Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ASPIRITY HOLDINGS LLC | Financial_Report.xls |

| EX-31.2 - CERTIFICATION - ASPIRITY HOLDINGS LLC | twincities_10q-ex3102.htm |

| EX-32.1 - CERTIFICATION - ASPIRITY HOLDINGS LLC | twincities_10q-ex3201.htm |

| EX-31.1 - CERTIFICATION - ASPIRITY HOLDINGS LLC | twincities_10q-ex3101.htm |

| EX-10.4 - ASSIGNMENT OF EMPLOYMENT AGREEMENT - ASPIRITY HOLDINGS LLC | twincities_10q-ex1004.htm |

UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2015

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from __ to __

Commission File Number: 333-179460

Twin Cities Power Holdings, LLC

(Exact name of registrant as specified in its charter)

| Minnesota | 6221 – Commodity Contracts Brokers and Dealers | 27-1658449 | ||

| (State of organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification Number) |

|

16233 Kenyon Avenue, Suite 210 Lakeville, Minnesota 55044 |

||

| (Address of principal executive offices, zip code) | ||

| (952) 241-3103 | ||

| (Registrant’s telephone number, including area code) | ||

| not applicable | ||

| (Former name, former address and former fiscal year, if changed since last report) |

_________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

TABLE OF CONTENTS

| Definitions | 3 |

| Forward Looking Statements | 8 |

| Non-GAAP Financial Measures | 9 |

| Part I – Financial Information | 10 |

| Item 1 - Financial Statements (Unaudited) | 10 |

| Consolidated Balance Sheets | 10 |

| Consolidated Statements of Comprehensive Income | 11 |

| Consolidated Statements of Cash Flows | 12 |

| Notes to Consolidated Financial Statements | 14 |

| Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations | 37 |

| Industry Background | 37 |

| Company Overview | 42 |

| Results of Operations | 46 |

| Liquidity, Capital Resources, and Cash Flow | 51 |

| Financing | 54 |

| Non-GAAP Financial Measures | 56 |

| Critical Accounting Policies and Estimates | 56 |

| Item 3 - Quantitative and Qualitative Disclosures about Market Risk | 58 |

| Commodity Price Risk | 58 |

| Interest Rate Risk | 60 |

| Liquidity Risk | 60 |

| Wholesale Counterparty Credit Risk | 60 |

| Retail Customer Credit Risk | 60 |

| Foreign Exchange Risk | 60 |

| Item 4 - Controls and Procedures | 61 |

| Part II – Other Information | 62 |

| Item 1 - Legal Proceedings | 62 |

| Item 1A - Risk Factors | 62 |

| Item 2 - Unregistered Sales of Equity Securities and Use of Proceeds | 62 |

| Item 3 - Defaults Upon Senior Securities | 62 |

| Item 4 - Mine Safety Disclosures | 62 |

| Item 5 - Other Information | 62 |

| Item 6 - Exhibits | 63 |

| Signatures | 64 |

| 2 |

Definitions

| Abbreviation or acronym | Definition | |

| ABN AMRO | ABN AMRO Clearing Chicago, LLC and ABN AMRO Clearing Bank, N.V. | |

| AESO | Alberta Electric System Operator, a statutory corporation of the Province of Alberta, is an ISO serving the Alberta Interconnected Electric System | |

| AOCI | Accumulated other comprehensive income | |

| Apollo | Apollo Energy Services, LLC, a wholly-owned, first-tier subsidiary of TCPH | |

| ASC | Accounting Standards Codification | |

| ASU | Accounting Standards Update | |

| BLS | Bureau of Labor Statistics, an agency within the U.S. Department of Labor | |

| Btu; therm; MMBtu | A “Btu” or British thermal unit is a measure of thermal energy or the amount of heat needed to raise the temperature of one pound of water from 39°F to 40°F. A “therm” is one hundred thousand Btu. One “MMBtu” is one million Btu. | |

| C$ | Canadian dollars | |

| CEF | Cygnus Energy Futures, LLC, a wholly-owned subsidiary of CP and a second-tier subsidiary of TCPH | |

| CFTC | Commodity Futures Trading Commission, an independent agency of the United States government that regulates futures and option markets | |

| CME | CME Group Inc. operates the CME (Chicago Mercantile Exchange), CBOT (Chicago Board of Trade), NYMEX (New York Mercantile Exchange), and COMEX (Commodities Exchange) derivatives exchanges and also offers certain cleared OTC products and services | |

| Company | TCPH and its subsidiaries | |

| CoV | Abbreviates the coefficient of variation, a simple measure of volatility useful for comparing two or more data series; equal to the standard deviation divided by the mean | |

| CP | Cygnus Partners, LLC, a wholly-owned, first-tier subsidiary of TCPH | |

| CP&U | Community Power & Utility, LLC, an electricity retailer acquired by TCP on June 29, 2012 | |

| CSE | Comparison shopping engine, a web site that compares prices for specific products. While most comparison shopping engines do not offer the products or services themselves, some may earn commissions when users follow the links in the search results and make a purchase from an online vendor | |

| CTG | Chesapeake Trading Group, LLC, a wholly-owned subsidiary of TCPH, effective April 30, 2015 | |

| Cyclone | Cyclone Partners, LLC, a wholly-owned, first-tier subsidiary of TCPH |

| 3 |

| Abbreviation or acronym | Definition | |

| Degree-days; CDD; HDD |

A “degree-day” compares outdoor temperatures to a standard of 65°F. Hot days require energy for cooling and are measured in cooling degree-days or “CDD” while cold days require energy for heating and are measured in heating degree-days or “HDD”. For example, a day with a mean temperature of 80°F would result in 15 CDD and a day with a mean temperature of 40°F would result in 25 HDD.

If heating degree-days are less than the average for an area for a period, the weather was “warmer than normal”; if they were greater, it was “colder than normal”. The converse is true for cooling degree-days - if CDD are less than the average for an area for a period, the weather was “colder than normal”; if they were greater, it was “warmer than normal”. | |

| DOE | U.S. Department of Energy | |

| EDC; LDC | Electric distribution company; may also be known as a local distribution company | |

| EIA | Energy Information Administration, an independent agency within DOE | |

| ERCOT | Electric Reliability Council of Texas, an ISO managing 85% of the electric Load of Texas and subject to oversight by the Public Utility Commission of Texas and the Texas Legislature but not FERC | |

| FASB | Financial Accounting Standards Board | |

| FERC | Federal Energy Regulatory Commission, an independent regulatory agency within DOE | |

| Form S-1 | The Company’s Registration Statement on Form S-1, declared effective by the Securities and Exchange Commission on May 10, 2012 with respect to the Company’s Notes Offering | |

| FTR | Financial Transmission Rights are financial instruments traded in certain ISOs and RTOs that entitle their holders to receive or pay charges based on congestion price differences in the day-ahead energy market across specific transmission paths. The value of an FTR reflects the difference in congestion prices rather than the difference in locational marginal prices, which includes energy, congestion, and marginal losses. FTRs are specified between any two pricing nodes on the system, including hubs, control zones, aggregates, generator buses, load buses and interface pricing points. FTRs are generally available in increments of 0.1 MW and for periods ranging from 1 month to multiple years. The value of an FTR can be positive or negative depending on the sink minus source congestion price difference, with a negative differences resulting in liability for the holder. | |

| GAAP | Generally accepted accounting principles in the United States | |

| ICE | InterContinental Exchange Group, Inc. operates a network of 17 regulated exchanges and 6 clearinghouses for financial and commodity markets in the U.S., Canada, Europe, and Asia. In November 2013, ICE completed the acquisition of NYSE Euronext. | |

| INC and DEC | An increment offer or “INC” is an offer in the day-ahead market to sell energy at a specified source bus. An INC will clear if the LMP at the bus equals or exceeds the offer price. A decrement bid or “DEC” is a bid in the day-ahead market to purchase energy at a specified sink bus. A DEC will clear if the LMP at the bus does not exceed the bid price. |

