Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - ASPIRITY HOLDINGS LLC | aspirity_8k.htm |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com | |

| November 16, 2015 | PRESS RELEASE |

Aspirity Reports

Financial Results for 2015’s Third Quarter and First Nine Months;

Revises Guidance for 2015;

Distribution of Krieger Enterprises Effective;

Aspirity Now Solely Focused On Retail Energy and Related Finance

MINNEAPOLIS, MN – Aspirity Holdings LLC (“Aspirity” or the “Company”) formerly known as Twin Cities Power Holdings, LLC (“TCPH”) today announced its financial results for the third quarter and first nine months ended September 30, 2015:

| · | Total revenues for Q3 2015 were $12,873,000 compared to $4,403,000 for the same period in 2014, an increase of 192%. |

| o | For the first nine months of this year, revenues were $38,214,000, down 6% from $40,856,000 for the same period in 2014. |

| · | For Q3 2015, the operating loss totaled $735,000, an improvement from an operating loss of $4,638,000 in Q3 2014. |

| o | For the first three quarters of 2015, the operating loss was $1,854,000 compared to operating income of $7,678,000 for the same period in 2014. |

| · | Comprehensive income attributable to members for 2015’s third quarter totaled $21,000 compared to a loss of $4,872,000 in the comparable period of 2014. |

| o | For the first nine months of 2015, the comprehensive loss was $2,389,000 compared to comprehensive income of $6,292,000 for the same period in 2014. |

| · | The ratio of earnings to fixed charges1 for the trailing 12 months ended September 30, 2015 was -0.29 times. Our unrestricted cash balances were $2,346,000 as of September 30, 2015 compared to $2,397,000 at December 31, 2014 and $2,938,000 as of September 30, 2014. |

| · | With respect to our balance sheet: |

| o | At September 30, 2015, our liquidity ratio (unrestricted cash, cash in trading accounts, and trade receivables divided by total assets) declined to 57.3% compared to 81.5% at December 31, 2014; |

| o | Our debt-to-total capital ratio (total debt divided by total debt plus equity) increased to 124.4% at September 30, 2015 from 87.7% at December 31, 2014; and |

| o | Our debt-to-equity ratio (total debt divided by total equity) was not meaningful at September 30, 2015 compared to 7.15 times at December 31, 2014. |

| · | We expect that revenues for 2015 will now be in a range of $55 to $60 million, down from guidance published in the second quarter of $55 to $65 million. This is based on the adjustment for the sale of TCP/Summit and management’s assessment of wholesale and retail electricity market conditions, but excluding the effects of the disposition of Krieger Enterprises. For the year, we now expect operating profit to range from a loss of $2.0 million to income of $0.5 million compared to the $2 to $4 million operating income range forecast earlier. |

| 1 | As defined by the SEC, the ratio of earnings to fixed charges is "earnings" (the sum of income before taxes and fixed charges) divided by "fixed charges" equal to interest expense, one-third of operating lease rental expense to approximate interest, and amortization of deferred financing costs. |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com |

“As you may know, at the end of May, our Board approved a restructuring of our business, the primary purpose of which is to position us for an initial public offering of equity perhaps as early as 2017 by eliminating the earnings volatility and regulatory exposure characteristic of the wholesale trading business and recasting the Company as a customer-focused retail energy and financial services business”, said Tim Krieger, the Company’s Chairman of the Board.

“To these ends, on June 1, we sold our TCP and Summit subsidiaries to Angell Energy for cash and a secured note. During the summer, we organized three new first-tier subsidiaries - Aspirity Energy, Aspirity Financial, and Krieger Enterprises - and transferred our remaining wholesale trading, retail energy, and diversified investments businesses to Enterprises. Aspirity Energy also began the process of becoming licensed in the 14 jurisdictions that allow all retail customers to choose their electricity supplier. To reflect our new direction and focus, on July 14, we legally changed our name from “Twin Cities Power Holdings, LLC” to “Aspirity Holdings LLC”,” said Mr. Krieger.

Mr. Krieger continued, “Under the terms of the restructuring plan, the transfer of our legacy businesses to our existing owners via the distribution of the equity interests of Enterprises required that two conditions be satisfied: a) noteholder approval of the transfer; and b) declaration of effectiveness by the SEC of our new S-1 registration statement regarding the sale of our renewable unsecured subordinated notes. We successfully solicited noteholder approval of the transfer in June and prepared and filed amendments to our S-1 in August and September. The SEC declared our S-1 effective on November 12 and we completed the distribution on November 13, effective November 1 for tax and accounting purposes”.

