Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Heritage Global Inc. | v343505_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Heritage Global Inc. | v343505_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Heritage Global Inc. | v343505_ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Heritage Global Inc. | Financial_Report.xls |

| EX-32.2 - EXHIBIT 32.2 - Heritage Global Inc. | v343505_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 0-17973

Counsel RB Capital Inc.

(Exact name of registrant as specified in its charter)

| FLORIDA | 59-2291344 | |

| (State or Other Jurisdiction of | ||

| Incorporation or Organization) | (I.R.S. Employer Identification No.) |

700 – 1 Toronto St., Toronto, ON M5C 2V6

(Address of Principal Executive Offices)

(416) 866-3000

(Registrant’s Telephone Number)

N/A

(Registrant’s Former Name)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter time period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Exchange Act Rule 12b-2).

| Large Accelerated Filer £ | Accelerated Filer £ |

| Non-Accelerated Filer £ | Smaller reporting company R |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No R

As of May 7, 2013, there were 28,945,228 shares of common stock, $0.01 par value, outstanding.

TABLE OF CONTENTS

| Part I. | Financial Information | |

| Item 1. | Financial Statements | |

| Unaudited Condensed Consolidated Balance Sheets as of March 31, 2013 and December 31, 2012 | 3 | |

| Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income for the three months ended March 31, 2013 and 2012 | 4 | |

| Unaudited Condensed Consolidated Statement of Changes in Stockholders’ Equity for the period ended March 31, 2013 | 5 | |

| Unaudited Condensed Consolidated Statements of Cash Flows for the three months ended March 31, 2013 and 2012 | 6 | |

| Notes to Unaudited Condensed Consolidated Financial Statements | 7 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 21 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 30 |

| Item 4. | Controls and Procedures | 30 |

| Part II. | Other Information | |

| Item 1. | Legal Proceedings | 31 |

| Item 1A. | Risk Factors | 31 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 31 |

| Item 3. | Defaults Upon Senior Securities | 31 |

| Item 4. | Mine Safety Disclosures | 31 |

| Item 5. | Other Information | 31 |

| Item 6. | Exhibits | 32 |

| 2 |

PART I – FINANCIAL INFORMATION

Item 1 – Financial Statements.

COUNSEL RB CAPITAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars, except share and per share amounts)

(unaudited)

March 31, 2013 | December 31, 2012 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,230 | $ | 4,314 | ||||

| Amounts receivable (net of allowance for doubtful accounts of $0; 2012 - $0) | 1,315 | 1,068 | ||||||

| Receivable from a related party | 2,224 | 2,929 | ||||||

| Deposits | 334 | 1,481 | ||||||

| Inventory – equipment | 510 | 820 | ||||||

| Other current assets | 283 | 312 | ||||||

| Income taxes recoverable | 119 | 70 | ||||||

| Deferred income tax assets | 1,949 | 1,956 | ||||||

| Total current assets | 7,964 | 12,950 | ||||||

| Non-current assets: | ||||||||

| Inventory – real estate | 6,078 | 6,078 | ||||||

| Asset liquidation investments | 2,901 | 3,618 | ||||||

| Investments | 1,729 | 2,426 | ||||||

| Property, plant and equipment, net | 49 | 52 | ||||||

| Intangible assets, net | 5,150 | 5,263 | ||||||

| Goodwill | 5,301 | 5,301 | ||||||

| Deferred income tax assets | 25,955 | 25,622 | ||||||

| Total assets | $ | 55,127 | $ | 61,310 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 3,349 | $ | 4,415 | ||||

| Debt payable to third parties | 6,260 | 10,883 | ||||||

| Total current liabilities | 9,609 | 15,298 | ||||||

| Commitments and contingencies | ||||||||

| Equity: | ||||||||

| Preferred stock, $10.00 par value, authorized 10,000,000 shares; issued and outstanding 592 Class N shares at March 31, 2013 and December 31, 2012, liquidation preference of $592 at March 31, 2013 and December 31, 2012 | 6 | 6 | ||||||

| Common stock, $0.01 par value, authorized 300,000,000 shares; issued and outstanding 28,945,228 shares at March 31, 2013 and December 31, 2012 | 290 | 290 | ||||||

| Additional paid-in capital | 283,441 | 283,281 | ||||||

| Accumulated deficit | (238,205 | ) | (237,558 | ) | ||||

| Accumulated other comprehensive loss | (14 | ) | (7 | ) | ||||

| Total equity | 45,518 | 46,012 | ||||||

| Total liabilities and equity | $ | 55,127 | $ | 61,310 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

COUNSEL RB CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME

(unaudited)

| Three Months Ended March 31, | ||||||||

| (In thousands of US dollars, except per share amounts) | 2013 | 2012 | ||||||

| Revenue: | ||||||||

| Asset liquidation | ||||||||

| Asset sales | $ | 446 | $ | 1,850 | ||||

| Commissions and other | 946 | 1,184 | ||||||

| Total asset liquidation revenue | 1,392 | 3,034 | ||||||

| Patent licensing | 200 | — | ||||||

| Total revenue | 1,592 | 3,034 | ||||||

| Operating costs and expenses: | ||||||||

| Asset liquidation | 356 | 1,533 | ||||||

| Inventory maintenance | 74 | 3 | ||||||

| Patent licensing and maintenance | 150 | 26 | ||||||

| Selling, general and administrative | 2,394 | 1,582 | ||||||

| Expenses paid to related parties | 204 | 157 | ||||||

| Depreciation and amortization | 121 | 3 | ||||||

| Total operating costs and expenses | 3,299 | 3,304 | ||||||

| (1,707 | ) | (270 | ) | |||||

| Earnings of equity accounted asset liquidation investments | 802 | 1,069 | ||||||

| Operating income (loss) | (905 | ) | 799 | |||||

| Other income (expenses): | ||||||||

| Other income | — | 10 | ||||||

| Interest expense – third party | (95 | ) | (59 | ) | ||||

| Total other income (expenses) | (95 | ) | (49 | ) | ||||

| Income (loss) before the undernoted | (1,000 | ) | 750 | |||||

| Income tax expense (recovery) | (353 | ) | 313 | |||||

| Earnings (loss) of other equity accounted investments (net of tax of $0) | — | (47 | ) | |||||

| Net income (loss) | (647 | ) | 390 | |||||

| Other comprehensive loss: | ||||||||

| Currency translation adjustment (net of tax of $0) | (7 | ) | — | |||||

| Comprehensive income (loss) | $ | (654 | ) | $ | 390 | |||

| Weighted average common shares outstanding – basic (in thousands) | 28,945 | 27,484 | ||||||

| Weighted average common shares outstanding – diluted (in thousands) | 28,945 | 27,844 | ||||||

| Net income (loss) per share – basic | $ | (0.02 | ) | $ | 0.01 | |||

| Net income (loss) per share – diluted | $ | (0.02 | ) | $ | 0.01 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

COUNSEL RB CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

For the period ended March 31, 2013

(in thousands

of US dollars, except share amounts)

(unaudited)

| Preferred stock | Common stock | Additional paid-in | Accumulated | Accumulated other comprehensive | ||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | Deficit | income (loss) | Total | |||||||||||||||||||||||||

| Balance at December 31, 2011 | 592 | $ | 6 | 27,117,450 | $ | 271 | $ | 278,408 | $ | (235,745 | ) | $ | — | $ | 42,940 | |||||||||||||||||

| Issuance of common stock | — | — | 1,800,000 | 19 | 3,135 | — | — | 3,154 | ||||||||||||||||||||||||

| Exercise of options | — | — | 27,778 | — | 14 | — | — | 14 | ||||||||||||||||||||||||

| Issuance of options | — | — | — | — | 1,131 | — | — | 1,131 | ||||||||||||||||||||||||

| Compensation cost related to stock options | — | — | — | — | 593 | — | — | 593 | ||||||||||||||||||||||||

| Comprehensive loss | — | — | — | — | — | (1,813 | ) | (7 | ) | (1,820 | ) | |||||||||||||||||||||

| Balance at December 31, 2012 | 592 | 6 | 28,945,228 | 290 | 283,281 | $ | (237,558 | ) | $ | (7 | ) | 46,012 | ||||||||||||||||||||

| Compensation cost related to stock options | — | — | — | — | 160 | — | — | 160 | ||||||||||||||||||||||||

| Comprehensive loss | — | — | — | — | — | (647 | ) | (7 | ) | (654 | ) | |||||||||||||||||||||

| Balance at March 31, 2013 | 592 | $ | 6 | 28,945,228 | $ | 290 | $ | 283,441 | $ | (238,205 | ) | $ | (14 | ) | $ | 45,518 | ||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 5 |

