Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - China United Insurance Service, Inc. | v461496_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China United Insurance Service, Inc. | v461496_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China United Insurance Service, Inc. | v461496_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China United Insurance Service, Inc. | v461496_ex31-1.htm |

| EX-21 - EXHIBIT 21 - China United Insurance Service, Inc. | v461496_ex21.htm |

| EX-10.94 - EXHIBIT 10.94 - China United Insurance Service, Inc. | v461496_ex10-94.htm |

| EX-10.93 - EXHIBIT 10.93 - China United Insurance Service, Inc. | v461496_ex10-93.htm |

| EX-10.92 - EXHIBIT 10.92 - China United Insurance Service, Inc. | v461496_ex10-92.htm |

| EX-10.91 - EXHIBIT 10.91 - China United Insurance Service, Inc. | v461496_ex10-91.htm |

| EX-10.90 - EXHIBIT 10.90 - China United Insurance Service, Inc. | v461496_ex10-90.htm |

| EX-10.89 - EXHIBIT 10.89 - China United Insurance Service, Inc. | v461496_ex10-89.htm |

| EX-10.88 - EXHIBIT 10.88 - China United Insurance Service, Inc. | v461496_ex10-88.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-54884

CHINA UNITED INSURANCE SERVICE, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation) |

30-0826400 (I.R.S Employer Identification No.) |

7F, No. 311 Section 3

Nan-King East Road

Taipei City, Taiwan

(Address of principal executive offices, with zip code)

+8862-87126958

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | None |

Securities registered under Section 12(g) of the Act:

| Title of each class | Common Stock, par value of $0.00001 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer | x | |

| Non-accelerated filer ¨ | Smaller reporting company | ¨ | |

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, as of the last business day of the registrant’s most recently completed second fiscal quarter was $244,457,153.

As of March 10, 2017, there were 29,452,669 shares of common stock issued and outstanding, and 1,000,000 preferred shares issued and outstanding.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward- looking statements. These risks and uncertainties include, but are not limited to, the factors described under Item 1 “Description of Business,” Item 1A “Risk Factors” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward- looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this annual report. You should read this annual report and the documents that we reference in this annual report, or that we filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

OTHER PERTINENT INFORMATION

References in this annual report to “we,” “us,” “our” and the “Company” and words of like import refer to China United Insurance Service, Inc., its subsidiaries and variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Republic of China.

Unless context indicates otherwise, reference to the “Company” in this annual report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries (defined below). Reference to “Anhou” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan and China using New Taiwanese Dollars (“NT$”), the currency of Taiwan, Hong Kong Dollars (“HK$”), the currency of Hong Kong, and RMB, the currency of China, respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this annual report, we refer to assets, obligations, commitments and liabilities in our financial statements in USD. These dollar references are based on the exchange rate of NT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of USD which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

| 3 |

Corporate History and Structure Overview

Our Company is a Delaware corporation organized on June 4, 2010 and was quoted on the OTCQB® Venture Market (“OTCQB”). We provide life insurance products and property and casualty insurance products to our customers. We operate our Taiwan business primarily through Law Insurance Broker Co., Ltd. (“Law Broker”) and our PRC business primarily through Law Anhou Insurance Agency Co., Ltd. (“Anhou”).

Law Broker

The history of our Company dates back to 1992, when Law Broker was established on October 9, 1992.

Law Enterprise Co., Ltd. (“Law Enterprise”), a company limited by shares and incorporated under the laws of Taiwan, holds (i) 100% interest in Law Broker, a company limited by shares and incorporated under the laws of Taiwan on October 9, 1992, (ii) 97.84% interest in Law Risk Management & Consultant Co., Ltd. (“Law Management”), a company limited by shares and incorporated under the laws of Taiwan on December 5, 1987, and (iii) 96% of Law Insurance Agent Co., Ltd., a company limited by shares and incorporated under the laws of Taiwan on June 3, 2000 (“Law Agent”, collectively with “Law Enterprise”, “Law Broker” and “Law Management”, the “Taiwan Subsidiaries”, each a “Taiwan Subsidiary”). As Law Management and Law Agent are not in active operation, they were dissolved on April 20, 2016 and April 12, 2016, respectively.

Acquisition of AHFL

Action Holdings Financial Limited (“AHFL”) was incorporated in British Virgin Islands with limited liability on April 30, 2012. AHFL holds 65.95% interest in Law Enterprise and certain of our other subsidiaries as more fully described below.

On August 24, 2012, an acquisition agreement (the “AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the AHFL Acquisition Agreement, our Company acquired 100% interest in AHFL and its subsidiaries in Taiwan and our Company agreed to pay NT$15.0 million ($500,815) on or prior to March 31, 2013 and NT$7.5 million ($250,095) subsequent to March 31, 2013 in cash in two installments. In addition, our Company agreed to (i) issue 8,000,000 shares of common stock of our Company to the shareholders of AHFL; (ii) issue 2,000,000 shares of common stock of our Company to certain employees of Law Broker; and (iii) create an employee stock option pool, consisting of available options, exercisable for up to 2,000,000 shares of common stock of our Company. Upon closing of the transaction, we acquired 100% interest in AHFL and its subsidiaries in Taiwan.

On March 14, 2013, an Amendment to the AHFL Acquisition Agreement (the “First Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the First Amendment to AHFL Acquisition Agreement, (i) the deadline for cash payment under the AHFL Acquisition Agreement was extended to March 31, 2015; and (ii) in lieu of the 2,000,000 employee stock option pool, our Company agreed to create an employee stock pool consisting of up to 4,000,000 shares of the common stock of our Company, among which 2,000,000 shares shall be solely granted to employees of Law Broker, and the remaining 2,000,000 shares shall be granted to employees of affiliated entities of our Company (including Law Broker employees).

| 4 |

On March 13, 2015, a second Amendment to the AHFL Acquisition Agreement (the “Second Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Second Amendment to AHFL Acquisition Agreement, the deadline for cash payment under the AHFL Acquisition Agreement was further extended to March 31, 2016.

On February 17, 2016, a third Amendment to the AHFL Acquisition Agreement (the “Third Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Third Amendment to AHFL Acquisition Agreement, on or prior to June 30, 2016, (i) our Company committed to complete the listing of our Company’s shares in a major capital market, where the net proceeds raised through such public offering financing shall be at least $10.0 million; (ii) our Company committed to distribute the cash payment in the amount of NT$22.5 million, on a pro rata basis, to the selling shareholders of AHFL and issue 5,000,000 common shares to its selected employees pursuant to its employee stock/option plan, and (iii) failure to timely complete either of the above-mentioned criteria shall be deemed as a material breach of our Company under Article 8 of the Acquisition Agreement, whereby the non-breaching party shall be entitled to terminate the Acquisition Agreement and unwind the Acquisition of AHFL by us and restore the status quo of our Company and the selling shareholders of AHFL as if the said acquisition had never happened.

On August 8, 2016, a fourth Amendment to the AHFL Acquisition Agreement (the “Fourth Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Fourth Amendment to AHFL Acquisition Agreement, (i) the Third Amendment to AHFL Acquisition Agreement was terminated with immediate effect on August 8, 2016, and (ii) our Company agreed to pay to the selling shareholders of AHFL NT$15.0 million on or prior to March 31, 2017 and NT$4.8 million on July 21, 2016. On July 21, 2016, our Company arranged for the payment of NT$4.8 million to the selling shareholders of AHFL.

On March 12, 2017, a fifth Amendment to the Acquisition Agreement (the “Fifth Amendment to AHFL Acquisition Agreement”) was entered into by and among our Company and the selling shareholders of AHFL named therein. Pursuant to the Fifth Amendment to AHFL Acquisition Agreement, our Company agreed to distribute the cash payment in the amount of NT$15 million to the selling shareholders of AHFL named therein on or prior to March 31, 2019.

