Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - StoneX Group Inc. | intlexhibit3229302019.htm |

| EX-32.1 - EXHIBIT 32.1 - StoneX Group Inc. | intlexhibit3219302019.htm |

| EX-31.2 - EXHIBIT 31.2 - StoneX Group Inc. | intlexhibit3129302019.htm |

| EX-31.1 - EXHIBIT 31.1 - StoneX Group Inc. | intlexhibit3119302019.htm |

| EX-23.1 - EXHIBIT 23.1 - StoneX Group Inc. | intlexhibit239302019.htm |

| EX-21 - EXHIBIT 21 - StoneX Group Inc. | intlexhibit219302019.htm |

| EX-10.23 - EXHIBIT 10.23 - StoneX Group Inc. | exhibit1023.htm |

| EX-10.22 - EXHIBIT 10.22 - StoneX Group Inc. | exhibit1022.htm |

| EX-10.20 - EXHIBIT 10.20 - StoneX Group Inc. | exhibit1020.htm |

| EX-10.19 - EXHIBIT 10.19 - StoneX Group Inc. | exhibit1019.htm |

| EX-10.17 - EXHIBIT 10.17 - StoneX Group Inc. | exhibit1017.htm |

| EX-10.13 - EXHIBIT 10.13 - StoneX Group Inc. | exhibit1013.htm |

| EX-10.12 - EXHIBIT 10.12 - StoneX Group Inc. | exhibit1012.htm |

| EX-4.5 - EXHIBIT 4.5 - StoneX Group Inc. | exhibit45.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Fiscal Year Ended September 30, 2019

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 000-23554

INTL FCStone Inc.

(Exact name of registrant as specified in its charter)

Delaware | 59-2921318 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

New York, NY 10017

(Address of principal executive offices) (Zip Code)

(212) 485-3500

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of each exchange on which registered | ||

Common Stock, $0.01 par value | INTL | The Nasdaq Stock Market LLC | ||

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | x | |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o |

Emerging growth company | o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of March 31, 2019, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $453.7 million.

As of December 9, 2019, there were 19,110,585 shares of the registrant’s common stock outstanding.

Document Incorporated by Reference

Certain portions of the definitive Proxy Statement for the Registrant’s Annual Meeting of Stockholders to be held on February 26, 2020 are incorporated by reference into Part III of this Annual Report on Form 10-K.

INTL FCStone Inc.

Annual Report on Form 10-K for the Fiscal Year Ended September 30, 2019

Table of Contents

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Cautionary Statement about Forward-Looking Statements

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” (refer to Part I, Item 1A). We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

Item 1. Business

Overview of Business and Strategy

We are a diversified global brokerage and financial services firm providing execution, risk management and advisory services, market intelligence and clearing services across asset classes and markets around the world. We help our clients to access market liquidity, maximize profits and manage risk. Our revenues are derived primarily from financial products and advisory services intended to fulfill our clients’ commercial needs and provide bottom-line benefits to their businesses. Our businesses are supported by our global infrastructure of regulated operating subsidiaries, our advanced technology platform and our team of more than 2,000 employees as of September 30, 2019. We believe our client-first approach differentiates us from large banking institutions, engenders trust and has enabled us to establish leadership positions in a number of complex fields in financial markets around the world.

We offer a vertically integrated product suite, including high-touch execution, electronic access through a wide variety of technology platforms in a number of important global markets, and insightful market intelligence and advice, as well as post-trade settlement, clearing and custody services. We believe this is a unique product suite offering outside of bulge bracket banks, which creates sticky relationships with our clients. Our business model has created a revenue stream that is diversified by asset class, client type and geography, with a significant portion of recurring revenue derived from monetizing non-trading client activity including consistent and predictable interest and fee earnings on client balances, while also earning both commissions and spreads as clients execute transactions across our financial network.

We currently serve more than 20,000 commercial and institutional clients, located in more than 130 countries. We believe we are the third largest independent, non-bank futures commission merchant (“FCM”) in the United States (“U.S.”) as measured by our $2.2 billion in required client segregated assets at our U.S. FCM as of September 30, 2019, and one of the top ranked market makers in foreign securities by dollar volume as determined through the three-year period ended December 31, 2018, making markets in approximately 5,000 different foreign securities. We are one of only nine Category One ring dealing members of the London Metals Exchange (the “LME”). Our clients include commercial entities, asset managers, regional, national and introducing broker-dealers, insurance companies, brokers, institutional investors and professional traders, commercial and investment banks and government and non-governmental organizations (“NGOs”). We believe our clients value us for our attention to their needs, our expertise and flexibility, our global reach, our ability to provide access to liquidity in hard to reach markets and opportunities, and our status as a well-capitalized and regulatory-compliant organization. Our correspondent clearing and independent wealth management businesses include approximately 70 correspondent clearing relationships representing more than 80,000 underlying individual securities accounts as of September 30, 2019.

We engage in direct sales efforts to seek new clients, with a strategy of extending our services to potential clients that are similar in size and operations to our existing client base. In executing this strategy, we intend to both target new geographic locations and expand the services offered in geographic locations in which we currently operate where there is an unmet demand for our services. In addition, we selectively pursue small- to medium-sized acquisitions, focusing primarily on targets that satisfy specified criteria, including client-centric organizations that may help us expand into new asset classes, client segments and geographies where we currently have a small or limited market presence.

We believe we are well positioned to capitalize on key trends impacting the financial services sector. Among others, these trends include the impact of increased regulation on banking institutions and other financial services providers; increased consolidation, especially of smaller sub-scale financial services providers and independent securities clearing firms; the growing importance and complexity of conducting secure cross-border transactions; and the demand among financial institutions to transact with well-capitalized counterparties.

3

We focus on mitigating exposure to market risk, ensuring adequate liquidity to maintain our daily operations and making non-interest expenses variable, to the greatest extent possible. Our strategy is to utilize a centralized and disciplined process for capital allocation, risk management and cost control, while delegating the execution of strategic objectives and day-to-day management to experienced individuals. This requires high quality managers, a clear communication of performance objectives and strong financial and compliance controls. We believe this strategy will enable us to build a more scalable and significantly larger organization that embraces an entrepreneurial approach to business, supported and underpinned by strong centralized financial and compliance controls.

INTL FCStone Inc. is a Delaware corporation formed in October 1987.

Available Information

Our internet address is www.intlfcstone.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, statements of changes in beneficial ownership and press releases are available free of charge in the Investor Relations section of this website. Our website also includes information regarding our corporate governance, including our Code of Ethics, which governs our directors, officers and employees.

Capabilities

We provide our clients access to financial markets and liquidity sources globally to enable them to efficiently hedge their risk and/or gain exposure. Our financial network connects over 20,000 commercial and institutional clients and over 80,000 retail clients to 36 derivatives exchanges, most global securities exchanges and a multitude of bilateral liquidity sources.

Execution

We provide execution services to our clients, both high-touch as well as electronically through a wide variety of technology platforms across the global marketplace. Asset and product types include listed futures and options on futures, equities, mutual funds, equity options, corporate, government and municipal bonds and unit investment trusts.

Clearing

We provide competitive and efficient clearing on all major futures exchanges globally. In addition, we act as an independent full-service provider of clearing, custody, research and security-based lending products in the global securities markets. We provide multi-asset prime brokerage, outsourced trading and custody, as well as self-clearing and introduced clearing services for hedge funds, mutual funds and family offices. We provide prime brokerage services in major foreign currency pairs and swap transactions to institutional clients. Additionally, we provide clearing of foreign exchange transactions, in addition to clearing of a wide range of over-the-counter “(OTC”) products.

