Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - INDUS REALTY TRUST, INC. | grif-20170831ex322f3fc52.htm |

| EX-32.1 - EX-32.1 - INDUS REALTY TRUST, INC. | grif-20170831ex32178186f.htm |

| EX-31.2 - EX-31.2 - INDUS REALTY TRUST, INC. | grif-20170831ex31213ff13.htm |

| EX-31.1 - EX-31.1 - INDUS REALTY TRUST, INC. | grif-20170831ex311cdbbd4.htm |

| EX-10.59 - EX-10.59 - INDUS REALTY TRUST, INC. | grif-20170831ex1059fe54f.htm |

| EX-10.58 - EX-10.58 - INDUS REALTY TRUST, INC. | grif-20170831ex10581f281.htm |

| EX-10.56 - EX-10.56 - INDUS REALTY TRUST, INC. | grif-20170831ex105698cdd.htm |

| 10-Q - 10-Q - INDUS REALTY TRUST, INC. | grif-20170831x10q.htm |

Exhibit 10.57

AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

This Amended and Restated Loan and Security Agreement dated July 14, 2017, amends and restates a certain Construction Loan and Security Agreement dated February 6, 2009, by and between Tradeport Development III, LLC, a Connecticut limited liability company, with a usual place of business at 204 West Newberry Road, Bloomfield, Connecticut (the “Borrower”), Griffin Industrial Realty, Inc. f/k/a Griffin Land & Nurseries, Inc., a Delaware corporation with a usual place of business at 204 West Newberry Road, Bloomfield, Connecticut (the “Guarantor”) and Berkshire Bank, a Massachusetts banking corporation, with a usual place of business at 19 Harrison Avenue, Springfield, Massachusetts.

1.00 DEFINITIONS AND RULES OF INTERPRETATION.

1.01 DEFINITIONS

The following terms shall have the meanings set forth in this Section 1.01 or elsewhere in the provisions of this Agreement or other Loan Documents referred to below:

“Advance” shall mean, any disbursement of the proceeds of the Loan made or to be made by the Lender pursuant to this Agreement.

“Agreement” shall mean, this Agreement, including the Schedules and Exhibits hereto, all of which are incorporated herein by reference.

“Appraisal” shall mean, an appraisal of the value of the Mortgaged Premises, determined on an “AS IS” basis, performed by a qualified independent appraiser approved by the Lender.

“Assignee”. See Section 23.01.

“Assignment of Leases” shall mean, the Assignment of Leases and Rents, dated or to be dated on or prior to the Closing Date, made by the Borrower in favor of the Lender, pursuant to which the Borrower assigns its right, title and interest as landlord in and to the Leases and the rents, issues and profits of the Mortgaged Premises, such Assignment of Leases and Rents to be in form and substance satisfactory to the Lender.

“Borrower” shall have the meaning as defined in the preamble hereto.

“Business Day” shall mean, any day on which the Lender is open for the transaction of banking business in Springfield, Massachusetts.

“CERCLA”. See Section 7.16 (a).

1

“Closing Date” shall mean, the first date on which the conditions set forth in Section 10.00 have been satisfied and the Advance is made.

“Code” shall mean, the Internal Revenue Code of 1986.

“Collateral” shall mean, all of (a) the property, rights and interests of the Borrower that are or are intended to be subject to the security interests, assignments, and mortgage liens created by the Security Documents, including, without limitation, that which is defined in Section 12.00 hereof.

“Commitment” shall mean, the terms letter for the Term Loan issued by the Lender to the Borrower, dated May 11, 2017.

"Debt" means, as applied to any Person, as of any date of determination (without duplication):

(a) all obligations of such Person for borrowed money (whether or not represented by bonds, debentures, notes, drafts or other similar instruments) or evidenced by bonds, debentures, notes, drafts or similar instruments;

(b)all obligations of such Person for all, or any part of, the deferred purchase price of property or services, or for the cost of property constructed or of improvements thereon, other than trade accounts payable incurred, in respect of property purchased, in the ordinary course of business, which are not overdue or which are being contested in good faith by appropriate proceedings and are not required to be classified on such Person's balance sheet, in accordance with GAAP, as debt;

(c)all obligations secured by any Lien on or payable out of the proceeds of production from property owned or held by such Person even though such Person has not assumed or become liable for the payment of such obligation;

(d)all capital lease obligations of such Person;

(e)all obligations of such Person, contingent or otherwise, in respect of any letter of credit facilities, bankers' acceptance facilities or other similar credit facilities other than any such obligation which relate to an underlying obligation which otherwise constitutes Debt of such Person hereunder or a current account payable of such Person incurred in the ordinary course of business;

(f)all obligations of such Person upon which interest payments are customarily made; and

2

(g)all Guaranties by such Person of or with respect to obligations of the character referred to in the foregoing clauses (a) through (f) of another Person;

provided, however, that in determining the Debt of any Person, (i) all liabilities for which such Person is jointly and severally liable with one or more other Persons (including, without limitation, all liabilities of any partnership or joint venture of which such Person is a general partner or co-venturer) shall be included at the full amount thereof without regard to any right such Person may have against any such other Persons for contribution or indemnity, and (ii) no effect shall be given to deposits, trust arrangements or similar arrangements which, in accordance with GAAP, extinguish Debt for which such Person remains legally liable.

“Debt Service Coverage Calculation Period” means beginning with the period December 1, 2016 to November 30, 2017, twelve (12) calendar months commencing on December 1st and ending on November 30th, and it shall be conducted annually thereafter.”

“Debt Service Coverage Ratio” means on each calculation date for the applicable Debt Service Coverage Ratio Calculation Period, by calculating the ratio of (x) the Net Operating Income from the Mortgaged Premises for the immediately preceding Debt Service Coverage Ratio Calculation Period, to (y) the sum of the monthly payments of principal and interest which were due and payable under the Note for the immediately preceding Debt Service Coverage Ratio Calculation Period.

“Default” shall mean, a condition or event which would, with the giving of notice or lapse of time or both, constitute an Event of Default.

“Default Rate” shall mean, the rate of interest (then) in effect at the time of an occurrence of an Event of Default plus five percent (5.00%).

“Distribution” shall mean, the declaration or payment of any distribution of cash or cash flow to the members of the Borrower, or other distribution on or in respect to any membership interests of the Borrower.

“Employee Benefit Plan” shall mean, any employee benefit plan within the meaning of Section 3(3) of ERISA maintained or contributed to by the Borrower or any ERISA Affiliate, other than a Multi- employer Plan.

Environmental Laws. See Section 9.15.(a).

“ERISA” shall mean, the Employee Retirement Income Security Act of 1974, as amended and in effect from time to time.

“ERISA Affiliate” shall mean, any Person which is treated as a single employer with the Borrower under Section 414 of the Code.

“Event of Default”. See Section 13.01

3

“Financing Statements” shall mean, Uniform Commercial Code Form 1 Financing Statement(s) from the Borrower in favor of the Lender giving notice of a security interest in the Collateral, such financing statements to be in form and substance satisfactory to the Lender.

“Generally Accepted Accounting Principles” shall mean, principles that are consistent with the principles promulgated or adopted by the Financial Accounting Standards Board and its predecessors, as in effect from time to time; provided that a certified public accountant would, insofar as the use of such accounting principles is pertinent, be in a position to deliver an unqualified opinion (other than a qualification regarding changes in generally accepted accounting principles) as to financial statements in which such principles have been properly applied.

“Governmental Authority” shall mean, the United States of America, the State of Connecticut, any political subdivision thereof, the City/Town of Windsor, and any agency, authority, department, commission, board, bureau, or instrumentality of any of them.

“Gross Revenues” means for each Loan Month, all rents, revenues and other payments received by, or for the benefit of Borrower in cash or current funds or other consideration from any source whatsoever in connection with its ownership, operation and management of the Mortgaged Premises, including all payments received by Borrower from all tenants or other occupants of the Mortgaged Premises; provided, however, secured deposits paid to Borrower by tenants under leases at the Mortgaged Premises and insurance proceeds following a casualty or damage by fire or other cause at the Mortgaged Premises, shall not be included in Gross Revenues.

“Guarantor” shall mean, Griffin Industrial Realty, Inc.

“Guaranty” shall mean the Limited Guaranty dated or to be dated on or prior to the Closing Date, made by the Guarantor in favor of the Lender, pursuant to which the Guarantor guarantees to the Lender the payment and performance of the Guaranteed Obligations, as defined in such Limited Guaranty.

“Hazardous Materials”. See, Section 7.16.

“Head Office” shall mean 19 Harrison Avenue, Springfield, MA 01103.

“Hedging Contract” (sometimes referred to as “SWAP Agreement”) means each ISDA Master Agreement and schedules and related confirmations, transactions executed or delivered in connection therewith with respect to any swap, forward, future or derivative transaction or option or similar agreement involving, or settled by reference to, one or more interest rates, currencies, commodities, equity or debt instruments or securities or economic, financial or pricing indices or measures of economic, financial or pricing risk or value or similar transaction or any combination of these transactions as the same may be hereafter amended, restated, renewed, replaced, supplemented or otherwise modified from time to time.

“Impositions” means with respect to Borrower relating to the Mortgaged Premises, all taxes of every kind and nature, sewer rents, charges for water, for setting or repairing meters and

4

for all other utilities serving the Mortgaged Premises, and assessments, levies, inspection and license fees and all other charges imposed or assessed against the Mortgaged Premises or any portion thereof, including the income derived from the Mortgaged Premises and any stamp or other taxes which might be required to be paid with respect to the Loan Documents, any of which might, if unpaid, result in a lien on the Mortgaged Premises or any portion thereof, regardless of whom assessed.