COUNSEL RB CAPITAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| (In thousands of US dollars) | Three months ended March 31, | |||||||

| 2013 | 2012 | |||||||

| Cash flows provided by operating activities: | ||||||||

| Net income (loss) | $ | (647 | ) | $ | 390 | |||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||

| Accrued interest added to principal of third party debt | 32 | 8 | ||||||

| Amortization of financing costs on debt payable to third party | — | 9 | ||||||

| Accrued interest added to principal of related party debt | — | 3 | ||||||

| Stock-based compensation expense | 160 | 115 | ||||||

| Loss of other equity accounted investments | — | 47 | ||||||

| Depreciation and amortization | 121 | 3 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Decrease (increase) in amounts receivable | (247 | ) | 136 | |||||

| Decrease (increase) in deposits | 1,147 | (1,960 | ) | |||||

| Decrease in inventory | 310 | 1,308 | ||||||

| Decrease in asset liquidation investments | 717 | 2,423 | ||||||

| Decrease (increase) in other assets | 29 | (5 | ) | |||||

| Increase in income taxes recoverable | (49 | ) | — | |||||

| Decrease (increase) in deferred income tax assets | (326 | ) | 239 | |||||

| Increase (decrease) in accounts payable and accrued liabilities | (1,073 | ) | 3,100 | |||||

| Decrease in income taxes payable | — | (144 | ) | |||||

| Net cash provided by operating activities | 174 | 5,672 | ||||||

| Cash flows provided by (used in) investing activities: | ||||||||

| Net cash paid for business acquisition | — | (2,344 | ) | |||||

| Investment in other equity accounted investments | (56 | ) | (20 | ) | ||||

| Cash distributions from other equity accounted investments | 753 | 157 | ||||||

| Purchase of property, plant and equipment | (5 | ) | — | |||||

| Net cash provided by (used in) investing activities | 692 | (2,207 | ) | |||||

| Cash flows used in financing activities: | ||||||||

| Proceeds of debt payable to third parties | 664 | 2,158 | ||||||

| Repayment of debt payable to third parties | (5,319 | ) | (4,801 | ) | ||||

| Proceeds of advances from a related party | 2,070 | 178 | ||||||

| Repayment of debt payable and advances to related parties | (1,365 | ) | (2,050 | ) | ||||

| Proceeds from exercise of options to purchase common shares | — | 8 | ||||||

| Net cash used in financing activities | (3,950 | ) | (4,507 | ) | ||||

| Decrease in cash | (3,084 | ) | (1,042 | ) | ||||

| Cash and cash equivalents at beginning of period | 4,314 | 6,672 | ||||||

| Cash and cash equivalents at end of period | $ | 1,230 | $ | 5,630 | ||||

| Supplemental schedule of non-cash investing and financing activities: | ||||||||

| Issuance of common stock in exchange for assets of acquired business | $ | — | $ | 1,950 | ||||

| Issuance of options to purchase common stock in exchange for assets of acquired business | — | 1,131 | ||||||

| Supplemental cash flow information: | ||||||||

| Taxes paid | $ | 22 | $ | 218 | ||||

| Interest paid | 121 | 56 | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 6 |

COUNSEL RB CAPITAL INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

(in thousands, except share and per share amounts and where specifically indicated)

Note 1 –Basis of Presentation

These unaudited condensed consolidated interim financial statements include the accounts of Counsel RB Capital Inc. together with its subsidiaries, including Counsel RB Capital LLC (“Counsel RB”), Equity Partners CRB LLC (“Equity Partners”), Heritage Global Partners, Inc. (“Heritage Global Partners”), C2 Communications Technologies Inc., and C2 Investments Inc. These entities, collectively, are referred to as “CRBCI”, the “Company”, “we” or “our” in these financial statements. Our unaudited condensed consolidated interim financial statements were prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”), as outlined in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”), and include the assets, liabilities, revenues, and expenses of all subsidiaries over which CRBCI exercises control. All significant intercompany accounts and transactions have been eliminated upon consolidation.

We have prepared the condensed consolidated interim financial statements included herein pursuant to the rules and regulations of the United States Securities and Exchange Commission (the “SEC”). In management’s opinion, these financial statements reflect all adjustments that are necessary to present fairly the results for interim periods. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations; however, we believe that the disclosures are appropriate. These unaudited condensed consolidated interim financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company’s annual report on Form 10-K for the year ended December 31, 2012, filed with the SEC on March 28, 2013.

The results of operations for the three-month period ended March 31, 2013 are not necessarily indicative of those operating results to be expected for any subsequent interim period or for the entire year ending December 31, 2013.

Note 2 – Summary of Significant Accounting Policies

Use of estimates

The preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Management bases its estimates and judgments on historical experience and various other factors that are believed to be reasonable under the circumstances. Actual results could differ from those estimates.

Significant estimates include the assessment of collectability of revenue recognized, and the valuation of amounts receivable, inventory, investments, deferred income tax assets, goodwill and intangible assets, liabilities, and stock-based compensation. These estimates have the potential to significantly impact our consolidated financial statements, either because of the significance of the financial statement item to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events that are continuous in nature.

The critical accounting policies used in the preparation of our audited consolidated financial statements are discussed in our Annual Report on Form 10-K for the year ended December 31, 2012. There have been no changes to these policies in the first quarter of 2013.

| 7 |

Recent Accounting Pronouncements

In February 2013, the FASB issued Accounting Standards Update 2013-02, Other Comprehensive Income (Topic 220) (“ASU 2013-02”). ASU 2013-02 requires entities to disclose additional information about items reclassified out of accumulated other comprehensive income (“AOCI”). Specifically, entities must report 1) changes in AOCI balances by component, including the income tax benefit or expense attributed to each component, and 2) significant items reclassified out of AOCI by component, either on the face of the income statement or as a separate footnote to the financial statements. ASU 2013-02 does not change the current GAAP requirement for a total for comprehensive income to be reported in condensed interim financial statements in either a single continuous statement or two separate but consecutive statements. ASU 2013-02 is effective for interim periods and fiscal years beginning after December 15, 2012, with early adoption permitted. The Company adopted ASU 2013-02 in the first quarter of 2013. As the Company’s AOCI is immaterial, and consists solely of cumulative foreign currency translation adjustments of a subsidiary, its adoption did not have a significant impact on the Company’s condensed consolidated interim financial statements.

Future Accounting Pronouncements

In March 2013, the FASB issued Accounting Standards Update 2013-05, Foreign Currency Matters (Topic 83) (“ASU 2013-05”). ASU 2013-05 specifies that a cumulative translation adjustment (CTA) is attached to a parent company’s investment in a foreign entity and should be released in a manner consistent with derecognition guidance on investments in entities. Therefore, the entire amount of the CTA associated with a foreign entity would be released upon 1) sale of a subsidiary or group of net assets within a foreign entity, which represents the substantially complete liquidation of the investment in the entity, 2) loss of a controlling financial interest in an investment in a foreign entity, or 3) step acquisition of a foreign entity. ASU 2013-05 does not change the requirement to release a pro rata portion of the CTA of the foreign entity into earnings for a partial sale of an equity method investment in a foreign entity. ASU 2013-05 is effective for interim periods and fiscal years beginning on or after December 15, 2013, with early adoption permitted. The Company does not expect that the adoption of ASU 2013-05 will have a significant impact on its consolidated financial statements.

Note 3 – Acquisition and Expansion of Heritage Global Partners, Inc.