| 4 |

| Abbreviation or acronym | Definition | |

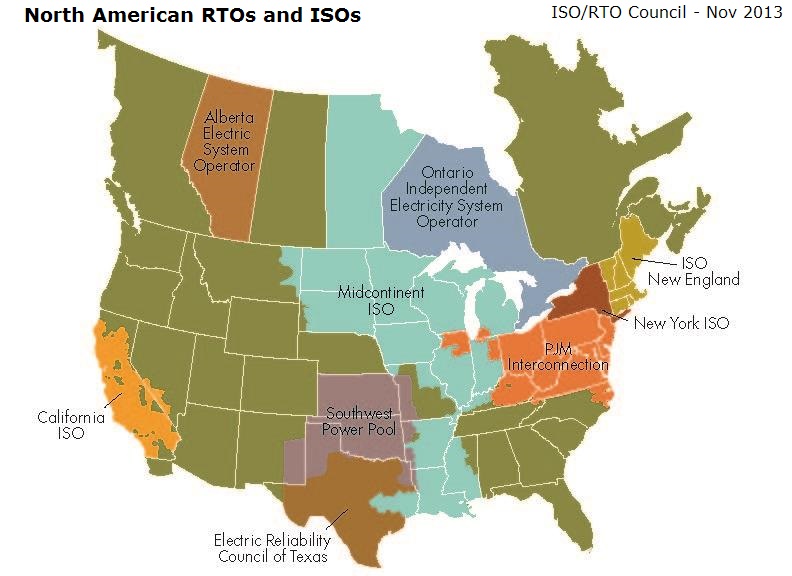

| ISO; RTO | Independent System Operator, a non-profit organization formed at the direction or recommendation of FERC that coordinates, controls, and monitors the operation of a bulk electric power system, usually within a single U.S. state, but sometimes encompassing multiple states. A Regional Transmission Organization (“RTO”) typically performs the same functions as an ISO, but covers a larger area. ISOs and RTOs may also operate centrally cleared wholesale markets for electric power quoted on both a “real-time” and “day ahead” basis. | |

| ISO-NE | ISO New England Inc., an RTO serving Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont | |

| LMP | One of the unique aspects of ISO electricity markets is the availability of “locational marginal prices” (“LMPs”). The theoretical price of electricity at each node on the network is calculated based on the assumptions that: (1) one additional megawatt-hour of energy is demanded at the node in question; and (2) the marginal cost to the system that would result from the re-dispatch of available generating units to serve such load can establish the production cost of the additional energy. LMPs are typically quoted on a “real-time” and “day-ahead” basis. In the real-time market, prices at specific nodes are updated every 5 minutes based on current and targeted supply and demand. Day-ahead prices are for power to be delivered at a specified hour and transmission point during the next day. LMPs vary by time and location due to physical system limitations, congestion, and loss factors; however, in an unconstrained system with no losses, all LMPs would be equal. This means that LMPs can be conceptually separated into three components - an energy price, a congestion component, and a loss component. | |

| MCA | The Company’s Member Control Agreement, as amended | |

| MEF | Minotaur Energy Futures, LLC, a wholly-owned subsidiary of TCP and a second-tier subsidiary of TCPH | |

| MISO | Midcontinent Independent System Operator, Inc., (formerly the Midwest Independent Transmission System Operator, Inc.), an RTO serving all or part of Arkansas, Illinois, Indiana, Iowa, Louisiana, Manitoba, Michigan, Minnesota, Mississippi, Missouri, Montana, North Dakota, South Dakota, Texas, and Wisconsin | |

| MCF | One thousand cubic feet, a common unit of price measure for natural gas. In 2010, one MCF of natural gas had a heat content of 1,025 Btu. | |

| NERC | North American Electric Reliability Corporation, a non-profit corporation formed on March 28, 2006 as the successor to the National Electric Reliability Council, also known as NERC, formed in 1968. NERC is the designated Electric Reliability Organization (“ERO”) for the U.S. and operates under the auspices of FERC. | |

| NGX | Natural Gas Exchange Inc., headquartered in Calgary, Alberta provides electronic trading, central counterparty clearing, and data services to the North American natural gas and electricity markets. NGX is wholly owned by TMX Group Inc. which collectively manages all aspects of Canada’s senior and junior equity markets. | |

| NOAA | National Oceanic and Atmospheric Administration, an agency of the U.S. Department of Commerce |

| 5 |

| Abbreviation or acronym | Definition | |

| Notes | The Company’s Renewable Unsecured Subordinated Notes issued pursuant to its ongoing Notes Offering | |

| Notes Offering | The direct public offering the Company’s Notes pursuant to a registration statement on Form S-1 declared effective by the SEC on May 10, 2012 | |

| NRSRO | A SEC-recognized Nationally Recognized Statistical Rating Organization; The major NRSROs that rate utilities are Standard & Poor’s Financial Services LLC (“S&P”), Moody’s Investor Services, Inc. (“Moody’s”), and Fitch Ratings Inc. (“Fitch”) | |

| NYISO | New York Independent System Operator, an ISO serving New York state | |

| OTC | Over-the-counter | |

| PJM | PJM Interconnection, a RTO serving all or part of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and the District of Columbia. | |

| POR; non-POR | All states with restructured retail markets have implemented laws and regulations with respect to permitted billing, credit, and collections practices. Some of these states require an EDC billing customers in their service territory on behalf of suppliers operating there to purchase the receivables generated as a result of energy sales, generally at a modest discount to reflect bad debt experience. These states are known as “purchase of receivables” or “POR” jurisdictions while those without this provision are known as “non-POR” areas. | |

| PURPA | Public Utilities Regulatory Policy Act of 1978 | |

| RECs | Renewable energy certificates represent the property rights to the environmental, social, and other non-power qualities of renewable electricity generation and can be sold separately from the underlying physical electricity. | |

| REH | Retail Energy Holdings, LLC, a wholly-owned, first-tier subsidiary of TCPH | |

| SEC | U.S. Securities and Exchange Commission, an independent agency of the United States government with primary responsibility for enforcing federal securities laws and regulating the securities industry and stock exchanges | |

| SUM | Summit Energy, LLC, a wholly-owned subsidiary of TCP and a second-tier subsidiary of TCPH | |

| TCE | Twin Cities Energy, LLC, an inactive, wholly-owned, first-tier subsidiary of TCPH | |

| TCP | Twin Cities Power, LLC, a wholly-owned, first-tier subsidiary of TCPH | |

| TCPC | Twin Cities Power – Canada, Ltd., an inactive, wholly-owned subsidiary of TCE and a second-tier subsidiary of TCPH | |

| TCPH | Twin Cities Power Holdings, LLC | |

| TSE | Town Square Energy, initially, an accounting division of TCP resulting from the acquisition of the business and assets of CP&U. Effective June 1, 2013, TSE became a wholly-owned first-tier subsidiary of the Company and on October 25, 2013, it became a wholly owned subsidiary of REH and a second-tier subsidiary of TCPH |

| 6 |

| Abbreviation or acronym | Definition | |

| TSEC | Town Square Energy Canada, Ltd, a wholly-owned subsidiary of REH and a second-tier subsidiary of TCPH | |

| TSEE | Town Square Energy East, LLC, a wholly-owned subsidiary of REH and second-tier subsidiary of TCPH formerly known as Discount Energy Group, LLC or “DEG” | |

| UTC | In an up-to-congestion or “UTC” transaction, a day-ahead market participant offers to inject energy at a specified source and simultaneously withdraw the same quantity at a specific sink at a maximum bid price difference between the two locations. The transaction will clear if the price differential between sink and source does not exceed the bid price. | |

| VaR | Value-at-Risk is a measure of the risk of loss on a specific portfolio of financial assets. For a given portfolio, probability, and time horizon, VaR is the value at which the probability that a mark-to-market loss over the given time horizon exceeds the calculated value, assuming normal markets and no trading. For example, if a portfolio has a one-day, 5% VaR of $1 million, there is a 5% probability that the portfolio will fall in value by more than $1 million over a one-day period. | |

| Watt (W); Watt-hour (Wh) | Although in everyday usage, the terms “energy” and “power” are essentially synonyms, scientists, engineers, and the energy business distinguish between them. Technically, energy is the ability to do work, or move a mass a particular distance by the application of force while power is the rate at which energy is generated or consumed.

In the case of electricity, power is measured in watts (W) and is equal to voltage or the difference in charge between two points multiplied by amperage or the current or rate of electrical flow. The energy supplied or consumed by a circuit is measured in watt-hours (Wh). For example, when a light bulb with a power rating of 100W is turned on for one hour, the energy used is 100 watt-hours. This same amount of energy would light a 40-watt bulb for 2.5 hours or a 50-watt bulb for 2.0 hours.

Multiples of watts and watt-hours are measured using International Systems of Units (“SI”) conventions. For example: |

| Prefix | Symbol | Multiple (Number) | Value |

| kilo | k | one thousand (1,000) | 103 |

| mega | M | one million (1,000,000) | 106 |

| giga | G | one billion (1,000,000,000) | 109 |

| tera | T | one trillion (1,000,000,000,000) | 1012 |

Kilowatt (kW) or kilowatt-hour (kWh): one thousand watts or watt-hours. Kilowatt-hours are typically used to measure residential energy consumption and retail prices. One kWh is equal to 3,412 Btu, but fuel with a heat content of 7,000 to 11,500 Btu must be consumed to generate and deliver one kWh of electricity.

