Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

Commission File No. 0-17973

HERITAGE GLOBAL INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Florida |

59-2291344 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

12625 High Bluff Drive, Suite 305, San Diego, CA |

92130 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

(858) 847-0656

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

|

Large Accelerated Filer o |

Accelerated Filer o |

Non-Accelerated Filer o |

Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of Common Stock held by non-affiliates based upon the closing price of $0.30 per share on June 30, 2015, as reported by the OTCQB, was approximately $7.1 million.

As of March 11, 2016, there were 28,467,648 shares of Common Stock, $0.01 par value, outstanding.

|

|

|

PAGE |

|

|

PART I |

|||

|

Item 1. |

3 |

||

|

Item 1A. |

6 |

||

|

Item 1B. |

9 |

||

|

Item 2. |

9 |

||

|

Item 3. |

9 |

||

|

Item 4. |

9 |

||

|

|

|

|

|

|

PART II |

|||

|

Item 5. |

10 |

||

|

Item 6. |

11 |

||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

11 |

|

|

Item 7A. |

18 |

||

|

Item 8. |

18 |

||

|

Item 9. |

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. |

18 |

|

|

Item 9A. |

19 |

||

|

Item 9B. |

19 |

||

|

|

|

|

|

|

PART III |

|||

|

Item 10. |

20 |

||

|

Item 11. |

24 |

||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

30 |

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

32 |

|

|

Item 14. |

33 |

||

|

|

|

|

|

|

PART IV |

|||

|

Item 15. |

35 |

||

2

This Annual Report on Form 10-K (the “Report”) contains certain “forward-looking statements” that are based on management’s exercise of business judgment as well as assumptions made by, and information currently available to, management. When used in this document, the words “may,” "will,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” and words of similar import, are intended to identify any forward-looking statements. You should not place undue reliance on these forward-looking statements. These statements reflect our current view of future events and are subject to certain risks and uncertainties, including those noted under Item 1A “Risk Factors” below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. We undertake no obligation, and do not intend, to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize.

PART I

Overview, History and Recent Developments

Heritage Global Inc. (“HGI,” “we” or the “Company”) was incorporated in Florida in 1983 under the name “MedCross, Inc.” The Company’s name was changed to “I-Link Incorporated” in 1997, to “Acceris Communications Inc.” in 2003, to “C2 Global Technologies Inc.” in 2005, to “Counsel RB Capital Inc.” in 2011, and to Heritage Global Inc. effective August 22, 2013. The most recent name change more closely identifies the Company with its core auction business, Heritage Global Partners, Inc. (“HGP”).

On March 20, 2014, the Company’s former majority shareholder, Street Capital Group Inc. (formerly Counsel Corporation, herein referred to as “Street Capital”), declared a dividend of all of its shares of the Company. This dividend was paid on April 30, 2014 to Street Capital’s common shareholders of record as of April 1, 2014.

On June 2, 2014, and effective May 31, 2014, the Company acquired all of the issued and outstanding capital stock in National Loan Exchange, Inc. (“NLEX”), a broker of charged-off receivables in the United States and Canada. NLEX operates as a wholly owned division of the Company. The acquisition of NLEX is consistent with HGI’s strategy to expand the services provided by its asset liquidation business. In connection with the acquisition, HGI entered into employment agreements with the previous owner and key employees of NLEX. The purchase price consisted of $2.0 million cash and an earn-out provision (“contingent consideration”) with a cap of $5.0 million, based on the Net Profits (as defined by the NLEX stock purchase agreement) of NLEX during the four years following the acquisition. At December 31, 2015 the present value of the contingent consideration is estimated to be $3.5 million. See Note 3 to the consolidated financial statements for further information.

On March 11, 2016, the Company entered into a purchase and sale agreement with International Auto Processing Inc. (“IAP”) to sell the Company’s real estate inventory. The purchase price of the real estate inventory is $4.1 million. Concurrently, the Company entered into a five year lease agreement with an affiliate of IAP to lease the building during the escrow period, which will terminate at the close of escrow. The purchase agreement gives IAP the right to terminate its obligation to consummate the sale for any reason, but in the event the sale is not consummated, the lease agreement will continue on through the end of the lease term. The purchase and sale agreement is attached hereto as Exhibit 10.24, which exhibit is incorporated by reference herein.

3

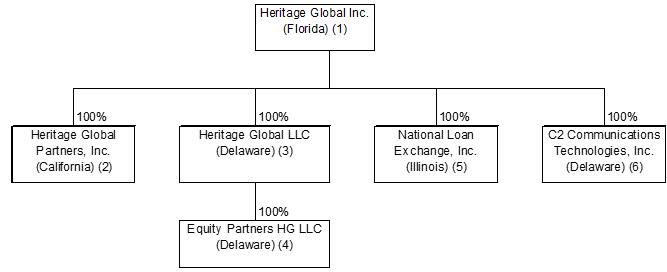

The organization chart on the following page outlines the basic corporate structure of the Company as of December 31, 2015.

|

(1) |

Registrant. |

|

(2) |

Full service global auction, appraisal and asset advisory company. |

|

(3) |

Asset liquidation company which acquires and monetizes distressed and surplus assets. |

|

(4) |

Mergers and acquisitions (M&A) advisory firm specializing in financially distressed companies and properties. |

|

(5) |

Broker of charged-off receivables. |

|

(6) |

Owns and licenses telecommunications patents. |

Asset liquidation

The Company is a value-driven, innovative leader in corporate and financial asset liquidation transactions, valuations and advisory services. The Company specializes both in acting as an adviser, as well as acquiring or brokering turnkey manufacturing facilities, surplus industrial machinery and equipment, industrial inventories, accounts receivable portfolios, intellectual property, and entire business enterprises.

The asset liquidation business began operations in 2009 with the establishment of Heritage Global LLC (“HG LLC”). In addition to acquiring turnkey manufacturing facilities and used industrial machinery and equipment, HG LLC arranges traditional asset disposition sales, including liquidation and auction sales. In 2011, HG LLC acquired 100% of the business of EP USA, LLC (d/b/a Equity Partners) (“Equity Partners”), thereby expanding the Company’s operations. Equity Partners is a boutique M&A advisory firm and provider of financial solutions for distressed businesses and properties.

In 2012 the Company increased its in-house asset liquidation expertise via its acquisition of 100% of the outstanding equity of Heritage Global Partners, Inc. (“HGP”), a global full-service auction, appraisal and asset advisory firm, and in 2012, the Company launched Heritage Global Partners Europe (“HGP Europe”). Through its wholly-owned subsidiary Heritage Global Partners UK Limited, the Company opened three European-based offices, one each in the United Kingdom, Germany and Spain.

In May 2014, the Company again expanded its asset liquidation operations with the acquisition of National Loan Exchange (‘NLEX”). NLEX is the largest volume broker of charged-off receivables in the United States and Canada, and its offerings include national, state and regional portfolios on behalf of many of the world’s top financial institutions. The NLEX acquisition is consistent with HGI’s strategy to expand and diversify the services provided by its asset liquidation business.