Global Payments

We have built a scalable platform to provide end-to-end global payment solutions to banks and commercial businesses, as well as charities, NGOs and government organizations. We offer payments services in approximately 140 currencies. In this business, we primarily act as a principal in buying and selling foreign currencies on a spot basis deriving revenue from the difference between the purchase and sale prices. Through our comprehensive platform and our commitment to client service, we provide simple and fast execution, delivering funds in any of these countries quickly through our global network of more than 325 correspondent banking relationships.

Advisory Services

We provide value-added advisory services and high-touch trade execution across a variety of financial markets, including commodities, foreign currencies, interest rates, institutional asset management and independent wealth management. For commercial clients with exposure to commodities, foreign currencies and interest rates, we work through our proprietary Integrated Risk Management Program (“IRMP®”) to systematically identify and quantify their risks and then develop strategic plans to effectively manage these risks with a view to protecting their margins and ultimately improving their bottom lines.

We also participate in the underwriting and trading of municipal securities in domestic markets as well as asset-backed securities in our Argentinian operations. Through our asset management activities, we leverage our specialist expertise in niche markets to provide institutional investors with tailored investment products. Through our independent wealth management business, we provide advisory services to the growing retail investor market.

Physical Trading

We act as a principal to support the needs of our clients in a variety of physical commodities, primarily precious metals, as well as across the commodity complex, including energy commodities, grains, oil seeds, cotton, coffee, cocoa, edible oils and feed products. Through these activities, we have the ability to offer a simplified risk management approach to our commercial clients by embedding more complex hedging structures as part of each physical contract to provide clients with enhanced price risk mitigation. We also offer clients efficient off-take or supply services, as well as logistics management.

4

OTC / Market-Making

We offer clients access to the OTC markets for a broad range of traded commodities, foreign currencies and interest rates, as well as to global securities markets. For clients with commodity price and financial risk, our customized and tailored OTC structures help mitigate those risks by integrating the processes of product design, execution of the underlying components of the structured risk product, transaction reporting and valuation.

We provide market-making and execution in a variety of financial products including commodity derivatives, unlisted American Depository Receipts (“ADRs”) and Global Depository Receipts (“GDRs”), foreign ordinary shares, and foreign currencies. In addition, we are an institutional dealer in fixed income securities including U.S. Treasury, U.S. government agency, agency mortgage-backed, asset-backed, corporate, emerging market, and high-yield securities.

Operating Segments

Our business activities are managed as operating segments and organized into reportable segments as follows:

Commercial Client Focused Operating Segments

Commercial Hedging

We serve our commercial clients through our team of risk management consultants, providing a high-value-added service that we believe differentiates us from our competitors and maximizes the opportunity to retain our clients. Our risk management consulting services are designed to quantify and monitor commercial entities’ exposure to commodity and financial risk. Upon assessing this exposure, we develop a plan to control and hedge these risks with post-trade reporting against specific client objectives. Our clients are assisted in the execution of their hedging strategies through a wide range of products from listed exchange-traded futures and options, to basic OTC instruments that offer greater flexibility, to structured OTC products designed for customized solutions.

Our services span virtually all traded commodity markets, with the largest concentrations in agricultural and energy commodities (consisting primarily of grains, energy and renewable fuels, coffee, sugar, cotton, and food service) and base metals products listed on the LME. Our base metals business includes a position as a Category One ring dealing member of the LME, providing execution, clearing and advisory services in exchange-traded futures and OTC products. We also provide execution of foreign currency forwards and options and interest rate swaps as well as a wide range of structured product solutions to our commercial clients who are seeking cost-effective hedging strategies. Generally, our clients direct their own trading activity, and our risk management consultants do not have discretionary authority to transact trades on behalf of our clients.

Within this segment, our risk management consultants organize their marketing efforts into client industry product lines, and currently serve clients in the following areas:

• | Financial Agricultural (“Ag”) & Energy |

◦ | Agricultural - |

▪ | Grain elevator operators, grain merchandisers, traders, processors, manufacturers and end-users. |

▪ | Livestock production, feeding and processing, dairy and users of agricultural commodities in the food industry. |

▪ | Coffee, sugar and cocoa producers, processors and end-users. |

▪ | Global fiber, textile and apparel industry. |

◦ | Energy and renewable fuels - |

▪ | Producers, refiners, wholesalers, transportation companies, convenience store chains, automobile and truck fleet operators, industrial companies, railroads, and municipalities. |

▪ | Consumers of natural gas including some of the largest natural gas consumers in North America, including municipalities and large manufacturing firms, as well as major utilities. |

▪ | Ethanol and biodiesel producers and end-users. |

◦ | Other - |

▪ | Lumber mills, wholesalers, distributors and end-users. |

▪ | Commercial entities seeking to hedge their interest rate and foreign exchange exposures. |

5

• | LME Metals |

◦ | Commercial - |

▪ | Producers, consumers and merchants of copper, aluminum, zinc, lead, nickel, tin and other ferrous products. |

◦ | Institutional - |

▪ | Commodity trading advisors and hedge funds seeking clearing and execution of LME and NYMEX/COMEX base metal products. |

Physical Commodities

The Physical Commodities segment consists of our Precious Metals trading and Physical Ag and Energy commodity businesses. In Precious Metals, we provide a full range of trading and hedging capabilities, including OTC products, to select producers, consumers, and investors. Through our websites we provide clients the ability to purchase physical gold and other precious metals, in multiple forms, and in denominations of their choice. In our trading activities, we act as a principal, committing our own capital to buy and sell precious metals on a spot and forward basis.

In our Physical Ag & Energy commodity business, we act as a principal to facilitate financing, structured pricing and logistics services to clients across the commodity complex, including energy commodities, grains, oil seeds, cotton, coffee, cocoa, edible oils and feed products. We provide financing to commercial commodity-related companies against physical inventories. We use sale and repurchase agreements to purchase commodities evidenced by warehouse receipts, subject to a simultaneous agreement to sell such commodities back to the original seller at a later date.

We generally mitigate the price risk associated with commodities held in inventory through the use of derivatives. We do not elect hedge accounting under accounting principles generally accepted in the United States of America (“U.S. GAAP”) in accounting for this price risk mitigation.

Institutional Client Focused Operating Segments

Clearing and Execution Services (“CES”)

We provide competitive and efficient clearing and execution in all major futures and securities exchanges globally as well as prime brokerage in equities and major foreign currency pairs and swap transactions. Through our platform, client orders are accepted and directed to the appropriate exchange for execution. We then facilitate the clearing of clients’ transactions. Clearing involves the matching of clients’ trades with the exchange, the collection and management of client margin deposits to support the transactions, and the accounting and reporting of the transactions to clients.

As of September 30, 2019, our U.S. FCM held $2.2 billion in required client segregated assets, which we believe makes us the third largest independent, non-bank FCM in the U.S., as measured by required client segregated assets. We seek to leverage our capabilities and capacity by offering facilities management or outsourcing solutions to other FCM’s.

We are an independent full-service provider to introducing broker-dealers (“IBD’s”) of clearing, custody, research, syndicated and security-based lending products and services, including a proprietary technology platform which offers seamless connectivity to ensure a positive client experience through the clearing and settlement process. Our independent wealth management business, which offers a comprehensive product suite to retail clients nationwide, clears through this platform. We believe we are one of the leading mid-market clearers in the securities industry, with approximately 70 correspondent clearing relationships with over $16 billion in assets under management or administration as of September 30, 2019.

