Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - China United Insurance Service, Inc. | v302117_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China United Insurance Service, Inc. | v302117_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China United Insurance Service, Inc. | v302117_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China United Insurance Service, Inc. | v302117_ex32-1.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| S | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2011

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT |

For the transition period from ______ to __________

COMMISSION FILE NUMBER: 333-174198

CHINA UNITED INSURANCE SERVICE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 98-6088870 | |

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

Building 4F, Hesheng Plaza No. 26 Yousheng S Rd.Jinshui District, Zhengzhou,

HenanPeople’s Republic of China

(Address of principal executive offices)

+86371-63976529

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Check whether the issuer (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| Large Accelerated Filer ¨ |

Accelerated Filer £ |

Non-Accelerated Filer ¨ | Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Yesx No ¨

As of February 14, 2012, there are 20,100,503 shares of common stock, par value $0.00001 per share, issued and outstanding.

TABLE OF CONTENTS

| PART I. | FINANCIAL INFORMATION | |

| ITEM 1. | CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | F-1 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 1 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | 12 |

| ITEM 4. | CONTROLS AND PROCEDURES | 13 |

| PART II. | OTHER INFORMATION | |

| ITEM 1. | LEGAL PROCEEDINGS | 14 |

| ITEM 1A. | RISK FACTORS | 14 |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 14 |

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | 14 |

| ITEM 4. | OTHER INFORMATION | 14 |

| ITEM 5. | EXHIBITS | 14 |

| SIGNATURES | 15 | |

| EXHIBIT 31.1 | ||

| EXHIBIT 31.2 | ||

| EXHIBIT 32.1 | ||

| EXHIBIT 32.2 |

PART I. FINANCIAL INFORMATION

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

| F-1 |

CHINA UNITED INSURANCE SERVICE, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| December 31, 2011 | June 30, 2011 | |||||||

| Unaudited | Audited | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and equivalents | $ | 1,367,465 | $ | 1,297,213 | ||||

| Accounts receivable, net | 95,146 | 79,939 | ||||||

| Other current assets | 78,515 | 56,518 | ||||||

| Total current assets | 1,541,126 | 1,433,670 | ||||||

| Property, plant and equipment, net | 106,812 | 126,832 | ||||||

| Restricted cash and deposits | 97,337 | 94,769 | ||||||

| Goodwill | 119,308 | 116,161 | ||||||

| TOTAL ASSETS | $ | 1,864,583 | $ | 1,771,432 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Taxes payable | $ | 889,619 | $ | 686,034 | ||||

| Other current liabilities | 186,256 | 159,253 | ||||||

| Due to related parties | 297,174 | 137,485 | ||||||

| TOTAL CURRENT LIABILITIES | 1,373,049 | 982,772 | ||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Common stock authorized 100,000,000 shares of common stock, par value $0.00001; 10,000,000 shares of preferred stock, par value $0.00001. Issued and outstanding 20,000,000 shares of common stock | 200 | 200 | ||||||

| Additional paid-in capital | 2,673,186 | 2,673,186 | ||||||

| Accumulated other comprehensive loss | (57,311 | ) | (69,222 | ) | ||||

| Accumulated deficit | (2,124,541 | ) | (1,815,504 | ) | ||||

| TOTAL STOCKHOLDERS’ EQUITY | 491,534 | 788,660 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 1,864,583 | $ | 1,771,432 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-2 |

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME / (LOSS) (UNAUDITED)

| Six Months Ended December 31, | Three Months Ended December 31, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Revenues | $ | 1,696,897 | $ | 1,141,071 | $ | 1,036,635 | $ | 804,464 | ||||||||

| Cost of revenue | 1,184,021 | 776,275 | 652,658 | 494,911 | ||||||||||||

| Gross profit | 512,876 | 364,796 | 383,977 | 309,553 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 635,594 | 488,279 | 284,951 | 374,575 | ||||||||||||

| Income (loss) from operations | (122,718 | ) | (123,483 | ) | 99,026 | (65,022 | ) | |||||||||

| Other income (expenses) | ||||||||||||||||

| Interest income | 2,389 | 1,611 | 1,309 | 1,382 | ||||||||||||

| Gain on acquisition of subsidiary | - | 259,401 | - | - | ||||||||||||

| Other - net | 347 | (551 | ) | 1,669 | 922 | |||||||||||

| 2,736 | 260,461 | 2,978 | 2,304 | |||||||||||||

| Income/(loss) before income taxes | (119,982 | ) | 136,978 | 102,004 | (62,718 | ) | ||||||||||

| Income tax expense | 189,055 | 140,424 | 116,636 | 99,974 | ||||||||||||

| Net income (loss) | (309,037 | ) | (3,446 | ) | (14,632 | ) | (162,692 | ) | ||||||||

| Other comprehensive income / (loss) | 12,634 | (650 | ) | 7,203 | 10,868 | |||||||||||

| Comprehensive income (loss) | $ | (297,126 | ) | $ | (4,096 | ) | $ | (8,152 | ) | $ | (151,824 | ) | ||||

| Weighted average shares outstanding: | ||||||||||||||||

| Basic and diluted | 20,000,000 | 20,000,000 | 20,000,000 | 20,000,000 | ||||||||||||

| Income (loss) per share: | ||||||||||||||||

| Basic and diluted | $ | (0.01 | ) | (0.00 | ) | 0.00 | (0.01 | ) | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

CHINA UNITED INSURANCE SERVICE, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Six Months Ended December 31, | Three Months Ended December 31, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Cash flows from operating activities: | ||||||||||||||||

| Net loss | $ | (309,037 | ) | $ | (3,446 | ) | $ | (14,632 | ) | $ | (162,692 | ) | ||||

| Adjustments to reconcile net loss to net cash provided by / (used in) operating activities: | ||||||||||||||||

| Depreciation | 39,064 | 9,404 | 25,245 | 7,410 | ||||||||||||

| Gain on bargain purchas of subsidiary | - | (259,401 | ) | - | - | |||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||

| Accounts receivable | (12,886 | ) | (68,698 | ) | (50,828 | ) | (64,294 | ) | ||||||||

| Other current assets | (20,223 | ) | 20,779 | 14,741 | 21,537 | |||||||||||

| Taxes payable | 182,786 | 146,376 | 123,892 | 107,247 | ||||||||||||

| Other current liabilities | 22,415 | 150,235 | 44,542 | 139,816 | ||||||||||||

| Total Adjustments | 211,156 | (1,305 | ) | 157,592 | 211,716 | |||||||||||

| Net cash provided / (used) in operating activities | (97,881 | ) | (4,751 | ) | 142,960 | 49,024 | ||||||||||

| Cash flows from investing activities: | ||||||||||||||||

| Cash paid on acquisition of subsidiaries | - | (19,721 | ) | - | - | |||||||||||

| Cash increase due to acquisition | - | 283,964 | - | 1,528 | ||||||||||||

| Purchase of property, plant and equipment | (15,888 | ) | (3,366 | ) | (5,692 | ) | (2,997 | ) | ||||||||

| Net cash provided by/(used in) investing activities | (15,888 | ) | 260,877 | (5,692 | ) | (1,469 | ) | |||||||||

| Cash flows from financing activities: | ||||||||||||||||

| Contributed capital | - | 1,175,440 | - | - | ||||||||||||

| Repayment on borrowings from related parties | - | (555,619 | ) | - | (259,819 | ) | ||||||||||

| Proceeds from related parties | 152,888 | 354,026 | 43,760 | 284,513 | ||||||||||||

| Net cash provided by financing activities | 152,888 | 973,847 | 43,760 | 24,694 | ||||||||||||

| Foreign currency translation | 31,133 | 35,920 | 13,685 | 15,410 | ||||||||||||

| Net increase/(decrease) in cash and equivalents | 70,252 | 1,265,893 | 194,713 | 87,659 | ||||||||||||

| Cash and equivalents, beginning balance | 1,297,213 | 17,071 | 1,172,754 | 1,195,305 | ||||||||||||

| Cash and equivalents, ending balance | $ | 1,367,465 | $ | 1,282,964 | $ | 1,367,465 | $ | 1,282,964 | ||||||||

| Interest paid | $ | - | $ | - | $ | - | $ | - | ||||||||

| Income tax paid | $ | 7,539 | $ | - | $ | 3,049 | $ | - | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

CHINA UNITED INSURANCE SERVICE, INC.

AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2011 AND 2010

(UNAUDITED)

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES

Organization and nature of operations

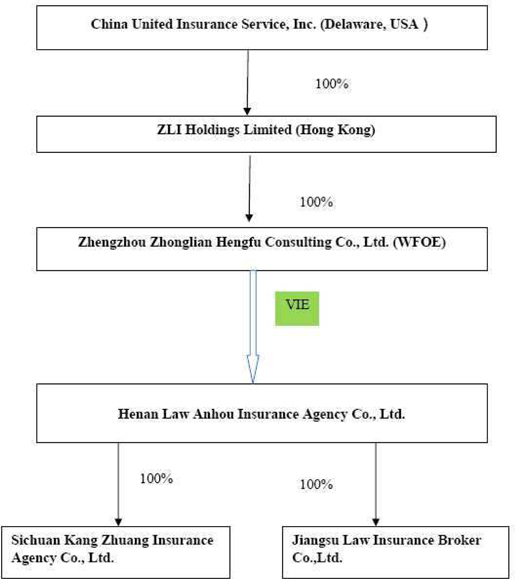

China United Insurance Service, Inc. (“China United” or the “Company”) is a Delaware corporation organized on June 4, 2010 by Mao Yi Hsiao, a Taiwanese citizen, as a listing vehicle for ZLI Holdings Limited (“CU Hong Kong”) to be quoted on the United States Over the Counter Bulletin Board (the “OTCBB”). CU Hong Kong, a wholly owned Hong Kong-based subsidiary of China United, was founded by China United, on July 12, 2010 under Hong Kong law. On October 20, 2010, CU Hong Kong founded a wholly foreign owned enterprise, Zhengzhou Zhonglian Hengfu Business Consulting Limited Company (“CU WFOE”) in Henan province in the People’s Republic of China (“PRC”).

On January 16, 2011, the Company issued 20,000,000 shares of common stock, $0.00001 par value, to several non U.S. persons for $300,000. As of December 31, 2011, the $300,000 was paid to the accounts of CU Hong Kong and CU WFOE. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended. As a result of the issuance of 20,000,000 shares, the owners of Henan Anhou (accounting acquirer) owned 100% of the Company. Accordingly, this transaction was accounted for as a recapitalization of Henan Anhou. The historical financial statements presented are those of the accounting acquirer for all periods presented. On January 28, 2011, the Company increased the number of authorized shares from 30,000,000 to 100,000,000 and 10,000,000 shares of preferred stock.

Henan Law Anhou Insurance Agency Co., Ltd. (“Henan Anhou”, formerly known as Zhengzhou Anhou Insurance Agency Co., Ltd.) was incorporated in the PRC on August 20, 2003. Henan Anhou provides insurance agency services in the PRC.

Sichuan Kangzhuang Insurance Agency Co., Ltd. (“Sichuan Kangzhuang”) was founded on July 10, 2006 in Sichuan province in the PRC and provides insurance agency services in the PRC. On August 23, 2010, at Sichuan Kangzhuang’s general meeting of shareholders, its shareholders voted to sell their shares in Sichuan Kangzhuang to Henan Anhou for RMB532,622 ($78,318). On September 6, 2010, the equity transfer agreements were signed between Henan Anhou and each shareholder of Sichuan Kangzhuang. Sichuan Kangzhuang then had net liabilities of RMB219,123 ($32,134). Goodwill of RMB751,745 ($110,452) was therefore recorded. Goodwill in the balance sheet differs from the acquisition date amount due to changes in exchange rates.

Jiangsu Law Insurance Broker Co., Ltd. (“Jiangsu Law”) was founded on May 18, 2005 in Jiangsu Province in the PRC. Jiangsu Law provides insurance brokerage services in the PRC. On August 12, 2010, at Jiangsu Law’s general meeting of shareholders, its shareholders voted to sell their shares in Jiangsu Law to Henan Anhou for RMB518,000 ($75,475) and Henan Anhou increased Jiangsu Law’s paid-in capital to RMB10,000,000 ($1,355,150) from RMB5,180,000 ($625,113), on January 18, 2011, to meet the PRC paid-in capital requirements for insurance brokerage companies. On September 28, 2010, the equity transfer agreements were signed between Henan Anhou and each shareholder of Jiangsu Law. The consideration had not been paid as at December 31, 2011. On acquisition date, Jiangsu Law had net assets of RMB2,286,842 ($341,425). Based on the purchase price allocation, the fair value of the identifiable assets and liabilities assumed exceeded the fair value of the consideration paid. As a result, the Company recorded a gain on acquisition of RMB1,768,842 ($259,401).

| F-5 |

On January 17, 2011, CU WFOE and Henan Anhou and its shareholders entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which CU WFOE has effective control over Henan Anhou. The corporate structure after the date of the series of VIE agreements is as follows:

The carrying amount of the total assets and total liabilities of the VIEs as of December 31, 2011 was $1,589,937 and $1,351,095, respectively. There was no pledge or collateralization of the VIEs' assets. Creditors of China United have no recourse to the general credit of the VIEs. Currently there is no contractual arrangement that could require the Company to provide additional financial support to the consolidated VIEs. As the Company is conducting substantial business in the PRC mainly through the VIEs, the Company may provide such support on a discretionary basis in the future, which could expose the Company to a loss.

| F-6 |

Going Concern

The accompanying consolidated financial statements were prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred net operating losses since inception. The Company faces the risks common to companies that are relatively new, including capitalization and uncertainty of funding sources, high initial expenditure levels, uncertain revenue streams, and difficulties in managing growth. At December 31, 2011, the Company had an accumulated deficit of $2,124,541. The Company’s recurring losses raise substantial doubt about its ability to continue as a going concern. The Company’s consolidated financial statements do not reflect any adjustments that might result from the outcome of this uncertainty. The Company plans to acquire more insurance agency companies in the PRC within the next 12 months, which will require more funding. The Company expects to incur losses from its operations and will require additional funding in the next 12 months.

Management plans to obtain funding through loans and equity. On March 31, 2011, the legal representative of Henan Anhou forgave $945,200 which Henan Anhou owed him, see note 11. Management believes its current and future plans enable it to continue as a going concern. The Company's ability to achieve these objectives cannot be determined at this time.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of China United and its subsidiaries. All significant intercompany transactions and balances were eliminated in consolidation.

Reclassification

Certain prior period account descriptions were reclassified to conform to the consolidated balance sheet as of December 31, 2011.

Basis of Presentation

The Company’s consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America ("US GAAP"). The functional currency for all our subsidiaries in the PRC is Chinese Renminbi (“RMB”); the functional currency of our subsidiary in Hong Kong is the Hong Kong dollar (“HKD”); the functional currency of China United is the US dollar. The accompanying consolidated financial statements were translated and presented in US dollars (“$” or “USD”).

| F-7 |

Use of Estimates

The preparation of the consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements and the amounts of revenues and expenses during the reporting periods.

