Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - WASHINGTON FEDERAL INC | wafdex3209302016.htm |

| EX-31.2 - EXHIBIT 31.2 - WASHINGTON FEDERAL INC | wafdex31209302016.htm |

| EX-31.1 - EXHIBIT 31.1 - WASHINGTON FEDERAL INC | wafdex31109302016.htm |

| EX-23.1 - EXHIBIT 23.1 - WASHINGTON FEDERAL INC | wafdex231dtconsent09302016.htm |

| EX-13 - EXHIBIT 13 - WASHINGTON FEDERAL INC | a9302016annualreportex13.htm |

| EX-10.2 - EXHIBIT 10.2 - WASHINGTON FEDERAL INC | wafdex1022011incentiveplan.htm |

United States

Securities and Exchange Commission

Washington, D.C. 20549

____________________________________________________________

FORM 10-K

____________________________________________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2016. | |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

____________________________________________________________

Washington Federal, Inc.

(Exact name of registrant as specified in its charter)

____________________________________________________________

Washington | 91-1661606 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

425 Pike Street, Seattle, Washington 98101

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (206) 624-7930

_____________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Name of each exchange on which registered | |

Common Stock, $1.00 par value per share | NASDAQ Stock Market | |

Securities registered pursuant to section 12(g) of the Act:

None

____________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant's common stock ("Common Stock") held on March 31, 2016, by non-affiliates was $2,044,610,449 based on the NASDAQ Stock Market closing price of $22.65 per share on that date. This is based on 90,269,777 shares of Common Stock that were issued and outstanding on this date, which excludes 1,000,464 shares held by all directors and executive officers of the Registrant.

At November 17, 2016, there were 89,081,623 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents incorporated by reference and the Part of Form 10-K into which the document is incorporated:

(1) Portions of the Registrant’s Annual Report to Stockholders for the fiscal year ended September 30, 2016, are incorporated into Part II, Items 5-8 and Part III, Item 12 of this Form 10-K.

(2) Portions of the Registrant’s definitive proxy statement for its Annual Meeting of Stockholders to be held on January 18, 2017 are incorporated into Part III, Items 10-14 of this Form 10-K.

PART I

Washington Federal, Inc. (the "Company") makes statements in this Annual Report on Form 10-K that constitute forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates,” “intends,” “forecasts,” “projects” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could” are intended to help identify such forward-looking statements. These statements are not historical facts, but instead represent current expectations, plans or forecasts of the Company and are based on the beliefs and assumptions of the management of the Company and the information available to management at the time that these disclosures were prepared. The Company intends for all such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumptions that are difficult to predict and often are beyond the Company's control. Actual outcomes and results may differ materially from those expressed in, or implied by, the Company's forward-looking statements.

You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties discussed elsewhere in this report, including under Item 1A. “Risk Factors,” and in any of the Company's other subsequent Securities and Exchange Commission filings, which could cause the Company's future results to differ materially from the plans, objectives, goals, estimates, intentions, and expectations expressed in forward-looking statements:

• | a deterioration in economic conditions, including declines in the real estate market and home sale volumes and financial stress on borrowers as a result of the uncertain economic environment; |

• | the severe effects of the continued economic downturn, including high unemployment rates and declines in housing prices and property values, in the Company's primary market areas; |

• | the effects of and changes in monetary and fiscal policies of the Board of Governors of the Federal Reserve System and the U.S. Government; |

• | fluctuations in interest rate risk and changes in market interest rates; |

• | the Company's ability to make accurate assumptions and judgments about the collectability of its loan portfolio, including the creditworthiness of its borrowers and the value of the assets securing these loans; |

• | the Company's ability to successfully complete merger and acquisition activities and realize expected strategic and operating efficiencies associated with such activities; |

• | legislative and regulatory limitations, including those arising under the Dodd-Frank Act and potential limitations in the manner in which the Company conducts its business and undertake new investments and activities; |

• | the ability of the Company to obtain external financing to fund its operations or obtain this financing on favorable terms; |

• | changes in other economic, competitive, governmental, regulatory, and technological factors affecting the Company's markets, operations, pricing, products, services and fees; |

• | the success of the Company at managing the risks involved in the foregoing and managing its business; and |

• | the timing and occurrence or non-occurrence of events that may be subject to circumstances beyond the Company's control. |

All forward-looking statements speak only as of the date on which such statements are made, and the Company undertakes no obligation to update or revise any forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events, changes to future operating results over time, or the impact of circumstances arising after the date the forward-looking statement was made.

2

Item 1. | Business |

General

Washington Federal, Inc., formed in November 1994, is a Washington corporation headquartered in Seattle, Washington. The Company is a bank holding company that conducts its operations through a federally-insured national bank subsidiary, Washington Federal, National Association (“Bank”). As used throughout this document, the terms “Washington Federal” or the “Company” refer to Washington Federal, Inc. and its consolidated subsidiaries and the term "Bank" refers to the operating subsidiary Washington Federal, National Association.

The Company's fiscal year end is September 30th. All references to 2016, 2015 and 2014 represent balances as of September 30, 2016, September 30, 2015 and September 30, 2014, respectively, or activity for the fiscal years then ended.

The business of the Bank consists primarily of accepting deposits from the general public and investing these funds in loans of various types, including first lien mortgages on single-family dwellings, construction loans, land acquisition and development loans, loans on multi-family, commercial real estate and other income producing properties, home equity loans and business loans. It also invests in certain United States government and agency obligations and other investments permitted by applicable laws and regulations. As of September 30, 2016, Washington Federal has 238 branches located in Washington, Oregon, Idaho, Arizona, Utah, Nevada, New Mexico and Texas. Through its subsidiaries, the Company is also engaged in real estate investment and insurance brokerage activities.

The principal sources of funds for the Company's activities are retained earnings, loan repayments, net deposit inflows, repayments and sales of investments and borrowings. Washington Federal's principal sources of revenue are interest on loans and interest and dividends on investments. Its principal expenses are interest paid on deposits, credit costs, general and administrative expenses, interest on borrowings and income taxes.

The Bank is subject to extensive regulation, supervision and examination by the Office of the Comptroller of the Currency ("OCC"), its primary federal regulator, the Consumer Financial Protection Bureau ("CFPB") and the Federal Deposit Insurance Corporation ("FDIC"), which insures its deposits up to applicable limits. Washington Federal, as a bank holding company, is subject to extensive regulation, supervision and examination by the Board of Governors of the Federal Reserve System (" Federal Reserve"). The CFPB has broad authority to regulate providers of credit, payments and other consumer financial products and services and to bring actions to enforce federal consumer protection legislation as necessary.

The regulatory structure gives the regulatory authorities extensive discretion in connection with their supervisory and enforcement activities. Any change in such regulation, whether by the OCC, the FDIC, the Federal Reserve, the CFPB or the U.S. Congress, could have a significant impact on the Company and its operations. See “Regulation” section below.

3

Average Statements of Financial Condition | ||||||||||||||||||||||||||||||||

Year Ended September 30, | ||||||||||||||||||||||||||||||||

2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||

Average Balance | Interest | Average Rate | Average Balance | Interest | Average Rate | Average Balance | Interest | Average Rate | ||||||||||||||||||||||||

(In thousands) | ||||||||||||||||||||||||||||||||

Assets | ||||||||||||||||||||||||||||||||

Loans receivable (1) | $ | 9,511,351 | $ | 454,085 | 4.77 | % | $ | 8,598,435 | $ | 437,002 | 5.08 | % | $ | 7,997,566 | $ | 430,850 | 5.39 | % | ||||||||||||||

Mortgage-backed securities | 2,737,947 | 62,949 | 2.30 | 3,073,180 | 71,392 | 2.32 | 3,275,846 | 80,260 | 2.45 | |||||||||||||||||||||||

Cash and other investment securities (2) | 1,167,596 | 16,282 | 1.39 | 1,634,441 | 20,363 | 1.25 | 1,866,560 | 20,964 | 1.12 | |||||||||||||||||||||||

FHLB & FRB stock | 113,664 | 3,477 | 3.06 | 138,443 | 1,796 | 1.30 | 168,078 | 1,623 | .97 | |||||||||||||||||||||||

Total interest-earning assets | 13,530,558 | 536,793 | 3.97 | % | 13,444,499 | 530,553 | 3.95 | % | 13,308,050 | 533,697 | 4.01 | % | ||||||||||||||||||||

Other assets | 1,181,975 | 1,102,827 | 969,653 | |||||||||||||||||||||||||||||

Total assets | $ | 14,712,533 | $ | 14,547,326 | $ | 14,277,703 | ||||||||||||||||||||||||||

Liabilities and Stockholders’ Equity | ||||||||||||||||||||||||||||||||

Customer accounts | $ | 10,589,817 | 52,485 | .50 | % | $ | 10,656,687 | 51,054 | .48 | % | $ | 10,325,110 | 58,524 | .57 | % | |||||||||||||||||

FHLB advances | 1,992,434 | 64,059 | 3.22 | 1,848,904 | 66,018 | 3.57 | 1,955,205 | 69,553 | 3.56 | |||||||||||||||||||||||

