Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - RREEF Property Trust, Inc. | rpt-20151231xex31x1.htm |

| EX-32.1 - EXHIBIT 32.1 - RREEF Property Trust, Inc. | rpt-20151231xex32x1.htm |

| EX-31.2 - EXHIBIT 31.2 - RREEF Property Trust, Inc. | rpt-20151231xex31x2.htm |

| EX-10.26 - EXHIBIT 10.26 - RREEF Property Trust, Inc. | wellsfargoletter-ex10x26.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________________

Form 10-K

_____________________________________________________________________________________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-55598

_____________________________________________________________________________________________

RREEF Property Trust, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________________________

Maryland | 45-4478978 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

345 Park Avenue, 26th Floor, New York, NY 10154 | (212) 454-6260 |

(Address of principal executive offices; zip code) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to section 12(b) of the Act

None

Securities registered pursuant to section 12(g) of the Act

Class A Common Stock, $.01 par value

Class I Common Stock, $.01 par value

Class T Common Stock, $.01 par value

Class N Common Stock, $.01 par value

Class D Common Stock, $.01 par value

_______________________________________________________________________________________________________________

Indicate by check if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post all such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | o (Do not check if smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

There is no established market for the registrant's shares of common stock. As of March 18, 2016, the registrant had 3,210,181 shares of Class A common stock, $.01 par value, outstanding, 3,193,244 shares of Class I common stock, $.01 par value, outstanding, 2,208 shares of Class T common stock, $.01 par value, outstanding and no Class N or Class D shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s proxy statement, which will be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2016 Annual Meeting of Stockholders, are incorporated by reference into Part III of this annual report.

RREEF PROPERTY TRUST, INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2015

TABLE OF CONTENTS

3

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K of RREEF Property Trust, Inc., other than historical facts may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), or Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable by law. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guaranty of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “would,” “could,” “should,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “plan,” “potential,” “predict” or other similar words.

The forward-looking statements included herein are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

• | our ability to raise and effectively deploy proceeds from our public offering; |

• | changes in economic conditions generally and the real estate and securities markets specifically; |

• | legislative or regulatory changes (including changes to the laws governing the taxation of REITs); |

• | the effect of financial leverage, including changes in interest rates, availability of credit, loss of flexibility due to negative and affirmative covenants, refinancing risk at maturity and generally the increased risk of loss if our investments fail to perform as expected; |

• | our ability to access sources of liquidity when we have the need to fund redemptions of common stock in excess of the proceeds from the sales of shares of our common stock in our continuous offering and the consequential risk that we may not have the resources to satisfy redemption requests; and |

• | changes to accounting principles generally accepted in the United States of America (“GAAP”). |

Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution readers not to place undue reliance on forward-looking statements, which reflect our management’s view only as of the date this Annual Report on Form 10-K is filed with the Securities and Exchange Commission (the “SEC”). We make no representation or warranty (express or implied) about the accuracy of any such forward-looking statements contained in this Annual Report on Form 10-K. Additionally, we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. The forward-looking statements should be read in light of the risk factors identified in “Item 1A. Risk Factors” of this Annual Report on Form 10-K.

4

PART I

ITEM 1. BUSINESS

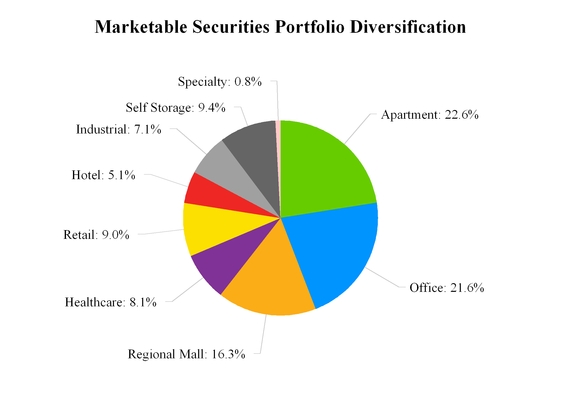

Formation

RREEF Property Trust, Inc. (the “Company,” “we,” “our” or “us”) is a Maryland corporation that was formed on February 7, 2012 and qualified as a real estate investment trust (“REIT”) for federal income tax purposes beginning with the taxable year ended December 31, 2013. We invest in a diversified portfolio of high quality, income-producing commercial real estate located throughout the United States, including, without limitation, office, industrial, retail and multifamily properties. Although we intend to invest primarily in real properties, we also intend to acquire common and preferred stock of publicly traded REITs and other real estate companies and debt backed principally by real estate, such as senior mortgage loans, subordinated mortgage loans, mezzanine loans and commercial mortgage-backed securities, or CMBS. We refer to real estate equity securities and real estate loans collectively as “real estate-related assets.” We will seek geographic diversification of our property portfolio and for the properties underlying our investments in real estate-related assets principally in major metropolitan areas that we consider target and investable markets throughout the United States. As of December 31, 2015, we owned six commercial properties and one student housing property (a subset of multifamily) located in six states, comprising 792,789 rentable square feet. As of December 31, 2015, these properties were 100% leased. As of December 31, 2015, we owned a real estate securities portfolio with a value of $8,569,004.

Substantially all of our business is conducted through our operating partnership, RREEF Property Operating Partnership, LP, a Delaware limited partnership (the “Operating Partnership”). We own, directly or indirectly, 100% of the partnership interest in the Operating Partnership. The Company is the sole general partner of the Operating Partnership and originally contributed $199,000 to the Operating Partnership in exchange for its general partner interest. The initial limited partner of the Operating Partnership is RREEF Property OP Holder, LLC (the “OP Holder”), a wholly-owned subsidiary of the Company, which originally contributed $1,000 to the Operating Partnership. We are externally managed by RREEF America, L.L.C. (“RREEF America” or our “advisor”), our advisor and sponsor. RREEF America is the alternatives real estate division of Deutsche Asset Management ("Deutsche AM"), a division of Deutsche Bank, AG.

RREEF America acts as our advisor pursuant to an advisory agreement with us, and is responsible for managing our affairs on a day-to-day basis and for identifying and making acquisitions and investments on our behalf. Our charter provides that our independent directors are responsible for reviewing the performance of our advisor and determining whether the compensation paid to our advisor and its affiliates is reasonable. The advisory agreement with RREEF America is for a one-year term and is renewed on an annual basis by our board of directors. We have no paid employees and rely upon RREEF America and its affiliates to provide substantially all of our day-to-day management.