On February 29, 2012 the Company expanded its asset liquidation operations by acquiring 100% of the issued and outstanding capital stock in Heritage Global Partners, a full-service, global auction and asset advisory firm. In connection with the acquisition, CRBCI entered into employment agreements with the previous owners and employees of Heritage Global Partners. In the third quarter of 2012, the Company finalized the valuation of all assets acquired and liabilities assumed. The following table summarizes the consideration paid for Heritage Global Partners and the amounts of the assets acquired and liabilities assumed recognized at the acquisition date:

| 8 |

| At February 29, 2012 | ||||

| $ | ||||

| Consideration paid | ||||

| Cash 1 | 3,000 | |||

| Promissory notes, net of receivable from owners 2 | 849 | |||

| Equity instruments: | ||||

| 1,000,000 CRBCI common shares 3 | 2,100 | |||

| 625,000 options to purchase CRBCI common shares at $2.00 per share 4 | 1,131 | |||

| Fair value of total consideration | 7,080 | |||

| Acquisition related costs (included in selling, general, and administrative expenses in CRBCI’s consolidated statement of operations for the year ended December 31, 2012) | 78 | |||

| Recognized amounts of identifiable assets acquired and liabilities assumed | ||||

| Cash 1 | 656 | |||

| Accounts receivable (net of $0 allowance for doubtful accounts) | 870 | |||

| Deposits | 20 | |||

| Prepaid expenses | 43 | |||

| Property, plant and equipment | 37 | |||

| Identifiable intangible assets | 5,640 | |||

| Accounts payable and accrued liabilities | (1,212 | ) | ||

| Client liability account | (1,424 | ) | ||

| Short-term note payable | (100 | ) | ||

| Future income taxes payable | (2,178 | ) | ||

| Total identifiable net assets assumed | 2,352 | |||

| Goodwill | 4,728 | |||

| 7,080 |

1 Net cash used for the acquisition was $2,344.

2 The notes (the “Promissory Notes”) were paid in full on their August 31, 2012 maturity date.

3 Value determined using the closing price of the Company’s common shares on February 29, 2012.

4 Value determined using the Black-Scholes Option Pricing Model. Inputs to the model included an expected volatility rate of 133%, a risk-free interest rate of 1.25%, an expected life of 4.75 years, and an expected dividend yield of $nil.

The fair value of the accounts receivable is the value as reported in the above table.

The goodwill and identifiable intangible assets are discussed in Note 6.

The only transactions recognized separately from the acquisition were the acquisition costs noted in the above table.

| 9 |

Note 4 – Stock-based Compensation

At March 31, 2013 the Company maintained six stock-based compensation plans, which are described more fully in Note 14 to the audited consolidated financial statements for the year ended December 31, 2012, contained in the Company’s most recently filed Annual Report on Form 10-K.

During the first three months of 2013 the Company issued 150,000 options to an officer of the Company in accordance with his employment agreement. During the first three months of 2012, the Company issued a total of 990,000 options to officers and employees. This included the 625,000 options to the former owners of Heritage Global Partners as part of the acquisition.

The following summarizes the changes in common stock options for the three months ended March 31, 2013:

Options | Weighted Average Exercise Price | |||||||

| Outstanding at December 31, 2012 | 3,898,198 | $ | 1.75 | |||||

| Granted | 150,000 | $ | 1.00 | |||||

| Exercised | — | N/A | ||||||

| Forfeited | — | N/A | ||||||

| Expired | — | N/A | ||||||

| Outstanding at March 31, 2013 | 4,048,198 | $ | 1.72 | |||||

| Options exercisable at March 31, 2013 | 1,888,198 | $ | 1.53 | |||||

Note 5 – Earnings Per Share

The Company is required, in periods in which it has net income, to calculate basic earnings per share (“basic EPS”) using the two-class method. The two-class method is required because the Company’s Class N preferred shares, each of which is convertible to 40 common shares, have the right to receive dividends or dividend equivalents should the Company declare dividends on its common stock. Under the two-class method, earnings for the period are allocated on a pro-rata basis to the common and preferred stockholders. The weighted-average number of common and preferred shares outstanding during the period is then used to calculate basic EPS for each class of shares.

In periods in which the Company has a net loss, basic loss per share is calculated by dividing the loss attributable to common stockholders by the weighted-average number of common shares outstanding during the period. The two-class method is not used, because the preferred stock does not participate in losses.

Options are included in the calculation of diluted earnings per share, since they are assumed to be exercised, except when their effect would be anti-dilutive. For the three months ended March 31, 2013, all of the Company’s 4,048,198 outstanding options were excluded due to the Company’s net loss. For the three months ending March 31, 2012, 3,123,198 of 3,758,198 options outstanding were excluded.

| 10 |

Basic and diluted EPS were calculated using the following:

| Three Months Ended March 31, | ||||||||

| (In thousands, except per share amounts) | 2013 | 2012 | ||||||

| Net income (loss) | $ | (647 | ) | $ | 390 | |||

| Less: income allocated to preferred stockholders | — | — | ||||||

| Net income (loss) allocated to common stockholders | $ | (647 | ) | $ | 390 | |||

| Weighted average shares for basic EPS | 28,945 | 27,484 | ||||||

| Add: incremental shares from assumed conversions of stock options | — | 360 | ||||||

| Weighted average shares for diluted EPS | 28,945 | 27,844 | ||||||

| Basic and diluted earnings (loss) per share attributable to common stockholders | $ | (0.02 | ) | $ | 0.01 | |||

Note 6 – Composition of Certain Financial Statement Items

Amounts receivable

The Company’s amounts receivable are primarily related to the operations of its subsidiaries Counsel RB, Equity Partners, and Heritage Global Partners. To date, the Company has not experienced any significant collectability issues with respect to any of its receivables. Given this experience, together with the ongoing business relationships between the Company and its joint venture partners, the Company has not yet been required to develop a policy for formal credit quality assessment. As the Company’s asset liquidation business continues to develop, more comprehensive credit assessments may be required.

At March 31, 2013 and December 31, 2012, the Company had one interest-bearing receivable in the amount of $10, which was an employee advance bearing interest at 10%.

At March 31, 2013 and December 31, 2012, the Company had no non-interest bearing financing receivables that were past due.

During the first three months of 2013, there were no changes in the Company’s accounting policies for financing receivables, and therefore no related change in the current-period provision for credit losses. During the same period, there were no purchases, sales or reclassifications of financing receivables. There were no troubled debt restructurings during the first three months of 2013.

Amounts receivable from third parties consisted of the following at March 31, 2013 and December 31, 2012:

March 31, 2013 | December 31, 2012 | |||||||

| Accounts receivable (net of allowance for doubtful accounts of $0; 2012 - $0) | $ | 1,305 | $ | 1,046 | ||||

| Notes receivable (net of allowance for doubtful accounts of $0; 2012 - $0) | 10 | 10 | ||||||

| Lease receivable | — | 12 | ||||||

| $ | 1,315 | $ | 1,068 | |||||

| 11 |

Intangible assets

The Company’s intangible assets are related to its asset liquidation business.

As discussed in Note 3, on February 29, 2012 the Company acquired Heritage Global Partners for a total purchase price of $7,080, of which $5,640 was assigned to identifiable intangible assets, as shown below. The Customer/Broker Network intangible asset is being amortized over 12 years, and the Trade Name intangible asset is being amortized over 14 years. No impairment resulted from the completion of the impairment tests at December 31, 2012, and there have been no events or circumstances in 2013 that would make it more likely than not that the carrying amount of the intangible assets may not be recoverable.

March 31, 2013 | December 31, 2012 | |||||||

| Customer/Broker Network | $ | 4,180 | $ | 4,180 | ||||

| Accumulated amortization | (377 | ) | (290 | ) | ||||

| 3,803 | 3,890 | |||||||

| Trade Name | 1,460 | 1,460 | ||||||

| Accumulated amortization | (113 | ) | (87 | ) | ||||

| 1,347 | 1,373 | |||||||

| Total net intangible assets | $ | 5,150 | $ | 5,263 | ||||

Goodwill

The Company’s goodwill is related to its asset liquidation business.

As part of its acquisition of Equity Partners in June 2011, the Company recognized goodwill of $573. No goodwill impairment resulted from the completion of the impairment tests at December 31, 2012, and there have been no events or changes in circumstances in 2013 that make it more likely than not that the carrying amount of this goodwill may be impaired.

