Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Kintara Therapeutics, Inc. | ktra-ex322_8.htm |

| EX-32.1 - EX-32.1 - Kintara Therapeutics, Inc. | ktra-ex321_9.htm |

| EX-31.2 - EX-31.2 - Kintara Therapeutics, Inc. | ktra-ex312_10.htm |

| EX-31.1 - EX-31.1 - Kintara Therapeutics, Inc. | ktra-ex311_11.htm |

| EX-10.1 - EX-10.1 - Kintara Therapeutics, Inc. | ktra-ex101_319.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2020

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37823

Kintara Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada |

|

99-0360497 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

12707 High Bluff Dr., Suite 200 |

|

92130 |

|

(Address of principal executive offices) |

|

(zip code) |

(858) 350-4364

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

|

Common Stock |

|

KTRA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☑ |

|

Smaller reporting company |

☑ |

|

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☑

Number of shares of common stock outstanding as of November 9, 2020 was 24,662,299.

|

|

|

|

|

Page No. |

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

|

19 |

|

Item 3. |

|

|

40 |

|

|

Item 4 |

|

|

40 |

|

|

|

|

|

|

|

|

Item 1. |

|

|

41 |

|

|

Item 1A. |

|

|

41 |

|

|

Item 2. |

|

Unregistered Sales of Equity Securities and Use of Proceeds. |

|

41 |

|

Item 3. |

|

|

41 |

|

|

Item 4. |

|

|

41 |

|

|

Item 5. |

|

|

41 |

|

|

Item 6. |

|

|

42 |

i

PART 1. - FINANCIAL INFORMATION

Kintara Therapeutics, Inc.

Condensed Consolidated Interim Financial Statements

(Unaudited)

For the three months ended September 30, 2020

(expressed in US dollars unless otherwise noted)

1

Condensed Consolidated Interim Balance Sheets

(In thousands, except par value amounts)

|

|

|

|

|

|

|

September 30, 2020 |

|

|

June 30, 2020 |

|

||

|

|

|

Note |

|

|

$ |

|

|

$ |

|

|||

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

22,602 |

|

|

|

2,392 |

|

|

Prepaid expenses and deposits |

|

|

|

|

|

|

343 |

|

|

|

356 |

|

|

Interest, taxes and other receivables |

|

|

|

|

|

|

10 |

|

|

|

9 |

|

|

Deferred loan costs |

|

|

5 |

|

|

|

— |

|

|

|

94 |

|

|

|

|

|

|

|

|

|

22,955 |

|

|

|

2,851 |

|

|

Intangible assets - net |

|

|

|

|

|

|

1 |

|

|

|

2 |

|

|

Property and equipment |

|

|

3 |

|

|

|

175 |

|

|

|

— |

|

|

Deferred financing costs |

|

|

6 |

|

|

|

— |

|

|

|

85 |

|

|

Total assets |

|

|

|

|

|

|

23,131 |

|

|

|

2,938 |

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

|

|

|

|

1,566 |

|

|

|

2,011 |

|

|

Loan payable, net of deferred loan costs |

|

|

5 |

|

|

|

441 |

|

|

|

— |

|

|

Related party payables |

|

|

4 |

|

|

|

382 |

|

|

|

664 |

|

|

|

|

|

|

|

|

|

2,389 |

|

|

|

2,675 |

|

|

Milestone payment liability |

|

|

3 |

|

|

|

188 |

|

|

|

— |

|

|

Total liabilities |

|

|

|

|

|

|

2,577 |

|

|

|

2,675 |

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

|

5,000 shares, $0.001 par value |

|

|

|

|

|

|

|

|

|

|

|

|

|

Issued and outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

279 Series A shares at September 30, 2020 (June 30, 2020 – 279) |

|

4,6 |

|

|

|

279 |

|

|

|

279 |

|

|

|

649 Series B shares at September 30, 2020 (June 30, 2020 – 649) |

|

|

6 |

|

|

|

4,525 |

|

|

|

4,525 |

|

|

25 Series C shares at September 30, 2020 (June 30, 2020 – 0) |

|

|

6 |

|

|

|

18,355 |

|

|

|

— |

|

|

Common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized |

|

|

|

|

|

|

|

|

|

|

|

|

|

95,000 shares at September 30, 2020 and June 30, 2020, $0.001 par value |

|

|

|

|

|

|

|

|

|

|

|

|

|

24,466 issued at September 30, 2020 (June 30, 2020 – 11,458) |

|

|

6 |

|

|

|

24 |

|

|

|

11 |

|

|

Additional paid-in capital |

|

|

6 |

|

|

|

89,777 |

|

|

|

65,148 |

|

|

Accumulated deficit |

|

|

|

|

|

|

(92,427 |

) |

|

|

(69,721 |

) |

|

Accumulated other comprehensive income |

|

|

|

|

|

|

21 |

|

|

|

21 |

|

|

Total stockholders’ equity |

|

|

|

|

|

|

20,554 |

|

|

|

263 |

|

|

Total liabilities and stockholders’ equity |

|

|

|

|

|

|

23,131 |

|

|

|

2,938 |

|

|

Nature of operations, corporate history, and liquidity risk and management plans (note 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Subsequent events (note 9) |

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

2

Condensed Consolidated Interim Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

Three months ended September 30, |

|

|||||

|

|

|

Note |

|

|

2020 |

|

|

2019 |

|

|||

|

|

|

|

|

|

|

$ |

|

|

$ |

|

||

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

|

|

|

1,357 |

|

|

|

721 |

|

|

General and administrative |

|

|

|

|

|

|

1,534 |

|

|

|

914 |

|

|

Merger costs |

|

|

3 |

|

|

|

500 |

|

|

|

— |

|

|

In-process research and development |

|

|

3 |

|

|

|

16,094 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

19,485 |

|

|

|

1,635 |

|

|

Other (income) loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange loss |

|

|

|

|

|

|

(1 |

) |

|

|

— |

|

|

Amortization of deferred loan costs |

|

|

5 |

|

|

|

27 |

|

|

|

— |

|

|

Interest expense |

|

|

5 |

|

|

|

8 |

|

|

|

— |

|

|

Interest income |

|

|

|

|

|

|

(1 |

) |

|

|

(29 |

) |

|

|

|

|

|

|

|

|

33 |

|

|

|

(29 |

) |

|

Net loss for the period |

|

|

|

|

|

|

19,518 |

|

|

|

1,606 |

|

|

Computation of basic loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period |

|

|

|

|

|

|

19,518 |

|

|

|

1,606 |

|

|

Deemed dividend recognized on beneficial conversion features of Series C Preferred stock issuance |

|

|

6 |

|

|

|

3,181 |

|

|

|

— |

|

|

Series A Preferred cash dividend |

|

|

6 |

|

|

|

2 |

|

|

|

2 |

|

|

Series B Preferred stock dividend |

|

|

6 |

|

|

|

5 |

|

|

|

2 |

|

|

Net loss for the period attributable to common stockholders |

|

|

|

|

|

|

22,706 |

|

|

|

1,610 |

|

|

Basic and fully diluted loss per share |

|

|

|

|

|

|

1.33 |

|

|

|

0.21 |

|

|

Basic and fully diluted weighted average number of shares |

|

|

|

|

|

|

17,106 |

|

|

|

7,539 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

3

Condensed Consolidated Interim Statements of Stockholders’ Equity

(Unaudited)

