activities | 207 | 156 | |||||

Cash Flows Used In Investing Activities: | |||||||

Capital expenditures | (49 | ) | (88 | ) | |||

Acquisition | (672 | ) | — | ||||

Other investing activities | — | (4 | ) | ||||

Net cash used in investing activities | (721 | ) | (92 | ) | |||

Cash Flows From (Used In) Financing Activities: | |||||||

Borrowings under revolving credit agreements | 44 | 297 | |||||

Repayments under revolving credit agreements | (334 | ) | (67 | ) | |||

Repayment of term loan facility | — | (250 | ) | ||||

Proceeds from issuance of common units, net of issuance costs | 281 | 5 | |||||

Proceeds from issuance of general partner units, net of issuance costs | 6 | — | |||||

Quarterly distributions to common unitholders | (94 | ) | (73 | ) | |||

Quarterly distributions to general partner | (46 | ) | (25 | ) | |||

Distributions in connection with acquisitions | (5 | ) | — | ||||

Financing costs | — | (8 | ) | ||||

Sponsor contributions of equity to the Predecessors | — | 39 | |||||

Capital contributions by affiliate | 9 | 6 | |||||

Net cash used in financing activities | (139 | ) | (76 | ) | |||

Decrease in Cash and Cash Equivalents | (653 | ) | (12 | ) | |||

Cash and Cash Equivalents, Beginning of Period | 688 | 16 | |||||

Cash and Cash Equivalents, End of Period | $ | 35 | $ | 4 | |||

(a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

March 31, 2017 | 5 | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

NOTE 1 – ORGANIZATION AND BASIS OF PRESENTATION

ORGANIZATION

Tesoro Logistics LP (“TLLP” or the “Partnership”) is a fee-based, growth-oriented Delaware limited partnership formed in December 2010 by Tesoro Corporation and its wholly-owned subsidiary, Tesoro Logistics GP, LLC (“TLGP”), our general partner, to own, operate, develop and acquire logistics assets. Unless the context otherwise requires, references in this report to “we,” “us,” “our,” or “ours” refer to Tesoro Logistics LP, one or more of its consolidated subsidiaries, or all of them taken as a whole. Unless the context otherwise requires, references in this report to “Tesoro” or our “Sponsor” refer collectively to Tesoro Corporation and any of its subsidiaries, other than TLLP, its subsidiaries and its general partner.

PRINCIPLES OF CONSOLIDATION AND BASIS OF PRESENTATION

Acquired assets from Tesoro, and the associated liabilities and results of operations, are collectively referred to as the “Predecessors.” See Note 1 of our Annual Report on Form 10-K for the year ended December 31, 2016 for additional information regarding the acquired assets from Tesoro. The accompanying condensed consolidated financial statements and related notes present the financial position, combined results of operations and combined cash flows of our Predecessors at historical cost. The financial statements of our Predecessors have been prepared from the separate records maintained by Tesoro and may not necessarily be indicative of the conditions that would have existed or the results of operations if our Predecessors had been operated as an unaffiliated entity. Our Predecessors did not record revenue for transactions with Tesoro and the expenses recognized were not material in the Terminalling and Transportation segment.

The interim condensed consolidated financial statements and notes thereto have been prepared by management without audit according to the rules and regulations of the Securities and Exchange Commission (“SEC”) and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of results for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

We prepare our condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). However, certain information and notes normally included in financial statements prepared under U.S. GAAP have been condensed or omitted pursuant to the SEC’s rules and regulations. Management believes that the disclosures presented herein are adequate to present the information fairly. The accompanying interim condensed consolidated financial statements and notes should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2016.

We are required under U.S. GAAP to make estimates and assumptions that affect the amounts of assets and liabilities and revenues and expenses reported as of and during the periods presented. We review our estimates on an ongoing basis using currently available information. Changes in facts and circumstances may result in revised estimates, and actual results could differ from those estimates. The results of operations of the Partnership, or our Predecessors, for any interim period are not necessarily indicative of results for the full year. Certain reclassifications have been made to prior period presentations to conform to the current year. See Note 8 for further discussion of reclassifications.

FINANCIAL INSTRUMENTS

Financial instruments including cash and cash equivalents, receivables, accounts payable and accrued liabilities are recorded at their carrying value. We believe the carrying value of these financial instruments approximates fair value. Our fair value assessment incorporates a variety of considerations, including:

• | the short term duration of the instruments (less than one percent for both our trade payables and our third-party receivables have been outstanding for greater than 90 days); and |

• | the expected future insignificance of bad debt expense, which includes an evaluation of counterparty credit risk. |

The evaluation of our third-party receivables with a short-term duration excludes amounts that are greater than 90 days related to the XTO Energy Inc.’s (“XTO”) legal dispute with QEP Field Services, LLC (“QEPFS”). See further discussion regarding the XTO litigation in Note 6.

The fair value of our senior notes is based on prices from recent trade activity and is categorized in level 2 of the fair value hierarchy. The borrowings under our amended secured revolving credit facility (the “Revolving Credit Facility”) and our secured

6 | Tesoro Logistics LP | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

dropdown credit facility (“Dropdown Credit Facility”), which include a variable interest rate, approximate fair value. The carrying value and fair value of our debt were approximately $3.8 billion and $4.0 billion as of March 31, 2017, respectively, and were approximately $4.1 billion and $4.3 billion at December 31, 2016, respectively. These carrying and fair values of our debt do not consider the unamortized issuance costs, which are netted against our total debt.

NEW ACCOUNTING STANDARDS AND DISCLOSURES

REVENUE RECOGNITION. In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09, “Revenue from Contracts with Customers” (“ASU 2014-09”), and has since amended the standard with ASU 2015-14, “Revenue From Contracts with Customers: Deferral of the Effective Date,” ASU 2016-08, ”Revenue From Contracts with Customers: Principal versus Agent Considerations (Reporting Revenue Gross versus Net),” ASU 2016-10, “Revenue From Contracts with Customers: Identifying Performance Obligations and Licensing,” and ASU 2016-12, “Revenue From Contracts with Customers: Narrow-Scope Improvements and Practical Expedients.” These standards replace existing revenue recognition rules with a single comprehensive model to use in accounting for revenue arising from contracts with customers. We are required to adopt ASU 2014-09 on January 1, 2018. We preliminarily expect to transition to the new standard under the modified retrospective transition method, whereby a cumulative effect adjustment is recognized upon adoption and the guidance is applied prospectively.

We are progressing through our implementation plan and continue to evaluate the impact of the standard’s revenue recognition model on our contracts with customers in the gathering and processing and terminalling and transportation segments along with our business processes, accounting systems, controls and financial statement disclosures. While we have made substantial progress in our review and documentation of the impact of the standard on our revenue agreements, we continue to assess the impact in certain other areas where industry consensus continues to be formed such as agreements with terms that include non-cash consideration, contributions in aid of construction, tiered pricing structures and other unique considerations. At this time, we are unable to estimate the full impact of the standard until the industry reaches a consensus on certain industry specific issues. However, we do expect some impact on presentation and disclosures in our financial statements.

