Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - INDUS REALTY TRUST, INC. | grif-20171130ex311f53a38.htm |

| EX-32.2 - EX-32.2 - INDUS REALTY TRUST, INC. | grif-20171130ex3225db876.htm |

| EX-32.1 - EX-32.1 - INDUS REALTY TRUST, INC. | grif-20171130ex3213480de.htm |

| EX-31.2 - EX-31.2 - INDUS REALTY TRUST, INC. | grif-20171130ex312ff4b2f.htm |

| EX-23.1 - EX-23.1 - INDUS REALTY TRUST, INC. | grif-20171130ex231106ffa.htm |

| EX-21 - EX-21 - INDUS REALTY TRUST, INC. | grif-20171130ex21a59c234.htm |

| EX-10.61 - EX-10.61 - INDUS REALTY TRUST, INC. | grif-20171130ex1061a67be.htm |

| EX-10.60 - EX-10.60 - INDUS REALTY TRUST, INC. | grif-20171130ex10603bc7f.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the fiscal year ended November 30, 2017 |

|

|

|

|

|

OR |

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12879

GRIFFIN INDUSTRIAL REALTY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

06-0868496 |

|

|

|

|

641 Lexington Avenue |

10022 (Zip Code) |

(212) 218-7910

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12 (b) OF THE ACT:

|

Title of Each Class |

Name of Each Exchange on Which Registered |

|

Common Stock $0.01 par value per share |

The Nasdaq Stock Market LLC |

SECURITIES REGISTERED PURSUANT TO SECTION 12 (g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☒ |

|

|||

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

Emerging growth company ☐ |

|||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the Common Stock held by non-affiliates of the registrant was approximately $81,533,000 based on the closing sales price on The Nasdaq Stock Market LLC on May 31, 2017, the last business day of the registrant’s most recently completed second quarter. Shares of Common Stock held by each executive officer, director and persons or entities known to the registrant to be affiliates of the foregoing have been excluded in that such persons may be deemed to be affiliates. This assumption regarding affiliate status is not necessarily a conclusive determination for other purposes.

As of January 31, 2018, 5,001,006 shares of common stock were outstanding.

FORWARD‑LOOKING STATEMENTS

This Annual Report on Form 10‑K (the “Annual Report”) contains forward‑looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). For this purpose, any statements contained in this Annual Report that relate to future events or conditions, including without limitation, the statements in Part I, Item 1. “Business” and Item 1A. “Risk Factors” and in Part II Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as located elsewhere in this Annual Report regarding industry prospects or Griffin Industrial Realty, Inc.’s (“Griffin”) plans, expectations, or prospective results of operations or financial position, may be deemed to be forward‑looking statements. Without limiting the foregoing, the words “believes,” “anticipates,” “plans,” “expects,” and similar expressions are intended to identify forward‑looking statements. Such forward‑looking statements represent management’s current expectations and are inherently uncertain. There are a number of important factors that could materially impact the value of Griffin’s common stock or cause actual results to differ materially from those indicated by such forward‑looking statements. Such factors include: adverse economic conditions and credit markets; a downturn in the commercial and residential real estate markets; risks associated with concentration of real estate holdings; risks associated with entering new real estate markets; risks associated with competition with other parties for acquisition of properties; risks associated with the use of third-party managers for day-to-day property management; risks relating to reliance on lease revenues; risks associated with nonrecourse mortgage loans; risks of financing arrangements that include balloon payment obligations; risks associated with failure to effectively hedge against interest rate changes; risks associated with volatility in the capital markets; risks associated with increased operating expenses; potential environmental liabilities; governmental regulations; inadequate insurance coverage; risks of environmental factors; risks associated with the cost of raw materials or energy costs; risks associated with deficiencies in disclosure controls and procedures or internal control over financial reporting; risks associated with information technology security breaches; litigation risks; and the concentrated ownership of Griffin common stock by members of the Cullman and Ernst families. These and the important factors discussed under the caption “Risk Factors” in Part I, Item 1A of this Annual Report for the fiscal year ended November 30, 2017, among others, could cause actual results to differ materially from those indicated by forward‑looking statements made in this Annual Report and presented elsewhere by management from time to time. Any such forward‑looking statements represent management’s estimates as of the date of this Annual Report. While Griffin may elect to update such forward‑looking statements at some point in the future, Griffin disclaims any obligation to do so, even if subsequent events cause Griffin’s views to change. These forward‑looking statements should not be relied upon as representing Griffin’s views as of any date subsequent to the date of this Annual Report.

2

GRIFFIN INDUSTRIAL REALTY, INC.

FORM 10-K

|

|

|

|

|

|

|

|

|

|

|

|

4 | ||

|

|

|

|

|

|

|

13 | ||

|

|

|

|

|

|

|

22 | ||

|

|

|

|

|

|

|

23 | ||

|

|

|

|

|

|

|

25 | ||

|

|

|

|

|

|

|

25 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 | ||

|

|

|

|

|

|

|

28 | ||

|

|

|

|

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

29 | |

|

|

|

|

|

|

|

44 | ||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

45 | |

|

|

|

|

|

|

|

|

46 | |

|

|

|

|

|

|

|

|

47 | |

|

|

|

|

|

|

|

|

48 | |

|

|

|

|

|

|

|

|

49 | |

|

|

|

|

|

|

|

|

50 | |

|

- |

|

|

|

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

78 | |

|

|

|

|

|

|

|

78 | ||

|

|

|

|

|

|

|

79 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

80 | ||

|

|

|

|

|

|

|

83 | ||

|

|

|

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

96 | |

|

|

|

|

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

98 | |

|

|

|

|

|

|

|

99 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 | ||

|

|

|

|

|

|

|

|

101 | |

|

|

|

|

|

|

|

|

106 |

3

ITEM 1. BUSINESS.

Griffin Industrial Realty, Inc. (“Griffin”) is a real estate business principally engaged in developing, managing and leasing industrial/warehouse properties, and to a lesser extent, office/flex properties. Griffin seeks to add to its property portfolio through the acquisition and development of land or the purchase of buildings in select markets targeted by Griffin. Periodically, Griffin may sell certain portions of its undeveloped land that it has owned for an extended time period and the use of which is not consistent with Griffin’s core development and leasing strategy. Prior to May 13, 2015, Griffin was known as Griffin Land & Nurseries, Inc. On May 13, 2015, Griffin changed its name to better reflect its ongoing real estate business and focus on industrial/warehouse properties after the sale in fiscal 2014 of the landscape nursery business that Griffin had operated through its wholly owned subsidiary, Imperial Nurseries, Inc.

As of November 30, 2017, Griffin owned thirty‑five buildings comprising approximately 3,710,000 square feet that was 95% leased. Approximately 88% of Griffin’s currently owned square footage is industrial/warehouse space, with the balance principally being office/flex space. As of November 30, 2017, approximately 98% of Griffin’s industrial/warehouse space was leased and approximately 71% of Griffin’s office/flex space was leased. As stated in “Item 2. Properties” below, Griffin uses nonrecourse mortgage loans to finance some of its real estate development activities, and as of November 30, 2017, approximately $131.0 million was outstanding under such loans. In fiscal 2017, profit from leasing activities (which Griffin defines as rental revenue less operating expenses of rental properties) was approximately $21.1 million, while debt service on nonrecourse mortgage loans was approximately $8.7 million.

