Attached files

| file | filename |

|---|---|

| EX-10.3 - SETTLEMENT AGREEMENT, DATED JANUARY 1, 2018, BETWEEN DELMAR PHARMACEUTICALS, INC - Kintara Therapeutics, Inc. | f10q1217ex10-3_delmarpharma.htm |

| EX-32.2 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q1217ex32-2_delmarpharma.htm |

| EX-32.1 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q1217ex32-1_delmarpharma.htm |

| EX-31.2 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q1217ex31-2_delmarpharma.htm |

| EX-31.1 - CERTIFICATION - Kintara Therapeutics, Inc. | f10q1217ex31-1_delmarpharma.htm |

| EX-10.4 - DELMAR PHARMACEUTICALS, INC. 2017 OMNIBUS EQUITY INCENTIVE PLAN (AS AMENDED AND - Kintara Therapeutics, Inc. | f10q1217ex10-4_delmarpharma.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2017

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to __________________________

Commission file number: 001-37823

DelMar Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 99-0360497 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

Suite 720-999 West Broadway Vancouver, British Columbia, Canada |

V5Z 1K5 | |

| (Address of principal executive offices) | (zip code) |

| (604) 629-5989 |

| (Registrant's telephone number, including area code) |

| N/A |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

Non-accelerated filer ☐ (Do not check if smaller reporting company) Emerging growth company ☐ |

Smaller reporting company þ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes ☐ No þ

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date, 21,927,517 shares of common stock are issued and outstanding as of February 13, 2018.

TABLE OF CONTENTS

| Page No. | ||||

| PART I. - FINANCIAL INFORMATION | ||||

| Item 1. | Financial Statements. | 1 | ||

| Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 22 | ||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 49 | ||

| Item 4 | Controls and Procedures. | 49 | ||

| PART II - OTHER INFORMATION | ||||

| Item 1. | Legal Proceedings. | 49 | ||

| Item 1A. | Risk Factors. | 49 | ||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 49 | ||

| Item 3. | Defaults Upon Senior Securities. | 49 | ||

| Item 4. | Mine Safety Disclosures. | 49 | ||

| Item 5. | Other Information. | 50 | ||

| Item 6. | Exhibits. | 50 | ||

PART 1. - FINANCIAL INFORMATION

Item 1. Financial Statements.

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Financial Statements

(Unaudited)

For the six months ended December 31, 2017

(expressed in US dollars unless otherwise noted)

| 1 |

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Balance Sheets

(Unaudited)

(expressed in US dollars unless otherwise noted)

| Note | December 31, 2017 $ | June 30, 2017 $ | ||||||||||

| Assets | ||||||||||||

| Current assets | ||||||||||||

| Cash | 11,021,568 | 6,586,014 | ||||||||||

| Prepaid expenses and deposits | 1,140,801 | 1,208,122 | ||||||||||

| Taxes and other receivables | 24,667 | 76,595 | ||||||||||

| 12,187,036 | 7,870,731 | |||||||||||

| Intangible assets - net | 29,080 | 40,290 | ||||||||||

| 12,216,116 | 7,911,021 | |||||||||||

| Liabilities | ||||||||||||

| Current liabilities | ||||||||||||

| Accounts payable and accrued liabilities | 1,829,137 | 1,182,312 | ||||||||||

| Related party payables | 4 | 397,856 | 88,957 | |||||||||

| Current portion of derivative liability | 5 | 95 | 33,091 | |||||||||

| 2,227,088 | 1,304,360 | |||||||||||

| Derivative liability | 5 | 5,454 | 28,137 | |||||||||

| 2,232,542 | 1,332,497 | |||||||||||

| Stockholders’ accumulated equity | ||||||||||||

| Preferred stock | ||||||||||||

| Authorized | ||||||||||||

| 5,000,000 shares, $0.001 par value | ||||||||||||

| Issued and outstanding | ||||||||||||

| 278,530 Series A shares at December 31, 2017 (June 30, 2017 – 278,530) | 3,6 | 278,530 | 278,530 | |||||||||

| 881,113 Series B shares at December 31, 2017 (June 30, 2017 – 881,113) | 6 | 6,146,880 | 6,146,880 | |||||||||

| 1 special voting share at December 31, 2017 (June 30, 2017 – 1) | - | - | ||||||||||

| Common stock | ||||||||||||

| Authorized | ||||||||||||

| 50,000,000 shares, $0.001 par value | ||||||||||||

| 22,608,837 issued at December 31, 2017 (June 30, 2017 – 14,509,633) | 6 | 22,609 | 14,510 | |||||||||

| Additional paid-in capital | 6 | 43,238,880 | 36,665,285 | |||||||||

| Warrants | 6 | 7,321,844 | 4,570,574 | |||||||||

| Accumulated deficit | (47,046,347 | ) | (41,118,433 | ) | ||||||||

| Accumulated other comprehensive income | 21,178 | 21,178 | ||||||||||

| 9,983,574 | 6,578,524 | |||||||||||

| 12,216,116 | 7,911,021 | |||||||||||

Nature of operations, corporate history, and liquidity risk (note 1) | ||||||||||||

Subsequent events (note 9) | ||||||||||||

The accompanying notes are an integral part of these consolidated condensed interim financial statements

| 2 |

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Statement of Loss and Comprehensive Loss

(Unaudited)

(expressed in US dollars unless otherwise noted)

Note | Three months ended December 31, 2017 $ | Three months ended December 31, 2016 $ | Six months ended December 31, 2017 $ | Six months ended December 31, 2016 $ | ||||||||||||||||

| Expenses | ||||||||||||||||||||

| Research and development | 4 | 2,141,945 | 1,120,910 | 4,076,588 | 1,853,639 | |||||||||||||||

| General and administrative | 4 | 1,011,879 | 571,286 | 1,756,500 | 1,887,925 | |||||||||||||||

| 3,153,824 | 1,692,196 | 5,833,088 | 3,741,564 | |||||||||||||||||

| Other loss (income) | ||||||||||||||||||||

| Change in fair value of stock option and derivative liabilities | 5, 6 | 889 | (361,668 | ) | (55,679 | ) | (135,980 | ) | ||||||||||||

| Foreign exchange loss (gain) | 7,120 | (8,495 | ) | 50,986 | 6,829 | |||||||||||||||

| Interest income | (235 | ) | (60 | ) | (391 | ) | (101 | ) | ||||||||||||

| 7,774 | (370,223 | ) | (5,084 | ) | (129,252 | ) | ||||||||||||||

| Net and comprehensive loss for the period | 3,161,598 | 1,321,973 | 5,828,004 | 3,612,312 | ||||||||||||||||

| Computation of basic loss per share | ||||||||||||||||||||

| Net and comprehensive loss for the period | 3,161,598 | 1,321,973 | 5,828,004 | 3,612,312 | ||||||||||||||||

| Series B Preferred stock dividend | 54,066 | 159,756 | 95,732 | 467,054 | ||||||||||||||||

| Net and comprehensive loss available to common stockholders | 3,215,664 | 1,481,729 | 5,923,736 | 4,079,366 | ||||||||||||||||

| Basic and fully diluted loss per share | 0.14 | 0.13 | 0.31 | 0.36 | ||||||||||||||||

| Basic weighted average number of shares | 22,559,234 | 11,424,485 | 18,882,259 | 11,363,237 | ||||||||||||||||

The accompanying notes are an integral part of these consolidated condensed interim financial statements.

| 3 |

DelMar Pharmaceuticals, Inc.

