Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q0317ex32ii_delmarpharma.htm |

| EX-32.1 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q0317ex32i_delmarpharma.htm |

| EX-31.2 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q0317ex31ii_delmarpharma.htm |

| EX-31.1 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q0317ex31i_delmarpharma.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to __________________________

Commission file number: 001-37823

| DelMar Pharmaceuticals, Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 99-0360497 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

| Suite

720-999 West Broadway Vancouver, British Columbia, Canada |

V5Z 1K5 | |

| (Address of principal executive offices) | (zip code) |

| (604) 629-5989 |

| (Registrant's telephone number, including area code) |

| N/A |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

Non-accelerated filer ☐ (Do not check if smaller reporting company) Emerging growth company ☐ |

Smaller reporting company þ

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes ☐ No þ

Indicated the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date, 13,461,645 shares of common stock are issued and outstanding as of May 12, 2017.

TABLE OF CONTENTS

| Page No. | ||

| PART I. - FINANCIAL INFORMATION | 1 | |

| Item 1. | Financial Statements. | 1 |

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 21 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 49 |

| Item 4 | Controls and Procedures. | 49 |

| PART II - OTHER INFORMATION | 50 | |

| Item 1. | Legal Proceedings. | 50 |

| Item 1A. | Risk Factors. | 50 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 50 |

| Item 3. | Defaults Upon Senior Securities. | 50 |

| Item 4. | Mine Safety Disclosures. | 50 |

| Item 5. | Other Information. | 50 |

| Item 6. | Exhibits. | 50 |

PART 1. - FINANCIAL INFORMATION

Item 1. Financial Statements.

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Financial Statements

(Unaudited)

For the nine months ended March 31, 2017

(expressed in US dollars unless otherwise noted)

| 1 |

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Balance Sheets

(Unaudited)

(expressed in US dollars unless otherwise noted)

| Note | March

31, 2017 $ | June

30, 2016 $ | ||||||||

| Assets | ||||||||||

| Current assets | ||||||||||

| Cash and cash equivalents | 2,100,406 | 6,157,264 | ||||||||

| Taxes and other receivables | 70,561 | 18,387 | ||||||||

| Prepaid expenses | 119,776 | 144,131 | ||||||||

| Deferred costs | 9 | 25,705 | - | |||||||

| 2,316,448 | 6,319,782 | |||||||||

| Intangible assets - net | 24,443 | 36,017 | ||||||||

| 2,340,891 | 6,355,799 | |||||||||

| Liabilities | ||||||||||

| Current liabilities | ||||||||||

| Accounts payable and accrued liabilities | 791,805 | 584,002 | ||||||||

| Related party payables | 4 | 70,259 | 43,444 | |||||||

| Current portion of derivative liability | 5 | 157,145 | - | |||||||

| 1,019,209 | 627,446 | |||||||||

| Stock option liability | 6 | - | 175,875 | |||||||

| Derivative liability | 5 | 91,545 | 693,700 | |||||||

| 1,110,754 | 1,497,021 | |||||||||

| Stockholders’ accumulated equity | ||||||||||

| Preferred stock | ||||||||||

| Authorized | ||||||||||

| 5,000,000 shares, $0.001 par value | ||||||||||

| Issued and outstanding | ||||||||||

| 278,530 Series A shares at March 31, 2017 (June 30, 2016 – 278,530) | 3,6 | 278,530 | 278,530 | |||||||

| 887,363 Series B shares at March 31, 2017 (June 30, 2016 – 902,238) | 6 | 6,190,482 | 6,294,255 | |||||||

| 1 special voting share at March 31, 2017 (June 30, 2016 – 1) | - | - | ||||||||

| Common stock | ||||||||||

| Authorized | ||||||||||

| 50,000,000 shares, $0.001 par value | ||||||||||

| 11,675,174 issued at March 31, 2017 (June 30, 2016 – 11,187,023) | 6 | 11,675 | 11,187 | |||||||

| Additional paid-in capital | 6 | 31,511,379 | 28,833,105 | |||||||

| Warrants | 6 | 1,618,656 | 1,658,382 | |||||||

| Accumulated deficit | (38,401,763 | ) | (32,237,859 | ) | ||||||

| Accumulated other comprehensive income | 21,178 | 21,178 | ||||||||

| 1,230,137 | 4,858,778 | |||||||||

| 2,340,891 | 6,355,799 | |||||||||

Nature of operations, corporate history, and liquidity risk (note 1)

Subsequent events (note 9)

The accompanying notes are an integral part of these consolidated condensed interim financial statements.

| 2 |

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Statement of Loss and Comprehensive Loss

(Unaudited)

(expressed in US dollars unless otherwise noted)

| Note | Three months ended March 31, 2017 $ | Three months ended March 31, 2016 $ | Nine months ended March 31, 2017 $ | Nine months ended March 31, 2016 $ | ||||||||||||||

| Expenses | ||||||||||||||||||

| Research and development | 4 | 1,086,107 | 790,323 | 2,939,746 | 2,183,355 | |||||||||||||

| General and administrative | 4 | 698,125 | 630,226 | 2,586,050 | 1,994,923 | |||||||||||||

| 1,784,232 | 1,420,549 | 5,525,796 | 4,178,278 | |||||||||||||||

| Other loss (income) | ||||||||||||||||||

| Change in fair value of stock option and derivative liabilities | 5,6 | 77,479 | (276,584 | ) | (58,501 | ) | 943,050 | |||||||||||

| Change in fair value of derivative liability due to change in warrant terms | 5,6 | - | 7,000 | - | 270,965 | |||||||||||||

| Foreign exchange | 6,897 | (10,523 | ) | 13,726 | 16,257 | |||||||||||||

| Interest income | (148 | ) | (41 | ) | (249 | ) | (71 | ) | ||||||||||

| 84,228 | (280,148 | ) | (45,024 | ) | 1,230,201 | |||||||||||||

| Net and comprehensive loss for the period | 1,868,460 | 1,140,401 | 5,480,772 | 5,408,479 | ||||||||||||||

| Computation of basic loss per share | ||||||||||||||||||

| Net and comprehensive loss for the period | 1,868,460 | 1,140,401 | 5,480,772 | 5,408,479 | ||||||||||||||

| Series B Preferred stock dividend | 209,811 | - | 676,865 | - | ||||||||||||||

| Net and comprehensive loss available to common stockholders | 2,078,271 | 1,140,401 | 6,157,637 | 5,408,479 | ||||||||||||||

| Basic and fully diluted loss per share | 0.18 | 0.10 | 0.54 | 0.50 | ||||||||||||||

| Basic weighted average number of shares | 11,574,052 | 11,077,275 | 11,432,376 | 10,896,887 | ||||||||||||||

The accompanying notes are an integral part of these consolidated condensed interim financial statements.

| 3 |

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Statement of Cash Flows

(Unaudited)

(expressed in US dollars unless otherwise noted)

| Nine months ended March 31, | ||||||||||

| 2017 | 2016 | |||||||||

| Note | $ | $ | ||||||||

| Cash flows from operating activities | ||||||||||

| Loss for the period | (5,480,772 | ) | (5,408,479 | ) | ||||||

| Items not affecting cash | ||||||||||

| Amortization of intangible assets | 11,574 | 6,430 | ||||||||

| Change in fair value of stock option and derivative liabilities | 5,6 | (58,501 | ) | 943,050 | ||||||

| Change in fair value of derivative liability due change in warrant terms | 5,6 | - | 270,965 | |||||||

| Shares issued for services | 6 | 564,000 | 80,400 | |||||||

| Warrants issued for services | 6 | 80,421 | 400,389 | |||||||

| Stock option expense | 6 | 106,571 | 138,711 | |||||||

| Changes in non-cash working capital | ||||||||||

| Taxes and other receivables | (52,174 | ) | (6,311 | ) | ||||||

| Prepaid expenses | 24,355 | 159,746 | ||||||||

| Accounts payable and accrued liabilities | 207,803 | (115,317 | ) | |||||||

| Related party payables | 4 | 26,815 | (61,802 | ) | ||||||

| (4,569,908 | ) | (3,592,218 | ) | |||||||

| Cash flows from investing activities | ||||||||||

| Intangible assets - website development costs | - | (16,762 | ) | |||||||

| (16,762 | ) | |||||||||

| Cash flows from financing activities | ||||||||||

| Net proceeds from the issuance of shares and warrants | 6 | - | 2,453,633 | |||||||

| Proceeds from the exercise of warrants | 6 | 545,022 | 405,183 | |||||||

| Series A preferred stock dividend | 6 | (6,267 | ) | (6,267 | ) | |||||

| Deferred costs | 6,9 | (25,705 | ) | (60,647 | ) | |||||

| 513,050 | 2,791,902 | |||||||||

| Decrease in cash and cash equivalents | (4,056,858 | ) | (817,078 | ) | ||||||

| Cash and cash equivalents - beginning of period | 6,157,264 | 1,754,433 | ||||||||

| Cash and cash equivalents - end of period | 2,100,406 | 937,355 | ||||||||

Supplementary information (note 8)