LEASES. In February 2016, the FASB issued ASU 2016-02, “Leases” (“ASU 2016-02”), which amends existing accounting standards for lease accounting and adds additional disclosures about leasing arrangements. Under the new guidance, lessees are required to recognize right-of-use assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either a finance lease or operating lease with the classification affecting the pattern of expense recognition in the income statement and presentation of cash flows in the statement of cash flows. ASU 2016-02 is effective for annual reporting periods beginning after December 15, 2018, and interim reporting periods within those annual reporting periods. Early adoption is permitted and modified retrospective application is required, however, we do not intend to early adopt the standard. While it is early in our assessment of the impacts from this standard, we expect the recognition of right-of-use assets and lease liabilities not currently reflected in our balance sheet could have a material impact on total assets and liabilities. Additionally, we expect the presentation changes required for amounts currently reflected in our statement of operations to impact certain financial statement line items. We cannot estimate the impact on our business processes, accounting systems, controls and financial statement disclosures due to the implementation of this standard given the preliminary stage of our assessment.

CREDIT LOSSES. In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which amends guidance on the impairment of financial instruments. The ASU estimates credit losses based on expected losses and provides for a simplified accounting model for purchased financial assets with credit deterioration. ASU 2016-13 is effective for annual reporting periods beginning after December 15, 2019, and interim reporting periods within those annual reporting periods. Early adoption is permitted for annual reporting periods beginning after December 15, 2018. While we are still evaluating the impact of ASU 2016-13, we do not expect the adoption of this standard to have a material impact on our financial statements.

DEFINITION OF A BUSINESS. In January 2017, the FASB issued ASU 2017-01, “Clarifying the Definition of a Business” (“ASU 2017-01”), which revises the definition of a business and assists in the evaluation of when a set of transferred assets and activities is a business. ASU 2017-01 is effective for interim and annual reporting periods beginning after December 15, 2017, and should be applied prospectively on or after the effective date. Early adoption is permitted under certain circumstances. At this time, we are evaluating the potential impact of this standard on our financial statements and whether we will early adopt this standard in 2017.

GOODWILL. In January 2017, the FASB issued ASU 2017-04, “Simplifying the Test for Goodwill Impairment” (“ASU 2017-04”), which eliminates the second step from the goodwill impairment test that required goodwill impairments to be measured at the amount the carrying amount of goodwill exceeded the implied fair value of reporting unit goodwill. Instead, an entity can perform

March 31, 2017 | 7 | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount with any impairment being limited to the total amount of goodwill allocated to that reporting unit. ASU 2017-04 is effective for interim and annual reporting periods beginning after December 15, 2019 and should be applied on a prospective basis. As permitted under ASU 2017-04, we have elected to early adopt this standard for our 2017 goodwill impairment tests to be performed as of November 1, 2017. The adoption of this standard is not expected to have a material impact on our financial statements.

PENSION AND POSTRETIREMENT COSTS. In March 2017, the FASB issued ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost” (“ASU 2017-07”), which requires the current service-cost component of net benefit costs to be presented similarly with other current compensation costs for related employees on the condensed statement of consolidated operations and stipulates that only the service cost component of net benefit cost is eligible for capitalization. Additionally, the Partnership will present other components of net benefit costs elsewhere on the condensed statement of consolidated operations since these costs are allocated to the Partnership’s financial statements by Tesoro. ASU 2017-07 is effective for interim and annual reporting periods beginning after December 15, 2017, with early adoption permitted in the first quarter of 2017 only. The amendments to the presentation of the condensed statement of consolidated operations in this update should be applied retrospectively while the change in capitalized benefit cost is to be applied prospectively. We have evaluated the impact of this standard on our financial statements and determined there will be no impact to net earnings, but it is expected to have an immaterial impact on other line items such as operating income. We have elected not to early adopt and will implement when the standard becomes effective.

NOTE 2 – ACQUISITION

NORTH DAKOTA GATHERING AND PROCESSING ASSETS

On January 1, 2017, the Partnership acquired crude oil, natural gas and produced water gathering systems and two natural gas processing facilities from Whiting Oil and Gas Corporation, GBK Investments, LLC and WBI Energy Midstream, LLC (“North Dakota Gathering and Processing Assets”) for total consideration of approximately $705 million, including payments for working capital amounts, funded with cash on-hand, which included the borrowings under our Revolving Credit Facility. The North Dakota Gathering and Processing Assets include crude oil, natural gas, and produced water gathering pipelines, natural gas processing and fractionation capacity in the Sanish and Pronghorn fields of the Williston Basin in North Dakota. With this acquisition, we expanded the assets in our Gathering and Processing segment located in the Williston Basin area of North Dakota to further grow our integrated, full-service logistics capabilities in support of third-party demand for crude oil, natural gas and water gathering services as well as natural gas processing services. In addition, this extends our capacity and capabilities by adding new origin and destination points for our common carrier pipelines in North Dakota and extends our crude oil, natural gas and water gathering and associated gas processing footprint to enhance and improve overall basin logistics efficiencies.

We accounted for the North Dakota Gathering and Processing Assets acquisition using the acquisition method of accounting, which requires, among other things, that assets acquired at their fair values and liabilities assumed be recognized on the balance sheet as of the acquisition date. The purchase price allocation for the North Dakota Gathering and Processing Assets acquisition is preliminary and has been allocated based on estimated fair values of the assets acquired and liabilities assumed at the acquisition date, pending the completion of an independent valuation and other information as it becomes available to us. The purchase price allocation adjustments can be made through the end of TLLP’s measurement period, which is not to exceed one year from the acquisition date.

PRELIMINARY ACQUISITION DATE PURCHASE PRICE ALLOCATION (in millions)

Inventory | $ | 5 | |

Property, plant and equipment | 540 | ||

Intangibles (a) | 154 | ||

Goodwill | 6 | ||

Total purchase price | $ | 705 | |

(a) | The intangibles consist entirely of customer contracts with a weighted average amortization period of 9.6 years. |

For the three months ended March 31, 2017, we recognized $99 million in revenues and $13 million of net earnings related to the assets acquired. If the North Dakota Gathering and Processing Assets acquisition had occurred prior to 2017, our pro forma revenues and net earnings would have been $344 million and $87 million, respectively, for the three months ended March 31, 2016.

8 | Tesoro Logistics LP | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

NOTE 3 – RELATED-PARTY TRANSACTIONS

AFFILIATE AGREEMENTS

The Partnership has various long-term, fee-based commercial agreements with Tesoro, under which we provide pipeline transportation, trucking, terminal distribution and storage services to Tesoro. Tesoro typically commits to provide us with minimum monthly throughput volumes of crude oil and refined products. For the natural gas liquids that we handle under keep-whole agreements, the Partnership has a fee-based processing agreement with Tesoro which minimizes the impact of commodity price movements during the annual period subsequent to renegotiation of terms and pricing each year.

In addition, we have agreements for the provision of various general and administrative services by Tesoro. Under our partnership agreement, we are required to reimburse TLGP and its affiliates for all costs and expenses that they incur on our behalf for managing and controlling our business and operations. Except to the extent specified under our amended omnibus agreement (the “Amended Omnibus Agreement”) or our amended secondment agreement (the “Amended Secondment Agreement”), TLGP determines the amount of these expenses. The Amended Omnibus Agreement and the Amended Secondment Agreement were amended and restated in connection with the Alaska Storage and Terminalling Assets purchase. Under the terms of the Amended Omnibus Agreement as of March 31, 2017, we are required to pay Tesoro an annual corporate services fee of $11 million for the provision of various centralized corporate services, including executive management, legal, accounting, treasury, human resources, health, safety and environmental, information technology, certain insurance coverage, administration and other corporate services. Tesoro charged the Partnership $5 million pursuant to the Amended Secondment Agreement each of the three months ended March 31, 2017 and 2016. Additionally, pursuant to the Amended Omnibus Agreement and Amended Secondment Agreement, we reimburse Tesoro for any direct costs actually incurred by Tesoro in providing other operational services with respect to certain of our other assets and operations.

