Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - China United Insurance Service, Inc. | tv511289_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China United Insurance Service, Inc. | tv511289_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China United Insurance Service, Inc. | tv511289_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China United Insurance Service, Inc. | tv511289_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

COMMISSION FILE NUMBER: 000-54884

CHINA UNITED INSURANCE SERVICE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 30-0826400 |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

7F, No. 311 Section 3

Nan-King East Road

Taipei City, Taiwan

(Address of principal executive offices)

+8862-87126958

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x |

| Non-accelerated filer ¨ | Smaller reporting company ¨ |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act.

Yes ¨ No x

As of January 29, 2019, there are 29,452,669 shares of common stock issued and outstanding, and 1,000,000 preferred shares issued and outstanding.

TABLE OF CONTENTS

| 2 |

EXPLANATORY NOTE REGARDING RESTATEMENT

On January 23, 2018, the Audit Committee of the Board of Directors of China United Insurance Service, Inc., based on the recommendations of the company’s management and after consultation with, Simon & Edward LLP, our independent registered public accounting firm, concluded that our consolidated financial statements as of and for each of the interim period ended June 30, 2017 should no longer be relied upon.

Within this report, we have included the restated unaudited condensed consolidated financial information for the quarterly periods as of and for the interim period ended March 31, 2017, which we refer to as the Restatement.

The Restatement corrects a material error related to the accounting for the acquisition of Genius Holdings Financial Limited (the

“GHFL Acquisition”) in 2015 The GHFL Acquisition has been accounted for as the acquisition of a business but, upon

further analysis, we have come to the conclusion that it would be more accurately accounted for as an asset acquisition. Our independent

registered accounting firm has concurred with this revised approach.

The Company has determined that this change in accounting for the GHFL Acquisition had the impact set forth below as of and for the interim period ended June 30, 2017 (the “Restated Period”) on the following key balance sheet items included in the financial statements the Restated Period, which the Company believes are of particular significance for investors. Please note that the Key Balance Sheet Items in the Restated Period set forth below changed as a result of the Restatement.

For further information, please see the section titled “Explanatory Note Regarding Restatement” in our Annual Report, as amended and filed on form 10-K/A (the “Amended Annual Report”), as filed with the Securities and Exchange Commission ( the “SEC”) on January 24, 2019, which is incorporated by reference herein.

Key Balance Sheet Items

Goodwill: Reported Goodwill as of the interim reporting period ended June 30, 2017 of $2,071,491 has been restated to total $31,651 as at such date, representing a reduction of $2,039840 (or 98.5%).

Total Assets: Reported Total Assets as of June 30, 2017 of $48,983,681 has been restated to total $46,943,841 as at such date, representing a reduction of $2,039,840 (or 4.2%.)

Retained Earnings: Reported Retained Earnings as of June 30, 2017 of $5,804,053 has been restated to total $3,764,213 as at such date, representing a reduction of $2,039,840 (or 35.1%).

Stockholders’ Equity Attributable to Parent’s Shareholders: Reported Stockholders’ Equity Attributable to Parent’s Shareholders reported as of June 30, 2017 of $18,721,318 has been restated to total $16,681,478 as at such date, representing a reduction of $2,039,840 (or 10.9%).

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievement expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described under Part 1 Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

| 3 |

OTHER PERTINENT INFORMATION

References in this annual report to “we,” “us,” “our” and the “Company” and words of like import refer to China United Insurance Service, Inc., its subsidiaries and variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Republic of China.

Unless context indicates otherwise, reference to the “Company” in this annual report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries. Reference to “Anhou” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan and China using New Taiwanese Dollars (“NT$”), the currency of Taiwan, Hong Kong Dollars (“HK$”), the currency of Hong Kong, and RMB, the currency of China, respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this annual report, we refer to assets, obligations, commitments and liabilities in our financial statements in USD. These dollar references are based on the exchange rate of NT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of USD which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

| 4 |

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| June 30, 2018 | December 31, 2017 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 12,289,286 | $ | 15,473,949 | ||||

| Time deposits | 26,883,900 | 21,470,113 | ||||||

| Marketable securities | 30,894 | 33,381 | ||||||

| Structured deposits | 2,206,313 | 1,248,340 | ||||||

| Accounts receivable | 8,092,502 | 13,301,006 | ||||||

| Contract assets | 1,317,465 | - | ||||||

| Other current assets | 1,317,157 | 2,193,086 | ||||||

| Total current assets | 52,137,517 | 53,719,875 | ||||||

| Property, plant and equipment, net | 1,178,015 | 946,302 | ||||||

| Intangible assets | 670,033 | 775,778 | ||||||

| Long-term investments | 2,544,122 | 1,399,762 | ||||||

| Other assets | 2,081,394 | 2,431,526 | ||||||

| TOTAL ASSETS | $ | 58,611,081 | $ | 59,273,243 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Short-term loans | $ | 3,028,417 | $ | 2,350,000 | ||||

| Income tax payable-short term | 2,360,169 | 3,508,790 | ||||||

| Convertible bonds | - | 200,000 | ||||||

| Commissions payable to sales professionals | 6,131,985 | 6,415,071 | ||||||

| Due to related parties | 785,712 | 801,017 | ||||||

| Other current liabilities | 5,624,586 | 6,163,765 | ||||||

| Total current liabilities | 17,930,869 | 19,438,643 | ||||||

| Long-term loans | 116,331 | 248,986 | ||||||

| Income tax payable-long term | 1,103,259 | - | ||||||

| Long-term liabilities | 2,699,833 | 4,842,240 | ||||||

| TOTAL LIABILITIES | 21,850,292 | 24,529,869 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred stock, par value $0.00001, 10,000,000 authorized, 1,000,000 issued and outstanding | 10 | 10 | ||||||

| Common stock, par value $0.00001, 100,000,000 authorized, 29,452,669 issued and outstanding | 295 | 295 | ||||||

| Additional paid-in capital | 8,190,449 | 8,190,449 | ||||||

| Statutory reserves | 5,739,525 | 5,781,008 | ||||||

| Retained earnings | 7,831,381 | 6,419,937 | ||||||

| Accumulated other comprehensive income | (96,311 | ) | 616,019 | |||||

| Stockholders’ equity attribute to parent’s shareholders | 21,665,349 | 21,007,718 | ||||||

| Noncontrolling interests | 15,095,440 | 13,735,656 | ||||||

| TOTAL STOCKHOLDERS’ EQUITY | 36,760,789 | 34,743,374 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 58,611,081 | $ | 59,273,243 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME (LOSS)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Revenue | $ | 20,175,337 | $ | 18,518,822 | $ | 37,664,717 | $ | 33,874,350 | ||||||||

| Cost of revenue | 13,696,717 | 11,890,592 | 23,318,420 | 20,674,435 | ||||||||||||

| Gross profit | 6,478,620 | 6,628,230 | 14,346,297 | 13,199,915 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling | 789,400 | 312,122 | 1,427,398 | 698,303 | ||||||||||||

| General and administrative | 4,078,909 | 3,653,864 | 8,030,530 | 7,006,304 | ||||||||||||

| Total operating expense | 4,868,309 | 3,965,986 | 9,457,928 | 7,704,607 | ||||||||||||

| Income from operations | 1,610,311 | 2,662,244 | 4,888,369 | 5,495,308 | ||||||||||||

| Other income (expenses): | ||||||||||||||||

| Interest income | 127,171 | 95,210 | 224,792 | 167,260 | ||||||||||||

| Interest expenses | (28,395 | ) | (8,200 | ) | (51,249 | ) | (16,269 | ) | ||||||||

| Dividend income | 361,571 | 329,749 | 361,571 | 329,749 | ||||||||||||

| Other - net | 114,267 | 166,015 | 194,505 | 47,048 | ||||||||||||

| Total other income, net | 574,614 | 582,774 | 729,619 | 527,788 | ||||||||||||

| Income before income taxes | 2,184,925 | 3,245,018 | 5,617,988 | 6,023,096 | ||||||||||||

| Income tax expense | 369,380 | 755,990 | 2,487,921 | 1,513,269 | ||||||||||||

| Net income | 1,815,545 | 2,489,028 | 3,130,067 | 4,509,827 | ||||||||||||

| Net income attributable to noncontrolling interests | 791,238 | 500,640 | 1,760,106 | 1,185,094 | ||||||||||||

