Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - RREEF Property Trust, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT - RREEF Property Trust, Inc. | rpt-20130930xex321.htm |

| EX-31.2 - EXHIBIT - RREEF Property Trust, Inc. | rpt-20130930xex312.htm |

| EX-31.1 - EXHIBIT - RREEF Property Trust, Inc. | rpt-20130930xex311.htm |

| EX-10.1 - EXHIBIT - RREEF Property Trust, Inc. | rpt-20130930xex101xamended.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form 10-Q

_________________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2013

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-180356

__________________________________________

RREEF Property Trust, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

Maryland | 45-4478978 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

345 Park Avenue, 24th Floor, New York, NY 10154 | (212) 454-6260 |

(Address of principal executive offices; zip code) | (Registrant’s telephone number, including area code) |

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | x (Do not check if smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

There is no established market for the registrant's shares of common stock. As of November 11, 2013, the registrant had 651,717 shares of Class A common stock, $.01 par value, outstanding, and 1,024,540 shares of Class B common stock, $.01 par value, outstanding, 868,032 of which were held by an affiliate.

RREEF PROPERTY TRUST, INC.

INDEX

2

PART I

FINANCIAL INFORMATION

RREEF PROPERTY TRUST, INC.

CONSOLIDATED BALANCE SHEETS

September 30, 2013 (unaudited) | December 31, 2012 | ||||||

ASSETS | |||||||

Investment in real estate assets: | |||||||

Land | $ | 2,310,684 | $ | — | |||

Buildings and improvements, less accumulated depreciation of $110,365 | 7,096,125 | — | |||||

Acquired intangible lease assets, less accumulated amortization of $230,971 | 3,551,855 | — | |||||

Total investment in real estate assets, net | 12,958,664 | — | |||||

Investment in marketable securities | 2,927,310 | — | |||||

Total investment in real estate assets and marketable securities, net | 15,885,974 | — | |||||

Cash and cash equivalents | 668,595 | 200,000 | |||||

Receivables | 46,177 | — | |||||

Prepaid expenses | 55,337 | — | |||||

Deferred financing costs, less accumulated amortization of $113,358 | 431,048 | — | |||||

Total assets | $ | 17,087,131 | $ | 200,000 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

Line of credit | $ | — | $ | — | |||

Accounts payable and accrued expenses | 8,164 | — | |||||

Due to affiliates | 4,064,160 | — | |||||

Distributions payable | 24,597 | — | |||||

Other liabilities | 97,729 | — | |||||

Total liabilities | 4,194,650 | — | |||||

Stockholders' Equity: | |||||||

Preferred stock, $0.01 par value; 50,000,000 shares authorized, none issued | — | — | |||||

Common stock, $0.01 par value; 500,000,000 Class A shares authorized, 456,231 and 0 shares issued and outstanding, respectively | 4,562 | — | |||||

Common stock, $0.01 par value; 500,000,000 Class B shares authorized, 945,900 and 16,667 shares issued and outstanding, respectively | 9,459 | 167 | |||||

Additional paid-in capital | 14,515,071 | 199,833 | |||||

Accumulated deficit | (1,471,851 | ) | — | ||||

Accumulated other comprehensive loss | (164,760 | ) | — | ||||

Total stockholders' equity | 12,892,481 | 200,000 | |||||

Total liabilities and stockholders' equity | $ | 17,087,131 | $ | 200,000 | |||

The accompanying notes are an integral part of these consolidated financial statements.

3

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENTS OF OPERATIONS

Three Months Ended September 30, 2013 | Nine Months Ended September 30, 2013 | ||||||

Revenues: | |||||||

Rental and other property income | $ | 313,307 | $ | 420,801 | |||

Investment income on marketable securities | 29,299 | 49,289 | |||||

Total revenues | 342,606 | 470,090 | |||||

Expenses: | |||||||

General and administrative expenses | 538,253 | 1,084,129 | |||||

Property operating expenses | 11,927 | 16,140 | |||||

Acquisition related expenses | 848 | 59,334 | |||||

Depreciation | 73,577 | 110,365 | |||||

Amortization | 171,407 | 230,386 | |||||

Total operating expenses | 796,012 | 1,500,354 | |||||

Operating loss | (453,406 | ) | (1,030,264 | ) | |||

Interest expense | (138,375 | ) | (211,473 | ) | |||

Realized gain (loss) upon sale of marketable securities | 4,678 | (25,075 | ) | ||||

Net loss | $ | (587,103 | ) | $ | (1,266,812 | ) | |

Weighted average number of common shares outstanding: | |||||||

Basic and diluted | 1,095,953 | 478,169 | |||||

Net loss per common share: | |||||||

Basic and diluted | $ | (0.54 | ) | $ | (2.65 | ) | |

Distributions declared per share of common stock* | $ | 0.15 | $ | 0.20 | |||

* Distributions declared per share of common stock for the nine months ended September 30, 2013 is based on the weighted average number of shares outstanding for the period from May 30, 2013, commencement of operations, to September 30, 2013, or 1,032,716 shares.

The accompanying notes are an integral part of these consolidated financial statements.

4

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENTS OF COMPREHENSIVE INCOME

Three Months Ended September 30, 2013 | Nine Months Ended September 30, 2013 | ||||||

Net loss | $ | (587,103 | ) | $ | (1,266,812 | ) | |

Other comprehensive loss: | |||||||

Reclassification of previously unrealized (gain) loss on marketable securities into net loss | (4,678 | ) | 25,075 | ||||

Unrealized loss on marketable securities | (101,262 | ) | (189,835 | ) | |||

Total other comprehensive loss | (105,940 | ) | (164,760 | ) | |||

Comprehensive loss | $ | (693,043 | ) | $ | (1,431,572 | ) | |

The accompanying notes are an integral part of these consolidated financial statements.

5

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENT OF STOCKHOLDERS' EQUITY

Preferred Stock | Class A Common Stock | Class B Common Stock | Additional Paid in Capital | Accumulated Deficit | Accumulated other comprehensive loss | Total Stockholders' Equity | ||||||||||||||||||||||||||||||

Number of Shares | Par Value | Number of Shares | Par Value | Number of Shares | Par Value | |||||||||||||||||||||||||||||||

Balance, December 31, 2012 | — | $ | — | — | $ | — | 16,667 | $ | 167 | $ | 199,833 | $ | — | $ | — | $ | 200,000 | |||||||||||||||||||

Issuance of common stock | — | — | 456,212 | 4,562 | 914,935 | 9,149 | 16,631,291 | — | — | 16,645,002 | ||||||||||||||||||||||||||

Issuance of common stock through the distribution reinvestment plan | — | — | 19 | — | 14,298 | 143 | 173,634 | — | — | 173,777 | ||||||||||||||||||||||||||

Distributions to stockholders | — | — | — | — | — | — | — | (205,039 | ) | — | (205,039 | ) | ||||||||||||||||||||||||

Dealer manager fees | — | — | — | — | — | — | (4,018 | ) | — | — | (4,018 | ) | ||||||||||||||||||||||||

Other offering costs | — | — | — | — | — | — | (2,485,669 | ) | — | — | (2,485,669 | ) | ||||||||||||||||||||||||

