Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALMOST FAMILY INC | form8k.htm |

November 2011

Forward Looking Statements

This presentation contains, and answers given to questions that may be asked today may constitute, forward-looking

statements that are subject to a number of risks and uncertainties, many of which are outside our control. All

statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs,

prospects, plans and objectives, other than statements of historical fact included in the presentation, are forward-

looking statements. When used in this presentation or in answers given to questions asked today, the words “may,”

“will,” “could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. You should not place undue reliance on forward-looking statements. While we believe

that we have a reasonable basis for each forward-looking statement that we make, we caution you that these

statements are based on a combination of facts and factors currently known by us and projections of future events or

conditions, about which we cannot be certain. For a more complete discussion regarding these and other factors which

could affect the Company's financial performance, refer to the Company's various filings with the Securities and

Exchange Commission, including its filing on Form 10-K for the year ended December 31, 2010 and subsequently filed

Forms 10-Q, in particular information under the headings "Special Caution Regarding Forward-Looking Statements"

and “Risk Factors.” These cautionary statements qualify all of the forward-looking statements. In addition, market and

industry statistics contained in this presentation are based on information available to us that we believe is accurate.

This information is generally based on publications that are not produced for purposes of securities offerings or

economic analysis.

statements that are subject to a number of risks and uncertainties, many of which are outside our control. All

statements regarding our strategy, future operations, financial position, estimated revenues or losses, projected costs,

prospects, plans and objectives, other than statements of historical fact included in the presentation, are forward-

looking statements. When used in this presentation or in answers given to questions asked today, the words “may,”

“will,” “could,” “would,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “potential,” “continue,” and

similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. You should not place undue reliance on forward-looking statements. While we believe

that we have a reasonable basis for each forward-looking statement that we make, we caution you that these

statements are based on a combination of facts and factors currently known by us and projections of future events or

conditions, about which we cannot be certain. For a more complete discussion regarding these and other factors which

could affect the Company's financial performance, refer to the Company's various filings with the Securities and

Exchange Commission, including its filing on Form 10-K for the year ended December 31, 2010 and subsequently filed

Forms 10-Q, in particular information under the headings "Special Caution Regarding Forward-Looking Statements"

and “Risk Factors.” These cautionary statements qualify all of the forward-looking statements. In addition, market and

industry statistics contained in this presentation are based on information available to us that we believe is accurate.

This information is generally based on publications that are not produced for purposes of securities offerings or

economic analysis.

All forward-looking statements speak only as of the date of this presentation. Except as required by law, we assume

no obligation to update these forward-looking statements publicly or to update the factors that could cause actual

results to differ materially, even if new information becomes available in the future.

no obligation to update these forward-looking statements publicly or to update the factors that could cause actual

results to differ materially, even if new information becomes available in the future.

2

Almost Family

Overview

Overview

Almost Family

Founded in Louisville KY - 1976

Two Home Health Segments:

- Visiting Nurse, Medicare-certified

Skilled (~82% of Revenue)

- Personal Care, primarily Medicaid-Waiver

Non-skilled (~18% of Revenue)

Revenue Run Rate of approximately

$370 Million

$370 Million

4

AFAM - Business Thesis

þ Compelling demographics and fragmentation present

long-term opportunity - outweigh short-term

regulatory pressures

long-term opportunity - outweigh short-term

regulatory pressures

þ Long history of outstanding revenue and earnings

growth

growth

þ Strong geographic cluster focus, cash flows and

capital structure

capital structure

þ Proven ability to grow the platform with a balanced

approach - organic and acquisitions

approach - organic and acquisitions

5

Almost Family

Northeast Cluster

Southeast Cluster

Midwest Cluster

6

Almost Family

($Millions)

$86.6

$209.3

$75.8

Revenue

Track Record of

Strong Performance

- 4 Yr CAGR Revenue 40%

- 4 Yr CAGR EPS 42%

- Last 4 Yrs:

- 58% Organic Growth

- Acquired $156 Million

in Revenue

$128.8

7

$296.0

$84.4

$86.2

$335.3

Characteristics of Medicare Population

Source: Kaiser Family Foundation Medicare Primer 2009

45 million beneficiaries

- Limited Resources - 1 out of 2 have income of less than

$21,000 (near poverty level)