Acquisition of GHFL

Genius Holdings Financial Limited (“GHFL”) is a wholly owned subsidiary of AHFL. On February 13, 2015, our Company, AHFL and Mr. Chwan Hau Li, being the selling shareholder of GHFL, entered into an acquisition agreement (the “GHFL Acquisition Agreement”). Pursuant to the GHFL Acquisition Agreement, our Company agreed to issue 352,166 fully paid and non-assessable shares of AHFL common stock (the “AHFL Shares”) together with a granted put option for 352,166 shares of common stock of our Company (the “Put Option”), in exchange for 704,333 shares of common stock of GHFL, being all of the issued and outstanding capital stock of GHFL. The Put Option may be exercised within six months of the closing date of the acquisition and the selling shareholder of GHFL would exchange the AHFL Shares as consideration for the exercise of the Put Option. Subsequent to the acquisition, GHFL became a wholly-owned subsidiary of our Company. GHFL holds 100% issued and outstanding shares of Genius Investment Consultant Co., Ltd. (“Taiwan Genius”), a company limited by shares and incorporated under the laws of Taiwan, which in turn holds approximately 15.64% issued and outstanding shares of Genius Insurance Broker Co., Ltd. (“Genius Broker”), a company limited by shares and incorporated under the laws of Taiwan. Both GHFL and Taiwan Genius have no substantive business operation other than the holding of shares of its subsidiary. Genius Broker is primarily engaged in broker business across Taiwan. Mr. Chwan Hau Li is the sole shareholder of GHFL and a director and shareholder of our Company. On March 31, 2015, Mr. Chwan Hau Li exercised the Put Option, pursuant to which, 352,166 shares of AHFL held by Mr. Chwan Hau Li were transferred back to our Company as the consideration for 352,166 shares of common stock of our Company, which were issued to Mr. Chwan Hau Li on April 29, 2015.

| 5 |

On February 17, 2016, our Company, AHFL and Mr. Chwan Hau Li entered into an Amendment 2 to the GHFL Acquisition Agreement (the “Second Amendment to GHFL Acquisition Agreement”), pursuant to which our Company agreed to complete the listing of our Company in a major capital market on or prior to February 28, 2016 where the net proceeds raised through such public offering financing shall be at least $10.0 million.

On August 8, 2016, our Company, AHFL and Mr. Chwan Hau Li entered into an Amendment 3 to the GHFL Acquisition Agreement (the “Third Amendment to GHFL Acquisition Agreement”), pursuant to which, the Second Amendment to GHFL Acquisition Agreement was terminated.

Anhou

On July 12, 2010, ZLI Holdings Limited (“CU Hong Kong”), a wholly owned subsidiary of our Company, was established in Hong Kong. On October 20, 2010, Zhengzhou Zhonglian Hengfu Consulting Co., Ltd., a wholly foreign owned enterprise (“CU WFOE”), a wholly owned subsidiary of CU Hong Kong, was established in Henan province of the PRC. On January 16, 2011, our Company issued 20,000,000 shares of common stock to several non-U.S. persons for their investment of $300,000 in CU WFOE. The issuance was made pursuant to an exemption from registration contained in Regulation S under the Securities Act of 1933, as amended.

Zhengzhou Anhou Insurance Agency Co., Ltd., the predecessor entity of Anhou, was founded in Henan province of the PRC on October 9, 2003. Due to PRC legal restrictions on foreign ownership and investment in the insurance agency businesses in China, particularly those based on qualifications as well as capital requirements of the investors. Able Capital Holding Co., Ltd., a company established with limited liability in Hong Kong, delegated four PRC individuals, namely Yanyan Wang, Zhaohui Chen, Weizhe Hou and Yong Zhang, to invest in Anhou on its behalf.

On September 26, 2013, Yanyan Wang, Zhaohui Chen, Jing Yue, Weizhe Hou, Yong Zhang, Li Chen (“Anhou New Investors”) and Shuqin Zhu, Qun Wei, Qunlei Fang and Yanxia Chen (“Anhou Original Shareholders”) agreed to increase the registered capital of Anhou to RMB50 million, among which, (i) Yanyan Wang agreed to invest RMB10 million, accounting for 20% of registered capital in Anhou, (ii) Zhaohui Chen agreed to invest RMB10 million, accounting for 20% of registered capital in Anhou, (iii) Jing Yue agreed to invest RMB7.5 million, accounting for 15% of registered capital in Anhou, (iv) Weizhe Hou agreed to invest RMB5 million, accounting for 10% of registered capital in Anhou, (v) Yong Zhang agreed to invest RMB4.5 million, accounting for 9% of registered capital in Anhou, and (vi) Li Chen agreed to invest RMB3 million, accounting for 6% of registered capital in Anhou, respectively.

The registered capital increase of Anhou was in response to the promulgations of certain regulations by the China Insurance Regulatory Commission (“CIRC”). On April 27, 2013, CIRC issued the Decision on Revising the Provisions of the Supervision and Administration of Specialized Insurance Agencies (the “Decision on Revising the Agency Provisions”), pursuant to which, CIRC mandated any insurance agency established subsequent to the Decision on Revising the Agency Provisions to meet a minimum registered capital requirement of RMB50 million. On May 16, 2013, CIRC issued Notice for Further Clarification on Related Issues of Access to Professional Insurance Intermediary Market (the “2013 Notice”), pursuant to which, professional insurance agencies established prior to the issuance of the Decision on Revising the Agency Provisions, with registered capital less than RMB50 million, can continue operation of their existing business within the provinces where they have the registered office or branch office, but shall not set up any new branches in any province where they do not have the registered office or any branch office. To better implement the expansion strategies of our Company, Anhou increased its registered capital to RMB50 million to meet the requirement of CIRC so that it is able set up new branches in any province beyond its current operations in the PRC.

| 6 |

On October 24, 2013, Anhou Original Shareholders transferred their interests in Anhou to Changrong Hu, a PRC citizen (“Mr. Hu,” together with Anhou New Investors, “Anhou Existing Shareholders”), for an aggregate consideration of RMB10 million. Mr. Hu is currently the legal representative, General Manager and the sole director of Anhou.

On November 17, 2016, Li Chen transferred his interests in Anhou to Chunyan Lu for an aggregate consideration of RMB3 million.

Sichuan Kangzhuang Insurance Agency Co., Ltd. (“Sichuan Kangzhuang”), a wholly owned subsidiary of Anhou, was established with limited liability on September 4, 2006 in Sichuan province of the PRC. On September 6, 2010, shareholders of Sichuan Kangzhuang transferred their interest in Sichuan Kangzhuang to Anhou for an aggregate consideration of RMB532,622.

Jiangsu Law Insurance Brokers Co., Ltd. (“Jiangsu Law”), a wholly owned subsidiary of Anhou, was established with limited liability on September 19, 2005 in Jiangsu province of the PRC. Jiangsu Law is allowed to provide insurance brokerage services. On September 28, 2010, Anhou and the shareholders of Jiangsu Law entered into an equity transfer agreements. Pursuant to Provisions on the Supervision and Administration of Insurance Brokerage Institution, effective on October 1, 2009, if an insurance brokerage entity fails to bring its registered capital to no less than RMB10,000,000 on or prior to October 1, 2012, the CIRC or its local counterpart, as applicable, may determine not to extend the insurance brokerage license. To meet such minimum registered capital requirement, on February 11, 2011, Anhou invested RMB4.82 million in Jiangsu Law to increase the registered capital to RMB10 million.