As part of its acquisition of Heritage Global Partners in February 2012, the Company recognized goodwill of $4,728. No goodwill impairment resulted from the completion of the impairment tests at December 31, 2012, and there have been no events or changes in circumstances in 2013 that make it more likely than not that the carrying amount of this goodwill may be impaired.

| 12 |

Accounts payable and accrued liabilities

Accounts payable and accrued liabilities consisted of the following at March 31, 2013 and December 31, 2012:

March

31, | December 31, 2012 | |||||||

| Due to auction clients | $ | 221 | $ | 2,242 | ||||

| Due to Joint Venture partners | 469 | 487 | ||||||

| Sales and other taxes | 461 | 552 | ||||||

| Customer deposits | 862 | — | ||||||

| Remuneration and benefits | 429 | 373 | ||||||

| Asset liquidation expenses | 95 | 184 | ||||||

| Auction expenses | 172 | 134 | ||||||

| Regulatory and legal fees | 102 | 87 | ||||||

| Accounting, auditing and tax consulting | 170 | 170 | ||||||

| Patent licensing and maintenance | 151 | 9 | ||||||

| Other | 217 | 177 | ||||||

| Total accounts payable and accrued liabilities | $ | 3,349 | $ | 4,415 | ||||

Note 7 – Asset Liquidation Investments and Other Investments

Summarized financial information – Equity accounted asset liquidation investments

The table below details the results of operations attributable to CRBCI from the Joint Ventures in which it was invested.

| Three months ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Gross revenues | $ | 2,113 | $ | 4,071 | ||||

| Gross profit | $ | 773 | $ | 1,066 | ||||

| Income from continuing operations | $ | 802 | $ | 1,069 | ||||

| Net income | $ | 802 | $ | 1,069 | ||||

| 13 |

The Company’s other investments as of March 31, 2013 and December 31, 2012 consisted of the following:

March 31, 2013 | December 31, | |||||||

| Knight’s Bridge Capital Partners Internet Fund No. 1 GP LLC | $ | 21 | $ | 20 | ||||

| Polaroid | 1,708 | 2,406 | ||||||

| Total investments | $ | 1,729 | $ | 2,426 | ||||

The Company accounts for its investments under the equity method.

Knight’s Bridge Capital Partners Internet Fund No. 1 GP LLC (“Knight’s Bridge GP”)

In December 2007 the Company acquired a one-third interest in Knight’s Bridge Capital Partners Internet Fund No. 1 GP LLC (“Knight’s Bridge GP”), a private company, for a purchase price of $20. The additional two-thirds interest in Knight’s Bridge GP was acquired by parties affiliated with Counsel. Knight’s Bridge GP is the general partner of Knight’s Bridge Capital Partners Internet Fund No. 1 LP (the “Fund”). The Fund holds investments in several non-public Internet-based e-commerce businesses. Since the Company’s initial investment, the Company’s share of earnings has been almost exactly offset by cash distributions, and at March 31, 2013 the Company’s net investment was $21. Based on the Company’s analysis of Knight’s Bridge GP’s financial statements and projections as at March 31, 2013, the Company concluded that there has been no impairment in the fair value of its investment, and that its book value is the best estimate of its fair value.

Polaroid

In the second quarter of 2009, the Company indirectly acquired an approximate 5% interest in Polaroid Corporation, pursuant to a Chapter 11 reorganization in a U.S. bankruptcy court. The investment was made as part of a joint venture investor group (the “JV Group”) that includes both related and non-related parties. The JV Group formed two operating companies (collectively, “Polaroid”) to hold the acquired Polaroid assets. The Company, the related parties and two of the unrelated parties formed KPL, LLC (“KPL” or the “LLC”) to pool their individual investments in Polaroid. The pooled investments totalled approximately $19,000 of the aggregate purchase price of approximately $55,000. KPL is managed by a related party, Knight’s Bridge Capital Partners Management, L.P. (the “Management LP”), which acts as the General Partner of the LLC. The Management LP is a wholly-owned subsidiary of the Company’s majority shareholder, Counsel Corporation (together with its subsidiaries, “Counsel”).

The Company’s investment in the LLC has two components:

| · | CRBCI acquired Counsel’s rights and obligations as an indirect limited partner (but not Counsel’s limited partnership interest) in Knight’s Bridge Capital Partners Fund I, L.P. (“Knight’s Bridge Fund”), a related party, with respect to its investment in Class A units. The investment is held by Knight’s Bridge Fund in the name of a Canadian limited partnership (the “LP”) comprised of Counsel (95.24%) and several parties related to Counsel. CRBCI is also responsible for Counsel’s share of the management fees, which are approximately $40 per year. The economic interest entitles CRBCI to an 8% per annum preferred return. Any profits generated in addition to the preferred return, subsequent to the return of invested capital, are subject to the Management LP’s 20% carried interest. |

| 14 |

| · | CRBCI directly acquired Class D units. These units are subject to a 2% annual management fee, payable to the General Partner, of approximately $11 per year. The units have a 10% per annum preferred return. Any profits generated in addition to the preferred return, subsequent to the return of invested capital, are subject to the Management LP’s 20% carried interest. |

The components of the Company’s investment in Polaroid at March 31, 2013 and December 31, 2012 are detailed below:

| March 31, 2013 | ||||||||||||||||

Unit type | Capital invested | Equity in earnings | Capital returned | Net investment | ||||||||||||

| Class A | $ | 2,492 | $ | 136 | $ | (1,259 | ) | $ | 1,369 | |||||||

| Class D | 617 | 30 | (308 | ) | 339 | |||||||||||

| Total | $ | 3,109 | $ | 166 | $ | (1,567 | ) | $ | 1,708 | |||||||

| December 31, 2012 | ||||||||||||||||

Unit type | Capital invested | Equity in earnings | Capital returned | Net investment | ||||||||||||

| Class A | $ | 2,447 | $ | 137 | $ | (654 | ) | $ | 1,930 | |||||||

| Class D | 606 | 30 | (160 | ) | 476 | |||||||||||

| Total | $ | 3,053 | $ | 167 | $ | (814 | ) | $ | 2,406 | |||||||

Note 8 – Debt

At March 31, 2013 and December 31, 2012, the Company’s only outstanding debt was a revolving credit facility (the “Credit Facility”), which had a balance of $6,260 and $10,883 at March 31, 2013 and December 31, 2012, respectively. The Credit Facility is provided to Counsel RB by a U.S. bank under the terms and provisions of a certain Loan and Security Agreement (the “Loan Agreement”) dated as of June 2, 2009 and most recently amended as of September 27, 2012 (the “Amendment Date”). It is utilized to finance the acquisition of eligible property and equipment for purposes of resale. The Credit Facility bears interest at the greater of prime rate + 1.0%, or 4.5%, and the maximum borrowing available under the Credit Facility is US $15,000, subject to Counsel RB maintaining a 1:2 ratio of capital funds, i.e. the sum of Counsel RB’s tangible net worth plus subordinated indebtedness, as defined in the Loan Agreement, to the outstanding balance. The amount of any advance is determined based upon the value of the eligible assets being acquired, which serve as collateral. At March 31, 2013, $8,474 of such assets served as collateral for the loan (December 31, 2012 - $13,392). Effective March 1, 2011, a monthly fee is payable with respect to unused borrowing (“Unused Line Fee”). The Unused Line Fee is equal to the product of 0.50% per annum multiplied by the difference between $15,000 and the average loan amount outstanding during the month. Effective the Amendment Date, an annual facility fee (“Facility Fee”) of $75 was payable to the lender. Subsequent payments of $50 will be due on each anniversary of the Amendment Date. The Credit Facility also contains other terms and provisions customary for agreements of this nature, and has been guaranteed by both the Company and Counsel. At March 31, 2013 and December 31, 2012 the Company was in compliance with all covenants of the Credit Facility.

