Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Great Elm Capital Group, Inc. | d165092d8k.htm |

| EX-2.1 - EX-2.1 - Great Elm Capital Group, Inc. | d165092dex21.htm |

| EX-10.3 - EX-10.3 - Great Elm Capital Group, Inc. | d165092dex103.htm |

| EX-10.2 - EX-10.2 - Great Elm Capital Group, Inc. | d165092dex102.htm |

| EX-10.1 - EX-10.1 - Great Elm Capital Group, Inc. | d165092dex101.htm |

| EX-99.1 - EX-99.1 - Great Elm Capital Group, Inc. | d165092dex991.htm |

Corporate Transformation 6 April 2016 Exhibit 99.2

Legal notices Forward-Looking Statements. This communication contains forward-looking statements, including but not limited to those regarding the proposed sale (the “Divestiture”) of subsidiaries and assets of Unwired Planet to Optis UP and our post-IP business. These statements may discuss the anticipated manner, terms and conditions upon which the Divestiture will be consummated, and the future performance of our business. Forward-looking statements may contain words such as "expect," "believe," "may," "can," "should," "will," "forecast," "anticipate" or similar expressions, and include the assumptions that underlie such statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, but not limited to: the ability of the parties to consummate the Divestiture in a timely manner or at all; satisfaction of the conditions precedent to consummation of the Divestiture; the possibility of litigation (including related to the Divestiture itself); our ability to finance our business and growth; our ability to realize the value the assets not sold in the Divestiture; and our acquisition program. All forward-looking statements are based on management's estimates, projections and assumptions as of the date hereof. Except as required under applicable law, we do not undertake any obligation to update any forward-looking statements. Additional Information and Where to Find It. We will file with the SEC a proxy statement with respect to our transformation, including the Divestiture. The definitive proxy statement will contain important information about our transformation, including the Divestiture. YOU ARE URGED AND ADVISED TO READ THE PROXY STATEMENT CAREFULLY WHEN IT BECOMES AVAILABLE. The proxy statement and other relevant materials (when they become available) and any other documents filed by us with the SEC may be obtained free of charge at the SEC's web site at www.sec.gov. In addition, security holders will be able to obtain free copies of the proxy statement from us, by contacting us at 20 First Street, First Floor, Los Altos, CA 94022 or by going to our website www.unwiredplanet.com. Participants in the Solicitation. We and our directors and executive officers may be deemed to be participants in the solicitation of proxies from our stockholders in connection with our transformation, including the Divestiture. Information about our directors and executive officers is set forth in our Proxy Statement on Schedule 14A filed with the SEC (together with additional information in our filings on Form 8-K and our stockholders’ filings on Form 13-D). These documents are available free of charge at the SEC's web site at www.sec.gov, and from us, by contacting us at 20 First Street, First Floor, Los Altos, CA 94022 or by going to our website www.unwiredplanet.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transformation will be included in the proxy statement that we intend to file with the SEC.

Overview The past year has been a transformative one for Unwired Planet. Boris Teksler joined the Company in June 2015, and quickly brought much needed stability and expertise to the Company. Not long after, Boris and the team secured Unwired Planet's first litigation victories in the United Kingdom and Germany. Further, they built upon this victory by securing an attractive transaction to sell the IP business. In anticipation of this transformative year, Unwired Planet has seen significant changes in its Board of Directors. Jess Ravich, Peter Reed, and Steve Wilson joined the Board bringing a wealth of experience in Mergers & Acquisitions, Investment Management and Leveraged Finance. Unwired Planet developed a Strategic Committee to evaluate strategic alternatives to the existing IP business, as well as to evaluate opportunities to enter into new businesses, either organically or via acquisition. The goal of these opportunities is to maximize per share equity value. While there can be no assurances about any transactions, the Company has made multiple proposals in the Investment Management industry, some which involve acquiring an existing business, and some which involve creating a new business. Our Board believes that each of these opportunities offers the potential to create an attractive stream of earnings, while effectively leveraging the Company's existing capital resources. With our cash balance, simplified legal structure, and enhanced Board of Directors, we have a bright future in building an investment management business. While this is the Company's primary near term focus, it will continue to opportunistically evaluate all alternatives to build shareholder value.