Through fiscal 2009, all of Griffin’s buildings were located in the north submarket of Hartford, Connecticut. In fiscal 2010, Griffin started the expansion of its real estate holdings to areas outside of Hartford by purchasing an industrial/warehouse building and undeveloped land in the Lehigh Valley of Pennsylvania (see “Lehigh Valley, Pennsylvania” on page 8). In fiscal 2017, Griffin expanded its real estate holdings into the southeast United States by acquiring 215 International Drive (“215 International”), an approximately 277,000 square foot industrial/warehouse building in Concord, North Carolina, which is in the greater Charlotte area (see “Charlotte, North Carolina” on page 9). 215 International was 74% leased at the time of acquisition. Subsequently, an existing tenant in that building leased all of the remaining vacant space. Griffin expects to continue to seek to acquire and develop properties that are consistent with its core strategy of developing and leasing industrial/warehouse properties. Griffin targets properties that are in close proximity to transportation infrastructure (highways, airports, railways and sea ports) that can accommodate single and multiple tenants in flexible layouts. Griffin expects that most of such potential acquisitions of either undeveloped land or land and buildings will likely be located outside of the Hartford area in select markets targeted by Griffin.

The Q4 2017 CBRE|New England Marketview Report (the “Q4 2017 CBRE|New England Report”) from CBRE Group, Inc. (“CBRE”), a national real estate services company, stated that as of December 31, 2017, the overall vacancy rate in the greater Hartford industrial market decreased to 8.8% at the end of 2017 from 12.3% at the end of 2014, with approximately 0.8 million square feet of net absorption in the greater Hartford industrial market in 2017. The greater Hartford industrial market had been stagnant in the years 2012 through 2014, but improved during the past three years. Griffin believes that it benefits from its reputation as a stable landlord with sufficient resources to meet its obligations and deliver space to tenants timely and in accordance with the terms of their lease agreements.

CBRE’s Q4 2017 Market Snapshot Report on Lehigh Valley PA Industrial stated that as of December 31, 2017, the vacancy rate in that market was 6.9%, with a net absorption of approximately 2.2 million square feet in 2017. CBRE’s Q4 2017 Marketview Charlotte Industrial Report stated a vacancy rate of 4.6% for warehouse space at the end of 2017, with absorption of 3.1 million square feet of warehouse space in 2017.

All of Griffin’s office/flex space is in the north submarket of Hartford. The Q4 2017 CBRE|New England Report stated that as of December 31, 2017, the overall vacancy rate in the greater Hartford office market was approximately 17.9%, as compared to 16% at the end of the two previous years, and the vacancy rate for office space in the north submarket increased to 30.9% at December 31, 2017 from 21% a year earlier. As of November 30, 2017, square footage of office/flex buildings comprised approximately 12% of Griffin’s total square footage. Griffin expects

4

that its office/flex space will continue to become a smaller percentage of its total space as Griffin expects to focus on the growth of its industrial/warehouse building portfolio either through the acquisition of fully or partially leased buildings, development of buildings on land currently owned or to be acquired, or both.

Additional capacity or an increase in vacancies in either the industrial or office markets could adversely affect Griffin’s operating results by potentially resulting in longer times to lease vacant space, eroding lease rates in Griffin’s properties or hindering renewals by existing tenants. There can be no assurances as to the directions of the Hartford, Lehigh Valley or Charlotte real estate markets in the near future.

In fiscal 2017, in addition to the acquisition of 215 International, Griffin completed construction, on speculation, of an approximately 137,000 square foot industrial/warehouse building (“330 Stone”) in New England Tradeport (“NE Tradeport”), Griffin’s master‑planned industrial park near Bradley International Airport and Interstate 91, located in Windsor and East Granby, Connecticut. As of November 30, 2017, Griffin had leased approximately 74,000 square feet of 330 Stone to a tenant that relocated from approximately 39,000 square feet in another of Griffin’s NE Tradeport industrial/warehouse buildings. Griffin was able to backfill the vacated space with a new tenant that is expected to take occupancy in the fiscal 2018 first quarter. In fiscal 2017, Griffin also leased approximately 104,000 square feet of previously vacant NE Tradeport industrial/warehouse space, including a ten and one-half year lease for approximately 89,000 square feet. Griffin extended leases aggregating approximately 387,000 square feet in fiscal 2017, including a full building lease of 100 International Drive (“100 International”) an approximately 304,000 square foot industrial/warehouse building in NE Tradeport. That lease extension, done in connection with refinancing the mortgage loan on 100 International, resulted in an additional six years of lease term beyond the original lease expiration date of July 31, 2019. Also in fiscal 2017, Griffin completed a full building lease of approximately 23,000 square feet of office/flex space, replacing the tenant that did not extend its lease of that building. The net effect of Griffin’s construction, acquisition and leasing transactions in fiscal 2017 was an increase of approximately 461,000 square feet of industrial/warehouse space under lease as of November 30, 2017 as compared to November 30, 2016 and a decrease of approximately 11,000 square feet in office/flex space under lease as of November 30, 2017 as compared to November 30, 2016. A lease of approximately 11,000 square feet of office/flex space was entered into subsequent to November 30, 2017.

In fiscal 2016, Griffin completed and placed in service an approximately 252,000 square foot industrial building (“5210 Jaindl”) in the Lehigh Valley of Pennsylvania, thus completing the development of an approximately 50 acre parcel of undeveloped land acquired in December 2013. As of November 30, 2016, Griffin had entered into two leases for 5210 Jaindl resulting in that building being fully leased. Both of those leases became effective in the fiscal 2017 first quarter. In addition to the two leases at 5210 Jaindl, Griffin entered into several other leases aggregating approximately 240,000 square feet in fiscal 2016, all but approximately 21,000 square feet of which was for industrial/warehouse space. Included in the fiscal 2016 leasing activity was a lease for approximately 101,000 square feet in 4270 Fritch Drive (“4270 Fritch”), an approximately 303,000 square foot industrial/warehouse building in the Lehigh Valley built in fiscal 2014. As of November 30, 2016, Griffin’s five Lehigh Valley industrial/warehouse buildings aggregating approximately 1,183,000 square feet were fully leased. In addition to the Lehigh Valley leasing, Griffin completed several leases aggregating approximately 139,000 square feet for its Connecticut properties, including approximately 118,000 square feet of industrial/warehouse space, mostly in NE Tradeport. In fiscal 2016, Griffin also extended leases aggregating approximately 248,000 square feet, most of which was NE Tradeport industrial/warehouse space. Also in fiscal 2016, leases for approximately 132,000 square feet expired, which included a lease for an entire approximately 57,000 square foot NE Tradeport industrial/warehouse building that was subsequently re-leased during the year. The net effect of these transactions was an increase of approximately 410,000 square feet in industrial/warehouse space under lease as of November 30, 2016 as compared to November 30, 2015 and a decrease of approximately 51,000 square feet in office/flex space under lease as of November 30, 2016 as compared to November 30, 2015.

In fiscal 2015, Griffin completed and placed in service an approximately 280,000 square foot industrial building (“5220 Jaindl”) in the Lehigh Valley of Pennsylvania. The tenant that initially leased approximately 196,000 square feet in 5220 Jaindl when the building was placed in service subsequently exercised its option under the lease to lease the balance of the building. Rental revenue on the additional space commenced in fiscal 2016. In addition to fully leasing 5220 Jaindl in fiscal 2015, Griffin completed several other leases aggregating approximately 191,000 square feet, of which approximately 90% was for industrial/warehouse space and approximately 10% was for office/flex space. In fiscal 2015, several leases aggregating approximately 52,000 square feet of office/flex space expired and were not renewed and

5

a lease of approximately 31,000 square feet of industrial/warehouse space was terminated early for which Griffin received a lease termination fee.

Periodically, Griffin may sell certain portions of its undeveloped land that it has owned for an extended time period and the use of which does not fit into Griffin’s core strategy of developing and leasing industrial and commercial properties. Such sale transactions may take place either before or after obtaining development approvals and building basic infrastructure.