Comprehensive loss | — | — | — | — | — | — | — | (1,266,812 | ) | (164,760 | ) | (1,431,572 | ) | |||||||||||||||||||||||

Balance, September 30, 2013 | — | $ | — | 456,231 | $ | 4,562 | 945,900 | $ | 9,459 | $ | 14,515,071 | $ | (1,471,851 | ) | $ | (164,760 | ) | $ | 12,892,481 | |||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

6

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENTS OF CASH FLOWS

Nine Months Ended September 30, 2013 | For the Period February 7, 2012 (inception) through September 30, 2012 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (1,266,812 | ) | $ | — | ||

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Depreciation | 110,365 | — | |||||

Realized loss upon sale of marketable securities | 25,075 | — | |||||

Amortization of intangible lease assets | 230,971 | — | |||||

Amortization of deferred financing costs | 113,358 | — | |||||

Changes in assets and liabilities: | |||||||

Receivables | (46,177 | ) | (744 | ) | |||

Prepaid expenses | (55,337 | ) | — | ||||

Accounts payable and accrued expenses | 2,956 | — | |||||

Other liabilities | 97,729 | — | |||||

Due to affiliates | 1,189,919 | — | |||||

Net cash provided by operating activities | 402,047 | (744 | ) | ||||

Cash flows from investing activities: | |||||||

Investment in real estate | (13,300,000 | ) | — | ||||

Investment in marketable securities | (4,445,872 | ) | — | ||||

Proceeds from sale of marketable securities | 1,328,727 | ||||||

Net cash used in investing activities | (16,417,145 | ) | — | ||||

Cash flows from financing activities: | |||||||

Proceeds from line of credit | 6,700,000 | — | |||||

Repayments of line of credit | (6,700,000 | ) | — | ||||

Proceeds from issuance of common stock | 16,645,002 | 200,000 | |||||

Payment of offering costs | (131,913 | ) | — | ||||

Distributions to investors | (180,442 | ) | — | ||||

Common stock issued through the distribution reinvestment plan | 173,777 | — | |||||

Deferred financing costs paid | (22,731 | ) | — | ||||

Net cash provided by financing activities | 16,483,693 | 200,000 | |||||

Net increase in cash and cash equivalents | 468,595 | 199,256 | |||||

Cash and cash equivalents, beginning of period | 200,000 | — | |||||

Cash and cash equivalents, end of period | $ | 668,595 | $ | 199,256 | |||

Supplemental disclosures of non-cash investing and financing activities: | |||||||

Accrued offering costs due to affiliate | $ | 2,352,565 | $ | — | |||

Distributions declared and unpaid | $ | 24,597 | $ | — | |||

Accrued deferred financing costs | $ | 521,675 | $ | — | |||

Unrealized loss on marketable securities | $ | (164,760 | ) | $ | — | ||

Supplemental cash flow disclosures: | |||||||

Interest paid | $ | 39,345 | $ | — | |||

The accompanying notes are an integral part of these consolidated financial statements.

7

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS

September 30, 2013

NOTE 1 — ORGANIZATION

RREEF Property Trust, Inc. (the “Company”) was formed on February 7, 2012 as a Maryland corporation and intends to qualify as a real estate investment trust (“REIT”) for federal income tax purposes. On February 14, 2012, RREEF America L.L.C., a Delaware limited liability company (“RREEF America”), the Company's sponsor and advisor, purchased 16,667 shares of the Company’s Class B common stock for a total cash consideration of $200,000 to provide the Company’s initial capitalization. Substantially all of the Company's business will be conducted through RREEF Property Operating Partnership, LP, the Company's operating partnership (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership and contributed $199,000 to the Operating Partnership in exchange for its general partner interest. RREEF Property OP Holder, LLC (the “OP Holder”), a wholly-owned subsidiary of the Company and the initial limited partner of the Operating Partnership, contributed $1,000 to the Operating Partnership. As the Company completes the settlement for purchase orders for shares of its common stock in its continuous public offering, it will continue to transfer substantially all of the net proceeds of the offering to the Operating Partnership.

The Company was organized to invest primarily in a diversified portfolio consisting primarily of high quality, income-producing commercial real estate located primarily in the United States, including, without limitation, office, industrial, retail and multifamily properties (“Real Estate Properties”). Although the Company intends to invest primarily in Real Estate Properties, it also intends to acquire common and preferred stock of REITs and other real estate companies (“Real Estate Equity Securities”) and debt investments backed principally by real estate (“Real Estate Loans” and, together with Real Estate Equity Securities, “Real Estate-Related Assets”).

The Company is offering to the public, pursuant to a registration statement, $2,250,000,000 of shares of its common stock in its primary offering and $250,000,000 of shares of its common stock pursuant to its distribution reinvestment plan (the “Offering”). The Company is offering to the public two classes of shares of its common stock, Class A shares and Class B shares. The Company is offering to sell any combination of Class A and Class B shares with a dollar value up to the maximum offering amount. The Company may reallocate the shares offered between the primary offering and the distribution reinvestment plan. On January 3, 2013, the Offering was initially declared effective by the Securities and Exchange Commission. On May 30, 2013, RREEF America purchased $10,000,000 of the Company's Class B shares in the Offering, and the Company’s board of directors authorized the release of the escrowed funds to the Company, thereby allowing the Company to commence operations.

Shares of the Company’s common stock are being sold at the Company’s net asset value (“NAV”) per share, plus, for Class A shares only, applicable selling commissions. Each class of shares may have a different NAV per share because of certain class specific fees and expenses, such as the distribution fee. NAV per share is calculated by dividing the NAV at the end of each business day for each class by the number of shares outstanding for that class on such day. The Company will not sell any shares to Pennsylvania investors unless it has received purchase orders for at least $75,000,000 (including purchase orders received from residents of other jurisdictions) in any combination of Class A shares and Class B shares from persons not affiliated with the Company or RREEF America.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”), the authoritative reference for U.S. generally accepted accounting principles (“GAAP”). The consolidated financial statements include the accounts of the Company and its subsidiaries. All significant intercompany balances and transactions are eliminated in consolidation. The financial statements of the Company’s subsidiaries are prepared using accounting policies consistent with those of the Company. In the opinion of management, the unaudited interim financial statements reflect all adjustments, which are of a normal and recurring nature, necessary to a fair statement of the results for the interim periods presented. In addition, the Company evaluates relationships with other entities to identify whether

8

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

there are variable interest entities as required by FASB ASC 810, Consolidations, and to assess whether it is the primary beneficiary of such entities. If the determination is made that the Company is the primary beneficiary, then that entity is included in the consolidated financial statements in accordance with FASB ASC 810.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. Cash equivalents may include cash and short-term investments. Short-term investments are stated at cost, which approximates fair value and may consist of investments in money market accounts. There are no restrictions on the use of the Company’s cash balance.

Real Estate Investments and Lease Intangibles

Real estate investments are stated at cost less accumulated depreciation and amortization. Buildings and improvements are depreciated utilizing the straight-line method over an estimated useful life of 20 to 40 years for industrial, retail and office properties, and 27.5 years for residential. Tenant improvements and lease commissions are amortized over the terms of the respective tenant leases. Furniture and equipment is depreciated over an estimated useful life ranging from five to seven years.

