Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - RREEF Property Trust, Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT - RREEF Property Trust, Inc. | rpt-20140930xex31x1.htm |

| EX-31.2 - EXHIBIT - RREEF Property Trust, Inc. | rpt-20140930xex31x2.htm |

| EX-32.1 - EXHIBIT - RREEF Property Trust, Inc. | rpt-20140930xex32x1.htm |

| EX-10.4 - EXHIBIT - RREEF Property Trust, Inc. | rpt-amendmenttocreditagmte.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form 10-Q

_________________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2014

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 333-180356

__________________________________________

RREEF Property Trust, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

Maryland | 45-4478978 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

345 Park Avenue, 26th Floor, New York, NY 10154 | (212) 454-6260 |

(Address of principal executive offices; zip code) | (Registrant’s telephone number, including area code) |

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | o (Do not check if smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 12, 2014, the registrant had 1,694,915 shares of Class A common stock, $.01 par value, outstanding, and 1,757,266 shares of Class B common stock, $.01 par value, outstanding.

RREEF PROPERTY TRUST, INC.

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended September 30, 2014

TABLE OF CONTENTS

2

PART I

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

RREEF PROPERTY TRUST, INC.

CONSOLIDATED BALANCE SHEETS

September 30, 2014 (unaudited) | December 31, 2013 | ||||||

ASSETS | |||||||

Investment in real estate assets: | |||||||

Land | $ | 15,940,201 | $ | 6,023,990 | |||

Buildings and improvements, less accumulated depreciation of $832,112 and $192,616, respectively | 37,307,701 | 14,640,468 | |||||

Acquired intangible lease assets, less accumulated amortization of $1,398,329 and $410,215, respectively | 10,266,363 | 5,551,759 | |||||

Total investment in real estate assets, net | 63,514,265 | 26,216,217 | |||||

Investment in marketable securities | 3,348,459 | 2,882,206 | |||||

Total investment in real estate assets and marketable securities, net | 66,862,724 | 29,098,423 | |||||

Cash and cash equivalents | 3,592,295 | 2,916,144 | |||||

Receivables | 366,672 | 266,756 | |||||

Prepaids and other assets | 637,193 | 22,505 | |||||

Deferred financing costs, less accumulated amortization of $448,800 and $183,684, respectively | 246,243 | 388,206 | |||||

Total assets | $ | 71,705,127 | $ | 32,692,034 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

Line of credit | $ | 29,300,000 | $ | 5,500,000 | |||

Accounts payable and accrued expenses | 285,458 | 53,956 | |||||

Due to affiliates | 9,053,376 | 6,005,822 | |||||

Acquired below market lease intangibles, less accumulated amortization of $68,629 and $2,067, respectively | 1,398,128 | 789,033 | |||||

Distributions payable | 73,468 | 42,308 | |||||

Other liabilities | 775,079 | 125,843 | |||||

Total liabilities | 40,885,509 | 12,516,962 | |||||

Stockholders' Equity: | |||||||

Preferred stock, $0.01 par value; 50,000,000 shares authorized, none issued | — | — | |||||

Common stock, $0.01 par value; 500,000,000 Class A shares authorized, 1,655,724 and 978,160 issued and outstanding as of September 30, 2014 and December 31, 2013, respectively | 16,557 | 9,782 | |||||

Common stock, $0.01 par value; 500,000,000 Class B shares authorized, 1,776,398 and 1,212,197 issued and outstanding as of September 30, 2014 and December 31, 2013, respectively | 17,764 | 12,122 | |||||

Additional paid in capital | 36,025,023 | 22,782,945 | |||||

Accumulated deficit | (5,401,468 | ) | (2,454,206 | ) | |||

Accumulated other comprehensive income (loss) | 161,742 | (175,571 | ) | ||||

Total stockholders' equity | 30,819,618 | 20,175,072 | |||||

Total liabilities and stockholders' equity | $ | 71,705,127 | $ | 32,692,034 | |||

The accompanying notes are an integral part of these consolidated financial statements.

3

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

Three Months ended September 30, | Nine Months ended September 30, | ||||||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||||||

Revenues | |||||||||||||||

Rental and other property income | $ | 1,389,716 | $ | 313,307 | $ | 2,775,259 | $ | 420,801 | |||||||

Tenant reimbursement income | 165,478 | — | 326,795 | — | |||||||||||

Investment income on marketable securities | 29,616 | 29,299 | 81,852 | 49,289 | |||||||||||

Total revenues | 1,584,810 | 342,606 | 3,183,906 | 470,090 | |||||||||||

Expenses | |||||||||||||||

General and administrative expenses | 543,793 | 538,253 | 1,635,963 | 1,084,129 | |||||||||||

Property operating expenses | 334,404 | 11,927 | 556,068 | 16,140 | |||||||||||

Advisory expenses | 145,382 | — | 265,985 | — | |||||||||||

Acquisition related expenses | 75,974 | 848 | 240,573 | 59,334 | |||||||||||

Depreciation | 306,179 | 73,577 | 639,496 | 110,365 | |||||||||||

Amortization | 457,618 | 171,407 | 949,055 | 230,386 | |||||||||||

Total operating expenses | 1,863,350 | 796,012 | 4,287,140 | 1,500,354 | |||||||||||

Operating loss | (278,540 | ) | (453,406 | ) | (1,103,234 | ) | (1,030,264 | ) | |||||||

Interest expense | (310,450 | ) | (138,375 | ) | (659,076 | ) | (211,473 | ) | |||||||

Net realized gain (loss) upon sale of marketable securities | 29,182 | 4,678 | 38,781 | (25,075 | ) | ||||||||||

Net loss | $ | (559,808 | ) | $ | (587,103 | ) | $ | (1,723,529 | ) | $ | (1,266,812 | ) | |||

Weighted average number of common shares outstanding: | |||||||||||||||

Basic and diluted | 3,068,502 | 1,095,953 | 2,658,068 | 478,169 | |||||||||||

Net loss per common share: | |||||||||||||||

Basic and diluted | $ | (0.18 | ) | $ | (0.54 | ) | $ | (0.65 | ) | $ | (2.65 | ) | |||

The accompanying notes are an integral part of these consolidated financial statements.

4

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

Three Months ended September 30, | Nine Months ended September 30, | ||||||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||||||

Net loss | $ | (559,808 | ) | $ | (587,103 | ) | $ | (1,723,529 | ) | $ | (1,266,812 | ) | |||

Other comprehensive (loss) income: | |||||||||||||||

Reclassification of previous unrealized (gain) loss on marketable securities into net gain or loss | (29,182 | ) | (4,678 | ) | (38,781 | ) | 25,075 | ||||||||

Unrealized (loss) gain on marketable securities | (113,469 | ) | (101,262 | ) | 376,094 | (189,835 | ) | ||||||||

Total other comprehensive (loss) income | (142,651 | ) | (105,940 | ) | 337,313 | (164,760 | ) | ||||||||

Comprehensive loss | $ | (702,459 | ) | $ | (693,043 | ) | $ | (1,386,216 | ) | $ | (1,431,572 | ) | |||

The accompanying notes are an integral part of these consolidated financial statements.