(In thousands)

For the three months ended September 30, 2020 and 2019

|

|

|

Number of shares |

|

|

Common stock $ |

|

|

Additional paid-in capital $ |

|

|

Accumulated other comprehensive income $ |

|

|

Preferred stock $ |

|

|

Accumulated deficit $ |

|

|

Stockholders' equity $ |

|

|||||||

|

Balance - June 30, 2020 |

|

|

11,458 |

|

|

|

11 |

|

|

|

65,148 |

|

|

|

21 |

|

|

|

4,804 |

|

|

|

(69,721 |

) |

|

|

263 |

|

|

Adgero merger (note 3) |

|

|

12,011 |

|

|

|

12 |

|

|

|

16,713 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16,725 |

|

|

Issuance of Series C Preferred stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25,028 |

|

|

|

— |

|

|

|

25,028 |

|

|

Series C placement agent warrants |

|

|

— |

|

|

|

— |

|

|

|

3,287 |

|

|

|

— |

|

|

|

(3,287 |

) |

|

|

— |

|

|

|

— |

|

|

Series C Preferred stock share issuance costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,386 |

) |

|

|

— |

|

|

|

(3,386 |

) |

|

Deemed dividend recognized on beneficial conversion features of Series C Preferred stock issuance |

|

|

— |

|

|

|

— |

|

|

|

3,181 |

|

|

|

— |

|

|

|

— |

|

|

|

(3,181 |

) |

|

|

— |

|

|

Exercise of warrants for cash |

|

|

993 |

|

|

|

1 |

|

|

|

993 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

994 |

|

|

Warrants issued for services |

|

|

— |

|

|

|

— |

|

|

|

45 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

45 |

|

|

Stock option expense |

|

|

— |

|

|

|

— |

|

|

|

405 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

405 |

|

|

Series A Preferred cash dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

Series B Preferred stock dividend |

|

|

4 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

(5 |

) |

|

|

— |

|

|

Loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19,518 |

) |

|

|

(19,518 |

) |

|

Balance - September 30, 2020 |

|

|

24,466 |

|

|

|

24 |

|

|

|

89,777 |

|

|

|

21 |

|

|

|

23,159 |

|

|

|

(92,427 |

) |

|

|

20,554 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - June 30, 2019 |

|

|

3,839 |

|

|

|

4 |

|

|

|

57,543 |

|

|

|

21 |

|

|

|

4,978 |

|

|

|

(60,578 |

) |

|

|

1,968 |

|

|

Issuance of shares and warrants - net of issue costs |

|

|

4,895 |

|

|

|

5 |

|

|

|

6,578 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,583 |

|

|

Exercise of pre-funded warrants for cash |

|

|

2,655 |

|

|

|

2 |

|

|

|

24 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

26 |

|

|

Conversion of Series B Preferred stock to common stock |

|

|

6 |

|

|

|

— |

|

|

|

174 |

|

|

|

— |

|

|

|

(174 |

) |

|

|

— |

|

|

|

— |

|

|

Shares issued for services |

|

|

7 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

|

Stock option expense |

|

|

— |

|

|

|

— |

|

|

|

51 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

51 |

|

|

Series A Preferred cash dividend |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

Series B Preferred stock dividend |

|

|

4 |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

Loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,606 |

) |

|

|

(1,606 |

) |

|

Balance - September 30, 2019 |

|

|

11,406 |

|

|

|

11 |

|

|

|

64,377 |

|

|

|

21 |

|

|

|

4,804 |

|

|

|

(62,188 |

) |

|

|

7,025 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

4

Condensed Consolidated Interim Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

Three months ended September 30, |

|

|||||

|

|

|

|

|

|

|

2020 |

|

|

2019 |

|

||

|

|

|

Note |

|

|

$ |

|

|

$ |

|

|||

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the period |

|

|

|

|

|

|

(19,518 |

) |

|

|

(1,606 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

|

|

|

|

|

1 |

|

|

|

3 |

|

|

In-process research and development |

|

|

3 |

|

|

|

16,094 |

|

|

|

— |

|

|

Amortization of deferred loan costs |

|

|

5 |

|

|

|

27 |

|

|

|

— |

|

|

Interest expense |

|

|

5 |

|

|

|

8 |

|

|

|

— |

|

|

Shares issued for services |

|

|

6 |

|

|

|

— |

|

|

|

5 |

|

|

Warrants issued for services |

|

|

6 |

|

|

|

45 |

|

|

|

— |

|

|

Stock option expense |

|

|

6 |

|

|

|

405 |

|

|

|

51 |

|

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses and deposits |

|

|

|

|

|

|

24 |

|

|

|

56 |

|

|

Interest, taxes and other receivables |

|

|

|

|

|

|

— |

|

|

|

(44 |

) |

|

Accounts payable and accrued liabilities |

|

|

|

|

|

|

(914 |

) |

|

|

(617 |

) |

|

Related party payables |

|

|

|

|

|

|

(282 |

) |

|

|

(114 |

) |

|

Net cash used in operating activities |

|

|

|

|

|

|

(4,110 |

) |

|

|

(2,266 |

) |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash acquired on merger with Adgero |

|

|

3 |

|

|

|

969 |

|

|

|

— |

|

|

Net cash provided by investing activities |

|

|

|

|

|

|

969 |

|

|

|

— |

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net proceeds from the issuance of shares and warrants |

|

|

6 |

|

|

|

21,859 |

|

|

|

6,583 |

|

|

Warrants exercised for cash |

|

|

6 |

|

|

|

994 |

|

|

|

26 |

|

|

Proceeds from loan |

|

|

5 |

|

|

|

500 |

|

|

|

— |

|

|

Series A preferred cash dividend |

|

|

4 |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

Net cash provided by financing activities |

|

|

|

|

|

|

23,351 |

|

|

|

6,607 |

|

|

Decrease in cash and cash equivalents |

|

|

|

|

|

|

20,210 |

|

|

|

4,341 |

|

|

Cash and cash equivalents – beginning of period |

|

|

|

|

|

|

2,392 |

|

|

|

3,719 |

|

|

Cash and cash equivalents – end of period |

|

|

|

|

|

|

22,602 |

|

|

|

8,060 |

|

|

Supplementary information (note 7) |

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

5

Notes to Condensed Consolidated Interim Financial Statements

(Unaudited)