We provide prime brokerage foreign exchange (“FX”) services to financial institutions and professional traders. We provide our clients with the full range of OTC products, including 24-hour a day execution of spot, forwards and options as well as non-deliverable forwards in both liquid and exotic currencies. We also operate a proprietary FX desk that arbitrages the exchange-traded foreign exchange markets with the cash markets.

Through our London-based Europe, Middle East and Africa (“EMEA”) oil voice brokerage business, we provide brokerage services across the fuel, crude and middle distillates markets to commercial and institutional clients throughout EMEA.

Securities

We provide value-added solutions that facilitate cross-border trading and believe our clients value our ability to manage complex transactions, including foreign exchange, utilizing our local understanding of market convention, liquidity and settlement protocols around the world. Our clients include U.S.-based regional and national broker-dealers and institutions investing or executing client transactions in international markets and foreign institutions seeking access to the U.S. securities markets. We are one of the leading market makers in foreign securities, making markets in over 5,000 ADRs, GDRs and foreign ordinary shares, of which over 3,600 trade in the OTC market. In addition, we will, on request, make prices in more

6

than 10,000 unlisted foreign securities. We are also a broker-dealer in Argentina and Brazil where we are active in providing institutional executions in the local capital markets.

We act as an institutional dealer in fixed income securities, including U.S. Treasury, U.S. government agency, agency mortgage-backed and asset-backed securities as well as investment grade, high yield, convertible and emerging market debt to a client base including asset managers, commercial bank trust and investment departments, broker-dealers and insurance companies.

We originate, structure and place debt instruments in the international and domestic capital markets. These instruments include complex asset-backed securities (primarily in Argentina) and domestic municipal securities. On occasion, we may invest our own capital in debt instruments before selling them. We also actively trade in a variety of international debt instruments as well as operate an asset management business in which we earn fees, commissions and other revenues for management of third party assets and investment gains or losses on our investments in funds and proprietary accounts managed either by our investment managers or by independent investment managers.

Payments Operating Segment

Global Payments

We provide customized foreign exchange and treasury services to banks and commercial businesses as well as charities and non-governmental and government organizations. We provide transparent pricing and offer payments services in more than 170 countries and 140 currencies, which we believe is more than any other payments solutions provider.

Our proprietary FXecute global payments platform is integrated with a financial information exchange (“FIX”) protocol. This FIX protocol is an electronic communication method for the real-time exchange of information, and we believe it represents one of the first FIX offerings for cross-border payments in exotic currencies. FIX functionality allows clients to view real time market rates for various currencies, execute and manage orders in real-time, and view the status of their payments through the easy-to-use portal.

Additionally, as a member of the Society for Worldwide Interbank Financial Telecommunication (“SWIFT”), we are able to offer our services to large money center and global banks seeking more competitive international payments services. In addition, we operate a fully accredited SWIFT Service Bureau which facilitates cross-border payments and acceptance transactions for financial institutions, trade networks and corporations.

Through this single comprehensive platform and our commitment to client service, we believe we are able to provide simple and fast execution, ensuring delivery of funds in local currency to any of these countries quickly through our global network of approximately 325 correspondent banks. In this business, we primarily act as a principal in buying and selling foreign currencies on a spot basis. We derive revenue from the difference between the purchase and sale prices.

We believe our clients value our ability to provide exchange rates that are significantly more competitive than those offered by large international banks, a competitive advantage that stems from our years of foreign exchange expertise focused on smaller, less liquid currencies.

Acquisitions during Fiscal Year 2019

Carl Kliem S.A.

On November 30, 2018, we acquired the entire issued and outstanding share capital of Carl Kliem S.A. Carl Kliem S.A. is an independent interdealer broker based in Luxembourg, providing foreign exchange, interest rate and fixed income products to institutional clients across the European Union (“E.U.”). Carl Kliem S.A. employs approximately 40 people and has more than 400 active institutional clients. This acquisition provides us with access to additional European institutional clients that can benefit from our full suite of financial services and an E.U.-based entity in anticipation of the United Kingdom’s (“U.K.”) planned exit from the E.U. The purchase price was $2.1 million of cash consideration, and was equal to the net tangible book value on the closing date less restructuring costs. We subsequently renamed Carl Kliem S.A. to INTL FCStone Europe S.A.

GMP Securities, LLC

On January 14, 2019 we acquired 100% of the U.S.-based broker-dealer GMP Securities, LLC (“GMP”), formerly known as Miller Tabak Securities, LLC, an independent, Securities and Exchange Commission (“SEC”)-registered broker-dealer and Financial Industry Regulatory Authority, Inc. (“FINRA”) member. GMP has an institutional fixed-income trading business dealing in high yield, convertible and emerging market debt securities and makes markets in certain equity securities. This acquisition allows us to expand our fixed income product offerings to clients and adds new institutional clients who can benefit from our full suite of financial services.

The purchase price was $8.2 million of cash consideration, and was equal to the final net tangible book value determined as of the acquisition date less $2.0 million. The fair value of the net assets acquired exceeded the aggregate cash purchase price, and

7

accordingly we recorded a bargain purchase gain of $5.4 million during the year ended September 30, 2019, which is presented within ‘other gains’ in the Consolidated Income Statement.

During the year ended September 30, 2019, GMP was merged into our wholly owned regulated U.S. subsidiary, INTL FCStone Financial Inc. (“INTL FCStone Financial”).

Akshay Financeware, Inc.

On February 13, 2019, we paid $0.2 million to purchase the remaining interest of a joint venture originally acquired in connection with the acquisition of INTL Technology Services, LLC in September 2018. As a result of this transaction, we recorded $2.7 million of indefinite life intangibles for SWIFT licenses held by the joint venture.

CoinInvest GmbH and European Precious Metal Trading GmbH

On April 1, 2019, our wholly owned subsidiary INTL FCStone (Netherlands) B.V. acquired 100% of the outstanding shares of CoinInvest GmbH and European Precious Metal Trading GmbH. Through the websites coininvest.com and silver-to go.com, CoinInvest GmbH and European Precious Metal Trading GmbH are leading European online providers of gold, silver, platinum, and palladium products to retail investors, institutional investors, and financial advisors. The addition of CoinInvest GmbH and European Precious Metal Trading GmbH to our global product suite expands our offering, providing clients the ability to purchase physical gold and other precious metals, in multiple forms, and in denominations of their choice, to add to their investment portfolios.

The purchase price consisted of cash consideration of $22.0 million, including $11.2 million for the purchase of shareholders loans outstanding with the acquired entities. Cash consideration transferred exceeds the fair value of the tangible net assets acquired by $6.8 million.

Fillmore Advisors, LLC

On September 1, 2019, we acquired 100% of the U.S.-based trading firm Fillmore Advisors, LLC (“Fillmore”). Fillmore is an independent, SEC-registered broker-dealer firm and FINRA member firm and a leading provider of outsourced trading solutions and operational consulting to institutional asset managers. The firm, headquartered in Park City, Utah, is composed of traders that specialize in global buy-side and sell-side experience. Institutional clients can benefit from Fillmore’s comprehensive product coverage offering for equities, equity-linked, foreign exchange, credit, rates, and commodities. Fillmore will become an extension of the newly established prime brokerage division of our Securities reportable segment.

The purchase price included $1.4 million of cash consideration and includes a contingent earn-out with payments over the eight quarters following acquisition. The contingent earn-out payments are variable in nature and are equal to 50% of Segment Income, as defined in the SPA, for each quarterly period. The consideration due to the sellers is estimated at $1.8 million as of the closing date.