5

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(Unaudited)

Preferred Stock | Class A Common Stock | Class B Common Stock | Additional Paid in Capital | Accumulated deficit | Accumulated other comprehensive income (loss) | Total Stockholders' Equity | ||||||||||||||||||||||||||||||

Number of Shares | Par Value | Number of Shares | Par Value | Number of Shares | Par Value | |||||||||||||||||||||||||||||||

Balance, December 31, 2013 | — | $ | — | 978,160 | $ | 9,782 | 1,212,197 | $ | 12,122 | $ | 22,782,945 | $ | (2,454,206 | ) | $ | (175,571 | ) | $ | 20,175,072 | |||||||||||||||||

Issuance of common stock | — | — | 668,057 | 6,680 | 532,465 | 5,325 | 14,974,608 | — | — | 14,986,613 | ||||||||||||||||||||||||||

Issuance of common stock through the distribution reinvestment plan | — | — | 19,515 | 195 | 39,926 | 399 | 737,431 | — | — | 738,025 | ||||||||||||||||||||||||||

Redemption of common stock | — | — | (10,008 | ) | (100 | ) | (8,190 | ) | (82 | ) | (221,969 | ) | — | — | (222,151 | ) | ||||||||||||||||||||

Distributions to investors | — | — | — | — | — | — | — | (1,223,733 | ) | — | (1,223,733 | ) | ||||||||||||||||||||||||

Dealer-manager fees | — | — | — | — | — | — | (89,834 | ) | — | — | (89,834 | ) | ||||||||||||||||||||||||

Other offering costs | — | — | — | — | — | — | (2,158,158 | ) | — | — | (2,158,158 | ) | ||||||||||||||||||||||||

Comprehensive loss | — | — | — | — | — | — | — | (1,723,529 | ) | 337,313 | (1,386,216 | ) | ||||||||||||||||||||||||

Balance, September 30, 2014 | — | $ | — | 1,655,724 | $ | 16,557 | 1,776,398 | $ | 17,764 | $ | 36,025,023 | $ | (5,401,468 | ) | $ | 161,742 | $ | 30,819,618 | ||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended September 30, 2014 | Nine Months Ended September 30, 2013 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (1,723,529 | ) | $ | (1,266,812 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Depreciation | 639,496 | 110,365 | |||||

Net realized (gain) loss upon sale of marketable securities | (38,781 | ) | 25,075 | ||||

Amortization of intangible lease assets | 921,552 | 230,971 | |||||

Amortization of deferred financing costs | 265,116 | 113,358 | |||||

Straight line rent | (203,293 | ) | (36,898 | ) | |||

Changes in assets and liabilities: | |||||||

Receivables | 30,019 | (9,279 | ) | ||||

Prepaids and other assets | (550,218 | ) | (55,337 | ) | |||

Accounts payable and accrued expenses | 202,620 | 2,956 | |||||

Other liabilities | (30,932 | ) | 386 | ||||

Due to affiliates | 2,005,184 | 1,189,919 | |||||

Net cash provided by operating activities | 1,517,234 | 304,704 | |||||

Cash flows from investing activities: | |||||||

Investment in real estate and related assets | (37,971,698 | ) | (13,202,657 | ) | |||

Investment in marketable securities | (2,584,844 | ) | (4,445,872 | ) | |||

Proceeds from sale of marketable securities | 2,509,357 | 1,328,727 | |||||

Net cash used in investing activities | (38,047,185 | ) | (16,319,802 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from line of credit | 32,300,000 | 6,700,000 | |||||

Repayments of line of credit | (8,500,000 | ) | (6,700,000 | ) | |||

Proceeds from issuance of common stock | 15,080,612 | 16,645,002 | |||||

Payment of offering costs | (899,948 | ) | (131,913 | ) | |||

Distributions to investors | (1,192,574 | ) | (180,442 | ) | |||

Repurchase of shares | (222,151 | ) | — | ||||

Common stock issued through the distribution reinvestment plan | 738,025 | 173,777 | |||||

Deferred financing costs paid | (97,862 | ) | (22,731 | ) | |||

Net cash provided by financing activities | 37,206,102 | 16,483,693 | |||||

Net increase in cash and cash equivalents | 676,151 | 468,595 | |||||

Cash and cash equivalents, beginning of period | 2,916,144 | 200,000 | |||||

Cash and cash equivalents, end of period | $ | 3,592,295 | $ | 668,595 | |||

Supplemental Disclosures of Non-Cash Investing and Financing Activities: | |||||||

Accrued offering costs payable to affiliates | $ | 1,678,430 | $ | 2,352,565 | |||

Distributions declared and unpaid | $ | 73,468 | $ | 24,597 | |||

Unrealized gain (loss) on marketable securities | $ | 337,313 | $ | (164,760 | ) | ||

Purchases of marketable securities not yet paid | $ | 64,791 | $ | — | |||

Proceeds from sale of marketable securities not yet received | $ | 42,523 | $ | — | |||

The accompanying notes are an integral part of these consolidated financial statements.

7

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued)

(Unaudited)

Nine Months Ended September 30, 2014 | Nine Months Ended September 30, 2013 | ||||||

Supplemental Cash Flow Disclosures: | |||||||

Interest paid | $ | 292,143 | $ | 39,345 | |||

In connection with the purchase of investments in real estate and related assets, the Company also assumed certain non-real estate assets and liabilities: | |||||||

Purchase price | $ | 38,250,000 | $ | 13,300,000 | |||

Prepaids and other assets assumed | 64,470 | — | |||||

Other liabilities assumed | (342,772 | ) | (97,343 | ) | |||

Investment in real estate and related assets | $ | 37,971,698 | $ | 13,202,657 | |||

The accompanying notes are an integral part of these consolidated financial statements.

8

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2014

(Unaudited)

NOTE 1 — ORGANIZATION

RREEF Property Trust, Inc. (the “Company”) was formed on February 7, 2012 as a Maryland corporation and has elected to qualify as a real estate investment trust (“REIT”) for federal income tax purposes. On February 14, 2012, RREEF America L.L.C., a Delaware limited liability company (“RREEF America”), the Company's sponsor and advisor, purchased 16,667 shares of the Company’s Class B common stock for a total cash consideration of $200,000 to provide the Company’s initial capitalization. Substantially all of the Company's business will be conducted through RREEF Property Operating Partnership, LP, the Company's operating partnership (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership and contributed $199,000 to the Operating Partnership in exchange for its general partner interest. RREEF Property OP Holder, LLC (the “OP Holder”), a wholly-owned subsidiary of the Company and the initial limited partner of the Operating Partnership, contributed $1,000 to the Operating Partnership. As the Company completes the settlement for purchase orders for shares of its common stock in its continuous public offering, it will continue to transfer substantially all of the net proceeds of the offering to the Operating Partnership.

The Company was organized to invest primarily in a diversified portfolio consisting primarily of high quality, income-producing commercial real estate located in the United States, including, without limitation, office, industrial, retail and multifamily properties (“Real Estate Properties”). Although the Company intends to invest primarily in Real Estate Properties, it also intends to acquire common and preferred stock of REITs and other real estate companies (“Real Estate Equity Securities”) and debt investments backed principally by real estate (“Real Estate Loans” and, together with Real Estate Equity Securities, “Real Estate-Related Assets”).

The Company is offering to the public, pursuant to a registration statement, $2,250,000,000 of shares of its common stock in its primary offering and $250,000,000 of shares of its common stock pursuant to its distribution reinvestment plan (the “Offering”). The Company is offering to the public two classes of shares of its common stock, Class A shares and Class B shares. The Company is offering to sell any combination of Class A and Class B shares with a dollar value up to the maximum offering amount. The Company may reallocate the shares offered between the primary offering and the distribution reinvestment plan. On January 3, 2013, the Offering was initially declared effective by the Securities and Exchange Commission. On May 30, 2013, RREEF America purchased $10,000,000 of the Company's Class B shares in the Offering, and the Company’s board of directors authorized the release of the escrowed funds to the Company, thereby allowing the Company to commence operations.

Shares of the Company’s common stock are being sold at the Company’s net asset value (“NAV”) per share, plus, for Class A shares only, applicable selling commissions. Each class of shares may have a different NAV per share because of certain class specific fees and expenses, such as the distribution fee. NAV per share is calculated by dividing the NAV at the end of each business day for each class by the number of shares outstanding for that class on such day. The Company will not sell any shares to Pennsylvania investors unless it has received purchase orders for at least $75,000,000 (including purchase orders received from residents of other jurisdictions) in any combination of Class A shares and Class B shares from persons not affiliated with the Company or RREEF America.