As a result of the events and acquisitions outlined above, management believes that HGI’s expanded global platform will allow the Company to achieve its long term industry leadership goals.

Intellectual property licensing

The Company holds several patents, including two that relate to Voice over Internet Protocol (“VoIP”). U.S. Patent No. 6,438,124 was developed by the Company, and encompasses the technology that allows two parties to converse phone-to-phone, regardless of

4

the distance, by transmitting voice/sound via the Internet. U.S. Patent No. 6,243,373 (the “VoIP Patent”) was purchased from a third party (the “Vendor”). These patents, together with related international patents and patent applications, form the Company’s international VoIP Patent Portfolio (the “Portfolio”) that covers the basic process and technology that enable VoIP communication as used in the market today. As part of the consideration for the acquisition of the VoIP Patent, the Vendor is entitled to receive 35% of the net earnings from the Portfolio. At this time, although the Company expects to continue to incur costs relating to maintaining ownership of these patents, it is not expected that either these costs or related revenue will be material.

Employees

As of December 31, 2015, HGI had 52 employees: 29 are employed by HGP, 15 by NLEX, and eight by Equity Partners. In addition, five employees of Street Capital provided management and administrative services to HGI during the first eight months of 2015 under the terms of a management services agreement (the “Services Agreement”) that is described in Item 13 of this Report and Note 14 to the consolidated financial statements. The Services Agreement was terminated effective August 31, 2015. Refer to Note 14 to the consolidated financial statements for more information.

Industry and Competition

The asset liquidation business consists primarily of the auction, appraisal and asset advisory services provided by HGP, mergers and acquisitions advisory services provided by Equity Partners, and the accounts receivable brokerage services provided by NLEX. It also includes the purchase and sale, including at auction, of industrial machinery and equipment, real estate, inventories, accounts receivable and distressed debt. The market for these services and assets is highly fragmented. To acquire auction or appraisal contracts, or assets for resale, HGI competes with other liquidators, auction companies, dealers and brokers. It also competes with them for potential purchasers, as well as with equipment manufacturers, distributors, dealers and equipment rental companies. Some competitors have significantly greater financial and marketing resources and name recognition.

HGI’s business strategy includes the option of partnering with one or more additional purchasers, pursuant to a partnership, joint venture or limited liability company agreement (collectively, “Joint Ventures”). These Joint Ventures give the Company access to more opportunities, helping to mitigate some of the competition from the market’s larger participants and contribute to the Company’s objective to be the leading resource for clients requiring capital asset solutions.

Government Regulation

We are subject to federal, state and local consumer protection laws, including laws protecting the privacy of customer non-public information and regulations prohibiting unfair and deceptive trade practices. Many jurisdictions also regulate "auctions" and "auctioneers" and may regulate online auction services. These consumer protection laws and regulations could result in substantial compliance costs and could interfere with the conduct of our business.

Legislation in the United States, including the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Act of 2010, has increased public companies’ regulatory and compliance costs as well as the scope and cost of work provided by independent registered public accountants and legal advisors. The mandatory adoption of XBRL reporting in 2011 has also increased the Company’s costs paid to third party service providers. As regulatory and compliance guidelines continue to evolve, we expect to continue to incur costs, which may or may not be material, in order to comply with legislative requirements or rules, pronouncements and guidelines by regulatory bodies.

Available Information

HGI is subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which requires that HGI file periodic reports, and other information with the SEC. The SEC maintains a website at http://www.sec.gov that contains periodic reports, proxy and information statements, and other information regarding issuers, including HGI, which file electronically with the SEC. In addition, HGI’s Exchange Act filings may be viewed at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company makes available free of charge through its web site, http://www.heritageglobalinc.com (follow Investor Relations tab to link to “SEC Filings”) its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such material has been electronically filed with, or furnished to, the SEC. The information on the Company’s corporate website is not a part of this Annual Report on Form 10-K.

5

You should carefully consider and evaluate these risk factors, as any of them could materially and adversely affect our business, financial condition and results of operations, which, in turn, can adversely affect the price of our securities.

We face significant competition in our asset liquidation business.

Our asset liquidation business depends on our ability to successfully obtain a continuous supply of auction or appraisal contracts, or distressed and surplus assets for profitable resale to third parties. In this regard, we compete with numerous other organizations, some of which are much larger and better-capitalized, with greater resources available for both asset acquisition and associated marketing to potential customers. Additionally, some competitors have a longer history of activity in the asset liquidation business, and may have advantages with respect to accessing both deals and capital.

Our asset liquidation business is subject to inventory risk and credit risk.

Under our business model, when not acting solely as an auctioneer, we assume the general and physical inventory and credit risks associated with purchasing assets for subsequent resale. Although we do enter into transactions for which a subsequent purchaser has already been identified, in most cases we purchase assets and assume the risk that they may sell for less than our forecasted price. As well, we may miscalculate demand or resale value, and subsequently sell the assets for less than their original purchase price. Either situation could have a material adverse effect upon our use of working capital and our results of operations.

Our operating results are subject to significant fluctuation.

Our revenue and operating results are subject to fluctuation from quarter to quarter and from year to year due to the nature of the asset liquidation business, which involves discrete deals of varying size that are very difficult to predict. The timing of revenue recognition related to significant transactions can materially affect quarterly and annual operating results. Despite the accompanying variability of direct asset liquidation costs, quarterly fixed costs that are largely composed of salaries and benefits could exceed our gross profit. There can therefore be no assurance that we can achieve or sustain profitability on a quarterly or annual basis.

We are subject to the risks associated with managing growth.

Since the establishment of our asset liquidation business in 2009, we have experienced significant growth. This has occurred through the acquisitions of Equity Partners in 2011, HGP in 2012 and NLEX in 2014, as well as through the expansion of our operations to Europe during 2012. This growth requires an increased investment in personnel, systems and facilities. In the absence of continued revenue growth, the Company’s operating margins could decline from current levels. Additional acquisitions will be accompanied by such risks as exposure to unknown liabilities of acquired businesses, unexpected acquisition expenses, greater than anticipated investments in personnel, systems and facilities, the expense of integrating new and existing operations, diversion of senior management resources, and dilution to existing shareholders. Failure to anticipate and manage these risks could have a material adverse effect upon our business and results of operations.

A portion of our asset liquidation business is conducted through Joint Ventures.

Conducting business through Joint Ventures, as described above under “Industry and Competition,” allows us to participate in significantly larger deals than those we could fund independently. If we ceased entering into Joint Ventures, or our Joint Venture partners decide not to partner with us, the pool of potential transactions would be reduced. Further, upon entering into Joint Ventures, we become exposed to the uncertainties of the activities of our partners. This could negatively impact our ability to obtain a continuous supply of assets for resale, and could have a material adverse effect upon our use of working capital and our results of operations.

We are subject to foreign currency exchange rate risk.

