Attached files

| file | filename |

|---|---|

| EX-99.1 - KNIGHT-SWIFT HOLDINGS INC ANNOUNCES FINANCIAL RESULTS FOR FOURTH QUARTER 2017 - Knight-Swift Transportation Holdings Inc. | knx-exhibit99112312017.htm |

| 8-K - KNX-12.31.2017 8-K - Knight-Swift Transportation Holdings Inc. | knx123120178-k.htm |

4Q 2017 Earnings Call Presentation

Exhibit 99??

Disclosure

This presentation, including documents incorporated herein by reference, will contain forward-

looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended

and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements

are subject to risks and uncertainties that could cause actual results to differ materially from those

contemplated by the forward-looking statements. Please review our disclosures in filings with the

Securities Exchange Commission.

Non-GAAP Financial Data

This presentation includes the use of adjusted operating income, operating ratio, adjusted operating

ratio, adjusted net income, and adjusted earnings per share, which are financial measures that are

not in accordance with generally accepted accounting principles (“GAAP”). Each such measure is a

supplemental non-GAAP financial measure that is used by management and external users of our

financial statements, such as industry analysts, investors and lenders. While management believes

such measures are useful for investors, they should not be used as a replacement for financial

measures that are in accordance with GAAP. In addition, our use of these non-GAAP measures

should not be interpreted as indicating that these or similar items could not occur in future

periods. In addition, adjusted operating ratio excludes trucking segment fuel surcharges from

revenue and nets these surcharges against fuel expense.

2

Disclosure

On September 8, 2017, pursuant to the Agreement and Plan of Merger, dated as of April 9, 2017, by

Swift Transportation Company (“Swift”), Bishop Merger Sub, Inc., a direct wholly owned subsidiary

of Swift, (“Merger Sub”), and Knight Transportation, Inc. (“Knight”), Merger Sub merged with and

into Knight, with Knight surviving as a direct wholly owned subsidiary of Swift (the “2017 Merger”).

Knight was the accounting acquirer and Swift was the legal acquirer in the 2017 Merger. In

accordance with the accounting treatment applicable to the 2017 Merger, throughout this

presentation, the reported results do not include the results of operations of Swift and its

subsidiaries on and prior to the 2017 Merger date of September 8, 2017 (the “2017 Merger Date”).

However, where indicated, certain historical information of Swift and its subsidiaries on and prior to

the 2017 Merger Date, including their results of operations and certain operational statistics

(collectively, the “Swift Historical Information”), has been provided. Management believes that

presentation of the Swift Historical Information will be useful to investors. The Swift Historical

Information has not been prepared in accordance with the rules of the Securities and Exchange

Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro

forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical

Information does not purport to indicate the results that would have been obtained had the Swift

and Knight businesses been operated together during the periods presented, or which may be

realized in the future.

3

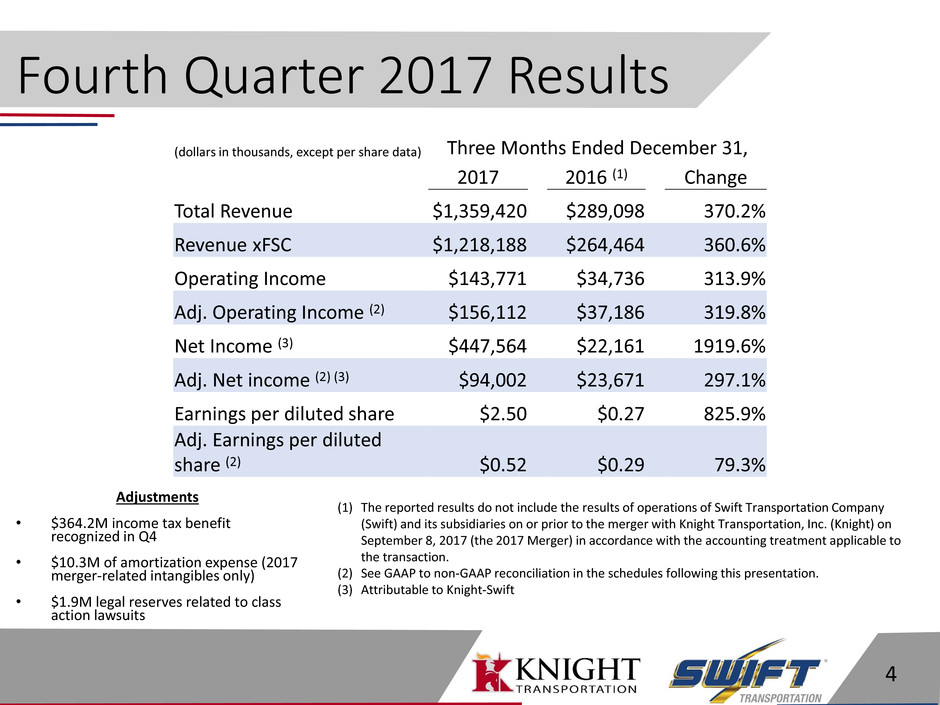

Adjustments

• $364.2M income tax benefit

recognized in Q4

• $10.3M of amortization expense (2017

merger-related intangibles only)

• $1.9M legal reserves related to class

action lawsuits

Fourth Quarter 2017 Results

(1) The reported results do not include the results of operations of Swift Transportation Company

(Swift) and its subsidiaries on or prior to the merger with Knight Transportation, Inc. (Knight) on

September 8, 2017 (the 2017 Merger) in accordance with the accounting treatment applicable to

the transaction.