Our Public Offering

On January 3, 2013, pursuant to a registration statement on Form S-11 (File No. 333-180356) filed under the Securities Act (the “Registration Statement”), we commenced our initial public offering on a “best efforts” basis of a maximum of $2,500,000,000 in shares of our common stock (the “Offering”). Of this amount, we are offering up to $2,250,000,000 to the public in shares in our primary offering and up to $250,000,000 in shares to our stockholders pursuant to our distribution reinvestment plan. Through December 31, 2015, we were offering to sell any combination of two classes of shares of our common stock, Class A shares and Class B shares, with a dollar value up to the maximum offering amount. On December 23, 2015, we filed a registration statement on Form S-11 (File No. 333-208751) registering $2,300,000,000 in shares of our common stock to be sold on a "best efforts" basis in any combination of Class A, Class I, Class T or Class N common stock for our follow-on offering. This registration statement is not yet effective.

On January 27, 2016, we amended our charter to (a) rename our Class B common stock as Class I common stock and (b) add new classes of commons stock, being Class T and Class N common stock. We did not make any other changes to our Class B common stock other than the renaming to Class I. All references to transactions involving Class B shares will be referred to as Class I shares in this Annual Report on Form 10-K, except within the audited financial statements contained herein beginning on page F-1.

5

On February 1, 2016, we filed a post-effective amendment to the Registration Statement that, among other things, reflected the re-naming of our Class B common stock to Class I and added our Class T common stock to the Offering. The Securities and Exchange Commission (the "SEC") declared that post-effective amendment effective on February 9, 2016.

Pursuant to the terms of the Offering, we were required to deposit all subscription proceeds in escrow until the date we received purchase orders for at least $10,000,000 (including shares purchased by our sponsor, its affiliates and our directors and officers and excluding purchase orders received from Pennsylvania investors) in any combination of Class A and Class I shares, and our board of directors authorized the release of the escrowed purchase order proceeds to us so we could commence operations. On May 30, 2013, RREEF America purchased $10,000,000 of our Class I shares, and on that same day, following the authorization of our board of directors, our escrow agent released all of the escrowed proceeds to us (excluding proceeds from Pennsylvania investors). On November 5, 2015, we met the Pennsylvania minimum offering amount of $75,000,000 (including purchase orders received from residents of other jurisdictions). Since then and going forward, the per share purchase price of our common stock varies from day-to-day, and on any given business day, for a given share class, is equal to our NAV of such share class divided by the number of shares of our common stock outstanding for such share class as of the end of business on such day, plus, for Class A, Class D and Class T shares only, applicable selling commissions and dealer manager fees.

We are structured as a perpetual-life, non-exchange traded REIT. This means that, subject to regulatory approval of our filing for additional offerings, we intend to sell shares of our common stock on a continuous basis and for an indefinite period of time. We will endeavor to take all reasonable actions to avoid interruptions in the continuous public offering of our shares of common stock. There can be no assurance, however, that we will not need to suspend our continuous public offering. The public offering must be registered in every state in which we offer or sell shares. Generally, such registrations are for a period of one year. Thus, we may have to stop selling shares in any state in which our registration is not renewed or otherwise extended annually. We reserve the right to terminate the Offering at any time and to extend the Offering's term to the extent permissible under applicable law.

On January 15, 2016, we amended our charter to add a new class of our common stock, Class D. On January 20, 2016, we launched a private offering of up to a maximum of $350,000,000 of our Class D shares (the “Private Placement”). The private placement is being conducted pursuant to Rule 506(c) of Regulation D promulgated under the Securities Act and other applicable exemptions.

Investment Strategy, Objectives and Policies

Our investment strategy is to acquire a diversified portfolio of: (1) high quality, income-producing commercial properties, (2) common and preferred stock of REITs and other real estate companies, which we refer to as “real estate equity securities,” and (3) debt backed principally by real estate, which we refer to as “real estate loans.” We refer to investments in real estate loans and real estate equity securities collectively as “real estate-related assets.” Our real property portfolio will be diversified in investable and target markets across the United States as selected by Deutsche AM and will consist primarily of office, industrial, retail and multifamily property types. The actual percentage of our portfolio that is invested in office, industrial, retail and multifamily property categories may fluctuate due to market conditions and investment opportunities. Deutsche AM investable markets include those markets that have relatively high liquidity and lower relative supply risks, and have outperformed during certain stages of previous real estate investment cycles. Deutsche AM target markets are a subset of the investable market universe in which Deutsche AM forecasts strong economic and real estate fundamentals and Deutsche AM believes are poised to outperform the overall U.S. real estate market during the next five years. We intend to provide our investors with superior risk-adjusted long-term returns, including attractive and stable distributions of current income as well as capital preservation and appreciation in our NAV. In addition, we believe that our structure as a perpetual-life REIT will allow us to acquire and manage our investment portfolio in a more active and flexible manner because we will not be limited by a pre-determined operational period and the need to provide a “liquidity event” at the end of that period.

We expect to maintain a level of liquid assets primarily in cash and real estate equity securities, in addition to a revolving line of credit, as a source of funds to meet redemption requests and satisfy other liquidity needs.

Our primary investment objectives are:

• | to generate an attractive level of current income for distribution to our stockholders; |

• | to preserve and protect our stockholders’ capital investments; |

• | to achieve appreciation of our NAV; and |

6

• | to enable stockholders to allocate a portion of their diversified, long-term investment portfolios to direct real estate as an alternative asset class. |

We cannot assure investors that we will attain our investment objectives.

Our board of directors is comprised of four directors who are independent from us and three directors who are employees of our advisor or its affiliates. Our board of directors, including our independent directors, reviews our investment portfolio on a quarterly basis. In addition, our board of directors has adopted investment guidelines which set forth, among other things, our portfolio allocation targets, guidelines for investing in our targeted property types and investment policies restricting certain types of investments, all of which we describe in more detail below. Our board of directors reviews the investment guidelines on an annual basis or more frequently as it deems appropriate. Changes to our investment guidelines must be approved by our board of directors, including a majority of our independent directors. Our board of directors may revise our investment guidelines without the concurrence of our stockholders. However, our board of directors will not amend our charter, including any investment policies that are provided in our charter, without the concurrence of holders of a majority of the outstanding shares entitled to vote, except for amendments that do not adversely affect the rights, preferences and privileges of our stockholders.

Our investment guidelines delegate to our advisor authority to execute acquisitions and dispositions of investments in properties and real estate-related assets, in each case so long as such acquisitions and dispositions are consistent with the investment guidelines adopted by our board of directors. Our board of directors has ultimate oversight over our investments and may change from time to time the scope of authority delegated to our advisor with respect to acquisition and disposition transactions. The consideration we pay for each property acquired will ordinarily be based on the fair market value of the property. However, in connection with an acquisition of a property from RREEF America, as our sponsor and advisor, a director or any of their affiliates, and in connection with any other acquisition in which a majority of our independent directors determines to be appropriate, the fair market value of the property acquired will be determined by an independent appraiser selected by our independent directors.

