Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TCF FINANCIAL CORP | tcf63017form8-kexhibit991r.htm |

| 8-K - 8-K - TCF FINANCIAL CORP | tcf63017form8-kearningsrel.htm |

2017 Second Quarter Earnings Presentation

July 24, 2017

Exhibit 99.2

Agenda

SECOND QUARTER OBSERVATIONS

• Craig Dahl (Chief Executive Officer)

REVENUE / LOANS AND LEASES / CREDIT

• Craig Dahl

DEPOSITS / INTEREST RATES / EXPENSES / CAPITAL

• Brian Maass (Chief Financial Officer)

CLOSING COMMENTS

• Craig Dahl

Q&A

2

CONTINUED FOCUS ON EXECUTING ON OUR STRATEGIC

PILLARS IN 2017

• Net income of $60.4 million, up 4.7% year-over-year

• Auto finance business performing as expected following recent strategic shift, resulting

in a more stable source of revenue

• Net interest income growth and margin expansion as interest rates have increased

primarily due to our asset sensitive balance sheet and continued pricing discipline

• Strategic investments to enhance technology capabilities and drive efficiencies

continue

• Year-over-year improvement in efficiency ratio

• Continued stable credit performance

• Effective income tax rate of 28.9% was primarily impacted by a favorable

state tax settlement

Second Quarter Observations

Diversification 1 Profitable Growth 2 Operating Leverage 3 Core Funding 4

3

Investments and other 1%

Consumer real estate &

other (first mortgage lien)

11%

Consumer

real estate

(junior lien)

16%

Auto

finance

16%Leasing &equipment

finance 19%

Commercial

15%

Inventory

finance 17%

Loans and leases held for sale 1%

Securities 4%

Other 3%

Fees and

service

charges 29%

ATM

revenue

4%

Card

revenue

12%

Leasing &

equipment

finance 35%

Gains on sales of loans, net 8%

Servicing fee income 9%

NIM up 17 bps YoY

350

300

250

200

150

100

50

0

5.25%

5.00%

4.75%

4.50%

4.25%

4.00%

2Q16 3Q16 4Q16 1Q17 2Q17

$118

$331

$120

$332

$116

$327

$104

$326

$115

$342

4.35% 4.34% 4.30%

4.46% 4.52%

Net Interest Margin1

2Q17 vs. 2Q16 revenue and net interest margin

impacted by the following 2Q17 items:

• Higher net interest income driven by the non-

auto finance portfolios through a combination

of higher variable- and adjustable-rate yields

and loan and lease growth

• Reduction in gains on sales of auto finance

loans largely offset by higher levels of leasing

and equipment finance non-interest income

1 Annualized

2 Includes gains on sales of consumer real estate loans and auto finance loans. Gains on sales of auto finance loans, net, was less than 1% of non-interest income.

Revenue Summary

REVENUE DIVERSIFICATION

$249 million

Non-interest Income

Interest Income

($ millions)

$213 $212 $211 $222 $227

Non-interest Income

Net Interest Income

$115 million

Strategic Pillars

Diversification 1

Profitable Growth 2

4

2

3,000

2,250

1,500

750

0

6/16 9/16 12/16 3/17 6/17

$2,813 $2,732 $2,648 $2,780

$3,243

$151

$2,964

$154

$2,886

$254

$2,902 $372

$3,152 $3,265

Loans Held for Sale

Loans Held for Investment8.00%

6.00%

4.00%

2.00%

4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

4.17% 4.14% 4.19% 4.06% 4.04% 4.15% 5.01%

NET CHARGE-OFF RATIO2

1 Annualized and presented on a fully tax-equivalent basis

2 Annualized

3 Excludes non-accrual loans

4 Includes loans held for sale of $22 million

($ millions)

Auto Finance Strategy

Progressing as Planned

0.30%

0.20%

0.10%

0.00%

4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

0.14% 0.09% 0.13%

0.20% 0.23%

0.13%

0.20%

1.20%

0.80%

0.40%

0.00%

4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

0.75% 0.81% 0.69%

0.86%

1.09% 1.12%

0.83%

5

60+ DAY DELINQUENCIES3

Originations $904 $881 $860 $863 $525

HELD FOR INVESTMENT LOAN YIELD1 AUTO FINANCE BALANCES

• Reclassified approximately $345 million of auto

loans from held for sale to held for investment

in the second quarter

• Year-over-year auto finance originations down

$379 million, or 42.0%

4

6/16 9/16 12/16 3/17 6/17

$17,472 $17,384 $17,844

$17,975 $18,367

14%

18%

24%

15%

16%

13%

13%

18%

24%

16%

15%

14%

16%

19%

24%

15%

14%

12%

• Year-over-year loan and lease

growth in wholesale businesses:

• Commercial up 12.7%

• Inventory Finance up 7.5%

• Leasing & Equipment Finance

up 5.2%

• Auto Finance up approximately

4% year-over-year, excluding the

reclassification of loans from held

for sale to held for investment in

the second quarter of

approximately $345 million

• Strong loan and lease

diversification by asset class,

geography, rate, average loan and

lease size, estimated weighted

average life and collateral type

• Proven loan and lease origination

platform allows for optimization of

growth and revenue

56%

Wholesale

44%

Consumer

Loan and Lease Portfolio

($ millions)

13%

18%

24%

16%

15%

14%

Inventory Finance

Leasing & Equipment Finance

Commercial

Auto Finance

Consumer Real Estate - Junior Lien

Consumer Real Estate & Other - First Mortgage Lien

$17,385

14%

19%

23%

18%

15%

11%

Strategic Pillar

Diversification 1

Loan and lease growth of

5.1% YoY

6

2Q16 3Q16 4Q16 1Q17 2Q17

Consumer Real Estate:

First Mortgage Lien 5.34% 5.35% 5.22% 5.33% 5.35%

Junior Lien 5.64 5.60 5.64 5.82 6.01

Commercial 4.30 4.22 4.25 4.43 4.50

Leasing & Equipment Finance 4.45 4.48 4.43 4.48 4.48

Inventory Finance 5.74 6.07 5.80 5.93 6.22

Auto Finance 4.19 4.06 4.04 4.15 5.01

Total Loans and Leases 4.88 4.88 4.82 4.95 5.15

Peer Group2 Average 4.40 4.38 4.40 4.40 N.A.

BALANCE SHEET ASSET SENSITIVITY, CONTINUED PRICING

DISCIPLINE AND AUTO FINANCE SHIFT RESULTING IN STRONG

YIELD PERFORMANCE

1 Annualized and presented on a fully tax-equivalent basis

2 All U.S. publicly-traded banks and thrifts, excluding TCF, with total assets between $10 and $50 billion as of March 31, 2017 that have

reported loan and lease yields for the past four quarters, includes loans held for sale (source: SNL Financial)

N.A. Not Available

Loan and Lease Yields1

Strategic Pillars

Diversification 1

Profitable Growth 2

7

PROVISION FOR CREDIT LOSSES

30

20

10

0

2Q16 3Q16 4Q16 1Q17 2Q17

$13 $14

$20

$12

$19

1 Excludes non-accrual loans and leases

2 Annualized

3 Excluding the $8.7 million recovery from the consumer real estate non-accrual loan sale, net charge-offs were $14 million and the net charge-off ratio was 0.31%

($ millions)

Credit Quality Trends

0.15%

0.12%

0.09%

0.06%

0.03%

0.00%

6/16 9/16 12/16 3/17 6/17

0.12% 0.12% 0.12%

0.09%

0.11%

400

300

200

100

0

6.00%

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

6/16 9/16 12/16 3/17 6/17

$232 $228

$171 $158

1.33% 1.28% 1.28% 0.95% 0.86%

($ millions)

60+ DAY DELINQUENCIES1

NET CHARGE-OFFSNON-PERFORMING ASSETS

Other Real Estate Owned

Non-accrual Loans & Leases

NPAs/Loans & Leases and Other Real Estate Owned

Strategic Pillar

Diversification 1

$224

15

12

9

6

3

0

1.50%

1.20%

0.90%

0.60%

0.30%

0.00%

2Q16 3Q16 4Q16 1Q17 2Q17

$10 $11

$12

$5

$13

0.23% 0.26% 0.27%

0.11%

0.28%

3

Net Charge-offs

Net Charge-off Ratio2

8

($ millions)

1 Annualized

2 Excluding the $8.7 million recovery from the consumer real estate non-accrual loan sale, consumer net charge-off ratio was 0.49% and total

net charge-off ratio was 0.31%

3 Includes Other

Net Charge-off Ratio

Quarter Ended1

Change from

Quarter Ended

Jun. 30, 2016 Sep. 30, 2016 Dec. 31, 2016 Mar. 31, 2017 Jun. 30, 2017 Jun. 30, 2016

Consumer:

Consumer Real Estate:

First Mortgage Lien 0.35% 0.34% 0.26% (0.18)% 0.15% (20) bps

Junior Lien 0.05 0.04 0.08 (0.89) 0.05 —

Total Consumer Real Estate 0.19 0.17 0.17 (0.58) 0.09 (10)

Auto Finance 0.69 0.86 1.09 1.12 0.83 14

Consumer 3 0.39 0.47 0.53 0.05 0.42 3

Wholesale:

Commercial 0.08 (0.01) 0.01 0.32 0.29 21

Leasing & Equipment Finance 0.11 0.18 0.10 0.13 0.14 3

Inventory Finance 0.09 0.10 0.07 0.01 0.09 —

Wholesale 0.10 0.10 0.06 0.16 0.18 8

Total 3 0.23 0.26 0.27 0.11 0.28 5

Strategic Pillar

Diversification 1

9

2

Total levels of net charge-offs remain in the low end of the expected range

18,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

2Q16 3Q16 4Q16 1Q17 2Q17

$17,284 $17,148 $17,069 $17,106 $17,323 • Relative value of retail deposits

increasing as short-term interest

rates rise

• 90% of average deposit balances

are consumer

• Average checking balances

increased 5.0% year-over-year

• Average interest rate on deposits

decreased year-over-year

• 86% of period-end certificates of

deposit are less than $250,000

0.37% 0.37% 0.35% 0.33% 0.33%

Average

interest cost:

Deposit Generation

Average Balances

($ millions)