“After the disposition of Enterprises, we will have operations in two business segments – retail energy and financial services. We expect that we will be able to offer electricity service to customers beginning in very early 2016”, said Mr. Krieger.

“As previously announced, with the disposition of Enterprises, executive management and ownership of the Company has changed. Mark A. Cohn, a board member since 2013 and President of Aspirity Energy, has assumed the roles of President and CEO of Aspirity Holdings. Scott Lutz, a seasoned brand marketing executive, and Jeremy Schupp, formerly president of a retail energy concern based in Chicago, will leave their positions with the legacy companies and become Chief Marketing Officer and Chief Operating Officer, respectively. Wiley Sharp, who has been our Chief Financial Officer since 2012, will remain in that role. These gentlemen, together with Keith Sperbeck, now VP of Operations of Enterprises, join me as owners of Aspirity”, Mr. Krieger continued.

“With respect to our usual review of the quarter’s results, with the completion of the distribution, 2015’s third quarter will be the last time our legacy operations are discussed in detail as noteholders are no longer directly exposed to the risks and rewards of Enterprises, although it is the first customer of Aspirity Financial”, said Mr. Krieger. “In any case, 2015 continues to be marked by exceptionally mild weather, low natural gas prices, and reduced volatility in the PJM West Hub price, resulting in adverse trading conditions for us as shown by the tables that follow. Further, the sale of TCP also reduced revenue from the segment. Consequently, for the first nine months, revenues were $13,363,000 compared to $27,310,000 last year, down 51%. Further, NOAA’s mid-October forecast for November, December, and January 2016 calls for above normal to normal temperatures in our key eastern markets, meaning that the trading outlook for the rest of the year isn’t great”, said Mr. Krieger.

| 2 |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com |

| Nine Months Ended September 30, | ||||||||||||||||||||||||||||

| Increase (decrease) | ||||||||||||||||||||||||||||

| Units | This year vs last year | This year vs LTA | ||||||||||||||||||||||||||

| 2015 | 2014 | LTA (1) | Units | Percent | Units | Percent | ||||||||||||||||||||||

| U.S. Weather | ||||||||||||||||||||||||||||

| Heating degree-days | 2,864 | 3,054 | 2,745 | (190 | ) | -6 | % | 119 | 4 | % | ||||||||||||||||||

| Cooling degree-days | 1,335 | 1,182 | 1,227 | 153 | 13 | % | 108 | 9 | % | |||||||||||||||||||

| Avg temperature (°F) | 56.9°F | 55.2°F | 56.9°F | 1.7°F | 3 | % | 0.0°F | 0 | % | |||||||||||||||||||

| Natural Gas | ||||||||||||||||||||||||||||

| Henry Hub spot price ($/MCF) | 2.80 | 4.57 | 3.76 | (1.77 | ) | -39 | % | (0.96 | ) | -26 | % | |||||||||||||||||

| Working gas in underground storage, Lower 48 states, EIA weekly estimates (BCF) | 2,402 | 1,832 | 2,417 | 517 | 31 | % | (15 | ) | -1 | % | ||||||||||||||||||

1 - “LTA” abbreviates long term average. For weather data, the 30 year period is 1984-2013 and for natural gas the 5 year period is 2009-2013.

| Nine Months Ended September 30, | ||||||||||||||||

| PJM West Hub Peak Day Ahead | Increase (decrease) | |||||||||||||||

| 2015 | 2014 | Units | Percent | |||||||||||||

| Price ($/MWh) | ||||||||||||||||

| Average | 43.89 | 58.65 | (14.76 | ) | -25 | % | ||||||||||

| Maximum | 237.48 | 655.75 | (418.27 | ) | -64 | % | ||||||||||

| Minimum | 24.99 | 26.49 | (1.49 | ) | -6 | % | ||||||||||

| Standard deviation | 22.38 | 54.81 | (32.43 | ) | -59 | % | ||||||||||

| Coefficient of variation (stdev ÷ avg) | 51 | % | 93 | % | -42 | % | -45 | % | ||||||||