The accompanying notes are an integral part of these consolidated condensed interim financial statements.

| 4 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

| 1 | Nature of operations, corporate history, and liquidity risk |

Nature of operations

DelMar Pharmaceuticals, Inc. (the “Company”) is a clinical stage drug development company with a focus on the treatment of cancer. We are conducting clinical trials in the United States of our first product candidate, VAL-083, as a potential new treatment for glioblastoma multiforme (“GBM”), the most common and aggressive form of brain cancer. We are also conducting preclinical research with VAL-083 as a potential treatment for other types of cancer. In addition, we have acquired certain exclusive commercial rights to VAL-083 in China where it is approved as a chemotherapy for the treatment of chronic myelogenous leukemia (“CML”) and lung cancer. In order to accelerate our development timelines and reduce risk, we leverage existing clinical and commercial data from a wide range of sources. We plan to pursue independent development and commercialization of VAL-083 for refractory GBM and potentially other product candidates that we may acquire or discover through our research activities. We will also seek collaborative development and commercialization partnerships in order to accelerate and expand our own product development efforts and potentially generate future royalty revenue.

The address of the Company’s administrative offices is Suite 720 - 999 West Broadway, Vancouver, British Columbia, V5Z 1K5 with clinical operations located at 3485 Edison Way, Suite R, Menlo Park, California, 94025.

Corporate history

The Company is a Nevada corporation formed on June 24, 2009 under the name Berry Only Inc. On January 25, 2013, the Company entered into and closed an exchange agreement (the “Exchange Agreement”), with Del Mar Pharmaceuticals (BC) Ltd. (“DelMar (BC)”), 0959454 B.C. Ltd. (“Callco”), and 0959456 B.C. Ltd. (“Exchangeco”) and the security holders of DelMar (BC). Upon closing the Exchange Agreement, DelMar (BC) became a wholly-owned subsidiary of the Company (the “Reverse Acquisition”).

DelMar Pharmaceuticals, Inc. is the parent company of DelMar (BC), a British Columbia, Canada corporation incorporated on April 6, 2010, which is a clinical stage company with a focus on the development of drugs for the treatment of cancer. The Company is also the parent company to Callco and Exchangeco which are British Columbia, Canada corporations. Callco and Exchangeco were formed to facilitate the Reverse Acquisition.

References to the Company refer to the Company and its wholly-owned subsidiaries, DelMar (BC), Callco and Exchangeco.

Liquidity risk

For the three and nine months ended March 31, 2017, the Company reported losses of $1,868,460 and $5,480,772 respectively and the Company has an accumulated deficit of $38,401,763 at that date. As at March 31, 2017, the Company had cash and cash equivalents on hand of $2,100,406. The Company does not have the prospect of achieving revenues in the near future and the Company will require additional funding to maintain its research and development projects and for general operations. There is a great degree of uncertainty with respect to the expenses the Company will incur in executing its business plan. In addition, the Company has not begun to commercialize or generate revenues from its product candidate.

| 5 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

Consequently, management is pursuing various financing alternatives to fund the Company’s operations so it can continue as a going concern in the medium to longer term. During the three months ended March 31, 2017, the Company received $545,022 in proceeds from the exercise of share purchase warrants (note 6). Subsequent to March 31, 2017 (note 9), the Company completed a registered public offering of an aggregate of 2,769,232 shares of common stock and warrants to purchase an aggregate of 2,076,924 shares of common stock at a price to the public of $3.25 per share and related warrant for gross proceeds of $9,000,004 (note 9). We believe, based on our current estimates, that we will be able to fund our operations beyond the next twelve months.

There is no assurance that our cost estimates will prove to be accurate or that unforeseen events, problems or delays will not occur with respect thereto. The ability of the Company to meet its obligations and continue the research and development of its product candidate is dependent on its ability to continue to raise adequate financing. There can be no assurance that such financing will be available to the Company in the amount required at any time or for any period or, if available, that it can be obtained on terms satisfactory to the Company. The Company may tailor its drug candidate development program based on the amount of funding the Company raises.

| 2 | Significant accounting policies |

Reverse stock split

On May 16, 2016, the Company filed a Certificate of Change with the Secretary of State of Nevada that effected a 1-for-4 reverse stock split of its common stock. The reverse split became effective on May 20, 2016. All warrants, stock options, conversion ratios, and per share information in these consolidated condensed interim financial statements give retroactive effect to this 1-for-4 reverse stock split. The Company’s authorized and issued preferred stock was not affected by the split. However, the conversion price for the conversion of the Company’s Series B preferred stock into common stock was adjusted as a result of the reverse stock split.

Basis of presentation

The consolidated condensed interim financial statements of the Company have been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”) and are presented in United States dollars. The functional currency of the Company and each of its subsidiaries is the United States dollar.

The accompanying consolidated condensed interim financial statements include the accounts of the Company and its wholly-owned subsidiaries, DelMar BC, Callco, and Exchangeco. All intercompany balances and transactions have been eliminated.

The principal accounting policies applied in the preparation of these financial statements are set out below and have been consistently applied to all periods presented.

| 6 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

Unaudited interim financial data

The accompanying unaudited March 31, 2017 consolidated condensed interim balance sheet, the consolidated condensed interim statements of loss and comprehensive loss for the three and nine months ended March 31, 2017 and 2016, and consolidated condensed cash flows for the nine months ended March 31, 2017 and 2016, and the related interim information contained within the notes to the consolidated condensed interim financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission for interim financial information. Accordingly, they do not include all of the information and the notes required by U.S. GAAP for complete financial statements. These consolidated condensed interim financial statements should be read in conjunction with the audited financial statements of the Company as at June 30, 2016 included in our Form 10-K filed with the Securities and Exchange Commission on September 13, 2016. In the opinion of management, the unaudited consolidated condensed interim financial statements reflect all adjustments, consisting of normal and recurring adjustments, necessary for the fair statement of the Company’s financial position at March 31, 2017 and results of its operations for the three and nine months ended March 31, 2017 and 2016, and its cash flows for the nine months ended March 31, 2017 and 2016. The results for three and nine months ended March 31, 2017 are not necessarily indicative of the results to be expected for the fiscal year ending June 30, 2017 or for any other future annual or interim period.

Use of estimates

The preparation of consolidated condensed interim financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions about future events that affect the reported amounts of assets, liabilities, expenses, contingent assets and contingent liabilities as at the end of, or during, the reporting period. Actual results could significantly differ from those estimates. Significant areas requiring management to make estimates include the derivative liability and the valuation of equity instruments issued for services. There have been no changes to the methodology used in determining these estimates from the period ended June 30, 2016.

Loss per share

Loss per share is calculated based on the weighted average number of common shares outstanding. For the three and nine month periods ended March 31, 2017 and 2016 diluted loss per share does not differ from basic loss per share since the effect of the Company’s warrants and stock options are anti-dilutive. At March 31, 2017, potential common shares of 4,413,520 (2016 – 4,597,236) relating to warrants, 1,120,850 (2016 – 866,250) relating to stock options, and 2,218,417 (2016 – nil) relating to the Series B convertible preferred stock were excluded from the calculation of net loss per common share because their inclusion would be anti-dilutive.

Recent accounting pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard setting bodies that are adopted by the Company as of the specified effective date.

ASU 2016-09, Compensation—Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting.