“Improvements” shall mean, an industrial warehouse containing 304,200 square feet leased by the Primary Tenant on the Land.

“Incipient Default” means any event or condition which, with the giving of notice or the lapse of time, or both, would become an Event of Default.

“Indebtedness” shall mean, all obligations, contingent and otherwise, that in accordance with generally accepted accounting principles should be classified upon the Borrower’s balance sheet as liabilities, or to which reference should be made by footnotes thereto, including in any event and whether or not so classified: (a) all debt and similar monetary obligations, whether direct or indirect; (b) all liabilities secured by any mortgage, pledge, security interest, lien, charge, or other encumbrance existing on property owned or acquired subject thereto, whether or not the liability secured thereby shall have been assumed; and (c) all guarantees, endorsements and other contingent obligations whether direct or indirect in respect of indebtedness of others, including any obligation to supply funds to or in any manner to invest in, directly or indirectly, the Borrower, to purchase indebtedness, or to assure the owner of indebtedness against loss, through an agreement to purchase goods, supplies, or services for the purpose of enabling Borrower to make payment of the indebtedness held by such owner or otherwise, and the obligations to reimburse the issuer in respect of any letters of credit.

“Indemnity Agreement” shall mean, the Amended and Restated Environmental Compliance and Indemnity Agreement Regarding Hazardous Materials, dated or to be dated on or prior to the Closing Date, made by the Borrower and the Guarantor in favor of the Lender, pursuant to which the Borrower and the Guarantor agree to indemnify the Lender with respect to Hazardous Materials and Environmental Laws, such Indemnity Agreement to be in form and substance satisfactory to the Lender.

"Interest Charges" for any period shall mean all interest (including the imputed interest factor in respect of Capitalized Leases) and all amortization of debt discount and expense on any particular Indebtedness for which such calculations are being made. Computations of Interest Charges on a proforma basis for indebtedness having a variable interest rate shall be calculated at the rate in effect on the day of any determination.

"Interest Expense" means for any period, the sum of the following amounts for the Borrower: (a) the aggregate amount of all interest accrued (whether or not actually paid) during such period in respect of Debt (including, without limitation, imputed interest on Capital Leases), plus (b) amortization of debt discount and expense.

5

“Investments” shall mean, all expenditures made and all liabilities incurred (contingently or otherwise) for the acquisition of stock or Indebtedness of, or for loans, advances, capital contributions or transfers of property to, or in respect of any guaranties (or other commitments as described under Indebtedness), or obligations of, any Person. In determining the aggregate amount of Investments outstanding at any particular time: (a) the amount of any Investment represented by a guaranty shall be taken at not less than the principal amount of the obligations guaranteed and still outstanding; (b) there shall be included as an Investment all interest accrued with respect to Indebtedness constituting an Investment unless and until such interest is paid; (c) there shall be deducted in respect of each such Investment any amount received as a return of capital (but only by repurchase, redemption, retirement, repayment, liquidating dividend or liquidating distribution); (d) there shall not be deducted in respect of any Investment any amounts received as earnings on such Investment, whether as dividends, interest or otherwise, except that accrued interest included as provided in the foregoing clause (b) may be deducted when paid; and (e) there shall not be deducted from the aggregate amount of Investments any decrease in the value thereof.

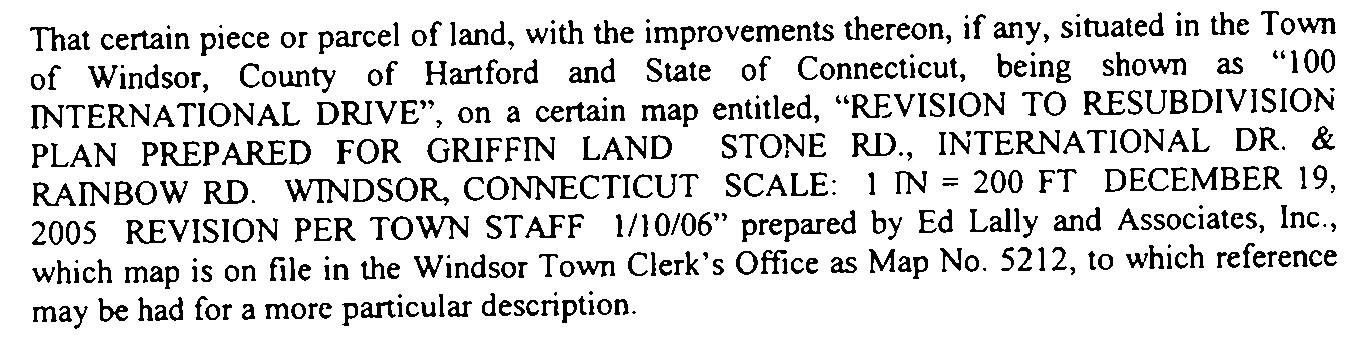

“Land” shall mean, the real property located at 100 International Drive, Windsor, Connecticut, and described in Exhibit “A” to this Agreement.

“Lease(s)” shall mean, leases, licenses and agreements, whether written or oral, relating to the use or occupation of space in the Improvements or on the Land by Persons other than the Borrower, and as of the date hereof, it shall mean that certain Indenture of Lease between the Borrower and the Primary Tenant dated January 9, 2009 as amended by First Amendment to Lease dated December 8, 2009, further amended by the Second Amendment to Indenture of Lease dated June 22, 2017, concerning the Mortgaged Premises.

“Lender” shall mean, Berkshire Bank, its successors and assigns.

“Lender Hedging Obligations” means all obligations of Borrower to Lender, any Affiliate of Lender or Berkshire Bank (if, any time after the Closing Date, Berkshire Bank has assigned its interest as “Lender” hereunder to a third party, with respect to such Lender Hedging Obligations arising under a Hedging Contract entered into prior to the date of such assignment) under any other agreement, contract or transaction that constitutes a “swap” within the meaning of Section 1a(47) of the Commodity Exchange Act and shall include without limitation, any interest rate swap transactions, basis swaps, forward rate transactions, commodity swaps, commodity options, equity or equity index swaps, equity or equity index options, bond options, interest rate options, foreign exchange transactions, cap transactions, floor transactions, collar transactions, forward transactions, currency swap transactions, cross-currency rate swap transactions, currency options or similar agreements including, without limitation, the Hedging Contract.

“LIBOR Interest Rate” means one (1) month LIBOR Rate.

“LIBOR Loan” means any Loan when and to the extent that the interest rate therefore is determined by reference to the LIBOR Interest Rate.

“LIBOR Rate” shall mean the rate of interest set, determined or announced on a periodic basis by the British Bankers Association as the average of the Interbank offered one (1) month rate

6

for U.S. Dollar deposit in the London Interbank market, published two (2) business days before each change date in the “Money Rate” section of “The Wall Street Journal” (or if such publication shall cease to publish such rate, then the rate published in such other nationally recognized publication as the Bank may from time to time specify). If the British Bankers Association, or its successors, shall no longer publish the “LIBOR Rate” for one (1) month, then “LIBOR Rate” hereunder shall mean the highest one (1) month LIBOR Rate set, determined or announced on a periodic basis by the largest London bank (the “Index”). If the Index becomes unavailable during the term of this loan, Bank may designate a substitute index after notifying Borrower.

“Loan” shall mean, the loan which is the subject of this Agreement.

“Loan Amount” means Ten Million Six Hundred Thousand and 00/100 Dollars ($10,600,000).

“Loan Documents” shall mean, this Agreement, the Term Note, the Indemnity Agreement and the Security Documents and all other agreements, documents and instruments now or hereafter evidencing, securing or otherwise relating to the Term Loan, excluding Hedging Contracts.

"London Banking Day" shall mean any Business Day on which commercial banks are open for international business (including dealing in U.S. dollar ($) deposits) in London, England and Boston, Massachusetts.

“Master Lease Agreement” means that certain Debt Service Master Lease of even date herewith between Borrower, as Landlord and Guarantor, as Tenant, an executed copy of which has been provided to Lender.

