Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended August 31, 2018

| ||

OR

| ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission file number: 000-55447

CORVUS GOLD INC.

(Exact Name of Registrant as Specified in its Charter)

| British Columbia, Canada | 98-0668473 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 1750-700 West Pender Street Vancouver, British Columbia, Canada, |

V6C 1G8 |

| (Address of Principal Executive Offices) | (Zip code) |

Registrant’s telephone number, including area code: (604) 638-3246

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Small reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ☐ No ☒

As of October 11, 2018, the registrant had 105,985,945 common shares outstanding.

Table of Contents

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Expressed in Canadian dollars)

| August 31, 2018 | May 31, 2018 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 4,783,695 | $ | 2,610,541 | ||||

| Accounts receivable | 28,665 | 25,438 | ||||||

| Prepaid expenses | 248,518 | 256,772 | ||||||

| Total current assets | 5,060,878 | 2,892,751 | ||||||

| Property and equipment (note 3) | 53,198 | 56,490 | ||||||

| Capitalized acquisition costs (note 4) | 5,283,809 | 5,238,789 | ||||||

| Total assets | $ | 10,397,885 | $ | 8,188,030 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities (note 6) | $ | 283,117 | $ | 330,704 | ||||

| Total current liabilities | 283,117 | 330,704 | ||||||

| Asset retirement obligations (note 4) | 371,398 | 366,641 | ||||||

| Total liabilities | 654,515 | 697,345 | ||||||

| Shareholders’ equity | ||||||||

| Share capital (note 5) | 88,091,883 | 83,606,486 | ||||||

| Contributed surplus (note 5) | 13,195,083 | 13,030,715 | ||||||

| Accumulated other comprehensive income - cumulative translation differences | 1,168,778 | 1,123,410 | ||||||

| Deficit accumulated during the exploration stage | (92,712,374 | ) | (90,269,926 | ) | ||||

| Total shareholders’ equity | 9,743,370 | 7,490,685 | ||||||

| Total liabilities and shareholders’ equity | $ | 10,397,885 | $ | 8,188,030 | ||||

Nature and continuance of operations (note 1)

Approved on behalf of the Directors:

| “Jeffrey Pontius” | Director | |

| “Anton Drescher” | Director |

These accompanying notes form an integral part of these condensed interim consolidated financial statements

3

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(Expressed in Canadian dollars)

THREE MONTHS ENDED AUGUST 31,

| 2018 | 2017 | |||||||

| Operating expenses | ||||||||

| Administration | $ | 106 | $ | 105 | ||||

| Consulting fees (notes 5 and 6) | 140,695 | 135,707 | ||||||

| Depreciation (note 3) | 3,673 | 4,314 | ||||||

| Exploration expenditures (note 4) | 1,653,100 | 728,339 | ||||||

| Insurance | 51,629 | 49,848 | ||||||

| Investor relations (note 5) | 217,671 | 146,981 | ||||||

| Office and miscellaneous | 23,408 | 40,175 | ||||||

| Professional fees (note 5) | 56,163 | 57,255 | ||||||

| Regulatory | 42,288 | 25,470 | ||||||

| Rent | 18,207 | 28,894 | ||||||

| Travel | 38,229 | 26,144 | ||||||

| Wages and benefits (notes 5 and 6) | 257,219 | 238,225 | ||||||

| Total operating expenses | (2,502,388 | ) | (1,481,457 | ) | ||||

| Other income (expense) | ||||||||

| Interest income | 15,300 | 441 | ||||||

| Foreign exchange gain (loss) | 44,640 | (145,149 | ) | |||||

| Total other income (expense) | 59,940 | (144,708 | ) | |||||

| Net loss for the period | (2,442,448 | ) | (1,626,165 | ) | ||||

| Other comprehensive income (loss) | ||||||||

| Exchange difference on translating foreign operations | 45,368 | (397,551 | ) | |||||

| Comprehensive loss for the period | $ | (2,397,080 | ) | $ | (2,023,716 | ) | ||

| Basic and diluted net loss per share | $ | (0.02 | ) | $ | (0.02 | ) | ||

| Weighted average number of shares outstanding | 105,891,881 | 97,209,473 | ||||||

These accompanying notes form an integral part of these condensed interim consolidated financial statements

4

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Expressed in Canadian dollars)

THREE MONTHS ENDED AUGUST 31,

| 2018 | 2017 | |||||||

| Operating activities | ||||||||

| Net loss for the period | $ | (2,442,448 | ) | $ | (1,626,165 | ) | ||

| Add items not affecting cash: | ||||||||

| Depreciation | 3,673 | 4,314 | ||||||

| Stock-based compensation (note 5) | 164,368 | 158,638 | ||||||

| Foreign exchange loss | (44,640 | ) | 145,149 | |||||

| Changes in non-cash items: | ||||||||

| Accounts receivable | (3,227 | ) | (1,278 | ) | ||||

| Prepaid expenses | 8,254 | (21,303 | ) | |||||

| Accounts payable and accrued liabilities | (47,587 | ) | (103,981 | ) | ||||

| Cash used in operating activities | (2,361,607 | ) | (1,444,626 | ) | ||||

| Financing activities | ||||||||

| Cash received from issuance of shares | 4,500,002 | 4,790,700 | ||||||

| Share issuance costs | (14,605 | ) | (22,491 | ) | ||||

| Cash provided by financing activities | 4,485,397 | 4,768,209 | ||||||

| Investing activities | ||||||||

| Expenditures on property and equipment | - | (1,424 | ) | |||||

| Cash used in investing activities | - | (1,424 | ) | |||||

| Effect of foreign exchange on cash | 49,364 | (184,157 | ) | |||||

| Increase in cash and cash equivalents | 2,173,154 | 3,138,002 | ||||||

| Cash and cash equivalents, beginning of the period | 2,610,541 | 1,300,553 | ||||||

| Cash and cash equivalents, end of the period | $ | 4,783,695 | $ | 4,438,555 | ||||

Supplemental cash flow information (note 9)

These accompanying notes form an integral part of these condensed interim consolidated financial statements

5

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(Unaudited)

(Expressed in Canadian dollars)

THREE MONTHS ENDED AUGUST 31, 2018

| Number of shares | Amount | Contributed Surplus | Accumulated Other Comprehensive Income – Cumulative Translation Differences | Deficit | Total | |||||||||||||||||||

| Balance, May 31, 2018 | 104,255,175 | $ | 83,606,486 | $ | 13,030,715 | $ | 1,123,410 | $ | (90,269,926 | ) | $ | 7,490,685 | ||||||||||||

| Net loss for the period | - | - | - | - | (2,442,448 | ) | (2,442,448 | ) | ||||||||||||||||

| Shares issued for cash | ||||||||||||||||||||||||

| Private placement | 1,730,770 | 4,500,002 | - | - | - | 4,500,002 | ||||||||||||||||||

| Other comprehensive income (loss) | ||||||||||||||||||||||||

| Exchange difference on translating foreign operations | - | - | - | 45,368 | - | 45,368 | ||||||||||||||||||

| Share issuance costs | - | (14,605 | ) | - | - | - | (14,605 | ) | ||||||||||||||||

| Stock-based compensation | - | - | 164,368 | - | - | 164,368 | ||||||||||||||||||

| Balance, August 31, 2018 | 105,985,945 | $ | 88,091,883 | $ | 13,195,083 | $ | 1,168,778 | $ | (92,712,374 | ) | $ | 9,743,370 | ||||||||||||

These accompanying notes form an integral part of these condensed interim consolidated financial statements

6

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

On August 25, 2010, International Tower Hill Mines Ltd. (“ITH”) completed a Plan of Arrangement (the “Arrangement”) whereby its existing Alaska mineral properties (other than the Livengood project) and related assets and the North Bullfrog mineral property and related assets in Nevada (collectively, the “Nevada and Other Alaska Business”) were indirectly spun out into a new public company, being Corvus Gold Inc. (“Corvus” or the “Company”). As part of the Arrangement, ITH transferred its wholly-owned subsidiary Corvus Gold Nevada Inc. (“Corvus Nevada”) (which held the North Bullfrog property), to Corvus and a wholly-owned Alaskan subsidiary of ITH, Talon Gold Alaska, Inc. sold to Raven Gold Alaska Inc. (“Raven Gold”), the Terra, Chisna, LMS and West Pogo properties. As a consequence of the completion of the Arrangement, the Terra, Chisna, LMS, West Pogo and North Bullfrog properties were transferred to Corvus.