| Net income attributable to parent's shareholders | 1,024,307 | 1,988,388 | 1,369,961 | 3,324,733 | ||||||||||||

| Other comprehensive income | ||||||||||||||||

| Foreign currency translation (loss) gain | (1,308,006 | ) | 31,438 | (712,861 | ) | 744,941 | ||||||||||

| Other | 6 | 248 | 531 | 42,719 | ||||||||||||

| Other comprehensive (loss) income attributable to parent's shareholders | (1,308,000 | ) | 31,686 | (712,330 | ) | 787,660 | ||||||||||

| Other comprehensive (loss) income attributable to noncontrolling interests | (708,329 | ) | (18,230 | ) | (400,322 | ) | 617,406 | |||||||||

| Comprehensive (loss) income attributable to parent's shareholders | $ | (283,693 | ) | $ | 2,020,074 | $ | 657,631 | $ | 4,112,393 | |||||||

| Comprehensive income attributable to noncontrolling interests | $ | 82,909 | $ | 482,410 | $ | 1,359,784 | $ | 1,802,500 | ||||||||

| Weighted average shares outstanding: | ||||||||||||||||

| Basic | 29,452,669 | 29,452,669 | 29,452,669 | 29,452,669 | ||||||||||||

| Diluted | 29,452,669 | 29,500,746 | 29,452,669 | 29,452,669 | ||||||||||||

| Earnings per share attributable to parent's shareholders: | ||||||||||||||||

| Basic | $ | 0.034 | $ | 0.065 | $ | 0.045 | $ | 0.109 | ||||||||

| Diluted | $ | 0.034 | $ | 0.065 | $ | 0.045 | $ | 0.109 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 6 |

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

| Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income | $ | 3,130,067 | $ | 4,509,827 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 305,000 | 272,088 | ||||||

| Amortization of bond premium | 134 | 127 | ||||||

| Loss (gain) on valuation of financial assets | 119,441 | (2,124 | ) | |||||

| Loss on disposal of fixed assets | 5,419 | 39,138 | ||||||

| Loss on debt forgiveness | 12,908 | - | ||||||

| Deferred income tax | (43,980 | ) | (23,376 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 5,080,989 | 9,381,505 | ||||||

| Contract assets | (1,359,771 | ) | - | |||||

| Other current assets | (617,844 | ) | (220,497 | ) | ||||

| Other assets | 993,243 | (1,115,713 | ) | |||||

| Income tax payable | 83,705 | 13,007 | ||||||

| Commissions payable to sales professionals | (114,865 | ) | (5,193,516 | ) | ||||

| Other current liabilities | (2,416,502 | ) | (3,924,066 | ) | ||||

| Long-term liabilities | (176,123 | ) | (992,495 | ) | ||||

| Net cash provided by operating activities | 5,001,821 | 2,743,905 | ||||||

| Cash flows from investing activities: | ||||||||

| Purchases of time deposits | (25,537,004 | ) | (18,827,390 | ) | ||||

| Proceeds from maturities of time deposits | 18,876,553 | 7,690,359 | ||||||

| Purchases of structured deposits | (4,910,401 | ) | - | |||||

| Proceeds from maturities of structured deposits | 3,905,499 | - | ||||||

| Proceeds from sale of marketable securities | - | 7,417,572 | ||||||

| Purchase of marketable securities | - | (4,896,542 | ) | |||||

| Purchase of long-term investment - REITs | (1,355,038 | ) | - | |||||

| Proceeds from repayment of loan made to RFL | 1,517,316 | - | ||||||

| Purchase of property, plant and equipment | (442,932 | ) | (221,100 | ) | ||||

| Purchase of intangible assets | (43,537 | ) | (65,260 | ) | ||||

| Net cash used in investing activities | (7,989,544 | ) | (8,902,361 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Repayment of convertible bonds | (200,000 | ) | ||||||

| Proceeds from short-term loans | 10,300,000 | - | ||||||

| Repayment of short-term loans | (9,750,000 | ) | - | |||||

| Proceeds from related party borrowing | 493,424 | 257,440 | ||||||

| Repayment to related party borrowing | (557,363 | ) | (559 | ) | ||||

| Net cash provided by financing activities | 286,061 | 256,881 | ||||||

| Foreign currency translation | (331,922 | ) | 1,559,382 | |||||

| Net decrease in cash, cash equivalents and restricted cash | (3,033,584 | ) | (4,342,193 | ) | ||||

| Cash, cash equivalents and restricted cash, beginning balance | 15,473,949 | 20,387,638 | ||||||

| Cash, cash equivalents and restricted cash, ending balance | $ | 12,440,365 | $ | 16,045,445 | ||||

| SUPPLEMENTARY DISCLOSURE: | ||||||||

| Interest paid | $ | 53,412 | $ | 17,699 | ||||

| Income tax paid | $ | 2,469,288 | $ | 1,494,425 | ||||

| SUPPLEMENTARY DISCLOSURE OF CASH FLOWS FOR NON-CASH TRANSACTION: | ||||||||

| Debt forgiveness - related party | $ | - | $ | 32,937 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 7 |

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

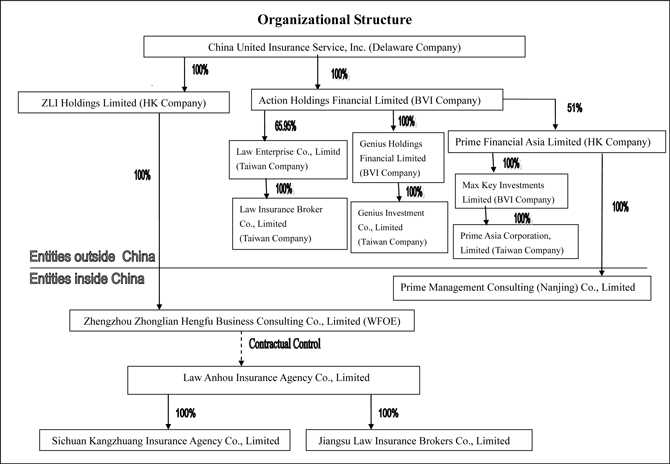

China United Insurance Service, Inc. (“China United”, “CUIS”, or the “Company”) is a Delaware corporation, organized on June 4, 2010 by Yi-Hsiao Mao, a Taiwan citizen, as a listing vehicle for both ZLI Holdings Limited (“CU Hong Kong”) and Action Holdings Financial Limited (“AHFL,” a company incorporated in the British Virgin Islands). The Company’s common stock currently trades over-the-counter under the ticker symbol “CUII” in the OTCQB marketplace.

The corporate structure as of June 30, 2018 is as follows:

| 8 |

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The unaudited consolidated financial statements include the accounts of China United, its subsidiaries and variable interest entities as shown in the corporate structure in Note 1. All significant intercompany transactions and balances have been eliminated in consolidation. Certain reclassifications have been made to the consolidated financial statements for prior years to the current year’s presentation.

Basis of Presentation

The unaudited consolidated financial statements presented herein have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Regulation S-X. Accordingly, the financial statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments, including normal recurring adjustments, considered necessary for a fair statement of the financial statements have been included. Operating results for the three and six months ended June 30, 2018 are not necessarily indicative of the results that may be expected for the year ending December 31, 2018.

These unaudited consolidated financial statements and notes thereto should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended December 31, 2017, which were included in the Company’s 2017 Annual Report on Form 10-K (“2017 Form 10-K”). The accompanying consolidated balance sheet as of December 31, 2017, has been derived from the Company’s audited consolidated financial statements as of that date.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the consolidated financial statements and footnotes thereto. Actual results may differ from those estimates and assumptions.