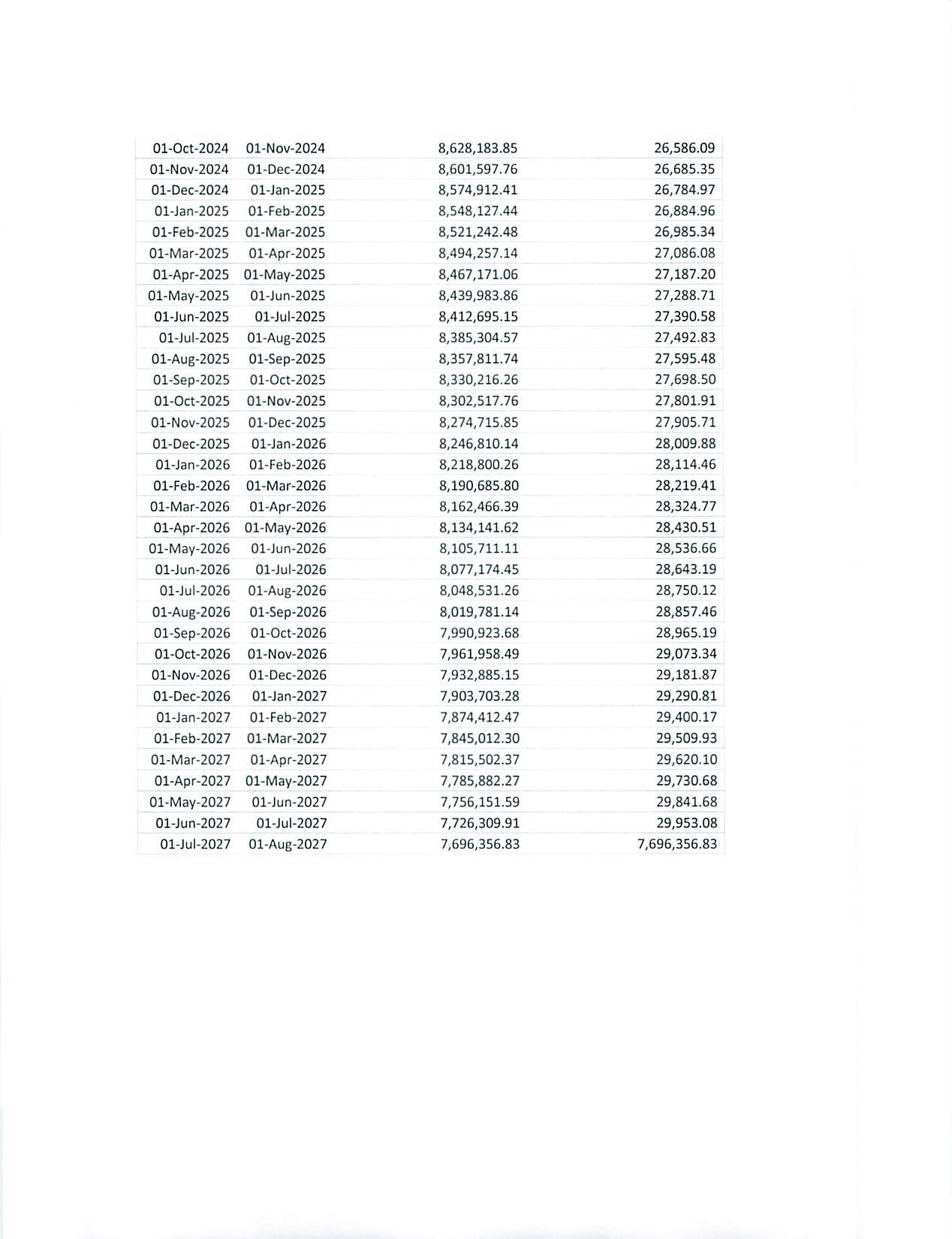

“Maturity Date” shall mean, ten (10) years from the Closing Date.

“Mortgage” shall mean, the Open-End Construction Mortgage, dated February 6, 2009, as modified by First Amendment to Open-End Construction Mortgage and Collateral Assignment of Rents and Leases of even date herewith made by Borrower in favor of the Lender, pursuant to which the Borrower granted a first mortgage lien and first security interest in and to the Mortgaged Premises.

“Mortgaged Premises” shall mean the Land, Improvements and other property secured by the Mortgage.

“Net Cash Flow” for each Loan Month shall mean, Net Operating Income, reduced by all monthly payments of principal and interest under the Term Note.

“Net Operating Income” for each Loan Month shall be calculated by Lender based upon Lender’s review of Borrower’s financial statements provided to Lender, together with such other financial information as Lender may request, and shall mean the Gross Revenues for the Loan Month less all Operating Expenses for the Loan Month. For the purposes of testing Debt Service Coverage Ratio for the initial test, annual Net Operating Income shall mean all in-place Gross Revenues evidenced by a current rent roll (annualized) less budgeted Operating Expenses (budget

7

subject to review and approval by Lender) for the upcoming twelve (12) month period, adjusted for interest and non-cash expenses.

“Obligations” shall mean, all indebtedness, obligations and liabilities of the Borrower to the Lender existing on the date of this Agreement or arising thereafter, direct or indirect, joint or several, absolute or contingent, matured or unmatured, liquidated or unliquidated, secured or unsecured, arising by contract, operation of law or otherwise, including, without limitation, those arising or incurred under this Agreement, any of the other Loan Documents, any Hedging Contract between Borrower and Lender, any Lender Hedging Obligations or any indebtedness, obligations and liabilities of Borrower to Lender in respect of any of the Advances or the Note or other instruments at any time evidencing any thereof.

“Outstanding” shall mean, that with respect to the Loan, the aggregate unpaid principal thereof, together with any unpaid and accrued interest thereon as of any date of determination.

“Permitted Liens” shall mean, liens, security interests and other encumbrances, as described in Exhibit “B”.

“Person” shall mean, any individual, corporation, partnership, trust, unincorporated association, business, or other legal entity, and any government or any governmental agency or political subdivision thereof.

“Personal Property” shall mean, all materials, furnishings, fixtures, furniture, machinery, equipment and all items of tangible personal property now or hereafter owned or acquired by the Borrower, wherever located, and either (i) to be located on or incorporated into the Land or the Improvements, (ii) used in connection with the construction of the Improvements or (iii) to be used in connection with the operation or maintenance of the Land or the Improvements or both.

“Primary Tenant” means The Tire Rack, Inc.

“Real Estate” shall mean, all real property at any time owned, leased (as lessee or sublessee) or operated by the Borrower., including without limitation, the Land.

“Release”. See Section 9.07.

“Requirements” shall mean, any law, ordinance, code, order, rule or regulation of any Governmental Authority relating in any way to the acquisition and ownership of the Mortgaged Premises, the construction of the Improvements, or the use, occupancy and operation of the Mortgaged Premises following the completion of construction of the Improvements, including those relating to subdivision control, zoning, building, use and occupancy, fire prevention, health, safety, sanitation, handicapped access, historic preservation and protection, tidelands, wetlands, flood control, access and earth removal, and all Environmental Laws.

“Security Documents” shall mean, the Mortgage, the Assignment of Leases, the Financing Statements and the Guaranty, and any other agreement, document or instrument now or hereafter securing the Obligations as amended.

8

“Survey” shall mean, an instrument survey of the Land and the Improvements prepared in accordance with the Lender's survey requirements, such survey to be satisfactory to the Lender in form and substance.

“Taking” shall mean, any condemnation for public use of, or damage by reason of, the action of any Governmental Authority, or any transfer by private sale in lieu thereof, either temporarily or permanently.

"Tangible Net Worth" means as of any date of determination, the net value of the Borrower's Member's Equity, as defined according to GAAP less the book value as of such date of Intangible Assets.

“Term Note” shall mean, the Term Note in the principal face amount of the Loan Amount dated or to be dated on or prior to the Closing Date, made by the Borrower to the order of the Lender, such Term Note to be in form and substance satisfactory to the Lender.

“Termination Date” shall mean, the Maturity Date.

“Title Insurance Company” shall mean, that certain Title Policy #288822195 from First American Title Insurance Company as endorsed as of the Closing Date.

1.02 RULES OF INTERPRETATION.

(a) A reference to any agreement, budget, document or schedule shall include such agreement, budget, document or schedule as revised, amended, modified or supplemented from time to time in accordance with its terms and the terms of this Agreement.

(b) The singular includes the plural and the plural includes the singular.

(c) A reference to any law includes any amendment or modification to such law.

(d) A reference to any Person includes its permitted successors and permitted assigns.

(e) Accounting terms not otherwise defined herein have the meaning assigned to them by generally accepted accounting principles applied on a consistent basis by the accounting entity to which they refer.

(f) The words "include", "includes" and "including" are not limiting.

(g) The words "approval" and "approved", as the context so determines, means an approval in writing given to the party seeking approval after full and fair disclosure to the party giving approval of all material facts necessary in order to determine whether approval should be granted.

9

(h) Reference to a particular Section refers to that section of this Agreement unless otherwise indicated.

(i) The words "herein", "hereof", "hereunder" and words of like import shall refer to this Agreement as a whole and not to any particular section or subdivision of this Agreement.