Certificates of Deposit

Money Market

Savings

Checking

Strategic Pillars

Profitable Growth 2

Core Funding 4

25%

15%

27%

33%

25%

15%

27%

33%

25%

14%

27%

34%

24%

14%

28%

34%

24%

13%

28%

35%

10

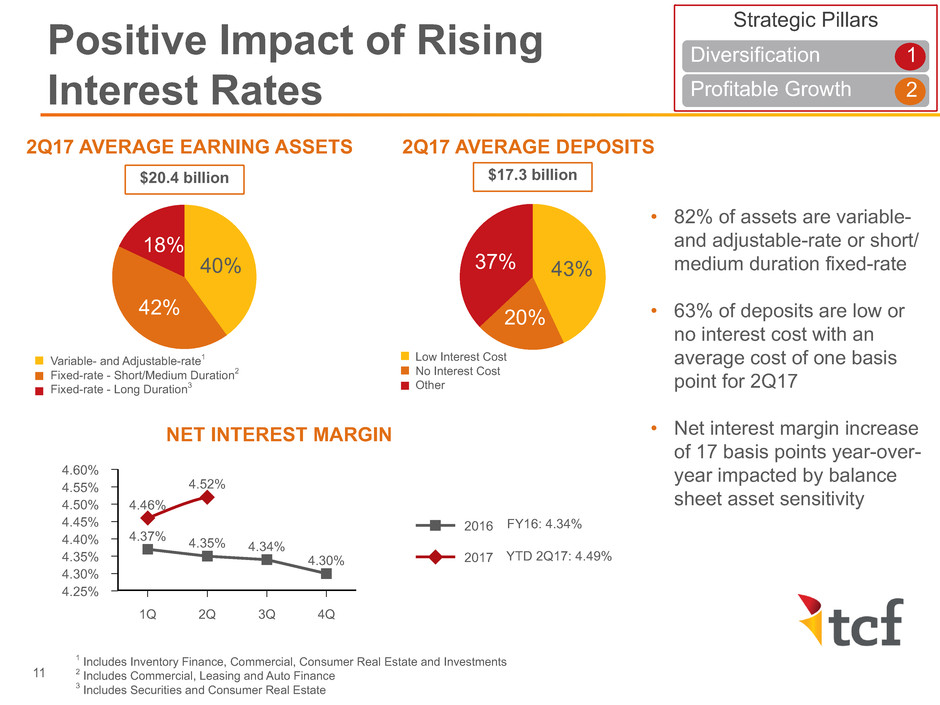

43%

20%

37%

2Q17 AVERAGE EARNING ASSETS 2Q17 AVERAGE DEPOSITS

$17.3 billion

2016

2017

4.60%

4.55%

4.50%

4.45%

4.40%

4.35%

4.30%

4.25%

1Q 2Q 3Q 4Q

4.37% 4.35% 4.34%

4.30%

4.46%

4.52%

40%

42%

18%

Positive Impact of Rising

Interest Rates

• 82% of assets are variable-

and adjustable-rate or short/

medium duration fixed-rate

• 63% of deposits are low or

no interest cost with an

average cost of one basis

point for 2Q17

• Net interest margin increase

of 17 basis points year-over-

year impacted by balance

sheet asset sensitivity

Variable- and Adjustable-rate1

Fixed-rate - Short/Medium Duration2

Fixed-rate - Long Duration3

Low Interest Cost

No Interest Cost

Other

Strategic Pillars

Diversification 1

Profitable Growth 2

$20.4 billion

1 Includes Inventory Finance, Commercial, Consumer Real Estate and Investments

2 Includes Commercial, Leasing and Auto Finance

3 Includes Securities and Consumer Real Estate

NET INTEREST MARGIN

FY16: 4.34%

YTD 2Q17: 4.49%

11

• Compensation and employee

benefits expense decreased

year-over-year primarily due to

reduced headcount in auto

finance

• Other non-interest expense

increased year-over-year

primarily due to higher

professional fees related to

strategic investments in

technology capabilities, as well

as advertising and marketing

expenses

• Efficiency ratio down 50 bps

year-over-year

1 Includes Occupancy & Equipment, Other Non-interest Expense, Foreclosed Real Estate & Repossessed Assets and Other Credit Costs

Non-interest Expense

250

200

150

100

50

0

2Q16 3Q16 4Q16 1Q17 2Q17

$118 $117 $115 $124 $116

$99 $102 $99

$109

$105

$10

$227

$10

$229

$11

$225 $11

$244

$12

$233

Compensation & Employee Benefits

Foreclosed Real Estate and Other Credit Cost

Compensation & Employee Benefits

350

300

250

200

150

100

50

0

$

(M

ill

io

ns

)

6/14 9/14 12/14 3/15 6/15

($ millions)

Operating Lease Depreciation

Other 1

Compensation & Employee Benefits

Efficiency

Ratio: 68.69% 69.00% 68.89% 74.93% 68.19%

Strategic Pillars

Profitable Growth 2

Operating Leverage 3

12

4Q16 2Q17

Common equity Tier 1 capital ratio1 10.24% 10.24%

Tier 1 risk-based capital ratio1 11.68% 11.66%

Total risk-based capital ratio1 13.69% 13.49%

Tier 1 leverage ratio1 10.73% 10.76%

Common equity ratio 10.09% 10.26%

Tangible common equity ratio2 9.13% 9.24%

Book value per common share $ 12.66 $ 13.20

Tangible book value per common

share2 $ 11.33 $ 11.74

Return on average common equity3 8.40% 9.96%

Return on average tangible common

equity3, 4 9.43% 11.15%

• Maintained strong capital

ratios with earnings

accumulation

• Common stock dividend

of 7.5 cents per share

declared on July 19, 2017

• Generating profitable

growth is a capital priority

Capital and Return

1 The regulatory capital ratios for 2Q17 are preliminary pending completion and filing of the Company’s regulatory reports

2 See “Reconciliation of GAAP to Non-GAAP Financial Measures – Tangible Common Equity Ratio and Tangible Book Value Per Common Share” slide

3 Annualized

4 See “Reconciliation of GAAP to Non-GAAP Financial Measures – Return on Average Tangible Common Equity” slide

13

Strategic Pillar Summary

STRATEGIC PILLARS 2017 OUTLOOK

DIVERSIFICATION

• Continue stable credit quality driven by diversification

philosophy

• Origination opportunities in multiple asset classes

provide flexibility to adjust asset composition based

on market conditions

PROFITABLE GROWTH

• Increase earnings predictability with reduction in

gains on sales replaced with more consistent interest

income driven by continued pricing discipline

• Balance sheet composition provides a competitive

advantage in the current rising rate environment

OPERATING LEVERAGE

• Expense growth related to strategic investments in

technology capabilities, including enhancing digital

channels and other efficiency initiatives

• Remain focused on revenue growth exceeding

expense growth

CORE FUNDING

• Retail deposits provide a competitive pricing

advantage in a rising rate environment

• Investments in the retail bank help drive core deposit

growth

1

2

3

4

14

Appendix

Cautionary Statements for Purposes of the Safe

Harbor Provisions of the Securities Litigation

Reform Act

Any statements contained in this presentation regarding the outlook for the Company's businesses and their respective markets, such as projections of

future performance, targets, guidance, statements of the Company's plans and objectives, forecasts of market trends and other matters, are forward-

looking statements based on the Company's assumptions and beliefs. Such statements may be identified by such words or phrases as "will likely result,"

"are expected to," "will continue," "outlook," "will benefit," "is anticipated," "estimate," "project," "management believes" or similar expressions. These

forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such

statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, TCF claims the

protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement

speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or

circumstances after such date or to reflect the occurrence of anticipated or unanticipated events.