During 2012, we expanded our operations to the United Kingdom (“UK”), Spain, and Germany. Our UK operations are conducted in pounds sterling (£) and our Spain and Germany operations are conducted in euros (€), rather than in U.S. dollars. To date we have been required to use funds generated by our US operations to meet a portion of European obligations as they come due. We thereby incur exchange rate risk. We conduct some of our asset liquidation transactions in currencies other than the U.S. dollar, which exposes us to foreign exchange risk. Although this risk has not had a material impact on our business and operations to date, failure to anticipate and continue to manage this risk could have a material adverse effect.

6

The auction portion of our asset liquidation business may be subject to a variety of additional costly government regulations.

Many states and other jurisdictions have regulations governing the conduct of traditional “auctions” and the liability of traditional “auctioneers” in conducting auctions, which may also apply to online auction services. In addition, certain states have laws or regulations that expressly apply to online auction services. We expect to continue to incur costs in complying with these laws and could be subject to fines or other penalties for any failure to comply with these laws. We may be required to make changes in our business to comply with these laws, which could increase our costs, reduce our revenue, and cause us to prohibit the listing of certain items, or otherwise adversely affect our financial condition or operating results.

Certain categories of merchandise that we sell are subject to government restrictions.

We sell merchandise, such as scientific instruments, that is subject to export control and economic sanctions laws, among other laws, imposed by the United States and other governments. Such restrictions include the U.S. Export Administration regulations, the International Traffic in Arms regulations, and economic sanctions and embargo laws administered by the Office of the Foreign Assets Control regulations. These restrictions prohibit us from, among other things, selling property to (1) persons or entities that appear on lists of restricted or prohibited parties maintained by the United States or other governments or (2) countries, regimes, or nationals that are the target of applicable economic sanctions or other embargoes.

We may incur significant costs or be required to modify our business to comply with these requirements. If we are alleged to have violated any of these laws or regulations we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines, and suspension or prohibition from doing business with U.S. federal government agencies. In addition, we could suffer serious harm to our reputation if allegations of impropriety are made against us, whether or not true.

We are subject to the U.S. Foreign Corrupt Practices Act (“FCPA”).

We are subject to the FCPA, which generally prohibits U.S. companies and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or retaining business. Our 2012 expansion into Europe has increased the risk of non-compliance with the FCPA. Failure to comply with the FCPA could subject the Company to, among other things, penalties and legal expenses that could harm our reputation and have a material adverse effect on our business, financial condition and results of operations.

Our asset liquidation business is subject to environmental risk.

Our asset liquidation business at times includes the purchase and resale of buildings and land. Although our purchase process includes due diligence to determine that there are no material adverse environmental issues, it is possible that such issues could be discovered subsequent to a completed purchase. Any remediation and related costs could have a material adverse effect upon our business and results of operations.

We are dependent upon key personnel.

Our operations are substantially dependent on the knowledge, skills and performance of several of our executive officers, particularly our Chief Executive Officer and Chief Operating Officer/President, President of NLEX, and Senior Managing Director of Equity Partners. The loss of any of these officers could damage key relationships and result in the loss of essential information and expertise. As our operations expand, we will be required to hire additional employees, and may face competition for them. Therefore, either the loss of the services of the above existing officers, or the inability to attract and retain appropriately skilled new employees, could have a material adverse effect upon our business and results of operations.

We may require additional financing in the future, which may not be available, or may not be available on favorable terms.

We may need additional funds to finance the operations of our asset liquidation business, to make additional investments, or to acquire complementary businesses or assets. We may be unable to generate these funds from our operations. If funds are not available, or not available on acceptable terms, we could experience a material adverse effect upon our business.

Provisions in our Articles of Incorporation, as amended, could prevent or delay stockholders' attempts to replace or remove current management.

Our Articles of Incorporation, as amended, provide for staggered terms for the members of our Board. The Board is divided into three staggered classes, and each director serves a term of three years. At an annual stockholders’ meeting, only those directors comprising one of the three classes will have completed their term and stand for re-election or replacement. These provisions may

7

tend to preserve our current management and the Board in a hostile tender offer, and may have an adverse impact on stockholders who may want to participate in such a tender offer, or who may want to replace some or all of the members of the Board.

Our Board of Directors may issue additional shares of preferred stock without stockholder approval.

Our Articles of Incorporation, as amended, authorize the issuance of up to 10,000,000 shares of preferred stock, $10.00 par value per share. The Board is authorized to determine the rights and preferences of any additional series or class of preferred stock. The Board may, without stockholder approval, issue shares of preferred stock with dividend, liquidation, conversion, voting or other rights that are senior to our shares of common stock or that could adversely affect the voting power or other rights of the existing holders of outstanding shares of preferred stock or common stock. The issuance of additional shares of preferred stock may also hamper or discourage an acquisition or change in control of HGI.

We may conduct future offerings of our common stock and preferred stock and pay debt obligations with our common and preferred stock that may diminish our investors’ pro rata ownership and depress our stock price.

We reserve the right to make future offers and sales, either public or private, of our securities including shares of our preferred stock, common stock or securities convertible into common stock at prices differing from the price of the common stock previously issued. In the event that any such future sales of securities are affected or we use our common or preferred stock to pay principal or interest on our debt obligations, an investor’s pro rata ownership interest may be reduced to the extent of any such issuances and, to the extent that any such sales are effected at consideration which is less than that paid by the investor, the investor may experience dilution and a diminution in the market price of the common stock.

There is a limited public trading market for our common stock; the market price of our common stock has been volatile and could experience substantial fluctuations.

Our common stock is currently traded in the OTC market in the United States and has a limited public trading market in the United States. Our common stock is traded on the Canadian Securities Exchange, and the market there is similarly limited. Without an active trading market, there can be no assurance regarding the liquidity or resale value of the common stock. In addition, the market price of our common stock has been, and may continue to be, volatile. Such price fluctuations may be affected by general market price movements or by reasons unrelated to our operating performance or prospects such as, among other things, announcements concerning us or our competitors, technological innovations, government regulations, and litigation concerning proprietary rights or other matters.

We may not be able to utilize income tax loss carryforwards.

Restrictions in our ability to utilize income tax loss carry forwards have occurred in the past due to the application of certain changes in ownership tax rules in the United States. There is no certainty that the application of these rules may not recur. In addition, further restrictions of, reductions in, or expiration of net operating loss and net capital loss carry forwards may occur through future merger, acquisition and/or disposition transactions or through failure to continue a significant level of business activities. Any such additional limitations could require us to pay income taxes in the future and record an income tax expense to the extent of such liability. We could be liable for income taxes on an overall basis while having unutilized tax loss carry forwards since these losses may be applicable to one jurisdiction and/or particular line of business while earnings may be applicable to a different jurisdiction and/or line of business. Additionally, income tax loss carry forwards may expire before we have the ability to utilize such losses in a particular jurisdiction and there is no certainty that current income tax rates will remain in effect at the time when we have the opportunity to utilize reported tax loss carry forwards.

We have not declared any dividends on our common stock to date and have no expectation of doing so in the foreseeable future.