Foreign Currency Transactions

The Company’s financial statements are presented in U.S. dollars ($), which is the Company’s reporting and functional currency. The functional currencies of the Company’s subsidiaries are NTD, RMB and HKD. The resulting translation adjustments are reported under other comprehensive income in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 220 (“ASC 220”), “Reporting Comprehensive Income”. Gains and losses resulting from the translation of foreign currency transactions are reflected in the consolidated statements of operations and other comprehensive income (loss). Monetary assets and liabilities denominated in foreign currency are translated at the functional currency using the rate of exchange prevailing at the balance sheet date. Any differences are taken to profit or loss as a gain or loss on foreign currency translation in the consolidated statements of operations and other comprehensive income (loss).

| 9 |

The Company translates the assets and liabilities into U.S. dollars using the rate of exchange prevailing at the balance sheet date and the statements of operations and cash flows are translated at an average rate during the reporting period. Adjustments resulting from the translation from NTD, RMB and HKD into U.S. dollars are recorded in stockholders’ equity as part of accumulated other comprehensive income. The exchange rates used for financial statements are as follows:

| Average Rate for the Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| New Taiwan dollar (NTD) | NTD | 29.519475 | NTD | 30.633866 | ||||

| China yuan (RMB) | RMB | 6.366551 | RMB | 6.837909 | ||||

| Hong Kong dollar (HKD) | HKD | 7.837374 | HKD | 7.773106 | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.000000 | ||||

| Exchange Rate at | ||||||||

| June 30, 2018 | December 31, 2017 | |||||||

| New Taiwan dollar (NTD) | NTD | 30.461500 | NTD | 29.65568 | ||||

| China yuan (RMB) | RMB | 6.619050 | RMB | 6.50638 | ||||

| Hong Kong dollar (HKD) | HKD | 7.845330 | HKD | 7.81493 | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.00000 | ||||

Earnings Per Share

Basic earnings per common share (“EPS”) is computed by dividing net income attributable to the common shareholders of the Company by the weighted-average number of common shares outstanding. Diluted EPS is computed in the same manner as basic EPS, except the number of shares includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued.

As the holders of preferred stock of the Company are entitled to share equally with the holders of common stock, on a per share basis, in such dividends and other distributions of cash, property or shares of stock of the Company as may be declared by the board of directors, the preferred stock is a participating security. When calculating the basic earnings per common share, the two-class method is used to allocate earnings to common stock and participating security as required by ASC Topic 260, “Earnings Per Share.” Potential common shares consist primarily of convertible bonds calculated using the if-converted method. However, convertible bonds were excluded from the calculation due to the antidilutive effect except for the three months ended June 30, 2017. The antidilutive common share equivalents excluded from the computation were 45,935 for the three months ended June 30, 2018, and were 54,369 and 45,078 for the six months ended June 30, 2018 and 2017, respectively.

The calculation for basic and diluted EPS is as follows:

| Three Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Amounts attributable to CUIS common shareholders: | $ | 990,671 | $ | 1,923,094 | ||||

| Effect of dilution | - | 3,000 | ||||||

| Income attributable to CUIS common shareholders after dilution | $ | 990,671 | $ | 1,926,094 | ||||

| Basic weighted-average number of common shares outstanding | 29,452,669 | 29,452,669 | ||||||

| Effect of convertible bond | - | 48,077 | ||||||

| Diluted weighted-average number of common shares outstanding | 29,452,669 | 29,500,746 | ||||||

| Earnings per share attributable to CUIS common shareholders: | ||||||||

| Basic | $ | 0.034 | $ | 0.065 | ||||

| Diluted | $ | 0.034 | $ | 0.065 | ||||

| 10 |

| Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Amounts attributable to CUIS common shareholders: | $ | 1,324,974 | $ | 3,215,556 | ||||

| Effect of dilution | - | - | ||||||

| Income attributable to CUIS common shareholders after dilution | $ | 1,324,974 | $ | 3,215,556 | ||||

| Basic weighted-average number of common shares outstanding | 29,452,669 | 29,452,669 | ||||||

| Effect of convertible bond | - | - | ||||||

| Diluted weighted-average number of common shares outstanding | 29,452,669 | 29,452,669 | ||||||

| Earnings per share attributable to CUIS common shareholders: | ||||||||

| Basic | $ | 0.045 | $ | 0.109 | ||||

| Diluted | $ | 0.045 | $ | 0.109 | ||||

Fair Value of Financial Instruments

Fair value accounting establishes a framework for measuring fair value and expands disclosure about fair value measurements. Fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

| · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

The following fair value hierarchy tables present information about the Company’s assets and liabilities measured at fair value on a recurring basis as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | ||||||||||||||||

| Fair Value | Carrying | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Value | |||||||||||||

| Assets | ||||||||||||||||

| Marketable securities (included in other current assets): | ||||||||||||||||

| Mutual fund | 30,894 | - | - | 30,894 | ||||||||||||

| Structured deposits | - | - | 2,206,313 | 2,206,313 | ||||||||||||

| Long-term investments: | ||||||||||||||||

| Government bonds (available-for-sale debt securities) | - | 100,548 | - | 100,548 | ||||||||||||

| REITs | 1,181,820 | - | - | 1,181,820 | ||||||||||||

| December 31, 2017 | ||||||||||||||||

| Fair Value | Carrying | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Value | |||||||||||||

| Assets | ||||||||||||||||

| Marketable securities (included in other current assets): | ||||||||||||||||

| Mutual fund | 33,381 | - | - | 33,381 | ||||||||||||

| Structured deposits | - | - | 1,248,340 | 1,248,340 | ||||||||||||

| Long-term investments: | ||||||||||||||||

| Government bonds (available-for-sale debt securities) | - | 103,723 | - | 103,723 | ||||||||||||

The following table presents a reconciliation from the opening balances to the closing balances for recurring fair value measurements categorized within level 3 of the fair value hierarchy:

| Opening balance as of January 1, 2018 | $ | 1,248,340 | ||

| Transfer into/ out of Level 3 | - | |||

| Total gains (losses) for the period included in earnings | 17,718 | |||

| Total gains (losses) for the period included in other comprehensive income | - | |||

| Purchases | 4,910,401 | |||

| Settlements | (3,905,499 | ) | ||

| Foreign exchange gains (losses) | (64,647 | ) | ||

| Ending balance as of June 30, 2018 | $ | 2,206,313 |

Changes in unrealized losses for the period included in earnings for assets held at the end of the reporting period are $50,733 and $(19,015) , respectively, for the three and six months ended June 30, 2018.

During the three and six months ended June 30, 2018, there were no assets or liabilities that were transferred between any of the levels.

Marketable securities and long-term investments in REITs – The fair value of the mutual fund and REITs is valued based on quoted market prices in active markets.

Structured deposits – Structured deposits are hybrid instruments containing embedded derivatives. The valuation of the hybrid instruments is predominantly driven by the derivative features embedded within the instruments. The structured deposits as of June 30, 2018 and December 31, 2017 are based on discounted cash flow analyses that consider the embedded derivative and terms and payment structure of the deposits. The embedded derivative features are valued using Black & Scholes option pricing model that used significant unobservable inputs, i.e., volatility of options. The fair value is determined by using the counterparty’s pricing information.

The volatility mentioned above is a pricing input for options. Generally, the higher the volatility of the underlying, the riskier the instrument. Given a long position in an option, an increase in volatility, in isolation, would generally result in an increase in a fair value measurement.

Government bonds – The fair value of government bonds is valued based on theoretical bond price in Taipei Exchange.

The carrying amounts of financial assets and liabilities in the consolidated balance sheets for cash and cash equivalents, time deposits, accounts receivable, short-term loans, due to related parties and accrued expense approximate fair value due to the short-term duration of those instruments.

The amortized cost of the investment in government bonds is $99,200 and $102,029 as of June 30, 2018 and December 31, 2017, respectively. The government bonds will mature on March 17, 2021.

| 11 |

Concentration of Risk

The Company maintains cash with banks in the USA, People’s Republic of China (“PRC” or “China”), Hong Kong, and Taiwan. Should any bank holding cash become insolvent, or if the Company is otherwise unable to withdraw funds, the Company would lose the cash with that bank; however, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts. In Taiwan, a depositor has up to NTD3,000,000 insured by Central Deposit Insurance Corporation (“CDIC”). In China, a depositor has up to RMB500,000 insured by the People’s Bank of China Financial Stability Bureau (“FSD”). In Hong Kong, a depositor has up to HKD500,000 insured by Hong Kong Deposit Protection Board (“DPB”). In the United States, the standard insurance amount is $250,000 per depositor in a bank insured by the Federal Deposit Insurance Corporation (“FDIC”).

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, time deposits, restricted cash, register capital deposits and accounts receivable. As of June 30, 2018 and December 31, 2017, approximately $1,798,000 and $1,512,000 of the Company’s cash and cash equivalents, time deposits, restricted cash and register capital deposits held by financial institutions, was insured, and the remaining balance of approximately $33,998,000 and $33,949,000, was not insured. With respect to accounts receivable, the Company generally does not require collateral and does not have an allowance for doubtful accounts.