In fiscal 2017, Griffin completed several land sales, the largest being the sale of approximately 67 acres of undeveloped land in Phoenix Crossing (the “2017 Phoenix Crossing Land Sale”) for approximately $10.3 million. The land sold under the 2017 Phoenix Crossing Land Sale is part of an approximately 268 acre parcel of land in Bloomfield and Windsor, Connecticut known as Phoenix Crossing. The proceeds from the 2017 Phoenix Crossing Land Sale were placed in escrow at closing and subsequently used in the acquisition of 215 International as part of a like-kind exchange (a “1031 Like-Kind Exchange”) under Section 1031 of the Internal Revenue Code of 1986, as amended. The Like-Kind Exchange enables Griffin to defer the gain on the 2017 Phoenix Crossing Land Sale for income tax purposes. In addition to the 2017 Phoenix Crossing Land Sale, Griffin also sold approximately 76 acres of undeveloped land in Southwick, Massachusetts (the “Southwick Land Sale”) for approximately $2.1 million. The proceeds from the Southwick Land Sale were also placed in escrow at closing and subsequently used for the purchase of approximately 14 acres of undeveloped land in the Lehigh Valley under a 1031 Like-Kind Exchange. In the fiscal 2017 fourth quarter, Griffin started site work for an approximately 134,000 square foot industrial building to be built on the Lehigh Valley land acquired. Construction is expected to begin in the fiscal 2018 first quarter, with completion anticipated during the fiscal 2018 third quarter.

In fiscal 2017, Griffin also completed two smaller sales of undeveloped land in Phoenix Crossing for a total of approximately $1.3 million and the sale of two small residential lots for a total of approximately $0.2 million. Griffin also recognized the remaining $0.1 million of revenue from the fiscal 2013 sale of approximately 90 acres of undeveloped land in Phoenix Crossing (the “2013 Phoenix Crossing Land Sale”). Under the terms of the 2013 Phoenix Crossing Land Sale, Griffin and the buyer each were required to construct roadways connecting the land parcel that was sold to existing town roads. As a result of Griffin’s continuing involvement with the land sold, the 2013 Phoenix Crossing Land Sale was accounted for under the percentage of completion method, whereby revenue and gain were recognized as costs related to the 2013 Phoenix Crossing Land Sale were incurred. From the closing of the 2013 Phoenix Crossing Land Sale through fiscal 2017, when Griffin completed its required roadwork, Griffin recognized total revenue of approximately $9.0 million and a total pretax gain of approximately $6.7 million from the 2013 Phoenix Crossing Land Sale.

In fiscal 2016, Griffin completed one land sale for approximately $3.8 million and recognized revenue of approximately $0.6 million related to the 2103 Phoenix Crossing Land Sale. In fiscal 2015, Griffin completed one land sale for approximately $0.6 million and recognized revenue of $2.5 million related to the 2013 Phoenix Crossing Land Sale.

A portion of Griffin’s landholdings in Connecticut is zoned for residential use. The weakness in the residential real estate market has adversely affected Griffin’s residential real estate development activities. The continued weakness of the residential real estate market could result in lower selling prices for Griffin’s land intended for residential use or delay the sale of such land.

Griffin’s development of its land is affected by regulatory and other constraints. Subdivision and other residential development may also be affected by the potential adoption of initiatives meant to limit or concentrate residential growth. Industrial/warehouse development activities on Griffin’s undeveloped land may also be affected by traffic considerations, potential environmental issues, community opposition and other restrictions to development imposed by governmental agencies.

Industrial/Warehouse Properties

Connecticut

A significant portion of Griffin’s industrial development in Connecticut has been focused on NE Tradeport, where Griffin has built and currently owns fourteen industrial/warehouse buildings aggregating approximately 1,603,000 square feet. NE Tradeport was approximately 96% leased as of November 30, 2017. Griffin’s total portfolio of approximately 1,818,000 square feet of industrial/warehouse space in Connecticut was 96% leased as of November 30, 2017. In NE Tradeport, Griffin holds the rights to 658,000 square feet available for development under the State Traffic

6

Certificate (“STC”) which relates to three approved building sites on approximately 70 acres and an approved addition to one of Griffin’s existing buildings. Construction of 220 Tradeport Drive (see below) would use two of the three approved building sites on the 70 acre parcel and reduce the square footage available for development under the STC in NE Tradeport by approximately 234,000 square feet. Griffin owns an additional 95 acres of undeveloped land within NE Tradeport, 60 acres of which are located in Windsor and the abutting 35 acres of which are located in East Granby. There are no STC or other approvals currently in place (other than zoning in the case of Windsor) for the development of this remaining land for industrial use. Griffin believes that additional infrastructure improvements, which may be significant, may be required to obtain approvals to develop portions of this land, particularly the portions in East Granby. Griffin expects to continue to direct much of its real estate efforts in Connecticut on the construction and leasing of its industrial/warehouse facilities at NE Tradeport.

On October 18, 2017, Griffin entered into a full building lease (the “220 Tradeport Lease”) for an approximately 234,000 square foot industrial/warehouse building (“220 Tradeport Drive”) to be built on two of the remaining three approved building sites in NE Tradeport. Construction of 220 Tradeport Drive would reduce the square feet available for development rights in NE Tradeport to approximately 370,000 square feet. The tenant is an investment grade company that intends to use 220 Tradeport Drive for the distribution of automotive parts. The 220 Tradeport Lease, which would commence upon completion of construction of 220 Tradeport Drive, has a term of twelve years and six months with the tenant having several five year renewal options. Provided the tenant meets certain conditions, the tenant has an option (the “Expansion Option”) to cause Griffin to construct an approximately 54,000 square foot addition to 220 Tradeport Drive. If the tenant exercises the Expansion Option, the term for the 220 Tradeport Lease would be extended for at least ten years upon the tenant occupying the additional space. Griffin expects to commence construction of 220 Tradeport Drive in the fiscal 2018 first quarter and complete 220 Tradeport Drive in the second half of fiscal 2018. Griffin expects to spend approximately $17.5 million related to development of 220 Tradeport Drive, including all related site work, building construction, tenant improvements, leasing and financing costs. Griffin has agreed to terms with State Farm Life Insurance Company (“State Farm”) on a construction to permanent mortgage loan for up to $13.8 million. The loan would provide financing during the construction period and, if 220 Tradeport Drive is completed and rent payments under the 220 Tradeport Lease commence, would convert to a fifteen year nonrecourse permanent mortgage loan. There is no guarantee that the construction to permanent mortgage loan with State Farm will be completed under its current terms, or at all.

In fiscal 2017, Griffin leased approximately 216,000 square feet in NE Tradeport, including approximately 74,000 square feet in 330 Stone, a new industrial/warehouse building that was completed and placed in service in the fiscal 2017 fourth quarter. The approximately 74,000 square feet in 330 Stone was leased to a tenant that relocated from approximately 39,000 square feet in another of Griffin’s NE Tradeport industrial/warehouse buildings. The space vacated was subsequently leased to a new tenant in fiscal 2017. Also in fiscal 2017, Griffin renewed several leases aggregating approximately 361,000 square feet, including the approximately 304,000 square feet at 100 International. The rental rates for leases in NE Tradeport that were renewed in fiscal 2017 were, on average, essentially unchanged from the rental rates of the expiring leases. Management believes that the rental rates on three of the four NE Tradeport leases aggregating approximately 58,000 square feet that are scheduled to expire in fiscal 2018 are essentially at the market rates for similar space, and one lease of approximately 48,000 square feet (see below) that is scheduled to expire in fiscal 2018 is above market rates due to the significant amount of tenant improvement work done to that space to meet the tenant’s requirements. Griffin has entered into an agreement with the tenant that will be vacating the approximately 48,000 square feet whereby the tenant has agreed to pay Griffin approximately $0.2 million in connection with a termination of the lease earlier than the original lease expiration.