The payment of cash dividends on our common stock rests within the discretion of our Board of Directors and will depend, among other things, upon our earnings, unencumbered cash, capital requirements and our financial condition, as well as other relevant factors. To date, we have not paid dividends on our common stock nor do we anticipate that we will pay dividends in the foreseeable future. As of December 31, 2015, we do not have any preferred stock outstanding that has any preferential dividends.

We may fail to either adequately protect our proprietary technology and processes, or enforce our intellectual property rights.

The Company’s VoIP Patent Portfolio consists of United States Patents No. 6,243,373 and No. 6,438,124. The ultimate value of these patents has yet to be determined. If we fail to obtain or maintain adequate protections, or are unsuccessful in enforcing our patent rights, we may not be able to either realize additional value from our patents, or prevent third parties from benefiting from those patents without benefit to the Company. Any currently pending or future patent applications may not result in issued patents. In

8

addition, any issued patents may not have priority over any patent applications of others or may not contain claims sufficiently broad to protect us against third parties with similar technologies, products or processes. In addition, the Company’s existing patents have finite lives (although they may be extended by filing continuations and/or divisional applications), most of which expire over the next three years. There is no guarantee that they will be fully exploited or commercialized before expiration.

Item 1B. Unresolved Staff Comments

Not applicable.

The Company, in connection with its asset liquidation business, leases or rents office space in several locations in the U.S. The principal locations are San Diego, CA and Foster City, CA, which are related to HGP’s operations, and Edwardsville, IL, which is related to NLEX’s operations. The Company also maintains offices in Scottsdale, AZ; Farmington Hills, MI; Marietta, GA and Easton, MD. The Foster City and Edwardsville offices are leased from related parties, as discussed in Note 14 to the consolidated financial statements.

The Company is involved in various legal matters arising out of its operations in the normal course of business, none of which are expected, individually or in the aggregate, to have a material adverse effect on the Company. Refer to Note 15 to the consolidated financial statements for further detail.

Item 4. Mine Safety Disclosures.

None.

9

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Shares of our common stock, $0.01 par value per share, are quoted under the symbol “HGBL” in the OTC market (“OTCQB”), and under the symbol “HGP” on the Canadian Securities Exchange (“CSE”).

The following table sets forth the high and low prices for our common stock, as quoted on the OTCQB, for the calendar quarters from January 1, 2014 through December 31, 2015, based on inter-dealer quotations, without retail mark-up, mark-down or commissions. These prices may not represent actual transactions, and are quoted in U.S. dollars:

|

Quarter Ended |

|

High |

|

|

Low |

|

||

|

March 31, 2014 |

|

$ |

0.74 |

|

|

$ |

0.31 |

|

|

June 30, 2014 |

|

|

0.80 |

|

|

|

0.27 |

|

|

September 30, 2014 |

|

|

0.50 |

|

|

|

0.26 |

|

|

December 31, 2014 |

|

|

0.44 |

|

|

|

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2015 |

|

$ |

0.47 |

|

|

$ |

0.05 |

|

|

June 30, 2015 |

|

|

0.51 |

|

|

|

0.17 |

|

|

September 30, 2015 |

|

|

0.35 |

|

|

|

0.15 |

|

|

December 31, 2015 |

|

|

0.26 |

|

|

|

0.11 |

|

On March 11, 2016, the closing price for a share of the Company’s common stock as quoted on the OTCQB was $0.28.

The following table sets forth the high and low prices for our common stock, as quoted on the CSE, for the calendar quarters from January 1, 2014 through December 31, 2015, based on inter-dealer quotations, without retail mark-up, mark-down or commissions. These prices may not represent actual transactions, and are quoted in Canadian dollars:

|

Quarter Ended |

|

High |

|

|

Low |

|

||

|

March 31, 2014 |

(1) |

N/A |

|

(1) |

N/A |

|

||

|

June 30, 2014 |

|

$ |

0.80 |

|

|

$ |

0.25 |

|

|

September 30, 2014 |

|

|

0.48 |

|

|

|

0.27 |

|

|

December 31, 2014 |

|

|

0.41 |

|

|

|

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2015 |

|

$ |

0.50 |

|

|

$ |

0.20 |

|

|

June 30, 2015 |

|

|

0.42 |

|

|

|

0.20 |

|

|

September 30, 2015 |

|

|

0.33 |

|

|

|

0.17 |

|

|

December 31, 2015 |

|

|

0.25 |

|

|

|

0.15 |

|

|

|

(1) |

The Company was not listed on the CSE until the second quarter of 2014, following the disposition by Street Capital. Refer to Item 13 and Note 14 to the consolidated financial statements for further detail on the disposition. |

On March 11, 2016, the closing price for a share of the Company’s common stock as quoted on the CSE was Canadian $0.22.

Holders

As of March 11, 2016, the Company had approximately 421 holders of common stock of record.

Dividends

To date, we have not paid dividends on our common stock nor do we anticipate that we will pay dividends in the foreseeable future. As of December 31, 2015, we do not have any preferred stock outstanding which has any preferential dividends.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities.

On November 1, 2014 the Company granted restricted stock awards for 300,000 shares to two key employees (150,000 each) as part of their employment agreements. The shares were restricted only by the continued employment of the individuals.

10

Issuer Purchases of Equity Securities.

None.

Item 6. Selected Financial Data.

As a Smaller Reporting Company, we are electing scaled reporting obligations and therefore are not required to provide the information requested by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with our Consolidated Financial Statements and Notes thereto, included in Item 15 of this Report. Our accounting policies have the potential to have a significant impact on our financial statements, either because of the significance of the financial statement item to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events that are continuous in nature.

Business Overview, Recent Developments and Outlook

Please see Item 1, above, of this Report for an overview of the Company’s business and recent developments. Please see Item 1A, above, for a discussion of the risk factors that may impact the Company’s current and future operations, and financial condition.

Liquidity and Capital Resources

Liquidity

At December 31, 2015 the Company had a working capital deficit of $5.1 million, as compared to a working capital deficit of $4.0 million at December 31, 2014, an increased deficit of $1.1 million. The Company’s current assets decreased to $4.3 million compared to $7.6 million at December 31, 2014, however the current liabilities also decreased to $9.4 million compared to $11.5 million at December 31, 2014. Within current assets, the most significant change was a decrease of $2.2 million in accounts receivable, the cash from which was used to pay down balances on the related party loan to Street Capital (the “Street Capital Loan”). The significant movements in current liabilities were: the line of credit with a balance of $0.5 million at December 31, 2014 was paid off and terminated during 2015, and the Street Capital Loan was reduced by $1.3 million during 2015.

The Company believes it can fund its operations and address the working capital deficit, through a combination of its on-going asset liquidation operations, sale of its real estate inventory, accessing new financing from related parties and flexibility on the timing of the repayment of its existing debt obligations with its related party creditor and third party creditor.