(2) See GAAP to non-GAAP reconciliation in the schedules following this presentation.

(3) Attributable to Knight-Swift

4

(dollars in thousands, except per share data) Three Months Ended December 31,

2017 2016 (1) Change

Total Revenue $1,359,420 $289,098 370.2%

Revenue xFSC $1,218,188 $264,464 360.6%

Operating Income $143,771 $34,736 313.9%

Adj. Operating Income (2) $156,112 $37,186 319.8%

Net Income (3) $447,564 $22,161 1919.6%

Adj. Net income (2) (3) $94,002 $23,671 297.1%

Earnings per diluted share $2.50 $0.27 825.9%

Adj. Earnings per diluted

share (2) $0.52 $0.29 79.3%

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

4Q15 4Q16 4Q17

M

ill

io

n

s

4th Qtr Rev xFSC

Knight Swift Pre-Merger Swift Post-Merger

Fourth Quarter 2017 Results

5

(1) The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange

Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that

would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the results that

would have been obtained had the Swift and Knight businesses been operated together during the periods presented, or which

may be realized in the future.

(2) See GAAP to non-GAAP reconciliation in the schedules following this release

(1)

$-

$25

$50

$75

$100

$125

$150

$175

$200

4Q15 4Q16 4Q17

M

ill

io

n

s

4th Qtr Adj. Operating Income

Knight Swift Pre-Merger Swift Post-Merger

(2)

(1)

+33%

Strong Balance Sheet

• Accelerated capex in the fourth quarter to maximize tax benefits

• Net debt of $894.9 million

• Shareholder equity of $5.2 billion

• $76.6 million of unrestricted cash and cash equivalents

• Change in composition of capex funding as we move away from

leasing equipment. Estimated net capex of $525-$575 million in

2018

• Strong leverage position should allow for greater operational and

strategic flexibility

6

Trucking

• Average revenue per tractor

increased 12.2%

• Miles per truck decreased 1.6%

Logistics

• Brokerage revenue increased 8.8%

• Brokerage gross margin remained

flat at 16%

Operating Performance – Knight

(1) See GAAP to non-GAAP reconciliation in the schedules following this presentation.

7

Adjusted Operating Ratio (1)

4Q17 4Q16 Change

Trucking 81.6% 83.7% -210 bps

Logistics 94.0% 93.3% 70 bps

Consolidated 84.5% 85.9% -140 bps

Revenue, xFSC

(dollars in thousands)

4Q17 4Q16 Change

Trucking $215,434 $202,747 6.3%

Logistics $65,899 $61,717 6.8%

Consolidated $281,333 $264,464 6.4%

• Seeing OR improvements in

each segment

• Improving freight market and

expense reduction

• Continued challenge with a

difficult driver market

Operating Performance - Swift

(1) See GAAP to non-GAAP reconciliation in the schedules following this presentation.

8

Adjusted Operating Ratio (1)

4Q17

Truckload 84.6%

Dedicated 86.5%

Refrigerated 92.9%

Intermodal 95.0%

Consolidated 88.0%

Revenue, excluding trucking fsc

(dollars in thousands)