In accordance with FASB ASC 805, Business Combinations, and FASB ASC 350, Intangibles—Goodwill and Other, acquisitions of properties are accounted for utilizing the acquisition method and, accordingly, the results of operations of acquired properties will be included in the Company’s results of operations from their respective dates of acquisition. Estimates of future cash flows and other valuation techniques believed to be similar to those used by independent appraisers are used to allocate the purchase price of identifiable assets acquired and liabilities assumed such as land, buildings and improvements, equipment and identifiable intangible assets and liabilities such as amounts related to in-place leases, acquired above- and below-market leases, tenant relationships, asset retirement obligations and mortgage notes payable. Values of buildings and improvements are determined on an as-if-vacant basis. Initial allocations are subject to change until such information is finalized, which may be no later than 12 months from the acquisition date.

The estimated fair value of acquired in-place leases are the costs the Company would have incurred to lease the properties to the occupancy level of the properties at the date of acquisition. Such estimates include the fair value of leasing commissions, legal costs and other direct costs that would be incurred to lease the properties to such occupancy levels. Additionally, the Company evaluates the time period over which such occupancy levels would be achieved. Such evaluation will include an estimate of the net market-based rental revenues and net operating costs (primarily consisting of forgone rents, real estate taxes, recoverable charges and insurance) that would be incurred during the lease-up period, which generally ranges up to one year. Acquired in-place leases as of the date of acquisition are amortized over the remaining lease terms.

Acquired above- and below-market lease values are estimated based on the present value (using an interest rate that reflects the risks associated with the lease acquired) of the difference between the contractual amounts to be paid pursuant to the in-place leases and the Company’s estimate of fair market value lease rates for the corresponding in-place leases. The capitalized above- and below-market lease values are amortized to rental revenue over the remaining terms of the respective leases, which include, for below-market leases, periods covered by bargain renewal options. If a lease is terminated prior to its scheduled expiration, the unamortized portion of the in-place lease is charged to amortization expense and the unamortized portion of the above- or below-market lease is charged to rental revenue.

The carrying value of the real estate investments are reviewed to ascertain if there are any indicators of impairment. Factors considered include the type of asset, the economic situation in the area in which the asset is

9

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

located, the economic situation in the industry in which the tenant is involved and the timeliness of the payments made by the tenant under its lease, as well as any current correspondence that may have been had with the tenant, including property inspection reports. A real estate investment is impaired if the undiscounted cash flows over the expected hold period are less than the real estate investment’s carrying amount. In this case, an impairment loss will be recorded to the extent that the estimated fair value is lower than the real estate investment’s carrying amount. The estimated fair value is determined primarily using information contained within independent appraisals obtained quarterly by the Company from its independent valuation agent. Real estate investments that are expected to be disposed of are valued at the lower of carrying amount or estimated fair value less costs to sell.

Investments in Marketable Securities

In accordance with the Company’s investment guidelines as approved by the Company’s board of directors, investments in marketable securities may consist of common and preferred stock of publicly-traded REITs and other real estate operating companies. The Company determines the appropriate classification for these securities at the time of purchase and reevaluates such designation as of each balance sheet date. As of September 30, 2013, the Company classified its investments in marketable securities as available-for-sale as the Company intends to hold the securities for the purpose of collecting dividend income and for longer term price appreciation. These investments are carried at their estimated fair value based on published prices for each security. Unrealized gains and losses are reported in accumulated other comprehensive loss.

Any non-temporary decline in the market value of an available-for-sale security below cost results in a reduction in the carrying amount to fair value. The impairment is charged to earnings and a new cost basis for the security is established. When a security is impaired, the Company considers whether it has the ability and intent to hold the investment for a time sufficient to allow for any anticipated recovery in market value and considers whether evidence indicating the cost of the investment being recoverable outweighs evidence to the contrary. Evidence considered in this assessment includes the reasons for the impairment, the severity and duration of the impairment, changes in value subsequent to period end and forecasted performance of the investee.

Securities may be sold if the Company believes a security has attained its target maximum value or if other conditions exist whereby the Company believes that the value of its investment in a particular security has a larger than desired risk of declining. The Company considers many factors in determining whether to hold or sell a security, including, but not limited to, recent events specific to the issuer or industry, external credit ratings and recent changes in such ratings. Upon the sale of a particular security, the realized net gain or loss is computed assuming the shares with the highest cost are sold first.

Deferred Financing Costs

Deferred financing costs are the direct costs associated with obtaining financing. Such costs include commitment fees, legal fees and other third-party costs associated with obtaining commitments for financing that result in a closing of such financing. The Company capitalizes these costs and amortizes them on a straight-line basis, which approximates the effective interest method, over the terms of the obligations, once the loan process is completed. Amortization of deferred financing costs is included in interest expense in the consolidated statements of operations.

Borrowings

The Company may obtain various forms of borrowings from market participants. Generally, borrowings originated by the Company will be recorded at amortized cost. The Company may also assume borrowings in connection with acquisitions. The Company will estimate the fair value of assumed borrowings based upon indications of then-current market pricing for similar types of debt with similar maturities. The assumed borrowings will initially be recorded at their estimated fair value as of the assumption date, with the difference between such estimated fair value and the borrowings’ outstanding principal balance being amortized over the remaining life of the borrowing.

10

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

Revenue Recognition

Rental revenue from real estate investments is recognized on a straight-line basis over the terms of the related leases. The differences between rental revenue earned from real estate investments and amounts due under the respective lease agreements are amortized or accreted, as applicable, to deferred rent receivable. Rental revenue will also include amortization of above- and below-market leases. Revenues relating to lease termination fees will be recognized at the time that a tenant’s right to occupy the leased space is terminated and collectability is reasonably assured. Also included in rental revenue are tenant reimbursements of certain operating expenses and percentage rents determined in accordance with the terms of the lease agreements.

Organization and Offering Expenses

RREEF America agreed to pay all of the Company’s organization and offering expenses through January 3, 2013 (the “Initial O&O”). This included costs and expenses incurred by the Company in connection with the Company’s formation, preparing for the Offering, the qualification and registration of the Offering, and the marketing and distribution of the Company’s shares. The offering expenses portion of the Initial O&O includes, but is not limited to, accounting and legal fees, including the legal fees of SC Distributors, LLC, the dealer manager for the Offering (the “Dealer Manager”), costs for registration statement amendments and prospectus supplements, printing, mailing and distribution costs, filing fees, amounts to reimburse RREEF America, as the Company’s advisor, or its affiliates for the salaries of employees and other costs in connection with preparing supplemental sales literature, amounts to reimburse the Dealer Manager for amounts that it may pay to reimburse the bona fide due diligence expenses of any participating broker-dealers supported by detailed and itemized invoices, telecommunication costs, fees of the transfer agent, registrars, trustees, depositories and experts, the cost of educational conferences held by the Company (including the travel, meal and lodging costs of registered representatives of any participating broker-dealers), and attendance fees and cost reimbursement for employees of affiliates to attend retail seminars conducted by broker-dealers.