Megawatt (MW) or megawatt-hour (MWh): one million watts or watt-hours or one thousand kilowatts or kilowatt-hours. Megawatts are typically used to measure electrical generation capacity and megawatt-hours are the pricing units used in the wholesale electricity market. |

| 7 |

Forward Looking Statements

Readers are urged to carefully review and consider the various disclosures made by us in this Form 10-Q and in our other reports filed with the SEC that attempt to advise interested parties of the factors that may affect our business.

Statements in this report that are not statements of historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results will be achieved. Any statements that express, or involve discussions as to, future expectations, risks, beliefs, plans, objectives, assumptions, events, uncertainties, financial performance, or growth strategies, often, but not always, through the use of words or phrases such as “anticipates”, “believes”, “estimates”, “expects”, “intends”, “plans”, “projects”, “likely”, “will continue”, “could”, “may”, “potential”, “target”, “outlook”, or words of similar meaning are not statements of historical facts and may be forward-looking.

In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause our actual results to differ materially from those indicated in forward-looking statements made by or on behalf of the Company in this Form 10-Q, in presentations, on our website, in response to questions, or otherwise. You should not place undue reliance on any forward-looking statement. Examples of forward-looking statements include, among others, statements we make regarding:

| · | Expected operating results, such as revenue growth and earnings; |

| · | Anticipated levels of capital expenditures and expansion of our retail electricity business segment; |

| · | Current or future price volatility in the energy markets and future market conditions; |

| · | Our belief that we have sufficient liquidity to fund our operations during the next 12 months; |

| · | Expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities, and governmental and regulatory investigations and proceedings; |

| · | Our strategies for risk management; and |

| · | Any other risk factors listed from time to time by the Company in reports filed with the Securities and Exchange Commission. |

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which that statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all of these factors, nor can it assess the impact of each of these factors on the businesses of the Company or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Additional disclosures regarding factors that could cause our results and performance to differ from results or performance anticipated by this report are discussed under the heading “Item 1A – Risk Factors” of our Form 10-K for 2014 (the “2014 Form 10-K”), the “Risk Factors” section beginning on page 10 of our Form S-1, and any assumptions and other factors referred to specifically in connection with such forward-looking statements that could cause our actual results to differ materially from those indicated in the forward-looking statements.

| 8 |

Non-GAAP Financial Measures

The Company’s communications may include certain non- GAAP financial measures. A “non-GAAP financial measure” is defined as a numerical measure of a company's financial performance, financial position, or cash flows that excludes, or includes, amounts that are included in, or excluded from, the most directly comparable measure calculated and presented in accordance with GAAP in the company's financial statements.

Non-GAAP financial measures utilized by the Company include “total liquid assets”. The most comparable GAAP measure is total current assets. The Company’s management believes that this non-GAAP financial measure provides useful information to investors and enables investors and analysts to more accurately compare the Company's ongoing financial performance over the periods presented.

| 9 |

Part I – Financial Information

Item 1 - Financial Statements (Unaudited)

Twin Cities Power Holdings, LLC and Subsidiaries

Consolidated Balance Sheets

As of March 31, 2015 and December 31, 2014

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Unaudited | ||||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash - unrestricted | $ | 4,396,005 | $ | 2,397,300 | ||||

| Cash in trading accounts | 16,003,961 | 21,099,652 | ||||||

| Accounts receivable - trade | 5,571,805 | 2,394,246 | ||||||

| Marketable securities | 2,579,875 | 311,586 | ||||||

| Prepaid expenses and other current assets | 284,544 | 416,419 | ||||||

| Total current assets | 28,836,190 | 26,619,203 | ||||||

| Property, equipment ,and furniture, net | 846,223 | 762,529 | ||||||

| Other assets | ||||||||

| Intangible assets, net | 192,103 | 269,149 | ||||||

| Deferred financing costs, net | 245,624 | 241,744 | ||||||

| Cash - restricted | 1,319,371 | 1,319,371 | ||||||

| Land held for development | 1,642,143 | 953,462 | ||||||

| Investment in convertible notes | 1,642,380 | 1,604,879 | ||||||

| Total assets | $ | 34,724,034 | $ | 31,770,337 | ||||

| Liabilities and Members' (Deficit) Equity | ||||||||

| Current liabilities | ||||||||

| Current portions of debt | ||||||||

| Revolver | $ | 2,754,814 | $ | 1,105,259 | ||||

| Senior notes | 789,541 | 312,068 | ||||||

| Renewable unsecured subordinated notes | 8,102,083 | 7,234,559 | ||||||

| Accounts payable - trade | 2,706,078 | 1,544,103 | ||||||

| Accrued expenses | 946,095 | 681,995 | ||||||

| Accrued compensation | 4,505,677 | 3,601,282 | ||||||

| Accrued distributions | 45,756 | – | ||||||

| Accrued interest | 1,031,457 | 849,913 | ||||||

| Obligations under settlement agreement | 582,565 | 582,565 | ||||||

| Total current liabilities | 21,464,066 | 15,911,744 | ||||||

| Long-term liabilities | ||||||||

| Senior notes | 215,617 | 217,451 | ||||||

| Renewable unsecured subordinated notes | 11,375,618 | 10,418,569 | ||||||

| Obligations under settlement agreement | 2,330,260 | 2,524,448 | ||||||

| Total liabilities | 35,385,561 | 29,072,212 | ||||||

| Commitments and contingencies | ||||||||

| Members' (deficit) equity | ||||||||

| Series A preferred equity | 2,745,000 | 2,745,000 | ||||||

| Common equity | (3,955,265 | ) | (193,624 | ) | ||||

| Accumulated other comprehensive income | 548,738 | 146,749 | ||||||

| Total members' (deficit) equity | (661,527 | ) | 2,698,125 | |||||

| Total liabilities and members' (deficit) equity | $ | 34,724,034 | $ | 31,770,337 | ||||

See notes to consolidated financial statements.

| 10 |

Twin Cities Power Holdings, LLC and Subsidiaries

Consolidated Statements of Comprehensive Income

Three Months ended March 31, 2015 and 2014

| Three Months | ||||||||

| Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| Unaudited | Unaudited | |||||||

| Revenue | ||||||||

| Wholesale trading revenue, net | $ | 10,849,696 | $ | 27,021,725 | ||||

| Retail electricity revenue | 5,377,109 | 2,912,526 | ||||||

| 16,226,805 | 29,934,251 | |||||||

| Costs and expenses | ||||||||

| Cost of retail electricity sold | 6,223,221 | 4,602,217 | ||||||

| Retail sales and marketing | 245,899 | 128,442 | ||||||

| Compensation and benefits | 6,196,239 | 11,040,699 | ||||||

| Professional fees | 586,380 | 727,322 | ||||||

| Other general and administrative | 1,236,065 | 904,327 | ||||||

| Trading tools and subscriptions | 327,305 | 219,206 | ||||||

| 14,815,109 | 17,622,213 | |||||||

| Operating income | 1,411,696 | 12,312,038 | ||||||

| Other income (expense) | ||||||||

| Interest expense | (764,013 | ) | (467,765 | ) | ||||

| Interest income | 49,285 | 12,150 | ||||||

| Gain on foreign currency exchange | 95,273 | 368 | ||||||

| Other income | 40,387 | – | ||||||

| (579,068 | ) | (455,247 | ) | |||||

| Net income | 832,628 | 11,856,791 | ||||||

| Distributions - preferred | (137,268 | ) | (137,268 | ) | ||||

| Net income attributable to common | 695,360 | 11,719,523 | ||||||

| Comprehensive income (loss) | ||||||||

| Net income | 832,628 | 11,856,791 | ||||||

| Foreign currency translation adjustment | (51,270 | ) | (75,182 | ) | ||||

| Change in fair value of cash flow hedges | 440,984 | (38,135 | ) | |||||

| Unrealized gain on securities | 12,275 | 11,875 | ||||||

| Comprehensive income | $ | 1,234,617 | $ | 11,755,349 | ||||

See notes to consolidated financial statements.