Our Consolidated Affiliated Entities

Due to PRC legal restrictions on foreign ownership and investment in insurance agency and brokerage businesses in China, especially those on qualifications as well as capital requirement of the investors, we operate our PRC business primarily through Anhou, Sichuan Kangzhuang and Jiangsu Law (collectively, the “Consolidated Affiliated Entities”, each a “Consolidated Affiliated Entity”). We do not hold equity interests in our Consolidated Affiliated Entities. However, through the VIE Agreements (defined below), we effectively control, and are able to derive substantial economic benefits from, these Consolidated Affiliated Entities. On January 19, 2015, the Ministry of Commerce of China (“MOFCOM”) published a draft version of a proposed Foreign Investment Law (the “Draft Foreign Investment Law”) with an explanatory note. MOFCOM has requested comments from the public on the Draft Foreign Investment Law by February 17, 2015, which, once promulgated, will replace and integrate the three existing laws over foreign investment, however, how these changes will affect entities currently operating in China, particularly foreign controlled variable interest entities, is not entirely clear. See “Risks Related to Our Corporate Structure in the PRC”.

Our Consolidated Affiliated Entities in China are variable interest entities through which all of our insurance services in China are operated. It is through the VIE Agreements that gives us effective control over our Consolidated Affiliated Entities in China and allows us to consolidate the financial results of our Consolidated Affiliated Entities in our financial statements.

On January 17, 2011, CU WFOE, Anhou and Anhou Original Shareholders entered into a series of agreements (the “Old VIE Agreements”) pursuant to which CU WFOE exercises effective control over Anhou. As a result of the capital increase and the share transfer described above, on October 24, 2013, CU WFOE, Anhou and Anhou Existing Shareholders entered into a series of agreements (the “VIE Agreements”), including Power of Attorneys, Exclusive Option Agreements, Share Pledge Agreements, in the same form as the previous Old VIE Agreements, other than the change of shareholder names and their respective shareholdings. The Old VIE Agreements were terminated by and among CU WFOE, Anhou and Anhou Original Shareholders on the same date, except that the Exclusive Business Cooperation Agreement executed by and between CU WFOE and Anhou on January 17, 2011 remains in full effect. The VIE Agreements now in effect include:

| 7 |

| 1. | An exclusive Business Cooperation Agreement, pursuant to which CU WFOE is appointed as the exclusive services provider to Anhou of complete technical support, business support and related consulting services in exchange for 90% of the net profits of Anhou. The Exclusive Business Cooperation Agreement was effective on January 17, 2011 with a term of ten years subject to extension at the discretion of CU WFOE. CU WFOE may terminate the agreement at any time with 30 days’ written notice but Anhou may only terminate the agreement if CU WFOE commits gross negligence or a fraudulent act against Anhou; |

| 2. | a Power of Attorney, pursuant to which the shareholders of Anhou have vested their collective voting control in Anhou to CU WFOE; |

| 3. | an Option Agreement, pursuant to which the shareholders of Anhou granted to CU WFOE the irrevocable right and option to acquire all of their equity interests in Anhou. The Option Agreement was effective on October 24, 2013 with a term of ten years subject to renewal at CU WFOE’s election; and |

| 4. | a Share Pledge Agreement, pursuant to which the shareholders of Anhou have pledged all of their equity interests in Anhou to CU WFOE to guarantee Anhou’s performance of its obligations under the Exclusive Business Cooperation Agreement. |

Please refer to “Item 13. Certain Relationships and Related Transactions, and Director Independence” for further information on the VIE Agreements.

PFAL

Prime Financial Asia Ltd. (“PFAL”) is a re-insurance broker company incorporated in Hong Kong. On April 23, 2014, AHFL and Chun Kwok Wong (“Mr. Wong”) entered into a Capital Increase Agreement, pursuant to which Mr. Wong agreed to increase PFAL’s registered capital from HK$500,000 to HK$1,470,000 and AHFL agreed to contribute HK$1,530,000 to PFAL’s registered capital. Upon the completion of capital increase on April 30, 2014, Mr. Wong and AHFL own 49% and 51% of PFAL’s equity interest, respectively.

On August 7, 2015, Max Key Investment Ltd. (“MKI”) was incorporated with limited liability in the British Virgin Islands. On August 15, 2015, Prime Management Consulting (Nanjing) Co., Ltd. (“PTC Nanjing”) was incorporated with limited liability in Nanjing province of the PRC. On September 3, 2015, Prime Asia Corporation Limited. (“PTC Taiwan”), a company limited by shares, was incorporated in Taiwan. Each of MKI, PTC Nanjing and PTC Taiwan is a wholly owned subsidiary of PFAL.

| 8 |

As a holding company with no business other than holding equity interest of our operating subsidiary, CU WFOE in China and Law Broker in Taiwan, we rely principally on dividends to be paid by CU WFOE in China and Law Broker in Taiwan. CU WFOE, being the exclusive service provider to Anhou, relies on the service fees to which it is entitled from Anhou. Pursuant to the Exclusive Cooperation Agreement between CU WFOE and Anhou, CU WFOE has the right to collect 90% of the net profits of Anhou. As Anhou is still operating at a loss, Anhou has not paid any service fees to CU WFOE yet and CU WFOE has not paid any dividend to us to date. We expect Anhou to make a profit beginning in the fiscal year ending December 31, 2017, when it should start to pay service fees to CU WFOE, although there can be no assurance that Anhou will become profitable by that time or ever. Our capability to receive dividends from CU WFOE, convert them into USD and make the repatriation out of China is subject to the applicable PRC restrictions on the payment of dividends by PRC companies, laws and regulations on foreign exchange and restrictions on foreign investment. For the year ended December 31, 2014, 93.55% and 6.45% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries and Consolidated Affiliated Entities, respectively. For the year ended December 31, 2015, 88.45%, 10.71% and 0.84% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries, Consolidated Affiliated Entities and PFAL, respectively. For the year ended December 31, 2016, 87.52%, 12.10% and 0.38% of our revenues in our consolidated financial statements were derived from our Taiwan Subsidiaries, Consolidated Affiliated Entities and PFAL, respectively.

Reclassification of Shares

On January 28, 2011, our Company increased the number of authorized shares from 30,000,000 shares of common stock to 100,000,000 shares of common stock and 10,000,000 shares of preferred stock. On July 2, 2012, our board of directors and stockholders approved, in connection with a reclassification of 1,000,000 issued and outstanding shares of common stock (the “Reclassified Shares”), par value $0.00001 per share held by Mr. Yi Hsiao Mao (“Mr. Mao”) into 1,000,000 shares of Series A Convertible Preferred Stock, par value $0.00001 per share (the “Series A Preferred Stock”) on a share-for-share basis (the “Reclassification”), the issuance of 1,000,000 shares of Series A Preferred Stock to Mr. Mao and cancellation of 1,000,000 common stock held and submitted by Mr. Mao pursuant to the Reclassification. All of the 1,000,000 shares of Series A Preferred Stock are reclassified from the 1,000,000 common stock held by Mr. Mao and no additional consideration has been paid by Mr. Mao in connection with the Reclassification. Each holder of common stock shall be entitled to one vote for each share of common stock held of record by such holder as of the applicable record date on any matter that is submitted to a vote of the stockholders of our Company; while each holder of Series A Preferred Stock shall be entitled to ten votes for each share of Series A Preferred Stock held of record by such holder as of the applicable record date on any matter that is submitted to a vote of the stockholders of our Company.