Consolidated Condensed Interim Statement of Cash Flows

(Unaudited)

(expressed in US dollars unless otherwise noted)

| Six months ended December 31, | ||||||||||||

| 2017 | 2016 | |||||||||||

| Note | $ | $ | ||||||||||

| Cash flows from operating activities | ||||||||||||

| Loss for the period | (5,828,004 | ) | (3,612,312 | ) | ||||||||

| Items not affecting cash | ||||||||||||

| Amortization of intangible assets | 11,210 | 7,716 | ||||||||||

| Change in fair value of stock option and derivative liabilities | 5,6 | (55,679 | ) | (135,980 | ) | |||||||

| Shares issued for services | 6 | - | 564,000 | |||||||||

| Warrants issued for services | 6 | (1,481 | ) | 50,244 | ||||||||

| Stock option expense (income) | 6 | 293,377 | (43,384 | ) | ||||||||

| Changes in non-cash working capital | ||||||||||||

| Taxes and other receivables | 51,928 | 399 | ||||||||||

| Prepaid expenses | 67,321 | 13,341 | ||||||||||

| Accounts payable and accrued liabilities | 646,825 | (68,369 | ) | |||||||||

| Related party payables | 4 | 308,899 | 161,937 | |||||||||

| (4,505,604 | ) | (3,062,408 | ) | |||||||||

| Cash flows from financing activities | ||||||||||||

| Net proceeds from the issuance of shares and warrants | 6 | 8,945,336 | - | |||||||||

| Proceeds from the exercise of warrants | 6 | - | 326,699 | |||||||||

| Series A preferred stock dividend | 6 | (4,178 | ) | (4,178 | ) | |||||||

| 8,941,158 | 322,521 | |||||||||||

| Increase (decrease) in cash | 4,435,554 | (2,739,887 | ) | |||||||||

| Cash - beginning of period | 6,586,014 | 6,157,264 | ||||||||||

| Cash - end of period | 11,021,568 | 3,417,377 | ||||||||||

Supplementary information (note 8) | ||||||||||||

The accompanying notes are an integral part of these consolidated condensed interim financial statements.

| 4 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

| 1 | Nature of operations, corporate history, and liquidity risk |

Nature of operations

DelMar Pharmaceuticals, Inc. (the “Company”) is a clinical stage drug development company with a focus on the treatment of cancer. We are conducting clinical trials in the United States with VAL-083 as a potential new treatment for glioblastoma multiforme, the most common and aggressive form of brain cancer. We have also acquired certain exclusive commercial rights to VAL-083 in China where it is approved as a chemotherapy for the treatment of chronic myelogenous leukemia and lung cancer. In order to accelerate our development timelines, we leverage existing clinical and commercial data from a wide range of sources. We may seek marketing partnerships to potentially generate future royalty revenue.

The address of the Company’s administrative offices is Suite 720 - 999 West Broadway, Vancouver, British Columbia, V5Z 1K5 with clinical operations located at 3485 Edison Way, Suite R, Menlo Park, California, 94025.

Corporate history

The Company is a Nevada corporation formed on June 24, 2009 under the name Berry Only, Inc. On January 25, 2013, the Company entered into and closed an exchange agreement (the “Exchange Agreement”), with Del Mar Pharmaceuticals (BC) Ltd. (“DelMar (BC)”), 0959454 B.C. Ltd. (“Callco”), and 0959456 B.C. Ltd. (“Exchangeco”) and the security holders of DelMar (BC). Upon completion of the Exchange Agreement, DelMar (BC) became a wholly-owned subsidiary of the Company (the “Reverse Acquisition”).

DelMar Pharmaceuticals, Inc. is the parent company of DelMar (BC), a British Columbia, Canada corporation incorporated on April 6, 2010, which is a clinical stage company with a focus on the development of drugs for the treatment of cancer. The Company is also the parent company to Callco and Exchangeco which are British Columbia, Canada corporations. Callco and Exchangeco were formed to facilitate the Reverse Acquisition.

References to the Company refer to the Company and its wholly-owned subsidiaries, DelMar (BC), Callco and Exchangeco.

Liquidity risk

For the six months ended December 31, 2017, the Company reported a loss of $5,828,004 and the Company had an accumulated deficit of $47,046,347 at that date. As at December 31, 2017, the Company had cash on hand of $11,021,568. During the six months ended December 31, 2017, the Company received $8,945,336 in net proceeds from a registered direct offering. We believe, based on our current estimates, that we will be able to fund our operations beyond the next twelve months.

The Company does not have the prospect of achieving revenues in the near future and the Company will require additional funding for its clinical trials, to maintain its research and development projects, and for general operations. There is a great degree of uncertainty with respect to the expenses the Company will incur in executing its business plan. Consequently, management continually evaluates various financing alternatives to fund the Company’s operations so it can continue as a going concern in the medium to longer term.

There is no assurance that our cost estimates will prove to be accurate or that unforeseen events, problems or delays will not occur with respect thereto. The ability of the Company to meet its obligations and continue the research and development of its product candidate is dependent on its ability to continue to raise adequate financing. There can be no assurance that such financing will be available to the Company in the amount required at any time or for any period or, if available, that it can be obtained on terms satisfactory to the Company. The Company may tailor its drug candidate development program based on the amount of funding the Company raises.

| 5 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

| 2 | Significant accounting policies |

Basis of presentation

The consolidated condensed interim financial statements of the Company have been prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”) and are presented in United States dollars. The functional currency of the Company and each of its subsidiaries is the United States dollar.

The accompanying consolidated condensed interim financial statements include the accounts of the Company and its wholly-owned subsidiaries, DelMar BC, Callco, and Exchangeco. All intercompany balances and transactions have been eliminated.

The principal accounting policies applied in the preparation of these financial statements are set out below and have been consistently applied to all periods presented.

Unaudited interim financial data

The accompanying unaudited December 31, 2017 consolidated condensed interim balance sheet, the consolidated condensed interim statements of loss and comprehensive loss for the three and six months ended December 31, 2017 and 2016, and consolidated condensed cash flows for the six months ended December 31, 2017 and 2016, and the related interim information contained within the notes to the consolidated condensed interim financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission for interim financial information. Accordingly, they do not include all of the information and the notes required by U.S. GAAP for complete financial statements. These consolidated condensed interim financial statements should be read in conjunction with the audited financial statements of the Company as at June 30, 2017 included in the Company’s Form 10-K filed with the Securities and Exchange Commission on September 27, 2017. In the opinion of management, the unaudited consolidated condensed interim financial statements reflect all adjustments, consisting of normal and recurring adjustments, necessary for the fair statement of the Company’s financial position at December 31, 2017 and results of its operations for the three and six months ended December 31, 2017 and 2016, and its cash flows for the six months ended December 31, 2017 and 2016. The results for six months ended December 31, 2017 are not necessarily indicative of the results to be expected for the fiscal year ending June 30, 2018 or for any other future annual or interim period.

| 6 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

Use of estimates

The preparation of consolidated condensed interim financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions about future events that affect the reported amounts of assets, liabilities, expenses, contingent assets and contingent liabilities as at the end of, or during, the reporting period. Actual results could significantly differ from those estimates. Significant areas requiring management to make estimates include the derivative liability, the valuation of equity instruments issued for services, and clinical trial accruals. There have been no changes to the methodology used in determining these estimates from the fiscal year ended June 30, 2017.

Loss per share

Loss per share is calculated based on the weighted average number of common shares outstanding. For the three-month period ended December 31, 2017 and 2016 diluted loss per share does not differ from basic loss per share since the effect of the Company’s warrants and stock options are anti-dilutive. At December 31, 2017, potential common shares of 15,028,906 (2016 – 4,505,852) relating to warrants, 1,420,850 (2016 – 896,250) relating to stock options, and 2,202,792 (2016 – 2,224,668) relating to the Series B convertible preferred stock were excluded from the calculation of net loss per common share because their inclusion would be anti-dilutive.

Recent accounting pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard setting bodies that are adopted by the Company as of the specified effective date.

Accounting Standards Update (“ASU”) 2017-11 — I. Accounting for Certain Financial Instruments with Down Round Features, II. Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Non-public Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception

The amendments in this update are intended to reduce the complexity associated with the accounting for certain financial instruments with characteristics of liabilities and equity. Specifically, a down round feature would no longer cause a freestanding equity-linked financial instrument (or an embedded conversion option) to be accounted for as a derivative liability at fair value with changes in fair value recognized in current earnings. In addition, the indefinite deferral of certain provisions of Topic 480 have been re-characterized to a scope exception. The re-characterization has no accounting effect. ASU 2017-11 is effective for public business entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. Early adoption is permitted. The Company is currently evaluating the potential impact of the adoption of this standard. The adoption of this guidance is not expected to have a material impact on the consolidated, condensed financial statements.

| 7 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

ASU 2016-09 —Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting.