The Company was incorporated on April 13, 2010 under the Business Corporations Act (British Columbia). These condensed interim consolidated financial statements reflect the cumulative operating results of the predecessor, as related to the mineral properties that were transferred to the Company from June 1, 2006.

The Company is engaged in the business of acquiring, exploring and evaluating mineral properties, and either joint venturing or developing these properties further or disposing of them when the evaluation is completed. At August 31, 2018, the Company had interests in properties in Nevada, U.S.A.

The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The Company has no source of revenue, and has significant cash requirements to meet its administrative overhead and maintain its mineral property interests. The recoverability of amounts shown for mineral properties is dependent on several factors. These include the discovery of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete the development of these properties, and future profitable production or proceeds from disposition of mineral properties. The carrying value of the Company’s mineral properties does not reflect current or future values.

These condensed interim consolidated financial statements have been prepared on a going concern basis, which presume the realization of assets and discharge of liabilities in the normal course of business for the foreseeable future. The Company’s ability to continue as a going concern is dependent upon achieving profitable operations and/or obtaining additional financing.

In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future within one year from the date the condensed interim consolidated financial statements are issued. There is substantial doubt upon the Company’s ability to continue as going concern, as explained in the following paragraphs.

The Company has sustained significant losses from operations, has negative cash flows, and has an ongoing requirement for capital investment to explore its mineral properties. As at August 31, 2018, the Company had working capital of $4,777,761 compared to working capital of $2,562,047 as at May 31, 2018. On June 7, 2018, the Company closed a non-brokered private placement equity financing and issued 1,730,770 common shares at a price of $2.60 per common share for gross proceeds of $4,500,002. Based on its current plans, budgeted expenditures, and cash requirements, the Company has sufficient cash to finance its current plans for the 15 months from the date the condensed interim consolidated financial statements are issued.

The Company expects that it will need to raise substantial additional capital to accomplish its business plan over the next several years. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Company as those previously obtained, or at all. Should such financing not be available in that time-frame, the Company will be required to reduce its activities and will not be able to carry out all of its presently planned exploration and development activities on its currently anticipated scheduling.

These condensed interim consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue in business.

All currency amounts are stated in Canadian dollars unless noted otherwise.

7

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of presentation

These condensed interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X under the Securities Exchange Act of 1934, as amended. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for annual financial statements. These condensed interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended May 31, 2018 as filed in our Annual Report on Form 10-K. In the opinion of the Company’s management these condensed interim consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary to present fairly the Company’s financial position at August 31, 2018 and the results of its operations for the three months then ended. Operating results for the three months ended August 31, 2018 are not necessarily indicative of the results that may be expected for the year ending May 31, 2019. The 2018 year-end balance sheet data was derived from audited financial statements but does not include all disclosures required by U.S. GAAP.

The preparation of these condensed interim consolidated financial statements in conformity with U.S. GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of these condensed interim consolidated financial statements, and the reported amounts of revenues and expenses during the period. These judgments, estimates and assumptions are continuously evaluated and are based on management’s experience and knowledge of the relevant facts and circumstances. While management believes the estimates to be reasonable, actual results could differ from those estimates and could impact future results of operations and cash flows.

Basis of consolidation

These condensed interim consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries (collectively, the “Group”), Corvus Gold (USA) Inc. (“Corvus USA”) (a Nevada corporation), Corvus Nevada (a Nevada corporation), Raven Gold (an Alaska corporation), SoN Land and Water LLC (“SoN”) (a Nevada limited liability company) and Mother Lode Mining Company LLC (a Nevada limited liability company). All intercompany transactions and balances were eliminated upon consolidation.

Loss per share

Basic loss per share is calculated using the weighted average number of common shares outstanding during the period. The Company uses the treasury stock method to compute the dilutive effect of options, warrants and similar instruments. Under this method, the dilutive effect on earnings (loss) per share is calculated presuming the exercise of outstanding options, warrants and similar instruments. It assumes that the proceeds of such exercise would be used to repurchase common shares at the average market price during the period. However, the calculation of diluted loss per share excludes the effects of various conversions and exercise of options and warrants that would be anti-dilutive. For the period ended August 31, 2018, 9,861,900 outstanding stock options (2017 - 9,976,900) were not included in the calculation of diluted earnings (loss) per share as their inclusion was anti-dilutive.

Recent accounting pronouncements

The Company continually assesses any new accounting pronouncements to determine their applicability. When it is determined that a new accounting pronouncement affects the Company's financial reporting, the Company undertakes a study to determine the consequences of the change to its consolidated financial statements and assures that there are proper controls in place to ascertain that the Company’s consolidated financial statements properly reflect the change.

In March 2016, the FASB issued ASU No. 2016-02, Leases. The main difference between the provisions of ASU No. 2016-02 and previous U.S. GAAP is the recognition of right-of-use assets and lease liabilities by lessees for those leases classified as operating leases under previous U.S. GAAP. ASU No. 2016-02 retains a distinction between finance leases and operating leases, and the recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly changed from previous U.S. GAAP. For leases with a term of 12 months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize right-of-use assets and lease liabilities. The accounting applied by a lessor is largely unchanged from that applied under previous U.S. GAAP. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. This ASU is effective for public business entities in fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted as of the beginning of any interim or annual reporting period. The Company has not yet determined the effect of the standard on its ongoing reporting.

8

In June 2016, the FASB issued ASU No. 2016-13, Credit Losses, Measurement of Credit Losses on Financial Instruments. ASU No. 2016-13 significantly changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. The standard will replace the current incurred loss approach with an expected loss model for instruments measured at amortized cost. Entities will apply the standard's provisions as a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective. This ASU is effective for public entities for annual and interim periods beginning after December 15, 2019. Early adoption is permitted for all entities for annual periods beginning after December 15, 2018, and interim periods therein. The Company has not yet determined the effect of this standard on its ongoing reporting.

| 3. | PROPERTY AND EQUIPMENT |

| Computer Equipment | Vehicles | Tent | Total | |||||||||||||

| Cost | ||||||||||||||||

| Balance, May 31, 2018 | $ | 83,619 | $ | 88,328 | $ | 64,740 | $ | 236,687 | ||||||||

| Currency translation adjustments | 490 | 729 | 535 | 1,754 | ||||||||||||

| Balance, August 31, 2018 | $ | 84,109 | $ | 89,057 | $ | 65,275 | $ | 238,441 | ||||||||

| Depreciation | ||||||||||||||||

| Balance, May 31, 2018 | $ | 60,144 | $ | 79,178 | $ | 40,875 | $ | 180,197 | ||||||||

| Depreciation for the period | 1,772 | 694 | 1,207 | 3,673 | ||||||||||||

| Currency translation adjustments | 387 | 652 | 334 | 1,373 | ||||||||||||

| Balance, August 31, 2018 | $ | 62,303 | $ | 80,524 | $ | 42,416 | $ | 185,243 | ||||||||

| Carrying amounts | ||||||||||||||||

| Balance, May 31, 2018 | $ | 23,475 | $ | 9,150 | $ | 23,865 | $ | 56,490 | ||||||||

| Balance, August 31, 2018 | $ | 21,806 | $ | 8,533 | $ | 22,859 | $ | 53,198 |

| 4. | MINERAL PROPERTIES |

The Company had the following activity related to capitalized acquisition costs:

| North Bullfrog | Mother Lode | Total | ||||||||||

| (note 4a)) | (note 4b)) | |||||||||||

| Balance, May 31, 2018 | $ | 4,428,752 | $ | 810,037 | $ | 5,238,789 | ||||||

| Asset retirement obligations | - | 1,727 | 1,727 | |||||||||

| Currency translation adjustments | 36,598 | 6,695 | 43,293 | |||||||||

| Balance, August 31, 2018 | $ | 4,465,350 | $ | 818,459 | $ | 5,283,809 | ||||||

9

The following table presents costs incurred for exploration and evaluation activities for the three months ended August 31, 2018:

| North Bullfrog | Mother Lode | Total | ||||||||||

| (note 4a)) | (note 4b)) | |||||||||||

| Exploration costs: | ||||||||||||

| Assay | $ | - | $ | 203,078 | $ | 203,078 | ||||||

| Drilling | - | 502,000 | 502,000 | |||||||||

| Equipment rental | - | 13,890 | 13,890 | |||||||||

| Field costs | 284 | 68,936 | 69,220 | |||||||||

| Geological/ Geophysical | 14,298 | 136,659 | 150,957 | |||||||||

| Land maintenance & tenure | 196,980 | 225,275 | 422,255 | |||||||||

| Permits | 4,385 | 40,400 | 44,785 | |||||||||

| Studies | 5,377 | 213,906 | 219,283 | |||||||||

| Travel | - | 27,632 | 27,632 | |||||||||

| Total expenditures for the period | $ | 221,324 | $ | 1,431,776 | $ | 1,653,100 | ||||||