SUMMARY OF AFFILIATE TRANSACTIONS

SUMMARY OF REVENUE AND EXPENSE TRANSACTIONS WITH TESORO, INCLUDING PREDECESSORS (in millions)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Revenues (a) | $ | 203 | $ | 169 | |||

Operating expenses (b) | 39 | 35 | |||||

General and administrative expenses | 20 | 17 | |||||

(a) | Tesoro accounted for 48% and 56% of our total revenues for the three months ended March 31, 2017 and 2016, respectively. |

(b) | Includes imbalance settlement gains of $3 million and $1 million for the three months ended March 31, 2017 and 2016, respectively. Also includes reimbursements from Tesoro pursuant predominantly to the Amended Omnibus Agreement and the Carson Assets Indemnity Agreement of $2 million and $6 million for the three months ended March 31, 2017 and 2016, respectively. |

PREDECESSOR TRANSACTIONS. Related-party transactions of our Predecessors were settled through equity. Our Predecessors did not record revenue for transactions with Tesoro in the Terminalling and Transportation segment.

DISTRIBUTIONS. In accordance with our partnership agreement, the unitholders of our common and general partner interests are entitled to receive quarterly distributions of available cash. During the three months ended March 31, 2017, we paid quarterly cash distributions of $77 million to Tesoro and TLGP, including incentive distribution rights (“IDRs”). On April 19, 2017, we declared a quarterly cash distribution of $0.94 per unit, which will be paid on May 15, 2017. The distribution will include payments of $71 million to Tesoro and TLGP, including IDRs. In connection with the North Dakota Gathering and Processing Assets acquisition, our general partner agreed to reduce its quarterly distributions with respect to incentive distribution rights by $12.5 million for each quarter in 2017 and 2018, including the three months ended March 31, 2017.

March 31, 2017 | 9 | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

NOTE 4 – PROPERTY, PLANT AND EQUIPMENT

PROPERTY, PLANT AND EQUIPMENT BY SEGMENT, AT COST (in millions)

March 31, 2017 | December 31, 2016 | ||||||

Gathering and Processing | $ | 2,540 | $ | 1,983 | |||

Terminalling and Transportation | 2,105 | 2,076 | |||||

Property, Plant and Equipment, at Cost | 4,645 | 4,059 | |||||

Accumulated depreciation | (659 | ) | (615 | ) | |||

Property, Plant and Equipment, Net | $ | 3,986 | $ | 3,444 | |||

NOTE 5 – DEBT

DEBT BALANCE, NET OF UNAMORTIZED ISSUANCE COSTS (in millions)

March 31, 2017 | December 31, 2016 | ||||||

Total debt | $ | 3,819 | $ | 4,109 | |||

Unamortized issuance costs | (53 | ) | (55 | ) | |||

Current maturities | (1 | ) | (1 | ) | |||

Debt, Net of Current Maturities and Unamortized Issuance Costs | $ | 3,765 | $ | 4,053 | |||

REVOLVING CREDIT FACILITY AND DROPDOWN CREDIT FACILITY

AVAILABLE CAPACITY UNDER CREDIT FACILITIES (in millions)

Total Capacity | Amount Borrowed as of March 31, 2017 | Outstanding Letters of Credit | Available Capacity | Expiration | |||||||||||||

TLLP Revolving Credit Facility (a) | $ | 600 | $ | 40 | $ | — | $ | 560 | January 29, 2021 | ||||||||

TLLP Dropdown Credit Facility | 1,000 | — | — | 1,000 | January 29, 2021 | ||||||||||||

Total Credit Facilities (b) | $ | 1,600 | $ | 40 | $ | — | $ | 1,560 | |||||||||

(a) The weighted average interest rate for borrowings under our Revolving Credit Facility was 3.23% at March 31, 2017.

(b) | We are allowed to request that the loan availability be increased up to an aggregate of $2.1 billion, subject to receiving increased commitments from the lenders. |

NOTE 6 – COMMITMENTS AND CONTINGENCIES

CONTINGENCIES

In the ordinary course of business, we may become party to lawsuits, administrative proceedings and governmental investigations, including environmental, regulatory and other matters. The outcome of these matters cannot always be predicted accurately, but we will accrue liabilities for these matters if the amount is probable and can be reasonably estimated. Other than described below and Note 3 of our Annual Report on Form 10-K for the year ended December 31, 2016, we do not have any other material outstanding lawsuits, administrative proceedings or governmental investigations.

10 | Tesoro Logistics LP | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

ENVIRONMENTAL LIABILITIES

TIOGA, NORTH DAKOTA CRUDE OIL PIPELINE RELEASE. In September 2013, the Partnership responded to the release of crude oil in a rural field northeast of Tioga, North Dakota (the “Crude Oil Pipeline Release”). No events have occurred in 2017 to require an adjustment to previously recognized amounts for this matter. In February 2017, we settled the Notice of Violation issued in March 2015 by the North Dakota Department of Health (“NDDOH”). The NDDOH had alleged violations of water pollution regulations as a result of the Crude Oil Pipeline Release. The ultimate resolution of the matter did not have a material impact on our liquidity, financial position, or results of operations.

LEGAL

XTO ENERGY INC. V. QEP FIELD SERVICES COMPANY. XTO is seeking monetary damages related to our allocation of charges related to XTO’s share of natural gas liquid transportation, fractionation and marketing costs associated with shortfalls in contractual firm processing volumes. Trial is set for July 2017. We continue to believe that a loss is not probable nor estimable in relation to $34 million and $31 million of amounts in our receivables as of March 31, 2017 and December 31, 2016, respectively, that are subject to dispute with XTO as a result of this matter. See Note 10 of our Annual Report on Form 10-K for the year ended December 31, 2016 for additional information regarding the dispute.

NOTE 7 – EQUITY AND NET EARNINGS PER UNIT

We had 73,947,231 common public units outstanding as of March 31, 2017. Additionally, Tesoro owned 34,055,042 of our common units and 2,202,880 of our general partner units (the 2% general partner interest) as of March 31, 2017, which together constitutes a 33% ownership interest in us.

UNIT ISSUANCE. We closed a registered public offering of 5,000,000 common units representing limited partner interests at a public offering price of $56.19 per unit on February 27, 2017. The net proceeds of $281 million were used to repay borrowings outstanding under our Revolving Credit Facility and for general partnership purposes. Also, general partner units of 101,980 were issued for proceeds of $6 million.

CHANGE IN THE CARRYING AMOUNT OF OUR EQUITY (in millions)

Partnership | Total | ||||||||||

Common | General Partner | ||||||||||

Balance at December 31, 2016 | $ | 1,608 | $ | (66 | ) | $ | 1,542 | ||||

Proceeds from issuance of units, net of issuance costs | 281 | 6 | 287 | ||||||||

Distributions to unitholders and general partner (a) | (94 | ) | (46 | ) | (140 | ) | |||||

Net earnings attributable to partners | 55 | 37 | 92 | ||||||||

Contributions (b) | 21 | 1 | 22 | ||||||||

Other | (2 | ) | 4 | 2 | |||||||

Balance at March 31, 2017 | $ | 1,869 | $ | (64 | ) | $ | 1,805 | ||||

(a) | Represents cash distributions declared and paid during the three months ended March 31, 2017, relating to the fourth quarter of 2016. |

(b) | Includes Tesoro and TLGP contributions to the Partnership primarily related to reimbursements for capital spending pursuant predominantly to the Amended Omnibus Agreement and the Carson Assets Indemnity Agreement. |

NET EARNINGS PER UNIT. We use the two-class method when calculating the net earnings per unit applicable to limited partners, because we have more than one participating security. At March 31, 2017, our participating securities consist of common units, general partner units and IDRs. Net earnings earned by the Partnership are allocated between the common and general partners in accordance with our partnership agreement. We base our calculation of net earnings per unit on the weighted average number of common limited partner units outstanding during the period.

