Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - China United Insurance Service, Inc. | tm205301d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China United Insurance Service, Inc. | tm205301d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China United Insurance Service, Inc. | tm205301d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China United Insurance Service, Inc. | tm205301d1_ex31-1.htm |

| EX-21 - EXHIBIT 21 - China United Insurance Service, Inc. | tm205301d1_ex21.htm |

| EX-4.2 - EXHIBIT 4.2 - China United Insurance Service, Inc. | tm205301d1_ex4-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-54884

CHINA UNITED INSURANCE SERVICE, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation) |

30-0826400 (I.R.S Employer Identification No.) |

7F, No. 311 Section 3

Nan-King East Road

Taipei City, Taiwan

(Address of principal executive offices, with zip code)

+8862-87126958

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | None |

Securities registered under Section 12(g) of the Act:

| Title of each class | Common Stock, par value of $0.00001 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x |

| Non-accelerated filer ¨ | Smaller reporting company x |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based upon the closing sale price of the registrant’s common stock on June 30, 2019, the last business day of the registrant’s most recently completed second fiscal quarter was $60,900,574.

As of March 6, 2020, there were 29,421,736 shares of common stock issued and outstanding, and 1,000,000 preferred shares issued and outstanding.

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward- looking statements. These risks and uncertainties include, but are not limited to, the factors described under Item 1 “Description of Business,” Item 1A “Risk Factors” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this annual report. You should read this annual report and the documents that we reference in this annual report, or that we filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

OTHER PERTINENT INFORMATION

References in this annual report to “we,” “us,” “our” and the “Company” and words of like import refer to China United Insurance Service, Inc., its subsidiaries and variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Republic of China.

Unless context indicates otherwise, reference to the “Company” in this annual report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries (as defined below). Reference to “Anhou” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan and China using New Taiwanese Dollars (“NT$” or “NTD”), the currency of Taiwan, Hong Kong Dollars (“HK$” or “HKD”), the currency of Hong Kong, and RMB, the currency of China, respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this annual report, we refer to assets, obligations, commitments and liabilities in our financial statements in USD. These dollar references are based on the exchange rate of NT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of USD which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

3

Corporate History and Structure Overview

Our Company is a Delaware corporation organized on June 4, 2010 and has been quoted on various tiers of the OTC Markets since August 2012. We provide our customers brokerage and related services with respect to life insurance and property and casualty insurance products. We operate our Taiwan business primarily through Law Insurance Broker Co., Ltd. (“Law Broker”) and our PRC business primarily through Law Anhou Insurance Agency Co., Ltd. (“Anhou”).

Taiwan Segment- Law Broker and GHFL

The history of our Company dates back to October 9, 1992, when Law Broker was established.

Law Enterprise Co., Ltd. (“Law Enterprise”), a company limited by shares and incorporated under the laws of Taiwan, holds 100% interest in Law Broker, a company limited by shares and incorporated under the laws of Taiwan on October 9, 1992. Law Enterprise used to operate two other subsidiaries during the past three fiscal years, namely Law Risk Management & Consultant Co., Ltd. (“Law Management”), a company limited by shares and incorporated under the laws of Taiwan on December 5, 1987, and Law Insurance Agent Co., Ltd., a company limited by shares and incorporated under the laws of Taiwan on June 3, 2000 (“Law Agent”, collectively with “Law Enterprise”, “Law Broker” and “Law Management”, the “Taiwan Subsidiaries”, each a “Taiwan Subsidiary”). Law Management and Law Agent ceased operations, and they were dissolved on April 20, 2016 and April 12, 2016, respectively.

| · | Acquisition of AHFL |

Action Holdings Financial Limited (“AHFL”) was incorporated in the British Virgin Islands with limited liability on April 30, 2012. AHFL holds a 65.95% interest in Law Enterprise and certain of our other subsidiaries as more fully described below.

On August 24, 2012, an acquisition agreement (the “AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the AHFL Acquisition Agreement, our Company acquired 100% interest in AHFL and its subsidiaries in Taiwan and our Company agreed to pay NT$15.0 million ($500,815) on or prior to March 31, 2013 and NT$7.5 million ($250,095) subsequent to March 31, 2013 in cash in two installments. In addition, our Company agreed to (i) issue 8,000,000 shares of common stock of our Company to the shareholders of AHFL; (ii) issue 2,000,000 shares of common stock of our Company to certain employees of Law Broker; and (iii) create an employee stock option pool, consisting of available options, exercisable for up to 2,000,000 shares of common stock of our Company. Upon closing of the transaction, we acquired 100% interest in AHFL and its subsidiaries in Taiwan.

4

On March 14, 2013, an Amendment to the AHFL Acquisition Agreement (the “First Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the First Amendment to AHFL Acquisition Agreement, (i) the deadline for cash payment under the AHFL Acquisition Agreement was extended to March 31, 2015; and (ii) in lieu of the 2,000,000 employee stock option pool, our Company agreed to create an employee stock pool consisting of up to 4,000,000 shares of the common stock of our Company, among which 2,000,000 shares shall be solely granted to employees of Law Broker, and the remaining 2,000,000 shares shall be granted to employees of affiliated entities of our Company (including Law Broker employees).

On March 13, 2015, a second Amendment to the AHFL Acquisition Agreement (the “Second Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Second Amendment to AHFL Acquisition Agreement, the deadline for cash payment under the AHFL Acquisition Agreement was further extended to March 31, 2016.

On February 17, 2016, a third Amendment to the AHFL Acquisition Agreement (the “Third Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Third Amendment to AHFL Acquisition Agreement, on or prior to June 30, 2016, (i) our Company committed to complete a public offering in connection with the listing of our Company’s shares on a national stock market, where the Company aimed to raise net proceeds through such public offering of at least $10.0 million; (ii) our Company committed to distribute a cash payment in the amount of NT$22.5 million, on a pro rata basis, to the selling shareholders of AHFL and to issue 5,000,000 common shares to select employees of AHFL pursuant to its employee stock/option plan, and (iii) failure to timely complete either of the above-mentioned criteria would be deemed a material breach by the Company under Article 8 of the Acquisition Agreement, and the non-breaching parties would be entitled to terminate the Acquisition Agreement and unwind the Acquisition of AHFL by us and restore the status quo of our Company and the selling shareholders of AHFL as if the acquisition had never happened.

On August 8, 2016, a fourth Amendment to the AHFL Acquisition Agreement (the “Fourth Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Fourth Amendment to AHFL Acquisition Agreement, (i) the Third Amendment to AHFL Acquisition Agreement was terminated with immediate effect on August 8, 2016, and (ii) our Company agreed to pay to the selling shareholders of AHFL NT$15.0 million on or prior to March 31, 2017 and NT$4.8 million on July 21, 2016.

5

On March 12, 2017, a fifth Amendment to the Acquisition Agreement (the “Fifth Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Fifth Amendment to AHFL Acquisition Agreement, our Company agreed to distribute the cash payment in the amount of NT$15 million to the selling shareholders of AHFL named therein on or prior to March 31, 2019.