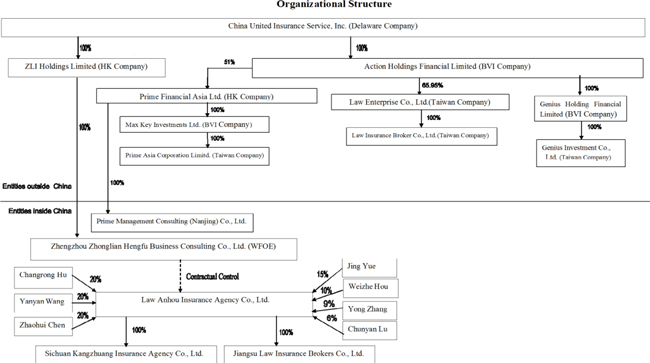

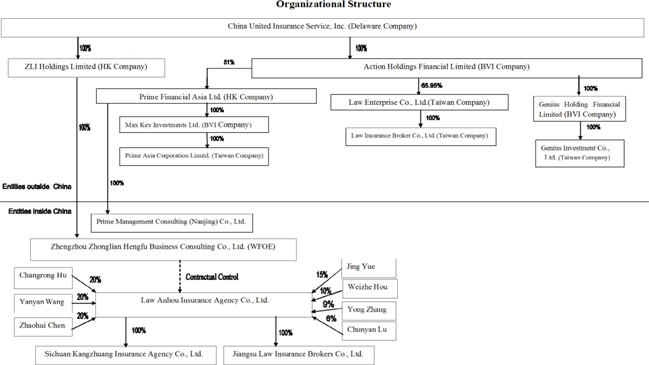

The following flow chart illustrates our Company’s organizational structure as of March 10, 2017:

| 9 |

Products and Services

Law Broker and Anhou market and sell to customers two broad categories of insurance products: life insurance products and property and casualty insurance products, both focused on meeting the particular insurance needs of individuals. The insurance products that Law Broker and Anhou sell are underwritten by some of the leading insurance companies in Taiwan and China, respectively.

Through Anhou’s wholly-owned insurance brokerage firm Jiangsu Law, it also closely interacts with insurance companies and actively locates and introduces the right customers in Anhou’s database matching the insurance products offered by such insurance companies to them.

Life Insurance Products

The life insurance products Law Broker distributes can be broadly classified into the categories set forth below. Due to constant product innovation by insurance companies, some of the insurance products Law Broker distributes combine features of one or more of the categories listed below. Total net revenues from life insurance products distributed by Law Broker is $57.8 million, accounted for approximately 94.60% of Law Broker’s total net revenues and 88.63% of our total net revenues of life insurance products for the fiscal year ended December 31, 2016, respectively.

| · | Individual Whole Life Insurance. The individual whole life insurance products Law Broker distributes provide insurance for the insured person’s entire life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated interest is paid upon the death of the insured. |

| · | Individual Term Life Insurance. The individual term life insurance products Law Broker distributes provide insurance for the insured for a specified time period or until the attainment of a certain age, in return for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years. Term life insurance policies generally expire without value if the insured survives the coverage period. |

| · | Individual Health Insurance. The individual health insurance products Law Broker distributes pay the insured amount of reasonable hospitalization cost, or certain death benefit in case of the death of the insured, due to sickness, accident or childbirth. Individual health insurance policies expire when the premium is not paid or a certain age is attained. |

| · | Casualty Insurance. Accidental Injury Insurance is the kind of life insurance that insurance benefit is given when the insured is dead or disabled because of accidental injury, which is unforeseen by the injured or against his will. Casualty insurance policies expire when the premium is not paid or a certain age is attained. |

| · | Investment-oriented Insurance. Investment-oriented insurance products are the market linked insurance plan which also provide life coverage. The premium amount (after deduction of certain charges) is invested into different funds. The performance of the fund will depend on the market. A growing upward trend in market will increase the fund value. Every investment-oriented insurance policy has market risk exposure depending on the fund invested and such investment risk is solely borne by the policyholder. Depending on the death benefit, investment-oriented insurance policies are categorized into two broad categories: (1) the death benefit is equal to the higher of insured amount or fund value; (2) the death benefit is equal to the insured amount plus fund value. |

| 10 |

| · | Foreign Currency Policy Commodity. It is a life insurance policy in which a policy benefit shall all be paid in foreign currencies. The foreign currency policy provides insurance for the insured person’s life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from six to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated interest, is paid upon the death of the insured. |

| · | Travel Accident Insurance. It is a kind of casualty insurance. The travel accident insurance provides monetary compensation in case the insured dies or loses a limb in an accident while he or she is traveling. The premium is based on the days of traveling and the insured amount. |

The life insurance products Law Broker distributed in the fiscal year ending December 31, 2016 were primarily underwritten by, in alphabetical order, AIA International Limited, Taiwan Branch, Farglory Life Insurance Co., Ltd., Fubon Life Insurance Co., Ltd., Taiwan Life Insurance Co., Ltd. and TransGlobe Life Insurance IncTaiwan. Among them, Farglory Life Insurance Co., Ltd., Taiwan Life Insurance Co., Ltd., and Fubon Life Insurance Co., Ltd. accounted for 33.87%, 11.98%, and 10.24% of our total net revenues in the fiscal year ending December 31, 2016, respectively.

The life insurance products Anhou distributes can be broadly classified into the categories set forth below. Due to constant product innovation by insurance companies, some of the insurance products Anhou distributes combine features of one or more of the categories listed below. Total net revenues from life insurance products is approximately $7.4 million, accounted for 87.67% of Anhou’s total net revenues and approximately 11.37% of our total net revenues of life insurance products for the fiscal year ending December 31, 2016, respectively.

| · | Individual Whole Life Insurance. The individual whole life insurance products Anhou distributes provide insurance for the insured person’s entire life in exchange for the periodic payment of fixed premiums over a pre-determined period, generally ranging from five to 20 years, or until the insured reaches a certain age. The face amount of the policy or, for some policies, the face amount plus accumulated interest is paid upon the death of the insured. |

| · | Individual Term Life Insurance. The individual term life insurance products Anhou distributes provide insurance for the insured for a specified time period or until the attainment of a certain age, in return for the periodic payment of fixed premiums over a pre-determined period, generally ranging from five to 20 years. Term life insurance policies generally expire without value if the insured survives the coverage period. |

| · | Individual Endowment Life Insurance. The individual endowment products Anhou distributes generally provide maturity benefits if the insured reaches a specified age, and provide to a beneficiary designated by the insured guaranteed benefits upon the death of the insured within the coverage period. In return, the insured makes periodic payment of premiums over a pre-determined period, generally ranging from five to 25 years. |

| · | Individual Education Annuity. The individual annuity products Anhou distributes are primarily education related products. They provide annual benefit payments after the insured attains a certain age, e.g., 18, for a fixed time period, or e.g., four years, and a lump payment at the end of the coverage period. In addition, the beneficiary designated in the annuity contract will receive guaranteed benefits upon the death of the insured during the coverage period. In return, the purchaser of the annuity products makes periodic payment of premiums during a pre-determined accumulation period. |

| · | Individual Health Insurance. The individual health insurance products Anhou distributes primarily consist of dreaded disease insurance products, which provide guaranteed benefits for specified dreaded diseases during the coverage period. In return, the insured makes periodic payment of premiums over a pre-determined period. |

| 11 |

The life insurance products Anhou distributed in the fiscal year ending December 31, 2016 were primarily underwritten by, in alphabetical order, Aegon THTF Life Insurance Co., Ltd., AVIVA Life Insurance Co., Ltd., Funde Sino Life Insurance Co., Ltd., Huaxia Insurance Co., Ltd., and Taikang Life Insurance Company. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2016.

In addition to the periodic premium payment schedules described above, most of the individual life insurance products we distribute also allow the insured to choose to make a single, lump-sum premium payment at the beginning of the policy term. If a periodic payment schedule is adopted by the insured, a life insurance policy can generate periodic payment of fixed premiums to the insurance company for a specified period of time. This means that once Anhou or Law Broker sells a life insurance policy with a periodic premium payment schedule, they will be able to derive commission and fee income from that policy for an extended period of time, sometimes up to 25 years. Because of this feature and the expected sustained growth of life insurance sales in China and Taiwan, we have focused significant resources ever since the incorporation of Anhou and Law Broker on developing our capability to distribute individual life insurance products with periodic payment schedules. We expect that sales of life insurance products will continuously be our primary source of revenue in the next several years.