In addition to the Initial O&O, RREEF America has agreed to pay the portion of the Company’s organization and offering expenses from January 3, 2013 through January 3, 2014 that are incurred in connection with sponsoring and attending industry conferences, preparing filings with the Securities and Exchange Commission under the Securities Act of 1933, as amended, membership dues for industry trade associations, broker-dealer due diligence and obtaining a private letter ruling from the Internal Revenue Service (the “Additional O&O” and, together with the Initial O&O, the “Deferred O&O”). RREEF America incurred $4,508,784 in Deferred O&O on behalf of the Company from the Company’s inception through September 30, 2013, of which $147,678 and $1,197,841 was incurred during the three and nine months ended September 30, 2013, respectively. Additionally, as a result of the Expense Support Agreement (as defined in Note 7), $90,000 of offering expenses were reclassified out of Deferred O&O, and instead will be covered under the Expense Support Agreement. See Note 7.

The Company will reimburse RREEF America for the Deferred O&O monthly on a straight-line basis over 60 months beginning January 3, 2014.

Prior to the Company’s commencement of operations, RREEF America also agreed to pay all of the Company’s expenses which are not included in the Deferred O&O (the “Other Expenses”), amounting to $940,000 from the Company’s inception through May 30, 2013. The Other Expenses will be covered under the expense support agreement discussed in Note 7, and thus will be subject to the repayment provisions of that agreement.

Prior to the commencement of operations, the Company was not obligated to reimburse RREEF America for the Deferred O&O or the Other Expenses. Accordingly, prior to the commencement of operations, neither the Deferred O&O nor the Other Expenses were accrued on the Company’s consolidated balance sheet.

Organizational expenses and Other Expenses which do not qualify as offering costs are expensed as incurred from and after the commencement of operations. Offering costs incurred by the Company, RREEF America and its affiliates on behalf of the Company will be deferred and will be paid from the proceeds of the Offering. These costs

11

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

will be treated as a reduction of the total proceeds. Total organization and offering costs incurred by the Company will not exceed 15% of the gross proceeds from the primary offering.

Income Taxes

The Company intends to elect to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), beginning with the year ending December 31, 2013. In order to maintain the Company’s qualification as a REIT, the Company is required to, among other things, distribute as dividends at least 90% of the Company’s REIT taxable income, determined without regard to the dividends-paid deduction and excluding net capital gains, to the Company’s stockholders, and meet certain tests regarding the nature of the Company’s income and assets. If the Company qualifies for taxation as a REIT, the Company generally will not be subject to federal income tax to the extent it meets certain criteria and distributes its REIT taxable income to its stockholders. Even if the Company qualifies for taxation as a REIT, the Company may be subject to (1) certain state and local taxes on its income, property or net worth, and (2) federal income and excise taxes on its undistributed income, if any income remains undistributed. The Company intends to operate in a manner that allows the Company to meet the requirements for taxation as a REIT, including creating taxable REIT subsidiaries to hold assets that generate income that would not be consistent with the rules applicable to qualification as a REIT if held directly by the REIT. If the Company were to fail to meet these requirements, it could be subject to federal income tax on the Company’s taxable income at regular corporate rates. The Company would not be able to deduct distributions paid to stockholders in any year in which it fails to qualify as a REIT. The Company will also be disqualified for the four taxable years following the year during which qualification was lost unless the Company is entitled to relief under specific statutory provisions.

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for future tax consequences and are attributable to (1) differences between the financial statement carrying amounts and their respective tax bases, and (2) net operating losses. A valuation allowance is established for uncertainties relating to realization of deferred tax assets. As of September 30, 2013, the Company had a deferred tax asset of approximately $510,000 sourced from the net operating losses realized by the Company, for which a valuation allowance was recorded in the same amount due to the uncertainty of realization.

Reportable Segments

The Company intends to operate in three primary segments: (1) Real Estate Properties, (2) Real Estate Equity Securities, and (3) Real Estate Loans.

Concentration of Credit Risk

As of September 30, 2013, the Company had cash on deposit at two financial institutions, one of which had deposits in excess of federally insured levels. The Company limits significant cash holdings to accounts held by financial institutions with a high credit standing. Therefore, the Company believes it is not exposed to any significant credit risk on its cash deposits.

Through September 30, 2013, 100% of the Company’s gross rental revenues were from an office building located outside Chicago, Illinois. The property is 100% leased to Allstate Insurance Company, a wholly-owned subsidiary of The Allstate Corporation. The Allstate Corporation trades on the New York Stock Exchange under the ticker symbol “ALL.”

NOTE 3 — FAIR VALUE MEASUREMENTS

Fair value measurements are determined based on the assumptions that market participants would use in pricing an asset or liability. As a basis for considering market participant assumptions in fair value measurements, FASB ASC 820, Fair Value Measurement and Disclosures, establishes a fair value hierarchy that distinguishes between market participant assumptions based on market data obtained from sources independent of the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and the reporting entity's own assumptions about market participant assumptions (unobservable inputs classified within Level 3 of the hierarchy).

12

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for the asset or liability (other than quoted prices), such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are the unobservable inputs for the asset or liability, which are typically based on an entity's own assumption, as there is little, if any, related market activity. In instances where the determination of the fair value measurement is based on input from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Company's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability.

The Company's investments in marketable securities are valued using Level 1 inputs as the securities are publicly traded on major stock exchanges.

FASB ASC 825-10-65-1 requires the Company to disclose fair value information for all financial instruments for which it is practicable to estimate fair value, whether or not recognized in the consolidated balance sheets. Fair value of lines of credit and loans payable is determined using Level 2 inputs and a discounted cash flow approach with an interest rate and other assumptions that approximate current market conditions. The carrying amount of the Company's line of credit at September 30, 2013 approximates its fair value.

The Company's financial instruments, other than the line of credit, are generally short-term in nature and contain minimal credit risk. These instruments consist of cash and cash equivalents, accounts and other receivables and accounts payable. The carrying amounts of these assets and liabilities in the consolidated balance sheets approximate their fair value.

NOTE 4 — REAL ESTATE INVESTMENTS

On May 31, 2013, the Company acquired 9022 Heritage Parkway, a low-rise office building located outside of Chicago, Illinois. The property was acquired for $13,300,000 (excluding acquisition costs) which was funded with approximately $6,600,000 of proceeds from the Offering, and $6,700,000 from the Company's line of credit. This property is 100% leased to Allstate Insurance Company through November 30, 2018. The Company allocated the purchase price of this property to the fair value of the assets acquired and liabilities assumed, as follows:

Land | $ | 2,310,684 | |

Building and improvements | 7,206,490 | ||

Acquired in-place lease | 3,773,246 | ||

Acquired above-market lease | 9,580 | ||

Total real estate at cost | $ | 13,300,000 | |

The Company recorded rental revenues and net income of $313,307 and $54,520, respectively, related to this property for the three months ended September 30, 2013. For the nine months ended September 30, 2013, the Company recorded rental revenues and net income of $420,801 and $4,576, respectively.

The Company’s estimated rental and other property income and net loss, on a pro forma basis (as if the acquisition of 9022 Heritage Parkway were completed on January 1, 2013), for the nine months ended September 30, 2013 is $882,012 and ($1,338,168), respectively. No pro forma information is presented for the quarter ended September 30, 2013 because the Company owned the property for the entire quarter.