For the three months ended June 30, 2018 and 2017, the Company’s revenues from sale of insurance policies underwritten by these companies were:

| Three Months Ended June 30, | ||||||||||||||||

| 2018 | 2017 | |||||||||||||||

| Amount | % of Total Revenue | Amount | % of Total Revenue | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 4,312,106 | 21 | % | $ | 4,563,775 | 25 | % | ||||||||

| TransGlobe Life Insurance Inc. | 2,533,169 | 13 | % | (* | ) | (* | ) | |||||||||

| Taiwan Life Insurance Co., Ltd. | 2,401,545 | 12 | % | 1,881,893 | 10 | % | ||||||||||

(*) Revenue for the three months ended had not exceeded 10% or more of the consolidated revenue.

For the six months ended June 30, 2018 and 2017, the Company’s revenues from sale of insurance policies underwritten by these companies were:

| Six Months Ended June 30, | ||||||||||||||||

| 2018 | 2017 | |||||||||||||||

| Amount | % of Total Revenue | Amount | % of Total Revenue | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 9,258,162 | 25 | % | $ | 8,774,002 | 26 | % | ||||||||

| Taiwan Life Insurance Co., Ltd. | 5,199,281 | 14 | % | 3,969,250 | 12 | % | ||||||||||

| TransGlobe Life Insurance Inc. | 4,362,188 | 12 | % | (* | ) | (* | ) | |||||||||

(*) Revenue for the six months ended had not exceeded 10% or more of the consolidated revenue.

As of June 30, 2018 and December 31, 2017, the Company’s accounts receivable from these companies were:

| June 30, 2018 | December 31, 2017 | |||||||||||||||

| Amount | % of Total Accounts Receivable | Amount | % of Total Accounts Receivable | |||||||||||||

| Farglory Life Insurance Co., Ltd. | $ | 1,657,179 | 21 | % | $ | 3,430,661 | 26 | % | ||||||||

| Taiwan Life Insurance Co., Ltd | 989,159 | 12 | % | 2,192,668 | 17 | % | ||||||||||

| TransGlobe Life Insurance Inc. | 1,095,948 | 14 | % | 1,811,401 | 14 | % | ||||||||||

The Company’s operations are in the PRC, Hong Kong and Taiwan. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic, foreign currency exchange and legal environments in the PRC, Hong Kong and Taiwan, and by the state of each economy. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, Hong Kong and Taiwan, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

| 12 |

New Accounting Pronouncements and Other Guidance

New Accounting Pronouncements Effective January 1, 2018:

Revenue from Contracts with Customers

In May 2014, the FASB issued new accounting guidance related to revenue from contracts with customers. The core principle of the guidance is that recognition of revenue occurs when a customer obtains control of promised goods or services in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In addition, the new guidance requires that companies disclose the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. The Company adopted the new guidance effective January 1, 2018, using the modified retrospective method, which applies the new guidance beginning in the year of adoption, with the cumulative effect of initially applying the guidance recognized as an adjustment to retained earnings at January 1, 2018. The Company elected to apply the modified retrospective method to all contracts.

The Company’s revenue is derived from insurance agency and brokerage services. The Company, through its subsidiaries, sells insurance products provided by insurance companies to individuals, and is compensated in the form of commissions from the respective insurance companies, according to the terms of each service agreement made by and between the Company and the insurance companies. The sale of an insurance product by the Company is considered complete when initial insurance premium is paid by an individual and the insurance policy is approved by the respective insurance company. When a policy is effective, the insurance company is obligated to pay the agreed-upon commission to the Company under the terms of its service agreement with the Company and such commission is recognized as revenue.

Upon adoption of the new revenue guidance, the timing of revenue recognition remains unchanged. However, the new guidance includes requirements to estimate variable or contingent consideration to be received and recognize variable consideration to the extent that a significant reversal of revenue will not probably occur in subsequent periods. Under the legacy GAAP, the Company recognized certain contingent commissions when fixed or determinable whereas the Company recognizes estimated contingent commissions when the policy has been submitted to insurance companies but yet effective under the new revenue guidance. This results in the revenue recognition accelerated from historical patterns and a shift in timing of quarterly revenue recognized. In addition, the Company recognizes the contingent commission as a contract asset when the performance obligation is fulfilled and the Company has not had the unconditional rights to the payment. As a result, the Company recognizes contract assets to distinguish from accounts receivable.

Since the majority of the Company’s fee arrangements involve contracts that cover a single year of services, the Company does not expect there will be a significant change in the amount of revenue recognized in an annual period.

The cumulative effect of adopting the new standard on January 1, 2018 is nil to the opening balance of retained earnings. The comparative information and prior periods were not restated and will continue to be reported under the legacy accounting standards.

The impact of adoption of the new revenue standard on the Company’s consolidated income statement was as follows:

| Three Months Ended June 30, 2018 | ||||||||||||

As Reported | Revenue Standard Impact | Legacy GAAP | ||||||||||

| Revenue | $ | 20,175,337 | $ | (981,162 | ) | $ | 19,194,175 | |||||

| Cost of revenue | 13,696,717 | - | 13,696,717 | |||||||||

| Gross profit | 6,478,620 | (981,162 | ) | 5,497,458 | ||||||||

| Income before income taxes | 2,184,925 | (981,162 | ) | 1,203,763 | ||||||||

| Income tax income | 369,380 | (191,482 | ) | 177,898 | ||||||||

| Net income | 1,815,545 | (789,680 | ) | 1,025,865 | ||||||||

| Net income attributable to noncontrolling interests | 791,238 | (260,799 | ) | 530,439 | ||||||||

| Net income attributable to parent’s shareholders | $ | 1,024,307 | $ | (528,881 | ) | $ | 495,426 | |||||

| 13 |

| Six Months Ended June 30, 2018 | ||||||||||||

As Reported | Revenue Standard Impact | Legacy GAAP | ||||||||||

| Revenue | $ | 37,664,717 | $ | (1,359,771 | ) | $ | 36,304,946 | |||||

| Cost of revenue | 23,318,420 | - | 23,318,420 | |||||||||

| Gross profit | 14,346,297 | (1,359,771 | ) | 12,986,526 | ||||||||

| Income before income taxes | 5,617,988 | (1,359,771 | ) | 4,258,217 | ||||||||

| Income tax expense | 2,487,921 | (264,888 | ) | 2,223,033 | ||||||||

| Net income | 3,130,067 | (1,094,883 | ) | 2,035,184 | ||||||||

| Net income attributable to noncontrolling interests | 1,760,106 | (360,778 | ) | 1,399,328 | ||||||||

| Net income attributable to parent’s shareholders | $ | 1,369,961 | $ | (734,105 | ) | $ | 635,856 | |||||

The impact of adoption of the new revenue standard on the Company’s consolidated balance sheet was as follows:

| June 30, 2018 | ||||||||||||

| As Reported | Revenue Standard Impact | Legacy GAAP | ||||||||||

| ASSETS | ||||||||||||

| Current assets: | ||||||||||||

| Contract assets | $ | 1,317,465 | $ | (1,317,465 | ) | $ | - | |||||

| Total current assets | 52,137,517 | (1,317,465 | ) | 50,820,052 | ||||||||

| TOTAL ASSETS | $ | 58,611,081 | $ | (1,317,465 | ) | $ | 57,293,616 | |||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||

| Total liabilities | 21,850,292 | (256,696 | ) | 21,593,596 | ||||||||

| Total stockholders’ equity | 36,760,789 | (1,060,769 | ) | 35,700,020 | ||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 58,611,081 | $ | (1,317,465 | ) | $ | 57,293,616 | |||||

The impact of adoption of the new revenue standard on the Company’s consolidated statement of cash flows was as follows:

| Six Months Ended June 30, 2018 | ||||||||||||

| As Reported | Revenue Standard Impact | Legacy GAAP | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net income | $ | 3,130,067 | $ | (1,094,883 | ) | $ | 2,035,184 | |||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Contract assets | (1,359,771 | ) | 1,359,771 | - | ||||||||

| Income tax payable | 83,705 | (256,696 | ) | (172,991 | ) | |||||||

| Net cash provided by operating activities | 5,001,821 | (34,115 | ) | (4,967,706 | ) | |||||||

| Foreign currency translation | (331,922 | ) | 34,115 | (297,807 | ) | |||||||

The adoption of the revenue recognition standard did not have an impact on the Company’s financing or investing cash flows.

