Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Reliant Bancorp, Inc. | brhc10026888_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Reliant Bancorp, Inc. | brhc10026888_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Reliant Bancorp, Inc. | brhc10026888_ex2-1.htm |

Exhibit 99.2

Acquisition of Reliant Bancorp, Inc. July 14, 2021 Entering Nashville MSA and Strengthening Our

Tennessee Franchise

Important Information For Stockholders and Investors This presentation relates to a proposed merger of

United Community Banks, Inc. ("United") and Reliant Bancorp, Inc. (“Reliant"). In connection with the proposed merger, United is required to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will

include a Proxy Statement of Reliant to be sent to Reliant’s stockholders seeking their approval of the merger. The registration statement also will contain the prospectus of United to register the shares of United common stock to be issued in

connection with the merger. A definitive proxy statement/prospectus will also be provided to Reliant’s stockholders as required by applicable law. INVESTORS AND STOCKHOLDERS OF RELIANT ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT,

INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE A PART OF THE REGISTRATION STATEMENT WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY UNITED OR RELIANT WITH THE SEC, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THE

REGISTRATION STATEMENT AND THOSE OTHER DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT UNITED, RELIANT AND THE PROPOSED TRANSACTION.The registration statement and other documents filed with the SEC may be obtained for free at

the SEC’s website (www.sec.gov). You will also be able to obtain these documents, free of charge, from United at the “Investor Relations” section of United’s website at www.UCBI.com or from Reliant at the “Investors” section of Reliant’s

website at www.reliantbank.com. Copies of the definitive proxy statement/prospectus will also be made available, free of charge, by contacting United Community Banks, Inc., P.O. Box 398, Blairsville, GA 30514, Attn: Jefferson Harralson,

Telephone: (864) 240-6208, or Reliant Bancorp, Inc., 6100 Tower Circle, Suite 120, Franklin TN 37067, Attn: Jerry Cooksey, Telephone: (615) 221-2020. This communication does not constitute an offer to sell, the solicitation of an offer to sell

or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of

such jurisdiction. This communication is also not a solicitation of any vote or approval with respect to the proposed transactions or otherwise. PARTICIPANTS IN THE TRANSACTIONUnited and Reliant and certain of their respective directors and

executive officers, under the rules of the SEC, may be deemed to be participants in the solicitation of proxies from Reliant’s stockholders in favor of the approval of the proposed merger. Information about the directors and officers of United

and their ownership of United common stock can also be found in United’s definitive proxy statement in connection with its 2021 annual meeting of shareholders, as filed with the SEC on March 30, 2021, and other documents subsequently filed by

United with the SEC. Information about the directors and executive officers of Reliant and their ownership of Reliant capital stock, as well as information regarding the interests of other persons who may be deemed participants in the

transaction, may be found in Reliant’s definitive proxy statement in connection with its 2021 annual meeting with shareholders, as filed with the SEC on April 8, 2021, and other documents subsequently filed and also may be obtained by reading

the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described above. *

Cautionary Statement About Forward-Looking Statements This communication contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In general, forward-looking statements usually may be identified through use of words

such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, and include statements related to the

expected timing of the closing of the merger, the expected returns and other benefits of the merger to stockholders, expected improvement in operating efficiency resulting from the merger, estimated expense reductions resulting from the

transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the merger on United’s capital ratios. Forward-looking statements are not historical

facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Actual results may prove to be materially

different from the results expressed or implied by the forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial

condition to differ materially from those expressed in or implied by such statements.Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings and any revenue synergies from

the merger may not be realized or take longer than anticipated to be realized, (2) disruption from the merger with customer, supplier, employee or other business partner relationships, (3) the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger agreement, (4) the failure to obtain the necessary approval by the stockholders of Reliant, (5) the possibility that the costs, fees, expenses and charges related to the merger

may be greater than anticipated, (6) the ability by United to obtain required governmental approvals of the merger, (7) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to

the merger, (8) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the merger, (9) the risks relating to the integration of Reliant’s operations into the operations of United,