Note 9 – Patent Participation Fee

In 2003, CRBCI acquired a VoIP patent from a third party. Consideration provided was $100 plus a 35% residual payable to the third party relating to the net proceeds from future licensing and/or enforcement actions from the CRBCI VoIP patent portfolio. Net proceeds are defined as amounts collected from third parties net of the direct costs associated with putting the licensing or enforcement in place and related collection costs. The vendor of the VoIP Patent was also granted a first priority security interest in the patent in order to secure CRBCI’s obligations under the associated purchase agreement.

| 15 |

In March 2013, the Company concluded a patent infringement lawsuit against PAETEC Corporation, which had initially been filed in August 2009, by entering into a settlement and license agreement in return for a payment of $200. No amounts were payable with respect to the residual discussed above, as the direct costs incurred since the Company last entered into settlement and licensing agreements were in excess of $200.

Note 10 – Income Taxes

In the first quarter of 2013, the Company recognized a current income tax recovery of $353 comprised of a current income tax recovery of $28 and a deferred tax recovery of $325. The $27,904 net deferred income tax asset balance as at March 31, 2013 reflects the tax benefit of available tax loss carry forwards that are more likely than not expected to be utilized against future income.

At March 31, 2013, the Company had available federal tax loss carry-forwards of approximately $56,000 of unrestricted net operating tax losses and approximately $28,800 of restricted net operating tax losses. The net operating loss carry forwards expire between 2024 and 2033.

The Company’s utilization of restricted net operating tax loss carry forwards against future income for tax purposes is restricted pursuant to the “change in ownership” rules in Section 382 of the Internal Revenue Code. These rules, in general, provide that an ownership change occurs when the percentage shareholdings of 5% direct or indirect stockholders of a loss corporation have, in aggregate, increased by more than 50 percentage points during the immediately preceding three years.

Restrictions in net operating loss carry forwards occurred in 2001 as a result of the acquisition of the Company by Counsel. Further restrictions may have occurred as a result of subsequent changes in the share ownership and capital structure of the Company and Counsel and disposition of business interests by the Company. Pursuant to Section 382 of the Internal Revenue Code, the annual usage of the Company’s net operating loss carry forwards was limited to approximately $2,500 per annum until 2008 and $1,700 per annum thereafter. There is no certainty that the application of these “change in ownership” rules may not recur, resulting in further restrictions on the Company’s income tax loss carry forwards existing at a particular time. In addition, further restrictions, reductions in, or expiry of net operating loss and net capital loss carry forwards may occur through future merger, acquisition and/or disposition transactions or failure to continue a significant level of business activities. Any such additional limitations could require the Company to pay income taxes on its future earnings and record an income tax expense to the extent of such liability, despite the existence of such tax loss carry forwards. Furthermore, any such additional limitations may result in the Company having to reverse all or a portion of its deferred tax balance or set up a valuation allowance at such time.

The Company, until recently, has had a history of incurring annual tax losses, beginning in1991. All loss taxation years remain open for audit pending the application of the respective tax losses against income in a subsequent taxation year. In general, the statute of limitations expires three years from the date that a company files a tax return applying prior year tax loss carry forwards against income for tax purposes in the later year. The Company applied historic tax loss carry forwards to offset income for tax purposes in 2008, 2010 and 2011, respectively. The 2009 through 2011 taxation years remain open for audit.

The Company is subject to state income tax in multiple jurisdictions. In most states, the Company does not have tax loss carry forwards available to shield income attributable to a particular state from being subject to tax in that particular state.

| 16 |

Note 11 – Related Party Transactions

Transactions with Counsel

At March 31, 2013 the Company had a receivable from Counsel in the amount of $2,224, as compared to a receivable of $2,929 at December 31, 2012. No interest is charged on this receivable. In the normal course of operations, the Company may receive advances from Counsel under an existing loan facility (the “Counsel Loan”). The Counsel Loan, which was originally entered into during the fourth quarter of 2003, accrues interest at 10% per annum compounded quarterly from the date funds are advanced, and is due on demand. Any outstanding balance under the Counsel Loan is secured by the assets of the Company. At March 31, 2013 and December 31, 2012, the balance of the Counsel Loan was zero due to the Company’s net receivable from Counsel.

Counsel Services Provided to Company

Since December 2004, CRBCI and Counsel have entered into successive annual management services agreements (the “Agreement”). Under the terms of the Agreement, CRBCI agrees to pay Counsel for ongoing services provided to CRBCI by Counsel personnel. These services include preparation of the Company’s financial statements and regulatory filings, taxation matters, stock-based compensation administration, Board administration, patent portfolio administration and litigation matters. The Counsel employees providing the services are: 1) its Executive Vice President, Secretary and Chief Financial Officer, 2) its Vice President, Tax & Asset Management, 3) an Accounting Manager, and 4) its Accounts Payable Clerk. These employees have the same or similar positions with CRBCI, but none of them receive compensation from CRBCI. Rather, Counsel allocates to CRBCI a percentage, based on time incurred, of the employees’ base compensation paid by Counsel. The amounts due under the Agreement are payable within 30 days following the respective year end, subject to applicable restrictions. Any unpaid fee amounts bear interest at 10% per annum commencing on the day after such year end. In the event of a change of control, merger or similar event of CRBCI, all amounts owing, including fees incurred up to the date of the event, will become due and payable immediately upon the occurrence of such event. Counsel has continued to provide these services in 2013 on the same cost basis.

In addition to the above, beginning in the first quarter of 2011, additional amounts have been charged to CRBCI for the services of Counsel personnel that relate to the ongoing operations of CRBCI’s asset liquidation business. All amounts charged by Counsel are detailed below:

| Item | Three months ended March 31, | |||||||

| 2013 | 2012 | |||||||

| Management fees | $ | 90 | $ | 90 | ||||

| Other charges | 18 | 18 | ||||||

| Total | $ | 108 | $ | 108 | ||||

| 17 |

Transactions with Other Related Parties

The Company leases office space in White Plains, NY and Los Angeles, CA as part of the operations of Counsel RB. Both premises are owned by entities that are controlled by a Co-CEO of Counsel RB and the Company. Additionally, the Company leases office space in Foster City, CA as part of the operations of Heritage Global Partners, which is owned by an entity that is jointly controlled by the former owners of Heritage Global Partners. The lease amounts paid by the Company to the related parties are detailed below:

| Leased premises location | Three months ended March 31, | |||||||

| 2013 | 2012 | |||||||

| White Plains, NY | $ | 33 | $ | 32 | ||||

| Los Angeles, CA | 6 | 6 | ||||||

| Foster City, CA | 57 | 11 | ||||||

| Total | $ | 96 | $ | 49 | ||||

As discussed in Note 3, as part of the acquisition of Heritage Global Partners in February 2012, the Company issued Promissory Notes totaling $1,000 to its two former owners, partially offset by $151 of accounts receivable from the former owners. During the third quarter of 2012, the Promissory Notes, which did not accrue interest, were repaid in full, and the accounts receivable were collected.

On August 10, 2012, the Company entered into intellectual property licensing agreements with each of the Company’s Co-CEOs. In return for an exclusive, perpetual license to use his name, each Co-CEO was issued 400,000 shares of common stock of the Company, valued at $1.31672 per share, resulting in a total transaction value of $1,054.

Note 12 – Segment Reporting

From 2005 until the second quarter of 2009, the Company operated in a single business segment, Patent Licensing. With the commencement of Counsel RB’s operations in the second quarter of 2009, the Company diversified into a second segment, Asset Liquidation. For the year ending December 31, 2012, only the Asset Liquidation segment had revenues and assets sufficiently significant to require separate reporting. In the first quarter of 2013, the Company entered into a settlement and license agreement with respect to its patents, and therefore was required to separately report Patent Licensing segment information.