| 14 |

Restricted Cash

In November 2016, the FASB issued an Accounting Standards Update (ASU) amending the presentation of restricted cash within the consolidated statements of cash flows. The new guidance requires that restricted cash be added to cash and cash equivalents on the consolidated statements of cash flows. The Company adopted this ASU in the first quarter of 2018 on a retrospective basis with the following impacts to the Company’s prior period consolidated statement of cash flows:

| Six Months Ended June 30, 2017 | ||||||||||||

| Previously Reported* | Adjustments | As Revised | ||||||||||

| Operating activities | $ | 2,527,098 | $ | 216,807 | $ | 2,743,905 | ||||||

| Investing activities | (8,902,361 | ) | - | (8,902,361 | ) | |||||||

| Financing activities | 256,881 | - | 256,881 | |||||||||

| Foreign currency translation | 1,559,382 | - | 1,559,382 | |||||||||

| Net change in cash, cash equivalents, and restricted cash | $ | (4,559,000 | ) | $ | 216,807 | $ | (4,342,193 | ) | ||||

| (*) | The reported amounts have been revised to incorporate the effect of reclassification made to prior year consolidated financial statements. Refer to Note 27 of 2017 Form 10-K. |

Financial Instruments – Recognition and Measurement

On January 1, 2018, the Company adopted, on a prospective basis, new accounting guidance that makes limited changes to the accounting for financial instruments. The changes primarily relate to (i) the requirement to measure equity investments (except those accounted for under the equity method of accounting, or those that result in consolidation of the investee) at fair value, with changes in the fair value recognized in net income, (ii) an alternative approach for the measurement of equity investments that do not have a readily determinable fair value, (iii) the elimination of the other-than-temporary impairment model and its replacement with a requirement to perform a qualitative assessment to identify the impairment of equity investments, and a requirement to recognize impairment losses in net income based on the difference between the fair value and the carrying value of the equity investment, (iv) the elimination of the requirement to disclose the methods and significant assumptions used to estimate the fair value of financial instruments measured at amortized cost, (v) the addition of a requirement to use the exit price concept when measuring the fair value of financial instruments for disclosure purposes and (vi) the addition of a requirement to present financial assets and financial liabilities separately in the notes to financial statements, grouped by measurement category (e.g., fair value, amortized cost, lower of cost or market) and by form of financial asset (e.g., loans, equity securities).

The equity investment without readily determinable fair value held by the Company is the investment in common stocks of Genius Insurance Broker Co., Ltd. The Company elects to measure the equity investment using measurement alternative and records the investment at cost minus impairment, if any, plus or minus changes resulting from qualifying observable prices changes. Adjustments resulting from impairments and observable prices changes are recorded in the income statement. Further, in accordance with the guidance, recurring fair value disclosures are no longer provided for equity securities measured using the measurement alternative. In addition, the existing impairment model has been replaced with a new one-step qualitative impairment model. No initial adoption adjustment was recorded for these instruments since the guidance is required to be applied prospectively for securities measured using the measurement alternative. For the three and six months ended June 30, 2018, there is no impairment indicator and no adjustment to the cost of the equity investment in Genius Insurance Broker Co., Ltd. As of June 30, 2018 and December 31, 2017, the equity investment in Genius Insurance Broker Co., Ltd. is classified under long-term investments and the carrying amount is $1,261,754 and $1,296,039, respectively.

Accounting Standards Issued but Not Yet Adopted

Leases

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The guidance in ASU No. 2016-02 supersedes the lease recognition requirements in ASC Topic 840, Leases (Statement of Financial Accounting Standards No. 13). ASU 2016-02 requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. ASU No. 2016-02 is effective for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the effect this standard will have on its consolidated financial statements.

Credit Losses

In June 2016, the FASB issued ASC Update No. 2016-13, (Topic 326), Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments. This ASC update introduces new guidance for the accounting for credit losses on financial instruments within its scope. A new model, referred to as the current expected credit losses model, requires an entity to determine credit-related impairment losses for financial instruments held at amortized cost and to estimate these expected credit losses over the life of an exposure (or pool of exposures). The estimate of expected credit losses should consider both historical and current information, reasonable and supportable forecasts, as well as estimates of prepayments. The estimated credit losses and subsequent adjustment to such loss estimates, will be recorded through an allowance account which is deducted from the amortized cost of the financial instrument, with the offset recorded in current earnings. ASC No. 2016-13 also modifies the impairment model for available-for-sale debt securities. The new model will require an estimate of expected credit losses only when the fair value is below the amortized cost of the asset, thus the length of time the fair value of an available-for-sale debt security has been below the amortized cost will no longer affect the determination of whether a credit loss exists. In addition, credit losses on available-for-sale debt securities will be limited to the difference between the security’s amortized cost basis and its fair value. The updated guidance is effective for interim and annual periods beginning after December 15, 2019. Early adoption is permitted for periods beginning after December 15, 2018. The Company is evaluating the impact of the adoption of ASC Update No. 2016-13 on its financial position and results of operations.

| 15 |

There were other updates recently issued. The management does not believe that other than disclosed above, the recently issued, but not yet adopted, accounting pronouncements will have a material impact on its financial position results of operations or cash flows.

NOTE 3 – CASH, CASH EQUIVALENTS AND RESTRICTED CASH

Cash, cash equivalents and restricted cash consisted of the following as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | December 31, 2017 | |||||||

| Cash and cash equivalents: | ||||||||

| Cash in banks and on hand | $ | 5,986,248 | $ | 11,774,489 | ||||

| Cash equivalent – re-purchase bonds | 4,431,824 | 2,697,628 | ||||||

| Time deposits – with original maturities less than three months | 1,871,214 | 1,001,832 | ||||||

| 12,289,286 | 15,473,949 | |||||||

| Restricted cash – noncurrent (included in other assets) | 151,079 | - | ||||||

| Total cash, cash equivalents and restricted cash shown in the statements of cash flows | $ | 12,440,365 | $ | 15,473,949 | ||||

On December 22, 2017, the Company and China Bills Finance Corporation entered into a repurchase agreement to purchase re-purchase bonds of $2,697,628 (NTD 80,000,000) and with 0.38% interest rate per annum. The re-purchase bonds were due in January and February 2018. During the six months ended June 30, 2018, the Company purchased another re-purchase bonds of $4,431,824 (NTD 135,000,000) and with 0.38% interest rate per annum. The re-purchase bonds are due from time to time during July of 2018.

Restricted cash - noncurrent was a certificate of deposit in the bank by the Company in conformity with Provisions of the Supervision and Administration of Specialized Insurance Agencies, which is not allowed to be withdrawn without the permission of the regulatory commission.

NOTE 4 – TIME DEPOSITS AND STRUCTURED DEPOSITS

| June 30, 2018 | December 31, 2017 | |||||||

| Time deposits – with original maturities less than three months | $ | 1,871,214 | $ | 1,001,832 | ||||

| Time deposits – with original maturities over three months but less than one year | 26,883,900 | 21,470,113 | ||||||

| Total time deposits | $ | 28,755,114 | $ | 22,471,945 | ||||

| Structured deposits | $ | 2,206,313 | $ | 1,248,340 | ||||

Time deposits

As of June 30, 2018 and December 31, 2017, the Company had time deposits of approximately $3,611,116 (NTD 110,000,000) and $1,686,017 (NTD 50,000,000) out of the total $28,755,114 and $22,471,945 time deposits, respectively, pledged as collateral for short-term loans. See Note 5. The amount was recorded in time deposits with original maturities over three months but less than one year.

Structured deposits

On July 7, 2017, the Company entered into an agreement with Cathay United Bank to purchase a 185-day structured deposit in effective on July 7, 2017 and mature on January 8, 2018, with principal approximately $1,229,563 (RMB8,000,000). The structured deposit has an embedded foreign exchange option linked to US Dollar to China Yuan offshore exchange rate (“USDCNH”). Strike price of the structured deposit is set at 7.3 USDCNH and the fixing date is on January 4, 2018. Yield rate will be at 4.1% per annum when the USDCNH is above or equal strike price on the fixing date, or at 3.9% per annum when below.