Property and Casualty Insurance Products

Law Broker’s main property and casualty insurance products are automobile insurance, casualty insurance and liability insurance. Law Broker commenced sale of automobile insurance, casualty insurance and liability insurance business in August 2003. Total net revenues from property and casualty insurance products is $3.3 million, accounted for approximately 5.40% of Law Broker’s total net revenues and 75.99% of our total net revenues of property and casualty insurance products in the fiscal year ending December 31, 2016, respectively.

The property and casualty insurance products Law Broker distributes can be further classified into the following categories:

| · | Automobile Insurance. Law Broker distributes both standard automobile insurance policies and supplemental policies, which we refer to as riders. The standard automobile insurance policies Law Broker sells generally have a term of one year and cover damages caused to the insured vehicle by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. Law Broker also sells standard third party liability insurance policies, which cover bodily injury and property damage caused by an accident involving an insured vehicle to a person not in the insured vehicle. The riders Law Broker distributes cover additional losses, such as liability to passengers, losses arising from vehicle theft and robbery, broken glass and vehicle body scratches. |

| · | Casualty Insurance. Casualty insurance is made to insure any loss or damage to property. This is designed to cover loss that is made by direct accident. The policy period is usually one year. The premium is based on the insured amount. |

| · | Liability Insurance. When the insured is legally obligated to indemnify a third party and subject to a claim in connection therewith, the liability insurer is liable to provide such indemnification on behalf of the insured. The policy period is usually one year. The premium is based on the insured amount. |

| 12 |

The property and casualty insurance products Law Broker distributed in the fiscal year ending December 31, 2016 were primarily underwritten by, in alphabetical order, Fubon Insurance Co., Ltd., South China Insurance Co., Ltd., Taian Insurance Co., Ltd., Union Insurance Company, and Zurich Insurance Company.

Anhou’s main property and casualty insurance products are automobile insurance and commercial property insurance. Anhou commenced its sale of commercial property insurance in 2009 and had developed its automobile insurance business since 2010. Total net revenues from property and casualty insurance products distributed by Anhous is $1.0 million, accounted for approximately 12.33% of Anhou’s total net revenues and 24.01% of our total net revenues of property and casualty insurance products for the fiscal year ending December 31, 2016.

The property and casualty insurance products Anhou distributes can be further classified into the following categories:

| · | Automobile Insurance. Automobile insurance is the largest segment of property and casualty insurance in the PRC in terms of gross written premiums. Anhou distributes both standard automobile insurance policies and supplemental policies, which we refer to as riders. The standard automobile insurance policies Anhou sells generally have a term of one year and cover damages caused to the insured vehicle by collision and other traffic accidents, falling or flying objects, fire, explosion and natural disasters. Anhou also sells standard third party liability insurance policies, which cover bodily injury and property damage caused by an accident involving an insured vehicle to a person not in the insured vehicle. The riders Anhou distributes cover additional losses, such as liability to passengers, losses arising from vehicle theft and robbery, broken glass and vehicle body scratches. |

| · | Commercial Property Insurance. The commercial property insurance products Anhou distributes include basic, comprehensive and all risk policies. Basic commercial property insurance policies generally cover damage to the insured property caused by fire, explosion and thunder and lightning. Comprehensive commercial property insurance policies generally cover damage to the insured property caused by fire, explosion and certain natural disasters. All risk commercial property insurance policies cover all causes of damage to the insured property not specifically excluded from the policies. |

The property and casualty insurance products Anhou distributed in the fiscal year ending December 31, 2016 were primarily underwritten by, in alphabetical order, Cathay Insurance Co., Ltd., China Pacific (Group) Co., Ltd., Fubon Property& Casualty Insurance Co., Ltd., Huatai P&C Insurance Co., Ltd., and PICC Property and Casualty Co., Ltd.

Strategic Alliance with AIATW

On June 10, 2013, AHFL entered into a Strategic Alliance Agreement (the “Alliance Agreement”) with AIA International Limited Taiwan Branch (“AIATW”). The purpose of the Alliance Agreement is to promote life insurance products provided by AIATW within the territory of Taiwan by insurance agency companies or insurance brokerage companies affiliated with AHFL or CUIS. The term of the Alliance Agreement is from April 15, 2013 to August 31, 2018. Pursuant to the terms of the Alliance Agreement, AIATW shall pay AHFL an execution fee of $8,326,700 (NT$ 250,000,000). The fee will be recorded as revenue upon fulfilling sales target over the next five years. As of September 23, 2013, AHFL has received $8,326,700 (NT$250,000,000) from AIATW under the Alliance Agreement. Pursuant to the Alliance Agreement, AHFL is entitled to the payment of the execution fee, subject to certain terms and conditions therein, including the satisfaction of the performance targets and the threshold 13-month persistency ratio. The execution fee may be required to be recalculated if certain performance targets are not met by AHFL.

| 13 |

On September 30, 2014, AHFL entered into an Amendment to Strategic Alliance Agreement (the “First Amendment to Alliance Agreement”) with AIATW. Pursuant to the First Amendment to Alliance Agreement, the expiration date of the Alliance Agreement has been extended from May 31, 2018 to December 31, 2020. In addition, both AHFL and AIATW agree to adjust certain terms and conditions set forth in the Strategic Alliance Agreement, including the downward adjustment of the performance targets as well as the mechanism and formula calculating the execution fee to be refunded, if any.

On January 6, 2016, AHFL entered into an Amendment 2 to Strategic Alliance Agreement (the “Second Amendment to Alliance Agreement”) with AIATW to further revise certain provisions in the Alliance Agreement and the previous amendment entered into by and between AHFL and AIATW.

Pursuant to the Second Amendment to Alliance Agreement, the expiration date of the Alliance Agreement was extended from May 31, 2018 to December 31, 2021, and the effect of the Alliance Agreement during the period from October 1, 2014 to December 31, 2015 has been suspended. In addition, both AHFL and AIATW agree to adjust certain terms and conditions set forth in the Alliance Agreement, among which: (i) expand the scope of services to be provided by AHFL to AIATW to include, without limitation, assessment and advice on suitability of cooperative partners, advice on product strategies suitable for promotion channel development, advice on promotion/sales channel improvement, advice on promotion channel marketing and strategic planning, and promotion channel talent training; and (ii) remove certain provisions related to performance milestones and refund of execution fees. On March 15, 2016, AHFL unilaterally issued a confirmation letter to AIATW, where it emphasized its commitment to achieve certain sales targets within a specific time frame and covenanted to refund a certain portion of execution fees calculated based on the formula therein upon failure to achieve such sales target, as applicable.

Unified Operating Platform

Law Broker has its own self-developed Unified Operating Platform. Since Law Broker’s establishment in 1992, it has successfully implemented the following components of its operating platform across its branch offices in Taiwan through a hub center located in Taipei:

| · | A centralized client and insurance policy management and analysis system, which encompasses our life insurance unit and property and casualty insurance unit, that will better support business operations and facilitate risk control; |

| · | An integrated administrative and information system, that increases the management efficiency among the subsidiaries, branches and sales departments; |

| · | A centralized and computerized accounting and financial management system, that increases the commission distribution and enforcement; |

| · | A human resources management and analysis system; and |

| · | An e-learning system to provide online training to sales professionals. |

Through years of operation, the Unified Operating Platform has proved to be an efficient and streamlined operating system which has contribute to the successful expansion and growth of Law Broker into one of the leading insurance brokerage companies in Taiwan, with 30 sales and service outlets (including the headquarters) across Taiwan and 2,523 employees and insurance sales professionals as of December 31, 2016.

| 14 |

In accordance with our growth strategy in China, Anhou has made significant effort to adapt the Unified Operating Platform utilized by Law Broker to better meet the operational need in China. Since September 2010, Anhou has successfully implemented the tailored operating platform across the PRC subsidiaries through a hub center located in Nantong, Jiangsu province. We expect that this tailored operating platform will make selling easier for sales agents in China, facilitate standardized business and financial management, enhance risk control and increase operational efficiency for the PRC subsidiaries.