- 1 out of 3 - have 3 or more chronic health conditions

- 1 out of 3 - have cognitive or mental impairment

- 1 out of 3 - are in poor health

- 1 out of 5 - have significant limitations in activities

of daily living

- 1 out of 8 - is over 85 years old

- 1 out of 20 - lives in a nursing home

8

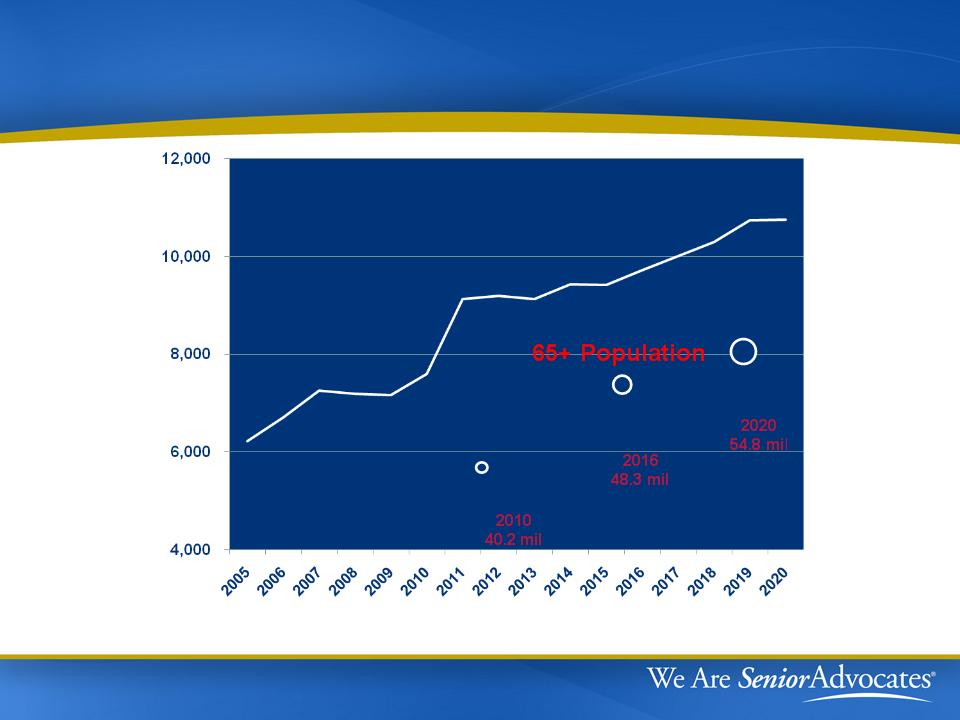

Number of New 65 Year Olds Per Day

9

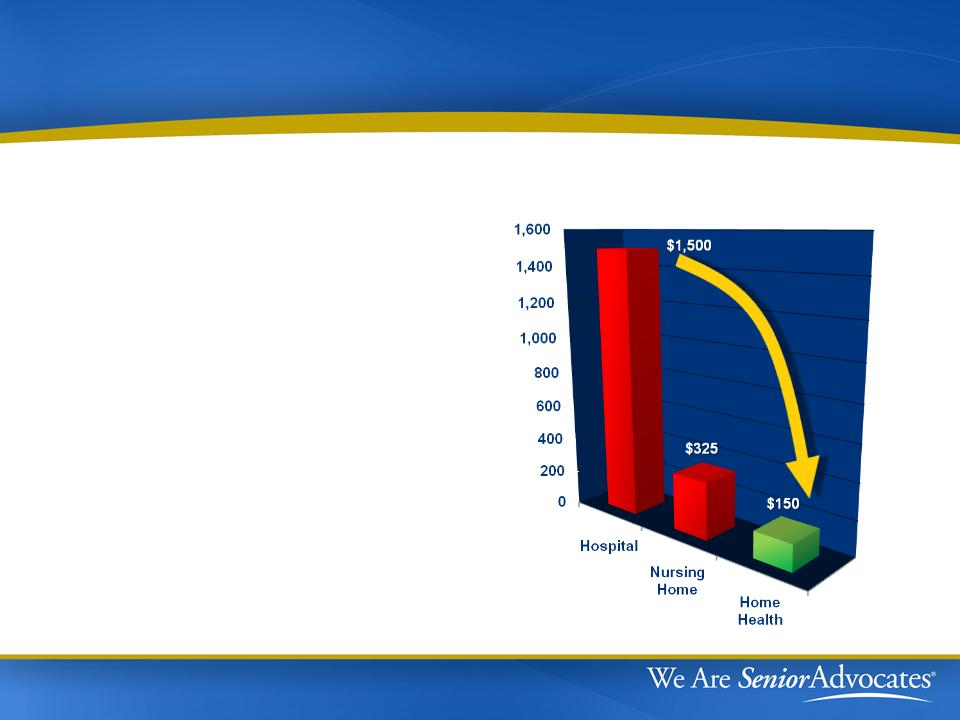

The Benefits of Home Health Care

Bending the Cost Curve

- Lower cost per day vs.

hospital & nursing homes

hospital & nursing homes

- Lower costs to Medicare

Program

Program

- Prevents mild exacerbations

from escalating into critical

situations

from escalating into critical

situations

Cost per day

10

Who Receives Home Health Care?