| 11 |

Twin Cities Power Holdings, LLC and Subsidiaries

Consolidated Statements of Cash Flows

Three Months Ended March 31, 2015 and 2014

| Three Months | ||||||||

| Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| Unaudited | Unaudited | |||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | 832,628 | $ | 11,856,791 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 164,909 | 220,283 | ||||||

| (Increase) decrease in: | ||||||||

| Trading accounts and deposits | 5,510,942 | (8,304,821 | ) | |||||

| Accounts receivable | (3,177,559 | ) | (1,504,740 | ) | ||||

| Prepaid expenses and other current assets | 131,875 | (17,288 | ) | |||||

| Increase (decrease) in: | ||||||||

| Accounts payable - trade | 1,161,975 | (4,920 | ) | |||||

| Accrued expenses | 264,100 | 52,300 | ||||||

| Accrued compensation | 904,395 | 9,362,620 | ||||||

| Accrued interest | 181,544 | 165,269 | ||||||

| Obligations under settlement agreement | (194,188 | ) | – | |||||

| Net cash provided by operating activities | 5,780,621 | 11,825,494 | ||||||

| Cash flows from investing activities | ||||||||

| Repayment of note receivable | – | 140,964 | ||||||

| Purchase of marketable securities | (2,256,014 | ) | (750,715 | ) | ||||

| Purchase of convertible promissory note | (37,501 | ) | (1,003,056 | ) | ||||

| Purchase of property, equipment, and furniture | (124,859 | ) | (25,163 | ) | ||||

| Purchase of land held for development | (211,295 | ) | (22,279 | ) | ||||

| Increase in restricted cash | – | (1,319,371 | ) | |||||

| Acquisition of Discount Energy Group, LLC | – | (680,017 | ) | |||||

| Net cash used in investing activities | (2,629,669 | ) | (3,659,637 | ) | ||||

| Cash flows from financing activities | ||||||||

| Deferred financing costs | (50,579 | ) | – | |||||

| Payments on senior notes | (1,747 | ) | (200,000 | ) | ||||

| Proceeds from revolver | 4,884,000 | – | ||||||

| Payments on revolver | (3,234,445 | ) | – | |||||

| Payment of obligations under non-competition agreement | – | (62,500 | ) | |||||

| Issuance of renewable unsecured subordinated notes | 2,541,679 | 1,939,561 | ||||||

| Redemption of renewable unsecured subordinated notes | (717,106 | ) | (136,666 | ) | ||||

| Distributions - preferred | (91,512 | ) | (137,268 | ) | ||||

| Distributions - common | (4,457,000 | ) | (1,401,080 | ) | ||||

| Net cash provided by (used in) financing activities | (1,126,710 | ) | 2,047 | |||||

| Net increase in cash | 2,024,242 | 8,167,904 | ||||||

| Effect of exchange rate changes on cash | (25,537 | ) | (75,180 | ) | ||||

| Cash - unrestricted | ||||||||

| Beginning of period | 2,397,300 | 3,190,495 | ||||||

| End of period | $ | 4,396,005 | $ | 11,283,219 | ||||

See notes to consolidated financial statements.

| 12 |

Twin Cities Power Holdings, LLC and Subsidiaries

Consolidated Statements of Cash Flows (Continued)

Three Months Ended March 31, 2015 and 2014

| Three Months | ||||||||

| Ended March 31, | ||||||||

| 2015 | 2014 | |||||||

| Unaudited | Unaudited | |||||||

| Non-cash investing and financing activities: | ||||||||

| Effective portion of cash flow hedges | $ | (422,424 | ) | $ | 318,479 | |||

| Accrued distributions - preferred | $ | 45,756 | $ | – | ||||

| Acquisition of land for development via assignment and assumption agreement | $ | 477,386 | $ | – | ||||

| Unrealized gain on investment securities | $ | 12,275 | $ | 11,875 | ||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash payments for interest | $ | 596,595 | $ | 302,496 | ||||

| Capitalized interest related to land held for development | $ | 5,255 | $ | – | ||||

See notes to consolidated financial statements.

| 13 |

Twin Cities Power Holdings, LLC and Subsidiaries

Notes to Consolidated Financial Statements

| 1. | Basis of Presentation and Description of Business |

Basis of Presentation

Twin Cities Power Holdings, LLC (“TCPH” or the “Company”) has prepared the foregoing unaudited consolidated financial statements in accordance with GAAP and the requirements of the SEC with respect to interim reporting. As permitted under these rules, certain footnotes and other financial information required by GAAP for complete financial statements have been condensed or omitted. The interim consolidated financial statements include all normal and recurring adjustments that are necessary for a fair presentation of our financial position and operating results and include the accounts of TCPH and its subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

For additional information, please refer to our audited consolidated financial statements and the accompanying notes for the years ended December 31, 2014 and 2013 included in our 2014 Form 10-K.

Businesses

TCPH is a Minnesota limited liability company formed on December 30, 2009. On November 14, 2011, TCPH entered into an Agreement and Plan of Reorganization (the “Reorganization”) with its then current members and Twin Cities Power, LLC (“TCP”), Cygnus Partners, LLC (“CP”), and Twin Cities Energy, LLC (“TCE”) which were affiliated through common ownership. Effective December 31, 2011, following receipt of approval from the Federal Energy Regulatory Commission (“FERC”), the members of TCP, CP, and TCE each contributed all of their ownership interests in these entities to TCPH in exchange for ownership interests in TCPH, which made TCPH a holding company and the sole member of each of TCP, CP, and TCE. The Reorganization was accounted for as a transaction among entities under common control.

Subsequent to the Reorganization, the Company formed two active first-tier subsidiaries, Retail Energy Holdings, LLC (“REH”) and Cyclone Partners LLC (“Cyclone”) and TCE and its wholly-owned subsidiary, Twin Cities Power – Canada, Ltd., became inactive. On October 27, 2014, the Company formed Apollo Energy Services, LLC (“Apollo”) as a wholly-owned subsidiary for the purpose of providing centralized services to the Company’s various other subsidiaries. Substantially all of the management rights and certain of the direct employees of TCPH were transferred to Apollo as of January 1, 2015.

With respect to active second-tier subsidiaries, as of March 31, 2015, TCP had two, Summit Energy, LLC (“SUM”) and Chesapeake Trading Group, LLC (“CTG”); CP had one, Cygnus Energy Futures, LLC (“CEF”); and REH had three, Town Square Energy, LLC (“TSE”), Town Square Energy East, LLC (“TSEE” formerly known as Discount Energy Group, LLC or “DEG”), and Town Square Energy Canada, Ltd. (“TSEC”).

Through its subsidiaries, the Company trades electricity in North American wholesale markets, provides electricity supply services to retail customers in certain states that permit retail choice, and engages in certain investment and real estate development activities. Consequently, we have three major business segments used to measure our activity – wholesale trading, retail energy services, and diversified investments.

| 14 |

Wholesale Trading

The Company trades contracts in wholesale electricity markets managed by Independent System Operators or Regional Transmission Organizations (collectively, the “ISOs”) and regulated by FERC, including those managed by the Midcontinent Independent System Operator (“MISO”), the PJM Interconnection (“PJM”), ISO New England (“ISO-NE”), and the New York Independent System Operator (“NYISO”). We also are members of the Electric Reliability Council of Texas (“ERCOT”) which is an ISO regulated by the Texas Public Utilities Commission and the Texas Legislature. The Company also trades electricity and other energy-related commodities and derivatives on exchanges operated by the Intercontinental Exchange® (“ICE”), the Natural Gas Exchange Inc. (“NGX”), and the CME Group (“CME”), all of which are regulated the Commodity Futures Trading Commission (“CFTC”).

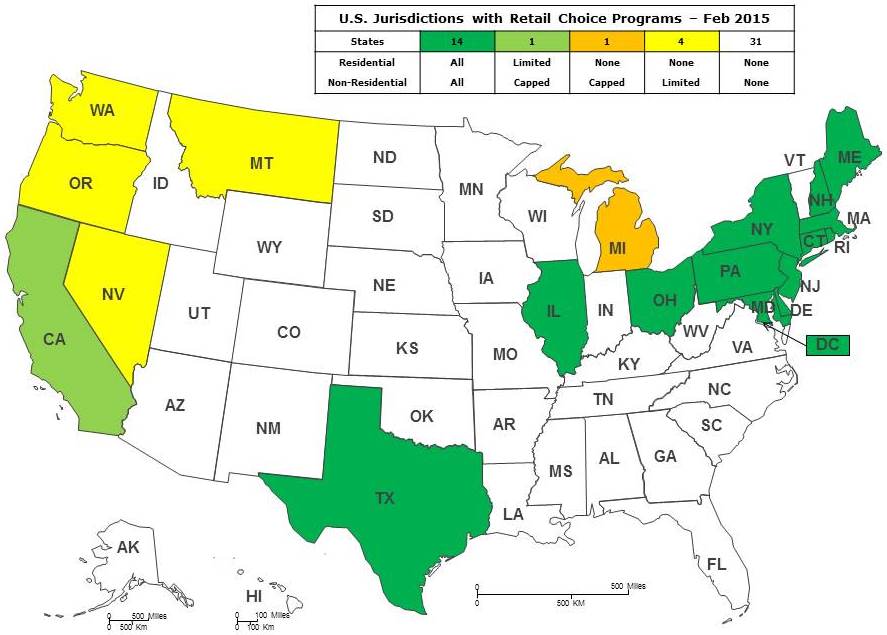

Retail Energy Services

On June 29, 2012, TCP acquired certain assets and the business of Community Power & Utility LLC, a retail energy supplier serving residential and small commercial markets in Connecticut. The business was re-named TSE, and beginning on July 1, 2012, the Company began selling electricity to retail accounts. Initially, TSE was run as a division of TCP but effective June 1, 2013, TSE was reorganized as a wholly-owned subsidiary of the Company. During late 2012 and early 2013, TSE applied for retail electricity supplier licenses for the states of Massachusetts, New Hampshire, and Rhode Island which were issued on various dates in 2013.