Total interest-bearing liabilities | 12,582,251 | 116,544 | .93 | % | 12,505,591 | 117,072 | .94 | % | 12,280,315 | 128,077 | 1.05 | % | ||||||||||||||||||||

Other liabilities | 161,446 | 89,140 | 27,437 | |||||||||||||||||||||||||||||

Total liabilities | 12,743,697 | 12,594,731 | 12,307,752 | |||||||||||||||||||||||||||||

Stockholders’ equity | 1,968,836 | 1,952,595 | 1,969,951 | |||||||||||||||||||||||||||||

Total liabilities and stockholders’ equity | $ | 14,712,533 | $ | 14,547,326 | $ | 14,277,703 | ||||||||||||||||||||||||||

Net interest income/Interest rate spread | $ | 420,249 | 3.04 | % | $ | 413,481 | 3.01 | % | $ | 405,620 | 2.96 | % | ||||||||||||||||||||

Net interest margin (3) | 3.11 | % | 3.08 | % | 3.05 | % | ||||||||||||||||||||||||||

___________________

(1) | Interest income includes net accretion of deferred loan fees and costs of $29.9 million, $29.7 million, and $27.8 million for year ended 2016, 2015 and 2014, respectively. |

(2) | Includes cash equivalents and non-mortgage backed security investments, such as U.S. agency obligations, mutual funds, corporate bonds, and municipal bonds. |

(3) | Net interest income divided by average interest-earning assets. |

Lending Activities

4

General. The Company's net portfolio of loans totaled $9.9 billion at September 30, 2016 and represents 66.6% of total assets. The Bank's lending activities include the origination of loans secured by real estate, including long-term fixed-rate and adjustable-rate mortgage loans, adjustable-rate construction loans, adjustable-rate land development loans, fixed-rate and adjustable-rate multi-family loans, fixed-rate and adjustable-rate commercial real estate loans and fixed-rate and adjustable-rate business loans.

The following table sets forth the composition of the Bank’s loan portfolio.

September 30, 2016 | September 30, 2015 | September 30, 2014 | September 30, 2013 | September 30, 2012 | |||||||||||||||||||||

(In thousands) | |||||||||||||||||||||||||

Non-Acquired loans | |||||||||||||||||||||||||

Single-family residential | $ | 5,621,066 | 51.3 | % | $ | 5,651,845 | 57.5 | % | $ | 5,560,203 | 62.6 | % | $ | 5,359,149 | 64.2 | % | $ | 5,778,922 | 70.1 | % | |||||

Construction | 1,110,411 | 10.1 | 200,509 | 2.0 | 140,060 | 1.6 | 130,778 | 1.6 | 129,637 | 1.6 | |||||||||||||||

Construction - custom | 473,069 | 4.3 | 396,307 | 4.0 | 385,824 | 4.3 | 302,722 | 3.6 | 211,690 | 2.6 | |||||||||||||||

Land - acquisition & development | 116,156 | 1.1 | 94,208 | 1.0 | 77,832 | 0.9 | 77,775 | 0.9 | 124,677 | 1.5 | |||||||||||||||

Land - consumer lot loans | 101,853 | 0.9 | 103,989 | 1.1 | 108,623 | 1.2 | 121,671 | 1.5 | 141,844 | 1.7 | |||||||||||||||

Multi-family | 1,118,801 | 10.2 | 1,125,722 | 11.5 | 917,286 | 10.3 | 831,684 | 10.0 | 710,140 | 8.6 | |||||||||||||||

Commercial real estate | 956,164 | 8.7 | 986,270 | 10.0 | 591,336 | 6.7 | 414,961 | 5.0 | 319,210 | 3.9 | |||||||||||||||

Commercial & industrial | 946,648 | 8.6 | 612,836 | 6.2 | 379,226 | 4.3 | 243,199 | 2.9 | 162,823 | 2.0 | |||||||||||||||

HELOC | 134,785 | 1.2 | 127,646 | 1.3 | 116,042 | 1.3 | 112,186 | 1.3 | 112,902 | 1.4 | |||||||||||||||

Consumer | 137,450 | 1.3 | 194,655 | 2.0 | 132,590 | 1.5 | 47,141 | 0.6 | 63,374 | 0.8 | |||||||||||||||

Total non-acquired loans | 10,716,403 | 97.9 | % | 9,493,987 | 96.6 | % | 8,409,022 | 94.7 | % | 7,641,266 | 91.5 | % | 7,755,219 | 94.1 | % | ||||||||||

Acquired loans | 115,394 | 1.1 | 166,293 | 1.7 | 184,188 | 2.1 | 250,379 | 3.0 | — | — | |||||||||||||||

Credit impaired acquired loans | 89,837 | 0.8 | 87,081 | 0.9 | 76,507 | 0.9 | 98,900 | 1.2 | 111,117 | 1.3 | |||||||||||||||

Covered loans | 28,974 | 0.3 | 75,909 | 0.8 | 213,203 | 2.4 | 363,046 | 4.3 | 374,356 | 4.5 | |||||||||||||||

Total gross loans | 10,950,608 | 100 | % | 9,823,270 | 100 | % | 8,882,920 | 100 | % | 8,353,591 | 100 | % | 8,240,692 | 100 | % | ||||||||||

Less: | |||||||||||||||||||||||||

Allowance for probable losses | 113,494 | 106,829 | 114,591 | 116,741 | 133,147 | ||||||||||||||||||||

Loans in process | 879,484 | 476,796 | 346,172 | 276,375 | 214,187 | ||||||||||||||||||||

Discount on acquired loans | 11,306 | 30,095 | 59,874 | 100,444 | 118,563 | ||||||||||||||||||||

Deferred net origination fees | 35,404 | 38,916 | 37,485 | 36,054 | 34,421 | ||||||||||||||||||||

Total loan contra accounts | 1,039,688 | 652,636 | 558,122 | 529,614 | 500,318 | ||||||||||||||||||||

Net Loans | $ | 9,910,920 | $ | 9,170,634 | $ | 8,324,798 | $ | 7,823,977 | $ | 7,740,374 | |||||||||||||||

5

The following table summarizes the Company’s loan portfolio, due for the periods indicated based on contractual terms to maturity or repricing. Amounts are presented prior to deduction of net discounts and premiums, loans in process, deferred net loan origination fees and costs and allowance for loan losses.

September 30, 2016 | Total | Less than 1 Year | 1 to 5 Years | After 5 Years | |||||||||||

(In thousands) | |||||||||||||||

Single-family residential | $ | 5,658,830 | $ | 1,051,400 | $ | 2,146,460 | $ | 2,460,970 | |||||||

Construction | 1,110,411 | 859,981 | 120,611 | 129,819 | |||||||||||

Construction – custom | 473,068 | 50,076 | 156,494 | 266,498 | |||||||||||

Land – acquisition and development | 118,497 | 113,726 | 4,771 | — | |||||||||||

Land – consumer lot loans | 104,567 | 33,170 | 56,031 | 15,366 | |||||||||||

Multi-family | 855,972 | 9,356 | 54,396 | 792,220 | |||||||||||

Commercial real estate | 1,361,957 | 451,045 | 910,912 | — | |||||||||||

Commercial & industrial | 978,589 | 582,958 | 181,447 | 214,184 | |||||||||||

HELOC | 149,716 | 149,164 | 552 | — | |||||||||||

Consumer | 139,001 | 74,796 | 37,168 | 27,037 | |||||||||||

$ | 10,950,608 | $ | 3,375,672 | $ | 3,668,842 | $ | 3,906,094 | ||||||||

The contractual loan payment period for residential mortgage loans originated by the Company normally ranges from 15 to 30 years. Experience during recent years has indicated that, because of prepayments in connection with refinancing and sales of property, residential loans have a weighted average life of four to ten years.

The following summary breaks down the Company's fixed rate and adjustable rate loans by time to maturity or to rate adjustment.

September 30, 2016 | ||||||||

Fixed-Rate | Adjustable-Rate | |||||||

Term To Maturity | Gross Loans | Term To Rate Adjustment | Gross Loans | |||||

(In thousands) | (In thousands) | |||||||

Within 1 year | $ | 29,428 | Less than 1 year | $ | 1,362,480 | |||

1 to 3 years | 326,859 | 1 to 3 years | 1,457,584 | |||||

3 to 5 years | 192,202 | 3 to 5 years | 552,402 | |||||

5 to 10 years | 693,099 | 5 to 10 years | 625,852 | |||||

10 to 20 years | 1,020,654 | 10 to 20 years | — | |||||

Over 20 years | 4,690,048 | Over 20 years | — | |||||

$ | 6,952,290 | $ | 3,998,318 | |||||

Lending Programs and Policies. The Bank's lending activities include the commercial and consumer loans, including the following loan categories.

Single-family residential loans. The Bank primarily originates 30 year fixed-rate mortgage loans secured by single-family residences. Moreover, it is the Bank's general policy to include in the documentation evidencing its conventional mortgage loans a due-on-sale clause, which facilitates adjustment of interest rates on such loans when the property securing the loan is sold or transferred.