Until we have raised substantial proceeds in the Offering and acquired a diversified portfolio of our target investments, which we refer to as our “stabilization period,” we will balance the goal of achieving our portfolio allocation targets with the goal of carefully evaluating and selecting investment opportunities in order to maximize diversification and risk-adjusted returns. As a result, prior to stabilization, the percentages of our net assets comprised of various categories of assets may fluctuate as we identify investment opportunities and make investments with a combination of proceeds from the Offering and proceeds from borrowings.

As we approach stabilization, we will seek to invest:

• | up to 80% of our net assets in properties; |

• | up to 35% of our net assets in real estate equity securities; |

• | up to 15% of our net assets in real estate loans; and |

• | up to 10% of our net assets in cash, cash equivalents and other short-term investments. |

Acquisition and Investment Policies

Commercial Real Estate Properties

We intend to have up to 80% of our net assets in a diversified portfolio of high quality, income-producing commercial real estate properties diversified across office, industrial, retail and multifamily property types. We believe that our advisor’s significant experience acquiring, managing and exiting real property investments across all of our targeted property types in various U.S. real estate markets will be beneficial to achieving our investment goals and objectives.

Headquartered in New York, our advisor has been acquiring and managing real estate investments in the United States since 1975. As of December 31, 2015, our advisor managed approximately $20.8 billion in real property in the Americas comprised of 299 properties and approximately 89.4 million square feet. Our advisor will utilize the personnel and resources of Deutsche AM’s real estate investment business as appropriate in performing services for us.

A more detailed description of the property types we will invest in is as follows:

7

Office Properties. Office sector properties are generally categorized based upon location and quality. Buildings may be located in Central Business Districts, or CBDs, or suburbs. Buildings are also classified by general quality and size, ranging from Class A properties which are generally large-scale buildings of the highest quality to Class C buildings which are below investment grade. We intend to invest in Class A or B office properties that are near executive housing, have sufficient transportation access or are located within well-established suburban office/business parks or CBDs. We expect the term of our office leases to be between five and ten years which can help mitigate the volatility of our portfolio’s income.

Industrial Properties. Industrial properties are generally categorized as distribution centers or warehouses, research and development facilities, flex space or manufacturing. The performance of industrial properties is typically dependent on the proximity to economic centers and the movement of trade and goods. In addition, industrial properties typically utilize a triple-net lease structure pursuant to which the tenant is generally responsible for property operating expenses in addition to base rent which helps mitigate the risks associated with rising expenses. We intend to invest in industrial properties that are located in major distribution hubs and near transportation modes such as port facilities, airports, rail lines and major highway systems.

Retail Properties. The retail sector is comprised of five main categories: neighborhood retail, community centers, regional centers, super-regional centers and single-tenant stores. Location, convenience, accessibility and tenant mix are generally considered to be among the key criteria for successful retail investments. Retail leases tend to range from three to five years for small tenants and ten to 15 years for large anchor tenants. Leases, particularly for anchor tenants, may include a base payment plus a percentage of retail sales. Income and population density are generally considered to be key drivers of local retail demand. We will seek investments in retail properties that are located within densely populated residential areas with favorable demographic characteristics and near other retail and service amenities.

Multifamily Properties. Multifamily properties are generally defined as having five or more dwelling units that are part of a single complex and offered for rental use as opposed to detached single-family residential properties. There are three main categories of multifamily properties: garden-style, low-rise and high-rise. Apartments generally have the lowest vacancy rates of any property type, with the better performing properties typically located in urban markets or locations with strong employment and demographic dynamics. We plan to invest in multifamily properties that are located in or near employment centers with favorable potential for employment growth and conveniently situated with access to transportation and retail and service amenities. Traditional multifamily properties are generally leased by apartment unit to individual tenants for one year terms. Certain multifamily properties, such as our student housing property, The Flats at Carrs Hill, are leased by individual bed for one year terms, regardless of the number of beds in a single unit.

Geographic Diversification

We generally will invest in properties in the largest metropolitan areas in the United States, classified into our target and investable markets. Our advisor's research group will produce forecasts for all of the major real estate markets that pass a set of screening criteria used to define the most attractive target real estate investment markets. Research specialists for the office, industrial, retail and multifamily sectors have designed appropriate models for assessing supply and demand in the major target submarkets for investment in these metros. Demand models are based upon economic and employment forecasts provided by our advisor's economists. The purpose of forecasting market behavior is to determine which of the target markets (and property sectors therein) are likely to outperform over the forecasted period in order to determine views on active tactical weighting of a portfolio.

Financing

We intend to incur debt to acquire properties where our advisor determines that incurring such debt is in our best interest, and in the best interest of our stockholders. We may finance the properties on our secured line of credit or obtain new property level debt. In addition, from time to time, we may acquire properties without financing and later incur mortgage debt secured by one or more of these properties if favorable financing terms are available. We will use the proceeds from the debt to acquire additional properties and maintain liquidity. See “Borrowing Policies” below for a more detailed description of our borrowing intentions and limitations.

Description of Leases

In general, we will seek a favorable mix of tenants in our properties to achieve greater economic diversification than is afforded by geographic and property type considerations alone. We will strive to maintain a stable blend of national and

8

international credit tenants and creditworthy regional and local tenants. Tenancy diversification criteria will be applied at the property level as well as at the portfolio level.

The length of tenancy generally will reflect local market conditions for each property. However, if possible, we will seek to negotiate longer-term leases to reduce the cash flow volatility associated with lease rollovers, provided that contractual rent increases are included. We intend to manage lease rollover risk on a portfolio basis. Where appropriate, we will also seek leases that provide for operating expenses, and/or expense increases, to be paid by the tenants. We may acquire properties under which the lease term has partially expired. We also may acquire properties with shorter lease terms if the property is in an attractive location, if the property is difficult to replace, or if the property has other favorable attributes.

Real Estate Underwriting Process

Our property acquisitions will be sourced by our advisor's real estate transactions group, which has offices strategically located in San Francisco, Chicago and New York. The acquisitions professionals of our advisor spend a majority of their time sourcing, evaluating, and closing transactions. These professionals are organized along regional lines with specific markets and regions of coverage.

Potential acquisitions are systematically screened in the investment process to select the most attractive opportunities. The transactions group applies a comprehensive, systematic, and in-depth process to the analysis of institutional real estate markets as well as to the future performance prospects of each potential investment. The criteria includes specifications such as transaction size, investment process (time frames), leverage, geographic location, property type, physical characteristics, return hurdles, and various other portfolio considerations.

After sourcing a potential acquisition and performing an initial analysis, the transactions group presents the potential transaction to the Americas Investment Committee. The Americas Investment Committee has responsibility for screening and approving each potential real property investment as well as investments in real estate loans. Once deal terms are agreed with a seller, the opportunity is first presented to the program or account that has the highest priority position on the rotation priority list. See "Conflicts of Interest-Certain Conflict Resolution Measures-Allocation of Investment Opportunities" below for further detail. If RREEF Property Trust has the highest priority position, and the acquisition is deemed appropriate for our portfolio and meriting future investigation, then the Americas Investment Committee, including our CEO and lead portfolio manager, formally allocates the investment to the Company. At this point the acquisition is approved to move forward and due diligence is commenced.

