Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANDEAVOR LOGISTICS LP | andx8-kxubsmlpconference.htm |

UBS Midstream and MLP Conference

January 9, 2018

Creating Superior Value

Go for Extraordinary

EXHIBIT 99.1

Andeavor Logistics

Forward Looking Statements

1

This presentation (and oral statements made regarding the subjects of this presentation) includes forward-looking statements within the meaning of the

federal securities laws. All statements, other than statements of historical fact, are forward-looking statements, including without limitation statements

concerning: our operational, financial and growth strategies, including significant business improvements, sustainable earnings growth, stable, fee-based

business focus, existing asset base optimization, pursuit of organic expansion opportunities, strategic acquisitions, growth capital projects, and future

dropdowns; our ability to successfully effect those strategies and the expected timing and results thereof; our financial and operational outlook, including

targets for EBITDA and capital expenditures, and ability to fulfill that outlook; financial position, liquidity and capital resources; expectations regarding future

economic and market conditions and their effects on us; our 2020 journey plan and targets, including targets for EBITDA and the components thereof,

investments in organic projects, acquisitions and dropdowns, dropdown portfolio and estimated EBITDA contribution from each project, third party revenue

targets, and the expected timing and benefits thereof; plans, goals and targets for growth and execution associated with our Permian, Delaware basin,

Bakken and Rockies gas gathering and processing assets; statements regarding the Conan Crude Oil Gathering Pipeline system and other major projects,

including the expected capacity, timing, capital investment, net earnings and EBITDA contribution and other benefits associated with each project; the

planned transfer of the Conan System and the Los Angeles Pipeline Interconnect System to Andeavor Logistics; the benefits to our business and growth

prospects of our strategic relationship with Andeavor, and Andeavor’s expected EBITDA contributions to us; our financial strategy, including targets for

EBITDA, coverage and leverage ratios, liquidity, growth and maintenance capital, and third party equity; statements regarding our restructuring and

investment grade status, including our ability to maintain investment grade status, and the expected savings and benefits therefrom; our 2018-2020

capitalization and funding plan, including the allocation, sources, uses and expected benefits thereof; our continued focus on unitholder value, and the main

drivers thereof; and other aspects of future performance. Although we believe the assumptions concerning future events are reasonable, a number of

factors could cause results to differ materially from those projected. Our operations involve risks and uncertainties, many of which are outside of our control

and could materially affect our results. For more information concerning factors that could affect these statements, see our annual report on Form 10-K,

quarterly reports on Form 10-Q, and other SEC filings, available at http://www.andeavorlogistics.com. We undertake no obligation to revise or update any

forward-looking statements as a result of new information, future events or otherwise.

See the Appendix for reconciliations of the differences between the non-GAAP financial measures used in this presentation, including various estimates of

EBITDA, and their most directly comparable GAAP financial measures.

Andeavor Logistics

Continue to grow customer-focused, full-service, diversified midstream

business, strategically integrated into Andeavor’s value chain

Targets:

Execute at least $1 billion of annual high-return growth investments

Grow Permian EBITDA* to $200+ million by 2020

Deliver $80+ million of annual EBITDA* from Bakken projects

Increase third-party business to 50% of revenues

Targeting EBITDA* of $1.4 – $1.5 billion in 2020

Positioned for Continued Growth

2 *Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most

directly comparable GAAP measure

Andeavor Logistics

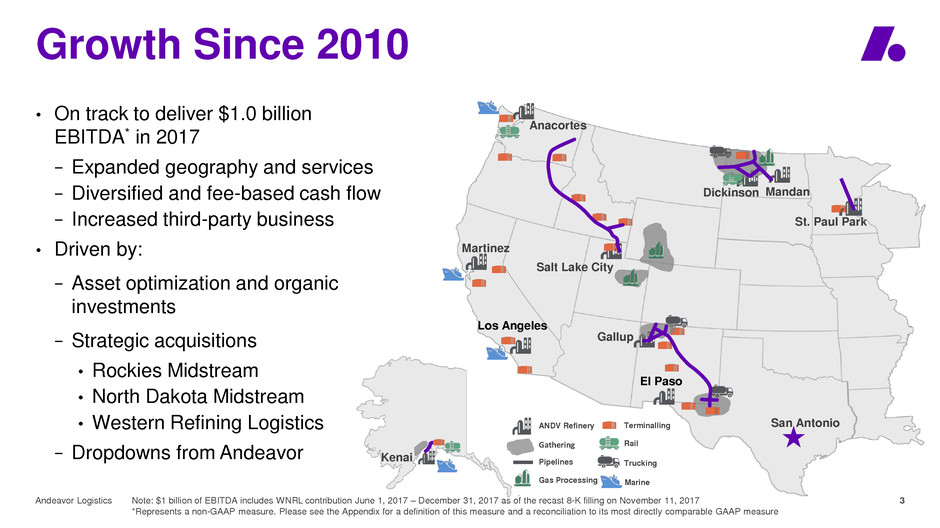

Growth Since 2010

3

Martinez

Anacortes

Dickinson Mandan

St. Paul Park

Salt Lake City

Gallup

San Antonio

Los Angeles

Kenai

Gathering

ANDV Refinery

Pipelines

Gas Processing Marine

Terminalling

Rail

Trucking

Note: $1 billion of EBITDA includes WNRL contribution June 1, 2017 – December 31, 2017 as of the recast 8-K filling on November 11, 2017

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most directly comparable GAAP measure

El Paso

• On track to deliver $1.0 billion

EBITDA* in 2017

− Expanded geography and services

− Diversified and fee-based cash flow

− Increased third-party business

• Driven by:

− Asset optimization and organic

investments

− Strategic acquisitions

• Rockies Midstream

• North Dakota Midstream

• Western Refining Logistics

− Dropdowns from Andeavor

Andeavor Logistics

Stable, Fee-Based Cash Flow

4

• Fee-Based Cash Flow

- 95% of cash flow fee based

- 60% backed by Minimum Volume

Commitments (MVCs) or take-or-pay

contracts

• Strong geographic diversity

- PADDs III, IV and V exposure in

Terminalling and Transportation

- Bakken, Permian, and Rockies regions in

Gathering and Processing

• Approximately 75% of revenue from

investment grade customers

Permian

Rockies

Bakken

2017E Pro Forma

Wholesale

Gathering &

Processing

Terminalling &

Transportation

Other

Investment

Grade

Other

Fee-Based

Segment Contribution

To EBITDA*

Gathering & Processing

EBITDA *

Revenues Revenues

Pro forma revenue figures include gross margin for WNRL wholesale

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure.

Andeavor Logistics

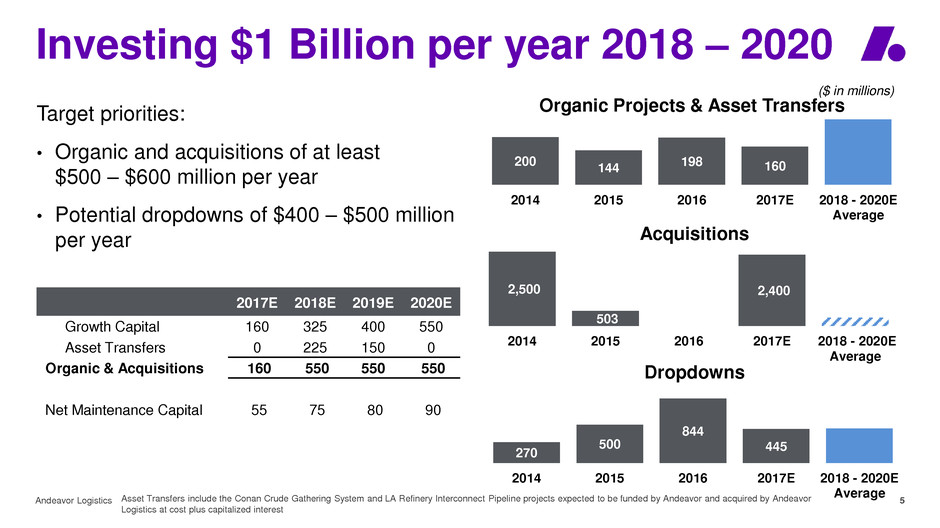

Investing $1 Billion per year 2018 – 2020

5

200

144

198 160

2014 2015 2016 2017E 2018 - 2020E

Average

2,500

503

-

2,400

2014 2015 2016 2017E 2018 - 2020E

Average

($ in millions)