The pro forma information is presented for informational purposes only and may not be indicative of what actual results of operations would have been had the transactions occurred at the beginning of period presented, nor does it purport to represent the results of future operations.

13

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

NOTE 5 — MARKETABLE SECURITIES

The following is a summary of the Company's marketable securities held as of September 30, 2013, which consisted entirely of publicly-traded shares of common stock in REITs. All marketable securities held at September 30, 2013 were available-for-sale securities and none were considered impaired on an other-than-temporary basis.

Marketable securities - cost | $ | 3,092,070 | |

Unrealized gains | 39,189 | ||

Unrealized losses | (203,949 | ) | |

Net unrealized loss | (164,760 | ) | |

Marketable securities—fair value | $ | 2,927,310 | |

Upon the sale of a particular security, the realized net gain or loss is computed assuming the shares with the highest cost are sold first. During the three and nine months ended September 30, 2013, marketable securities sold generated proceeds of $562,752 and $1,328,727, respectively, resulting in gross realized gains of $11,156 and $12,693, respectively, and gross realized losses of $6,478 and $37,768, respectively.

NOTE 6 — LINE OF CREDIT

On May 1, 2013, the Operating Partnership, as borrower, and the Company, as guarantor, entered into a secured revolving line of credit arrangement (the “Line of Credit”) pursuant to a credit agreement with Regions Bank and its affiliates, as administrative agent, sole lead arranger and sole book runner, and other lending institutions that may become parties to the credit agreement. The Line of Credit has an initial capacity of $50 million and is expandable up to a maximum capacity of $150 million within 12 months upon satisfaction of certain conditions and payment of certain fees. The Line of Credit may be used to fund acquisitions, redeem shares pursuant to the Company’s redemption plan and for any other corporate purpose. The initial term expires on May 1, 2015, subject to a single one-year extension option. Borrowings under the Line of Credit carry a specified interest rate which, at the option of the Company, may be comprised of (1) a base rate, currently equal to the prime rate, or (2) a rate based on the one-, two- or three-month London Interbank Offered Rate (“LIBOR”) plus a spread ranging from 220 to 250 basis points, depending on the Company's consolidated debt-to-value ratio. As of June 30, 2013, the outstanding balance and interest rate were $6,700,000 and 2.40%, respectively. During the three months ended September 30, 2013, the Company utilized proceeds raised in the Offering to fully repay the outstanding balance. Accordingly, as of September 30, 2013, the outstanding balance on the Line of Credit was zero.

If the Company does not have at least $50 million of tangible net worth (as defined in the Line of Credit agreement) by May 1, 2014, the available, undrawn commitments under the Line of Credit will be canceled, and the Company will have no ability to borrow additional amounts, or re-borrow amounts subsequently repaid, under the Line of Credit. Otherwise, the Line of Credit agreement contains customary representations, warranties, borrowing conditions and affirmative, negative and financial covenants, including minimum net worth, debt service coverage requirements, leverage ratio requirements and dividend payout and REIT status requirements. The Company believes it was in compliance with all such covenants as of September 30, 2013.

The borrowing capacity under the Line of Credit (the “Borrowing Base”) at any time is equal to the sum of (1) the lesser of (a) 60% of the value of the Company's real estate investments which are encumbered by the Line of Credit (such value as determined by the administrative agent on an annual basis), and (b) the amount determined by reference to a specified debt service coverage calculation, and (2) 50% of the value of the Company’s investments in eligible marketable securities. The portion of the Borrowing Base attributable to marketable securities cannot exceed 20% of the total Borrowing Base. Additionally, up to 15% of the amount of the Borrowing Base attributable to real estate investments can be utilized for ground leased properties. As of September 30, 2013, the Company’s Borrowing Base was $9,466,520.

NOTE 7 — RELATED PARTY ARRANGEMENTS

14

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

RREEF America receives compensation and reimbursements in connection with the management of the Company's investments. The Company pays RREEF America an advisory fee equal to (a) a fixed component that accrues daily in an amount equal to 1/365th of 1.0% of the Company's NAV for each class of shares for such day; provided that the fixed component will not be earned and, therefore, will not begin to accrue until the date on which the Company's combined NAV for both classes of shares has reached $50,000,000, and (b) a performance component calculated for each class of shares on the basis of the total return to stockholders of each class for any calendar year, such that for any year in which the Company's total return per share allocable to a class exceeds 6% per annum, RREEF America will receive 25% of the excess total return allocable to that class; provided that in no event will the performance component exceed 10% of the aggregate total return allocable to such class for such year. In the event the Company's NAV per share decreases below $12.00 for any class, the performance component will not be earned on any increase in NAV up to $12.00 with respect to that class, provided that the Company may decrease this threshold if (i) there has been a fundamental and unexpected change in the overall real estate market and (ii) the Company's board of directors, including a majority of its independent directors, has determined that such change is necessary to appropriately incent RREEF America to perform in a manner that maximizes stockholder value and is in the best interests of the Company's stockholders. The fixed component of the advisory fee is payable monthly in arrears and the performance component is payable annually in arrears. For the year ended December 31, 2013, the Class B performance component will be measured from May 30, 2013, the date the Company commenced operations, to December 31, 2013. The Class A performance component will be measured from August 12, 2013, the date the first Class A share was sold, to December 31, 2013.

On May 29, 2013, the Company entered into an expense support agreement with RREEF America, which was amended and restated on November 11, 2013 (as amended and restated, the “Expense Support Agreement”). Pursuant to the terms of the Expense Support Agreement, RREEF America has incurred, and may continue to incur, expenses related to the Company that are not part of the Deferred O&O (“Expense Payments”). The Expense Payments include the Other Expenses referred to in Note 2, and may include, without limitation, organizational and offering expenses and operating expenses under the Company's advisory agreement. RREEF America may incur these expenses until the earlier of (i) the date the Company has raised $200,000,000 in aggregate gross proceeds from the Offering or (ii) the date upon which the aggregate Expense Payments by RREEF America exceed $5,100,000.

Pursuant to the Expense Support Agreement, commencing with the earlier of (i) the quarter beginning on January 1, 2015 or (ii) the quarter in which the Company surpasses $200,000,000 in aggregate gross proceeds from the Offering, within five business days after the end of such quarter and each calendar quarter thereafter, the Company will reimburse RREEF America in an amount, subject to certain limitations, equal to the lesser of (i) $250,000 and (ii) the aggregate amount of all Expense Payments made by RREEF America prior to the last day of the previous calendar quarter that have not been previously reimbursed by the Company to RREEF America, until the aggregate of all Expense Payments have been reimbursed by the Company.

The Company or RREEF America may terminate the Expense Support Agreement at any time, without penalty, upon 30 days' notice. If the Expense Support Agreement is terminated by RREEF America, the Company shall continue to reimburse RREEF America for all unreimbursed Expense Payments on a quarterly basis as provided in the Expense Support Agreement. If the agreement is terminated by the Company, the Company shall reimburse the Advisor for all unreimbursed Expense Payments within 30 days after such termination. At the Company's discretion, such reimbursement may be in the form of cash, a non-interest bearing promissory note with equal monthly principal payments over a term of no more than five years, or any combination thereof.