The amendments in this update change existing guidance related to accounting for employee share-based payments affecting the income tax consequences of awards, classification of awards as equity or liabilities, and classification on the statement of cash flows. ASU 2016-09 is effective for annual reporting periods beginning after December 15, 2016, including interim periods within those annual periods, with early adoption permitted. The Company has adopted this standard as of its September 30, 2017 quarter end.

ASU 2016-02 — Leases (Topic 842).

The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the consolidated balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the consolidated income statement. ASU 2016-02 is effective for annual periods beginning after December 15, 2018, including interim periods within those annual periods, with early adoption permitted. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The Company is currently evaluating the potential impact of the adoption of this standard.

ASU No. 2016-01 — Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities.

The updated guidance enhances the reporting model for financial instruments and requires entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes, and the separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (i.e., securities or loans and receivables) on the balance sheet or the accompanying notes to the financial statements. The guidance is effective for annual and interim reporting periods beginning after December 15, 2017. The Company is currently assessing this standard for its impact on future reporting periods.

| 3 | Valent Technologies, LLC |

On September 30, 2014, the Company entered into an exchange agreement (the “Valent Exchange Agreement”) with Valent Technologies, LLC (“Valent”), an entity owned by Dr. Dennis Brown, the Company’s Chief Scientific Officer and director, and DelMar (BC). Pursuant to the Valent Exchange Agreement, Valent exchanged its loan payable in the outstanding amount of $278,530 (including aggregate accrued interest to September 30, 2014 of $28,530), issued to Valent by DelMar (BC), for 278,530 shares of the Company’s Series A Preferred Stock. The Series A Preferred Stock has a stated value of $1.00 per share (the “Series A Stated Value”) and is not convertible into common stock. The holder of the Series A Preferred Stock is entitled to dividends at the rate of 3% of the Series A Stated Value per year, payable quarterly in arrears.

For the three months ended December 31, 2017 and 2016 respectively, the Company recorded $2,089 related to the dividend payable to Valent. For the six months ended December 31, 2017 and 2016 respectively, the Company recorded $4,178 related to the dividend payable to Valent. The dividends have been recorded as a direct increase in accumulated deficit.

| 8 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

| 4 | Related party transactions |

Pursuant to employment and consulting agreements with the Company’s officers the Company recognized a total of $226,667 (2016 - $275,000) in expenses for the three months ended December 31, 2017 and $369,167 (2016 - $395,000) for the six months ended December 31, 2017. In addition, at December 31, 2017, the Company also recognized a total of $311,683 relating to the settlement agreement with the Company’s former President and Chief Operating Officer. Amounts owed to related parties, including to the Company’s former President and Chief Operating Officer, are non-interest bearing and payable on demand.

The Company recognized $43,750 (2016 – $37,000) in directors’ fees during the three months ended December 31, 2017 and $96,250 (2016 - $82,000) during the six months ended December 31, 2017.

As part of the Series B preferred stock dividend (note 6) the Company issued 1,511 (2016 – 1,511) shares of common stock to officers and directors of the Company and recognized an amount of $1,647 (2016 - $4,819) for the three months ended December 31, 2017. For the six months ended December 31, 2017, the Company issued 3,022 (2016 – 3,022) shares of common stock and recognized $2,916 (2016 - $13,960). All of the dividends have been recognized as a direct increase to deficit.

The Company recorded $2,089 (2016 - $2,089) in dividends related to the Series A preferred stock issued to Valent (note 3) for the three months ended December 31, 2017 and $4,178 (2016 - $4,178) for the six months ended December 31, 2017.

During the six months ended December 31, 2017, the Company granted a total of 180,000 stock options to the Company’s independent directors. The stock options are exercisable at a price of $2.11 and have a term of 10 years. One-third of the options vest on June 30, 2018 and 15,000 options vest on a quarterly basis thereafter commencing September 30, 2018. In addition, during the three and six months ended December 31, 2017, the Company granted 120,000 stock options at an exercise price of $0.87 to its Interim President and Chief Executive Officer. The stock options have a term of 10 years and vest pro rata monthly during the year following grant. The Company also modified certain stock options held by its former President and Chief Operating Officer (note 6).

| 9 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

| 5 | Derivative liability |

The Company has issued common stock purchase warrants. Based on the terms of certain of these warrants the Company determined that the warrants were a derivative liability which is recognized at fair value at the date of the transaction and re-measured at fair value each reporting period with the changes in fair value recorded in the consolidated condensed interim statement of loss and comprehensive loss.

2013 Investor Warrants

During the quarter ended March 31, 2013 the Company issued an aggregate of 3,281,250 units at a purchase price of $3.20 per unit, for aggregate gross proceeds of $10,500,000 (the “Private Offering”). Each unit consisted of one share of common stock and one five-year warrant (the “2013 Investor Warrants”) to purchase one share of common stock at an initial exercise price of $3.20. The exercise price of the 2013 Investor Warrants is subject to adjustment in the event that the Company issues common stock at a price lower than the exercise price, subject to certain exceptions. The 2013 Investor Warrants are redeemable by the Company at a price of $0.004 per 2013 Investor Warrant at any time subject to the conditions that (i) the Company’s common stock has traded for twenty (20) consecutive trading days with a closing price of at least $6.40 per share with an average trading volume of 50,000 shares per day, and (ii) the underlying shares of common stock are registered for resale.

As a result of the financing completed by the Company during the three months ended September 30, 2015, the exercise price of all of the 2013 Investor Warrants was reduced from $3.20 to $3.14. As a result of the financing completed by the Company during the three months ended September 30, 2017 the exercise price of the un-amended 2013 Investor Warrants was further reduced from $3.14 to $2.68. The change in exercise price did not result in a material change in the fair value of the derivative liability.

2013 Investor Warrant exercises

During the three months ended December 31, 2016, 22,188 of the 2013 Investor Warrants were exercised for 22,188 shares of common stock at an exercise price of $3.14 per share. The Company received proceeds of $69,759 from these exercises. The warrants that have been exercised were revalued at their respective exercise dates and then the reclassification to equity was recorded resulting in $57,466 of the derivative liability being reclassified to equity.

During the six months ended December 31, 2016, 65,095 of the 2013 Investor Warrants were exercised for 65,095 shares of common stock at an exercise price of $3.14 per share. The Company received proceeds of $204,659 from these exercises. The warrants that have been exercised were revalued at their respective exercise dates and then the reclassification to equity was recorded resulting in $238,474 of the derivative liability being reclassified to equity.

There were no exercises of 2013 Investor Warrants during the three or six months ended December 31, 2017.

2013 Investor Warrant amendments

During the year ended June 30, 2016, the Company entered into amendments (the “2013 Investor Warrant Amendments”) with the holders of certain of the 2013 Investor Warrants to extend the expiration date to March 31, 2019 and remove the provision requiring an adjustment of the warrant exercise price in the event the Company sells common stock at a purchase price lower than the current warrant exercise price. During the six months ended December 31, 2016, 15,944 of the 2013 Investor Warrants were amended. The warrants that have been amended were revalued at their respective amendment dates and then the reclassification to equity was recorded resulting in $53,006 of the derivative liability being reclassified to equity.

There were no amendments of the 2013 Investor Warrants during the three months ended December 31, 2017 and 2016 or during the six months ended December 31, 2017.

| 10 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

2015 Agent Warrants

As part of a financing completed by the Company in a prior period, the Company issued warrants to purchase 23,477 shares of common stock to certain placement agents (“2015 Agent Warrants”) and recognized them as a derivative liability of $29,594 at the time of issuance. The 2015 Agent Warrants are exercisable at a per share price equal to $3.00 until July 15, 2020. During the six months ended December 31, 2016, 680 of the 2015 Agent Warrants were exercised for cash proceeds of $2,040 and 1,000 of the 2015 Agent Warrants were exercised on a cashless basis for 594 shares of common stock. The total reclassification to equity subsequent to revaluation at the respective exercise dates was $9,935.

There were no exercises of the 2015 Agent Warrants during the three and six months ended December 31, 2017.