The amendments in this update change existing guidance related to accounting for employee share-based payments affecting the income tax consequences of awards, classification of awards as equity or liabilities, and classification on the statement of cash flows. ASU 2016-09 is effective for annual reporting periods beginning after December 15, 2016, including interim periods within those annual periods, with early adoption permitted. The Company is currently evaluating the potential impact of the adoption of this standard.

| 7 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

ASU 2016-02, Leases (Topic 842).

The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the consolidated balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the consolidated income statement. ASU 2016-02 is effective for annual periods beginning after December 15, 2018, including interim periods within those annual periods, with early adoption permitted. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The Company is currently evaluating the potential impact of the adoption of this standard.

ASU No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities.

The updated guidance enhances the reporting model for financial instruments, and requires entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes, and the separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (i.e., securities or loans and receivables) on the balance sheet or the accompanying notes to the financial statements. The guidance is effective for annual and interim reporting periods beginning after December 15, 2017. The Company is currently assessing this standard for its impact on future reporting periods.

Accounting Standards Update (“ASU”) 2014-15 - Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern

The objective of the guidance is to require management to explicitly assess an entity's ability to continue as a going concern, and to provide related footnote disclosures in certain circumstances. In connection with each annual and interim period, management will assess if there is substantial doubt about an entity's ability to continue as a going concern within one year after the issuance date of an entity’s financial statements. The new standard defines substantial doubt and provides examples of indicators thereof. The definition of substantial doubt incorporates a likelihood threshold of "probable" similar to the current use of that term in U.S. GAAP for loss contingencies. The new standard will be effective for all entities in the first annual period ending after December 15, 2016 (March 31, 2017 for calendar year-end entities). The Company has adopted this standard as of its December 31, 2016 quarter end.

| 3 | Valent Technologies, LLC |

On December 31, 2014, the Company entered into an exchange agreement (the “Valent Exchange Agreement”) with Valent Technologies, LLC (“Valent”), an entity owned by Dr. Dennis Brown, the Company’s Chief Scientific Officer and director, and DelMar (BC). Pursuant to the Valent Exchange Agreement, Valent exchanged its loan payable in the outstanding amount of $278,530 (including aggregate accrued interest to December 31, 2014 of $28,530), issued to Valent by DelMar (BC), for 278,530 shares of the Company’s Series A Preferred Stock. The Series A Preferred Stock has a stated value of $1.00 per share (the “Series A Stated Value”) and is not convertible into common stock. The holder of the Series A Preferred Stock is entitled to dividends at the rate of 3% of the Series A Stated Value per year, payable quarterly in arrears.

| 8 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

For the three months ended March 31, 2017 and 2016 respectively, the Company recorded $2,089 related to the dividend payable to Valent. For the nine months ended March 31, 2017 and 2016 respectively, the Company recorded $6,267 related to the dividend payable to Valent. The dividends have been recorded as a direct increase in accumulated deficit.

| 4 | Related party transactions |

Pursuant to employment and consulting agreements with the Company’s officers the Company recognized a total of $162,500 (2016 - $120,000) for the three months ended March 31, 2017 and $557,500 (2016 - $360,000) in expenses for the nine months ended March 31, 2017. Amounts owed to related parties are non-interest bearing and payable on demand.

The Company incurred $44,500 (2016 – $42,583) in directors’ fees during the three months ended March 31, 2017 and $126,500 (2016 – $127,583) in directors’ fees during the nine months ended March 31, 2017.

As part of the Series B preferred stock dividend (note 6) the Company issued 1,511 (2016 – 0) shares of common stock to officers and directors of the Company and recognized $6,346 (2016 - 0) as a direct increase to deficit for the three months ended March 31, 2017. For the nine months ended March 31, 2017, the Company issued 4,533 (2016 – 0) shares of common stock and recognized $20,306 (2016 – 0) as a direct increase to the deficit in relation to the Series B preferred stock dividend.

The Company recorded $2,089 (2016 - $2,089) in dividends related to the Series A preferred stock issued to Valent (note 6) for the three months ended March 31, 2017 and $6,267 (2016 - $6,267) for the nine months ended March 31, 2017 (note 3).

During the three and nine months ended March 31, 2017 Valent (note 3) exercised 125,000 common stock purchase warrants at $1.54 per share (CDN $2.00) for total proceeds of $192,075.

During the three and nine months ended March 31, 2017 the Company issued 224,600 (2016 – nil) stock options to officers of the Company at an exercise price of $4.95. The stock options vest pro rata on a monthly basis over 36 months and expire on February 17, 2027.

| 5 | Derivative liability |

The Company has issued common stock purchase warrants. Based on the terms of certain of these warrants the Company determined that the warrants were a derivative liability which is recognized at fair value at the date of the transaction and re-measured at fair value each reporting period with the changes in fair value recorded in the consolidated condensed interim statement of loss and comprehensive loss.

| 9 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

2013 Investor Warrants

During the quarter ended March 31, 2013 the Company issued an aggregate of 3,281,250 units at a purchase price of $3.20 per unit, for aggregate gross proceeds of $10,500,000 (the “Private Offering”). Each unit consisted of one share of common stock and one five-year warrant (the “2013 Investor Warrants”) to purchase one share of common stock at an initial exercise price of $3.20. The exercise price of the 2013 Investor Warrants is subject to adjustment in the event that the Company issues common stock at a price lower than the exercise price, subject to certain exceptions. The 2013 Investor Warrants are redeemable by the Company at a price of $0.004 per 2013 Investor Warrant at any time subject to the conditions that (i) the Company’s common stock has traded for twenty (20) consecutive trading days with a closing price of at least $6.40 per share with an average trading volume of 50,000 shares per day, and (ii) the underlying shares of common stock are registered for resale.

As a result of the financing completed by the Company during the nine months ended March 31, 2016 the exercise price of the 2013 Investor Warrants was reduced from $3.20 to $3.144.

2013 Investor Warrant exercises

During the nine months ended March 31, 2017, 65,095 (2016 – 128,875) of the 2013 Investor Warrants were exercised at an exercise price of $3.144 per share. The Company received proceeds of $204,659 (2016 - $405,183) from these exercises. The warrants that have been exercised were revalued at their respective exercise dates and then the reclassification to equity was recorded resulting in $238,474 (2016 - $247,440) of the derivative liability being reclassified to equity.

There were no exercises of 2013 Investor Warrants during the three months ended March 31, 2017 and 2016.

2013 Investor Warrant amendments

During the three and nine months ended March 31, 2016, the Company entered into amendments (the “2013 Investor Warrant Amendments”) with the holders of certain 2013 Investor Warrants to extend the expiration date to March 31, 2019 and remove the provision requiring an adjustment of the warrant exercise price in the event the Company sells common stock at a purchase price lower than the current warrant exercise price. During the three and nine months ended March 31, 2016, 62,500 of the 2013 Investor Warrants were amended resulting in the recognition of a loss of $7,000 and a reclassification of $65,750 from the derivative liability to equity.

During the nine months ended March 31, 2017 pursuant to the 2013 Investor Warrant Amendments, 15,944 of the 2013 Investor Warrants were amended. As a result, the Company has reclassified $53,006 from the derivative liability to equity. The 2013 Investor Warrants were revalued to their respective amendment dates and were then reclassified to equity.

During the three months ended March 31, 2017 there were no amendments to the 2013 Investor Warrants.

| 10 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

2013 Placement Agent Warrants

On December 30, 2015, the Company entered into amendments (the “2013 Placement Agent Warrant Amendments”) with the holders of warrants the Company issued to the placement agent for the Private Offering (the “2013 Placement Agent Warrants”). Pursuant to the 2013 Placement Agent Warrant Amendments, 1,262,500 of the 2013 Placement Agent Warrants were amended to extend the expiration date to June 30, 2019 and remove the provision requiring an adjustment of the exercise price in the event the Company sells common stock at a purchase price lower than the current warrant exercise price. As a result of the 2013 Placement Agent Warrant Amendments, for the nine months ended March 31, 2016 the Company has recognized a loss of $242,400 and has reclassified $2,277,550 from the derivative liability to equity. The 2013 Placement Agent Warrants were revalued to the date of the amendment and were then reclassified to equity.