The Company will reimburse RREEF America for all expenses paid or incurred by RREEF America in connection with the services provided to the Company, subject to the limitation that the Company will not reimburse RREEF America for any amount by which its operating expenses (including the advisory fee and any reimbursements pursuant to the Expense Support Agreement) at the end of the four preceding fiscal quarters exceeds the greater of (a) 2% of its average invested assets or (b) 25% of its net income determined without reduction for any additions to reserves for depreciation, bad debts or other similar non-cash reserves and excluding any gain from the sale of the Company's assets for that period. Notwithstanding the foregoing, the Company may reimburse RREEF America for expenses in excess of this limitation if a majority of the Company's independent directors determines that such excess expenses are justified based on unusual and non-recurring factors.

15

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

Notwithstanding the above provisions, the Company will not reimburse RREEF America for any organizational and offering costs which would cause the Company's total organizational and offering costs to exceed 15% of the gross proceeds from the primary offering (excluding shares issued via the distribution reinvestment plan). Further, the Company will not reimburse RREEF America for any underwriting compensation (a subset of organizational and offering costs) which would cause the Company's total underwriting compensation to exceed 10% of the gross proceeds from the primary offering. In accordance with these limitations, the total organizational and offering expenses incurred by RREEF America through September 30, 2013 exceeded these limitations by $2,607,173.

Through September 30, 2013, no fees were earned by RREEF America. As of September 30, 2013, the Company owed RREEF America for the following amounts, after application of the aforementioned reimbursement limitations:

Offering | Organizational | Operating | Due to Affiliate | |||||||||||||

Deferred O&O | $ | 1,864,547 | $ | 37,064 | $ | — | $ | 1,901,611 | (1) | |||||||

Expense Payments | 488,018 | — | 1,674,531 | 2,162,549 | (2) | |||||||||||

Total due to RREEF America | 2,352,565 | $ | 37,064 | $ | 1,674,531 | $ | 4,064,160 | |||||||||

Offering costs not subject to reimbursement by RREEF America | 137,122 | |||||||||||||||

Total offering costs | $ | 2,489,687 | ||||||||||||||

(1) To be repaid ratably over 60 months beginning January 2014.

(2) | To be repaid in quarterly payments of $250,000 (subject to certain limitations), commencing in the quarter after the earlier of (a) the quarter beginning January 1, 2015 or (b) the quarter in which the Company raises at least $200,000,000 in aggregate gross proceeds from the Offering. |

The excess organizational and offering costs incurred by RREEF America of $2,607,173 on behalf of the Company is not reflected in the Company's consolidated financial statements as a liability. However, as the Company raises additional proceeds from the Offering, it may become obligated to RREEF America for all or a portion of this additional amount.

NOTE 8 — CAPITALIZATION

Under the Company's charter, the Company has the authority to issue 1,000,000,000 shares of common stock, 500,000,000 of which are classified as Class A shares and 500,000,000 of which are classified as Class B shares. In addition, the Company has the authority to issue 50,000,000 shares of preferred stock. All shares of such stock have a par value of $0.01 per share. Class A shares issued in the primary offering are subject to selling commissions of up to 3% of the purchase price, dealer manager fees and distribution fees. Class B shares are subject to dealer manager fees, but are not subject to any selling commissions or distribution fees. The Company's board of directors is authorized to amend its charter from time to time, without the approval of the stockholders, to increase or decrease the aggregate number of authorized shares of capital stock or the number of shares of any class or series that the Company has authority to issue.

Distribution Reinvestment Plan

The Company has adopted a distribution reinvestment plan that will allow stockholders to have the cash distributions attributable to the class of shares that the stockholder owns automatically invested in additional shares of the same class. Shares are offered pursuant to the Company's distribution reinvestment plan at the NAV per share applicable to that class, calculated as of the distribution date and after giving effect to all distributions. Stockholders who elect to participate in the distribution reinvestment plan, and who are subject to U.S. federal income taxation laws, will incur a tax liability on an amount equal to the fair value on the relevant distribution date of the shares of

16

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

the Company's common stock purchased with reinvested distributions, even though such stockholders have elected not to receive the distributions used to purchase those shares of the Company's common stock in cash.

Redemption Plan

In an effort to provide the Company's stockholders with liquidity in respect of their investment in shares of the Company's common stock, the Company has adopted a redemption plan whereby on a daily basis stockholders may request the redemption of all or any portion of their shares. The redemption price per share is equal to the Company's NAV per share of the class of shares being redeemed on the date of redemption. The total amount of redemptions in any calendar quarter will be limited to Class A and Class B shares whose aggregate value (based on the redemption price per share on the date of the redemption) is equal to 5% of the Company's combined NAV for both classes of shares as of the last day of the previous calendar quarter. In addition, if redemptions do not reach the 5% limit in a calendar quarter, the unused portion generally will be carried over to the next quarter and not any subsequent quarter, except that the maximum amount of redemptions during any quarter may never exceed 10% of the combined NAV for both classes of shares as of the last day of the previous calendar quarter. If the quarterly volume limitation is reached on or before the third business day of a calendar quarter, redemption requests during the next quarter will be satisfied on a stockholder by stockholder basis, which the Company refers to as a per stockholder allocation, instead of a first-come, first-served basis. Pursuant to the per stockholder allocation, each stockholder would be allowed to request redemption at any time during such quarter of a total number of shares not to exceed 5% of the shares of common stock the stockholder held as of the end of the prior quarter. The per stockholder allocation requirement will remain in effect for each succeeding quarter for which the total redemptions for the immediately preceding quarter exceeded 4% of the Company's NAV on the last business day of such preceding quarter. If total redemptions during a quarter for which the per stockholder allocation applies are equal to or less than 4% of the Company's NAV on the last business day of such preceding quarter, then redemptions will again be satisfied on a first-come, first-served basis for the next succeeding quarter and each quarter thereafter.

Each redemption request will be evaluated by the Company in consideration of rules and regulations promulgated by the Internal Revenue Service with respect to dividend equivalent redemptions. Redemptions that may be considered dividend equivalent redemptions may adversely affect the Company and/or shareholders. Accordingly, the Company may reject any redemption request that it reasonably believes may be treated as a dividend equivalent redemption.

While there is no minimum holding period, shares redeemed within 365 days of the date of purchase will be redeemed at the Company's NAV per share of the class of shares being redeemed on the date of redemption less a short-term trading discount equal to 2% of the gross proceeds otherwise payable with respect to the redemption.

In the event that any stockholder fails to maintain a minimum balance of $500 of shares of common stock, the Company may redeem all of the shares held by that stockholder at the redemption price per share in effect on the date it is determined that the stockholder has failed to meet the minimum balance, less the short-term trading discount of 2%, if applicable. Minimum account redemptions will apply even in the event that the failure to meet the minimum balance is caused solely by a decline in the Company's NAV.