On October 25, 2013, in anticipation of receipt of FERC approval of the Company’s acquisition of TSEE formerly known as DEG, a retail energy business licensed by the states of Maryland, New Jersey, Pennsylvania, and Ohio, the Company formed REH and transferred the ownership of TSE to this entity. FERC approval of the acquisition was received on December 13, 2013 and the transaction closed on January 2, 2014. Consequently, the retail markets in which the Company competes include: Connecticut, Maryland, Massachusetts, New Hampshire, New Jersey, Pennsylvania, Ohio, and Rhode Island.

Diversified Investments

On October 23, 2013, the Company formed Cyclone as a wholly-owned subsidiary to take advantage of certain investment opportunities present in the residential real estate market. Specifically, Cyclone acquires and develops land for resale, either as improved sites for construction of single- and multi-family homes or as completed dwellings. In addition to real estate investments, the Company’s diversified investments segment includes certain securities issued by privately-held companies.

| 2. | Summary of Significant Accounting Policies |

A description of our significant accounting policies is included in the 2014 Form 10-K and our interim consolidated financial statements should be read in conjunction with the financial statements and accompanying notes included in that report.

Results for the three month period ended March 31, 2015 are not necessarily indicative of the results expected for the year ending December 31, 2015.

| 15 |

Cash Equivalents

Cash equivalents include highly liquid investments with an original maturity of three months or less at the time of purchase. As of March 31, 2015 and December 31, 2014, the Company had no cash equivalents.

Reclassifications

Certain amounts reported in prior periods have been reclassified to conform to the current period’s presentation. There was no effect on members’ equity or net income as previously reported.

Revenue Recognition

Wholesale Trading

The Company’s wholesale trading activities use derivatives such as swaps, forwards, futures, and options to generate trading revenues. These contracts are marked to fair value in the accompanying consolidated balance sheets. The Company’s agreements with the ISOs and the exchanges permit net settlement of contracts, including the right to offset cash collateral in the settlement process. Accordingly, the Company nets cash collateral against the derivative position in the accompanying consolidated balance sheets. All realized and unrealized gains and losses on derivative instruments held for trading purposes are recorded in revenues.

Retail Energy Services

Revenue from the retail sale of electricity to customers is recorded in the period in which the commodity is consumed, net of any applicable sales tax. The Company follows the accrual method of accounting for revenues whereby electricity consumed by customers but not yet billed under the cycle billing method is estimated and accrued along with the related costs. Changes in estimates are reflected in operations in the period in which they are refined.

Diversified Investments

Revenues from real estate developments, if any, are recognized at the time of sale closing if all significant conditions are satisfied, including adequate down payment, reasonable assurance of collectability of any notes received, and completion of other contract requirements. Recognition of all or part of the revenue is deferred if any significant conditions are not satisfied.

Derivative Instruments

In our wholesale operations, we use derivative contracts for trading purposes, seeking to profit from perceived opportunities driven by expected changes in market prices. In our retail business, the Company is exposed to volatility in the cost of energy acquired for sale to customers, and as a result, we use derivatives to hedge or reduce this variability.

In our retail operations, we are exposed to volatility in the cost of energy acquired for sale to customers, and as a result, we use derivatives to hedge or reduce this variability. We follow ASC 815, Derivatives and Hedging (“ASC 815”) guidance that permits “hedge accounting” under which the effective portion of gains or losses from the derivative and the hedged item are recognized in earnings in the same period. To qualify for hedge accounting, the relationship between the “hedged item” - say power purchases for a given delivery zone - and a derivative used as a “hedging instrument” - say, a swap contract for future delivery of electricity at a related hub - must meet extensive documentation requirements and hedge effectiveness and ineffectiveness must be assessed and measured on an on-going basis.

| 16 |

For these derivatives “designated” as cash flow hedges, the effective portion of any change in the hedging instrument’s fair value is recorded as other comprehensive income and deferred until the change in value of the hedged item is recognized in earnings. Our risk management policies also permit the use of undesignated derivatives which we refer to as “economic hedges”. For an undesignated economic hedge, all changes in the derivative financial instrument’s fair value are recognized currently in revenues.

“Hedge effectiveness” is the extent to which changes in the fair value of the hedging instrument offset the changes in the cash flows of the hedged item. Conversely, “hedge ineffectiveness” is the measure of the extent to which the change in fair value of the hedging instrument does not offset those of the hedged item. If a transaction qualifies as a “highly effective” hedge, ASC 815 permits matching of the timing of gains and losses of the hedged item and the hedging instrument.

For a cash flow hedge, the effective portion of any change in the hedging instrument’s fair value is recorded as other comprehensive income until the change in value of the hedged item is recognized in earnings.

Financial Instruments

The Company holds various financial instruments. The nature of these instruments and the Company’s operations expose the Company to foreign currency risk, credit risk, and fair value risk.

Foreign Currencies

A portion of the Company’s assets and liabilities are denominated in Canadian dollars and are subject to fluctuations in exchange rates. The Company does not have any exposure to any highly inflationary foreign currencies.

For foreign subsidiaries whose functional currency is the local foreign currency, balance sheet accounts are translated at exchange rates in effect at the end of the month and income statement accounts are translated at average monthly exchange rates for the period. Foreign currency transactions denominated in a foreign currency result in gains and losses due to the increase or decrease in exchange rates between periods. Translation gains and losses are included in accumulated other comprehensive income, as a separate component of equity. Gains and losses from foreign currency transactions are included in other income or expense. Foreign currency transactions resulted in gains of $95,273 and $368 for the three months ended March 31, 2015 and 2014, respectively.

Concentrations of Credit Risk

Financial instruments that subject the Company to concentrations of credit risk consist principally of deposits in trading accounts and accounts receivable. The Company has a risk policy that includes value-at-risk calculations, position limits, stop loss limits, stress testing, system controls, position monitoring, liquidity guidelines, and compliance training.

At any given time there may be a concentration of receivables balances with one or more of the exchanges upon which we transact our wholesale business or, in the case of retail, one or more of the utilities operating in purchase-of-receivables states in which we do business.

| 17 |

Fair Value

The fair values of the Company’s cash, accounts receivable, accounts payable, and revolver were considered to approximate their carrying values at March 31, 2015 and December 31, 2014 due to the short-term nature of the accounts.

Management believes the carrying values of the Company’s Renewable Unsecured Subordinated Notes reasonably approximate their fair values at March 31, 2015 and December 31, 2014 due to the relatively new age of these particular instruments. No assessment of the fair value of these obligations has been completed and there is no readily available market price.

See also “Note 7 – Fair Value Measurements”.

Accounts Receivable

Receivables are reported at the amount management expects to collect from outstanding balances. Differences between amounts due and expected collections are reported in the results of operations for the period in which those differences are determined. Receivables are written off only after collection efforts have failed, and the Company typically does not charge interest on past due accounts. There was no allowance for doubtful accounts as of March 31, 2015 and December 31, 2014.

Business Combinations

The Company accounts for business combinations in accordance with ASC 805, Business Combinations (“ASC 805”), which requires an acquirer to recognize and measure in its financial statements the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquisition at fair value at the transaction date. In addition, transaction costs are expensed as incurred. See “Note 8 - Intangible Assets”.

Impairment of Long-Lived Assets

The Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset group to future net undiscounted cash flows expected to be generated by the asset group. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of, if any, are reported at the lower of the carrying amount or fair value less costs to sell. To date, the Company has determined that no impairment of long-lived assets exists.

Profits Interests

Specific second-tier subsidiaries of the Company have Class B members. Under the terms of the subsidiaries’ member control agreements, Class B members have no voting rights, are not required to contribute capital, and have no rights to distributions following termination of employment, but are entitled to a defined share of profits while employed. Since Class B members have no corporate governance rights or risk of capital loss (or gain), they do not own non-controlling equity interests and profits interests payments are recorded as compensation expense during the period earned and are classified as accrued compensation on the balance sheet.

During the three months ended March 31, 2015 and 2014, the Company included $1,766,527 and $5,186,635, respectively, recorded in compensation and benefits on the consolidated statements of comprehensive income, representing the allocation of profits interests to Class B members.