September 30, 2020

(expressed in US dollars unless otherwise noted)

|

1 |

Nature of operations, corporate history, and liquidity risk and management plans |

Nature of operations

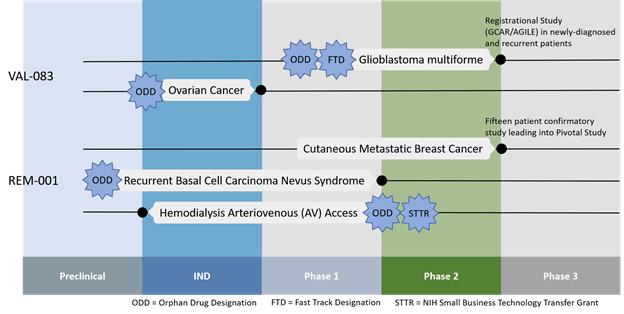

Kintara Therapeutics, Inc. (formerly DelMar Pharmaceuticals, Inc.) (the “Company”) is a clinical stage drug development company with a focus on the development of novel cancer therapies for patients with unmet medical needs. The Company is developing two late-stage, Phase 3-ready therapeutics - VAL-083 for glioblastoma multiforme and REM-001 for cutaneous metastatic breast cancer. In order to accelerate the Company’s development timelines, it leverages existing preclinical and clinical data from a wide range of sources. The Company may seek marketing partnerships in order to potentially offset clinical costs and to generate future royalty revenue from approved indications of its product candidates.

On June 9, 2020, the Company entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”), by and among Adgero Acquisition Corp., the Company’s wholly-owned subsidiary incorporated in the State of Delaware (“Merger Sub”), and Adgero Biopharmaceuticals Holdings, Inc., a Delaware corporation (“Adgero”). On August 19, 2020, upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub merged with and into Adgero (the “Merger”), the separate corporate existence of Merger Sub ceased and Adgero continued its existence under Delaware law as the surviving corporation in the Merger and became a direct, wholly-owned subsidiary of the Company. As a result of the Merger, each issued and outstanding share of Adgero common stock, par value $0.0001 per share (the “Adgero Common Stock”) (other than treasury shares held by Adgero), was converted automatically into the right to receive 1.5740 shares (the “Exchange Ratio”) of the Company’s common stock, and cash in lieu of any fractional shares. Also, each outstanding warrant to purchase Adgero Common Stock was converted into a warrant exercisable for that number of shares of the Company’s common stock equal to the product of (x) the aggregate number of shares of Adgero Common Stock for which such warrant was exercisable and (y) the Exchange Ratio.

Following the completion of the Merger, the Company changed its name from DelMar Pharmaceuticals, Inc. to Kintara Therapeutics, Inc. and began trading on Nasdaq under the symbol “KTRA”.

Corporate history

The Company is a Nevada corporation formed on June 24, 2009 under the name Berry Only, Inc. On January 25, 2013, the Company entered into and closed an exchange agreement (the “Exchange Agreement”), with Del Mar Pharmaceuticals (BC) Ltd. (“Del Mar (BC)”), 0959454 B.C. Ltd. (“Callco”), and 0959456 B.C. Ltd. (“Exchangeco”) and the security holders of Del Mar (BC). Upon completion of the Exchange Agreement, Del Mar (BC) became a wholly-owned subsidiary of the Company (the “Reverse Acquisition”).

Kintara Therapeutics, Inc. is the parent company of Del Mar (BC), a British Columbia, Canada corporation and Adgero, a Delaware corporation, which are clinical stage companies with a focus on the development of drugs for the treatment of cancer. The Company is also the parent company to Callco and Exchangeco which are British Columbia, Canada corporations. Callco and Exchangeco were formed to facilitate the Reverse Acquisition. In connection with the Merger, the Company also became the parent company of Adgero Biopharmaceuticals, Inc. (“Adgero Bio”), formerly a wholly-owned subsidiary of Adgero.

References to the Company refer to the Company and its wholly-owned subsidiaries.

Liquidity risk and management plans

During the three months ended September 30, 2020, the Company reported a net loss of $19.5 million. As of September 30, 2020, the Company had $22.6 million of cash and cash equivalents and used $4.1 million of cash in its operating activities during the three months ended September 30, 2020. The Company is in the clinical stage and has not generated any revenues to-date. The Company does not have the prospect of achieving revenues until such time that its product candidates are commercialized, or partnered, which may not ever occur. In the future, the Company will require additional funding to maintain its clinical trials, research and development projects, and for general operations. The Company may tailor its drug development programs based on the amount of funding the Company is able to raise in the future. During the three months ended September 30, 2020, the Company completed a private placement in three closings for aggregate net proceeds of approximately $21.6 million (note 6). The Company believes that based on its current estimates, the cash and cash equivalents at September 30, 2020 of $22.6 million, as well as cash from the proceeds from stock purchase warrants exercised subsequent to September 30, 2020, will be sufficient to fund its planned operations for at least

6

the next twelve months from the date these condensed consolidated interim financial statements are issued. However, the coronavirus (“COVID-19”) pandemic has created significant economic uncertainty and volatility in the credit and capital markets. The ultimate impact of the COVID-19 pandemic on the Company’s ability to raise additional capital in the future is unknown and will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak and any new information which may emerge concerning the severity of the COVID-19 pandemic.

|

2 |

Significant accounting policies |

Basis of presentation

The condensed consolidated interim financial statements of the Company have been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”) and are presented in United States dollars. The functional currency of the Company and each of its subsidiaries is the United States dollar.

The accompanying condensed consolidated interim financial statements include the accounts of the Company and its wholly-owned subsidiaries, Adgero, Adgero Bio, Del Mar BC, Callco, and Exchangeco. All intercompany balances and transactions have been eliminated in consolidation.

The principal accounting policies applied in the preparation of these condensed consolidated interim financial statements are set out below and have been consistently applied to all periods presented.

Certain prior period balances have been reclassified to conform with the current period’s presentation.

Unaudited interim financial data

The accompanying unaudited condensed consolidated interim financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission for interim financial information. Accordingly, they do not include all of the information and the notes required by U.S. GAAP for complete financial statements. These unaudited condensed consolidated interim financial statements should be read in conjunction with the audited financial statements of the Company as at June 30, 2020 included in our Form 10-K. In the opinion of management, the unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of normal and recurring adjustments, necessary for a fair presentation. The results for three months ended September 30, 2020 are not necessarily indicative of the results to be expected for the fiscal year ending June 30, 2021, or for any other future annual or interim period.