The Company's board of directors has the discretion to suspend or modify the redemption plan at any time, including in circumstances where it (1) determines that such action is in the best interest of the Company's stockholders, (2) determines that it is necessary due to regulatory changes or changes in law or (3) becomes aware of undisclosed material information that it believes should be publicly disclosed before shares are redeemed. In addition, the Company's board of directors may suspend the Offering, including the redemption plan, if it determines that the calculation of NAV is materially incorrect or there is a condition that restricts the valuation of a material portion of the Company's assets. If the board of directors materially amends (including any reduction of the quarterly limit) or suspends the redemption plan during any quarter, other than any temporary suspension to address certain external events unrelated to the Company's business, any unused portion of that quarter’s 5% limit will not be carried forward to the next quarter or any subsequent quarter.

NOTE 9 — DISTRIBUTIONS

17

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

In order to qualify as a REIT, the Company is required, among other things, to make distributions each taxable year of at least 90% of its taxable income determined without regard to the dividends-paid deduction and excluding net capital gains, and to meet certain tests regarding the nature of the Company's income and assets. The Company expects that its board of directors will continue to declare distributions with a daily record date, payable monthly in arrears. Any distributions the Company makes will be at the discretion of its board of directors, considering factors such as its earnings, cash flow, capital needs and general financial condition and the requirements of Maryland law. The Company commenced operations on May 30, 2013 and intends to elect to be treated as a REIT for the year ending December 31, 2013.

On May 22, 2013, the Company's board of directors declared the Company's first cash distribution of $0.00164384 per Class A and Class B share (as adjusted to reflect applicable class-specific expenses) for all such shares of record on each day from June 1, 2013 through September 30, 2013. Distributions for each month are payable on or before the first day of the following month. However, any distributions reinvested by the stockholders in accordance with the Company's dividend reinvestment plan are reinvested at the per share NAV of the same class determined at the close of business on the last business day of the month in which the distributions were accrued. All of the distributions for June 2013 were reinvested pursuant to the Company's distribution reinvestment plan, resulting in the issuance of approximately 3,469 additional Class B shares. During the quarter ended September 30, 2013, distributions reinvested resulted in the issuance of approximately 19 Class A shares and 10,829 Class B shares.

NOTE 10 — SEGMENT INFORMATION

For the three and nine months ended September 30, 2013, the Company had two segments with reportable information: Real Estate Properties and Real Estate Equity Securities. The Company organizes and analyzes the operations and results of each of these segments independently, due to inherently different considerations for each segment. Such considerations include, but are not limited to, the nature and characteristics of the investment, and investment strategies and objectives. The following tables set forth the carrying value, revenue and the components of operating income of the Company's segments reconciled to total assets as of September 30, 2013 and net loss for the three and nine months ended September 30, 2013.

18

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

Real Estate Properties | Real Estate Equity Securities | Total | ||||||||||

Carrying value as of September 30, 2013 | $ | 12,958,664 | $ | 2,927,310 | $ | 15,885,974 | ||||||

Reconciliation to total assets of September 30, 2013 | ||||||||||||

Carrying value per reportable segments | $ | 15,885,974 | ||||||||||

Corporate-level assets | 1,201,157 | |||||||||||

Total assets | $ | 17,087,131 | ||||||||||

Three Months Ending September 30, 2013 | ||||||||||||

Revenues | ||||||||||||

Rental and other property income | $ | 313,307 | $ | — | $ | 313,307 | ||||||

Investment income on marketable securities | — | 29,299 | 29,299 | |||||||||

Total revenues | 313,307 | 29,299 | 342,606 | |||||||||

Operating expenses | ||||||||||||

Property operating expenses | 11,927 | — | 11,927 | |||||||||

Total segment operating expenses | 11,927 | — | 11,927 | |||||||||

Operating income - Segments | $ | 301,380 | $ | 29,299 | $ | 330,679 | ||||||

Reconciliation to net loss | ||||||||||||

Operating Income - Segments | $ | 330,679 | ||||||||||

General and administrative expenses | (538,253 | ) | ||||||||||

Acquisition related expenses | (848 | ) | ||||||||||

Depreciation | (73,577 | ) | ||||||||||

Amortization | (171,407 | ) | ||||||||||

Operating loss | (453,406 | ) | ||||||||||

Interest expense | (138,375 | ) | ||||||||||

Realized gain upon sale of marketable securities | 4,678 | |||||||||||

Net loss | $ | (587,103 | ) | |||||||||

19

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

Real Estate Properties | Real Estate Equity Securities | Total | ||||||||||

Nine Months Ending September 30, 2013 | ||||||||||||

Revenues | ||||||||||||

Rental and other property income | $ | 420,801 | $ | — | $ | 420,801 | ||||||

Investment income on marketable securities | — | 49,289 | 49,289 | |||||||||

Total revenues | 420,801 | 49,289 | 470,090 | |||||||||

Operating expenses | ||||||||||||

Property operating expenses | 16,140 | — | 16,140 | |||||||||

Total segment operating expenses | 16,140 | — | 16,140 | |||||||||

Operating income - Segments | $ | 404,661 | $ | 49,289 | $ | 453,950 | ||||||

Reconciliation net loss | ||||||||||||

Operating Income - Segments | $ | 453,950 | ||||||||||

General and administrative expenses | (1,084,129 | ) | ||||||||||

Acquisition related expenses | (59,334 | ) | ||||||||||

Depreciation | (110,365 | ) | ||||||||||

Amortization | (230,386 | ) | ||||||||||

Operating loss | (1,030,264 | ) | ||||||||||

Interest expense | (211,473 | ) | ||||||||||

Realized loss upon sale of marketable securities | (25,075 | ) | ||||||||||

Net loss | $ | (1,266,812 | ) | |||||||||

NOTE 11 — ECONOMIC DEPENDENCY

The Company depends on RREEF America and the Dealer Manager for certain services that are essential to the Company, including the sale of the Company's shares of common stock, asset acquisition and disposition decisions and other general and administrative responsibilities. In the event that RREEF America or the Dealer Manager is unable to provide such services, the Company would be required to find alternative service providers.

NOTE 12 — COMMITMENTS AND CONTINGENCIES

In the normal course of business, from time to time, the Company may be involved in legal actions relating to the ownership and operations of real estate investments. In the Company's opinion, the liabilities, if any, that may ultimately result from such legal actions are not expected to have a material adverse effect on the Company's consolidated financial position, results of operations or liquidity.

The Company, as an owner of real estate, is subject to various environmental laws of federal and local governments. All of the Company's properties were subject to assessments, involving visual inspections of the properties and their neighborhoods. The Company carries environmental liability insurance on its properties that provides coverage for remediation liability and pollution liability for third-party bodily injury and property damage claims. The Company does not believe such environmental assessments will have a material adverse impact on the Company's consolidated financial position or results of operations in the future.

As discussed in Notes 2 and 7, the Company may become liable to RREEF America for additional amounts that RREEF America has paid on behalf of the Company, with such additional liability dependent upon the amount of shares sold by the Company.

20

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

September 30, 2013

NOTE 13 — STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

The Company commenced operations on May 30, 2013. As a result, for the period February 7, 2012 (inception) through September 30, 2012, the Company did not recognize revenues or expenses of any kind. Accordingly, the consolidated statements of operations and the consolidated statements of comprehensive income for the quarter ended September 30, 2012 and for the period February 7, 2012 (inception) through September 30, 2012 have not been included within these consolidated financial statements.

