Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WASHINGTON FEDERAL INC | wafd8-k.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE VERBIAGE - WASHINGTON FEDERAL INC | exhibit991mar2013pressre.htm |

| EX-99.1 - EXHIBIT 99.1 INCOME STATEMENT - WASHINGTON FEDERAL INC | exhibit991mar2013incomes.htm |

| EX-99.1 - EXHIBIT 99.1 BALANCE SHEET - WASHINGTON FEDERAL INC | exhibit991mar2013balance.htm |

| EX-99.2 - EXHIBIT 99.2 DELINQUENCY SUMMARY - WASHINGTON FEDERAL INC | exhibit992mar2013delinqu.htm |

| EX-99.2 - EXHIBIT 99.2 FACT SHEET - WASHINGTON FEDERAL INC | exhibit992mar2013factshe.htm |

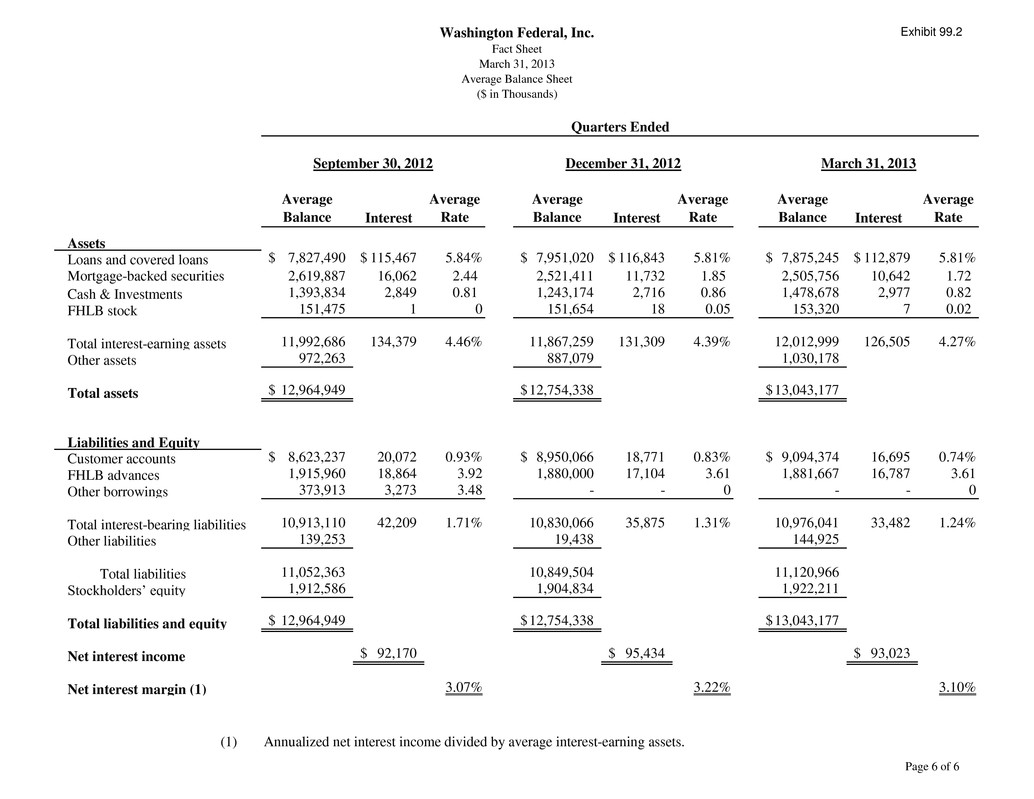

Washington Federal, Inc. Fact Sheet March 31, 2013 Average Balance Sheet ($ in Thousands) Exhibit 99.2 Quarters Ended Average Average Average Average Average Average Balance Rate Balance Rate Balance Rate Assets Loans and covered loans 7,827,490$ 115,467$ 5.84% 7,951,020$ 116,843$ 5.81% 7,875,245$ 112,879$ 5.81% Mortgage-backed securities 2,619,887 16,062 2.44 2,521,411 11,732 1.85 2,505,756 10,642 1.72 Cash & Investments 1,393,834 2,849 0.81 1,243,174 2,716 0.86 1,478,678 2,977 0.82 FHLB stock 151,475 1 0 151,654 18 0.05 153,320 7 0.02 Total interest-earning assets 11,992,686 134,379 4.46% 11,867,259 131,309 4.39% 12,012,999 126,505 4.27% Other assets 972,263 887,079 1,030,178 Total assets 12,964,949$ 12,754,338$ 13,043,177$ Liabilities and Equity Customer accounts 8,623,237$ 20,072 0.93% 8,950,066$ 18,771 0.83% 9,094,374$ 16,695 0.74% FHLB advances 1,915,960 18,864 3.92 1,880,000 17,104 3.61 1,881,667 16,787 3.61 Other borrowings 373,913 3,273 3.48 - - 0 - - 0 Total interest-bearing liabilities 10,913,110 42,209 1.71% 10,830,066 35,875 1.31% 10,976,041 33,482 1.24% Other liabilities 139,253 19,438 144,925 Total liabilities 11,052,363 10,849,504 11,120,966 Stockholders’ equity 1,912,586 1,904,834 1,922,211 Total liabilities and equity 12,964,949$ 12,754,338$ 13,043,177$ Net interest income 92,170$ 95,434$ 93,023$ Net interest margin (1) 3.07% 3.22% 3.10% (1) Annualized net interest income divided by average interest-earning assets. Interest Interest Interest September 30, 2012 December 31, 2012 March 31, 2013 Page 6 of 6