Diluted net earnings per unit include the effects of potentially dilutive units on our common units, which consist of unvested service and performance phantom units. Distributions less than or greater than earnings are allocated in accordance with our partnership agreement.

March 31, 2017 | 11 | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

NET EARNINGS PER UNIT (in millions, except per unit amounts)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Net earnings | $ | 92 | $ | 85 | |||

Special allocations of net earnings (“Special Allocations”) (a) | 1 | — | |||||

Net earnings, including Special Allocations | 93 | 85 | |||||

General partner’s distributions | (3 | ) | (2 | ) | |||

General partner’s IDRs (b) | (36 | ) | (30 | ) | |||

Limited partners’ distributions on common units | (101 | ) | (76 | ) | |||

Distributions greater than earnings | $ | (47 | ) | $ | (23 | ) | |

General partner’s earnings: | |||||||

Distributions | $ | 3 | $ | 2 | |||

General partner’s IDRs (b) | 36 | 30 | |||||

Allocation of distributions greater than earnings (c) | (1 | ) | (7 | ) | |||

Total general partner’s earnings | $ | 38 | $ | 25 | |||

Limited partners’ earnings on common units: | |||||||

Distributions | $ | 101 | $ | 76 | |||

Special Allocations (a) | (1 | ) | — | ||||

Allocation of distributions greater than earnings | (46 | ) | (16 | ) | |||

Total limited partners’ earnings on common units | $ | 54 | $ | 60 | |||

Weighted average limited partner units outstanding: | |||||||

Common units - basic | 104.8 | 93.6 | |||||

Common units - diluted | 104.9 | 93.6 | |||||

Net earnings per limited partner unit: | |||||||

Common - basic | $ | 0.51 | $ | 0.64 | |||

Common - diluted | $ | 0.51 | $ | 0.64 | |||

(a) | Normal allocations according to percentage interests are made after giving effect, if any, to priority income allocations in an amount equal to incentive cash distributions fully allocated to the general partner and any special allocations. The adjustment reflects the special allocation to common units held by TLGP for the interest incurred in connection with borrowings on the Revolving Credit Facility in lieu of using all cash on hand to fund the North Dakota Gathering and Processing Assets acquisition during the three months ended March 31, 2017. |

(b) | IDRs entitle the general partner to receive increasing percentages, up to 50%, of quarterly distributions in excess of $0.3881 per unit per quarter. The amount above reflects earnings distributed to our general partner net of $12.5 million of IDRs waived by TLGP for the three months ended March 31, 2017. See Note 12 of our Annual Report on Form 10-K for the year ended December 31, 2016 for further discussion related to IDRs. |

(c) | We have revised the historical allocation of general partner earnings to include the Predecessors’ losses of $7 million for the three months ended March 31, 2016. There were no Predecessor losses for the three months ended March 31, 2017. |

CASH DISTRIBUTIONS

Our partnership agreement, as amended, sets forth the calculation to be used to determine the amount and priority of cash distributions that the limited partner unitholders and general partner will receive.

QUARTERLY DISTRIBUTIONS

Quarter Ended | Quarterly Distribution Per Unit | Total Cash Distribution including general partner IDRs (in millions) | Date of Distribution | Unitholders Record Date | |||||||

December 31, 2016 | $ | 0.91 | $ | 140 | February 14, 2017 | February 3, 2017 | |||||

March 31, 2017 (a) | 0.94 | 140 | May 15, 2017 | May 5, 2017 | |||||||

(a) | This distribution was declared on April 19, 2017 and will be paid on the date of distribution. This distribution is net of $12.5 million of IDRs waived by TLGP for the three months ended March 31, 2017. |

12 | Tesoro Logistics LP | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

NOTE 8 – OPERATING SEGMENTS

We changed our operating segment presentation in the first quarter of 2017 to reflect our expanded gathering and processing assets and operations and how our chief operating decision maker (“CODM”) manages our business. With the completion of the North Dakota Gathering and Processing Assets acquisition on January 1, 2017, our gathering and processing assets and operations expanded significantly and enhanced our ability to offer integrated gathering and processing services to our customers. Given the business’s focus on providing integrated services along with the revised reporting structure implemented by management to assess performance and make resource allocation decisions, we have determined our operating segments, which are the same for reporting purposes, are the (i) Gathering and Processing segment and (ii) Terminalling and Transportation segment. Comparable prior period information for the newly presented Gathering and Processing segment has been recast to reflect our current presentation. No changes were deemed necessary to our Terminalling and Transportation segment.

In addition, as part of the CODM’s reevaluation of how it monitors and evaluates the business and allocates resources, management revised its methodology for the allocation of corporate general and administrative expenses which resulted in additional corporate costs being allocated to our Gathering and Processing segment for certain administrative activities associated with our gathering and processing business in the Rockies region. The change to our Terminalling and Transportation segment was nominal. Comparable prior period segment information has been recast to reflect our revised allocation methodology.

Our Gathering and Processing segment consists of crude oil and natural gas gathering systems in the Bakken Shale/Williston Basin area of North Dakota and Montana and the Green River Basin, Uinta Basin and Vermillion Basin in the states of Utah, Colorado and Wyoming as well as gas processing complexes and fractionation facilities. Our Terminalling and Transportation segment consists of crude oil and refined products terminals and marine terminals, storage facilities for crude oil, refined products and petroleum coke handling, rail-car unloading facilities and pipelines, which transport products and crude oil.

Our revenues are generated from commercial contracts we have entered into with Tesoro, under which Tesoro pays us fees, and from third-party contracts for gathering crude oil, natural gas and produced water, processing natural gas and distributing, transporting and storing crude oil, refined products, natural gas and natural gas liquids. The commercial agreements with Tesoro are described in Note 3 to our Annual Report on Form 10-K for the year ended December 31, 2016. We do not have any foreign operations.

Our operating segments are strategic business units that offer different services in various geographical locations. We evaluate the performance of each segment based on its respective operating income. Certain general and administrative expenses and interest and financing costs are excluded from segment operating income as they are not directly attributable to a specific operating segment. Identifiable assets are those used by the segment, whereas other assets are principally cash, deposits and other assets that are not associated with a specific operating segment.

