Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WASHINGTON FEDERAL INC | wafd8-k.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE VERBIAGE - WASHINGTON FEDERAL INC | exhibit991mar2013pressre.htm |

| EX-99.1 - EXHIBIT 99.1 INCOME STATEMENT - WASHINGTON FEDERAL INC | exhibit991mar2013incomes.htm |

| EX-99.1 - EXHIBIT 99.1 BALANCE SHEET - WASHINGTON FEDERAL INC | exhibit991mar2013balance.htm |

| EX-99.2 - EXHIBIT 99.2 AVERAGE BALANCE SHEET - WASHINGTON FEDERAL INC | exhibit992mar2013average.htm |

| EX-99.2 - EXHIBIT 99.2 FACT SHEET - WASHINGTON FEDERAL INC | exhibit992mar2013factshe.htm |

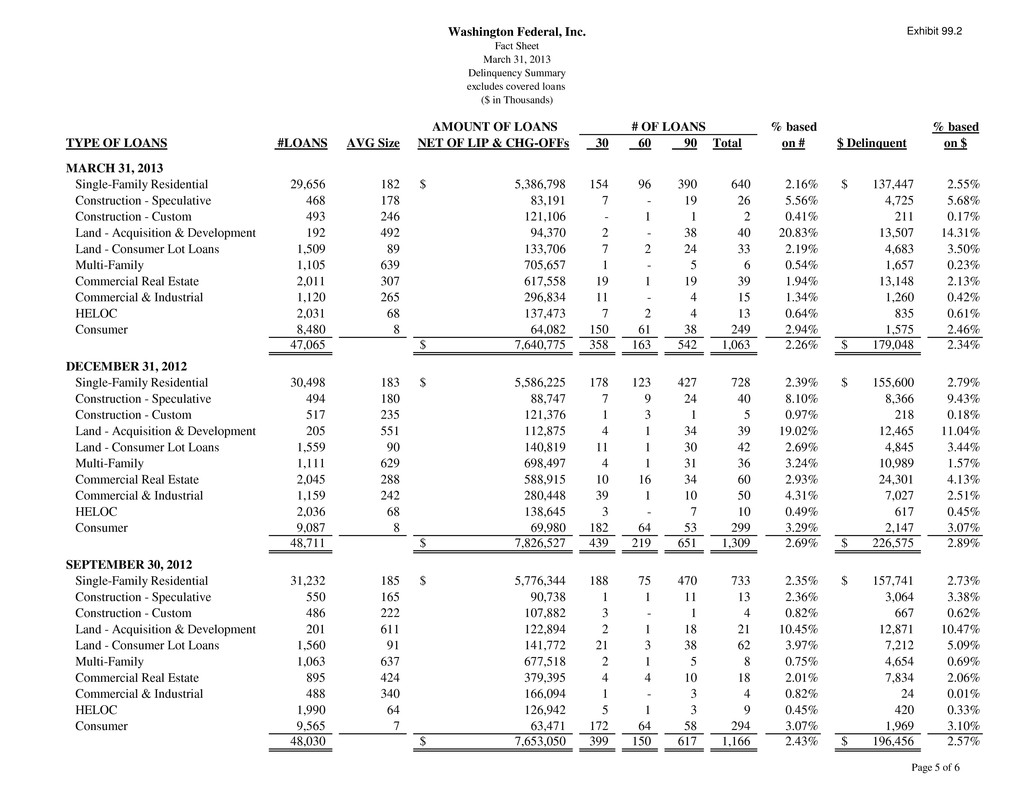

Washington Federal, Inc. Fact Sheet March 31, 2013 Delinquency Summary excludes covered loans ($ in Thousands) Exhibit 99.2 AMOUNT OF LOANS # OF LOANS % based % based TYPE OF LOANS #LOANS AVG Size NET OF LIP & CHG-OFFs 30 60 90 Total on # $ Delinquent on $ MARCH 31, 2013 Single-Family Residential 29,656 182 5,386,798$ 154 96 390 640 2.16% 137,447$ 2.55% Construction - Speculative 468 178 83,191 7 - 19 26 5.56% 4,725 5.68% Construction - Custom 493 246 121,106 - 1 1 2 0.41% 211 0.17% Land - Acquisition & Development 192 492 94,370 2 - 38 40 20.83% 13,507 14.31% Land - Consumer Lot Loans 1,509 89 133,706 7 2 24 33 2.19% 4,683 3.50% Multi-Family 1,105 639 705,657 1 - 5 6 0.54% 1,657 0.23% Commercial Real Estate 2,011 307 617,558 19 1 19 39 1.94% 13,148 2.13% Commercial & Industrial 1,120 265 296,834 11 - 4 15 1.34% 1,260 0.42% HELOC 2,031 68 137,473 7 2 4 13 0.64% 835 0.61% Consumer 8,480 8 64,082 150 61 38 249 2.94% 1,575 2.46% 47,065 7,640,775$ 358 163 542 1,063 2.26% 179,048$ 2.34% DECEMBER 31, 2012 Single-Family Residential 30,498 183 5,586,225$ 178 123 427 728 2.39% 155,600$ 2.79% Construction - Speculative 494 180 88,747 7 9 24 40 8.10% 8,366 9.43% Construction - Custom 517 235 121,376 1 3 1 5 0.97% 218 0.18% Land - Acquisition & Development 205 551 112,875 4 1 34 39 19.02% 12,465 11.04% Land - Consumer Lot Loans 1,559 90 140,819 11 1 30 42 2.69% 4,845 3.44% Multi-Family 1,111 629 698,497 4 1 31 36 3.24% 10,989 1.57% Commercial Real Estate 2,045 288 588,915 10 16 34 60 2.93% 24,301 4.13% Commercial & Industrial 1,159 242 280,448 39 1 10 50 4.31% 7,027 2.51% HELOC 2,036 68 138,645 3 - 7 10 0.49% 617 0.45% Consumer 9,087 8 69,980 182 64 53 299 3.29% 2,147 3.07% 48,711 7,826,527$ 439 219 651 1,309 2.69% 226,575$ 2.89% SEPTEMBER 30, 2012 Single-Family Residential 31,232 185 5,776,344$ 188 75 470 733 2.35% 157,741$ 2.73% Construction - Speculative 550 165 90,738 1 1 11 13 2.36% 3,064 3.38% Construction - Custom 486 222 107,882 3 - 1 4 0.82% 667 0.62% Land - Acquisition & Development 201 611 122,894 2 1 18 21 10.45% 12,871 10.47% Land - Consumer Lot Loans 1,560 91 141,772 21 3 38 62 3.97% 7,212 5.09% Multi-Family 1,063 637 677,518 2 1 5 8 0.75% 4,654 0.69% Commercial Real Estate 895 424 379,395 4 4 10 18 2.01% 7,834 2.06% Commercial & Industrial 488 340 166,094 1 - 3 4 0.82% 24 0.01% HELOC 1,990 64 126,942 5 1 3 9 0.45% 420 0.33% Consumer 9,565 7 63,471 172 64 58 294 3.07% 1,969 3.10% 48,030 7,653,050$ 399 150 617 1,166 2.43% 196,456$ 2.57% Page 5 of 6