Due Diligence

Our advisor will perform a comprehensive due diligence review on each property that it proposes to purchase on our behalf. As part of this review, our advisor will obtain an environmental site assessment, which at a minimum includes a Phase I assessment, and structural condition reports. Our advisor will propose to purchase a property only if our advisor is satisfied with the physical and environmental status of the property as well as the property’s tenancy. Our advisor will also perform tax due diligence on the property to ensure that any purchased asset will not adversely affect our ability to qualify as a REIT for federal income tax purposes. In addition, our advisor will generally seek to condition our obligation to acquire the property on the delivery and verification of certain documents from the seller or developer, including, where appropriate:

• | plans and specifications; |

• | surveys; |

• | evidence of marketable title; |

• | title and liability insurance policies; |

• | asbestos, soil, physical, structural and engineering reports; |

• | evidence of compliance with zoning, the Americans with Disabilities Act, and fair housing laws; |

• | tenant leases and other relevant legal documents; and |

• | financial statements covering recent operations of properties having operating histories. |

Closing

The transactions group which sourced and evaluated the acquisition, negotiated the agreement, and coordinated the due diligence process also takes responsibility for closing the transaction. Many resources are utilized during closing and

9

may include engineering, finance, legal counsel, accounting, portfolio management, asset management and risk management personnel.

Disposition Policies

We anticipate that we will hold most of our properties for an extended period. However, we may determine to sell a property before the end of its anticipated holding period. We will monitor each investment within the portfolio and the overall portfolio composition for appropriateness in meeting our investment objectives. Our advisor may determine to sell a property before the end of its anticipated holding period if:

• | an opportunity arises to enhance overall investment returns by reallocating capital through sale of the property to a more attractive investment; |

• | there are diversification benefits associated with disposing of the property and rebalancing our investment portfolio; |

• | in the judgment of our advisor, the value of the property might decline or the property may underperform; |

• | the property was acquired as part of a portfolio acquisition and does not meet our investment guidelines; |

• | we need to generate liquidity to satisfy redemption requests, to pay distributions to our stockholders or for working capital; or |

• | in the judgment of our advisor, the sale of the property is otherwise in our best interest. |

Generally, we will reinvest proceeds from the sale, financing or other disposition of properties in a manner consistent with our investment strategy, although we may be required to distribute such proceeds to the stockholders in order to comply with REIT requirements or in other instances.

Ownership Structure

In most cases, our Operating Partnership or one or more subsidiary entities controlled by our Operating Partnership will acquire properties on our behalf. We may also utilize qualified REIT subsidiaries or taxable REIT subsidiaries if such structures would provide an economic benefit to us. Generally, we will acquire the entire equity ownership interest in properties. However, we may also enter into joint ventures, general partnerships, co-tenancies and other participation arrangements with other investors to acquire properties. In most cases in which less than the entire equity ownership interest is acquired, we will seek critical elements of control. We will generally acquire fee simple interests for the properties (in which we own both the land and the building improvements), but may consider leased fee and leasehold interests if we believe the investment is consistent with our investment strategy and objectives.

Joint Venture Investments

We may co-invest in the future with third parties through partnerships or other entities, which we collectively refer to as joint ventures, acquiring non-controlling interests in or sharing responsibility for managing the affairs of the joint venture. In such event, we would not be in a position to exercise sole decision-making authority regarding the joint venture. Investments in joint ventures may, under certain circumstances, involve risks not present were a third party not involved, including the possibility that partners or co-venturers might become bankrupt or fail to fund their required capital contributions. Co-venturers may have economic or other business interests or goals which are inconsistent with our business interests or goals, and may be in a position to take actions contrary to our policies or objectives. Such investments may also have the potential risk of impasses on decisions, such as a sale, because neither we nor the co-venturer would have full control over the joint venture. Disputes between us and co-venturers may result in litigation or arbitration that would increase our expenses and prevent our officers and directors from focusing their time and effort on our business. Consequently, actions by or disputes with co-venturers might result in subjecting properties owned by the joint venture to additional risk. In addition, we may in certain circumstances be liable for the actions of our co-venturers.

Joint Venture and Co-ownership Arrangements with Affiliates

Subject to approval by our board of directors and the separate approval of our independent directors, we may invest in properties and assets jointly with affiliates of our advisor as well as third parties. Joint ownership of properties, under certain circumstances, may involve conflicts of interest. Examples of these conflicts include:

• | such partners or co-investors might have economic or other business interests or goals that are inconsistent with our business interests or goals, including goals relating to the financing, management, operation, |

10

leasing or sale of properties held in the joint venture or the timing of the termination and liquidation of the venture;

• | such partners or co-investors may be in a position to take action contrary to our policies or objectives, including our policy with respect to maintaining our qualification as a REIT; |

• | under joint venture or other co-investment arrangements, neither co-venturer or co-investor may have the power to control the venture or co-investment and, under certain circumstances, an impasse could result and this impasse could have an adverse impact on the joint venture or co-investment, which could adversely impact the operations and profitability of the joint venture or co-investment and/or the amount and timing of distributions we receive from such joint venture or co-investment; and |

• | under joint venture or other co-investment arrangements, each joint venturer or co-investor may have a buy/sell right and, as a result of the exercise of such a right, we may be forced to sell our interest, or buy a co-venturer’s interest, at a time when it would not otherwise be in our best interest to do so. |

Each transaction we enter into with our advisor or its affiliates is subject to an inherent conflict of interest. Our board of directors may encounter conflicts of interest in enforcing our rights against any affiliate in the event of a default by or disagreement with an affiliate, or in invoking powers, rights or options pursuant to any agreement between us and any affiliate. A majority of our directors, including a majority of the independent directors, who are disinterested in the transaction must approve each transaction between us and our advisor or any of its affiliates as being fair and reasonable to us and on terms and conditions no less favorable to us than those available from unaffiliated third parties.

Value-Add Opportunities

We may periodically seek to enhance investment returns through various value-add opportunities. Examples of potential value-add investments include properties with significant leasing risk, forward purchase commitments, renovation opportunities and other nontraditional property types. These investments generally have a higher risk and higher return profile than properties that fall within our primary investment strategy. Currently, value-add investments are capped at 15% of our gross asset value so long as, in the aggregate, they are not expected to materially change the risk profile of the overall portfolio.

Development Opportunities

We do not intend to acquire higher risk and higher return properties in need of significant renovation, redevelopment or repositioning. However, we may invest in these types of properties if we believe that attractive risk-adjusted investment returns can be achieved through proactive management techniques or value-added programs. Investments in development assets are included in, and subject to, the 15% value-added cap described in the "Value-Add Opportunities" section above. We are permitted to undertake speculative development at or adjacent to properties we own.

