Attached files

| file | filename |

|---|---|

| EX-10.57 - EX-10.57 - INDUS REALTY TRUST, INC. | grif-20170831ex1057d845c.htm |

| EX-32.2 - EX-32.2 - INDUS REALTY TRUST, INC. | grif-20170831ex322f3fc52.htm |

| EX-32.1 - EX-32.1 - INDUS REALTY TRUST, INC. | grif-20170831ex32178186f.htm |

| EX-31.2 - EX-31.2 - INDUS REALTY TRUST, INC. | grif-20170831ex31213ff13.htm |

| EX-31.1 - EX-31.1 - INDUS REALTY TRUST, INC. | grif-20170831ex311cdbbd4.htm |

| EX-10.59 - EX-10.59 - INDUS REALTY TRUST, INC. | grif-20170831ex1059fe54f.htm |

| EX-10.58 - EX-10.58 - INDUS REALTY TRUST, INC. | grif-20170831ex10581f281.htm |

| 10-Q - 10-Q - INDUS REALTY TRUST, INC. | grif-20170831x10q.htm |

Exhibit 10.56

TERM NOTE

|

$10,600,000 |

July 14, 2017 |

FOR VALUE RECEIVED, Tradeport Development III, LLC (the "Borrower"), a Connecticut limited liability company, having a chief executive principal place of business at 204 West Newberry Road, Bloomfield, Connecticut, promises to pay to the order of Berkshire Bank (the “Lender”), a Massachusetts banking corporation, at Lender's office located at 19 Harrison Avenue, Springfield, Massachusetts 01103, or at such other place as Lender may designate in writing, the principal sum of Ten Million Six Hundred Thousand and 00/100 Dollars ($10,600,000), plus interest from the date hereof, all as hereinafter set forth. This Note replaces a certain Construction Note dated February 6, 2009, given by Borrower to Lender. This Note is the Term Note described in an Amended and Restated Loan and Security Agreement of even date herewith between the Borrower and the Lender (the “Loan Agreement”). The terms defined in the Loan Agreement shall have their defined meanings apply herein. This Note is subject to, and governed by the Loan Agreement in all respects.

INTEREST

For the entire term of the Loan, the Loan shall bear interest at an adjustable annual rate equal to the one (1) month LIBOR Rate, plus two hundred five (205) basis points. Such adjustments shall become effective on the 1st day of each month (the “Reset Date”). Lender shall not be required to notify Borrower of adjustments in said interest rate.

REPAYMENT

Principal and interest due Lender hereunder shall be repaid as follows:

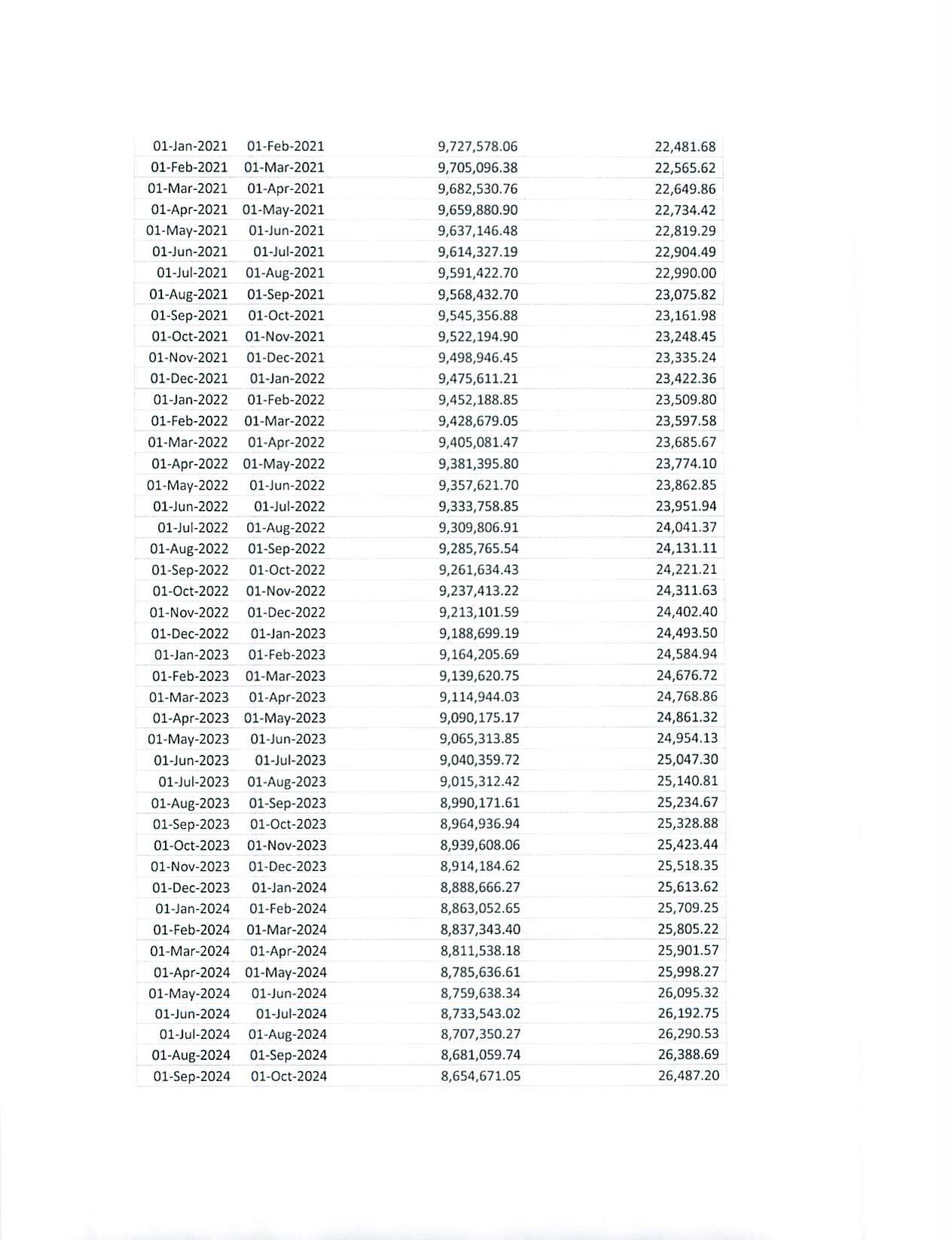

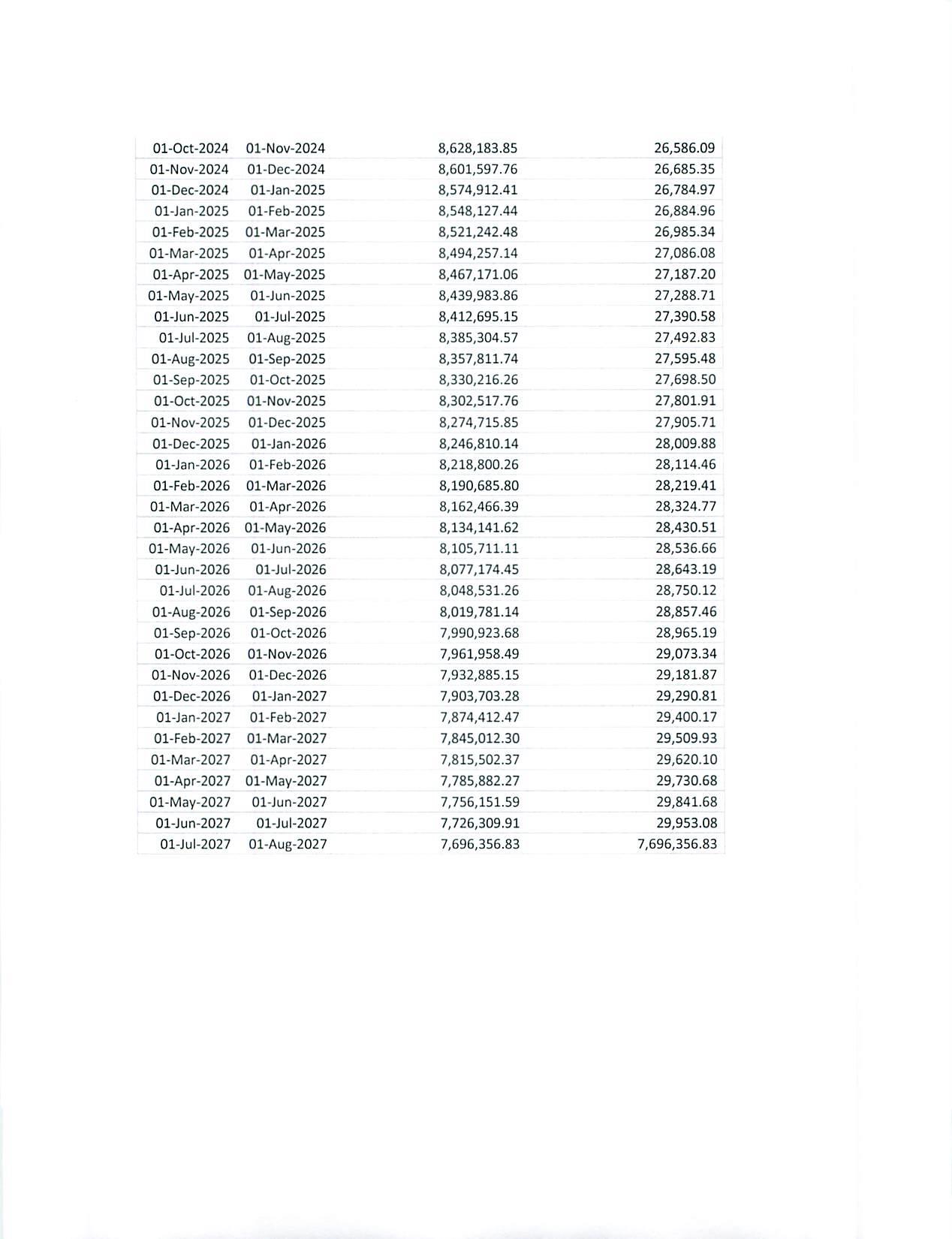

A. Commencing on August 1, 2017 and thereafter on the same day of each succeeding month (“Interest Period”) for a period of one hundred twenty (120) months (excepting the final payment) and based on an amortization period of twenty-five (25) years, monthly payments of principal plus interest, in arrears, calculated at the above rate of interest on the outstanding principal balance. A repayment schedule based on the payments under this Note is attached hereto as Exhibit A.

B. Any remaining unpaid principal, and all accrued interest thereon, shall be due and payable IN FULL on August 1, 2027 (the “Maturity Date”).

Any payments received by Lender with respect to this Note prior to demand, acceleration

1

or maturity shall be applied first to any costs, expenses or charges due Lender from Borrower, second to any unpaid accrued interest hereunder, and third to the unpaid principal hereunder. Any payments received after demand, acceleration or maturity shall be applied in such a manner as Lender shall determine.

If any payment required hereunder is more than ten (10) days past due, (in addition to interest accruing hereunder) a late charge of five (5.00%) percent of the overdue payment shall be charged to Borrower and be immediately due and payable to Lender. Any payment having a due date falling upon a Saturday, Sunday, or legal holiday shall be due and payable on the next business day for which Lender is open for business, and interest shall continue to accrue during the extended period.

If any payment received by Lender with respect to this Note shall be deemed by a court of competent jurisdiction to have been a voidable preference or fraudulent conveyance under federal or state law, or otherwise due any party other than Lender, then the obligation for which the payment was made shall not be discharged by the payment and shall survive as an obligation due hereunder, notwithstanding Lender's return to Borrower or any other party of the original of this Note or other instrument evidencing the obligation for which payment was made.