On March 27, 2019, a sixth Amendment to the Acquisition Agreement (the “Sixth Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Sixth Amendment to the AHFL Acquisition Agreement, our Company agreed to distribute cash payment in the amount of NT$15 million to the selling shareholders of AHFL named therein on or prior to March 31, 2021.

| · | Acquisition of GHFL |

Genius Holdings Financial Limited (“GHFL”) is a wholly owned subsidiary of AHFL. On February 13, 2015, our Company, AHFL and Mr. Chwan Hau Li, the then sole shareholder of GHFL, entered into an acquisition agreement (the “GHFL Acquisition Agreement”). Pursuant to the GHFL Acquisition Agreement, our Company issued Mr. Chwan Hau Li 352,166 fully paid and non-assessable shares of AHFL common stock (the “AHFL Shares”) together with put options to sell 352,166 shares of common stock of our Company (the “Put Option”), in exchange for 704,333 shares of common stock of GHFL previously held by Mr. Chwan Hau Li, which constituted all of the then issued and outstanding capital stock of GHFL. The Put Option was exercisable within six months of the closing date of the acquisition. The holder of the Put Option would need to forfeit the AHFL Shares to exercise of the Put Option. Subsequent to the acquisition, GHFL became a wholly-owned subsidiary of our Company. GHFL holds 100% issued and outstanding shares of Genius Investment Co., Ltd. (“GIC”), a company limited by shares and incorporated under the laws of Taiwan, which in turn holds approximately 15.64% issued and outstanding shares of Genius Insurance Broker Co., Ltd. (“Genius Broker”), a company limited by shares and incorporated under the laws of Taiwan. Both GHFL and GIC have no substantive business operation other than the holding of shares of its subsidiary. Genius Broker is primarily engaged in broker business across Taiwan. On March 31, 2015, Mr. Chwan Hau Li exercised the Put Option, pursuant to which Mr. Chwan Hau Li transferred 352,166 shares of AHFL to our Company and received 352,166 shares of common stock of our Company in exchange. After the exercise of the Put Option, the Company became the sole shareholder of GHFL and AHFL.

On February 17, 2016, our Company, AHFL and Mr. Chwan Hau Li entered into an Amendment 2 to the GHFL Acquisition Agreement (the “Second Amendment to GHFL Acquisition Agreement”), pursuant to which our Company agreed to complete a public offering with net proceeds of at least $10 million and listing of our Company’s securities on a national stock market on or prior to February 28, 2016. However, as of the date of this annual report, our Company’s securities had not been listed on a national stock exchange.

6

On August 8, 2016, our Company, AHFL and Mr. Chwan Hau Li entered into an Amendment 3 to the GHFL Acquisition Agreement (the “Third Amendment to GHFL Acquisition Agreement”), pursuant to which, the Second Amendment to GHFL Acquisition Agreement was terminated.

In July of 2018, the Company acquired Joint Broker Co., Limited (“JIB”), a Taiwan Insurance brokerage company, previously known as Kao Te Insurance Broker (“KT Broker”), through GIC. On July 1, 2018, GIC entered into an acquisition agreement (“KT Broker Acquisition Agreement”) with the selling shareholder of KT Broker, Ms. Ma. Pursuant to the KT Broker Acquisition Agreement, GIC agreed to pay $29,545 (NT$ 900,000) in exchange for the insurance brokerage licenses issued to KT Broker by the Taiwanese government, along with right to the KT Broker’s company name and $13,131 (NT$ 400,000) of legal deposits, which were required by the Taiwanese insurance regulations. The Company has no intention of operating the KT Broker existing brokerage business nor retaining any of its sales personnel, therefore the Company recognized for accounting purposes only the acquisition of assets as part of this transaction. The Taiwanese laws do not allow a legal entity to transfer its brokerage license. In order to obtain the desired licenses that KT Broker had, we acquired KT Broker and renamed KT Broker as Joint Insurance Broker Co., Limited to serve as a holding entity for the brokerage licenses. The change of control due to KT Broker Acquisition Agreement and name change did not affect the effectiveness of the insurance brokerage license owned by JIB in Taiwan.

| · | Recent Development- Uniwill Insurance Broker Co., Ltd. |

On November 15, 2019, the Company, through one of its subsidiaries, entered into a joint venture agreement (the “Joint Venture Agreement”) with Cyun-Jhan Enterprise Co., Ltd. (“Cyun-Jhan”) and Jian-Zao International Industrial Co., Ltd. to contribute funds, human resources, and technology into Uniwill Insurance Broker Co., Ltd. (“Uniwill”), a wholly owned subsidiary of the Company incorporated in Taiwan, according to the Joint Venture Agreement. Under the terms of the Joint Venture Agreement, a total of $13.3 million (NTD 400 million) will be injected to Uniwill if and when all of the conditions are met as set forth in the Joint Venture Agreement no later than December 31, 2021. For more information, please see a current report on Form 8-K filed on November 21, 2019.

PRC Segment- Anhou

On July 12, 2010, ZLI Holdings Limited (“CU Hong Kong”), a wholly owned subsidiary of our Company, was established under the laws of Hong Kong. On October 20, 2010, Zhengzhou Zhonglian Hengfu Consulting Co., Ltd., a wholly foreign owned enterprise (“CU WFOE”), a wholly owned subsidiary of CU Hong Kong, was established in Henan province of the PRC. On January 16, 2011, our Company issued 20,000,000 shares of common stock to several non-U.S. persons for their investment of $300,000 in CU WFOE. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended.

Zhengzhou Anhou Insurance Agency Co., Ltd., the predecessor entity of Anhou, was founded in Henan province of the PRC on October 9, 2003. Due to PRC legal restrictions on foreign ownership and investment in an insurance agency businesses in China, Able Capital Holding Co., Ltd., a company established with limited liability in Hong Kong, delegated four PRC individuals, namely Yanyan Wang, Zhaohui Chen, Weizhe Hou and Yong Zhang, to invest in Anhou on its behalf.

On September 26, 2013, Yanyan Wang, Zhaohui Chen, Jing Yue, Weizhe Hou, Yong Zhang, Li Chen (“Anhou New Investors”) and Shuqin Zhu, Qun Wei, Qunlei Fang and Yanxia Chen (“Anhou Original Shareholders”) increased the registered capital of Anhou to RMB50 million, among which, (i) Yanyan Wang agreed to invest RMB10 million, accounting for 20% of registered capital in Anhou, (ii) Zhaohui Chen agreed to invest RMB10 million, accounting for 20% of registered capital in Anhou, (iii) Jing Yue agreed to invest RMB7.5 million, accounting for 15% of registered capital in Anhou, (iv) Weizhe Hou agreed to invest RMB5 million, accounting for 10% of registered capital in Anhou, (v) Yong Zhang agreed to invest RMB4.5 million, accounting for 9% of registered capital in Anhou, and (vi) Li Chen agreed to invest RMB3 million, accounting for 6% of registered capital in Anhou, respectively.

7

The registered capital increase of Anhou was in response to the promulgations of certain regulations by the China Insurance Regulatory Commission (“CIRC”). On April 27, 2013, CIRC issued the Decision on Revising the Provisions of the Supervision and Administration of Specialized Insurance Agencies (the “Decision on Revising the Agency Provisions”), pursuant to which, CIRC mandated any insurance agency established subsequent to the Decision on Revising the Agency Provisions to meet a minimum registered capital requirement of RMB50 million. On May 16, 2013, CIRC issued Notice for Further Clarification on Related Issues of Access to Professional Insurance Intermediary Market (the “2013 Notice”), pursuant to which, professional insurance agencies established prior to the issuance of the Decision on Revising the Agency Provisions, with registered capital less than RMB50 million, can continue operation of their existing business within the provinces where they have the registered office or branch office, but shall not set up any new branches in any province where they do not have the registered office or any branch office. To better implement the expansion strategies of our Company, Anhou increased its registered capital to RMB50 million to meet the requirement of CIRC so that it is able set up new branches in any province beyond its current operations in the PRC.

On October 24, 2013, Anhou Original Shareholders transferred their interests in Anhou to Changrong Hu, a PRC citizen (“Mr. Hu,” together with Anhou New Investors, “Anhou Existing Shareholders”), for an aggregate consideration of RMB10 million. Mr. Hu is currently the legal representative, General Manager and the sole director of Anhou.

On November 17, 2016, Li Chen transferred his interests in Anhou to Chunyan Lu for an aggregate consideration of RMB3 million.