All of the Bank's mortgage lending is subject to written, nondiscriminatory underwriting standards, loan origination procedures and lending policies approved by the Company's Board of Directors (the "Board"). Property valuations are required on all real estate loans. Appraisals are prepared by independent appraisers, reviewed by staff of the Bank, and approved by the Bank's management. Property evaluations are sometimes utilized in lieu of appraisals on single-family real estate loans of $250,000 or less and are reviewed by the Bank's staff. Detailed loan applications are obtained to determine the borrower's ability to repay and the more significant items on these applications are verified through the use of credit reports, financial statements or written confirmations.

6

Depending on the size of the loan involved, a varying number of officers of the Bank must approve the loan application before the loan can be granted. Federal guidelines limit the amount of a real estate loan made to a specified percentage of the value of the property securing the loan, as determined by an evaluation at the time the loan is originated. This is referred to as the loan-to-value ratio. The Board sets the maximum loan-to-value ratios for each type of real estate loan offered by the Bank.

When establishing general reserves for loans with loan-to-value ratios exceeding 80% that are not insured by private mortgage insurance, the Bank considers the additional risk inherent in these products, as well as their relative loan loss experience, and provides reserves when deemed appropriate. The total balance for loans with loan-to-value ratios exceeding 80% at origination as of September 30, 2016, was $477 million, with allocated reserves of $9.8 million.

Construction loans. The Bank originates construction loans to finance construction of single-family and multi-family residences as well as commercial properties. Loans made to builders are generally tied to an interest rate index and normally have maturities of two years or less. Loans made to individuals for construction of their home generally are 30 year fixed rate loans. The Bank's policies provide that for residential construction loans, loans may be made for 85% or less of the appraised value of the property upon completion. As a result of activity over the past four decades, the Bank believes that builders of single-family residences in its primary market areas consider it to be a construction lender of choice. Because of this history, the Bank has developed a staff with in-depth land development and construction experience and working relationships with selected builders based on their operating histories and financial stability.

Construction lending involves a higher level of risk than single-family residential lending due to the concentration of principal in a limited number of loans and borrowers and the effects of general economic conditions in the homebuilding industry. Moreover, a construction loan can involve additional risks because of the inherent difficulty in estimating both the estimated cost (including interest) of the project and the property's value at completion of the project.

Land loans. The Bank's land development loans are of a short-term nature and are generally made for 75% or less of the appraised value of the unimproved property. Funds are disbursed periodically at various stages of completion as authorized by the Company's personnel. The interest rate on these loans generally adjusts daily in accordance with a designated index.

Land development loans involve a higher degree of credit risk than long-term financing on owner-occupied real estate. Mitigation of risk of loss on a land development loan is dependent largely upon the accuracy of the initial estimate of the property's value at completion of development compared to the estimated cost (including interest) of development and the financial strength of the borrower.

The Bank's permanent land loans (also called consumer lot loans) are generally made on improved land, with the intent of building a primary or secondary residence. These loans are limited to 80% or less of the appraised value of the property, up to a maximum loan amount of $350,000. The interest rate on permanent land loans is generally fixed for 20 years.

Multi-family residential loans. Multi-family residential (five or more dwelling units) loans generally are secured by multi-family rental properties, such as apartment buildings. In underwriting multi-family residential loans, the Bank considers a number of factors, which include the projected net cash flow to the loan's debt service requirement, the age and condition of the collateral, the financial resources and income level of the borrower and the borrower's experience in owning or managing similar properties. Multi-family residential loans are originated in amounts up to 80% of the appraised value of the property securing the loan.

Loans secured by multi-family residential real estate generally involve a greater degree of credit risk than single-family residential loans and carry larger loan balances. This increased credit risk is a result of several factors, including the concentration of principal in a limited number of loans and borrowers, the effects of general economic conditions on income-producing properties, and the increased difficulty of evaluating and monitoring these types of loans. Furthermore, the repayment of loans secured by multi-family mortgages typically depends upon the successful operation of the related real estate property. If the cash flow from the project is reduced, the borrower's ability to repay the loan may be impaired. The Bank seeks to minimize these risks through its underwriting policies, which require such loans to be qualified at origination on the basis of the property's income and debt service ratio.

It is the Bank's policy to obtain title insurance ensuring that it has a valid first lien on the mortgaged real estate serving as collateral for the loan. Borrowers must also obtain hazard insurance prior to closing and, when required by regulation, flood insurance. Borrowers may be required to advance funds on a monthly basis, together with each payment of principal and interest, to a mortgage escrow account from which the Bank makes disbursements for items such as real estate taxes, hazard insurance premiums and private mortgage insurance premiums when due.

Commercial and industrial loans. The Bank makes various types of business loans to customers in its market area for working capital, acquiring real estate, equipment or other business purposes, such as acquisitions. The terms of these loans generally range from less than one year to a maximum of ten years. The loans are either negotiated on a fixed-rate basis or carry adjustable interest rates indexed to the LIBOR rate, prime rate or another market rate.

7

Commercial loans are made based upon assessment of the borrower's ability and willingness to repay along with an evaluation of secondary repayment sources such as the value and marketability of collateral. Most such loans are extended to closely held businesses and the personal guaranty of the principals is usually obtained. Commercial loans have a relatively high risk of default compared to residential real estate loans. Pricing of commercial loans is based on the credit risk of the borrower with consideration given to the overall relationship of the borrower, including deposits. The acquisition of business deposits is an important focus of this business line. The Bank provides a full line of treasury management products to support the depository needs of its clients.

Consumer loans. The Bank's non-mortgage consumer loan portfolio consists of approximately $118.4 million prime quality student loans acquired from an independent financial investment firm that retains 1% of each loan, plus various other non-mortgage consumer loans obtained through acquisitions.

Home equity loans. The Bank extends revolving lines of credit to consumers that are secured by a first or second mortgage on a single family residence. The interest rate on these loans adjusts monthly indexed to prime. Total loan-to-value ratios when combined with any underlying first liens are limited to 80% or less. Loan terms are a ten year draw period followed by a fifteen year amortization period.

Origination and Purchase of Loans. The Bank has general authority to lend anywhere in the United States; however, its primary lending areas are within the states of Washington, Oregon, Idaho, Arizona, Utah, Nevada, New Mexico and Texas. Loan originations come from a variety of sources. Residential loan originations result from referrals from real estate brokers, walk-in customers, purchasers of property in connection with builder projects that are financed by the Bank, mortgage brokers and refinancings for existing customers. Business purpose loans are obtained primarily by direct solicitation of borrowers and ongoing relationships.

The Bank also purchases loans and mortgage-backed securities when lending rates and mortgage volume for new loan originations in its market area do not fulfill its needs. Over the past few years, single-family residential loan originations were lower than historical levels due to the low interest rate environment and excessive government participation in the mortgage market.

The table below shows the Company's total loan origination, purchase and repayment activities.

Twelve Months Ended September 30, | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

(In thousands) | |||||||||||||||||||

Loans originated (1): | |||||||||||||||||||

Single-family residential | $ | 692,575 | $ | 705,741 | $ | 696,999 | $ | 707,310 | $ | 539,222 | |||||||||

Construction | 900,649 | 263,532 | 170,539 | 173,446 | 146,494 | ||||||||||||||

Construction – custom | 421,816 | 365,220 | 359,073 | 304,156 | 210,308 | ||||||||||||||

Land – acquisition & development | 59,511 | 78,818 | 53,960 | 22,590 | 21,323 | ||||||||||||||

Land – consumer lot loans | 29,661 | 21,422 | 12,441 | 14,324 | 13,169 | ||||||||||||||

Multi-family | 361,261 | 349,442 | 239,352 | 309,636 | 189,692 | ||||||||||||||

Commercial real estate | 353,265 | 600,610 | 258,367 | 163,577 | 87,471 | ||||||||||||||

Commercial & industrial | 1,051,950 | 642,309 | 332,871 | 225,809 | 143,849 | ||||||||||||||

HELOC | 74,538 | 74,455 | 47,054 | 44,872 | 38,750 | ||||||||||||||

Consumer | 3,308 | 1,966 | 1,359 | 315 | — | ||||||||||||||

Total loans originated | 3,948,534 | 3,103,515 | 2,172,015 | 1,966,035 | 1,390,278 | ||||||||||||||

Loans purchased (2) | 105,420 | 279,936 | 211,228 | 646,408 | 129,670 | ||||||||||||||

Loan principal repayments | (2,935,167 | ) | (2,418,547 | ) | (1,857,597 | ) | (2,353,061 | ) | (1,964,593 | ) | |||||||||

Net change in loans in process, discounts, etc. (3) | (378,501 | ) | (119,068 | ) | (24,825 | ) | (175,779 | ) | (133,041 | ) | |||||||||

Net loan activity increase (decrease) | $ | 740,286 | $ | 845,836 | $ | 500,821 | $ | 83,603 | $ | (577,686 | ) | ||||||||

Beginning balance | $ | 9,170,634 | $ | 8,324,798 | $ | 7,823,977 | $ | 7,740,374 | $ | 8,318,060 | |||||||||

Ending balance | $ | 9,910,920 | $ | 9,170,634 | $ | 8,324,798 | $ | 7,823,977 | $ | 7,740,374 | |||||||||

___________________

(1) | Includes undisbursed loan in process and for years prior to 2016 does not include savings account loans, which were not material during the periods indicated. |

(2) | Includes non-covered loans acquired through acquisitions and whole loan purchases. |

(3) Includes non-cash transactions.