The Company’s current debt consists of the “Street Capital Loan”. At December 31, 2015, the third party debt had an outstanding balance of $2.5 million, however consistent with the prior year the outstanding balance was classified as non-current as the maturity date was extended to January 2017. The Street Capital Loan is with the Company’s former majority shareholder, Street Capital, and has fluctuated over time. At December 31, 2015 it had an outstanding balance of $1.7 million as compared to $3.0 million at December 31, 2014.

During 2015, the Company’s primary sources of cash were the operations of its asset liquidation business, cash receipts of $3.5 million related to its equity method investments (including receipt of proceeds of $2.0 million from the sale of the Company’s investment in Polaroid in 2014), and advances of $0.8 million under the Street Capital Loan. Cash disbursements, other than those related to debt repayment of $2.9 million ($0.5 million to third parties and $2.4 million under the Street Capital Loan), were primarily related to operating expenses. Additionally, the Company made its first payment of the contingent consideration owed to the former owner (and current president) of NLEX in the amount of $0.5 million during 2015.

The Company has historically classified both real estate inventory and asset liquidation related equity method investments as non-current, although they are expected to be converted to cash within a year. At December 31, 2015 and 2014, these assets totaled approximately $3.7 million and $7.5 million, respectively.

The Company expects that its asset liquidation business will continue to be the primary source of cash required for ongoing operations for the foreseeable future.

11

Ownership Structure and Capital Resources

|

|

· |

At December 31, 2015 the Company had stockholders’ equity of $3.4 million, as compared to $13.5 million at December 31, 2014. The decrease in the stockholders’ equity was primarily the result of the Company’s $10.4 million net loss for the year-ended December 31, 2015. |

|

|

· |

In 2013, Street Capital, the Company’s former majority shareholder, announced that its Board of Directors had approved a plan to focus Street Capital’s operations on its core business, mortgage lending, and therefore to dispose of its other operating segments, including its interest in HGI. On March 20, 2014, Street Capital declared a dividend of all of its shares of the Company. This dividend was paid on April 30, 2014 to Street Capital’s common shareholders of record as of April 1, 2014. On May 1, 2014, HGI and Street Capital entered into a management services agreement (the “Services Agreement”) under which Street Capital continued to provide management and other services to HGI until the Services Agreement was terminated effective August 31, 2015. For more detail regarding the Services Agreement, see Note 14 to the consolidated financial statements. |

|

|

· |

The Company determines its future capital and operating requirements based upon its current and projected operating performance and the extent of its contractual commitments. The Company expects to be able to finance its future operations through a combination of its asset liquidation business and securing additional debt financing. The Company’s contractual requirements are limited to the outstanding loans and lease commitments with related and unrelated parties. Capital requirements are generally limited to the Company’s purchases of surplus and distressed assets. The Company believes that its current capital resources are sufficient for these requirements. In the event additional capital is needed, the Company believes it can obtain additional debt financing through either related party loans or through a new credit facility. |

Cash Position and Cash Flows

Cash and cash equivalents at December 31, 2015 were $2.8 million compared to $3.6 million at December 31, 2014.

Cash used in operating activities. Cash used in operating activities was $0.8 million during 2015 as compared to $0.6 million cash provided during 2014, which represents an approximate $1.4 million change in operating cash flows between the two years. The $1.4 million change was primarily attributed to the following: the net loss adjusted for noncash items was $0.6 million greater in 2015 compared to 2014 as a result of some general under performance of our asset liquidation business (with the exception of NLEX) during 2015; we generated $0.3 million less of return on investment in equity method investments in 2015 compared to 2014, and we had a net unfavorable change of $0.5 million in the operating assets and liabilities in 2015 compared to 2014. The significant noncash items in 2015 included a $5.4 million impairment of goodwill and intangible assets charge and a $2.7 million real estate inventory write-down charge; whereas the most significant noncash item in 2014 was a $24.7 million income tax expense relating primarily to recording a valuation allowance against our deferred tax assets.

The significant changes in operating assets and liabilities during 2015 as compared to 2014 are primarily due to the nature of the Company’s operations. The Company earns revenue from discrete asset liquidation deals that vary considerably with respect to their magnitude and timing, and that can consist of fees, commissions, asset sale proceeds, or a combination of these. The operating assets and liabilities associated with these deals are therefore subject to the same variability and can be quite different at the end of any given period.

Cash provided by or used in investing activities. Cash provided by investing activities during 2015 was $2.7 million, as compared to $1.5 million cash used during 2014. The 2015 activity consisted primarily of the following cash receipts related to the Company’s equity method investments: $2.0 million of proceeds from the Company’s December 2014 exit from its investment in Polaroid (received in 2015), and $0.9 million of distributions from the Company’s other equity method investments. In 2014 the most significant items were the net $1.4 million cash paid to acquire NLEX and $0.6 million of investments in equity method investments.

Cash used in or provided by financing activities. Cash used in financing activities was $2.7 million during 2015, as compared to $1.3 million cash provided during 2014. The 2015 activity consisted of net $1.6 million of debt repaid to Street Capital, $0.5 million of debt repaid on our credit facility that we terminated in 2015, and $0.5 million of contingent consideration paid to the former owner (and current president) of NLEX. In 2014, the Company received $1.6 million (net of repayments) as loans from third parties, primarily used for the purchase of NLEX.

12

Management’s Discussion of Results of Operations

The following table summarizes our consolidated results of operations for 2015 and 2014 (in thousands).

|

|

|

Year ended December 31, |

|

|||||

|

|

|

2015 |

|

|

2014 |

|

||

|

Revenues: |

|

|

|

|

|

|

|

|

|

Services revenue |

|

$ |

13,485 |

|

|

$ |

13,270 |

|

|

Asset sales |

|

|

3,946 |

|

|

|

6,716 |

|

|

Total revenue |

|

|

17,431 |

|

|

|

19,986 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

Cost of services revenue |

|

|

3,125 |

|

|

|

4,882 |

|

|

Cost of asset sales |

|

|

3,412 |

|

|

|

5,398 |

|

|

Real estate inventory write-down |

|

|

2,748 |

|

|

|

- |

|

|

Selling, general and administrative |

|

|

12,774 |

|

|

|

11,183 |

|

|

Depreciation and amortization |

|

|

575 |

|

|

|

566 |

|

|

Impairment of goodwill and intangible assets |

|

|

5,437 |

|

|

|

- |

|

|

Total operating costs and expenses |

|

|

28,071 |

|

|

|

22,029 |

|

|

Earnings of equity method investments |

|

|

286 |

|

|

|

143 |

|

|

Operating loss |

|

|

(10,354 |

) |

|

|

(1,900 |

) |

|

Other income |

|

|

297 |

|

|

|

603 |

|

|

Interest expense |

|

|

(349 |

) |

|

|

(495 |

) |

|

Loss before income tax expense |

|

|

(10,406 |

) |

|

|

(1,792 |

) |

|

Income tax expense |

|

|

15 |

|

|

|

24,722 |

|

|

Net loss |

|

$ |

(10,421 |

) |

|

$ |

(26,514 |

) |

The Company’s asset liquidation revenue has several components: (1) traditional fee based asset disposition services, such as commissions from on-line and webcast auctions, liquidations and negotiated sales, and commissions from the NLEX charged-off receivables business, (2) the acquisition and subsequent disposition of distressed and surplus assets, including industrial machinery and equipment and real estate, and (3) fees earned for appraisal and management advisory services. The Company also earns income from its asset liquidation business through its earnings from equity method investments.