Income Taxes

The Company and its subsidiaries are not taxable entities for U.S. federal income tax purposes. As such, the Company and its subsidiaries do not directly pay federal income tax. Taxable income or loss, which may vary substantially from the net income or net loss reported in our consolidated statements of comprehensive income, is includable in the federal income tax returns for each member. The holder of the Company’s preferred units is taxed based on distributions received, while holders of common units are taxed on their proportionate share of the Company’s taxable income. Therefore, no provision or liability for federal or state income taxes has been made for those entities.

| 18 |

TCPC files tax returns with the Canada Revenue Agency and the Tax and Revenue Administration of Alberta.

In accounting for uncertainty in income taxes, we recognize the financial statement benefit of a tax position only after determining that the relevant tax authority would more likely than not sustain the position following an audit. The Company recognizes interest and penalties on any unrecognized tax benefits as a component of income tax expense. Based on evaluation of the Company’s tax positions, management believes all positions taken would be upheld under an examination.

The Company’s federal and state tax returns are potentially open to examinations for the years 2011 through 2014 and its Canadian tax returns are potentially open to examination for the years 2011 through 2014.

On January 6, 2014, TCPH received a notice from the Internal Revenue Service notifying that the Company’s 2012 return was under review. On July 31, 2014, the Company was informed by the IRS that its 2012 return was accepted with no adjustments.

New Accounting Pronouncements

In April 2015, FASB issued a proposal for a one-year deferral of the effective date for Accounting Standards Update 2014-09 Revenue from Contracts with Customers (Topic 606) ("ASU 2014-09"). Originally, in May 2014, the FASB issued new accounting guidance related to revenue recognition. This new standard will eliminate all industry-specific guidance and replace all current U.S. GAAP guidance on the topic. The new revenue recognition standard provides a unified model to determine when and how revenue is recognized. The core principle is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration for which the entity expects to be entitled in exchange for those goods or services. The Company was originally required to adopt the standard on January 1, 2017. Subsequently, the FASB proposed a one-year deferral of the effective date for this standard. If the deferral is adopted, the Company would now be required to adopt the standard on January 1, 2018. Early application is not permitted. The update may be applied using one of two methods: retrospective application to each prior reporting period presented, or retrospective application with the cumulative effect of initially applying the update recognized at the date of initial application. We are currently assessing the impact on the Company’s consolidated financial statements.

In April 2015, the FASB issued ASU 2015-03, Interest – Imputation of Interest (Topic 835) (“ASU 2015-03”) simplifying the presentation of debt issuance costs. The new guidance requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability. The recognition and measurement guidance for debt issuance costs are not affected by the new guidance. This guidance is effective for annual and interim periods beginning after December 15, 2015, and early adoption is permitted for financial statements that have not been previously issued. The Company is currently evaluating the impact of ASU 2015-03 on the Company’s consolidated financial position and disclosures.

| 3. | Cash |

The Company deposits its unrestricted cash in financial institutions. Balances, at times, may exceed federally insured limits.

Restricted cash at March 31, 2015 and December 31, 2014 was $1,319,371. All restricted cash was posted as security in connection with certain litigation in the Canadian courts. See “Note 15 - Commitments and Contingencies”.

| 19 |

Cash held in trading accounts may be unavailable at times for immediate withdrawal depending upon trading activity. Cash needed to meet credit requirements for outstanding trades and that was available for immediate withdrawal as of March 31, 2015 and December 31, 2014 was as follows:

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Credit requirement | $ | 3,691,230 | $ | 6,113,160 | ||||

| Available credit | 12,312,731 | 14,986,492 | ||||||

| Cash in trading accounts | $ | 16,003,961 | $ | 21,099,652 | ||||

| 4. | Accounting for Derivatives and Hedging Activities |

The following table lists the fair values

of the Company’s derivative assets and liabilities as of March 31, 2015 and December 31, 2014:

| Fair Value | ||||||||

| Asset Derivatives | Liability Derivatives | |||||||

| At March 31, 2015 | ||||||||

| Designated as cash flow hedges: | ||||||||

| Energy commodity contracts | $ | 51,728 | $ | (474,152 | ) | |||

| Not designated as hedging instruments: | ||||||||

| Energy commodity contracts | 2,062,643 | (2,262,177 | ) | |||||

| FTRs | 539,838 | – | ||||||

| Total derivative instruments | 2,654,209 | (2,736,329 | ) | |||||

| Cash deposits in collateral accounts | 16,086,081 | – | ||||||

| Cash in trading accounts, net | $ | 18,740,290 | $ | (2,736,329 | ) | |||

| At December 31, 2014 | ||||||||

| Designated as cash flow hedges: | ||||||||

| Energy commodity contracts | $ | 15,732 | $ | (879,140 | ) | |||

| Not designated as hedging instruments: | ||||||||

| Energy commodity contracts | 2,350,662 | (2,556,862 | ) | |||||

| FTRs | 1,435,819 | – | ||||||

| Total derivative instruments | 3,802,213 | (3,436,002 | ) | |||||

| Cash deposits in collateral accounts | 20,733,441 | – | ||||||

| Cash in trading accounts, net | $ | 24,535,654 | $ | (3,436,002 | ) | |||

As of March 31, 2015, we had hedged the cost of 45,912 MWh (approximately 25% of expected 2015 electricity purchases for the customers receiving service from us as of that date) and $422,424 of the net loss on the effective portion of the hedge was deferred and included in AOCI. This amount is expected to be reclassified to cost of retail electricity sold by December 31, 2015.

As of December 31, 2014, we had hedged the cost of 48,947 MWh (approximately 10.5% of expected 2015 electricity purchases for the customers receiving service from us as of that date) and $863,408 of the net loss on the effective portion of the hedge was deferred and included in AOCI. This amount is expected to be reclassified to cost of retail electricity sold by December 31, 2015.

| 20 |

The following table summarizes the amount of gain or loss recognized in AOCI or earnings for derivatives designated as cash flow hedges for the periods indicated:

| Gain (Loss) Recognized in AOCI | Income Statement Classification | Gain (Loss) Reclassified from AOCI | ||||||||

| Three Months Ended March 31, 2015 | ||||||||||

| Cash flow hedges | $ | (34,624 | ) | Cost of energy sold | $ | (475,608 | ) | |||

| Year Ended December 31, 2014 | ||||||||||

| Cash flow hedges | $ | (1,128,514 | ) | Cost of energy sold | $ | 91,508 | ||||

The following table provides details with respect to changes in AOCI as presented in our consolidated balance sheets, including those relating to our designated cash flow hedges, for the period from December 31, 2014 to March 31, 2015:

| Foreign Currency | Cash Flow Hedges | Available for Sale Securities | Total | |||||||||||||

| Balance - December 31, 2014 | $ | 999,041 | $ | (863,408 | ) | $ | 11,116 | $ | 146,749 | |||||||

| Other comprehensive income (loss) before reclassifications | (51,270 | ) | (34,624 | ) | 12,275 | (73,619 | ) | |||||||||

| Amounts reclassified from AOCI | – | 475,608 | – | 475,608 | ||||||||||||

| Net current period other comprehensive income (loss) | (51,270 | ) | 440,984 | 12,275 | 401,989 | |||||||||||

| Balance - March 31, 2015 | $ | 947,771 | $ | (422,424 | ) | $ | 23,391 | $ | 548,738 | |||||||

| 5. | Accounts Receivable |

Accounts receivable – trade consists of receivables from both our wholesale trading and retail segments. Wholesale trading receivables represent net settlement amounts due from a market operator or an exchange while those from retail include amounts resulting from sales to end-use customers.

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Wholesale trading | $ | 1,529,723 | $ | 515,999 | ||||

| Retail energy services - billed | 2,529,082 | 1,158,019 | ||||||

| Retail energy services - unbilled | 1,513,000 | 720,228 | ||||||

| Accounts receivable - trade | $ | 5,571,805 | $ | 2,394,246 | ||||

As of March 31, 2015, there were two accounts, each with a balance greater than 10% of the total, summing to 64% of all receivables - one account in the wholesale segment represented 17% of the total and one in the retail energy services segment equaled 47% of all receivables.

As of December 31, 2014, there were two individual accounts with receivable balances greater than 10%; one in the wholesale segment, representing 21% of the balance at year end, and one in the retail energy services segment, representing 44% of the balance at year end.