Certain factors could cause the Company's future results to differ materially from those expressed or implied in any forward-looking statements contained

herein. These factors include the factors discussed in Part I, Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31,

2016 under the heading "Risk Factors", the factors discussed below and any other cautionary statements, written or oral, which may be made or referred

to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as

complete or exhaustive.

Adverse Economic or Business Conditions; Competitive Conditions; Credit and Other Risks. Deterioration in general economic and banking industry

conditions, including those arising from government shutdowns, defaults, anticipated defaults or rating agency downgrades of sovereign debt (including

debt of the U.S.), or increases in unemployment; adverse economic, business and competitive developments such as shrinking interest margins, reduced

demand for financial services and loan and lease products, deposit outflows, increased deposit costs due to competition for deposit growth and evolving

payment system developments, deposit account attrition or an inability to increase the number of deposit accounts; customers completing financial

transactions without using a bank; adverse changes in credit quality and other risks posed by TCF's loan, lease, investment, securities held to maturity

and securities available for sale portfolios, including declines in commercial or residential real estate values, changes in the allowance for loan and lease

losses dictated by new market conditions or regulatory requirements, or the inability of home equity line borrowers to make increased payments caused

by increased interest rates or amortization of principal; deviations from estimates of prepayment rates and fluctuations in interest rates that result in

decreases in the value of assets such as interest-only strips that arise in connection with TCF's loan sales activity; interest rate risks resulting from

fluctuations in prevailing interest rates or other factors that result in a mismatch between yields earned on TCF's interest-earning assets and the rates

paid on its deposits and borrowings; foreign currency exchange risks; counterparty risk, including the risk of defaults by our counterparties or diminished

availability of counterparties who satisfy our credit quality requirements; decreases in demand for the types of equipment that TCF leases or finances;

the effect of any negative publicity.

Legislative and Regulatory Requirements. New consumer protection and supervisory requirements and regulations, including those resulting from action

by the Consumer Financial Protection Bureau ("CFPB") and changes in the scope of Federal preemption of state laws that could be applied to national

banks and their subsidiaries; the imposition of requirements that adversely impact TCF's deposit, lending, loan collection and other business activities

such as mortgage foreclosure moratorium laws, further regulation of financial institution campus banking programs, or new restrictions on loan and lease

products; changes affecting customer account charges and fee income, including changes to interchange rates; (continued)

16

Cautionary Statements for Purposes of the Safe

Harbor Provisions of the Securities Litigation

Reform Act (cont.)

regulatory actions or changes in customer opt-in preferences with respect to overdrafts, which may have an adverse impact on TCF; governmental regulations

or judicial actions affecting the security interests of creditors; deficiencies in TCF's compliance programs, including under the Bank Secrecy Act in past or

future periods, which may result in regulatory enforcement action including monetary penalties; increased health care costs including those resulting from

health care reform; regulatory criticism and resulting enforcement actions or other adverse consequences such as increased capital requirements, higher

deposit insurance assessments or monetary damages or penalties; heightened regulatory practices, requirements or expectations, including, but not limited

to, requirements related to enterprise risk management, the Bank Secrecy Act and anti-money laundering compliance activity.

Earnings/Capital Risks and Constraints, Liquidity Risks. Limitations on TCF's ability to pay dividends or to increase dividends because of financial performance

deterioration, regulatory restrictions or limitations; increased deposit insurance premiums, special assessments or other costs related to adverse conditions

in the banking industry; the impact on banks of regulatory reform, including additional capital, leverage, liquidity and risk management requirements or

changes in the composition of qualifying regulatory capital; adverse changes in securities markets directly or indirectly affecting TCF's ability to sell assets

or to fund its operations; diminished unsecured borrowing capacity resulting from TCF credit rating downgrades or unfavorable conditions in the credit

markets that restrict or limit various funding sources; costs associated with new regulatory requirements or interpretive guidance including those relating to

liquidity; uncertainties relating to future retail deposit account changes, including limitations on TCF's ability to predict customer behavior and the impact on

TCF's fee revenues.