8

Interest Rates, Loan Fees and Service Charges. Interest rates charged by the Bank on mortgage loans are primarily determined by the competitive loan rates offered in its lending areas and in the secondary market. Mortgage loan rates reflect factors such as general interest rates, the supply of money available to the industry and the demand for such loans. General economic conditions, the regulatory programs and policies of federal and state agencies, including the FRB’s monetary policies, changes in tax laws and governmental budgetary programs influence these factors.

The Bank receives fees for originating loans in addition to various fees and charges related to existing loans, including prepayment charges, late charges and assumption fees. In making one-to-four- family home mortgage loans, the Bank normally charges an origination fee and as part of the loan application, the borrower pays the Bank for out-of-pocket costs, such as the appraisal fee, whether or not the borrower closes the loan. The interest rate charged is normally the prevailing rate at the time the loan application is approved and accepted. In the case of construction loans, the Bank normally charges an origination fee. Loan origination fees and other terms of multi-family residential loans are individually negotiated.

Non-Performing Assets. When a borrower violates a condition of a loan, the Bank attempts to cure the default by contacting the borrower. In most cases, defaults are cured promptly. If the default is not cured within an appropriate time frame, typically 90 days, the Bank may institute appropriate action to collect the loan, such as making demand for payment or initiating foreclosure proceedings on the collateral. If foreclosure occurs, the collateral will typically be sold at public auction and may be purchased by the Bank.

Loans are placed on nonaccrual status when, in the judgment of management, the probability of collecting interest or principal is deemed to be insufficient to warrant further accrual. When a loan is placed on nonaccrual status, previously accrued but unpaid interest is deducted from interest income. The Bank does not accrue interest on loans 90 days past due or more. See Note A to the Consolidated Financial Statements included in Item 8 hereof for additional information.

The Bank will consider modifying the interest rate and terms of a loan if it determines that a modification is deemed to be the best option available for collection in full or to minimize the loss to the Bank. Most loans restructured in troubled debt restructurings ("TDRs") are accruing and performing loans where the borrower has proactively approached the Bank about a modification due to temporary financial difficulties. Each request is individually evaluated for merit and likelihood of success. The modification of these loans is typically a payment reduction through a rate reduction of from 100 to 200 bps for a specific term, usually six to twelve months. Interest-only payments may also be approved during the modification period. Principal forgiveness generally is not an available option for restructured loans. As of September 30, 2016, single-family residential loans comprised 87.2% of restructured loans. The Bank reserves for restructured loans within its allowance for loan loss methodology by taking into account the following performance indicators: 1) time since modification, 2) current payment status and 3) geographic market conditions.

Real estate acquired by foreclosure or deed-in-lieu thereof (“REO” or “Real Estate Owned”) is classified as real estate held for sale. When property is acquired, it is recorded at the fair market value less estimated selling costs at the date of acquisition. Interest accrual ceases on the date of acquisition and all costs incurred in maintaining the property from that date forward are expensed as incurred. Costs incurred for the improvement or development of such property is capitalized. See Note A to the Consolidated Financial Statements included in Item 8 hereof for additional information.

9

The following table sets forth information regarding the Company's restructured and non-accrual loans and REO.

September 30, | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

(In thousands) | |||||||||||||||||||

Performing restructured loans | $ | 251,583 | $ | 289,587 | $ | 350,653 | $ | 391,415 | $ | 403,238 | |||||||||

Non-performing restructured loans | 9,948 | 13,126 | 24,090 | 24,281 | 30,040 | ||||||||||||||

Total restructured loans | 261,531 | 302,713 | 374,743 | 415,696 | 433,278 | ||||||||||||||

Non-accrual loans: | |||||||||||||||||||

Single-family residential | 33,148 | 59,074 | 74,067 | 100,460 | 131,193 | ||||||||||||||

Construction | — | 754 | 1,477 | 4,560 | 10,634 | ||||||||||||||

Construction – custom | — | 732 | — | — | 539 | ||||||||||||||

Land – acquisition & development | 58 | — | 811 | 2,903 | 13,477 | ||||||||||||||

Land – consumer lot loans | 510 | 1,273 | 2,637 | 3,337 | 5,149 | ||||||||||||||

Multi-family | 776 | 2,558 | 1,742 | 6,573 | 4,185 | ||||||||||||||

Commercial real estate | 7,100 | 2,176 | 5,106 | 11,736 | 7,653 | ||||||||||||||

Commercial & industrial | 583 | — | 7 | 477 | 16 | ||||||||||||||

HELOC | 239 | 563 | 795 | 263 | 198 | ||||||||||||||

Consumer | — | 680 | 789 | 990 | 383 | ||||||||||||||

Total non-accrual loans (1) | 42,414 | 67,810 | 87,431 | 131,299 | 173,427 | ||||||||||||||

Real estate owned | 29,027 | 61,098 | 59,880 | 82,317 | 99,478 | ||||||||||||||

Total non-performing assets | 71,441 | 128,908 | 147,311 | 213,616 | 272,905 | ||||||||||||||

Total non-performing assets and performing restructured loans | $ | 323,024 | $ | 418,495 | $ | 497,964 | $ | 605,031 | $ | 676,143 | |||||||||

Total non-performing assets and restructured loans as a percent of total assets | 2.17 | % | 2.87 | % | 3.37 | % | 4.62 | % | 5.42 | % | |||||||||

Total non-performing assets to total assets | 0.48 | % | 0.88 | % | 1.00 | % | 1.63 | % | 2.19 | % | |||||||||

___________________

(1) | For the year ended September 30, 2016, the Company recognized $5,434,000 in interest income on cash payments received from borrowers on non-accrual loans. The Company would have recognized interest income of $2,348,000 for the same period had these loans performed according to their original contract terms. The recognized interest income may include more than twelve months of interest for some of the non-accrual loans that were brought current or paid off. In addition to the non-accrual loans reflected in the above table, the Company had $117,536,000 of loans that were less than 90 days delinquent at September 30, 2016 but were classified as substandard for one or more reasons. If these loans were deemed non-performing, the Company's ratio of total non-performing assets and performing restructured loans as a percent of total assets would have increased to 2.96% at September 30, 2016. For a discussion of the Company's policy for placing loans on nonaccrual status, see Note A to the Consolidated Financial Statements included in Item 8 hereof. |

Allowance for Loan Losses. The Company maintains an allowance for loan losses to absorb losses inherent in the loan portfolio. The amount of this allowance is based on ongoing, quarterly assessments of the probable and estimable losses inherent in the loan portfolio. The Bank’s method for assessing the appropriateness of the allowance is to apply a loss percentage factor to the different loan types. The loss percentage factor is made up of two parts - the historical loss factor (“HLF”) and the qualitative loss factor (“QLF”). The HLF takes into account historical charge-offs by loan type. The Company uses an average of historical loss rates for each loan category multiplied by an estimated loss emergence period. The QLFs are based on management's continuing evaluation of the pertinent factors underlying the quality of the loan portfolio, including changes in the size and composition of the loan portfolio, actual loan loss experience, current economic conditions, collateral values, geographic concentrations, seasoning of the loan portfolio, specific industry conditions, and the duration of the current business cycle. These factors are considered by loan type. Specific allowances are established in cases where management has identified conditions or circumstances related to a loan that management believes indicate the probability that a loss has been incurred. The Company has also established a reserve for unfunded commitments.

As part of the process for determining the adequacy of the allowance for loan losses, management reviews the loan portfolio for specific weaknesses and considers the factors noted above. The recovery of the carrying value of loans is susceptible to future market conditions

10

beyond the Bank's control, which may result in losses or recoveries differing from those provided. In those cases, a portion of the allowance is then allocated to reflect the estimated loss exposure.

The following table provides detail regarding the Company's allowance for loan losses.