There are no material inter-segment revenues or expenses. To date the Company’s business has been conducted principally in North America, but the establishment of offices in Europe in the third quarter of 2012 will result in more international operations in future periods. To date these operations have not been sufficiently significant to require reporting as a separate segment. The table below presents information about the Company’s segments as of and for the three months ended March 31, 2013 and 2012:

| For the three months ended March 31, 2013 | ||||||||||||

| Asset Liquidation | Patent Licensing |

Total | ||||||||||

| Revenues from external customers | $ | 1,392 | $ | 200 | $ | 1,592 | ||||||

| Earnings from equity accounted asset liquidation investments | 802 | — | 802 | |||||||||

| Other income | — | — | — | |||||||||

| Interest expense | 95 | — | 95 | |||||||||

| Depreciation and amortization | 121 | — | 121 | |||||||||

| Segment income (loss) | (587 | ) | 50 | (537 | ) | |||||||

| Investment in equity accounted asset liquidation investees | 2,901 | — | 2,901 | |||||||||

| Segment assets | 20,297 | 228 | 20,525 | |||||||||

| 18 |

| For the three months ended March 31, 2012 | ||||||||||||

| Asset Liquidation | Patent Licensing |

Total | ||||||||||

| Revenues from external customers | $ | 3,034 | $ | — | $ | 3,034 | ||||||

| Earnings from equity accounted asset liquidation investments | 1,069 | — | 1,069 | |||||||||

| Other income | 10 | — | 10 | |||||||||

| Interest expense | 56 | — | 56 | |||||||||

| Depreciation and amortization | 3 | — | 3 | |||||||||

| Segment income (loss) | 1,225 | (26 | ) | 1,199 | ||||||||

| Investment in equity accounted asset liquidation investees | 1,032 | — | 1,032 | |||||||||

| Segment assets | 19,401 | 28 | 19,429 | |||||||||

The following table reconciles reportable segment information to the unaudited condensed consolidated interim financial statements of the Company:

Three months ended March 31, 2013 | Three months ended March 31, 2012 | |||||||

| Total other income for reportable segments | $ | — | $ | 10 | ||||

| Unallocated other income (expense) | — | — | ||||||

| Total other income | $ | — | $ | 10 | ||||

| Total interest expense for reportable segments | $ | 95 | $ | 56 | ||||

| Unallocated interest expense from related party debt | — | 3 | ||||||

| $ | 95 | $ | 59 | |||||

| Total depreciation and amortization for reportable segments | $ | 121 | $ | 3 | ||||

| Other unallocated depreciation from corporate assets | — | — | ||||||

| $ | 121 | $ | 3 | |||||

| Total segment income (loss) | $ | (537 | ) | $ | 1,199 | |||

| Other income (expense) and earnings (loss) of other equity accounted investments | — | (47 | ) | |||||

| Other corporate expenses (primarily corporate level interest, general and administrative expenses) | (463 | ) | (449 | ) | ||||

| Income tax expense (recovery) | (353 | ) | 313 | |||||

| Net income (loss) from continuing operations | $ | (647 | ) | $ | 390 | |||

| Segment assets | $ | 20,525 | $ | 19,429 | ||||

| Other assets not allocated to segments(1) | 34,602 | 35,350 | ||||||

| Total assets | $ | 55,127 | $ | 54,779 | ||||

| (1) | Other assets not allocated to segments are corporate assets such as cash, non-trade accounts receivable, prepaid insurance, investments and deferred income tax assets. |

| 19 |

Note 13 – Commitments and Contingencies

At March 31, 2013, CRBCI has no commitments other than the Unused Line Fee on its third party debt and the leases on its offices in New York and California. The lease on the New York office expires on December 31, 2015. The leases on the California offices expire on September 30, 2013, December 11, 2015 and July 31, 2016. The annual lease obligations are as shown below:

| 2013 | $ | 324 | ||

| 2014 | 428 | |||

| 2015 | 442 | |||

| 2016 | 145 | |||

| $ | 1,339 |

In the normal course of its business, CRBCI may be subject to contingent liability with respect to assets sold either directly or through Joint Ventures. At March 31, 2013 CRBCI does not expect any of these liabilities, individually or in the aggregate, to have a material adverse effect on its assets or results of operations.

The Company is involved in various other legal matters arising out of its operations in the normal course of business, none of which are expected, individually or in the aggregate, to have a material adverse effect on the Company.

Note 14 – Subsequent Events

The Company has evaluated events subsequent to March 31, 2013 for disclosure. There have been no material subsequent events requiring disclosure in this Report.

| 20 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

(All dollar amounts are presented in thousands of U.S. dollars, unless otherwise indicated, except per share amounts)

The following discussion and analysis should be read in conjunction with the information contained in the unaudited condensed consolidated interim financial statements of the Company and the related notes thereto for the three months ended March 31, 2013, appearing elsewhere herein, and in conjunction with the Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, filed with the Securities and Exchange Commission (“SEC”).

Forward Looking Information

This Quarterly Report on Form 10-Q (the “Report”) contains certain “forward-looking statements” that are based on management’s exercise of business judgment as well as assumptions made by, and information currently available to, management. When used in this document, the words “may”, "will”, “anticipate”, “believe”, “estimate”, “expect”, “intend”, and words of similar import, are intended to identify any forward-looking statements. You should not place undue reliance on these forward-looking statements. These statements reflect our current view of future events and are subject to certain risks and uncertainties, as noted in the Company’s Annual Report on Form 10-K, filed with the SEC, and as noted below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. We undertake no obligation, and do not intend, to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize.

Overview, History and Recent Developments

Counsel RB Capital Inc. (“CRBCI”, “we” or the “Company”) was incorporated in the State of Florida in 1983 under the name “MedCross, Inc.” The Company’s name was changed to “I-Link Incorporated” in 1997, to “Acceris Communications Inc.” in 2003, to “C2 Global Technologies Inc.” in 2005, and to “Counsel RB Capital Inc.” in 2011. The most recent name change reflects the continued significance of the Company’s asset liquidation business, which commenced operations in 2009.

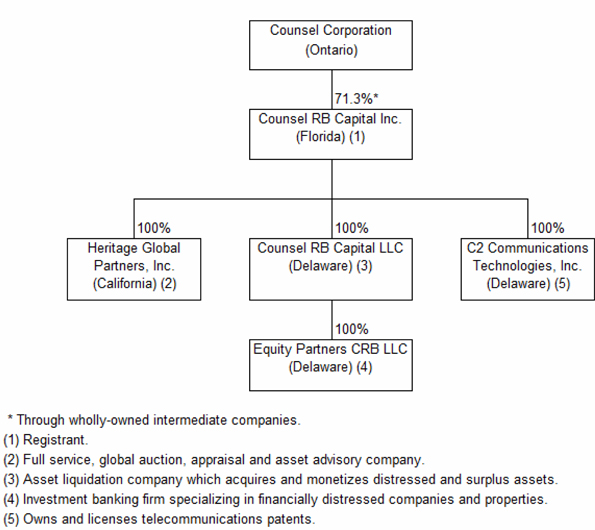

The organization chart below outlines the basic corporate structure of the Company:

| 21 |

Asset liquidation

The Company’s asset liquidation business is its principal operating segment, and the Company’s objective is to be the leading resource for clients requiring capital asset solutions. The asset liquidation business began operations in 2009 with the establishment of Counsel RB Capital LLC (“Counsel RB”), which has become a leader in finding, acquiring and monetizing distressed and surplus assets in North America. In addition to acquiring turnkey manufacturing facilities and used industrial machinery and equipment, Counsel RB arranges traditional asset disposition sales, including liquidation and auction sales. Counsel RB was originally owned 75% by the Company and 25% by Counsel RB’s Co-CEOs. In November 2010, the Company acquired the Co-CEOs’ 25% interest in exchange for approximately 3.2 million shares of the Company.

The Company expanded its asset liquidation operations in the second quarter of 2011, when Counsel RB, through its wholly-owned subsidiary Equity Partners CRB LLC, acquired 100% of the business of EP USA, LLC (d/b/a Equity Partners) (“Equity Partners”). Equity Partners is a boutique investment banking firm and provider of financial solutions for distressed businesses and properties. It was founded in 1988, and works with financially distressed companies and properties to arrange customized financial solutions in the form of debt/refinancing or equity investments, to create joint venture relationships, or to organize going concern sales of a business or property. Its services are intended to allow distressed businesses to remain intact in order to maintain their going concern values, which typically are significantly higher than their liquidation values. Counsel RB worked with Equity Partners prior to the acquisition, and the combined operations serve a variety of clients at different stages of the distressed business and surplus asset continuum.

| 22 |

CRBCI remains focused on building a sustainable, long-term global capital asset solutions business. On February 29, 2012 the Company increased its in-house asset liquidation expertise via its acquisition of 100% of the outstanding equity of Heritage Global Partners Inc. (“Heritage Global Partners”), a full-service, global auction, appraisal and asset advisory firm. The purchase price consisted of $3,000 in cash, $1,000 in notes payable, 1.0 million CRBCI common shares valued at $2.10 per share, and options to purchase 625,000 CRBCI common shares with a Black-Scholes fair value of $1.8092 per option. This transaction is also discussed in Note 3 of the unaudited condensed consolidated interim financial statements.