In addition to its industrial/warehouse buildings in NE Tradeport, Griffin owns a 165,000 square foot industrial building (“1985 Blue Hills”) in Griffin Center, Griffin’s office park in Windsor and Bloomfield, Connecticut, that is being used principally as a data center and call center, an approximately 31,000 square foot industrial/warehouse building (“131 Phoenix”) in Bloomfield, Connecticut that is being used principally as a research and development facility and an approximately 18,000 square foot industrial/warehouse building (“210 West Newberry”) in Griffin Center South, Griffin’s office/flex park in Bloomfield, Connecticut. 131 Phoenix is on an approximately 5 acre site that is part of Phoenix Crossing. As of November 30, 2017, Griffin owns approximately 76 acres of undeveloped land in Phoenix Crossing that is zoned for industrial and commercial development.

As of November 30, 2017, approximately $74.1 million was invested (net book value) by Griffin in its Connecticut industrial/warehouse buildings, approximately $3.7 million was invested (net book value) by Griffin in the

7

undeveloped NE Tradeport land and approximately $1.5 million was invested in the undeveloped Phoenix Crossing land. As of November 30, 2017, fourteen of Griffin’s Connecticut industrial/warehouse buildings were mortgaged for an aggregate of approximately $64.7 million and 210 West Newberry was included in the collateral for Griffin’s $15.0 million revolving line of credit. Subsequent to November 30, 2017, a subsidiary of Griffin closed on the refinancing of an existing mortgage loan that was collateralized by two NE Tradeport industrial/warehouse buildings. The refinancing generated additional mortgage proceeds of $7.0 million and added 330 Stone to the collateral.

A summary of Griffin’s Connecticut industrial/warehouse square footage owned and leased at the end of each of the past three fiscal years and leases in Griffin’s Connecticut industrial/warehouse buildings scheduled to expire during each of the next three fiscal years are as follows:

|

Connecticut industrial/warehouse space |

|

Square |

|

Square |

|

|

|

|

|

|

Footage |

|

Footage |

|

Percentage |

|

|

|

|

Owned |

|

Leased |

|

Leased |

|

|

November 30, 2015 |

|

1,681,000 |

|

1,507,000 |

|

90 |

% |

|

November 30, 2016 |

|

1,681,000 |

|

1,564,000 |

|

93 |

% |

|

November 30, 2017 |

|

1,817,000 |

|

1,748,000 |

|

96 |

% |

|

|

|

2018 |

|

2019 |

|

2020 |

|

|||

|

Square footage of leases expiring |

|

|

106,000 |

|

|

172,000 |

|

|

66,000 |

|

|

Percentage of total leased space at November 30, 2017 |

|

|

3 |

% |

|

5 |

% |

|

2 |

% |

|

Number of tenants with leases expiring |

|

|

4 |

|

|

4 |

|

|

2 |

|

|

Annual rental revenue of expiring leases |

|

$ |

1,003,000 |

|

$ |

1,336,000 |

|

$ |

530,000 |

|

|

Annual rental revenue of expiring leases as a percentage of Griffin’s total fiscal 2017 rental revenue |

|

|

3 |

% |

|

4 |

% |

|

2 |

% |

Lehigh Valley, Pennsylvania

In fiscal 2010, Griffin completed its first acquisitions of property outside of the Hartford, Connecticut area, when it acquired a fully leased approximately 120,000 square foot industrial building and approximately 51 acres of undeveloped land in the Lehigh Valley of Pennsylvania. Subsequently, Griffin acquired an approximately 49 acre parcel of undeveloped land in the Lehigh Valley. Over the past five years, Griffin has built, on speculation, four additional industrial/warehouse buildings aggregating approximately 1,063,000 square feet on those two land parcels. As of November 30, 2017, Griffin owned five fully leased industrial/warehouse buildings in the Lehigh Valley aggregating approximately 1,183,000 square feet. Approximately $65.2 million was invested (net book value) in these buildings as of November 30, 2017. All five Lehigh Valley industrial/warehouse buildings are mortgaged under three separate nonrecourse mortgage loans for a total of approximately $49.8 million as of November 30, 2017.

In the fiscal 2017 fourth quarter, Griffin purchased approximately 14 acres of undeveloped land in the Lehigh Valley that had been under agreement. The closing on this purchase took place after Griffin received all governmental approvals for its planned development, on speculation, of an approximately 134,000 square foot industrial/warehouse building on the land acquired. Griffin started site work in the fiscal 2017 fourth quarter with building construction anticipated to begin in the fiscal 2018 first quarter. Griffin expects to spend approximately $7.8 million for site work and construction of the building shell and complete construction in the fiscal 2018 third quarter.

On January 11, 2018, Griffin entered into an agreement to purchase an approximately 14 acre parcel of undeveloped land in the Lehigh Valley for $3.6 million in cash. If the transaction closes, Griffin plans to construct an industrial/warehouse building on the land to be purchased, the size of which will be based upon findings during due diligence. The closing of this purchase, anticipated to take place in late fiscal 2018 or early fiscal 2019, is subject to several conditions, including the satisfactory outcome of due diligence and obtaining all governmental approvals for

8

Griffin’s development plans for the land to be purchased. There is no guarantee that this transaction will be completed under its current terms, or at all.

A summary of Griffin’s Lehigh Valley industrial/warehouse square footage owned and leased at the end of each of the past three fiscal years and leases in Griffin’s Lehigh Valley industrial/warehouse buildings scheduled to expire during each of the next three fiscal years are as follows:

|

Lehigh Valley industrial/warehouse space |

|

Square |

|

Square |

|

|

|

|

|

|

Footage |

|

Footage |

|

Percentage |

|

|

|

|

Owned |

|

Leased |

|

Leased |

|

|

November 30, 2015 |

|

931,000 |

|

829,000 |

|

89 |

% |

|

November 30, 2016 |

|

1,183,000 |

|

1,183,000 |

|

100 |

% |

|

November 30, 2017 |

|

1,183,000 |

|

1,183,000 |

|

100 |

% |

|

|

|

2018 |

|

2019 |

|

2020 |

|

|||

|

Square footage of leases expiring |

|

|

228,000 |

|

|

— |

|

|

201,000 |

|

|

Percentage of total leased space at November 30, 2017 |

|

|

6 |

% |

|

— |

% |

|

6 |

% |

|

Number of tenants with leases expiring |

|

|

1 |

|

|

— |

|

|

1 |

|

|

Annual rental revenue of expiring leases |

|

$ |

1,501,000 |

|

$ |

— |

|

$ |

1,330,000 |

|

|

Annual rental revenue of expiring leases as a percentage of Griffin’s total fiscal 2017 rental revenue |

|

|

5 |

% |

|

— |

% |

|

4 |

% |

Charlotte, North Carolina

On June 9, 2017, Griffin closed on the acquisition of 215 International, Griffin’s first property in the Charlotte area. 215 International was constructed in 2015 and was 74% leased at the time it was acquired. Subsequent to the closing, one of the tenants in 215 International leased all of the remaining approximately 73,000 square feet that had been vacant at the time the building was acquired. None of the leases for 215 International expire within the next three years. On August 30, 2017, Griffin closed on a $12.15 million nonrecourse mortgage loan collateralized by 215 International.

On October 4, 2017, Griffin entered into an agreement to purchase an approximately 22 acre parcel of undeveloped land in Concord, North Carolina (the “Concord Land”) for $2.6 million in cash. If the transaction closes, Griffin plans to construct an industrial/warehouse development on the Concord Land, which is located near 215 International. The amount of industrial/warehouse space to be developed there will be based upon findings during due diligence. The closing of this purchase, anticipated to take place in fiscal 2018, is subject to several conditions, including the satisfactory outcome of due diligence and obtaining all governmental approvals for Griffin’s development plans for the Concord Land. There is no guarantee that this transaction will be completed under its current terms, or at all.