270

500

844

445

2014 2015 2016 2017E 2018 - 2020E

Average

Dropdowns

Organic Projects & Asset Transfers Target priorities:

• Organic and acquisitions of at least

$500 – $600 million per year

• Potential dropdowns of $400 – $500 million

per year Acquisitions

2017E 2018E 2019E 2020E

Growth Capital 160 325 400 550

Asset Transfers 0 225 150 0

Organic & Acquisitions 160 550 550 550

Net Maintenance Capital 55 75 80 90

Asset Transfers include the Conan Crude Gathering System and LA Refinery Interconnect Pipeline projects expected to be funded by Andeavor and acquired by Andeavor

Logistics at cost plus capitalized interest

Andeavor Logistics

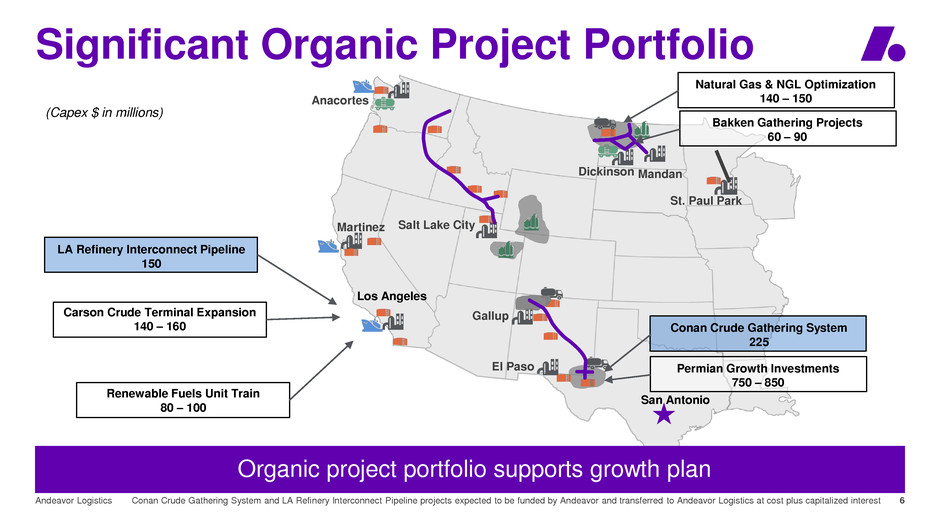

Significant Organic Project Portfolio

6

Martinez

Anacortes

Dickinson Mandan

St. Paul Park

Salt Lake City

Gallup

El Paso

Los Angeles

Permian Growth Investments

750 – 850

Natural Gas & NGL Optimization

140 – 150

Bakken Gathering Projects

60 – 90

Organic project portfolio supports growth plan

San Antonio

Conan Crude Gathering System

225

LA Refinery Interconnect Pipeline

150

Carson Crude Terminal Expansion

140 – 160

Renewable Fuels Unit Train

80 – 100

Conan Crude Gathering System and LA Refinery Interconnect Pipeline projects expected to be funded by Andeavor and transferred to Andeavor Logistics at cost plus capitalized interest

(Capex $ in millions)