| Daily percentage changes | ||||||||||||||||

| Average | 2.1 | % | 2.5 | % | -0.5 | % | -19 | % | ||||||||

| Maximum | 209.3 | % | 200.3 | % | 9.0 | % | 4 | % | ||||||||

| Minimum | -63.5 | % | -78.1 | % | 14.7 | % | -19 | % | ||||||||

| Standard deviation | 23.4 | % | 25.8 | % | -2.4 | % | -9 | % | ||||||||

| Number of days | ||||||||||||||||

| Up 10% or more | 54 | 51 | 3 | 6 | % | |||||||||||

| Between 10% up and 10% down | 84 | 90 | (6 | ) | -7 | % | ||||||||||

| Down 10% or more | 53 | 50 | 3 | 6 | % | |||||||||||

“On the other hand, with respect to our legacy retail business, we had a very nice first nine months in customer acquisitions and ended the period with about 35,000, up 139% from the same time last year. Also, for the first nine months of 2015, segment revenues increased by over 128% to $23,285,000”, Mr. Krieger concluded.

| Key Operating Statistics | For/At Nine Months Ended September 30, | |||||||||||||||

| (in units unless otherwise indicated) | Increase (decrease) | |||||||||||||||

| 2015 | 2014 | Units | Percent | |||||||||||||

| Retail electricity sales ($000s) | 23,566 | 8,115 | 15,451 | 190.4 | % | |||||||||||

| Wholesale trading revenue, net ($000s) | (281 | ) | 2,105 | (2,386 | ) | -113.3 | % | |||||||||

| Total segment revenues ($000s) | 23,285 | 10,220 | 13,065 | 127.8 | % | |||||||||||

| Unit sales (MWh) | 268,797 | 80,655 | 188,142 | 233.3 | % | |||||||||||

| Weighted average retail price (¢/kWh) | 8.66 | 12.67 | (4.01 | ) | -31.6 | % | ||||||||||

| Customers receiving service, end of period | 34,980 | 14,644 | 20,336 | 138.9 | % | |||||||||||

| 3 |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com |

About Aspirity Holdings LLC

Aspirity Holdings LLC, formerly known as Twin Cities Power Holdings, LLC is a Minnesota limited liability company that serves as a holding company and is headquartered at 701 Xenia Avenue South, Suite 475, Minneapolis MN 55416, telephone 763-432-1500. Following the spin-off of Krieger Enterprises, the Company has operations in two business segments - retail energy through Aspirity Energy and financial services through Aspirity Financial. More information about the Company is available at www.aspirityholdings.com.

Aspirity Energy and its subsidiaries, as applicable, have begun the process of becoming licensed as a competitive supplier in all 14 jurisdictions that allow all retail electricity customers served by investor owned utilities to choose their provider. We expect that we will be able to offer service beginning early in 2016. Aspirity Energy Northeast (“AENE”) will serve customers in the ISONE and NYISO footprints; Aspirity Energy Mid-States (“AEMS”) will serve those in PJM and MISO; and Aspirity Energy South LLC (“AES”) will serve those in ERCOT. Aspirity Financial was formed to provide energy-related financial services to companies and households and its first customer is Enterprises.

While the equity of Aspirity is privately held, our Renewable Unsecured Subordinated Notes are registered with the SEC and may be purchased by residents of California, Colorado, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Kansas, Michigan, Minnesota, Mississippi, Missouri, New Jersey, New Mexico, New York, South Dakota, Texas, Utah, Vermont, and Wisconsin. To obtain an investment kit or our most recent interest rate offerings, visit www.aspirityholdings.com.

About Krieger Enterprises, LLC

Krieger Enterprises, which was spun off from Aspirity Holdings effective November 1, 2015, is headquartered at 16233 Kenyon Avenue, Lakeville MN 55044, telephone 952-241-3103. Enterprises trades electricity for its own account in wholesale markets regulated by the Federal Energy Regulatory Commission as well as other energy-related derivative contracts on exchanges regulated by the Commodity Futures Trading Commission. Enterprises also holds retail electricity supplier licenses from the states of Connecticut, Maryland, Massachusetts, New Hampshire, New Jersey, Ohio, Pennsylvania, and Rhode Island (see www.townsquareenergy.com and www.discountenergygroup.com), and engages in certain asset management activities, including real estate development and investments in privately held businesses.

| 4 |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com |

Forward Looking Statements

This press release contains forward-looking statements. Forward-looking statements can be identified by words such as: "may", "will", "expect", "anticipate", "believe", "estimate" "continue", "predict", or other similar words making reference to future periods, including expectations of current year revenues and operating income. In addition, forward-looking statements include statements regarding our intent, belief, or current expectation about trends affecting the markets in which we participate, our businesses, financial condition, and growth strategies, among other things. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those predicted in forward-looking statements as a result of various factors, including, but not limited to, those set forth in the "Risk Factors" sections of our filings with the Securities and Exchange Commission.