including the risk that such integration will be materially delayed or will be more costly or difficult than expected, (10) the risk of potential litigation or regulatory action related to the merger, (11) the risks associated with United’s

pursuit of future acquisitions, (12) the risk of expansion into new geographic or product markets, (13) the dilution caused by United’s issuance of additional shares of its common stock in the merger, and (14) general competitive, economic,

political and market conditions. Further information regarding additional factors which could affect the forward-looking statements can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors” in United’s Annual Report on Form 10-K for the year ended December 31, 2020, and other documents subsequently filed by United with the SEC. Many of these factors are beyond United’s and Reliant’s ability to

control or predict. If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking statements.

Accordingly, stockholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this communication, and neither United nor Reliant undertakes any

obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for

United or Reliant to predict their occurrence or how they will affect United or Reliant. United and Reliant qualify all forward-looking statements by these cautionary statements. *

Strengthens Tennessee Franchise $3 billion community bank with top 10 market share in the Nashville,

MSARecognized by Raymond James for performing in the top 10% of domestic community banks One of two Tennessee banks recognized by S&P Global Market Intelligence as a top performing community bank out of 4,287 banks with under $3 billion in

assets6th fastest growing MSA in the Southeast (1)6th largest metro in the SoutheastPro forma top 10 deposit market share in Tennessee Transaction Highlights * Expansion into Nashville MSA, one of the top markets in the

Southeast Financially Compelling and Poised for Growth Mid-single digit EPS % accretion in 2022; high single-digit EPS % accretion in 2023 (first full year of cost savings recognition)IRR greater than 25%Improves efficiency ratio by 350+ bps

and ROTCE by ~135 bps (first full year of cost savings realization)Manageable tangible book value dilution and earnback period of approximately 3 yearsNo revenue synergies projected, but opportunity to leverage Reliant’s commercial

relationships through United’s diversified platform and larger balance sheet Strong Cultural Fit Gaining talented Tennessee leadership team, led by DeVan Ard’s nearly 40 years of banking experience and knowledge of the Nashville

marketplaceRelationship-oriented bank centered on delivering excellent customer service and recognized as the best community bank in Tennessee by NewsweekMultiple years of recognition as a top workplace Note: Financial data as of March 31,

2021; deposit market share and demographic data as of June 30, 2020Based on projected population growth between 2021-2026 of MSAs with a population greater than 1,000,000Source: S&P Global Market Intelligence; company documents, Reliant

investor relations website Consistent M&A Strategy Transaction consistent with United’s strategy of acquiring high-quality, franchise-enhancing companies in growth marketsHighly experienced acquirer with a long track record of

successfully integrating whole-bank transactionsConservative assumptions supported by extensive due diligence

Preliminary Transaction Assumptions Total gross credit marks of $63.1 million; or 2.6% of total loans

(ex-PPP)Day 1 gross credit mark of $44.8 million or 1.9% of loans (ex-PPP); 1.0% net of Reliant’s $20.8 million loan loss reserve$13.9 million non-PCD; $30.9 million PCDDay 2 estimated allowance related to CECL of $15.7 millionAdditional $2.5

million reserve for unfunded commitmentsPositive gross interest rate mark of $2.8 million, or 0.12% of total loans (ex-PPP) $34.0 million of pre-tax one-time expenses (6.6% of transaction value) Aggregate Price-to-Tangible Book Value:

194.1%Aggregate Price-to-LTM Net Income: 11.8xAggregate Price-to-2022E Net Income after Cost Savings (2) : 8.3xCore Deposit Premium 12.1%Market Price Premium (3): 11.0% * 0.9842 shares of United common stock to be issued for each share of

Reliant common stockAggregate transaction value (1) of $517 millionAggregate consideration includes $7.1 million for restricted stock awards and units, and $1.2 million for stock optionsTransaction value per share (1) of $30.58 84% United /