Real Estate Equity Securities

We may invest up to 35% of our net assets in U.S. real estate equity securities. We believe that the inclusion of an allocation to real estate equity securities allows us to improve the total return profile of an investment in our shares of common stock. We believe that our advisor’s ability to acquire real estate equity securities in conjunction with acquiring a diverse portfolio of properties and real estate loans affords us additional liquidity and diversification, which provides greater financial flexibility and discretion to construct an investment portfolio designed to achieve our investment objectives throughout various economic cycles.

We believe that execution of our strategy to include U.S. real estate equity securities in our overall investment portfolio will be greatly enhanced due to the expertise that our advisor provides to us through its access to the in-house real estate equity securities platform of Deutsche AM’s real estate investment business ("Deutsche AM Real Estate Securities"). As of December 31, 2015, the Deutsche AM Real Estate Securities team was comprised of 21 professionals who manage approximately $8.7 billion of real estate securities globally, making Deutsche AM one of the largest managers of actively managed listed real estate securities in the world. The investment approach of Deutsche AM Real Estate Securities focuses on active stock selection by local investment teams with a global top-down overlay of strategic allocation and risk management. The importance of underlying real estate fundamentals is emphasized in the selection and valuation of stocks.

Subject to the percentage of ownership limitations and gross income and asset requirements required for REIT qualification, we invest in equity securities of companies engaged in the real estate sector where such investment would

11

be consistent with our investment policies and our status as a REIT. In any event, we do not intend that our investments in securities will require us to register as an investment company under the Investment Company Act, and we intend to generally divest appropriate securities before any such registration would be required.

Equity securities in the real estate sector include those issued by REITs and similar tax-transparent entities, real estate operating companies (“REOCs”) and other real estate related companies that, as their primary business own, develop, operate or finance real estate in the United States of America. Equity securities issued by REITs, REOCs and other real estate related companies include any stapled security or an issued security of an equity nature of a unit trust company that derives the majority of its earnings from real estate activities. REOCs and other real estate related companies in which we invest typically will either have at least 50% of their assets in real estate or related operations, or derive at least 50% of their revenues from such sources. Our real estate equity securities portfolio may consist of securities investments of different types of REITs, such as equity or mortgage REITs. Equity REITs buy real estate and pay investors from the rents they receive and from any profits on the sale of their properties. Mortgage REITs lend money to real estate companies and pay investors from the interest they receive on those loans. Hybrid REITs engage in owning real estate and making real estate based loans. While our advisor expects that our assets will be invested primarily in equity REITs, in changing market conditions we may invest more significantly in other types of REITs. We may also acquire exchange-traded funds and mutual funds focused on REITs and real estate companies. We intend to invest primarily in common stock, but may also include other types of equities, such as preferred or convertible stock.

We may invest in securities that are listed on one or more national stock exchanges. Subject to our ability to participate in such investments, we may also invest in securities that are not yet listed on a public stock exchange, but for which (1) the issuer has publicly announced its intention to list the securities on a public stock exchange within 180 days of the date of such announcement or (2) are securities of a listed company and the securities are expected to list on a public stock exchange within 180 days of the date of issuance.

We may also invest in securities that our advisor has determined are not sufficiently marketable to be considered liquid securities, including securities that are eligible for resale in reliance on an exemption from registration with the SEC. We may also invest in exchange-traded funds, including those primarily designed to replicate or model the performance of securities market indices.

We may also invest in securities issued or guaranteed by the U.S. government, its agencies or instrumentalities (“U.S. Government Securities”); certificates of deposit, demand and time deposits and bankers’ acceptances; prime commercial paper, including master demand notes; and repurchase agreements secured by U.S. Government Securities (or other interim investments in foreign government and other non-U.S. short-term investments).

Our charter requires that any investment in equity securities (other than equity securities traded on a national securities exchange or included for quotation on an inter-dealer quotation system) must be approved by a majority of our directors, including a majority of our independent directors, not otherwise interested in the transaction as being fair, competitive and commercially reasonable.

We may not acquire (1) securities of companies with a market capitalization of less than $50 million at the time of purchase nor (2) interests or equity securities in any entity either holding investments, or engaging in activities, prohibited by our charter. We also may not engage in the business of securities trading, underwriting or the agency distribution of securities issued by other persons.

Real Estate Equity Securities - Investment Decision Process

In evaluating prospective real estate equity securities investments, our advisor’s portfolio construction process encompasses a two-step investment strategy through a combination of bottom-up stock selection and top-down sector allocation.

Portfolio Construction Process

Deutsche AM Real Estate Securities combines fundamental real estate analysis with detailed bottom-up company valuation to derive expected returns by company. Our advisor’s investment process begins with a top-down view of the real estate markets utilizing information from third party research providers and its in-house resources. Deutsche AM Real Estate Securities has the ability to take advantage of accessing real-time property market information provided through our advisor’s direct property investment activities, which include research, transactions, portfolio management, asset

12

management, and capital markets expertise. In addition, Deutsche AM Real Estate Securities has significant history and long-standing relationships with REITs and their management teams.

Sector Allocations

Sector allocations are established at a minimum on a quarterly basis and reviewed by our advisor’s Real Estate Securities Strategic Investment Committee, whose membership consists of senior members from the Chief Investment Office, acquisitions, portfolio management, and research teams of the advisor, as well as the Deutsche AM Real Estate Securities portfolio management team. Sector allocations are based on analyzing trends in each property sector, individual company performance and valuation, and recommendations for property sector allocations for the upcoming quarter. Members of the committee from our advisor’s direct property investment business discuss views on trends within property sectors and geographic regions.

After discussing individual property sectors and geographic regions, specific property sector allocation recommendations are discussed with each Investment Committee member. Deutsche AM Real Estate Securities coordinates comments on final allocations, which are stated as ranges within which the portfolio will be positioned. The keys to the property sector allocation process involve (1) discussing real-time trends and future expectations for property type sectors from the direct side participants, (2) comparing these to the public markets views, and (3) positioning the portfolio to take advantage of discrepancies.

Stock Selection

Once property sector weights have been determined, issuers within each sector are selected by using a valuation process in which Deutsche AM Real Estate Securities forecasts total return utilizing our advisor’s proprietary valuation model. Sector specialists within Deutsche AM Real Estate Securities forecast 10-year cash flows for each issuer by utilizing our advisor’s market-level revenue forecasts and a detailed breakdown of each issuer’s portfolio. Deutsche AM Real Estate Securities calculates a unique required return for each issuer based on the issuer’s market exposure and property quality. Deutsche AM Real Estate Securities leverages information provided by our advisor’s property acquisition and disposition professionals to determine a net real estate value for the issuer's portfolio. Net asset values for the issuers are adjusted for differences in operations and corporate strategy, management quality, liquidity, general and administrative expense and franchise value. Stocks are then selected and weights are identified based on our advisor’s review of total return potential for each issuer through this valuation process, and through discussion of these expectations among the portfolio management team and the property sector analyst. Decisions on which securities to buy or sell are based on in-depth research of public and direct property markets, while taking a disciplined approach to managing risk. The stock valuation and portfolio construction process focuses primarily on price/NAV, but also considers price/cash flow, and enterprise value/EBIDTA (or inversely, equity cash flow yield and implied capitalization rates).