Griffin may seek to acquire additional properties and/or undeveloped land parcels to expand the industrial/warehouse portion of its real estate business. Griffin continues to examine potential properties for acquisition in the Middle Atlantic, Northeast and Southeast states and selected markets targeted by Griffin.

Office/Flex Properties

Griffin’s office/flex properties are located in Griffin Center in Windsor and Bloomfield, Connecticut and Griffin Center South in Bloomfield. In Griffin Center, Griffin currently owns two multi‑story office buildings that have an aggregate of approximately 161,000 square feet, a single story office building of approximately 48,000 square feet and a small restaurant building of approximately 7,000 square feet. In Griffin Center South, Griffin currently owns eight office/flex buildings with an aggregate of approximately 217,000 square feet of single story office/flex space. As of November 30, 2017, Griffin’s total office/flex space of approximately 433,000 square feet comprised approximately 12% of Griffin’s total real estate portfolio. Griffin’s office/flex square footage was approximately 71% leased as of November 30, 2017.

In fiscal 2017, Griffin entered into a ten year full building lease for the approximately 23,000 square feet at 206 West Newberry Road in Griffin Center South to replace the tenant in that building that did not renew its lease. The full

9

building tenant there had previously informed Griffin that it would not be renewing its lease when it expired in fiscal 2017. In addition, Griffin renewed two leases aggregating approximately 25,000 square feet of office/flex space in fiscal 2017 and a lease for approximately 12,000 square feet of office/flex space expired and was not renewed.

In fiscal 2016, Griffin entered into two new leases for office/flex space aggregating approximately 21,000 square feet, including a lease for approximately 16,000 square feet in the single story Griffin Center office building that resulted in that building becoming fully leased. Also in fiscal 2016, two leases of office/flex space aggregating approximately 26,000 square feet were renewed, while leases aggregating approximately 72,000 square feet of office/flex space expired. The tenant of one of the expired office/flex leases (approximately 21,000 square feet) did not renew because they entered into a full building lease for 131 Phoenix, Griffin’s approximately 31,000 square foot industrial/warehouse building in Phoenix Crossing. The rental rates for office/flex leases that were renewed in fiscal 2016 were, on average, approximately 5% lower than the rental rates of the expiring leases. Currently there are approximately 156 acres of undeveloped land in Griffin Center and approximately 75 acres of undeveloped land in Griffin Center South that are owned by Griffin. As of November 30, 2017, approximately $18.7 million was invested (net book value) in Griffin’s office/flex buildings and approximately $1.6 million was invested by Griffin in the undeveloped land in Griffin Center and Griffin Center South. Griffin’s two multi‑story office buildings in Griffin Center are mortgaged for approximately $4.4 million as of November 30, 2017, and Griffin’s single story office building in Griffin Center and the eight single-story office/flex buildings and industrial/warehouse building in Griffin Center South are the collateral for Griffin’s $15.0 million revolving line of credit. There were no borrowings under the revolving line of credit as of November 30, 2017.

A summary of Griffin’s office/flex square footage owned and leased at the end of each of the past three fiscal years and leases in Griffin’s office/flex buildings scheduled to expire (excluding the space where a replacement lease has been secured) during each of the next three fiscal years are as follows:

|

Connecticut office/flex space |

|

Square |

|

Square |

|

|

|

|

|

|

Footage |

|

Footage |

|

Percentage |

|

|

|

|

Owned |

|

Leased |

|

Leased |

|

|

November 30, 2015 |

|

433,000 |

|

370,000 |

|

85 |

% |

|

November 30, 2016 |

|

433,000 |

|

319,000 |

|

74 |

% |

|

November 30, 2017 |

|

433,000 |

|

308,000 |

|

71 |

% |

|

|

|

2018 |

|

2019 |

|

2020 |

|

|||

|

Square footage of leases expiring |

|

|

15,000 |

|

|

62,000 |

|

|

62,000 |

|

|

Percentage of total leased space at November 30, 2017 |

|

|

— |

% |

|

2 |

% |

|

2 |

% |

|

Number of tenants with leases expiring |

|

|

2 |

|

|

4 |

|

|

5 |

|

|

Annual rental revenue of expiring leases |

|

$ |

316,000 |

|

$ |

1,003,000 |

|

$ |

1,083,000 |

|

|

Annual rental revenue of expiring leases as a percentage of Griffin’s total fiscal 2017 rental revenue |

|

|

1 |

% |

|

3 |

% |

|

4 |

% |

Residential Developments

Simsbury, Connecticut

Several years ago, Griffin filed plans for the creation of a residential community, called Meadowood, on a 363 acre site in the Town of Simsbury, Connecticut (“Simsbury”). After several years of litigation with the town regarding this proposed residential development, a settlement was reached. The settlement terms included, among other things, approval for up to 296 homes, certain remediation measures and offsite road improvements to be performed by Griffin and the purchase by Simsbury of a portion of the Meadowood land for open space. The sale of land to Simsbury closed in fiscal 2008. In fiscal 2012, Griffin performed a portion of the required remediation work on the site and completed the required offsite road improvements. In fiscal 2014, Griffin completed the required remediation work. As of November 30, 2017, the book value of the land for this development, including design, development and legal costs, was approximately $8.5 million. Griffin is continuing to evaluate its plans for Meadowood.

10

Suffield, Connecticut

In fiscal 2006, Griffin completed the infrastructure for a fifty lot residential subdivision in Suffield, Connecticut called Stratton Farms. Griffin sold twenty‑five residential lots in Stratton Farms to a local homebuilder in fiscal 2006 and fiscal 2007. Griffin subsequently sold five additional lots. As of November 30, 2017, Griffin held twenty Stratton Farms residential lots. The book value for Griffin’s Stratton Farms holdings was approximately $1.1 million at November 30, 2017. Subsequent to November 30, 2017, Griffin sold an additional Stratton Farms residential lot.

Other

Concurrently with the sale of the landscape nursery business in fiscal 2014, Imperial Nurseries, Inc. (“Imperial”), Griffin and Monrovia Connecticut LLC (“Monrovia”) entered into a Lease and Option Agreement, which was amended in fiscal 2016 (as amended, the “Imperial Lease”) pursuant to which Monrovia leased Imperial’s production nursery located in Granby and East Granby, Connecticut (the “Connecticut Farm”) for a ten year period, with options to extend for up to an additional fifteen years exercisable by Monrovia. The Imperial Lease also grants Monrovia an option to purchase the land, land improvements and other operating assets that were used by Imperial on the Connecticut Farm during the first thirteen years of the lease period for $9.5 million, or $7.0 million if only a certain portion of the Connecticut Farm is purchased, subject in each case to certain adjustments as provided for in the Imperial Lease.

Prior to the fiscal 2009 third quarter, Imperial operated a production nursery in Quincy, Florida (the “Florida Farm”). In fiscal 2009, Imperial shut down its growing operations on the Florida Farm and leased that facility to a grower of landscape nursery plants. In fiscal 2015, the tenant exercised its option to acquire the Florida Farm, but subsequently informed Imperial that it would not close on the acquisition. As a result, Griffin retained the tenant’s deposit of $400,000 and the Florida Farm lease was extended through April 30, 2016. After the expiration of that lease, Griffin then entered into a new lease of the Florida Farm with another grower of landscape nursery plants that started July 1, 2016. The new lease of the Florida Farm has a three year term and contains an option for the tenant to purchase the Florida Farm at any time during the lease period for a purchase price between $3.4 million and $3.9 million depending upon the date of sale. On December 18, 2017, the tenant leasing the Florida Farm declared bankruptcy under Chapter 11 of the U.S. Bankruptcy Code. Griffin has yet to determine the impact, if any, this will have on their lease of the Florida Farm, which expires on June 30, 2019.