Management makes these estimates using the best information available at the time the estimates are made; however, actual results could differ materially from those results.

Risks and Uncertainties

The Company is subject to substantial risks from, among other things, intense competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, limited operating history, and foreign currency exchange rates.

Comprehensive Income

The Company follows Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 220 (“ASC 220”) “Reporting Comprehensive Income” which establishes standards for the reporting and display of comprehensive income, its components and accumulated balances in a full set of general purpose financial statements. ASC 220 defines comprehensive income as net income and all changes to the statements of stockholders' equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders, including adjustments to minimum pension liabilities, accumulated foreign currency translation, and unrealized gains or losses on marketable securities.

Foreign Currency Transactions

The consolidated financial statements were translated into USD in accordance with FASB ASC Topic 830 "Foreign Currency Transaction". According to the statement, all assets and liabilities were translated at the exchange rate on the balance sheet dates; stockholders’ equity is translated at historical rates and statement of operations items are translated at the weighted average exchange rate for the period. The resulting translation adjustments are reported under other comprehensive income in accordance with ASC 220 "Comprehensive Income". Gains and losses resulting from the translations of foreign currency transactions are reflected in the consolidated statements of operations.

Cash and Equivalents

For Statements of Cash Flows purposes, the Company considers cash on hand and in banks, including certificates of deposit and other highly-liquid investments with maturities of three months or less when purchased, to be cash and equivalents.

| F-8 |

The Company maintains cash with various banks in China and Hong Kong. Cash accounts are not insured or otherwise protected. Should any bank holding cash become insolvent, or if the Company is otherwise unable to withdraw funds, the Company would lose the cash with that bank; however, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Accounts Receivable

The Company reviews its accounts receivable regularly to determine if a bad debt allowance is necessary at each period-end. Management reviews the composition of accounts receivable and analyzes the age of receivables outstanding, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the necessity of making such allowance.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost. Gain or loss on disposal of property, plant or equipment will be recorded in income at disposal. Expenditures for betterments, renewals and additions are capitalized. Repairs and maintenance expenses are expensed as incurred.

Depreciation for financial reporting purposes is provided using the straight-line method over a useful life of five years.

Impairment of Long-Lived Assets

In accordance with ASC 360, “Property, Plant and Equipment”, the Company reviews the carrying values of long-lived assets whenever facts and circumstances indicate an asset may be impaired. Recoverability of assets to be held and used is measured by comparing the carrying amount of an asset to future net undiscounted cash flows expected to be generated by it. If an asset is considered impaired, the impairment recognized is measured by the amount by which the carrying amount of the asset exceeds its fair value. Assets to be disposed of are reported at the lower of the carrying amount or fair value, less costs of disposal. No impairment was recognized for the six months and three months ended December 31, 2011 or 2010.

Goodwill

Goodwill arose from the acquisition of Sichuan Kangzhuang (Note 7). Goodwill represents the excess of the cost of an acquisition over the fair value of the net assets acquired. Goodwill is tested for impairment annually or more frequently if events or changes in circumstances indicate it might be impaired, using the prescribed two-step process under US GAAP. The first step screens for potential impairment of goodwill to determine if the fair value of the reporting unit is less than its carrying value, while the second step measures the amount of goodwill impairment, if any, by comparing the implied fair value of goodwill to its carrying value. As of December 31, 2011, there are no indications of any impairment.

| F-9 |

Revenue Recognition

The Company’s revenue is derived from insurance agency and brokerage services. The Company, through its VIEs in the PRC, sells insurance products to customers, and obtains commissions from the respective insurance companies according to the terms of each insurance company service agreement. The Company recognizes revenue when the following have occurred: persuasive evidence of an agreement between the insurance company and insured exists, services were provided, the fee for such services is fixed or determinable and collectability of the fee is reasonably assured. Insurance agency services are considered complete, and revenue is recognized, when an insurance policy becomes effective, that is, when the signed insurance policy is in place and the premium is collected from the insured. The Company has met all the four criteria of revenue recognition when the premiums are collected by the respective insurance companies and not before because collectability is not ensured until receipt of the premium. Accordingly, the Company does not accrue commissions and fees prior to the receipt of the related commissions from the respective insurance companies. No allowance for cancellation was recorded, as the management of the Company estimates, based on its past experience, the cancellation of policies rarely occurs. Any subsequent commission adjustments in connection with policy cancellations have been de minims to date are recognized upon notification from the insurance carriers.

The Company pays commissions to its sub-agents when an insurance product is sold by the sub-agent. The Company recognizes commission revenue on a gross basis. The commissions paid by the Company to its sub-agents are recorded as costs of services.

Income Taxes

The Company utilizes ASC 740 “Income Taxes”, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

When tax returns are filed, it is likely some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of operations and other comprehensive income (loss). As of December 31, 2011, the Company did not have any uncertain tax positions.

| F-10 |

The Company was not subjected to income tax examinations by taxing authorities during the current or past fiscal years. During the six months and three months ended December 31, 2011 and 2010, the Company did not recognize any interest or penalties.

Fair Values of Financial Instruments

ASC 820 “Fair Value Measurements and Disclosures”, defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. The carrying amounts reported in the balance sheets for receivables and current liabilities each qualify as financial instruments and are reasonable estimates of fair value because of the short period of time between the origination of such instruments and their expected realization and their current market rate of interest. The three levels are defined as follows:

· Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

· Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

· Level 3 inputs to the valuation methodology are unobservable and significant to the fair value.

As of December 31, 2011 and June 30, 2011, the Company did not identify any assets or liabilities required to be presented on the balance sheets at fair value.

Concentration of Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and equivalents and accounts receivable. As of December 31 and June 30, 2011, substantially all of the Company’s cash and equivalents and restricted cash was held by major financial institutions in the PRC, which management believes are of high credit quality. With respect to accounts receivable, the Company generally does not require collateral and does not have an allowance for doubtful accounts.

The Company has two principal clients, Taiping Insurance Co., Ltd. (“Taiping Insurance”) and Sunshine Insurance Co., Ltd. (“Sunshine”), for which it acts as an insurance agent. For the six months ended December 31, 2011 and 2010, the Company’s revenue derived from sale of insurance policies underwritten by Taiping Insurance was $514,277 and $573,854, respectively, and the Company’s revenue derived from sale of insurance policies underwritten by Sunshine was $415,127 and $317,472, respectively. For the three months ended December 31, 2011 and 2010, the Company’s revenue derived from sale of insurance policies underwritten by Taiping Insurance was $315,958 and $212,018, respectively, and the Company’s revenue derived from sale of insurance policies underwritten by Sunshine was $394,759 and $176,451, respectively. As of December 31 and June 30, 2011, the Company had no receivables from Taiping Insurance or Sunshine.

| F-11 |

The Company's operations are in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic, foreign currency exchange and legal environments in the PRC, and by the general state of the PRC's economy. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

Operating Leases

Leases, where substantially all the rewards and risks of ownership of assets remain with the leasing company that do not meet the capitalization criteria of ASC 840 “Leases”, are accounted for as operating leases. Rentals under operating leases are expensed on the straight-line basis over the lease term.

Segment Reporting

The Company follows ASC 280 “Segment Reporting”, for its segment reporting. For the six months ended December 31, 2011 and 2010, the Company’s chief operating decision maker managed and reviewed its business as a single operating segment providing insurance brokerage and agency services across the PRC. All revenues are derived from the PRC and all long-lived assets are located in the PRC.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which could result in a loss to the Company but which will be resolved when one or more future events occur or fail to occur. The Company’s management assesses such contingent liabilities, and such assessment inherently involves judgment. In assessing loss contingencies arising from legal proceedings pending against the Company or unasserted claims that may rise from such proceedings, the Company’s management evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought.