16% ReliantIssuing 16,606,718 shares to Reliant common shareholders Early Q1 2022 31% of Reliant’s 2022 estimated adjusted non-interest expense (4)75% realization of cost savings in 2022, and 100% in years

thereafter Consideration Transaction Metrics Pro Forma Ownership Expected Closing Cost Savings Credit / Interest Marks Financial Impacts and Returns Expected to be $0.15 per share (6.1%) accretive to EPS in 2022 and $0.22 per share

(8.5%) in 2023 (first full year of cost savings recognition)Anticipated initial tangible book value dilution of $0.70, or 3.7%, and a ~3 year earn back periodEstimated pro forma leverage ratio at transaction close of 9.5% Based on United’s

closing stock price of $31.07 as of the market close on July 13, 2021, and value of the stock options and restricted stock unitsMetric includes 100% realization of projected annual after-tax cost savingsBased on Reliant’s stock price of $27.54

as of July 13, 2021Adjusted non-interest expense excludes Reliant’s mortgage operations One-Time Expenses

Overview of Reliant Bancorp, Inc. * Reliant’s Branch Network Company Overview Ticker: RBNC

(NASDAQCM)Market Capitalization: $458.7Chairman and CEO: DeVan Ard, Jr.Headquarters: Brentwood, TNBank Subsidiary: Reliant Bank; 25 branches, 1 LPOReliant Bank founded in 2006Completed four whole bank acquisitions since 2014 Reliant also has

an LPO in Knoxville, TN; Does not include 6 mortgage offices in Tennessee and Arkansas leased by subsidiary Reliant Mortgage Ventures, LLCNote: Financial data as of March 31, 2021; Market data as of July 13, 2021; Dollar values in

millionsSource: S&P Global Market Intelligence; Reliant Documents Reliant Branches (25) (1) United Tennessee Branches (7) Nashville Chattanooga Clarksville Columbia Financial Highlights Knoxville Projected Population Growth

by MSA Nationwide Proj. Population Growth: 2.9%

Top 10 Market Share in High-Growth Nashville Market Flourishing local economy continues to strengthen

and forecasters are predicting substantial economic growth over the next five yearsNashville ranked in the top 10 metros for job and population growth for the past eight years#1 in Metropolitan Economic Strength Rankings – (Policom – 2019,

2020)Downtown Nashville population increased 130% between 2010-2018Current population is 1,900,980Tennessee is home to 10 Fortune 500 companiesIn 2020, Nashville saw significant investments from industry leading companies such as Amazon,

Facebook, General Motors, etc.Recent corporate relocations to the Nashville MSA include Nissan, Dell Computer, Mitsubishi Motors, and Ernst & YoungHealthcare is a major driver of Nashville’s economy with over 500 healthcare companies and

nearly 400 professional services firms focused on the healthcare industryThe healthcare industry contributes over $46.7 billion and 270,000 jobs to the local economy EXPANSION RATIONALE Nashville, TN MSA Deposit Market Share Note: Deposit

data as of June 30, 2020Source: S&P Global Market Intelligence, The Center Square, Area Development, Nashville Area Chamber of Commerce, The Tennessean, Nashville Health Care Council, Policom Thriving Marketplace Reliant * Nashville

and Surrounding Cities

Chattanooga is home to a fast-growing business district and thriving downtown situated along the

Tennessee RiverAn industrial hub best known for the manufacturing of automobiles and food & beverage products as well as its sophisticated freight and logistics networkAnnounced corporate investments in Chattanooga in 2019 and 2020 totaled

$1.1 billion and $732 million, respectively, and resulted in the creation of an estimated 2,925 and 1,752 jobs, respectively Entrance into Attractive Clarksville & Chattanooga Markets Source: S&P Global Market Intelligence,

Clarksville Chamber of Commerce, Clarksville-Montgomery County Industrial Development Board, Chattanooga Chamber of Commerce, Greater Chattanooga Economic Partnership * CHATTANOOGA OVERVIEW Population: 571,204 Proj. Population Growth