Sichuan Kangzhuang Insurance Agency Co., Ltd. (“Sichuan Kangzhuang”), a wholly owned subsidiary of Anhou, was established with limited liability on September 4, 2006 in Sichuan province of the PRC. On September 6, 2010, shareholders of Sichuan Kangzhuang transferred their interest in Sichuan Kangzhuang to Anhou for an aggregate consideration of RMB532,622. For the purpose of procuring certain economic benefits and enabling a centralized control over the business operations in Sichuan province, the Company commenced the dissolution process of Sichuan Kangzhuang, a wholly owned subsidiary of Anhou and set up a branch office of Anhou in Sichuan province. Accordingly, Sichuan Kangzhuang filed a dissolution application to the local Bureau of Administration and Commerce and made a public announcement published in local newspaper in October 2017. As Sichuan Kangzhuang ceased operations, it was dissolved on October 8, 2018.

Jiangsu Law Insurance Brokers Co., Ltd. (“Jiangsu Law”), a wholly owned subsidiary of Anhou, was established with limited liability on September 19, 2005 in Jiangsu province of the PRC. Jiangsu Law is licensed to provide insurance brokerage services in Jiangsu Province. On September 28, 2010, Anhou and the shareholders of Jiangsu Law entered into an equity transfer agreements. Pursuant to Provisions on the Supervision and Administration of Insurance Brokerage Institution, effective on October 1, 2009, if an insurance brokerage entity fails to bring its registered capital to no less than RMB10 million on or prior to October 1, 2012, the CIRC or its local agency, as applicable, may determine not to extend the insurance brokerage license. To meet such minimum registered capital requirement, on February 11, 2011, Anhou invested RMB4.82 million in Jiangsu Law to increase the registered capital to RMB10 million.

8

Our Consolidated Affiliated Entities

Due to PRC legal restrictions on foreign ownership and investment in insurance agency and brokerage businesses in China, especially those on qualifications as well as capital requirement of the investors, we operate our PRC business primarily through Anhou and Jiangsu Law (collectively, the “Consolidated Affiliated Entities”, each a “Consolidated Affiliated Entity”). We do not directly hold equity interests in our Consolidated Affiliated Entities. However, through the VIE Agreements (defined as below), we effectively control, and are able to derive substantial economic benefits from, these Consolidated Affiliated Entities. On March 12, 2019, the Ministry of Commerce of the People’s Republic of China (“MOFCOM”) passed the Foreign Investment Law, which replaced the three existing laws over foreign investment. From January 1, 2020, foreign individuals, enterprises and other organizations that directly or indirectly make investment activities in China are subject to the Foreign Investment Law. However, it remains unclear as to how these changes will affect entities currently operating in China, particularly foreign controlled variable interest entities.

Our Consolidated Affiliated Entities in China are variable interest entities through which all of our insurance services in China are operated. These VIE Agreements give us effective control over our Consolidated Affiliated Entities in China and allow us to consolidate the financial results of our Consolidated Affiliated Entities in our financial statements.

On January 17, 2011, CU WFOE, Anhou and Anhou Original Shareholders entered into a series of agreements (the “Old VIE Agreements”) pursuant to which CU WFOE exercises effective control over Anhou. As a result of the capital increase and the share transfer described above, on October 24, 2013, CU WFOE, Anhou and Anhou Existing Shareholders entered into a series of agreements (the “VIE Agreements”), including Power of Attorneys, Exclusive Option Agreements, Share Pledge Agreements, in the same form as the previous Old VIE Agreements, other than the change of shareholder names and their respective shareholdings. The Old VIE Agreements were terminated by and among CU WFOE, Anhou and Anhou Original Shareholders on the same date, except that the Exclusive Business Cooperation Agreement executed by and between CU WFOE and Anhou on January 17, 2011 remains in full effect. The VIE Agreements now in effect include:

9

| 1. | An exclusive Business Cooperation Agreement, pursuant to which CU WFOE is appointed as the exclusive services provider to Anhou of complete technical support, business support and related consulting services in exchange for 90% of the net profits of Anhou. The Exclusive Business Cooperation Agreement was effective on January 17, 2011 with a term of ten years subject to renewal at the discretion of CU WFOE. CU WFOE may terminate the agreement at any time with 30 days’ written notice but Anhou may only terminate the agreement if CU WFOE commits gross negligence or a fraudulent act against Anhou; |

| 2. | a Power of Attorney, pursuant to which the shareholders of Anhou have vested their collective voting control in Anhou to CU WFOE; |

| 3. | an Option Agreement, pursuant to which the shareholders of Anhou granted to CU WFOE the irrevocable right and option to acquire all of their equity interests in Anhou. The Option Agreement was effective on October 24, 2013 with a term of ten years subject to renewal at CU WFOE’s election; and |

| 4. | a Share Pledge Agreement, pursuant to which the shareholders of Anhou have pledged all of their equity interests in Anhou to CU WFOE to guarantee Anhou’s performance of its obligations under the Exclusive Business Cooperation Agreement. |

Hong Kong Segment Reinsurance Brokerage- PFAL

Prime Financial Asia Ltd. (“PFAL”) is a re-insurance broker company incorporated in Hong Kong and is a majority-owned subsidiary of the Company due to the fact that AHFL owns 51% of PFAL. On April 23, 2014, AHFL and Chun Kwok Wong (“Mr. Wong”) entered into a Capital Increase Agreement, pursuant to which Mr. Wong increased PFAL’s registered capital from HK$500,000 to HK$1,470,000 and AHFL contributed HK$1,530,000 to PFAL’s registered capital. Upon the completion of capital increase on April 30, 2014, Mr. Wong and AHFL owned 49% and 51% of PFAL’s equity interest, respectively.

On August 7, 2015, Max Key Investment Ltd. (“MKI”) was incorporated with limited liability in the British Virgin Islands. On August 15, 2015, Prime Management Consulting (Nanjing) Co., Ltd. (“PTC Nanjing”) was incorporated with limited liability in Nanjing province of the PRC. On September 3, 2015, Prime Asia Corporation Limited. (“PTC Taiwan”), a company limited by shares, was incorporated in Taiwan. Each of MKI, PTC Nanjing and PTC Taiwan is a wholly owned subsidiary of PFAL.

Revenue Generation

As a holding company with no business other than holding equity interest of our operating subsidiary, CU WFOE in China and the Taiwan Segment, we rely principally on dividends to be paid by CU WFOE in China and the Taiwan Segment. CU WFOE, being the exclusive service provider to Anhou, relies on the service fees to which it is entitled from Anhou. Pursuant to the Exclusive Cooperation Agreement (the “Cooperation Agreement”) between CU WFOE and Anhou, CU WFOE has the right to collect 90% of the net profits of Anhou. Anhou has been paying service fees according to the Cooperation Agreement, but has not paid any dividend to CU WFOE to date. As of December 31, 2019, Anhou was operating at a profit, but since Anhou remains a growing company that requires financial resources to support further expansion, the decision as to a dividend payment will be decided in the future depending on the financial circumstances, including maintaining prudent cash reserves. Our capability to receive dividends from CU WFOE, convert them into USD and make the repatriation out of China is subject to the applicable PRC restrictions on the payment of dividends by PRC companies, laws and regulations on foreign exchange and restrictions on foreign investment.

10

For the year ended December 31, 2018, 85.82 %, 13.31% and 0.87% of our revenues in our consolidated financial statements were derived from our Taiwan Segment, PRC Segment, and Hong Kong Segment, respectively. For the year ended December 31, 2019, 91.14 %, 8.87% and 0.30% of our revenues in our consolidated financial statements were derived from our Taiwan Segment, PRC Segment, and Hong Kong Segment, respectively. Revenues in our consolidated financial statements are composed of commissions earned from insurance companies according to the terms of each insurance company service agreement, as well as revenues earned in association with the Strategic Alliance Agreement with AIA International Limited Taiwan Branch.