Use of estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions about future events that affect the reported amounts of assets, liabilities, expenses, contingent assets, and contingent liabilities as at the end of, or during, the reporting period. Actual results could significantly differ from those estimates. Significant areas requiring management to make estimates include the fair value of the milestone payment liability, the valuation of equity instruments issued for services, and clinical trial accruals. Further details of the nature of these assumptions and conditions may be found in the relevant notes to these condensed consolidated interim financial statements.

Loss per share

Income or loss per share is calculated based on the weighted average number of common shares outstanding. For the three-month periods ended September 30, 2020 and 2019 diluted loss per share does not differ from basic loss per share since the effect of the Company’s warrants, stock options, and convertible preferred shares is anti-dilutive. As of September 30, 2020, potential common shares of 11,858,152 (2019 – 9,683,596) related to outstanding common share warrants, 2,152,701 (2019 – nil) related to outstanding Series C preferred stock warrants, 6,543,569 (2019 – 780,000) related to stock options, 162,177 (2019 – 162,177) relating to outstanding Series B convertible preferred shares, and 21,516,484 (2019 – nil) relating to outstanding Series C convertible preferred shares were excluded from the calculation of net loss per common share.

Acquired in-process research and development expense

The Company acquired in-process research and development assets in connection with its Merger with Adgero. As the acquired in-process research and development assets were deemed to have no current or alternative future use, an expense of $16.1 million was recognized in the condensed consolidated interim statements of operations for the three month period ended September 30, 2020.

7

Property and equipment is stated at cost less accumulated depreciation. Depreciation is calculated on a straight-line basis over its estimated useful life of five years. Depreciation expense is recognized from the date the equipment is put into use.

Recent accounting pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard setting bodies that are adopted by the Company as of the specified effective date.

Not yet adopted

Accounting Standards Update (“ASU”) 2020-06 — Debt - Debt with conversion and other options (subtopic 470-20) and derivatives and hedging – contracts in entity’s own equity (subtopic 815-40): accounting for convertible instruments and contracts in an entity’s own equity

The amendments in this update are intended to simplify the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. The ASU is part of the FASB’s simplification initiative, which aims to reduce unnecessary complexity in U.S. GAAP. For public business entities that are not smaller reporting companies, the ASU’s amendments are effective for fiscal years beginning after December 15, 2021, and interim periods within those fiscal years. For all other entities, the effective date is for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. The guidance may be early adopted for fiscal years beginning after December 15, 2020, and interim periods within those fiscal years. The Company has not yet evaluated the impact of adoption of this ASU on its condensed consolidated interim financial statements and related disclosures.

During the three-months ended September 30, 2020, other than ASU 2020-06 there have been no new, or existing recently issued, accounting pronouncements that are of significance, or potential significance, that impact the Company’s condensed consolidated interim financial statements.

|

3 |

Merger |

As described in Note 1, on August 19, 2020, the Company completed its Merger with Adgero in accordance with the terms of the Merger Agreement. To determine the accounting for this transaction under ASU 2017-01, an assessment must be made as to whether an integrated set of assets and activities should be accounted for as an acquisition of a business or an asset acquisition. The guidance requires an initial screen test to determine if substantially all of the fair value of the gross assets acquired is concentrated in a single asset or group of similar assets. If that screen is met, the set is not a business. In connection with the Merger, substantially all of the fair value is concentrated in in-process research and development (“IPR&D”). As such, the Merger has been treated as an acquisition of Adgero assets and an assumption of Adgero liabilities.

Under the terms of the Merger Agreement, upon closing of the Merger, the Company issued 11,439,013 shares of Company common stock and 2,313,904 stock purchase warrants to the security holders of Adgero (“Adgero Warrants”). The Adgero Warrants are exercisable at $3.18 per share (note 6). The Adgero Warrants were valued using a Black-Scholes valuation with a weighted-average risk-free interest rate of 0.21%, a term of one year, a volatility of 115.96%, and a dividend rate of 0%. The estimated volatility of the Company’s common stock at the date of measurement is based on the historical volatility of the Company. The risk-free interest rate is based on rates published by the government for bonds with a maturity similar to the expected remaining life of the instrument at the valuation date. The expected term has been estimated using the remaining life of the warrant. Also, in conjunction with the Merger, the Company issued 571,951 shares of common stock to the placement agent as a success fee. The common shares issued to the former Adgero stockholders as well as the success fee shares, have been value at $1.34 per share which was the closing price of the Company’s common stock on August 19, 2020, the date the Merger closed.

The Company incurred approximately $1.55 million of legal, consulting and other professional fees related to the Merger, of which approximately $1.1 million had been incurred in the year ended June 30, 2020. The transaction costs have been classified as merger expenses in the accompanying unaudited condensed consolidated interim statement of operations for the three months ended September 30, 2020.

8

The following summarizes total consideration transferred to the Adgero stockholders under the Merger as well as the assets acquired and liabilities assumed under the Merger:

|

|

|

$ (in thousands) |

|

|

|

Consideration: |

|

|

|

|

|

Common stock |

|

|

15,328 |

|

|

Warrants |

|

|

630 |

|

|

Success fee shares |

|

|

766 |

|

|

|

|

|

16,724 |

|

|

Net assets acquired: |

|

|

|

|

|

Cash |

|

|

(969 |

) |

|

Other current assets |

|

|

(11 |

) |

|

Property and equipment |

|

|

(175 |

) |

|

Accounts payable and accrued liabilities |

|

|

337 |

|

|

Milestone payment liability |

|

|

188 |

|

|

In-process research and development |

|

|

16,094 |

|

Property and equipment include office furniture that was subsequently sold and laboratory equipment that has not yet been put into use.

The milestone payment liability relates to an asset purchase agreement with St. Cloud Investments, LLC (“St. Cloud”) that Adgero has regarding the acquisition of REM-001. The Agreement, as amended, is dated November 26, 2012 (the “St. Cloud Agreement”). Pursuant to the terms of the St. Cloud Agreement, the Company is obligated to make certain payments under the agreement. The future contingent amounts payable under that agreement are as follows:

|

|

• |

Upon the earlier of (i) a subsequent equity financing to take place after the Company conducts a Phase 2B clinical study in which fifty patients complete the study and their clinical data can be evaluated or (ii) the commencement of a clinical study intended to be used as a definitive study for market approval in any country, the Company is obligated to pay an aggregate amount of $300,000 in cash or an equivalent amount of common stock, with $240,000 to St. Cloud and $60,000 to an employee of the Company; and |

|

|

• |

Upon receipt of regulatory approval of REM-001 Therapy, the Company is obligated to pay an aggregate amount of $700,000 in cash or an equivalent amount of common stock, with $560,000 to St. Cloud and $140,000 to an employee of the Company. |

With respect to the $300,000 and $700,000 potential milestone payments referenced above (each a “Milestone Payment”), if either such Milestone Payment becomes payable, and in the event the Company elects to pay either such Milestone Payment in shares of its common stock, the value of the common stock will equal the average of the closing price per share of the Company’s common stock over the twenty (20) trading days following the first public announcement of the applicable event described above.