The following table presents costs incurred for exploration and evaluation activities for the three months ended August 31, 2017:

| North Bullfrog | Mother Lode | Total | ||||||||||

| (note 4a)) | (note 4b)) | |||||||||||

| Exploration costs: | ||||||||||||

| Assay | $ | 43,842 | $ | - | $ | 43,842 | ||||||

| Drilling | (3,323 | ) | 66 | (3,257 | ) | |||||||

| Equipment rental | 14,426 | 11,628 | 26,054 | |||||||||

| Field costs | 14,807 | 59,542 | 74,349 | |||||||||

| Geological/ Geophysical | 26,767 | 49,075 | 75,842 | |||||||||

| Land maintenance & tenure | 194,707 | 33,839 | 228,546 | |||||||||

| Permits | 6,240 | 2,999 | 9,239 | |||||||||

| Studies | 219,755 | 39,500 | 259,255 | |||||||||

| Travel | 8,883 | 5,586 | 14,469 | |||||||||

| Total expenditures for the period | $ | 526,104 | $ | 202,235 | $ | 728,339 | ||||||

| a) | North Bullfrog Project, Nevada |

The Company’s North Bullfrog project consists of certain leased patented lode mining claims and federal unpatented mining claims owned 100% by the Company.

| (i) | Interests acquired from Redstar Gold Corp. |

On October 9, 2009, a US subsidiary of ITH at the time (Corvus Nevada) completed the acquisition of all of the interests of Redstar Gold Corp. (“Redstar”) and Redstar Gold U.S.A. Inc. (“Redstar US”) in the North Bullfrog project, which consisted of the following leases:

| (1) | Pursuant to a mining lease and option to purchase agreement made effective October 27, 2008 between Redstar and an arm’s length limited liability company, Redstar has leased (and has the option to purchase) 12 patented mining claims referred to as the “Connection” property. The ten-year, renewable mining lease requires advance minimum royalty payments (recoupable from production royalties, but not applicable to the purchase price if the option to purchase is exercised) of USD 10,800 (paid) on signing and annual payments for the first three anniversaries of USD 10,800 (paid) and USD 16,200 for every year thereafter (paid to October 27, 2017). Redstar has an option to purchase the property (subject to the net smelter return (“NSR”) royalty below) for USD 1,000,000 at any time during the life of the lease. Production is subject to a 4% NSR royalty, which may be purchased by the lessee for USD 1,250,000 per 1% (USD 5,000,000 for the entire royalty). |

10

| (2) | Pursuant to a mining lease made and entered into as of May 8, 2006 between Redstar and two arm’s length individuals, Redstar has leased three patented mining claims which form part of the North Bullfrog project holdings. The lease is for an initial term of ten years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 4,000 on execution, USD 3,500 on each of May 8, 2007, 2008 and 2009 (paid), USD 4,500 on May 8, 2010 and each anniversary thereafter, adjusted for inflation (paid to May 8, 2018). The lessor is entitled to receive a 2% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

| (3) | Pursuant to a mining lease made and entered into as of May 8, 2006 between Redstar and an arm’s length private Nevada corporation, Redstar has leased two patented mining claims which form part of the North Bullfrog project holdings. The lease is for an initial term of ten years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 2,000 on execution, USD 2,000 on each of May 8, 2007, 2008 and 2009 (paid), USD 3,000 on May 8, 2010 and each anniversary thereafter, adjusted for inflation (paid to May 8, 2018). The lessor is entitled to receive a 3% NSR royalty on all production, which may be purchased by the lessee for USD 850,000 per 1% (USD 2,550,000 for the entire royalty). On May 29, 2014, the parties signed a First Amendment Agreement whereby the Lease is amended to provide that in addition to the Advance Minimum Royalty payments payable in respect of the Original Claims, the lessee will now pay to the lessor Advance Minimum Royalty payments in respect of the Yellow Rose Claims of USD 2,400 on execution, USD 2,400 on each of May 29, 2015, 2016 and 2017 (paid), USD 3,600 on May 29, 2018 and each anniversary thereafter (paid to May 29, 2018). The Lessor is entitled to receive a 3% NSR royalty on all production from the Yellow Rose claims, which may be purchased by the lessee for USD 770,000 per 1% (USD 2,310,000 for the entire royalty). |

| (4) | Pursuant to a mining lease made and entered into as of May 16, 2006 between Redstar and an arm’s length individual, Redstar has leased twelve patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of ten years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 20,500 on execution and USD 20,000 on each anniversary thereafter (paid to May 16, 2018). The lessor is entitled to receive a 4% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 4,000,000 for the entire royalty). |

| (5) | Pursuant to a mining lease made and entered into as of May 22, 2006 between Redstar and an arm’s length individual, Redstar has leased three patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of ten years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 8,000 on execution, USD 4,800 on each of May 22, 2007, 2008 and 2009 (paid), USD 7,200 on May 22, 2010 and each anniversary thereafter, adjusted for inflation (paid to May 22, 2018). The lessor is entitled to receive a 2% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

| (6) | Pursuant to a mining lease made and entered into as of June 16, 2006 between Redstar and an arm’s length individual, Redstar has leased one patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of ten years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 2,000 on execution, USD 2,000 on each of June 16, 2007, 2008 and 2009 (paid), USD 3,000 on June 16, 2010 and each anniversary thereafter, adjusted for inflation (paid to June 16, 2018). The lessor is entitled to receive a 2% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

As a consequence of the acquisition of Redstar and Redstar US’s interest in the foregoing leases, Corvus Nevada is now the lessee under all of such leases.

11

| (ii) | Interests acquired directly by Corvus Nevada |

| (1) | Pursuant to a mining lease and option to purchase agreement made effective December 1, 2007 between Corvus Nevada and a group of arm’s length limited partnerships, Corvus Nevada has leased (and has the option to purchase) patented mining claims referred to as the “Mayflower” claims which form part of the North Bullfrog project. The terms of the lease/option are as follows: |

| ☐ | Terms: Initial term of five years, commencing December 1, 2007, with the option to extend the lease for an additional five years. The lease will continue for as long thereafter as the property is in commercial production or, alternatively, for an additional three years if Corvus Nevada makes advance minimum royalty payments of USD 100,000 per year (which are recoupable against actual production royalties). Pursuant to an extension agreement dated January 15, 2016 and fully executed and effective as of November 22, 2017, the parties agreed to extend the lease and option granted for an additional ten years with the same lease payment terms. |

| ☐ | Lease Payments: USD 5,000 (paid) and 25,000 common shares of ITH (delivered) following regulatory acceptance of the transaction; and an additional USD 5,000 and 20,000 common shares on each of the first through fourth lease anniversaries (paid and issued). Pursuant to an agreement with the lessors, in lieu of the 20,000 ITH common shares due December 1, 2010, Corvus Nevada paid USD 108,750 on November 10, 2010 and delivered 46,250 common shares of the Company on December 2, 2010. If Corvus Nevada elects to extend the lease for a second five-year term, it will pay USD 10,000 and deliver 50,000 common shares of ITH upon election being made, and an additional 50,000 common shares of ITH on each of the fifth through ninth anniversaries (USD 10,000 paid on October 31, 2012 and 50,000 common shares of ITH delivered on October 25, 2012 paid with cash of $126,924; USD 10,000 paid on November 13, 2013 and 50,000 common shares of ITH delivered on November 25, 2013 paid with cash of $35,871; USD 10,000 paid on November 17, 2014 and 50,000 common shares of ITH delivered on November 7, 2014 paid with cash of $21,200; USD 10,000 paid on November 23, 2015 and 50,000 common shares of ITH delivered on November 5, 2015 paid with cash of $19,237; USD 10,000 paid on November 17, 2016 and 50,000 common shares of ITH, purchased for $53,447 in the market by the Company, were delivered on November 10, 2016; and USD 10,000 paid on November 22, 2017 and 50,000 common shares of ITH, purchased for $25,655 in the market by the Company, were delivered on November 30, 2017). |

| ☐ | Anti-Dilution: Pursuant to an amended agreement agreed to by the lessors in March 2015, the Company shall deliver a total of 85,000 common shares (issued) of the Company for the years 2011 to 2014 (2011: 10,000 common shares; 2012 to 2014: 25,000 common shares each year). All future payments will be satisfied by the delivery of an additional ½ common shares of the Company for each of the ITH common shares due per the original agreement (issued 25,000 common shares of the Company on November 18, 2015; 25,000 shares of the Company on November 18, 2016 and 25,000 shares of the Company on November 30, 2017). |