March 31, 2017 | 13 | ||

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | ||

SEGMENT INFORMATION (in millions)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Revenues | |||||||

Gathering and Processing: | |||||||

NGL sales | $ | 83 | $ | 27 | |||

Gas gathering and processing | 80 | 68 | |||||

Crude oil and water gathering | 39 | 35 | |||||

Pass-thru and other revenue | 43 | 32 | |||||

Total Gathering and Processing Revenue | 245 | 162 | |||||

Terminalling and Transportation: | |||||||

Terminalling revenues | 145 | 108 | |||||

Pipeline transportation revenues | 30 | 30 | |||||

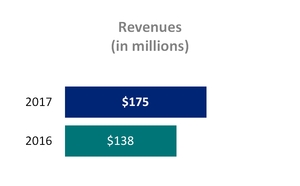

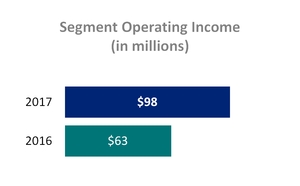

Total Terminalling and Transportation | 175 | 138 | |||||

Total Segment Revenues | $ | 420 | $ | 300 | |||

Segment Operating Income | |||||||

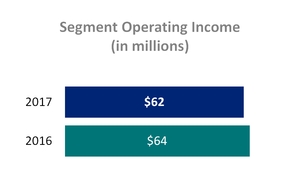

Gathering and Processing | $ | 62 | $ | 64 | |||

Terminalling and Transportation | 98 | 63 | |||||

Total Segment Operating Income | 160 | 127 | |||||

Unallocated general and administrative expenses | (10 | ) | (8 | ) | |||

Interest and financing costs, net | (60 | ) | (44 | ) | |||

Equity in earnings of equity method investments | 2 | 4 | |||||

Other income, net | — | 6 | |||||

Net Earnings | $ | 92 | $ | 85 | |||

Capital Expenditures | |||||||

Gathering and Processing | $ | 18 | $ | 30 | |||

Terminalling and Transportation | 27 | 30 | |||||

Total Capital Expenditures | $ | 45 | $ | 60 | |||

TOTAL IDENTIFIABLE ASSETS BY OPERATING SEGMENT (in millions)

March 31, 2017 | December 31, 2016 | ||||||

Identifiable Assets | |||||||

Gathering and Processing | $ | 4,054 | $ | 3,392 | |||

Terminalling and Transportation | 1,775 | 1,768 | |||||

Other (a) | 44 | 700 | |||||

Total Identifiable Assets | $ | 5,873 | $ | 5,860 | |||

(a) | Other consists mainly of $688 million in cash and cash equivalents as of December 31, 2016, of which $672 million was used to fund the acquisition of the North Dakota Gathering and Processing Assets on January 1, 2017, increasing the Gathering and Processing segment’s identifiable assets as of March 31, 2017. |

14 | Tesoro Logistics LP | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Unless the context otherwise requires, references in this report to “Tesoro Logistics LP,” “TLLP,” “the Partnership,” “we,” “us” or “our” refer to Tesoro Logistics LP, one or more of its consolidated subsidiaries or all of them taken as a whole. Unless the context otherwise requires, references in this report to “Tesoro” refer collectively to Tesoro Corporation and any of its subsidiaries, other than TLLP, its subsidiaries and its general partner. Unless the context otherwise requires, references in this report to “Predecessors” refer collectively to the acquired assets from Tesoro, and those assets, liabilities and results of operations.

Those statements in this section that are not historical in nature should be deemed forward-looking statements that are inherently uncertain. See “Important Information Regarding Forward-Looking Statements” section for a discussion of the factors that could cause actual results to differ materially from those projected in these statements.

This section should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2016.

BUSINESS STRATEGY AND OVERVIEW

OVERVIEW

We are a leading full-service logistics company operating primarily in the western and mid-continent regions of the United States. We own and operate networks of crude oil, refined products and natural gas pipelines, terminals with dedicated and non-dedicated storage capacity for crude oil and refined products, rail facilities with loading and offloading capabilities, marine terminals, a trucking fleet and natural gas processing and fractionation complexes. We are a fee-based, growth oriented Delaware limited partnership formed by Tesoro Corporation and are headquartered in San Antonio, Texas. Our assets are categorized into a Gathering and Processing segment and a Terminalling and Transportation segment. For the three months ended March 31, 2017, approximately 48% of our total revenues were derived from Tesoro under various long-term, fee-based commercial agreements, the majority of which include minimum volume commitments.

We generate revenues by charging fees for gathering crude oil and produced water, gathering and processing natural gas as well as fees for terminalling, transporting and storing crude oil and refined products. We do not engage in the trading of crude oil, natural gas, natural gas liquids (“NGLs”) or refined products; therefore, we have minimal direct exposure to risks associated with commodity price fluctuations as part of our normal operations. However, as part of our acquisition of gathering systems and processing

facilities from Whiting Oil and Gas Corporation, GBK Investments, LLC and WBI Energy Midstream, LLC (“North Dakota Gathering and Processing Assets”), we acquired certain natural gas gathering and processing contracts structured as Percent of Proceeds (“POP”) arrangements. Under these POP arrangements, we gather and process the producers’ natural gas and retain and market a portion of the natural gas and NGLs and remit a percentage of the proceeds to the producer. Under these arrangements, we will have exposure to fluctuations in commodity prices; however, this exposure is not expected to be material to our results of operations. The revenue and costs associated with these POP arrangements are reported gross on our financial statements. Also, we may be subject to nominal commodity risk exposure due to pipeline loss allowance provisions in many of our pipeline gathering and transportation contracts and a nominal amount of condensate retained as part of our natural gas gathering services. In the event actual measured pipeline losses are less than the loss allowance we are able to sell the natural gas and crude oil at market price adjusted for premiums; correspondingly, when actual losses exceed loss allowances we purchase natural gas or crude oil at market prices. For the NGLs that we handle under keep-whole agreements, the Partnership has a fee-based processing agreement with Tesoro, which minimizes the impact of commodity price movements during the annual period subsequent to renegotiation of terms and pricing. See Item 3 for additional discussion regarding our Market Risk.

March 31, 2017 | 15 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

BUSINESS STRATEGY AND GOALS

Our primary business objectives are to maintain stable cash flows and to increase our quarterly cash distribution per unit over time. We have been implementing our strategy and goals discussed above, allowing us to increase our distributions by 16% over the last year. We intend to accomplish these objectives by executing the following strategies:

Growing a stable, fee-based business that provides a competitive, full-service logistics offering to customers | |||

Optimizing Existing Asset Base | ● Operating an incident free workplace ● Improving operational efficiency and maximizing asset utilization ● Expanding third-party business; delivering extraordinary customer service | ||

Pursuing Organic Expansion Opportunities | ● Identifying and executing low-risk, high-return growth projects ● Investing to capture the full commercial value of logistics assets ● Growing asset capability to support Tesoro value chain optimization | ||

Growing through Third Party Acquisitions | ● Pursuing assets and businesses in strategic western U.S. geography that fit integrated business model, delivering synergies and growth ● Focusing on high quality assets that provide stable, fee-based income and enhancing organizational capacity | ||

Growing through Tesoro Strategic Expansion | ● Strategically partnering with Tesoro on acquisitions in refining and marketing value chains ● Capturing full value of Tesoro’s embedded logistics assets | ||

Relative to these goals, in 2017, we intend to continue implementing this strategy and have completed or announced plans to expand our assets on our Gathering and Processing segment located in the Bakken Shale/Williston Basin area of North Dakota and Montana (the “Bakken Region”) and Green River Basin, Uinta Basin and Vermillion Basin in the states of Utah, Colorado and Wyoming (the “Rockies Region”) in support of third-party demand for crude oil, natural gas and water gathering services, natural gas processing services, as well as serving Tesoro’s demand for Bakken crude oil in the mid-continent and west coast refining systems, including:

• | further expanding capacity and capabilities as well as adding new origin and destination points for our common carrier pipelines in North Dakota and Montana (the “High Plains Pipeline”); |

• | expanding our crude oil, natural gas and water gathering and associated gas processing footprint in the Bakken Region to enhance and improve overall basin logistics efficiencies; |

• | increasing compression on our natural gas gathering systems in the Green River and Vermillion basins to enhance natural gas volumes recovered from existing wells and support potential new drilling activity; |

• | expanding our gathering footprint and increase compression capabilities in the Uinta basin to increase volumes on our gathering systems and through our processing assets; and |