Andeavor Logistics

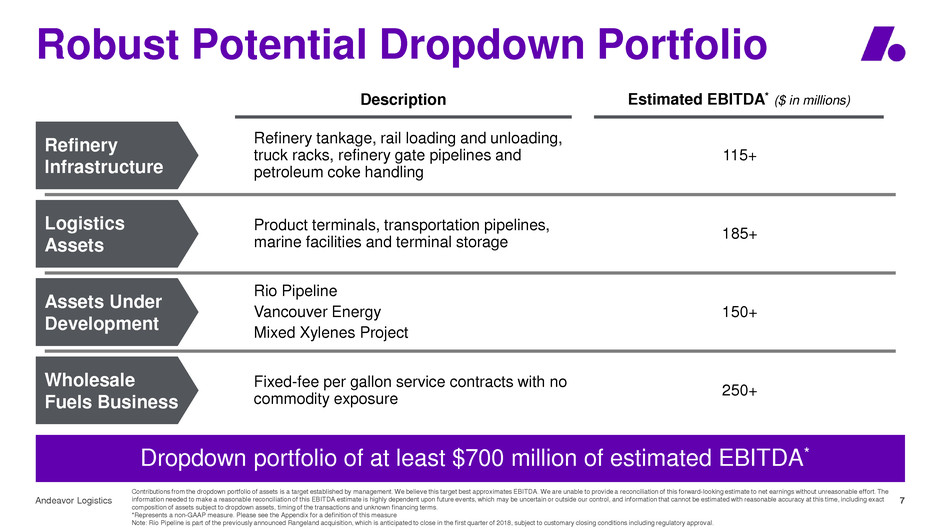

Robust Potential Dropdown Portfolio

7

Dropdown portfolio of at least $700 million of estimated EBITDA*

Description

Logistics

Assets

Product terminals, transportation pipelines,

marine facilities and terminal storage

185+

Assets Under

Development

Rio Pipeline

Vancouver Energy

Mixed Xylenes Project

150+

Wholesale

Fuels Business

Fixed-fee per gallon service contracts with no

commodity exposure

250+

Refinery

Infrastructure

115+

Refinery tankage, rail loading and unloading,

truck racks, refinery gate pipelines and

petroleum coke handling

Estimated EBITDA* ($ in millions)

Contributions from the dropdown portfolio of assets is a target established by management. We believe this target best approximates EBITDA. We are unable to provide a reconciliation of this forward-looking estimate to net earnings without unreasonable effort. The

information needed to make a reasonable reconciliation of this EBITDA estimate is highly dependent upon future events, which may be uncertain or outside our control, and information that cannot be estimated with reasonable accuracy at this time, including exact

composition of assets subject to dropdown assets, timing of the transactions and unknown financing terms.

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure

Note: Rio Pipeline is part of the previously announced Rangeland acquisition, which is anticipated to close in the first quarter of 2018, subject to customary closing conditions including regulatory approval.

Andeavor Logistics

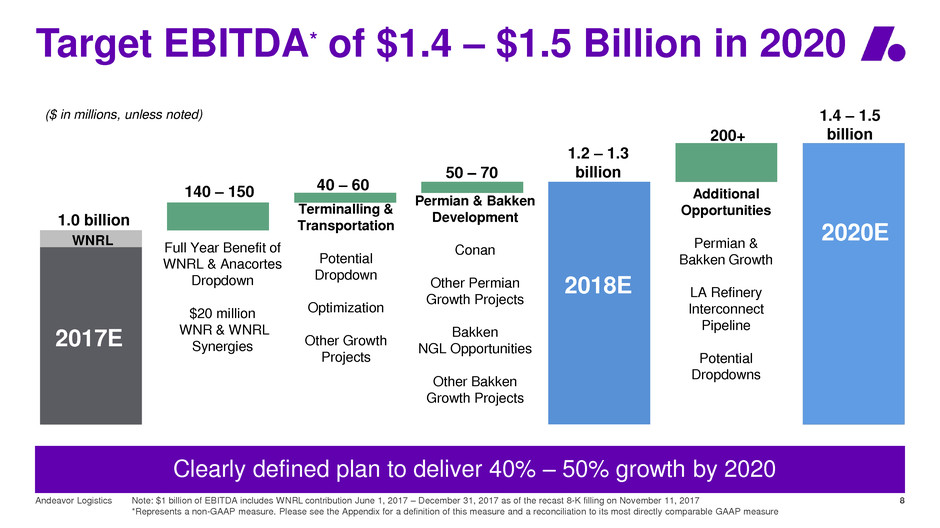

Target EBITDA* of $1.4 – $1.5 Billion in 2020

8

2017E

Clearly defined plan to deliver 40% – 50% growth by 2020

Note: $1 billion of EBITDA includes WNRL contribution June 1, 2017 – December 31, 2017 as of the recast 8-K filling on November 11, 2017