2015 Agent Warrants

As part of the Company’s financing completed during the nine months ended December 31, 2015, the Company issued warrants to purchase 23,477 shares of common stock to certain placement agents (“2015 Agent Warrants”) and recognized them as a derivative liability of $29,594 at the time of issuance. The 2015 Agent Warrants are exercisable at a per share price equal to $3.00 until July 15, 2020. During the nine months ended March 31, 2017, 680 (2016 – 0) of the 2015 Agent Warrants were exercised for cash proceeds of $2,040 and 1,000 (2016 – 0) of the 2015 Agent Warrants were exercised on a cashless basis for 594 shares of common stock. The total reclassification to equity subsequent to revaluation at the respective exercise dates was $9,935.

There were no 2015 Agent Warrant exercises during the three months ended March 31, 2017 and 2016.

The Company’s derivative liability is summarized as follows:

| Three months ended | |||||||||

| March 31, | |||||||||

| 2017 | 2016 | ||||||||

| $ | $ | ||||||||

| Opening balance | 171,211 | 1,352,584 | |||||||

| Change in fair value of warrants | 77,479 | (276,584 | ) | ||||||

| Change in fair value due to change in warrant terms | - | 7,000 | |||||||

| Reclassification to equity upon amendment of warrants | - | (65,750 | ) | ||||||

| Closing balance | 248,690 | 1,017,250 | |||||||

| Less current portion | (157,145 | ) | - | ||||||

| Long term portion | 91,545 | 1,017,250 | |||||||

| 11 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

| Nine months ended | |||||||||

| March 31, | |||||||||

| 2017 | 2016 | ||||||||

| $ | $ | ||||||||

| Opening balance | 693,700 | 2,364,381 | |||||||

| Change in fair value of warrants | (143,595 | ) | 943,050 | ||||||

| Change in fair value due to change in warrant terms | - | 270,965 | |||||||

| Reclassification to equity upon amendment of warrants | (53,006 | ) | (2,343,300 | ) | |||||

| Issuance of 2015 Agent Warrants | - | 29,594 | |||||||

| Reclassification to equity upon exercise of warrants | (248,409 | ) | (247,440 | ) | |||||

| Closing balance | 248,690 | 1,017,250 | |||||||

| Less current portion | (157,145 | ) | - | ||||||

| Long term portion | 91,545 | 1,017,250 | |||||||

| 6 | Stockholders’ equity |

Preferred stock

Authorized

5,000,000 preferred shares, $0.001 par value

Issued and outstanding

Special voting shares – at March 31, 2017 – 1 (June 30, 2016 – 1)

Series A shares – at March 31, 2017 – 278,530 (June 30, 2016 – 278,530)

Series B shares – at March 31, 2017 – 887,363 (June 30, 2016 – 902,238)

Series B Preferred Shares

During the year ended June 30, 2016 the Company issued an aggregate of 902,238 shares of Series B Preferred Stock at a purchase price of at $8.00 per share. Each share of Series B Preferred Stock is convertible into 2.5 shares of common stock equating to a conversion price of $3.20 (the “Conversion Price”) and will automatically convert to common stock at the earlier of 24 hours following regulatory approval of VAL-083 with a minimum closing bid price of $8.00 or five years from the final closing dates. The holders of the Series B Preferred Stock are entitled to an annual cumulative, in arrears, dividend at the rate of 9% payable quarterly. The 9% dividend accrues quarterly commencing on the date of issue and is payable quarterly on June 30, December 31, December 31, and March 31 of each year commencing on June 30, 2016. Dividends are payable solely by delivery of shares of common stock (the “PIK Shares”), in an amount for each holder equal to the aggregate dividend payable to such holder with respect to the shares of Series B Preferred Stock held by such holder divided by the Conversion Price. The Series B Preferred Stock does not contain any repricing features.

| 12 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

In addition, the Company and the holders entered into a royalty agreement, pursuant to which the Company will pay the holders of the Series B Preferred Stock, in aggregate, a low, single-digit royalty based on their pro rata ownership of the Series B Preferred Stock on products sold directly by the Company or sold pursuant to a licensing or partnering arrangement (the “Royalty Agreement”).

Upon conversion of a holder’s Series B Preferred Stock to common stock, such holder shall no longer receive ongoing royalty payments under the Royalty Agreement but will be entitled to receive any residual royalty payments that have vested. Rights to the royalties shall vest during the first three years following the applicable closing date, in equal thirds to holders of the Series B Preferred Stock on each of the three vesting dates, upon which vesting dates such royalty amounts shall become “Vested Royalties”.

Pursuant to the Series B Preferred Stock dividend, during the three months ended March 31, 2017, the Company issued 49,955 (2016 – 0) shares of common stock and recognized $209,811 (2016 – 0) as a direct increase in accumulated deficit and during the nine months ended March 31, 2017, the Company issued 150,844 (2016 – 0) shares of common stock and recognized $676,865 (2016 – 0) as a direct increase in accumulated deficit.

During the three months ended March 31, 2017, a total of 2,500 (2016 – 0) shares of Series B Preferred Stock were converted for an aggregate 6,250 (2016 – 0) shares of common stock and during the nine months ended March 31, 2017, a total of 14,875 (2016 – 0) shares of Series B Preferred Stock were converted for an aggregate 37,188 (2016 – 0) shares of common stock.

Series A Preferred Shares

Effective December 31, 2014 pursuant to the Company’s Valent Exchange Agreement (note 3), the Company filed a Certificate of Designation of Series A Preferred Stock (the “Series A Certificate of Designation”) with the Secretary of State of Nevada. Pursuant to the Series A Certificate of Designation, the Company designated 278,530 shares of preferred stock as Series A Preferred Stock. The shares of Series A Preferred Stock have a stated value of $1.00 per share (the “Series A Stated Value”) and are not convertible into common stock. The holder of the Series A Preferred Stock is entitled to dividends at the rate of 3% of the Series A Stated Value per year, payable quarterly in arrears. Upon any liquidation of the Company, the holder of the Series A Preferred Stock will be entitled to be paid, out of any assets of the Company available for distribution to stockholders, the Series A Stated Value of the shares of Series A Preferred Stock held by such holder, plus any accrued but unpaid dividends thereon, prior to any payments being made with respect to the common stock.

| 13 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

Common stock

Authorized - 50,000,000 common shares, $0.001 par value

Issued and outstanding - March 31, 2017 – 11,675,174 (June 30, 2016 – 11,187,023)

| Shares of common stock | Common stock | Additional paid-in capital | Warrants | ||||||||||||||

| outstanding | $ | $ | $ | ||||||||||||||

| Balance – June 30, 2016 | 11,187,023 | 11,187 | 28,833,105 | 1,658,382 | |||||||||||||

| Warrants exercised for cash | 239,525 | 239 | 908,183 | (120,147 | ) | ||||||||||||

| Cashless exercise of warrants | 594 | 1 | 5,158 | - | |||||||||||||

| Shares issued for services | 60,000 | 60 | 563,940 | - | |||||||||||||

| Warrants issued for services | - | - | - | 80,421 | |||||||||||||

| Amendment of warrants | - | - | 53,006 | - | |||||||||||||

| Amendment of stock options | - | - | 260,969 | - | |||||||||||||

| Series B Preferred stock dividends | 150,844 | 151 | 676,714 | - | |||||||||||||

| Conversion of Series B preferred stock | 37,188 | 37 | 103,734 | - | |||||||||||||

| Stock option expense | - | - | 106,570 | - | |||||||||||||

| Balance – March 31, 2017 | 11,675,174 | 11,675 | 31,511,379 | 1,618,656 | |||||||||||||

The issued and outstanding common shares at March 31, 2017 include 982,761 shares of common stock on an as-exchanged basis with respect to the shares of Exchangeco that can be exchanged for shares of common stock of the Company.

Nine months ended March 31, 2016

During the nine months ended March 31, 2016, pursuant to a public offering under a Registration Statement on Form S-1, the Company issued 1,069,417 shares of common stock at $2.40 per share and 1,069,417 warrants (the “2015 Investor Warrants”) to purchase shares of common stock at $0.004 per warrant for total gross proceeds of $2,566,660. The 2015 Investor Warrants are exercisable at $3.00 per share for a period of five years until they expire on July 31, 2020.