If the assessment of a contingency indicates it is probable that a material loss will be incurred and the amount of the liability can be reasonably estimated, then the estimated liability is accrued in the Company’s financial statements. If the assessment indicates a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material would be disclosed.

Statement of Cash Flows

In accordance with ASC 230, “Statement of Cash Flows”, cash flows from the Company's operations are calculated based upon the local currencies and an average exchange rate is used. As a result, amounts related to assets and liabilities reported on the consolidated statements of cash flows may not necessarily agree with changes in the corresponding balances on the consolidated balance sheets.

| F-12 |

Variable Interest Entities

The Company follows ASC 810-10-05-8”, "Consolidation of VIEs” which states that a VIE is a corporation, partnership, limited liability corporation, trust or any other legal structure used to conduct activities or hold assets that either (1) has an insufficient amount of equity to carry out its principal activities without additional subordinated financial support, (2) has a group of equity owners that are unable to make significant decisions about its activities, or (3) has a group of equity owners that do not have the obligation to absorb losses or the right to receive returns generated by its operations.

Due to PRC legal restrictions on foreign ownership and investment in insurance agency and brokerage businesses in China, especially those on qualifications as well as capital requirement of the investors, the Company operates insurance agency and brokerage business primarily through Henan Anhou, a VIE owned by four individual shareholders, and two subsidiaries of Henan Anhou.

On January 17, 2011, CU WFOE and Henan Anhou and its shareholders entered into VIE Agreements which included:

| · | Exclusive Business Cooperation Agreement through which: (1) CU WFOE has the right to provide Henan Anhou with complete technical support, business support and related consulting services during the term of this Agreement; (2) Henan Anhou agrees to accept all the consultations and services provided by CU WFOE. Henan Anhou further agrees that unless with CU WFOE's prior written consent, during the term of this Agreement, Henan Anhou shall not directly or indirectly accept the same or any similar consultations and/or services provided by any third party and shall not establish similar cooperation relationship with any third party regarding the matters contemplated by this Agreement; (3) Henan Anhou shall pay CU WFOE fees equal to 90% of the net income of Henan Anhou, and the payment is on a quarterly basis, and (4) CU WFOE retains all exclusive and proprietary rights and interests in all rights, ownership, interests and intellectual properties arising out of or created during the performance of this Agreement. |

The term of this Agreement shall be 10 years. Subsequent to the execution of this Agreement, both CU WFOE and Henan Anhou shall review this Agreement on an annual basis to determine whether to amend or supplement the provisions. The term of this Agreement may be extended if confirmed in writing by CU WFOE prior to the expiration thereof. The extended term shall be determined by CU WFOE, and Henan Anhou shall accept such extended term unconditionally.

During the term of this Agreement, unless CU WFOE commits gross negligence, or a fraudulent act, against Henan Anhou, Henan Anhou may not terminate this Agreement prior to its expiration date. Nevertheless, CU WFOE shall have the right to terminate this Agreement upon giving 30 days' prior written notice to Henan Anhou at any time.

| · | Power of Attorney under which each shareholder of Henan Anhou executed an irrevocable power of attorney to authorize CU WFOE to act on behalf of the shareholder to exercise all of his/her rights as equity owner of Henan Anhou, including without limitation to: (1) attend shareholders' meetings of Henan Anhou; (2) exercise all the shareholder's rights and shareholder's voting rights that he/she is entitled to under the laws of PRC and Henan Anhou's Articles of Association, including but not limited to the sale or transfer or pledge or disposition of the shareholder’s shareholding in part or in whole, and (3) designate and appoint on behalf of the shareholder the legal representative, the director, supervisor, the chief executive officer and other senior management members of Henan Anhou. |

| · | Option Agreement under which the shareholders of Henan Anhou irrevocably granted CU WFOE or its designated person an exclusive and irrevocable right to acquire, at any time, the entire portion of Henan Anhou’s equity interest held by each shareholder of Henan Anhou, or any portion thereof, to the extent permitted by PRC law. The purchase price for the shareholders’ equity interests in Henan Anhou shall be the lower of (i) RMB 1 ($0.15) and (ii) the lowest price allowed by relevant laws and regulations. If appraisal is required by the laws of PRC when CU WFOE exercises the Equity Interest Purchase Option (as defined in the Option Agreement), the Parties shall negotiate in good faith and based on the appraisal result make necessary adjustment to the Equity Interest Purchase Price (as defined in the Option Agreement) so that it complies with any and all then applicable laws of PRC. The term of this Agreement shall be 10 years, and may be renewed at CU WFOE's election. |

| · | Share Pledge Agreement under which the owners of Henan Anhou pledged their equity interests in Henan Anhou to CU WFOE to guarantee Henan Anhou’s performance of its obligations under the Exclusive Business Cooperation Agreement. Pursuant to this agreement, if Henan Anhou fails to pay the exclusive consulting or service fees in accordance with the Exclusive Business Cooperation Agreement, CU WFOE shall have the right, but not the obligation, to dispose of the owners of Henan Anhou’s equity interests in Henan Anhou. This Agreement shall be continuously valid until all payments due under the Exclusive Business Cooperation Agreement have been repaid by Henan Anhou or its subsidiaries. |

As a result of the agreements among CU WFOE, the shareholders of Henan Anhou and Henan Anhou, CU WFOE is considered the primary beneficiary of Henan Anhou, CU WFOE has taken effective control over Henan Anhou. Therefore, CU WFOE shall consolidate the results of operations of Henan Anhou and its subsidiaries. Accordingly the results of operations, assets and liabilities of Henan Anhou and its subsidiaries are consolidated in Company’s financial statements from the earliest period presented. However, the VIE is continually monitored by the Company to determine if any events have occurred that could cause its primary beneficiary status to change. These events include:

| a. | The legal entity's governing documents or contractual arrangements are changed in a manner that changes the characteristics or adequacy of the legal entity's equity investment at risk. |

| b. | The equity investment or some part thereof is returned to the equity investors, and other interests become exposed to expected losses of the legal entity. |

| c. | The legal entity undertakes additional activities or acquires additional assets, beyond those that were anticipated at the later of the inception of the entity or the latest reconsideration event, that increase the entity's expected losses. |

| d. | The legal entity receives an additional equity investment that is at risk, or the legal entity curtails or modifies its activities in a way that decreases its expected losses. |

| F-13 |

Recent Accounting Pronouncements

On March 2010, the FASB issued ASU No. 2010-11 Derivatives and Hedging Topic 815 “Scope Exception Related to Embedded Credit Derivatives.” This ASU clarifies the guidance within the derivative literature that exempts certain credit related features from analysis as potential embedded derivatives requiring separate accounting. The ASU specifies that an embedded credit derivative feature related to the transfer of credit risk that is only in the form of subordination of one financial instrument to another is not subject to bifurcation from a host contract under ASC 815-15-25, Derivatives and Hedging – Embedded Derivatives – Recognition. All other embedded credit derivative features should be analyzed to determine whether their economic characteristics and risks are “clearly and closely related” to the economic characteristics and risks of the host contract and whether bifurcation is required. The ASU was effective for the Company on July 1, 2010. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

In April 2010, the FASB issued ASU 2010-17 (Topic 605) to provide guidance on defining a milestone and determining when it may be appropriate to apply the milestone method of revenue recognition for research and development transactions. ASU 2010-17 is effective for fiscal years beginning on or after June 15, 2010, and is effective on a prospective basis for milestones achieved after the adoption date. The adoption of ASU 2010-17 did not have a material effect on the Company’s consolidated financial statements.