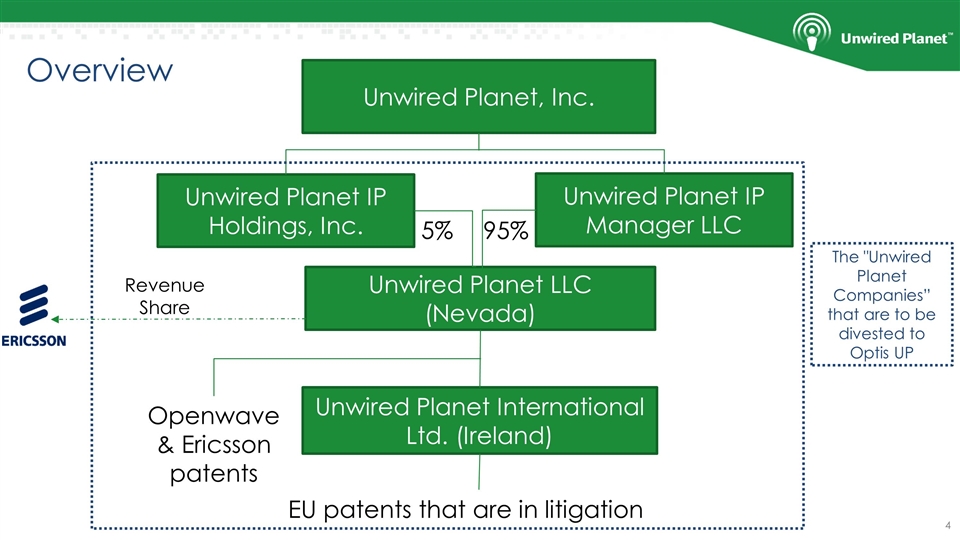

Overview Unwired Planet LLC (Nevada) Unwired Planet International Ltd. (Ireland) EU patents that are in litigation Openwave & Ericsson patents Revenue Share Unwired Planet, Inc. Unwired Planet IP Holdings, Inc. Unwired Planet IP Manager LLC 95% 5% The "Unwired Planet Companies” that are to be divested to Optis UP

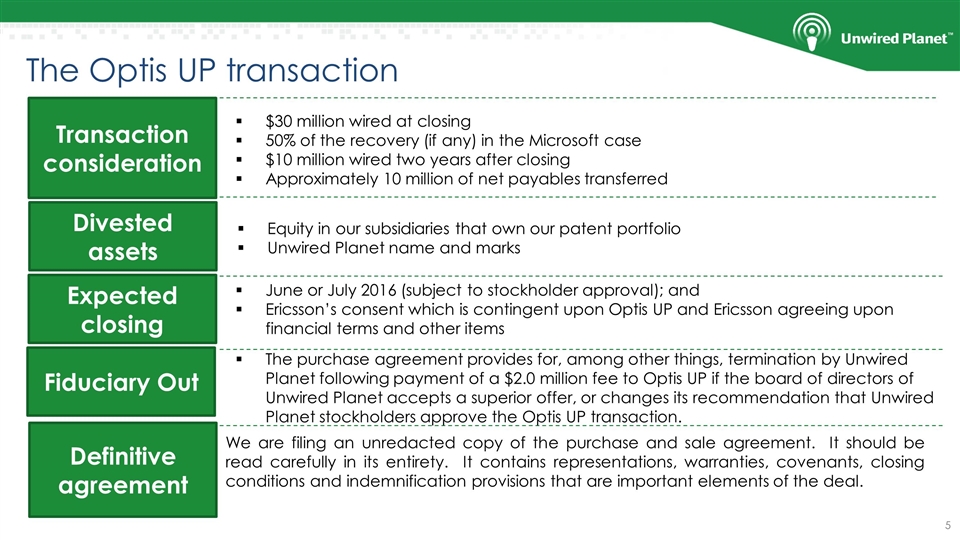

The Optis UP transaction Transaction consideration $30 million wired at closing 50% of the recovery (if any) in the Microsoft case $10 million wired two years after closing Approximately 10 million of net payables transferred Divested assets Equity in our subsidiaries that own our patent portfolio Unwired Planet name and marks Expected closing June or July 2016 (subject to stockholder approval); and Ericsson’s consent which is contingent upon Optis UP and Ericsson agreeing upon financial terms and other items Definitive agreement We are filing an unredacted copy of the purchase and sale agreement. It should be read carefully in its entirety. It contains representations, warranties, covenants, closing conditions and indemnification provisions that are important elements of the deal. Fiduciary Out The purchase agreement provides for, among other things, termination by Unwired Planet following payment of a $2.0 million fee to Optis UP if the board of directors of Unwired Planet accepts a superior offer, or changes its recommendation that Unwired Planet stockholders approve the Optis UP transaction.