The Company believes that any risk associated with these concentrations is minimal.

| 21 |

| 6. | Marketable Securities |

The following table shows the cost and estimated fair value of available-for-sale securities at March 31, 2015 and December 31, 2014:

| Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | |||||||||||||

| At March 31, 2015 | ||||||||||||||||

| U.S. equities | $ | 548,756 | $ | 23,391 | $ | – | $ | 572,147 | ||||||||

| Money market fund | 2,007,728 | – | – | 2,007,728 | ||||||||||||

| Total | $ | 2,556,484 | $ | 23,391 | $ | – | $ | 2,579,875 | ||||||||

| At December 31, 2014 | ||||||||||||||||

| U.S. equities | $ | 299,836 | $ | 11,116 | $ | – | $ | 310,952 | ||||||||

| Money market fund | 634 | – | – | 634 | ||||||||||||

| Total | $ | 300,470 | $ | 11,116 | $ | – | $ | 311,586 | ||||||||

For the quarter ended March 31, 2015, the Company had no sales of securities, and recognized no impairment charges.

For the year ended December 31, 2014, the Company had sales of securities and realized a gain of $65,655, and recognized no impairment charges.

As of March 31, 2015 and December 31, 2014, the Company had no securities that were in an unrealized loss positions.

| 7. | Fair Value Measurements |

The Fair Value Measurement Topic of FASB’s ASC establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The three types of valuation inputs in the fair market hierarchy are as follows:

| · | “Level 1 inputs” are quoted prices in active markets for identical assets or liabilities. |

| · | “Level 2 inputs” are inputs other than quoted prices that are observable either directly or indirectly for the asset or liability. |

| · | “Level 3 inputs” are unobservable inputs for which little or no market data exists. |

Financial instruments categorized as Level 1 holdings are publicly traded in liquid markets with daily quotes and include exchange-traded derivatives such as futures contracts and options, certain highly-rated debt obligations, and some equity securities. Holdings such as shares in money market mutual funds that are based on net asset values as derived from quoted prices in active markets of the underlying securities are also classified as Level 1.

The fair values of financial instruments that are not publicly traded in liquid markets, but do have characteristics similar to observable market information such as wholesale commodity prices, interest rates, credit margins, maturities, collateral, and the like upon which valuations are based are categorized in Level 2.

| 22 |

Financial instruments that are not traded in publicly quoted markets or that are acquired based on prices and terms determined by direct negotiation with the issuer are classified as Level 3. Level 3 securities are carried at book value which management believes approximates fair value, until circumstances otherwise dictate while Level 3 derivatives are adjusted to fair value based on appropriate mark-to-model methodologies.

Generally, with respect to valuation of Level 3 instruments, significant changes in inputs will result in higher or lower fair value measurements, any particular calculation or valuation methodology may produce estimates that may not be indicative of net realizable value or reflective of future fair values, and such variations could be material.

From time to time, the Company may engage third parties such as appraisers, brokers, or investment bankers to assist management in its valuation and classification of financial instruments.

There have been no changes in the methodologies used since December 31, 2014.

The following table presents certain assets measured at fair value on a recurring basis as of the dates indicated:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| At March 31, 2015 | ||||||||||||||||

| Cash in trading accounts, net | $ | 15,464,123 | $ | – | $ | – | $ | 15,464,123 | ||||||||

| FTR positions, net | – | – | 539,838 | 539,838 | ||||||||||||

| Marketable securities | 2,579,875 | – | – | 2,579,875 | ||||||||||||

| Investment in convertible notes | – | – | 1,642,380 | 1,642,380 | ||||||||||||

| At December 31, 2014 | ||||||||||||||||

| Cash in trading accounts, net | $ | 19,663,833 | $ | – | $ | – | $ | 19,663,833 | ||||||||

| FTR positions, net | – | – | 1,435,819 | 1,435,819 | ||||||||||||

| Marketable securities | 311,586 | – | – | 311,586 | ||||||||||||

| Investment in convertible notes | – | – | 1,604,879 | 1,604,879 | ||||||||||||

There were no transfers during the three months ended March 31, 2015 between Levels 1 and 2.

Level 3 Assets

The following table reconciles beginning and ending Level 3 fair value financial instrument balances for the three months ended March 31, 2015:

| Balance - December 31, 2014 | $ | 3,040,698 | ||

| Total gains and losses: | ||||

| Included in other comprehensive income | – | |||

| Included in earnings | (895,981 | ) | ||

| Purchases | 37,501 | |||

| Sales | – | |||

| Transfers into Level 3 | – | |||

| Transfers out of Level 3 | – | |||

| Balance - March 31, 2015 | $ | 2,182,218 | ||

| Losses for the period included in earnings attributable to the change in unrealized gains or losses relating to assets still held as of March 31, 2015 | $ | (895,981 | ) |

| 23 |

| 8. | Intangible Assets |

On June 29, 2012, TCP acquired certain assets and the business of Community Power & Utility LLC (“CP&U”), a retail energy supplier serving residential and small commercial markets in Connecticut, for $160,000. The business has been re-named “Town Square Energy” and is now a wholly-owned second-tier subsidiary of the Company. Of the purchase price, $85,000 was allocated to the acquisition of an existing service contract with an industry-specific provider of transaction management, billing, and customer information software and services, and $75,000 was allocated to customer relationships. The purchase price will be amortized over 36 months using the straight line method.

Effective January 1, 2013, in connection with the sale of his units to Timothy S. Krieger, the Company’s founder, Chairman, Chief Executive Officer, and controlling member, the Company entered into a Non-Competition Agreement (the “NCA”) with David B. Johnson, a current governor of the Company valued at $500,000, to be amortized and paid in equal installments over 24 months.

On January 2, 2014, the Company acquired 100% of the outstanding membership interests of Discount Energy Group, LLC (“DEG”) for a total purchase price of $848,527, consisting of $680,017 in cash and $168,510 in assumption of accounts payable. Of this total consideration, $293,869 was allocated to tangible assets including deposits with PJM and certain utilities and prepaid expenses and $554,658 was allocated to intangible assets. Intangible assets acquired included state licenses and utility relationships, the DEG brand name, a fully functional website, active and inactive customer lists, and domain names. The intangible assets will be amortized over 24 months using the straight line method.

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Other intangibles | $ | 714,658 | $ | 714,658 | ||||

| Non-competition agreement | – | 500,000 | ||||||

| Less: accumulated amortization | (522,555 | ) | (945,509 | ) | ||||

| Intangible assets, net | $ | 192,103 | $ | 269,149 | ||||

Total amortization of intangible assets for the three months ended March 31, 2015 and the year ended December 31, 2014 was $77,046 and $591,487, respectively and is included in other general and administrative expenses.

| 9. | Deferred Financing Costs |

Prior to the May 10, 2012 effective date of its Notes Offering, the Company incurred certain professional fees and filing costs associated with the offering totaling $393,990. The Company has capitalized these costs and amortizes them on a monthly basis over the weighted average term of the Notes sold, exclusive of any expected renewals. During the three month period ended March 31, 2015 the Company incurred $50,579 in professional fees for the purpose of renewing its public offering. The costs will be amortized when the filing is effective with the SEC.

On October 14, 2014, the Company entered into a credit agreement with a bank and $35,000 of the associated transaction costs were capitalized and will be amortized over 24 months.

| March 31, | December 31, | |||||||

| 2015 | 2014 | |||||||

| Deferred financing costs | $ | 479,569 | $ | 428,990 | ||||

| Less: accumulated amortization | (233,945 | ) | (187,246 | ) | ||||

| Deferred financing costs | $ | 245,624 | $ | 241,744 | ||||

Total amortization of deferred financing costs for the three months ended March 31, 2015 and the year ended December 31, 2014 was $46,699 and $130,815, respectively and is included in other general and administrative expenses.

| 24 |

| 10. | Land Held for Development; Mortgage Receivable |

As of March 31, 2015 and December 31, 2014 land held for development consisted of $1,642,143 and $953,462, respectively.

On January 26, 2015, Cyclone closed on the purchase of a single family home located in New Prague, Minnesota for a price of $198,650, paid in cash. On April 13, 2015, the property was sold to a related party, CEO Tim Krieger, from Cyclone for a price of $197,382.

| 11. | Convertible Promissory Note |

During 2014, the Company invested $1,500,000 in privately placed Series C Convertible Promissory Notes issued by Ultra Green Packaging, Inc. (“Ultra Green”). Ultra Green develops, manufactures, and markets “ecopaper” products made from wheat straw, bamboo, or sugarcane fibers and bioplastic products made from cornstarch. Ultra Green’s ecopaper and bioplastic products are certified as biodegradable and sustainable, and are compostable in about 160 days.

In addition to its cash investments as described above, the Company has lent the services of Mr. Keith Sperbeck, its Vice President – Operations, to Ultra Green as its Interim CEO for an indefinite period concluding when Ultra Green hires a full-time chief executive officer. In lieu of any cash compensation to either Mr. Sperbeck or the Company, on June 19, 2014, Ultra Green issued the Company a non-statutory option to purchase 50,000,000 shares of its common stock for $0.01 per share, which option was fully vested and exercisable immediately upon issuance.

