Attached files

| file | filename |

|---|---|

| EX-21 - Heritage Global Inc. | v178705_ex21.htm |

| EX-32.2 - Heritage Global Inc. | v178705_ex32-2.htm |

| EX-31.2 - Heritage Global Inc. | v178705_ex31-2.htm |

| EX-31.1 - Heritage Global Inc. | v178705_ex31-1.htm |

| EX-32.1 - Heritage Global Inc. | v178705_ex32-1.htm |

| EX-10.21 - Heritage Global Inc. | v178705_ex10-21.htm |

| EX-10.20 - Heritage Global Inc. | v178705_ex10-20.htm |

| EX-10.22 - Heritage Global Inc. | v178705_ex10-22.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

x ANNUAL REPORT PURSUANT TO SECTION

13

OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2009

Commission

File No. 0-17973

C2

GLOBAL TECHNOLOGIES INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

Florida

|

59-2291344

|

|

(State

or Other Jurisdiction

|

(I.R.S.

Employer

|

|

of

Incorporation or Organization)

|

Identification

No.)

|

|

3200

– 40 King St. West, Toronto, Ontario, Canada

|

M5H

3Y2

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

(416)

866-3000

(Registrant’s

Telephone Number, Including Area Code)

Securities

registered pursuant to Section 12(b) of the Act: None.

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $0.01 par

value.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the

registrant: (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes

þ No ¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit

and post such files). Yes ¨ No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company (as

defined in Rule 12b-2 of the Exchange Act).

Large

Accelerated Filer ¨ Accelerated

Filer ¨ Non-Accelerated Filer þ Smaller Reporting Company ¨

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No þ

The

aggregate market value of Common Stock held by non-affiliates based upon the

closing price of $0.15 per share on June 30, 2009, as reported by the OTC -

Bulletin Board, was approximately $311,000.

As of

March 25, 2010, there were 22,718,074 shares of Common Stock, $0.01 par value,

outstanding.

TABLE

OF CONTENTS

|

PAGE

|

|||

|

PART

I

|

|||

|

Item

1.

|

Business.

|

3

|

|

|

Item

1A.

|

Risk

Factors.

|

9

|

|

|

Item

1B.

|

Unresolved

Staff Comments.

|

11

|

|

|

Item

2.

|

Properties.

|

11

|

|

|

Item

3.

|

Legal

Proceedings.

|

12

|

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders.

|

12

|

|

|

PART

II

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities.

|

13

|

|

|

Item

6.

|

Selected

Financial Data.

|

16

|

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

17

|

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

28

|

|

|

Item

8.

|

Financial

Statements and Supplementary Data.

|

28

|

|

|

Item

9.

|

Changes

In and Disagreements With Accountants on Accounting and Financial

Disclosure.

|

28

|

|

|

Item

9A(T).

|

Controls

and Procedures.

|

29

|

|

|

Item

9B.

|

Other

Information.

|

30

|

|

|

PART

III

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance.

|

31

|

|

|

Item

11.

|

Executive

Compensation.

|

34

|

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters.

|

43

|

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

44

|

|

|

Item

14.

|

Principal

Accountant Fees and Services.

|

44

|

|

|

PART

IV

|

|||

|

Item

15.

|

Exhibits

and Financial Statement Schedules.

|

46

|

|

2

Forward-Looking

Information

This Annual Report on Form 10-K (the

“Report”) contains certain “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Exchange Act of 1934, as amended, that are based on management’s exercise of

business judgment as well as assumptions made by, and information currently

available to, management. When used in this document, the words

“may”, "will”,

“anticipate”, “believe”, “estimate”, “expect”, “intend”, and words of similar

import, are intended to identify any forward-looking statements. You

should not place undue reliance on these forward-looking

statements. These statements reflect our current view of future

events and are subject to certain risks and uncertainties, as noted

below. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, our actual

results could differ materially from those anticipated in these forward-looking

statements. We undertake no obligation, and do not intend, to update,

revise or otherwise publicly release any revisions to these forward-looking

statements to reflect events or circumstances after the date hereof, or to

reflect the occurrence of any unanticipated events. Although we

believe that our expectations are based on reasonable assumptions, we can give

no assurance that our expectations will materialize.

PART

I

(All

dollar amounts are presented in thousands of U.S. dollars (“USD”), unless

otherwise indicated, except per share amounts)

Item

1. Business.

Overview

and Recent Developments

C2 Global

Technologies Inc. (“C2”, “we” or the “Company”) was incorporated in the State of

Florida in 1983 under the name “MedCross, Inc.” which was changed to “I-Link

Incorporated” in 1997, to “Acceris Communications Inc.” in 2003, and to “C2

Global Technologies Inc.” in 2005. The most recent name change

reflects a change in the strategic direction of the Company following the

disposition of its Telecommunications business in the third quarter of

2005.

C2 owns

certain patents, detailed below under “History and Development of the Business”

and “Intellectual Property”, including two foundational patents in voice over

internet protocol (“VoIP”) technology – U.S. Patent Nos. 6,243,373 and 6,438,124

(together the “VoIP Patent Portfolio”), which it licenses. All

activities relating to the Company’s licensing of the VoIP Patent Portfolio, or

its other intellectual property, constitute the Company’s Patent Licensing

operating segment. C2’s target market consists of carriers, equipment

manufacturers, service providers and end users in the internet protocol (“IP”)

telephone market who are using C2’s patented VoIP technologies by deploying VoIP

networks for phone-to-phone communications. The Company has engaged,

and intends to continue to engage, in licensing agreements with third parties

domestically and internationally.

The

Company’s objective is to obtain ongoing licensing and royalty revenue from the

target market for its patents. In this regard, in the third quarter

of 2005, the Company retained legal counsel with expertise in the enforcement of

intellectual property rights, and on June 15, 2006, C2 Communications

Technologies Inc., a wholly-owned subsidiary of the Company, filed a patent

infringement lawsuit against seven major U.S. telecommunications carriers, which

alleged that these companies’ VoIP services and systems infringed C2’s U.S.

Patent No. 6,243,373, entitled “Method and Apparatus for

Implementing a Computer Network/Internet Telephone System” (the “VoIP

Patent”). The complaint sought an injunction, monetary damages, and

costs. The litigation resulted in the Company entering into

settlement and license agreements in 2008, for which C2 was paid $17,625 in

aggregate, whereby C2 granted the defendants non-exclusive, perpetual,

worldwide, fully paid up, royalty free licenses under any of C2’s present

patents and patent applications, including the VoIP Patent, to make, use, sell

or otherwise dispose of any goods and services based on such

patents.

On August

27, 2009 C2 Communications Technologies Inc. filed a similar lawsuit against

PAETEC Corporation, Matrix Telecom, Inc., Windstream Corporation, and Telephone

and Data Systems, Inc. The complaint was filed in the United States

District Court for the Eastern District of Oklahoma and also alleges that the

defendants’ services and systems utilizing VoIP infringe the Company’s U.S.

Patent No. 6,243,373. The complaint seeks an injunction, monetary

damages and costs. In the fourth quarter of 2009, the complaint

against Matrix Telecom, Windstream Corporation and Telephone and Data Systems,

Inc. was dismissed without prejudice. Also in the fourth quarter of

2009, the case was transferred to the Eastern District of Texas. A

trial date has not been set.