The Company's NAV per share for its Class A and Class B shares is posted to the Company's website at www.rreefpropertytrust.com after the stock market close each business day. Additionally, the Company's NAV per share is published daily via NASDAQ's Mutual Fund Quotation System under the symbols ZRPTAX and ZRPTBX for its Class A shares and Class B shares, respectively.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The accompanying interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and with Rule 10-01 of Regulation S-X for interim

9

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

financial statements. Accordingly, these consolidated financial statements do not include all the information and footnotes required by GAAP for complete consolidated financial statements. In the opinion of the Company's management, the accompanying consolidated financial statements include all adjustments and eliminations, consisting only of normal recurring items necessary for their fair presentation in conformity with GAAP. Interim results are not necessarily indicative of operating results for a full year. The unaudited information included in this Quarterly Report on Form 10-Q should be read in conjunction with our audited financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2013. There have been no significant changes to Company's significant accounting policies during the nine months ended September 30, 2014.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Organization and Offering Expenses

Organizational expenses and other expenses which do not qualify as offering costs are expensed as incurred from and after the commencement of operations. Offering costs are those costs incurred by the Company, RREEF America and its affiliates on behalf of the Company which relate directly to the Company’s activities of raising capital in the Offering, preparing for the Offering, the qualification and registration of the Offering, and the marketing and distribution of the Company’s shares. This includes, but is not limited to, accounting and legal fees, including the legal fees of SC Distributors, LLC, the dealer manager for the Offering (the “Dealer Manager”), costs for registration statement amendments and prospectus supplements, printing, mailing and distribution costs, filing fees, amounts to reimburse RREEF America as the Company’s advisor or its affiliates for the salaries of employees and other costs in connection with preparing supplemental sales literature, amounts to reimburse the Dealer Manager for amounts that it may pay to reimburse the bona fide due diligence expenses of any participating broker-dealers supported by detailed and itemized invoices, telecommunication costs, fees of the transfer agent, registrars, trustees, depositories and experts, the cost of educational conferences held by the Company (including the travel, meal and lodging costs of registered representatives of any participating broker-dealers), and attendance fees and cost reimbursement for employees of affiliates to attend retail seminars conducted by broker-dealers. Offering costs will be deferred and will be paid from the proceeds of the Offering. These costs will be treated as a reduction of the total proceeds. Total organization and offering costs incurred by the Company will not exceed 15% of the gross proceeds from the primary offering.

Concentration of Credit Risk

As of September 30, 2014, the Company had cash on deposit at multiple financial institutions which were in excess of federally insured levels. The Company limits significant cash holdings to accounts held by financial institutions with a high credit standing. Therefore, the Company believes it is not exposed to any significant credit risk on its cash deposits.

As of September 30, 2014, the Company owned four properties housing eleven tenants. Percentages of gross rental revenues by location and tenant representing more than 10% of the Company's total gross rental revenues are shown below.

10

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

Property | Three Months Ended September 30, 2014 | Nine Months Ended September 30, 2014 | ||||

Heritage Parkway, Woodridge, IL | 20.1 | % | 30.3 | % | ||

Wallingford Plaza, Seattle, WA | 20.1 | % | 27.8 | % | ||

Commerce Corner, Logan Township, NJ | 27.9 | % | 25.9 | % | ||

Anaheim Hills Office Plaza, Anaheim, CA | 31.9 | % | 16.0 | % | ||

100.0 | % | 100.0 | % | |||

Tenant | Three Months Ended September 30, 2014 | Nine Months Ended September 30, 2014 | ||||

Allstate Insurance - Heritage Parkway | 20.1 | % | 30.3 | % | ||

Performance Food Group, Inc. - Commerce Corner | 16.8 | % | 15.7 | % | ||

Walgreen Company - Wallingford Plaza | 9.5 | % | 14.3 | % | ||

Gateway One Lending and Finance, L.L.C. - Anaheim Hills Office Plaza | 21.6 | % | 10.8 | % | ||

Mission Produce, Inc. - Commerce Corner | 11.1 | % | 10.3 | % | ||

Total | 79.1 | % | 81.4 | % | ||

As of September 30, 2014, in-place annualized base rental revenues were concentrated 23.8% in Gateway One Lending and Finance, L.L.C., 23.8% in Allstate Insurance Company and 15.9% in Performance Food Group Inc.

Correction of a Prior Period Misstatement

During the second quarter of 2014, the Company identified errors to prior periods related to amounts presented in the consolidated statement of cash flows for business combinations. The Company concluded the errors were not material to any prior period consolidated financial statements. The Company corrected the consolidated statement of cash flows for the nine months ended September 30, 2013 to reclassify assets acquired and liabilities assumed related to business combinations by reducing the cash paid for investment in real estate and related assets by $97,343 in the investing activities section and increasing the change in other liabilities by $97,343 in the operating activities section. Additionally, the Company included the comparative non-cash disclosure to reconcile the purchase price to the cash paid for investment in real estate and related assets.

Reclassifications

Certain reclassifications to prior period amounts have been made to conform to the current period presentation. For the nine months ended September 30, 2013, $36,898 was reclassified from the change in receivables to the adjustment for straight line rent in the operating activities section on the consolidated statement of cash flows.

Recent Accounting Pronouncements

On April 10, 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2014-08, Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity. ASU 2014-08 amends the definition of what qualifies as discontinued operations to disposals of assets, assets held for sale, or abandoned assets which represent a major strategic shift that has or will have a major effect on an entity’s operations and financial results. In addition, ASU 2014-08 may modify an entity's presentation of held for sale assets in prior periods. Further, ASU 2014-08 contains some disclosure changes. ASU 2014-08 is effective for the Company beginning January 1, 2015, and is not expected to have an effect on the Company's consolidated financial statements.

11

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

On May 28, 2014, the FASB issued ASU 2014-09, Revenue From Contracts With Customers. ASU 2014-09 requires entities to recognize revenue in their financial statements in a manner that depicts the transfer of the promised goods or services to its customers in an amount that reflects the consideration to which the entity is entitled at the time of transfer of those goods or services. As a result, the amount and timing of revenue recognition may be affected. However, certain types of contracts are excluded from the provisions of ASU 2014-09, including leases. Presently, the Company's rental and other property income and tenant reimbursement income as reflected on the Company's consolidated statements of operations are the result of lease contracts and as such, are not within the scope of ASU 2014-09. However, other types of real estate related contracts, such as for dispositions or development of real estate, may be impacted by ASU 2014-09. In addition, ASU 2014-09 requires additional disclosures regarding revenue recognition. ASU 2014-09 is effective for the Company beginning January 1, 2017. The Company has not yet evaluated the impact of ASU 2014-09 on its consolidated financial statements.

On August 27, 2014, the FASB issued ASU 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. ASU 2014-15 provides guidance on determining when and how to disclose going concern uncertainties in an entity's financial statements. The new standard requires management to perform interim and annual assessments of the likelihood the entity will be unable to meet its obligations as they come due for a period of one year beyond the date the financial statements are issued. An entity must provide certain disclosures if there is substantial doubt about the entity’s ability to meet those obligations. The ASU applies to all entities and is effective for annual periods ending after December 15, 2016, and interim periods thereafter, with early adoption permitted. The Company has not yet evaluated the impact of ASU 2014-15 on its consolidated financial statements.

NOTE 3 — FAIR VALUE MEASUREMENTS

Fair value measurements are determined based on the assumptions that market participants would use in pricing an asset or liability. As a basis for considering market participant assumptions in fair value measurements, FASB ASC 820, Fair Value Measurement and Disclosures, establishes a fair value hierarchy that distinguishes between market participant assumptions based on market data obtained from sources independent of the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and the reporting entity's own assumptions about market participant assumptions (unobservable inputs classified within Level 3 of the hierarchy).

Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for the asset or liability (other than quoted prices), such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are the unobservable inputs for the asset or liability, which are typically based on an entity's own assumption, as there is little, if any, related market activity. In instances where the determination of the fair value measurement is based on input from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Company's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability.

The Company's investments in marketable securities are valued using Level 1 inputs as the securities are publicly traded on major stock exchanges.

FASB ASC 825-10-65-1 requires the Company to disclose fair value information for all financial instruments for which it is practicable to estimate fair value, whether or not recognized in the consolidated balance sheets. Fair value of lines of credit and loans payable is determined using Level 2 inputs and a discounted cash flow approach with an interest rate and other assumptions that approximate current market conditions. The carrying amount of the Company's line of credit at September 30, 2014 and at December 31, 2013 approximated its fair value.

The Company's financial instruments, other than the line of credit, are generally short-term in nature and contain minimal credit risk. These instruments consist of cash and cash equivalents, accounts and other receivables

12

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

and accounts payable. The carrying amounts of these assets and liabilities in the consolidated balance sheets approximate their fair value.

NOTE 4 — REAL ESTATE INVESTMENTS

On May 31, 2013, the Company acquired 9022 Heritage Parkway ("Heritage"), a low-rise office building located outside of Chicago, Illinois. Heritage was acquired for $13,300,000, excluding closing costs. The acquisition was funded with proceeds from the Offering and $6,700,000 from the Company's line of credit. Heritage is 100% leased to Allstate Insurance Company through November 30, 2018.

On December 18, 2013, the Company acquired a mixed-use (retail and office) building located in Seattle, Washington ("Wallingford Plaza") for a purchase price of approximately $12,750,000, excluding closing costs. The acquisition was funded with proceeds from the Offering and by borrowing $5,500,000 under the Company's line of credit.

On April 11, 2014, the Company acquired 1109 Commerce Boulevard ("Commerce Corner") for a purchase price of $19,750,000 (excluding closing costs). The acquisition was funded with proceeds from the Offering and by borrowing $17,600,000 under the Company's line of credit. Of this borrowed amount, $8,840,000 relates to Commerce Corner while the balance was borrowed against available capacity from Heritage and Wallingford Plaza. Commerce Corner consists of a 259,910 square foot industrial building fully leased to two tenants and an adjacent land parcel.

On July 2, 2014, the Company acquired Anaheim Hills Office Plaza ("Anaheim Hills") for a purchase price of $18,500,000 (excluding closing costs). The acquisition was funded with proceeds from the Offering and by borrowing $14,700,000 under the Company's line of credit. Of this borrowed amount, $10,130,000 relates to Anaheim Hills while the balance was borrowed against available capacity from the other three properties. Anaheim Hills consists of a 73,892 square foot office building fully leased to three tenants.

All leases at the Company's properties have been classified as operating leases. The Company allocated the purchase price of the Company's properties as of September 30, 2014 to the fair value of the assets acquired and liabilities assumed, using Level 3 inputs and assumptions, as follows:

Heritage | Wallingford Plaza | Commerce Corner | Anaheim Hills | Total | |||||||||||||||

Land | $ | 2,310,684 | $ | 3,713,306 | $ | 3,396,680 | $ | 6,519,531 | $ | 15,940,201 | |||||||||

Building and improvements | 7,206,490 | 7,626,594 | 14,304,272 | 9,002,457 | 38,139,813 | ||||||||||||||

Acquired in-place leases | 3,773,246 | 2,179,148 | 2,258,817 | 2,830,140 | 11,041,351 | ||||||||||||||

Acquired above-market leases | 9,580 | — | 393,562 | 220,199 | 623,341 | ||||||||||||||

Acquired below-market leases | — | (791,100 | ) | (603,331 | ) | (72,327 | ) | (1,466,758 | ) | ||||||||||

Total purchase price | $ | 13,300,000 | $ | 12,727,948 | $ | 19,750,000 | $ | 18,500,000 | $ | 64,277,948 | |||||||||

Recent Acquisitions

On October 2, 2014, the Company acquired Terra Nova Plaza ("Terra Nova") for a purchase price of $21,850,000 (excluding closing costs). The acquisition was funded with proceeds from the Offering and by borrowing $19,100,000 under the Company's line of credit. Of this borrowed amount, $12,000,000 relates to Terra Nova while the balance was borrowed against available capacity from the other four properties. Terra Nova consists of a 96,114 square foot retail building fully leased to two tenants. As the Company recently acquired Terra

13

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

Nova, for purposes of the pro forma disclosures below, a preliminary allocation of the purchase price to the fair value of the assets acquired and liabilities assumed has been utilized.

The Company recorded revenues and net income related to the properties acquired during the three and nine months ended September 30, 2014 as follows:

Three Months Ended September 30, 2014 | Nine Months Ended September 30, 2014 | ||||||

Revenues | $ | 929,301 | $ | 1,300,137 | |||

Net income | $ | 251,007 | $ | 414,191 | |||

The Company’s estimated revenues and net loss, on a pro forma basis (as if the acquisitions of Commerce Corner, Anaheim Hills and Terra Nova were completed on January 1, 2013), for the three and nine months ended September 30, 2014 are as follows:

Three Months Ended September 30, 2014 | Nine Months Ended September 30, 2014 | ||||||

Revenues | $ | 2,120,933 | $ | 6,206,612 | |||

Net loss | $ | (506,270 | ) | $ | (1,266,162 | ) | |

The Company’s estimated revenues and net loss, on a pro forma basis (as if the acquisitions of Heritage, Wallingford Plaza, Commerce Corner, Anaheim Hills and Terra Nova were completed on January 1, 2013), for the three and nine months ended September 30, 2013 are as follows:

Three Months Ended September 30, 2013 | Nine Months Ended September 30, 2013 | ||||||

Revenues | $ | 1,961,307 | $ | 5,560,418 | |||

Net loss | $ | (417,802 | ) | $ | (936,120 | ) | |

The pro forma information for the three and nine months ended September 30, 2014 does not include acquisition costs of $75,974 and $240,573, respectively, as such costs are non-recurring. The pro forma information for the three and nine months ended September 30, 2013 does not include acquisition costs of $59,334 as such costs are non-recurring.

The pro forma information is presented for informational purposes only and may not be indicative of what actual results of operations would have been had the transactions occurred at the beginning of period presented, nor does it purport to represent the results of future operations.

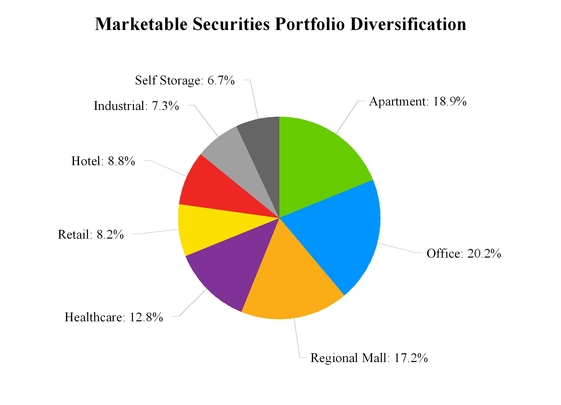

NOTE 5 — MARKETABLE SECURITIES

The following is a summary of the Company's marketable securities held as of September 30, 2014 and December 31, 2013, which consisted entirely of publicly-traded shares of common stock in REITs as of each date. All marketable securities held as of September 30, 2014 and December 31, 2013 were available-for-sale securities and none were considered impaired on an other-than-temporary basis.