NOTE 14 — SUBSEQUENT EVENTS

The Company entered into the Amended and Restated Expense Support Agreement by and between the Company and RREEF America L.L.C., dated November 11, 2013 (the "Expense Support Agreement"). The Expense Support Agreement extended the period during which RREEF America may make Expense Payments to the earlier of (i) the date the Company has raised $200,000,000 in aggregate gross proceeds from the Offering or (ii) the date the aggregate Expense Payments by RREEF America exceed $5,100,000. All other material terms of the Expense Support Agreement remain unchanged.

On October 2, 2013, the Company announced that its board of directors declared a cash distribution equal to $0.00166682 per Class A and Class B share (as adjusted to reflect applicable class-specific expenses) for all such shares of record on each day from October 1, 2013 through December 31, 2013.

21

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated unaudited financial statements, the notes thereto and the other unaudited financial data included in this Quarterly Report on Form 10-Q, or this Quarterly Report. The following discussion should also be read in conjunction with our audited consolidated financial statements and the notes thereto, included in our special financial report on Form 10-K for the period February 7, 2012 (inception) through December 31, 2012. We also invite you to visit our website, www.rreefpropertytrust.com, where we routinely post additional information about our company, such as, without limitation, our daily net asset value, or NAV, per share and information about upcoming investor update calls. The terms “we,” “us,” “our” and the “Company” refer to RREEF Property Trust, Inc. and its subsidiaries.

Forward-Looking Statements

We make statements in this Quarterly Report that are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Quarterly Report.

The forward-looking statements included herein are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

• | our ability to effectively raise and deploy proceeds from our continuous public offering, or our offering; |

• | changes in global economic conditions generally and the real estate and capital markets specifically; |

• | the effect of financial leverage, including changes in interest rates, availability of credit, loss of flexibility due to negative and affirmative covenants, refinancing risk at maturity and generally the increased risk of loss if our investments fail to perform as expected; |

• | legislative or regulatory changes (including changes to the laws governing the taxation of REITs); |

• | our ability to access sources of liquidity when we have the need to fund redemptions of common stock in excess of the proceeds from the sale of shares of our common stock in our offering and the consequential risk that we may not have the resources to satisfy redemption requests; and |

• | changes to generally accepted accounting principles in the United States, or GAAP. |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Quarterly Report. All forward-looking statements are made as of the date of this Quarterly Report, and the risk that actual results will differ materially from the expectations expressed in this Quarterly Report will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking

22

statements after the date of this Quarterly Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Quarterly Report, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Quarterly Report will be achieved.

Overview

We are a Maryland corporation formed on February 7, 2012, our inception date, to invest in a diversified portfolio of high quality, income-producing commercial real estate properties and other real estate-related assets. We are an externally advised, perpetual-life corporation that intends to qualify as a REIT for federal income tax purposes. We hold our properties, real estate-related assets and other investments through RREEF Property Operating Partnership, LP, or our operating partnership, of which we are the sole general partner.

We intend to invest primarily in the office, industrial, retail and multifamily sectors of the commercial real estate industry. Real estate-related assets include common and preferred stock of publicly traded REITs and other real estate companies, which we refer to as “real estate equity securities,” and debt investments backed by real estate, which we refer to as “real estate loans.”

Our board of directors will at all times have ultimate oversight and policy-making authority over us, including responsibility for governance, financial controls, compliance and disclosure. Pursuant to our advisory agreement, our board has delegated to our advisor authority to manage our day-to-day business in accordance with our investment objectives, strategy, guidelines, policies and limitations.

On May 30, 2013, upon receipt of purchase orders from our sponsor for $10,000,000 of Class B shares and the release to us of funds in the escrow account, we commenced operations. Prior to May 30, 2013, we had neither engaged in any operations nor generated any revenues. Our entire activity from our inception date through May 30, 2013 was to prepare for and implement our public offering of our common stock.

Portfolio Information

On May 31, 2013, we acquired our first real estate investment at 9022 Heritage Parkway, a 94,233 square foot low-rise office building located in Woodridge, Illinois, approximately 25 miles west of downtown Chicago. The purchase price was $13,300,000, excluding closing costs, and was funded with $6,600,000 of proceeds from the sale of our common stock and $6,700,000 of borrowings under our line of credit with Regions Bank. The borrowing carried an initial interest rate of 2.40%.

Also on May 31, 2013, we invested approximately $3,066,000 in a portfolio of publicly traded common stock of 31 REITs. We believe that investing a portion of our proceeds from our offering into a diversified portfolio of common and preferred shares of REITs and other real estate operating companies will provide the overall portfolio some flexibility with near-term liquidity as well as potentially enhance our NAV over a longer period. The portfolio is regularly reviewed and evaluated to determine whether the marketable securities held at any time continue to serve their original intention. We will likely have a limited amount of sales and reinvestments in any given period due to repositioning of the portfolio. As of September 30, 2013, our real estate equity securities portfolio consisted of publicly traded common stock of 38 REITs with a value of $2,927,310.

23

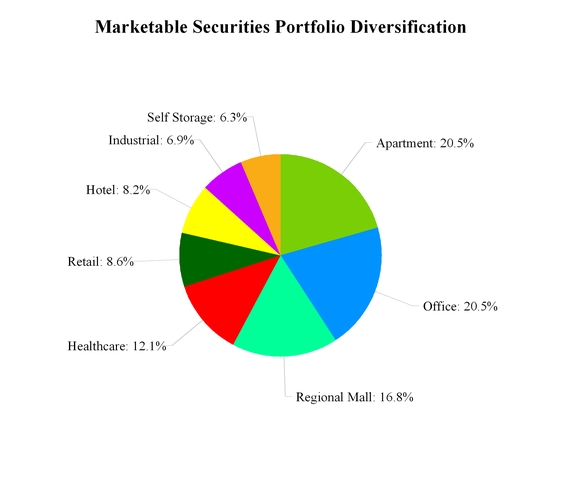

The following chart summarizes our marketable securities by property type as of September 30, 2013:

Results of Operations

We commenced operations on May 30, 2013 upon receipt of $10,000,000 in proceeds from our offering. On May 31, 2013, we acquired our first property and made our initial investments in marketable securities. As a result, our nine-month operating results described below reflect only four months of investment activity and are not indicative of future periods. In addition, we have not invested all of the proceeds from our offering that we have received to date, and we expect to continue to raise additional capital, increase our borrowings and make future acquisitions, which would have a significant impact on our future results of operations.

Revenues

Our total revenue for the three months ended September 30, 2013 was $342,606, comprised of $313,307 of rental income and $29,299 of investment income. Our total revenue for the nine months ended September 30, 2013 was $470,090, comprised of $420,801 of rental income and $49,289 of investment income. All of our rental income, which is inclusive of $26,201 and $36,898, respectively, of straight-line rental revenue for the three and nine months ended September 30, 2013, was derived from our first property, 9022 Heritage Parkway.

24

On May 31, 2013, $3,066,298 was invested in a diversified portfolio of publicly traded common stock of 31 REITs. Since that date, some of these securities were sold and the proceeds were reinvested in the common stock of other publicly traded REITs. All of our $29,299 and $49,289 of investment income for the three and nine months ended September 30, 2013 was comprised of dividend income from these investments.

Operating Expenses