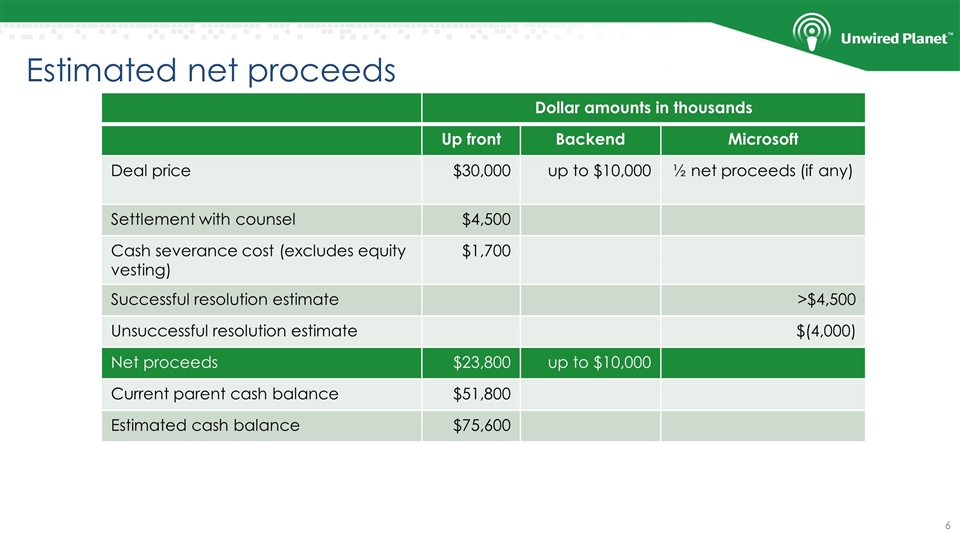

Estimated net proceeds Dollar amounts in thousands Up front Backend Microsoft Deal price $30,000 up to $10,000 ½ net proceeds (if any) Settlement with counsel $4,500 Cash severance cost (excludes equity vesting) $1,700 Successful resolution estimate >$4,500 Unsuccessful resolution estimate $(4,000) Net proceeds $23,800 up to $10,000 Current parent cash balance $51,800 Estimated cash balance $75,600

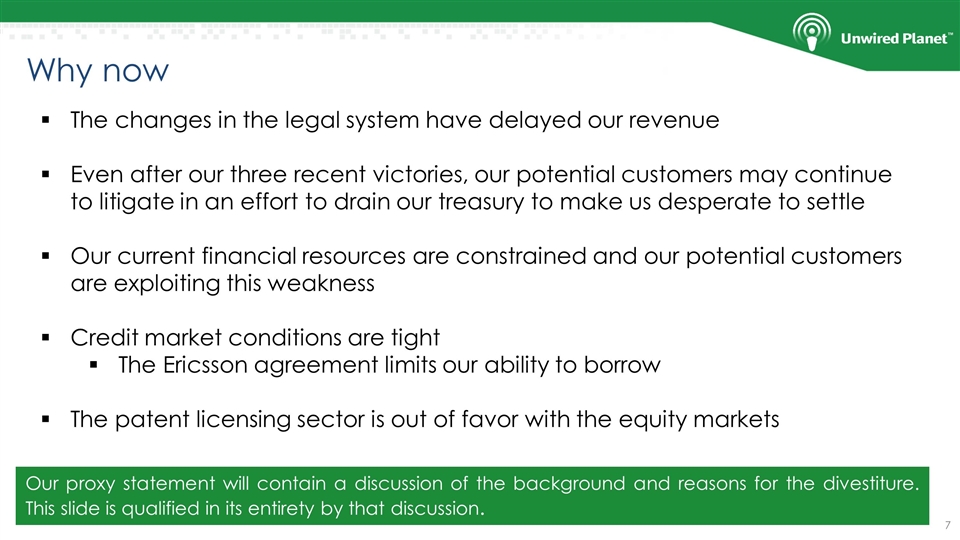

Why now The changes in the legal system have delayed our revenue Even after our three recent victories, our potential customers may continue to litigate in an effort to drain our treasury to make us desperate to settle Our current financial resources are constrained and our potential customers are exploiting this weakness Credit market conditions are tight The Ericsson agreement limits our ability to borrow The patent licensing sector is out of favor with the equity markets Our proxy statement will contain a discussion of the background and reasons for the divestiture. This slide is qualified in its entirety by that discussion.