• | pursuing strategic assets across the western U.S. including potential acquisitions from Tesoro. |

In addition, we have completed or announced plans to grow our terminalling and transportation business across the western U.S. through:

• | increasing our terminalling volumes by expanding capacity and growing our third-party services at certain of our terminals; |

• | optimizing Tesoro volumes and growing third-party throughput at our terminalling and transportation assets; and |

• | pursuing strategic assets in the western U.S. |

ACQUISITION

NORTH DAKOTA GATHERING AND PROCESSING ASSETS. On January 1, 2017, we acquired the North Dakota Gathering and Processing Assets for total consideration of approximately $705 million, including payments for working capital adjustments, funded with cash on-hand, which included the borrowings under our secured revolving credit facility (the “Revolving Credit Facility”). The North Dakota Gathering and Processing Assets include crude oil, natural gas, and produced water gathering pipelines, natural gas processing capacity and fractionation capacity in the Sanish and Pronghorn fields of the Williston Basin in North Dakota. With this acquisition, we expanded the assets in our Gathering and Processing segment located in the Williston Basin area of North Dakota to further grow our integrated, full-service logistics capabilities in support of third-party demand for crude oil, natural gas and water gathering services as well as natural gas processing services. In addition, this extends our capacity and capabilities by adding new origin and destination points for our common

16 | Tesoro Logistics LP | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

carrier pipelines in North Dakota and extends our crude oil, natural gas and water gathering and associated gas processing footprint to enhance and improve overall basin logistics efficiencies.

CURRENT MARKET CONDITIONS

During the first quarter, we saw increases in the majority of spot prices of the commodities that we handle; including crude oil, natural gas, NGLs, and refined products. Crude oil prices rose to the highest levels since mid-2015 on OPEC and non-OPEC producers agreeing to a reduction of crude production; however, in March crude oil prices declined as visible onshore inventories failed to show stock declines. The U.S. oil and gas drilling landscape continues to improve given recent price appreciation, increased rig counts, premium locational drilling, and enhanced completion techniques. Additionally, the current administration took steps in advancing major midstream projects such as approvals for the Dakota Access Pipeline and the Keystone XL pipeline. Looking forward, these factors create positive outlook for U.S. oil and gas production growth and associated throughput volumes.

Continued improvements in the U.S. economic landscape, such as lower unemployment, wage growth, strong consumer sentiment, and robust manufacturing, support healthy refined product demand from our downstream and marketing customers. Also, growing U.S. export opportunities in both crude oil and refined products creates additional outlets for incremental production. We continue to monitor the impact of these changes in market prices and fundamentals as it relates to our business. Given the outlined market conditions, we believe our diversified portfolios of businesses as well as our strong customer base are sufficient to continue to meet our goals and objectives outlined above.

RESULTS OF OPERATIONS

A discussion and analysis of the factors contributing to our results of operations presented below includes the financial results of our Predecessors and the consolidated financial results of TLLP. The financial statements of our Predecessors were prepared from the separate records maintained by Tesoro and may not necessarily be indicative of the conditions that would have existed or the results of operations if our Predecessors had been operated as an unaffiliated entity. The financial statements, together with the following information, are intended to provide investors with a reasonable basis for assessing our historical operations, but should not serve as the only criteria for predicting future performance.

OPERATING METRICS

Management utilizes the following operating metrics to evaluate performance and compare profitability to other companies in the industry:

• | Average margin on NGL sales per barrel—calculated as the difference between the NGL sales and the costs associated with the NGL sales divided by total NGL sales volumes; |

• | Average gas gathering and processing revenue per Million British thermal units (“MMBtu”)—calculated as total gathering and processing fee-based revenue divided by total gas gathering throughput; |

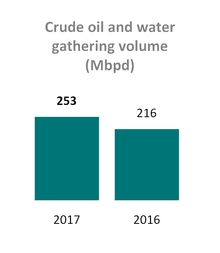

• | Average crude oil and water gathering revenue per barrel—calculated as total crude oil and water gathering fee-based revenue divided by total crude oil and water gathering throughput; |

• | Average terminalling revenue per barrel—calculated as total terminalling revenue divided by total terminalling throughput; and |

• | Average pipeline transportation revenue per barrel—calculated as total pipeline transportation revenue divided by total pipeline transportation throughput. |

There are a variety of ways to calculate average revenue per barrel, average margin per barrel, average revenue per MMBtu, and average keep-whole fee per barrel; other companies may calculate these in different ways.

NON-GAAP MEASURES

As a supplement to our financial information presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), our management uses certain “non-GAAP” measures to analyze our results of operations, assess internal performance against budgeted and forecasted amounts and evaluate future impacts to our financial performance as a result of capital investments, acquisitions, divestitures and other strategic projects. These measures are important factors in assessing our operating results and profitability and include:

• | Financial non-GAAP measure of earnings before interest, income taxes, and depreciation and amortization expenses (“EBITDA”); and |

• | Liquidity non-GAAP measure of distributable cash flow, which is calculated as U.S. GAAP-based net cash flow from operating activities plus or minus changes in working capital, amounts spent on maintenance capital net of reimbursements and other adjustments not expected to settle in cash. |

We present these measures because we believe they may help investors, analysts, lenders and ratings agencies analyze our results of operations and liquidity in conjunction with our U.S. GAAP results, including but not limited to:

• | our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; |

• | the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; |

• | our ability to incur and service debt and fund capital expenditures; and |

• | the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. |

March 31, 2017 | 17 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

Management also uses these measures to assess internal performance, and we believe they may provide meaningful supplemental information to the users of our financial statements. Non-GAAP measures have important limitations as analytical tools, because they exclude some, but not all, items that affect net earnings, operating income and net cash from operating activities. These measures should not be considered substitutes for their most directly comparable U.S. GAAP financial measures.

ITEMS IMPACTING COMPARABILITY

Our financial results may not be comparable for the reasons described below. Our Predecessors did not record revenues with Tesoro and our Predecessors recorded general and administrative expenses and financed operations differently than the Partnership. See “Factors Affecting the Comparability of Our Financial Results” in our Annual Report on Form 10-K for the year ended December 31, 2016 for further discussion.

On January 1, 2017, the Partnership acquired the North Dakota Gathering and Processing Assets. The North Dakota Gathering and Processing Assets include crude oil, natural gas, and produced water gathering pipelines, natural gas processing and fractionation capacity in the Sanish and Pronghorn fields of the Williston Basin in North Dakota.

We changed our operating segment presentation in the first quarter of 2017 to reflect our expanded gathering and processing operations and capabilities. With the completion of the North Dakota Gathering and Processing Assets acquisition on January 1, 2017, our gathering and processing

assets and operations expanded significantly and enhanced our ability to offer integrated gathering and processing services to our customers. Given the business’s focus on providing integrated services along with the revised reporting structure implemented by management to assess performance and make resource allocation decisions, we have determined our operating segments, which are the same for reporting purposes, are the (i) Gathering and Processing segment and (ii) Terminalling and Transportation segment. Comparable prior period information for the newly presented Gathering and Processing segment has been recast to reflect our current presentation. No changes were deemed necessary to our Terminalling and Transportation segment.

On November 21, 2016, we acquired certain terminalling and storage assets located in Martinez, California purchased from subsidiaries of Tesoro (“Northern California Terminalling and Storage Assets”) for a total consideration of $400 million. The Northern California Terminalling and Storage Assets include crude oil, feedstock, and refined product storage capacity at Tesoro’s Martinez Refinery along with the Avon marine terminal capable of handling throughput of feedstocks and refined products.