Twelve Months Ended September 30, | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

(In thousands) | |||||||||||||||||||

Beginning balance | $ | 106,829 | $ | 114,591 | $ | 116,741 | $ | 133,147 | $ | 160,926 | |||||||||

Charge-offs: | |||||||||||||||||||

Single-family residential | 3,106 | 5,524 | 8,529 | 20,947 | 53,789 | ||||||||||||||

Construction | — | 388 | 949 | 1,446 | 4,916 | ||||||||||||||

Construction – custom | 60 | — | — | 481 | — | ||||||||||||||

Land – Acquisition & development | 42 | 38 | 541 | 3,983 | 16,978 | ||||||||||||||

Land – consumer lot loans | 732 | 459 | 658 | 1,363 | 2,670 | ||||||||||||||

Multi-family | — | — | — | 1,043 | 1,393 | ||||||||||||||

Commercial real estate | 103 | 1,711 | 105 | 747 | 814 | ||||||||||||||

Commercial & industrial loans | 941 | 3,354 | 826 | 1,145 | 249 | ||||||||||||||

HELOC | 54 | 66 | 48 | 163 | 232 | ||||||||||||||

Consumer | 962 | 3,060 | 3,443 | 2,783 | 3,538 | ||||||||||||||

6,000 | 14,600 | 15,099 | 34,101 | 84,579 | |||||||||||||||

Recoveries: | |||||||||||||||||||

Single-family residential | 3,251 | 13,403 | 17,684 | 9,416 | 8,164 | ||||||||||||||

Construction | 745 | 120 | 97 | 501 | 711 | ||||||||||||||

Construction – custom | 60 | — | — | — | — | ||||||||||||||

Land – Acquisition & development | 8,220 | 207 | 3,071 | 4,105 | 1,341 | ||||||||||||||

Land – consumer lot loans | 5 | 221 | 22 | 40 | — | ||||||||||||||

Multi-family | — | 220 | — | 171 | 504 | ||||||||||||||

Commercial real estate | 1,812 | 735 | 33 | 17 | 225 | ||||||||||||||

Commercial & industrial loans | 2,933 | 1,374 | 5,043 | 95 | 2,366 | ||||||||||||||

HELOC | 21 | 2 | — | — | 66 | ||||||||||||||

Consumer | 2,018 | 3,688 | 3,513 | 2,000 | 1,480 | ||||||||||||||

19,065 | 19,970 | 29,463 | 16,345 | 14,857 | |||||||||||||||

Net charge-offs (recoveries) | (13,065 | ) | (5,370 | ) | (14,364 | ) | 17,756 | 69,722 | |||||||||||

Provision (release) for loan losses and transfers | (6,400 | ) | (13,132 | ) | (16,514 | ) | 1,350 | 41,943 | |||||||||||

Ending balance (1) | $ | 113,494 | $ | 106,829 | $ | 114,591 | $ | 116,741 | $ | 133,147 | |||||||||

Ratio of net charge-offs (recoveries) to average loans outstanding | (0.14 | )% | (0.06 | )% | (0.18 | )% | 0.23 | % | 0.87 | % | |||||||||

__________________

(1) This does not include a reserve for unfunded commitments of $3,235,000; $3,085,000, and $2,910,000 as of September 30, 2016, 2015 and 2014, respectively.

11

The following table sets forth the amount of the Company’s allowance for loan losses by loan category.

September 30, | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||||||||||||||||||||||||||

ALLL Amount | Loans to Total Loans (1) | Coverage Ratio (2) | ALLL Amount | Loans to Total Loans (1) | Coverage Ratio (2) | ALLL Amount | Loans to Total Loans (1) | Coverage Ratio (2) | ALLL Amount | Loans to Total Loans (1) | Coverage Ratio (2) | ALLL Amount | Loans to Total Loans (1) | Coverage Ratio (2) | ||||||||||||||||||||||||||||||

(In thousands) | ||||||||||||||||||||||||||||||||||||||||||||

Allowance allocation: | ||||||||||||||||||||||||||||||||||||||||||||

Single-family residential | $ | 37,796 | 51.5 | % | 0.7 | % | $ | 47,347 | 57.8 | % | 0.8 | % | $ | 62,067 | 62.6 | % | 0.8 | % | $ | 64,184 | 64.3 | % | 0.8 | % | $ | 81,815 | 70.2 | % | 0.8 | % | ||||||||||||||

Construction | 19,838 | 10.1 | 4.0 | 6,680 | 2.0 | 5.1 | 6,742 | 1.6 | 5.1 | 8,407 | 1.6 | 5.1 | 12,060 | 1.6 | 5.1 | |||||||||||||||||||||||||||||

Construction – custom | 1,080 | 4.3 | 0.5 | 990 | 4.0 | 0.5 | 1,695 | 4.3 | 50.0 | 882 | 3.6 | 50.0 | 347 | 2.6 | 50.0 | |||||||||||||||||||||||||||||

Land – acquisition & development | 6,023 | 1.1 | 6.6 | 5,781 | 1.0 | 7.7 | 5,592 | 0.9 | 7.7 | 9,165 | 1.0 | 7.7 | 15,598 | 1.6 | 7.7 | |||||||||||||||||||||||||||||

Land – consumer lot loans | 2,535 | 1.0 | 2.7 | 2,946 | 1.1 | 2.8 | 3,077 | 1.3 | 2.8 | 3,552 | 1.5 | 2.8 | 4,937 | 1.7 | 2.8 | |||||||||||||||||||||||||||||

Multi-family | 6,925 | 10.3 | 0.6 | 5,304 | 11.6 | 0.5 | 4,248 | 10.4 | 0.5 | 3,816 | 10.0 | 0.5 | 5,280 | 8.6 | 0.5 | |||||||||||||||||||||||||||||

Commercial real estate | 8,588 | 10.0 | 0.9 | 8,960 | 11.7 | 1.0 | 7,548 | 8.5 | 1.0 | 5,595 | 7.5 | 1.0 | 1,956 | 4.9 | 1.0 | |||||||||||||||||||||||||||||

Commercial & industrial | 28,008 | 8.9 | 2.9 | 24,980 | 6.7 | 3.9 | 17,223 | 4.9 | 3.9 | 16,614 | 3.9 | 3.9 | 7,626 | 2.0 | 3.9 | |||||||||||||||||||||||||||||

HELOC | 813 | 1.3 | 0.6 | 902 | 1.4 | 0.7 | 928 | 1.5 | 0.7 | 1,002 | 1.6 | 0.7 | 965 | 1.5 | 0.7 | |||||||||||||||||||||||||||||

Consumer | 1,888 | 1.3 | 1.4 | 2,939 | 2.0 | 1.5 | 3,227 | 1.6 | 1.5 | 3,524 | 0.7 | 1.5 | 2,563 | 0.8 | 1.5 | |||||||||||||||||||||||||||||

Covered loans | — | 0.2 | — | 0.7 | 2,244 | 2.4 | — | 4.3 | — | 4.5 | ||||||||||||||||||||||||||||||||||

Total allowance for loan losses (3) | $ | 113,494 | 100 | % | $ | 106,829 | 100 | % | $ | 114,591 | 100 | % | $ | 116,741 | 100 | % | $ | 133,147 | 100 | % | ||||||||||||||||||||||||

___________________

(1) | Represents the gross loan amount for each respective loan category as a % of total gross loans. |

(2) | Represents the allocated allowance for each respective loan category as a % of gross loans for that same category, excluding covered loans and acquired loans outstanding that are not subject to the allowance for loan loss. |

(3) | This does not include a reserve for unfunded commitments of $3,235,000; $3,085,000; and $2,910,000 as of September 30, 2016, 2015 and 2014, respectively. |

12

Investment Activities

As a national association, the Bank is obligated to maintain adequate liquidity and does so by holding cash and cash equivalents and by investing in securities. These investments may include, among other things, certain certificates of deposit, repurchase agreements, bankers’ acceptances, loans to financial institutions whose deposits are federally-insured, federal funds, United States government and agency obligations and mortgage-backed securities.

The following table sets forth the composition of the Company’s investment portfolio.

September 30, | 2016 | 2015 | 2014 | ||||||||||||||||||||

Amortized Cost | Fair Value | Amortized Cost | Fair Value | Amortized Cost | Fair Value | ||||||||||||||||||

(In thousands) | |||||||||||||||||||||||

U.S. government and agency securities | $ | 263,946 | $ | 259,351 | $ | 486,968 | $ | 482,464 | $ | 729,299 | $ | 731,943 | |||||||||||

Equity securities | 100,422 | 101,824 | 100,422 | 101,952 | 100,500 | 101,387 | |||||||||||||||||

Corporate debt securities | 461,530 | 461,138 | 506,172 | 505,800 | 505,741 | 509,007 | |||||||||||||||||

Municipal bonds | 24,013 | 27,670 | 23,970 | 27,123 | 20,402 | 23,681 | |||||||||||||||||

Agency pass-through certificates | 2,396,554 | 2,434,597 | 2,788,003 | 2,797,938 | 3,109,904 | 3,083,726 | |||||||||||||||||

Commercial MBS | 80,318 | 79,870 | 103,131 | 102,706 | 98,851 | 98,916 | |||||||||||||||||

$ | 3,326,783 | $ | 3,364,450 | $ | 4,008,666 | $ | 4,017,983 | $ | 4,564,697 | $ | 4,548,660 | ||||||||||||

The table below shows the investment portfolio categorized by maturity band.