In the

third quarter of 2007, the Company began investing in Internet-based e-commerce

businesses, when it acquired minority positions in MyTrade.com, Inc., Buddy

Media, Inc. (“Buddy Media”) and LIMOS.com LLC (“LIMOS.com”). Its

investments in MyTrade.com, Inc. and LIMOS.com were subsequently sold in 2007

and 2008, respectively. In the fourth quarter of

2007 the Company acquired a one-third interest in Knight’s Bridge Capital

Partners Internet Fund No. 1 GP LLC (“Knight’s Bridge GP”). The

additional two-thirds interest in Knight’s Bridge GP was acquired by parties

affiliated with the Company’s majority stockholder, Counsel Corporation

(together with its subsidiaries, “Counsel”).

3

In the

second quarter of 2009, the Company sold a portion of its investment in Buddy

Media, recognizing a gain of $21 on an initial investment of

$100. Also in the second quarter of 2009, the Company invested $2,621

to indirectly acquire an approximate 5% interest in Polaroid Corporation,

pursuant to a Chapter 11 reorganization in a U.S. bankruptcy

court. C2’s interest is managed by Knight’s Bridge Capital Management

L.P., an affiliate of Counsel. The Company’s investments are

discussed in more detail in Note 5 of the audited consolidated financial

statements included in Item 15 of this Report.

In

February 2009 the Company established Counsel RB Capital LLC (“Counsel RB”),

which commenced operations in the second quarter of 2009. Counsel RB

is owned 75% by the Company and 25% by its Co-CEO’s. It specializes

in the acquisition and disposition of distressed and surplus assets throughout

the United States and Canada. Counsel RB’s operations are discussed

in more detail in Note 2 of the audited consolidated financial

statements. Counsel RB’s operations constitute the Company’s Asset

Liquidation operating segment. The Company’s segments are discussed

in more detail in Note 15 of the audited consolidated financial

statements.

History

and Development of the Business

In 1994,

we began operating as an Internet service provider and quickly identified that

the emerging IP environment was a promising basis for enhanced service

delivery. We soon turned to designing and building an IP

telecommunications platform consisting of proprietary software and hardware, and

leased telecommunications lines. The goal was to create a platform

with the quality and reliability necessary for voice transmission. In

1997, we began offering enhanced services over a mixed IP-and-circuit-switched

network platform. These services offered a blend of traditional and

enhanced communication services and combined the inherent cost advantages of an

IP-based network with the reliability of the existing Public Switched Telephone

Network (“PSTN”).

In August

1997, we acquired MiBridge, Inc. (“MiBridge”), a communications technology

company engaged in the design, development, integration and marketing of a range

of software telecommunications products that support multimedia communications

over the PSTN, local area networks (“LANs”) and IP networks. The

acquisition of MiBridge permitted us to accelerate the development and

deployment of IP technology across our network platform.

In 1998,

we first deployed our real-time IP communications network

platform. With this new platform, all core operating functions such

as switching, routing and media control became software-driven. This

new platform represented the first nationwide, commercially viable VoIP platform

of its kind. Following the launch of our software-defined VoIP

platform in 1998, we continued to refine and enhance the platform to make it

even more efficient and capable for our partners and customers.

In 2001,

the Company entered the Telecommunications business. The assets of

the Company’s Telecommunications segment were owned through a wholly-owned

subsidiary, Acceris Communications Corp. (name changed to WXC Corp. (“WXCC”) in

October 2005). This business was sold effective September 30,

2005.

In 2002,

the U.S. Patent and Trademark Office issued U.S. patent No. 6,438,124 (the “C2

Patent”) for the Company’s Voice Internet Transmission System. Filed

in 1996, the C2 Patent reflects foundational thinking, application, and practice

in the VoIP services market. The C2 Patent encompasses the technology

that allows two parties to converse phone-to-phone, regardless of the distance,

by transmitting voice/sound via the Internet. No special telephone or

computer is required at either end of the call. The apparatus that

makes this technically possible is a system of Internet access nodes, or voice

engines, which provide digitized, compressed, and encrypted duplex or simplex

Internet voice/sound. The end result is a high-quality calling

experience whereby the Internet serves only as the transport medium and, as

such, can lead to reduced toll charges. On May 1, 2003, shortly after

the issuance of our core C2 Patent, we disposed of our domestic U.S. VoIP

network. The sale included the physical assets required to operate

our nationwide network using our patented VoIP technology (constituting the core

business of the I-Link Communications Inc. (“ILC”) business) and included a

fully paid non-exclusive perpetual license to our proprietary software-based

network convergence solution for voice and data. The sale of the ILC

business removed essentially all operations that did not pertain to this

convergence solution. As part of the sale, we retained all of our

intellectual property rights and patents.

In 2003,

we added to our VoIP patent holdings when we acquired the VoIP Patent, which

included a corresponding foreign patent and related international patent

applications. The vendor of the VoIP Patent was granted a first

priority security interest in the patent in order to secure C2’s obligations

under the associated purchase agreement. The VoIP Patent, together

with the C2 Patent and related international patents and patent applications,

form our international VoIP Patent Portfolio that covers the basic process and

technology that enable VoIP communication as it is used in the market

today. Telecommunications companies that enable their customers to

originate a phone call on a traditional handset, transmit any part of that call

via IP, and then terminate the call over the traditional telephone network, are

utilizing C2’s patented technology. The comprehensive nature of the

VoIP Patent is summarized in the patent’s abstract, which, in pertinent part,

describes the technology as follows: “A method and apparatus are provided

for communicating audio information over a computer network. A

standard telephone connected to the PSTN may be used to communicate with any

other PSTN-connected telephone, where a computer network, such as the Internet,

is the transmission facility instead of conventional telephone transmission

facilities.” As part of the consideration for the acquisition

of the VoIP Patent, the vendor is entitled to receive 35% of the net earnings

from our VoIP Patent Portfolio.

4

Up to

December 31, 2004, revenue related to our intellectual property was based on the

sales and deployment of our VoIP solutions, which we ceased directly marketing

in 2005. No revenue was due to the receipt of licensing fees and

royalties. Revenue in 2008 was the result of entering into settlement

and license agreements with six major U.S. telecommunications carriers, as

described above. We expect to generate ongoing licensing and royalty

revenue in this business as we gain recognition of the underlying value in our

VoIP Patent Portfolio through the enforcement of our intellectual property

rights, as discussed above under “Overview and Recent

Developments”.

The

Company has previously conducted research and development activities related to

its patents, most recently in 2005, when it invested $389. The

Company suspended its investment in research and development in the third

quarter of 2005 in conjunction with its decision to focus on the realization of

licensing fees associated with its intellectual property.

As

discussed above under “Overview and Recent Developments”, in the third quarter

of 2007, the Company began investing in Internet-based e-commerce businesses

through its acquisitions of minority positions in MyTrade.com, Inc. (sold in the

fourth quarter of 2007), Buddy Media, Inc. (partially sold in the second quarter

of 2009) and LIMOS.com LLC (sold in the fourth quarter of 2008). It

continued its investment activities in the fourth quarter of 2007 with the

acquisition of a one-third interest in Knight’s Bridge Capital Partners Internet

Fund No. 1 GP LLC. In the second quarter of 2009, the Company

invested $2,621 in Polaroid, and in the third quarter it invested an additional

$10. At December 31, 2009 the Company’s investment in these

businesses totaled $2,791. In the fourth quarter of 2009 the Company

received distributions from Polaroid totalling $232. The Company’s

objective is to realize long-term capital appreciation as the value of these

businesses is developed and recognized. In this regard, to date the

Company recognized a gain of $75 on MyTrade.com, Inc., a gain of $425 on

LIMOS.com LLC, and a gain of $21 on Buddy Media, Inc.