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most directly comparable GAAP measure

140 – 150

50 – 70

40 – 60

200+

1.2 – 1.3

billion

1.0 billion

WNRL

Full Year Benefit of

WNRL & Anacortes

Dropdown

$20 million

WNR & WNRL

Synergies

Additional

Opportunities

Permian &

Bakken Growth

LA Refinery

Interconnect

Pipeline

Potential

Dropdowns

Permian & Bakken

Development

Conan

Other Permian

Growth Projects

Bakken

NGL Opportunities

Other Bakken

Growth Projects

Terminalling &

Transportation

Potential

Dropdown

Optimization

Other Growth

Projects

2017E

2018E

2020E

1.4 – 1.5

billion

($ in millions, unless noted)

Andeavor Logistics

Differentiated Permian Position

9

Gallup

New

Mexico Texas

Four Corners Gathering

TexNew Mex System

Bobcat Pipeline

Conan Gathering Project

Refinery

ANDX Pipeline

Andeavor Pipeline

Third-Party Pipeline

Andeavor Receipt

Point / Station

• Cost and capability advantages in the

Delaware Basin and New Mexico

• Inter-basin pipeline transportation for

major gathering systems

• Multiple revenue streams – gathering,

transportation, storage and marketing

• Leverages existing commercial and

refining capabilities

• Physically integrated with El Paso and

Gallup refineries

• Connectivity to multiple takeaway options

from strategically positioned Wink Station

El Paso

Wink Station

Midland

Rio Pipeline

Note: Rio Pipeline is part of the previously announced Rangeland acquisition, which is anticipated to close in the first quarter of 2018, subject to customary closing conditions

including regulatory approval

Andeavor Logistics

Conan Crude Oil Gathering System

10

Conan

Gathering

System

• Expected online 3Q 2018

• Expected EBITDA* $30 – $40 million

• Connectivity to multiple long-haul pipelines from new

terminal in Loving County, Texas

• Initial capacity 250 MBD expandable to 500 MBD

• Three new crude truck offloading points

• Storage capacity 720,000 barrels

• Capex $225 million

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most directly comparable GAAP measure

Note: Rio Pipeline is part of the previously announced Rangeland acquisition, which is anticipated to close in the first quarter of 2018, subject to customary closing conditions including

regulatory approval

New Assets Existing Assets

Crude Gathering

New Truck

Offloading

Gathering

Pipelines

Conan

Terminal

Plains Pipeline

Enterprise Pipeline

Midland market hub

Existing Pipelines

CR-1 Station

TexNew Mex

System

Wink Station

Conan

ANDX Pipeline

Andeavor Pipeline

Rio Pipeline

To Midland

Andeavor Logistics

Positioned to Capture Expected Production

Growth in Delaware Basin

11

November 2017 Permian basin

180 day permit activity, current rigs

Delaware

Basin

Midland

Basin

(MBD)

56

200+

2017E 2020E

Permian EBITDA*

($ in millions)

Permian EBITDA represents all Gathering & Processing EBITDA in Texas and New Mexico; 2017E Permian EBITDA includes WNRL on a full year basis

Permian 180 day heat map and production data from DrillingInfo YTD through August 2017, historical rig counts from Marketview, forecast from Andeavor analysis

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most directly comparable GAAP measure

Note: Rio Pipeline is part of the previously announced Rangeland acquisition, which is anticipated to close in the first quarter of 2018, subject to customary closing conditions including regulatory approval

1

2

3 4 5

6

7 8

10

11

• Significant production growth expected

in Delaware basin 2017 – 2020 (40%+)

• Potential opportunities:

− Crude oil focused gathering projects

− Long haul pipelines to market hubs

− Strategic partnerships / joint ventures

− Bolt-on acquisitions at accretive

multiples

Conan

Gathering

System

Identified Additional Near-Term

Permian Opportunities

9

Rio Pipeline

Andeavor Logistics

Physically Integrated Bakken System

12

ND

SD

MN

Robinson Lake

Gathering & Processing

Belfield Gathering & Processing

Fryburg Rail Terminal

DAPL

Connection

To Mandan Refinery

Dickinson Refinery

To Guernsey, WY

DAPL &

Enbridge

Connections

• Premier aggregator with wide

geographic footprint and

interconnectivity

• Highly integrated system

supplying four Andeavor

refineries

• Providing crude oil, natural gas,

NGL and water services

• Strong customer value due to

multiple takeaway connections

• Well positioned to capture

upside as production increases

Andeavor Refinery

ANDX Gas Processing

ANDX Crude Pipelines

ANDX Gas Pipelines

ANDX Crude, Gas & Water Pipelines

Andeavor Crude Pipeline

ANDX Bakken Storage Hub

Andeavor Logistics

Executing Bakken Plan

13

1,180

1,040 1,050

88

35

50

2015 2016 2017 YTD 2018E 2020E

Physically integrated, diversified service offering

Actuals data from the State of North Dakota Department of Mineral Resources, YTD through September 2017, forecast based on Andeavor analysis

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most directly comparable GAAP measure

• Flat outlook for oil prices and production

• Associated natural gas production at all time

highs; gas liquids rich

• Identified opportunities through 2020 of

$80+ million EBITDA*

− Low capital, high return well connections

on existing systems

− New crude oil and natural gas gathering

projects

− Processing plant capacity expansions

− NGL opportunities

1.6 1.7 1.8

18

11 11

2015 2016 2017 YTD 2018E 2020E

Bakken Crude Oil Production (MBD)

& Rig Count

Bakken Natural Gas Production (Bcf/d)

& Gas Flared (%)

Andeavor Logistics

Increase Third-Party Revenue to 50%

14

2017E Pre-WNRL 2017E Pro Forma 2020E

Affiliate Affiliate

Third-

Party Affiliate

Third-

Party Third-

Party

0.9

1.3

2017E 2020E

• Increases and diversifies Andeavor

earnings

• Permian and Bakken projects underpin

plan

• Strengthens logistics as a customer-

focused, full service midstream business

2017 pro forma includes WNRL on a full year basis, all figures exclude WNRL wholesale business

Third-Party Revenue

($ in billions)

Andeavor Logistics

Sponsor Profile:

A premier refiner in western United States

Investment grade credit rating

No IDRs

Robust and growing Dropdown portfolio

Equity support in Dropdowns

Major project development

Strategic Relationship With Andeavor

15

Andeavor growth creates opportunities for Andeavor Logistics

2011 2012 2013 2014 2015 2016 2017E 2018E 2019E 2020E

Potential

Dropdowns

Initial

Contribution

BP

Carson

Tranche

1 & 2

Alaska &

Northern

California

Anacortes

LA

Storage

West

Coast

&

Alaska

Martinez

Long Beach

Anacortes

CROF

Ten Accretive Dropdowns from Andeavor

Since Initial contribution

Andeavor Logistics

Financial Principles Support

Sustainable Growth

16

Distribution Growth 6% or greater

Debt To EBITDA Ratio Approximately 4x

Available Liquidity $1.0 – $2.0 Billion

Annual Growth Investments At least $1.0 Billion

Maintain

Ample

Liquidity

Strong

Balance

Sheet

Disciplined

Capital

Allocation &

Investment

Sustainable

Cash

Distributions

Annual Maintenance Capital $0.1 Billion

Maintain strong liquidity to allow for

execution of growth plans

Committed to strengthening

investment grade credit ratings

Investing in high return projects

Targeting distribution growth and

coverage consistent with financial

targets

Net maintenance capital spend estimated for 2017, 2018, 2019, and 2020 is $55, $75, $80, and $90 million respectively