2015 Compared to 2014

Revenues and cost of revenues - Revenues were $17.4 million in 2015 compared to $20.0 million in 2014, costs of services revenue and asset sales were $6.5 million in 2015 compared to $10.3 million in 2014, and earnings of equity method investments were $0.3 million in 2015 compared to $0.1 million in 2014. The gross profits of these three items were therefore $11.2 million in 2015 compared to $9.9 million in 2014, an increase of approximately $1.3 million or approximately 14%. Because the Company conducts its asset liquidation operations both independently and through partnerships, and the ratio of the two is unlikely to remain constant in each period, the operations must be considered as a whole rather than on a line-by-line basis. The increased gross profit in the current year reflects the vagaries of the timing of asset liquidation transactions as well as the inclusion of a full year of NLEX gross profit as compared to only seven months of gross profit in 2014. NLEX generated $4.5 million of gross profit in 2015 as compared to $2.1 million of gross profit in 2014.

Real estate inventory write-down - The Company recorded a $2.7 million real estate inventory write-down charge during 2015. No charge was taken in the comparable 2014 period. The write-down represented a net realizable value adjustment to the carrying value of the Company’s real estate inventory and was triggered by the Company’s decision to list the property for sale at a much lower price than which it had previously been listed.

Selling, general and administrative expense – Selling, general and administrative expense, including expenses paid to related parties, was $12.8 million in 2015 as compared to $11.2 million in 2014, an increase of $1.6 million or 14%. Expenses increased overall primarily due to the inclusion of NLEX expenses of $2.8 million for the entire year in 2015, compared to only $1.4 million for the seven month period from acquisition in June 2014 through the end of the year. The Company’s personnel expense also contributed to the increase, as we increased the headcount in our asset liquidation businesses to promote operational growth.

13

Significant components of selling, general and administrative expense were as shown below (dollars in thousands):

|

|

|

Year ended December 31, |

|

|

|

|

|

|||||

|

|

|

2015 |

|

|

2014 |

|

|

% change |

|

|||

|

Compensation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

HGP |

|

$ |

4,233 |

|

|

$ |

3,935 |

|

|

|

8 |

% |

|

Equity Partners |

|

|

1,617 |

|

|

|

1,702 |

|

|

|

-5 |

% |

|

NLEX |

|

|

2,155 |

|

|

|

1,205 |

|

|

|

79 |

% |

|

Former President’s salary |

|

|

138 |

|

|

|

138 |

|

|

|

0 |

% |

|

Stock-based compensation |

|

|

358 |

|

|

|

484 |

|

|

|

-26 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal |

|

|

219 |

|

|

|

268 |

|

|

|

-18 |

% |

|

Consulting |

|

|

553 |

|

|

|

507 |

|

|

|

9 |

% |

|

Street Capital management fees |

|

|

240 |

|

|

|

360 |

|

|

|

-33 |

% |

|

Accounting and tax consulting |

|

|

190 |

|

|

|

323 |

|

|

|

-41 |

% |

|

Insurance |

|

|

233 |

|

|

|

162 |

|

|

|

44 |

% |

|

Occupancy |

|

|

611 |

|

|

|

370 |

|

|

|

65 |

% |

|

Travel and entertainment |

|

|

875 |

|

|

|

717 |

|

|

|

22 |

% |

|

Advertising and promotion |

|

|

408 |

|

|

|

360 |

|

|

|

13 |

% |

|

Other |

|

|

944 |

|

|

|

652 |

|

|

|

45 |

% |

|

Total selling, general and administrative expense |

|

$ |

12,774 |

|

|

$ |

11,183 |

|

|

|

|

|

Depreciation and amortization expense – Depreciation and amortization expense was $0.6 million in both 2015 and 2014. The increased amortization from a full year of expense on the NLEX intangible assets acquired in the second quarter of 2014 was offset by a reduction to the amortization on the HGP customer network resulting from the reduction in carrying value subsequent to the impairment charge at the beginning of the fourth quarter of 2015. In both years the depreciation of property and equipment was not material.

Impairment of goodwill and intangible assets – The Company recorded an impairment charge of $5.4 million to reduce the carrying value of the goodwill and customer network, which resulted from the acquisition of HGP in 2012, to their respective fair values as of October 1, 2015 (the date at which the Company tested its goodwill and intangibles for impairment). There was no such similar charge in 2014. The sustained losses incurred by the Company, and the qualitative and quantitative review of the HGP reporting unit, led to the impairment charge in the fourth quarter of 2015. Refer to Note 8 to the consolidated financial statements for further detail.

Other income – The significant items within other income included the following: In 2014, the Company recorded $0.6 million as its gain on the sale of its investment in Polaroid. There were no similar transactions in 2015. In 2014, the Company recorded $0.3 million as its share of income from its other equity accounted investments. Income from these other equity accounted investments was not material in 2015. In 2015 the Company recorded other income of $0.2 million related to the mark-to-market revaluation of the NLEX contingent consideration. In 2014 the mark-to-market revaluation resulted in other expense of $0.2 million.

Off-Balance Sheet Arrangements – The Company had no off balance sheet arrangements during the years ended December 31, 2015 and 2014.

Future Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards update 2014-09, Revenue from Contracts with Customers (“ASU 2014-09”). ASU 2014-09 specifies a comprehensive model to be used in accounting for revenue arising from contracts with customers, and supersedes most of the current revenue recognition guidance, including industry-specific guidance. It applies to all contracts with customers except those that are specifically within the scope of other FASB topics, and certain of its provisions also apply to transfers of nonfinancial assets, including in-substance nonfinancial assets that are not an output of an entity’s ordinary activities. The core principal of the model is that revenue is recognized to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the transferring entity expects to be entitled in exchange. To apply the revenue model, an entity will: 1) identify the contract(s) with a customer, 2) identify the performance obligations in the contract, 3) determine the transaction price, 4) allocate the transaction price to the performance obligations in the contract, and 5)

14

recognize revenue when (or as) the entity satisfies a performance obligation. For public companies, ASU 2014-09 is effective for annual reporting periods (including interim reporting periods within those periods) beginning after December 15, 2017. Early adoption is not permitted. Upon adoption, entities can choose to use either a full retrospective or modified approach, as outlined in ASU 2014-09. As compared with current Generally Accepted Accounting Principles (“GAAP”), ASU 2014-09 requires significantly more disclosures about revenue recognition. The Company has not yet assessed the potential impact of ASU 2014-09 on its consolidated financial statements.