2.00 THE $10,600,000 TERM LOAN FACILITY

2.01 THE $10,600,000 TERM LOAN

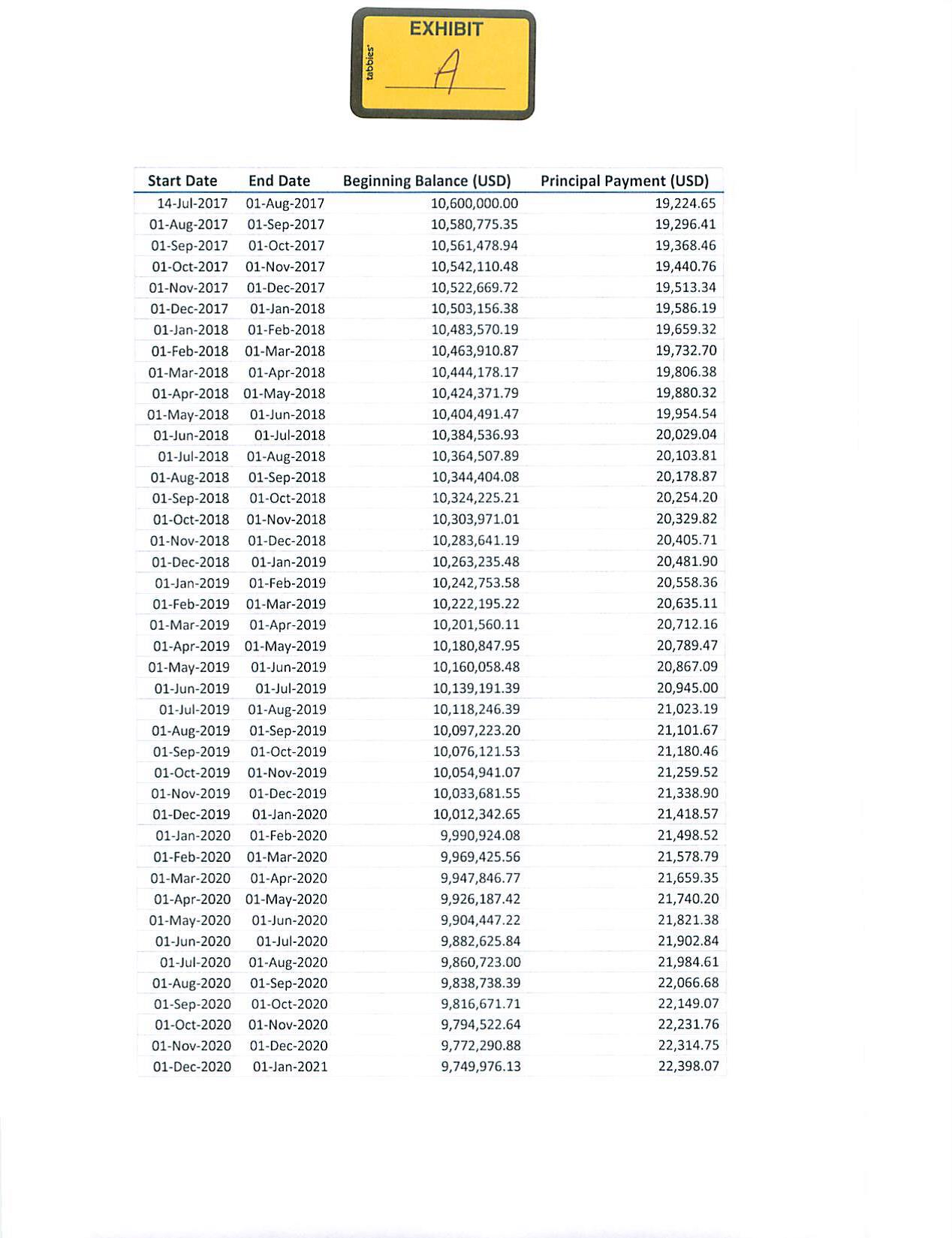

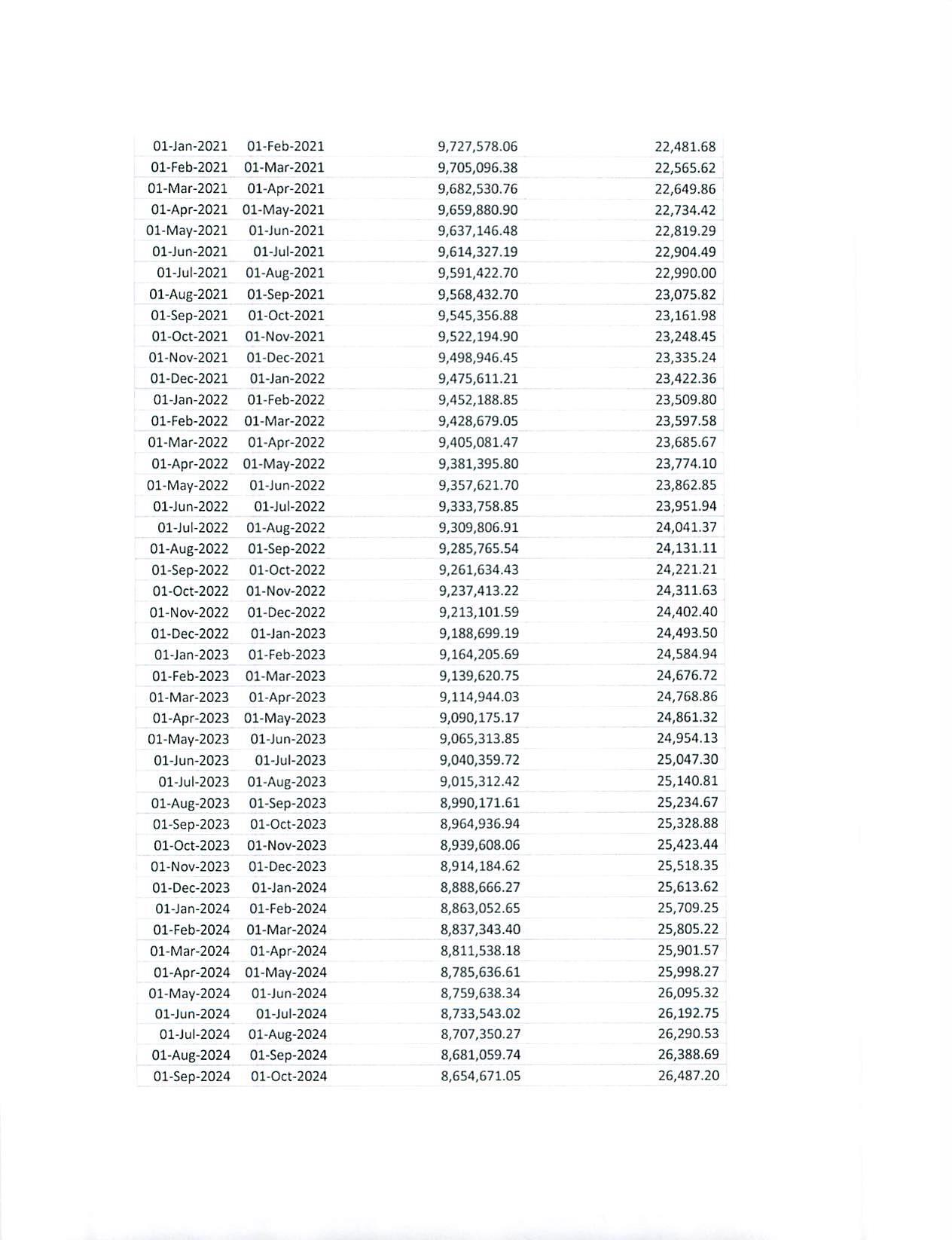

A Ten Million Six Hundred Thousand and 00/100 Dollar ($10,600,000) Term Loan will be made available to Borrower. The $10,600,000 Term Loan shall be repaid over a ten (10) year term based upon a twenty-five (25) year amortization schedule.

2.02 CALCULATION AND PAYMENT OF INTEREST

Interest on the Term Loan shall be calculated on the basis of a year of 360 days for the actual number of days elapsed for each Interest Period. Interest on the Loan shall be paid in immediately available funds at the Lending Office of the Lender. Interest shall accrue at the applicable rates specified in the Term Note. Any principal amount not paid when due (at maturity, by acceleration or otherwise) shall bear interest thereafter until paid in full, payable on demand, at the Default Rate.

2.03 THE TERM LOAN PROMISSORY NOTE

The Term Loan made by the Lender under this Agreement shall be evidenced by, and repaid with interest in accordance with the Term Note substantially in the form of Exhibit “C”.

2.04 USE OF PROCEEDS

The Term Loan shall be used by the Borrowers to refinance a certain Construction Note of Borrower to Lender.

2.05 SWAP AGREEMENT

Borrower shall hedge the floating interest expense arising under the Term Loan by maintaining at all times a Hedging Contract that satisfies the following conditions: (i) any ISDA Master Agreement must utilize the ISDA 1992 Master Agreement and related Schedule and Confirmation; the counterparty to any ISDA Master Agreement must be either Lender or another financial institution reasonably acceptable to Lender; provided, that if the counterparty is not Lender, the counterparty must have a long term, unsecured and unsubordinated debt rating of at least “A” by Standard & Poor’s Rating Services, a division of The McGraw Hill Companies, Inc. and “A2” by Moody’s Investors Service, Inc.; (ii) the initial ISDA Master Agreement must have (a) with respect to any initial Hedging Contract, a term commencing on the Closing Date and ending on the Maturity Date, or (b) with respect to any Replacement Hedging Contract, a term commencing on the effective date of such replacement swap transaction and ending on the

10

Maturity Date; (iii) any Hedging Contract must have at all times a notional amount not less than the then outstanding principal amount of the Term Loan; and (iv) any Hedging Contract must swap the LIBOR Rate under the Term Loan for a fixed rate of interest acceptable to Borrower and Lender. Notwithstanding the foregoing, if for any reason, such Hedging Contract shall terminate or otherwise leave any principal under the Term Loan uncovered thereby, or if for any other reason any principal portion of the Term Loan is otherwise no longer hedged by such Hedging Contract, such uncovered amount shall be immediately due and payable by Borrower; provided however, such uncovered amount shall not be immediately due and payable by Borrower if the Borrower executes and delivers a replacement Hedging Contract (the “Replacement Hedging Contract”) meeting the conditions set forth above for such uncovered amount within four (4) business days of the effective date of such termination of the Hedging Contract or the failure of any principal portion of the Term Loan to continue to be hedged thereby. Any Hedging Contract entered into by Borrower is subject to events of default and termination events pursuant to the terms and conditions thereof, including, without limitation, any payment of principal of the Term Loan prior to the due date of such payment.

2.06 MATURITY

The Borrower promises to pay the Lender on the Maturity Date, and there shall become absolutely due and payable on the Maturity Date, all of the unpaid principal on the Loan outstanding on such date together with any and all accrued and unpaid interest thereon.

2.07 FUNDING LOSS INDEMNIFICATION

The Borrower shall also pay to the Lender, upon the request of the Lender, such amount or amounts as shall be sufficient (in the reasonable opinion of the Lender) to compensate it for any loss, cost, or expense (including the then present value of any lost interest earnings as a result of any re-deployment of prepaid funds) incurred as a result of any payment of a LIBOR Loan on a date other than a scheduled principal payment day or the last day of the interest period for such Loan including, but not limited to, acceleration of the Loan by the Lender pursuant to Section 13.00

Upon request, Lender will provide Borrower with reasonable documentation of the calculation of compensation requested and relating hereto.