As also

discussed above under “Overview and Recent Developments”, in February 2009 the

Company established Counsel RB. The Counsel RB operations have

allowed the Company to diversify into a new operating segment, Asset

Liquidation.

5

Intellectual

Property

Below is

a summary of the Company’s patents:

|

Type

|

Title

|

Number

|

Status

|

|||

|

VoIP

Architecture

|

Computer

Network/Internet Telephone System (“VoIP Patent”)

|

U.S.

No. 6,243,373

|

Issued: June

5, 2001

Expires:

November 1, 2015

|

|||

|

Australia

No. 716096

|

Issued: June

1, 2000

Expires:

October 29, 2016

|

|||||

|

People’s

Republic of China

No.

ZL96199457.6

|

Issued: December

14, 2005

Expires:

October 29, 2016

|

|||||

|

Canada

No. 2,238,867

|

Issued: October

18, 2005

Expires:

October 29, 2016

|

|||||

|

Hong

Kong No. HK1018372

|

Issued: August

11, 2006

Expires:

October 29, 2016

|

|||||

|

Europe

No. 0873637

|

Granted

March 21, 2007 1

|

|||||

|

Voice

Internet Transmission System

(“C2

Patent”)

|

U.S.

No. 6,438,124

|

Issued: August

20, 2002

Expires:

July 22, 2018

|

||||

|

People’s

Republic of China

No.

ZL97192954.8

|

Issued: May

21, 2004

Expires:

February 5, 2017

|

|||||

|

Canada

No. 2,245,815

|

Issued: October

10, 2006

Expires:

February 5, 2017

|

|||||

|

South

Korea No. 847335

|

Issued: July

14, 2008

Expires:

February 5, 2017

|

|||||

|

South

Korea No. 892950

|

Issued: April

3, 2009

Expires:

February 5, 2017

|

|||||

|

Private

IP Communication

Network

Architecture

|

U.S.

No. 7,215,663

|

Issued: May

8, 2007

Expires: June

12, 2017

|

||||

|

Conferencing

|

Delay

Synchronization in Compressed

Audio

Systems

|

U.S.

No. 5,754,534

|

Issued: May

19, 1998

Expires:

May 6, 2016

|

|||

|

|

Volume

Control Arrangement for Compressed Information Signal

Delays

|

|

U.S.

No. 5,898,675

|

|

Issued: April

27, 1999

Expires:

April 29, 2016

|

1 The

European patent has been validated in Austria, Belgium, Denmark, Finland,

France, Germany, Great Britain, Greece, Ireland, Italy, the Netherlands,

Portugal, Spain, Sweden and Switzerland.

In

addition to the C2 and VoIP patents, which cover the foundation of any VoIP

system, our patent portfolio includes:

Private IP Communication Network

Architecture (U.S. Patent No. 7,215,663 granted May 8, 2007) - This

invention relates generally to multimedia communications

networks. The patent’s Internet Linked Network Architecture delivers

telecommunication type services across a network utilizing digital technology.

The unique breadth and flexibility of telecommunication services offered by the

Internet Linked Network Architecture flow directly from the network over which

they are delivered and the underlying design principles and architectural

decisions employed during its creation.

6

C2 also

owns intellectual property that solves teleconferencing problems:

Delay Synchronization in Compressed

Audio Systems (U.S. Patent No. 5,754,534 granted May 19, 1998) - This

invention eliminates popping and clicking when switching between parties in a

communications conferencing system employing signal compression techniques to

reduce bandwidth requirements.

Volume Control Arrangement for

Compressed Information Signals (U.S. Patent No. 5,898,675 granted April 27,

1999) - This invention allows for modifying amplitude, frequency or phase

characteristics of an audio or video signal in a compressed signal system

without altering the encoder or decoder employed by each conferee in a

conferencing setting, so that individuals on the conference call can each adjust

their own gain levels without signal degradation.

Employees

As of

December 31, 2009, C2 had ten employees. Four of them are employed

directly by Counsel RB. Six employees are also employees of Counsel,

and, except for the CEO, their salaries are paid by Counsel. Under

the terms of a management services agreement (the “Agreement”), as described in

Item 11 of this Report, the Counsel employees provide management and

administrative services to C2 and the associated costs are allocated to

C2. The CEO has a separate employment arrangement with C2, as

discussed in Item 11.

Industry

and Competition

Patent

Licensing

The

communications services industry continues to evolve, both domestically and

internationally, providing significant opportunities and risks to the

participants in these markets. Factors that have driven this change

include:

|

|

·

|

entry

of new competitors and investment of substantial capital in existing and

new services, resulting in significant price

competition

|

|

|

·

|

technological

advances resulting in a proliferation of new services and products and

rapid increases in network capacity

|

|

|

·

|

the

Telecommunications Act of 1996; as amended,

and

|

|

|

·

|

growing

deregulation of communications services markets in the United States and

in other countries around the world

|

Historically,

the communications services industry transmitted voice and data over separate

networks using different technologies. Traditional carriers have

typically built telephone networks based on circuit switching technology, which

establishes and maintains a dedicated path for each telephone call until the

call is terminated.

VoIP is a

technology that can replace the traditional telephone network. This

type of data network is more efficient than a dedicated circuit network because

the data network is not restricted by the one-call, one-line limitation of a

traditional telephone network. This improved efficiency creates cost

savings that can be either passed on to the consumer in the form of lower rates

or retained by the VoIP provider. In addition, VoIP technology

enables the provision of enhanced services such as unified

messaging.

We are

seeking to have telecommunications service providers (“TSPs”), equipment

suppliers (“ESs”) and end users license our patents. In this regard,

our competition is existing technology, outside the scope of our patents, which

allows TSPs and ESs to deliver communication services to their

customers.

VoIP has

become a widespread and accepted telecommunications technology, with a variety

of applications in the telecommunications and other industries. While

we believe that there will be continued proliferation of this technology in the

coming years, and while we believe that this proliferation will occur within the

context of our patents, there is no certainty that this will occur, and that it

will occur in a manner that requires organizations to license our

patents.

7

Asset

liquidation

Our asset

liquidation business, Counsel RB, is involved primarily in the purchase and

sale, including at auction, of industrial machinery and equipment, real estate,

inventories, accounts receivable and distressed debt. The market for

these assets is highly fragmented. Counsel RB competes with other

liquidators, auction companies, dealers and brokers. It competes for

potential purchasers with other liquidators and auction companies, as well as

with equipment manufacturers, distributors, dealers and equipment rental

companies. Some of Counsel RB’s competitors have significantly

greater financial and marketing resources and name recognition.

Government

Regulation

Recent

legislation in the United States, including the Sarbanes-Oxley Act of 2002, has

increased regulatory and compliance costs as well as the scope and cost of work

provided to us by our independent registered public accountants and legal

advisors. The Company became subject to Section 404 reporting as of

December 31, 2007. As implementation guidelines continue to evolve,

we expect to continue to incur costs, which may or may not be material, in order

to comply with legislative requirements or rules, pronouncements and guidelines

by regulatory bodies.