| ☐ | Work Commitments: USD 100,000 per year for the first three years (incurred), USD 200,000 per year for the years four to six (incurred), USD 300,000 for the years seven to ten (incurred) and USD 300,000 for the years 11 – 20 (incurred). Excess expenditures in any year may be carried forward. If Corvus Nevada does not incur the required expenditures in year one, the deficiency is required to be paid to the lessors. |

| ☐ | Retained Royalty: Corvus Nevada will pay the lessors a NSR royalty of 2% if the average gold price is USD 400 per ounce or less, 3% if the average gold price is between USD 401 and USD 500 per ounce and 4% if the average gold price is greater than USD 500 per ounce. |

| (2) | Pursuant to a mining lease and option to purchase made effective March 1, 2011 between Corvus Nevada and an arm’s length individual, Corvus Nevada has leased, and has the option to purchase, two patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of ten years, subject to extension for an additional ten years (provided advance minimum royalties are timely paid), and for so long thereafter as mining activities continue on the claims. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties, but not applicable to the purchase price if the option to purchase is exercised) of USD 20,000 on execution (paid), USD 25,000 on each of March 1, 2012 (paid), 2013 (paid) and 2014 (paid), USD 30,000 on March 1, 2015 and each anniversary thereafter (paid to March 1, 2018), adjusted for inflation. The lessor is entitled to receive a 2% NSR royalty on all production. The lessee may purchase the royalty for USD 1,000,000 per 1%. If the lessee purchases the entire royalty (USD 2,000,000) the lessee will also acquire all interest of the lessor in the subject property. |

12

| (3) | Pursuant to a purchase agreement made effective March 28, 2013, Corvus Nevada agreed to purchase the surface rights of five patented mining claims owned by two arm’s length individuals for USD 160,000 paid on closing (March 28, 2013). The terms include payment by Corvus Nevada of a fee of USD 0.02 per ton of overburden to be stored on the property, subject to payment for a minimum of 12 million short tons. The minimum tonnage fee (USD 240,000) bears interest at 4.77% per annum from closing and is evidenced by a promissory note due on the sooner of the commencing of use of the property for waste materials storage or December 31, 2015 (balance paid December 17, 2015). As a result, the Company recorded $406,240 (USD 400,000) in acquisition costs with $157,408 paid in cash and the remaining $248,832 (USD 240,000) in promissory note payable during the year ended May 31, 2013. |

| (4) | In December 2013, SoN completed the purchase of a parcel of land approximately 30 kilometres north of the North Bullfrog project which carries with it 1,600 acre feet of irrigation water rights. The cost of the land and associated water rights was cash payment of $1,100,118 (USD 1,034,626). |

| (5) | On March 30, 2015, Lunar Landing, LLC signed a lease agreement with Corvus Nevada to lease private property containing the three patented Sunflower claims to Corvus Nevada, which are adjacent to the Yellow Rose claims leased in 2014. The term of the lease is three years with provision to extend the lease for an additional seven years, and an advance minimum royalty payment of USD 5,000 per year with USD 5,000 paid upon signing (paid to March 2018). The lease includes a 4% NSR royalty on production, with an option to purchase the royalty for USD 500,000 per 1% or USD 2,000,000 for the entire 4% royalty. The lease also includes the option to purchase the property for USD 300,000. |

| b) | Mother Lode Property, Nevada |

Pursuant to a purchase agreement made effective June 9, 2017 between Corvus Nevada and Goldcorp USA, Inc. (“Goldcorp USA”), Corvus Nevada has acquired 100% of the Mother Lode property (the “Mother Lode Property”). In addition, Corvus Nevada staked two additional adjacent claim blocks to the Mother Lode Property. In connection with the acquisition, the Company issued 1,000,000 common shares at a price of $0.81 per common share to Goldcorp USA. The Mother Lode Property is subject to an NSR in favour of Goldcorp USA. The NSR pays 1% from production at the Mother Lode Property when the price of gold is less than USD 1,400 per ounce and an additional 1% NSR for a total of 2% NSR when gold price is greater than or equal to USD 1,400 per ounce.

Acquisitions

The acquisition of title to mineral properties is a detailed and time-consuming process. The Company has taken steps, in accordance with industry norms, to verify title to mineral properties in which it has an interest. Although the Company has taken every reasonable precaution to ensure that legal title to its properties is properly recorded in the name of the Company (or, in the case of an option, in the name of the relevant optionor), there can be no assurance that such title will ultimately be secured.

Environmental Expenditures

The operations of the Company may in the future be affected from time to time in varying degrees by changes in environmental regulations, including those for future removal and site restoration costs. Both the likelihood of new regulations and their overall effect upon the Company vary greatly and are not predictable. The Company’s policy is to meet or, if possible, surpass standards set by relevant legislation by application of technically proven and economically feasible measures.

Environmental expenditures that relate to ongoing environmental and reclamation programs are charged against earnings as incurred or capitalized and amortized depending on their future economic benefits. Estimated future removal and site restoration costs, when the ultimate liability is reasonably determinable, are charged against earnings over the estimated remaining life of the related business operation, net of expected recoveries.

13

The Company has estimated the fair value of the liability for asset retirement that arose as a result of exploration activities to be $371,398 (USD 284,000) (May 31, 2018 - $366,641 (USD 283,000)). The fair value of the liability was determined to be equal to the estimated remediation costs. Due to the early stages of the project, and that extractive activities have not yet begun, the Company is unable to predict with any precision the timing of the cash flow related to the reclamation activities.

| 5. | SHARE CAPITAL |

Authorized

Unlimited common shares without par value.

Share issuances

During the period ended August 31, 2018:

| a) | On June 7, 2018, the Company closed a private placement equity financing and issued 1,730,770 common shares at a price of $2.60 per common share for gross proceeds of $4,500,002. The Company paid an additional $14,605 in share issuance costs. |

Stock options

Stock options awarded to employees and non-employees by the Company are measured and recognized in the Condensed Interim Consolidated Statement of Operations and Comprehensive Loss over the vesting period.

The Company has adopted an incentive stock option plan, first adopted in 2010 and then amended in 2013 (the “Amended 2010 Plan”). The essential elements of the Amended 2010 Plan provide that the aggregate number of common shares of the Company’s share capital that may be made issuable pursuant to options granted under the Amended 2010 Plan (together with any other shares which may be issued under other share compensation plans of the Company) may not exceed 10% of the number of issued common shares of the Company at the time of the granting of the options. Options granted under the Amended 2010 Plan will have a maximum term of ten years. The exercise price of options granted under the Amended 2010 Plan will not be less than the greater of the market price of the common shares (as defined by TSX, currently defined as the five day volume weighted average price for the 5 trading days immediately preceding the date of grant) or the closing market price of the Company’s common shares for the trading day immediately preceding the date of grant, or such other price as may be agreed to by the Company and accepted by the TSX. Options granted under the Amended 2010 Plan vest immediately, unless otherwise determined by the directors at the date of grant.

A summary of the status of the stock option plan as of August 31, 2018, and May 31, 2018, and changes during the periods are presented below:

| Three months ended August 31, 2018 | Year ended May 31, 2018 | |||||||||||||||

| Number of Options | Weighted Average Exercise Price | Number of Options | Weighted Average Exercise Price | |||||||||||||

| Balance, beginning of the period | 9,861,900 | $ | 0.85 | 8,846,900 | $ | 0.87 | ||||||||||

| Granted | - | - | 1,840,000 | 0.77 | ||||||||||||

| Exercised | - | - | (256,660 | ) | (0.66 | ) | ||||||||||

| Forfeited | - | - | (568,340 | ) | (0.93 | ) | ||||||||||

| Balance, end of the period | 9,861,900 | $ | 0.85 | 9,861,900 | $ | 0.85 | ||||||||||

The weighted average remaining contractual life of options outstanding at August 31, 2018 was 1.55 years (May 31, 2018 - 1.74 years).