The acquisition and integration of Heritage Global Partners created additional global opportunities. In July 2012 an exclusive strategic alliance agreement was signed with Asset Remarketing S. De R.L. de C.V., a Mexican company specializing in the monetization of manufacturing assets and real estate in Latin America, including Mexico, Costa Rica and the Dominican Republic. This agreement was terminated during the first quarter of 2013.

In the fourth quarter of 2012, the Company launched Heritage Global Partners Europe. Through its wholly-owned subsidiary Heritage Global Partners UK Limited (“HGP UK”), the Company opened three European-based offices, one each in the United Kingdom, Germany and Spain. Management believes that CRBCI’s expanded global platform will both provide its customer base with an array of value-added capital asset solutions, and achieve the Company’s long-term goal of growing its principal and fee-based revenue channels.

Patent licensing

In 1994, the Company began operating as an Internet service provider, and designed and built an internet protocol (“IP”) telecommunications platform. In 1997, it began offering enhanced services over a mixed IP-and-circuit-switched network platform, and in 1998 the Company deployed its real-time IP communications network platform, which represented the first nationwide, commercially viable VoIP platform of its kind. In 2001, the Company expanded its telecommunications business, through the acquisition of WXC Corp. This business was sold effective September 30, 2005.

In 2002, the U.S. Patent and Trademark Office issued U.S. patent No. 6,438,124 (the “C2 Patent”) for the Company’s Voice Internet Transmission System, which reflects foundational thinking, application, and practice in the VoIP services market. It encompasses the technology that allows two parties to converse phone-to-phone, regardless of the distance, by transmitting voice/sound via the Internet. In May 2003, shortly after the issuance of the C2 Patent, the Company disposed of its domestic U.S. VoIP network, but retained all of its intellectual property rights and patents.

Also in 2003, the Company added to its VoIP patent holdings when it acquired U.S. Patent No. 6,243,373, “Method and Apparatus for Implementing a Computer Network/Internet Telephone System” (the “VoIP Patent”), which included a corresponding foreign patent and related international patent applications. The VoIP Patent, together with the C2 Patent and related international patents and patent applications, form the Company’s international VoIP Patent Portfolio that covers the basic process and technology that enable VoIP communication as used in the market today. Telecommunications companies that enable customers to originate a phone call on a traditional handset, transmit any part of that call via IP, and then terminate the call over the traditional telephone network, are utilizing CRBCI’s patented technology. As part of the consideration for the acquisition of the VoIP Patent, the vendor is entitled to receive 35% of the net earnings from the VoIP Patent Portfolio.

All activities relating to the Company’s licensing of the VoIP Patent Portfolio, or its other intellectual property, constitute the Company’s Patent Licensing operating segment. CRBCI’s target market consists of carriers, equipment manufacturers, service providers and end users in the IP telephone market who are using CRBCI’s patented VoIP technologies by deploying VoIP networks for phone-to-phone communications. The Company’s objective is to obtain ongoing licensing and royalty revenue from the target market for its patents.

Until December 31, 2004, intellectual property revenue was based on the sales and deployment of the Company’s VoIP solutions, which it ceased directly marketing in 2005. In June 2006, C2 Communications Technologies Inc. (“C2 Technologies”), a wholly-owned subsidiary of the Company, filed a patent infringement lawsuit against seven major U.S. telecommunications carriers, which alleged that these companies’ VoIP services and systems infringed the VoIP Patent. The litigation resulted in the Company entering into settlement and license agreements in 2008, for which CRBCI was paid $17,625 in aggregate, whereby CRBCI granted the defendants non-exclusive, perpetual, worldwide, fully paid up, royalty-free licenses under any of CRBCI’s present patents and patent applications, including the VoIP Patent, to make, use, sell or otherwise dispose of any goods and services based on such patents.

| 23 |

In August 2009, C2 Technologies filed a similar lawsuit against PAETEC Corporation, Matrix Telecom, Inc., Windstream Corporation, and Telephone and Data Systems, Inc., alleging that the defendants’ services and systems utilizing VoIP infringe the Company’s U.S. Patent No. 6,243,373. The complaint sought an injunction, monetary damages and costs. In the fourth quarter of 2009, the complaint against Matrix Telecom, Windstream Corporation and Telephone and Data Systems, Inc. was dismissed without prejudice. A trial date was set for March 13, 2013, but in the first quarter of 2013 the Company entered into a settlement and license agreement with the remaining defendant for a payment of $200 on similar terms to the litigation discussed above.

The Company’s segments are discussed in more detail in Note 12 of the unaudited condensed consolidated interim financial statements.

Other

On August 10, 2012, the Company issued 800,000 shares to its Co-CEOs in connection with the acquisition of intellectual property from them, consisting of an exclusive, perpetual license to use their names in connection with the Company and its affiliates.

Industry and Competition

Asset Liquidation

Our asset liquidation business is involved primarily in the purchase and sale, including at auction, of industrial machinery and equipment, real estate, inventories, accounts receivable and distressed debt. The market for these assets is highly fragmented. To acquire assets for resale, the Company competes with other liquidators, auction companies, dealers and brokers. It competes for potential purchasers with other liquidators and auction companies, as well as with equipment manufacturers, distributors, dealers and equipment rental companies. Some of our competitors have significantly greater financial and marketing resources and name recognition.

Counsel RB’s business strategy includes the option of partnering with one or more additional purchasers, pursuant to a partnership, joint venture or limited liability company agreement (collectively, “Joint Ventures”). These Joint Ventures allow Counsel RB to have access to more opportunities, and to mitigate some of the competition from the market’s larger participants. Counsel RB’s objective is to be the leading resource for clients requiring capital asset solutions. To achieve this objective, it continues to strengthen its core competencies. CRBCI’s 2011 and 2012 acquisitions of Equity Partners and Heritage Global Partners have resulted in Counsel RB being able to offer a full-service industrial auction division, an asset-based debtor in possession (“DIP”) facility and a valuation practice to provide equipment appraisals to companies and financial institutions. The Company’s expansion of its operations into Europe in the fourth quarter of 2012 is also consistent with this strategy.

Patent Licensing

Historically, the communications services industry transmitted voice and data over separate networks using different technologies, such as circuit switching. VoIP technology can replace the traditional telephone network, and is more efficient than a dedicated circuit network, because it is not restricted by the one-call, one-line limitation of a traditional telephone network. In addition, VoIP technology enables the provision of enhanced services such as unified messaging. It has become widespread and accepted, with a variety of applications in the telecommunications and other industries.

The Company’s objective is to have telecommunications service providers (“TSPs”), equipment suppliers (“ESs”) and end users license its patents. In this regard, its competition is existing technology, outside the scope of its patents, which allows TSPs and ESs to deliver communication services to their customers. While we believe that there will be continued proliferation of VoIP technology in the coming years and that this proliferation will occur within the context of our patents, there is no certainty that this will occur, and/or that it will occur in a manner that requires organizations to license our patents.

| 24 |

Government Regulation

We are subject to federal, state and local consumer protection laws, including laws protecting the privacy of customer non-public information and regulations prohibiting unfair and deceptive trade practices. Many jurisdictions also regulate "auctions" and "auctioneers" and may regulate online auction services. These consumer protection laws and regulations could result in substantial compliance costs and could interfere with the conduct of our business.

Legislation in the United States, including the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Act of 2010, has increased public companies’ regulatory and compliance costs as well as the scope and cost of work provided by independent registered public accountants and legal advisors. As regulatory and compliance guidelines continue to evolve, we expect to continue to incur costs, which may or may not be material, in order to comply with legislative requirements or rules, pronouncements and guidelines by regulatory bodies.