The Company engaged certain placement agents for the sale of a portion of the shares and 2015 Investor Warrants. Under the Company’s engagement agreements with these placement agents, the Company agreed to pay up to a 7% cash commission and issue warrants to purchase shares of common stock (the “2015 Agent Warrants”) up to the number of shares of our common stock equal to 5% of the aggregate number of shares sold in the offering by such placement agent. Pursuant to the placement agent agreements the Company paid a total cash commission of $80,575 and issued 23,477 2015 Agent Warrants (note 5). The 2015 Agent Warrants are exercisable at a per share price equal to $3.00 until July 15, 2020.

| 14 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

In addition to the cash commission of $80,575 the Company also incurred additional cash issue and closing costs of $582,511 resulting in net cash proceeds from the public offering of $1,903,514. The 2015 Agent Warrants have been recognized as non-cash issue costs of $29,594.

Stock Options

The following table sets forth the options outstanding:

| Number of stock options outstanding | Weighted average exercise

price $ | ||||||||

| Balance – June 30, 2016 | 856,250 | 3.77 | |||||||

| Granted | 264,600 | 4.82 | |||||||

| Balance – March 31, 2017 | 1,120,850 | 4.02 | |||||||

| 15 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

The following table summarizes stock options currently outstanding and exercisable at March 31, 2017:

| Exercise price $ | Number Outstanding at March 31, 2017 | Weighted average remaining contractual life (years) | Number exercisable at March 31, 2017 | ||||||||

| 1.50 | 25,000 | 4.89 | 25,000 | ||||||||

| 2.00 | 131,250 | 4.89 | 131,250 | ||||||||

| 2.96 | 45,000 | 7.84 | 45,000 | ||||||||

| 3.20 | 30,000 | 8.00 | 30,000 | ||||||||

| 3.32 | 30,000 | 8.83 | 11,667 | ||||||||

| 3.60 | 25,000 | 8.96 | 8,634 | ||||||||

| 3.76 | 45,000 | 8.75 | 18,750 | ||||||||

| 4.00 | 12,500 | 2.50 | 12,500 | ||||||||

| 4.10 | 40,000 | 9.61 | 5,222 | ||||||||

| 4.20 | 412,500 | 6.37 | 412,500 | ||||||||

| 4.48 | 30,000 | 8.77 | 12,333 | ||||||||

| 4.76 | 25,000 | 9.08 | 7,639 | ||||||||

| 4.95 | 224,600 | 9.88 | 9,150 | ||||||||

| 6.16 | 15,000 | 6.00 | 15,000 | ||||||||

| 9.20 | 30,000 | 6.17 | 30,000 | ||||||||

| 1,120,850 | 774,645 | ||||||||||

Included in the number of stock options outstanding are 25,000 stock options granted at an exercise price of CDN $2.00. The exercise prices shown in the above table have been converted to $1.50 using the period ending closing exchange rate. Certain stock options have been granted to non-employees and will be revalued at each reporting date until they have fully vested. The stock options have been re-valued using a Black-Scholes pricing model using the following assumptions:

| March 31, 2017 | |||||

| Dividend rate | 0 | % | |||

| Volatility | 77.8% to 88.7 | % | |||

| Risk-free rate | 1.1% to 1.7 | % | |||

| Term - years | 2.0 to 3.0 | ||||

| 16 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

The Company has recognized the following amounts as stock option expense for the periods noted:

| Three months ended March 31, | Nine months ended March 31, | ||||||||||||||||

2017 $ | 2016 $ | 2017 $ | 2016 $ | ||||||||||||||

| Research and development | 117,775 | 20,165 | 82,763 | 36,395 | |||||||||||||

| General and administrative | 32,179 | 3,678 | 23,808 | 102,316 | |||||||||||||

| 149,954 | 23,843 | 106,571 | 138,711 | ||||||||||||||

All of the stock option expense for the periods ended March 31, 2017 and 2016 has been recognized as additional paid in capital. The aggregate intrinsic value of stock options outstanding at March 31, 2017 was $508,255 (2016 - $396,538) and the aggregate intrinsic value of stock options exercisable at March 31, 2017 was $468,674 (2016 - $396,538). As of March 31, 2017, there was $664,071 in unrecognized compensation expense that will be recognized over the next three years. No stock options granted under the Plan have been exercised to March 31, 2017. Upon the exercise of stock options new shares will be issued.

A summary of status of the Company’s unvested stock options under all plans is presented below:

| Number of Options | Weighted average exercise price $ | Weighted average grant date fair value $ | |||||||||||

| Unvested at June 30, 2016 | 141,016 | 3.17 | 1.73 | ||||||||||

| Granted | 264,600 | 4.82 | 2.61 | ||||||||||

| Vested | (59,411 | ) | 4.14 | 2.26 | |||||||||

| Unvested at March 31, 2017 | 346,205 | 4.59 | 2.49 | ||||||||||

Stock option liability

Certain of the Company’s stock options have been issued in $CDN. Of these, a portion were classified as a stock option liability which is revalued at each reporting date. During the nine months ended March 31, 2017, the Company amended 43,750 of these stock options held by five optionees such that the exercise price of the options was adjusted to be denominated in $USD. No other terms of the stock options were amended. As a result of the amendment, the Company recognized $85,094 in stock option liability expense and $260,969 was reclassified to equity during the nine months ended March 31, 2017.

| 17 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

Warrants

Certain of the Company’s warrants have been recognized as a derivative liability (note 5). The following table summarizes all of the Company’s outstanding warrants as of March 31, 2017:

| Description | Number | ||||

| Balance – June 30, 2016 | 4,612,627 | ||||

| 2013 Investor Warrants (i) | (65,077 | ) | |||

| Valent warrants (ii) | (125,000 | ) | |||

| 2015 Investor Warrants (iii) | (48,750 | ) | |||

| 2015 Agent Warrants (iv) | (1,680 | ) | |||

| Warrants issued for services (v) | 41,400 | ||||

| Balance - March 31, 2017 | 4,413,520 | ||||

| i) | 2013 Investor Warrants were exercised at $3.144 per share for cash proceeds of $204,659. |

| ii) | Warrants issued to Valent (note 4) were exercised at $1.54 (CDN $2.00) per share for cash proceeds of $192,075. |

| iii) | 2015 Investor Warrants were exercised at $3.00 per share for cash proceeds of $146,250. |

| iv) | 680 of the 2015 Agent Warrants were exercised at $3.00 per share for cash proceeds of $2,040 and 1,000 of the 2015 Agent Warrants were exercised on a cashless basis for 594 shares of common stock. |

| v) | Warrants were issued on February 27, 2017 and are exercisable at $5.93 until they expire on February 27, 2020. They vest pro rata over six months from February 27, 2017 and are exercisable commencing 180 days from the date of issuance. |

| 7 | Financial instruments |

The Company has financial instruments that are measured at fair value. To determine the fair value, we use the fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use to value an asset or liability and are developed based on market data obtained from independent sources. Unobservable inputs are inputs based on assumptions about the factors market participants would use to value an asset or liability. The three levels of inputs that may be used to measure fair value are as follows:

| ● | Level one - inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities; |

| ● | Level two - inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals; and |

| 18 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

| ● | Level three - unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect those assumptions that a market participant would use. |

Assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurements. Changes in the observability of valuation inputs may result in a reclassification of levels for certain securities within the fair value hierarchy.

The Company’s financial instruments consist of cash and cash equivalents, other receivables, accounts payable, related party payables and derivative liability. The carrying values of cash and cash equivalents, other receivables, accounts payable and related party payables approximate their fair values due to the immediate or short-term maturity of these financial instruments.