Available

Information

C2 is

subject to the informational requirements of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), which requires that C2 file reports,

proxy statements and other information with the Securities and Exchange

Commission (“SEC”). The SEC maintains a website on the Internet at

http://www.sec.gov that

contains reports, proxy and information statements, and other information

regarding issuers, including C2, which file electronically with the

SEC. In addition, C2’s Exchange Act filings may be inspected and

copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C.

20549. The public may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-800-SEC-0330. The

Company makes available free of charge through its Internet web site, http://www.c2global.com

(follow Investor Relations tab to link to “SEC Filings”) its annual

report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K

and amendments to those reports filed or furnished pursuant to Section 13(a) or

15(d) of the Exchange Act as soon as reasonably practicable after such material

has been electronically filed with, or furnished to, the SEC.

`

8

Item

1A. Risk Factors.

You

should carefully consider and evaluate these risk factors, as any of them could

materially and adversely affect our business, financial condition and results of

operations, which, in turn, can adversely affect the price of our

securities.

We

are subject to the risks of having entered into a new line of

business.

In the

first quarter of 2009 the Company established its 75%-owned subsidiary, Counsel

RB, which commenced operations in the second quarter of 2009. As

discussed elsewhere in this Report, Counsel RB specializes in the acquisition

and disposition of distressed and surplus assets throughout the United States

and Canada. The Company has therefore acquired exposure to the risks

inherent in this business, such as those associated with the collectability of

accounts receivable, inventory valuation and turnover.

We

face significant competition in our asset liquidation business.

Our asset

liquidation business depends on our ability to successfully obtain a continuous

supply of distressed and surplus assets for profitable resale to third

parties. In this regard, we compete with numerous other

organizations, of which some are much larger and better-capitalized, with

greater resources available for both asset acquisition and associated marketing

to potential customers. As competition in this business increases, we

may be unable to compete successfully against current and future

competitors.

Our

asset liquidation business is subject to inventory risk and credit

risk.

Under our

business model, we assume the general and physical inventory and credit risks

associated with purchasing assets for subsequent resale. Although we

do enter into transactions for which a subsequent purchaser has already been

identified, in most cases we purchase assets and assume the risk that they may

sell for less than our forecasted price. As well, we may miscalculate

demand or resale value, and subsequently sell the assets for less than their

original purchase price. Either situation could have a material

adverse effect upon our use of working capital and our results of

operations.

Our

asset liquidation business is subject to environmental risk.

Our asset

liquidation at times includes the purchase and resale of buildings and

land. Although our purchase process includes due diligence to

determine that there are no adverse environmental issues, it is possible that

such issues could be discovered subsequent to a completed

purchase. Any remediation and related costs could have a material

adverse effect upon our business and results of operations.

We

are dependent upon key personnel.

Our

operations, particularly those of Counsel RB, are substantially dependent on the

knowledge, skills and performance of our executive officers. The loss

of any one of these officers could damage key relationships, and result in the

loss of essential information and expertise. As our operations expand

we will be required to hire additional employees, and may face intense

competition for them. Therefore, either the loss of the services of

our existing officers, or the inability to attract and retain appropriately

skilled new employees, could have a material adverse effect upon our business

and therefore our results of operations.

We

may require additional financing in the future, which may not be available, or

may not be available on favourable terms.

We may

need additional funds to finance our operations, particularly our asset

liquidation business, to make additional investments, or to acquire

complementary businesses or assets. We may be unable to generate

these funds from our operations. Additionally, in connection with

Counsel RB’s operations, the Company, together with Counsel, has guaranteed

Counsel RB’s variable and fixed rate debt. If funds are not

available, or not available on acceptable terms, we could experience a material

adverse effect upon our business.

Our

investments are particularly subject to risk of loss.

The

Company’s portfolio investment in Buddy Media, Inc. is in a development stage

company that has yet to provide a return to shareholders. The

Company’s equity investment in Knight’s Bridge Capital Partners Internet Fund

No. 1 GP LLC is in a company whose underlying investments are also primarily in

development stage companies. Although the Company’s analyses of these

investments as at December 31, 2009 resulted in the conclusion that no

impairment was present, development stage companies are particularly vulnerable

during an economic downturn such as the one currently in

progress. There can be no assurance that the Company will either

recover the value of its initial investments or earn a positive

return.

We

have significantly increased our investment in non-publicly traded

equity.

The

investment that the Company has made in Polaroid during 2009 represents

approximately 23% of its total assets at December 31, 2009. The

investment is in a private company and therefore not easily

liquidated. Although the Company’s analysis of this investment

opportunity concluded that it will ultimately have a positive return, and

although cash distributions were received during 2009, there can be no assurance

that the Company will either recover the entire value of its initial investment

or earn a positive return to the extent that it expects.

9

We

are subject to litigation.

We are,

from time to time, involved in various claims, legal proceedings and complaints

arising in the ordinary course of business. The significant

litigation matters in which we are involved at this time are detailed in Item 3

of this Report.

We

may fail to either adequately protect our proprietary technology and processes,

or enforce our intellectual property rights, which would allow competitors to

take advantage of our development efforts.

The

Company’s VoIP Patent Portfolio consists of United States Patents No. 6,243,373

and No. 6,438,124. The ultimate value of these patents has yet to be

determined. If we fail to obtain or maintain adequate protections, or

are unsuccessful in enforcing our patent rights, we may not be able to either

realize additional value from our patents, or prevent third parties from

benefiting from those patents without benefit to the Company. Any

currently pending or future patent applications may not result in issued

patents. In addition, any issued patents may not have priority over

any patent applications of others or may not contain claims sufficiently broad

to protect us against third parties with similar technologies, products or

processes. In February 2010, at the request of certain third parties,

the U.S. Patent and Trademark Office agreed to re-examine the validity of U.S.

Patent No. 6,243,373; this re-examination is currently in progress and its

outcome cannot be determined at this time. In addition, the Company’s

existing patents have finite lives (although they may be extended by filing

continuations and/or divisional applications), most of which expire in

approximately seven years. There is no guarantee that they will be

fully exploited or commercialized before expiry.

The

telecommunications market is volatile.

During

the last several years, the telecommunications industry has been very volatile

as a result of overcapacity, which has led to price erosion and

bankruptcies. These negative trends may become even more significant

during the current economic downturn. Our potential licensees may

experience increased customer attrition, may have difficulty generating and

collecting revenue, or may even be forced into bankruptcy. Our

potential revenue could therefore decrease significantly as the licensees become

unable to meet their financial obligations.

If

we were to default on our related party loan, Counsel could foreclose on our

assets.

At

December 31, 2009, Counsel owned approximately 91% of the Company’s common

stock. Our assets serve as collateral for our related party

debt. In the event that we were to default on this debt, and Counsel

foreclosed on our assets, we would be unable to continue our operations as they

are presently conducted, if at all. Our aggregate total debt to

Counsel at December 31, 2009 was $1,564. See Note 7 and Note 11 of

the consolidated financial statements included in Item 15 of this Report for

further discussion of the debt to Counsel.

Our

principal stockholder, Counsel, has voting control of the Company and our

executive officers are employees of Counsel.