The milestone payment liability has been determined using the discounted cash flow value of the two respective milestone payments. A discount rate of 79% has been used which accounts for the probability of success given the phase of clinical development of REM-001. The term is based on an estimate of the planned timing of completion of the respective milestones that would result in payment of the milestones.

The fair value of the IPR&D assets is expensed as a charge in the condensed consolidated interim statements of operations for the three months ended September 30, 2020 as there is no alternative use for these assets.

|

4 |

Related party transactions |

Valent Technologies, LLC Agreements

One of the Company’s officers is a principal of Valent Technologies, LLC (“Valent”) and as result Valent is a related party to the Company.

On September 12, 2010, the Company entered into a Patent Assignment Agreement (the “Valent Assignment Agreement”) with Valent pursuant to which Valent transferred to the Company all its right, title and interest in, and to, the patents for VAL-083 owned by Valent. The Company now owns all rights and title to VAL-083 and is responsible for the drug’s further development and commercialization. In accordance with the terms of the Valent Assignment Agreement, Valent is entitled to receive a future royalty on

9

all revenues derived from the development and commercialization of VAL-083. In the event that the Company terminates the agreement, the Company may be entitled to receive royalties from Valent’s subsequent development of VAL-083 depending on the development milestones the Company has achieved prior to the termination of the Valent Assignment Agreement.

On September 30, 2014, the Company entered into an exchange agreement (the “Valent Exchange Agreement”) with Valent and Del Mar (BC). Pursuant to the Valent Exchange Agreement, Valent exchanged its loan payable in the outstanding amount of $278,530 (including aggregate accrued interest to September 30, 2014 of $28,530), issued to Valent by Del Mar (BC), for 278,530 shares of the Company’s Series A Preferred Stock. The Series A Preferred Stock has a stated value of $1.00 per share (the “Series A Stated Value”) and is not convertible into common stock. The holder of the Series A Preferred Stock is entitled to dividends at the rate of 3% of the Series A Stated Value per year, payable quarterly in arrears. For the three months ended September 30, 2020 and 2019 respectively, the Company recorded $2,089 related to the dividend paid to Valent. The dividends have been recorded as a direct increase in accumulated deficit.

Related party payables

At September 30, 2020 there is an aggregate amount of $382,004 (June 30, 2020 - $663,865) payable to the Company’s officers and directors for fees, expenses, and accrued liabilities.

|

5 |

Loan from National Brain Tumor Society and National Foundation for Cancer Research |

|

|

|

$ (in thousands) |

|

|

|

Balance – June 30, 2020 |

|

|

— |

|

|

Funding |

|

|

500 |

|

|

Financing costs |

|

|

(94 |

) |

|

Interest expense |

|

|

8 |

|

|

Amortization of deferred financing costs |

|

|

27 |

|

|

Balance – September 30, 2020 |

|

|

441 |

|

During the period ended September 30, 2020, the Company received a loan of $500,000 from National Brain Tumor Society (“NBTS”) and the National Foundation for Cancer Research to support VAL-083's preparation for participation in the Global Coalition for Adaptive Research's (“GCAR”) sponsored trial, Glioblastoma (“GBM”) Adaptive Global Innovative Learning Environment (“GBM AGILE”) study (the “NBTS Loan”). In relation to the NBTS Loan, the Company issued 125,000 share purchase warrants which are exercisable at a price of $1.09 per common share until June 19, 2025 and had been included in deferred financing costs as at June 30, 2020 (“NBTS Warrants”). The NBTS Loan is secured by a promissory note, accrues interest at a rate of 6% per annum and matures on June 19, 2021.

The NBTS Warrants were valued at $93,701 using a Black-Scholes valuation with a risk-free interest rate of 0.37%, a term of 5 years, a volatility of 89.82%, and a dividend rate of 0%. The estimated volatility of the Company’s common stock at the date of measurement is based on the historical volatility of the Company. The risk-free interest rate is based on rates published by the government for bonds with a maturity similar to the expected remaining life of the instrument at the valuation date. The expected term has been estimated using the remaining life of the warrant.

|

6 |

Stockholders’ equity |

Preferred stock

Series C Preferred stock

|

|

|

Series C Preferred Stock |

|

|||||

|

|

|

Number of shares |

|

|

$ (in thousands) |

|

||

|

Balance – June 30, 2020 |

|

|

— |

|

|

|

— |

|

|

Issuance |

|

|

25,028 |

|

|

|

18,355 |

|

|

Balance – September 30, 2020 |

|

|

25,028 |

|

|

|

18,355 |

|

10

In connection with the Merger (note 3), the Company issued 25,028 shares of Series C Convertible Preferred Stock (the “Series C Preferred Stock”) in three separate closings of a private placement (Series C-1, C-2, and C-3) in August, 2020. Each share of Series C Preferred Stock was issued at a purchase price of $1,000 per share and is convertible into shares of common stock based on the respective conversion prices which were determined at the closing of each round of the private placement. Subject to ownership limitations, the owners of the Series C Preferred Stock are entitled to receive dividends, payable in shares of common stock at a rate of 10%, 15%, 20% and 25% of the number of shares of common stock issuable upon conversion of the Series C Preferred Stock, on the 12th, 24th, 36th and 48th month, anniversary of the initial closing of the private placement which occurred on August 19, 2020. The Series C Preferred Stock dividends do not require declaration by the Board of Directors and are accrued annually as of the date the dividend is earned in an amount equal to the applicable rate of the stated value. Any outstanding shares of Series C Preferred Stock will automatically convert to shares of common stock on August 19, 2024.

The conversion prices for the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock are $1.16, $1.214 and $1.15, respectively. Based on the conversion prices of the three respective classes of the Series C Preferred Stock, the 25,028 shares of Series C Preferred Stock will be convertible into an aggregate of 21,516,484 shares of common stock. The cumulative dividends to be issued on the 12th, 24th, 36th and 48th month anniversary of the initial closing of the private placement are 15,061,952.

The conversion feature of the Series C Convertible Preferred Stock at the time of issuance was determined to be beneficial on the commitment date. Because the Series C Convertible Preferred Stock was perpetual with no stated maturity date, and the conversions could occur any time from inception, the Company immediately recorded a non-cash deemed dividend of $3.18 million related to the beneficial conversion feature arising from the issuance of Series C Convertible Preferred Stock. This non-cash deemed dividend increased the Company’s net loss attributable to common stockholders and net loss per share.