On July 1 and September 16, 2016, the Partnership purchased certain terminalling and storage assets owned by Tesoro (the “Alaska Storage and Terminalling Assets”) for total consideration of $444 million. The storage assets include tankage and ancillary facilities used for the operations at Tesoro’s Kenai Refinery. The refined product terminals are located in Anchorage and Fairbanks.

CONSOLIDATED RESULTS

HIGHLIGHTS - FOR THE THREE MONTHS ENDED MARCH 31, 2017 AND 2016 (in millions)

18 | Tesoro Logistics LP | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

RECONCILIATION OF NET EARNINGS TO EBITDA (in millions)

RECONCILIATION OF NET CASH FROM OPERATING ACTIVITIES TO DISTRIBUTABLE CASH FLOW (in millions)

Three Months Ended March 31, | |||||||

2017 | 2016 (a) | ||||||

Net cash from operating activities | $ | 207 | $ | 156 | |||

Changes in assets and liabilities | (49 | ) | (11 | ) | |||

Predecessors impact | — | 5 | |||||

Maintenance capital expenditures (b) | (17 | ) | (10 | ) | |||

Reimbursement for maintenance capital expenditures (b) | 8 | 4 | |||||

Other | 3 | (2 | ) | ||||

Distributable Cash Flow | $ | 152 | $ | 142 | |||

(a) | Adjusted to include the historical results of the Predecessors. |

(b) | We adjust our reconciliation of distributable cash flows for maintenance capital expenditures, tank restoration costs and expenditures required to ensure the safety, reliability, integrity and regulatory compliance of our assets with an offset for any reimbursements received for such expenditures. |

2017 QUARTER VERSUS 2016 QUARTER

OVERVIEW. Our net earnings for the three months ended March 31, 2017 (“2017 Quarter”) increased $7 million to $92 million from $85 million for the three months ended March 31, 2016 (“2016 Quarter”) primarily driven by increases in revenue partially offset by an increase in operating costs largely in cost of sales as well as an increase in interest and financing costs. As part of our acquisition of the North Dakota Gathering and Processing Assets, we acquired certain natural gas gathering and processing contracts structured as POP arrangements. The revenue and costs of sales associated with these POP arrangements are reported gross on our financial statements. EBITDA increased $35 million reflecting the contributions of the acquisitions from Tesoro during 2016, the North Dakota Gathering and Processing Assets acquisition and organic growth in the pipeline and terminalling assets.

REVENUES. The increase in revenue of $120 million, or 40%, to $420 million was driven primarily by the North Dakota Gathering and Processing Assets purchased in January 2017 as well as the acquisitions of the Alaska Storage and Terminalling Assets and the Northern California Terminalling and Storage Assets that were purchased in 2016.

COST OF SALES AND OPERATING EXPENSES. Cost of sales and operating expenses increased $59 million and $16 million, respectively, for the 2017 Quarter compared to the 2016 Quarter primarily due to the North Dakota Gathering and Processing Assets acquired during the 2017 Quarter.

GENERAL AND ADMINISTRATIVE EXPENSES. General and administrative expenses were relatively flat for the 2017 Quarter compared to the 2016 Quarter.

DEPRECIATION AND AMORTIZATION EXPENSES. Depreciation and amortization expenses increased $12 million for the 2017 Quarter compared to the 2016 Quarter primarily due to the North Dakota Gathering and Processing Assets and the Northern California Terminalling and Storage Assets acquired.

INTEREST AND FINANCING COSTS, NET. Net interest and financing costs increased $16 million in the 2017 Quarter compared to the 2016 Quarter primarily related to the issuance of new senior notes in May and December 2016.

OTHER INCOME, NET. Other income decreased $6 million due to a one-time settlement gain in 2016. There were no settlement gains in 2017.

March 31, 2017 | 19 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

SEGMENT RESULTS OF OPERATIONS

GATHERING AND PROCESSING SEGMENT

GATHERING AND PROCESSING SEGMENTHIGHLIGHTS - FOR THE 2017 QUARTER AND THE 2016 QUARTER

Our Gathering and Processing segment consists of crude oil, natural gas and produced water gathering systems and processing complexes in the Bakken Region and the Rockies Region. Our High Plains System, located in the Bakken Region, gathers and transports crude oil from various production locations in this area for transportation to Tesoro’s North

Dakota refineries and other destinations in the Bakken Region, including export rail terminals and pipelines. Approximately 25-30% of our plant production is currently supported by long-term, fee-based processing agreements with minimum volume commitments.

SEGMENT VOLUMETRIC DATA

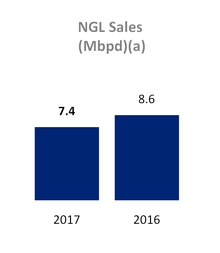

(a) | Volumes represent barrels sold under our keep-whole arrangements, net barrels retained under our POP arrangements and other associated products. |

20 | Tesoro Logistics LP | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

GATHERING AND PROCESSING SEGMENT OPERATING RESULTS (in millions, except per barrel and per MMBtu amounts)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Revenues | |||||||

NGL sales (a) | $ | 83 | $ | 27 | |||

Gas gathering and processing | 80 | 68 | |||||

Crude oil and water gathering | 39 | 35 | |||||

Pass-thru and other revenue | 43 | 32 | |||||

Total Revenues | 245 | 162 | |||||

Costs and Expenses | |||||||

Cost of NGL sales (a)(b) | 59 | — | |||||

Operating expenses (c) | 77 | 63 | |||||

General and administrative expenses | 10 | 8 | |||||

Depreciation and amortization expenses | 37 | 26 | |||||

Loss on asset disposals and impairments | — | 1 | |||||

Gathering and Processing Segment Operating Income | $ | 62 | $ | 64 | |||

Rates | |||||||

Average margin on NGL sales per barrel (a)(b) | $ | 39.15 | $ | 34.49 | |||

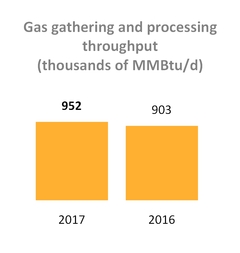

Average gas gathering and processing revenue per MMBtu | $ | 0.94 | $ | 0.83 | |||

Average crude oil and water gathering revenue per barrel | $ | 1.73 | $ | 1.77 | |||

(a) | For the 2017 Quarter, we had 21.1 thousand barrels per day (“Mbpd”) of gross NGL sales under POP and keep-whole arrangements. We retained 7.4 Mbpd under these arrangements. The difference between gross sales barrels and barrels retained is reflected in costs of NGL sales resulting from the gross presentation required for the POP arrangements associated with the North Dakota Gathering and Processing Assets. |

(b) | Included in cost of NGL sales for the 2017 Quarter were approximately $2 million of cost of sales related to crude oil volumes obtained in connection with the North Dakota Gathering and Processing Assets acquisition. The corresponding revenues were recognized in pass-thru and other revenue. As such, the calculation of the average margin on NGL sales per barrel excludes this amount. |

(c) | Operating expenses include an imbalance settlement gain of $2 million for the 2017 Quarter. |

2017 QUARTER VERSUS 2016 QUARTER

VOLUMES. The decrease in NGL sales volumes of 1.2 Mbpd, or 14%, in the 2017 Quarter as compared to the 2016 Quarter was primarily due to keep-whole volume decreases in the Rockies Region slightly offset by an increase of approximately 500 barrels per day related to the equity NGLs associated with the acquired North Dakota Gathering and Processing Assets. The increase in gas gathering and processing throughput volumes of 49 thousand MMBtu per day (“MMBtu/d”), or 5%, in the 2017 Quarter as compared to the 2016 Quarter was primarily driven by the North Dakota Gathering and Processing Assets acquired which led to increased volumes on our gathering system and processed at our facilities. Crude oil and water throughput volumes increased 37 Mbpd, or 17%, in the 2017 Quarter as a result of projects to expand the pipeline gathering system capabilities, which include additional origin and destination inter-connections and the North Dakota Gathering and Processing Assets acquired.