Over 3.5 million Americans

rely on home health care to stay

in their homes.

- 80+ year old, sick patients

- Chronic conditions, sickest of the sick

- Want to “Age in Place”, out of

hospitals & nursing homes

- Want to restore their ability to care

for themselves

11

Home Health Evolving as a Broader

Solution

Solution

12

Industry evolving from post-

hospital stay to serve broader

category of patients:

hospital stay to serve broader

category of patients:

-Still serving hospital discharged

“post-acute” patients - Shorten length

of stay

“post-acute” patients - Shorten length

of stay

- Evolving to serve more chronically

ill patients on a “pre-acute” basis to

avoid unnecessary hospitalizations

ill patients on a “pre-acute” basis to

avoid unnecessary hospitalizations

-Hospital Inpatient stays down 4%

over 5 years

over 5 years

Our Mission - “We Are Senior Advocates”

One Shared Goal - allow

Seniors to “Age in Place”

at home at a lower cost to

Medicare

Seniors to “Age in Place”

at home at a lower cost to

Medicare

Advocates on behalf of the

sick & elderly

sick & elderly

Make lives of elderly, acute

& chronically ill better

& chronically ill better

Backbone of who we are &

how we run our business

13

Local Market Emphasis

Managing Successfully by:

Placing Senior Management

closer to local markets

Local “Course Knowledge”

hometown business

hometown business

Growing locally based sales &

marketing staff

marketing staff

Standard local office operating model,

with local office flexibility in

marketing & clinical programs

with local office flexibility in

marketing & clinical programs

14

Regulatory Front

2011 Medicare Changes

|

Topic

|

Discussion

|

|

Reimbursement

Rate Cut |

~ 5.2% cut in national payment rate -

reduced margins ($11.5M reduction to YTD Q3 2011 revenue) |

|

Physician Face-

to-Face Encounter |

Agencies must get documentation of

encounter 90 days before or 30 days after admit |

|

Therapy

Reassessments |

Agencies must reassess therapy

need at 30 days and visits 13 and 19 |

16

2012 Medicare Changes

|

Topic

|

Discussion

|

|

Reimbursement

Rate Cut |

• “Market basket update” rate increase of 1.4%

• “Case mix creep” adjustment of 3.79%

• Effective rate cut of approximately 2.31%

nationwide |

|

Other changes

|

• Reduced payments for high therapy episodes

• Removed two hypertension codes

• Recalibrated case-mix weights

• Shifted a -1.32% case-mix adjustment to 2013

|

|

Impact on

AFAM reimbursement |

• Preliminary analysis indicates 5.0 to 5.5%

effective 2012 rate cut for AFAM with Q4 2011 phase-in |

17

PPACA Long-Term Impact

|

Topic

|

Impact

|

|

Market Basket

Updates |

Reduces updates by 1% in 2011,

2012 and 2013 |

|

Re-basing

Rates |

Begin 2014, phased in over 4 years

with adjustments limited to 3.5% per year |

|

Productivity

Adjustment |

Begin 2015

|

|

Rural Add-on

|

3% in 4/1/2010 - 2015

|

|

Outlier Cap

|

10% of revenue beginning 2011

(implemented by CMS in 2010)

|

18

MedPac 2011 Recommendations

|

Number

|

Recommendation

|

|

8-1

|

CMS should improve controls in counties

with aberrant utilization, suspend payment if fraud indicated |

|

8-2

|

Accelerate rebasing to two year phase-in

starting 2013, eliminate 2012 market basket update |

|

8-3

|

Revise HH PPS to remove number of

therapy visits as a payment factor |

|

8-4

|

Establish co-pay for episodes not

preceded by an inpatient stay |

19

Financial Highlights

2010 and YTD Q3 11 Highlights

YE2010 YTD

- Revenues +13% -

- Diluted EPS +15% -35%

- MCR Admissions +12% + 7%

- MCR Episodes +12% + 3%

21

Organic Medicare Growth

YE2010 YTD

- Admissions +11% +5%

- Episodes +12% +3%

Cambridge Acquisition

- $6.2M Revenue and $0.06 EPS

for 2 months in Q3

- Transition proceeding

according to expectations

Investment Highlights

Annual Revenue run rate over $370 million

Leading Regional Home Health Provider

- 40% four year revenue CAGR

- Decentralized operating model

Strong Capital Position

- $155 million immediately available

for future growth

Disciplined Approach to acquisitions driven

by Seasoned Management

Growing Force in consolidating home health care market

- 10 acquisitions in four years

- Three geographic clusters: Northeast, Southeast & Midwest

22

Contact Information

23