14

Stock options outstanding are as follows:

| August 31, 2018 | May 31, 2018 | |||||||||||||||||||||||

| Expiry Date | Exercise Price | Number of Options | Exercisable at Period- End | Exercise Price | Number of Options | Exercisable at Year- End | ||||||||||||||||||

| September 19, 2017* | $ | 0.96 | 1,966,900 | 1,966,900 | $ | 0.96 | 1,966,900 | 1,966,900 | ||||||||||||||||

| August 16, 2018* | $ | 0.76 | 2,095,000 | 2,095,000 | $ | 0.76 | 2,095,000 | 2,095,000 | ||||||||||||||||

| September 8, 2019 | $ | 1.40 | 1,250,000 | 1,250,000 | $ | 1.40 | 1,250,000 | 1,250,000 | ||||||||||||||||

| September 9, 2020 | $ | 0.46 | 625,000 | 625,000 | $ | 0.46 | 625,000 | 625,000 | ||||||||||||||||

| November 13, 2020 | $ | 0.49 | 1,000,000 | 1,000,000 | $ | 0.49 | 1,000,000 | 1,000,000 | ||||||||||||||||

| September 15, 2021 | $ | 0.91 | 1,085,000 | 722,610 | $ | 0.91 | 1,085,000 | 722,610 | ||||||||||||||||

| July 31, 2022 | $ | 0.77 | 1,840,000 | 612,720 | $ | 0.77 | 1,840,000 | - | ||||||||||||||||

| 9,861,900 | 8,272,230 | 9,861,900 | 7,659,510 | |||||||||||||||||||||

*The Company’s share trading policy (the “Policy”) requires that all restricted persons and others who are subject to the Policy refrain from conducting any transactions involving the purchase or sale of the Company’s securities, during the period in any quarter commencing 30 days prior to the scheduled issuance of the next quarter or year-end public disclosure of the financial results as well as when there is material data on hand. In accordance with the terms of the Amended 2010 Plan, if stock options are set to expire during a restricted period and are not exercised prior to any such restriction, they will not expire but instead will be available for exercise for ten days after such restrictions are lifted.

The Company uses the fair value method for determining stock-based compensation for all options granted during the periods. The fair value of options granted was $nil (2017 - $951,067), determined using the Black-Scholes option pricing model based on the following weighted average assumptions:

| For the three months ended August 31, | 2018 | 2017 | ||||||

| Risk-free interest rate | N/A | 1.65 | % | |||||

| Expected life of options (in years) | N/A | 5 | ||||||

| Annualized volatility | N/A | 79.14 | % | |||||

| Dividend yield | N/A | 0 | % | |||||

| Exercise price | N/A | $ | 0.77 | |||||

| Fair value per share | N/A | $ | 0.52 | |||||

Annualized volatility was determined by reference to historic volatility of the Company.

Stock-based compensation has been allocated to the same expenses as cash compensation paid to the same employees or consultants, as follows:

| For the three months ended August 31, | 2018 | 2017 | ||||||

| Consulting fees | $ | 75,445 | $ | 69,957 | ||||

| Exploration expenditures - Geological/geophysical | 14,298 | 12,260 | ||||||

| Investor relations | 22,534 | 21,738 | ||||||

| Professional fees | 1,821 | 1,884 | ||||||

| Wages and benefits | 50,270 | 52,799 | ||||||

| $ | 164,368 | $ | 158,638 | |||||

15

| 6. | RELATED PARTY TRANSACTIONS |

The Company entered into the following transactions with related parties:

| For the three months ended August 31, | 2018 | 2017 | ||||||

| Consulting fees to CFO | $ | 22,500 | $ | 20,000 | ||||

| Wages and benefits to CEO and COO | 180,125 | 146,890 | ||||||

| Directors fees (included in consulting fees) | 33,750 | 36,750 | ||||||

| Stock-based compensation to related parties | 117,649 | 123,150 | ||||||

| $ | 354,024 | $ | 326,790 | |||||

As at August 31, 2018, included in accounts payable and accrued liabilities was $8,747 (May 31, 2018 - $15,537) in expenses owing to companies related to officers and officers of the Company.

These amounts were unsecured, non-interest bearing and had no fixed terms or terms of repayment. Accordingly, fair value could not be readily determined.

The Company has also entered into change of control agreements with officers of the Company. In the case of termination, the officers are entitled to an amount equal to a multiple (ranging from two times to three times) of the sum of the annual base salary or fees then payable to the officer, the aggregate amount of bonus(es) (if any) paid to the officer within the calendar year immediately preceding the Effective Date of Termination, and an amount equal to the vacation pay which would otherwise be payable for the one year period next following the Effective Date of Termination.

| 7. | GEOGRAPHIC SEGMENTED INFORMATION |

The Company operates in one industry segment, the mineral resources industry, and in two geographical segments, Canada and the United States. All current exploration activities are conducted in the United States. The significant asset categories identifiable with these geographical areas are as follows:

| Canada | United States | Total | ||||||||||

| August 31, 2018 | ||||||||||||

| Capitalized acquisition costs | $ | - | $ | 5,283,809 | $ | 5,283,809 | ||||||

| Property and equipment | $ | 10,360 | $ | 42,838 | $ | 53,198 | ||||||

| May 31, 2018 | ||||||||||||

| Capitalized acquisition costs | $ | - | $ | 5,238,789 | $ | 5,238,789 | ||||||

| Property and equipment | $ | 11,200 | $ | 45,290 | $ | 56,490 | ||||||

| For the period ended August 31, | 2018 | 2017 | ||||||

| Net loss for the period - Canada | $ | (527,747 | ) | $ | (633,776 | ) | ||

| Net loss for the period - United States | (1,914,701 | ) | (992,389 | ) | ||||

| Net loss for the period | $ | (2,442,448 | ) | $ | (1,626,165 | ) | ||

16

| 8. | SUBSIDIARIES |

Significant subsidiaries for the three months ended August 31, 2018 and 2017 are:

| Country of Incorporation | Principal Activity | The Company’s effective interest for 2018 | The Company’s effective interest for 2017 | |||||||||||

| Corvus Gold (USA) Inc. | USA | Holding company | 100 | % | 100 | % | ||||||||

| Raven Gold Alaska Inc. | USA | Exploration company | 100 | % | 100 | % | ||||||||

| Corvus Gold Nevada Inc. | USA | Exploration company | 100 | % | 100 | % | ||||||||

| SoN Land & Water LLC | USA | Exploration company | 100 | % | 100 | % | ||||||||

| Mother Lode Mining Company LLC | USA | Exploration company | 100 | % | 100 | % | ||||||||

| 9. | SUPPLEMENTAL CASH FLOW INFORMATION |

| For the three months ended August 31, | 2018 | 2017 | ||||||

| Supplemental cash flow information | ||||||||

| Interest paid | $ | - | $ | - | ||||

| Income taxes paid (received) | $ | - | $ | - | ||||

| Non-cash financing and investing transactions | ||||||||

| Shares issued to acquire mineral properties | $ | - | $ | 810,000 | ||||

| Reclassification of contributed surplus on exercise of stock options | $ | - | $ | 103,028 | ||||

17

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our condensed interim consolidated financial statements for the three months ended August 31, 2018, and the related notes thereto, which have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). This discussion and analysis contains forward-looking statements and forward-looking information that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements and information as a result of many factors. See section heading “Note Regarding Forward-Looking Statements” below. All currency amounts are stated in Canadian dollars unless noted otherwise.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES AND PROVEN AND PROBABLE RESERVES

Corvus Gold Inc. (“we”, “us”, “our,” “Corvus” or the “Company”) is a mineral exploration company engaged in the acquisition and exploration of mineral properties. The mineral estimates in the Technical Report (as defined below) referenced in this Quarterly Report on Form 10-Q have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. As used in the Technical Report referenced in this Quarterly Report on Form 10-Q, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ materially from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this report and the Technical Report referenced in this report contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTIONARY NOTE TO ALL INVESTORS CONCERNING ECONOMIC ASSESSMENTS THAT INCLUDE INFERRED RESOURCES AND HISTORICAL ESTIMATES

The Company currently holds or has the right to acquire interests in an advanced stage exploration project in Nye County, Nevada referred to as the North Bullfrog Project (the “NBP”) and interests in the Mother Lode Property (“MLP” or “Mother Lode”). Mineral resources that are not mineral reserves have no demonstrated economic viability. The preliminary economic assessment included in the Technical Report on the NBP is preliminary in nature and includes “inferred Mineral Resources” that have a great amount of uncertainty as to their existence, and are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies. There is no certainty that such inferred Mineral Resources at the NBP will ever be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Readers should refer to the Technical Report for additional information.