In October 2010, the FASB issued ASU 2010-26, Financial Services—Insurance (Topic 944), to address diversity in practice regarding the interpretation of which costs relating to the acquisition of new or renewal insurance contracts qualify for deferral. ASU 2010-26 specifies that the incremental direct costs of contract acquisition and certain costs related directly to the acquisition activities, such as underwriting, Policy issuance and processing, Medical and inspection, Sales force contract selling, which are performed by the insurer in the acquisition of new and renewal contracts should be capitalized. This update is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2011. The Company does not expect the provisions of ASU 2010-11 to have a material effect on its consolidated financial statements.

In December 2010, the FASB issued ASU 2010-28, Intangibles—Goodwill and Other (Topic 350), to modify Step 1 of the goodwill impairment test for reporting units with zero or negative carrying amounts. For those reporting units, an entity is required to perform Step 2 of the goodwill impairment test if it is more likely than not that a goodwill impairment exists. In determining whether it is more likely than not that goodwill impairment exists, an entity should consider whether there are any adverse qualitative factors indicating impairment may exist, and the qualitative factors are consistent with the existing guidance. The amendments in this update are effective for fiscal years, and interim periods within those years, beginning after December 15, 2010 and 2011 for public and nonpublic entities, respectively. The adoption of ASU 2010-28 did not have a material effect on the Company’s consolidated financial statements.

In December 2010, the FASB issued ASU 2010-29, Business Combinations (Topic 805), to address diversity in practice about the interpretation of the pro forma revenue and earnings disclosure requirements for business combinations. The amendments in this update specify that if a public entity presents comparative financial statements, the entity should disclose revenue and earnings of the combined entity as though the business combination(s) that occurred during the current year had occurred as of the beginning of the comparable prior annual reporting period only. The amendments in this update are effective prospectively for business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2010. The adoption of ASU 2010-29 did not have a material effect on the Company’s consolidated financial statements.

| F-14 |

In January 2011, the FASB issued ASU 2011-01, Receivables (Topic 310), to temporarily delay the effective date of the disclosures about troubled debt restructurings in ASU 2010-20 (Receivables (Topic 310): Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses) for public entities. The delay is intended to allow the Board time to complete its deliberations on what constitutes a troubled debt restructuring. Under the existing effective date in Update 2010-20, public-entity creditors would have provided disclosures about troubled debt restructurings for periods beginning on or after December 15, 2010. The deferral in this update will result in more consistent disclosures about troubled debt restructurings. This amendment does not apply to nonpublic entities and does not defer the effective date of the other disclosure requirements in Update 2010-20. The deferral in this amendment is effective upon issuance. The Company does not expect this update to have any material effect on its consolidated financial statements.

In January 2011, the FASB issued ASU 2011-02 Receivables Topic 310 "A Creditor's Determination of Whether a Restructuring is a Troubled Debt Restructuring". The amendments in ASU 2011-02 provide additional guidance to clarify when a loan modification or restructuring is considered a troubled debt restructuring (TDR) in order to address current diversity in practice and lead to more consistent application of U.S. GAAP for debt restructurings. In evaluating whether a restructuring constitutes a troubled debt restructuring, a creditor must separately conclude that both of the following exist:

1. The restructuring constitutes a concession.

2. The debtor is experiencing financial difficulties.

The amendments to Topic 310 clarify the guidance regarding the evaluation of both considerations above. Additionally, the amendments clarify that a creditor is precluded from using the effective interest rate test in the debtor's guidance on restructuring of payables (paragraph 470-60-55-10) when evaluating whether a restructuring constitutes a TDR. ASU No. 2011-02 is effective for fiscal year beginning on or after June 15, 2011. The adoption of ASU 2011-02 did not have a material effect on the Company’s consolidated financial statements.

In April, 2011, the FASB issued ASU 2011-03 Transfers and Servicing (Topic 860), “Reconsideration of Effective Control for Repurchase Agreements”. The amendments in this ASU 2011-03 remove from the assessment of effective control:

| 1. | The criterion requiring the transferor to have the ability to repurchase or redeem the financial assets on the substantially agreed terms, even in the event of default by the transferee, and |

| 2. | The collateral maintenance implementation guidance related to that criterion. |

Other criteria applicable to the assessment of effective control are not changed by the amendments in this Update. The guidance in this Update is effective for the first interim or annual period beginning on or after December 15, 2011. The guidance should be applied prospectively to transactions or modifications of existing transactions that occur on or after the effective date. Early adoption is not permitted. The adoption of this ASU will not have a material impact on the Company's consolidated financial statements.

| F-15 |

In June 2011, the FASB issued ASU 2011-04 Fair Value Measurement (Topic 820), “Amendments to achieve Common Fair Value Measurement and Disclosure Requirements in US GAAP and IFRSs”. The amendments in this Update change the wording used to describe the requirements in US GAAP for measuring fair value and for disclosing information about fair value measurements. The amendments include the following:

| 1. | Those that clarify the Board’s intent about the application of existing fair value measurement and disclosure requirements. |

| 2. | Those that change a particular principle or requirement for measuring fair value or for disclosing information about fair value measurements. |

In addition, to improve consistency in application across jurisdictions some changes in wording are necessary to ensure that US GAAP and IFRS fair value measurement and disclosure requirements are described in the same way (for example, using the word shall rather than should to describe the requirements in US GAAP).

The amendments in this Update are to be applied prospectively. For public entities, the amendments are effective during interim and annual periods beginning after December 15, 2011. Early application by public entities is not permitted. The adoption of this ASU will not have a material impact on the Company's consolidated financial statements.

In June 2011, the FASB issued ASU 2011-05 Comprehensive Income (Topic 220), “Presentation of Comprehensive Income”. In this Update, an entity has the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In both choices, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. Regardless of whether an entity chooses to present comprehensive income in a single continuous statement or in two separate but consecutive statements, the entity is required to present on the face of the financial statements reclassification adjustments for items that are reclassified from other comprehensive income to net income in the statement(s) where the components of net income and the components of other comprehensive income are presented.

The amendments in this Update should be applied retrospectively. For public entities, the amendments are effective for fiscal years, and interim periods within those years, beginning after December 15, 2011, and early adoption is permitted. The adoption of this ASU will not have a material impact on the Company's consolidated financial statements.

NOTE 3 – RESTRICTED CASH AND DEPOSITS

Restricted cash is a deposit in bank by the Company in conformity with Provisions on the Supervision and Administration of Specialized Insurance Agencies, and cannot be withdrawn without the permission of the China Insurance Regulatory Commission. Deposits include long-term leasing deposits.

NOTE 4 – ACCOUNTS RECEIVABLE

As of December 31 and June 30, 2011, the Company had no allowance for doubtful accounts.

| F-16 |

NOTE 5 – OTHER CURRENT ASSETS

The Company’s other receivables and other current assets consisted of the following, as of:

| December 31, 2011 | June 30, 2011 | |||||||

| Prepaid rent | $ | 57,407 | $ | 28,133 | ||||

| Deposit for rent | 11,868 | 11,246 | ||||||

| Other | 9,240 | 17,139 | ||||||

| Total other current assets | $ | 78,515 | $ | 56,518 | ||||

NOTE 6– PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following, as of:

| Office equipment | $ | 31,588 | $ | 23,567 | ||||

| Office furniture | 57,235 | 55,725 | ||||||

| Computers | 54,724 | 48,463 | ||||||

| Electronic equipment | 183,893 | 176,725 | ||||||

| Machinery | 17,759 | 17,291 | ||||||

| Transportation equipment | 99,847 | 104,738 | ||||||

| Total | 445,046 | 426,509 | ||||||

| Less: Accumulated Depreciation | (338,234 | ) | (299,677 | ) | ||||

| Total property, plant and equipment, net | 106,812 | $ | 126,832 |

NOTE 7 – GOODWILL AND ACQUISITIONS

On September 6, 2010, Henan Anhou paid RMB 532,622 ($78,318) to acquire a 100% share of Sichuan Kangzhuang from its previous shareholders. Sichuan Kangzhuang then had net liabilities of RMB219,123 ($32,134). Goodwill of RMB 751,745 ($110,452) was therefore recorded. Goodwill in the balance sheet differs from the acquisition date amount due to changes in exchange rates. As of December 31, 2011, there are no indications of any impairment. No intangible assets are identified in the acquisition date. At the date of acquisition, Sichuan Kangzhuang has no unfulfilled customer contract or software. Sichuan Kangzhuang’s business process and accounting system are not unique and the management planned to use unified operating platform after the acquisition. Sichuan Kangzhuang’s business is mainly with retailing customers, and the management considered there is no customer relationship or customer list that will probably create future business opportunities for the Company.