September 30, 2016 | Amortized Cost | Weighted Average Yield | ||||

(In thousands) | ||||||

Due in less than 1 year | $ | 299,434 | 1.29 | % | ||

Due after 1 year through 5 years | 237,954 | 2.32 | ||||

Due after 5 years through 10 years | 165,710 | 1.45 | ||||

Due after 10 years | 2,623,685 | 2.88 | ||||

$ | 3,326,783 | 2.62 | % | |||

Sources of Funds

General. Deposits are the primary source of the Bank’s funds for use in lending and other general business purposes. In addition to deposits, the Bank derives funds from loan repayments, advances from the FHLB, other borrowings, and from investment repayments and sales. Loan repayments are a relatively stable source of funds, while deposit inflows and outflows are influenced by general interest rates, money market conditions, the availability of FDIC insurance and the market perception of the Company’s financial stability. Borrowings may be used on a short-term basis to compensate for reductions in normal sources of funds, such as deposit inflows at lower than projected levels. Borrowings may also be used on a longer-term basis to support expanded activities and to manage interest rate risk.

Deposits. The Bank relies on a mix of deposit types, including business and personal checking accounts, term certificates of deposit, and other savings deposit alternatives that have no fixed term, such as money market accounts and passbook savings accounts The Bank offers several consumer checking account products, both interest bearing and non-interest bearing and three business checking accounts, two of which target small businesses with relatively simple and straightforward banking needs and one for larger, more complex business depositors with an account that prices monthly based on the volume and type of activity. Savings and money market accounts are offered to both businesses and consumers, with interest paid after certain threshold amounts are exceeded.

Certificates of deposit with a maturity of one year or less have penalties for premature withdrawal equal to 90 days of interest. When the maturity is greater than one year but less than four years, the penalty is 180 days of interest. When the maturity is greater than four years, the penalty is 365 days interest. Early withdrawal penalty fee income for the year ended 2016, 2015 and 2014 amounted to $450,000, $546,000 and $552,000, respectively.

13

The Bank’s deposits are obtained primarily from residents of Washington, Oregon, Idaho, Arizona, Utah, Nevada, New Mexico and Texas. The Bank does not advertise for deposits outside of these states.

The following table sets forth certain information relating to the Company’s deposits.

September 30, | 2016 | 2015 | 2014 | ||||||||||||||||

Amount | Rate | Amount | Rate | Amount | Rate | ||||||||||||||

(In thousands) | |||||||||||||||||||

Balance by interest rate: | |||||||||||||||||||

Checking accounts | $2,721,721 | 0.06 | % | $2,555,766 | 0.06 | % | $2,331,170 | 0.06 | % | ||||||||||

Passbook and statement accounts | 820,980 | 0.10 | 700,794 | 0.10 | 622,546 | 0.10 | |||||||||||||

Money market accounts | 2,462,891 | 0.15 | 2,564,318 | 0.13 | 2,536,971 | 0.18 | |||||||||||||

6,005,592 | 5,820,878 | 5,490,687 | |||||||||||||||||

Fixed-rate time deposit accounts: | |||||||||||||||||||

Under 1.00% | 3,268,272 | 3,126,119 | 3,454,682 | ||||||||||||||||

1.00% to 1.99% | 1,292,612 | 1,177,356 | 1,069,476 | ||||||||||||||||

2.00% to 2.99% | 34,376 | 501,409 | 602,683 | ||||||||||||||||

3.00% to 3.99% | — | 5,156 | 98,610 | ||||||||||||||||

4.00% or higher | — | 785 | 790 | ||||||||||||||||

4,595,260 | 4,810,825 | 5,226,241 | |||||||||||||||||

$ | 10,600,852 | $ | 10,631,703 | $ | 10,716,928 | ||||||||||||||

The following table sets forth, by various interest rate categories, the amount of fixed-rate time deposits that mature during the periods indicated.

Maturing in | |||||||||||||||||||||||||||

September 30, 2016 | 1 to 3 Months | 4 to 6 Months | 7 to 12 Months | 13 to 24 Months | 25 to 36 Months | 37 to 60 Months | Total | ||||||||||||||||||||

(In thousands) | |||||||||||||||||||||||||||

Fixed-rate time deposits: | |||||||||||||||||||||||||||

Under 1.00% | $ | 865,407 | $ | 900,163 | $ | 1,126,800 | $ | 375,090 | $ | 812 | $ | — | $ | 3,268,272 | |||||||||||||

1.00 to 1.99% | 264 | 772 | 956 | 418,345 | 297,121 | 575,154 | 1,292,612 | ||||||||||||||||||||

2.00% to 2.99% | — | 538 | — | — | — | 33,838 | 34,376 | ||||||||||||||||||||

3.00 to 3.99% | — | — | — | — | — | — | — | ||||||||||||||||||||

4.00% or higher | — | — | — | — | — | — | — | ||||||||||||||||||||

Total | $ | 865,671 | $ | 901,473 | $ | 1,127,756 | $ | 793,435 | $ | 297,933 | $ | 608,992 | $ | 4,595,260 | |||||||||||||

Historically, a significant number of certificate of deposit holders roll over their balances into new certificates of the same term at the Bank’s then current rate. To ensure a continuity of this trend, the Bank expects to continue to offer market rates of interest. Its ability to retain maturing deposits in certificate accounts is difficult to project; however, the Bank believes that by competitively pricing these certificates, levels deemed appropriate by management can be achieved on a continuing basis.

At September 30, 2016, the Bank had $442,510,000 of certificates of deposit in amounts of $250,000 or more outstanding, maturing as follows: $88,667,000 within 3 months; $89,305,000 over 3 months through 6 months; $97,485,000 over 6 months through 12 months; and $167,053,000 thereafter.

14

Borrowings. The Bank has a credit line with the Federal Home Loan Bank of Des Moines ("FHLB") equal to 49.0% of total assets. The Bank obtains advances from the FHLB upon the security of the FHLB capital stock it owns and certain of its loans, provided certain standards related to credit worthiness have been met. See “Regulation-Washington Federal-Federal Home Loan Bank System” below. Such advances are made pursuant to several different credit programs. Each credit program has its own interest rate and range of maturities, and the FHLB prescribes acceptable uses to which the advances pursuant to each program may be put, as well as limitations on the size of such advances. Depending on the program, such limitations are based either on a fixed percentage of assets or the Company's credit worthiness. The FHLB is required to review its credit limitations and standards at least every two years. FHLB advances have, from time to time, been available to meet seasonal and other withdrawals of savings accounts and to expand the Bank's lending program. The Bank had $2,080,000,000 of FHLB advances outstanding at September 30, 2016.

The Bank may need to borrow funds for short periods of time to meet day-to-day financing needs. In these instances, funds are borrowed from other financial institutions or the Federal Reserve, for periods generally ranging from one to seven days at the then current borrowing rate. At September 30, 2016, the Bank had no such short-term borrowings.

The Bank also offers two forms of repurchase agreements to its customers. One form has an interest rate that floats like that of a money market deposit account. The other form has a fixed rate and is offered in a minimum denomination of $100,000. Both forms are fully collateralized by securities. These obligations are not insured by the FDIC and are classified as borrowings for regulatory purposes. The Bank had $48,920,000 of such agreements outstanding at September 30, 2016.

The following table presents additional information regarding the Company's borrowings.

Twelve Months Ended September 30, | 2016 | 2015 | 2014 | ||||||||

(In thousands) | |||||||||||

FHLB advances: | |||||||||||

Average balance outstanding | $ | 1,992,434 | $ | 1,848,904 | $ | 1,955,205 | |||||

Maximum amount outstanding at any month-end during the period | 2,080,000 | 1,930,000 | 2,083,226 | ||||||||

Weighted-average interest rate during the period (1) | 3.22 | % | 3.57 | % | 3.56 | % | |||||

Securities sold to customers under agreements to repurchase: | |||||||||||

Average balance outstanding | $ | 49,885 | $ | 52,382 | $ | 46,905 | |||||

Maximum amount outstanding at any month-end during the period | 56,310 | 62,315 | 51,615 | ||||||||

Weighted-average interest rate during the period (1) | 0.22 | % | 0.23 | % | 0.25 | % | |||||

Total average borrowings: | $ | 2,042,319 | $ | 1,901,286 | $ | 2,002,110 | |||||

Weighted-average interest rate on total average borrowings (1) | 3.14 | % | 3.48 | % | 3.42 | % | |||||

___________________

(1) | Interest expense divided by average daily balances. |

Other Ratios

The following table sets forth certain ratios related to the Company.

Twelve Months Ended September 30, | ||||||||

2016 | 2015 | 2014 | ||||||

Return on assets (1) | 1.12 | % | 1.10 | % | 1.10 | % | ||

Return on equity (2) | 8.33 | 8.21 | 7.99 | |||||

Average equity to average assets | 13.27 | 13.42 | 13.37 | |||||

Dividend payout ratio (3) | 30.43 | 31.85 | 26.45 | |||||

___________________

(1) | Net income divided by average total assets. |

(2) | Net income divided by average equity. |

(3) | Dividends paid per share divided by net income per share. |

15

Rate/Volume Analysis

The table below sets forth certain information regarding changes in interest income and interest expense of the Company for the years indicated. For each category of interest-earning asset and interest-bearing liability, information is provided on changes attributable to: (1) changes in volume (changes in volume multiplied by old rate) and (2) changes in rate (changes in rate multiplied by old average volume). The change in interest income and interest expense attributable to changes in both volume and rate has been allocated proportionately to the change due to volume and the change due to rate.