Subsequent Acquisition

UOB Bullion and Futures Limited

On March 19, 2019, our subsidiary INTL FCStone Pte. Ltd executed an asset purchase agreement to acquire the futures and options brokerage and clearing business of UOB Bullion and Futures Limited, a subsidiary of United Overseas Bank Limited. Closing was conditional upon receiving regulatory approval by the Monetary Authority of Singapore (“MAS”). The acquisition provides us access to an established institutional client base and also augments our global service capabilities in Singapore. The purchase price for the acquired assets is $5.0 million of which $2.5 million was due upon the execution of the asset purchase agreement and is included in ‘other assets’ on the Consolidated Balance Sheet as of September 30, 2019. The remaining $2.5 million was paid to the seller at closing of the acquisition, which occurred on October 7, 2019.

Acquisition during Fiscal Year 2018

PayCommerce Financial Solutions, LLC

During September 2018, we acquired all of the outstanding membership interests of PayCommerce Financial Solutions, LLC. PayCommerce Financial Solutions, LLC is a fully accredited SWIFT Service Bureau provider. The acquisition enables us to act as a SWIFT Service Bureau for our 300-plus correspondent banking network, thus providing another important service for delivering local currency, cross-border payments to the developing world. The purchase price was approximately $3.8 million and was not material to us. We renamed PayCommerce Financial Solutions, LLC to INTL Technology Services LLC.

Acquisition during Fiscal Year 2017

ICAP’s EMEA Oils Broking Business

During October 2016, our wholly owned subsidiary, INTL FCStone Ltd (“IFL”), acquired the London-based EMEA oils voice brokerage business of ICAP plc. The business provides brokerage services across the fuel, crude, and middle distillates markets

8

to commercial and institutional clients throughout EMEA. The purchase price included cash consideration of $6.0 million paid directly to ICAP as well as incentive amounts payable to employees acquired based upon their continued employment.

Competition

The international commodities and financial markets are highly competitive and rapidly evolving. In addition, these markets are dominated by firms with significant capital and personnel resources that are not matched by our resources. We expect these competitive conditions to continue in the future, although the nature of the competition may change as a result of ongoing changes in the regulatory environment. We believe that we can compete successfully with other commodities and financial intermediaries in the markets we seek to serve, based on our expertise, products and quality of consulting and execution services.

We compete with a large number of firms in the exchange-traded futures and options on futures execution sector and in the OTC derivatives sector. We compete primarily on the basis of diversity and value of services offered, and to a lesser extent on price. Our competitors in the exchange-traded futures and options sector include international, national and regional brokerage firms as well as local introducing brokers, with competition driven by price level and quality of service. Many of these competitors also offer OTC trading programs. In addition, there are a number of financial firms and physical commodities firms that participate in the OTC markets, both directly in competition with us and indirectly through firms like us. We compete in the OTC market by making specialized OTC transactions available to our clients in contract sizes that are smaller than those usually available from major counterparties.

Investor interest in the markets we serve impact and will continue to impact our activities. The instruments traded in these markets compete with a wide range of alternative investment instruments. We seek to counterbalance changes in demand in specified markets by diversifying our business activities into multiple uncorrelated markets.

Technology has increased competitive pressures on commodities and financial intermediaries by improving dissemination of information, making markets more transparent and facilitating the development of alternative execution mechanisms. In certain instances, we compete by providing technology-based solutions to facilitate client transactions and solidify client relationships.

Administration and Operations

We employ operations personnel to supervise and, for certain products, complete the clearing and settlement of transactions.

INTL FCStone Financial is a self-clearing broker-dealer which holds client funds and maintains deposits with the National Securities Clearing Corporation, Inc. (“NSCC”), MBS Clearing Corporation, Inc., Depository Trust & Clearing Corporation, Inc. (“DTCC”) and the Options Clearing Corporation (“OCC”). In addition, it clears a portion of its securities transactions through Broadcort, a division of Merrill Lynch, Pierce, Fenner & Smith, Inc and Pershing LLC, a subsidiary of The Bank of New York Mellon.

INTL FCStone DTVM Ltda., our broker-dealer subsidiary based in Brazil, clears its securities transactions through BM&F Bovespa.

We utilize front-end electronic trading, back office and accounting systems to process transactions on a daily basis. In some cases these systems are integrated. The systems provide record keeping, trade reporting to exchange clearing organizations, internal risk controls, and reporting to government and regulatory entities, corporate managers, risk managers and clients. A third-party service bureau located in Hopkins, MN maintains our futures and options back office system. It has a disaster recovery site in Salem, NH.

We hold client funds in relation to certain of our activities. In regulated entities, these client funds are segregated, but in unregulated entities they are not. For a further discussion of client segregated funds in our regulated entities, please see the “Client Segregated Assets” discussion below.

Our administrative staff manages our internal financial controls, accounting functions, office services and compliance with regulatory requirements.

Governmental Regulation and Exchange Membership

Our activities are subject to significant governmental regulation, both in the U.S. and overseas. Failure to comply with regulatory requirements could result in administrative or court proceedings, censure, fines, issuance of cease-and-desist orders, or suspension or disqualification of the regulated entity, its officers, supervisors or representatives. The regulatory environment in which we operate is subject to frequent change and these changes directly impact our business and operating results.

The commodities industry in the U.S. is subject to extensive regulation under federal law. We are required to comply with a wide range of requirements imposed by the Commodity Futures Trading Commission (the “CFTC”), the National Futures Association (the “NFA”) and the Chicago Mercantile Exchange, which is our designated self-regulatory organization. We are also a member of the Chicago Mercantile Exchange’s divisions: the Chicago Board of Trade, the New York Mercantile

9

Exchange and COMEX, InterContinental Exchange, Inc. (“ICE”) Futures US, ICE Europe Ltd, the New Zealand Exchange and the Minneapolis Grain Exchange. These regulatory bodies protect clients by imposing requirements relating to capital adequacy, licensing of personnel, conduct of business, protection of client assets, record-keeping, trade-reporting and other matters.

The securities industry in the U.S. is subject to extensive regulation under federal and state securities laws. We must comply with a wide range of requirements imposed by the SEC, state securities commissions, the Municipal Securities Rulemaking Board (“MSRB”) and FINRA. These regulatory bodies safeguard the integrity of the financial markets and protect the interests of investors in these markets. They also impose minimum capital requirements on regulated entities. In connection with our wealth management business, one of our subsidiaries, SA Stone Investment Advisors Inc., is registered with, and subject to oversight by, the SEC as an investment adviser. As such, in its relations with its advisory clients, SA Stone Investment Advisers Inc. is subject to the fiduciary and other obligations imposed on investment advisers under the Investment Advisers Act of 1940 and the rules and regulations promulgated thereunder, as well as various state securities laws. These laws and regulations include obligations relating to, among other things, custody and management of client assets, marketing activities, self-dealing and full disclosure of material conflicts of interest, and generally grant the SEC and other supervisory bodies administrative powers to address non-compliance. Failure to comply with these requirements could result in a variety of sanctions, including, but not limited to, revocation of an advisory firm’s registration, restrictions or limitations on its ability to carry on its investment advisory business or the types of clients with which it can deal, suspensions of individual employees and significant fines.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) created a comprehensive new regulatory regime governing swaps and further regulations on listed derivatives. The Dodd-Frank Act also created a registration regime for new categories of market participants, such as “swap dealers”, among others. Our wholly owned subsidiary, INTL FCStone Markets, LLC is a CFTC provisionally registered swap dealer, whose business is overseen by the National Futures Association (“NFA”), the self-regulatory organization for the U.S. derivatives industry.