Counsel

owns approximately 91% of our outstanding common stock. As a result,

Counsel controls all matters requiring approval by the stockholders, including

the election of the Board of Directors and significant corporate

transactions. Our Board of Directors has five members, four of whom

are not employees or otherwise affiliated with Counsel. The Board

establishes corporate policies and has the sole authority to nominate and elect

officers to carry out those policies. Our Chief Executive Officer,

Chief Financial Officer, Vice President of Accounting and Corporate Secretary

are all employees of Counsel. Counsel’s control over C2 could delay

or prevent a change in control of the Company, impede a merger, consolidation,

takeover or other business combination, or discourage a potential acquirer from

making a tender offer or otherwise attempting to obtain control of the

Company.

Provisions

in our Articles of Incorporation, as amended, could prevent or delay

stockholders' attempts to replace or remove current management.

Our

Articles of Incorporation, as amended, provide for staggered terms for the

members of our Board. The Board is divided into three staggered

classes, and each director serves a term of three years. At each

annual stockholders’ meeting only those directors comprising one of the three

classes will have completed their term and stand for re-election or

replacement. These provisions may be beneficial to our management and

the Board in a hostile tender offer, and may have an adverse impact on

stockholders who may want to participate in such a tender offer, or who may want

to replace some or all of the members of the Board.

We

are restating our unaudited consolidated financial statements for the quarters

ended June 30 and September 30, 2009.

In March

2010 management concluded that the previously issued unaudited consolidated

financial statements as of and for the quarters ended June 30, 2009 and

September 30, 2009 required restatement to correct errors in (i) the recognition

of patent licensing revenue in the three months ended June 30, 2009, and (ii)

the proportionate consolidation of the Company's interests in certain

non-controlled entities. These errors, and the restated financial

information as of and for the three and six months ended June 30, 2009 and the

three and nine months ended September 30, 2009, are discussed in Items 7 and

9A(T) and in Note 17 of the audited consolidated financial statements included

in this Report. Any regulatory proceeding or litigation that might

result from the foregoing restatement, if and when it occurs, and even if

ultimately resolved in our favor, could cause us to incur significant legal and

other expenses, including management time and resources.

10

Our Board of Directors may issue additional shares of preferred stock without stockholder approval.

Our

Articles of Incorporation, as amended, authorize the issuance of up to

10,000,000 shares of preferred stock, $10.00 par value per share. The

Board is authorized to determine the rights and preferences of any additional

series or class of preferred stock. The Board may, without

stockholder approval, issue shares of preferred stock with dividend,

liquidation, conversion, voting or other rights which are senior to our shares

of common stock or which could adversely affect the voting power or other rights

of the existing holders of outstanding shares of preferred stock or common

stock. The issuance of additional shares of preferred stock may also

hamper or discourage an acquisition or change in control of C2.

We

may conduct future offerings of our common stock and preferred stock and pay

debt obligations with our common and preferred stock that may diminish our

investors’ pro rata ownership and depress our stock price.

We

reserve the right to make future offers and sales, either public or private, of

our securities including shares of our preferred stock, common stock or

securities convertible into common stock at prices differing from the price of

the common stock previously issued. In the event that any such future

sales of securities are effected or we use our common or preferred stock to pay

principal or interest on our debt obligations, an investor’s pro rata ownership

interest may be reduced to the extent of any such issuances and, to the extent

that any such sales are effected at consideration which is less than that paid

by the investor, the investor may experience dilution and a diminution in the

market price of the common stock.

There

is a limited public trading market for our common stock; the market price of our

common stock has been volatile and could experience substantial

fluctuations.

Our

common stock is currently quoted on the OTC Bulletin Board and has a limited

public trading market. Without an active trading market, there can be

no assurance regarding the liquidity or resale value of the common

stock. In addition, the market price of our common stock has been,

and may continue to be, volatile. Such price fluctuations may be

affected by general market price movements or by reasons unrelated to our

operating performance or prospects such as, among other things, announcements

concerning us or our competitors, technological innovations, government

regulations, and litigation concerning proprietary rights or other

matters.

We

may not be able to utilize income tax loss carryforwards.

Restrictions

in our ability to utilize income tax loss carry forwards have occurred in the

past due to the application of certain changes in ownership tax rules in the

United States. There is no certainty that the application of these

rules may not recur. In addition, further restrictions of, reductions

in, or expiry of net operating loss and net capital loss carry forwards may

occur through future merger, acquisition and/or disposition transactions or

failure to continue a significant level of business activities. Any

such additional limitations could require us to pay income taxes in the future

and record an income tax expense to the extent of such liability. We

could be liable for income taxes on an overall basis while having unutilized tax

loss carry forwards since these losses may be applicable to one jurisdiction

and/or particular line of business while earnings may be applicable to a

different jurisdiction and/or line of business. Additionally, income

tax loss carry forwards may expire before we have the ability to utilize such

losses in a particular jurisdiction and there is no certainty that current

income tax rates will remain in effect at the time when we have the opportunity

to utilize reported tax loss carry forwards.

We

have not declared any dividends on our common stock to date and have no

expectation of doing so in the foreseeable future.

The

payment of cash dividends on our common stock rests within the discretion of our

Board of Directors and will depend, among other things, upon our earnings,

unencumbered cash, capital requirements and our financial condition, as well as

other relevant factors. To date, we have not paid dividends on our

common stock nor do we anticipate that we will pay dividends in the foreseeable

future. As of December 31, 2009, we do not have any preferred stock

outstanding that has any preferential dividends.

Item

1B. Unresolved Staff Comments

Not

applicable.

Item

2. Properties.

The

Company, in connection with its intellectual property licensing business, rents

approximately 200 square feet of office space in Marshall, TX on a month to

month basis for a nominal amount. Should the Company be required to

vacate these premises, ample alternative space is available.

The

Company, in connection with its asset liquidation business, leases office space

in White Plains, NY and Los Angeles, CA. The White Plains space is

approximately 2,850 square feet and its lease is in effect until February 28,

2014. The Los Angeles space is approximately 300 square feet; it is

currently leased on a month-to-month basis pending the negotiation of final

lease terms.

11

All

accounting and reporting functions are carried out from the corporate office of

its majority stockholder, Counsel, located in Toronto, Ontario,

Canada. The Company is not required to pay rent or other occupancy

costs to Counsel.

Item

3. Legal Proceedings.

Shareholder

Litigation

At our

Adjourned Meeting of Stockholders held on December 30, 2003, our stockholders,

among other things, approved an amendment to our Articles of Incorporation,

deleting Article VI thereof (regarding liquidations, reorganizations, mergers

and the like). Stockholders who were entitled to vote at the meeting

and advised us in writing, prior to the vote on the amendment, that they

dissented and intended to demand payment for their shares if the amendment was

effectuated, were entitled to exercise their appraisal rights and obtain payment

in cash for their shares under Sections 607.1301 – 607.1333 of the Florida

Business Corporation Act (the “Florida Act”), provided their shares were not

voted in favor of the amendment. In January 2004, we sent appraisal

notices in compliance with Florida corporate statutes to all stockholders who

had advised us of their intention to exercise their appraisal

rights. The appraisal notices included our estimate of fair value of

our shares, at $4.00 per share on a post-split basis. Approximately

33 stockholders holding approximately 74,000 shares of our stock returned

completed appraisal notices indicating that they did not accept our

offer. Because we did not agree with the estimates submitted by the

dissenting stockholders, we sought a judicial determination of the fair value of

their common stock. On June 24, 2004, we filed suit against the

dissenting stockholders seeking a declaratory judgment, appraisal and other

relief in Florida. On February 4, 2005, the declaratory judgment

action was stayed pending the resolution of direct and derivative lawsuits filed

in California. This decision was made by the judge in the Florida

declaratory judgment action due to the similar nature of certain allegations

brought by the defendants in the declaratory judgment matter and the California

lawsuits. As a result of the June 2008 settlement of the derivative

and securities lawsuits in California, the stay of the Florida declaratory

judgment action was lifted. In the first quarter of 2009, the Company

completed an agreement with the holders of 27,221 of the 27,536 shares

(including common share equivalents) held by the remaining dissenting

stockholders, whereby the stockholders agreed to accept $4.60 per share in full

payment for their respective shares, for cancellation by the Company, and a

release of any other claims that they may have against the Company and

Counsel. In the third quarter of 2009, the Company completed a

similar agreement with the remaining dissenting stockholders, who agreed to

accept $5.00 per share under the same terms and conditions as described above,

as well as the payment of $1 of legal expenses that they had incurred, thereby

concluding this matter.