Derivative liability

The Company accounts for certain warrants under the authoritative guidance on accounting for derivative financial instruments indexed to, and potentially settled in, a company’s own stock, on the understanding that in compliance with applicable securities laws, the warrants require the issuance of securities upon exercise and do not sufficiently preclude an implied right to net cash settlement. The Company classifies these warrants on its balance sheet as a derivative liability which is fair valued at each reporting period subsequent to the initial issuance. The Company has used a simulated probability valuation model to value the warrants. Determining the appropriate fair-value model and calculating the fair value of warrants requires considerable judgment. Any change in the estimates (specifically probabilities) used may cause the value to be higher or lower than that reported. The estimated volatility of the Company’s common stock at the date of issuance, and at each subsequent reporting period, is based on the historical volatility of similar life sciences companies. The risk-free interest rate is based on rates published by the government for bonds with a maturity similar to the expected remaining life of the warrants at the valuation date. The expected life of the warrants is assumed to be equivalent to their remaining contractual term.

| a) | Fair value of derivative liability |

The derivative is not traded in an active market and the fair value is determined using valuation techniques. The Company uses judgment to select a variety of methods to make assumptions that are based on specific management plans and market conditions at the end of each reporting period. The Company uses a fair value estimate to determine the fair value of the derivative liability. The carrying value of the derivative liability would be higher or lower as management estimates around specific probabilities change. The estimates may be significantly different from those recorded in the consolidated financial statements because of the use of judgment and the inherent uncertainty in estimating the fair value of these instruments that are not quoted in an active market. All changes in the fair value are recorded in the consolidated statement of operations and comprehensive loss each reporting period. This is considered to be a Level 3 financial instrument as volatility is considered a level 3 input.

| 19 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

March 31, 2017

(expressed in US dollars unless otherwise noted)

The Company has the following liabilities under the fair value hierarchy:

| March 31, 2017 | |||||||||||||

| Liability | Level 1 | Level 2 | Level 3 | ||||||||||

| Derivative liability | - | - | $ | 248,690 | |||||||||

| June 30, 2016 | |||||||||||||

| Liability | Level 1 | Level 2 | Level 3 | ||||||||||

| Derivative liability | - | - | $ | 693,700 | |||||||||

| 8 | Supplementary statement of cash flows information |

| Nine months ended | |||||||||

| March 31, | |||||||||

| 2017 | 2016 | ||||||||

| $ | $ | ||||||||

| Reclassification of derivative liability to equity upon the exercise of warrants (note 5) | 248,409 | 247,440 | |||||||

| Reclassification of derivative liability to equity upon the amendment of warrants (note 5) | 53,006 | 2,343,300 | |||||||

| Reclassification of stock option liability to equity upon settlement (note 6) | 260,969 | - | |||||||

| Series B Preferred share common stock dividend (note 6) | 676,865 | - | |||||||

| Reclassification of stock option liability upon forfeiture of stock options | - | 29,747 | |||||||

| Deferred costs recognized as equity issue costs | - | 550,119 | |||||||

| 9 | Subsequent events |

Subsequent to March 31, 2017 the Company completed a registered public offering (the “2017 Public Offering”) of an aggregate of 2,769,232 shares of common stock and 2,076,924 warrants to purchase an additional 2,076,924 shares of common stock at a price of $3.25 per share and related warrant for gross proceeds of approximately $9.0 million. The warrants have an exercise price of $3.50 per share, are immediately exercisable and have a term of exercise of five years.

The Company engaged a placement agent for the 2017 Public Offering. Under the Company’s engagement agreement with the placement agent, the Company agreed to pay up to an 8% cash commission and issue warrants to purchase shares of common stock (the “2017 Agent Warrants”) up to the number of shares of common stock equal to 5% of the aggregate number of shares issued in the 2017 Public Offering. Pursuant to the placement agent agreement the Company issued 138,462 2017 Agent Warrants. The 2017 Agent Warrants are exercisable at a per share price equal to $4.06 and have a term of exercise of five years.

In addition to the cash commission the Company also incurred additional cash issue costs of approximately $280,000 resulting in net cash proceeds of approximately $8.0 million. At March 31, 2017, the Company had recognized $25,705 in deferred costs relating to the 2017 Public Offering.

| 20 |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

This Management’s Discussion and Analysis (“MD&A”) contains “forward-looking statements”, within the meaning of the Private Securities Litigation Reform Act of 1995, which represent our projections, estimates, expectations or beliefs concerning, among other things, financial items that relate to management’s future plans or objectives or to our future economic and financial performance. In some cases, you can identify these statements by terminology such as “may”, “should”, “plans”, “believe”, “will”, “anticipate”, “estimate”, “expect” “project”, or “intend”, including their opposites or similar phrases or expressions. You should be aware that these statements are projections or estimates as to future events and are subject to a number of factors that may tend to influence the accuracy of the statements. These forward-looking statements should not be regarded as a representation by the Company or any other person that the events or plans of the Company will be achieved. You should not unduly rely on these forward-looking statements, which speak only as of the date of this report. Except as may be required under applicable securities laws, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this report or to reflect the occurrence of unanticipated events.

You should review the factors and risks we describe under “Risk Factors” in our report on Form 10-K for the year ended June 30, 2016 and in the Company’s other filings with the Securities and Exchange Commission, available at www.sec.gov. Actual results may differ materially from any forward-looking statement.

Recent Highlights

| ● | In April 2017, we completed a public offering of common stock and warrants for gross proceeds of $9.0 million. In addition, during the nine months ended March 31, 2017 we received $545,022 in proceeds from the exercise of warrants. We plan to use these funds to support advancement of our product candidate VAL-083 into a pivotal Phase 3 clinical trial for refractory GBM and for general corporate and research purposes. We estimate that this cash is sufficient to fund our planned operations for the next 18-24 months. |

| ● | We continued to advance and expand the development of VAL-083 as a potential new treatment for Glioblastoma Multiforme (“GBM”) for patients whose tumors express features, such as high expression of the enzyme MGMT, that make their cancer resistant to, or unlikely to, respond to currently available therapy. Further, | |

| ● | We reported data from our Phase 1-2 clinical trial in refractory GBM at the American Society of Clinical Oncology’s (“ASCO”) annual meeting demonstrating that VAL-083 may offer improved survival for GBM patients whose tumors have progressed following treatment with chemoradiation and subsequent bevacizumab (Avastin™) therapy; | |

| ● | Based on input from our ‘End of Phase 2’ meeting with the United States Food and Drug Administration (“FDA”), we have submitted a protocol to the FDA for a pivotal, controlled Phase 3 Study in Temozolomide-Avastin Recurrent GBM (“STAR-3”) to evaluate overall survival versus salvage chemotherapy for GBM patients who have previously failed both temozolomide (Temodar™) and bevacizumab (Avastin™); |

| ● | In May 2017, we announced a collaboration with PRA Health Sciences to work with us as our contract research organization to oversee and manage our pivotal VAL-083 STAR-3 GBM clinical trial; |

| ● | We initiated a new Phase 2 clinical study of VAL-083 in patients with MGMT-unmethylated GBM at first recurrence/progression prior to bevacizumab (Avastin®) exposure in collaboration with the University of Texas MD Anderson Cancer Center (“MD Anderson”); and |

| ● | We received ethics committee approval, retained a contract research organization, and submitted a required application for human genomic testing to allow for initiation of a separate Phase 2 clinical trial in newly diagnosed GBM for patients with MGMT-unmethylated GBM at Sun Yat Sen University in Guangzhou, China. |

| 21 |

| ● | We continued to obtain promising research results supporting the potential of VAL-083 in the treatment of other cancers. For example: | |

| ● | We presented data supporting the effectiveness of VAL-083 against chemotherapy-resistant ovarian cancers at the 11th Biennial Ovarian Cancer Research Symposium; | |

| ● | We presented new non-clinical data supporting the differentiation of VAL-083 in the treatment of lung cancer at the American Association for Cancer Research’s (“AACR”) annual meeting; and | |

| ● | We presented data indicating that VAL-083 offers potential therapeutic alternatives in difficult-to-treat pediatric brain tumors at the AACR – Advances in Pediatric Research: From Mechanisms and Models to Treatment and Survivorship Conference. |

| ● | In April 2017, we announced an expansion of our research collaborations with leading academic institutions through a sponsored research agreement with Duke University to evaluate VAL-083 as a front-line treatment for newly diagnosed patients with GBM. |

| ● | We continued to strengthen our intellectual property portfolio. DelMar now holds seven issued US patents and eight issued patents outside of the US. We have fourteen patent families in various stages of prosecution, and over 100 patent filings in total. |

Overview

DelMar Pharmaceuticals, Inc. (the “Company”) is a clinical stage drug development company with a focus on the treatment of cancer. We are conducting clinical trials in the United States of our first product candidate, VAL-083, as a potential new treatment for GBM, the most common and aggressive form of brain cancer. We are also conducting preclinical research with VAL-083 as a potential treatment for other types of cancer. We have also acquired certain exclusive commercial rights to VAL-083 in China where it is approved as a chemotherapy for the treatment of chronic myelogenous leukemia (“CML”) and lung cancer. In order to accelerate our development timelines and reduce risk, we leverage existing clinical and commercial data from a wide range of sources. We plan to pursue independent development and commercialization of VAL-083 for refractory GBM and potentially other product candidates that we may acquire or discover through our research activities. We will also seek collaborative development and commercialization partnerships in order to accelerate and expand our own product development efforts and potentially generate future royalty revenue.