The Dodd-Frank Act generally introduced a framework for (i) swap data reporting and record keeping on counterparties and data repositories; (ii) centralized clearing for swaps, with limited exceptions for end-users; (iii) the requirement to execute swaps on regulated swap execution facilities; (iv) imposition on swap dealers to exchange margin on uncleared swaps with counterparties; and (v) the requirement to comply with new capital rules.

During 2016, CFTC 23.154, Calculation of Initial Margin rules came into effect, imposing new requirements on registered swap dealers (such as our subsidiary, INTL FCStone Markets, LLC) and certain counterparties to exchange initial margin, with phased-in compliance dates, with INTL FCStone Markets, LLC falling in the final compliance date tier of September 2021. We will continue to monitor all applicable developments in the ongoing implementation of the Dodd-Frank Act. The legislation and implementing regulations affect not only us, but also our clients and counterparties.

The USA PATRIOT Act contains anti-money laundering and financial transparency laws and mandates the implementation of various regulations applicable to broker-dealers and other financial services companies. The USA PATRIOT Act seeks to promote cooperation among financial institutions, regulators and law enforcement entities in identifying parties that may be involved in terrorism or money laundering. Anti-money laundering laws outside of the U.S. contain similar provisions. We believe that we have implemented, and that we maintain, appropriate internal practices, procedures and controls to enable us to comply with the provisions of the USA PATRIOT Act and other anti-money laundering laws.

The U.S. maintains various economic sanctions programs administered by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”). The OFAC administered sanctions take many forms, but generally prohibit or restrict trade and investment in and with sanctions targets, and in some cases require blocking of the target’s assets. Violations of any of the OFAC-administered sanctions are punishable by civil fines, criminal fines, and imprisonment. We established policies and procedures designed to comply with applicable OFAC requirements. Although we believe that our policies and procedures are effective, there can be no assurance that our policies and procedures will effectively prevent us from violating the OFAC-administered sanctions in every transaction in which we may engage.

The Financial Conduct Authority (“FCA”), the regulator of the financial services industry in the U.K., regulates our subsidiary, INTL FCStone Ltd, as a Markets in Financial Instruments Directive (“MiFID”) investment firm under part IV of the Financial Services and Markets Act 2000. The regulations impose regulatory capital, as well as conduct of business, governance, and other requirements. The conduct of business rules include those that govern the treatment of client money and other assets which, under certain circumstances for certain classes of clients must be segregated from the firm’s own assets. INTL FCStone Ltd is a member of the LME, ICE Europe Ltd, Euronext Amsterdam, Euronext Paris, the European Energy Exchange, Eurex and Norexco ASA.

The European Markets Infrastructure Regulation (“EMIR”) is the European regulation on OTC derivatives, central counterparties and trade repositories. The Markets in Financial Instruments Regulation and a revision of MiFID (together, “MiFID II”) generally took effect on January 3, 2018, and introduced comprehensive, new trading and market infrastructure

10

reforms in the E.U. Principal areas of impact related to these regulatory provisions involve the emergence and oversight of organized trade facilities (“OTF’s”) for trading OTC non-equity products, client categorization, enhanced investor protection, conflicts of interest and execution policies, transparency obligations and extended transaction reporting requirements. We have made changes to our operations, including systems and controls, in order to be in compliance with MiFID II. We will continue to monitor all applicable regulatory developments.

Net Capital Requirements

INTL FCStone Financial is a dually registered broker-dealer/FCM and is subject to minimum capital requirements under Section 4(f)(b) of the Commodity Exchange Act, Part 1.17 of the rules and regulations of the CFTC and the SEC Uniform Net Capital Rule 15c3-1 under the Securities Exchange Act of 1934 (“the Exchange Act”). These rules specify the minimum amount of capital that must be available to support our clients’ open trading positions, including the amount of assets that INTL FCStone Financial must maintain in relatively liquid form, and are designed to measure general financial integrity and liquidity. Net capital and the related net capital requirement may fluctuate on a daily basis. Compliance with minimum capital requirements may limit our operations if we cannot maintain the required levels of capital and restrict the ability of INTL FCStone Financial to make distributions to us. Moreover, any change in these rules or the imposition of new rules affecting the scope, coverage, calculation or amount of capital we are required to maintain could restrict our ability to operate our business and adversely affect our operations.

SA Stone Wealth Management Inc. (formerly Sterne Agee Financial Services, Inc.) is subject to the SEC Uniform Net Capital Rule 15c3-1 under the Exchange Act.

INTL FCStone Ltd, a financial services firm regulated by the FCA is subject to a net capital requirement.

INTL FCStone Pty Ltd is regulated by the Australian Securities and Investment Commission, and is subject to a net tangible asset capital requirement.

INTL FCStone DTVM Ltda. (“INTL FCStone DTVM”) and INTL FCStone Banco de Cambio S.A. are regulated by the Brazilian Central Bank and Securities and Exchange Commission of Brazil. They are a registered broker-dealer and registered foreign exchange bank, respectively, and are subject to capital adequacy requirements.

INTL Gainvest S.A. and INTL CIBSA S.A. are regulated by the Comision Nacional de Valores, and they are subject to net capital and capital adequacy requirements. INTL Capital, S.A., is regulated by the Rosario Futures Exchange and the General Inspector of Justice, and is subject to a capital adequacy requirement.

Certain of our other non-U.S. subsidiaries are also subject to capital adequacy requirements promulgated by authorities of the countries in which they operate.

Our subsidiaries are in compliance with all of their capital regulatory requirements as of September 30, 2019. Additional information on our subsidiaries subject to significant net capital and minimum net capital requirements can be found in Note 13 to the Consolidated Financial Statements.

Segregated Client Assets

INTL FCStone Financial maintains client segregated deposits from its clients relating to their trading of futures and options on futures on U.S. commodities exchanges held with INTL FCStone Financial, making it subject to CFTC regulation 1.20, which specifies that such funds must be held in segregation and not commingled with the firm’s own assets. INTL FCStone Financial maintains acknowledgment letters from each depository at which it maintains client segregated deposits in which the depository acknowledges the nature of funds on deposit in the account. In addition, CFTC regulations require filing of a daily segregation calculation which compares the assets held in clients segregated depositories (“segregated assets”) to the firm’s total segregated assets held on deposit from clients (“segregated liabilities”). The amount of client segregated assets must be in excess of the segregated liabilities owed to clients and any shortfall in such assets must be immediately communicated to the CFTC. As of September 30, 2019, INTL FCStone Financial maintained $56.6 million in segregated assets in excess of its segregated liabilities.

In addition, INTL FCStone Financial is subject to CFTC regulation 1.25, which governs the acceptable investment of client segregated assets. This regulation allows for the investment of client segregated assets in readily marketable instruments including U.S. Treasury securities, municipal securities, government sponsored enterprise securities, certificates of deposit, commercial paper and corporate notes or bonds which are guaranteed by the U.S. under the Temporary Liquidity Guarantee Program, interest in money market mutual funds, and repurchase transactions with unaffiliated entities in otherwise allowable securities. INTL FCStone Financial predominately invests its client segregated assets in U.S. Treasury securities and interest-bearing bank deposits.

In addition, INTL FCStone Financial in its capacity as a securities clearing broker-dealer, clears transactions for clients and certain proprietary accounts of broker-dealers (“PABs”). In accordance with Rule 15c3-3 of the Securities Exchange Act of

11

1934 (“Rule 15c3-3”), the Company maintains special reserve bank accounts (“SRBAs”) for the exclusive benefit of securities clients and PABs. As of September 30, 2019, we prepared reserve computations for the clients accounts and PAB accounts in accordance with the client reserve computation guidelines set forth in Rule 15c3-3. Based upon these computations, the customer reserve requirement was $19.4 million as of September 30, 2019. Additional deposits of $21.4 million were made to the customer SRBA in the week subsequent to September 30, 2019 to meet the customer segregation and segregated deposit timing requirements of Rule 15c3-3. The PAB reserve requirement was $2.6 million as of September 30, 2019. Additional deposits of $3.6 million were made to the PAB SRBA in the week subsequent to September 30, 2019 to meet the PAB segregation and segregated deposit timing requirements of Rule 15c3-3.