Reclassification of Shares

On January 28, 2011, our Company increased the number of authorized shares from 30,000,000 shares of common stock to 100,000,000 shares of common stock and 10,000,000 shares of preferred stock. On July 2, 2012, our board of directors and stockholders approved, in connection with a reclassification of 1,000,000 issued and outstanding shares of common stock (the “Reclassified Shares”), par value $0.00001 per share held by Mr. Yi Hsiao Mao (“Mr. Mao”) into 1,000,000 shares of Series A Convertible Preferred Stock, par value $0.00001 per share (the “Series A Preferred Stock”) on a share-for-share basis (the “Reclassification”), the issuance of 1,000,000 shares of Series A Preferred Stock to Mr. Mao and cancellation of 1,000,000 common stock held and submitted by Mr. Mao pursuant to the Reclassification. All of the 1,000,000 shares of Series A Preferred Stock are reclassified from the 1,000,000 common stock held by Mr. Mao and no additional consideration has been paid by Mr. Mao in connection with the Reclassification. Each holder of common stock shall be entitled to one vote for each share of common stock held of record by such holder as of the applicable record date on any matter that is submitted to a vote of the stockholders of our Company; while each holder of Series A Preferred Stock shall be entitled to ten votes for each share of Series A Preferred Stock held of record by such holder as of the applicable record date on any matter that is submitted to a vote of the stockholders of our Company.

2017 Long Term Incentive Plan

On May 12, 2017, the Company’s 2017 Long Term Incentive Plan (the “2017 Plan”) was approved by the shareholders at the 2017 Annual Meeting of Stockholders of China United Insurance Service, Inc. Up to 10,000,000 shares of our Common Stock may be granted under the 2017 Plan (the “Share Pool”), provided that 2,000,000 shares of the Share Pool is reserved for issuance to eligible participants providing services to AHFL and its subsidiaries. Eligibility to participate is open to officers, directors and employees of, and other individuals (including sales agents who are exclusive agents of the Company or its subsidiaries or derive more than 50% of their income from those entities) who provide bona fide services to or for, us or any of our subsidiaries. Given that metrics for evaluating performance goals are rather complex and exhaustive, and that the Company’s management and Board of Directors are still working to develop a series of reward policies that specify various performance target levels and the size of the award or payout of performance shares with respect to each different target level attained, no awards were granted under the 2017 Plan as of December 31, 2019.

11

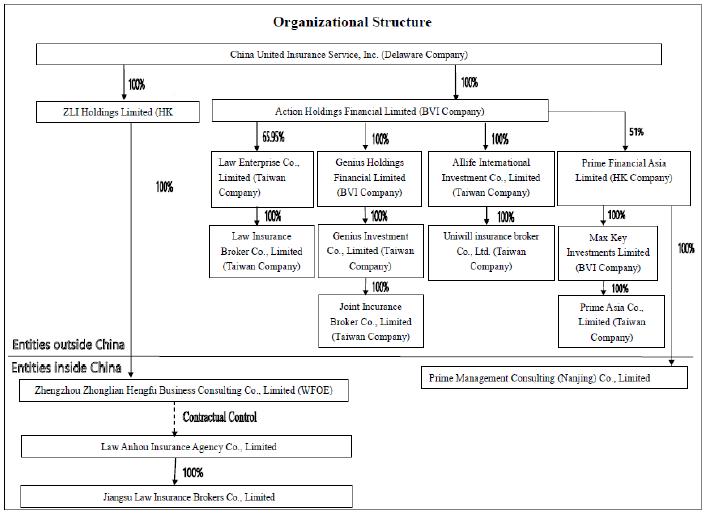

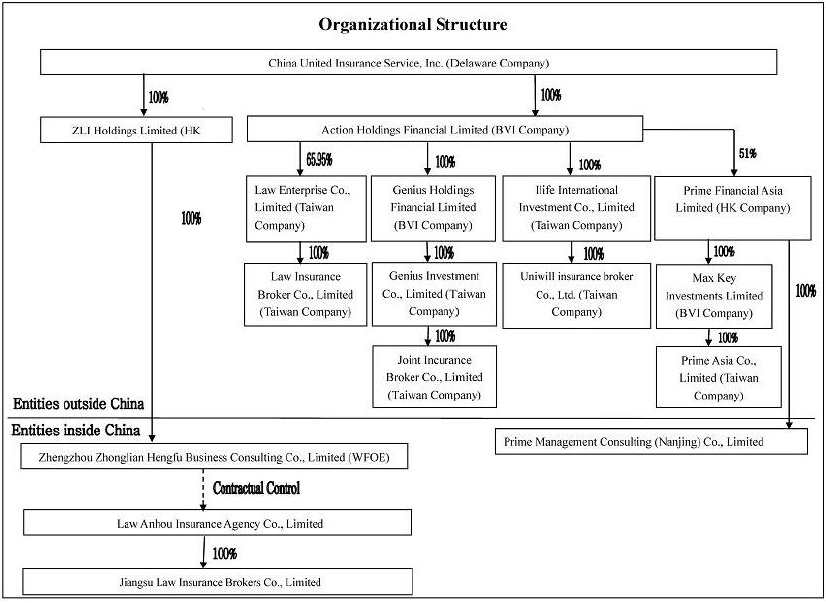

The following flow chart illustrates our Company’s organizational structure as of March 6, 2020:

Products and Services

The Taiwan and PRC Segments market and sell to customers two broad categories of insurance products: life insurance products and property and casualty insurance products, both focused on meeting the particular insurance needs of individuals. The insurance products that the Taiwan and PRC Segments sell are underwritten by some of the leading insurance companies in Taiwan and China, respectively.

Through Anhou’s wholly-owned insurance brokerage firm, Jiangsu Law, Anhou also closely interacts with insurance companies and actively locates and introduces the right customers in Anhou’s database matching the insurance products offered by such insurance companies to them.

The Taiwan and PRC Segments are compensated primarily by commissions and fees paid by insurance companies, typically based on a percentage of the premium paid by the insured or a percentage of the amount recovered from insurance companies. Commission and fee rates generally depend on the type of insurance products and the particular insurance company that issues the particular insurance products.

12

Life Insurance Products

The Taiwan Segment

The life insurance products the Taiwan segment distributes can be broadly classified into the categories set forth below. Due to continuous product innovation by insurance companies, some of the insurance products Taiwan segment distributes combine features of one or more of the categories listed below. Total net revenues from life insurance products distributed by Taiwan segment in the fiscal year of 2019 was approximately $81.54 million, accounted for approximately 93.96% of Taiwan segment’s total net revenues and approximately 85.01% of our total net revenues for the fiscal year ended December 31, 2019, respectively.

| · | Individual Whole Life Insurance. The individual whole life insurance products the Taiwan segment distributes provide insurance for the insured person’s entire life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated interest is paid upon the death of the insured. |

| · | Individual Term Life Insurance. The individual term life insurance products the Taiwan segment distributes provide insurance for the insured for a specified time period or until the attainment of a certain age, in return for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years. Term life insurance policies generally expire without value if the insured survives the coverage period. |

| · | Individual Health Insurance. The individual health insurance products the Taiwan segment distributes pay the insured amount of reasonable hospitalization cost, or certain death benefit in case of the death of the insured, due to illness, accident or childbirth. Individual health insurance policies expire when the premium is not paid or a certain age is attained. |

| · | Accidental Injury Insurance. The accidental injury insurance products the Taiwan segment distributes provide benefits when the insured is dead or disabled because of accidental injury, which is unforeseen by the injured or against his will. |

| · | Investment-Oriented Insurance. The investment-oriented insurance products the Taiwan segment distributes are market linked insurance plans which also provide life coverage, combining advantages of investment and protection. The premium amount (after deduction of certain charges) is invested into different funds. The performance of the fund will depend on the market conditions. A growing upward trend in market will increase the fund value. Every investment-oriented insurance policy has market risk exposure depending on the fund invested and such investment risk is solely borne by the policyholder. Depending on the death benefit, investment-oriented insurance policies are categorized into two broad categories: (1) the death benefit is equal to the higher of insured amount or fund value; (2) the death benefit is equal to the insured amount plus fund value. |

| · | Foreign Currency Insurance Commodities. The foreign currency insurance commodities the Taiwan segment distributes are life insurance policies in which policy benefits are paid in foreign currencies. The foreign currency policy provides insurance for the insured person’s life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated interest, is paid upon the death of the insured. |

| · | Travel Accident Insurance. The travel accident insurance products the Taiwan segment distributes provide accident coverage for accidental death, bodily injury, and other travel injuries. The premium is based on the number of travel days and the insured amount. |