Sale of Real Estate Equity Securities

Our advisor may choose to sell a security for a variety of reasons, including but not limited to the following:

• | the security is not fulfilling its investment purpose; |

• | our advisor determines that the security has reached its optimum valuation; or |

• | a particular company’s condition or general economic conditions have changed. |

Investing in and Originating Real Estate Loans

We may invest up to 15% of our net assets in real estate loans. The inclusion of an allocation to real estate loans allows us to add sources of income and further diversify our portfolio. The type of debt interests we will seek to acquire will be obligations backed principally by real estate of the type that generally meets our criteria for direct investment, including, without limitation, senior mortgage loans, subordinated mortgage loans, mezzanine loans and commercial mortgage-backed securities ("CMBS"). We do not intend to invest in real estate loans until our total NAV reaches $100 million. The criteria that our advisor will use in making or investing in loans on our behalf is substantially the same as those involved in acquiring our investments in properties. We expect that the average duration of real estate loans will typically be three to ten years.

We believe that execution of our strategy to include real estate loans in our overall investment portfolio will be greatly enhanced due to the expertise that our advisor provides us through its access to our advisor’s in-house real estate

13

debt investment platform, (the "Debt Investments Group"). The Debt Investments Group is comprised of four professionals with extensive experience in originating, underwriting and investing in mezzanine loans, B-notes, preferred equity and mortgages secured by cash-flowing, or transitional, real estate and real estate related assets across various property types.

Our real estate loans investment strategy is to originate or acquire well-structured, moderate loan-to-value, senior mortgage loans and subordinate real estate debt for institutionally desirable commercial real estate properties sponsored by experienced, financially sound borrowers that achieve strong risk-adjusted returns for investors.

We may originate or acquire interests in mortgage loans, generally on the same types of properties we might otherwise buy. These mortgage loans may pay fixed or variable interest rates or have “participating” features described below. Normally, our mortgage loans will be secured by income-producing properties. They usually will be non-recourse, which means they will not be the borrower’s personal obligations. We expect that most will be first mortgage loans, with first priority liens on the property. These loans may provide for payments of principal and interest or may provide for interest-only payments, with a balloon payment at maturity.

We may make mortgage loans that permit us to participate in the revenues from or appreciation of the underlying property consistent with the rules applicable to qualification as a REIT. These participations will let us receive additional interest, usually calculated as a percentage of the gross income the borrower receives from operating, selling or refinancing the property above cost. We may also receive an option to buy an interest in the property securing the participating loan. If the nature of the underlying property is not consistent with the rules applicable to qualification as a REIT, we may assign participation rights to a taxable REIT subsidiary to avoid prohibited transaction exposure.

We may invest in mezzanine loans, which are a type of subordinate loan where the loan is secured by one or more direct or indirect ownership interests in an entity that directly or indirectly owns real estate. Investors in mezzanine loans are compensated for the increased credit risk from a pricing perspective and still benefit from the right to foreclose on its security, in many instances more efficiently than first mortgage loans. Upon a default by the borrower under a mezzanine loan, the mezzanine lender generally can take control of the entity that owns the property on an expedited basis, subject to the rights of the holders of debt senior in priority on the property. Rights of holders of mezzanine loans are usually governed by an intercreditor agreement that provides the mezzanine lender with the right to cure defaults and limit certain decisions of holders of any senior debt secured by the same properties, which provides for additional downside protection and higher recoveries.

We also may invest in CMBS, which are securities that evidence interests in, or are secured by, a single commercial mortgage loan or a pool of commercial mortgage loans. As a result, these securities are subject to all of the risks of the underlying mortgage loans. In a typical CMBS transaction, many single mortgage loans of varying size, property type and location are pooled and transferred to a trust. The trust then issues multiple tranches of bonds that may vary in yield, duration and payment priority, thereby allowing an investor to select a credit level that suits its risk profile. Losses and other shortfalls from expected amounts to be received on the mortgage pool are borne by the most subordinate tranches, which receive payments only after the more senior tranches have received all principal and/or interest to which they are entitled.

The securitization process for CMBS is governed by one or more nationally recognized rating agencies, including Fitch, Moody’s and Standard & Poor’s, who determine the respective bond class sizes, generally based on a sequential payment structure commonly referred to as a “waterfall.” Bonds that are rated from AAA to BBB- by the rating agencies are considered “investment grade.” Bond classes that are subordinate to the BBB class, including unrated bond classes, are considered below investment grade, and are often collectively referred to as the “B-piece” of a CMBS securitization transaction. The respective bond class sizes are determined based on the review of the underlying collateral by the rating agencies. The payments received from the underlying loans are used to make the payments on the securities. Based on the sequential payment priority, the risk of nonpayment for the AAA securities is lower than the risk of nonpayment for the non-investment grade bonds. Accordingly, the AAA class is typically sold at a lower yield compared to the non-investment grade classes that are sold at higher yields. Due to its lower credit ratings and higher risk, successful investing in B-piece debt requires thorough and detailed loan-level due diligence (similar to loan origination), which we believe reduces the competition among potential buyers and presents an opportunity for us to benefit from the experience of our management team and the resources available to it. In addition, B-piece buyers generally have strong negotiating leverage in a CMBS securitization transaction, which may be utilized to favorably influence the structure of the transaction and reject undesirable loans. We may invest in CMBS which are rated AAA through BBB as well as CMBS that are considered below investment grade or are unrated.

14

Given the complexity of investments in CMBS and CMBS B-pieces and the infrastructure and skills required to successfully make such investments, we believe that the resources of our advisor provide us a competitive advantage in making these types of investments. Our advisor’s ability to evaluate CMBS based on the credit risk of the underlying collateral and the risk of the transactional structure is crucial in creating attractive risk-adjusted investment returns based on our expected performance of a CMBS investment.

We may not make or invest in individual mortgage loans (excluding any investments in mortgage pools, commercial mortgage-backed securities or residential mortgage-backed securities) unless an appraisal is obtained concerning the underlying property, except for mortgage loans insured or guaranteed by a government or government agency. In cases where a majority of our independent directors determines the need, and in all cases in which the transaction is with our advisor, any of our directors or any of their affiliates, an appraisal shall be obtained from an independent appraiser. We will maintain the appraisal in our records for at least five years and it will be available for inspection and duplication by common stockholders. We will also obtain a mortgagee’s or owner’s title insurance policy as to the priority of the mortgage.