Anhou has tailored and refined the platform on the basis of Law Broker’s well-developed operating platform in Taiwan and believes that it is difficult for our competitors in China, particularly new market entrants, to reproduce a similar platform without substantial financial resources, time and operating experience.

Because the various systems, policies and procedures under both of operating platforms utilized by Law Broker and Anhou can be rolled out quickly as we enter new regions or make acquisitions, we believe we can expand our distribution network rapidly and efficiently while maintaining the quality of our services.

Distribution and Service Network and Marketing

Since Law Broker’s establishment in 1992, it has devoted substantial resources to building up its distribution and service network. Law Broker currently has 30 sales and service outlets spread across Taiwan (including the headquarters), among which, nine are located in the northern region, 13 are located in the central region, five are located in the southern region and two are located in the eastern region. As of December 31, 2016, Law Broker had 2,346 sales professionals and 177 administrative staff members.

The following table sets forth some additional information of Law Broker’s distribution and service network by region as of December 31, 2016:

| Region | Number of Sales and Service Outlets | Number of Sales Professionals | ||

| Northern region (including the headquarters) | 10 | 608 | ||

| Southern region | 5 | 518 | ||

| Central region | 13 | 1,167 | ||

| Eastern region | 2 | 53 | ||

| Total | 30 | 2,346 |

Law Broker markets and sells life insurance products, property and casualty insurance products directly to the targeted customers through the sales professionals, who are not its employees.

Since Anhou’s establishment in 2003, it has devoted substantial resources in building up its distribution and service network. Anhou has targeted its distribution and service network in provinces with most population in China, such as Henan, Jiangsu, Sichuan, Fujian, Guangdong, Yunnan. As of December 31, 2016, Anhou has two insurance agencies and one insurance brokerage firm, with 2,557 sales professionals and 111 administrative staff members operating across 45 cities within these six provinces.

| 15 |

The following table sets forth some additional information of Anhou’s distribution and service network by province as of December 31, 2016:

| Province | Number of Sales and Service Outlets | Number of Sales Agents | ||

| Henan | 38 | 1,732 | ||

| Sichuan | 6 | 444 | ||

| Jiangsu | 1 | 365 | ||

| Fujian | 1 | - | ||

| Guangdong | 1 | 16 | ||

| Yunnan | 1 | - | ||

| Total | 49 | 2,557 |

Anhou markets and sells life insurance products, property and casualty insurance products directly to the targeted customers through the sales agents, who are not its employees.

Customers

As of December 31, 2016, Law Broker had approximately 501,727 customers, among which approximately 82.4% purchased life insurance products and approximately 17.6% purchased property and casualty insurance products from Law Broker.

Due to its extensive line of insurance products underwritten by the insurance companies in Taiwan, Law Broker managed to offer a variety of insurance products to customers of different ages or professions. However, as an aging population in Taiwan has gradually become a more recognized social issue, despite relatively healthy government-sponsored retirement and medical programs, more and more Taiwanese, especially those with stable financial means and aiming for high-end retirement and medical treatment, have been focusing on endowment and medical type of commercial insurance products, while the investment type of insurance products have been playing a less significant role since the economic downturn.

In addition, from time to time, Law Broker has been, either voluntarily or upon request of insurance companies, advising insurance companies or providing feedback on particular types of insurance products before they are put on the market. This interaction with insurance companies has not only enhanced the close cooperation between Law Broker and the insurance companies, but also gives it an edge in understanding the in-depth features of such insurance products for marketing and distribution purposes.

Law Broker sells automobile insurance and casualty insurance primarily to individual customers. Law Broker sells liability insurance to institutional customers.

As of December 31, 2016, Anhou had 37,421 customers, among which 99% purchased life insurance products and 1% purchased property and casualty insurance products from Anhou.

Anhou sells automobile insurance and individual accident insurance primarily to individual customers. Anhou sells commercial property insurance to institutional customers.

The revenues of Anhou are primarily generated from the sale of life insurance products and we expect the continuous growth in this regard, as more and more customers in China realized the insufficiency of the mandatory social insurance coverage and the necessity to supplement it with commercial insurance.

| 16 |

Insurance Company Partners

We are selective in terms of choosing insurance companies as our partners. We take into consideration a variety of factors, such as the reputation and integrity of the insurance company, the quality and competitiveness of insurance products offered, the prudence and health of the financial standing of the insurance company as well as the complexity and efficiency of claim adjustment and settlement. During years of operation, both Law Broker and Anhou have formed strategic relationships with numerous insurance companies in Taiwan and China, respectively, as of December 31, 2016, Law Broker had established business relationships with 21 insurance companies in Taiwan and Anhou had established business relationships with 26 insurance companies in China.

In the fiscal year ended December 31, 2016, Law Broker’s major insurance company partners, after aggregating the business conducted between Law Broker and the various local branches of the insurance companies were AIATW, Farglory Life Insurance Co., Ltd., Fubon Life Insurance Co., Ltd., Shin Kong Life Insurance Co., Ltd., Taiwan Life Insurance Co., Ltd., and TransGlobal Life Insurance Co., Ltd, arranged in alphabetical order. Among them, Farglory Life Insurance Co., Ltd., Taiwan Life Insurance Co., Ltd. and Fubon Life Insurance Co., Ltd., accounted for 33.87%, 11.98% and 10.24% Taiwan of the Company’s total net revenues for the year ended December 31, 2016, respectively.

In the fiscal year ended December 31, 2016, Anhou’s major insurance company partners, after aggregating the business conducted between Anhou and the various local branches of the insurance companies were Aegon THTF Life Insurance Co., Ltd., AVIVA Life Insurance Co., Ltd., Funde Sino Life Insurance Co., Ltd., Huaxia Insurance Co., Ltd., and Taikang Life Insurance Co., Ltd., arranged in alphabetical order. None of these insurance company partners accounted for more than 10% of our total net revenues for the year ended December 31, 2016.

Competition

A number of industry players are involved in the distribution of insurance products in Taiwan and PRC. We compete for customers on the basis of product offerings, customer services and reputation. Because we primarily distribute individual insurance products, our principal competitors include:

| · | Professional insurance intermediaries. Life insurance is our core business and has a strong regional feature. Through years of business development, we believe that we can compete effectively with other insurance intermediary companies as we have a longer operational history and over the years have assembled a strong and stable team of managers and sales professionals. With the implementation of our unified operating platform, we believe that we could strengthen our lead in our developed local regions and expand our operation to our newly selected areas. However, with increasing consolidation expected in the insurance intermediary sector in the coming years, we expect competition within this sector to intensify. |

| · | Insurance companies. The distribution of individual life insurance products in Taiwan and China historically has been dominated by insurance companies, which usually use both in-house sales force and exclusive sales agents to distribute their own products. We believe that we can compete effectively with insurance companies because we focus only on distribution and offer our customers a broad range of insurance products underwritten by multiple insurance companies. |

| 17 |

| · | Other business entities. In recent years, business entities that distribute insurance products as an ancillary business, primarily commercial banks and postal offices have been playing an increasingly important role in the distribution of insurance products, especially life insurance products. However, the insurance products distributed by these entities are usually confined to those related to their main lines of business, such as investment-related life insurance products. We believe that we can compete effectively with these business entities because we offer our customers a broader variety of products. |