Well-positioned to achieve all financial targets in 2018

Distribution Coverage Ratio Approximately 1.1x

Targets

Andeavor Logistics

Investment Grade and IDR Buy-In Benefits

17

13.5%

8.4%

Pre-Announcement Post-Announcement

Pre-Announcement IG Issuance

170 bps

Improvement

• Elimination of IDR results in lower cost of

equity

− Increases breakeven multiple on new

investments by 3 - 4x

− Reduces need for public common equity

• Investment grade rating reduces cost of debt

and allows for extended maturity

− $29 million in annual run-rate interest

savings already realized; additional savings

anticipated

− Extended average maturities by 4.9 years to

9.6 years

• ANDV owns 59% of ANDX common units

Equity cost of capital is calculated as distribution yield grossed up for GP cash flow at time of announcement

Equity cost of capital post-announcement based on current distribution and unit price as of January 2, 2018

Andeavor Logistics Cost of Equity

Andeavor Logistics Cost of Debt

Andeavor Logistics

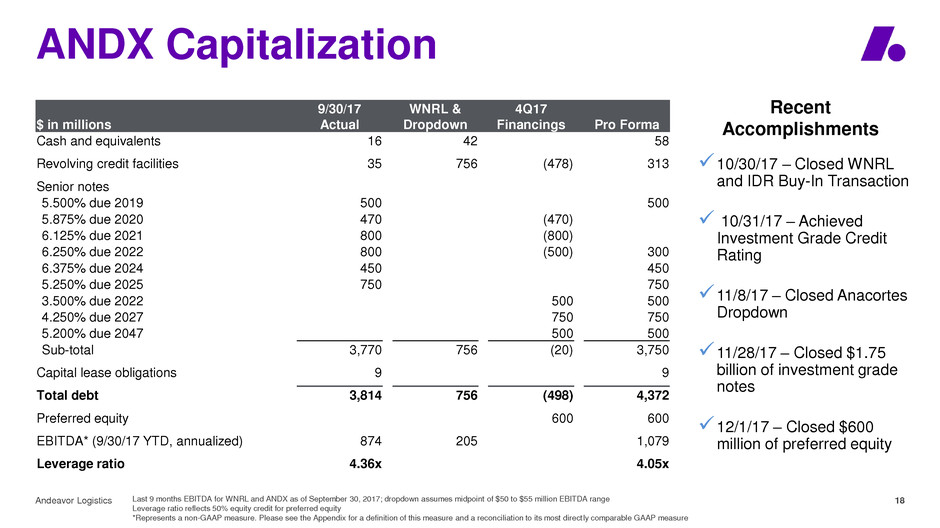

ANDX Capitalization

18 Last 9 months EBITDA for WNRL and ANDX as of September 30, 2017; dropdown assumes midpoint of $50 to $55 million EBITDA range

Leverage ratio reflects 50% equity credit for preferred equity

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most directly comparable GAAP measure

$ in millions

9/30/17

Actual

WNRL &

Dropdown

4Q17

Financings Pro Forma

Cash and equivalents 16 42 58

Revolving credit facilities 35 756 (478) 313

Senior notes

5.500% due 2019 500 500

5.875% due 2020 470 (470)

6.125% due 2021 800 (800)

6.250% due 2022 800 (500) 300

6.375% due 2024 450 450

5.250% due 2025 750 750

3.500% due 2022 500 500

4.250% due 2027 750 750

5.200% due 2047 500 500

Sub-total 3,770 756 (20) 3,750

Capital lease obligations 9 9

Total debt 3,814 756 (498) 4,372

Preferred equity 600 600

EBITDA* (9/30/17 YTD, annualized) 874 205 1,079

Leverage ratio 4.36x 4.05x

10/30/17 – Closed WNRL

and IDR Buy-In Transaction

10/31/17 – Achieved

Investment Grade Credit

Rating

11/8/17 – Closed Anacortes

Dropdown

11/28/17 – Closed $1.75

billion of investment grade

notes

12/1/17 – Closed $600

million of preferred equity

Recent

Accomplishments

Andeavor Logistics

Limited Public Common Equity Needs

19

3,300 3,300

Uses Sources

2018 – 2020 Capital Plan

($ in Millions)

