Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WASHINGTON FEDERAL INC | wafd8-k.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE VERBIAGE - WASHINGTON FEDERAL INC | exhibit991mar2013pressre.htm |

| EX-99.1 - EXHIBIT 99.1 INCOME STATEMENT - WASHINGTON FEDERAL INC | exhibit991mar2013incomes.htm |

| EX-99.2 - EXHIBIT 99.2 DELINQUENCY SUMMARY - WASHINGTON FEDERAL INC | exhibit992mar2013delinqu.htm |

| EX-99.2 - EXHIBIT 99.2 AVERAGE BALANCE SHEET - WASHINGTON FEDERAL INC | exhibit992mar2013average.htm |

| EX-99.2 - EXHIBIT 99.2 FACT SHEET - WASHINGTON FEDERAL INC | exhibit992mar2013factshe.htm |

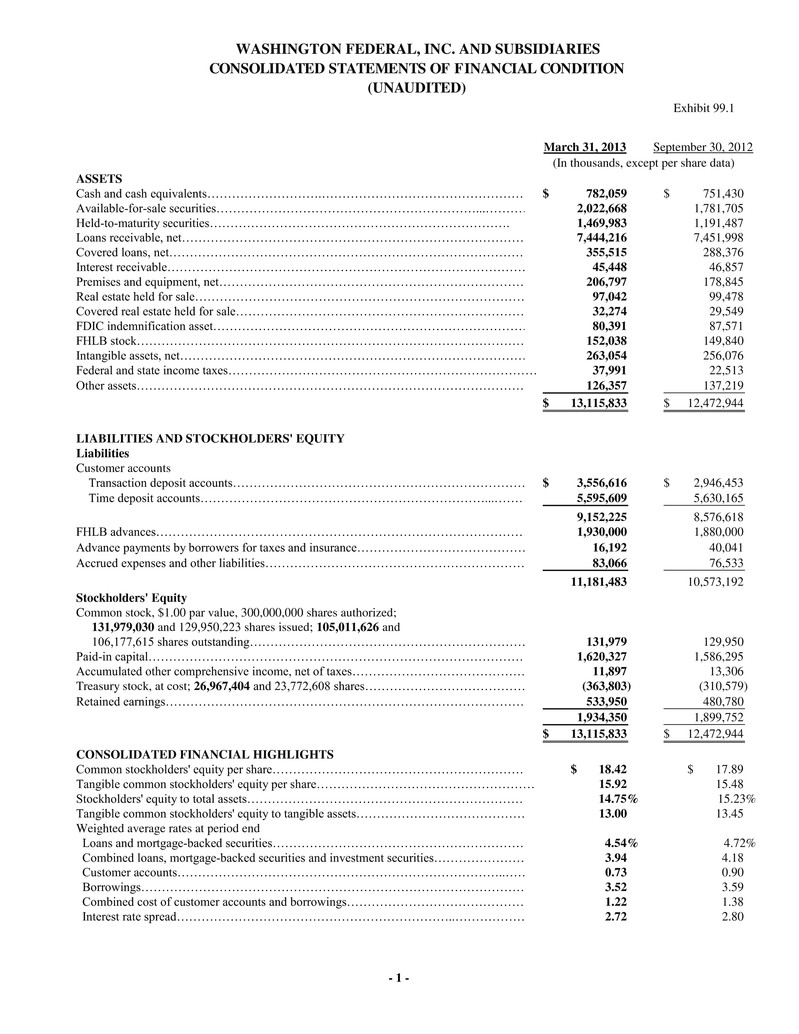

Exhibit 99.1 ASSETS Cash and cash equivalents……………………….………………………………………………………………………………………………………………… 782,059$ 751,430$ Available-for-sale securities………………………………………………………...………………………….. 2,022,668 1,781,705 Held-to-maturity securities………………………………………………………………. 1,469,983 1,191,487 Loans receivable, net……………………………………………………………………………………………….…………………………………………… 7,444,216 7,451,998 Covered loans, net…………………………………………………………………………………………………………………….………………………………………. 355,515 288,376 Interest receivable…………………………………………………………………………………………………………………….………………………………………. 45,448 46,857 Premises and equipment, net……………………………………………………………………..…………………………….. 206,797 178,845 Real estate held for sale…………………………………………………………………………...………………………………………………………...…………………………. 97,042 99,478 Covered real estate held for sale…………………………………………………………………………...………………………………………………………...…………………………. 32,274 29,549 FDIC indemnification asset…………………………………………………………………………...………………………………………………………...…………………………. 80,391 87,571 FHLB stock………………………………………………………………………………………..……………………………………………….. 152,038 149,840 Intangible assets, net…………………………………………………………………………….………………………………. 263,054 256,076 Federal and state income taxes………………………………………………………………………………………………..………………………………………….37,991 22,513 Other assets………………………………………………………………………………………………..…………………………………………. 126,357 137,219 13,115,833$ 12,472,944$ LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities Customer accounts Transaction deposit accounts…………………………………………………………………………………………………..………………………………….. 3,556,616$ 2,946,453$ Time deposit accounts……………………………………………………………...……………………………...………………………….. 5,595,609 5,630,165 9,152,225 8,576,618 FHLB advances…………………………………………………………………………………….……………………………………….. 1,930,000 1,880,000 Advance payments by borrowers for taxes and insurance……………………………………………...…………………………………….. 16,192 40,041 Accrued expenses and other liabilities……………………………………………………………..…………………………………………………….. 83,066 76,533 11,181,483 10,573,192 Stockholders' Equity Common stock, $1.00 par value, 300,000,000 shares authorized; 131,979,030 and 129,950,223 shares issued; 105,011,626 and 106,177,615 shares outstanding………………………………………………………………………….…………………………………………………….. 131,979 129,950 Paid-in capital……………………………………………………………………………………….……………………………………. 1,620,327 1,586,295 Accumulated other comprehensive income, net of taxes………………………………………………..………………………………………. 11,897 13,306 Treasury stock, at cost; 26,967,404 and 23,772,608 shares………………………………………………..………………………………………….. (363,803) (310,579) Retained earnings……………………………………………………………………………………………………...…………………………………….. 533,950 480,780 1,934,350 1,899,752 13,115,833$ 12,472,944$ CONSOLIDATED FINANCIAL HIGHLIGHTS Common stockholders' equity per share……………………………………………………………………………………...………………………………………….. $ 18.42 $ 17.89 Tangible common stockholders' equity per share……………………………………………………………………………………...…………………………………………..15.92 15.48 Stockholders' equity to total assets……………………………………………………………………….……………………………………………. Tangible common stockholders' equity to tangible assets……………………………………………………………………….……………………………………………. 13.00 13.45 Weighted average rates at period end Loans and mortgage-backed securities……………………………………………………………...………………………………………………………………. Combined loans, mortgage-backed securities and investment securities……………………...……………………………………………………….. 3.94 4.18 Customer accounts……………………………………………………………………..…………………………………………………………………. 0.73 0.90 Borrowings…………………………………………………………………………………………….………………………………………………… 3.52 3.59 Combined cost of customer accounts and borrowings………………………………………………….………………………………………………………. 1.22 1.38 Interest rate spread…………………………………………………………..……………….………………………………………………… 2.72 2.80 WASHINGTON FEDERAL, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED) March 31, 2013 September 30, 2012 14.75% 15.23% 4.54% 4.72% (In thousands, except per share data) - 1 -