FINANCIAL RESULTS. Our Gathering and Processing segment’s operating income decreased by $2 million to $62 million for the 2017 Quarter compared to the 2016 Quarter reflecting increased income from the acquired North Dakota Gathering and Processing Assets and expanded capabilities on our High Plains System offset by incremental administrative, operating and depreciation expenses primarily associated with the acquisition.

The North Dakota Gathering and Processing Assets added margin of $2 million associated with the sale of NGLs. With the acquisition and expanded capabilities on existing assets, revenues increased across our natural gas gathering and processing systems and our crude oil and water gathering systems partially offset by a decline in revenues resulting from lower volumes in the Rockies Region.

March 31, 2017 | 21 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

TERMINALLING AND TRANSPORTATION SEGMENT

TERMINALLING AND TRANSPORTATION SEGMENTHIGHLIGHTS - FOR THE 2017 QUARTER AND THE 2016 QUARTER

Our Terminalling and Transportation segment consists of regulated common carrier refined products pipeline systems and other pipelines, which transport products and crude oil from Tesoro’s refineries to nearby facilities, as well as crude oil and refined products terminals and storage facilities, a rail-car unloading facility and a petroleum coke handling and storage facility.

SEGMENT VOLUMETRIC DATA

22 | Tesoro Logistics LP | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

TERMINALLING AND TRANSPORTATION SEGMENT OPERATING RESULTS (in millions, except per barrel amounts)

Three Months Ended March 31, | |||||||

2017 | 2016 (a) | ||||||

Revenues | |||||||

Terminalling revenues | $ | 145 | $ | 108 | |||

Pipeline transportation revenues | 30 | 30 | |||||

Total Revenues | 175 | 138 | |||||

Costs and Expenses | |||||||

Operating expenses (b) | 49 | 47 | |||||

General and administrative expenses | 7 | 8 | |||||

Depreciation and amortization expenses | 21 | 20 | |||||

Terminalling and Transportation Segment Operating Income | $ | 98 | $ | 63 | |||

Rates | |||||||

Average terminalling revenue per barrel | $ | 1.58 | $ | 1.31 | |||

Average pipeline transportation revenue per barrel | $ | 0.40 | $ | 0.40 | |||

2017 QUARTER VERSUS 2016 QUARTER

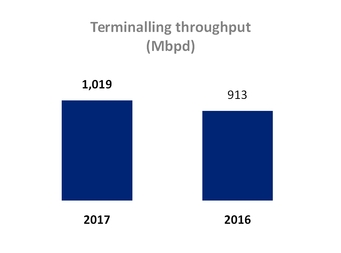

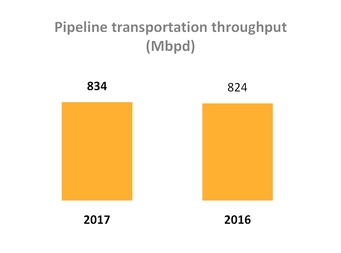

VOLUMES. Terminalling throughput volumes increased 106 Mbpd, or 12%, and pipeline transportation throughput volumes increased 10 Mbpd, or 1%, in the 2017 Quarter compared to the 2016 Quarter. The increase was primarily due to an increase in marine volumes in the 2017 Quarter as well as contributions from the Alaska Storage and Terminalling Assets acquisition.

FINANCIAL RESULTS. The Terminalling and Transportation segment’s operating income increased $35 million primarily due to revenues associated with new commercial terminalling and storage agreements executed with Tesoro in connection with the Northern California Terminalling and Storage Assets and the Alaska Storage and Terminalling Assets acquisitions in the second half of 2016. Additionally, segment operating income increased primarily due to higher marine terminalling revenues.

(a) | Adjusted to include the historical results of the Predecessors. Our Predecessors did not record revenue for transactions with Tesoro in the Terminalling and Transportation segment prior to the effective date of the acquisition of the Alaska Storage and Terminalling Assets and the Northern California Terminalling and Storage Assets. |

(b) | Operating expenses include imbalance settlement gains of $1 million for both 2017 Quarter and 2016 Quarter. |

CAPITAL RESOURCES AND LIQUIDITY

OVERVIEW

Our primary cash requirements relate to funding capital expenditures, acquisitions, meeting operational needs and paying distributions to our unitholders. We expect our ongoing sources of liquidity to include cash generated from operations, reimbursement for certain maintenance and expansion expenditures, borrowings under the Revolving Credit Facility and issuances of additional debt and equity securities. We believe that cash generated from these sources will be sufficient to meet our short-term working capital, long-term capital expenditure, acquisition and debt servicing requirements and allow us to fund at least the minimum quarterly cash distributions.

CAPITALIZATION

CAPITAL STRUCTURE (in millions)

Debt principal, including current maturities: | March 31, 2017 | December 31, 2016 | |||||

Credit Facilities | $ | 40 | $ | 330 | |||

Senior Notes | 3,770 | 3,770 | |||||

Capital lease obligations | 9 | 9 | |||||

Total Debt | 3,819 | 4,109 | |||||

Unamortized Issuance Costs | (53 | ) | (55 | ) | |||

Debt, Net of Unamortized Issuance Costs | 3,766 | 4,054 | |||||

Total Equity | 1,805 | 1,542 | |||||

Total Capitalization | $ | 5,571 | $ | 5,596 | |||

March 31, 2017 | 23 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS | ||

DEBT OVERVIEW AND AVAILABLE LIQUIDITY

Our Revolving Credit Facility, Dropdown Credit Facility and Senior Notes due 2019, 2020, 2021, 2022, 2024 and 2025 contain covenants that may, among other things, limit or restrict our ability (as well as the ability of our subsidiaries) to engage in certain activities. There have been no changes in these covenants from those described in our Annual Report on Form 10-K for the year ended December 31, 2016. Our Revolving Credit Facility is non-recourse to Tesoro, except for TLGP, and is guaranteed by all of our consolidated subsidiaries and secured by substantially all of our assets.

AVAILABLE CAPACITY UNDER OUR CREDIT FACILITIES (in millions)

Total Capacity | Amount Borrowed as of March 31, 2017 | Available Capacity | Weighted Average Interest Rate | Expiration | ||||||||||||

Revolving Credit Facility | $ | 600 | $ | 40 | $ | 560 | 3.23 | % | January 29, 2021 | |||||||

Dropdown Credit Facility | 1,000 | — | 1,000 | — | % | January 29, 2021 | ||||||||||

Total Credit Facilities | $ | 1,600 | $ | 40 | $ | 1,560 | ||||||||||

EXPENSES AND FEES OF OUR CREDIT FACILITIES

Credit Facility | 30 day Eurodollar (LIBOR) Rate at March 31, 2017 | Eurodollar Margin | Base Rate | Base Rate Margin | Commitment Fee (unused portion) | ||||

Revolving Credit Facility (a) | 0.98% | 2.25% | 4.00% | 1.25% | 0.375% | ||||

Dropdown Credit Facility (a) | 0.98% | 2.26% | 4.00% | 1.26% | 0.375% | ||||