2021 – 2026: 4% Household Median Income: $59,055 Proj. Household Median Income Growth 2021 - 2026: 11% $100K+ Household Income: 26% Chattanooga MSA Demographic Information CHATTANOOGA NOTABLE EMPLOYERS Clarksville is the 5th largest

city in Tennessee and the county seat of Montgomery CountyNearby Fort Campbell supports ~250,000 active duty military and their families, and contributes over $4.5 billion annually to the TN economyLocated in the heart of auto alley within one

day shipping time to 76% of major U.S cities, Clarksville is home to 14 major automotive facilitiesThe right combination of fiber infrastructure, low cost developable land, and a vibrant business environment all supported Google’s decision to

choose Clarksville as the location for its $600 million data center in February 2018 CLARKSVILLE OVERVIEW Population: 313,385 Proj. Population Growth 2021 – 2026: 5% Household Median Income: $55,155 Proj. Household Median Income

Growth 2021 – 2026: 6% $100K+ Household Income: 22% Clarksville MSA Demographic Information CLARKSVILLE NOTABLE EMPLOYERS

United MSA Presence * Includes MSAs with a population greater than 1,000,000Reliant has 18 offices in

the Nashville area, 4 offices in Clarksville, TN, 2 offices in Hickman, TN, 1 office in Chattanooga, TN, and 1 LPO in Knoxville, TNMarkets weighted by depositsIncludes pending acquisitionsSource: S&P Global Market Intelligence Reliant MSA

Presence Deposits per Branch ($ millions) Projected Population Growth (3) 2021 – 2026 (%) Projected Household Income Growth (3) 2021 – 2026 (%) Median Household Income($000): $62.1 $73.9 NationalAvg. NationalAvg. High-Growth MSAs

in the Southeast $67.8 Added through acquisitions in 2020 / 2021 (4) United Now Operates in 8 of the Top 10 Growth Markets Additive to Our Existing Growth-Oriented Southeast Footprint

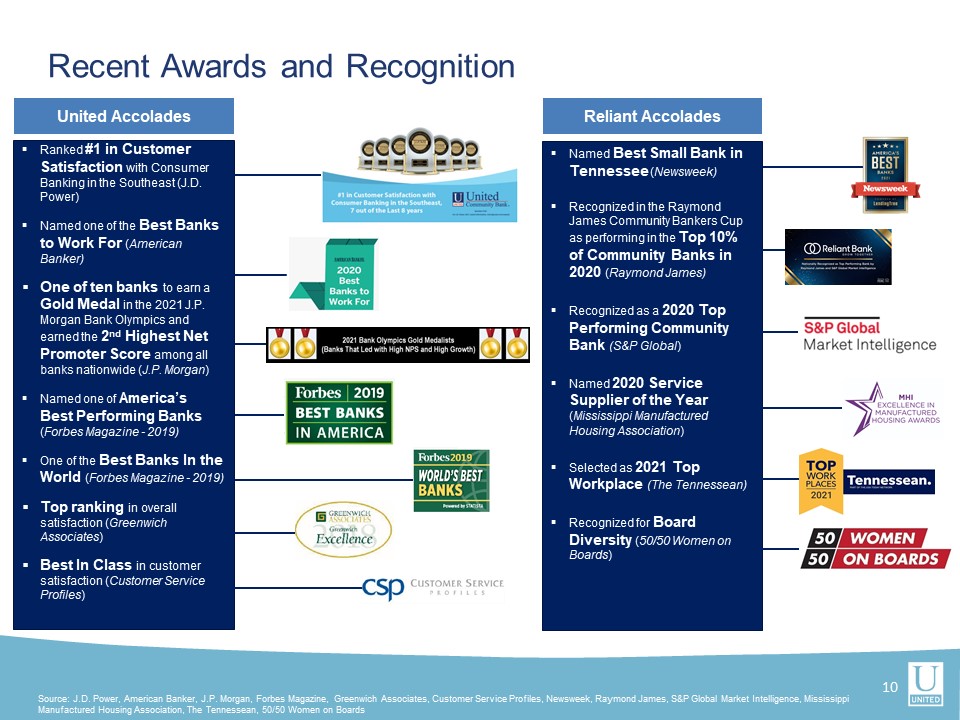

Recent Awards and Recognition * 23.14%$100-199K Growth Ranked #1 in Customer Satisfaction with