Intellectual

Property Enforcement Litigation

On August

27, 2009 the Company’s wholly-owned subsidiary, C2 Communications Technologies

Inc., filed a patent infringement lawsuit against PAETEC Corporation, Matrix

Telecom, Inc., Windstream Corporation, and Telephone and Data Systems,

Inc. The complaint was filed in the United States District Court for

the Eastern District of Oklahoma and alleges that the defendants’ services and

systems utilizing VoIP infringe the Company’s U.S. Patent No.

6,243,373. The complaint seeks an injunction, monetary damages and

costs. In the fourth quarter of 2009, the complaint against Matrix

Telecom, Windstream Corporation and Telephone and Data Systems, Inc. was

dismissed without prejudice. Also in the fourth quarter of 2009, the

case was transferred to the Eastern District of Texas. A trial date

has not been set.

The

Company is involved in various other legal matters arising out of its operations

in the normal course of business, none of which are expected, individually or in

the aggregate, to have a material adverse effect on the Company.

Item

4. Submission of Matters to a Vote of Security Holders

None

12

PART

II

Item 5. Market for Registrant’s

Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

Market

Information

Shares of

C2’s common stock, $0.01 par value per share, are traded on the OTC Bulletin

Board (“OTCBB”) under the symbol COBT.OB.

The

following table sets forth the high and low prices for our common stock, as

quoted on the OTCBB, for the calendar quarters from January 1, 2008 through

December 31, 2009, based on inter-dealer quotations, without retail markup,

markdown, commissions or adjustments. These prices may not represent

actual transactions:

|

Quarter Ended

|

High

|

Low

|

||||||

|

March

31, 2008

|

$

|

1.47

|

$

|

0.31

|

||||

|

June

30, 2008

|

1.30

|

0.47

|

||||||

|

September

30, 2008

|

1.01

|

0.35

|

||||||

|

December

31, 2008

|

0.75

|

0.11

|

||||||

|

March

31, 2009

|

$

|

0.50

|

$

|

0.14

|

||||

|

June

30, 2009

|

0.30

|

0.15

|

||||||

|

September

30, 2009

|

0.45

|

0.08

|

||||||

|

December

31, 2009

|

0.45

|

0.07

|

||||||

On March

25, 2010, the closing price for a share of the Company’s common stock was

$0.08.

Holders

As of

March 25, 2010, the Company had approximately 398 holders of common stock of

record.

Dividends

To date,

we have not paid dividends on our common stock nor do we anticipate that we will

pay dividends in the foreseeable future. As of December 31, 2009, we

do not have any preferred stock outstanding which has any preferential

dividends.

Securities

Authorized for Issuance Under Equity Compensation Plans

The

following table sets forth, as of December 31, 2009, information with respect to

equity compensation plans (including individual compensation arrangements) under

which the Company’s securities are authorized for issuance.

During

the twelve months ended December 31, 2009, 40,000 options were granted to

directors under the 2003 Employee Stock Option and Appreciation Rights

Plan. These options were issued with an exercise price of

$0.15/share, which equalled fair market value on the date of the grant, and they

vest over a 4-year period subject to the grantee’s continued service as a

director with the Company. The Company

relied on an exemption from registration under Section 4(2) of the

Securities Act of 1933, as amended (the “1933 Act”). No other options

were granted during the twelve months ended December 31,

2009.

13

|

Plan Category (1)

|

Number of Securities to be

issued upon exercise of

outstanding options

|

Weighted-average

exercise price of

outstanding options

|

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

|

|||||||||

|

(a)

|

(b)

|

(c)

|

||||||||||

|

Equity compensation plans approved by security

holders:

|

||||||||||||

|

2003

Stock Option and Appreciation Rights Plan

|

678,250 |

$

|

1.37 | 1,321,750 | ||||||||

|

1997

Recruitment Stock Option Plan

|

236,111 | 1.55 | 133,889 | |||||||||

|

1995

Directors Stock Option and Appreciation Rights Plan

|

— | — | 12,500 | |||||||||

|

1995

Employee Stock Option and Appreciation Rights Plan

|

— | — | 20,000 | |||||||||

|

Equity compensation plans not approved by security

holders:

|

||||||||||||

|

Issuance

of non-qualified options to employees and outside

consultants

|

79,666 | 58.87 | — | |||||||||

|

Total

|

994,027 |

$

|

6.02 | 1,488,139 | ||||||||

(1) For a

description of the material terms of these plans, see Note 14 in the Company’s

audited financial statements included in Item 15 of this Report.

Recent Sales of Unregistered

Securities; Use of Proceeds from Registered Securities.

None.

Issuer

Purchases of Equity Securities.

We did

not make any stock repurchases during the last quarter of 2009.

Performance

Graph.

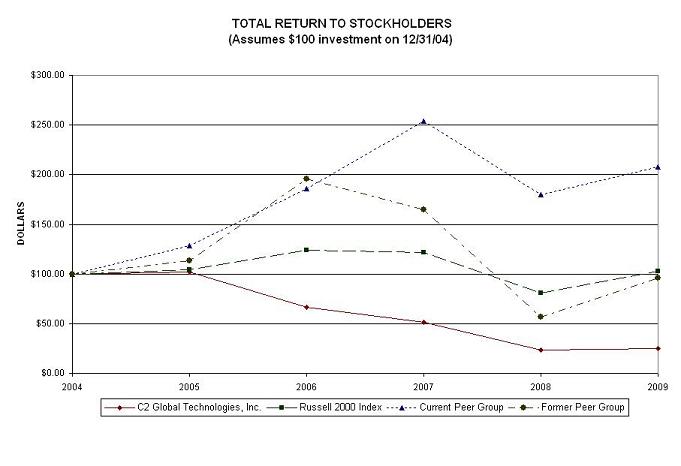

The

following Performance Graph and related information shall not be deemed

“soliciting material” or to be “filed” with the Securities and Exchange

Commission, nor shall such information be incorporated by reference into any

future filings under the Securities Act of 1933 or Securities Exchange Act of

1934, each as amended, except to the extent that the Company specifically

incorporates it by reference into such filing.

The

following graph compares our cumulative total stockholder return with that of

the Russell 2000 index of small-capitalization companies, our former peer group

(“Former Group”), and our current peer group (“Current Group”). The graph

assumes an initial investment of $100.00 made on December 31, 2004, and the

reinvestment of dividends (where applicable). We have never paid a dividend on

our common stock.