On February 9, 2018, the Company entered into an agreement with CTBC Bank Co., Ltd. (CTBC) to purchase a one-month FX Swap and Forward Linked structured product in effective on February 13, 2018 and mature on March 29, 2018, with principal approximately $1,273,855 (RMB8,000,000). The structured deposit has an embedded foreign exchange forward linked to USDCNH.

In May and June of 2018, the Company entered into agreements with CTBC to purchase dual currency investment structured products which are embedded a foreign exchange option linked to USDCNH. The settlement amount on the maturity date is referring to the USDCNH on a valuation date which is compared with a pre-determined USDCNH (i.e., strike price). The Company might receive the original investment amount in original currency back or might receive investment amount exchanged into another currency at the strike price back depending on the appreciation or depreciation between US dollar and offshore China Yuan. The Company bears the risk of exchange losses of the investment amount. In addition, the Company will receive interest income at the maturities and the coupon rate ranges from 4.03% to 4.62% per annum.

As of June 30, 2018 and December 31, 2017, the Company had structured deposits of $2,206,313 and $1,248,340, respectively. The loss on valuation of structured deposits was both $6,648 for the three and six months ended June 30, 2018 and was both nil for the three and six months ended June 30, 2017.

| 16 |

NOTE 5 – SHORT-TERM LOANS

The Company’s short-term loans consisted of the following as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | December 31, 2017 | |||||||

| Credit facility, FEIB | $ | 1,500,000 | $ | - | ||||

| Credit facility, O-Bank | 1,400,000 | 1,400,000 | ||||||

| Credit facility, CTBC | - | 950,000 | ||||||

| Subtotal | $ | 2,900,000 | $ | 2,350,000 | ||||

| Current portion of long-term loans (Note 9) | 128,417 | - | ||||||

| Total short-term loans | 3,028,417 | 2,350,000 | ||||||

The Company entered into three credit agreements with several commercial banks as follows:

| · | O-Bank Co., Ltd. (“O-Bank”): The Company entered into a line of credit agreement with O-Bank for a $1,500,000 revolving credit facility from June 22, 2017 to June 21, 2018. The line of credit was renewed on September 4, 2018 and matures on September 3, 2019, with a revolving credit limit raised to $4,000,000. Borrowings under the agreement bear interest at the O-Bank’s cost of fund plus a margin of 0.5%. On December 11, 2017, the Company draw down a borrowing of $600,000 with interest at a rate of 2.35% per annum. On December 26, 2017, the Company borrowed $800,000 with interest at a rate of 2.70% per annum. These amounts were paid off in March of 2018. On June 12, 2018, the Company draw down borrowings of $1,400,000 with interest at rates of 2.89% per annum. The credit facility is secured by a total amount of approximately $1,641,416 (NTD50,000,000) of time deposits. |

| · | Far Eastern International Bank (“FEIB”): On September 21, 2017, the Company entered into a line of credit agreement with FEIB for a revolving credit facility of $2,000,000 from September 21, 2017 to September 21, 2018. Borrowings under the agreement bear interest at the higher of the LIBOR rate plus a margin of 1.3% or the TAIFX3 rate plus a margin of 1.25%. On June 15 and June 22, 2018, the Company draw down borrowings of $1,000,000 and $500,000, respectively, with an annum interest rate of 3.45%. These amounts were paid off in July of 2018.The credit facility is secured by a total amount of approximately $1,969,700 (NTD60,000,000) of time deposits. |

| · | CTBC Bank Co., Ltd. (“CTBC”): On November 17, 2017, the Company entered into a line of credit agreement with CTBC, pursuant to which the Company has a revolving credit facility of $1,000,000 from November 17, 2017 to July 31, 2018. This line of credit was renewed on September 12, 2018 and matures on August 31, 2019, with a revolving credit limit raised to $1,500,000. Borrowings under the agreement bear interest at the CTBC’s cost of fund plus a margin of 1%. On December 28, 2017, the Company draw down a borrowing of $950,000 with interest at a rate of 3.30% per annum. Law Broker is the guarantor of the credit facility. On January 29, 2018, the Company paid off the entire principal and interest of the borrowing. |

Total interest expenses of short-term loans were $17,689 and nil for the three months ended June 30, 2018 and 2017, and were $36,705 and nil for the six months ended June 30, 2018 and 2017.

NOTE 6 – INCOME TAX PAYABLE

The Company’s income tax payable consisted of the following as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | December 31, 2017 | |||||||

| Taiwan Tax | $ | 2,263,277 | $ | 3,232,996 | ||||

| U.S.A. Tax (Note 13) | 1,199,195 | - | ||||||

| PRC Tax | 956 | 270,267 | ||||||

| Hong Kong Tax | - | 5,527 | ||||||

| Total Income tax payable | $ | 3,463,428 | $ | 3,508,790 | ||||

| Income tax payable-short term | $ | 2,360,169 | $ | 3,508,790 | ||||

| Income tax payable-long term (Note 13) | $ | 1,103,259 | $ | - | ||||

| 17 |

NOTE 7 – COMMISSIONS PAYABLE TO SALES PROFESSIONALS

Commissions payable to sales professionals consisted of the following as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | December 31, 2017 | |||||||

| Taiwan | $ | 5,388,495 | $ | 6,206,269 | ||||

| PRC | 743,490 | 208,802 | ||||||

| Hong Kong | - | - | ||||||

| Total commissions payable to sales professionals | $ | 6,131,985 | $ | 6,415,071 | ||||

Commissions payable to sales professionals, salary payable to administrative staff and accrued bonus are usually settled within 12 months.

As of June 30, 2018 and December 31, 2017, the company had the commissions payable obligation to sale professionals amounted $6,131,985 and $6,415,071, respectively.

NOTE 8 – OTHER CURRENT LIABILITIES

Other current liabilities consisted of the following as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | December 31, 2017 | |||||||

| Unearned revenue - current (Note 10) | 1,376,944 | 1,237,684 | ||||||

| Salary payable to administrative staff | 1,082,200 | 1,194,725 | ||||||

| Accrued bonus | 1,052,094 | 1,730,278 | ||||||

| Due to previous shareholders of AHFL | 480,559 | - | ||||||

| Accrued business tax | 616,552 | 487,586 | ||||||

| Withholding tax for others | 390,330 | 347,824 | ||||||

| Accrued labor, health insurance and employee retirement plan | 114,803 | 114,556 | ||||||

| Other accrued liabilities | 511,104 | 1,051,112 | ||||||

| Total other current liabilities | $ | 5,624,586 | $ | 6,163,765 | ||||

Due to previous shareholders of AHFL is the remaining balance payable of the acquisition cost. The Company and the selling shareholders of AHFL entered into a third Amendment to the Acquisition Agreement, pursuant to which, the Company committed to distribute the cash payment in the amount approximately $676,466 (NTD22.5 million) to the selling shareholders of AHFL on or prior to June 30, 2016. On July 21, 2016, the Company arranged for the payment of $153,097 (NTD4,830,514) to the selling shareholders. On March 12, 2017, the Company and the selling shareholders of AHFL entered into a fifth amendment to the acquisition agreement, pursuant to which, the Company agreed to make the cash payment in the amount of $480,559 (NTD15 million) on or prior to March 31, 2019. As such, the amount was reclassified to other current liabilities as of June 30, 2018.

On June 23, 2016, the Company issued two units of the convertible bonds with an aggregate principal amount of $200,000 to a non-US person. On June 22, 2018, the bondholder did not exercise the conversion option and the convertible bonds were paid off. Total interest expense was $2,637 and $3,000 for the three months ended June 30, 2018 and 2017, respectively, and was $5,637 and $6,000 for the six months ended June 30, 2018 and 2017, respectively.

| 18 |

NOTE 9 – LONG-TERM LOANS

The Company’s long-term loans consisted of the following as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | December 31, 2017 | |||||||

| Loan A, interest at 8% per annum, maturity date May 15, 2019 | $ | 128,417 | $ | 130,641 | ||||

| Loan B, interest at 8% per annum, maturity date July 20, 2019 | 116,331 | 118,345 | ||||||

| Total loans | 244,748 | 248,986 | ||||||

| Less: current portion (Note 5) | (128,417 | ) | - | |||||

| Total long-term loans | $ | 116,331 | $ | 248,986 | ||||

Law Anhou Insurance Agency Co., Limited (“Anhou”) in Nanjing City, PRC is a variable interest entity (VIE) of which the Company is the primary beneficiary. The Company contractually control Anhou through CU Hong Kong.