The Company’s derivative liability is summarized as follows:

| Three months ended | |||||||||

| December 31, | |||||||||

| 2017 | 2016 | ||||||||

| $ | $ | ||||||||

| Opening balance | 4,660 | 590,345 | |||||||

| Change in fair value of warrants | 889 | (361,668 | ) | ||||||

| Reclassification to equity upon exercise of warrants | - | (57,466 | ) | ||||||

| Closing balance | 5,549 | 171,211 | |||||||

| Less current portion | (95 | ) | - | ||||||

| Long term portion | 5,454 | 171,211 | |||||||

| Six months ended | |||||||||

| December 31, | |||||||||

| 2017 | 2016 | ||||||||

| $ | $ | ||||||||

| Opening balance | 61,228 | 693,700 | |||||||

| Change in fair value of warrants | (55,679 | ) | (221,074 | ) | |||||

| Reclassification to equity upon amendment of warrants | - | (53,006 | ) | ||||||

| Reclassification to equity upon exercise of warrants | - | (248,409 | ) | ||||||

| Closing balance | 5,549 | 171,211 | |||||||

| Less current portion | (95 | ) | - | ||||||

| Long term portion | 5,454 | 171,211 | |||||||

| 11 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

The derivative liability consists of the following warrants:

| December 31, 2017 | |||||||||

| Number of warrants | $ | ||||||||

| 2013 Investor Warrants | 105,129 | 23 | |||||||

| Warrants issued for services | 43,750 | 72 | |||||||

| 2015 Agent Warrants | 21,768 | 5,454 | |||||||

| Closing balance | 170,647 | 5,549 | |||||||

| Less current portion | (148,879 | ) | (95 | ) | |||||

| Long-term portion | 21,768 | 5,454 | |||||||

| 6 | Stockholders’ equity |

Preferred stock

Authorized

5,000,000 preferred shares, $0.001 par value

Issued and outstanding

Special voting shares – at December 31, 2017 – 1 (June 30, 2017 – 1)

Series A shares – at December 31, 2017 – 278,530 (June 30, 2017 – 278,530)

Series B shares – at December 31, 2017 – 881,113 (June 30, 2017 – 881,113)

Series B Preferred Shares

During the year ended June 30, 2016 the Company issued an aggregate of 902,238 shares of Series B Preferred Stock at a purchase price of at $8.00 per share. Each share of Series B Preferred Stock is convertible into 2.5 shares of common stock equating to a conversion price of $3.20 (the “Conversion Price”) and will automatically convert to common stock at the earlier of 24 hours following regulatory approval of VAL-083 with a minimum closing bid price of $8.00 or five years from the final closing date. The holders of the Series B Preferred Stock are entitled to an annual cumulative, in arrears, dividend at the rate of 9% payable quarterly. The 9% dividend accrues quarterly commencing on the date of issue and is payable quarterly on September 30, December 31, March 31, and June 30 of each year commencing on June 30, 2016. Dividends are payable solely by delivery of shares of common stock (the “PIK Shares”), in an amount for each holder equal to the aggregate dividend payable to such holder with respect to the shares of Series B Preferred Stock held by such holder divided by the Conversion Price. The Series B Preferred Stock does not contain any repricing features.

| 12 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

In addition, the Company and the holders entered into a royalty agreement, pursuant to which the Company will pay the holders of the Series B Preferred Stock, in aggregate, a low, single-digit royalty based on their pro rata ownership of the Series B Preferred Stock on products sold directly by the Company or sold pursuant to a licensing or partnering arrangement (the “Royalty Agreement”).

Upon conversion of a holder’s Series B Preferred Stock to common stock, such holder shall no longer receive ongoing royalty payments under the Royalty Agreement but will be entitled to receive any residual royalty payments that have vested. Rights to the royalties shall vest during the first three years following the applicable closing date, in equal thirds to holders of the Series B Preferred Stock on each of the three vesting dates, upon which vesting dates such royalty amounts shall become “Vested Royalties”.

Pursuant to the Series B Preferred Stock dividend, during the three months ended December 31, 2017, the Company issued 49,602 (2016 – 50,096) shares of common stock and recognized a total of $54,066 (2016 – $159,756). During the six months ended December 31, 2017, the Company issued 99,204 (2016 – 100,889) shares of common stock and recognized a total of $95,732 (2016 – $467,054). All dividends have been recognized as a direct increase in accumulated deficit.

A total of 881,113 (2016 – 889,863) shares of Series B Preferred Stock are outstanding as of December 31, 2017, such that a total of 2,202,792 (2016 – 2,224,668) shares of common stock are issuable upon conversion of the Series B Preferred Stock as at December 31, 2017. Converted shares are rounded up to the nearest whole share.

No shares of the Series B Preferred Stock were converted to common stock during the three and six months ended December 31, 2017. During the three and six months ended December 31, 2016, a total of 12,375 shares of Series B preferred stock were converted for an aggregate 30,938 shares of common stock.

Series A Preferred Shares

Effective September 30, 2014 pursuant to the Company’s Valent Exchange Agreement (note 3), the Company filed a Certificate of Designation of Series A Preferred Stock (the “Series A Certificate of Designation”) with the Secretary of State of Nevada. Pursuant to the Series A Certificate of Designation, the Company designated 278,530 shares of preferred stock as Series A Preferred Stock. The shares of Series A Preferred Stock have a stated value of $1.00 per share (the “Series A Stated Value”) and are not convertible into common stock. The holder of the Series A Preferred Stock is entitled to dividends at the rate of 3% of the Series A Stated Value per year, payable quarterly in arrears. Upon any liquidation of the Company, the holder of the Series A Preferred Stock will be entitled to be paid, out of any assets of the Company available for distribution to stockholders, the Series A Stated Value of the shares of Series A Preferred Stock held by such holder, plus any accrued but unpaid dividends thereon, prior to any payments being made with respect to the common stock.

| 13 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

Common stock

Authorized - 50,000,000 common shares, $0.001 par value

Issued and outstanding - December 31, 2017 – 22,608,837 (June 30, 2017 – 14,509,633)

| Shares of common stock | Common stock | Additional paid-in capital | Warrants | Accumulated deficit | |||||||||||||||||

| outstanding | $ | $ | $ | $ | |||||||||||||||||

| Balance – June 30, 2017 | 14,509,633 | 14,510 | 36,665,285 | 4,570,574 | (41,118,433 | ) | |||||||||||||||

| Issuance of shares and warrants | 8,000,000 | 8,000 | 6,184,585 | 2,752,751 | - | ||||||||||||||||

| Series B Preferred stock dividend | 99,204 | 99 | 95,633 | - | (95,732 | ) | |||||||||||||||

| Stock option expense | - | - | 293,377 | - | - | ||||||||||||||||

| Warrants issued for services | - | - | - | (1,481 | ) | - | |||||||||||||||

| Series A Preferred cash dividend | - | - | - | - | (4,178 | ) | |||||||||||||||

| Loss for the period | - | - | - | - | (5,828,004 | ) | |||||||||||||||

| Balance – December 31, 2017 | 22,608,837 | 22,609 | 43,238,880 | 7,321,844 | (47,046,347 | ) | |||||||||||||||

The issued and outstanding common shares at December 31, 2017 include 932,761 (June 30, 2017 – 982,761) shares of common stock on an as-exchanged basis with respect to the shares of Exchangeco that can be exchanged for shares of common stock of the Company.

Six months ended December 31, 2017

During the six months ended December 31, 2017 the Company completed a registered direct offering (the “2018 Registered Offering”) of an aggregate of 8,000,000 shares of common stock and warrants to purchase an additional 8,000,000 shares of common stock at a price of $1.25 per share and related warrant for gross proceeds of $10.0 million. The warrants have an exercise price of $1.25 per share, are immediately exercisable and have a term of exercise of five years (the “2018 Investor Warrants”).

The Company engaged a placement agent for the 2018 Registered Offering. Under the Company’s engagement agreement with the placement agent, the Company paid $800,000 in cash commission and other fees to the placement agent and issued warrants to purchase 400,000 shares of common stock to the placement agent (the “2018 Agent Warrants”). The 2018 Agent Warrants are exercisable at a per share price of $1.25 and have a term of exercise of five years.

In addition to the cash commission and other placement agent fees, the Company also incurred additional cash issue costs of $254,664 resulting in net cash proceeds of $8,945,336.