We also may not make or invest in mortgage loans that are subordinate to any lien or other indebtedness of any of our directors, advisor or our advisor’s affiliates. Additionally, we may not make or invest in mortgage loans, including construction loans but excluding any investment in commercial mortgage-backed securities or residential mortgage-backed securities, on any one real property if the aggregate amount of all mortgage loans on such real property would exceed an amount equal to 80% of the appraised value of such real property as determined by appraisal unless substantial justification exists because of the presence of other underwriting criteria.

Real Estate Loans - Investment Decision Process

In evaluating prospective real estate loan investments, our advisor will consider factors such as, but not limited to, the following:

• | conducting site visits; |

• | understanding submarket, regional and property market trends as well as the general economic climate; |

• | reviewing the reputation, track record and objectives of the deal sponsor and guarantor; |

• | meeting key personnel of the deal sponsor; |

• | performing property analysis and valuation; |

• | current and projected cash flow |

• | expected levels of rental and occupancy rates |

• | potential for capital appreciation |

• | condition and use; |

• | analyzing competition and business plan objectives; |

• | determining the ratio of the investment amount to the underlying property value; |

• | evaluating the degree of liquidity of the investment; |

• | in the case of mezzanine loans, determining the ability to acquire the underlying real property; |

• | evaluating the legal, tax, regulatory and accounting aspects of the investment structure; |

• | performing credit analysis; |

• | developing an asset management plan; and |

• | considering any additional factors our advisor deems relevant. |

The factors considered, including the specific weight we place on each factor, will vary for each prospective loan investment. As a result, we do not, and are not able to, assign a specific weight or level of importance to any particular factor. In addition, we will seek to obtain a customary lender’s title insurance policy or commitment as to the priority of the mortgage or condition of the title. We will also consider the requirements of the REIT rules, which may limit our ability to make certain loan investments.

We may originate loans from mortgage brokers or personal solicitations of suitable borrowers, or may purchase existing loans that were originated by other lenders. Our advisor will evaluate all potential real estate loans to determine if the security for the loan and the loan-to-value ratio ("LTV") meets our investment criteria and objectives. Most loans that we will consider for investment would provide for monthly payments of interest and some may also provide for principal amortization, although many loans of the nature that we will consider provide for payments of interest only and a payment of principal in full at the end of the loan term. We will not originate loans with negative amortization provisions.

15

Our loans may be subject to regulation by federal, state and local authorities and subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, including, among other things, regulating credit granting activities, establishing maximum interest rates and finance charges, requiring disclosures to customers, governing secured transactions and setting collection, repossession and claims handling procedures and other trade practices. In addition, certain states have enacted legislation requiring the licensing of mortgage bankers or other lenders and these requirements may affect our ability to effectuate our proposed investments in loans. Commencement of operations in these or other jurisdictions may be dependent upon a finding of our financial responsibility, character and fitness. We may determine not to make loans in any jurisdiction in which the regulatory authority determines that we have not complied in all material respects with applicable requirements.

Sale of Real Estate Loans

Our primary investment objective is to hold our real estate loans until the date of maturity. However, in the event an opportunity arises, we may consider a sale of a loan before its maturity date.

Cash, Cash Equivalents and Other Short-Term Investments

We intend to invest up to 10% of our assets in cash, cash equivalents and other short-term investments. These types of investments may include the following, to the extent consistent with our qualification as a REIT:

• | money market instruments, cash and other cash equivalents (such as high-quality short-term debt instruments, including commercial paper, certificates of deposit, bankers’ acceptances, repurchase agreements, interest- bearing time deposits and credit rated corporate debt securities); |

• | U.S. government or government agency securities; and |

• | credit rated corporate debt or asset-backed securities of U.S. or foreign entities, or credit rated debt securities of foreign governments or multi-national organizations. |

Other Investments

We may, but do not presently intend to, make investments other than as described above. At all times, we intend to make investments in such a manner consistent with maintaining our qualification as a REIT under the Internal Revenue Code. We do not intend to underwrite securities of other issuers.

Derivative Instruments and Hedging Activities

In the normal course of business, we may be exposed to the effect of interest rate changes and price changes and may seek to limit these risks by following established risk management policies and procedures including the use of derivatives. To mitigate exposure to variability in interest rates, we may use derivatives primarily to fix the interest rate on debt which is based on floating-rate indices and to manage the cost of borrowing obligations. We may use a variety of commonly used derivative products, including interest rate swaps, caps, collars and floors. We intend to enter into contracts with only major financial institutions based upon minimum credit ratings and other factors. We will periodically review the effectiveness of each hedging transaction. We intend to conduct our hedging activities in a manner consistent with the REIT qualification requirements.

Borrowing Policies

We use moderate financial leverage to provide additional funds to support our investment activities. This allows us to make more investments than would otherwise be possible, resulting in a more diversified portfolio. Our target leverage ratio at stabilization is approximately 40% of our gross assets, inclusive of property-level and entity-level debt. Before entering the stabilization period, we may employ greater leverage in order to more quickly build a diversified portfolio of assets. We may leverage our portfolio by assuming or incurring secured or unsecured property-level or entity-level debt. An example of property-level debt is a mortgage loan secured by an individual property or portfolio of properties incurred or assumed in connection with our acquisition of such property or portfolio of properties. An example of entity-level debt is a line of credit obtained by our operating partnership. In an effort to provide a ready source of liquidity to fund redemptions of shares of our common stock in the event that redemption requests exceed net proceeds from our continuous offering, we may decide to seek to obtain a line of credit under which we would reserve borrowing capacity. Since May 1, 2013, we have had a revolving secured line of credit with available borrowing capacity at all times.

16

Borrowings under the line may be used not only to redeem shares, but also to fund acquisitions or for any other corporate purpose.

Our actual leverage level will be affected by a number of factors, some of which are outside our control. Significant inflows of proceeds from the sale of shares of our common stock will generally cause our leverage as a percentage of our net assets, or our leverage ratio, to decrease, at least temporarily. Significant outflows of equity as a result of redemptions of shares of our common stock will generally cause our leverage ratio to increase, at least temporarily. Our leverage ratio will also increase or decrease with decreases or increases, respectively, in the value of our portfolio. If we borrow under a line of credit to fund redemptions of shares of our common stock or for other purposes, our leverage would increase and may exceed our target leverage. In such cases, our leverage may remain at the higher level until we receive additional net proceeds from our continuous offering or sell some of our assets to repay outstanding indebtedness.