18

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and the exhibits attached hereto contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended, and “forward-looking information” within the meaning of applicable Canadian securities legislation, collectively “forward-looking statements”. Such forward-looking statements concern our anticipated results and developments in the operations of the Company in future periods, planned exploration activities, the adequacy of the Company’s financial resources and other events or conditions that may occur in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible” and similar expressions, or statements that events, conditions or results “will,” “may,” “could” or “should” (or the negative and grammatical variations of any of these terms) occur or be achieved. These forward-looking statements may include, but are not limited to, statements concerning:

| · | the Company’s strategies and objectives, both generally and in respect of its specific mineral properties; |

| · | the timing of decisions regarding the timing and costs of exploration programs with respect to, and the issuance of the necessary permits and authorizations required for, the Company’s exploration programs, including for the NBP and the MLP; |

| · | the Company’s estimates of the quality and quantity of the Mineral Resources at its mineral properties; |

| · | the timing and cost of planned exploration programs of the Company, and the timing of the receipt of results therefrom; |

| · | the Company’s future cash requirements and use of proceeds of sales; |

| · | general business and economic conditions; |

| · | the Company’s ability to meet its financial obligations as they come due, and the ability to raise the necessary funds to continue operations; |

| · | the Company’s expectation that it will be able to add additional mineral projects of merit to its assets; |

| · | the potential for the existence or location of additional high-grade veins at the NBP, or high-grade mineralization at the MLP; |

| · | the potential to expand Company’s existing deposits and discover new deposits; |

| · | the potential for any delineation of higher grade mineralization at the NBP or MLP; |

| · | the potential for there to be one or more additional vein zones; |

| · | the potential discovery and delineation of mineral deposits/resources/reserves and any expansion thereof beyond the current estimate; |

| · | the potential for the NBP or the MLP mineralization systems to continue to grow and/or to develop into a major new higher-grade, bulk tonnage, Nevada gold discovery; |

| · | the Company’s expectation that it will be able to build itself into a non-operator gold producer with significant carried interests and royalty exposure; |

| · | that the Company will operate at a loss; |

| · | that the Company will need to scale back anticipated costs and activities or raise additional funds; |

| · | that the Company will have to raise substantial additional capital to accomplish its business plan over the next couple of years; |

| · | the historic estimates of the MLP as an indication of the presence of mineralization; |

| · | the estimated reclamation and asset retirement costs; |

| · | the plans related to the development of the MLP and the NBP; and |

| · | the MLP work plan and mine development plan/program. |

Such forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, risks related to:

| · | our requirement of significant additional capital; |

| · | our limited operating history; |

| · | our history of losses; |

| · | cost increases for our exploration and, if warranted, development projects; |

| · | our properties being in the exploration stage; |

| · | mineral exploration and production activities; |

| · | our lack of mineral production from our properties; |

| · | estimates of Mineral Resources; |

| · | changes in mineral resource estimates; |

| · | differences in United States and Canadian mineral reserve and mineral resource reporting; |

| · | our exploration activities being unsuccessful; |

19

| · | fluctuations in gold, silver and other metal prices; |

| · | our ability to obtain permits and licenses for production; |

| · | government and environmental regulations that may increase our costs of doing business or restrict our operations; |

| · | proposed legislation that may significantly affect the mining industry; |

| · | land reclamation requirements; |

| · | competition in the mining industry; |

| · | equipment and supply shortages; |

| · | tax issues; |

| · | current and future joint ventures and partnerships; |

| · | our ability to attract qualified management; |

| · | the ability to enforce judgment against certain of our Directors; |

| · | currency fluctuations; |

| · | claims on the title to our properties; |

| · | surface access on our properties; |

| · | potential future litigation; |

| · | our lack of insurance covering all our operations; |

| · | our status as a “passive foreign investment company” under US federal tax code; and |

| · | the common shares. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including without limitation those discussed in Part I, Item 1A, Risk Factors, of our Annual Report on Form 10-K, as filed with the SEC on August 27, 2018, which are incorporated herein by reference, as well as other factors described elsewhere in this report and the Company’s other reports filed with the SEC.

The Company’s forward-looking statements contained in this Quarterly Report on Form 10-Q are based on the beliefs, expectations and opinions of management as of the date of this report. The Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements.

Current Business Activities

General

The Company’s material mineral property is the NBP, an advanced exploration stage project in Nevada which has a number of high-priority, bulk tonnage and high-grade vein targets (held through Corvus Nevada, a Nevada subsidiary). In addition to the NBP, the Company has acquired the MLP which is located approximately 12 miles to the south east of the NBP. The MLP was mined in the late 1980s and has substantial gold mineralization remaining unexploited extending to the north of the existing open pit mine.

The primary focus of the Company will be to leverage its exploration expertise to expand its existing deposits and discover major new gold deposits. Other than with respect to the ongoing exploration of the NBP, the Company’s strategy is to leverage its other non-core assets by maintaining a retained royalty.

Highlights of activities during the period and to the date of this MD&A include:

| · | Phase II of the MLP drill program, completed in late July 2018, produced 43 additional holes for 13,386 metres (“m”) of RC drilling. |

| · | A maiden Mineral Resource* estimation was completed for the MLP using the Corvus Phase I and II drilling data plus qualified historical drilling data, and released on September 18, 2018 (see NR18-15). Highlights of the MLP Mineral Resource estimation are as follows: |

| o | total of 1.16Mozs of gold in the Measured and Indicated category with 0.24Mozs gold in the Inferred category. 83% of resource is Measured and Indicated (“M&I”); |

| o | total M&I .Mill Mineral Resource of 733,000 ounces of gold at an average grade of 1.72 g/t gold in 13.2Mt and an Inferred Resource of 112,000 ounces of gold at an average grade of 1.6 g/t gold in 2.17Mt; |

20

| o | total M&I , oxide, Run of Mine, Heap Leach Mineral Resource of 427,000 ounces gold at avg. grade of 0.33 g/t gold in 40Mt & Inferred Mineral Resource of 129,000 ounces gold at avg. grade of 0.29 g/t gold in 14.1Mt; and |

| o | pit constrained deposit has an overall strip ratio of 2.68-1. |

| · | Phase III of the MLP drill program began on July 24, 2018, with a total of eight RC holes drilled for 3,043 m by the end of September; |

| · | Environmental Assessment and Plan of Operations documents were submitted to the Bureau of Land Management (“BLM”) for the expanded exploration of the MLP. |

| · | BLM issued a Notice of Intent for exploration drilling at the Willy’s and Sawtooth targets. |

| · | Baseline characterization activities at NBP continued with the water quality sampling of monitor wells and springs, and meteorological monitoring reports, which are submitted to the Nevada Department of Environmental Protection quarterly. |

| · | The water rights at Sarcobatus were changed to a temporary mining use category by the Nevada Division of Water Resources. The point of extraction of 80 acre-feet of this water was transferred to the NBP to support future exploration activities. |

| · | The Sarcobatus water rights were renewed for the 2018-2019 period. |

* - See Cautionary Note Regarding to U.S. Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves above.

Corporate Financial Activities

The Company announced the completion of a $4,500,002 non-brokered private placement on June 7, 2018, where the Company issued 1,730,770 common shares at a price of $2.60 per share to a key strategic shareholder. No warrants were issued. The Company expects that the proceeds of the financing will fully fund the Company’s planned 2019 exploration program at its MLP.

Nevada Properties

North Bullfrog Project

Our principal mineral property is the NBP, a gold exploration project located in northwestern Nye County, Nevada, in the Northern Bullfrog Hills about 10 kilometres (“km”) north of the town of Beatty. The NBP does not have any known proven or probable reserves under SEC Industry Guide 7 and the project is exploratory in nature. The Technical Report is available under Corvus’ SEDAR profile at www.sedar.com and EDGAR profile at www.sec.gov. The Technical Report is referred to herein for informational purposes only and is not incorporated herein by reference. The Technical Report contains disclosure regarding Mineral Resources that are not SEC Industry Guide 7 compliant proven or probable reserves. See “Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above.