The Series C Preferred Stock shall with respect to distributions of assets and rights upon the occurrence of a liquidation, rank (i) senior to the Company’s common stock and (ii) senior to any other class or series of capital stock of the Company hereafter created which does not expressly rank pari passu with, or senior to, the Series C Preferred Stock. The Series C Preferred Stock shall be pari passu in liquidation to the Company’s Series A and Series B Preferred Stock. The liquidation value of the Series C Preferred Stock at September 30, 2020 is the stated value of $25,028,000.

Total gross proceeds from the private placement were $25 million, or $21.6 million in net proceeds after deducting financing costs of $3.4 million with respect to agent commissions and expenses, as well as legal and accounting fees. Of the total financing costs, $84,944 was deferred as of June 30, 2020. In addition, the Company issued warrants to purchase 2,504 shares of Series C Stock to the placement agent (“2020 Agent Warrants”) that are convertible into an aggregate 2,152,701 shares of common stock.

A total of 25,028 (June 30, 2020 – Nil) shares of Series C Preferred Stock are outstanding as of September 30, 2020, such that a total of 21,516,484 (June 30, 2020 – Nil) shares of common stock are issuable upon conversion of the Series C Preferred Stock as at September 30, 2020. Converted shares are rounded up to the nearest whole share.

Series B Preferred Stock

During the year ended June 30, 2016, the Company issued an aggregate of 902,238 shares of Series B Preferred Stock at a purchase price of $8.00 per share. Each share of Series B Preferred Stock is convertible into 0.25 shares of common stock equating to a conversion price of $32.00 (the “Conversion Price”) and will automatically convert to common stock at the earlier of 24 hours following regulatory approval of VAL-083 with a minimum closing bid price of $80.00, or five years from the respective final closing dates. The holders of the Series B Preferred Stock are entitled to an annual cumulative, in arrears, dividend at the rate of 9% payable quarterly. The 9% dividend accrues quarterly commencing on the date of issue and is payable quarterly on September 30, December 31, March 31, and June 30 of each year commencing on June 30, 2016. Dividends are payable solely by delivery of shares of common stock, in an amount for each holder equal to the aggregate dividend payable to such holder with respect to the shares of Series B Preferred Stock held by such holder divided by the Conversion Price. The Series B Preferred Stock does not contain any repricing features. Each share of Series B Preferred Stock entitles its holder to vote with the common stock on an as-converted basis.

The Series B Preferred Stock shall with respect to distributions of assets and rights upon the occurrence of a liquidation, rank (i) senior to the Company’s common stock and (ii) senior to any other class or series of capital stock of the Company hereafter created which does not expressly rank pari passu with, or senior to, the Series B Preferred Stock. The Series B Preferred Stock shall be pari passu in liquidation to the Company’s Series A and Series C Preferred Stock. The liquidation value of the Series B Preferred Stock at September 30, 2020 is the stated value of $5.2 million (June 30, 2020 - $5.2 million).

11

In addition, the Company and the holders entered into a royalty agreement, pursuant to which the Company will pay the holders of the Series B Preferred Stock, in aggregate, a low, single-digit royalty based on their pro rata ownership of the Series B Preferred Stock on products sold directly by the Company or sold pursuant to a licensing or partnering arrangement (the “Royalty Agreement”).

Upon conversion of a holder’s Series B Preferred Stock to common stock, such holder shall no longer receive ongoing royalty payments under the Royalty Agreement but will be entitled to receive any residual royalty payments that have vested. Rights to the royalties shall vest during the first three years following the applicable closing date, in equal thirds to holders of the Series B Preferred Stock on each of the three vesting dates, upon which vesting dates such royalty amounts shall become vested royalties.

Pursuant to the Series B Preferred Stock dividend, during the three months ended September 30, 2020, the Company issued 3,700 (2019 – 3,700) shares of common stock and recognized $5,180 (2019 – $2,046) as a direct increase in accumulated deficit. During the three months ended September 30, 2020 there were no conversions (2019 - 25,000) of Series B Preferred Stock for nil (2019 – 6,250) shares of common stock.

A total of 648,613 (June 30, 2020 – 648,613) shares of Series B Preferred Stock are outstanding as of September 30, 2020, such that a total of 162,177 (June 30, 2020 – 162,177) shares of common stock are issuable upon conversion of the Series B Preferred Stock as at September 30, 2020. Converted shares are rounded up to the nearest whole share.

Series A Preferred Stock

Effective September 30, 2014, the Company filed a Certificate of Designation of Series A Preferred Stock (the “Series A Certificate of Designation”) with the Secretary of State of Nevada. Pursuant to the Series A Certificate of Designation, the Company designated 278,530 shares of preferred stock as Series A Preferred Stock. The shares of Series A Preferred Stock have a stated value of $1.00 per share (the “Series A Stated Value”) and are not convertible into common stock. The holder of the Series A Preferred Stock is entitled to dividends at the rate of 3% of the Series A Stated Value per year, payable quarterly in arrears. Upon any liquidation of the Company, the holder of the Series A Preferred Stock will be entitled to be paid, out of any assets of the Company available for distribution to stockholders, the Series A Stated Value of the shares of Series A Preferred Stock held by such holder, plus any accrued but unpaid dividends thereon, prior to any payments being made with respect to the common stock. The Series A Preferred Stock is held by Valent (note 4).

The Series A Preferred Stock shall with respect to distributions of assets and rights upon the occurrence of a liquidation, rank (i) senior to the Company’s common stock, and (ii) senior to any other class or series of capital stock of the Company hereafter created which does not expressly rank pari passu with, or senior to, the Series A Preferred Stock. The Series A Preferred Stock shall be pari passu in liquidation to the Company’s Series B and Series C Preferred Stock. The liquidation value of the Series A Preferred stock at September 30, 2020 and June 30, 2020 was $278,530.

There was no change to the Series A Preferred stock for the three months ended September 30, 2020 or 2019.

Common stock

Stock Issuances

Three months ended September 30, 2019

Underwritten public offering

On August 16, 2019, the Company closed on the sale of (i) 4,895,000 shares of its common stock, par value $0.001 per share (the “Common Stock”), (ii) pre-funded warrants (“PFW”) to purchase an aggregate of 2,655,000 shares of Common Stock and (iii) common warrants to purchase an aggregate of 7,762,500 shares of Common Stock (“2020 Investor Warrants”), including 800,000 shares of Common Stock and 2020 Investor Warrants to purchase an aggregate of 1,012,500 shares of Common Stock sold pursuant to a partial exercise by the underwriters of the underwriters’ option to purchase additional securities, in the Company’s underwritten public offering (the “Offering”). Each share of Common Stock or PFW, as applicable, was sold together with a 2020 Investor Warrant to purchase one share of Common Stock at a combined effective price to the public of $1.00 per share of Common Stock and accompanying 2020 Investor Warrant.