On September 28, 2010, Henan Anhou acquired 100% of Jiangsu Law for RMB 518,000 ($75,475). Jiangsu Law then had net assets of RMB 2,286,842 ($341,425). Based on the purchase price allocation, the fair value of the identifiable assets and liabilities assumed exceeded the fair value of the consideration paid. As a result, the Company recorded a gain on acquisition of RMB 1,768,842 ($259,401). We believe the gain on acquisition resulted from the sellers’ intent to exit the insurance business. To comply with the PRC requirements for the insurance brokerage companies, Henan Anhou contributed cash to increase the paid-in capital of Jiangsu Law to RMB10,000,000 ($1,355,150) from RMB5,180,000 ($625,113) on January 18, 2011.

The summary of assets and liabilities acquired as of the dates of acquisition is presented below:

| Jiangsu Law September 30, 2010 | Sichuan Kangzhuang August 31, 2010 | |||||||

| Current assets | ||||||||

| Cash and equivalents | $ | 269,090 | $ | 15,735 | ||||

| Accounts receivable, net | 12,482 | 1,386 | ||||||

| Other current assets | - | 39,162 | ||||||

| Total current assets | 281,572 | 56,283 | ||||||

| Property, plant and equipment, net | 78,418 | 12,871 | ||||||

| TOTAL ASSETS | 359,990 | 69,154 | ||||||

| Accounts payable | - | 205 | ||||||

| Accrued expenses and other payables | 10,861 | 41,243 | ||||||

| Taxes payable | 5,637 | 45,177 | ||||||

| Due to related party | 2,067 | 14,665 | ||||||

| TOTAL LIABILITIES | 18,565 | 101,290 | ||||||

| NET ASSETS / (LIABILITIES) | $ | 341,425 | $ | 32,136 | ||||

NOTE 8 –OTHER CURRENT LIABILITIES

Other current liabilities are summarized as follows, as of:

| December 31, 2011 | June 30, 2011 | |||||||

| Due to previous shareholders of Jiangsu Law | $ | 82,210 | $ | 80,042 | ||||

| Salary & welfare payables | 65,016 | 27,021 | ||||||

| Other | 39,030 | 52,190 | ||||||

| Total other current liabilities | $ | 186,256 | $ | 159,253 | ||||

| F-17 |

Due to previous shareholders of Jiangsu Law is the remaining balance of the acquisition cost. The acquisition agreement between the parties has not specified the exact time for payment of the acquisition price or imposed any interest for late payment.

NOTE 9 - TAXES PAYABLE

Taxes payable consisted of the following as of:

| December 31, 2011 | June 30, 2011 | |||||||

| Income tax | $ | 860,275 | $ | 658,344 | ||||

| Other | 29,344 | 27,690 | ||||||

| Total | $ | 889,619 | $ | 686,034 | ||||

| F-18 |

NOTE 10 - RELATED PARTY TRANSACTIONS

Due to related parties

The related parties listed below loaned money to the Company for working capital. Due to related parties consisted of the following as of:

| December 31, 2011 | June 30, 2011 | |||||||

| Due to Mr. Mao (Principal Shareholder of the Company) | $ | 22,000 | $ | 64,266 | ||||

| Due to Ms. Zhu (Shareholder of Henan Anhou) | 2,197 | 71,080 | ||||||

| Due to Mr. Zhu (Legal Representative of Jiangsu Law) | 272,977 | 2,139 | ||||||

| Total | $ | 297,174 | $ | 137,485 | ||||

The amounts are interest-free, unsecured and repayable on demand.

| F-19 |

NOTE 11 – ADDITIONAL PAID-IN CAPITAL

On August 16, 2010, Ms. Zhu Shuqin contributed capital of RMB 8,000,000 ($1,175,440) in cash to Henan Anhou and controlled 80% of the shares of Henan Anhou.

On March 31, 2011, Mr. Li forgave $945,200 that Henan Anhou owed him.

NOTE 12– INCOME TAX

CU WFOE, the Company’s subsidiary, and the VIEs in the PRC, are governed by the Income Tax Law of the PRC concerning the private-run enterprises, which are generally subject to tax at a statutory rate of 25% on income reported in the statutory financial statements after appropriated tax adjustments.

Per the Income Tax Law of the PRC, the loss brought forward from the prior periods can be deducted against income before tax first. However, according to regulations by Chinese tax authorities effective January 1, 2008, commissions paid to sub-agents in excess of 5% of the commission revenue of the Company is not tax deductible. Therefore, the Company is still subject to corporate income tax although it has been making losses. In addition, according to the requirement by the local tax authorities in Jiangsu province, the calculation of income tax expense is based on 10% of the Jiangsu Law's revenue, which means that it is subject to corporate income tax as long as it generates revenues, no matter whether it is making losses or not. The tax is calculated based on 10% of revenue, and the tax rate is 25%.

The following table reconciles the US statutory rates to the Company’s effective tax rate for the six months ended December 31, 2011 and 2010:

| 2011 | 2010 | |||||||

| US statutory rate | (34 | )% | (34 | )% | ||||

| Tax rate difference | (7 | )% | (7 | )% | ||||

| Tax basis difference | (7 | )% | (8 | )% | ||||

| Tax un-deductible cost | 206 | % | 148 | % | ||||

| Gain on bargain purchase of subsidiary | - | % | (64 | )% | ||||

| Tax per financial statements | 158 | % | 103 | % | ||||

The following table reconciles the US statutory rates to the Company’s effective tax rate for the three months ended December 31, 2011 and 2010:

| 2011 | 2010 | |||||||

| US statutory rate | 34 | % | (34 | )% | ||||

| Tax rate difference | 1 | % | (7 | )% | ||||

| Tax basis difference | 30 | % | (17 | )% | ||||

| Tax un-deductible cost | 49 | % | 217 | % | ||||

| Tax per financial statements | 114 | % | 159 | % | ||||

| F-20 |

NOTE 13 – COMMITMENTS

Operating Leases

The Company has operating leases for its offices in Henan, Sichuan and Jiangsu provinces. The rental expenses for the six months ended December 31, 2011 and 2010 are $48,364 and $58,751, respectively. At December 31, 2011, total future minimum lease payments under operating leases were as follows, by years:

| 12 months ending December 31, 2012 | $ | 190,005 | ||

| 12 months ending December 31, 2013 | 150,053 | |||

| 12 months ending December 31, 2014 | 56,923 | |||

| Total | 396,981 |

| F-21 |

NOTE 14 – FINANCIAL RISK MANAGEMENT AND FAIR VALUES

The Company has exposure to credit, liquidity and market risks which arise from the normal course of the Company's business. This note presents information about the Company's exposure to each of these risks, the Company's objectives, policies and processes for measuring and managing risk, and the Company's management of capital. Further quantitative disclosures are included throughout these consolidated financial statements.