The C Notes will mature on December 31, 2019 and bear interest at a fixed rate of 10% per annum. Interest will accrue until June 30, 2015, at which time all accrued and unpaid interest will become due and payable. Thereafter, interest will be due and payable on a quarterly basis. Each dollar of C Note principal and accrued but unpaid interest is ultimately convertible into 100 shares of Ultra Green’s common stock.

| 25 |

| 12. | Debt |

Notes payable by the Company are summarized

as follows:

| March 31, 2015 | December 31, 2014 | |||||||

| Demand and Revolving Debt | ||||||||

| Payable to ABN AMRO | $ | – | $ | – | ||||

| Payable to Royal Bank of Canada | – | – | ||||||

| Revolving note payable to Maple Bank | 2,754,814 | 1,105,259 | ||||||

| Subtotal | 2,754,814 | 1,105,259 | ||||||

| Term Debt | ||||||||

| Mortgage note payable to Security State Bank | 222,820 | 224,568 | ||||||

| Mortgage note payable to Lakeview Bank | 119,976 | 119,976 | ||||||

| Construction note payable to American Land & Capital | 662,362 | 184,975 | ||||||

| Renewable unsecured subordinated notes | 19,477,701 | 17,653,128 | ||||||

| Subtotal | 20,482,859 | 18,182,647 | ||||||

| Total | $ | 23,237,673 | $ | 19,287,906 | ||||

Notes payable by maturity are summarized as follows:

| March 31, 2015 | December 31, 2014 | |||||||

| Demand and Revolving Debt | ||||||||

| Demand | $ | – | $ | – | ||||

| 2016 | 2,754,814 | 1,105,259 | ||||||

| Subtotal | 2,754,814 | 1,105,259 | ||||||

| Term Debt | ||||||||

| 2015 | 7,135,966 | 7,546,627 | ||||||

| 2016 to March 31 | 1,755,658 | – | ||||||

| Current maturities | 8,891,624 | 7,546,627 | ||||||

| 2016 after March 31 | 2,433,730 | – | ||||||

| 2016 | – | 2,648,150 | ||||||

| 2017 | 3,047,249 | 2,869,383 | ||||||

| 2018 | 3,302,387 | 2,642,972 | ||||||

| 2019 | 1,223,227 | 1,213,227 | ||||||

| 2020 & thereafter | 1,584,642 | 1,262,288 | ||||||

| Long term debt | 11,591,235 | 10,636,020 | ||||||

| Subtotal | 20,482,859 | 18,182,647 | ||||||

| Total | $ | 23,237,673 | $ | 19,287,906 | ||||

ABN-AMRO Margin Agreement

In February 2012, the Company executed a Futures Risk-Based Margin Finance Agreement (“Margin Agreement”) with ABN AMRO. The Margin Agreement provides CEF with an uncommitted $25,000,000 revolving line of credit on which it pays a commitment fee of $35,000 per month. Any loans outstanding are payable on demand and bear interest at an annual rate equal to 1.00% in excess of the Federal Funds Target Rate, or approximately 1.25%. The Margin Line is secured by all balances in CEF’s trading accounts with ABN AMRO. Under the Margin Agreement, the Company is also subject to certain reporting, affirmative, and negative covenants, including certain financial tests. The Margin Agreement was amended on May 31, 2013 to reduce the uncommitted credit line to $15,000,000, the commitment fee to $25,000 per month, and the covenant with respect to net liquidating equity as defined to $1,500,000.

As of March 31, 2015 and December 31, 2014, there were no borrowings outstanding under the Margin Agreement and the Company was in compliance with all covenants.

| 26 |

RBC Line of Credit

On May 12, 2014, the Company drew $700,000 under an evergreen, uncommitted line of credit from Royal Bank of Canada (the “RBC Line” and “RBC”, respectively). Advances under the RBC Line bear interest at a variable annual interest rate of 1 month LIBOR plus 2.25% set at the time of advance for a 30 day term, mature at various dates, and are collateralized by assets held in the Company’s marketable securities account. RBC is not obligated to make any extensions of credit to the Company and availability of funds may be increased or decreased by RBC in its sole and absolute discretion. Prepayment of any outstanding principal under the RBC Line may subject the Company to LIBOR break funding costs.

As of March 31, 2015 and December 31, 2014, there were no borrowings outstanding under the RBC Line and the Company was in compliance with all terms and conditions.

Maple Bank Revolver

On October 14, 2014, REH, TSE, and DEG entered into a Credit Agreement with the Toronto, Ontario branch of Maple Bank GmbH (the “Maple Agreement” and “Maple Bank”), expiring October 31, 2016. The Maple Agreement provides the Company’s retail energy services businesses with a revolving line of credit of up to $5,000,000 in committed amount secured by a first position security interest in all of the assets, a pledge of the equity of such companies by TCPH, and certain guarantees. Availability of loans is keyed to advance rates against certain eligible receivables as defined. Any loans outstanding bear interest at an annual rate equal to 3 month LIBOR, subject to a floor of 0.50%, plus a margin of 6.00%. In addition, the Company is obligated to pay an annual fee of 1.00% of the committed amount on a monthly basis and a monthly non-use fee of 1.00% of the difference between the committed amount and the average daily principal balance of any outstanding loans. The Company is also subject to certain reporting, affirmative, and negative covenants.

As of March 31, 2015, there was $2,754,814 outstanding under the Maple Agreement and the Company was in compliance with all covenants.

Security State Mortgage

On June 16, 2014, the Company purchased a single family home in Garrison, Minnesota for use as a corporate retreat (the “Garrison Property”) for a purchase price of $285,000, paid with $57,000 of cash and the proceeds of a $228,000 note (the “Security State Mortgage”) advanced by the Security State Bank of Aitkin (“Security State Bank”) and secured by a first mortgage. The loan is payable in 239 equal installments of $1,482 due on the 16th of each month beginning on July 16, 2014 and one irregular installment of $1,482 due on June 16, 2034 (the “maturity date”). The note bears interest at an annual rate equal to the prime rate as published from time to time by The Wall Street Journal plus 0.75%, subject to a floor of 4.75%. Whenever increases occur in the interest rate, Security State, at its option and with notice to the Company, may: (a) increase the Company’s payments to insure the loan will be paid off by the maturity date; (b) increase the Company’s payments to cover accruing interest; (c) increase the number of the Company’s payments; or (d) continue the payments at the same amount and increase the Company’s final payment. The loan may be prepaid in whole or in part at any time without penalty.

As of March 31, 2015 the Company was in compliance with all terms and conditions of the Security State Mortgage.

| 27 |

Lakeview Bank Mortgage

On December 23, 2014, via an assignment and assumption agreement between Cyclone and Kenyon Holdings, LLC (“Kenyon”), a related party, Cyclone took ownership of a 10 acre parcel of undeveloped land located at 170xx Texas Avenue, Credit River Township, Minnesota and assumed a note secured by a mortgage on the property and owed to Lakeview Bank (the “Lakeview Bank Mortgage”). Kenyon is owned by Mr. Krieger, the Company’s primary owner and its Chief Executive Officer, and Keith W. Sperbeck, the Company’s Vice President of Operations. The Lakeview Bank Mortgage bears interest at the highest prime rate reported as such from time to time by The Wall Street Journal. Interest only is payable monthly on the 25th, the note matured on April 30, 2015, and the Company is currently waiting for the bank’s final approval to extend the note to April 30, 2016. The loan may be prepaid in whole or in part at any time without penalty.

As of March 31, 2015, there was $119,976 outstanding under the Lakeview Bank Mortgage and the Company was in compliance with all terms and conditions of the loan.

American Land and Capital Construction Loans

On November 21, 2014, American Land and Capital, LLC (“American Land”) and Cyclone entered into four construction loan agreements, each for a committed amount of $205,000 or $820,000 in total (the “Construction Loans”). Each commitment is secured by a mortgage on a lot (numbers 1, 2, 3, and 4) in Block 1 of Fox Meadows 3rd Addition and is personally guaranteed by Mr. Krieger. Fox Meadows is a townhouse development located in Lakeville, Minnesota in which Cyclone owns 35 attached residential building sites. Proceeds of the Construction Loans will be used to construct the first four spec/model homes on Cyclone’s Fox Meadows property. Draws on the Construction Loans bear interest at the higher of: (a) 6.50% or (b) the prime rate as reported from time to time by The Wall Street Journal plus 3.00%. Interest only is payable monthly on the 10th and the notes mature on May 21, 2015 and is anticipated to be renewed. The loans may be prepaid in whole or in part at any time without penalty.