4Q17

Truckload $434,688

Dedicated $144,642

Refrigerated $186,595

Intermodal $91,861

Consolidated $936,856

Market Update

9

• Improved GDP growth

• Tax Cuts and Jobs Act

• Driver shortage

• ELD mandate

• We expect contract rates will increase high single-digits to

low double-digits throughout the year

Execution Strategy

• Maintaining Knight and Swift distinct brands

• Excel at safety and service

• Excel at sourcing and developing qualified driving associates

• Leverage capabilities of both brands to provide capacity to

our markets

• Improve yield by actively managing our markets

• Achieve synergy goals

• Grow profitably in our Logistics business

10

Synergies

• Realized savings from

synergies are ahead of

schedule

• Cross-functional teams

include leaders from both

companies

• Excitement and cooperation

displayed

• We still expect synergies of

$150M by 2019

11

Appendix

12

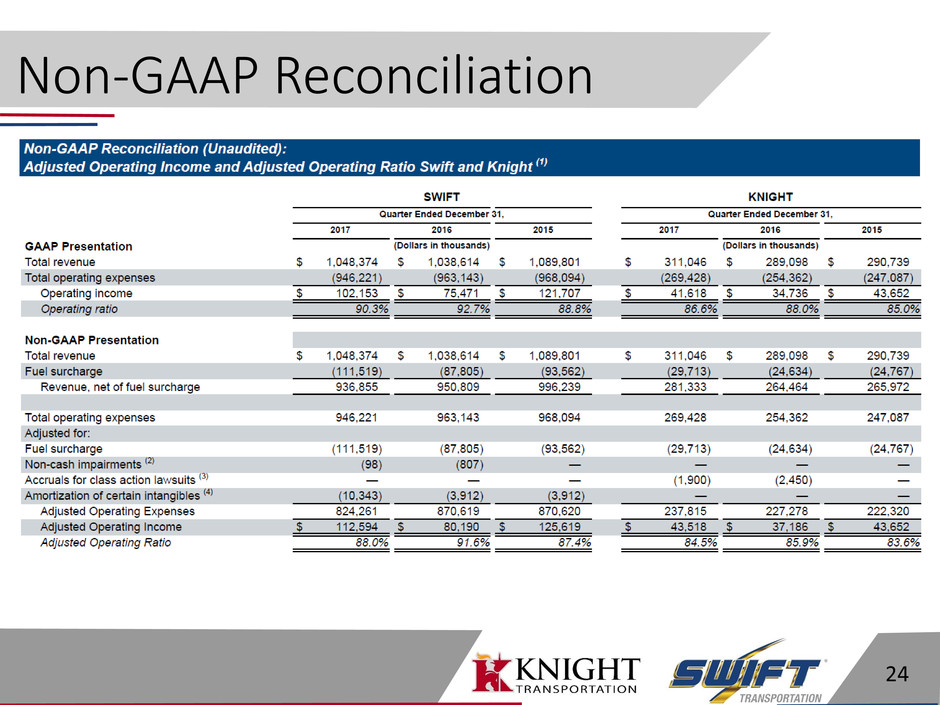

Non-GAAP Reconciliation

13

Non-GAAP Reconciliation

14

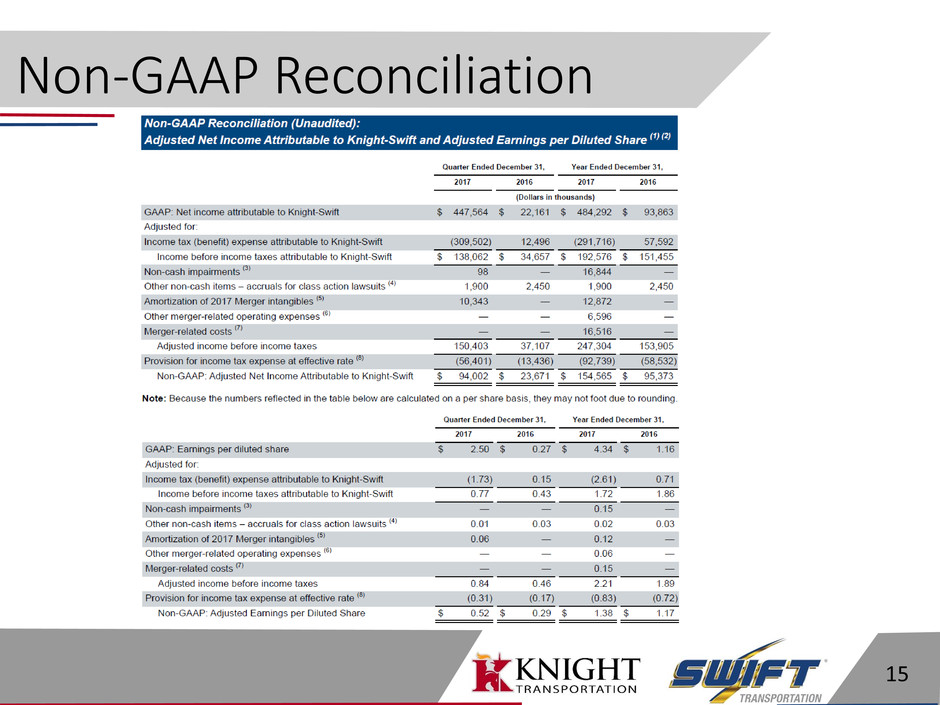

Non-GAAP Reconciliation

15

Non-GAAP Reconciliation

16

Non-GAAP Reconciliation

17

Non-GAAP Reconciliation

18

Non-GAAP Reconciliation

19

Non-GAAP Reconciliation

20

Non-GAAP Reconciliation

21

Non-GAAP Reconciliation

22

Non-GAAP Reconciliation

23

Non-GAAP Reconciliation

24

Non-GAAP Reconciliation

25