2017 Omnibus Incentive Plan

On July 7, 2017, as amended on February 9, 2018, and subject to approval by the Company’s stockholders, the Company’s board of directors approved adoption of the Company’s 2017 Omnibus Equity Incentive Plan (the “2017 Plan”). The board of directors also approved a form of Performance Stock Unit Award Agreement to be used in connection with grants of performance stock units (“PSUs”) under the 2017 Plan.

| 14 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

Under the 2017 Plan, 7,800,000 shares of Company common stock are reserved for issuance, less the number of shares of common stock issued under the Del Mar Pharmaceuticals (BC) Ltd. 2013 Amended and Restated Stock Option Plan (the “Legacy Plan”) or that are subject to grants of stock options made, or that may be made, under the Legacy Plan. A total of 1,420,850 shares of common stock have been issued under the Legacy Plan and/or are subject to outstanding stock options granted under the Legacy Plan, leaving a potential 6,379,150 shares of common stock available for issuance under the 2017 Plan if all such options under the Legacy Plan were exercised and no new grants are made under the Legacy Plan. The number of shares of Company common stock available for issuance under the 2017 Plan has been set at approximately 20% of the Company’s fully diluted shares of common stock as of February 9, 2018 (excluding the number of shares of common stock issued under the 2017 Plan and/or the Legacy Plan or subject to outstanding awards granted under the 2017 Plan and/or the Legacy Plan). The maximum number of shares of Company common stock with respect to which any one participant may be granted awards during any calendar year is 8% of the Company’s fully diluted shares of common stock on the date of grant (excluding the number of shares of common stock issued under the 2017 Plan and/or the Legacy Plan or subject to outstanding awards granted under the 2017 Plan and/or the Legacy Plan). No award will be granted under the 2017 Plan on or after July 7, 2027, but awards granted prior to that date may extend beyond that date.

Performance Stock Unit grants

Subject to approval by the Company’s stockholders of the 2017 Plan, the Company’s board of directors granted a total of 1,000,000 PSUs under the 2017 Plan to the Company’s independent directors. In total, the awards represent the right to receive an aggregate of 1,000,000 shares of the Company’s common stock upon vesting of the PSU based on targets approved by the Company’s board of directors related to the Company’s fully diluted market capitalization. The PSUs will vest in full upon the later of one year from the grant date and the Company achieving a fully diluted market capitalization of at least $500 million for five consecutive business days. The PSUs expire on July 7, 2022.

Stock Options (granted under the Legacy Plan)

The following table sets forth the stock options outstanding under the Legacy Plan:

| Number of stock options outstanding | Weighted average exercise price $ | ||||||||

| Balance – June 30, 2017 | 1,120,850 | 4.18 | |||||||

| Granted | 300,000 | 1.61 | |||||||

| Balance – December 31, 2017 | 1,420,850 | 3.64 | |||||||

| 15 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

The following table summarizes stock options currently outstanding and exercisable at December 31, 2017 under the Legacy Plan:

| Exercise price $ | Number Outstanding at December 31, 2017 | Weighted average remaining contractual life (years) | Number exercisable at December 31, 2017 | ||||||||||

| 0.87 | 120,000 | 9.84 | 10,000 | ||||||||||

| 1.59 | 25,000 | 3.87 | 25,000 | ||||||||||

| 2.00 | 131,250 | 3.87 | 131,250 | ||||||||||

| 2.11 | 180,000 | 9.52 | - | ||||||||||

| 2.96 | 45,000 | 7.09 | 45,000 | ||||||||||

| 3.20 | 30,000 | 7.25 | 30,000 | ||||||||||

| 3.76 | 45,000 | 8.11 | 27,495 | ||||||||||

| 4.00 | 12,500 | 1.75 | 12,500 | ||||||||||

| 4.10 | 40,000 | 8.86 | 14,443 | ||||||||||

| 4.20 | 412,500 | 5.62 | 412,500 | ||||||||||

| 4.48 | 30,000 | 8.11 | 18,332 | ||||||||||

| 4.95 | 224,600 | 6.56 | 129,990 | ||||||||||

| 5.32 | 80,000 | 8.35 | 42,223 | ||||||||||

| 6.16 | 15,000 | 5.25 | 15,000 | ||||||||||

| 9.20 | 30,000 | 5.42 | 30,000 | ||||||||||

| 1,420,850 | 943,733 | ||||||||||||

Included in the number of stock options outstanding are 25,000 stock options granted at an exercise price of CDN $2.00. The exercise prices shown in the above table have been converted to $1.59 using the period ending closing exchange rate. Certain stock options have been granted to non-employees and will be revalued at each reporting date until they have fully vested. The stock options have been re-valued using a Black-Scholes pricing model using the following assumptions:

| December 31, 2017 | |||||

| Dividend rate | 0 | % | |||

| Volatility | 76.4% to 80.0 | % | |||

| Risk-free rate | 1.90% to 2.17 | % | |||

| Term - years | 1.0 to 2.0 | ||||

| 16 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

The Company has recognized the following amounts as stock option expense for the periods noted:

| Three months ended December 31, | Six months ended December 31, | ||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||||||

| $ | $ | $ | $ | ||||||||||||||

| Research and development | 126,375 | (65,727 | ) | 121,401 | (35,012 | ) | |||||||||||

| General and administrative | 102,132 | (9,475 | ) | 171,976 | (8,372 | ) | |||||||||||

| 228,507 | (75,202 | ) | 293,377 | (43,384 | ) | ||||||||||||

All of the stock option expense for the periods ended December 31, 2017 and 2016 has been recognized as additional paid in capital. The aggregate intrinsic value of stock options outstanding at December 31, 2017 was $26,400 (2016 - $208,846) and the aggregate intrinsic value of stock options exercisable at December 31, 2017 was $2,200 (2016 - $208,846). As of December 31, 2017, there was $257,895 in unrecognized compensation expense that will be recognized over the next 2.50 years. No stock options granted under the Plan have been exercised to December 31, 2017. Upon the exercise of stock options new shares will be issued.

A summary of status of the Company’s unvested stock options under the Legacy Plan is presented below:

| Number of Options | Weighted average exercise price $ | Weighted average grant date fair value $ | |||||||||||

| Unvested at June 30, 2017 | 318,033 | 4.81 | 2.57 | ||||||||||

| Granted | 300,000 | 1.61 | 0.86 | ||||||||||

| Vested | (140,916 | ) | 4.58 | 2.47 | |||||||||

| Unvested at December 31, 2017 | 477,117 | 2.87 | 1.54 | ||||||||||

Stock option modification

During the three and six months ended December 31, 2017, certain stock options were modified pursuant to a separation agreement with the Company’s former President and Chief Operating Officer. A total of 67,600 options had their vesting accelerated such that they became fully vested on December 22, 2017, resulting in additional stock option expense of $93,777. In addition, a total of 218,600 options were modified such that their remaining exercise period was increased from one year to three years, resulting in additional stock option expense of $28,561.

| 17 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

Stock option liability

Certain of the Company’s stock options have been issued in $CDN. Of these, a portion were classified as a stock option liability which is revalued at each reporting date. During the six months ended December 31, 2016, the Company amended 43,750 of these stock options held by five optionees such that the exercise price of the options was adjusted to be denominated in $USD. No other terms of the stock options were amended. As a result of the amendment, the Company recognized $85,094 in stock option liability expense and $260,969 was reclassified to equity during the three months ended September 30, 2016.