Following

our investment in Counsel RB and diversification of our business into asset

liquidation, we reevaluated the composition of our Former Group, as previously

utilized to assess our stock performance, and concluded that it required

amendment. Accordingly, we constructed the Current

Group. The Current Group consists of Acacia Technologies Group,

Patriot Scientific Corporation, Network-1 Security Solutions Inc. and Ritchie

Bros. Auctioneers. The Former Group consists of Acacia Technologies

Group, Forgent Networks Inc. (d/b/a Asure Software), UTEK Corporation, Patriot

Scientific Corporation and Network-1 Security Solutions Inc.

14

|

Total Return Analysis

|

||||||||||||||||||||||||

|

12/31/04

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

12/31/09

|

|||||||||||||||||||

|

C2

Global Technologies Inc.

|

$ | 100.00 | $ | 101.67 | $ | 66.67 | $ | 51.67 | $ | 23.33 | $ | 25.00 | ||||||||||||

|

Russell

2000 Index

|

$ | 100.00 | $ | 104.55 | $ | 123.76 | $ | 121.82 | $ | 80.66 | $ | 102.58 | ||||||||||||

|

Current

Peer Group

|

$ | 100.00 | $ | 128.31 | $ | 185.93 | $ | 254.24 | $ | 179.60 | $ | 207.51 | ||||||||||||

|

Former

Peer Group

|

$ | 100.00 | $ | 113.00 | $ | 195.79 | $ | 164.39 | $ | 56.82 | $ | 96.30 | ||||||||||||

Source: Morningstar, Inc. (312)

384-4055

15

Item

6. Selected Financial Data.

The

following selected consolidated financial information was derived from the

audited consolidated financial statements and notes thereto. The

information set forth below is not necessarily indicative of the results of

future operations and should be read in conjunction with Item 7, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” as

well as the Consolidated Financial Statements and Notes thereto included in Item

15 in this Report.

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

Statement

of Operations Data :

|

||||||||||||||||||||

|

Patent

licensing revenue

|

$ | — | $ | 17,625 | $ | — | $ | — | $ | — | ||||||||||

|

Asset

liquidation revenue

|

5,991 | — | — | — | — | |||||||||||||||

|

Earnings

of equity accounted asset liquidation investments

|

64 | — | — | — | — | |||||||||||||||

|

Operating

income (loss)

|

(769 | ) | 5,603 | (1,236 | ) | (1,301 | ) | (3,179 | ) | |||||||||||

|

Other

income (expense)

|

(88 | ) | 442 | (213 | ) | 155 | 1,084 | |||||||||||||

|

Interest

expense

|

(325 | ) | (43 | ) | (196 | ) | (10,900 | ) | (12,812 | ) | ||||||||||

|

Income

tax expense (recovery)

|

269 | 125 | (1,000 | ) | — | — | ||||||||||||||

|

Earnings

(loss) from equity accounted investments

|

252 | (38 | ) | 6 | — | — | ||||||||||||||

|

Income

(loss) from continuing operations

|

(1,199 | ) | 5,839 | (639 | ) | (12,046 | ) | (14,907 | ) | |||||||||||

|

Income

(loss) from discontinued operations

|

— | (12 | ) | (6 | ) | 4,370 | (3,582 | ) | ||||||||||||

|

Net

(income) loss attributable to non-controlling interest

|

(65 | ) | — | — | — | — | ||||||||||||||

|

Net

income (loss) attributable to controlling interest

|

(1,264 | ) | 5,827 | (645 | ) | (7,676 | ) | (18,489 | ) | |||||||||||

|

Earnings

(loss) from continuing operations per common share – basic and

diluted:

|

$ | (0.06 | ) | $ | 0.25 | $ | (0.03 | ) | $ | (0.63 | ) | $ | (0.77 | ) | ||||||

|

Balance

Sheet Data:

|

||||||||||||||||||||

|

Total

assets

|

$ | 11,627 | $ | 5,443 | $ | 1,796 | $ | 1,386 | $ | 3,490 | ||||||||||

|

Total

current liabilities

|

$ | 7,673 | $ | 472 | $ | 2,737 | $ | 1,855 | $ | 79,852 | ||||||||||

|

Total

long-term obligations

|

$ | — | $ | — | $ | — | $ | — | $ | 1,580 | ||||||||||

|

Stockholders’

equity (deficit)

|

$ | 3,954 | $ | 4,971 | $ | (941 | ) | $ | (469 | ) | $ | (77,942 | ) | |||||||

16

Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations.

(All

dollar amounts are presented in thousands of USD, unless otherwise indicated,

except per share amounts)

The

following discussion and analysis should be read in conjunction with our

Consolidated Financial Statements and Notes thereto, included in Item 15 of this

Report. Our accounting policies have the potential to have a

significant impact on our financial statements, either because of the

significance of the financial statement item to which they relate, or because

they require judgment and estimation due to the uncertainty involved in

measuring, at a specific point in time, events which are continuous in

nature.

Business

Overview, Recent Developments and Outlook

Please

see Item 1, above, of this Report for an overview of the Company’s business and

development. Please see Item 1A, above, for a discussion of the risk

factors that may impact the Company’s current and future operations, and

financial condition.

Liquidity

and Capital Resources

Liquidity

At

December 31, 2009 the Company’s working capital deficit was $4,346 as compared

to working capital of $4,556 at December 31, 2008. The primary

contributor to the change was the commencement of Counsel RB’s operations, with

its resulting use of cash to acquire assets for resale, along with the

acquisition of third party debt to partially finance these

transactions. As well, the Company used cash to invest in Polaroid,

and acquired related party debt in connection with that

investment. The net result was that cash decreased by $3,983, from

$4,076 at December 31, 2008 to $93 at December 31, 2009. During 2009

the Company received cash distributions of $237 from its

investments. This was composed of $232 from Polaroid and $5 from

Knight’s Bridge GP.

During

2009 the Company recognized $5,991 in revenue from Counsel RB’s operations,

$1,230 of which was outstanding at December 31, 2009. Minimal amounts

of cash were received as interest on the Company’s bank

deposits. During 2009, the Company repurchased common shares for

cancellation for $126, as discussed in Note 12, and remitted $139 relating to a

patent participation fee that was outstanding at December 31,

2008. The remainder of the cash disbursements related to recurring

operating expenses.

The

Company’s liabilities at December 31, 2009 and December 31, 2008 totalled $7,673

and $472, respectively. At December 31, 2009 these were composed of

$4,626 of third party debt, $1,564 of related party debt, $1,457 of accounts

payable and accrued liabilities, and $26 of income taxes payable. The

Company’s liabilities at December 31, 2008 consisted solely of $472 in accounts

payable and accrued liabilities.

During

2009, the Company continued to pursue licensing and royalty agreements with

respect to its patents, and, through Counsel RB’s operations, entered into

trading activities in distressed and surplus assets. The Company

expects to generate sufficient cash from these activities to meet its ongoing

operating cash requirements for at least twelve months. Additionally,

Counsel RB has a revolving credit facility in place to finance its purchases of

assets for resale.