Twelve Months Ended September 30, | |||||||||||||||||||||||||||||||||||

2016 vs. 2015 Increase (Decrease) Due to | 2015 vs. 2014 Increase (Decrease) Due to | 2014 vs. 2013 Increase (Decrease) Due to | |||||||||||||||||||||||||||||||||

Volume | Rate | Total | Volume | Rate | Total | Volume | Rate | Total | |||||||||||||||||||||||||||

(In thousands) | (In thousands) | (In thousands) | |||||||||||||||||||||||||||||||||

Interest income: | |||||||||||||||||||||||||||||||||||

Loan portfolio | $ | 44,395 | $ | (27,312 | ) | $ | 17,083 | $ | 30,507 | $ | (24,355 | ) | $ | 6,152 | $ | 10,399 | $ | (34,464 | ) | $ | (24,065 | ) | |||||||||||||

Mortgage-backed securities | (7,824 | ) | (619 | ) | (8,443 | ) | (4,941 | ) | (3,927 | ) | (8,868 | ) | 15,032 | 16,708 | 31,740 | ||||||||||||||||||||

Investments (1) | (7,283 | ) | 4,883 | (2,400 | ) | (2,594 | ) | 2,166 | (428 | ) | 4,291 | 5,440 | 9,731 | ||||||||||||||||||||||

All interest-earning assets | 29,288 | (23,048 | ) | 6,240 | 22,972 | (26,116 | ) | (3,144 | ) | 29,722 | (12,316 | ) | 17,406 | ||||||||||||||||||||||

Interest expense: | |||||||||||||||||||||||||||||||||||

Customer accounts | (370 | ) | 1,801 | 1,431 | 1,879 | (9,349 | ) | (7,470 | ) | 8,670 | (18,049 | ) | (9,379 | ) | |||||||||||||||||||||

FHLB advances and other borrowings | 3,900 | (5,859 | ) | (1,959 | ) | (3,358 | ) | (177 | ) | (3,535 | ) | 2,340 | (1,043 | ) | 1,297 | ||||||||||||||||||||

All interest-bearing liabilities | 3,530 | (4,058 | ) | (528 | ) | (1,479 | ) | (9,526 | ) | (11,005 | ) | 11,010 | (19,092 | ) | (8,082 | ) | |||||||||||||||||||

Change in net interest income | $ | 25,758 | $ | (18,990 | ) | $ | 6,768 | $ | 24,451 | $ | (16,590 | ) | $ | 7,861 | $ | 18,712 | $ | 6,776 | $ | 25,488 | |||||||||||||||

___________________

(1) | Includes interest on cash equivalents and dividends on stock of the FHLB of Des Moines and FRB of San Francisco. |

Interest Rate Risk

The primary source of income for the Company is net interest income, which is the difference between the interest income generated by interest-earning assets and the interest expense incurred for interest-bearing liabilities. The level of net interest income is a function of the average balance of interest-earning assets and interest-bearing liabilities and the difference between the yield on earning assets and the cost of interest-bearing liabilities. Both the pricing and mix of the Company's interest-earning assets and interest-bearing liabilities influence these factors. All else being equal, if the interest rates on the Company's interest-bearing liabilities increase at a faster pace than the interest rates on its interest-earning assets, the result would be a reduction in net interest income and with it, a reduction in net earnings.

The net interest margin is measured using the interest income and expense over the average assets and liabilities for the period. The net interest margin increased to 3.11% for the year ended September 30, 2016 from 3.08% for the year ended September 30, 2015. The yield on earning assets increased 2 basis points to 3.97% and the cost of interest bearing liabilities declined by 1 basis point to 0.93%. The higher yield on earning assets is the result of changes in the asset mix as the average balance of mortgage-backed securities and other investment securities decreased while the average balance of loans receivable increased. The decrease in interest cost was due to changes in the mix of customer deposits and FHLB advances.

Interest rate risk arises in part due to the Bank's significant holdings of fixed-rate single-family home loans, which are longer-term than customer accounts that constitute its primary liabilities. Accordingly, assets do not usually respond as quickly to changes in interest rates as liabilities. In the absence of management action, net interest income can be expected to decline when interest rates rise and to expand when interest rates fall. Shortening the maturity or repricing of the investment portfolio is one action that management can take. The composition of the investment portfolio was 39.7% variable rate and 60.3% fixed rate as of September 30, 2016 to provide some protection against rising rates. In addition, the Bank is producing more short term or variable rate loans and has increased less rate sensitive transaction accounts to 56.7% of the deposit portfolio.

16

The Company's balance sheet strategy, in conjunction with low operating costs, has allowed the Company to manage interest rate risk, within guidelines established by the Board, through all interest rate cycles. It is management's objective to grow the dollar amount of net interest income, through the rate cycles, acknowledging that there will be some periods of time when that will not be feasible.

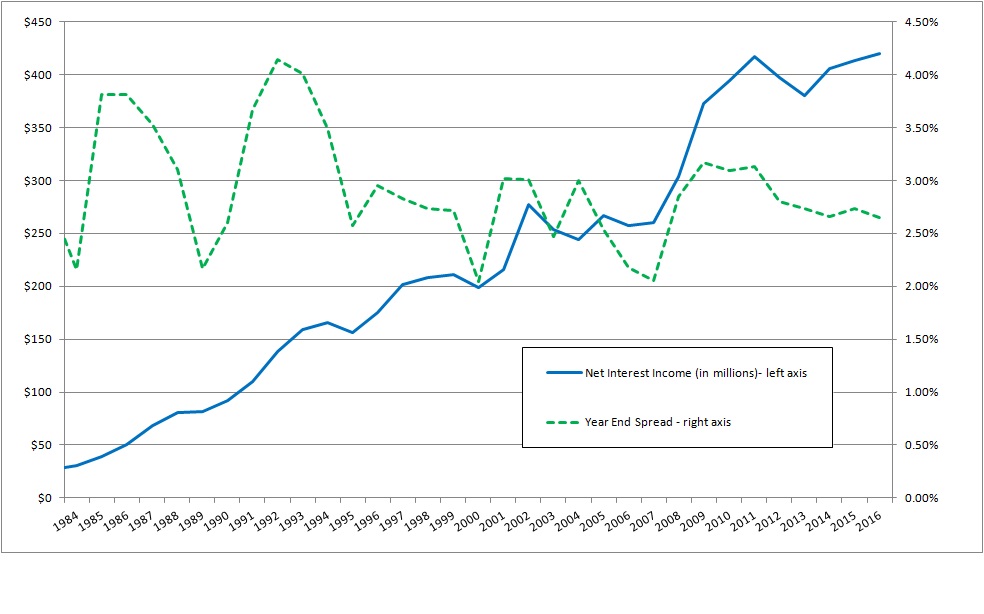

The chart below shows the volatility of the Company's period end net interest spread (dotted line which is measured against the right axis) compared to the relatively consistent growth in net interest income (solid line which is measured against the left axis). As noted above, this consistency is accomplished by managing the size and composition of the balance sheet through different rate cycles.

The following table shows the estimated repricing periods for earning assets and paying liabilities.

September 30, 2016 | Repricing Period | ||||||||||||||

Within One Year | After 1 year - before 6 Years | Thereafter | Total | ||||||||||||

(In thousands) | |||||||||||||||

Earning assets (1) | $ | 5,095,776 | $ | 4,885,359 | $ | 3,763,346 | $ | 13,744,481 | |||||||

Paying liabilities | (6,599,318 | ) | (3,922,868 | ) | (2,174,161 | ) | (12,696,347 | ) | |||||||

Excess (liabilities) assets | $ | (1,503,542 | ) | $ | 962,491 | $ | 1,589,185 | ||||||||

Excess as % of total assets | (10.10 | )% | |||||||||||||

Policy limit for one year excess | (20.00 | )% | |||||||||||||

(1) Asset repricing period includes estimated prepayments based on historical activity

At September 30, 2016, the Company had approximately $1,503,542,000 more in liabilities subject to maturity or repricing in the next year than assets, which resulted in a one-year repricing gap of (10.1)% of total assets. This compares to the (13.4)% gap as of September 30, 2015. A negative repricing gap implies that funding costs will change more rapidly than interest income on earning assets with movements in interest rates. A negative repricing gap typically results in lower margins when interest rates rise and higher margins when interest rates decline. The interest rate gap analysis provides management with a high-level indication of interest rate risk, but it is

17

considered less reliable than more detailed modeling. Cash and cash equivalents of $450,368,000 and stockholders' equity of $1,975,731,000 provide management with additional flexibility in managing interest rate risk going forward. If management were to take steps to change the size and/or mix of the balance sheet or slow the repricing of deposit rates upward, rising rates might not cause a decrease in net interest income.

The following table shows the potential impact of rising interest rates on net income for one year. The Company's focus is primarily on the impact of rising rates, given the negative gap position which implies that generally when rates fall income should increase and when rates increase income is at risk to decrease (assuming no change in the size or composition of the balance sheet).