VAL-083

Our product candidate, VAL-083, represents a “first-in-class” small molecule chemotherapeutic which means that the molecular structure of VAL-083 is not an analogue or derivative of other small molecule chemotherapeutics approved for the treatment of cancer. VAL-083 was originally discovered in the 1960’s and has been assessed in 42 Phase 1 and Phase 2 clinical trials sponsored by the National Cancer Institute (“NCI”) in the United States as a treatment against various cancers including lung, brain, cervical, ovarian tumors and leukemia. Published pre-clinical and clinical data suggest that VAL-083 may be active against a range of tumor types. VAL-083 is approved as a cancer chemotherapeutic in China for the treatment of CML and lung cancer. VAL-083 has not been approved for any indications outside of China.

Upon obtaining regulatory approval, we intend to commercialize VAL-083 for the treatment of orphan cancer indications such as refractory GBM. We also plan to seek collaborative development and commercialization partnerships to accelerate and expand the development of VAL-083 in newly diagnosed GBM and other non-orphan cancer indications.

The FDA Office of Orphan Products Development (“OOPD”) granted orphan drug designations to VAL-083 for the treatment of glioma, ovarian cancer and medulloblastoma. VAL-083 has also been granted an orphan drug designation for in the treatment of glioma in Europe. Orphan diseases are defined in the United States under the Rare Disease Act of 2002 as “any disease or condition that affects fewer than 200,000 persons in the United States”. The Orphan Drug Act of 1983 is a federal law that provides financial and other incentives including a seven-year period of market exclusivity in the United States to encourage the development of new treatments for orphan diseases.

| 22 |

We research the mechanism of action of potential product candidates to determine the clinical indications best suited for therapy and seek to rapidly advance into human clinical trials and toward commercialization. The mechanism of action of VAL-083 is understood to be a bi-functional alkylating agent. Alkylating agents are a commonly used class of chemotherapy drugs. They exhibit anti-cancer effects by binding to DNA and interfering with normal processes within the cancer cell, which prevents the cell from making the proteins needed to grow and survive. After exposure to alkylating agents, the cancer cell becomes dysfunctional and dies. There are a number of alkylating agents on the market that are used by physicians to treat different types of cancer.

VAL-083 Mechanism of Action and the Opportunity in the Treatment of Cancer

Chemotherapy forms the basis of treatment in nearly all cancers. We believe that VAL-083 may be effective in treating cancer patients whose tumors exhibit features that cause resistance to currently available chemotherapy. that have failed or become resistant to other chemotherapies.

Our research suggests that VAL-083 attacks cancer cells via a unique mechanism of action which is distinct from other chemotherapies used in the treatment of cancer. Our data indicate that VAL-083 forms a crosslink at the N7 position of guanine on the DNA of cancer cells. Our data also indicate that this crosslink forms rapidly and is not easily repaired by the cancer cell resulting in cell-cycle arrest and lethal double-strand DNA breaks in cancer cells. VAL-083 readily crosses the blood brain barrier where it maintains a long half-life in comparison to the plasma. Published pre-clinical and clinical research demonstrate that VAL-083 is absorbed more readily in tumor cells versus normal cells.

Based on published research and our own data, the cytotoxic functional groups and the mechanism of action of VAL-083 are understood to be functionally different from alkylating agents commonly used in the treatment of cancer. VAL-083 has previously demonstrated activity in cell-lines that are resistant to other types of chemotherapy. No evidence of cross-resistance has been reported in published clinical studies.

Our data also demonstrate that VAL-083’s mechanism is distinct from current standard-of-care chemotherapy and is able to overcome drug resistance against a range of cancers in vitro. For example, VAL-083 is active against MGMT-unmethylated GBM cells which are resistant to treatment with temozolomide and nitrosoureas. VAL-083 also retains a high level of activity in p53 mutated NSCLC, ovarian cancer and medulloblastoma cell lines that are resistant to platinum-based chemotherapy.

Importantly, clinical activity against each of the tumors mentioned above was established in prior NCI-sponsored Phase 2 clinical trials. We believe that these historical clinical data and our own research support the development of VAL-083 as a potential new treatment for multiple cancers.

The main dose-limiting toxicity (“DLT”) related to the administration of VAL-083 in previous NCI-sponsored clinical studies and our own clinical trials is myelosuppression. Myelosuppression is the decrease in cells responsible for providing immunity, carrying oxygen, and those responsible for normal blood clotting. Myelosuppression is a common side effect of chemotherapy. There is no evidence of lung, liver or kidney toxicity even with prolonged treatment by VAL-083. Commercial data from the Chinese market where the drug has been approved for more than 15 years supports the safety findings of the NCI studies.

Modern medicine allows for better management of myelosuppressive side effects. We believe this offers the potential opportunity to improve upon the drug’s already established efficacy profile by substantially increasing the dose of VAL-083 that can be safely administered to cancer patients.

| 23 |

Background on GBM

Worldwide, there are an estimated 240,000 new cases of brain and central nervous system (“CNS”) tumors each year. Gliomas are a type of CNS tumor that arises from glial cells in the brain or spine. Glial cells are the cells surrounding nerves. Their primary function is to provide support and protection for neurons in the CNS.

GBM is the most common and the most lethal form of glioma. According to the World Health Organization, GBM occurs with an incidence of 3.17 per 100,000 person-years. Approximately 15,000 new cases of GBM are expected to be diagnosed in the United States during 2016.

GBM progresses quickly and patients’ conditions deteriorate rapidly progressing to death in less than two years for most patients. Common symptoms include headaches, seizures, nausea, weakness, paralysis and personality or cognitive changes such as loss of speech or difficulty in thinking clearly. The majority of GBM patients do not survive for more than two years following diagnosis, and the median survival in newly diagnosed patients with best available treatments is less than 15 months.

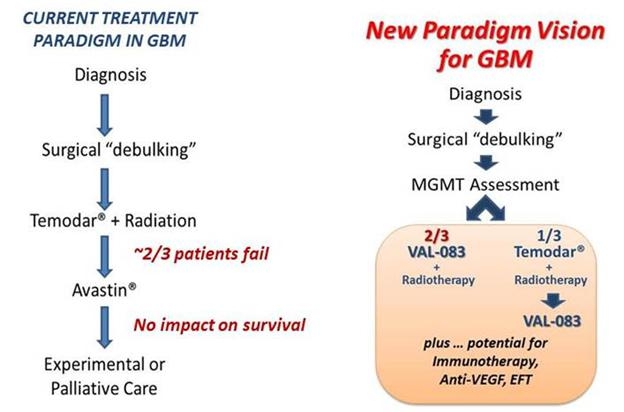

Standard treatment following diagnosis includes surgical resection to remove as much of the tumor as possible (“debulking”) followed by radiotherapy with concomitant and adjuvant chemotherapy with Temodar® (temozolomide “TMZ”). Nearly all patients diagnosed with GBM will relapse following first-line treatment, with a 1-year survival rate of approximately 25% following failure of front-line therapy, with an average 5-year survival rate less than 3%.

Avastin® (bevacizumab, an anti-VEGF antibody) is approved as a single agent for patients with recurrent GBM following prior therapy as an alternative to corticosteroids to relieve disease symptoms in the US, Canada, Australia and Japan. Avastin® carries a “black-box warning” related to severe, sometimes fatal, side effects such as gastrointestinal perforations, wound healing complications and hemorrhage. There are no data demonstrating an improvement in disease-related symptoms or increased survival in refractory GBM with Avastin®.

TMZ and the nitrosoureas, including carmustine, lomustine, and nimustine, are alkylating agents that readily cross the blood-brain-barrier and are used in the treatment of CNS cancers, including GBM. Alkylating agents are among the oldest type of cancer chemotherapies in use today. Alkylating agents bind to DNA to cause damage to cancer cells. Their anti-tumor mechanism is via alkylation of DNA resulting in base-pair mismatch or strand-mediated crosslinks between base pairs. The DNA damage caused by alkylating agents mimics naturally occurring errors, resulting in apoptosis and tumor cell death.