The Board of Directors (“BOD”) has overall responsibility for the establishment and oversight of the Company's risk management framework. The Company's risk management policies are established to identify and analyze the risks faced by the Company, to set appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management policies and systems are reviewed regularly to reflect changes in market conditions and the Company's activities. The Company, through its training and management standards and procedures, aims to develop a disciplined and constructive control environment in which all employees understand their roles and obligations.

The Company's BOD oversees how management monitors compliance with the Company's risk management policies and procedures and reviews the adequacy of the risk management framework in relation to the risks faced by the Company.

| F-22 |

| (a) | Credit risk |

Company's credit risk arises principally from trade and other receivables, pledged deposits and cash and equivalents. Management has a credit policy in place and the exposures to these credit risks are monitored on an ongoing basis. The carrying amounts of trade and other receivables, pledged deposits and cash and cash equivalents represent the Company's maximum exposure to credit risks. Trade receivables are due within 30 days from the date of billing and immaterial.

| (b) | Liquidity risk |

The BOD of the Company is responsible for the Company's overall cash management and the raising of borrowings to cover expected cash demands. The Company regularly monitors its liquidity requirements, to ensure it maintains sufficient reserves of cash and readily realizable marketable securities and adequate committed lines of funding from major financial institutions to meet its liquidity requirements in the short and longer term.

| (c) | Currency risk |

The functional currency for the VIEs of the Company is RMB and the financial statements of the Company are translated in USD. The fluctuation of RMB will affect our operating results expressed in USD. The Company reviews its foreign currency exposures. The management does not consider its present foreign exchange risk to be significant.

NOTE 15– CONDENSED FINANCIAL INFORMATION OF U.S. PARENT

China United is a holding company and owns no operating assets and has no significant operations independent of its subsidiaries. Set forth below are condensed financial statements for China United on a stand-alone, unconsolidated basis as of December 31, 2011 and June 30, 2011, and for the six months ended December 31, 2011 and December 31, 2010.

CHINA UNITED INSURANCE SERVICE, INC.

BALANCE SHEETS

| December 31, 2011 | June 30, 2011 | |||||||

| ASSETS | ||||||||

| Investment in subsidiaries | $ | 432,117 | $ | 729,243 | ||||

| TOTAL ASSETS | $ | 432,117 | $ | 729,243 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Due to related party | $ | 583 | $ | 583 | ||||

| TOTAL LIABILITIES | $ | 583 | $ | 583 | ||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Common Stock (authorized 100,000,000 shares, 20,000,000 issued, $0.00001 par value) | 200 | 200 | ||||||

| Additional paid-in capital | 2,613,186 | 2,613,186 | ||||||

| Accumulated other comprehensive loss | (57,311 | ) | (69,222 | ) | ||||

| Accumulated deficit | (2,124,541 | ) | (1,815,504 | ) | ||||

| TOTAL SHAREHOLDERS’ EQUITY | 431,534 | 728,660 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 432,117 | $ | 729,243 | ||||

| F-23 |

CHINA UNITED INSURANCE SERVICE, INC.

STATEMENTS OF OPERATIONS

| Six Months Ended December 31, 2011 | Six Months Ended December 31, 2010 | |||||||

| Revenues | $ | - | $ | - | ||||

| Cost of service | - | - | ||||||

| Gross profit | - | - | ||||||

| Operating expenses: | - | |||||||

| General and administrative | - | - | ||||||

| Loss from operations | - | - | ||||||

| Other expenses | ||||||||

| Equity loss from subsidiaries | (297,126 | ) | (3,446 | ) | ||||

| Loss before income taxes | (297,126 | ) | (3,446 | ) | ||||

| Income tax expense | - | - | ||||||

| Net loss | $ | (297,126 | ) | $ | (3,446 | ) | ||

| F-24 |

CHINA UNITED INSURANCE SERVICE, INC.

STATEMENTS OF CASH FLOWS

| Six Months Ended December 31, 2011 | Six Months Ended December 31, 2010 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (297,126 | ) | $ | (3,446 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Equity loss from in subsidiaries | 297,126 | 3,446 | ||||||

| Net cash used in operating activities | - | - | ||||||

| NET INCREASE IN CASH & EQUIVALENTS | - | - | ||||||

| CASH & EQUIVALENTS, BEGINNING BALANCE | - | - | ||||||

| CASH & EQUIVALENTS, ENDING BALANCE | $ | - | $ | - | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Interest paid | $ | - | $ | - | ||||

| Income taxes paid | $ | - | $ | - | ||||

| F-25 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion contains forward-looking statements. Forward looking statements are identified by words and phrases such as “anticipate”, “intend”, “expect”, and words and phrases of similar import. We caution investors that forward-looking statements are predictions based on our current expectations about future events and are not guarantees of future performance. Actual results, performance or achievements could differ materially from those expressed or implied by the forward-looking statements due to risks, uncertainties and assumptions that are difficult to predict. We encourage you to read those risk factors carefully along with the other information provided in this current report and in our other filings with the SEC before deciding to invest in our stock or to maintain or change your investment. We undertake no obligation to revise or update any forward-looking statement for any reason, except as required by law.

You should read this Management’s Discussion and Analysis in conjunction with the Consolidated Financial Statements and Related Notes.

Overview

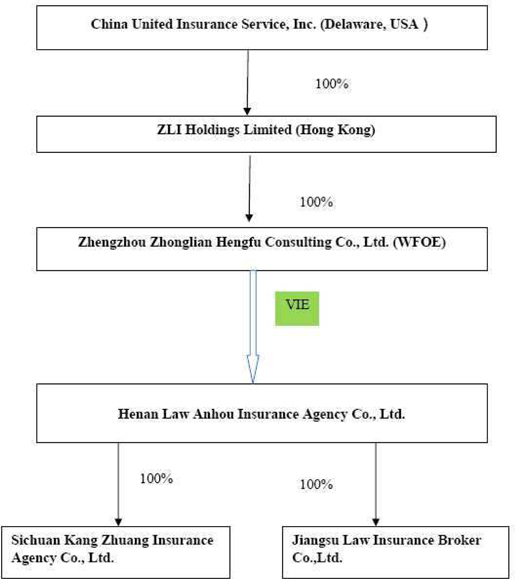

China United Insurance Service, Inc. (“China United”) is a Delaware corporation organized on June 4, 2010 by Mao Yi Hsiao, a Taiwanese citizen, as a listing vehicle for ZLI Holdings Limited (“CU Hong Kong”) to be quoted on the Over the Counter Bulletin Board (the “OTCBB”). CU Hong Kong, a wholly owned Hong Kong-based subsidiary of China United, was originally founded by China United on July 12, 2010 under Hong Kong laws. On October 20, 2010, CU Hong Kong founded a wholly foreign owned enterprise, Zhengzhou Zhonglian Hengfu Business Consulting Limited Company (“CU WFOE”) in Henan province in the PRC.

On January 16, 2011, China United issued 20,000,000 shares of common stock, $0.00001 par value per share, to several non U.S. persons for their investment of $300,000 in cash. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended. The consideration was paid to the account of CU Hong Kong by May 6, 2011. Among which, $60,090 was contributed into the bank account of CU WFOE as registered capital on November 26, 2010, with the remaining $239,910 to be contributed into CU WFOE on or prior to October 20, 2012. On January 28, 2011, the Company increased the number of authorized shares from 30,000,000 shares of common stock to 100,000,000 shares of common stock and 10,000,000 shares of preferred stock.