The life insurance products the Taiwan segment distributed in the year ending December 31, 2019 were primarily underwritten by, in alphabetical order, AIA International Limited Taiwan Branch, Farglory Life Insurance Co., Ltd., Shin Kong Life Insurance Co., Ltd., Taiwan Life Insurance Co., Ltd. and TransGlobe Life Insurance Inc. Among them, Taiwan Life Insurance Co., Ltd., Farglory Life Insurance Co., Ltd., and TransGlobe Life Insurance Inc. accounted for 19.35%, 17.15%, and 13.96% of our total net revenues in the fiscal year ending December 31, 2019, respectively.

13

Anhou

The life insurance products Anhou distributes can be broadly classified into the categories set forth below. Due to constant product innovation by insurance companies, some of the insurance products Anhou distributes combine features of one or more of the categories listed below. Total net revenues from life insurance products in the fiscal year of 2019 was approximately $ 8.03 million, accounting for approximately 94.25% of Anhou’s total net revenues and approximately 8.37% of our total net revenues for the year ending December 31, 2019, respectively.

| · | Individual Whole Life Insurance. The individual whole life insurance products Anhou distributes provide insurance for the insured person’s entire life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from five to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated interest is paid upon the death of the insured. |

| · | Individual Term Life Insurance. The individual term life insurance products Anhou distributes provide insurance for the insured for a specified time period or until the attainment of a certain age, in return for the periodic payment of fixed premiums over a pre-determined period, generally ranging from five to 20 years. Term life insurance policies generally expire without value if the insured survives the coverage period. |

| · | Individual Endowment Life Insurance. The individual endowment products Anhou distributes generally provide maturity benefits if the insured reaches a specified age, and provide to a beneficiary designated by the insured guaranteed benefits upon the death of the insured within the coverage period. In return, the insured makes periodic payment of premiums over a pre-determined period, generally ranging from five to 25 years. |

| · | Individual Annuity Insurance. The individual annuity insurance products Anhou distributes provide annual benefit payments after the insured attains a certain age, or for a fixed time period, and provide a lump payment at the end of the coverage period. In addition, the beneficiary designated in the annuity contract will receive guaranteed benefits upon the death of the insured during the coverage period. In return, the purchaser of the annuity products makes periodic payment of premiums during a pre-determined accumulation period. |

| · | Individual Health Insurance. The individual health insurance products Anhou distributes primarily consist of critical illness insurance products, which provide guaranteed benefits for specified critical illnesses during the coverage period. In return, the insured makes periodic payment of premiums over a pre-determined period. |

14

The life insurance products Anhou distributed in the year ending December 31, 2019 were primarily underwritten by, in alphabetical order, Aegon THTF Life Insurance Co., Ltd., AVIVA Life Insurance Co., Ltd., Evergrande Life Assurance Co., Ltd., Funde Sino Life Insurance Co., Ltd., Huaxia Insurance Co., Ltd., and Tianan Life Insurance Co., Ltd. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2019.

In addition to the periodic premium payment schedules described above, most of the individual life insurance products we distribute also allow the insured to choose to make a single, lump-sum premium payment at the beginning of the policy term. If a periodic payment schedule is adopted by the insured, a life insurance policy can generate periodic payment of fixed premiums to the insurance company for a specified period of time. This means that once Anhou or the Taiwan Segment sells a life insurance policy with a periodic premium payment schedule, they will be able to derive commission and fee income from that policy for an extended period of time, sometimes up to 25 years. Because of this feature and the expected sustainable growth of life insurance sales in China and Taiwan, we have focused significant resources on developing our capability to distribute individual life insurance products with periodic payment schedules since the inception of Anhou and the Taiwan Segment. We expect that sales of life insurance products will continue to be our primary source of revenue in the next several years.

15

Property and Casualty Insurance Products

The Taiwan Segment

The Taiwan Segment’s main property and casualty insurance products are automobile insurance, casualty insurance, and liability insurance. The Taiwan Segment commenced sale of automobile insurance, casualty insurance and liability insurance business in August 2003. Our total net revenues from property and casualty insurance products in the fiscal year of 2019 year was approximately $5.25 million, accounted for approximately 6.04% of the Taiwan Segment’s total net revenues and approximately 5.47% of our total net revenues in the year ending December 31, 2019, respectively.

The property and casualty insurance products the Taiwan Segment distributes can be further classified into the following categories:

| · | Automobile Insurance. The Taiwan Segment distributes both standard automobile insurance policies and supplemental policies, which we refer to as riders. The standard automobile insurance policies the Taiwan Segment sells generally have a term of one year and cover damages of the insured vehicle caused by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. The Taiwan Segment also sells standard third party liability insurance policies, which cover bodily injury and property damages caused by an accident involving an insured vehicle to a person not in the insured vehicle. The riders the Taiwan Segment distributes cover additional losses, such as liability to passengers, losses arising from vehicle theft and robbery, broken glass and vehicle body scratches. |

| · | Casualty Insurance. The casualty insurance the Taiwan Segment distributes are primarily designed to insure any losses or damages to properties caused directly by accidents. The policy period is usually one year and the premium is generally calculated based on the insured amount. |

| · | Liability Insurance. The liability insurance products the Taiwan Segment distributes are primarily designed to protect an individual or business from the risk that they may be sued and held legally liable for something, such as malpractice, third party injuries or negligence. The policy period is usually one year and the premium is generally calculated based on the insured amount. |

The property and casualty insurance products the Taiwan Segment distributed in the year ending December 31, 2019 were primarily underwritten by, in alphabetical order, Fubon Insurance Co., Ltd., Hotai Insurance Co., Ltd., Shinkong Insurance Co., Ltd., Taiwan Insurance Co. Ltd. and TLG Insurance Co. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2019.

16

Anhou

Anhou’s main property and casualty insurance products are automobile insurance and commercial property insurance. Anhou commenced its sale of commercial property insurance in 2009 and developed its automobile insurance business in 2010. The total net revenues from property and casualty insurance products distributed by Anhou in the 2019 fiscal year was approximately $0.49 million, accounted for approximately 5.75% of Anhou’s total net revenues and approximately 0.51% of our total net revenues for the fiscal year ending December 31, 2019.

The property and casualty insurance products Anhou distributes can be further classified into the following categories:

| · | Automobile Insurance. Automobile insurance is the largest segment of property and casualty insurance in the PRC in terms of gross written premiums. Anhou distributes both standard automobile insurance policies and supplemental policies, which we refer to as riders. The standard automobile insurance policies Anhou sells generally have a term of one year and cover damages caused to the insured vehicle by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. Anhou also sells standard third party liability insurance policies, which cover bodily injury and property damage caused by an accident involving an insured vehicle to a person not in the insured vehicle. The riders Anhou distributes cover additional losses, such as liability to passengers, losses arising from vehicle theft and robbery, broken glass and vehicle body scratches. |

| · | Commercial Property Insurance. The commercial property insurance products Anhou distributes include basic, comprehensive and all risk policies. Basic commercial property insurance policies generally cover damages to the insured property caused by fire, explosion and thunder and lightning. Comprehensive commercial property insurance policies generally cover damages to the insured property caused by fire, explosion and certain natural disasters. All risk commercial property insurance policies cover all causes of damage to the insured property not specifically excluded from the policies. |

The property and casualty insurance products Anhou distributed in the fiscal year ending December 31, 2019 were primarily underwritten by, in alphabetical order, China Pacific (Group) Co., Ltd., Huatai P&C Insurance Co., Ltd., PICC Property and Casualty Co., Ltd., Ping An Insurance (Group) Company of China, Ltd., and Tianan Property Insurance Co., Ltd. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2019.

