Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALMOST FAMILY INC | form8k.htm |

Bank of America Merrill Lynch 2016 Healthcare Conference Las Vegas May 2016

Forward Looking Statements * This presentation contains, and answers given to questions that may be asked today may constitute, forward-looking statements that are subject to a number of risks and uncertainties, many of which are outside our control. All statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs, prospects, plans and objectives, other than statements of historical fact included in the presentation, are forward-looking statements. When used in this presentation or in answers given to questions asked today, the words “may,” “will,” “could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. You should not place undue reliance on forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement that we make, we caution you that these statements are based on a combination of facts and factors currently known by us and projections of future events or conditions, about which we cannot be certain. For a more complete discussion regarding these and other factors which could affect the Company's financial performance, refer to the Company's various filings with the Securities and Exchange Commission, including its filing on Form 10-K for the year ended January 1, 2016 and subsequently filed Form 10-Q, in particular information under the headings "Special Caution Regarding Forward-Looking Statements" and “Risk Factors.” These cautionary statements qualify all of the forward-looking statements. In addition, market and industry statistics contained in this presentation are based on information available to us that we believe is accurate. This information is generally based on publications that are not produced for purposes of securities offerings or economic analysis. All forward-looking statements speak only as of the date of this presentation. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the factors that could cause actual results to differ materially, even if new information becomes available in the future. We use various Center for Medicare Services (CMS) national data throughout the presentation which may be either from specific CMS reports or derived from public data readily available from CMS.

Who We Are * Founded in 1976, Almost Family is the fourth largest home health provider in the US Seasoned senior management team with decades in home health ~$615M revenue run-rate based in Louisville KY (Q1-16Ann) 231 branches in 15 states

Focused Geographic Development * Cluster: Midwest Revenue: $205M Branches: 88 Cluster: Northeast Revenue: $185M Branches: 46 Cluster: Southeast Revenue: $85M Branches: 42 Cluster: Florida Revenue: $125M Branches: 55 Branches: 58 HH Total: Revenue: $600M Branches: 231 Q1-16 Annualized

AFAM – Our Business Model * VN provides skilled in-home health care to shorten or avoid hospital or SNF placement ~$440M Rev (1) PC provides home care services, primarily unskilled, to keep patients at home and avoid higher cost long-term institutional care ~$160M Rev (1) HCI helps us innovate and adapt our business model as the US health care delivery system evolves ~$20M Rev (1) (1) Q1-16 Annualized

Last Twelve Months’ Developments *

Last Twelve Months’ Developments * Most acquisitive year in AFAM History Home Health Acquisitions Innovations Segment WillCare (NY) Black Stone (OH) Bayonne (NJ) Add $116M Revenue Three 2015 transactions lead to $24M revenue run rate and positive cash flows

Innovations – How it Fits Together * Connecting payers, providers and patients with opportunities for enhanced use of home health services to lower costs and improve outcomes Developmental activities outside the traditional home health platform Four total investments, $24M revenue run rate and positive cash flows Assessments, clinical advancements, technology, pop health, patient and physician engagement

Home Health Acquisition – WillCare * largest in our history 2nd Adds important state of NY with $53M revenue, significantly expanding our Northeast cluster $53M Approximately half VN, half PC

Home Health Acquisition – Black Stone * $50M Black Stone Revenue Enhances position in OH, our second state to top $120M annual revenue run rate $120M PC segment revenues to top $160M Provides focused effort to pursue duals and state-wide management Further strengthens state-wide service capabilities Offers significant synergies at home office and branches

Innovation – Ingenios Highlights * In-home Health Risk Assessments primarily for Medicare Advantage payers Proprietary tablet-based technology platform could be used for all AFAM business units Management experience in logistics, software, and preventative medicine Performs 18,000 assessments per year Key to improved care planning and delivery

Innovation – LTS Highlights * In-home health assessments for long term care insurers Suite of planning and support services Majority of assessments result in home health, ALF or SNF services 2015 $16M revenue from 60,000+ in-home RN-performed assessments in all 50 states Revenue CAGR 20% for past 6 years $16M Opportunity for expansion to Medicaid and Managed Care Programs

Innovation – Other Investments * Goal – Deliver savings to Medicare Partnership with Aneesh Chopra and Sanju Bansal NavHealth Tools allow providers to combine patient mediated and open data with internal information for new insights Imperium provides strategic management services to ACO’s Links primary care physicians with home care through ACO’s