Henan Law Anhou Insurance Agency Co., Ltd. (“Henan Anhou”, formerly known as Zhengzhou Anhou Insurance Agency Co., Ltd.) was incorporated in the People’s Republic of China (the “PRC”) on August 20, 2003. Henan Anhou provides insurance agency services in the PRC. On August 16, 2010, Ms. Zhu Shuqin contributed capital of RMB 8,000,000 ($1,175,440) by cash to Henan Anhou and controlled 80% shares of Henan Anhou.

| 1 |

Sichuan Kangzhuang Insurance Agency Co., Ltd. (“Sichuan Kangzhuang”) was founded on July 10, 2006 in the Sichuan province in the PRC and provides insurance agency services in the PRC. On August 23, 2010, at Sichuan Kangzhuang’s general meeting of shareholders, its shareholders voted to sell their shares in Sichuan Kangzhuang to Henan Anhou for RMB532,622 ($83,444). On September 6, 2010, the equity transfer agreements were signed between Henan Anhou and each shareholder of Sichuan Kangzhuang.

Jiangsu Law Insurance Broker Co., Ltd. (“Jiangsu Law”) was founded on September 19, 2005 in Jiangsu Province in the PRC and provides insurance brokerage services in the PRC. On August 12, 2010, at Jiangsu Law’s general meeting of shareholders, its shareholders voted to sell their shares to Henan Anhou for RMB518,000 ($81,153) and Henan Anhou increased Jiangsu Law’s paid-in capital to RMB10,000,000 ($1,566,661) from RMB5,180,000 ($811,531) on January 18, 2011 to meet the PRC paid-in capital requirements for insurance brokerage companies. On September 28, 2010, the equity transfer agreements were signed between Henan Anhou and each shareholder of Jiangsu Law.

Due to PRC legal restrictions on foreign ownership and investment in insurance agency and brokerage businesses in China, especially those on qualifications as well as capital requirement of the investors, we operate our business primarily through our Consolidated Affiliated Entities in China. We do not hold equity interests in our Consolidated Affiliated Entities. However, through the VIE Agreements with these Consolidated Affiliated Entities and their respective shareholders, we effectively control, and are able to derive substantially all of the economic benefits from, these Consolidated Affiliated Entities.

Our Consolidated Affiliated Entities in China are variable interest entities through which all of our insurance services are operated. It is through the VIE Agreements that we have effective control of the Consolidated Affiliated Entities, which allows us to consolidate the financial results of the Consolidated Affiliated Entities in our financial statements. If Henan Anhou and its shareholders fail to perform their obligations under the VIE Agreements, we could be limited in our ability to enforce the VIE Agreements that give us effective control. Furthermore, if we are unable to maintain effective control of our Consolidated Affiliated Entities, we would not be able to continue to consolidate the Consolidated Affiliated Entities’ financial results with our financial results. During each of the fiscal years ended June 30, 2010 and 2011, 100% of our revenues in our consolidated financial statements were derived from our Consolidated Affiliated Entities.

On January 17, 2011, CU WFOE and Henan Anhou and its shareholders entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which CU WFOE has executed effective control over Henan Anhou through these contractual arrangements. The corporate structure after the date of the series of VIE agreements is as following:

| 2 |

By December 31, 2011, through our Consolidated Affiliated Entities we had 13 branches and 22 offices, and about 1,255 individual sub-agents in Henan, Sichuan and Jiangsu provinces.

Critical Accounting Policies

The preparation of financial statements in conformity with Generally Accepted Accounting Principles in the United States of America ("US GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the consolidated financial statements and the amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available when the estimates are made. However, actual results could differ materially from those results. While there are a number of significant accounting policies affecting the Company’s financial statements; the Company believes the following critical accounting policies involve the most complex, difficult and subjective estimates and judgments The Company has not made any material changes in the methodology used in these accounting polices during the past two years.

| 3 |

Principles of consolidation

The accompanying consolidated financial statements include the balance sheets of China United, its wholly owned subsidiaries CU Hong Kong and CU WFOE, the variable interest entity Henan Anhou and wholly owned subsidiaries Sichuan Kangzhuang and Jiangsu Law, as of June 30, 2011. As Henan Anhou acquired 100% of Sichuan Kangzhuang on September 6, 2010, for accounting convenience, its operating results from September 1, 2010 through June 30, 2011 and the balance sheet of Sichuan Kangzhuang as of June 30, 2011 were included in the consolidated financial statements. As Henan Anhou acquired 100% of Jiangsu Law on September 30, 2010, the operating results of Jiangsu Law from October 1, 2010 through June 30, 2011 and the balance sheet as of June 30, 2011 were included in the consolidated financial statements. The operating results for the fiscal year ended June 30, 2010 and the balance sheet as of June 30, 2010 only contain Henan Anhou, as Sichuan Kangzhuang and Jiangsu Law were not acquired, CU Hong Kong and CU WFOE were not founded, and the VIE agreements were not signed, as of such date. All significant inter-company accounts and transactions were eliminated in consolidation.

Accounts receivable

The Company reviews its accounts receivable on a regular basis to determine if a bad debt allowance is necessary. Management reviews the composition of accounts receivable and analyzes the age of receivable outstanding, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the necessity of making such allowance.

Revenue recognition

In accordance with US GAAP, the Company recognizes revenue when the following have occurred: persuasive evidence of an agreement between the insurance companies and insured exists, services were provided, the fees for such services are fixed or determinable and collectability of the fee is reasonably assured. Insurance agency services are considered to be rendered and completed, and revenue is recognized, when an insurance policy becomes effective, that is, when the signed insurance policy is in place and the premium is collected from the insured. The Company has met all the four criteria of revenue recognition when the premiums are collected by the respective insurance companies and not before, because collectability is not ensured until receipt of the premium. Any subsequent commission adjustments in connection with policy cancellations which have been de minims to date are recognized upon notification from the insurance carriers.

The Company pays commissions to its sub-agents when an insurance product is sold by the sub-agent. The Company recognizes commission revenue on a gross basis. The commissions paid by the Company to its sub-agents are recorded as costs of services.

Income taxes

The Company utilizes ASC 740 “Income Taxes”, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

| 4 |

When tax returns are filed, it is likely some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of operations and other comprehensive income (loss).

The Company was not subjected to income tax examinations by taxing authorities during the current and past fiscal years. During the three months and six months ended December 31, 2011 and 2010, the Company did not recognize any interest or penalties.

Impairment of Long-Lived Assets

In accordance with ASC 360, “Property, Plant and Equipment” the Company reviews the carrying values of long-lived assets whenever facts and circumstances indicate that the assets may be impaired. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net undiscounted cash flows expected to be generated by the asset. If an asset is considered impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds the fair value. Assets to be disposed of are reported at the lower of the carrying amount or fair value, less costs of disposal.

Goodwill

Goodwill arose from the acquisition of Sichuan Kangzhuang. Goodwill represents the excess of the cost of an acquisition over the fair value of the net assets acquired. Goodwill is tested for impairment annually or more frequently if events or changes in circumstances indicate that it might be impaired, using the prescribed two-step process under US GAAP. The first step screens for potential impairment of goodwill to determine if the fair value of the reporting unit is less than its carrying value, while the second step measures the amount of goodwill impairment, if any, by comparing the implied fair value of goodwill to its carrying value.

| 5 |

Results of Operations for the three months ended December 31,

| 2010 to 2011 | |||||||||||

| Percentage | |||||||||||

| 2011 | 2010 | Change | |||||||||

| $ | $ | % | |||||||||

| Revenues | 1,036,635 | 804,464 | 32 | % | |||||||