Ownership

Structure and Capital Resources

|

|

·

|

At

December 31, 2009 the Company had stockholders’ equity of $3,954

attributable to the Company’s common shareholders, as compared to $4,971

at December 31, 2008.

|

|

|

·

|

The

Company is 90.9% owned by Counsel. The remaining 9.1% is owned

by public stockholders.

|

|

|

·

|

Beginning

in 2001, Counsel invested over $100,000 in C2 to fund the development of

C2’s technology and its Telecommunications business, and at December 29,

2006 C2 owed $83,582 to Counsel, including accrued and unpaid

interest. On December 30, 2006 Counsel converted $3,386 of this

debt into 3,847,475 common shares of C2, and forgave the balance of

$80,196. Counsel subsequently provided additional advances, of

which $1,564 was outstanding at December 31,

2009.

|

17

Cash

Position and Cash Flows

Cash at

December 31, 2009 was $93 compared to $4,076 and $67 at the same date in 2008

and 2007, respectively. As noted above, the significant decrease of

$3,983 in 2009 is primarily related to two items: the

commencement of the operations of Counsel RB and the investment in

Polaroid.

Cash provided by

or used in operating activities. Cash used by operating

activities (excluding discontinued operations) during 2009 was $7,842, as

compared to cash provided of $5,692 in 2008 and cash used of $1,275 in

2007. A major reason for the change was that in 2009 the Company had

a loss of $1,199 from continuing operations, as compared to income of $5,839 in

2008 and a loss of $639 in 2007. During 2009, in connection with the

commencement of Counsel RB’s operations, the Company used cash of $1,951 to

acquire inventory and invested $4,155 in asset liquidation investments; there

were no similar transactions in 2008 or 2007. During 2009, accounts

receivable increased by $1,000, also primarily due to the operations of Counsel

RB. This was partially offset by an increase of $985 in accounts

payable and accrued liabilities; the corresponding amounts in 2008 and 2007 were

an increase of $70 and a decrease of $148, respectively. In

connection with the Company’s assumption of both third party and related party

debt during 2009, interest of $169 was accrued, compared to $0 in 2008 and $184

in 2007; in 2009 the Company also amortized $112 of deferred financing costs on

the third party debt. In 2009 deferred income tax assets decreased by

$146, as compared to decreasing by $125 in 2008 and increasing by $1,000 in

2007. The Company recorded $252 in earnings from equity investments

during 2009, $246 of which was from Polaroid, as compared to a loss of $38

during 2008 and income of $6 in 2007. The Company’s gains on the sale

of investments were $21 in 2009, $425 in 2008 and $75 in 2007.

Cash provided by

or used in investing activities. Net cash used by investing

activities during 2009 was $2,273, as compared to $664 and $662 of cash provided

during 2008 and 2007, respectively. During 2009, the primary

transaction was the use of $2,631 to invest in Polaroid, partially offset by

subsequent distributions of $232 from Polaroid and $5 from Knight’s Bridge

GP. In 2008, the Company made investments of $125, and received $8 in

cash distributions, and in 2007 the Company invested $595 and received

distributions of $7. In 2009, proceeds from the sale of a portion of

the Company’s investment in Buddy Media were $121, as compared to proceeds from

investment sales of $781 and $150 in 2008 and 2007, respectively. In

2007, the Company’s $1,100 preferred share investment in AccessLine

Communications was redeemed in full; there were no similar transactions in 2008

or 2009.

Cash provided by

or used in financing activities. Net cash of $6,132 was

provided by financing activities during 2009, as compared to cash used of $2,335

in 2008 and cash provided of $683 in 2007. In 2009, in connection

with the operations of Counsel RB, the Company received net cash of $4,565 from

third party lenders and a contribution of $237 from the non-controlling interest

associated with Counsel RB. Also during 2009 the Company’s parent,

Counsel, provided net cash of $1,456. $126 was used to purchase and

cancel preferred and common shares, as part of a settlement with dissenting

shareholders. During 2008, the single financing activity was

repayment of the $2,335 debt owing to Counsel. During 2007, Counsel

provided net cash of $2,145, and the Company paid $1,462 to a third party

lender.

Contractual

Obligations

The

following table summarizes the amounts of payments due, including accrued

interest to December 31, 2009 and estimated interest to maturity, under

specified contractual obligations outstanding at December 31,

2009. We have no liabilities associated with income taxes that

require disclosure.

|

Payment due by period

|

||||||||||||||||||||

|

Contractual obligations:

|

Total

|

Less than 1

year

|

1-3

years

|

3-5

years

|

More than

5 years

|

|||||||||||||||

|

Promissory

Note

|

$ | 1,446 | $ | 1,446 | $ | — | $ | — | $ | — | ||||||||||

|

Revolving

Credit Facility

|

3,282 | 3,282 | — | — | — | |||||||||||||||

|

Related

party debt

|

1,726 | 1,726 | — | — | — | |||||||||||||||

|

Operating

leases

|

310 | 74 | 149 | 87 | — | |||||||||||||||

|

Total

|

$ | 6,764 | $ | 6,528 | $ | 149 | $ | 87 | $ | — | ||||||||||

18

Consolidated

Results of Operations

Key

selected financial data for the three years ended December 31, 2009, 2008 and

2007 are as follows:

|

2009

|

2008

|

2007

|

||||||||||

|

Revenue:

|

||||||||||||

|

Patent

licensing

|

$ | — | $ | 17,625 | $ | — | ||||||

|

Asset

liquidation

|

5,991 | — | — | |||||||||

|

Total

revenue

|

5,991 | 17,625 | — | |||||||||

|

Operating

costs and expenses:

|

||||||||||||

|

Patent

licensing

|

29 | 10,729 | — | |||||||||

|

Asset

liquidation

|

4,138 | — | — | |||||||||

|

Selling,

general and administrative

|

2,657 | 1,273 | 1,216 | |||||||||

|

Depreciation

and amortization

|

— | 20 | 20 | |||||||||

|

Total

operating costs and expenses

|

6,824 | 12,022 | 1,236 | |||||||||

| (833 | ) | 5,603 | (1,236 | ) | ||||||||

|

Earnings

of equity accounted asset liquidation investments

|

64 | — | — | |||||||||

|

Operating

income (loss)

|

(769 | ) | 5,603 | (1,236 | ) | |||||||

|

Other

income (expenses):

|

||||||||||||

|

Other

income (expense)

|

(88 | ) | 442 | (213 | ) | |||||||

|

Interest

expense – third party

|

(217 | ) | — | (12 | ) | |||||||

|

Interest

expense – related party

|

(108 | ) | (43 | ) | (184 | ) | ||||||

|

Total

other income (expenses)

|

(413 | ) | 399 | (409 | ) | |||||||

|

Income

(loss) from continuing operations before the undernoted

|

(1,182 | ) | 6,002 | (1,645 | ) | |||||||

|

Income

tax expense (recovery)

|

269 | 125 | (1,000 | ) | ||||||||

|

Earnings

(loss) of equity accounted investments (net of $0 tax)

|

252 | (38 | ) | 6 | ||||||||

|

Income

(loss) from continuing operations

|

(1,199 | ) | 5,839 | (639 | ) | |||||||

|

Loss

from discontinued operations

|

— | (12 | ) | (6 | ) | |||||||

|

Net

income (loss)

|

(1,199 | ) | 5,827 | (645 | ) | |||||||

|

Net

(income) loss attributable to non-controlling interest

|

(65 | ) | — | — | ||||||||

|

Net

income (loss) attributable to controlling interest

|