Home Health Industry *

Where Home Health Fits in Healthcare * Patients prefer receiving care in their own home rather than in institutional settings. Home health provides the lowest cost care venue because patients are able to stay in their own homes, avoid shifting substantial facility, dietary, housekeeping and other costs to payors. COST VALUE

Home Health Evolving as a Broader Solution * Industry evolving from post-hospital stay to serve broader category of patients: Still serving hospital discharged “post-acute” patients – Shorten length of stay Evolving to serve more chronically ill patients on a “pre-acute” basis to avoid unnecessary hospitalizations Hospital Inpatient stays down 4% over 5 years

The Benefits of Home Health Care * Lower costs to Medicare Program Lower cost per day vs. hospital & nursing homes Prevents mild exacerbations from escalating into critical situations Cost per day $1,500 $150 $325

Positive Home Health Growth Indicators * AFAM VN 2015 Organic Admission Growth 4% Positive factors for increasing appropriate home health utilization: Increasing ACO patient attribution Post-acute bundling initiatives Greater re-hospitalization penalties State Medicaid programs actively exploring greater use to avoid high-cost institutions Outside FL 10% Florida (4%)

Regulatory Front *

Home Health Value Based Purchasing * “Pilot” covers ¼ of US Medicare Population and ½ AFAM VN segment (FL, TN & MA) No effect on 2016 or 2017 reimbursement rates Medicare Rates for 2018 could be as much as 3% higher or lower depending on quality measures We support the VBP concepts Preparation underway for some time

Senior Focused Model requires representation: Federal Medicare Program State Level for Medicaid Frequent commenter, we offer solutions Frequently invited by Committees & CMS to offer input AFAM’s Policy Efforts Continue… * Acceptance of Home Health Continues to Grow Advocacy and program integrity efforts help home health become a permanent and trusted solution

Regulatory Horizon – Relative Stability * Physician SGR Fix removed annual over-hang State Medicaid programs exploring more and better ways to reduce Hospital, ER and Nursing Home spend with home health CBO Base-line spending estimates HH relatively flat spending

Why AFAM? *

AFAM Advantages * Branches: 58 Strong history of navigating changes Solid proven management that thinks and acts deliberately: Conditions right to continue trajectory as a consolidator and market leader Proactively seeking to evolve with the health care delivery system Conservatively when conditions call for it 2009-2012 Aggressively when conditions permit 2005-2008 and again in late 2013-2016

Putting Capital to Work… * Ten Year Summary 5 years 2011 – 2015 5 years 2006 - 10 10 years 2006 - 2015 # Transactions Acquisition capital 10 $ 236,007,183 12 $ 93,709,014 22 $ 329,716,197 Acquisitions Subsequent to 2015 Revenue Run Rate Cash or Debt Equity LTS Bayonne VNA $ 16,000,000 4,000,000 $ 26,000,000 4,000,000 $ 11,000,000 $ 20,000,000 $ 30,000,000 $ 11,000,000 Source: transaction announcements

A Decade of Growth 2005-2015 * Q1 2016 Ann. Year 10 2015 2005 CAGR Yrs 1-10 States 15 15 7 7.9% Branches 231 238 52 16.4% Revenue $ 614,790,876 $ 532,214,175 $ 72,514,260 22.1% Adj. HH EBITDA $ 52,606,169(1) $ 43,938,141(1) $ 4,949,384 24.4% Adj. HH EPS diluted $ 2.35(1) $ 2.20(1) $ 0.35 20.2% Share Price $ 40.73 (2) $ 38.23 $ 7.26 18.1% Market Cap $ 422,632,279 (2) $ 383,117,931 $ 37,887,457 26.0% Enterprise Value $ 561,234,021(2) $ 495,969,104 $ 31,013,883 31.9% Debt, net of cash $ 138,601,742 $ 112,851,173 $ (6,873,574) Debt to Adj. EBITDA 2.62(3) 2.29(3) (1.39) (3) Computed on bank covenant basis (2) As of May 6, 2016 (1) Non-GAAP reconciliation is included on Appendix I