Our board of directors will review our aggregate borrowings at least quarterly. In connection with such review, our board of directors may determine to modify our financial leverage policy in light of then-current economic conditions, relative costs of debt and equity capital, fair values of our properties, general conditions in the market for debt and equity securities, growth and investment opportunities or other factors. If we utilize a line of credit to fund redemptions, we will consider actual borrowings when determining whether we are at our leverage target, but not unused borrowing capacity. If, therefore, we are at our target leverage ratio of 40% and we borrow additional amounts under a line of credit, or if the value of our portfolio decreases, our leverage could exceed 40% of our gross assets. In the event that our leverage ratio exceeds our target, regardless of the reason, we will thereafter endeavor to manage our leverage back down to our target.

There is no limitation in our charter on the amount we may borrow against any single improved real property. However, we may not borrow more than approximately 75% of the sum of the cost of our investments (before non-cash reserves and depreciation), which is based upon the limit specified in our charter that borrowing may not exceed 300% of the cost of our net assets. “Net assets” is defined as our total assets other than intangibles valued at cost (prior to deducting depreciation, reserves for bad debts and other non-cash reserves) less total liabilities. However, we may temporarily borrow in excess of this amount if such excess is approved by a majority of our directors, including a majority of our independent directors, and disclosed to stockholders in our next quarterly report, along with justification for such excess. In such event, we will review our debt levels at that time and take action to reduce any such excess as soon as practicable. In addition to the limitation in our charter regarding our borrowings, our advisor has adopted a guideline stating that the leverage on any single improved property divided by its value may not exceed 75% LTV at the time of acquisition. For this purpose, the LTV ratio will be measured at the time such leverage is committed (not giving effect to any subsequent reductions in the value of the properties at closing or thereafter).

Our charter prohibits us from obtaining loans from any of our directors, our advisor or any of their affiliates, unless a majority of our directors (including a majority of our independent directors) not otherwise interested in the transaction approves the loan as fair, competitive and commercially reasonable and on terms and conditions not less favorable than comparable loans between unaffiliated parties under the same or similar circumstances.

Relationship with the Dealer Manager, SCAS and Former Wholesaler

SC Distributors, LLC (the “Dealer Manager”) provides distribution-related services to us for our Offering on a contractual basis. In addition, Strategic Capital Advisory Services, LLC (“SCAS”) provides our advisor with certain administrative and operational services. The Dealer Manager and SCAS exercise no control or influence over our investment, asset management or accounting functions or any other aspect of our management or operations, and neither the Dealer Manager nor SCAS owns any equity interests in our advisor. During the year ended December 31, 2015, the Dealer Manager and SCAS were owned by RCS Capital Corporation (“RCAP”), but were sold on January 29, 2016 to Validus/Strategic Capital LLC.

Realty Capital Securities, LLC (“RCS LLC”) formerly served as the Dealer Manager’s distribution agent, in which capacity it assisted the Dealer Manager with various aspects of our Offering. On November 14, 2015, we terminated the relationship with RCS LLC, effective November 24, 2015.

We operate under the direction of our board of directors, a majority of which are independent of us, RREEF America and its affiliates. Furthermore, no member of our board of directors also serves, or historically has served, as a director or executive officer of RCAP, the Dealer Manager, SCAS, RCS LLC or any of their affiliates.

Conflicts of Interest

17

We are subject to various conflicts of interest arising out of our relationship with our advisor, its affiliates and its employees, some of whom serve as our executive officers and directors. These conflicts include (1) conflicts with respect to the allocation of the time of our advisor and its key personnel, (2) conflicts with respect to the allocation of investment opportunities and (3) conflicts related to the compensation arrangements between our advisor, its affiliates and us. Our independent directors have an obligation to function on our behalf in all situations in which a conflict of interest may arise. All of our directors have a fiduciary obligation to act on behalf of our stockholders. We have adopted corporate governance measures to mitigate material conflict risk.

Interests of Our Advisor and Its Affiliates in Other Real Estate Programs

We rely on the real estate professionals employed by, and acting on behalf of, our advisor to source potential investments in properties, real estate-related assets and other investments in which we may be interested. Our advisor and certain members of its management team are presently, and in the future intend to be, involved with a number of other real estate programs and activities. Our advisor currently manages private commingled investment funds which are focused on the major real estate property types and markets primarily throughout the United States and, to a limited extent, internationally. Existing funds, such as RREEF America REIT II, and future programs, may directly compete with us for investment opportunities because the programs also may seek to provide investors with an attractive level of current income by means of stable distributions from investments in real estate as an asset class. In addition, our advisor manages a number of separate accounts on behalf of institutional investors that seek similar investment opportunities and may compete with us in receiving allocated investment opportunities.

Our advisor and other affiliates are not prohibited from engaging, directly or indirectly, in any other business or from possessing interests in any other business venture or ventures, including businesses and ventures involved in the acquisition, ownership, development, management, leasing or sale of real property or the acquisition, ownership, management and disposition of real estate-related assets. None of the entities affiliated with our advisor are prohibited from raising money for another entity that makes the same types of investments that we target, and we may co-invest with any such entity. Any such potential co-investment will be subject to approval by our independent directors.

Our advisor will not make any investment in properties on our behalf or recommend that we make any investment in properties unless the opportunity is approved in advance by our advisor’s Americas Investment Committee. The Americas Investment Committee, which is comprised of certain key personnel of our advisor, is responsible for determining which of its investment programs will have the opportunity to acquire and participate in real property investments as they become available and could face conflicts of interest in making these determinations. As a result, other investment programs and investors advised by our advisor or its affiliates may compete with us with respect to certain investments that we may want to acquire. Pursuant to the Americas Investment Committee charter, the committee administers an allocation policy designed to address this potential conflict of interest. See “—Certain Conflict Resolution Measures—Allocation of Investment Opportunities” below.

Competition for Acquiring, Leasing and Selling Investments

We may compete with other entities that our advisor's affiliates may advise for opportunities to acquire, lease, finance or sell investments. As a result of this competition, certain investment opportunities may not be available to us. Our advisor has developed procedures to resolve potential conflicts of interest in the allocation of investment opportunities between us and other programs or investors it advises. Our advisor will be required to provide information to our board of directors to enable the board, including the independent directors, to determine whether such procedures are being fairly applied to us. See “—Certain Conflict Resolution Measures—Allocation of Investment Opportunities” below for a further description of how potential investment opportunities will be allocated between us and affiliated and other related entities.

Our executive officers, certain of our directors and their affiliates also may acquire or develop real estate and real estate-related assets for their own accounts, and have done so in the past. Furthermore, our executive officers, certain of our directors and their affiliates may form additional real estate investment entities in the future, whether public or private, which can be expected to have the same or similar investment objectives and targeted assets as we have, and such persons may be engaged in sponsoring one or more of such entities at approximately the same time as the offering of our shares of common stock. Our advisor, its employees and certain of its affiliates and related parties will experience conflicts of interest as they simultaneously perform investment services for us and other real estate programs that they sponsor or have involvement with.

18