In the event the Borrower prepays all or any portion of this Note, whether as a result of acceleration or otherwise, the Borrower will pay to the Lender on the same date that any such payment is made any breakage fee, yield maintenance charge, termination fee or similar fee or charge as may be required pursuant to the Hedging Contract (as defined in the Loan Agreement) to cover loss, cost and expense attributable to such prepayment. All prepayments (with prepayment defined herein as any payment of principal in advance of its due date) shall be applied against the principal payments due hereunder in the inverse order of their maturity.

The following described property from Borrower, in addition to all other collateral now or hereafter provided by Borrower to Lender, shall secure this Note and all other present and future obligations of Borrower to Lender: Mortgage and Security Agreement and Collateral Assignment of Rents and Leases with respect to all of Borrower’s property and chose-in-action, including, without limitation, real estate located at 100 International Drive, Windsor, Connecticut.

Any and all deposits or other sums at any time credited by, or due to Borrower hereof from Lender or any of its banking or lending affiliates or any loan participant under any loan arrangement between Lender and Borrower, and any cash, instruments, securities or other property of Borrower, now or hereafter in the possession of Lender, or any of its banking or lending affiliates or any loan participant under any loan arrangement between Lender and Borrower, whether for safekeeping or otherwise, shall at all times constitute security (and hereby remain subject to a pledge and grant of a security interest by Borrower) for the payment of this Note and all other obligations, whether now existing or hereafter arising, of Borrower to Lender and may be applied or set off against such Note or other obligations at any time, whether or not then due.

This Note shall be in default, and all unpaid principal, interest, and other amounts due hereunder, shall, at Lender's option, be immediately due and payable, without prior notice, protest,

2

or demand, upon the occurrence of any Event of Default. Default upon this Note shall also operate as a default upon all other obligations of Borrower to Lender.

Upon the occurrence of an Event of Default hereunder, interest upon the principal balance hereof, and to the extent permitted by law, on any accrued but unpaid interest hereon, shall, at Lender's option, accrue at the Default Rate.