On May 15, 2016, Anhou entered into a loan agreement (“Loan A”) with an individual third party. The loan agreement provided for approximately $128,417 (RMB 850,000) and $130,641 (RMB 850,000) as of June 30, 2018 and December 31, 2017, respectively, loan to the Company. The Loan A bears an interest rate of 8% per annum and interest is payable annually. The principal and the accrued interest will be due on May 15, 2019. As of June 30, 2018, the principal amount was reclassified to current liabilities.

On July 20, 2016, Anhou entered into a loan agreement (“Loan B”) with an individual third party. The loan agreement provided for approximately $116,331 (RMB 770,000) and $118,345 (RMB 770,000) as of June 30, 2018 and December 31, 2017, respectively, loan to the Company. The Loan B bears an interest rate of 8% per annum and interest is payable annually. The principal and the accrued interest will be due on July 20, 2019.

Total interest expenses for the Loan A and Loan B were $5,069 and $5,200, respectively, for the three months ended June 30, 2018 and 2017, and were $8,907 and $10,269, respectively, for the six months ended June 30, 2018 and 2017.

| 19 |

NOTE 10 – LONG-TERM LIABILITIES

The Company’s long-term liabilities consisted of the following as of June 30, 2018 and December 31, 2017:

| June 30, 2018 | December 31, 2017 | |||||||

| Unearned revenue – AIATW | $ | 2,579,368 | $ | 4,239,130 | ||||

| Due to previous shareholders of AHFL (Note 8) | - | 480,559 | ||||||

| Deferred tax liabilities | 120,465 | 122,551 | ||||||

| Total long-term liabilities | $ | 2,699,833 | $ | 4,842,240 | ||||

Unearned revenue – AIATW

On June 10, 2013, AHFL entered into a Strategic Alliance Agreement (the “Alliance Agreement”) with AIA International Limited Taiwan Branch (“AIATW”), the purpose to which is to promote life insurance products provided by AIATW within Taiwan by insurance agencies or brokerage companies affiliated with AHFL or CUIS. The original term of the Alliance Agreement was from June 1, 2013 to May 31, 2018. Pursuant to the terms of the Alliance Agreement, AIATW paid AHFL an execution fee approximately $8,326,700 (NTD250,000,000, including the tax of NTD11,904,762, the “Execution Fee”), which is to be recorded as revenue upon fulfilling sales targets and the 13-month persistency ratio, as defined, over the next five years. The Execution Fee may be required to be recalculated if certain performance targets are not met by AHFL.

On September 30, 2014, AHFL entered into a Strategic Alliance Supplemental Agreement (the “Supplemental Agreement”) with AIATW. In the Supplemental Agreement, the performance targets and the provision about refunding the Execution Fee on a pro rata basis when the performance targets are not met were revised.

On January 6, 2016, AHFL entered into an Amendment 2 to Strategic Alliance Agreement (the “Amendment No. 2”) with AIATW to further revise certain provisions in the Strategic Alliance Agreement and the previous amendment entered into by and between AHFL and AIATW. To the extent permitted by applicable laws and regulations, AHFL shall assist and encourage any insurance agency company or insurance brokerage company duly approved by the competent government authorities of Taiwan (the “Appointed Broker/Agent”), to cooperate with AIATW for the promotion of life insurance products of AIATW. Pursuant to the Amendment No. 2, the expiration date of the Strategic Alliance Agreement was extended from May 31, 2018 to December 31, 2021, and the effect of the Strategic Alliance Agreement during the period from October 1, 2014 to December 31, 2015 was suspended. In addition, both AHFL and AIATW agreed to adjust certain terms and conditions set forth in the Strategic Alliance Agreement, among which: (i) expand the scope of services to be provided by AHFL to AIATW to include, without limitation, assessment and advice on suitability of cooperative partners, advice on product strategies suitable for promotion channel development, advice on promotion/sales channel improvement, advice on promotion channel marketing and strategic planning, and promotion channel talent training; and (ii) remove certain provisions related to performance milestones and refund of Execution Fees. On March 15, 2016, AHFL issued a promise letter (the “2016 Letter”) to AIATW that AHFL is required to (i) fulfill sales targets and (ii) the 13-month persistency ratio.

On June 14, 2017, with AIATW’s consent, the 2016 Letter was revoked in order to conform with the latest terms and conditions regarding the cooperation between AHFL and AIATW as set forth in a third amendment (Amendment No. 3). Pursuant to the Amendment No. 3, both AHFL and AIATW agreed to adjust certain terms and conditions set forth this amendment, among which (i) except the first contract year (April 15th, 2013 to September 30th, 2014), the sales target of the alliance between the parties shall be changed to (a) value of new business (“VONB”) and (b) the 13-month persistency ratio; and (ii) AIATW will calculate and recognize the VONB and 13-month persistency ratio each contract year and inform the Company the result; and (iii) the Company agrees to return the basic business promotion fees to AIATW within thirty (30) days of receipt of the notice sent by AIATW if the Company fails to meet the targets set forth in Amendment No. 3, AIATW reserves the right to offset such amount against the amount payable by it to the Company; and (iv) upon the termination of the Alliance Agreement and its amendments pursuant to the Section 8.2 of the Alliance Agreement, both parties agreed to calculate the amount to be returned or repaid, as applicable, based on the past and current contract years. The Company shall return the basic business promotion fees at NTD 33,000,000 for each contract years within one month after the termination.

| 20 |

The following table presents the amounts recognized as revenue and refund for each contract year:

| Contract Year | Period | Execution Fees | Revenue

Amount |

Revenue

VAT Amount | Refund Amount |

Refund

VAT Amount | ||||||||||||||||

| First | 4/15/2013 ~ 9/30/2014 | NTD | 50,000,000 | NTD | 27,137,958 | (1) | NTD | 1,356,898 | NTD | 20,481,090 | (1) | NTD | 1,024,054 | |||||||||

| Second | 1/1/2016 ~ 12/31/2016 | NTD | 35,000,000 | NTD | 12,855,000 | (2) | NTD | 642,750 | NTD | 20,478,333 | (2) | NTD | 1,023,917 | |||||||||

| Third | 1/1/2017 ~ 12/31/2017 | NTD | 33,000,000 | NTD | 12,628,201 | (3) | NTD | 631,410 | NTD | 18,800,370 | (3) | NTD | 940,019 | |||||||||

| Fourth | 1/1/2018 ~ 12/31/2018 | NTD | 33,000,000 | NTD | 9,838,513 | (4) | NTD | 491,926 | NTD | 21,590,059 | (4) | NTD | 1,079,502 | |||||||||

| Fifth | 1/1/2019 ~ 12/31/2019 | NTD | 33,000,000 | NTD | - | NTD | - | NTD | - | |||||||||||||

| Sixth | 1/1/2020 ~ 12/31/2020 | NTD | 33,000,000 | NTD | - | NTD | - | NTD | - | |||||||||||||

| Seventh | 1/1/2021 ~ 12/31/2021 | NTD | 33,000,000 | NTD | - | NTD | - | NTD | - | |||||||||||||

| TOTAL | NTD | 250,000,000 | NTD | 62,459,672 | NTD | 3,122,984 | NTD | 81,349,852 | NTD | 4,067,492 | ||||||||||||

| (1) | The revenue recognition for the first contract year is based on the annual first year premium (“AFYP”) set in Alliance Agreement, which is different from other contract years. From the second contract year to the seventh contract year, the revenue calculation is based on VONB. The Company recognized the first contract year’s revenue amount of $892,742 (NTD27,137,958), net of Value-Added Tax (“VAT”) in 2017 due to uncertainty resolved after Amendment 3 went effective. Besides, on December 3, 2015 and February 23, 2016, the Company refunded the amounts of $160,573 (NTD4,761,905), net of VAT, and $530,056 (NTD15,719,185), net of VAT, to AIATW, respectively, due to the portion of performance sales targets not met during the first contract year based on original agreement and earlier amendments. |

| (2) | For the year ended December 31, 2017, the Company recognized the second contract year’s revenue amount of $422,883 (NTD12,855,000), net of VAT, and refunded the amount of $690,537 (NTD20,478,333), net of VAT, due to uncertainty resolved after Amendment 3 went effective. |

| (3) | For the year ended December 31, 2017, the Company recognized the third contract year’s revenue amount of $415,423 (NTD12,628,201), net of VAT, and estimated refund amount of $633,955 (NTD18,800,370), net of VAT, for the same contract period based on the calculation of VONB and 13-month persistency. The revenue recorded and refund amounts were trued up to $412,230 (NTD12,068,571) and $661,286 (NTD19,360,000), respectively, in the six months ended June 30, 2018 based on notice received from AIATW. |

| (4) | The Company estimates VONB and 13-month persistency ratio for the year ending December 31, 2018 and calculated the revenue amount to be $336,058 (NTD9,838,513) for the year. The amounts will be reassessed every quarter until receiving AIATW’s notice. |