14

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

September 30, 2014 | December 31, 2013 | ||||||

Marketable securities—cost | $ | 3,186,717 | $ | 3,057,777 | |||

Unrealized gains | 190,149 | 42,003 | |||||

Unrealized losses | (28,407 | ) | (217,574 | ) | |||

Net unrealized gain (loss) | 161,742 | (175,571 | ) | ||||

Marketable securities—fair value | $ | 3,348,459 | $ | 2,882,206 | |||

Upon the sale of a particular security, the realized net gain or loss is computed assuming the shares with the highest cost are sold first. During the three months ended September 30, 2014, marketable securities sold generated proceeds of $922,158 resulting in gross realized gains of $45,520 and gross realized losses of $16,338. During the nine months ended September 30, 2014, marketable securities sold generated proceeds of $2,530,000 resulting in gross realized gains of $106,182 and gross realized losses of $67,401.

NOTE 6 — LINE OF CREDIT

On May 1, 2013, the Operating Partnership, as borrower, and the Company, as guarantor, entered into a secured revolving line of credit arrangement (the “Line of Credit”) pursuant to a credit agreement with Regions Bank and its affiliates, as administrative agent, sole lead arranger and sole book runner, and other lending institutions that may become parties to the credit agreement. The Line of Credit has a capacity of $50 million and may be used to fund acquisitions, redeem shares pursuant to the Company’s redemption plan and for any other corporate purpose. The initial term expires on May 1, 2015, at which point the Company can exercise a single one-year extension option upon satisfaction of specified conditions. Borrowings under the Line of Credit carry a specified interest rate which, at the option of the Company, may be comprised of (1) a base rate, currently equal to the prime rate, or (2) a rate based on the one-, two- or three-month London Interbank Offered Rate (“LIBOR”) plus a spread ranging from 220 to 250 basis points, depending on the Company's consolidated debt-to-value ratio. As of September 30, 2014, the outstanding balance and interest rate were $29,300,000 and 2.35%, respectively.

The borrowing capacity under the Line of Credit (the “Borrowing Base”) at any time is equal to the sum of (1) the lesser of (a) 60% of the value of the Company's real estate investments which are encumbered by the Line of Credit (such value as determined by the administrative agent on an annual basis), and (b) the amount determined by reference to a specified debt service coverage calculation, and (2) 50% of the value of the Company’s investments in eligible marketable securities. The portion of the Borrowing Base attributable to marketable securities cannot exceed 20% of the total Borrowing Base. Additionally, up to 15% of the amount of the Borrowing Base attributable to real estate investments can be utilized for ground leased properties. As of September 30, 2014, the Company’s Borrowing Base was $39,307,694.

The Line of Credit agreement contains customary representations, warranties, borrowing conditions and affirmative, negative and financial covenants, including minimum net worth, debt service coverage requirements, fixed charge ratio requirements, leverage ratio requirements and distribution payout and REIT status requirements. In December 2013, the Company obtained an extension of time to comply with the fixed charge coverage ratio such that this particular covenant would not apply to the Company until the three months ended June 30, 2014. The Company would need to comply with this covenant to expand the capacity of the Line of Credit. A breach of this covenant would trigger an event of default, which provides the lenders the right to exercise their rights and remedies under the credit agreement. In addition, the Line of Credit contained a provision whereby if the Company did not have at least $50 million of tangible net worth (as defined in the Line of Credit agreement) by May 1, 2014, the available, undrawn commitments under the Line of Credit would be canceled, and the Company would have no ability to borrow additional amounts, or re-borrow amounts subsequently repaid, under the Line of Credit.

On April 30, 2014, the Company and Regions Bank entered into an amendment to the Line of Credit whereby satisfaction of the fixed charge coverage ratio and achieving $50 million of tangible net worth would not be required

15

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

until the earlier of (a) the date the Company achieved total cumulative capital raise of $200 million, (b) the Line of Credit is syndicated to one or more additional lenders (upon meeting the criteria for such syndication) or (c) December 31, 2014. As of September 30, 2014, none of these events had yet occurred. If the Company does not meet either the fixed charge coverage ratio or have $50 million of tangible net worth by the first of the three possible occurrences, then, while a default under the Line of Credit will not be triggered, the undrawn commitments may be reduced to zero in which case the Company will have no ability to borrow additional funds nor re-borrow amounts subsequently repaid. In addition, if either (1) the financial support provided by RREEF America under the advisory and expense support agreements ends or is otherwise terminated, or (2) the undrawn commitments are reduced to zero, resulting from the Company not meeting the fixed charge coverage ratio or achieving $50 million of tangible net worth, by the applicable date, then the interest rate under the Line of Credit will increase by 100 basis points above the then current interest rate. If both of the tests identified above as (1) and (2) are not met by the applicable date, then the interest rate under the Line of Credit will increase by 200 basis points over the interest rate in effect prior to either test not being met. The Company was in compliance with all covenants as of September 30, 2014.

NOTE 7 — RELATED PARTY ARRANGEMENTS

Advisory Agreement

RREEF America is entitled to compensation and reimbursements in connection with the management of the Company's investments in accordance with an advisory agreement between RREEF America and the Company. The advisory agreement is for a one-year term and is renewable annually upon the review and approval of the Company's board of directors, including the approval of a majority of the Company's independent directors. The advisory agreement has a current expiration date of January 3, 2015. There is no limit to the number of terms for which the advisory agreement can be renewed.

Fees

Under the advisory agreement, RREEF America can earn an advisory fee split between two components as described below.

1. | The fixed component accrues daily in an amount equal to 1/365th of 1.0% of the Company's NAV for each class of shares for such day; provided, however, that the fixed component will not be earned and, therefore, will not begin to accrue until the date on which the Company's combined NAV for both classes of shares has reached $50,000,000. The fixed component of the advisory fee is payable monthly in arrears. |

2. | The performance component is calculated for each class of shares on the basis of the total return to stockholders and is measured by the total distributions per share paid to such class plus the change in the NAV per share for such class. For any calendar year in which the total return per share allocable to a class exceeds 6% per annum, RREEF America will receive 25% of the excess total return allocable to that class; provided, however, that in no event will the performance component exceed 10% of the aggregate total return allocable to such class for such year. The performance component earned by RREEF America for each class is subject to certain other adjustments which do not apply unless the NAV per share is below $12.00 per share. The performance component is payable annually in arrears. The actual performance component earned by RREEF America during the year ended December 31, 2014, if any, is dependent on several factors, including but not limited to the performance of the Company's investments, interest rates, and the expense support provided by RREEF America, as hereinafter described. |

The fees earned by RREEF America for the three and nine months ended September 30 are shown below.

16

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

Three Months Ended September 30, 2014 | Nine Months Ended September 30, 2014 | Three Months Ended September 30, 2013 | Nine Months Ended September 30, 2013 | ||||||||||||

Fixed component (1) | $ | — | $ | — | $ | — | $ | — | |||||||

Performance component (2) | 145,382 | 265,985 | — | — | |||||||||||

$ | 145,382 | $ | 265,985 | $ | — | $ | — | ||||||||

(1) | No fixed component was earned for any period as the Company’s combined NAV for both classes of shares had not yet reached $50,000,000. |

(2) | RREEF America waived the performance component earned for 2013. |

Organization and offering costs

Under the advisory agreement, RREEF America agreed to pay all of the Company’s organization and offering costs through January 3, 2013. In addition, RREEF America agreed to pay certain of the Company’s organization and offering costs from January 3, 2013 through January 3, 2014 that were incurred in connection with certain offering related activities. In total, RREEF America incurred $4,618,318 of these costs (the “Deferred O&O”) on behalf of the Company from the Company’s inception through January 3, 2014. Pursuant to the advisory agreement, the Company began reimbursing RREEF America monthly for the Deferred O&O on a straight-line basis over 60 months beginning in January 2014.