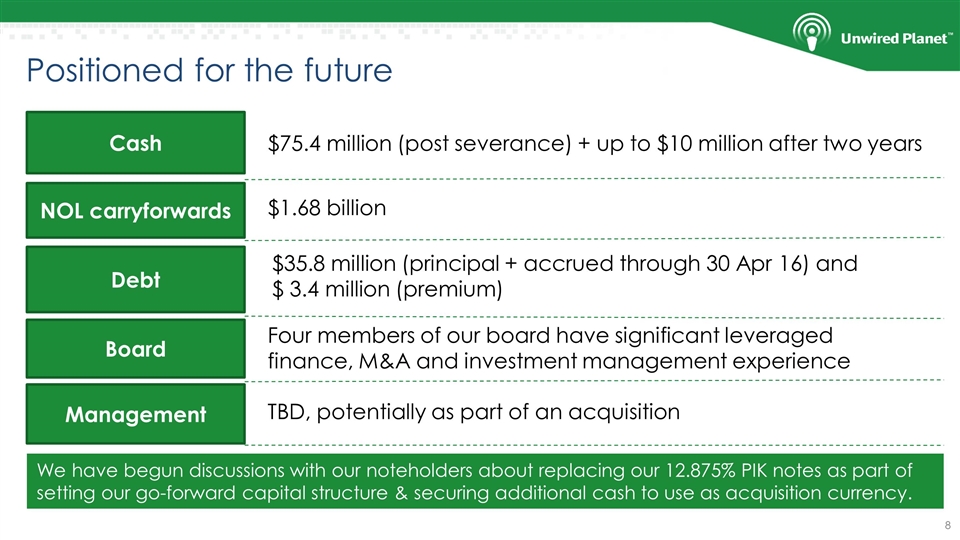

Positioned for the future Cash NOL carryforwards Debt Board Management $75.4 million (post severance) + up to $10 million after two years $1.68 billion $35.8 million (principal + accrued through 30 Apr 16) and $ 3.4 million (premium) Four members of our board have significant leveraged finance, M&A and investment management experience TBD, potentially as part of an acquisition We have begun discussions with our noteholders about replacing our 12.875% PIK notes as part of setting our go-forward capital structure & securing additional cash to use as acquisition currency.

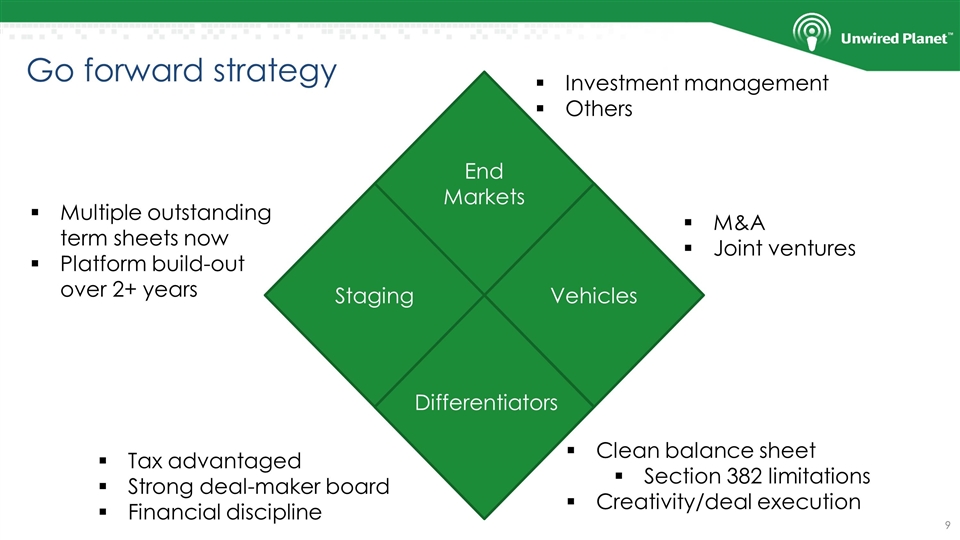

Go forward strategy End Markets Staging Vehicles Differentiators Investment management Others M&A Joint ventures Multiple outstanding term sheets now Platform build-out over 2+ years Tax advantaged Strong deal-maker board Financial discipline Clean balance sheet Section 382 limitations Creativity/deal execution