INTL FCStone Ltd is subject to certain business rules, including those that govern the treatment of client money and other assets which under certain circumstances for certain classes of client must be segregated from the firm’s own assets. As of September 30, 2019, INTL FCStone Ltd was in compliance with the applicable segregated funds requirements.

Secured Client Assets

INTL FCStone Financial maintains client secured deposits from its clients funds relating to their trading of futures and options on futures traded on, or subject to the rules of, a foreign board of trade held with INTL FCStone Financial, making it subject to CFTC Regulation 30.7, which requires that such funds must be carried in separate accounts in an amount sufficient to satisfy all of INTL FCStone Financial’s current obligations to clients trading foreign futures and foreign options on foreign commodity exchanges or boards of trade, which are designated as secured clients’ accounts. As of September 30, 2019, INTL FCStone Financial maintained $12.5 million in secured assets in excess of its secured liabilities.

Foreign Operations

We operate in a number of foreign jurisdictions, including Canada, Ireland, the United Kingdom, Luxembourg, Germany, Spain, Argentina, Brazil, Colombia, Uruguay, Paraguay, Mexico, Nigeria, Dubai, China, India, Hong Kong, Australia and Singapore. We established wholly owned subsidiaries in Uruguay and Nigeria but do not have offices or employees in those countries.

In the U.K., INTL FCStone Ltd is subject to regulation by the FCA.

In Argentina, INTL Gainvest S.A. and INTL CIBSA S.A. are subject to regulation by the Comision Nacional de Valores and INTL Capital, S.A. is subject to regulation by the Rosario Futures Exchange and the General Inspector of Justice.

In Brazil, FCStone do Brasil Ltda. is subject to regulation by BM&F Bovespa, and INTL FCStone DTVM Ltda. and INTL FCStone Banco de Cambio S.A. are regulated by the Brazilian Central Bank and Securities and Exchange Commission of Brazil.

In Canada, INTL FCStone Financial (Canada) Inc. is subject to regulation by the Investment Industry Regulatory Organization of Canada.

In Dubai, INTL Commodities DMCC is subject to regulation by the Dubai Multi Commodities Centre.

In Singapore, INTL FCStone Pte. Ltd. is subject to regulation by the Monetary Authority of Singapore.

In Australia, INTL FCStone Pty Ltd. is subject to regulation by the Australian Securities and Investments Commission.

In Hong Kong, INTL FCStone (Hong Kong) Limited holds a type 2 derivatives license and is subject to regulation by the Securities & Futures Commission of Hong Kong.

In Luxembourg, INTL FCStone Europe S.A. (formerly Carl Kliem S.A.) is subject to regulation by the Commission de Surveillance du Secteur Financier.

Business Risks

We seek to mitigate the market and credit risks arising from our financial trading activities through an active risk management program. The principal objective of this program is to limit trading risk to an acceptable level while maximizing the return generated on the risk assumed.

We have a defined risk policy administered by our risk management committee, which reports to the risk committee of our board of directors. We established specific exposure limits for inventory positions in every business, as well as specific issuer limits and counterparty limits. We designed these limits to ensure that in a situation of unexpectedly large or rapid movements or disruptions in one or more markets, systemic financial distress, and the failure of a counterparty or the default of an issuer, the potential estimated loss will remain within acceptable levels. The risk committee of our board of directors reviews the performance of the risk management committee on a quarterly basis to monitor compliance with the established risk policy.

12

Employees

As of September 30, 2019, we employed 2,012 people globally: 1,194 in the U.S., 302 in the U.K., 167 in Brazil, 80 in Argentina, 76 in India, 65 in Singapore, 47 in Luxembourg, 14 in Canada 11 in Dubai, 11 in Paraguay, 10 in the Republic of Ireland, 9 in Australia, 9 in China, 7 in Mexico, 6 in Germany and 4 in Hong Kong. None of our employees operate under a collective bargaining agreement, and we have not suffered any work stoppages or labor disputes. Many of our employees are subject to employment agreements, certain of which contain non-competition provisions.

Item 1A. Risk Factors

We face a variety of risks that could adversely impact our financial condition and results of operations, including the following:

Our ability to achieve consistent profitability is subject to uncertainty due to the nature of our businesses and the markets in which we operate. During the fiscal year ended September 30, 2019 we recorded net income of $85.1 million, compared to net income of $55.5 million in fiscal 2018 and $6.4 million in fiscal 2017.

Our revenues and operating results may fluctuate significantly in the future because of the following factors:

• | market conditions, such as price levels and volatility in the commodities, securities and foreign exchange markets in which we operate; |

• | changes in the volume of our market-making and trading activities; |

• | changes in the value of our financial instruments, currency and commodities positions and our ability to manage related risks; |

• | the level and volatility of interest rates; |

• | the availability and cost of funding and capital; |

• | our ability to manage personnel, overhead and other expenses; |

• | changes in execution and clearing fees; |

• | the addition or loss of sales or trading professionals; |

• | reduction in fee revenues from client trading and wealth management services; |

• | changes in legal and regulatory requirements; and |

• | general economic and political conditions. |

Although we continue our efforts to diversify the sources of our revenues, it is likely that our revenues and operating results will continue to fluctuate substantially in the future and such fluctuations could result in losses. These losses could have a material adverse effect on our business, financial condition and operating results.

The manner in which we account for certain of our precious metals and energy commodities inventory may increase the volatility of our reported earnings. Our net income is subject to volatility due to the manner in which we report our precious metals and energy commodities inventory held by subsidiaries that are not broker-dealers. Our precious metals and energy inventory held in subsidiaries which are not broker-dealers is stated at the lower of cost or net realizable value. We generally mitigate the price risk associated with our commodities inventory through the use of derivatives. We do not elect hedge accounting under U.S. GAAP for this price risk mitigation. In such situations, any unrealized gains in our precious metals and energy inventory in our non-broker-dealer subsidiaries are not recognized under U.S. GAAP, but unrealized gains and losses in related derivative positions are recognized under U.S. GAAP. As a result, our reported earnings from these business segments are subject to greater volatility than the earnings from our other business segments.

Our level of indebtedness could adversely affect our financial condition. As of September 30, 2019, our total consolidated indebtedness, before the netting of debt issuance costs, was $370.7 million, and we may increase our indebtedness in the future as we continue to expand our business. Our indebtedness could have important consequences and significant effects on our business, including:

• | increasing our vulnerability to general adverse economic and industry conditions; |

• | requiring that a portion of our cash flow from operations be used for the payment of interest on our indebtedness, thereby reducing our ability to use our cash flow to fund working capital, capital expenditures, acquisitions, investments and general corporate requirements; |

• | making it difficult for us to optimally manage the cash flow for our businesses; |

• | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions, investments and general corporate requirements; |

• | limiting our flexibility in planning for, or reacting to, changes in our business and the markets in which we operate; and |

• | subjecting us to a number of restrictive covenants that, among other things, limit our ability to pay dividends and make distributions, make acquisitions and dispositions, borrow additional funds and make capital expenditures and other investments. |

13

We may be able to incur additional indebtedness in the future, including secured indebtedness. If new indebtedness is added to our current indebtedness levels, the related risks that we now face could intensify.