Borrower hereby waives presentment, demand, notice and protest and also waives any delay on the part of the holder hereof. Each also assents to (i) any extension, or other indulgence (including, without limitation, any release or substitution of collateral or of any direct or indirect obligor) permitted by Lender with respect to this Note and/or any collateral given to secure this Note and (ii) any extension or other indulgence, as described above, with respect to any other obligation or any collateral given to secure such other obligation of Borrower to Lender. A discharge or release of any party directly or indirectly liable hereon shall not discharge or otherwise affect the liability of any other party directly or indirectly liable hereon.

No indulgence, delay, or omission by Lender in exercising or enforcing any of its rights or remedies hereunder shall operate as a waiver thereof on that occasion nor on any other occasion. No waiver of any default hereunder shall operate as a waiver of any other default hereunder, nor as a continuing waiver. No waiver of a default or of any other right or remedy hereunder, nor any modification of any provision of this Note, shall be enforceable unless it is in writing signed by the party against whom the waiver or modification is to be enforced. All of Lender's rights and remedies hereunder and under any other related loan documents shall be cumulative and may be exercised singularly or concurrently, at Lender's sole and exclusive discretion.

It is not intended under this Note to charge interest at a rate exceeding the maximum rate of interest permitted to be charged under applicable law, but if interest exceeding said maximum rate should be paid hereunder, the excess shall, at Lender's option, be (a) deemed a voluntary prepayment of principal not subject to the prepayment premium (if any) set forth herein or (b) refunded to Borrower.

Borrower agrees to pay on demand all costs and expenses, including, but not limited to, reasonable attorneys' fees, incurred by Lender in connection with the protection and/or enforcement of any of Lender's rights or remedies against Borrower (whether or not any suit has been instituted by or against Lender).

This Note shall be binding upon Borrower hereof and upon its respective heirs, successors, and representatives, and shall inure to the benefit of Lender and its successors, endorsees and assigns.

No party obligated on account of this Note may seek contribution from any other party also obligated unless and until all obligations to Lender of the party to whom contribution is sought have been satisfied in full. Each reference to Lender herein is to the named payee hereto or any subsequent holder hereof, and their respective successors, endorsees and assigns.

3

Borrower represents to Lender that the proceeds of this Note will not be used for personal, family or household purposes and that this loan is strictly a commercial transaction.

Except as provided below, notwithstanding anything else to the contrary contained in this Term Note or in any other document or instrument, the indebtedness evidenced by this Term Note or evidence or secured thereunder shall be non-recourse to the Borrower and Borrower shall be liable upon the indebtedness evidence hereby or evidenced or secured thereby to the full extent (but only to the extent) of the security therefore, the same being the Mortgaged Premises and all rights, estates and interests therein or related thereto securing the payment of this Term Note. If an Event of Default occurs hereunder or under any of the Obligations, or in the timely and proper performance of any Obligations of Borrower thereunder, any judicial proceedings brought by Lender, or the holder hereof, against Borrower shall be limited to the preservation, enforcement and foreclosure, or any thereof, of the liens, security, title, estates, rights and security interests now or at any time hereafter securing the payment of this Term Note or the other Obligations of Borrower to Lender, and no attachment, execution or other writ of process shall be sought, issued, or levied upon any assets, properties or funds of Borrower other than the Mortgaged Premises (except as provided hereafter), and in the event of foreclosure of such liens, security, title, estates, rights or security interests, securing the payment of the Term Note, and/or other Obligations of Borrower, no judgment for any deficiency upon the indebtedness evidenced hereby or evidenced or secured thereby shall be sought or obtained by Lender, or the holder hereof, against Borrower, except on account of the occurrence of (i) any of the conditions specified in an Amended and Restated Environmental Indemnity Agreement of even date herewith, or (ii) any of the following A-I, in which case the Borrower shall be personally liable to Lender for all of Lender’s loss, cost and damages (including without limitation, reasonable attorneys’ fees) due to Lender by reason of, or in connection with the occurrence of any of the following events:

A. The misapplication by Borrower of any insurance proceeds or condemnation awards, including, but not limited to, the failure to deliver same to Lender, any receiver or any purchaser at foreclosure, if appropriate;

B. The failure of the Borrower to pay any real estate taxes and assessments or insurance premiums with respect to the Mortgaged Premises or any charges for labor or materials which may result in the creation of liens on the Mortgaged Premises to the extent of Rents actually received;

C.Following the occurrence of an Event of Default, the misapplication of any tenant rents or security deposits or any other refundable deposits, including, but not limited to, the failure to deliver same to Lender, any receiver or any purchaser at foreclosure, if appropriate;