Strategic Alliance with AIATW

On June 10, 2013, AHFL entered into a Strategic Alliance Agreement (the “Alliance Agreement”) with AIA International Limited Taiwan Branch (“AIATW”), the purpose of which is to promote life insurance products provided by AIATW within Taiwan by insurance agency companies or insurance brokerage companies affiliated with AHFL or CUII. The original term of the Alliance Agreement was from June 1, 2013 to May 31, 2018. Pursuant to the terms of the Alliance Agreement, AIATW was required to pay AHFL an execution fee of $8,326,700 (NT$ 250,000,000) to be recorded as revenue upon fulfilling sales target over the next five years. As of September 23, 2013, AHFL received $8,326,700 (NT$250,000,000) from AIATW under the Alliance Agreement. Pursuant to the Alliance Agreement, AHFL was entitled to the payment of the execution fee, subject to certain terms and conditions therein, including the satisfaction of the performance targets and the threshold 13-month persistency ratio, which is an indicator of how long customers stay with their policies.

17

On September 30, 2014, AHFL entered into an Amendment to the Alliance Agreement (the “First Amendment to the Alliance Agreement”) with AIATW. Pursuant to the First Amendment to the Alliance Agreement, the expiration date of the Alliance Agreement was extended from May 31, 2018 to December 31, 2020. In addition, both AHFL and AIATW agreed to adjust certain terms and conditions set forth in the Alliance Agreement, including the downward adjustment of the performance targets as well as the mechanism and formula calculating the execution fee to be refunded, if any.

On January 6, 2016, AHFL entered into an Amendment No. 2 to the Alliance Agreement (the “Second Amendment to the Alliance Agreement”) with AIATW to further revise certain provisions in the Alliance Agreement and the previous amendment entered into by and between AHFL and AIATW.

Pursuant to the Second Amendment to the Alliance Agreement, the expiration date of the Alliance Agreement was extended from May 31, 2018 to December 31, 2021, and the effect of the Alliance Agreement during the period from October 1, 2014 to December 31, 2015 was suspended. In addition, both AHFL and AIATW agree to adjust certain terms and conditions set forth in the Alliance Agreement, among which are to: (i) expand the scope of services to be provided by AHFL to AIATW to include, without limitation, assessment and advice on suitability of cooperative partners, advice on product strategies suitable for promotion channel development, advice on promotion/sales channel improvement, advice on promotion channel marketing and strategic planning, and promotion channel talent training; and (ii) remove certain provisions related to performance milestones and refund of execution fees. On March 15, 2016, AHFL unilaterally issued a confirmation letter to AIATW (the “2016 Letter”), where it emphasized its commitment to achieve certain sales targets within a specific time frame and covenanted to refund a certain portion of execution fees calculated based on the formula therein upon failure to achieve such sales target, as applicable.

On June 14, 2017, AHFL entered into an Amendment No. 3 to the Alliance Agreement (the “Third Amendment to the Alliance Agreement) with AIATW to further revise certain provisions in the Alliance Agreement and the previous amendments to the Alliance Agreement entered into by and between AHFL and AIATW.

Pursuant to the Third Amendment to the Alliance Agreement, except for the first contract year (April 15, 2013 to September 30, 2014), the sales targets for the remaining contract term under the Alliance Agreement shall be changed by reference to (i) the amount of the value of new business (“VONB”) and (ii) the 13-month persistency ratio as set forth therein, provided that to the extent any underlying insurance contract is revoked, invalid or terminated and premiums is refunded to such policyholder, the amount of the related VONB shall be correspondingly reduced. Both AHFL and AIATW agreed to calculate the business promotion fees (equivalent to the “execution fee” referred above) to be returned in case of failure to achieve the sales targets or the fees to be increased in case of exceeding the sales targets, as the case may be, based on two formulas specified in the Third Amendment to the Alliance Agreement. The primary factor under formula one focuses on the annual and/or accumulated achievement rate(s), while the primary factor under formula two focuses on the 13-month persistency ratio(s), subject to terms and conditions therein. The expanded scope of services to be provided by AHFL to AIATW as set forth in Section 4 of the Second Amendment to the Alliance Agreement is removed under the Third Amendment to the Alliance Agreement as well.

On June 14, 2017, with AIATW's consent, the 2016 Letter was revoked in order to conform to the latest terms and conditions regarding the cooperation between AHFL and AIATW as set forth in the Third Amendment to the Alliance Agreement.

18

Online Business

In recent years, the online insurance business has experienced rapid growth. Many insurance companies, portal websites, and professional insurance intermediaries have begun launching its e-commerce platforms, providing real-time information to consumers and allowing consumers to directly complete transactions online. Law Broker began developing its online platform in 2016, and became the first brokerage company to receive formal approval from the Financial Supervisory Commission of Taiwan (“FSC”) to commence online business on May 9, 2016. The platform, SARAcares (website: https://www.saracares.com.tw), was launched on January 26, 2017. It offers a broad range of insurance products underwritten by multiple insurance companies, policy comparison features, and post-sale services that are backed by our online service staffs and nationwide sales network. As required by the relevant laws and regulations regarding e-commerce provided by the FSC, Law Broker has obtained the ISO 27001 certification of Information Security Management System (ISMS) and BS 10012 certification of Personal Information Management System since June 20, 2017. Our online business in Taiwan was still at a nascent stage with the majority of the sales still being completed by off-line agents as of the date of this annual report.

Unified Operating Platform

Law Broker has self-constructed a Unified Operating Platform, an information technology infrastructure that serves to enhance operational, sales processes, and administrative efficiency. Since Law Broker’s establishment in 1992, it has successfully implemented the following components of its operating platform across its branch offices in Taiwan through a hub center located in Taipei:

| · | A centralized client and insurance policy management and analysis system, which encompasses our life insurance unit and property and casualty insurance unit, that will better support business operations and facilitate risk control; |

| · | A centralized client relations management system, that manages and analyzes client interactions to drive sales growth; |

| · | An integrated administrative and information system, that increases the management efficiency among the subsidiaries, branches and sales departments; |

| · | A centralized and computerized accounting and financial management system, that improves the efficiency of commission distribution and enforcement; |

| · | A human resources management and performance tracking system; and |

| · | An e-training system to provide online trainings to sales professionals. |

19

The Unified Operating Platform has proved to be an efficient and streamlined operating system which has contributed to the successful expansion and growth of Law Broker into one of the leading insurance brokerage companies in Taiwan, with 35 sales and service outlets (including the headquarters) across Taiwan and 2,857 insurance sales professionals as of December 31, 2019. Law Broker, Uniwill Insurance Broker Co., Ltd. (“Uniwill Insurance Broker”) and Joint Insurance Broker Co., Ltd. (“Joint Insurance”) have a total of 51 sales and service outlets (including the headquarters) across Taiwan and 4,161 insurance sales professionals as of December 31, 2019.

In accordance with our growth strategy in China, Anhou has made significant effort to adapt the Unified Operating Platform utilized by Law Broker to better meet the operational need in China. Since September 2010, Anhou has successfully implemented the tailored operating platform across the PRC subsidiaries through a hub center located in Nantong, Jiangsu province. We expect that this tailored operating platform will make selling easier for sales agents in China, facilitate standardized business and financial management, enhance risk control and increase operational efficiency for the PRC subsidiaries.