The net proceeds from the Offering, including from the partial exercise of the underwriters’ option to purchase additional securities, were $6,582,966 after deducting underwriting discounts and commissions, and other offering expenses.

The 2020 Investor Warrants are exercisable at $1.00 per share until their expiry on August 16, 2024 and the PFW are exercisable at $0.01 per share at any time after August 16, 2019. The Company also issued 377,500 warrants to the underwriters of the

12

Offering. The underwriter warrants are exercisable at $1.15 per share commencing February 10, 2020 until their expiry on August 14, 2022.

During the three months ended September 30, 2019, all of the 2,655,000 PFW were exercised at $0.01 per PFW for proceeds of $26,550.

Shares issued for services

During the three months ended September 30, 2020, the Company issued Nil (2019 – 6,925) shares of common stock for services resulting in the recognition of $Nil (2019 – $4,843) in expense. All of the shares issued for services for the three months ended September 30, 2019 have been recognized as research and development expense.

2017 Omnibus Incentive Plan

The Company’s board of directors has approved adoption of the Company’s 2017 Omnibus Equity Incentive Plan (the “2017 Plan”) that has also been approved by the Company’s stockholders. The board of directors also approved a form of Performance Stock Unit Award Agreement to be used in connection with grants of performance stock units (“PSUs”) under the 2017 Plan. Under the 2017 Plan, 6,700,000 shares of Company common stock are currently reserved for issuance, less the number of shares of common stock issued under the Del Mar (BC) 2013 Amended and Restated Stock Option Plan (the “Legacy Plan”) or that are subject to grants of stock options made, or that may be made, under the Legacy Plan. As of September 30, 2020, a total of 164,235 shares of common stock are currently outstanding under the Legacy Plan and/or are subject to outstanding stock options granted under the Legacy Plan, and a total of 6,379,334 shares of common stock have been issued under the 2017 Plan and/or are subject to outstanding stock options granted under the 2017 Plan leaving 156,431 shares of common stock available at September 30, 2020 for issuance under the 2017 Plan if all such options under the Legacy Plan were exercised.

The maximum number of shares of Company common stock with respect to which any one participant may be granted awards during any calendar year is 8% of the Company’s fully diluted shares of common stock on the date of grant (excluding the number of shares of common stock issued under the 2017 Plan and/or the Legacy Plan or subject to outstanding awards granted under the 2017 Plan and/or the Legacy Plan). No award will be granted under the 2017 Plan on or after July 7, 2027, but awards granted prior to that date may extend beyond that date.

During the three months ended September 30, 2020, a total of 222,584 stock options issued to directors of the Company were amended such that the period to exercise vested stock options from the date of termination of continuous service with the Company was extended from 90 days to one year. Of the total of 222,584, 66,850 had their expiry increased from September 26, 2020 to June 26, 2021 and 155,734 had their expiry increased from November 19, 2020 to August 19, 2021. As a result of the amendments, a total of $8,569 stock-based compensation expense has been recognized. In addition, 250,000 stock options previously granted to an officer of the Company were amended such that the vesting of the stock options was changed from a completely contingent vesting to a time-based vesting such that 1/6th of the stock options vest on the six-month anniversary of the amendment date with the remaining portion vesting in equal monthly installments over a period of 30 months commencing on the seven-month anniversary of the amendment date. A total compensation expense of $319,376 will be recognized over the amended vesting period for the 250,000 stock options.

During the three months ended September 30, 2020, a total of 4,758,687 stock options were granted to executive officers and directors of the Company. Of these, 4,698,687 have an exercise price of $1.70 per share and 60,000 have an exercise price of $1.355 per share. Of the total granted, 4,278,687 stock options vest as to 1/6 on the six month anniversary of the grant date with the remaining portion vesting in equal monthly installments over a period of 30 months commencing on the seven month anniversary of the grant date. Of the total stock options granted to executive officers and directors, 480,000 vest in 12 equal monthly installments beginning on October 15, 2020. All of the stock options granted have a 10-year term and are subject to cancellation upon the grantees’ termination of service for the Company, with certain exceptions.

Stock Options

The following table sets forth changes in stock options outstanding under all plans:

|

|

|

Number of stock options outstanding (in thousands) |

|

|

Weighted average exercise price |

|

||

|

Balance – June 30, 2020 |

|

|

1,559 |

|

|

|

4.61 |

|

|

Granted |

|

|

4,999 |

|

|

|

1.68 |

|

|

Forfeited |

|

|

(14 |

) |

|

|

1.42 |

|

|

Balance – September 30, 2020 |

|

|

6,544 |

|

|

|

2.38 |

|

13

The following table summarizes stock options outstanding and exercisable under all plans at September 30, 2020:

|

Exercise price $ |

|

|

Number Outstanding at September 30, 2020 (in thousands) |

|

|

Weighted average remaining contractual life (years) |

|

|

Number exercisable at September 30, 2020 (in thousands) |

|

||||

|

|

0.61 |

|

|

|

1,010 |

|

|

|

8.93 |

|

|

|

566 |

|

|

|

0.74 |

|

|

|

250 |

|

|

|

9.12 |

|

|

|

— |

|

|

|

1.36 |

|

|

|

300 |

|

|

|

9.98 |

|

|

|

— |

|

|

|

1.70 |

|

|

|

4,699 |

|

|

|

9.96 |

|

|

|

— |

|

|

|

6.10 |

|

|

|

30 |

|

|

|

8.11 |

|

|

|

26 |

|

|

|

7.00 |

|

|

|

3 |

|

|

|

7.73 |

|

|

|

3 |

|

|

|

8.70 |

|

|

|

12 |

|

|

|

7.09 |

|

|

|

12 |

|

|

|

9.83 |

|

|

|

83 |

|

|

|

7.64 |

|

|

|

65 |

|

|

|

10.60 |

|

|

|

4 |

|

|

|

7.54 |

|

|

|

3 |

|

|

|

11.70 |

|

|

|

30 |

|

|

|

2.41 |

|

|

|

30 |

|

|

|

14.94 |

|

|

|

3 |

|

|

|

1.67 |

|

|

|

3 |

|

|

|

20.00 |

|

|

|

13 |

|

|

|

1.02 |

|

|

|

13 |

|

|

|

21.10 |

|

|

|

14 |

|

|

|

6.77 |

|

|

|

14 |

|

|

|

29.60 |

|

|

|

5 |

|

|

|

4.35 |

|

|

|

5 |

|

|

|

37.60 |

|

|

|

5 |

|

|

|

5.36 |

|

|

|

5 |

|

|

|

41.00 |

|

|

|

4 |

|

|

|

6.11 |

|

|

|

4 |

|

|

|

42.00 |

|

|

|

41 |

|

|

|

2.31 |

|

|

|

41 |

|

|

|

44.80 |

|

|

|

3 |

|

|

|

5.36 |

|

|

|

3 |

|

|

|

49.50 |

|

|

|

22 |

|

|

|

3.82 |

|

|

|

22 |

|

|

|

53.20 |

|

|

|

8 |

|

|

|

5.60 |

|

|

|

8 |

|

|

|

61.60 |

|

|

|

2 |

|

|

|

2.50 |

|

|

|

2 |

|

|

|

92.00 |

|

|

|

3 |

|

|

|

2.67 |

|

|

|

3 |

|

|

|

|

|

|

|

6,544 |

|

|

|

|

|

|

|

828 |

|

Included in the number of stock options outstanding are 2,500 stock options granted at an exercise price of CA$20.00. The exercise price of these options shown in the above table have been converted to US$14.94 using the period ending closing exchange rate. Stock options granted during the three months ended September 30, 2020 have been valued using a Black-Scholes pricing model with the following assumptions:

|

|

|

September 30, 2020 |

|

|

|

|

Dividend rate |

|

|

— |

|

% |

|

Volatility |

|

121% to 153 |

|

% |

|

|

Risk-free rate |

|

0.19% to 0.42 |

|

% |

|

|

Term – years |

|

0.4 to 5.8 |

|

|

|

The estimated volatility of the Company’s common stock at the date of issuance of the stock options is based on the historical volatility of the Company. The risk-free interest rate is based on rates published by the government for bonds with a maturity similar to the expected remaining life of the stock options at the valuation date. The expected life of the stock options has been estimated using the plain vanilla method.

The Company has recognized the following amounts as stock option expense for the periods noted (in thousands):

|

|

|

Three months ended September 30, |

|

|||||

|

|

|

2020 $ |

|

|

2019 $ |

|

||

|

Research and development |

|

|

91 |

|

|

8 |

|

|

|

General and administrative |

|

|

314 |

|

|

|

43 |

|

|

|

|

|

405 |

|

|

|

51 |

|

All of the stock option expense for the periods ended September 30, 2020 and 2019 has been recognized as additional paid in capital. The aggregate intrinsic value of stock options outstanding at September 30, 2020 was $977,465 (2019 - $0) and the aggregate

14

intrinsic value of stock options exercisable at September 30, 2020 was $446,950 (2019 - $0). As of September 30, 2020, there was $7,802,208 in unrecognized compensation expense that will be recognized over the next 3.0 years. No stock options granted under the Company’s equity plans have been exercised during the three months ended September 30, 2020. Upon the exercise of stock options new shares will be issued.

The following table sets forth changes in unvested stock options under all plans:

|

|

|

Number of Options (in thousands) |

|

|

Weighted average exercise price $ |

|

||

|

Unvested at June 30, 2020 |

|

|

858 |

|

|

|

0.98 |

|

|

Granted |

|

|

4,999 |

|

|

|

1.68 |

|

|

Vested |

|

|

(127 |

) |

|

|

1.18 |

|

|

Forfeited |

|

|

(14 |

) |

|

|

1.42 |

|

|

Unvested at September 30, 2020 |

|

|

5,716 |

|

|

|

1.59 |

|

The aggregate intrinsic value of unvested stock options at September 30, 2020 was $530,516 (2019 - $0). The unvested stock options have a remaining weighted average contractual term of 9.83 (2019 – 9.76) years.

Common Stock Warrants

The following table sets forth changes in outstanding common stock warrants:

|

|

|

Number of Warrants (in thousands) |

|

|

Weighted average exercise price $ |

|

||

|

Balance – June 30, 2020 |

|

|

10,309 |

|

|

|

2.71 |

|

|

Issuance of Adgero Warrants |

|

|

2,314 |

|

|

|

3.18 |

|

|

Exercise of warrants (i) |

|

|

(994 |

) |

|

|

1.00 |

|

|

Warrants issued for services (ii) |

|

|

330 |

|

|

|

1.49 |

|

|

Expiry of warrants (iii) |

|

|

(101 |

) |

|

|

30.00 |

|

|

Balance – September 30, 2020 |

|

|

11,858 |

|

|

|

2.67 |

|

|

i) |

A total of 994,000 2020 Investor Warrants were exercised at $1.00 per share. |

|

ii) |

Warrants issued for services are exercisable at various prices and expire at the various dates noted in the table below. |

|

iii) |

The warrant expiries include the 2015 Investor Warrants, the 2015 Agent Warrants, and certain warrants issued for services. All of the expired warrants were exercisable at $30 per share. |

15

The following table summarizes the Company’s outstanding common stock warrants as of September 30, 2020:

|

Description of warrants |

|

Number (in thousands) |

|

|

Exercise price $ |

|

|

Expiry date |

||

|

2020 Investor warrants |

|

|

6,744 |

|

|

|

1.00 |

|

|

August 16, 2024 |

|

2019 Investor warrants |

|

|

760 |

|

|

|

3.10 |

|

|

June 5, 2024 |

|

2019 Investor warrants |

|

|

280 |

|

|

|

12.50 |

|

|

September 22, 2022 |

|

2017 Investor warrants |

|

|

208 |

|

|

|

35.00 |

|

|

April 19, 2022 |

|

NBTS Warrants |

|

|

125 |

|

|

|

1.09 |

|

|

June 19, 2025 (i) |

|

Warrants issued for services |

|

|

25 |

|

|

|

30.00 |

|

|

December 1, 2020 to February 1, 2021 |

|

Warrants issued for services |

|

|

6 |

|

|

|

17.80 |

|

|

January 25, 2023 |

|

Warrants issued for services |

|

|

34 |

|

|

|

11.70 |

|

|

February 27, 2023 |

|

Warrants issued for services |

|

|

14 |

|

|

|

9.00 |

|

|

September 15, 2023 and October 11, 2023 |

|

Warrants issued for services |

|

|

280 |

|

|

|

0.75 |

|

|

November 18, 2023 |

|

Warrants issued for services |

|

|

250 |

|

|

|

0.64 |

|

|

January 20, 2024 |

|

Warrants issued for services |

|

|

330 |

|

|

|

1.49 |

|

|

September 22, 2023 |

|

2020 Underwriter Warrants |

|

|

377 |

|

|

|

1.15 |

|

|

August 14, 2022 |

|

2019 Agent warrants |