2.08 PREPAYMENT PREMIUM

In the event the Borrower prepays all or any portion of the Note, whether as a result of acceleration or otherwise, the Borrower will pay to the Lender on the same date that any such payment is made any breakage fee, yield maintenance charge, close out amount, termination fee or similar fee or charge as may be required pursuant to any Hedging Contract between Borrower and Lender to cover loss, cost and expense attributable to such prepayment.

3.00 THE GUARANTY

3.01The Guarantor shall execute the Limited Guaranty on or before the Closing Date. The form of the Limited Guaranty is attached hereto as Exhibit “D.”

11

3.02 MASTER LEASE OBLIGATIONS ABSOLUTE AND UNCONDITIONAL. Subject to the Primary Tenant extending its lease at the end of the current term, the Guarantor hereby agrees that its obligations under the Master Lease Agreement shall become absolute and unconditional and are subject to no limitations except those expressly set forth in this Loan Agreement. Notwithstanding any limitation contained in any Loan Document or any other agreement, the Guarantor shall at all times be liable to Lender following demand on Guarantor for the prompt and full payment (and not merely of the collectability), performance and observance of one hundred percent (100%) of all amounts due to Borrower under the Master Lease Agreement. The Guarantors obligations under the Master Lease Agreement are not conditioned or contingent upon the genuineness, validity or enforceability of any of the Loan Documents between the Borrower, the Guarantor and/or the Lender or other instruments relating to the creation or performance of any Obligations of the Borrower or the pursuit by the Lender of any remedies which the Lender has now or may hereafter have with respect thereto under any of the Loan Documents at law, in equity, or otherwise. Notwithstanding anything to the contrary contained in the Master Lease Agreement or any of the Loan Documents, the Guarantor shall forthwith pay all sums due to the Borrower (or the Lender if it exercises its rights under its Collateral Assignment of Rents and Leases) without regard to any counterclaim, setoff, deduction or defense of any kind which any party obligated under the Loan Documents or Master Lease may have or assert, and without abatement, suspension, deferment, or reduction on account of any occurrence whatsoever.

3.03 NO AMENDMENTS, TERMINATIONS OR WAIVERS.

(a)The Guarantor will not amend, supplement or otherwise modify, any of the terms and conditions of the Master Lease Agreement without in each case, the prior written approval of the Lender; and

(b)The Guarantor will not, directly or indirectly, terminate or cancel, or cause or permit to exist any condition which would result in the termination or cancellation of, or which would relieve the performance of any obligations of any other party under the Master Lease Agreement.

(c)The Guarantor will not, directly or indirectly, waive or agree or consent to the waiver of, or performance of any Obligations of the Borrower under the Master Lease Agreement.

4.00 LOAN FEES; PAYMENTS AND COMPUTATIONS; CAPITAL ADEQUACY, ETC.

4.01 LOAN FEE

The Borrower agrees to pay to the Lender on or before the Closing Date of the Loan a loan underwriting fee of 25 basis points, or Twenty-Six Thousand Five Hundred and 00/100 Dollars ($26,500).

12

4.02 FUNDS FOR PAYMENT

(a) All payments of principal, interest, fees and any other amounts due under the Note or under any of the other Loan Document shall be made to the Lender at its Head Office or at such other location that the Lender may from time to time designate, in each case not later than 2:00 p.m. (Boston time) on the date when due in immediately available funds in lawful money of the United States.

(b) All payments by the Borrower under the Note and under any of the other Loan Documents shall be made without setoff or counterclaim and free and clear of and without deduction for any taxes, levies, imposts, duties, charges, fees, deductions, withholdings, compulsory loans, restrictions or conditions of any nature now or hereafter imposed or levied by any jurisdiction or any political subdivision thereof or taxing or other authority therein unless the Borrower is compelled by law to make such deduction or withholding. If any such obligation to deduct or withhold is imposed upon the Borrower with respect to any amount payable by it under the Note or under any of the other Loan Documents, the Borrower will pay to the Lender, on the date on which such amount is due and payable under the Note or under such other Loan Document, such additional amount as shall be necessary to enable the Lender to receive the same amount which the Lender would have received on such due date had no such obligation been imposed upon the Borrower. The Borrower will deliver promptly to the Lender certificates or other valid vouchers for all taxes or other charges deducted from or paid with respect to payments made by the Borrower under the Note or under such other Loan Document.

4.03 COMPUTATIONS

Except as otherwise provided in this Agreement, the Note, whenever a payment thereunder or under any of the other Loan Documents becomes due on a day that is not a Business Day, the due date for such payment shall be extended to the next succeeding Business Day, and interest shall accrue during such extension. The outstanding amount of the Loan as reflected on the Record from time to time shall be considered correct and binding on the Borrower unless within ten (10) Business Days after receipt of any notice by the Borrower of such outstanding amount, the Borrower shall notify the Lender to the contrary.

4.04 ILLEGALITY

Notwithstanding any other provision in this Agreement, if the Lender determines that any applicable law, rule, or regulation, or any change therein, or any change in the interpretation or administration thereof by any governmental authority, central bank, or comparable agency charged with the interpretation or administration thereof, or compliance by the Lender (or its Lending Office) with any request or directive (whether or not having the force of law) of any such authority, central bank, or comparable agency shall make it unlawful or impossible for the Lender (or its Lending Office) to (1) maintain the Loan, then upon notice to the Borrower by the Lender the Loan shall terminate; or (2) maintain or fund LIBOR Loans, then upon notice to the Borrower by the Lender the outstanding principal amount of the LIBOR Loans, together with interest accrued thereon, and any other amounts payable to the Lender under this Agreement shall be repaid or converted to a prime Loan at the option of the Borrower (a) immediately upon demand of the

13

Lender if such change or compliance with such request, in the judgment of the Lender, requires immediate repayment; or (b) at the expiration of the last Interest Period to expire before the effective date of any such change or request.

4.05 DISASTER

Notwithstanding anything to the contrary herein, if the Lender determines (which determination shall be conclusive) that quotations of interest rates for the relevant deposits referred to in the definition of LIBOR is not being provided in the relevant amounts or for the relative maturities for purposes of determining the rate of interest on LIBOR Loan as provided in this Agreement then the Lender shall forthwith give notice thereof to the Borrower, whereupon (a) the obligation of the Lender to make LIBOR Loans shall be suspended until the Lender notifies the Borrower that the circumstances giving rise to such suspension no longer exist; and (b) the Borrower shall repay in full, or convert to a Loan with a comparable rate of interest, in full, the then outstanding principal amount of the Loan, together with accrued interest thereon.

4.06 ADDITIONAL PAYMENTS

If after the date of this Agreement the Lender determines that (i) the adoption of or change in any law, rule, regulation or guideline regarding capital requirements for banks or bank holding companies, or any change in the interpretation or application thereof by any governmental authority charged with the administration thereof, or (ii) as a result from any change after the date of this Agreement in United States, Federal, State, Municipal or Foreign Laws or Regulations (whether or not having the force of law) by any court or governmental or monetary authority charged with the interpretation or administration thereof which changes the basis of taxation of any amounts payable to the Lender under this Agreement, including the Loan, (other than taxes imposed on the overall net income of the Lender for any of such loans by the jurisdiction where the principal office of the Lender is located), then the Lender shall notify the Borrower thereof. The Borrower agrees to pay to the Lender the amount of such reduction in the return on capital as and when such reduction is determined, upon presentation by the Lender of a statement in the amount and setting forth the Lender's calculation thereof, which statement shall be deemed true and correct absent manifest error. In determining such amount, the Lender may use reasonable averaging and attribution methods.

5.00 COLLATERAL SECURITY AND GUARANTY

5.01 MORTGAGE LIEN

The Obligations shall be secured by, inter alia, (i) a perfected first priority mortgage lien on the Mortgaged Premises, (ii) a perfected first absolute assignment of rentals and leases concerning the Mortgaged Premises, and (iii) a first perfected priority security interest in all Collateral, whether now owned or hereafter acquired, pursuant to the terms of Section 12.00 of this Agreement and the Security Documents to which the Borrower is a party. This security interest is in addition to, and not in substitution of, a security interest of even date granted from Borrower to Lender in the Mortgage and the definition of "Collateral" therein shall be incorporated herein by reference as if originally stated herein. Any conflict between this Agreement and the

14

Mortgage and Security Agreement shall be resolved in each instance, in the sole discretion of the Lender.

5.02 CONTROL

Borrower will cooperate with Lender, and execute agreements required by Lender, in obtaining control with respect to Collateral consisting of:

(i) deposit accounts;

(ii) investment property;

(iii) letter of credit rights; and

(iv) electronic and chattel paper.

The Borrower grants Lender a limited power of attorney to enter into a Control Agreement on behalf of the Borrower to effectuate the forgoing.

Borrower will not create any chattel paper without placing a legend on the chattel paper acceptable to Lender, indicating that Lender has a security interest in the chattel paper.

5.03 CROSS DEFAULT

A default of any of the terms and conditions of any Obligation, of the Borrower and/or Guarantor to the Lender (including, without limitation any reimbursement obligations arising out of any Letters of Credit which the Lender may later issue on behalf of the Borrower and/or Guarantor) or any document or instrument evidencing such an obligation, shall constitute a default of the Note, this Agreement, and all Obligations of the Borrower and/or Guarantor to the Lender whether evidenced by notes or otherwise.