Expense Support Agreement

Pursuant to the terms of the Expense Support Agreement as amended on May 8, 2014, RREEF America has agreed to defer reimbursement of certain expenses related to the Company's operations that RREEF America has incurred, and may continue to incur, that are not part of the Deferred O&O described above and therefore are in addition to the Deferred O&O amount (“Expense Payments”). The Expense Payments may include organization and offering costs and operating expenses as described above under the Company's advisory agreement. RREEF America may incur these expenses until the earlier of (i) the date the Company has raised $200 million in aggregate gross proceeds from the Offering or (ii) the date upon which the aggregate Expense Payments by RREEF America exceed $7,100,000. Through September 30, 2014, the Company had raised $42.45 million in the Offering and had incurred a total of $5,877,277 in Expense Payments in addition to the $4,618,318 of Deferred O&O noted above. Details of the Expense Payments incurred by RREEF America are detailed below.

Organization and offering costs | Operating expenses | Total | |||||||||

Balance, December 31, 2013 | $ | 741,361 | $ | 2,277,061 | $ | 3,018,422 | |||||

Additions | 1,070,303 | 1,788,552 | 2,858,855 | ||||||||

Reimbursements made to RREEF America | — | — | — | ||||||||

Balance, September 30, 2014 | $ | 1,811,664 | $ | 4,065,613 | $ | 5,877,277 | |||||

Pursuant to the Expense Support Agreement, RREEF America has agreed to defer reimbursement of Expense Payments until the earlier of (i) the quarter beginning on January 1, 2015 or (ii) the quarter in which the Company surpasses $200 million in aggregate gross proceeds from the Offering. Upon the commencement of reimbursement, the Company will reimburse RREEF America $250,000 per quarter, subject to adjustment as described in the Expense Support Agreement. Through September 30, 2014, the Company has made no reimbursements to RREEF America under the Expense Support Agreement.

Reimbursement Limitations

17

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

Organization and offering costs

The Company will not reimburse RREEF America for any organization and offering costs which would cause the Company's total organization and offering costs to exceed 15% of the gross proceeds from the primary offering (excluding shares issued via the distribution reinvestment plan). Further, the Company will not reimburse RREEF America for any underwriting compensation (a subset of organization and offering costs) which would cause the Company's total underwriting compensation to exceed 10% of the gross proceeds from the primary offering. A summary of the Company's total organization and offering costs is shown below.

Deferred O&O - RREEF America | Expense Payments | Costs not subject to reimbursement by RREEF America | Amount in excess of the 15% limit | Total | |||||||||||||||

Balance, December 31, 2013 | $ | 4,618,318 | $ | 741,361 | $ | 229,237 | $ | (1,630,918 | ) | $ | 3,957,998 | ||||||||

Additions | — | 1,070,303 | 569,562 | 608,127 | 2,247,992 | ||||||||||||||

Reimbursements made to RREEF America | — | — | — | — | — | ||||||||||||||

Balance, September 30, 2014 | $ | 4,618,318 | $ | 1,811,664 | $ | 798,799 | $ | (1,022,791 | ) | $ | 6,205,990 | ||||||||

At any point in time, the amount of the organization and offering costs in excess of the 15% limitation is not reflected in the Company's consolidated financial statements as a liability. However, as the Company raises additional proceeds from the Offering, it may become obligated to RREEF America for all or a portion of this additional amount. For purposes of reimbursement to RREEF America, the amount of organization and offering costs in excess of the 15% limitation is deducted from the Deferred O&O. The amounts of organization and offering costs payable to RREEF America are therefore as follows.

September 30, 2014 | December 31, 2013 | |||||||

Total Deferred O&O | $ | 4,618,318 | $ | 4,618,318 | ||||

Amount in excess of 15% limitation | (1,022,791 | ) | (1,630,918 | ) | ||||

Reimbursements made to RREEF America | (685,413 | ) | — | |||||

Deferred O&O reimbursable to RREEF America | 2,910,114 | 2,987,400 | ||||||

Expense Payments | 1,811,664 | 741,361 | ||||||

Total organization and offering costs payable to RREEF America | $ | 4,721,778 | $ | 3,728,761 | ||||

Operating expenses

Pursuant to the Company’s charter, the Company may reimburse RREEF America, at the end of each fiscal quarter, for total operating expenses incurred by RREEF America, whether under the Expense Support Agreement or otherwise. However, commencing with the quarter ended June 30, 2014, the Company may not reimburse RREEF America at the end of any fiscal quarter for total operating expenses (as defined in the Company’s charter) that, in the four consecutive fiscal quarters then ended, exceed the greater of 2% of average invested assets or 25% of net income determined without reduction for any additions to reserves for depreciation, bad debts or other similar non-cash reserves and excluding any gain from the sale of the Company's assets for that period (the “2%/25% Guidelines”). Notwithstanding the foregoing, the Company may reimburse RREEF America for expenses in excess

18

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

of the 2%/25% Guidelines if a majority of the Company’s independent directors determines that such excess expenses (an “Excess Amount”) are justified based on unusual and non-recurring factors. For the four fiscal quarters ended September 30, 2014, total operating expenses of the Company were $2,200,143, which exceeded the 2%/25% Guidelines by $1,367,734. On November 11, 2014, the Company’s independent directors determined that the Excess Amount of total operating expenses for the four quarters ended September 30, 2014 was justified because (1) the amounts reflect legitimate operating expenses necessary for the operation of the Company’s business, (2) the Company is currently in its acquisition and development stage, (3) the expenses incurred as a result of being a public company (including for audit and legal services, director and officer liability insurance and fees for directors) are significant and disproportionate to the Company’s average invested assets and net income, and (4) the Company’s average invested assets was low due to the Company’s ownership of only 1 - 4 properties during the four fiscal quarters ended September 30, 2014. The Excess Amount approved by the Company’s independent directors will be eligible for reimbursement in the future pursuant to the terms and conditions of the Expense Support Agreement with RREEF America.

Due to Affiliates

In accordance with all the above, as of September 30, 2014 and December 31, 2013, the Company owed RREEF America for the following amounts:

September 30, 2014 | December 31, 2013 | ||||||

Deferred O&O | $ | 2,910,114 | $ | 2,987,400 | |||

Expense Payments | 5,877,277 | 3,018,422 | |||||

Performance component of advisory fees | 265,985 | — | |||||

Due to affiliates | $ | 9,053,376 | $ | 6,005,822 | |||

NOTE 8 — CAPITALIZATION

Under the Company's charter, the Company has the authority to issue 1,000,000,000 shares of common stock, 500,000,000 of which are classified as Class A shares and 500,000,000 of which are classified as Class B shares. In addition, the Company has the authority to issue 50,000,000 shares of preferred stock. All shares of such stock have a par value of $0.01 per share. Class A shares issued in the primary offering are subject to selling commissions of up to 3% of the purchase price, dealer manager fees and distribution fees. Class B shares are subject to dealer manager fees, but are not subject to any selling commissions or distribution fees. The Company's board of directors is authorized to amend its charter from time to time, without the approval of the stockholders, to increase or decrease the aggregate number of authorized shares of capital stock or the number of shares of any class or series that the Company has authority to issue.

Distribution Reinvestment Plan

The Company has adopted a distribution reinvestment plan that will allow stockholders to have the cash distributions attributable to the class of shares that the stockholder owns automatically invested in additional shares of the same class. Shares are offered pursuant to the Company's distribution reinvestment plan at the NAV per share applicable to that class, calculated as of the distribution date and after giving effect to all distributions. Stockholders who elect to participate in the distribution reinvestment plan, and who are subject to U.S. federal income taxation laws, will incur a tax liability on an amount equal to the fair value on the relevant distribution date of the shares of the Company's common stock purchased with reinvested distributions, even though such stockholders have elected not to receive the distributions used to purchase those shares of the Company's common stock in cash.