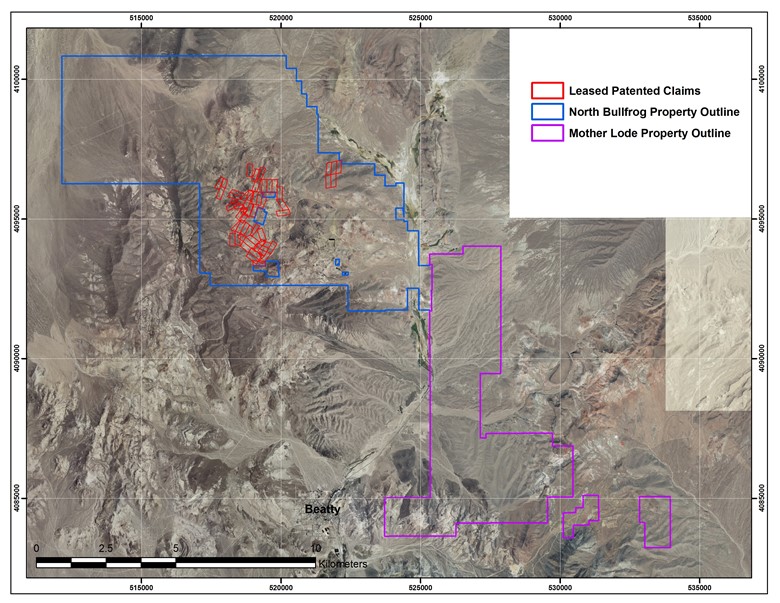

The NBP is located in the Bullfrog Hills of northwestern Nye County, Nevada (Figure 1). The NBP covers about 7,223 hectares of patented and unpatented mining claims in Sections 20, 21, 25, 26, 27, 28, 29, 32, 33, 34, 35, and 36 of T10S, R46E; sections 1, 2, 11, 12, 13, and 14 of T11S, R46E; section 31 of T10S, R47E; and sections 6, 9, 15, 16, and 17 T11S, R47E, MDBM. We have a total of nine option/lease agreements in place that give us control of an aggregate of 51 patented lode mining claims (Figure 2). Corvus Nevada owns an additional five patented claims (the Millman claims) and a 430 acre property with 1600 acre-feet of water rights located north of NBP in the Sacrobatus hydrographic basin (Basin 146).

21

Figure 1. Property Map showing the Location of the NBP and the MLP with respect to the town of Beatty, NV.

Studies at NBP have been focused on the integration of NBP and the newly acquired MLP into a single mining operation. An updated Technical Report is planned for release in late October, 2018.

NBP Project Development Activities

Monitoring programs to develop baseline characterization data for support of future permitting activities continued during the period. Water quality monitoring wells and surface springs were sampled in July 2018.

The Company operated a meteorological monitoring station at NBP and submitted its latest quarterly report to NBP in July 2018.

The Sarcobatus water rights have been renewed for the 2018-2019 period. A temporary change of use to mining was granted by the Nevada Division of Water Resources. The extraction point of 80 acre-feet of the water was transferred to the NBP to support future exploration operations.

Mother Lode Property, Nevada

On June 9, 2017, the Company acquired the MLP (Figure 1), which is located approximately six kilometres east of Beatty, Nevada, in Nye County. The MLP is in the Bare Mountain District, and was previously mined by Gold Search Inc. The Company acquired the 13 Federal mining claims comprising the MLP from Goldcorp USA. The Company staked an additional 105 claims (the MN claim group) to the northwest of the MLP claims and an additional 22 claims (the ME claim group) to the east of the MLP claims. The MN claim group was expanded again by an additional 54 claims during the third quarter 2017-2018, as surface exploration work revealed potential for mineralized targets similar to previously defined systems immediately to the south. An additional 255 MN claims were added in Q1 2018-2019 extending the MLP north to connect with the southeast end of NBP.

The MLP is located in the northern Bare Mountain area of northwestern Nye County, Nevada. Figure 1 shows the MLP land position defined by unpatented lode mining claims in purple. The location of the property is indicated by the coordinate grid on the map which is in the UTM metres, NAD27, Zone 11 coordinate system. The MLP consists of approximately 3,590 hectares (8,872 acres) of unpatented lode mining claims located in Sections 10, 11, 14, 15, 22, 23, 26, 27, 34, 35 and 36 of T11S, R47E; Sections 1, 2, 3, 9, 10, 11, 12, and 13 of T12S, R47E; and Sections 6, 7, 8, 9, 16, 17 and 18 of T12S, R48E, Mount Diablo Base and Meridian. Corvus owns, through its wholly-owned subsidiary, Mother Lode Mining Company LLC, the historic MLP which consisted of 13 unpatented lode mining claims. The MN and ME claim groups were staked by Corvus in 2017 and 2018 and are also 100% owned by Corvus.

22

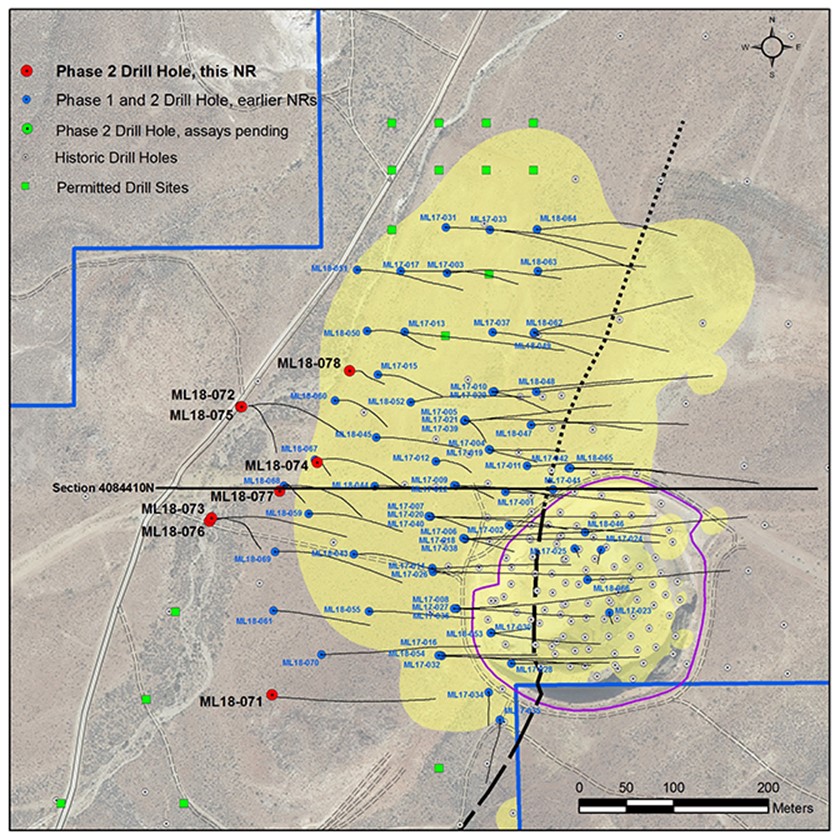

The Company began its Phase I MLP drill program which utilized up to three drill rigs (two reverse circulation and one core), in September 2017. The initial program completed 13,000 metres of drilling and focused on confirming the existing 172-hole database consisting of drilling results developed by previous exploration companies and mine operators at the MLP site. The initial program addressed resource expansion and exploration targets in four main zones of historic mineralization. Phase II of the MLP drilling program began in early January 2018 with a single RC drilling rig completing an additional 43 holes for 13,386 metres. Phase III drilling began in late July 2018, with an additional eight holes completed for 3,044 metres to date.

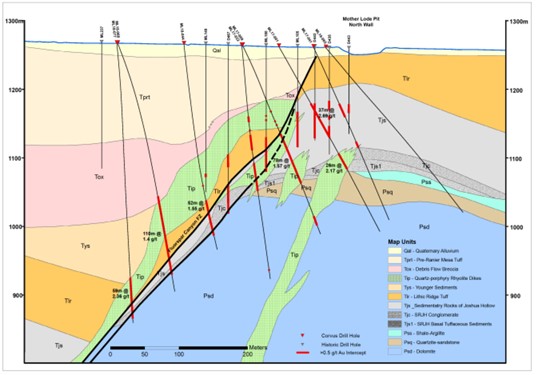

The Phase I and II drilling was used to verify and supplement the historic drill data and have been used as the basis for a maiden Mineral Resource estimation that was announced on September 18, 2018 (NR18-15). Preliminary results for 52 holes have been released between October 11, 2017 and April 5, 2018, consisting of intervals in each hole with significant gold mineralization. Results for holes ML17-001 to -015 were reported in NR17-13 (October 11, 2017), NR17-15 (October 25, 2017), NR17-17 (November 7, 2017) and NR17-19 (December 12, 2017). Refer to news releases NR18-1 (January 10, 2018), NR18-2 (January 18, 2018), NR18-3 (February 1, 2018), NR18-5 (February 22, 2018), NR18-6 (March 1, 2018), NR18-7 (March 22, 2018), NR18-8 (April 5, 2018), NR18-9 (April 25, 2018), NR18-10 (May 24, 2018), NR18-12 (June 13, 2018), NR18-13 (July 12, 2018), and NR18-14 (September 5, 2018) for information on assay results, data verification, drilling parameters and locations of the drill holes. Figure 2 shows the location of holes ML17-001 to -078 used in the Mineral Resource estimation, with respect to the MLP open pit and the MLP claim boundaries. Figure 3 illustrates the deposit geology on the E-W cross section along 4084410 N.