The primary anti-cancer mechanism of TMZ and the nitrosoureas is to attack the tumor’s DNA via alkylation of the O6-position of the DNA base residue, guanine. TMZ treatment causes DNA damage mainly by methylation at the O6-position of guanine resulting in guanine-thymine base pair mismatches during replication. Nitrosoureas mediate their cytotoxic effect by methylation at the O6-position of guanine which produces a cross-link to cytosine residues resulting in double-strand DNA breaks during mitosis.

A majority of GBM patients’ tumors are resistant to TMZ or nitrosourea therapy due to high expression of a naturally occurring enzyme called O6-DNA methylguanine methyl-transferase (“MGMT”) enzyme which repairs O6-guanine lesions. MGMT repair in turn inhibits the activity of TMZ and nitrosoureas and allows a patients’ GBM tumor to continue to grow in spite of treatment.

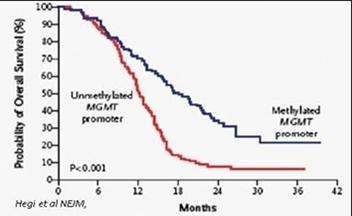

Consistent with the importance of its repair activity, high expression of MGMT is strongly correlated with poor patient outcomes. Several clinical studies have established that MGMT is an important prognostic indicator of response to TMZ and patient survival.

We have demonstrated that VAL-083 forms inter-strand DNA crosslinks at the N7 position of guanine – a building block of DNA. VAL-083 is active independent of MGMT which is highly expressed in approximately 67% of GBM patients and correlated with resistance to temozolomide, the current front-line chemotherapy in the treatment of GBM. Of patients tested in the DelMar trial, 84% exhibited high MGMT expression.

| 24 |

Probability of GBM Patient Survival Correlated to Expression of MGMT Enzyme

(Unmethylated promoter = High MGMT Expression and Significantly Shorter Survival)

VAL-083 in GBM

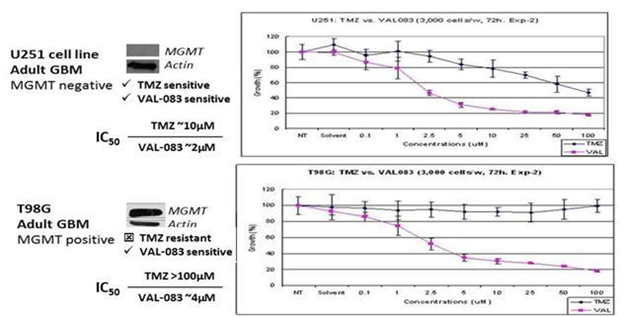

Data from prior NCI sponsored clinical trials with VAL-083 demonstrates activity against GBM and other central nervous system tumors. VAL-083 is an alkylating agent which readily crosses the blood-brain-barrier. Its primary cytotoxic mechanism, epoxide derived DNA cross-links at the N7 position of guanine, is distinct from TMZ or the nitrosoureas.

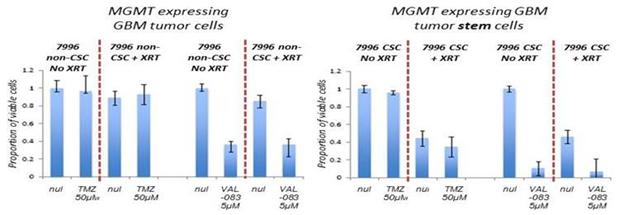

Our research demonstrates that VAL-083’s unique cytotoxic mechanism forms DNA cross-links at the N7 position of guanine and retains cytotoxic activity independent of MGMT expression in vitro. We have presented research at peer-reviewed scientific meetings demonstrating that VAL-083 is active in patient-derived tumor cell lines and cancer stem cells that are resistant to other chemotherapies. Of particular importance is resistance to Temodar® due to activity of the repair enzyme MGMT, which results in chemoresistance in many GBM patients. We have presented data demonstrating that VAL-083 is active independent of MGMT resistance in laboratory studies. VAL-083 has more potent activity against brain tumor cells in comparison to TMZ and overcome resistance associated with MGMT suggesting the potential to surpass the current standard-of-care in the treatment of GBM.

A

Summary of Our Data Demonstrating that VAL-083’s Anti-Tumor Mechanism is Distinct from, and can

Overcome, MGMT-Related Chemoresistance in the Treatment of GBM

| 25 |

In addition, historical NCI clinical trial data and our own research support the activity of VAL-083 as a potentiator of radiotherapy. Radiotherapy in combination with temozolomide is the current standard of care in the treatment of glioblastoma. Our research demonstrates that temozolomide and radiotherapy are ineffective against GBM cells exhibiting a high expression of MGMT, whereas VAL-083 potentiates the tumor-killing effect of radiation in these cells. Furthermore, the combination of VAL-083 and radiation has been demonstrated to be active against GBM tumor stem cells in vitro. Tumor stem cells are often resistant to chemotherapy and form the basis for tumor recurrence and metastasis.

VAL-083’s more potent activity against brain tumor cells in comparison to TMZ, the ability to overcome MGMT-mediated resistance and activity against GBM cancer stem cells suggests the potential of VAL-083 to surpass the current standard-of-care in the treatment of GBM. We believe these data support a potential paradigm shift in the treatment of GBM where VAL-083 would be the chemotherapy of choice in the treatment of the majority of GBM patients whose tumors are known to express MGMT and other factors correlated with resistance to temozolomide or whose tumors become resistant to temozolomide over time.

| 26 |

VAL-083’s activity in GBM has been established in historical NCI-sponsored clinical studies as chemotherapy in the treatment of newly diagnosed and recurrent brain tumors and other cancers. In general, tumor regression in brain cancer was achieved following therapy in greater than 40% of patients treated and stabilization was achieved in an additional 20% to 30%. In published clinical studies VAL-083 has previously been shown to have a statistically significant impact on median survival in high grade glioma brain tumors when combined with radiation versus radiation alone with results similar or superior to other chemotherapies approved for use in GBM (p value = <0.05).

A Summary of Published Data adapted from Separate Sources Comparing the Efficacy of VAL-083

and Other Therapies in the Treatment of GBM

| Comparative Therapy | ||||||

| Chemotherapy | Radiation (XRT) | Radiation + Chemotherapy | Median Survival Benefit vs. XRT alone | |||

VAL-083 (Eagan 1979) | 8.4 months | 16.8 months | 8.4 months | |||

Temozolomide (Temodar®) (Stupp 2005) | 12.1 months | 14.6 months | 2.5 months | |||

| Lomustine (CCNU) (Walker 1976) | 11.8 months | 13 months | 1.2 months | |||

| Carmustine (BCNU) (Reagan 1976) | 10 months | 12.5 months | 2.5 months | |||

| Semustine (ACNU) (Walker 1976) | 8.8 months | Not reported | ||||

Bevacizumab (Avastin®) (Genentech, Inc) | n.a. | No survival benefit per Avastin® label | ||||

| 27 |

Additional support for the differentiated profile of VAL-083 and TMZ comes from the results of studies with GBM cancer stem cells (“CSCs”). GBM CSCs display strong resistance to TMZ, even where MGMT expression is low. However, our data demonstrates that GBM CSCs are susceptible to VAL-083 independent of MGMT expression.

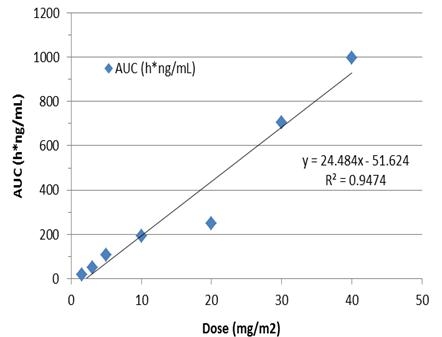

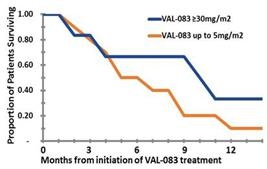

Based on historical data and our own research, we believe that VAL-083 has the potential to offer physicians and patients a new paradigm in the treatment of GBM that will address significant unmet medical needs. In addition, the profile of VAL-083 offers the potential of additive or synergistic benefit as a future combination therapy with existing chemotherapeutic agents or novel vaccines or immunotherapy approaches currently under investigation.