In August 2014, the FASB issued Accounting Standards update 2014-15, Disclosure of Uncertainties About an Entity’s Ability to Continue as a Going Concern (“ASU 2014-15”). ASU 2014-15 requires management to determine whether substantial doubt exists regarding the entity’s going concern presumption, which generally refers to an entity’s ability to meet its obligations as they become due, and provides guidance on determining when and how to disclose going-concern uncertainties in an entity’s financial statements. It requires management to perform both interim and annual assessments of an entity’s ability to continue as a going concern within one year of the date the financial statements are issued. The ASU contains guidance on 1) how to perform a going-concern assessment, and 2) when to provide going-concern disclosures. An entity must provide specified disclosures if conditions or events raise substantial doubt about its ability to continue as a going concern. ASU 2014-15 applies to all entities and is effective for annual periods ending after December 15, 2016, and interim periods thereafter, with early adoption permitted. The Company has not yet adopted ASU 2014-15 nor assessed its potential impact on its disclosures.

In January 2015, the FASB issued Accounting Standards update 2015-01, Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items (“ASU 2015-01”). ASU 2015-01 eliminates the requirement for entities to consider whether an underlying event or transaction is extraordinary, and, if so, to separately present the item in the income statement net of tax, after income from continuing operations. Instead, items that are both unusual and infrequent should be separately presented as a component of income from continuing operations, or be disclosed in the notes to the financial statements. ASU 2015-01 will be effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 31, 2015. Early adoption is permitted provided that the new standard is applied from the beginning of the fiscal year of adoption. The Company has not historically reported extraordinary items in its consolidated financial statements, and is not aware of any pending transactions or events that might have required reporting as extraordinary items, and therefore does not expect the adoption of ASU 2015-01 to have a material impact on its consolidated financial statements.

In March 2015, the FASB issued Accounting Standards update 2015-02, Amendments to the Consolidation Analysis (“ASU 2015-02”). ASU 2015-02 eliminates entity specific consolidation guidance for limited partnerships, and revises other aspects of the consolidation analysis, but does not change the existing consolidation guidance for corporations that are not variable interest entities (“VIEs”). For public business entities, ASU 2015-02 will be effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015, with early adoption permitted. The Company does not believe that ASU 2015-02 will have a material impact on its consolidated financial statements.

In April 2015, the FASB issued Accounting Standards update 2015-03, Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-03”). ASU 2015-03 changes the presentation of debt issuance costs in financial statements, by requiring them to be presented in the balance sheet as a direct deduction from the related debt liability, rather than as an asset. Amortization of the costs is reported as interest expense. There is no change to the current guidance on the recognition and measurement of debt issuance costs. For public business entities, ASU 2015-03 will be effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015, with early adoption permitted. The Company does not believe that ASU 2015-03 will have a material impact on its consolidated financial statements.

In August 2015, the FASB issued Accounting Standards update 2015-15, Interest – Imputation of Interest, (“ASU 2015-15”). ASU 2015-15 amends subtopic 835-30 of the accounting standards codification (which was previously amended by ASU 2015-03), to allow for the capitalization of debt issuance costs related to line of credit agreements. Capitalized costs would be presented as an asset and subsequently amortized ratably over the term of the line of credit. The Company does not believe that ASU 2015-15 will have a material impact on its consolidated financial statements.

In September 2015, the FASB issued Accounting Standards update 2015-16, Simplifying the Accounting for Measurement-Period Adjustments (“ASU 2015-16”). ASU 2015-16 changes the recognition of business combination adjustments by requiring acquirers to recognize adjustments to provisional amounts identified during the measurement period in the reporting period in which the adjustment amounts are determined. The acquirer is required to record the effect on earnings of changes in depreciation, amortization, or other income effects, if any, as a result of the change to the provisional amounts. These amounts are calculated as if the accounting was completed at acquisition date. The acquirer is also required to present separately on the face of the income statement, or disclose in the notes, the amount recorded in current-period earnings (by line item) that would have been recorded in previous reporting periods had the adjustments been recognized as of the acquisition date. ASU 2015-16 will be effective for fiscal years, and interim

15

periods within those fiscal years, beginning after December 15, 2015. The Company does not believe ASU 2015-16 will have a material impact on its consolidated financial statements.

In November 2015, the FASB issued Accounting Standards update 2015-17, Balance Sheet Classification of Deferred Taxes (“ASU 2015-17”). ASU 2015-17 requires all deferred tax assets and liabilities to be classified as non-current on the balance sheet. This amendment simplifies the presentation of deferred income taxes. ASU 2015-17 will be effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. The Company has not yet adopted ASU 2015-17, however its effects are not expected to have a material impact on the consolidated financial statements.

In February 2016, the FASB issued Accounting Standards update 2016-02, Leases (“ASU 2016-02”). ASU 2016-02 requires a lessee to recognize a lease asset representing its right to use the underlying asset for the lease term, and a lease liability for the payments to be made to lessor, on its balance sheet for all operating leases greater than 12 months. ASU 2016-02 will be effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The Company has not yet adopted ASU 2016-02 nor assessed its potential impact on the financial statements.

Critical Accounting Policies

Use of estimates

The preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Management bases its estimates and judgments on historical experience and various other factors that are believed to be reasonable under the circumstances. Actual results could differ from those estimates.

Significant estimates include the assessment of collectability of revenue recognized, and the valuation of accounts receivable, inventory, investments, goodwill and intangible assets, liabilities, contingent consideration, deferred income tax assets and liabilities, and stock-based compensation. These estimates have the potential to significantly impact our consolidated financial statements, either because of the significance of the financial statement item to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events that are continuous in nature.

Revenue recognition

Services revenue generally consists of commissions and fees from providing auction services, appraisals, brokering of sales transactions and providing merger and acquisition advisory services. Revenue is recognized when persuasive evidence of an arrangement exists, the selling price is fixed and determinable, goods or services have been provided, and collectability is reasonably assured. For asset sales revenue is recognized in the period in which the asset is sold, the buyer has assumed the risks and awards of ownership, the Company has no continuing substantive obligations and collectability is reasonably assured.

We evaluate revenue from asset liquidation transactions in accordance with the accounting guidance to determine whether to report such revenue on a gross or net basis. We have determined that we act as an agent for our fee based asset liquidation transactions and therefore we report the revenue from transactions in which we act as an agent on a net basis.

The Company also earns income through asset liquidation transactions that involve the Company acting jointly with one or more additional purchasers, pursuant to a partnership, joint venture or limited liability company (“LLC”) agreements (collectively, “Joint Ventures”). For these transactions, the Company does not record the revenue or expenses associated with these Joint Ventures. Instead, the Company’s proportionate share of the net income (loss) is reported as Earnings of equity method investments. In general, the Joint Ventures apply the same revenue recognition and other accounting policies as the Company.

Cost of services revenue and asset sales

Cost of services revenue generally includes the direct costs associated with generating commissions and fees from the Company’s auction and appraisal services, merger and acquisition advisory services, and brokering of charged-off receivable portfolios. The Company generally recognizes these expenses in the period in which the revenue they relate to is recorded. Cost of asset sales generally includes the cost of purchased inventory and the related direct costs of selling inventory. The Company recognizes these expenses in the period in which title to the inventory passes to the buyer and the buyer assumes the risk and reward of the inventory.