Warrants

Certain of the Company’s warrants have been recognized as a derivative liability (note 5). The following table summarizes changes in the Company’s outstanding warrants as of December 31, 2017:

| Description | Number | ||||

| Balance – June 30, 2017 | 6,628,906 | ||||

| Issuance of 2018 Investor Warrants (i) | 8,000,000 | ||||

| Issuance of 2018 Agent Warrants (ii) | 400,000 | ||||

| Balance - December 31, 2017 | 15,028,906 | ||||

| i) | The 2018 Investor Warrants are exercisable at $1.25 per share until September 22, 2022. |

| ii) | The 2018 Agent Warrants are exercisable at $1.25 per share until September 20, 2022. |

The following table summarizes the Company’s outstanding warrants as of December 31, 2017:

| Description | Number | Exercise price $ | Expiry date | ||||||||

| 2017 Investor | 2,076,924 | 3.50 | April 19, 2022 | ||||||||

| 2013 Placement Agent | 1,262,500 | 3.14 | June 30, 2019 | ||||||||

| 2018 Investor | 8,000,000 | 1.25 | September 22, 2022 | ||||||||

| 2015 Investor | 979,003 | 3.00 | July 31, 2020 | ||||||||

| 2013 Investor – Amended | 778,504 | 3.14 | March 31, 2019 | ||||||||

| 2013 Investor – Un-amended (note 5) | 105,129 | 2.68 | January 25 to March 6, 2018 | ||||||||

| Dividend | 812,502 | 5.00 | January 24, 2018 | ||||||||

| Issued for services | 265,000 | 3.00 | March 1, 2020 to February 1, 2021 | ||||||||

| Issued for services | 43,750 | 7.04 | September 12, 2018 | ||||||||

| Issued for services | 41,400 | 5.93 | February 27, 2020 | ||||||||

| 2018 Agent | 400,000 | 1.25 | September 20, 2022 | ||||||||

| 2017 Agent | 138,462 | 4.06 | April 12, 2022 | ||||||||

| 2016 Agent | 103,964 | 4.00 | May 12, 2021 | ||||||||

| 2015 Agent | 21,768 | 3.00 | July 15, 2020 | ||||||||

| 15,028,906 | 2.25 | ||||||||||

| 18 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

| 7 | Financial instruments |

The Company has financial instruments that are measured at fair value. To determine the fair value, we use the fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use to value an asset or liability and are developed based on market data obtained from independent sources. Unobservable inputs are inputs based on assumptions about the factors market participants would use to value an asset or liability. The three levels of inputs that may be used to measure fair value are as follows:

| ● | Level one - inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities; |

| ● | Level two - inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals; and |

| ● | Level three - unobservable inputs developed using estimates and assumptions, which are developed by the reporting entity and reflect those assumptions that a market participant would use. |

Assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurements. Changes in the observability of valuation inputs may result in a reclassification of levels for certain securities within the fair value hierarchy.

The Company’s financial instruments consist of cash and cash equivalents, other receivables, accounts payable, related party payables and derivative liability. The carrying values of cash and cash equivalents, other receivables, accounts payable and related party payables approximate their fair values due to the immediate or short-term maturity of these financial instruments.

Derivative liability

The Company accounts for certain warrants under the authoritative guidance on accounting for derivative financial instruments indexed to, and potentially settled in, a company’s own stock, on the understanding that in compliance with applicable securities laws, the warrants require the issuance of securities upon exercise and do not sufficiently preclude an implied right to net cash settlement. The Company classifies these warrants on its balance sheet as a derivative liability which is fair valued at each reporting period subsequent to the initial issuance. The Company has used a simulated probability valuation model to value the warrants. Determining the appropriate fair-value model and calculating the fair value of warrants requires considerable judgment. Any change in the estimates (specifically probabilities) used may cause the value to be higher or lower than that reported. The estimated volatility of the Company’s common stock at the date of issuance, and at each subsequent reporting period, is based on the historical volatility of similar life sciences companies. The risk-free interest rate is based on rates published by the government for bonds with a maturity similar to the expected remaining life of the warrants at the valuation date. The expected life of the warrants is assumed to be equivalent to their remaining contractual term.

| 19 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

| a) | Fair value of derivative liability |

The derivative is not traded in an active market and the fair value is determined using valuation techniques. The Company uses judgment to select a variety of methods to make assumptions that are based on specific management plans and market conditions at the end of each reporting period. The Company uses a fair value estimate to determine the fair value of the derivative liability. The carrying value of the derivative liability would be higher or lower as management estimates around specific probabilities change. The estimates may be significantly different from those recorded in the consolidated financial statements because of the use of judgment and the inherent uncertainty in estimating the fair value of these instruments that are not quoted in an active market. All changes in the fair value are recorded in the consolidated statement of operations and comprehensive loss each reporting period. This is considered to be a Level 3 financial instrument as volatility is considered a level 3 input.

The Company has the following liabilities under the fair value hierarchy:

| December 31, 2017 | |||||||||||||

| Liability | Level 1 | Level 2 | Level 3 | ||||||||||

| Derivative liability | - | - | $ | 5,549 | |||||||||

| June 30, 2017 | |||||||||||||

| Liability | Level 1 | Level 2 | Level 3 | ||||||||||

| Derivative liability | - | - | $ | 61,228 | |||||||||

| 8 | Supplementary statement of cash flows information |

| Six months ended | |||||||||

| December 31, | |||||||||

| 2017 | 2016 | ||||||||

| $ | $ | ||||||||

| Reclassification of derivative liability to equity upon the exercise of warrants (note 5) | - | 248,409 | |||||||

| Reclassification of derivative liability to equity upon the amendment of warrants (note 5) | - | 53,006 | |||||||

| Reclassification of stock option liability to equity upon settlement (note 6) | - | 260,969 | |||||||

| Series B Preferred share common stock dividend (note 6) | 95,732 | 467,054 | |||||||

| Income taxes paid | - | - | |||||||

| Interest paid | - | - | |||||||

| 20 |

DelMar Pharmaceuticals, Inc.

Notes to Consolidated Condensed Interim Financial Statements

(Unaudited)

December 31, 2017

(expressed in US dollars unless otherwise noted)

| 9 | Subsequent events |

Exercise of warrants

Subsequent to December 31, 2017, 250,000 share purchase warrants were exercised at $1.25 per share for gross proceeds of $312,500.

Issuance of warrants

Subsequent to December 31, 2017, 60,000 share purchase warrants were issued for services. Each is warrant exercisable at $1.78 per share until January 25, 2023.

Expiry of warrants

Subsequent to December 31, 2017, 812,502 share purchase warrants exercisable at $5.00 per share and 21,564 share purchase warrants exercisable at $2.68 expired.

| 21 |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

This Management’s Discussion and Analysis (“MD&A”) contains “forward-looking statements”, within the meaning of the Private Securities Litigation Reform Act of 1995, which represent our projections, estimates, expectations, or beliefs concerning, among other things, financial items that relate to management’s future plans or objectives or to our future economic and financial performance. In some cases, you can identify these statements by terminology such as “may”, “should”, “plans”, “believe”, “will”, “anticipate”, “estimate”, “expect” “project”, or “intend”, including their opposites or similar phrases or expressions. You should be aware that these statements are projections or estimates as to future events and are subject to a number of factors that may tend to influence the accuracy of the statements. These forward-looking statements should not be regarded as a representation by the Company or any other person that the events or plans of the Company will be achieved. You should not unduly rely on these forward-looking statements, which speak only as of the date of this report. Except as may be required under applicable securities laws, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this report or to reflect the occurrence of unanticipated events.

You should review the factors and risks we describe under “Risk Factors” in our report on Form 10-K for the year ended June 30, 2017 and the Company’s other filings with the Securities and Exchange Commission (the “SEC”), available at www.sec.gov. Actual results may differ materially from any forward-looking statement.