The Company recognized revenue of $87,330 (NTD2,599,536) and $1,305,514 (NTD39,992,958), net of VAT, for the three months ended June 30, 2018 and 2017, and $157,008 (NTD4,639,443) and $1,305,514 (NTD39,992,958), net of VAT, for the six months ended June 30, 2018 and 2017 related to this agreement. As of June 30, 2018 and December 31, 2017, the Company had non-current portion of unearned revenue of $2,579,368 and $4,239,130, respectively, and amounts in other current liabilities of $1,376,944 and $633,955, respectively, related to the Alliance Agreement.

Unearned revenue – Farglory

On April 20, 2016, the Company entered into a service agreement (“Service Agreement”) with Farglory. The Company was to provide consulting services to Farglory for NTD4,000,000 per year and the aggregate consulting services fee was NTD20,000,000 from May 1, 2016 to April 30, 2021. On January 2, 2018, both parties reached the final agreement and the Company received termination notice from Farglory. Pursuant to the termination notice, the Company should refund approximately $603,729 (NTD17,904,000) to Farglory which was paid off in January 2018.

NOTE 11 – REVENUE

The Company’s revenue is derived from insurance agency and brokerage services. The Company, through its subsidiaries, sells insurance products provided by insurance companies to individuals, and is compensated in the form of commissions from the respective insurance companies, according to the terms of each service agreement made by and between the Company and the insurance companies. The sale of an insurance product by the Company is considered complete when initial insurance premium is paid by an individual and the insurance policy is approved by the respective insurance company. When a policy is effective, the insurance company is obligated to pay the agreed-upon commission to the Company under the terms of its service agreement with the Company and such commission is recognized as revenue.

The Company considers the contracts with insurance companies contain one performance obligation and consideration should be recorded when performance obligation is satisfied at point in time. The amount of revenue to be recognized when the insurance policy is effective includes first year commission and other contingent commission that a significant reversal of revenue would not occur in the subsequent periods. When other contingent commission that could not be determined if a significant reversal of revenue would occur, the Company recognizes the commission after receiving insurance companies’ notice. The revenue by segment is disaggregated as below:

| Three Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Geographical Areas | ||||||||

| Revenue | ||||||||

| Taiwan | $ | 16,998,019 | $ | 15,956,177 | ||||

| PRC | 3,166,721 | 2,543,599 | ||||||

| Hong Kong | 41,085 | 29,999 | ||||||

| Elimination adjustment | (30,488 | ) | (10,593 | ) | ||||

| Total revenue | $ | 20,175,337 | $ | 18,518,822 | ||||

| Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Geographical Areas | ||||||||

| Revenue | ||||||||

| Taiwan | $ | 31,738,791 | $ | 28,377,258 | ||||

| PRC | 5,875,342 | 5,435,531 | ||||||

| Hong Kong | 81,072 | 72,514 | ||||||

| Elimination adjustment | (30,488 | ) | (10,953 | ) | ||||

| Total revenue | $ | 37,664,717 | $ | 33,874,350 | ||||

| 21 |

The prior year information in the above table has not been adjusted under the modified retrospective method of adoption of the new revenue recognition guidance.

Contract Assets and Unearned Revenue

| June 30, 2018 | December 31, 2017 | |||||||

| Contract assets – current | $ | 1,317,465 | $ | - | ||||

| Unearned revenue – current (Note 8) | 1,376,944 | 1,237,684 | ||||||

| Unearned revenue – noncurrent (Note 10) | 2,579,368 | 4,239,130 | ||||||

Contract assets are the Company’s conditional rights to consideration for completed performance obligation. The Company recognizes the contingent commission as a contract asset when the performance obligation is fulfilled, and the Company has not had the unconditional rights to the payment.

Unearned revenue relates to advances received prior to performance under the contract. The related contracts are the Alliance Agreement with AIATW and the Service Agreement with Farglory which are disclosed in Note 10 to the consolidated financial statements.

NOTE 12 – NONCONTROLLING INTERESTS

Noncontrolling interests consisted of the following as of June 30, 2018 and December 31, 2017:

| Name of Controlled Entity | % of Non- controlling Interests | As of December 31, 2017 | Net Income (Loss) of Non-Controlling Interests | Other Comprehensive Income (Loss) of Non-Controlling Interests | As of June 30, 2018 | |||||||||||||||

| Law Enterprise | 34.05 | % | $ | (243,240 | ) | $ | 260,256 | $ | (24,137 | ) | $ | (7,121 | ) | |||||||

| Law Broker | 34.05 | % | 13,900,341 | 1,524,228 | (374,889 | ) | 15,049,680 | |||||||||||||

| PFAL | 49.00 | % | 228,079 | (26,365 | ) | (467 | ) | 201,247 | ||||||||||||

| MKI | 49.00 | % | (2,117 | ) | (514 | ) | - | (2,631 | ) | |||||||||||

| PA Taiwan | 49.00 | % | (145,442 | ) | 2,525 | (697 | ) | (143,614 | ) | |||||||||||

| PTC Nanjing | 49.00 | % | (1,965 | ) | (24 | ) | (132 | ) | (2,121 | ) | ||||||||||

| Total | $ | 13,735,656 | $ | 1,760,106 | $ | (400,322 | ) | $ | 15,095,440 | |||||||||||

| Name of Controlled Entity | % of Non- controlling Interests | As of December 31, 2016 | Net Income (Loss) of Non-Controlling Interests | Other Comprehensive Income (Loss) of Non-Controlling Interests | As of December 31, 2017 | |||||||||||||||

| Law Enterprise | 34.05 | % | $ | 17,386 | $ | (307,217 | ) | $ | 46,591 | $ | (243,240 | ) | ||||||||

| Law Broker | 34.05 | % | 9,621,159 | 3,387,038 | 892,144 | 13,900,341 | ||||||||||||||

| PFAL | 49.00 | % | 232,414 | (3,817 | ) | (518 | ) | 228,079 | ||||||||||||

| MKI | 49.00 | % | (1,569 | ) | (548 | ) | - | (2,117 | ) | |||||||||||

| PA Taiwan | 49.00 | % | (95,448 | ) | (52,169 | ) | 2,175 | (145,442 | ) | |||||||||||

| PTC Nanjing | 49.00 | % | (2,400 | ) | (60 | ) | 495 | (1,965 | ) | |||||||||||

| Total | $ | 9,771,542 | $ | 3,023,227 | $ | 940,887 | $ | 13,735,656 | ||||||||||||

| 22 |

NOTE 13 – INCOME TAX

The following table reconciles the Company’s statutory tax rates to effective tax rates for the three and six months ended June 30, 2018 and 2017:

| Three Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| US statutory rate | 21 | % | 34 | % | ||||

| Tax rate difference | (1 | )% | (19 | )% | ||||

| Tax base difference | 1 | % | 1 | % | ||||

| Income tax on undistributed earnings | 4 | % | - | % | ||||

| Loss in subsidiaries | (1 | )% | 4 | % | ||||

| Un-deductible and non-taxable items | (4 | )% | 3 | % | ||||

| True up of prior year income tax | (44 | )% | - | % | ||||

| Withholding tax | 41 | % | ||||||

| Effective tax rate | 17 | % | 23 | % | ||||

| Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| US statutory rate | 21 | % | 34 | % | ||||

| Tax rate difference | (1 | )% | (18 | )% | ||||

| Tax base difference | 1 | % | 1 | % | ||||

| Income tax on undistributed earnings | 4 | % | - | % | ||||

| Loss in subsidiaries | - | % | 4 | % | ||||

| Un-deductible and non-taxable items | (1 | )% | 4 | % | ||||