Anhou has tailored and refined the platform on the basis of Law Broker’s well-developed operating platform in Taiwan and believes that it is difficult for our competitors in China, particularly new market entrants, to reproduce a similar platform without substantial financial resources, time and operating experience.

Because the various systems, policies and procedures under both of operating platforms utilized by Law Broker and Anhou can be rolled out quickly as we enter new regions or make acquisitions, we believe we can expand our distribution network rapidly and efficiently while maintaining the quality of our services.

Distribution and Service Network and Marketing

The Taiwan Segment had a total of 51 sales and service outlets (including the headquarters) across Taiwan as of December 31, 2019, among which, 17 were located in the northern region, 25 in the central region, 7 in the southern region and 2 in the eastern region. As of December 31, 2019, Law Broker, Uniwill Insurance Broker and Joint Insurance together had 250 administrative staff members.

20

The Taiwan Segment markets and sells life insurance products, property and casualty insurance products directly to the targeted customers through the sales professionals, who are independent contractors, not its employees.

Since Anhou’s establishment in 2003, it has devoted substantial resources in building up its distribution and service network in the PRC. Anhou has targeted its distribution and service network in provinces with most population in China, such as Henan, Jiangsu, Sichuan, Fujian, and Guangdong. As of December 31, 2019, Anhou had one insurance agency and one insurance brokerage firm, with 1,856 sales professionals and 100 administrative staff members operating across 37 cities within these five provinces.

Anhou markets and sells life insurance products, property and casualty insurance products directly to the targeted customers through the sales agents, who are independent contractors, not its employees.

Customers

Due to its extensive line of insurance products underwritten by the insurance companies in Taiwan, the Taiwan Segment managed to offer a variety of insurance products to customers of different ages or professions. Despite relatively healthy government-sponsored retirement and medical programs, more and more Taiwanese, especially those with stable financial means and desire for high-end retirement life, have been focusing on endowment and medical commercial insurance products, while the investment insurance products have been playing a less significant role since the economic downturn.

In addition, from time to time, the Taiwan Segment has been, either voluntarily or upon request of insurance companies, advising insurance companies or providing feedback on particular types of insurance products before they are put on the market. This interaction with insurance companies has not only enhanced the close cooperation between the Taiwan Segment and the insurance companies, but also gives it an edge in understanding the in-depth features of such insurance products for marketing and distribution purposes.

The Taiwan Segment sells automobile insurance and casualty insurance primarily to individual customers and liability insurance to institutional customers.

Anhou sells automobile insurance and individual accident insurance primarily to individual customers and commercial property insurance to institutional customers.

The revenues of Anhou are primarily generated from the sale of life insurance products and we expect the continuous growth in this sector, as more and more customers in China realized the insufficiency of the mandatory social insurance coverage and the necessity to supplement it with commercial insurance.

21

Insurance Company Partners

We are selective in terms of choosing insurance companies as our partners. We take into consideration a variety of factors, such as the reputation and integrity of the insurance company, the quality and competitiveness of insurance products offered, the prudence and health of the financial standing of the insurance company as well as the complexity and efficiency of claim adjustment and settlement. Both the Taiwan Segment and Anhou have formed strategic relationships with numerous insurance companies in Taiwan and China, respectively.

In the fiscal year ended December 31, 2019, the Taiwan Segment’s major insurance company partners in Taiwan, after aggregating the business conducted between the Taiwan Segment and the various local branches of the insurance companies, were AIA International Limited Taiwan Branch, Farglory Life Insurance Co., Ltd., Shin Kong Life Insurance Co., Ltd., Taiwan Life Insurance Co., Ltd. and TransGlobe Life Insurance Inc., arranged in alphabetical order. Among them, Taiwan Life Insurance Co., Ltd., Farglory Life Insurance Co., Ltd., and TransGlobe Life Insurance Inc., accounted for approximately 19.35%, 17.15%, and 13.96% of the Company’s total net revenues for the year ended December 31, 2019, respectively.

In the fiscal year ended December 31, 2019, Anhou’s major insurance company partners, after aggregating the business conducted between Anhou and the various local branches of the insurance companies were Aegon THTF Life Insurance Co., Ltd., AVIVA Life Insurance Co., Ltd., Evergrande Life Insurance Company Limited, Funde Sino Life Insurance Co., Ltd., Huaxia Insurance Co., Ltd., and Tianan Life Insurance Co., Ltd., arranged in alphabetical order. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2019.

Competition

A number of industry players are involved in the distribution of insurance products in Taiwan and PRC. We compete for customers on the basis of product offerings, customer services and reputation. Because we primarily distribute individual insurance products, our principal competitors include:

| · | Professional insurance intermediaries. Life insurance is our core business and has a strong regional feature. Through years of business development, we believe that we can compete effectively with other insurance intermediary companies as we have a longer operational history and over the years have assembled a strong and stable team of managers and sales professionals. With the implementation of our unified operating platform, we believe that we could strengthen our lead in our developed local regions and expand our operation to our newly selected areas. However, with increasing consolidation expected in the insurance intermediary sector in the coming years, we expect competition within this sector to intensify. |

| · | Insurance companies. The distribution of individual life insurance products in Taiwan and China historically has been dominated by insurance companies, which usually use both in-house sales force and exclusive sales agents to distribute their own products. We believe that we can compete effectively with insurance companies because we focus only on distribution and offer our customers a broad range of insurance products underwritten by multiple insurance companies. |

| · | Other business entities. In recent years, business entities that distribute insurance products as an ancillary business, primarily commercial banks and postal offices have been playing an increasingly important role in the distribution of insurance products, especially life insurance products. However, the insurance products distributed by these entities are usually confined to those related to their main lines of business, such as investment-related life insurance products. We believe that we can compete effectively with these business entities because we offer our customers a broader variety of products. |

22

Law Broker is one of the leading insurance brokerage firms in Taiwan. The Taiwan Segment had a total of 51 sales and service outlets (including the headquarters) across Taiwan as of December 31, 2019, among which, 17 were located in the northern region, 25 in the central region, 7 in the southern region and 2 in the eastern region. As of December 31, 2019, Law Broker, Uniwill Insurance Broker and Joint Insurance together had 250 administrative staff members. Other than insurance companies and commercial banks, the Taiwan Segment’s primary competitors are Taiwan insurance brokerage companies of relatively large size, such as Everpro Insurance Brokers Co., Ltd.

During the past 16 years, Anhou has expanded its business across 37 cities within Henan, Sichuan, Jiangsu, Fujian, and Guangdong provinces with 1,856 sales professionals and 100 administrative staff members. Based on the insurance products Anhou is offering and the geographic areas of its branch offices, Anhou’s primary competitors are small-sized and middle-sized insurance agency companies. Anhou is relatively larger in terms of the number of salesmen as well as the sales revenue comparing to those competing insurance agency companies.

Awards and Recognitions

Through years of operation, Law Broker has been recognized by various organizations and government entities for its best practices in the industry. Especially noteworthy is the “Taiwan Insurance Excellence Award”, the highest acclaim in the Taiwan insurance industry, co-sponsored by the Taiwan Insurance Institute, FSC and Taiwan Consumer Protection Committee.

| Year of Award | Award/Recognition |

| 2019 |

Eighth Taiwan Insurance Excellence Award Excellence in Talent Training Award–Gold Medal Excellence in Corporate Social Responsibility Award–Gold Medal Excellence in Digital Application Award–Silver Medal Excellence in Customer Service–Silver Medal

|

| 2017 | Seventh Taiwan Insurance Excellence Award Excellence in Talent Training Award–Gold Medal Excellence in Corporate Social Responsibility Award–Silver Medal Excellence in Digital Application Award–Silver Medal Excellence in Customer Service–Silver Medal |

| 2015 | Sixth Taiwan Insurance Excellence Award Excellence in Talent Training Award–Silver Medal Excellence in Customer Service–Silver Medal |

| 2013 | Fifth Taiwan Insurance Excellence Award Excellence in Digital Application Award–Gold Medal Excellence in Talent Training Award–Silver Medal Excellence in Customer Service–Silver Medal |

| 2011 | Fourth Taiwan Insurance Excellence Award Excellence in Talent Training Award Excellence in Customer Service |

23

Intellectual Property

To protect our intellectual property, we rely on a combination of trademark, copyright and trade secret laws as well as confidentiality agreements with our employees, sales agents, independent contractors and others.