The Mineral Resource estimation is based on 267 drill holes with 8,296 gold composites. Geologic volumes were defined by geologic interpretations and used to define the estimation. Seventy-five of the holes were drilled by Corvus in the Phases I and II drill program, and 192 of the holes were historical data developed between 1988 – 1996 by earlier exploration and mining operations at the MLP and Daisy Projects.

The Mineral Resource was characterized by a high-grade core surrounded by lower grade mineralization. The high-grade core was estimated using Inverse Distance Squared. The surrounding mineralized portion of the deposit was estimated with Ordinary Kriging. To estimate the reasonable prospects of eventual economic extraction, Resource Development Associates Inc. confined the resources to mining volumes defined by Whittle TM analysis. The Mineral Resource is summarized in Table 1 according to sulfide processing and heap leach oxide processing, and is also listed by the classification of Measured, Indicated and Inferred mineralization. Economic parameters used in the WhittleTM analysis are listed in Table 2. There are no known legal, political or environmental risks that could materially affect the potential development of the Mineral Resources.

Table 1

Mother Lode, Measured, Indicated, and Inferred Mineral Resource Estimations constrained by Whittle TM pit at a gold price of USD $1,250 per ounce

| Resource Category | Mill-Sulfide @ 0.63 g/t COG |

ROM Heap Leach @ 0.06 g/t COG |

Total | ||||||

| Kt | Au g/t | Kozs | Kt | Au g/t | Kozs | Kt | Au g/t | Kozs | |

| Measured | 3,292 | 1.41 | 149 | 20,035 | 0.29 | 185 | 23,327 | 0.45 | 334 |

| Indicated | 9,934 | 1.83 | 583 | 20,123 | 0.37 | 242 | 30,057 | 0.85 | 825 |

| Total M & I | 13,226 | 1.72 | 733 | 40,158 | 0.33 | 427 | 53,383 | 0.68 | 1,159 |

| Inferred | 2,168 | 1.60 | 112 | 14,073 | 0.29 | 129 | 16,241 | 0.46 | 241 |

| · | The Mineral Resources are not SEC Industry Guide 7 compliant proven and probable reserves See “Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above |

| · | The Mineral Resources above are effective as of September 18, 2018 |

| · | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability |

| · | Silver resources have not been included in the maiden Mother Lode Mineral Resource Estimate |

| · | There are no known legal, political, environmental, or other risks that could materially affect the potential development of the Mineral Resources |

23

Figure 2. Map with inset showing the MLP claim boundary (blue) and the locations of Corvus boreholes used in the Mother Lode Mineral Resource Estimate.

24

Figure 3. Geologic cross section through the Mother Lode deposit along 4084410 N in Figure 2.

Table 2

WhittleTM Input Parameters used for the MLP Mineral Resource Estimation (USD)

| Parameter | Unit | MLP-Mill | MLP-Heap Leach |

| Mining Cost | total tonne | $1.40 | $1.40 |

| Au Cut-Off | g/t | 0.63 | 0.06 |

| Processing Cost | process tonne | $19.50 | $1.20 |

| Au Recovery | % | 80.0 | 74.0 |

| Ag Recovery | % | 0.0 | 0.0 |

| Admin Cost | process tonne | $0.50 | $0.50 |

| Refining & Sales | $/Au oz | $5.00 | $5.00 |

| Au Selling Price | oz | $1,250 | $1,250 |

| Slope Angle | Degrees | 60 | 60 |

| · | Assumes heap leach processing of disseminated oxidized mineralization |

| · | Assumes Pressure Oxidation mill processing of MLP sulfide mineralization |

| · | Au Cut-Off - break-even grade derived from Whittle input parameters at USD $1,250 per ounce gold price |

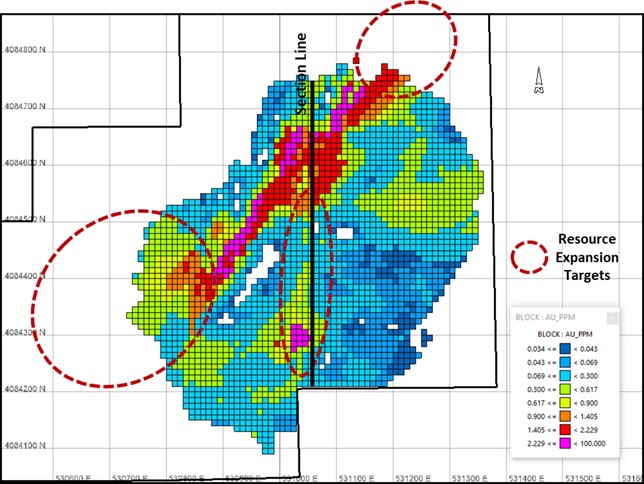

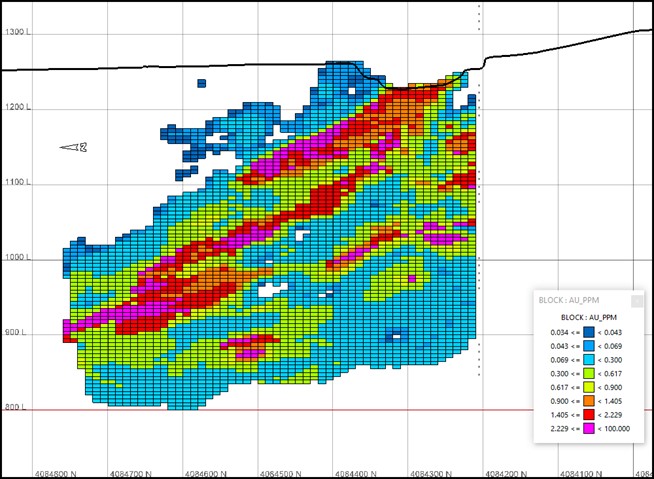

The Mineral Resource block model is shown in Figures 4 and 5, which display a plan view and long section view with the range of gold grade shown as color labeling of the individual blocks. Sensitivity of the resource to gold price is illustrated in Table 3, which shows the robustness of the resource at lower gold price. The Table 3 estimate of mineralization at USD $1,000 gold still captures a measured and indicates resource of over one million ounces.

25

Figure 4. Plan View of Mother Lode resource block model at 970 m elevation (UTm NAD27 Z11)

Figure 5. Long-section through Mother Lode resource block model at 531,055 m east, looking east (UTm NAD27 Z11)

A metallurgical testing program is underway to define the processing alternatives for exploitation of the Mother Lode deposit. This testing is focused on developing a flotation concentrate from the mill-sulfide mineralization and evaluating pressure oxidation, roasting, ambient atmospheric oxidation and bio-oxidation of the resulting concentrate. CN extraction of the gold from the oxidized concentrate is will be used to establish the gold recovery. Testing of the oxide components of the Mineral Resource mineralization are underway, in parallel with the sulfide testing, with CN bottle rolls and CN shake leach tests to establish gold recovery.

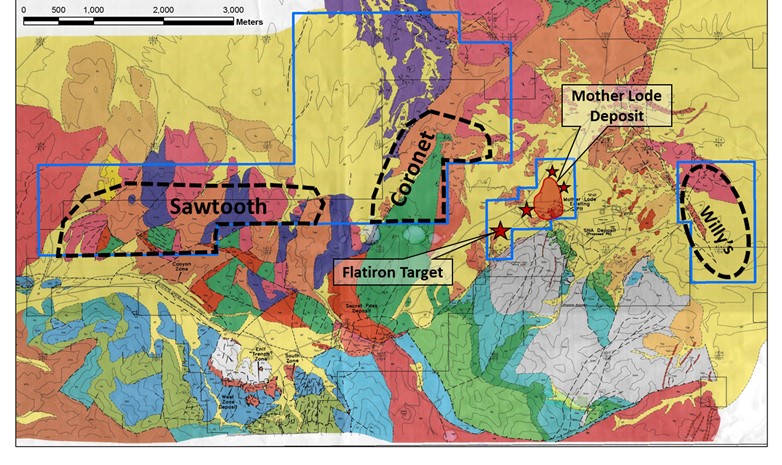

Surface exploration at MLP has identified new targets along the Daisy, Secret Pass and Sterling trends, which have motivated the Company to expand its claim packages to the northwest and southeast of the MLP claims. Targets in these extensions areas are named Sawtooth, Coronet and Willy’s, and the locations are indicated with respect to the MLP claims by the map in Figure 6. Corvus has received permits from BLM for notice level exploration drilling at the Willy’s and the Sawtooth targets. Environmental Assessment and Plan of Operations documents were submitted to BLM to permit expanded exploration of the MLP.

26

Table 3