Committed credit facilities currently available to us might not be renewed. We currently have four committed credit facilities under which we may borrow up to $743.9 million, consisting of:

• | a $386.4 million facility available to the Company, for general working capital requirements, committed until February 22, 2022. |

• | a $75.0 million facility available to INTL FCStone Financial, for short-term funding of margin to commodity exchanges, committed until April 3, 2020. |

• | a $232.5 million committed facility available to our wholly owned subsidiary, FCStone Merchant Services, LLC, for financing traditional commodity financing arrangements and commodity repurchase agreements, committed until February 1, 2020. |

• | a $50.0 million facility available to our wholly owned subsidiary, INTL FCStone Ltd, for short-term funding of margin to commodity exchanges, committed until January 31, 2020. |

Of our committed credit facilities, $357.5 million are scheduled to expire during the 12-month period beginning with the filing date of this Annual Report on Form 10-K. There is no guarantee that we will be successful in renewing, extending or rearranging these facilities.

The Company’s business requires substantial cash to support its operating activities. Our business involves the establishment and carrying of substantial open positions for clients on futures exchanges and in the OTC derivatives markets. We are required to post and maintain margin or credit support for these positions. Although we collect margin or other deposits from our clients for these positions, significant adverse price movements can occur which will require us to post margin or other deposits on short notice, whether or not we are able to collect additional margin or credit support from our clients. We have systems in place to collect margin and other deposits from clients on a same-day basis; however, there can be no assurance that these facilities and systems will be adequate to eliminate the risk of margin calls in the event of severe adverse price movements affecting open positions of our clients. As such, the Company may be dependent on its lines of credit and other financing facilities in order to fund margin calls and other operating activities.

It is possible that these facilities might not be renewed at the end of their commitment periods and that we will be unable to replace them with other facilities on terms favorable to us or at all. If our credit facilities are unavailable or insufficient to support future levels of business activities, we may need to raise additional funds externally, either in the form of debt or equity. If we cannot raise additional funds on acceptable terms, we may not be able to develop or enhance our business, take advantage of future opportunities or respond to competitive pressure or unanticipated requirements, leading to reduced profitability.

Our failure to successfully integrate the operations of businesses acquired could have a material adverse effect on our business, financial condition and operating results. From time to time, we may seek to expand our product offerings and /or geographic presence through acquisitions of complementary businesses, technologies or services. Our ability to engage in suitable acquisitions will depend on our ability to identify opportunities for potential acquisitions that fit within our business model, enter into the agreements necessary to take advantage of these potential opportunities and obtain any necessary financing. We may not be able to do so successfully. We are regularly evaluating potential acquisition opportunities.

We will need to meet challenges to realize the expected benefits and synergies of these acquisitions, including:

• | integrating the management teams, strategies, cultures, technologies and operations of the acquired companies; |

• | retaining and assimilating the key personnel of acquired companies; |

• | retaining existing clients of the acquired companies; |

• | creating uniform standards, controls, procedures, policies and information systems; and |

• | achieving revenue growth because of risks involving (1) the ability to retain clients, (2) the ability to sell the services and products of the acquired companies to the existing clients of our other business segments, and (3) the ability to sell the services and products of our other business segments to the existing clients of the acquired companies. |

The accomplishment of these objectives will involve considerable risk, including:

• | the potential disruption of each company’s ongoing business and distraction of their respective management teams; |

• | unanticipated expenses related to technology integration; and |

• | potential unknown liabilities associated with the acquisitions. |

It is possible that the integration process could result in the loss of the technical skills and management expertise of key employees, the disruption of the ongoing businesses or inconsistencies in standards, controls, procedures and policies due to possible cultural conflicts or differences of opinions on technical decisions and product road maps that adversely affect our ability to maintain relationships with clients, counterparties, and employees or to achieve the anticipated benefits of the acquisition.

14

We face risks associated with our market-making and trading activities. We conduct our market-making and trading activities predominantly as a principal, which subjects our capital to significant risks. These activities involve the purchase, sale or short sale for clients and for our own account of financial instruments, including equity and debt securities, commodities and foreign exchange. These activities are subject to a number of risks, including risks of price fluctuations, rapid changes in the liquidity of markets and counterparty creditworthiness.

These risks may limit our ability to either resell financial instruments we purchased or to repurchase securities we sold in these transactions. In addition, we may experience difficulty borrowing financial instruments to make delivery to purchasers to whom we sold short, or lenders from whom we have borrowed. From time to time, we have large position concentrations in securities of a single issuer or issuers in specific countries and markets. This concentration could result in higher trading losses than would occur if our positions and activities were less concentrated.

The success of our market-making activities depends on:

• | the price volatility of specific financial instruments, currencies and commodities, |

• | our ability to attract order flow; |

• | the skill of our personnel; |

• | the availability of capital; and |

• | general market conditions. |

To attract market-trading, market-making and trading business, we must be competitive in:

• | providing enhanced liquidity to our clients; |

• | the efficiency of our order execution; |

• | the sophistication of our trading technology; and |

• | the quality of our client service. |

In our role as a market maker and trader, we attempt to derive a profit from the difference between the prices at which we buy and sell financial instruments, currencies and commodities. However, competitive forces often require us to:

• | match the quotes other market makers display; and |

• | hold varying amounts of financial instruments, currencies and commodities in inventory. |

By having to maintain inventory positions, we are subject to a high degree of risk. We cannot ensure that we will be able to manage our inventory risk successfully or that we will not experience significant losses, either of which could materially adversely affect our business, financial condition and operating results.

Fluctuations in currency exchange rates could negatively impact our earnings. A significant portion of our international business is conducted in currencies other than the U.S. dollar, and changes in foreign exchange rates relative to the U.S. dollar can therefore affect the value of our non‑U.S. dollar net assets, revenues and expenses. Although we closely monitor potential exposures as a result of these fluctuations in currencies and adopt strategies designed to reduce the impact of these fluctuations on our financial performance, there can be no assurance that we will be successful in managing our foreign exchange risk. Our exposure to currency exchange rate fluctuations will grow if the relative contribution of our operations outside the U.S. increases. Any material fluctuations in currencies could have a material effect on our financial condition, results of operations and cash flows.

We are exposed to certain risks as a result of operating in countries with high levels of inflation. We are exposed to risks as a result of operating in countries with high levels of inflation. These risks include the risk that the rate of price increases will not keep pace with the cost of inflation, adverse economic conditions may discourage business growth which could affect demand for our services, the devaluation of the currency may exceed the rate of inflation and reported U.S. dollar revenues and profits may decline, and these countries may be deemed “highly inflationary” for U.S. GAAP purposes.

For example, we have wholly owned subsidiaries in Argentina which employed 80 people as of September 30, 2019, and primarily conduct debt trading and asset management business activities for clients. The Argentinian economy was determined to be highly inflationary. For U.S. GAAP purposes, a highly inflationary economy is one where the cumulative inflation rate for the three years preceding the beginning of the reporting period, including interim reporting periods, is in excess of 100 percent. Argentina’s inflation rate reached this threshold during the quarterly period ended June 30, 2018. For periods up until June 30, 2018, the functional currency for certain of our subsidiaries was the Argentinian peso, the local currency of these subsidiaries. In accordance with this designation, effective July 1, 2018 we reported the financial results of the subsidiaries in Argentina at the functional currency of their parent, which is the U.S. dollar. Going forward, fluctuations in the Argentinian peso to U.S. dollar exchange rate could negatively impact our earnings.