In fiscal 2017, Griffin leased approximately 560 acres of undeveloped land in Connecticut and Massachusetts to local farmers. Approximately 650 acres and 550 acres were leased to local farmers in fiscal 2016 and fiscal 2015, respectively. The revenue generated from the leasing of farmland is not material to Griffin’s total revenue.

On January 25, 2016, Griffin entered into an Option Purchase Agreement (the “Simsbury Option Agreement”) whereby Griffin granted the buyer an exclusive three month option, in exchange for a nominal fee, to purchase approximately 280 acres of undeveloped land in Simsbury, Connecticut for approximately $7.7 million. The buyer may extend the option period for up to three years upon payment of additional option fees. Through November 30, 2017, the buyer paid approximately $0.1 million of additional option fees, and subsequent to November 30, 2017 the buyer paid an additional $0.1 million to extend its option period through January 2019. Subsequent to November 30, 2017, the buyer received approval from the state regulatory authority for the buyer’s planned use of the land, which is to generate solar electricity. A closing on the land sale contemplated by the Simsbury Option Agreement is subject to several significant contingencies, including the potential appeal of the approvals recently granted by the state regulatory authority. Griffin expects the decision of the state regulatory authority to be appealed. There is no guarantee that the sale of land as contemplated under the Simsbury Option Agreement will be completed under its current terms, or at all.

On May 5, 2017, Griffin entered into an Option Purchase Agreement (the “EGW Option Agreement”) whereby Griffin granted the buyer an exclusive three month option, in exchange for a nominal fee, to purchase approximately 288 acres of undeveloped land in East Granby and Windsor, Connecticut for approximately $7.8 million. The buyer may extend the option period for up to three years upon payment of additional option fees. The land subject to the EGW Option Agreement does not have any of the approvals that would be required for the buyer’s planned use of the land, which is to generate solar electricity. A closing on the land sale contemplated by the EGW Option Agreement is subject to several significant contingencies, including the buyer procuring electrical utility supply contracts, approval by the state public utility regulatory authorities and governmental approvals for the planned use of the land. There is no

11

guarantee that the sale of land as contemplated under the EGW Option Agreement will be completed under its current terms, or at all.

Griffin is evaluating its other land holdings for development or sale in the future. Griffin anticipates that obtaining subdivision approvals for residential development in many of the towns where it owns residentially‑zoned land will be an extended process.

Investments

Centaur Media plc

In fiscal 2017, Griffin sold all of its 1,952,462 shares of Centaur Media plc (“Centaur Media”), a publicly traded company listed on the London Stock Exchange, for cash proceeds of approximately $1.2 million and a pretax gain of approximately $0.3 million. Griffin had reflected its investment in Centaur Media as an available‑for‑sale security. Accordingly, prior to the sale of the shares of Centaur Media, changes in the fair value of Griffin’s investment in Centaur Media, including both changes in the stock price and changes in the foreign currency exchange rate, were not included in Griffin’s net income but were included in Griffin’s other comprehensive income. Upon the sale of its investment in Centaur, all amounts that had been reflected in other comprehensive income were reclassified into net income on Griffin’s consolidated statement of operations.

Employees

As of November 30, 2017, Griffin employed 30 people on a full‑time basis and two employees on a part-time basis. Presently, none of Griffin’s employees are represented by a union. Griffin believes that relations with its employees are satisfactory.

Competition

The market for leasing industrial/warehouse space and office/flex space is highly competitive. Griffin competes for tenants with owners of numerous properties located in the portions of Connecticut, Massachusetts, the Lehigh Valley of Pennsylvania and Charlotte, North Carolina in which Griffin’s real estate holdings are located. Some of these competitors have greater financial resources than Griffin. Griffin’s real estate business competes on the bases of location, price, availability of space, convenience and amenities.

There is a great amount of competition for the acquisition of industrial/warehouse buildings and for the acquisition of undeveloped land for construction of such buildings. Griffin competes for the acquisition of industrial/warehouse properties with real estate investment trusts (“REITs”) and institutional investors, such as pension funds, private real estate investment funds, insurance company investment accounts, public and private investment companies, individuals and other entities engaged in real estate investment activities. Some of these competitors have greater financial resources than Griffin, and may be able to accept more risk, including risk related to the creditworthiness of tenants or the degree of leverage they may be willing to take on. Competitors for acquisitions may also have advantages from a lower cost of capital or greater operating efficiencies associated with being a larger entity.

Regulation: Environmental Matters

Under various federal, state and local laws, ordinances and regulations, an owner or operator of real estate may be required to investigate and clean up hazardous or toxic substances or petroleum product releases at such property and may be held liable to a governmental entity or to third parties for property damage and for investigation and cleanup costs incurred by such parties in connection with contamination. The cost of investigation, remediation or removal of such substances may be substantial, and the presence of such substances, or the failure to remediate properly such substances, may adversely affect the owner’s ability to sell or rent such property or to borrow using such property as collateral. In connection with the ownership (direct or indirect), operation, management and development of real estate properties, Griffin may be considered an owner or operator of such properties or as having arranged for the disposal or treatment of hazardous or toxic substances and, therefore, potentially liable for removal or remediation costs, as well as certain other related costs, including governmental fines and injuries to persons and property. The value of Griffin’s land may be affected by the presence of residual chemicals from the prior use of the land for farming, principally on a portion of the land that is intended for residential use. In the event that Griffin is unable to remediate adequately any of its land

12

intended for residential use, Griffin’s ability to develop such property for its intended purposes would be materially affected.

Griffin periodically reviews its properties for the purpose of evaluating such properties’ compliance with applicable state and federal environmental laws. In connection with the sale of Imperial, Griffin has incurred a small amount of costs to remediate a small area of the Connecticut Farm that is leased to Monrovia under the Imperial Lease. As of the date of this Annual Report on Form 10‑K, Griffin is in discussions with the Connecticut Department of Energy and Environmental Protection (“DEEP”) regarding the recent findings of exceedances of certain residual pesticides on a limited portion of the Connecticut Farm being leased to Monrovia. At this time, Griffin does not anticipate experiencing, in the next twelve months, any material expense in complying with such laws. Griffin may incur remediation costs in the future in connection with its development operations. Such costs are not expected to be significant as compared to expected proceeds from development projects or property sales.

Griffin maintains a corporate website at www.griffinindustrial.com. Griffin’s Annual Report on Form 10‑K, quarterly reports on Form 10‑Q, current reports on Form 8‑K and the proxy statement for Griffin’s Annual Meeting of Stockholders can be accessed through Griffin’s website or through the SEC website at www.sec.gov. Griffin will provide electronic or paper copies of its foregoing filings free of charge upon request. Griffin was incorporated in 1970.

ITEM 1A. RISK FACTORS.

Griffin’s real estate business is subject to a number of risks. The risk factors discussed below are those that management deems to be material, but they may not be the only risks facing Griffin. Additional risks not currently known or currently deemed not to be material may also impact Griffin. If any of the following risks occur, Griffin’s business, financial condition, operating results and cash flows could be adversely affected. Investors should also refer to Griffin’s quarterly reports on Form 10-Q for any material updates to these risk factors.

Risks Related to Griffin’s Business and Properties

Griffin’s real estate portfolio is concentrated in the industrial real estate sector, and its business would be adversely affected by an economic downturn in that sector.

88% of Griffin’s buildings are warehouse/distribution facilities and light manufacturing facilities in the industrial real estate sector. This level of concentration exposes Griffin to the risk of economic downturns in the industrial real estate sector to a greater extent than if its properties were more diversified across other sectors of the real estate industry. In particular, an economic downturn affecting the leasing market for industrial properties could have a material adverse effect on Griffin’s results of operations, cash flows, financial condition, ability to satisfy debt obligations and ability to pay dividends to stockholders.