Consumer Banking in the Southeast (J.D. Power)Named one of the Best Banks to Work For (American Banker)One of ten banks to earn a Gold Medal in the 2021 J.P. Morgan Bank Olympics and earned the 2nd Highest Net Promoter Score among all banks

nationwide (J.P. Morgan)Named one of America’s Best Performing Banks (Forbes Magazine - 2019)One of the Best Banks In the World (Forbes Magazine - 2019)Top ranking in overall satisfaction (Greenwich Associates)Best In Class in customer

satisfaction (Customer Service Profiles) United Accolades Named Best Small Bank in Tennessee (Newsweek)Recognized in the Raymond James Community Bankers Cup as performing in the Top 10% of Community Banks in 2020 (Raymond James)Recognized as

a 2020 Top Performing Community Bank (S&P Global)Named 2020 Service Supplier of the Year (Mississippi Manufactured Housing Association) Selected as 2021 Top Workplace (The Tennessean)Recognized for Board Diversity (50/50 Women on

Boards) Reliant Accolades Source: J.D. Power, American Banker, J.P. Morgan, Forbes Magazine, Greenwich Associates, Customer Service Profiles, Newsweek, Raymond James, S&P Global Market Intelligence, Mississippi Manufactured Housing

Association, The Tennessean, 50/50 Women on Boards

Pro Forma Loan and Deposit Composition * Bank-level loan and deposit information as of March 31,

2021Source: S&P Global Market Intelligence Total Deposits: $18.9 billionCost of Deposits: 0.19% Total Deposits: $16.3 billionCost of Deposits: 0.14% Total Deposits: $2.6 billionCost of Deposits: 0.52% Total Loans: $14.2 billionYield on

Loans: 4.5% Total Loans: $11.8 billionYield on Loans: 4.3% Total Loans: $2.4 billionYield on Loans: 5.3%

Summary of Transaction * Provides market entrance into key Southeast marketsAchieves critical size in

one of the fastest growing markets in the Southeast; #10 deposit market share in the attractive Nashville MSAPro forma, with United’s existing Tennessee franchise, will have top 10 deposit market share in the stateAdds a talented Tennessee

leadership team to lead our growing Tennessee franchiseStrong cultural fit with a focus on customer service, relationship-based banking, and being a great place to work for great peopleFinancially compelling transaction consistent with United’s

stated M&A criteria~9% accretive to EPS in 2023IRR of +25%Improves ROTCE by ~135 bpsManageable tangible book value dilution earned back in ~3 yearsFurther establishes United’s position as a premier acquirer of Southeast community

banksAdvances United’s strategy to build the leading regional bank in the Southeast Source: S&P Global Market Intelligence

Enhancing Our Franchise Through Strategic M&A EXPANSION RATIONALE 1. Includes MSAs with a

population greater than 300,0002. Does not include merger adjustments3. FinTrust has approximately $2 billion assets under management4. Reliant also has an LPO in Knoxville, TNNote: Dollar values in millions, except per share valuesSource:

S&P Global Market Intelligence, public filings Pro Forma Branch Map Reliant (25) (4) * Estimated EPS Accretion Pro Forma Balance Sheet (2) Enhancing United’s High-Growth Southeast Footprint Aquesta (9) United

(161) 7/14/2021 – Announced acquisition of Reliant Bancorp, Inc,5/27/2021 – Announced acquisition of Aquesta Financial Holdings, Inc.5/13/2021 – Announced acquisition of FinTrust Capital Partners, LLC Expanding into the attractive Nashville,

TN, Charlotte, NC, and Wilmington, NC markets, 3 of the top 20 fastest growing MSAs in the Southeast (1) (As of 3/31/2021) Well-Capitalized at Close 8.7% TCE / TCA 9.5% Leverage Ratio 12.1% CET-1 Ratio 12.7% Tier 1 Ratio 14.5% Total

Capital Ratio (3) (Pro Forma as of 12/31/2021)