We operate as a principal in the OTC derivatives markets which involves the risks associated with commodity derivative instruments. We offer OTC derivatives to our clients in which we act as a principal counterparty. We endeavor to simultaneously offset the underlying risk of the instruments, such as commodity price risk, by establishing corresponding offsetting positions with commodity counterparties, or alternatively we may offset those transactions with similar but not

15

identical positions on an exchange. To the extent that we are unable to simultaneously offset an open position or the offsetting transaction is not effective to fully eliminate the derivative risk, we have market risk exposure on these unmatched transactions. Our exposure varies based on the size of the overall positions, the terms and liquidity of the instruments brokered, and the amount of time the positions remain open.

To the extent an unhedged position is not disposed of intra-day, adverse movements in the reference assets or rates underlying these positions or a downturn or disruption in the markets for these positions could result in a substantial loss. In addition, any principal gains and losses resulting from these positions could on occasion have a disproportionate effect, positive or negative, on our financial condition and results of operations for any particular reporting period.

Transactions involving OTC derivative contracts may be adversely affected by fluctuations in the level, volatility, correlation or relationship between market prices, rates, indices and/or other factors. These types of instruments may also suffer from illiquidity in the market or in a related market.

OTC derivative transactions are subject to unique risks. OTC derivative transactions are subject to the risk that, as a result of mismatches or delays in the timing of cash flows due from or to counterparties in OTC derivative transactions or related hedging, trading, collateral or other transactions, we or our counterparty may not have adequate cash available to fund our or its current obligations.

We could incur material losses pursuant to OTC derivative transactions because of inadequacies in or failures of our internal systems and controls for monitoring and quantifying the risk and contractual obligations associated with OTC derivative transactions and related transactions or for detecting human error, systems failure or management failure.

OTC derivative transactions may generally only be modified or terminated only by mutual consent of the parties to any such transaction (other than in certain limited default and other specified situations (e.g., market disruption events)) and subject to agreement on individually negotiated terms. Accordingly, it may not be possible to modify, terminate or offset obligations or exposure to the risk associated with a transaction prior to its scheduled termination date.

In addition, we note that as a result of rules recently adopted by U.S. regulators concerning certain financial contracts (including OTC derivatives) entered into with our counterparties that have been designated as global systemically important banking organizations, we may be restricted in our ability to terminate such contracts following the occurrence of certain insolvency-related default events. The rules are being progressively implemented between January 1, 2019 and January 1, 2020.

Changes to the U.S. corporate tax system could have an adverse effect on our business, cash flows, income and financial condition. Additionally, changes have had and may in the future continue to result in additional U.S. corporate tax liabilities on unremitted earnings from deemed repatriation of earnings of our foreign subsidiaries. The recent reform of the U.S. tax system included changes to corporate tax rates, and will affect subsequent fiscal years, including, but not limited to, (1) elimination of the corporate alternative minimum tax, (2) a new provision designed to tax global intangible low-taxed income, (3) limitations on the utilization of net operating losses incurred in tax years beginning after September 30, 2018 to 80% of taxable income per tax year, (4) the creation of the base erosion anti-abuse tax, (5) a general elimination of U.S. federal income taxes on dividends from foreign subsidiaries, and (6) limitations on the deductibility of interest expense and certain executive compensation.

Changes in applicable U.S. state, federal or foreign tax laws and regulations, or their interpretations and application, could materially affect our tax expense and profitability. Most state and local income tax jurisdictions have updated their conformity or issued guidance on their level of conformity with the U.S. federal income tax changes as of September 30, 2019. We are able to calculate the impact of the reduction in corporate rate and the deemed repatriation transition tax for state and local income tax purposes and the impact on tax expense is immaterial.

We may have difficulty managing our growth. We have experienced significant growth in our business. Our operating revenues grew from $624.3 million in fiscal 2015 to $1,106.1 million in fiscal 2019. This growth may continue, including as a result of any acquisitions we have recently undertaken or may undertake in the future.

This growth required, and will continue to require, us to increase our investment in management personnel, financial and management systems and controls, and facilities. In the absence of continued revenue growth, or if growth is at a rate lower than our expectations, the costs associated with our expected growth would cause our operating margins to decline from current levels. In addition, as is common in the financial industry, we are and will continue to be highly dependent on the effective and reliable operation of our communications and information systems.

The scope of procedures for assuring compliance with applicable rules and regulations changes as the size and complexity of our business increases. In response, we have implemented and continue to revise formal compliance procedures; however, there can be no assurances that such procedures will be effective.

16

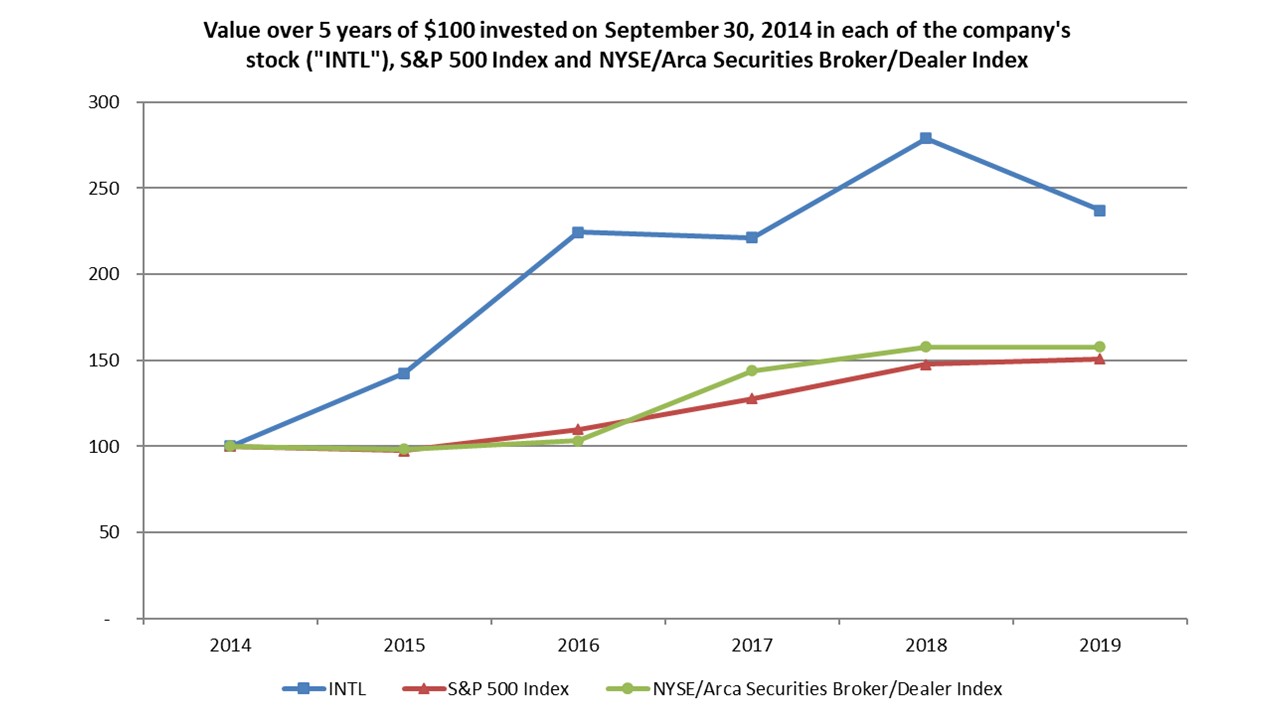

It is possible that we will not be able to manage our growth successfully. Our inability to do so could have a material adverse effect on our business, financial condition and operating results.