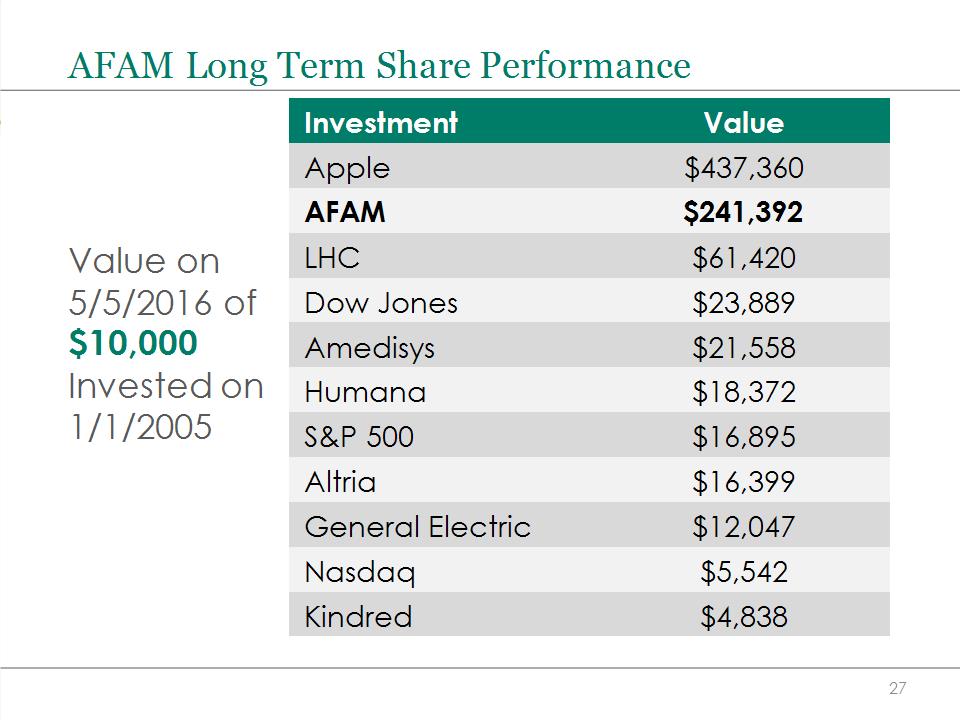

AFAM Long Term Share Performance * Investment Value Apple $437,360 AFAM $241,392 LHC $61,420 Dow Jones $23,889 Amedisys $21,558 Humana $18,372 S&P 500 $16,895 Altria $16,399 General Electric $12,047 Nasdaq $5,542 Kindred $4,838 Value on 5/5/2016 of $10,000 Invested on 1/1/2005

Value Creation – Low Cost Care Delivery Platform * As care delivery, reimbursement and risk-sharing models evolve – wherever they end up – those responsible will seek to optimize cost and quality by providing more care in more homes than ever before

Appendix I – Reconciliation of Non-GAAP Measures * Adjusted Home Health EBITDA (In thousands) Q1 2016 Year 10 2015 Net income attributable to Almost Family, Inc. $ 3,917 $ 20,009 Add back: Interest expense, net 1,332 2,006 Income tax expense 2,677 10,556 Depreciation and amortization 985 3,628 Stock-based compensation 717 2,121 Deal, transition and other 2,609 4,139 Adjusted EBITDA 12,237 42,459 Healthcare Innovations operating loss 914 1,479 Adjusted EBITDA – Home Health Operations $ 13,151 $ 43,938 X 4 Annualized $ 52,606

Appendix I – Reconciliation of Non-GAAP Measures * Adjusted Home Health EPS - Diluted (In thousands) Q1 2016 Year 10 2015 Net income attributable to Almost Family, Inc. $ 3,917 $ 20,009 Addback: Deal, transition and other, net of tax 1,552 737 Adjusted earnings 5,469 20,746 Healthcare Innovations operating loss after NCI, net of tax 563 665 Adjusted Earnings – Home Health Operations $ 6,032 $ 21,411 Per share amounts – diluted: Average shares outstanding 10,260 9,745 Net income attributable to Almost Family, Inc. $ 0.38 $ 2.05 Addback: Deal, transition and other, net of tax 0.15 0.08 Adjusted earnings 0.53 2.13 Healthcare Innovations operating loss after NCI, net of tax 0.05 0.07 Adjusted Earnings – Home Health Operations $ 0.59 $ 2.20 X 4 Annualized $ 2.35