Griffin’s real estate portfolio is geographically concentrated, which causes it to be especially susceptible to adverse developments in those markets.

In addition to general, regional, national and international economic conditions, Griffin’s operating performance is impacted by the economic conditions of the specific geographic markets in which it has concentrations of properties. The portfolio includes holdings in Connecticut, the Lehigh Valley of Pennsylvania and Concord, North Carolina, which represented 61%, 32% and 7% of Griffin’s portfolio by square footage, respectively, as of November 30, 2017. This geographic concentration could adversely affect Griffin’s operating performance if conditions become less favorable in any of the states or regions in which it has a concentration of properties. Griffin cannot assure that any of its markets will grow or that underlying real estate fundamentals will be favorable to owners and operators of properties. Griffin’s operations may also be adversely affected if competing properties are built in its target markets. The construction of new facilities by competitors would increase capacity in the marketplace, and an increase in the amount of vacancies in competitors’ properties and negative absorption of space could result in Griffin experiencing longer times to lease vacant space, eroding lease rates or hindering renewals by existing tenants. Any adverse economic or real estate developments in Griffin’s target markets, or any decrease in demand for industrial space resulting from the regulatory environment, business climate or energy or fiscal problems in these markets, could materially and adversely impact Griffin’s results of operations, cash flows, financial condition, ability to satisfy debt obligations and ability to pay dividends to stockholders.

13

Griffin’s ability to grow its portfolio partially depends on its ability to develop properties, which may suffer under certain circumstances.

Griffin intends to continue to develop properties when warranted by its assessment of market conditions. Griffin’s general construction and development activities include the risks that:

|

§ |

Griffin’s assessment of market conditions may be inaccurate; |

|

§ |

development activities may require the acquisition of undeveloped land. Competition from other real estate investors may significantly increase the purchase price of that land; |

|

§ |

Griffin may be unable to obtain, or may face delays in obtaining required zoning, land-use, building, occupancy, and other governmental permits and authorizations, which could result in increased costs and could require Griffin to abandon its activities entirely with respect to a project; |

|

§ |

construction and leasing of a property may not be completed on schedule, which could result in increased expenses and construction costs, and would result in reduced profitability; |

|

§ |

construction costs (including required offsite infrastructure costs) may exceed Griffin’s original estimates due to increases in interest rates and increased materials, labor or other costs, possibly making the property less profitable than projected or unprofitable because Griffin may not be able to increase rents to compensate for the increase in construction costs; |

|

§ |

Griffin may abandon development opportunities after it begins to explore them and as a result, Griffin may fail to recover costs already incurred. If Griffin alters or discontinues its development efforts, costs of the investment may need to be expensed rather than capitalized and Griffin may determine the investment is impaired, resulting in a loss; |

|

§ |

Griffin may expend funds on and devote management's time to projects that it does not complete; |

|

§ |

occupancy rates and rents at newly completed properties may not meet Griffin’s expectations. This may result in lower than projected occupancy and rental rates resulting in an investment that is less profitable than projected or unprofitable; and |

|

§ |

Griffin may incur losses under construction warranties, guaranties and delay damages under Griffin’s contracts with tenants and other customers. |

Griffin’s ability to achieve growth in its portfolio partially depends in part on Griffin’s ability to acquire properties, which may suffer under certain circumstances.

Griffin acquires individual properties and in the future, may acquire portfolios of properties. Griffin’s acquisition activities and their success are generally subject to the following risks:

|

§ |

when Griffin is able to locate a desirable property, competition from other real estate investors may significantly increase the purchase price; |

|

§ |

acquired properties may fail to perform as expected; |

|

§ |

the actual costs of repositioning or redeveloping acquired properties may be higher than Griffin’s estimates; |

|

§ |

acquired properties may be located in new markets where Griffin faces risks associated with an incomplete knowledge or understanding of the local market, a limited number of established business relationships in the area and a relative unfamiliarity with local governmental and permitting procedures; and |

|

§ |

Griffin may be unable to quickly and efficiently integrate new acquisitions, particularly acquisitions of portfolios of properties and operating entities, into its existing operations, and as a result, Griffin’s results of operations and financial condition could be adversely affected. |

14

Griffin may acquire properties subject to liabilities and without any recourse, or with only limited recourse, with respect to unknown liabilities. As a result, if a liability were asserted against Griffin based upon ownership of those properties, Griffin might have to pay substantial sums to settle it, which could adversely affect its cash flow.

Weakness in Griffin’s office/flex portfolio could negatively impact its business.

Griffin’s office/flex portfolio, which comprises 12% of its total square footage and was 71% occupied as of November 30, 2017, is concentrated in the north submarket of Hartford. The demand for office/flex space in this market is weak and competitive, with market vacancy in excess of 30% as of December 31, 2017, according to the Q4 2017 CBRE|New England Report. There is no certainty that Griffin will retain existing tenants or attract new tenants to its office/flex buildings. Re-leasing Griffin’s office/flex properties typically requires greater investment per square foot than for Griffin’s industrial/warehouse properties and could negatively impact Griffin’s results of operations and cash flow.

Griffin may experience increased operating costs, which could adversely affect Griffin’s results of operations.

Griffin’s properties are subject to increases in operating expenses such as real estate taxes, fuel, utilities, labor, repairs and maintenance, building materials and insurance. While many of Griffin’s current tenants generally are obligated to pay a significant portion of these costs, there are no assurances that existing or new tenants will agree to or make such payments. If operating expenses increase, Griffin may not be able to pass these costs on to its tenants and, therefore, any such increases could have an adverse effect on Griffin’s results of operations and cash flow.

Griffin relies on third party managers for day-to-day property management of certain of its properties.

Griffin relies on local third party managers for the day-to-day management of its Lehigh Valley and Concord, North Carolina properties. To the extent that Griffin uses a third party manager, the cash flows from its Lehigh Valley and Concord properties may be adversely affected if the property manager fails to provide quality services. These third party managers may fail to manage Griffin’s properties effectively or in accordance with their agreements with Griffin, may be negligent in their performance and may engage in criminal or fraudulent activity. If any of these events occur, Griffin could incur losses or face liabilities from the loss or injury to its property or to persons at its properties. In addition, disputes may arise between Griffin and these third party managers, and Griffin may incur significant expenses to resolve those disputes or terminate the relevant agreement with these third parties and locate and engage competent and cost-effective alternative service providers to manage the relevant properties. Additionally, third party managers may manage and own other properties that may compete with Griffin’s properties, which may result in conflicts of interest and decisions regarding the operation of Griffin’s properties that are not in Griffin’s best interests. Griffin likely would rely on third-party managers in any new markets it enters through its acquisition activities.

Unfavorable events affecting Griffin’s existing and potential tenants and its properties, or negative market conditions that may affect Griffin’s existing and potential tenants, could have an adverse impact on Griffin’s ability to attract new tenants, re-let space, collect rent and renew leases, and thus could have a negative effect on Griffin’s results of operations and cash flow.

The substantial majority of Griffin’s revenue is derived from lease revenue from its industrial/warehouse and office/flex buildings. Griffin’s results of operations and cash flows depend on its ability to lease space to tenants on economically favorable terms. Therefore, Griffin could be adversely affected by various factors and events over which Griffin has limited control, such as:

|

· |

inability to retain existing tenants and attract new tenants; |

|

· |

oversupply of or reduced demand for space and changes in market rental rates in the areas where Griffin’s properties are located; |

|

· |

defaults by Griffin’s tenants due to bankruptcy or other factors or their failure to pay rent on a timely basis; |

|

· |

physical damage to Griffin’s properties and the need to repair such damage; |

|

· |

economic or physical decline of the areas where Griffin’s properties are located; and |

15

|

· |

potential risk of functional obsolescence of Griffin’s properties over time. |

If a tenant is unable to pay rent due to Griffin, Griffin may be forced to evict the tenant, or engage in other remedies, which may be expensive and time consuming and may adversely affect Griffin’s results of operation and cash flows.