6.00 CERTAIN RIGHTS OF LENDER

6.01 APPRAISAL

At any time during the term of the Loan, Borrower shall cooperate with Lender and use reasonable efforts to assist Lender in obtaining an appraisal of the Mortgaged Premises. Such cooperation and assistance from Borrower shall include but not be limited to the obligation to provide Lender or Lender’s appraiser with the following: (i) reasonable access to the Mortgaged Premises, (ii) a current certified rent roll for the Mortgaged Premises in form and substance satisfactory to Lender, including current asking rents and a history of change in asking rents and historical vacancy for the past three years, (iii) current and budgeted income and expense statements for the prior three years, (iv) a site plan and survey of Mortgaged Premises and the Building, (v) the building plans and specifications, including typical elevation and floor plans, (vi) a photocopy of the transfer documents conveying the beneficial interest in the Mortgaged Premises to Borrower, together with the legal description of the Mortgaged Premises, (vii) the current and prior year real estate tax bills, (viii) a detailed list of past and scheduled capital improvements and

15

the costs thereof, (ix) a summary of the then current ownership entity, (x) all environmental reports and other applicable information relating to the Mortgaged Premises and the Building, and (xi) copies of all recent appraisals/property description information or brochures, including descriptions of amenities and services relating to the Mortgaged Premises and the Building. The appraiser performing any such appraisal shall be engaged by Lender, and if an Event of Default has occurred then Borrower shall be responsible for any fees payable to said appraiser in connection with an appraisal of the Mortgaged Premises.

7.00A REPRESENTATIONS AND WARRANTIES

The Borrower represents and warrants to the Lender as follows:

7.01A ORGANIZATION, AUTHORITY, ETC.

(a) Organization; Good Standing. The Borrower is a limited liability company duly organized pursuant to the Articles of Organization dated October 20, 2008 and filed with the Connecticut Secretary of State on October 20, 2008, and is validly existing and in good standing under the laws of the State of Connecticut. The Borrower, (i) has all requisite power to own its property and conduct its business as now conducted and as presently contemplated, and (ii) is in good standing and is duly authorized to do business in the jurisdiction where the Land is located and in each other jurisdiction where such qualification is necessary.

(b) Authorization. The execution, delivery and performance of this Agreement and the other Loan Documents to which the Borrower is or is to become a party and the transaction contemplated hereby and thereby (i) are within the authority of such Person, (ii) have been duly authorized by all necessary proceedings on the part of such Person, (iii) do not conflict with or result in any breach or contravention of any provision of law, statute, rule or regulation to which such Person is subject or any judgment, order, writ, injunction, license or permit applicable to such Person, (iv) do not conflict with any provision of any operating agreement and articles of organization, or any agreement or other instrument binding upon, such Person, and (v) do not require the approval or consent of, or filing with, any governmental agency or authority other than those already obtained and the filing of the Mortgage, the Assignment of Leases and the Financing Statements in the appropriate public records with respect thereto.

(c) Enforceability. The execution and delivery of this Agreement and the other Loan Documents to which the Borrower is or is to become a party will result in valid and legally binding obligations of such Person enforceable against it in accordance with the respective terms and provisions hereof and thereof, except as enforceability is limited by bankruptcy, insolvency, reorganization, moratorium or other laws relating to or affecting generally the enforcement of creditors' rights and except to the extent that availability of the remedy of specific performance or injunctive relief is subject to the discretion of the court before which any proceeding therefore may be brought.

7.02A TITLE TO MORTGAGED PREMISES AND OTHER PROPERTIES

Excluding the Permitted Liens:

16

(a) The Borrower holds good clear record and marketable fee simple absolute title to the Land and the Improvements, and owns the Personal Property, subject to no rights of others, including any mortgages, leases, conditional sale agreements, title retention agreements, liens or other encumbrances.

(b) The Borrower owns all of the assets reflected in any financial statements provided to Lender as at the Balance Sheet Date or acquired since that date (except property and assets sold or otherwise disposed of in the ordinary course of business since that date), subject to no rights of others, including any mortgages, leases, conditional sales agreements, title retention agreements, liens or other encumbrances except Permitted Liens.

7.03A FINANCIAL STATEMENTS

There has been furnished to the Lender financial information of the Borrower in connection with the application for the Loan (the “Financial Information”). Such Financial Information, to the best of Borrower’s knowledge, has been prepared in accordance with generally accepted accounting principles and fairly present the financial condition of the Borrower as at the close of business on the date thereof and the results of operations for the fiscal year then ended.

7.04A NO MATERIAL CHANGES, ETC.

Since the date of the Financial Information, there has occurred no material adverse change in the financial condition or business of the Borrower other than changes in the ordinary course of business that have not had any material adverse effect either individually or in the aggregate on the business or financial condition of the Borrower.

7.05A INTELLECTUAL PROPERTY

Borrower owns or has a valid right to use all patents, copyrights, trademarks, licenses, trade names or franchises now being used or necessary to conduct its business, all of which are listed on Exhibit “E”, hereto and the conduct of its business as now operated does not conflict with valid patents, copyrights, trademarks, licenses, trade names or franchises of others in any manner that could materially adversely affect in any manner the business or assets or condition, financial or otherwise, of Borrower. True and complete copies of each license and franchise agreement, and evidence of all patents, copyrights, trademarks and trade names, have previously been delivered to the Lender.

7.06A LITIGATION

There are no actions, suits, proceedings or investigations of any kind pending or threatened against the Borrower before any court, tribunal or administrative agency or board that, if adversely determined, might, either in any case or in the aggregate, adversely affect the properties, assets, financial condition or business of such Person or materially impair the right of such Person to carry on business substantially as now conducted by it, or result in any liability not adequately covered by insurance, or for which adequate reserves are not maintained on the balance sheet of such Person, or which question the validity of this Agreement or any of the other Loan Documents, any action taken or to be taken pursuant hereto or thereto, or any lien or security interest created or

17

intended to be created pursuant hereto or thereto, or which will adversely affect the ability of the Borrower to construct, use and occupy the Improvements or to pay and perform the Obligations in the manner contemplated by this Agreement and the other Loan Documents.

7.07A NO MATERIALLY ADVERSE CONTRACTS, ETC.

The Borrower is not subject to any charter, corporate or other legal restriction, or any judgment, decree, order, rule or regulation that has or is expected in the future to have a materially adverse effect on the business, assets or financial condition of the Borrower. The Borrower is not a party to any contract or agreement that has or is expected, in the judgment of the Borrower's officers, to have any materially adverse effect on the business of the Borrower.

7.08A COMPLIANCE WITH OTHER INSTRUMENTS

The Borrower is not in violation of any provision of its Certificate of Organization or Operating Agreement or any agreement or instrument to which it may be subject or by which it or any of its properties may be bound or any decree, order, judgment, statute, license, rule or regulation, in any of the foregoing cases in a manner that could result in the imposition of penalties or materially and adversely affect the financial condition, properties or business of the Borrower.

7.09A TAX STATUS

The Borrower (a) has made or filed all federal and state income and all other tax returns, reports and declarations required by any jurisdiction to which it is subject, (b) has paid all taxes and other governmental assessments and charges shown or determined to be due on such returns, reports and declarations, except those being contested in good faith and by appropriate proceedings. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Borrower knows of no basis for any such claim.

7.10A NO EVENT OF DEFAULT

No Default or Event of Default has occurred and is continuing.

7.11A INVESTMENT COMPANY ACT

The Borrower is not an "investment company", or an "affiliated company" or a "principal underwriter" of an "investment company", as such terms are defined in the Investment Company Act of 1940.

7.12A ABSENCE OF FINANCING STATEMENTS, ETC.

There is no financing statement, security agreement, chattel mortgage, real estate mortgage or other document filed or recorded with any filing records, registry, or other public office, that purports to cover, affect or give notice of any present or possible future lien on, or security interest in, (a) any Collateral or (b) any other assets or property of the Borrower or any rights relating thereto, except with respect to Permitted Liens.

18

7.13A SETOFF, ETC.

The Collateral and the Lender's rights with respect to the Collateral are not subject to any setoff, claims, withholdings or other defenses. The Borrower is the owner of the Collateral free from any lien, security interest, encumbrance and any other claim or demand.

7.14A CERTAIN TRANSACTIONS

Except as set forth on Exhibit “F” hereto, none of the officers, trustees, directors, partners, members or employees of the Borrower are presently a party to any transaction with the Borrower (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, or otherwise requiring payments to or from any officer, trustee, director, partner or such employee or, to the knowledge of the Borrower, any corporation, partnership, trust or other entity in which any officer, trustee, director, partner, member or any such employee has a substantial interest or is an officer, director, trustee, member or partner.

7.15A EMPLOYEE BENEFIT PLANS MULTI-EMPLOYER PLANS GUARANTEED PENSION PLANS

Neither the Borrower nor any ERISA Affiliate other than the Guarantor, maintains or contributes to any Employee Benefit Plan, Multi- employer Plan or Guaranteed Pension Plan.

7.16A ENVIRONMENTAL COMPLIANCE

The Borrower has taken all necessary action to investigate the past and present condition and usage of the Real Estate and the operations conducted thereon and, based upon such diligent investigation, makes the following representations and warranties to its knowledge.

(a) None of the Borrower, or any operator of the Real Estate, or any operations thereon, is in violation, or alleged violation, of any judgment, decree, order, law, license, rule or regulation pertaining to environmental matters, including without limitation, those arising under the Resource Conservation and Recovery Act ("RCRA"), the Comprehensive Environmental Response, Compensation and Liability Act of 1980 as amended ("CERCLA"), the Superfund Amendments and Reauthorization Act of 1986 ("SARA"), the Federal Clean Water Act, the Federal Clean Air Act, the Toxic Substances Control Act or any state or local statute, regulation, ordinance, order or decree relating to health, safety or the environment (hereinafter "Environmental Laws"), which violation involves the Land or would have a material adverse effect on the environment or the business, assets or financial condition of the Borrower.