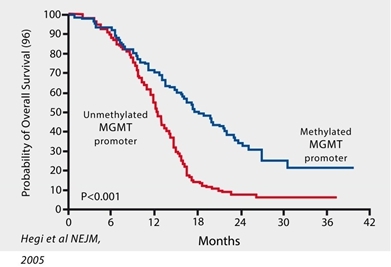

Changing Landscape and Recent Highlights

| ● | We believe the evaluation of MGMT promotor methylation status has increasingly become common practice in the diagnostic assessment of GBM providing us with an enhanced ability to leverage MGMT methylation as a biomarker to optimize patient selection for our novel DNA-targeting agent in the treatment of GBM. |

| ● | In September 2017, the National Comprehensive Cancer Network (“NCCN”), provided updated guidelines for the standard treatment of glioblastoma multiforme (“GBM”) based on MGMT methylation status. We believe these recently published guidelines provide for enhanced opportunities for us to capitalize on VAL-083’s unique mechanism of action to target the majority of GBM patients who are diagnosed with MGMT-unmethylated tumors. |

| ● | In September 2017, the US Food and Drug Administration (“FDA”) allowed a second Investigational New Drug Application ("IND") for our lead drug candidate, VAL-083, as a potential treatment for platinum-resistant ovarian cancer. |

| ● | In September 2017, we completed an offering of common stock and warrants for aggregate gross proceeds of $10.0 million. We intend to use the proceeds to support our research, clinical trials and for general corporate purposes. |

| ● | In October 2017, we announced: |

| o | The first patient dosing for our STAR-3 registration study for refractory patients with recurrent GBM (“rGBM”). This was a part of a planned U.S.-based 180 patient, 25 site study initiated in July 2017; and |

| o | The first patient dosing of our open label Phase 2 clinical trial of VAL-083 in newly diagnosed patients with MGMT-unmethylated GBM, which is being conducted at Sun Yat-sen University Cancer Center with funding support through our collaboration with Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. |

| ● | In November 2017, at the annual meeting of the Society for NeuroOncology (“SNO”) we presented a positive interim update from our ongoing open label Phase 2 clinical trial in patients with MGMT-unmethylated rGBM whose tumors have recurred following treatment with temozolomide (Avastin naïve). This study was initiated in February 2017 and is being conducted at the University of Texas MD Anderson Cancer Center. |

| 22 |

| ● | In December 2017, the FDA fully approved Avastin (bevacizumab) which may impact our ability to recruit suitable patients for our STAR-3 Phase 3 clinical trial. |

| ● | In December 2017, the FDA granted Fast Track designation for the company's lead product candidate, VAL-083, in recurrent glioblastoma. Fast Track designation is designed to expedite the review of drugs that show promise in treating life-threatening diseases and address unmet medical needs, with the goal of getting new treatments to patients earlier. Fast Track designation provides sponsors with an opportunity for increased frequency of communication with the FDA to ensure an optimal development plan and to collect appropriate data needed to support drug approval. |

| ● | Update on clinical trial status as of December 31, 2017: |

| ○ | Phase 3 STAR-3 Refractory trial: 4 sites activated with one (1) patient enrolled in our registration study for rGBM patients. As further described below, we have decided to suspend further enrollment in this trial until a full analysis of the potential impact of the Avastin approval can be undertaken. |

| ○ | Phase 2 MGMT-unmethylated rGBM: 17 patients have been enrolled in our ongoing open label Phase 2 clinical trial in patients with MGMT-unmethylated (Avastin naïve) rGBM. Patients in this trial have rGBM following standard-of-care chemo-radiation treatment with temozolomide. This study was initiated in February 2017 and is designed to enroll up to 48 patients and is being conducted in collaboration with the University of Texas MD Anderson Cancer Center (“MDACC”); and |

| ○ | Phase 2 trial in MGMT-unmethylated newly diagnosed GBM: One (1) patient has been enrolled in our single site, open label Phase 2 clinical trial of newly diagnosed MGMT-unmethylated GBM patients. Patients in this trial will be treated with VAL-083 in combination with radiotherapy as a potential alternative to the current standard-of-care chemo-radiation regimen. This study was initiated in September 2017, and is designed to enroll up to 30 patients at Sun Yat-sen University Cancer Center in Guangzhou, China and is being conducted under the terms of our collaboration with Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. |

| ● | During the three months ended December 31, 2017, we strengthened our management team by appointing Saiid Zarrabian as interim president and chief executive officer. Mr. Zarrabian’s experience in overseeing the growth of multiple companies will augment our management team as we continue to efficiently advance our product candidates to maximize shareholder value. |

| ● | During the three months ended December 31, 2017, we presented promising research results supporting the potential of VAL-083 in the treatment of cancers for patients whose tumors exhibit features that make them resistant to, or unlikely to respond to, currently available therapies. For example: |

| ● | At the American Association for Cancer Research (“AACR”)-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics we presented incremental VAL-083 data suggesting the potential for synergy with treatments that depend on a cancer cell to be in the S-phase for activity. Such agents include topoisomerase inhibitors, commonly used in the treatment of brain cancer and other solid tumors, and PARP inhibitors, commonly used in the treatment of platinum resistant ovarian cancer; and |

| ● | At AACR’s Special Conference: Addressing Critical Questions in Ovarian Cancer Research and Treatment, we presented data demonstrating how VAL-083 targets the DNA of cancer cells in a mechanistically different fashion than platinum (Pt)-based chemotherapeutic agents or PARP inhibitors, and how these differences position VAL-083 as a potential new therapeutic option in the treatment of platinum-resistant ovarian cancer, a significant and well recognized unmet medical need. |

| ● | Based on our updated strategy, as described below, we believe we have cash available to fund operations into the second quarter of calendar 2019. |

| 23 |

VAL-083 Clinical Trials and Updated Strategic Direction

Our recent research has highlighted the opportunities afforded by VAL-083’s unique mechanism of action and its potential to address unmet medical needs by focusing our development efforts on patients whose tumors exhibit biological features that make them resistant to, or unlikely to respond to, currently available therapies. For example, our research demonstrating VAL-083’s activity in GBM independent of the expression of the MGMT methylation status allows us to focus patient selection based on this important biomarker. Our current priority is to leverage this research and VAL-083’s unique mechanism of action to efficiently advance our drug candidate for the most promising indications, including:

| ● | MGMT-unmethylated GBM, currently comprising two ongoing separate Phase 2 clinical trials for: |

| ○ | rGBM patients (ongoing study at MDACC); and |

| ○ | Newly diagnosed GBM patients (ongoing study at Sun Yat-sen University); and |

| ● | Platinum-resistant ovarian cancer; and | |

| ● | Undertaking an assessment of the full approval of Avastin on our STAR-3 program and patient selection criteria in order to reach a formal decision on the future of this program within the next 12 months. |

Phase 3: VAL-083 STAR-3 GBM Trial

In July 2017, we initiated our VAL-083 STAR-3 GBM trial as an adaptive, randomized, controlled pivotal Phase 3 clinical trial in patients with GBM whose tumor has progressed following treatment with Avastin (bevacizumab).

Based on a number of factors, including low patient enrollment to-date, and our belief that the recent full approval of Avastin for rGBM may negatively impact the timely recruitment of suitable patients for this trial, we have made the decision to park this trial for up to 12 months while we undertake a detailed assessment of the trial. We are suspending additional enrollment in the STAR-3 trial until:

| ● | Further information is available regarding the potential impact of the recent FDA approval of Avastin on this patient population; |

| ● | Further data is available from our ongoing, open label clinical trials in MGMT-unmethylated GBM; |

| ● | We have evaluated whether possible protocol amendments designed to increase patient enrollment can be implemented without negatively impacting our ability to recruit subjects with the chance for a measurable clinical benefit following treatment; and/or |

| ● | We potentially find a partner to support the costs of the STAR-3 trial. |

During this interim evaluation period, we will continue to provide treatment to patients already enrolled in the STAR-3 trial but we will not be recruiting further patients for this trial. During this interim period, we will also consider, on a case-by-case basis, and subject to required institutional and regulatory approvals, providing VAL-083 to patients in this population in accordance with our expanded access policy.

| 24 |

A detailed description of the STAR-3 trial and DelMar’s expanded access program can be found at clinicaltrials.gov, Identifier Number: NCT03149575 and NCT03138629, respectively.

MGMT-unmethylated GBM

GBM is the most common and the most lethal form of glioma. According to the World Health Organization, GBM occurs with an incidence of 3.17 per 100,000 person-years. Approximately 18,000 new cases of GBM are expected to be diagnosed in the United States and 26,000 in Europe during 2017.

Measurement of MGMT methylation status has become routine in clinical practice as a biomarker that correlates with resistance to the standard-of-care chemotherapy with temozolomide (Temodar® “TMZ”), and patient outcomes in GBM. The majority of GBM patient’s tumors are characterized as “MGMT-unmethylated” and exhibit a high expression of O6-methyl guanine methyltransferase (“MGMT”), a naturally occurring DNA-repair enzyme, the activity of which nullifies the chemotherapeutic activity of TMZ. The development of new therapies for MGMT-unmethylated GBM is a significant unmet medical need. Importantly, the most recent update to NCCN guidelines states that the treatment benefit of TMZ is likely to be lower in GBM patients with an unmethylated MGMT promoter and therefore allows for withholding of TMZ in the treatment of newly diagnosed GBM patients with MGMT-unmethylated tumors due to lack of efficacy.