Redemption Plan

19

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

In an effort to provide the Company's stockholders with liquidity in respect of their investment in shares of the Company's common stock, the Company has adopted a redemption plan whereby on a daily basis stockholders may request the redemption of all or any portion of their shares. The redemption price per share is equal to the Company's NAV per share of the class of shares being redeemed on the date of redemption. The total amount of redemptions in any calendar quarter will be limited to Class A and Class B shares whose aggregate value (based on the redemption price per share on the date of the redemption) is equal to 5% of the Company's combined NAV for both classes of shares as of the last day of the previous calendar quarter. In addition, if redemptions do not reach the 5% limit in a calendar quarter, the unused portion generally will be carried over to the next quarter and not any subsequent quarter, except that the maximum amount of redemptions during any quarter may never exceed 10% of the combined NAV for both classes of shares as of the last day of the previous calendar quarter. If the quarterly volume limitation is reached on or before the third business day of a calendar quarter, redemption requests during the next quarter will be satisfied on a stockholder by stockholder basis, which the Company refers to as a per stockholder allocation, instead of a first-come, first-served basis. Pursuant to the per stockholder allocation, each stockholder would be allowed to request redemption at any time during such quarter of a total number of shares not to exceed 5% of the shares of common stock the stockholder held as of the end of the prior quarter. The per stockholder allocation requirement will remain in effect for each succeeding quarter for which the total redemptions for the immediately preceding quarter exceeded 4% of the Company's NAV on the last business day of such preceding quarter. If total redemptions during a quarter for which the per stockholder allocation applies are equal to or less than 4% of the Company's NAV on the last business day of such preceding quarter, then redemptions will again be satisfied on a first-come, first-served basis for the next succeeding quarter and each quarter thereafter.

Each redemption request will be evaluated by the Company in consideration of rules and regulations promulgated by the Internal Revenue Service with respect to dividend equivalent redemptions. Redemptions that may be considered dividend equivalent redemptions may adversely affect the Company or its stockholders. Accordingly, the Company may reject any redemption request that it reasonably believes may be treated as a dividend equivalent redemption.

While there is no minimum holding period, shares redeemed within 365 days of the date of purchase will be redeemed at the Company's NAV per share of the class of shares being redeemed on the date of redemption less a short-term trading discount equal to 2% of the gross proceeds otherwise payable with respect to the redemption.

In the event that any stockholder fails to maintain a minimum balance of $500 of shares of common stock, the Company may redeem all of the shares held by that stockholder at the redemption price per share in effect on the date it is determined that the stockholder has failed to meet the minimum balance, less the short-term trading discount of 2%, if applicable. Minimum account redemptions will apply even in the event that the failure to meet the minimum balance is caused solely by a decline in the Company's NAV.

During the nine months ended September 30, 2014, three redemption requests were received and processed. During the first quarter of 2014, the Company processed one redemption request for 7,962 Class A shares at a price of $12.21 per share, before allowing for the 2% short-term trading discount. During the second quarter of 2014, the Company processed one redemption request for 2,047 Class A shares at a price of $12.30 per share, before allowing for the 2% short-term trading discount. During the third quarter of 2014, the Company processed one redemption request for 8,190 Class B shares at a price of $12.48 per share. The Company funded these redemptions with cash flows from operations.

The Company's board of directors has the discretion to suspend or modify the redemption plan at any time, including in circumstances where it (1) determines that such action is in the best interest of the Company's stockholders, (2) determines that it is necessary due to regulatory changes or changes in law or (3) becomes aware of undisclosed material information that it believes should be publicly disclosed before shares are redeemed. In addition, the Company's board of directors may suspend the Offering, including the redemption plan, if it determines that the calculation of NAV is materially incorrect or there is a condition that restricts the valuation of a material portion of the Company's assets. If the board of directors materially amends (including any reduction of the quarterly limit) or suspends the redemption plan during any quarter, other than any temporary suspension to address

20

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

certain external events unrelated to the Company's business, any unused portion of that quarter’s 5% limit will not be carried forward to the next quarter or any subsequent quarter.

NOTE 9 — DISTRIBUTIONS

In order to qualify as a REIT, the Company is required, among other things, to make distributions each taxable year of at least 90% of its taxable income determined without regard to the dividends-paid deduction and excluding net capital gains, and to meet certain tests regarding the nature of the Company's income and assets. The Company expects that its board of directors will continue to declare distributions with a daily record date, payable monthly in arrears. Any distributions the Company makes will be at the discretion of its board of directors, considering factors such as its earnings, cash flow, capital needs and general financial condition and the requirements of Maryland law. The Company commenced operations on May 30, 2013 and elected taxation as a REIT for the year ended December 31, 2013.

Shown below are details of the Company's distributions for 2014.

Three Months Ended | Nine Months Ended September 30, 2014 | ||||||||||||||

March 31, 2014 | June 30, 2014 | September 30, 2014 | |||||||||||||

Declared daily distribution rate, before adjustment for class-specific expenses | $ | 0.00167167 | $ | 0.00169307 | $ | 0.00169924 | |||||||||

Distributions paid or payable in cash | $ | 130,908 | $ | 154,435 | $ | 200,365 | $ | 485,708 | |||||||

Distributions reinvested | 217,739 | 242,092 | 278,194 | 738,025 | |||||||||||

Distributions declared | $ | 348,647 | $ | 396,527 | $ | 478,559 | $ | 1,223,733 | |||||||

Class A shares issued upon reinvestment | 5,162 | 6,244 | 8,109 | 19,515 | |||||||||||

Class B shares issued upon reinvestment | 12,505 | 13,296 | 14,125 | 39,926 | |||||||||||

NOTE 10 — INCOME TAXES

The Company elected taxation as a REIT for federal income tax purposes for the year ended December 31, 2013. In each calendar year that the Company qualifies for taxation as a REIT, the Company generally will not be subject to federal income tax to the extent it meets certain criteria and distributes its REIT taxable income to its stockholders. Distributions declared and paid by the Company may consist of ordinary income, qualifying dividends, return of capital, capital gains or a combination thereof. The characterization of the distributions into these various components will impact how the distributions are taxable to the stockholder who received them. Distributions that constitute a return of capital generally are non-taxable and will reduce the stockholder's basis in the shares. The characterization of the distributions is generally determined during the month of January following the close of the tax year.

NOTE 11 — SEGMENT INFORMATION

For the three and nine months ended September 30, 2014, the Company had two segments with reportable information: Real Estate Properties and Real Estate Equity Securities. The Company organizes and analyzes the operations and results of each of these segments independently, due to inherently different considerations for each segment. Such considerations include, but are not limited to, the nature and characteristics of the investment, and investment strategies and objectives. The following tables set forth the carrying value, revenue and the components of operating income of the Company's segments reconciled to total assets as of September 30, 2014 and December 31, 2013 and net loss for the three and nine months ended September 30, 2014 and 2013.

21

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

Real Estate Properties | Real Estate Equity Securities | Total | ||||||||||

Carrying value as of September 30, 2014 | $ | 63,514,265 | $ | 3,348,459 | $ | 66,862,724 | ||||||

Reconciliation to total assets of September 30, 2014 | ||||||||||||

Carrying value per reportable segments | $ | 66,862,724 | ||||||||||

Corporate level assets | 4,842,403 | |||||||||||

Total assets | $ | 71,705,127 | ||||||||||

Carrying value as of December 31, 2013 | $ | 26,216,217 | $ | 2,882,206 | $ | 29,098,423 | ||||||

Reconciliation to total assets of December 31, 2013 | ||||||||||||

Carrying value per reportable segments | $ | 29,098,423 | ||||||||||

Corporate level assets | 3,593,611 | |||||||||||

Total assets | $ | 32,692,034 | ||||||||||

22

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

Real Estate Properties | Real Estate Equity Securities | Total | ||||||||||

Three Months Ended September 30, 2014 | ||||||||||||

Revenues | ||||||||||||

Rental and other property income | $ | 1,389,716 | $ | — | $ | 1,389,716 | ||||||