(b) The Borrower has not received notice from any third party including, without limitation any federal, state or local governmental authority, (i) that it has been identified by the United States Environmental Protection Agency ("EPA") as a potentially responsible party under CERCLA with respect to a site listed on the National Priorities List, 40 C.F.R. Part 300 Appendix B (1986); (ii) that any hazardous waste, as defined by 42 U.S.C. § 9601(5), any hazardous

19

substances as defined by 42 U.S.C. § 9601(14), any pollutant or contaminant as defined by 42 U.S.C.§ 9601(33) or any toxic substances, oil or hazardous materials as defined by M.G.L. c. .21E, or other chemicals or substances regulated by any Environmental Laws ("Hazardous Materials") which it has generated, transported or disposed of have been found at any site at which a federal, state or local agency or other third party has conducted or has ordered that the Borrower or the Guarantor conduct a remedial investigation, removal or other response action pursuant to any Environmental Laws; or (iii) that it is or shall be a named party to any claim, action, cause of action, complaint, or legal or administrative proceeding (in each case, contingent or otherwise) arising out of any third party's incurrence of costs, expenses, losses or damages of any kind whatsoever in connection with the release of Hazardous Materials.

(c) Except as set forth on Exhibit “G” attached hereto: (i) no portion of the Real Estate has been used for the handling, processing, storage or disposal of Hazardous Materials except in accordance with applicable Environmental Laws; and no underground tank or other underground storage receptacle for Hazardous Materials is located on any portion of the Real Estate; (ii) in the course of any activities conducted by the Borrower, or the operators of their properties, no Hazardous Materials have been generated or are being used on the Real Estate except in accordance with applicable Environmental Laws; (iii) there has been no past or present releasing, spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, disposing or dumping (a "Release") or threatened Release of Hazardous Materials on, upon, into or from the Real Estate, which Release would have a material adverse effect on the value of any of the Real Estate or adjacent properties or the environment; (iv) to the best of the Borrower's knowledge, there have been no Releases on, upon, from or into any real property in the vicinity of any of the Real Estate which, through soil or groundwater contamination, may have come to be located on, and which would have a material adverse effect on the value of, the Real Estate; and (v) any Hazardous Materials that have been generated on any of the Real Estate have been transported off-site only by carriers having an identification number issued by the EPA, treated or disposed of only by treatment or disposal facilities maintaining valid permits as required under applicable Environmental Laws, which transporters and facilities have been and are, to the best of the Borrower's knowledge, operating in compliance with such permits and applicable Environmental Laws.

(d) Except as set forth in Exhibit “G”, none of the Real Estate is or shall be subject to any applicable environmental clean-up responsibility law or environmental restrictive transfer law or regulation, by virtue of the transactions set forth herein and contemplated hereby.

7.17A MEMBERS AND MANAGERS

The members of the Borrower are identified on the organizational chart attached as Exhibit “H”.

7.18A CONDITION OF MORTGAGED PREMISES

None of the Mortgaged Premises nor any part thereof is now damaged or injured as result of any fire, explosion, accident, flood or other casualty or has been the subject of any Taking, and to the knowledge of the Borrower, no Taking is pending or contemplated.

20

7.19A RESERVED

7.20A REAL PROPERTY TAXES; SPECIAL ASSESSMENTS

There are no unpaid or outstanding real estate or other taxes or assessments on or against the Mortgaged Premises or any part thereof which are payable by the Borrower (except only real estate taxes not yet due and payable). The Borrower has delivered to the Lender true and correct copies of real estate tax bills for the Mortgaged Premises for the past fiscal tax year. No abatement proceedings are pending with reference to any real estate taxes assessed against the Mortgaged Premises. There are no betterment assessments or other special assessments presently pending with respect to any part of the Mortgaged Premises, and the Borrower has received no notice of any such special assessment being contemplated.

7.21A VIOLATIONS

The Borrower has received no notices of, or has any knowledge of, any violations of any applicable law.

7.22A PRINCIPAL DEPOSITORY

The Borrower further agrees that it shall conduct its principal (majority) banking business with the Lender, including, without limitation, retaining the Lender as its principal depository savings accounts, checking accounts, general demand depository accounts, and such other accounts as are utilized by the Borrower from time-to-time.

7.23A FINANCIAL STATEMENTS

The balance sheet of the Borrower and the related statements of income and retained earnings and cash flow of the Borrower for the fiscal year then ended, and the accompanying footnotes, together with any interim financial statements of the Borrower, copies of which have been furnished to the Lender, are complete and correct and fairly present the financial condition of the Borrower as at such dates and the results of the operations of the Borrower for the periods covered by such statements, all in accordance with GAAP consistently applied (subject to year‑end adjustments in the case of the interim financial statements), and there has been no material adverse change in the condition (financial or otherwise), business, or operations of the Borrower since the presentation to the Lender of the most recently dated financial statements, nor are there any liabilities of the Borrower , fixed or contingent, which are material but are not reflected in such financial statements or in the notes thereto, other than liabilities arising in the ordinary course of business. No information, exhibit or report furnished by the Borrower to the Lender in connection with the negotiation of this Agreement contained any material misstatement of fact or omitted to state a material fact or any fact necessary to make the statement contained therein not materially misleading.

21

7.24A LABOR DISPUTES AND ACTS OF GOD

Neither the business nor the properties of the Borrower are affected by any fire, explosion, accident, strike, lockout or other labor dispute, drought, storm, hail, earthquake, embargo, act of God or of the public enemy, or other casualty (whether or not covered by insurance), materially and adversely affecting such business or properties or the operation of the Borrower.

7.25A OTHER AGREEMENTS

The Borrower is not a party to any indenture, loan or credit agreement, or to any lease or other agreement or instrument, or subject to any charter or limited liability company restriction which could have a material adverse effect on the business, properties, assets, operations, or conditions, financial or otherwise, of the Borrower, or the ability of the Borrower to carry out its obligations under the Loan Documents to which it is a party. The Borrower is not in default in any material respect in the performance, observance, or fulfillment of any of the obligations, covenants, or conditions contained in any agreement or instrument material to its business to which it is a party.

7.26A LITIGATION

There is no pending or threatened action or proceeding against or affecting the Borrower before any court, governmental agency, or arbitrator, which may, in any one case or in the aggregate, materially adversely affect the financial condition, operations, properties, or business of the Borrower, or the ability of the Borrower to perform their obligations under the Loan Documents to which it is a party.

7.27A NO JUDGMENTS

The Borrower has satisfied all judgments, and the Borrower is not in default with respect to any judgment, writ, injunction, decree, rule or regulation of any court, arbitrator, or Federal, state, municipal, or other governmental authority, commission, board, bureau, agency, or instrumentality, domestic or foreign.

7.28A ERISA

The Borrower is to the best of its knowledge in compliance in all material respects with all applicable provisions of ERISA. Neither a Reportable Event nor a Prohibited Transaction has occurred and is continuing with respect to any Plan; no notice of intent to terminate a Plan has been filed, nor has any Plan been terminated; no circumstances exist which constitute grounds entitling the PBGC to institute proceedings to terminate, or appoint a trustee to administer, a Plan, nor has the PBGC instituted any such proceedings; the Borrower, nor any Commonly Controlled Entity has completely or partially withdrawn from a Multiemployer Plan; the Borrower and each Commonly Controlled Entity have met their minimum funding requirements under ERISA with respect to all of their Plans and the present value of all vested benefits under each Plan does not exceed the fair market value of all Plan assets allocable to such benefits, as determined on the most recent valuation date of the Plan and in accordance with the provisions of ERISA; and neither the

22

Borrower, nor any Commonly Controlled Entity has incurred any liability to the PBGC under ERISA.

7.29A DEBT

Set forth in the financial statements referred to in this Agreement, to the extent required by GAAP, is a complete and correct list of all Debt in respect of which the Borrower is in any manner directly or contingently obligated; and the maximum principal or face amounts of the credit in question, which are outstanding and which can be outstanding, are correctly stated, and all Liens of any nature given or agreed to be given as security therefore are correctly described or indicated in such financial statements. Exhibit “I” correctly lists all secured and unsecured Debt of the Borrower outstanding as of the date of this Agreement, and shows, as to each item of Debt listed thereon, the obligor and obligee, the aggregate principal amount outstanding on the date hereof.

7.30A EXECUTIVE AGREEMENTS

None of the executive officers of the Borrower is subject to any agreement in favor of anyone, other than Borrower, which limits or restricts that person’s right to engage in the type of business activity conducted or proposed to be conducted by such Borrower or to use therein any property or confidential information or which grants to anyone other than the Borrower any rights in any inventions or other ideas susceptible to legal protection developed or conceived by any such officer.

7.31A FOREIGN ASSET CONTROL REGULATIONS

Neither the execution of this Agreement nor the use of the proceeds thereof violates the Trading with the Enemy Act of 1917, as amended, nor any of the Foreign Assets Control Regulations promulgated thereunder or under the International Emergency Economic Powers Act or the U.N. Participation Act of 1945.

7.00B REPRESENTATIONS AND WARRANTIES

The Guarantor represents and warrants to the Lender as follows:

7.01B ORGANIZATION, AUTHORITY, ETC.