Law Enterprise and Law Broker jointly own the following trademarks registered in Taiwan:

the Service Mark of Law Insurance Broker Co., Ltd. under the registration number 01462327, with a 10-year validity from June 16, 2011 to June 15, 2021;

the logo of Law Insurance Broker Co., Ltd. under the registration number 01604254, with a 10-year validity from October 16, 2013 to October 15, 2023;

the logo of Blue Magpie (藍鵲), under the registration number 01462329, with a 10-year validity from June 16, 2011 to June 15, 2021;

24

the logo of Law (錠嵂) under the registration number 01462328, with a 10-year validity from June 16, 2011 to June 15, 2021;

the logo of Law (錠嵂) under the registration number 01611772, with a 10-year validity from December 1, 2013 to November 30, 2023;

the logo of Bao Xian Tong and INS under the registration number 01580261 , with a 10-year validity from May 16, 2013 to May 15, 2023; and

the logo of Magpie Baby under the registration number 01518573 , with a 10-year validity from May 16, 2012 to May 15, 2022.

25

the logo of Magpie Baby 2.0 under the registration number 01763557, with a 10 year validity from April 1, 2016 to March 31, 2026; and

the logo of SARACARES under the registration number 01876419 , with a 10 year validity from October 16, 2017 to October 15, 2027

26

Law Broker has the following registered trademarks in Taiwan. All of the trademarks will be renewed for another 10-year before their respective expiry:

the logo of Blue Magpie Cycling Team Fleet, under the registration number 01340567, with a 10-year validity from December 1, 2018 to November 30, 2028;

the logo of Law Insurance Broker under the registration 01340565, with a 10-year validity from December 1, 2018 to November 30, 2028;

the logo of Law Blue Magpie under

the registration number 01340566, with a 10-year validity from December 1, 2018 to November 30, 2028;

the logo of Symbiosis, Co-cultivation Co-Prosperity and Law Blue Magpie Picture under the registration number 01317020, with a 10-year validity from July 1, 2018 to June 30, 2028;

27

the logo of Education Training Blue Magpie under the registration number 01313467, with a 10-year validity from June 1, 2018 to May 31, 2028;

the logo of Cartoon Blue Magpie under the registration number 01313464, with a 10-year validity from June 1, 2018 to May 31, 2028;

28

the logo of Little Blue Magpie under the registration number 01313468, with a 10-year validity from June 1, 2018 to May 31, 2028;

the logo of Triumph Blue Magpie under the registration number 01313465, with a 10-year validity from June 1, 2018 to May 31, 2028;

the logo of Blue Magpie Fleet Picture under the registration number 01310350 , with a 10-year validity from May 1, 2018 to April 30, 2028; and

29

the logo of Fighting Blue Magpie under the registration number 01313466, with a 10-year validity from June 1, 2018 to May 31, 2028.

Jiangsu Law has one registered trademark in China, the logo of Jiangsu Law:

30

Employees

As of December 31, 2019, Law Broker, Uniwill Insurance Broker and Joint Insurance together had 250 administrative staff members and Anhou has 100 full-time employees. Our employees are not represented by any collective bargaining agreement. We believe that we have good relations with our employees and we have never experienced a work stoppage.

Segments

The Company currently operates as three reporting segments. Revenues, net income and total assets can be found in Item 8 of Part II, “Financial Statements and Supplementary Data” of this Annual Report on Form 10-K.

Regulation

Taiwan Regulations of the Insurance Industry

The insurance industry in Taiwan is highly regulated. The FSC, is the regulatory authority responsible for the supervision of the insurance industry in Taiwan. Insurance activities undertaken within Taiwan are primarily governed by the Insurance Law and the related rules and regulations.

Taiwan Insurance Law

The current principal regulation governing insurance in Taiwan is the Insurance Law, most recently amended on January 16, 2019 by Legislative Yuan, which provided the basic framework for regulating the insurance industry.

The Taiwan Insurance Law defines several participants in the insurance industry, such as insurer, insurance agency, insurance brokerage and insurance adjustor. It established requirements for form of organization, and qualifications and procedures to establish an insurance organization as well as separation of property insurance and life insurance. The Taiwan Insurance Law distinguishes insurance between fire disaster, marine, land and air, liability, surety, and other casualty and property insurance on one hand, and life insurance, health insurance, casualty insurance and annuity on the other. Unless permitted by the FSC, insurance companies are not allowed to engage in both types of insurance businesses.

31

The insurers, insurance agencies, insurance brokerages and insurance adjustors must join the related industry associations, or they are prohibited from conducting business operation. An insurance agency company or broker company of certain sizes shall establish internal control and audit systems as well as business solicitation systems and procedures.

Taiwan FSC

The Taiwan FSC is in charge of the financial market and financial service industries, among the insurance industry and has the power to control the following items:

| 1. | Financial system and supervision policy. |

| 2. | The preparation, amendment and abolishment of financial laws and regulations. |

| 3. | Supervision and management of the financial institutions, including its establishment, revocation, abolishment, change, merger, dissolution, and business scope. |

| 4. | Development, supervision and management of financial market. |

| 5. | Inspection of financial institution. |

| 6. | Inspection on public listing company related to their securities market-related matters. |

| 7. | Foreign financial matters. |

| 8. | Protection of financial customers. |

| 9. | Dealing and penalizing the violation of related laws and regulations of finance. |

| 10. | Collection of and analysis on relevant statistic data related to financial supervision, management and inspection. |

| 11. | Other matters related to financial supervision, management and inspection. |

Regulation of Insurance Brokers and Brokerage Companies

The current principal regulation governing insurance brokers and brokerage companies is the Regulations Governing Insurance Brokers last amended on November 18, 2019 by Insurance Bureau of FSC (the “Broker Rule”). An insurance broker stipulated under the Insurance Law refers to a person who negotiates to conclude an insurance contract on behalf of the insured and charges fees from the insured. Depending on their focused insurance areas, i.e. property or life insurance, insurance brokers can be divided into property insurance brokers and life insurance brokers. No matter what insurance industry an insurance broker is engaged in, it must have one of the following qualifications: (1) have passed the insurance brokerage examination for professional and technical staff; (2) have passed the insurance brokerage qualification test; or (3) have obtained the insurance brokerage practitioner certificate and practiced the same business.

32

There are special requirements for Taiwan insurance brokerage companies, such as the name of an brokerage company must contain the words “insurance broker”; when an brokerage company applies to operate brokerage business, the minimum registered capital must be at least NT$5 million ($157,953) fully paid up in cash, according to which, insurance brokerage companies with business license obtained prior to the implementation of this latest Broker Rule shall adjust their registered capital within five years upon the its implementation.

The Practitioner Certificate

The insurance broker practitioner certificate is valid for five years, and must be renewed before expiration. In case a broker has the qualifications for both property insurance and life insurance, he may obtain both insurance brokerage practitioner certificates.

Education and Training

There are two types of education and training for an insurance broker, pre-vocational and on-the-job education and training. An insurance broker must attend pre-vocational education and training for at least 32 hours during the year prior to applying for practicing insurance broker business and on-the-job education and training for at least 16 hours with law courses for no less than 8 hours per year, commencing after one year from the issuance of this latest Broker Rule.

Management of Insurance Brokerages