Branching Risk; Growth Risks. Adverse developments affecting TCF's supermarket banking relationships or either of the primary supermarket chains in

which TCF maintains supermarket branches; costs related to closing underperforming branches; inability to timely close underperforming branches due to

long-term lease obligations; slower than anticipated growth in existing or acquired businesses; inability to successfully execute on TCF's growth strategy

through acquisitions or expanding existing business relationships; failure to expand or diversify TCF's balance sheet through new or expanded programs

or opportunities; failure to effectuate, and risks of claims related to, sales and securitizations of loans; risks related to new product additions and addition of

distribution channels (or entry into new markets) for existing products.

Technological and Operational Matters. Technological or operational difficulties, loss or theft of information, cyber-attacks and other security breaches,

counterparty failures and the possibility that deposit account losses (fraudulent checks, etc.) may increase; failure to keep pace with technological change,

such as by failing to develop and maintain technology necessary to satisfy customer demands, costs and possible disruptions related to upgrading systems;

the failure to attract and retain key employees.

Litigation Risks. Results of litigation or government enforcement actions such as TCF's pending litigation with the CFPB and related matters, including class

action litigation or enforcement actions concerning TCF's lending or deposit activities, including account opening/origination, servicing practices, fees or

charges, employment practices, or checking account overdraft program "opt in" requirements; possible increases in indemnification obligations for certain

litigation against Visa U.S.A.

Accounting, Audit, Tax and Insurance Matters. Changes in accounting standards or interpretations of existing standards; federal or state monetary, fiscal or

tax policies, including adoption of state legislation that would increase state taxes; ineffective internal controls; adverse federal, state or foreign tax assessments

or findings in tax audits; lack of or inadequate insurance coverage for claims against TCF; potential for claims and legal action related to TCF's fiduciary

responsibilities.

17

Reconciliation of GAAP to Non-GAAP Financial

Measures – Tangible Common Equity Ratio and

Tangible Book Value Per Common Share1

At At

Dec. 31, 2016 Jun. 30, 2017

Total equity $ 2,444,645 $ 2,549,831

Less: Non-controlling interest in subsidiaries 17,162 22,766

Total TCF Financial Corporation stockholders' equity 2,427,483 2,527,065

Less: Preferred stock 263,240 263,240

Total common stockholders' equity (a) 2,164,243 2,263,825

Less:

Goodwill 225,640 227,072

Other intangibles 1,738 22,682

Tangible common equity (b) $ 1,936,865 $ 2,014,071

Total assets (c) $ 21,441,326 $ 22,054,651

Less:

Goodwill 225,640 227,072

Other intangibles 1,738 22,682

Tangible assets (d) $ 21,213,948 $ 21,804,897

Common stock shares outstanding (e) 170,991,940 171,489,921

Common equity ratio (a) / (c) 10.09% 10.26%

Tangible common equity ratio (b) / (d) 9.13% 9.24%

Book value per common share (a) / (e) $ 12.66 $ 13.20

Tangible book value per common share (b) / (e) $ 11.33 $ 11.74

1 When evaluating capital adequacy and utilization, management considers financial measures such as the tangible common equity ratio and tangible

book value per common share. These measures are non-GAAP financial measures and are viewed by management as useful indicators of capital

levels available to withstand unexpected market or economic conditions, and also provide investors, regulators and other users with information to be

viewed in relation to other banking institutions.

($ thousands, except per share data)

18

Reconciliation of GAAP to Non-GAAP Financial

Measures – Return on Average Tangible Common

Equity1

QTD QTD

Dec. 31, 2016 Jun. 30, 2017

Net income available to common stockholders (a) $ 45,245 $ 55,585

Plus: Other intangibles amortization 290 238

Less: Income tax expense attributable to other intangibles amortization 103 83

Adjusted net income available to common stockholders (b) $ 45,432 $ 55,740

Average balances:

Total equity $ 2,436,136 $ 2,520,870

Less: Non-controlling interest in subsidiaries 18,914 26,188

Total TCF Financial Corporation stockholders' equity 2,417,222 2,494,682

Less: Preferred stock 263,240 263,240

Average total common stockholders' equity (c) 2,153,982 2,231,442

Less:

Goodwill 225,640 225,876

Other intangibles 1,872 5,045

Average tangible common equity (d) $ 1,926,470 $ 2,000,521

Return on average common equity2 (a) / (c) 8.40% 9.96%

Return on average tangible common equity2 (b) / (d) 9.43% 11.15%

($ thousands)

1 When evaluating capital adequacy and utilization, management considers financial measures such as return on average tangible common equity. This

measure is a non-GAAP financial measure and is viewed by management as a useful indicator of capital levels available to withstand unexpected

market or economic conditions, and also provide investors, regulators and other users with information to be viewed in relation to other banking

institutions.

2 Annualized

19