Tenant reimbursement income | 165,478 | — | 165,478 | |||||||||

Investment income on marketable securities | — | 29,616 | 29,616 | |||||||||

Total revenues | 1,555,194 | 29,616 | 1,584,810 | |||||||||

Operating expenses | ||||||||||||

Property operating expenses | 334,404 | — | 334,404 | |||||||||

Total segment operating expenses | 334,404 | — | 334,404 | |||||||||

Operating income - segments | $ | 1,220,790 | $ | 29,616 | $ | 1,250,406 | ||||||

Three Months Ended September 30, 2013 | ||||||||||||

Revenues | ||||||||||||

Rental and other property income | $ | 313,307 | $ | — | $ | 313,307 | ||||||

Tenant reimbursement income | — | — | — | |||||||||

Investment income on marketable securities | — | 29,299 | 29,299 | |||||||||

Total revenues | 313,307 | 29,299 | 342,606 | |||||||||

Operating expenses | ||||||||||||

Property operating expenses | 11,927 | — | 11,927 | |||||||||

Total segment operating expenses | 11,927 | — | 11,927 | |||||||||

Operating income - Segments | $ | 301,380 | $ | 29,299 | $ | 330,679 | ||||||

Reconciliation to net loss | Three Months Ended September 30, 2014 | Three Months Ended September 30, 2013 | ||||||||||

Operating income - segments | $ | 1,250,406 | $ | 330,679 | ||||||||

General and administrative expenses | (543,793 | ) | (538,253 | ) | ||||||||

Advisory expenses | (145,382 | ) | — | |||||||||

Acquisition related expenses | (75,974 | ) | (848 | ) | ||||||||

Depreciation | (306,179 | ) | (73,577 | ) | ||||||||

Amortization | (457,618 | ) | (171,407 | ) | ||||||||

Operating loss | (278,540 | ) | (453,406 | ) | ||||||||

Interest expense | (310,450 | ) | (138,375 | ) | ||||||||

Net realized gain (loss) upon sale of marketable securities | 29,182 | 4,678 | ||||||||||

Net loss | $ | (559,808 | ) | $ | (587,103 | ) | ||||||

23

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

Real Estate Properties | Real Estate Equity Securities | Total | ||||||||||

Nine Months Ended September 30, 2014 | ||||||||||||

Revenues | ||||||||||||

Rental and other property income | $ | 2,775,259 | $ | — | $ | 2,775,259 | ||||||

Tenant reimbursement income | 326,795 | — | 326,795 | |||||||||

Investment income on marketable securities | — | 81,852 | 81,852 | |||||||||

Total revenues | 3,102,054 | 81,852 | 3,183,906 | |||||||||

Operating expenses | ||||||||||||

Property operating expenses | 556,068 | — | 556,068 | |||||||||

Total segment operating expenses | 556,068 | — | 556,068 | |||||||||

Operating income - Segments | $ | 2,545,986 | $ | 81,852 | $ | 2,627,838 | ||||||

Nine Months Ended September 30, 2013 | ||||||||||||

Revenues | ||||||||||||

Rental and other property income | $ | 420,801 | $ | — | $ | 420,801 | ||||||

Tenant reimbursement income | — | — | — | |||||||||

Investment income on marketable securities | — | 49,289 | 49,289 | |||||||||

Total revenues | 420,801 | 49,289 | 470,090 | |||||||||

Operating expenses | ||||||||||||

Property operating expenses | 16,140 | — | 16,140 | |||||||||

Total segment operating expenses | 16,140 | 49,289 | 16,140 | |||||||||

Operating income - Segments | $ | 404,661 | $ | 19,990 | $ | 453,950 | ||||||

Reconciliation to net loss | Nine Months Ended September 30, 2014 | Nine Months Ended September 30, 2013 | ||||||||||

Operating income - Segments | $ | 2,627,838 | $ | 453,950 | ||||||||

General and administrative expenses | (1,635,963 | ) | (1,084,129 | ) | ||||||||

Advisory expenses | (265,985 | ) | — | |||||||||

Acquisition related expenses | (240,573 | ) | (59,334 | ) | ||||||||

Depreciation | (639,496 | ) | (110,365 | ) | ||||||||

Amortization | (949,055 | ) | (230,386 | ) | ||||||||

Operating loss | (1,103,234 | ) | (1,030,264 | ) | ||||||||

Interest expense | (659,076 | ) | (211,473 | ) | ||||||||

Net realized gain (loss) upon sale of marketable securities | 38,781 | (25,075 | ) | |||||||||

Net loss | $ | (1,723,529 | ) | $ | (1,266,812 | ) | ||||||

24

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

September 30, 2014

(Unaudited)

NOTE 12 — ECONOMIC DEPENDENCY

The Company depends on RREEF America, the Dealer Manager and Realty Capital Securities, LLC (the "Wholesaler") for certain services that are essential to the Company, including the sale of the Company's shares of common stock, asset acquisition and disposition decisions and other general and administrative responsibilities. In the event that RREEF America, the Dealer Manager or the Wholesaler is unable to provide such services, the Company would be required to find alternative service providers.

NOTE 13 — COMMITMENTS AND CONTINGENCIES

In the normal course of business, from time to time, the Company may be involved in legal actions relating to the ownership and operations of real estate investments. In the Company's opinion, the liabilities, if any, that may ultimately result from such legal actions are not expected to have a material adverse effect on the Company's consolidated financial position, results of operations or liquidity.

The Company, as an owner of real estate, is subject to various environmental laws of federal and local governments. All of the Company's properties were subject to assessments, involving visual inspections of the properties and their neighborhoods. The Company carries environmental liability insurance on its properties that provides coverage for remediation liability and pollution liability for third-party bodily injury and property damage claims. The Company does not believe such environmental assessments will have a material adverse impact on the Company's consolidated financial position or results of operations in the future.

As discussed in Note 7, the Company may become liable to RREEF America for additional amounts that RREEF America has paid on behalf of the Company, with such additional liability dependent upon the amount of shares sold by the Company.

NOTE 14 — SUBSEQUENT EVENTS

On October 1, 2014, the Company announced that its board of directors declared a cash distribution equal to $0.00173473 per Class A and Class B share (before adjustment for applicable class-specific expenses) for all such shares of record on each day from October 1, 2014 through December 31, 2014.

On October 2, 2014, the Company acquired a retail building in a shopping center known as Terra Nova Plaza in Chula Vista, California ("Terra Nova") for a purchase price of $21,850,000, excluding closing costs. This property is comprised of a single, 96,114 square foot one-story retail building fully leased to two tenants. This acquisition was funded with existing capital and by borrowing $19,100,000 from the Company's line of credit.

During October 2014, the Company received requests for and processed three redemptions for a total of 52,201 Class B shares at a weighted average price of $12.70 per share before allowing for the 2% short term trading discount, as applicable.

On November 11, 2014, the Company’s independent directors determined that the amount by which the Company’s total operating expenses for the four quarters ended September 30, 2014 exceeded the 2%/25% Guidelines was justified. See Note 7.

25

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited consolidated financial statements, the notes thereto and the other unaudited financial data included in this Quarterly Report on Form 10-Q, or this Quarterly Report. The following discussion should also be read in conjunction with our audited consolidated financial statements and the notes thereto, included in our Annual Report on Form 10-K for the year ended December 31, 2013. We further invite you to visit our website, www.rreefpropertytrust.com, where we routinely post additional information about our company, such as, without limitation, our daily net asset value, or NAV, per share, press releases and information about upcoming investor conference calls. The public may find this information in the Newsroom section of our website. The contents of our website are not incorporated by reference. The terms “we,” “us,” “our” and the “Company” refer to RREEF Property Trust, Inc. and its subsidiaries.

The Company's NAV per share is published daily via NASDAQ's Mutual Fund Quotation System under the symbols ZRPTAX and ZRPTBX for its Class A shares and Class B shares, respectively.

Forward-Looking Statements

Certain statements contained in this Quarterly Report on Form 10-Q, other than historical facts, may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), or Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable by law. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guaranty of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “would,” “could,” “should,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “plan,” “potential,” “predict” or other similar words.