Potential

Dropdowns

Growth Capital

Maintenance

Debt

Retained Cash

ANDV Equity

Public Common Equity

• No public common equity expected in 2018

• Less than $200 million public common

equity per year expected 2019 – 2020

• Andeavor plans to take $100 - $150 million of

common equity annually from dropdowns

• Additional perpetual preferred or hybrid capital

will be considered as alternative financing

Andeavor Logistics

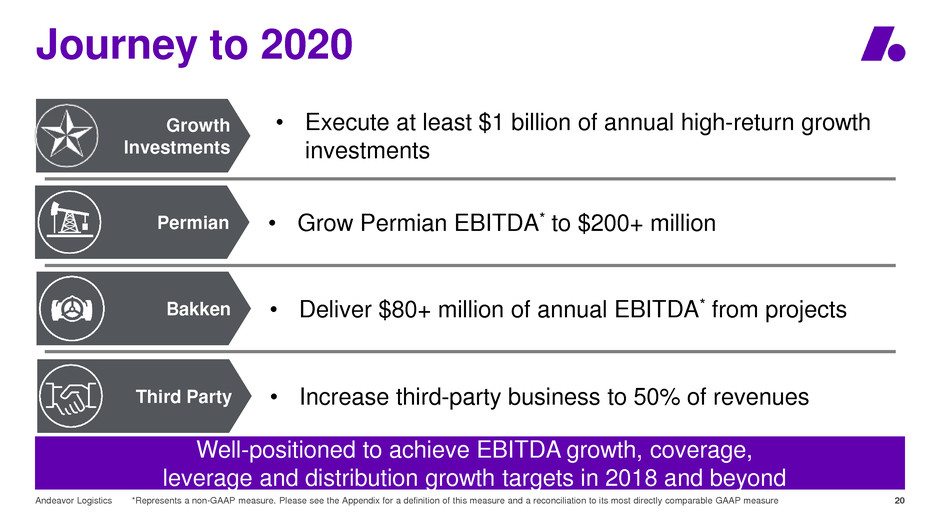

Journey to 2020

20

Well-positioned to achieve EBITDA growth, coverage,

leverage and distribution growth targets in 2018 and beyond

*Represents a non-GAAP measure. Please see the Appendix for a definition of this measure and a reconciliation to its most directly comparable GAAP measure

• Execute at least $1 billion of annual high-return growth

investments

Permian • Grow Permian EBITDA* to $200+ million

Third Party • Increase third-party business to 50% of revenues

• Deliver $80+ million of annual EBITDA* from projects

Growth

Investments

Bakken

Andeavor Logistics

Appendix

21

Andeavor Logistics

Non-GAAP Financial Measures

22

Our management uses certain ―non-GAAP‖ operational measures to analyze operating segment performance and ―non-GAAP‖ financial measures to evaluate past performance and

prospects for the future to supplement our financial information presented in accordance with accounting principles generally accepted in the United States of America (―GAAP‖). These

financial and operational non-GAAP measures are important factors in assessing our operating results and profitability and include:

• EBITDA—GAAP-based net earnings before interest, income taxes, and depreciation and amortization expenses;

• Segment EBITDA—a segment’s GAAP-based operating income before depreciation and amortization expenses plus equity in earnings (loss) of equity method investments and

other income (expense), net;

We present these measures because we believe they may help investors, analysts, lenders and ratings agencies analyze our results of operations and liquidity in conjunction with our

GAAP results, including but not limited to:

• our operating performance as compared to other publicly traded companies in the marketing, logistics and refining industries, without regard to historical cost basis or financing

methods;

• our ability to incur and service debt and fund capital expenditures; and

• the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities.

Non-GAAP measures have important limitations as analytical tools, because they exclude some, but not all, items that affect net earnings and operating income. These measures

should not be considered substitutes for their most directly comparable GAAP financial measures. See ―Non-GAAP Reconciliations‖ below for reconciliations between non-GAAP

measures and their most directly comparable GAAP measures.

Andeavor Logistics

Non-GAAP Reconciliations

23