If any of the events described in these "Risk Factors" occur, they could have a material adverse effect on our business, financial condition, and results of operations. When considering forward-looking statements, you should keep these risk factors, as well as the other cautionary statements in our SEC filings, in mind. You should not place undue reliance on any forward-looking statement. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise after the date of this press release.

Non-GAAP Financial Measures

Aspirity’s press releases and other communications may include certain “non-GAAP financial measures”, defined as a numerical measure of a company's financial performance, financial position, or cash flows that excludes, or includes, amounts that are included in, or excluded from, the most directly comparable measure calculated and presented in accordance with GAAP in the company's financial statements.

Non-GAAP financial measures utilized by the Company include presentations of coverage ratios, liquidity measures, and debt-to-equity ratios. The Company’s management believes that these non-GAAP financial measures provide useful information and enables investors and analysts to more accurately compare the Company's ongoing financial performance over the periods presented.

Investor Relations Contact

Wiley H. Sharp III

CFO, 763-432-1502

| 5 |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com |

Aspirity Holdings LLC & Subsidiaries

| Dollars in thousands | For & at 3 months ended Sep 30, | For & at 9 months ended Sep 30, | For & at year ended Dec 31, | |||||||||||||||||

| 2015 | 2014 | 2015 | 2014 | 2014 | ||||||||||||||||

| Statement of Operations Data | ||||||||||||||||||||

| Wholesale trading | $ | 1,309 | $ | 1,414 | $ | 13,081 | $ | 32,741 | $ | 38,612 | ||||||||||

| Retail energy services | 10,122 | 2,988 | 23,566 | 8,115 | 11,229 | |||||||||||||||

| Diversified investments | 1,441 | – | 1,566 | – | – | |||||||||||||||

| Net revenue | 12,873 | 4,403 | 38,214 | 40,856 | 49,841 | |||||||||||||||

| Total costs of revenues & operations | 13,607 | 9,041 | 40,068 | 33,178 | 43,402 | |||||||||||||||

| Operating income (loss) | (735 | ) | (4,638 | ) | (1,854 | ) | 7,678 | 6,440 | ||||||||||||

| Interest expense | (1,009 | ) | (604 | ) | (2,678 | ) | (1,586 | ) | (2,293 | ) | ||||||||||

| Interest income | 319 | 48 | 539 | 100 | 143 | |||||||||||||||

| Other income (expense), net | 661 | (76 | ) | 1,246 | (331 | ) | (510 | ) | ||||||||||||

| Net income (loss) | (764 | ) | (5,272 | ) | (2,747 | ) | 5,861 | 3,779 | ||||||||||||

| Preferred distributions | (137 | ) | (137 | ) | (412 | ) | (412 | ) | – | |||||||||||

| Net loss attributable to non-controlling interest | 61 | – | 61 | – | – | |||||||||||||||

| Net income (loss) attributable to common | (840 | ) | (5,409 | ) | (3,098 | ) | 5,449 | 3,779 | ||||||||||||

| Net income (loss) | (764 | ) | (5,272 | ) | (2,747 | ) | 5,861 | 3,779 | ||||||||||||

| Foreign currency translation adjustment | 24 | 142 | (388 | ) | 360 | – | ||||||||||||||

| Change in fair value of cash flow hedges | 871 | 321 | 849 | 78 | – | |||||||||||||||

| Unrealized gain on marketable securities | (171 | ) | (64 | ) | (165 | ) | (6 | ) | – | |||||||||||

| Loss attributable to non-controlling interest | 61 | – | 61 | – | – | |||||||||||||||

| Comprehensive income (loss) attributable to members | $ | 21 | $ | (4,872 | ) | $ | (2,389 | ) | $ | 6,292 | $ | 3,779 | ||||||||