Law Broker is one of the leading insurance brokerage firms in Taiwan. During the past two decades, Law Broker has expanded its business across Taiwan, with 30 sales and service outlets (including the headquarters) and 2,346 sales professionals and 177 administrative staff members spread over the four regions of Taiwan as of December 31, 2016. Other than insurance companies and commercial banks, Law Broker’s primary competitors are Taiwan insurance brokerage companies of relatively large size, such as Everpro Insurance Brokers Co., Ltd. Through years of operation, Law Broker has won numerous awards from various Taiwan government authorities for its excellence in the insurance brokerage industry. Among which, from year 2005 to year 2008, Law Broker has won the “Taiwan Insurance Excellence Award - Talent Training” for four consecutive years, the “Taiwan Insurance Excellence Award - E-commerce” in 2009, the “Taiwan Insurance Excellence Award - Customer Service and Personal Training” in 2011, the “Taiwan Insurance Excellence Award - Golden Medal for Information Application, Silver Medal for Personnel Training and Silver Medal for Customer Service” in 2013, the “Insurance Dragon and Phoenix Award” in 2012 and 2013 as well as the Most Desirable Insurance Brokerage Company of Finance Insurance Graduates in 2013. In 2015, Law Broker won the “Insurance Dragon and Phoenix Award” and the “Taiwan Insurance Excellence Award - Silver Medal for Personnel Training and Silver Medal for Customer Service”. The “Taiwan Insurance Excellence Award" is one of most prestigious as well as well-participated insurance events in Taiwan, co-sponsored by the Taiwan Insurance Institute, Taiwan Financial Supervisory Committee and Taiwan Consumer Protection Committee, to encourage the insurance industry participants to actively enhance insurance service quality as well as to improve customer services. In 2016, Law Broker was awarded, as the fifth consecutive year, the “Insurance Dragon and Phoenix Award” for the Most Desirable Insurance Brokerage Company of Finance Insurance Graduates. Law Broker was also approved by the Financial Supervisory Committee as the first insurance brokerage company to operate online insurance business in 2016.

During the past 13 years, Anhou has expanded its business across 45 cities within Henan, Sichuan, Jiangsu, Fujian, Guangdong and Yunnan provinces with 2,557 sales professionals and 111 administrative staff members. Based on the insurance products Anhou is offering and the geographic areas of its branch offices, Anhou’s primary competitors are small-sized and middle-sized insurance agency companies. Anhou is relatively larger in terms of the number of salesmen as well as the sales revenue comparing to those competing insurance agency companies. On April 20, 2012, Anhou obtained the nationwide license from CIRC, pursuant to which Anhou may set up its branch office across the PRC to carry out the insurance agency business with no further approval requirement from CIRC other than filing with the local CIRC at the provincial level.

On March 26, 2012, CIRC issued the Notice on Suspension of Market Entry Approval of Regional Insurance Agencies and Certain Part-time Insurance Agencies (“2012 Notice”). Pursuant to the 2012 Notice, CIRC and its local counterparts will suspend granting any new license to full-time insurance agencies operating on a regional basis (“Regional Insurance Agencies”) as well as to branch offices of existing Regional Insurance Agencies. In addition, no new license for part-time insurance agency businesses will be granted unless such applicant is a financial institution or a China Post office. However, CIRC emphasized in the 2012 Notice that its local counterparts shall continue to support the establishment of insurance intermediary groups and full-time insurance agencies operating on a nationwide basis, as well as continue to support their respective branch offices.

| 18 |

As indicated in the 2012 Notice, it appears that CIRC is aiming to increase the entry thresholds of Regional Insurance Agencies and part-time insurance agencies with a view to reducing the number, as well as, enhancing the quality of insurance agencies in the market. CIRC has also indicated in the 2012 Notice that it intends to further amend related rules and regulations to improve the market entry and exit mechanism for insurance agencies, and promote the professionalism as well as enhance the quality of insurance agencies in the market.

On April 27, 2013, CIRC issued the Decision on Revising the Provisions of the Supervision and Administration of Specialized Insurance Agencies (the “Decision on Revising the Agency Provisions”), pursuant to which, CIRC has mandated any insurance agency established subsequent to the Decision on Revising the Agency Provisions to meet a minimum registered capital requirement of RMB50 million.

On May 16, 2013, CIRC issued the 2013 Notice, pursuant to which, professional insurance agencies established prior to the issuance of the Decision on Revising the Agency Provisions, with registered capital less than RMB50 million, can continuously operate their existing business within the provinces where they have the registered office or branch office, but shall not set up any new branches in any province where they do not have the registered office or any branch office.

With the promulgation and implementation of the above-mentioned regulations, we expect a better regulated insurance agency market in China with orderly competition and pursuit for professional excellence, which will accentuate our competitive advantage due to our continuous commitment to quality service. On October 24, 2013, Anhou increased its registered capital to RMB50 million. As of the date of filing of this Annual Report on Form 10-K, Anhou is one of the approximately 100 insurance agencies with a PRC nationwide license. We believe that we will be in a better position to obtain the full support expressly provided in the 2012 Notice from the local CIRC on our expansion strategy nationwide.

Intellectual Property

To protect our intellectual property, we rely on a combination of trademark, copyright and trade secret laws as well as confidentiality agreements with our employees, sales agents, contractors and others.

Law Enterprise and Law Broker jointly own the following registered trademarks in Taiwan:

the Service Mark of Law Insurance Broker Co., Ltd. under the registration number 01462327, with a 10-year validity from June 16, 2011 to June 15, 2021;

the logo of Law Insurance Broker Co., Ltd. under the registration number 01604254, with a 10-year validity from October 16, 2013 to October 15, 2023;

| 19 |

the logo of Blue Magpie, with a 10-year validity from June 16, 2011 to June 15, 2021;

the logo of Law (定律) under the registration number 01462328, with a 10-year validity from June 16, 2011 to June 15, 2021;

the logo of Law (定律) under the registration number 01611772, with a 10-year validity from December 1, 2013 to November 30, 2023;

the logo of Bao Xian Tong and INS, with a 10-year validity from May 16, 2013 to May 15, 2023; and

| 20 |

the logo of Magpie Baby, with a 10-year validity from May 16, 2012 to May 15, 2022.

Law Broker has the following registered trademarks in Taiwan:

the logo of Blue Magpie Fleet, with a 10-year validity from December 1, 2008 to November 30, 2018;

the logo of Law Insurance Broker, with a 10-year validity from December 1, 2008 to November 30, 2018;

the logo of Law Blue Magpie, with a 10-year validity from December 1, 2008 to November 30, 2018;

| 21 |

the logo of Symbiosis, Co-cultivation Co-Prosperity and Law Blue Magpie Picture, with a 10-year validity from July 1, 2008 to June 30, 2018;

the logo of Education Training Blue Magpie, with a 10-year validity from June 1, 2008 to May 31, 2018;

the logo of Cartoon Blue Magpie, with a 10-year validity from June 1, 2008 to May 31, 2018;

| 22 |

the logo of Little Blue Magpie, with a 10-year validity from June 1, 2008 to May 31, 2018;

the logo of Triumph Blue Magpie, with a 10-year validity from June 1, 2008 to May 31, 2018;

| 23 |

the logo of Blue Magpie Fleet Picture, with a 10-year validity from May 1, 2008 to April 30, 2018; and

the logo of Fighting Blue Magpie, with a 10-year validity from June 1, 2008 to May 31, 2018.

| 24 |

Jiangsu Law has one registered trademark in China, the logo of Jiangsu Law:

Segments

The Company currently operates as three reporting segments. Revenues, net income and total assets can be found in Item 8 of this Annual Report on Form 10-K.