Accounts receivable

The Company’s accounts receivable primarily relate to the operations of its asset liquidation business. They generally consist of three major categories: fees, commissions and retainers relating to appraisals and auctions, receivables from asset sales, and

16

receivables from Joint Venture partners. The initial value of an account receivable corresponds to the fair value of the underlying goods or services. To date, a majority of the receivables have been classified as current and, due to their short-term nature, any decline in fair value would be due to issues involving collectability. At each financial statement date the collectability of each outstanding account receivable is evaluated, and an allowance is recorded if the book value exceeds the amount that is deemed collectable. See Note 9 to the consolidated financial statements for more detail regarding the Company’s accounts receivable.

Inventory

The Company’s inventory consists of assets acquired for resale. Machinery and equipment inventory is classified as current, and historically is sold within a one-year operating cycle. Real estate inventory is classified as non-current due to uncertainties relating to the timing of resale. All inventory is recorded at the lower of cost or net realizable value. There is a risk that assets acquired for resale may be subsequently sold for less than their cost, or may remain unsold. Historically, the assets’ selling prices have generally been in excess of their cost. However, during 2015, the Company recorded an inventory write down charge of $2.7 million related to its real estate inventory. See Note 4 to the consolidated financial statements for further detail.

Equity Method Investments

As noted above, the Company conducts a portion of its asset liquidation business through Joint Ventures. These are accounted for using the equity method of accounting whereby the Company’s proportionate share of the Joint Venture’s net income (loss) is reported in the consolidated statement of operations as Earnings of equity method investments. At the balance sheet date, the Company’s investments in these Joint Ventures are reported in the consolidated balance sheet as equity method investments. The Company monitors the value of each Joint Ventures’ underlying assets and liabilities, and records a write down of its investments should the Company conclude that there has been a decline in the value of the net assets. Given that the underlying transactions are identical, in all material aspects, to asset liquidation transactions that the Company undertakes independently, the net assets are similarly expected to be sold within a one-year operating cycle. However, these investments have historically been classified as non-current in the consolidated financial statements due to the uncertainties relating to the timing of resale of the underlying assets as a result of the Joint Venture relationship.

Intangible assets and goodwill

Intangible assets are recorded at fair value upon acquisition. Those with an estimated useful life are amortized, and those with an indefinite useful life are unamortized. Subsequent to acquisition, the Company monitors events and changes in circumstances that require an assessment of intangible asset recoverability. Indefinite-lived intangible assets are assessed at least annually to determine both if they remain indefinite-lived and if they are impaired. The Company assesses whether or not there have been any events or changes in circumstances that suggest the value of the asset may not be recoverable. Amortized intangible assets are not tested annually, but are assessed when events and changes in circumstances suggest the assets may be impaired. If an assessment determines that the carrying amount of any intangible asset is not recoverable, an impairment loss is recognized in the statement of operations, determined by comparing the carrying amount of the asset to its fair value. All of the Company’s identifiable intangible assets at December 31, 2015 have been acquired as part of the acquisitions of HGP in 2012 and NLEX in 2014, and are discussed in more detail in Note 8 to the consolidated financial statements. During 2015 the Company recorded an impairment charge of $2.7 million related to the customer network acquired as part of the acquisition of HGP. No impairment charges were recorded during 2014. See Note 3 and Note 8 to the consolidated financial statements for more detail regarding the Company’s identifiable intangible assets.

Goodwill, which results from the difference between the purchase price and the fair value of net identifiable tangible and intangible assets acquired in a business combination, is not amortized, but is tested at least annually for impairment. The Company performs its annual impairment test on October 1. Testing goodwill is a two-step process, in which the carrying amount of the reporting unit associated with the goodwill is first compared to the reporting unit’s estimated fair value. If the carrying amount of the reporting unit exceeds its estimated fair value, the fair values of the reporting unit’s assets and liabilities are analyzed to determine whether the goodwill of the reporting unit has been impaired. An impairment loss is recognized to the extent that the Company’s recorded goodwill exceeds its implied fair value as determined by this two-step process. Accounting Standards Update 2011-08, Testing Goodwill for Impairment, provides the option to perform a qualitative assessment prior to performing the two-step process, which may eliminate the need for further testing. Goodwill, in addition to being tested for impairment annually, is tested for impairment at interim periods if an event occurs or circumstances change such that it is more likely than not that the carrying amount of goodwill may be impaired.

In testing goodwill, the Company initially uses a qualitative approach and analyzes relevant factors to determine if events and circumstances have affected the value of the goodwill. If the result of this qualitative analysis indicates that the value has been impaired, the Company then applies a quantitative approach to calculate the difference between the goodwill’s recorded value and its fair value. An impairment loss is recognized to the extent that the recorded value exceeds its fair value. All of the Company’s goodwill relates to its acquisitions of Equity Partners in 2011, HGP in 2012 and NLEX in 2014, and is discussed in more detail in

17

Note 3 and Note 8 to the consolidated financial statements. During 2015 the Company recorded an impairment charge of $2.7 million related to the goodwill from its acquisition of HGP. No impairment charges were recorded during 2014.

Future impairment of the Company’s intangible assets and goodwill could result from changes in assumptions, estimates or circumstances, some of which are beyond the Company’s control. The most significant items that could impact the Company’s business and result in an impairment charge are outlined above in Item 1A. Risk Factors.

Deferred income taxes

The Company recognizes deferred tax assets and liabilities for temporary differences between the tax bases of assets and liabilities and the amounts at which they are carried in the financial statements, based upon the enacted tax rates in effect for the year in which the differences are expected to reverse. The Company periodically assesses the value of its deferred tax assets, which have been generated by a history of net operating and net capital losses, and determines the necessity for a valuation allowance that will reduce deferred tax assets to the amount expected to be realized. The Company evaluates which portion of the deferred tax assets, if any, will more likely than not be realized by offsetting future taxable income, taking into consideration any limitations that may exist on its use of its net operating and net capital loss carryforwards. In 2014, as a result of incurring losses in prior years, the Company recorded a valuation allowance that reduced its deferred tax assets to $0. The Company continued to carry a full valuation allowance in 2015. For further discussion of the Company’s income taxes, see Note 13 to the consolidated financial statements.

Contingent consideration

At December 31, 2015 the Company’s contingent consideration consists of the estimated fair value of an earn-out provision that was part of the consideration for the acquisition of NLEX in 2014. The amount assigned to the contingent consideration at the acquisition date was determined using a discounted cash flow analysis. Its present value is assessed quarterly, and any adjustments, together with the accretion of the fair value discount, are reported as other income/expense on the Company’s consolidated statement of operations. See Note 3 to the consolidated financial statements for more discussion of the acquisition of NLEX and the related contingent consideration.

Liabilities and contingencies