| Ratio of earnings to fixed charges, trailing 12 months | – | – | -0.29 | x | – | 2.47 | x | |||||||||||||

| Ratio of earnings to fixed charges, for period | 0.31 | x | -6.94 | x | 0.07 | x | 4.30 | x | 2.47 | x | ||||||||||

| 6 |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com |

| Balance Sheet Data | |||||||||||

| Cash - unrestricted | $ | 2,346 | $ | 2,938 | $ | 2,397 | |||||

| Cash in trading accounts | 8,921 | 16,513 | 21,100 | ||||||||

| Trade receivables | 6,211 | 2,560 | 2,394 | ||||||||

| Marketable securities | 390 | – | 312 | ||||||||

| Other current assets | 1,115 | 501 | 416 | ||||||||

| Total current assets | 18,983 | 22,512 | 26,619 | ||||||||

| Prpoerty, equipment & furnishings, net | 1,145 | 781 | 763 | ||||||||

| Other assets, net | 10,395 | 4,095 | 4,389 | ||||||||

| Total assets | $ | 30,522 | $ | 27,388 | $ | 31,770 | |||||

| Current debt | $ | 13,613 | $ | 7,508 | $ | 8,652 | |||||

| Trade payables | 4,245 | 1,660 | 1,544 | ||||||||

| Accrued expenses | 1,752 | 499 | 5,133 | ||||||||

| Other current liabilities | 2,718 | 2,485 | 583 | ||||||||

| Total current liabilities | 22,328 | 12,152 | 15,912 | ||||||||

| Long term debt | 13,506 | 8,840 | 10,636 | ||||||||

| Other liabilities | – | 2,718 | 2,524 | ||||||||

| Total liabilities | 35,834 | 23,710 | 29,072 | ||||||||

| Series A preferred equity | 2,745 | 2,745 | 2,745 | ||||||||

| Common equity | (9,024 | ) | (200 | ) | (194 | ) | |||||

| Accumulated comprehensive income | 444 | 1,133 | 147 | ||||||||

| Non-controlling interest | 523 | – | – | ||||||||

| Total equity | (5,312 | ) | 3,678 | 2,698 | |||||||

| Total liabilities & equity | $ | 30,522 | $ | 27,388 | $ | 31,770 | |||||

| Liquidity, percent of total assets | 57.3 | % | 80.4 | % | 81.5 | % | |||||

| Debt to total capital ratio | 124.4 | % | 81.6 | % | 87.7 | % | |||||

| Debt to equity ratio | nm | 4.44 | x | 7.15 | x |

| 7 |

|

701 Xenia Avenue South, Suite 475 Minneapolis MN 55416 763-432-1500 · www.aspirityholdings.com |

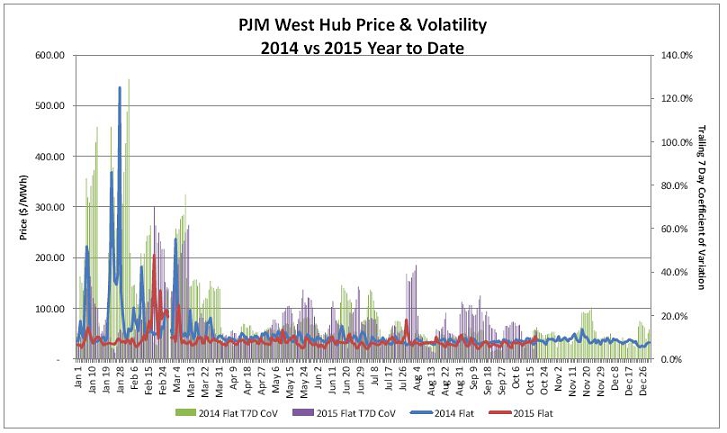

This chart shows the level and volatility of PJM West Hub day-ahead power prices for all of 2014 and for 2015 on a year to date basis. Our trading revenues generally correspond to weather- and gas driven volatility or lack thereof. Other factors come into play as well, which might cause revenues to correlate less directly to volatility. Among others, these factors include the size and nature of the trades we may or may not have in place when and if the market moves, as well as the duration of profitable trading opportunities. As you can see, price levels and volatility have decreased in 2015 compared to 2014.

| 8 |