Employees

As of December 31, 2016, Law Broker has a total of 117 full-time employees and Anhou has 111 full-time employees. Our employees are not represented by any collective bargaining agreement. We believe that we have good relations with our employees and we have never experienced a work stoppage.

Regulation

Taiwan Regulations of the Insurance Industry

The insurance industry in Taiwan is highly regulated. Financial Supervisory Committee of Republic of China, the FSC, is the regulatory authority responsible for the supervision of the insurance industry in Taiwan. Insurance activities undertaken within Taiwan are primarily governed by the Insurance Law and the related rules and regulations.

| 25 |

Insurance Law

The current principal regulation governing insurance in Taiwan is Insurance Law, latest amended on December 28, 2016 by Legislative Yuan, which provided the initial framework for regulating the insurance industry.

The Insurance Law defines several subjects of insurance industry, such as insurer, insurance agency, insurance brokerage and insurance adjustor. It established requirements for form of organization, and qualifications and procedures to establish an insurance organization as well as separation of property insurance businesses and life insurance businesses. The Insurance Law distinguishes insurance between fire disaster, marine, land and air, liability, surety, and other casualty and property insurance businesses on the one hand, and life insurance, health insurance, casualty insurance and annuity businesses on the other. Unless permitted by the FSC, insurance companies are not allowed to engage in both types of insurance businesses.

The insurers, insurance agencies, insurance brokerages and insurance adjustors must join the related industry associations, or they are prohibited from conducting business operation.

FSC

The FSC is in charge of the financial market and financial service industries, among the insurance industry and has the power to control the following items:

| 1. | Financial system and supervision policy. |

| 2. | The preparation, amendment and abolishment of financial laws and regulations. |

| 3. | Supervision and management of the financial institutions, include its establishment, revocation, abolishment, change, merger, dissolution, and business scope. |

| 4. | Development, supervision and management of financial market. |

| 5. | Inspection of financial institution. |

| 6. | Inspection on public listing company related to their securities market-related matters. |

| 7. | Foreign financial matters. |

| 8. | Protection of financial customers. |

| 9. | Dealing and penalizing the violation of related laws and regulations of finance. |

| 10. | Collection of and analysis on relevant statistic data related to financial supervision, management and inspection. |

| 11. | Other matters related to financial supervision, management and inspection. |

| 26 |

Regulation of Insurance Agents and Agencies

The current principal regulation governing insurance agents and agencies is the Regulations Governing Insurance Agents latest amended on June 18, 2015 by Insurance Bureau of FSC (the “Agent Rule”). An insurance agent stipulated under the Insurance Law refers to a person who is on behalf of the insurer to conduct agency business pursuant to the agency contract or the power of attorney and charges fees from the insurer. Depending on their focused insurance areas, i.e. property insurance and life insurance, insurance agents can be divided into property insurance agents and life insurance agents. No matter what insurance industry an insurance agent is engaged in, it must have one of the following qualifications: (1) having passed the insurance agency examination for professional and technical staff; (2) having passed the insurance agency qualification test; or (3) having obtained the agency practitioner certificate and practiced the same business. Those who have agent qualifications required by the Agent Rule may conduct business after they obtain the practitioner certificates under the name of themselves or the company they work for. An agency company must hire more than one agent to act as signatory(ies), and registered with the administrative authority, the number of whom can be adjusted appropriately in accordance with the scale of business. If necessary, the administrative authority may, in its discretion, require the company to add more signatories. An insurance agent may only work for one insurance agency company as signatory at one time.

There are special requirements for agency companies, such as the name of an agent company must contain the words “insurance agency”, and when an agency company applies to operate agency business, the minimum registered capital must be at least NT$5 million ($157,953) fully paid up in cash, according to which, insurance agency companies with business license obtained prior to the implementation of this latest Agent Rule shall adjust their registered capital within five years upon the its implementation.

The Practitioner Certificate

The practitioner certificate has a duration of five years, and must be renewed before expiration. In case an agent has the qualifications for both of property and life insurance, unless otherwise approved by the administrative authority, only one kind of insurance agency practitioner certificate may be obtained upon his selection.

Education and Training

There are two types of education and training for an insurance agent, pre-vocational and on-the-job education and training. An insurance agent must attend in pre-vocational education and training for at least 32 hours during the one year before applying for practicing insurance agency business and on-the-job education and training for at least 16 hours with law courses for no less than 8 hours per year, commencing after one year from the issuance of this latest Agent Rule.

Management of Insurance Agencies

The rules describing how to conduct insurance agency business concentrate on the concept that the agencies must take care of customers' matters in good faith. To ensure this concept is properly carried out, the rules require insurance agency companies must have legal compliance officers with one of the following qualifications: (1) are qualified to be insurance agents or brokers and have worked as actual signatories; (2) have five years working experience in the insurance industry, insurance agency or insurance brokerage; or (3) having graduated from departments related to insurance or law departments of colleges and universities with more than three years working experience in insurance industry, insurance agency or insurance brokerage.

| 27 |

Regulation of Insurance Brokers and Brokerage Companies

The current principal regulation governing insurance brokers and brokerage companies is the Regulations Governing Insurance Brokers last amended on June 18, 2015 by Insurance Bureau of FSC (the “Broker Rule”). An insurance broker stipulated under the Insurance Law refers to a person who negotiates to conclude an insurance contract on behalf of the insured and charges fees from the insured. Depending on their focused insurance areas, i.e. property or life insurance, insurance brokers can be divided into property insurance brokers and life insurance brokers. No matter what insurance industry an insurance broker is engaged in, it must have one of the following qualifications: (1) have passed the insurance brokerage examination for professional and technical staff; (2) have passed the insurance brokerage qualification test; or (3) have obtained the insurance brokerage practitioner certificate and practiced the same business.

Those who have brokerage qualifications required by the Broker Rule may conduct business after they obtain the practitioner certificates under their own name or the company they work for. A brokerage company must hire more than one broker to act as signatory(ies), and registered with the administrative authority, the number of whom can be adjusted appropriately in accordance with the scale of business. If necessary, the administrative authority may, in its discretion, require the company to add signatories. An insurance broker may only work for one insurance brokerage company as signatory at one time.

There are special requirements for brokerage companies, such as the name of an brokerage company must contain the words “insurance broker”; when an brokerage company applies to operate brokerage business, the minimum registered capital must be at least NT$5 million ($157,953) fully paid up in cash, according to which, insurance brokerage companies with business license obtained prior to the implementation of this latest Broker Rule shall adjust their registered capital within five years upon the its implementation.

The Practitioner Certificate

The insurance broker practitioner certificate has a validation duration of five years, and must be renewed before expiration. In case a broker has the qualifications for both property insurance and life insurance, he may obtain both insurance brokerage practitioner certificates.

Education and Training

There are two types of education and training for an insurance broker, pre-vocational and on-the-job education and training. An insurance broker must attend pre-vocational education and training for at least 32 hours during the one year before applying for practicing insurance broker business and on-the-job education and training for at least 16 hours with law courses for no less than 8 hours per year, commencing after one year from the issuance of this latest Broker Rule.

Management of Insurance Brokerages

The rules describing how to conduct brokerage business concentrate on the concept that the brokerages must take care of customers' matters in good faith. To ensure that this concept is properly carried out, the rules require insurance brokerage companies must have legal compliance officers who have one of the following qualifications: (1) are qualified to be insurance agents or brokers and have worked as actual signatories; (2) have five years working experience in the insurance industry, insurance agency or insurance brokerage; or (3) have graduated from college and university departments related to insurance or law with more than three years working experience in insurance industry, insurance agency or insurance brokerage.

| 28 |

Regulation of Insurance Salespersons