D.Waste committed on the Mortgaged Premises or damage to the Mortgaged Premises as a result of the intentional misconduct or gross negligence of Borrower or the wrongful removal or destruction of any portion of the Mortgaged Premises; or

4

E.Any fraud or the material breach of any material representation or warranty made in connection with the Loan known by Borrower or any member of Borrower to have been false when made or deemed made, including any material misrepresentation or inaccuracy contained in any financial statement or other document provided to the Lender pursuant to this Term Note known by Borrower or any member of Borrower known to have been false or inaccurate when provided; or

F.Any filing by Borrower of a petition or application for relief, extension, moratorium or reorganization under any bankruptcy, insolvency or debtor’s relief law, or the making of an assignment for the benefit of creditors, or the appointment of a receiver of any property of Borrower in any action initiated by, colluded in, or consented to, by Borrower; or

G. The contesting or opposition by Borrower of any motion for relief from the automatic stay filed by Lender in any involuntary bankruptcy proceeding of Borrower; or

H.Any acts of Borrower that are judicially determined to have been taken in bad faith with the intent to hinder, delay or interfere with the exercise by Lender of its rights and remedies under the Loan Documents after the occurrence of an Event of Default; or

I.The transfer of any ownership interest in or to creation of any voluntary lien on the Mortgaged Premises not permitted by the Loan Documents.

THIS NOTE SHALL BE GOVERNED BY THE LAWS OF THE COMMONWEALTH OF MASSACHUSETTS, AND THE BORROWER SUBMITS TO THE JURISDICTION OF ITS COURTS WITH RESPECT TO ALL CLAIMS CONCERNING THIS NOTE OR ANY COLLATERAL SECURING IT.

ALL PARTIES TO THIS NOTE, INCLUDING LENDER, AND AS A NEGOTIATED PART OF THIS TRANSACTION, HEREBY EXPRESSLY WAIVE ALL RIGHTS TO TRIAL BY JURY, AS TO ALL ISSUES, INCLUDING ANY COUNTERCLAIMS, WITHOUT EXCEPTION, IN ANY ACTION OR PROCEEDING RELATING, DIRECTLY OR INDIRECTLY, TO THIS NOTE AND/OR OTHER INSTRUMENTS OR LOAN DOCUMENTS (IF ANY) EXECUTED IN CONNECTION HEREWITH.

BORROWER HEREBY WAIVES ANY AND ALL RIGHTS THAT THE BORROWER MAY HAVE UNDER SECTION 52-278(a) THROUGH 52-278(g) OF THE CONNECTICUT GENERAL STATUTES (AS AMENDED), INTENDING THEREBY THAT IN THE EVENT OF ANY LEGAL ACTION BETWEEN THE BORROWER AND THE LENDER ARISING OUT OF THIS AGREEMENT, THE LENDER MAY INVOKE ANY PRE-JUDGMENT REMEDY, INCLUDING BUT NOT BEING LIMITED TO, GARNISHMENT, ATTACHMENT,

5

FOREIGN ATTACHMENT AND REPLEVIN, WITHOUT GIVING BORROWER ANY NOTICE OR OPPORTUNITY FOR A HEARING. THIS WAIVER IS MADE BY THE BORROWER ON BEHALF OF THE BORROWER, ITS HEIRS, SUCCESSORS, AND ASSIGNS, AND SHALL APPLY TO ANY AND ALL ACTIONS AGAINST SUCH HEIRS, SUCCESSORS AND ASSIGNS.

This Note constitutes a final written expression of all of its terms and is a complete and exclusive statement of those terms. Any modification or waiver of any of these terms must be in writing signed by the party against whom the modification or waiver is to be enforced.

The Borrower agrees to be bound by the terms of this Note and acknowledge receipt of a signed copy hereof.

This Note shall be governed by the laws of the Commonwealth of Massachusetts, without regard to its principles of conflicts of laws, and shall take effect as a sealed instrument.

{SIGNATURE PAGE FOLLOWS}

6

Signed under seal as of the day and year first above written.

|

|

TRADEPORT DEVELOPMENT III, LLC |

|

|

By: |

River Bend Holdings, LLC |

|

|

|

Its Sole Member |

|

|

By: |

Griffin Industrial, LLC |

|

|

|

Its Sole Member |

|

/s/ THOMAS M. DANIELLS |

By: |

/s/ ANTHONY GALICI |

|

Witness Thomas M. Daniells |

|

Name: Anthony J. Galici |

|

/s/ MATTHEW J. HOBERMAN |

|

Title: Vice President |

|

Witness Matthew J. Hoberman |

|

|

{Signature Page to Term Note}

7

8

9

10