It is important to note that this is not a forecast or prediction of future events, but is used as a tool for measuring potential risk. This analysis assumes zero balance sheet growth and a constant percentage composition of assets and liabilities.

Potential Impact on Net Interest Income | |||||||

Basis Point Increase in Interest Rates | September 30, 2016 | September 30, 2015 | |||||

(In thousands) | |||||||

100 | $ | 4,834 | $ | (413 | ) | ||

200 | 12,938 | (9,288 | ) | ||||

300 | 7,382 | (22,292 | ) | ||||

Actual results will differ from the assumptions used in this model, as management monitors and adjusts both the size and the composition of the balance sheet in order to respond to changing interest rates. In a rising interest rate environment, it is likely that the Company will grow its balance sheet to offset margin compression that may occur. Improvement in the net income sensitivity during the year is the result of changing the loan and deposit mix toward shorter term and/or floating rate instruments.

Another method used to quantify interest rate risk is the net portfolio value (“NPV”) analysis. This analysis calculates the difference between the present value of interest-bearing liabilities and the present value of expected cash flows from interest-earning assets and off-balance-sheet contracts. The following tables set forth an analysis of the Company’s interest rate risk as measured by the estimated changes in NPV resulting from instantaneous and sustained parallel shifts in the yield curve (measured in 100-basis-point increments).

The tables below express the NPV under varying interest scenarios.

September 30, 2016 | ||||||||||||

Change in Interest Rates | Estimated NPV Amount | Estimated (Decrease) in NPV Amount | NPV as % of Assets | |||||||||

(Basis Points) | (In thousands) | (In thousands) | ||||||||||

300 | $ | 1,784,802 | $ | (784,757 | ) | 13.19 | % | |||||

200 | 2,090,469 | (479,090 | ) | 14.83 | % | |||||||

100 | 2,354,413 | (215,146 | ) | 16.09 | % | |||||||

No change | 2,569,559 | — | 16.94 | % | ||||||||

September 30, 2015 | ||||||||||||

Change in Interest Rates | Estimated NPV Amount | Estimated (Decrease) in NPV Amount | NPV as % of Assets | |||||||||

(Basis Points) | (In thousands) | (In thousands) | ||||||||||

300 | $ | 1,852,417 | $ | (874,372 | ) | 14.03 | % | |||||

200 | 2,190,841 | (535,948 | ) | 15.91 | ||||||||

100 | 2,500,300 | (226,490 | ) | 17.45 | ||||||||

No change | 2,726,790 | — | 18.39 | |||||||||

18

As of September 30, 2016, the Company was in compliance with all of its interest rate risk policy guidelines.

Subsidiaries

Washington Federal is a bank holding company that conducts its primary business through its only directly-owned subsidiary, the Bank. The Bank has a national bank charter with the OCC. The Bank has three active wholly owned subsidiaries, discussed further below.

WAFD Insurance Group, Inc. is incorporated under the laws of the state of Washington and is an insurance agency that offers a full line of individual and business insurance policies to customers of the Bank, as well as to the general public. As of September 30, 2016 and September 30, 2015, WAFD Insurance Group, Inc. had total assets of $12,206,000 and $10,436,000, respectively.

Statewide Mortgage Services Company is incorporated under the laws of the state of Washington. As of September 30, 2016 and September 30, 2015, Statewide Mortgage Services Company had total assets of $1,376,000 and $14,182,000, respectively. The decrease in assets primarily relates to the sale-leaseback of a branch property in late 2016 that resulted in a gain of $3,800,000.

Washington Services, Inc. is incorporated under the laws of the state of Washington. It holds certain branch properties and equipment and also acts as a trustee under deeds of trust as to which the Bank is beneficiary. As of September 30, 2016 and September 30, 2015, Washington Services, Inc. had total assets of $214,000.

Employees

As of September 30, 2016, the Company had approximately 1,806 employees, including the full-time equivalent of 27 part-time employees and its service corporation employees. None of these employees are represented by a collective bargaining agreement.

Regulation

Set forth below is a brief description of certain laws and regulations that relate to the regulation of the Company and the Bank. The description of these laws and regulations, and descriptions of laws and regulations contained elsewhere herein, do not purport to be complete and are qualified in their entirety by reference to applicable laws and regulations. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) amended certain federal banking laws.

The Company

General. The Company is registered as a bank holding company and is subject to regulation, examination, supervision and reporting requirements of the Federal Reserve.

Restrictions on Activities and Acquisitions. Bank holding companies are subject to a variety of restrictions on their activities and the acquisitions they can make. Generally, the activities or acquisition of a bank holding company that is not a financial holding company are limited to those that constitute banking or managing or controlling banks or which are closely related to banking. In addition, without the prior approval of the Federal Reserve, bank holding companies are generally prohibited from acquiring more than 5% of the outstanding shares of any class of voting securities of a bank or bank holding company, taking any action that causes a bank to become a subsidiary of the bank holding company, acquiring all or substantially all of the assets of a bank, or merging with another bank holding company.

Control of Company or Bank. Pursuant to the Change in Bank Control Act, (the “CIBC Act”) individuals, corporations or other entities acquiring Company equity interests may, alone or together with other investors, be deemed to control a holding company or a bank. If an acquisition is deemed to constitute control of the holding company or bank and is not subject to approval under the Bank Holding Company Act or certain other statutes, such person or group will be required to file a notice under the CIBC Act. Generally, ownership of, or power to vote, more than 25% of any class of voting securities constitutes control. In the case of a bank or bank holding company the securities of which are registered with the Securities and Exchange Commission ("SEC"), ownership of or power to vote more than 10% of any class of voting securities creates a presumption of control.

Source of Strength. Under long-standing Federal Reserve policy, a bank holding company is expected to serve as a source of financial and management strength to its subsidiary bank. Under this policy, a bank holding company is expected to stand ready to provide adequate capital funds to its subsidiary bank during periods of financial adversity and to maintain financial flexibility and capital raising capacity to assist its subsidiary bank. The Dodd-Frank Act codified the source of strength doctrine by adopting

19

a statutory provision requiring, among other things, that bank holding companies serve as a source of financial strength to their subsidiary banks.

Restrictions on Company Dividends. The Company’s ability to pay dividends to its shareholders is affected by several factors. Since the Company is a separate legal entity from the Bank and its subsidiaries and does not have significant operations of its own, the Company may not be able to pay dividends to its shareholders if the Bank is unable to pay dividends to the Company. The Bank’s ability to pay dividends is subject to various regulatory restrictions.

See “Washington Federal, National Association, wholly owned subsidiary (Bank) - Restrictions on Dividends.” In addition, the Company’s ability to pay dividends is subject to rules and policies of the Federal Reserve. It is the policy of the Federal Reserve that bank holding companies should pay cash dividends only out of income available over the past year and only if prospective earnings retention is consistent with the company’s expected future needs and financial condition. New capital rules adopted by the Federal Reserve, effective in January 2015, may limit the Company’s ability to pay dividends if the Company fails to meet certain requirements under the rules.

See “Washington Federal, National Association, wholly owned operating subsidiary (Bank) - Restrictions on Dividends.”

Since the Company is a Washington state corporation, it is also subject to restrictions under Washington corporate law relating to dividends. Generally under Washington law, a corporation may not pay a dividend if, after giving effect to the dividend, the corporation would be unable to pay its liabilities as they become due in the ordinary course of business or the corporation’s total assets would be less than the sum of its total liabilities plus (with some exceptions) the amount that would be needed, if the corporation were to be dissolved at the time of the dividend payment, to satisfy the dissolution preferences of senior equity securities.

Washington Federal, National Association, wholly-owned operating subsidiary (Bank)

General. The Bank is a federally-chartered national bank and certain deposits of the bank are federally insured and backed by the full faith and credit of the United States government. Accordingly, the Bank is subject to broad federal regulation and oversight by its primary regulator, the OCC, extending to all aspects of its operations. The Bank is a member of the FDIC and its deposits are insured up to applicable limits of the Depository Insurance Fund (“DIF”), which is administered by the FDIC. As a result, the FDIC has certain regulatory and examination authority over the Bank.

As a national bank, the Bank is required to be a member of the Federal Reserve. As a member, it is required to purchase and maintain stock in the Federal Reserve Bank of San Francisco (“FRBSF”) in an amount equal to 3.00% of the paid-up capital stock and surplus of the Bank and have available another 3.00% in reserves. At September 30, 2016, the Bank had $24.0 million in FRBSF stock, which was in compliance with this requirement.

Federal Institution Regulations. On July 17, 2013, the Bank completed its conversion from a federally chartered savings association to a national bank charter with the OCC. In addition, the Company became a bank holding company registered with the Federal Reserve. The OCC has extensive authority over the operations of national banks. As part of this authority, national banks are required to file periodic reports with the OCC and are subject to periodic examinations by the OCC. Federal laws and regulations prescribe the investment and lending authority of the Bank, and the Bank is prohibited from engaging in any activities not permitted by such laws and regulations. While the Bank has broad authority to engage in all types of lending activities, a variety of restrictions apply to certain other investments by the Bank.