If Griffin’s tenants do not renew their leases as they expire, Griffin may not be able to re-lease the space. Furthermore, leases that are renewed, or new leases for space that is re-let, may have terms that are less economically favorable to Griffin than current lease terms, or may require Griffin to incur significant costs, such as for renovations, tenant improvements or lease transaction costs.

Any of these events could adversely affect Griffin’s results of operations and cash flows and its ability to make dividend payments and service its indebtedness.

A significant portion of Griffin’s costs, such as real estate taxes, insurance costs, and debt service payments, are fixed, which means that they generally are not reduced when circumstances cause a decrease in cash flow from its properties.

Declining real estate valuations and any related impairment charges could materially adversely affect Griffin’s financial condition, results of operations, cash flows, ability to satisfy debt obligations and ability to pay dividends on, and the per share trading price of, its common stock.

Griffin reviews the carrying value of its properties when circumstances, such as adverse market conditions, indicate a potential impairment may exist. Griffin bases its review on an estimate of the future cash flows (excluding interest charges) expected to result from the property’s use and eventual disposition on an undiscounted basis. Griffin considers factors such as future operating income, trends and prospects, as well as the effects of leasing demand, competition and other factors. With respect to undeveloped land, Griffin evaluates the cash flow to be generated from the potential use or sale of such land as compared to the costs, including entitlement and infrastructure costs for the intended use or costs required to prepare the land for sale. If Griffin’s evaluation indicates that it may be unable to recover the carrying value of a real estate investment, an impairment loss would be recorded to the extent that the carrying value exceeds the estimated fair value of the property.

Impairment losses have a direct impact on Griffin’s results of operations because recording an impairment loss results in an immediate negative adjustment to Griffin’s operating results. The evaluation of anticipated cash flows is highly subjective and is based in part on assumptions regarding future occupancy, rental rates and capital requirements that could differ materially from actual results in future periods. A worsening real estate market may cause Griffin to reevaluate the assumptions used in its impairment analysis. Impairment charges could materially adversely affect Griffin’s financial condition, results of operations, cash flows and ability to pay dividends on, and the per share trading price of, its common stock.

Griffin’s use of nonrecourse mortgage loans could have a material adverse effect on its financial condition.

As of November 30, 2017, Griffin had indebtedness under nonrecourse mortgage loans of approximately $131.0 million, collateralized by approximately 88% of the total square footage of its industrial/warehouse and office/flex buildings. If a significant number of Griffin’s tenants were unable to meet their obligations to Griffin or if Griffin were unable to lease a significant amount of space in its properties on economically favorable lease terms, there would be a risk that Griffin would not have sufficient cash flow from operations for payments of required principal and interest on these loans. If Griffin was unable to make such payments and was to default, the property collateralizing the mortgage loan could be foreclosed upon, and Griffin’s financial condition and results of operations would be adversely affected. In addition, two of Griffin’s nonrecourse mortgage loans contain cross default provisions. A default under a mortgage loan that has cross default provisions may cause Griffin to automatically default on another loan.

Griffin’s use of financing arrangements that include balloon payment obligations could have a material adverse effect on its financial condition.

Approximately 91% of Griffin’s nonrecourse mortgage loans as of November 30, 2017 require a lump-sum or “balloon” payment at maturity. Griffin’s ability to make a balloon payment at maturity may be uncertain and may depend upon its ability to obtain additional financing. At the time the balloon payment is due, Griffin may or may not be

16

able to refinance the balloon payment on terms as favorable as the original mortgage terms. If Griffin were to be unable to refinance the balloon payment, then it may be forced to sell the property or pay the balloon payment using its existing cash on hand or other liquidity sources, or the property could be foreclosed. Any balloon payments that Griffin makes out of its existing cash or liquidity may have a material adverse effect on its financial condition and leave it with insufficient cash to invest in other properties, pay dividends to stockholders or meet its other obligations.

Griffin’s failure to effectively hedge against interest rate fluctuation could have a material adverse effect on its financial condition.

Griffin has entered into several interest rate swap agreements to hedge its interest rate exposures related to its variable rate nonrecourse mortgages on certain of its industrial/warehouse and office/flex buildings. These agreements have costs and involve the risks that these arrangements may not be effective in reducing Griffin’s exposure to interest rate fluctuations and that a court could rule that such agreements are not legally enforceable. The failure to hedge effectively against interest rate fluctuations may materially adversely affect Griffin’s results of operations if interest rates were to rise materially. Additionally, any settlement charges incurred to terminate an interest rate swap agreement may result in increased interest expense, which may also have an adverse effect on Griffin’s results of operations.

Griffin may suffer adverse effects as a result of the terms of and covenants relating to its revolving credit facility.

Griffin’s continued ability to borrow under its $15 million revolving credit facility is subject to compliance with financial and other covenants. Griffin’s failure to comply with such covenants could cause a default under this credit facility, and Griffin may then be required to repay amounts outstanding, if any, under the facility with capital from other sources. Under those circumstances, other sources of capital may not be available to Griffin, or may be available only on unattractive terms.

Griffin relies on key personnel.

Griffin’s success depends to a significant degree upon the contribution of certain key personnel, including but not limited to Griffin’s Executive Chairman, President and Chief Executive Officer, Griffin Industrial, LLC’s Senior Vice President and Griffin Industrial, LLC’s Vice President of Construction. If any of Griffin’s key personnel were to cease employment, Griffin’s operating results could suffer. Griffin’s ability to retain its senior management group or attract suitable replacements should any members of the senior management group leave is dependent on the competitive nature of the employment market. The loss of services from key members of the management group or a limitation on their availability could adversely affect Griffin’s results of operations and cash flows. Griffin has not obtained and does not expect to obtain key man life insurance on any of its key personnel.

Risks Related to the Real Estate Industry

Changing or adverse political and economic conditions and credit markets may impact Griffin’s results of operations and financial condition.

Griffin’s real estate business may be affected by market conditions and political and economic uncertainty experienced by the U.S. economy as a whole, conditions in the credit markets or by local economic conditions in the markets in which its properties are located. Such conditions may impact Griffin’s results of operations, financial condition or ability to expand its operations and pay dividends to stockholders as a result of the following:

|

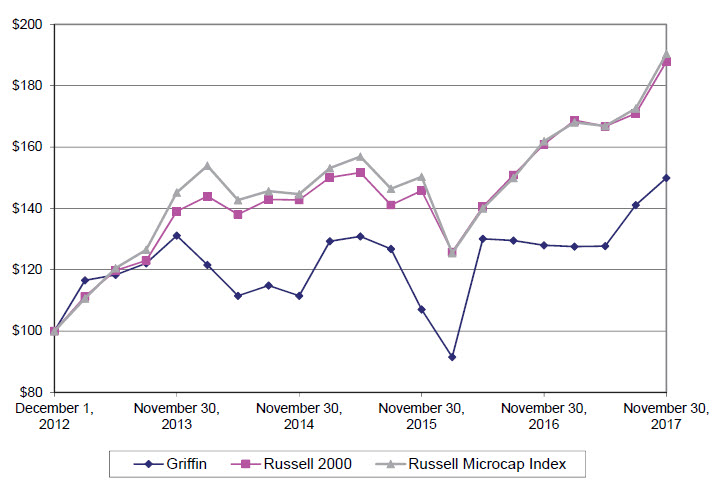

· |