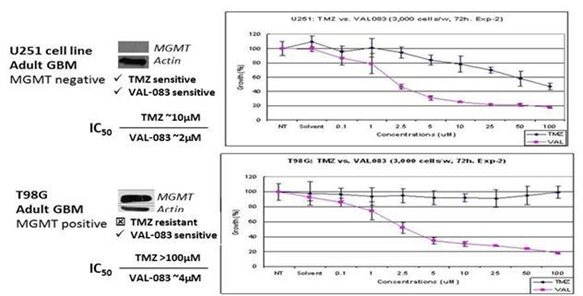

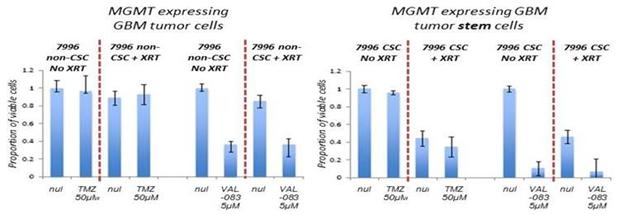

We have demonstrated that VAL-083’s anti-tumor mechanism is active independent from the MGMT status in vitro. We believe this suggests the potential of VAL-083 as a replacement for the current standard-of-care chemotherapy, temozolomide, in MGMT-unmethylated GBM. We are therefore utilizing MGMT-methylation status to identify GBM patients who are unlikely to respond to temozolomide and instead treat them with VAL-083.

We believe that our research, in the context of the recent amendment to NCCN guidelines, highlights this unmet need and the opportunity for VAL-083 as a potential new standard-of-care in the treatment of MGMT-unmethylated GBM.

Phase 2 Study in MGMT-unmethylated rGBM in Collaboration with University of Texas MD Anderson Cancer Center

In February 2017, we initiated a biomarker driven, open-label, single-arm Phase 2 study in collaboration with the University of Texas MD Anderson Cancer Center. This trial will enroll up to 48 MGMT-unmethylated GBM patients whose tumors have recurred following treatment with temozolomide. These patients will not have been treated previously with Avastin.

The primary endpoint of the trial is overall survival. Safety data from this trial will become part of the overall safety dossier to support future filings with the FDA and other regulatory agencies.

As of December 31, 2017, seventeen (17) patients had been enrolled in this trial. We believe a positive outcome from this trial will establish a strong position for VAL-083 in the treatment of MGMT-unmethylated GBM.

Data from the trial will be used to help form potential future clinical trial designs with VAL-083 in MGMT-unmethylated rGBM. We anticipate providing updates regarding the progress of this trial, including safety data and observations regarding outcomes, at scientific meetings during 2018. A detailed description of this trial can be found at clinicaltrials.gov, Identifier Number: NCT03050736.

Phase 2 Trial in Newly Diagnosed MGMT-unmethylated GBM

In September 2017, we initiated a single arm, biomarker driven, open-label Phase 2 study in newly diagnosed MGMT-unmethylated GBM patients at Sun Yat-sen University Cancer Center in Guangzhou, China. The trial is being conducted in the context of our 2012 collaboration agreement with Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. Under the terms of this agreement, Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. is responsible for funding VAL-083 clinical trials that we conduct in China.

| 25 |

In this study, VAL-083 is combined with radiotherapy as a potential replacement for standard-of-care chemoradiation with temozolomide in patients with MGMT-unmethylated GBM. The main goal of the trial will be to confirm the safety of DelMar’s optimized dosing regimen in combination with radiotherapy and to investigate outcomes of the combination of VAL-083 and radiotherapy in MGMT-unmethylated GBM patients.

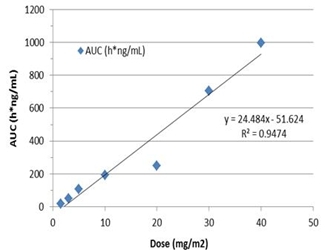

We plan to enroll up to 30 newly diagnosed MGMT-unmethylated GBM patients in this trial. The primary efficacy endpoint is the determination of tumor response in patients measured by progression free survival (“PFS”). Assessments of safety and tolerability will be used to support further clinical development of VAL-083 in combination with radiotherapy. Pharmacokinetic assessments of VAL-083 in plasma and cerebral spinal fluid (“CSF”) will be used to correlate drug exposure in the central nervous system with patient outcomes.

We plan to use data from the trial to establish a dosing regimen and trial design for advanced registration-directed clinical trials with VAL-083 in newly diagnosed MGMT-unmethylated GBM.

We anticipate providing updates regarding the progress of this trial, including safety data and observations regarding outcomes, at scientific meetings during 2018. A detailed description of this trial can be found at clinicaltrials.gov, Identifier Number: NCT02717962.

Ovarian Cancer Summary

Ovarian cancer is the fifth most common cancer in women and is the leading cause of death among women diagnosed with gynecological malignancies. In 2016, approximately 22,300 women in the US were diagnosed with ovarian cancer and 14,300 died from their disease.

Platinum-based chemotherapy is the standard-of-care in the treatment of advanced ovarian cancer. Ovarian cancer patients whose tumors are sensitive to Pt-based chemotherapy have the most favorable outcome. Recently, the approval of PARP inhibitors in the treatment of ovarian cancer patients demonstrated improved outcomes, particularly in patients whose tumors remain sensitive to Pt-based treatments.

Unfortunately, the development of resistance to Pt-based agents is nearly inevitable, leading to disease recurrence and increased mortality. Ultimately, most women with advanced ovarian cancer develop recurrent disease with progressively shorter disease-free intervals. Those whose tumors recur within 6 months of Pt-based therapy are considered Pt-resistant/refractory and have a very poor prognosis.

Currently, there are no high-efficacy therapeutic options for Pt-resistant ovarian tumors, leaving these cancer patients with a very poor prognosis. The response rate to second line therapy for Pt-resistant ovarian cancer patients is in the 10-15% range and overall survival is approximately 12 months. The development of new chemotherapies and targeted agents to overcome Pt resistance in ovarian cancer is a significant unmet medical need.

Phase 1-2 Study in Platinum-resistant Ovarian Cancer

In April 2016, the FDA granted orphan drug designation for the use of VAL-083 in the treatment of ovarian cancer.

In September 2017, we received notice of allowance from the FDA of an IND to initiate a Phase 1/2, open-label, multicenter, study of VAL-083 in patients with Recurrent Platinum Resistant Ovarian Cancer (the REPROVe trial).

The Phase 1 portion of the trial will enroll approximately 24 patients with Pt-resistant ovarian cancer to evaluate the response to treatment with VAL-083.

Ovarian cancer patients enrolled in the trial will have been previously treated with at least two lines of Pt-based chemotherapy and up to two other cytotoxic regimens, and whose cancer has recurred within 6 months of prior Pt-based chemotherapy.

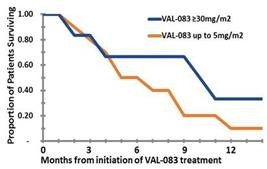

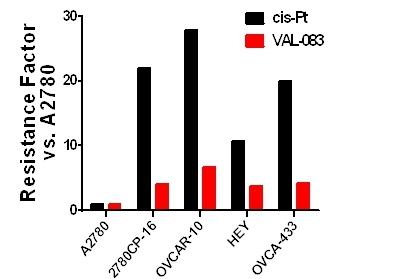

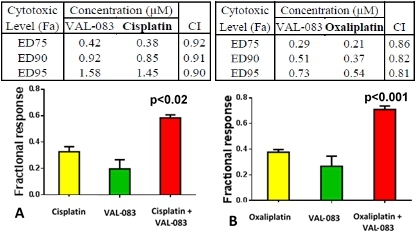

The primary efficacy of the trial will be overall response rate (“ORR”) based on Response Evaluation Criteria in Solid Tumors (RECIST) criteria. RECIST is a set of published rules that define when tumors in cancer patients improve (“respond”), stay the same (“stabilize”), or worsen (“progress”) during treatment.