(a) Organization; Good Standing. The Guarantor is a corporation duly organized pursuant to the Articles of Organization dated March 10, 1970 and filed with the Delaware Secretary of State on March 10, 1970 and is validly existing and in good standing under the laws of the State of Delaware. The Guarantor, (i) has all requisite power to own its property and conduct its business as now conducted and as presently contemplated, and (ii) is in good standing and is duly authorized to do business in the jurisdiction where the Land is located and in each other jurisdiction where such qualification is necessary.

(b) Authorization. The execution, delivery and performance of this Agreement and the other Loan Documents to which the Guarantor is or is to become a party and the transaction

23

contemplated hereby and thereby (i) are within the authority of such Person, (ii) have been duly authorized by all necessary proceedings on the part of such Person, (iii) do not conflict with or result in any breach or contravention of any provision of law, statute, rule or regulation to which such Person is subject or any judgment, order, writ, injunction, license or permit applicable to such Person, (iv) do not conflict with any provision of any operating agreement and articles of organization, or any agreement or other instrument binding upon, such Person, and (v) do not require the approval or consent of, or filing with, any governmental agency or authority other than those already obtained and the filing of the Mortgage, the Assignment of Leases and the Financing Statements in the appropriate public records with respect thereto.

(c) Enforceability. The execution and delivery of this Agreement and the other Loan Documents to which the Guarantor is or is to become a party will result in valid and legally binding obligations of such Person enforceable against it in accordance with the respective terms and provisions hereof and thereof, except as enforceability is limited by bankruptcy, insolvency, reorganization, moratorium or other laws relating to or affecting generally the enforcement of creditors' rights and except to the extent that availability of the remedy of specific performance or injunctive relief is subject to the discretion of the court before which any proceeding therefore may be brought.

7.02B FINANCIAL STATEMENTS

There has been furnished to the Lender financial information of the Guarantor in connection with the application for the Loan (the “Financial Information”). Such Financial Information, to the best of Guarantor’s knowledge, has been prepared in accordance with generally accepted accounting principles and fairly present the financial condition of the Guarantor as at the close of business on the date thereof and the results of operations for the fiscal year then ended.

7.03B NO MATERIAL CHANGES, ETC.

Since the date of the Financial Information, there has occurred no material adverse change in the financial condition or business of the Guarantor other than changes in the ordinary course of business that have not had any material adverse effect either individually or in the aggregate on the business or financial condition of the Guarantor.

7.04B LITIGATION

There are no actions, suits, proceedings or investigations of any kind pending or threatened against the Guarantor before any court, tribunal or administrative agency or board that, if adversely determined, might, either in any case or in the aggregate, adversely affect the properties, assets, financial condition or business of such Person or materially impair the right of such Person to carry on business substantially as now conducted by it, or result in any liability not adequately covered by insurance, or for which adequate reserves are not maintained on the balance sheet of such Person, or which question the validity of this Agreement or any of the other Loan Documents, any action taken or to be taken pursuant hereto or thereto, or any lien or security interest created or intended to be created pursuant hereto or thereto, or which will adversely affect the ability of the

24

Guarantor to construct, use and occupy the Improvements or to pay and perform the Obligations in the manner contemplated by this Agreement and the other Loan Documents.

7.05B NO MATERIALLY ADVERSE CONTRACTS, ETC.

The Guarantor is not subject to any charter, corporate or other legal restriction, or any judgment, decree, order, rule or regulation that has or is expected in the future to have a materially adverse effect on the business, assets or financial condition of the Guarantor. The Guarantor is not a party to any contract or agreement that has or is expected, in the judgment of the Guarantor's officers, to have any materially adverse effect on the business of the Guarantor.

7.06B COMPLIANCE WITH OTHER INSTRUMENTS

The Guarantor is not in violation of any provision of its Certificate of Organization or Operating Agreement or any agreement or instrument to which it may be subject or by which it or any of its properties may be bound or any decree, order, judgment, statute, license, rule or regulation, in any of the foregoing cases in a manner that could result in the imposition of penalties or materially and adversely affect the financial condition, properties or business of the Guarantor.

7.07B TAX STATUS

The Guarantor (a) has made or filed all federal and state income and all other tax returns, reports and declarations required by any jurisdiction to which it is subject, (b) has paid all taxes and other governmental assessments and charges shown or determined to be due on such returns, reports and declarations, except those being contested in good faith and by appropriate proceedings. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Guarantor knows of no basis for any such claim.

7.08B FINANCIAL STATEMENTS

The balance sheet of the Guarantor and the related statements of income and retained earnings and cash flow of the Guarantor for the fiscal year then ended, and the accompanying footnotes, together with any interim financial statements of the Guarantor, copies of which have been furnished to the Lender, are complete and correct and fairly present the financial condition of the Guarantor as at such dates and the results of the operations of the Guarantor for the periods covered by such statements, all in accordance with GAAP consistently applied (subject to year‑end adjustments in the case of the interim financial statements), and there has been no material adverse change in the condition (financial or otherwise), business, or operations of the Guarantor since the presentation to the Lender of the most recently dated financial statements, nor are there any liabilities of the Guarantor , fixed or contingent, which are material but are not reflected in such financial statements or in the notes thereto, other than liabilities arising in the ordinary course of business. No information, exhibit or report furnished by the Guarantor to the Lender in connection with the negotiation of this Agreement contained any material misstatement of fact or omitted to state a material fact or any fact necessary to make the statement contained therein not materially misleading.

25

7.08B LABOR DISPUTES AND ACTS OF GOD

Neither the business nor the properties of the Guarantor are affected by any fire, explosion, accident, strike, lockout or other labor dispute, drought, storm, hail, earthquake, embargo, act of God or of the public enemy, or other casualty (whether or not covered by insurance), materially and adversely affecting such business or properties or the operation of the Guarantor.

7.09B OTHER AGREEMENTS

The Guarantor is not a party to any indenture, loan or credit agreement, or to any lease or other agreement or instrument, or subject to any charter or limited liability company restriction which could have a material adverse effect on the business, properties, assets, operations, or conditions, financial or otherwise, of the Guarantor, or the ability of the Guarantor to carry out its obligations under the Loan Documents to which it is a party. The Guarantor is not in default in any material respect in the performance, observance, or fulfillment of any of the obligations, covenants, or conditions contained in any agreement or instrument material to its business to which it is a party.

7.10B LITIGATION

There is no pending or threatened action or proceeding against or affecting the Guarantor before any court, governmental agency, or arbitrator, which may, in any one case or in the aggregate, materially adversely affect the financial condition, operations, properties, or business of the Guarantor, or the ability of the Guarantor to perform their obligations under the Loan Documents to which it is a party.

7.11B NO JUDGMENTS

The Guarantor has satisfied all judgments, and the Guarantor is not in default with respect to any judgment, writ, injunction, decree, rule or regulation of any court, arbitrator, or Federal, state, municipal, or other governmental authority, commission, board, bureau, agency, or instrumentality, domestic or foreign.

7.12B ERISA

The Guarantor is to the best of its knowledge in compliance in all material respects with all applicable provisions of ERISA. Neither a Reportable Event nor a Prohibited Transaction has occurred and is continuing with respect to any Plan; no notice of intent to terminate a Plan has been filed, nor has any Plan been terminated; no circumstances exist which constitute grounds entitling the PBGC to institute proceedings to terminate, or appoint a trustee to administer, a Plan, nor has the PBGC instituted any such proceedings; the Guarantor, nor any Commonly Controlled Entity has completely or partially withdrawn from a Multiemployer Plan; the Guarantor and each Commonly Controlled Entity have met their minimum funding requirements under ERISA with respect to all of their Plans and the present value of all vested benefits under each Plan does not exceed the fair market value of all Plan assets allocable to such benefits, as determined on the most

26

recent valuation date of the Plan and in accordance with the provisions of ERISA; and neither the Guarantor, nor any Commonly Controlled Entity has incurred any liability to the PBGC under ERISA.

7.13B DEBT

Set forth in the financial statements referred to in this Agreement, to the extent required by GAAP, is a complete and correct list of all Debt in respect of which the Guarantor is in any manner directly or contingently obligated; and the maximum principal or face amounts of the credit in question, which are outstanding and which can be outstanding, are correctly stated, and all Liens of any nature given or agreed to be given as security therefore are correctly described or indicated in such financial statements. Exhibit “I” correctly lists all secured and unsecured Debt of the Guarantor outstanding as of the date of this Agreement, and shows, as to each item of Debt listed thereon, the obligor and obligee, the aggregate principal amount outstanding on the date hereof.

7.14B EXECUTIVE AGREEMENTS

None of the executive officers of the Guarantor is subject to any agreement in favor of anyone, other than Guarantor, which limits or restricts that person’s right to engage in the type of business activity conducted or proposed to be conducted by such Guarantor or to use therein any property or confidential information or which grants to anyone other than the Guarantor any rights in any inventions or other ideas susceptible to legal protection developed or conceived by any such officer.

7.15B FOREIGN ASSET CONTROL REGULATIONS

Neither the execution of this Agreement nor the use of the proceeds thereof violates the Trading with the Enemy Act of 1917, as amended, nor any of the Foreign Assets Control Regulations promulgated thereunder or under the International Emergency Economic Powers Act or the U.N. Participation Act of 1945.

8.00 AFFIRMATIVE COVENANTS OF THE BORROWER

The Borrower covenants and agrees that, so long as the Loan is outstanding or the Lender has any obligation to make any Advances:

8.01 PUNCTUAL PAYMENT

The Borrower will duly and punctually pay or cause to be paid the principal and interest on the Loan and all other amounts provided for in the Note, this Agreement and the other Loan Documents to which the Borrower is a party, all in accordance with the terms of the Note, this Agreement and such other Loan Documents.

27

8.02 MAINTENANCE OF OFFICE