Critical Accounting Policies

Management’s Discussion and Analysis of Financial Condition and Results of Operations discusses our unaudited condensed consolidated interim financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). This requires management to make estimates and assumptions based on historical experience and various other factors that are considered to be reasonable under the circumstances. These affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

Significant estimates required in the preparation of the unaudited condensed consolidated interim financial statements included in this Report include the assessment of collectability of revenue recognized, and the valuation of amounts receivable, inventory, investments, deferred income tax assets, goodwill and intangible assets, liabilities and stock-based compensation. These estimates are considered significant because of the significance of the financial statement items to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events that are continuous in nature.

The critical accounting policies used in the preparation of our audited consolidated financial statements are discussed in our Annual Report on Form 10-K for the year ended December 31, 2012. There have been no changes to these policies in the first three months of 2013.

| 25 |

Management’s Discussion of Financial Condition

Liquidity and Capital Resources

Liquidity

At March 31, 2013 the Company had a working capital deficit of $1,645, as compared to a working capital deficit of $2,348 at December 31, 2012. The most significant changes in the Company’s current assets were decreases of $3,084 in cash and cash equivalents, and $1,147 in deposits. The most significant changes to current liabilities were decreases of $1,066 in accounts payable and accrued liabilities, and $4,623 in debt payable to third parties.

The Company’s debt payable to third parties consists of borrowings under Counsel RB’s revolving credit facility (the “Credit Facility”), and is subject to significant fluctuation depending on the number and magnitude of asset liquidation transactions in process at any given date. The Credit Facility has a maximum of $15,000 in place to finance its purchases of assets for resale, as discussed in Note 8 of the unaudited condensed consolidated interim financial statements.

During the first three months of 2013, the Company’s primary sources of cash were the operations of its asset liquidation business and borrowings under the associated Credit Facility. The Company also received net advances of $705 from its parent company, Counsel Corporation (collectively, with its subsidiaries, “Counsel”), and $753 of cash distributions from its investment in Polaroid. Cash disbursements, other than those related to repayment of debt, were primarily related to operating expenses.

It should be noted that GAAP requires the Company to classify both real estate inventory and asset liquidation investments as non-current, although they are expected to be converted to cash within a year. If these assets were classified as current, the Company would report working capital of $7,334 at March 31, 2013 and working capital of $7,348 at December 31, 2012.

The Company is continuing to pursue licensing and royalty agreements with respect to its patents. However, the Company expects that its asset liquidation business will continue to be the primary source of cash required for ongoing operations for the foreseeable future, and that its operations will generate sufficient cash to cover the Company’s requirements.

The Company’s portfolio investments are in companies that are not publicly traded, and therefore these investments are illiquid. The Company’s investments were made with the objective of recognizing long-term capital gains, and neither the amount nor the timing of such gains can be predicted with any certainty. To date the Company has realized capital gains on its investments in MyTrade.com, LIMOS.com and Buddy Media, Inc., and has not sold any investments at a loss.

Ownership Structure and Capital Resources

| · | At March 31, 2013 the Company had stockholders’ equity of $45,518, as compared to $46,012 at December 31, 2012. |

| · | At March 31, 2013 and December 31, 2012 the Company was 71.3% owned, and therefore controlled, by Counsel. At December 31, 2011 the Co-CEOs of Counsel RB each owned 5.98% of the Company. One million shares, or 3.7%, were held by a single investor. The remaining 8.2% was owned by public stockholders. On February 29, 2012, as discussed in Note 3 of the unaudited condensed consolidated interim financial statements, the Company issued one million common shares as part of the consideration for its acquisition of Heritage Global Partners, representing 3.69% of the then-outstanding common shares. Subsequently, on August 10, 2012, the Company issued 800,000 shares to its Co-CEOs in connection with the acquisition of intellectual property from them. Counsel’s ownership was thereby decreased to 71.3%, that of the Co-CEOs increased to 7.0% each, that of both the single investor referenced above, and the former owners of Heritage Global Partners, decreased to 3.5%, and that of the remaining public stockholders decreased to 7.7%. |

| 26 |

| · | On April 1, 2013, Counsel announced that its board of directors had approved a plan to focus Counsel’s operations on its core business, mortgage lending, and therefore to dispose of its other operating segments, including its interest in CRBCI. Although Counsel expects that the disposal process will be completed within twelve months from the announcement date, at this point no formal disposal of CRBCI is in progress. To date, Counsel’s decision has had no impact on CRBCI’s operations. |

Cash Position and Cash Flows

Cash and cash equivalents at March 31, 2013 were $1,230 as compared to $4,314 at December 31, 2012, a decrease of $3,084.

Cash provided by operating activities Cash provided by operating activities during the three months ended March 31, 2013 was $174, as compared to $5,672 provided during the same period in 2012. During the first three months of 2013 the Company had a loss of $647, as compared to income of $390 for the same period in 2012. Although operating expenses were approximately $3,000 in both 2013 and 2012, total revenues declined by approximately $1,400, and earnings from asset liquidation investments declined by approximately $300. This net decline of approximately $1,700 was partially offset by the Company recording a tax recovery of $353 in the first quarter of 2013, compared to tax expense of $313 during the same period of 2012. It should be noted that the 2013 results include the operations of Heritage Global Partners for a full quarter, whereas the 2012 results only include the operations for the period beginning February 29, 2012.

The most significant changes in operating activities during the first three months of 2013 as compared to the first three months of 2012 were in deposits, inventory, asset liquidation investments, deferred income tax assets and accounts payable and accrued liabilities. Deposits decreased by $1,147 in 2013 as compared to increasing by $1,960 in 2012. Inventory decreased by $310 in 2013 as compared to decreasing by $1,308 in 2012. Asset liquidation investments decreased by $717 in 2013 as compared to decreasing by $2,423 in 2012. Deferred income taxes increased by $326 in 2013 as compared to decreasing by $239 in 2012. Accounts payable and accrued liabilities decreased by $1,073 in 2013 as compared to increasing by $3,100 in 2012. The changes in deposits, inventory and asset liquidation investments are due to the variability of the operations of Counsel RB. The change in accounts payable and accrued liabilities is primarily due to the variability of all business units, combined with the initial effect of the acquisition of Heritage Global Partners in the first quarter of 2012.

Cash provided by or used in investing activities Cash provided by investing activities during the three months ended March 31, 2013 was $692, as compared to $2,207 of cash used during the same period in 2012. In 2012, the most significant transaction was the net cash outflow of $2,344 in connection with the Company’s acquisition of Heritage Global Partners; there were no acquisitions in the first quarter of 2013. In 2013 the Company received $753 in cash distributions from its investment in Polaroid, compared to $156 in 2012. Additional investments in Polaroid were $56 and $20 in 2013 and 2012, respectively. In the first three months of 2013 the Company did not receive any cash distributions from Knight’s Bridge GP, compared to receiving $3 in 2012. In 2013 the Company invested $5 in property, plant and equipment; there were no similar transactions in 2012.

Cash used in financing activities Cash used in financing activities was $3,950 during the three months ended March 31, 2013, as compared to $4,507 cash used during the same period in 2012. In 2013 the Company repaid net cash of $4,655 to its third party lender, compared to a net repayment of $2,643 in 2012. In 2013, the Company received net cash of $705 from Counsel, compared to advancing net cash of $1,872 in 2012. In the first three months of 2012 the Company received $8 related to the exercise of 31,750 options to purchase common stock; there were no exercises in 2013.

Management’s Discussion of Results of Operations

Asset liquidation revenue is primarily earned from the acquisition and subsequent disposition of distressed and surplus assets, including industrial machinery and equipment, real estate, inventories, accounts receivable and distressed debt. Following the acquisitions of Heritage Global Partners and Equity Partners, it is also earned from more traditional asset disposition services, such as commissions from on-site and webcast auctions, liquidations and negotiated sales, and fees earned for management advisory services. The Company also earns income from its asset liquidation business through its earnings from equity accounted asset liquidation investments.

| 27 |

The revenues and expenses discussed below include the operating results of Heritage Global Partners for the period following its acquisition by the Company on February 29, 2012. In the near-term, the Company’s earnings have been impacted by the incremental costs associated with the acquisition and integration of Heritage Global Partners and the expansion of its operations into Europe, as discussed above under Overview, History and Recent Developments.

Three-Month Period Ended March 31, 2013 Compared to Three-Month Period Ended March 31, 2012